SCE GANN PredictionsThis is a script designed to give an insight on price direction from being above or below a GANN Value.

What Are GANN Waves?

The SCE GANN Predictions indicator is inspired by the work of W.D. Gann, a renowned trader who believed that price movements follow geometric and mathematical patterns. GANN waves use past price behavior—specifically momentum or "velocity"—to forecast where prices might head next.

How Does the Indicator Work?

Calculating Velocity

The script starts by measuring the "velocity" of price movement over a user-defined lookback period (denoted as n). This velocity is the average difference between the close and open prices over n bars. Think of it as the market’s speed in a given direction.

Predicting the Future Price

Using this velocity, the indicator estimates a future price after a specific time horizon—calculated as n + n*2 bars into the future (e.g., if n = 15, it predicts 45 bars ahead). It scales the velocity by a ratio (Gr) to determine the "end price." This is the raw GANN prediction.

Optimizing the Ratio (Gr)

The key to a good prediction is finding the right Gr. The script tests a range of Gr values (from Gr_min to Gr_max, stepping by Gr_step) and evaluates each one by calculating the sum of squared errors (SSE) between the predicted prices and the actual historical close prices. The Gr with the lowest SSE is deemed "optimal" and used for the final prediction.

Smoothing with an SMA

The raw GANN prediction is then smoothed using a simple moving average (SMA) over the lookback period (n). This SMA is plotted on your chart, serving as a dynamic trend line. The plot’s color changes based on the current price: teal if the close is above the SMA (bullish), and red if below (bearish).

Visuals

This example shows how the value explains price strength and changes color. When the price is above the line, and it’s green, we’re showing an up trend. The opposite is when the price is below the line, and it’s red, showing a down trend.

We can see that there may be moments where price drops under the value for just that one bar.

In scenarios with sideways price action, even though the price crosses, there is no follow through. This is a shortcoming of the overall concept.

Customizable Inputs

Timeframe: Choose the timeframe for analysis (default is 2 minutes).

Show GANN Wave: Toggle the GANN SMA plot on or off (default is true).

Lookback Period (Gn): Set the number of bars for velocity and SMA calculations (default is 15).

Min Ratio (Gr_min): The lower bound for the Gr optimization (default is 0.05).

Max Ratio (Gr_max): The upper bound for Gr (default is 0.2).

Step for Gr (Gr_step): The increment for testing Gr values (default is 0.01).

How to Use SCE GANN Predictions

Trend Direction

The colored SMA provides a quick visual cue. Teal suggests an uptrend, while red hints at a downtrend. Use this to align your trades with the broader momentum.

Crossover Signals

Watch for the close price crossing the GANN SMA. A move above could signal a buy opportunity, while a drop below might indicate a sell. Combine this with other indicators for confirmation.

Fine-Tuning

Experiment with the lookback period (Gn) and Gr range to optimize for your market. Shorter lookbacks might suit fast-moving assets, while longer ones could work for slower trends.

Like any technical tool, SCE GANN Predictions isn’t a crystal ball. It’s based on historical data and mathematical assumptions, so it won’t always be spot-on.

Индикаторы и стратегии

Volume-Powered S/R TraderThis advanced TradingView indicator combines volume analysis, dynamic support/resistance levels, and technical indicators to identify high-probability trading opportunities. It focuses on detecting institutional-level activity through volume spikes at key price levels.

Key Components

Volume Analysis Engine

Tracks volume spikes (150%+ of 20-period average)

Color-coded volume bars:

Green: Bullish volume spike (high volume + bullish candle)

Red: Bearish volume spike (high volume + bearish candle)

Dynamic Support/Resistance System

Auto-detects swing points using pivot high/low

Maintains rolling arrays of:

Support Levels (green semi-transparent lines)

Resistance Levels (red semi-transparent lines)

Displays only the 5 most recent levels for clarity

Trend Analysis

50-period EMA trend filter

RSI momentum indicator (14-period)

Trend direction classification:

Bullish: EMA rising

Bearish: EMA falling

Average True Range com Média MóvelUsing ATR and Moving Average: A Technical Analysis Strategy

The Average True Range (ATR) and the Moving Average are two important technical analysis tools that can be used together to identify trading opportunities in the market. In this article, we will explore how to use these two tools and how the crossover between them can indicate changes in the market.

