Dynamic Support and Resistance"Dynamic Support & Resistance" Indicator: Find Key Price Levels Easily

This indicator helps you quickly spot potential support and resistance levels on your chart. Think of these levels as price "floors" (support) and "ceilings" (resistance) where the price might bounce or change direction.

How to Use It:

Add it to your chart: Search for "Support and Resistance Zones" in TradingView's indicator library and add it to your chart.

See the lines: You'll see green dashed lines for support and red dashed lines for resistance.

Understand the levels:

Green lines (Support): These show price levels where buyers might step in and push the price back up.

Red lines (Resistance): These show price levels where sellers might step in and push the price back down.

Adjust the settings (optional):

You can change how sensitive the indicator is by adjusting the "Support Window" and "Resistance Window" settings. A smaller number finds more levels, a larger number finds fewer, but potentially stronger levels.

Use it for your trading:

Look for price bounces at support levels to consider buying.

Look for price reversals at resistance levels to consider selling.

These levels can also help you decide where to place stop-loss orders.

Why it's useful:

Saves time: It automatically finds these important price levels, so you don't have to draw them manually.

Easy to see: The colored lines make the levels clear and easy to understand.

Helps with decisions: It gives you potential entry and exit points for your trades.

In simple terms, this indicator makes it easier to see where the price might change direction, helping you make smarter trading choices.

Индикаторы и стратегии

Relative Volume Indicator (RVOL)Relative Volume Indicator (RVOL)

The Relative Volume Indicator (RVOL) helps traders identify unusual volume activity by comparing the current volume to the average historical volume. This makes it easier to spot potential breakouts, reversals, or significant market events that are accompanied by volume confirmation.

What This Indicator Shows

This indicator displays volume as a multiple of average volume, where:

- 1.0x means 100% of average volume

- 2.0x means 200% of average volume (twice the average)

- 0.5x means 50% of average volume (half the average)

Color Coding

The volume bars are color-coded based on configurable thresholds:

- Red: Below average volume (< Average Volume Threshold)

- Yellow: Average volume (between Average Volume and Above Average thresholds)

- Green: Above average volume (between Above Average and Extreme thresholds)

- Magenta: Extreme volume (> Extreme Volume Threshold)

Horizontal Reference Lines

Three dotted horizontal reference lines help you visualize the thresholds:

- Lower gray line: Average Volume Threshold (default: 0.8x)

- Upper gray line: Above Average Threshold (default: 1.25x)

- Magenta line: Extreme Volume Threshold (default: 4.0x)

How To Use This Indicator

1. Volume Confirmation: Use green bars to confirm breakouts or trend changes - stronger moves often come with above-average volume.

2. Low Volume Warning: Red bars during price movements may indicate weak conviction and potential reversals.

3. Extreme Volume Events: Magenta bars (extreme volume) often signal major market events or potential exhaustion points that could lead to reversals.

4. Volume Divergence: Look for divergences between price and volume - for example, if price makes new highs but volume is decreasing (more yellow/red bars), the move may be losing strength.

Settings Configuration

- Average Volume Lookback Period: Number of bars used to calculate the average volume (default: 20)

- Average Volume Threshold: Volume below this level is considered below average (default: 0.8x)

- Above Average Threshold: Volume above this level is considered above average (default: 1.25x)

- Extreme Volume Threshold: Volume above this level is considered extreme (default: 4.0x)

- Colors: Customize colors for each volume category

Important Note: Adjust threshold values only through the indicator settings (not in the Style tab). Changing values in the Style tab will not adjust the coloring of the volume bars.

Adjust these settings based on the specific asset being analyzed and your trading timeframe. More volatile assets may require higher thresholds, while less volatile ones might need lower thresholds.

