Weight Convergence DivergenceWeight Convergence Divergence ⚖️

1. Introduction

The Weight Convergence Divergence (WCD) indicator applies principles of rotational equilibrium from classical physics to financial market analysis. By quantifying market momentum as a physical balance system, this indicator helps traders identify potential price reversals and continuation patterns through the visualization of market forces .

2. Theoretical Grounds 📚

The WCD draws inspiration from the physical concept of rotational equilibrium, where opposing forces create a balance or imbalance in a system (Giancoli, 2016, pp.247–249). In market analysis, this can be translated to the comparative measurement of bullish and bearish momentum (Bouchaud and Potters, 2003) . Lo and MacKinlay (1988) and Corbet and Katsiampa (2018) demonstrate that markets exhibit both mean-reverting and momentum characteristics, supporting the concept of opposing market forces that the WCD seeks to visualize. Bouchaud and Potters (2003) further highlight that principles from statistical physics can be applied to financial markets, providing a theoretical foundation for approaches like we are doing with the WCD.

3. Methodology 🧪

The WCD indicator quantifies market mass through the following approach:

Calculates mass by multiplying the candle's body (close-open) with volume mass = body * volume

Compares recent market mass (right side) with historical mass (left side)

Visualizes the equilibrium point with a dynamic balance line balance_ln

Generates signals when the balance shifts buy_signal = ta.crossover(right_mass, 0) and left_mass <= 0 and ly > middle_level

sell_signal = ta.crossunder(right_mass, 0) and left_mass >= 0 and ly < middle_level

4. Visual Elements 🎨

Balance Line: A tilting dashed line representing equilibrium between past and present market forces

🟩 Green Boxes: Positive market mass (bullishness)

🟥 Red Boxes: Negative market mass (bearishness)

▲ Buy Signals: When right mass turns positive while left mass is negative

▼ Sell Signals: When right mass turns negative while left mass is positive

5. Integrated Risk Management 🛡️

Automatic stop loss calculation based on Average True Range (ATR)

Dynamic profit targets calibrated to user-defined risk-reward ratios

Visual position management table to track entries, targets, and stops throughout trade duration

6. Parametrization ⚙️

Distance: Number of bars for mass calculation

ATR Length: Period for volatility calculation

ATR Factor: Multiplier applied to ATR for stop loss determination

Risk-Reward Ratio: Factor used for target calculation

7. Implementation Strategies 📈

7.1. Trend Reversal Strategy (More Risky) 🔄

Identify overextended market conditions

Wait for a counter-trend signal

Consider the calculated stop loss and take profit

7.2. Momentum Continuation Strategy (Less Risky) ➡️

Identify the prevailing trend

Look for multiple signals in the trend direction ( the balance line is not the trend! )

Wait for a second or third signal confirmation

Consider the calculated stop loss and take profit

8. Timeframe Flexibility: ⏱️

Lower timeframes (5-15m): Quick signals for scalping

Medium timeframes (30m-4h): Balanced for day trading

Higher timeframes (Daily+): Reliable signals for swing trading

9. References 📗

Bouchaud, J.-P. and Potters, M. (2003). Theory of Financial Risk and Derivative Pricing. doi: doi.org .

Corbet, S. and Katsiampa, P. (2018). Asymmetric mean reversion of Bitcoin price returns. International Review of Financial Analysis. doi: doi.org .

Giancoli, D.C. (2016). Physics : Principles with Applications. 7th ed. Harlow: Pearson Education, pp.247–249.

Lo, A.W. and MacKinlay, A.C. (1988). Stock Market Prices Do Not Follow Random Walks: Evidence from a Simple Specification Test. Review of Financial Studies, 1(1), pp.41–66. doi: doi.org .

Disclaimer ⚠️

The Weight Convergence Divergence indicator is designed for informational and educational purposes only. Past performance is not necessarily indicative of future results. Traders should conduct thorough analysis and employ proper risk management techniques. This tool does not constitute financial advice and should be used at the user's own discretion.

Индикаторы и стратегии

Nasdaq Risk Calculator - DTFXNasdaq Risk Calculator

This Pine Script (v5) indicator provides a dashboard-style tool for calculating trading risk based on manually input tick measurements for Nasdaq futures contracts (NQ and MNQ). Designed as an overlay on the main chart, it displays key risk metrics in a fixed-position table, allowing traders to assess contract type, lot size, risk ticks, and actual risk in dollars relative to a user-defined risk amount.