What is ATR?

The Average True Range (ATR) is a measure of the volatility of an asset, which calculates the average true range of an asset over a period of time. The true range is the difference between the closing price and the opening price of an asset, or the difference between the closing price and the highest or lowest price of the day. ATR is an important measure of volatility, as it helps to identify the magnitude of price fluctuations of an asset.

What is Moving Average?

The Moving Average is a technical analysis tool that calculates the average price of an asset over a period of time. The Moving Average can be used to identify trends and price patterns, and is an important tool for traders. There are different types of Moving Averages, including the Simple Moving Average (SMA), the Exponential Moving Average (EMA), and the Weighted Moving Average (WMA).

Crossover between ATR and Moving Average

The crossover between ATR and Moving Average can be an important indicator of changes in the market. When ATR crosses above the Moving Average, it may indicate that the volatility of the asset is increasing and that the price may be about to rise. This occurs because ATR is increasing, which means that the true range of the asset is increasing, and the Moving Average is being surpassed, which means that the price is rising.

On the other hand, when ATR crosses below the Moving Average, it may indicate that the volatility of the asset is decreasing and that the price may be about to fall. This occurs because ATR is decreasing, which means that the true range of the asset is decreasing, and the Moving Average is being surpassed, which means that the price is falling.

Trading Strategies

There are several trading strategies that can be used with the crossover between ATR and Moving Average. Some of these strategies include:

Buying when ATR crosses above the Moving Average, with the expectation that the price will rise.

Selling when ATR crosses below the Moving Average, with the expectation that the price will fall.

Using the crossover between ATR and Moving Average as a filter for other trading strategies, such as trend analysis or pattern recognition.

In summary, the crossover between ATR and Moving Average can be an important indicator of changes in the market, and can be used as a technical analysis tool to identify trading opportunities. However, it is important to remember that no trading strategy is foolproof, and that it is always important to use a disciplined approach and manage risk adequately.

Setup Venda EMA + RSI📌 Setup Summary

✅ Sell when:

🔻 The price is below the EMAs (9 and 20).

🔻 The price has pulled back to the EMAs before falling again.

🔻 The RSI is below 50 and falling.

🔻 The entry candle closes below the pullback's low.

📌 Stop Loss: Above the EMA 20 or the last high.

📌 Take Profit: At the next support or 1.5x to 2x the stop size.

RiskCalc FX & GoldRiskCalc FX & Gold is a multi-market position sizing tool designed to help you manage risk quickly and accurately. With this script, simply enter your account capital, the percentage of risk you wish to take, and your stop in ticks. Depending on the selected market—Forex or XAUUSD—the script automatically adjusts its calculations:

Forex: Assumes 1 lot equals 100,000 units.

XAUUSD: Assumes 1 lot equals 100 ounces.

The script calculates your risk in dollars and, using a fixed value of 1 USD per tick per lot, determines the ideal position size in both lots and total contracts. Results are displayed in a clear, centralized table at the top of the chart for real-time decision-making.

Perfect for traders operating across multiple markets who need an automated and consistent approach to risk management.

Four MAs with Bands Pack by Rising Falcon# **Four MAs with Bands Pack by Rising Falcon**

## **Overview**

The **Four MAs with Bands Pack** is a dynamic multi-moving average indicator designed to enhance trend identification, momentum analysis, and volatility assessment. It allows traders to configure and visualize up to four different moving averages (MAs) with an optional **higher timeframe Hull MA (HMA)** for advanced trend confirmation. The indicator also incorporates **band structures** around each MA, providing additional insights into price volatility, breakout zones, and trend strength.

---

## **Fundamental Aspects**

Moving Averages (MAs) are a foundational tool in technical analysis, widely used to **smooth out price fluctuations** and identify directional bias over time. This indicator leverages four MAs of varying lengths to **capture different time horizons** of market trends, making it useful for:

- **Short-Term Analysis (Scalping):** Fast MAs (e.g., 20, 50) respond quickly to price action, allowing traders to catch early trend shifts.