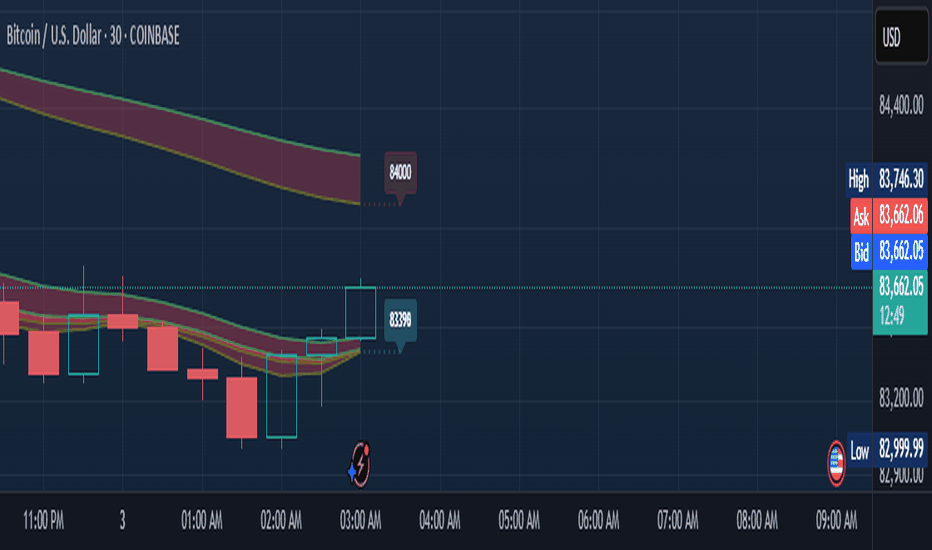

EMA Price Range by tuanduongEMA Price Range Indicator – Dynamic Range Analysis with Custom EMA (tuanduong2511)

Overview

The EMA Price Range Indicator is designed to help traders visualize the distance between price action and a key Exponential Moving Average (EMA). This indicator dynamically calculates the range from each candle to a user-defined EMA and displays it in a real-time table. By understanding the relationship between price and the EMA, traders can better gauge potential support, resistance, and overextension in the market.

Key Features

✅ Customizable EMA – Allows users to choose the EMA period that best suits their strategy (default: 144).

✅ Real-Time Range Calculation – Computes the absolute difference between the EMA and the price (using the high or low, depending on whether the candle is above or below the EMA).

✅ Minimalist UI – The EMA is plotted directly on the chart, while a small table in the bottom-right corner provides numerical insights, reducing chart clutter.

✅ Versatile Use Cases – Suitable for trend-following traders (identifying pullbacks to EMA) and mean-reversion traders (spotting extended price movements).

How It Works

User-Defined EMA:

The script calculates an Exponential Moving Average (EMA) based on the selected period.

EMA adapts dynamically, giving more weight to recent price movements.

Range Calculation:

If the price is above the EMA, the range is measured from the high point of the candle to the EMA.

If the price is below the EMA, the range is measured from the low point of the candle to the EMA.

This approach ensures that we’re measuring the most relevant distance for price interaction.

Live Table Display:

The current EMA value and the distance (range) from the price are displayed in a small table in the bottom-right corner of the chart.

How to Use It

📌 Trend Traders: Use the indicator to track pullbacks to key EMAs (e.g., EMA 50, 144, or 200). When the price is far from the EMA, it may indicate an overextended trend or potential retracement zone.

📌 Mean Reversion Traders: Look for extreme deviations between price and the EMA. Large distances can signal potential price snapbacks to the mean.

📌 Scalping & Day Trading: Short-term traders can use it with fast EMAs (e.g., EMA 21 or 34) to measure quick price movements relative to short-term momentum.

Why This Indicator?

Unlike traditional EMA indicators, which only plot a moving average, this script provides quantifiable price distance to the EMA, helping traders make data-driven decisions. It allows traders to answer:

✅ Is the price stretched too far from the EMA?

✅ Should I wait for a pullback before entering?

✅ Is the trend strong, or is the price losing momentum?

By integrating EMA-based range analysis, traders gain a clearer understanding of market conditions and can improve their entry, exit, and risk management strategies.

EMA CloudIt's provide the area of value between 2 EMA. Additional 1 EMA long term for determine the market status.

FunkyQuokka's $ Volume💡 Why $ Volume Matters

Share volume alone is a half-truth — 1M shares traded at $5 isn’t the same as 1M shares at $500. That’s where dollar volume steps in, offering a far more accurate view of institutional interest, breakout validity, liquidity zones and overall trader conviction.