Features:

Manual Tick Input: Enter the number of ticks (e.g., from a ruler measurement) to define the price range for risk calculation.

Risk Calculation: Computes the optimal contract (NQ or MNQ), number of lots, risk ticks (half the input range), and actual risk in dollars, targeting the specified risk amount (default: $100).

Customizable Dashboard: Displays results in a single-cell table with a semi-transparent white background and gray border, positioned in one of four chart corners (Top Left, Top Right, Bottom Left, Bottom Right) via user selection.

Reset Option: Includes a toggle to clear the dashboard and start anew.

How to Use:

Add the indicator to your chart (best suited for NQ or MNQ futures).

In the settings, input your "Risk Amount ($)" and "Ticks" (e.g., 400 for a 100-point range on NQ).

Select the "Dashboard Corner" to position the table.

View the calculated risk details in the chosen corner.

Adjust inputs or reset as needed.

Notes:

NQ tick value is $5.00 (NQ_MULTIPLIER = 5.0), and MNQ tick value is $0.50 (MNQ_MULTIPLIER = 0.5).

Ideal for traders planning risk based on measured price ranges, such as support/resistance zones.

VCP Pattern with Pocket Pivots by Mark MinerviniBelow is a Pine Script designed to identify and plot Mark Minervini's Volatility Contraction Pattern (VCP) along with Pocket Pivots on TradingView. The VCP is characterized by a series of price contractions (tightening price ranges) with decreasing volume, often followed by a breakout. Pocket Pivots, a concept from Chris Kacher and Gil Morales, identify early buying opportunities within a consolidation or uptrend based on volume surges. This script combines both concepts to help traders spot potential setups.

NHPF (Normalized Hodrick-Prescott Filter)This indicator applies a normalized Hodrick–Prescott filter (NHPF) to Bitcoin’s price data. It separates the underlying trend from short-term cyclical fluctuations by recursively smoothing the price using a user-defined lambda (HP Filter Period). The raw trend is then normalized by calculating a ratio between the trend and the current price, which is scaled and shifted according to subjective parameters (Mean and Scale). The result is a dimensionless value that highlights deviations from the long-term trend—serving as a signal for potential overbought (positive values) or oversold (negative values) market conditions. A zero line provides a clear reference, allowing traders to visually gauge when Bitcoin’s price is significantly above or below its expected trajectory.

Feel free to adjust the inputs to best match your analysis preferences.

TheStrat: Failed 2'sThis indicator identifies and highlights Failed 2-Up (2U) and Failed 2-Down (2D) patterns in The Strat trading framework. These patterns signal a potential reversal when a 2-Up (higher high) or 2-Down (lower low) candle fails to follow through and reverses, offering high-probability trade setups.

FFT Approximation StrategyExperimenting FFT Strategy on YCL (USD/JPY 2 x)

This script approximates the effects of FFT by identifying convergence between short- and long-term cycles. While it doesn't provide the precision of true spectral analysis, it captures the essence of cyclical market behavior.

How FFT Concepts Improve YCL Entry Points

Cycle Identification:

Use external FFT analysis to identify dominant cycles in USD/JPY price movements.

Apply these cycles to refine entry zones for YCL.

Noise Filtering:

High-frequency components identified by FFT can help filter out market noise.

Focus on low-frequency trends for more reliable signals.

Timing Optimization:

Combine cycle analysis with gamma exposure proxies to pinpoint moments of accelerated price movement.

CCI with Subjective NormalizationCCI (Commodity Channel Index) with Subjective Normalization

This indicator computes the classic CCI over a user-defined length, then applies a subjective mean and scale to transform the raw CCI into a pseudo Z‑score range. By adjusting the “Subjective Mean” and “Subjective Scale” inputs, you can shift and rescale the oscillator to highlight significant tops and bottoms more clearly in historical data.

1. CCI Calculation:

- Uses the standard formula \(\text{CCI} = \frac{\text{price} - \text{SMA(price, length)}}{0.015 \times \text{mean deviation}}\) over a user-specified length (default 500 bars).

2. Subjective Normalization:

- After CCI is calculated, it is divided by “Subjective Scale” and offset by “Subjective Mean.”