- **Mid-Term Analysis (Swing Trading):** Medium-length MAs (e.g., 100) help validate trend continuation.

- **Long-Term Analysis (Position Trading):** Slow MAs (e.g., 200) provide macro trend direction and filter noise from short-term fluctuations.

By **color-coding** the MAs based on trend direction and incorporating a **band system**, the indicator helps traders identify price momentum shifts, consolidation zones, and potential breakout opportunities.

---

## **Technical Aspects**

### **1. Configurable Moving Averages**

Each of the four MAs can be customized using three calculation methods:

- **SMA (Simple Moving Average):** A traditional average of past prices, best for stable trend confirmation.

- **EMA (Exponential Moving Average):** Gives more weight to recent price action, making it more reactive to new trends.

- **WMA (Weighted Moving Average):** Assigns greater importance to more recent data, reducing lag while maintaining smoothness.

#### **Formulae:**

1. **SMA:**

\

2. **EMA:**

\

where \( k = \frac{2}{N+1} \)

3. **WMA:**

\

where \( W_i \) is the weight assigned to each period.

Each moving average has an optional **higher timeframe setting**, allowing traders to plot an MA from a larger timeframe on their current chart for **multi-timeframe analysis (MTA)**. This is useful for confirming trends and filtering noise from lower timeframes.

---

### **2. Dynamic Bands & Volatility Visualization**

Each moving average has an associated band, defined by:

- **Upper Band:** The MA value at the current bar.

- **Lower Band:** The MA value from two bars ago (**lagging component** for trend assessment).

- **Color Coding:**

- **Green:** Uptrend (price above the moving average).

- **Red:** Downtrend (price below the moving average).

- **Orange:** Neutral (no strong trend bias).

The band thickness and transparency are customizable, helping traders **visually assess market conditions**:

- **Expanding Bands:** Increased price volatility (potential breakout).

- **Contracting Bands:** Reduced volatility (possible consolidation).

Mathematically, the **band region is defined by**:

\

This concept is similar to **Keltner Channels** or **Bollinger Bands**, but instead of standard deviations, it uses historical MA differences to capture trend momentum.

---

### **3. Trend Alerts & Crossover Signals**

To assist traders in making timely decisions, the indicator generates alerts when **fast MAs cross slow MAs**:

- **Bullish Crossover (Uptrend Confirmation):**

\

- **Bearish Crossover (Downtrend Confirmation):**

\

- These alerts can be used to set up **automated notifications** for trade entries/exits.

---

## **How to Use This Indicator**

### **Scalping Strategy**

1. Use **shorter length MAs (20, 50)** with **higher timeframe Hull MA** enabled.

2. Look for **bullish crossovers** of fast MAs over slow MAs.

3. Ensure the band is **expanding** before entering a trade.

4. Exit when the opposite crossover occurs or when bands **contract**.

### **Swing Trading Strategy**

1. Use a combination of **medium and long MAs (50, 100, 200)** for trend confirmation.

2. Look for **price pullbacks** into the bands before **trend continuation**.

3. Set alerts for **crossovers** to validate trend direction.

### **Trend Reversal Strategy**

1. Look for **bearish crossovers** near resistance levels for short trades.

2. Wait for **bullish crossovers** at support levels for long trades.

3. Confirm with **higher timeframe MA direction** to reduce false signals.

---

## **Key Benefits**

✅ **Versatile:** Works for scalping, swing trading, and trend following.

✅ **Multi-Timeframe Support:** View higher timeframe MAs for broader trend validation.

✅ **Customizable:** Adjust MA type, length, color coding, and band visibility.

✅ **Alerts:** Automatic notifications for trend shifts and crossovers.

✅ **Clear Visualization:** Helps traders identify breakout zones, volatility spikes, and reversals.

---

## **Final Thoughts**

The **Four MAs with Bands Pack by Rising Falcon** is an advanced yet intuitive tool for traders looking to enhance their trend-following strategies. By combining **multiple moving averages, band structures, and trend color coding**, it provides a comprehensive view of price action, helping traders make **informed trading decisions** with greater confidence.