📈 Features:

Clean histogram of dollar volume (close × volume)

Orange line showing customizable average $ volume

K/M/B formatting for axis scale (no huge ugly numbers)

Minimal design to blend into a multi-pane layout

⚙️ Inputs:

Tweakable average length – defaults to 20

By FunkyQuokka 🦘

Turnover in CroreA simple indicator for turnover in crores.

You can set a threshold volume of your choice, and the indicator will display volumes below this threshold in red and volumes above it in green.

Triple EMA + Volume/Price SignalsOverview

This script merges three exponential moving averages (EMA) with adaptive volume thresholds to identify high-confidence trends. Unlike basic volume indicators, it triggers signals only when volume exceeds both a user-defined absolute value (e.g., 500k) and a percentage increase (e.g., 5%) – reducing noise in volatile markets.

Key Features

Triple EMA System:

Short (9), Medium (21), and Long (50) EMAs for trend direction.

Bullish Signal: Short EMA > Medium EMA > Long EMA.

Bearish Signal: Short EMA < Medium EMA < Long EMA.

Dual-Threshold Volume Confirmation:

Absolute Volume: Highlight bars where volume exceeds X (e.g., 500,000).

Percentage Increase: Highlight bars where volume rises by Y% (e.g., 5%) vs. prior bar.

Users can enable/disable either threshold.

Customizable Alerts:

Trigger alerts only when both EMA alignment and volume conditions are met.

How It Works

Trend + Volume Synergy:

A bullish EMA crossover alone might be a false breakout. This script requires additional volume confirmation (e.g., 500k volume + 5% spike) to validate the move.

Flexibility: Adjust thresholds for different assets:

Stocks: Higher absolute volume (e.g., 1M shares).

Crypto: Smaller absolute volume but larger % spikes (e.g., 10%).

Usage Examples

Swing Trading:

Set EMA lengths to 20/50/200 and volume thresholds to 500k + 5% on daily charts.

Scalping:

Use 5/13/21 EMAs with 100k volume + 3% spikes on 5-minute charts.

Tendencia y Fuerza [4H - Sin Límites]This custom indicator combines two key elements for analyzing financial markets on a 4-hour timeframe:

Trend direction (bullish/bearish).

Brute force of the movement (no numerical limits).

🔍 Main Components:

1. Trend Line (Green/Red):

Green: Uptrend (20 EMA > 50 EMA on the 4-hour period).

Red: Downtrend (20 EMA < 50 EMA on the 4-hour period).

Purpose: To quickly identify market direction.

--------------------------------------------------------------------------------------------------------------------

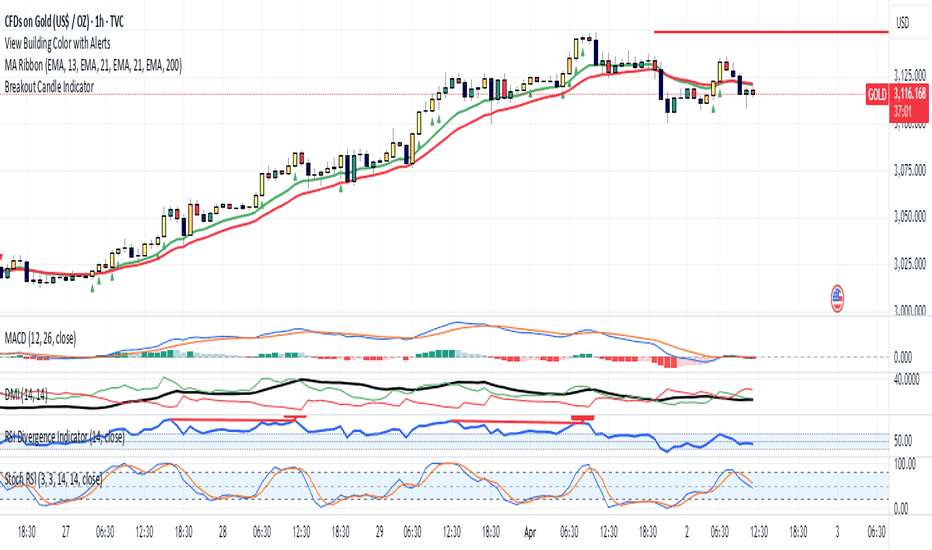

EMA & RSI & MACD & Stochastic sec TTD

---

## **EMA & RSI & MACD – Trend Dashboard by Timeframe**

This script is a **multi-timeframe trend dashboard** that combines several popular technical indicators across key timeframes to give traders a **quick snapshot of trend direction**.