- This step effectively re-centers and re-scales the oscillator, helping you align major lows or highs at values like –2 or +2 (or any desired range).

3. Usage Tips:

- CCI Length controls how far back the script measures average price and deviation. Larger values emphasize multi-year cycles.

- Subjective Mean and Scale let you align the oscillator’s historical lows and highs with numeric levels you prefer (e.g., near ±2).

- Adjust these parameters to fit your particular market analysis or to match known cycle tops/bottoms.

4. Plot & Zero Line:

- The indicator plots the normalized CCI in yellow, along with a zero line for quick reference.

- Positive values suggest price is above its long-term mean, while negative values suggest it’s below.

This approach offers a straightforward momentum oscillator (CCI) combined with a customizable normalization, making it easier to spot historically significant overbought/oversold conditions without writing complex code yourself.

[blackcat] L3 Breakout IndicatorOVERVIEW

This script provides a breakout detection system ( L3 Breakout Indicator) analyzing price momentum across timeframes. It identifies market entry/exit zones through dynamically scaled thresholds and visual feedback layers.

FEATURES

Dual momentum visualization: • Price Momentum Ratio Plot ( yellow ) • Filtered Signal Value Plot ( fuchsia )

Adjustable trade boundaries: ▪ Lower Threshold (default: 0.5) ▪ Upper Threshold (default: 2.9) ▪ Central boundary ( fixed at 2.0 )

Real-time visual feedback: ☀ Buy zone highlights ( lime ) on momentum crossover ⚠ Sell zone highlights ( red ) on momentum cross-under ♦ Dynamic convergence area between plots ( colored gradient )

HOW TO USE

Interpretation Flow

Monitor momentum plots relative to threshold lines

Actionable signals occur when momentum crosses thresholds

Persistent movement above/below central boundary indicates trend continuation

Key Zones

• Below 0.5: Potential buying opportunity zone

• Above 2.0: Cautionary selling region

• Between 0.5-2.0: Neutral consolidation phase

Optimization Tips

Adjust thresholds based on asset volatility

Combine with volume metrics for confirmation

Backtest parameters using historical data

LIMITATIONS

• Lag induced by 4-period EMA smoothing

• Historical dependency in calculating extremes (lowest(100)/highest(250))

• No built-in risk management protocols (stop loss take profit)

• Performance variability during sideways markets

SuperTrend AI with RSI, EMA & Dynamic S/RSupport, resistance, entry and exit signals, and combining the average with the relative strength

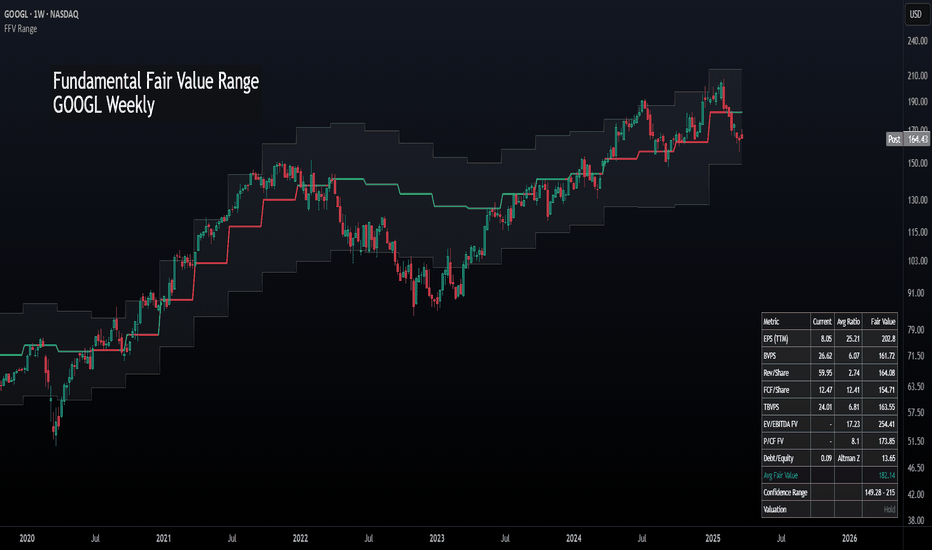

Fundamental Fair Value RangeFundamental Fair Value Range

This indicator calculates and visualizes a company's intrinsic fair value based on several fundamental valuation metrics, including Price-to-Earnings (P/E), Price-to-Book (P/B), Price-to-Sales (P/S), Price-to-Free Cash Flow (P/FCF), Price-to-Tangible Book Value (P/TBV), Enterprise Value-to-EBITDA (EV/EBITDA), and Price-to-Cash Flow (P/CF). It dynamically computes median historical ratios to establish a robust fair value range, enhanced by forward-looking estimates and adjusted for financial risk and dividend yield.