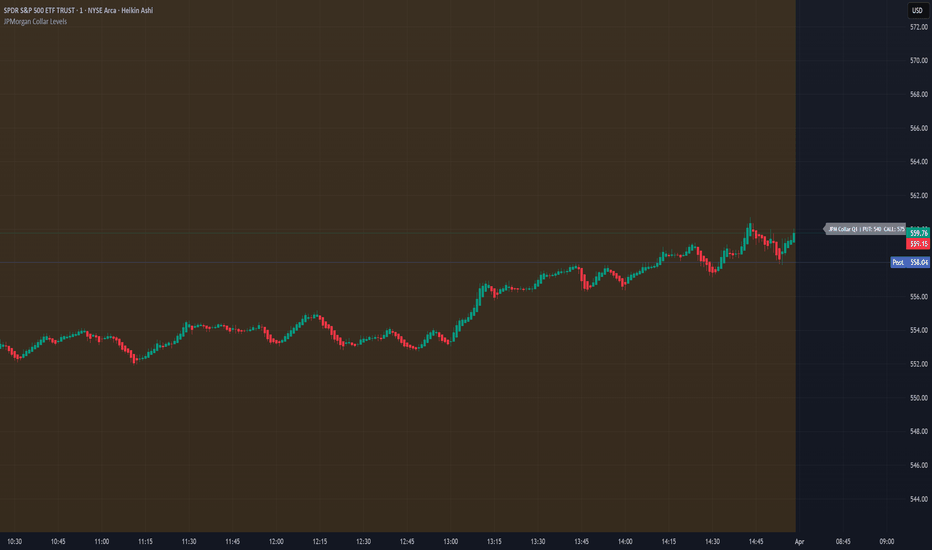

JPMorgan Collar LevelsJPMorgan Collar Levels – SPX/SPY Auto-Responsive (Quarterly Logic)

This script tracks the JPMorgan Hedged Equity Fund collar strategy, one of the most watched institutional positioning tools on SPX/SPY. The strategy rolls quarterly and often acts as a magnet or resistance/support zone for price.

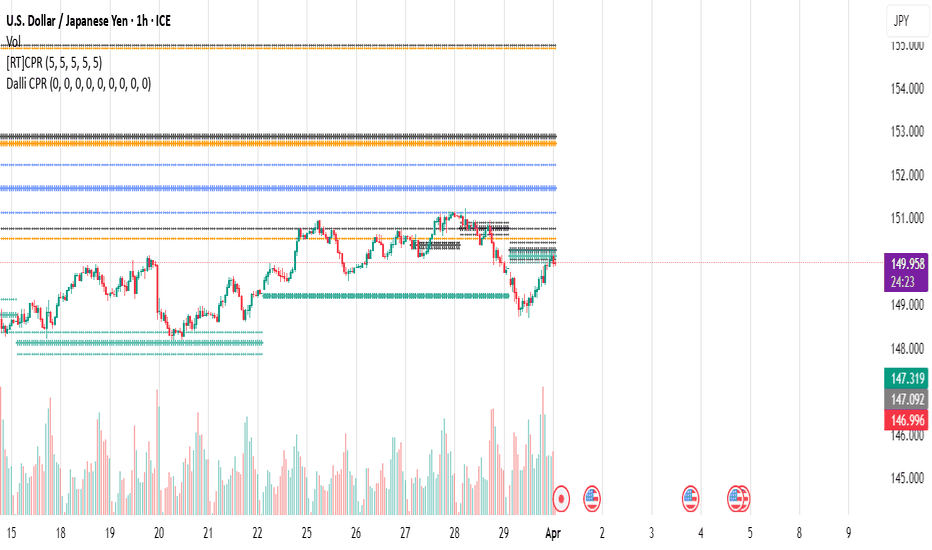

Dalli CPRMulti-Timeframe CPR Indicator for TradingView

This TradingView Pine Script calculates and displays the Central Pivot Range (CPR) across multiple timeframes, including daily, weekly, monthly, quarterly, half-yearly, and yearly. CPR is a powerful tool used by traders to identify key support and resistance levels, potential trend reversals, and breakout opportunities.