---

### 🔍 **What This Indicator Does**

This indicator visually displays the **trend bias** from five key indicators:

- **EMA 50/200**: Long-term trend (classic golden/death cross logic)

- **EMA 5/7/9**: Short-term trend

- **RSI (14)**: Momentum trend using RSI vs its own 14-SMA

- **MACD**: MACD line vs Signal line

- **EMA 5 vs SMA 14**: A unique short-to-mid-term trend perspective

Each trend is represented by an emoji symbol:

- 🟢 **Uptrend**

- 🔴 **Downtrend**

- ⚫️ **Neutral**

---

### 🕒 **Covered Timeframes**

You can toggle on/off each timeframe as needed:

- 2H

- 3H

- 4H

- 8H

- 12H

- 1D

These are displayed vertically, with trend indicators across columns, so you can spot multi-timeframe confluence easily.

---

### 📊 **Dashboard Features**

- Positioned **on chart** at customizable screen locations (e.g., Middle Right, Bottom Left, etc.)

- **Table color, text size, and emojis** can all be customized in the settings

- **Live updating table** (last bar only) to reduce lag and clutter

---

### 📈 **Calculation Logic**

Each trend indicator is derived as follows:

#### ✅ **EMA 5/7/9 Trend**

- 🟢 if 5 > 7 > 9 (short-term bullish)

- 🔴 if 5 < 7 < 9 (short-term bearish)

- ⚫️ otherwise (neutral)

#### ✅ **EMA 50/200 Trend**

- 🟢 if price > EMA50 > EMA200 (classic bullish)

- 🔴 if price < EMA50 < EMA200 (classic bearish)

- ⚫️ otherwise

#### ✅ **RSI Trend**

- 🟢 if RSI > SMA(RSI)

- 🔴 if RSI < SMA(RSI)

- ⚫️ otherwise

#### ✅ **MACD Trend**

- 🟢 if MACD Line > Signal Line

- 🔴 if MACD Line < Signal Line

- ⚫️ otherwise

#### ✅ **EMA 5 vs SMA 14 Trend**

- 🟢 if EMA5 > SMA14

- 🔴 if EMA5 < SMA14

- ⚫️ otherwise

---

### 🛠️ **Customization**

In the settings panel, users can:

- Show/hide each timeframe

- Change the table's position

- Adjust text size and color

- Customize emoji symbols used for trends

---

### 📌 Use Case

This dashboard is ideal for:

- **Swing traders** and **intraday traders** monitoring multiple timeframes

- Identifying **trend confluence zones** across indicators

- Making quick, high-confidence trading decisions

---

Multiple MAsHere's a well-written description in English for your "Multiple MAs" indicator that you can use when publishing on TradingView. It’s concise, professional, and highlights the key features of the indicator while explaining its purpose for traders.

---

### Multiple MAs Indicator

#### Overview

The **Multiple MAs** indicator is a versatile and straightforward tool designed to help traders visualize price trends using multiple Simple Moving Averages (SMAs) on a single chart. By plotting six SMAs with customizable lengths (MA5, MA10, MA20, MA50, MA100, and MA200), this indicator provides a clear view of short-term, medium-term, and long-term trends, making it ideal for trend-following strategies, crossover analysis, and identifying potential support/resistance levels.

#### Features

- **Customizable MA Lengths**: Adjust the periods of all six moving averages (MA5, MA10, MA20, MA50, MA100, MA200) to suit your trading style and timeframe.