Features :

Dynamic Valuation Metrics : Combines historical and forward-looking financial data to calculate realistic fair value estimates.

Flexible Weighting System : Assign customized weights to valuation metrics depending on profitability conditions (positive or negative EPS).

Risk & Dividend Adjustments : Includes risk assessment via Debt-to-Equity and Altman Z-Score, and adjusts valuations for dividends up to a specified cap.

Confidence Range Visualization : Displays fair value with clearly marked upper and lower confidence bounds to simplify interpretation.

Customizable Display : Table position, text size, and theme (dark or light mode) can be adjusted for optimal readability and integration into your chart layout.

Strengths:

Incorporates multiple robust valuation metrics for a comprehensive analysis.

Adapts dynamically to changing financial conditions.

Provides clear actionable signals for investors.

Weaknesses:

Relies heavily on historical data, which may not fully capture future market disruptions.

Sensitivity to user-defined parameters may impact reliability; careful selection is required.

To use this indicator, simply apply it to your chart and customize parameters according to your analysis preferences. Monitor signals closely to identify stocks trading below or above intrinsic value, guiding investment decisions with greater confidence.

This indicator is freely available and open-source on TradingView for everyone to use. Enjoy!

US500 Institutional Bias - MultiTF Pro EditionUS500 Institutional Bias – Multi-Timeframe Pro Edition

This custom-built TradingView indicator is designed to replicate an institutional-level bias model using multi-timeframe analysis, trend structure, and volume-based smart money signals. It combines over 20 high-value components into a single, weighted directional score — helping traders determine whether the environment favors long, short, or neutral positioning.

✅ Key Features & What It Does:

📈 Multi-Timeframe Trend Following

Analyzes EMA structures (fast > mid > slow) on:

M1 (intrabar)

M5

M15

H1

1D

Each timeframe contributes to the final bias based on its weight.

Higher timeframes like H1 and D1 have stronger influence on the overall direction.

🧠 Bias Score Calculation

The script calculates a composite Bias Score by summing weighted signals from:

Moving Averages (Trend)

MACD Histogram (Momentum)

RSI & Stochastic (Mean Reversion)

MFI, OBV, ADL, CMF (Volume Flow)

TSI & ROC (True Strength)

VWAP relationship

Bollinger Band squeeze detection

Donchian Channel positioning

RSI divergence detection

Relative Vigor Index & Volatility Index

Seasonality (month-based behavior)

🔺 Smart Money & Liquidity Zones

Highlights potential Order Blocks

Detects Volume Spikes and Support/Resistance pivots

📊 Visual Outputs

Color-coded chart background based on bias intensity

Triangle signals for Strong Long or Strong Short zones

Divergence dots when price and RSI disagree (early reversal alerts)

Optional Bias Panel to show total score and market state

🧭 Use Case

This tool is ideal for:

Intraday scalpers and swing traders

Confirming trend alignment across timeframes

Avoiding trades during neutral or conflicting structure

Combining technical and sentiment-based signals

ES vs Bond ROCThis Pine Script plots the Relative Rate of Change (ROC) between the S&P 500 E-mini Futures (ES) and 30-Year Treasury Bond Futures (ZB) over a specified period. It helps identify when equities are overperforming or underperforming relative to long-term bonds—an insight often used to detect risk-on/risk-off sentiment shifts in the market.

