Fibonacci Pivots [PQ_MOD]This comprehensive indicator calculates pivot points based on Fibonacci retracement and extension levels derived from historical price data. It dynamically computes a full suite of Fibonacci levels (e.g., 0, 0.236, 0.382, 0.5, 0.618, 1, 1.618, and others, including negative levels) using customizable deviation thresholds and depth settings across various timeframes, and then plots corresponding lines and labels on the chart. Additionally, the script integrates higher time frame OHLC analysis to enhance pivot determination and projects Fibonacci time zones by drawing vertical lines at intervals following the Fibonacci sequence. Optional add-ons incorporate volume and volatility measures to highlight potential exhaustion or high-volatility bars, while built-in alert functions notify users when key levels are crossed. Overall, this tool offers an advanced, multi-dimensional approach for identifying significant support, resistance, and trend reversal areas in market price action.

Индикаторы и стратегии

Money Flow Oscillator [BullByte]

Overview :

The Money Flow Oscillator is a versatile technical analysis tool designed to provide traders with insights into market momentum through the Money Flow Index (MFI). By integrating trend logic, dynamic support/resistance levels, multi-timeframe analysis, and additional indicators like ADX and Choppiness, this script delivers a detailed view of market conditions and signal strength—all while adhering to TradingView’s publication guidelines.

Key Features :

Money Flow Analysis :

Uses the MFI to assess buying and selling pressure, helping traders gauge market momentum.

Trend Switch Logic :

Employs ATR-based calculations to determine trend direction. The background color adjusts dynamically to signal bullish or bearish conditions, and a prominent center line changes color to reflect the prevailing trend.

Dynamic Support/Resistance :

Calculates oscillator support and resistance over a pivot lookback period. These levels help you identify potential breakouts or reversals as the MFI moves above or below prior levels.

Signal Metrics & Classifications :

Combines MFI values with additional metrics to classify signals into categories such as “Strong Bullish,” “Bullish,” “Bearish,” or “Strong Bearish.” An accompanying note provides details on momentum entry and overall signal strength.

Multi-Timeframe Order Flow Confirmatio n:

Analyzes the MFI on a higher timeframe to confirm order flow. This extra layer of analysis helps verify the short-term signals generated on your primary chart.

Volume and ADX Integration :

Incorporates volume analysis and a manual ADX calculation to further validate signal strength and trend stability. A dashboard displays these metrics for quick reference.

Choppiness Indicator :

Includes a choppiness index to determine if the market is trending or choppy. When the market is identified as choppy, the script advises caution by adjusting the overall signal note.

Comprehensive Dashboard :

A built-in dashboard presents key metrics—including ADX, MFI, order flow, volume score, and support/resistance details—allowing you to quickly assess market conditions at a glance.

How to Use :

Trend Identification : Monitor the dynamic background and center line colors to recognize bullish or bearish market conditions.

Signal Confirmation : Use the oscillator support/resistance levels along with the signal classifications and dashboard data to make informed entry or exit decisions.

Multi-Timeframe Analysis : Validate short-term signals with the higher timeframe MFI order flow confirmation.

Risk Management : Always combine these insights with your own risk management strategy and further analysis.

Disclaimer :

This indicator is provided for educational and informational purposes only. It does not constitute financial advice. Always perform your own analysis and use proper risk management before making any trading decisions. Past performance is not indicative of future results.

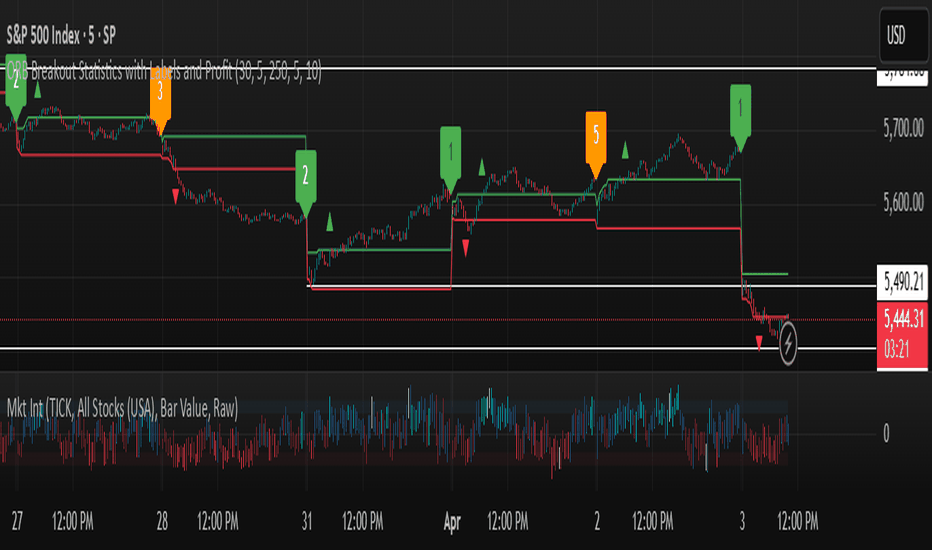

ORB Breakout Statistics with Labels and ProfitOpening Range Breakout Statistics – This indicator identifies the opening range based on user-defined inputs and detects breakouts above the high or below the low. At the end of each trading day, it classifies the session into a specific category based on price action. Additionally, it tracks profit and loss for each classification, allowing you to backtest the strategy using log files.