- **Distinct Visuals**: Each MA is plotted with a unique color and line width for easy identification:

- MA5 (Dodger Blue, 1px)

- MA10 (Green, 1px)

- MA20 (Red, 2px)

- MA50 (Purple, 3px)

- MA100 (Gray, 3px)

- MA200 (White, 3px)

- **Overlay on Price Chart**: The indicator overlays directly on the price chart, allowing for seamless integration with other technical analysis tools.

- **High Precision**: Displays values with 8-decimal precision, ensuring accuracy for assets with small price movements (e.g., forex pairs or cryptocurrencies).

#### How to Use

1. **Trend Identification**: Use the longer MAs (e.g., MA100, MA200) to determine the overall trend direction. If the price is above these MAs, the trend is likely bullish; if below, it’s likely bearish.

2. **Crossover Signals**: Look for crossovers between shorter MAs (e.g., MA5 crossing MA20) for potential entry or exit signals. For example:

- A bullish signal occurs when a shorter MA crosses above a longer MA.

- A bearish signal occurs when a shorter MA crosses below a longer MA.

3. **Support and Resistance**: MAs often act as dynamic support or resistance levels. Watch for price reactions around these lines, especially the MA50, MA100, and MA200.

4. **Divergence Analysis**: Compare the slope of different MAs to identify potential trend reversals or weakening momentum.

#### Settings

- **MA5 Length**: Default is 5 bars.

- **MA10 Length**: Default is 10 bars.

- **MA20 Length**: Default is 20 bars.

- **MA50 Length**: Default is 50 bars.

- **MA100 Length**: Default is 100 bars.

- **MA200 Length**: Default is 200 bars.

#### Best Practices

- **Timeframe**: This indicator works on any timeframe but is particularly effective on daily, 4-hour, and 1-hour charts for swing trading or trend-following strategies.

- **Combine with Other Tools**: Pair the Multiple MAs with other indicators like RSI, MACD, or volume analysis to confirm signals and avoid false breakouts.

- **Adjust for Volatility**: For highly volatile assets, consider increasing the MA lengths to reduce noise and focus on broader trends.

#### Notes

- The indicator is lightweight and optimized for performance, ensuring it runs smoothly even on lower timeframes.

- Colors and line widths are pre-set for clarity but can be customized in the indicator settings if needed.

#### Credits

Created by kosar_v. Feedback and suggestions are welcome to improve this tool for the TradingView community!

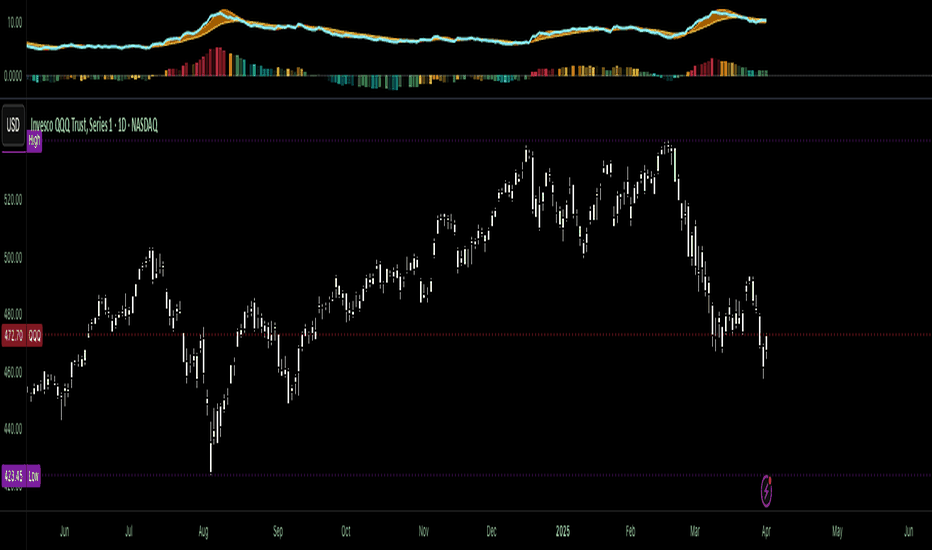

VNIndex Over 6.5% Downside Drop Indicator with TableOverview: The VNIndex 6.5% Downside Drop Indicator is a powerful tool designed to help traders and investors identify significant market drops on the VNIndex (or any other asset) based on a 6.5% downside threshold. This Pine Script® indicator automatically detects when the price of an asset drops by more than 6.5% within a single day, and visually marks those events on the chart.