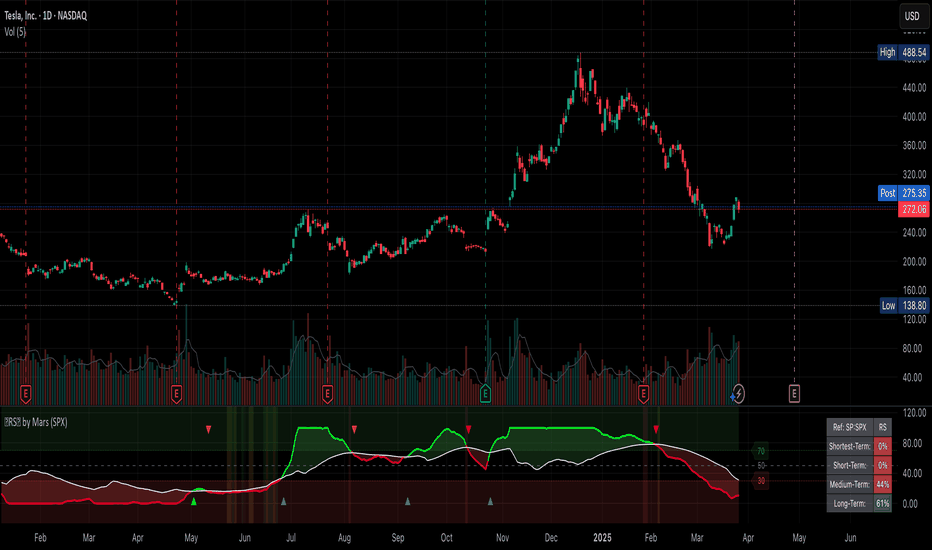

Relative Strength Indicator## ✨RS✨ by Mars: Advanced Relative Strength Indicator

This indicator solves the primary weakness of traditional RS tools: excessive choppiness and false signals. By combining three calculation methods (ratio, performance, or logarithmic comparison) with dynamic filtering techniques, it identifies true trend changes and stock leadership with significantly higher reliability.

### Key Features:

- Multi-timeframe strength analysis (default 10, 21, 63, and 200-period measurements)

- Dynamic signal line with customizable crossing alerts

- Clear visualization with color-coded fills and special crossover signals

- Reversal detection system using momentum and line convergence

- RSI-like scaling (0-100) for easier interpretation with special crossings on overbought and oversold zones.

### Trading Applications:

- Filter out market noise to identify genuine sector/asset leadership shifts

- Eliminate false signals through the convergence of multiple confirmation factors (momentum, proximity, signal crossovers)

- Detect high-probability reversals only when multiple conditions align, reducing premature entries

- Use special signals (bright triangles) for high-confidence entry/exit points when crossovers occur in extreme zones

- Monitor trend reliability through multi-timeframe RS strength percentages

Unlike conventional RS indicators that produce frequent whipsaws, this tool waits for confluent signals across multiple factors. The combination of smoothed RS readings, signal line convergence, and multi-timeframe analysis creates a comprehensive system for identifying market leadership with dramatically reduced false signals. Perfect for rotation strategies and sector allocation decisions where reliability matters more than frequency.

Video:

HBND ReferenceChart the HBND as an index based on weighting found on the HBND Etf website. For best results display the adjusted close since HBND is a high yielding fund. The weightings have to be updated manually.

There are three display options:

1. Normalize the index relative to the symbol on the chart (presumably HBND) and this is the default.

2. Percentage change relative to the first bar of the index

3. The raw value which will be the tlt price * tlt percentage weighting + vglt price * vglt percentage weighting + edv percentage weighting * edv price.

Relative Crypto Dominance Polar Chart [LuxAlgo]The Relative Crypto Dominance Polar Chart tool allows traders to compare the relative dominance of up to ten different tickers in the form of a polar area chart, we define relative dominance as a combination between traded dollar volume and volatility, making it very easy to compare them at a glance.

🔶 USAGE

The use is quite simple, traders just have to load the indicator on the chart, and the graph showing the relative dominance will appear.

The 10 tickers loaded by default are the major cryptocurrencies by market cap, but traders can select any ticker in the settings panel.

Each area represents dominance as volatility (radius) by dollar volume (arc length); a larger area means greater dominance on that ticker.

🔹 Choosing Period

The tool supports up to five different periods

Hourly

Daily

Weekly

Monthly

Yearly

By default, the tool period is set on auto mode, which means that the tool will choose the period depending on the chart timeframe

timeframes up to 2m: Hourly

timeframes up to 15m: Daily

timeframes up to 1H: Weekly

timeframes up to 4H: Monthly

larger timeframes: Yearly

🔹 Sorting & Sizing

Traders can sort the graph areas by volatility (radius of each area) in ascending or descending order; by default, the tickers are sorted as they are in the settings panel.