Multi-TF Volume & Price Analysis[BullByte]This indicator offers a comprehensive view of market dynamics by combining volume and price analysis across multiple timeframes. It calculates key metrics—such as bullish/bearish volume percentages, relative volume (RVol), cumulative volume delta (CVD), and price change percentages—for each timeframe that you choose (for example, 1, 3, 5, and 15 minutes). Here are the main features in simple terms:

- Multi-Timeframe Analysis:

The tool analyzes volume and price action from four different timeframes simultaneously. This means you get insights from short-term and slightly longer-term trends in one view.

- Volume Breakdown:

It splits the volume into bullish and bearish parts by comparing closing and opening prices. This helps you see how much of the trading volume is driving the market upward versus downward.

- Relative Volume & Spike Detection:

It calculates relative volume (current volume compared to a moving average) and flags any significant volume spikes based on a customizable multiplier. This feature helps identify unusual trading activity.

- Volume Smoothing Option:

For a cleaner signal, you can enable a smoothing option (using an exponential moving average) to reduce noise in the volume data.

- Advanced Summary:

The indicator combines volume data, price changes, and volume spikes to produce an overall market summary for each timeframe—labeling conditions as “Bullish Strong,” “Bullish Moderate,” “Bearish Strong,” “Bearish Moderate,” or “Neutral.”

- Cumulative Overview:

In addition to individual timeframe analysis, it aggregates the data to offer a cumulative view. This includes a collective bullish/bearish percentage, overall CVD, and even a simplified volume level (Low, Normal, or High).

- Customizable Dashboard:

All these metrics are neatly displayed in a dashboard on the chart. You can customize its position and text size. The dashboard uses dynamic, color-coded cells to instantly convey the market sentiment—making it easy to spot trends at a glance.

- VWAP Integration:

Finally, the dashboard includes VWAP information, providing an additional layer of context to the price action.

Overall, this indicator is designed to provide a quick yet thorough snapshot of market conditions, enabling traders to make more informed decisions with a clear visual representation of volume and price activity across different timeframes.

0900 and 1500 Candle Marker with Rectangles and FibonacciWelcome to the Indicator

// This tool is designed to help you analyze stock - crypto - or futures charts on TradingView by marking specific times - 9:00 AM and 3:00 PM (Eastern Time) - with colored rectangles and optional Fibonacci levels.

// It is perfect for spotting key moments in your trading day - like market opens or afternoon shifts - and understanding price ranges with simple lines and numbers.

// Whether you are new to trading or just want an easy way to visualize these times - this indicator is here to assist you.

//

// What It Does

// - Draws a green rectangle at 9:00 AM and a red rectangle at 3:00 PM on your chart - based on Eastern Time (America/New_York timezone).

// - Adds dashed lines inside these rectangles (called Fibonacci levels) to show important price points - like 0.236 or 0.618 of the rectangle’s height.

// - Places numbers on these lines (e.g. "0.5") so you can see exactly what each level represents.

// - Works on different chart types (stocks - crypto - futures) and adjusts for futures trading hours if needed.

// - Is designed to work best on timeframes of 1 hour or shorter (like 1-hour - 30-minute - 15-minute - 5-minute - or 1-minute charts) - where you can see the 9:00 AM and 3:00 PM candles clearly.

// - Lets you customize what you see through a settings menu - like hiding some lines or changing colors.

YOU MAY NOT MONETIZE

ANY PORTION OF THIS CODE.

WE ARE ALL IN THIS THING TOGETHER TO WIN.

BE A BLESSING ONTO THE WORLD AND GIVE.:)

Gufs VWAPI expanded on a public script to be able to show customizable horizontal price lines (and standard) on multiple timeframes (session, week, month, year) with corresponding text labels.

I like my charts clutter free, and this helps me accomplish that.

Let me know what you think, it's my first publish. Thanks!

Exponential Action Map (EAM)### **Exponential Action Map (EAM) – Description and Differences from VPVR**

The Exponential Action Map (EAM) indicator is a Pine Script-based volume profile indicator that offers **a weighted representation of buying and selling activity**. Unlike the standard **Volume Profile Visible Range (VPVR)**, which simply shows traded volume at various price levels, the EAM provides the following additional features:

1. **Exponential Weighting**:

- Instead of treating the volume of all considered bars equally, the EAM uses a **decay factor** to gradually diminish the significance of older data. This allows **more recent price movements to have greater influence**, making it particularly useful for short-term analysis.

2. **Exponential Stealth Move (ESM)**:

- In addition to buy and sell volume, the EAM calculates and displays the **Exponential Stealth Move (ESM)**.

- This measures the relative price movement compared to volume and highlights areas where **significant price changes occur with low volume**, which may indicate institutional activity or strong momentum.

- The ESM visualization is not present in VPVR, making it a distinct and valuable feature.