Key Features:

6.5% Downside Drop Detection: Automatically calculates the daily percentage drop and identifies when the price falls by more than 6.5%.

Table Display: Displays the dates and corresponding percentage drops of all identified instances in a convenient table at the bottom right of the chart.

Markers: Red down-pointing markers are plotted above bars where the price drop exceeds the 6.5% threshold, making it easy to spot critical drop events at a glance.

Easy-to-Read Table: The table lists the date and drop percentage, updating dynamically as new drops are detected. This allows for easy tracking of significant downside moves over time.

How to Use:

Install the Script: Add this indicator to your TradingView chart.

Monitor Price Drops: The indicator will automatically detect when the price drops by over 6.5% from the previous close and display a marker on the chart and the table in the bottom right corner.

View the Table: The table displays the date and the percentage drop of each detected event, making it easy to track past significant moves.

Alerts: You can set an alert for 6.5% drops to receive notifications in real-time.

Customization Options:

The drop percentage threshold (6.5%) can be adjusted in the script to fit other market conditions or assets.

The table can be resized or styled based on user preference for better visibility.

Why Use This Indicator? This indicator is perfect for traders looking to spot large, significant price movements quickly. Large downside drops can signal potential market reversals or trading opportunities, and this tool helps you track such events effortlessly. Whether you're monitoring the VNIndex or any other asset, this indicator provides crucial insights into volatile price action, helping you make more informed decisions.

Open Source License: This indicator is open source and free to use under the Mozilla Public License 2.0. You are welcome to modify, distribute, and contribute to the project.

Contributions: Feel free to contribute improvements, fixes, or new features by creating a pull request. Let’s collaborate to make this indicator even better for the community!

SublimeDubs EMA CloudShoutout Ripster for open-sourcing his code! This is a slight improvement/update to his code. A lot is customizable via settings instead of in the script. You can change the colors more easily now. I also added lines with price labels for the clouds and offset them by x amount of bar lengths. I can't do much about the vertical spacing but at least you can move it horizontally.

Manual Trade Ledger# Manual Options Trade Journal – Pine Script

This project is a Pine Script implementation for TradingView that allows users to manually log options trades into a live table overlay on a chart.

## ✨ Features

- 📥 Manual entry of ticker, premium, contracts, strike, expiry, notes

- 📈 Auto-filled live data: timestamp, price, and % change since first log

- 🧾 Tabular logging for trade journaling and exporting to Google Sheets

- 🔧 Fully customizable and designed to support product experimentation

## 🎯 Use Case

This project was built to support a real-world trading workflow for options traders who:

- Prefer to manually log trades while watching charts

- Want a visual, copyable ledger that evolves in real-time

- Want to later analyze entries/exits in spreadsheets or dashboards

## 🛠 How It Works

1. Toggle the `Log Trade` switch inside TradingView’s indicator settings

2. Fill in your trade metadata (ticker, premium, etc.)

3. The script captures timestamp, price, and calculates % change

4. Each new trade adds a row to the table (up to 50 max)

Highlight Fascia Oraria 07:00-21:00Highlight Time Range 07:00–21:00 + New Year's Line

This script automatically highlights the time range between 07:00 and 21:00 (based on the chart’s server time) with a light green semi-transparent background — perfect for traders focusing on specific intraday sessions.

It also adds a red vertical line every January 1st, clearly marking the start of each new year on the chart.

Ideal for:

Intraday trading and session analysis

Seasonal or yearly pattern tracking

Clear visual reference for time cycles

💡 Easy to customize: You can adjust the startHour and endHour values to set your preferred time range.

Ryna 3 EMA Multi-Timeframe Indicator**EMA Multi-Timeframe Strategy (Pine Script v6)**

This TradingView indicator is designed to assist traders using a **multi-timeframe trend-following strategy** based on Exponential Moving Averages (EMAs).