The tool also allows you to adjust the width of the chart on a percentage basis, i.e., at 100% size, all the available width is used; if the graph is too wide, just decrease the graph size parameter in the settings panel.

🔹 Set your own style

The tool allows great customization from the settings panel, traders can enable/disable most of the components, and add a very nice touch with curved lines enabled for displaying the areas with a petal-like effect.

🔶 SETTINGS

Period: Select up to 5 different time periods from Hourly, Daily, Weekly, Monthly and Yearly. Enable/disable Auto mode.

Tickers: Enable/disable and select tickers and colors

🔹 Style

Graph Order: Select sort order

Graph Size: Select percentage of width used

Labels Size: Select size for ticker labels

Show Percent: Show dominance in % under each ticker

Curved Lines: Enable/disable petal-like effect for each area

Show Title: Enable/disable graph title

Show Mean: Enable/disable volatility average and select color

Zero-Lag MA Trend Levels [jineet]hello this indicator can be used for crypto and forex both works well.....

hammer1822Indicator that helps identify hammer patterns, both bullish and bearish, taking into account previous highs and lows.

EMA Stacking Indicator with VWAP, MACD and ConfirmationEMA Stacking Indicator with VWAP & MACD Confirmation

This indicator combines EMA stacking, VWAP positioning, and MACD crossovers to help identify potential trend continuation and reversal points.

Features:

✅ EMA Stacking Strategy – Uses 10, 20, and 50 EMA to detect bullish and bearish trends.

✅ VWAP Confirmation – Ensures price is above VWAP for bullish signals and below for bearish signals.

✅ MACD Crossovers – Highlights bullish and bearish MACD crossovers with arrows for extra confirmation.

✅ Custom Colors & Signals – Clearly plotted moving averages and buy/sell markers to improve chart visibility.

How It Works:

A bullish trend is detected when the 10 EMA > 20 EMA > 50 EMA, and price is above VWAP.

A bearish trend is detected when the 10 EMA < 20 EMA < 50 EMA, and price is below VWAP.

MACD Bullish Crossovers (green arrows) indicate potential uptrend momentum.

MACD Bearish Crossovers (red arrows) suggest possible downtrend shifts.

This tool is perfect for traders looking to combine moving averages with volume-weighted confirmation and MACD momentum shifts for stronger trade setups.

🔹 Let me know your thoughts and feedback! 🚀

DOPT---

## 🔍 **DOPT - Daily Open & Price Time Markers**

This script is designed to support directional bias development and price behavior analysis around key time-based reference points on the **1H and 4H timeframes**.

### ✨ **What It Does**

- **1800 Open Marker** (6 PM NY time): Plots the **daily open** from 1800 in **black dotted lines**.

- **0000 Open Marker** (Midnight NY time): Plots the **midnight open** in **blue dotted lines**.

- **Day Letters**: Each 1800 open is labeled with the corresponding **day of the week** (e.g., M, T, W...), helping visually segment your chart.

- **Hour Labels**: Select specific candles (e.g., 0000 = '0', 0800 = '8') to be labeled above the bar. These are fully customizable.

- **Candle Midpoints**: Option to mark the **50% level** of a specific candle (good for CE or CRT references).

- **CRT High/Low Tracking**: Ability to plot **extended high and low lines** from a selected candle back (e.g., for CRT modeling).

- **4H Timeframe Candle Numbering**: Helpful when analyzing sequences on the 4-hour timeframe. Candles are numbered `1`, `5`, and `9` for reference.

---

### 🧠 **How I Use It**

- I mostly use this on the **1-hour timeframe** to decide **directional bias** for the day:

- If price **closes above 1800 open**, I consider that a **green daily close** — potential bullish sentiment.

- If price **closes below**, I treat it as a **red daily close** — potential bearish behavior.

- Price often uses these opens as **support/resistance**, so I watch for reactions there.

- On the **4H**, the candle numbers help track structure and flow.

- Combine with CRT tools to mark **key candle highs/lows** and their **equilibrium (50%)** — great for refining entries or understanding how price is respecting a particular candle.