Key Features:

✅ Multi-Timeframe CPR: Calculates CPR levels for six different timeframes to provide a comprehensive market outlook.

✅ Dynamic Updates: CPR levels adjust based on the selected timeframe to ensure accurate and real-time analysis.

✅ Support & Resistance Zones: Displays Pivot Point (PP), Top Central Pivot (TC), and Bottom Central Pivot (BC) to help traders make informed decisions.

✅ Customizable Display: Users can enable/disable specific timeframes and adjust line colors and styles for better visualization.

✅ Ideal for Swing & Intraday Trading: Provides insights into market trends by analyzing CPR levels across different timeframes.

15% Below Daily LowESPP discount pricing (15%) - Line chart that follows the daily low of the chart to show what price you could buy a company stock with the typical discount of 15%.

Wave IdentifierThis Pine Script indicator creates a 2x3 table that displays the current wave, target percentage, and timeframe information based on the time of day in Eastern Time. Here's what the indicator does:

It divides the trading day into three waves:

Wave 1: 9:30 AM ET to 11:00 AM ET

Wave 2: 12:00 PM ET to 2:00 PM ET

Wave 3: 3:00 PM ET to 4:00 PM ET

Any other time is labeled as "Between Waves"

It shows the target percentage for each wave:

Wave 1: 40% - 70%

Wave 2: 80% - 200%

Wave 3: 100% - 1000%

It recommends specific timeframes for each wave:

Wave 1: 2-minute candles

Wave 2: 5-minute candles

Wave 3: 10-minute candles

It checks if your current chart timeframe matches the recommended timeframe:

If it matches, it displays the timeframe in green

If it doesn't match, it displays "Timeframe mismatch" in red

The table is positioned in the middle-right of the chart and updates with each new candle. Feedback is always welcome!

Key LevelsI couldn't find an indicator that plotted previous day and intraday key levels like I wanted.

This indicator plots key levels on the chart:

Current session high (HOD) and low (LOD)

Previous day high (PDH), low (PDL), and close (PDC)

Overnight high (ONH) and low (ONL) based on a defined overnight window

At the start of a new session (day), the indicator resets its values and creates a new set of labels.

These labels are positioned in a fixed horizontal column (offset from the current bar) and are updated each bar so that they remain vertically aligned with their corresponding level (with a small vertical offset).

Inputs you can modify:

Futures Mode and session times for equities and futures.

Horizontal label offset (in bars) and vertical offset (price units) for label positioning.

Colors, line widths, and styles for each level (day high, day low, overnight high/low, previous day levels).

Adjust these inputs to match your market hours and desired appearance.

Zero background in coding, but worked with chatGPT to develop this, and it works for me. Would welcome any and all feedback.

3 EMAs with Price Action by Sap KarCombines three EMAs with Price Action. Price action visible as GREEN and RED ARROWS below and above bars.

Buy when bars start forming above 9,21 emas GREEN arrows starts forming below bars.

Sell when bars start forming below 9,21 emas RED arrows starts forming above bars.

Sap Kar 3 EMAs + PA; (P)This script plots 3 EMAs and also shows price action in the form of GREEN ARROWS at the bottom of the bars for LONG trades and RED ARROWS @ top of the bars for SHORT TRADE.

Will be useful for trend and momentum following. The input parameters for price action ae

1. No of Bars for price action calculation:- This should be ideally between 3 to 6.

2. Maximum Close % should preferably be above 75 and should always be above 50.

3. Minimum Close % should preferably be below 25 and should always be below 50.

Should buy when above EMAs and green arrows start forming below bars. Should sell when below EMAs and red arrows start forming above bars.

Doji Breakout 3:1 DetectorFinds a proper doji for you to buy its high or sell its low for a 3:1 reward

Global Liquidity Index with Editable DEMA + 107 Day OffsetGlobal Liquidity DEMA (107-Day Lead)

This indicator visualizes a smoothed version of global central bank liquidity with a forward time shift of 107 days. The concept is based on the macroeconomic observation that markets tend to lag changes in global liquidity — particularly from central banks like the Federal Reserve, ECB, BOJ, and PBOC.