3. **Visualization Methodology**:

- Instead of simple histograms like in VPVR, volume is represented by **dynamic boxes** that encompass Buy (EBA), Sell (ESA), and Stealth Move (ESM) activities.

- The size and color of these boxes are **customizable**, allowing for clear differentiation between various volume types.

4. **Flexibility & Configuration**:

- Users can adjust parameters such as **Number of Bars, Decay Factor, Bar Width, and Maximum History Data**.

- The ability to **toggle historical data visibility** offers a **tailored view** that VPVR does not provide.

**Conclusion:** The EAM extends the classic volume profile (VPVR) by introducing **time-weighted volume analysis and detection of Stealth Moves (ESM)**. This not only highlights price levels with high trading volume but also reveals **price movements with low liquidity**, which can potentially indicate institutional interest.

Weekday Labels with Infinite Vertical LinesThis indicator is 2 part of "Daily Separator with Day". Add this indicator for open all adventage this 2 indicator

RSTrenderEMA based trend indicator with color candle logic.

Strategy: Enter one 1st white candle close coming off colored candles.

Target 1:1

www.youtube.com

Accumulation-Distribution CandlesThis enhanced price visualization tool interprets each candle through the lens of effort versus result, blending volume, range, and closing bias into a rich, color-coded display of Accumulation and Distribution pressure.

While compatible with any timeframe, this indicator is designed primarily for use on the 1D chart, where Wyckoff-style market phases are most clearly expressed. (Adjust visibility setting accordingly). After analyzing the high-timeframe phase, traders may switch to lower timeframes and apply faster execution tools more effectively.

Candle bodies are dynamically colored using a five-tier scale:

💙 Dark Blue — heavy accumulation

🩵 Pale Blue — mild accumulation

🌚 Gray — neutral / balanced behavior

💛 Pale Yellow — mild distribution

🧡 Deep Yellow — heavy distribution

Coloring is based on a normalized strength score, calculated using a blend of price movement and effort (with or without volume). This helps visually isolate Markup, Markdown, Re-accumulation, and Distribution at a glance.

The indicator also features optional microstructure overlays:

🟦 🟧 Zone highlighting — background shading for strong accumulation/distribution zones

📌 Pin bars — classic rejection wicks, optionally filtered by above-average volume

🔺 Fractals — 5-bar swing highs and lows, color-matched to the reference candle (not shown)

🟥 🟩 Engulfing candles — basic engulfing logic filtered by directional strength (not shown)

Every element is toggleable. The candle logic will auto-adjust for volume-less tickers such as DXY, and includes structural defaults for both traditional and crypto assets (5-day vs 7-day week logic).

🧐 Strategy tips: This tool is not meant to generate signals — it's meant to show the story. Start by identifying the market phase using the 1D chart, then move to lower timeframes with confluence tools such as SUPeR TReND 2.718 and/or the Granular MA Ribbon. This indicator is designed to slot cleanly into a multi-layered workflow of visual structure and informed execution.

Aarika MACDHello Traders,

This is a simple MACD just like any others as it looks, but I added MA with Options to choose from SMA, EMA or RMA instead of traditional macd signal. It allows a trader to be in the trade for longer time (moving average runs inside the macd bars), exit the position on time (moving average starts running outside the macd bars), shows a probable reversal of the trend (when 3 candles forms in light colour either light Green or light Red).

Default settings must be changed according to one's trading style. This indicator is published only to get you the idea about the probable trend and predict the next movements.

Please note that the author is not a financial advisor nor take any responsibility of traders' losses if script is traded on this basis.

Author personally uses this MACD as a supportive indicator or can say as a double confirmation.

Your suggestions are always welcome.

Thanks.

Range Filter Buy and Sell 5min## **Enhanced Range Filter Strategy: A Comprehensive Overview**

### **1. Introduction**

The **Enhanced Range Filter Strategy** is a powerful technical trading system designed to identify high-probability trading opportunities while filtering out market noise. It utilizes **range-based trend filtering**, **momentum confirmation**, and **volatility-based risk management** to generate precise entry and exit signals. This strategy is particularly useful for traders who aim to capitalize on trend-following setups while avoiding choppy, ranging market conditions.

---

### **2. Key Components of the Strategy**

#### **A. Range Filter (Trend Determination)**

- The **Range Filter** smooths price fluctuations and helps identify clear trends.

- It calculates an **adjusted price range** based on a **sampling period** and a **multiplier**, ensuring a dynamic trend-following approach.

- **Uptrends:** When the current price is above the range filter and the trend is strengthening.

- **Downtrends:** When the price falls below the range filter and momentum confirms the move.

#### **B. RSI (Relative Strength Index) as Momentum Confirmation**

- RSI is used to **filter out weak trades** and prevent entries during overbought/oversold conditions.

- **Buy Signals:** RSI is above a certain threshold (e.g., 50) in an uptrend.

- **Sell Signals:** RSI is below a certain threshold (e.g., 50) in a downtrend.

#### **C. ADX (Average Directional Index) for Trend Strength Confirmation**

- ADX ensures that trades are only taken when the trend has **sufficient strength**.