---

### ⚠️ **Note on Daylight Savings**

This is a **daylight saving time-dependent script**. When DST kicks in or out, you’ll need to **adjust the time inputs** accordingly to keep the opens accurate (e.g., 1800 might shift to 1700 depending on the season).

---

### 🔁 **Backtesting & Reference**

- The **1800 and 0000 opens** are plotted for **as far back** as your chart loads, making it great for backtesting historical reactions.

- The CRT marking tools only go back **50 candles max**, so use that for recent structure only.

---

Advanced Swing High/Low Trend Lines with MA Filter# Advanced Swing High/Low Trend Lines Indicator

## Overview

This advanced indicator identifies and draws trend lines based on swing highs and lows across three different timeframes (large, middle, and small trends). It's designed to help traders visualize market structure and potential support/resistance levels at multiple scales simultaneously.

## Key Features

- *Multi-Timeframe Analysis*: Simultaneously tracks trends at large (200-bar), middle (100-bar), and small (50-bar) scales

- *Customizable Visualization*: Different colors, widths, and styles for each trend level

- *Trend Confirmation System*: Requires minimum consecutive pivot points to validate trends

- *Trend Filter Option*: Can align trends with 200 EMA direction for consistency

## Recommended Settings

### For Long-Term Investors:

- Large Swing Length: 200-300

- Middle Swing Length: 100-150

- Small Swing Length: 50-75

- Enable Trend Filter: Yes

- Confirmation Points: 4-5

### For Swing Traders:

- Large Swing Length: 100

- Middle Swing Length: 50

- Small Swing Length: 20-30

- Enable Trend Filter: Optional

- Confirmation Points: 3

### For Day Traders:

- Large Swing Length: 50

- Middle Swing Length: 20

- Small Swing Length: 5-10

- Enable Trend Filter: No

- Confirmation Points: 2-3

## How to Use

### Identification:

1. *Large Trend Lines* (Red/Green): Show major market structure

2. *Middle Trend Lines* (Purple/Aqua): Intermediate levels

3. *Small Trend Lines* (Orange/Blue): Short-term price action

### Trading Applications:

- *Breakout Trading*: Watch for price breaking through multiple trend lines

- *Bounce Trading*: Look for reactions at confluence of trend lines

- *Trend Confirmation*: Aligned trends across timeframes suggest stronger moves

### Best Markets:

- Works well in trending markets (forex, indices)

- Effective in higher timeframes (1H+)

- Can be used in ranging markets to identify boundaries

## Customization Tips

1. For cleaner charts, reduce line widths in congested markets

2. Use dotted styles for smaller trends to reduce visual clutter

3. Adjust confirmation points based on market volatility (higher for noisy markets)

## Limitations

- May repaint on current swing points

- Works best in trending conditions

- Requires sufficient historical data for longer swing lengths

This indicator provides a comprehensive view of market structure across multiple timeframes, helping traders make more informed decisions by visualizing the hierarchy of support and resistance levels.

SMA & EMA Trend IndicatorIndicator that will use SMA and EMA to determine the price direction. The logic is:

If EMA (fast) is above SMA (slow) → uptrend (up arrow).

If EMA is below SMA → downtrend (down arrow).

ALTIN - XAUTRYG % Fiyat Farkı AlarmıThis indicator calculates the percentage difference between GOLD and XAUTRYG prices, displays it visually as a label and generates an alarm when it goes below the threshold value you set.

🔍 Features:

✅ Calculates the **percentage price difference** between GOLD and XAUTRYG

✅ User-defined 3 level colour threshold: e.g. 1-2-3% → green-yellow-orange-red

✅ Increase/decrease indication with **🔼 / 🔽 direction arrow** according to the changing difference

✅ Comment based on its position in the last 20 bars:

- (**HIGHEST** of the last 20 bars)

- (**LOWEST** of the last 20 bars)

✅ Only visible on **GOLD** or **XAUTRYG** chart

✅ Alarm condition: Triggered when the difference falls below the set percentage threshold value

💡 What does it do?

This tool is ideal for investors who want to analyse the price difference between gram gold mint and spot gold, observe **arbitrage opportunities** and receive **alerts** at certain levels.

📈 Quickly recognise when the price gap widens or narrows.

🔔 Don't miss opportunities by setting an alarm if you wish!

💬 I welcome your improvement suggestions and feedback.