The script uses a Double Exponential Moving Average (DEMA) to smooth the combined balance sheets and money supply inputs. It then offsets the result into the future by 107 days, allowing you to visually align liquidity trends with delayed market reactions. A second plot (ROC SMA) is included to help identify liquidity momentum shifts.

🔍 How to Use:

Add this indicator to any chart (S&P 500, BTC, Gold, etc.)

Compare price action to the forward-shifted liquidity trend

Look for divergence, confirmation, or crossovers with price

Use as a macro timing tool for long-term entries/exits

📌 Included Features:

Editable DEMA smoothing length

ROC + SMA overlay for momentum signals

Fixed 107-day forward projection

Includes main DEMA and ROC SMA both real-time and shifted

Fourier-Inspired Forex PredictorThis strategy aims to using a Fourier-inspired approach to transform non-repetitive forex price patterns into a repetitive signal for predicting future prices

Opal Title: Opal Lines

Short Title: Opal Lines

Description:

Opal Lines is a dynamic overlay indicator that plots horizontal price levels at the open of key market sessions throughout the trading day, based on Eastern Time (ET). Designed for traders who rely on session-based price action, it marks significant intraday events such as the European Open (3:00 AM ET), Gold Open (8:20 AM ET), Regular Market Open (9:30 AM ET), and Globex Open (6:00 PM ET), among others. Each line is color-coded and toggleable via inputs, allowing users to customize which sessions they want to track.

Unlike generic time-based tools, Opal Lines captures the opening price at precise minute intervals and extends these levels across the chart until the daily reset at 5:00 PM ET (except for the Globex line, which persists into the next day). This makes it ideal for identifying support/resistance zones, breakout levels, or reference points tied to major market openings. Traders can use it across forex, futures, equities, or commodities to align their strategies with global session dynamics.

Key Features:

Seven toggleable session lines with distinct colors for easy identification.

Time-specific logic using ET, adaptable to any chart timeframe.

Persistent lines that reset daily, with Globex extending overnight.

Lightweight and overlay-friendly, preserving chart clarity.

How to Use:

Add the indicator to your chart and enable the sessions relevant to your trading style. Watch for price interactions with these levels—e.g., bounces, breaks, or retests—especially during high-volume periods. Combine with other tools like volume or oscillators for confirmation.

Note: Ensure your chart’s timezone is set to “America/New_York” (ET) for accurate alignment.

Small Range Stocks (ATR 7)This indicator identifies stocks with a small daily range relative to their ATR(7). It plots a small green tick below candles where the daily range is ≤ 0.9 × ATR(7), helping traders spot consolidation zones for potential breakouts.

MA Distance (% and ATR) + Threshold CountMA Distance (% & ATR) + Threshold Count

This script visualizes how far price is extended from key moving averages using both percentage and ATR-based distance. It includes a dynamic threshold system that tracks how unusually extended price is, based on historical volatility.

🔍 Features:

Calculates distance from:

10 EMA, 20 SMA, 50 SMA, 100 SMA, 200 SMA

Measures both:

% distance from each MA

ATR-multiple distance from each MA

Automatically calculates dynamic upper/lower thresholds using a rolling standard deviation

Plots a colored dot when distance exceeds these thresholds

Dots appear above or below the bar depending on direction

Color-coded summary table displays:

% distance

ATR distance

Threshold extremes

Total number of threshold hits

🎯 Customization:

Toggle which MAs to display in the table

Set your own lookback window and threshold sensitivity (via stdev multiplier)

Show/hide dots based on how many thresholds are hit

Use this tool to identify when price is overextended from its moving averages and approaching historically significant levels of deviation. Great for spotting mean reversion setups, parabolic runs, or deep pullbacks.

ProfitPivotProfitPivot dynamically shows the difference between unit cost and current market price of an asset, both in absolute term and in percentage. Traders can ascertain the profit level of a particular asset at a glance. Traders can input or change unit cost of the asset at any time directly through attribute settings. Previous bar close price will be used by default if the unit cost is not supplied.

ProfitPivot is developed by @isarab with the assistance of Copilot. It is licensed under Mozilla Public License Version 2.0.