- Avoids trading in low-volatility, ranging markets.

- **Threshold (e.g., 25):** Only trade when ADX is above this value, indicating a strong trend.

#### **D. ATR (Average True Range) for Risk Management**

- **Stop Loss (SL):** Placed **one ATR below** (for long trades) or **one ATR above** (for short trades).

- **Take Profit (TP):** Set at a **3:1 reward-to-risk ratio**, using ATR to determine realistic price targets.

- Ensures volatility-adjusted risk management.

---

### **3. Entry and Exit Conditions**

#### **📈 Buy (Long) Entry Conditions:**

1. **Price is above the Range Filter** → Indicates an uptrend.

2. **Upward trend strength is positive** (confirmed via trend counter).

3. **RSI is above the buy threshold** (e.g., 50, to confirm momentum).

4. **ADX confirms trend strength** (e.g., above 25).

5. **Volatility is supportive** (using ATR analysis).

#### **📉 Sell (Short) Entry Conditions:**

1. **Price is below the Range Filter** → Indicates a downtrend.

2. **Downward trend strength is positive** (confirmed via trend counter).

3. **RSI is below the sell threshold** (e.g., 50, to confirm momentum).

4. **ADX confirms trend strength** (e.g., above 25).

5. **Volatility is supportive** (using ATR analysis).

#### **🚪 Exit Conditions:**

- **Stop Loss (SL):**

- **Long Trades:** 1 ATR below entry price.

- **Short Trades:** 1 ATR above entry price.

- **Take Profit (TP):**

- Set at **3x the risk distance** to achieve a favorable risk-reward ratio.

- **Ranging Market Exit:**

- If ADX falls below the threshold, indicating a weakening trend.

---

### **4. Visualization & Alerts**

- **Colored range filter line** changes based on trend direction.

- **Buy and Sell signals** appear as labels on the chart.

- **Stop Loss and Take Profit levels** are plotted as dashed lines.

- **Gray background highlights ranging markets** where trading is avoided.

- **Alerts trigger on Buy, Sell, and Ranging Market conditions** for automation.

---

### **5. Advantages of the Enhanced Range Filter Strategy**

✅ **Trend-Following with Noise Reduction** → Helps avoid false signals by filtering out weak trends.

✅ **Momentum Confirmation with RSI & ADX** → Ensures that only strong, valid trades are executed.

✅ **Volatility-Based Risk Management** → ATR ensures adaptive stop loss and take profit placements.

✅ **Works on Multiple Timeframes** → Effective for day trading, swing trading, and scalping.

✅ **Visually Intuitive** → Clearly displays trade signals, SL/TP levels, and trend conditions.

---

### **6. Who Should Use This Strategy?**

✔ **Trend Traders** who want to enter trades with momentum confirmation.

✔ **Swing Traders** looking for medium-term opportunities with a solid risk-reward ratio.

✔ **Scalpers** who need precise entries and exits to minimize false signals.

✔ **Algorithmic Traders** using alerts for automated execution.

---

### **7. Conclusion**

The **Enhanced Range Filter Strategy** is a powerful trading tool that combines **trend-following techniques, momentum indicators, and risk management** into a structured, rule-based system. By leveraging **Range Filters, RSI, ADX, and ATR**, traders can improve trade accuracy, manage risk effectively, and filter out unfavorable market conditions.

This strategy is **ideal for traders looking for a systematic, disciplined approach** to capturing trends while **avoiding market noise and false breakouts**. 🚀

Breakout & Breakdown Detector with CPRwhwn a break out is indicated enter into a buy position and whwn breakdown is indicated exit trade

EMA Technical Analysis with Reversal ZonesThis Pine Script is a comprehensive technical analysis indicator that combines multiple trend and momentum indicators to provide trading signals and market insights. It consists of two main components:

1. EMA-Based Technical Analysis:

• Uses multiple Exponential Moving Averages (EMAs) (8, 9, 20, 21, 50) to identify trends and crossovers.

• Includes Volume Weighted Average Price (VWAP) for institutional price tracking.

• Incorporates MACD, Parabolic SAR (PSAR), RSI, Bollinger Bands (BB), and ADX for additional trend confirmation.

• Monitors SPX (S&P 500) and VIX (Volatility Index) for broader market conditions.

• Plots bullish/bearish EMA crossovers and allows alert conditions for trading signals.

• Displays a technical analysis table summarizing market conditions.

2. Reversal and Confirmation Zones:

• Uses Bollinger Bands and RSI to identify overbought/oversold conditions.

• Highlights potential reversal zones with background color shading.

• Includes alert conditions for deep overbought/oversold signals.

• Implements an additional EMA (9/21) and MACD-based confirmation system to filter false signals.

Overall, this script is designed for traders looking to identify both trend-following and reversal opportunities while keeping track of key market indicators. It offers visual cues, alerts, and a structured technical analysis framework for decision-making.

FRACTAL DIMENSIONSFRACTAL DIMENSIONS was created to allow us to properly visualize

the higher time frame dimensional data, While remaining on a lower

time frame. The Fractal dimensions are basically the higher time frames.

Remaining on a lower time frame allows us to get tighter entries and exits.

Each dimension is set in a wave degree formation. From primary to sub-minute,

depending on the time frame being utilized.

These multidimensional wave degrees will be utilized later in the strategy.

This indicator was broken off of the whole for the sake of drawing lines.

The data here is just for debugging purposes and is not used in the strategy,

but yet remains pretty awesome by itself.

Fractal dimensions is the foundation of the main strategy to come.

Now that we have this data, what are we going to do with it?

Cz ASR indicatorAverage session range indicator built by me. Great tool to gauge volatility and intraday reversal zones. Great for FX as there is an included table that shows range in pips; however, this can be applied across all assets as a volatility measure.

How it works:

The script measures the range of sessions, including Asia, London, and New York. The lookback period could be adjusted so you can find what length works best and is most accurate. This is then averaged out to provide the ASR. This provides us with an upper and lower bound of which the price could potentially fluctuate in based on the past session ranges. I have also added the 50% ASR, which is also a super useful metric for reversals or continuations.

There is also a configurable UTC so that you can adjust the indicator so it can accurately measure the range within certain sessions.

Note - different session start and stop times vary from market to market. I have set the code to the standard forex market opens however, if you wish to change the time ,you are able to do so by editing the variables in the script

Enjoy :)

15-Min Breakout Strategy✅ Marks the highest high & lowest low from the 2nd and 3rd 15-minute candles

✅ Plots horizontal lines from the 3rd candle onwards (not extending forever)

✅ Detects when the next candle (4th or beyond) crosses these levels

✅ Plots a Green "Buy Signal" if price breaks the highest high

✅ Plots a Red "Sell Signal" if price breaks the lowest low

LIT - Timing V2This is the update script of LIT Timing.

This script is a session box indicator for timing with the differents sessions of Asia, London and New York.

Combined + Reversal By DemirkanThis indicator is a comprehensive tool designed to identify potential trend reversals, trend direction, and entry/exit points by combining multiple technical analysis instruments. It includes the following components:

Two Reversal Lines (Based on Donchian Channel): Two lines with different periods indicate potential support/resistance levels and trend changes.

Hull Moving Average (HMA): A smoother, less lagging moving average helps determine trend direction and short-term momentum.

Fibonacci Level: A dynamic Fibonacci retracement level, calculated based on the highest high and lowest low over a specific period, serves as a potential support or area of interest.

Signal Generation: Produces Buy/Sell signals based on the crossovers and conditions of these components.

Visual Aids: Enhances interpretation by coloring the area between lines, coloring candlesticks, and adding labels.

Detailed Component Description:

Input Parameters (Settings):

Reversal Line 1 Length (Default: 100): The period (number of bars) used to calculate the first reversal line. Longer periods capture slower, more significant trends.

Reversal Line 2 Length (Default: 33): The period used to calculate the second reversal line. Shorter periods react to faster, shorter-term changes.

HMA Length (Default: 100): The period for calculating the Hull Moving Average.

Source (Default: close): The price source used for all calculations (close, open, high, low, etc.).

Reversal Line Bar Offset (Default: 3): Determines how many bars forward the Reversal Lines are shifted on the chart. This can make signals appear slightly earlier (or later, depending on the strategy). 0 means no shift.

Fibonacci Level (Default: 0.382): Specifies the Fibonacci retracement level (between 0.0 and 1.0). Common levels like 0.382, 0.5, 0.618 can be used.

Lookback Period (Default: 20): The period (number of bars) over which to look back for the highest high and lowest low to calculate the Fibonacci level.

Price Margin (Default: 0.005): Tolerance (as a percentage) determining how close the price needs to be to the Fibonacci level to be considered "at the level". E.g., 0.005 = 0.5%. If the price is within 0.5% of the calculated Fibonacci level, the condition is met.

Calculations:

donchian(len) Function: Calculates the average (math.avg) of the highest high (ta.highest) and lowest low (ta.lowest) over a specific period (len). This is effectively the midline of a classic Donchian Channel and is used here as the "Reversal Line".

Reversal Lines (conversionLine1, conversionLine2): Calculated using the donchian function based on the user-defined conversionPeriods1 and conversionPeriods2 lengths.

Hull Moving Average (hullMA): Calculated using the hma function. This function uniquely combines Weighted Moving Averages (WMA) to achieve less lag.

Fibonacci Level Calculation (fibLevel1, isAtFibLevel): Finds the highest high and lowest low within the lookbackPeriod, calculates the range (priceRange). fibLevel1 is determined by subtracting priceRange * fibLevel from the highest high (representing a retracement level). isAtFibLevel checks if the current closing price is within the priceMargin tolerance of the calculated fibLevel1.

Visual Elements (Plots/Drawing):

plot(conversionLine1 , ...): Plots the first reversal line in blue, shifted forward by barOffset.

plot(conversionLine2 , ...): Plots the second reversal line in black, shifted forward by barOffset.

plot(hullMA, ...): Plots the Hull Moving Average in orange.

plot(fibLevel1, ...): Plots the calculated Fibonacci level as a light blue, dashed line.

fill(...): Fills the area between the two (shifted) reversal lines. The area is colored blue if conversionLine1 > conversionLine2 (often interpreted as bullish) and red otherwise (bearish). The color transparency is set to 90 (almost opaque).

label.*: Adds labels at trend change points. A "Buy" label appears when the area turns blue (Line 1 crosses above Line 2), and a "Sell" label appears when it turns red (Line 1 crosses below Line 2). Labels appear once when the trend starts and are updated/deleted when the trend changes.

plotshape(...): Plots shapes (arrows/labels) on the chart when specific conditions are met:

Reversal Crossover Signals: A green up arrow (shape.labelup) appears when conversionLine2 crosses above conversionLine1 (Buy Signal - buySignal). A red down arrow (shape.labeldown) appears when conversionLine1 crosses below conversionLine2 (Sell Signal - sellSignal).

Hull MA Signals: A green up arrow (hullBuySignal) appears when the price closes above the HMA after being below it. A red down arrow (hullSellSignal) appears when the price closes below the HMA after being above it.

Fibonacci Buy Signal: A purple up arrow (fibBuySignal) appears when both the price is near the calculated Fibonacci level (isAtFibLevel) and a Hull MA Buy signal (hullBuySignal) occurs simultaneously. This signifies a "confluence" signal.

barcolor(...): Changes the color of the candlesticks. Bars turn blue on a Hull MA Buy signal (hullBuySignal) and red on a Hull MA Sell signal (hullSellSignal). Otherwise, the bar color remains the default chart color.

How to Use / Interpret:

Trend Direction:

Observe the color of the filled area between the reversal lines (Blue = Uptrend, Red = Downtrend).

Note whether the price is above or below the Hull MA.

Consider the slope of the Hull MA (upward or downward).

Entry/Exit Signals:

Aggressive: Use the crossovers of the reversal lines (buySignal, sellSignal). Green arrow suggests buy, red arrow suggests sell.

Trend Following: Use the HMA crossovers (hullBuySignal, hullSellSignal). Green arrow suggests buy, red arrow suggests sell. The bar colors also confirm these signals visually.

Confirmed Buy: Look for the Fibonacci Buy Signal (Purple arrow). When the price reaches a potential support level (Fibonacci) and simultaneously gets an HMA Buy signal, it can be considered a stronger buy indication.

Support/Resistance:

The reversal lines themselves can act as dynamic support/resistance levels.

The plotted Fibonacci level (fibLevel1) can be monitored as a potential retracement and support zone.

Strategy:

Confluence (multiple signals aligning) can increase confidence. For example, a buySignal or hullBuySignal occurring while the HMA is pointing up and the fill area is blue might be considered stronger.

Adjust the barOffset parameter to fine-tune the timing of the visual signals according to your trading style.

Use the Fibonacci Buy signal to potentially find entry points after pullbacks in an uptrend or near potential bottoms after a decline.

Important Notes:

No single indicator provides 100% accurate signals. It's crucial to use this indicator in conjunction with other analysis methods (price action, chart patterns, volume, etc.) and sound risk management strategies.

The indicator's performance might vary in different market conditions (trending, sideways) and across different timeframes. Backtesting before live trading is recommended.

The barOffset value shifts the plotting of the lines forward visually but does not change the time at which the underlying calculation occurs (it's still based on the data up to the current closing bar).

Gioteen-NormThe "Gioteen-Norm" indicator is a versatile and powerful technical analysis tool designed to help traders identify key market conditions such as divergences, overbought/oversold levels, and trend strength. By normalizing price data relative to a moving average and standard deviation, this indicator provides a unique perspective on price behavior, making it easier to spot potential reversals or continuations in the market.

The indicator calculates a normalized value based on the difference between the selected price and its moving average, scaled by the standard deviation over a user-defined period. Additionally, an optional moving average of this normalized value (Green line) can be plotted to smooth the output and enhance signal clarity. This dual-line approach makes it an excellent tool for both short-term and long-term traders.

***Key Features

Divergence Detection: The Gioteen-Norm excels at identifying divergences between price action and the normalized indicator value. For example, if the price makes a higher high while Red line forms a lower high, it may signal a bearish divergence, hinting at a potential reversal.

Overbought/Oversold Conditions: Extreme values of Red line (e.g., significantly above or below zero) can indicate overbought or oversold conditions, helping traders anticipate pullbacks or bounces.

Trend Strength Insight: The normalized output reflects how far the price deviates from its average, providing a measure of momentum and trend strength.

**Customizable Parameters

Traders can adjust the period, moving average type, applied price, and shift to suit their trading style and timeframe.

**How It Works

Label1 (Red Line): Represents the normalized price deviation from a user-selected moving average (SMA, EMA, SMMA, or LWMA) divided by the standard deviation over the specified period. This line highlights the relative position of the price compared to its historical range.

Label2 (Green Line, Optional): A moving average of Label1, which smooths the normalized data to reduce noise and provide clearer signals. This can be toggled on or off via the "Draw MA" option.

**Inputs

Period: Length of the lookback period for normalization (default: 100).

MA Method: Type of moving average for normalization (SMA, EMA, SMMA, LWMA; default: EMA).

Applied Price: Price type used for calculation (Close, Open, High, Low, HL2, HLC3, HLCC4; default: Close).

Shift: Shifts the indicator forward or backward (default: 0).

Draw MA: Toggle the display of the Label2 moving average (default: true).

MA Period: Length of the moving average for Label2 (default: 50).

MA Method (Label2): Type of moving average for Label2 (SMA, EMA, SMMA, LWMA; default: SMA).

**How to Use

Divergence Trading: Look for discrepancies between price action and Label1. A bullish divergence (higher low in Label1 vs. lower low in price) may suggest a buying opportunity, while a bearish divergence could indicate a selling opportunity.

Overbought/Oversold Levels: Monitor extreme Label1 values. For instance, values significantly above +2 or below -2 could indicate overextension, though traders should define thresholds based on the asset and timeframe.

Trend Confirmation: Use Label2 to confirm trend direction. A rising Label2 suggests increasing bullish momentum, while a declining Label2 may indicate bearish pressure.

Combine with Other Tools: Pair Gioteen-Norm with support/resistance levels, RSI, or volume indicators for a more robust trading strategy.

**Notes

The indicator is non-overlay, meaning it plots below the price chart in a separate panel.

Avoid using a Period value of 1, as it may lead to unstable results due to insufficient data for standard deviation calculation.

This tool is best used as part of a broader trading system rather than in isolation.

**Why Use Gioteen-Norm?

The Gioteen-Norm indicator offers a fresh take on price normalization, blending statistical analysis with moving average techniques. Its flexibility and clarity make it suitable for traders of all levels—whether you're scalping on short timeframes or analyzing long-term trends. By publishing this for free, I hope to contribute to the TradingView community and help traders uncover hidden opportunities in the markets.

**Disclaimer

This indicator is provided for educational and informational purposes only. It does not constitute financial advice. Always backtest and validate any strategy before trading with real capital, and use proper risk management.

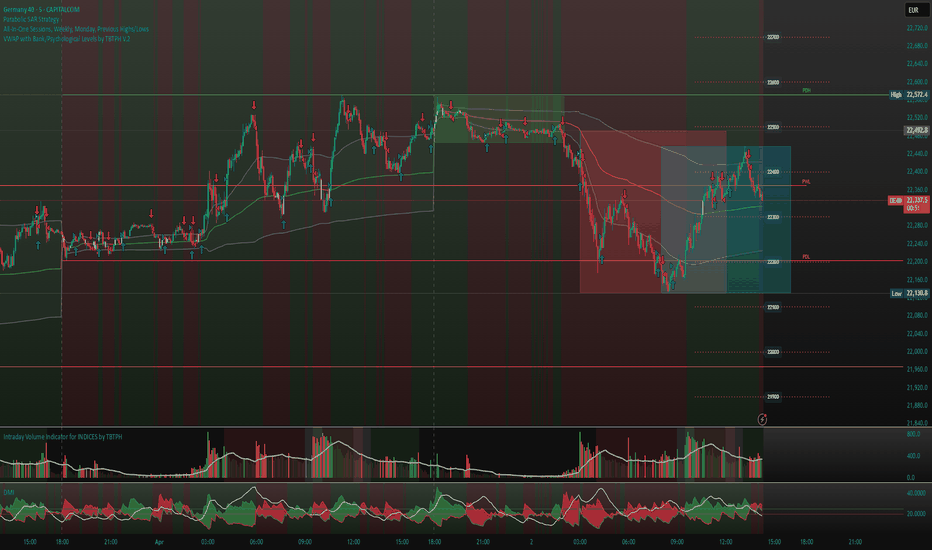

VWAP with Bank/Psychological Levels by TBTPH V.2This Pine Script defines a custom VWAP (Volume Weighted Average Price) indicator with several additional features, such as dynamic bands, bank levels, session tracking, and price-crossing detection. Here's a breakdown of the main elements and logic:

Key Components:

VWAP Settings:

The VWAP calculation is based on a source (e.g., hlc3), with an option to hide the VWAP on daily (1D) or higher timeframes.

You can choose the VWAP "anchor period" (Session, Week, Month, etc.) for adjusting the VWAP calculation to different time scales.

VWAP Bands:

The script allows you to plot bands above and below the VWAP line.

You can choose the calculation mode for the bands (Standard Deviation or Percentage), and the bands' width can be adjusted with a multiplier.

These bands are drawn using a gray color and can be filled to create a shaded area.

Bank Level Calculation:

The concept of bank levels is added as horizontal levels spaced by a user-defined multiplier.

These levels are drawn as dotted lines, and price labels are added to indicate each level.

You can define how many bank levels are drawn above and below the base level.

Session Indicators (LSE/NYSE):

The script identifies the open and close times of the London Stock Exchange (LSE) and the New York Stock Exchange (NYSE) sessions.

It limits the signals to only appear during these sessions.

VWAP Crossing Logic:

If the price crosses the VWAP, the script colors the candle body white to highlight this event.

Additional Plot Elements:

A background color is applied based on whether the price is above or below the 50-period Simple Moving Average (SMA).

The VWAP line dynamically changes color based on whether the price is above or below it (green if above, red if below).

Explanation of Key Sections:

1. VWAP and Band Calculation:

pinescript

Copy

= ta.vwap(src, isNewPeriod, 1)

vwapValue := _vwap

stdevAbs = _stdevUpper - _vwap

bandBasis = calcModeInput == "Standard Deviation" ? stdevAbs : _vwap * 0.01

upperBandValue1 := _vwap + bandBasis * bandMult_1

lowerBandValue1 := _vwap - bandBasis * bandMult_1

This code calculates the VWAP value (vwapValue) and standard deviation-based bands (upperBandValue1 and lowerBandValue1).

2. Bank Levels:

pinescript

Copy

baseLevel = math.floor(currentPrice / bankLevelMultiplier) * bankLevelMultiplier

The base level for the bank levels is calculated by rounding the current price to the nearest multiple of the bank level multiplier.

Then, a loop creates multiple bank levels:

pinescript

Copy

for i = -bankLevelRange to bankLevelRange

level = baseLevel + i * bankLevelMultiplier

line.new(x1=bar_index - 50, y1=level, x2=bar_index + 50, y2=level, color=highlightColor, width=2, style=line.style_dotted)

label.new(bar_index, level, text=str.tostring(level), style=label.style_label_left, color=labelBackgroundColor, textcolor=labelTextColor, size=size.small)

3. Session Logic (LSE/NYSE):

pinescript

Copy

lse_open = timestamp("GMT", year, month, dayofmonth, 8, 0)

lse_close = timestamp("GMT", year, month, dayofmonth, 16, 30)

nyse_open = timestamp("GMT-5", year, month, dayofmonth, 9, 30)

nyse_close = timestamp("GMT-5", year, month, dayofmonth, 16, 0)

The script tracks session times and filters the signals based on whether the current time falls within the LSE or NYSE session.

4. VWAP Crossing Detection:

pinescript

Copy

candleCrossedVWAP = (close > vwapValue and close <= vwapValue) or (close < vwapValue and close >= vwapValue)

barcolor(candleCrossedVWAP ? color.white : na)

If the price crosses the VWAP, the candle's body is colored white to highlight the cross.

Multi-Timeframe MA DashboardThis indicator monitors 5 timeframes: 5min, 15min, 1hr, 4hr, and Daily. It displays fast and slow moving averages for each timeframe, along with the current price. The trend direction is color-coded: green for bullish (fast MA above slow MA) and red for bearish (fast MA below slow MA).

The dashboard also shows the last crossover signal (Buy/Sell) for each timeframe.

Visual arrows are plotted on the chart for the current timeframe. A green up arrow indicates a potential bullish crossover (Buy signal), while a red down arrow indicates a potential bearish crossover (Sell signal).

The dashboard is elegant and professional, with alternating row colors for better readability. It can be placed in any corner of the screen and customized with user-defined colors for bullish and bearish trends.

Alerts are triggered when a crossover occurs on any timeframe. These alerts include the timeframe and signal type (e.g., "5min: ↑ BUY").

How to Read the Indicator

The dashboard displays the following for each timeframe:

Fast MA: The value of the fast moving average.

Slow MA: The value of the slow moving average.

Price: The current price for the timeframe.

Trend: The current trend direction (Bullish or Bearish).

Signal: The last crossover signal (↑ BUY or ↓ SELL).

On the chart, green up arrows indicate a bullish crossover (Fast MA crosses above Slow MA), while red down arrows indicate a bearish crossover (Fast MA crosses below Slow MA).

Green text in the dashboard indicates a bullish trend or signal, while red text indicates a bearish trend or signal.

How to Use the Indicator

Use the dashboard to monitor the trend direction across multiple timeframes. Look for confluence (agreement) between timeframes to identify stronger trends. Observe the "Signal" column in the dashboard for the last crossover on each timeframe. Use the arrows on the chart to identify potential crossover points for the current timeframe.

Enable alerts to be notified of crossover signals on any timeframe. Alerts include the timeframe and signal type for easy reference.

Adjust the fast and slow moving average lengths to suit your trading style. Choose between EMA, SMA, or WMA for the moving average type. Customize the dashboard placement and colors for better visibility.

Important Notes

This indicator is not a buy or sell recommendation. It is a tool to assist traders in their analysis. Always use this indicator in conjunction with other tools, such as support/resistance levels, volume analysis, and price action. Past performance of moving averages does not guarantee future results.

How to Add the Indicator

Add the indicator to your chart from the TradingView library. Configure the inputs:

Fast MA Length: Default is 20.

Slow MA Length: Default is 50.

MA Type: Choose between EMA, SMA, or WMA.

Dashboard Placement: Select the corner of the screen where the dashboard will appear.

Colors: Customize the colors for bullish and bearish trends.

Monitor the dashboard and chart for trends and signals.

Disclaimer

This indicator is for educational and informational purposes only. It does not provide financial, investment, or trading advice. Always perform your own analysis and consult with a financial advisor before making trading decisions.