**Core Functionality**

- **Trend Identification:**

Uses a configurable **EMA (e.g., EMA 50)** on a **higher timeframe** (e.g., H1, D1, W1) to determine the market bias:

- If price is **above** the trend EMA → **Long bias**

- If price is **below** the trend EMA → **Short bias**

- **Entry Signals:**

Uses two EMAs (fast & slow, e.g., EMA 8 & EMA 21) on either:

- The **current chart timeframe**, or

- A **separately selected timeframe** (e.g., entry on M15, trend on H1)

→ Signals are generated based on **EMA crossovers**:

- **Bullish crossover** (fast crosses above slow) → Long signal

- **Bearish crossover** (fast crosses below slow) → Short signal

- Only when aligned with the higher-timeframe trend

- **Visual Output:**

- Optional display of entry EMAs when sourced from the trend timeframe

- Always displays the trend EMA

- Entry signals shown with triangle markers on the chart

- **Info Panel (Top Center):**

- Shows selected timeframes and EMA settings

- Indicates current trend bias (LONG / SHORT / NEUTRAL)

- Notes if entry EMAs are hidden due to settings

- **Alerts:**

- Optional alerts for long and short entry signals based on EMA crossovers

#### **User Inputs**

- **Trend Timeframe & EMA Length**

- **Entry Timeframe & EMA Fast/Slow Lengths**

- **Option to show/hide entry EMAs when using the trend timeframe**

- **Option to show/hide Infobox on Chart**

Global M2 Money Supply // Days Offset =Total M2 Supply globally summing the liquidity of the global main central banks with a daily offset

Breakout Candle Indicatorit decide breakout candles. if you higher time frame view fixed. you can use this indicator on lower time frame

SMC + Price Action IndicatorThe SPAZ indicator combines Supply and Demand Zone (SMC) analysis with Price Action strategies to identify high-probability trading opportunities. This indicator is designed to help traders confirm trading signals and gauge the strength of supply and demand zones. By identifying key areas of support and resistance, traders can make more informed decisions and increase their chances of success. The SPAZ indicator is a powerful tool for traders of all levels, providing a clear and concise visual representation of market dynamics.

Will%R by SizovOption for combining the Williams Range% indicator of different lengths, for working in trend and counter-trend modes, in TF from 15m to 4H (version 6.2.00)

For the short and long WR% line, I recommend using the Fibonacci numbers: 3, 5, 8, 13, 21, 34, 55, 89, 144

@YuryGST

Options Trading Strategy with AlertsTitle: Options Trading Strategy with Buy/Sell Alerts

Description:

This script is designed for day traders and short-term options traders who focus on directional and trend-based trades. It integrates key indicators to identify high-probability entry and exit points for call and put options.

Features & Strategy Logic:

✅ Moving Averages (9 EMA, 21 EMA, 200 EMA) → Identifies short-term and long-term trends.

✅ VWAP (Volume Weighted Average Price) → Tracks institutional buying/selling pressure.

✅ RSI (Relative Strength Index, 14) → Confirms momentum and trend strength.

✅ MACD (12, 26, 9) → Detects shifts in momentum for trend continuation or reversals.

✅ Buy & Sell Alerts → Automatically notifies traders when optimal conditions are met.

How It Works:

• BUY (Call Signal):

• 9 EMA crosses above 21 EMA (bullish momentum).

• Price is above VWAP (institutional buying pressure).

• RSI is above 50 (bullish confirmation).

• MACD is trending upward.

• Trigger: Green “BUY” label appears below the candle.

• SELL (Put Signal):

• 9 EMA crosses below 21 EMA (bearish momentum).

• Price is below VWAP (institutional selling pressure).

• RSI is below 50 (bearish confirmation).

• MACD is trending downward.

• Trigger: Red “SELL” label appears above the candle.

How to Use:

1. Apply the script to 5-minute or 15-minute charts for best results.

2. Look for buy/sell labels and confirm with market context before entering trades.

3. Set alerts to receive real-time notifications when conditions align.

Ideal For:

✔️ Day traders looking for quick, high-probability trades.

✔️ Options traders focusing on directional movement.

✔️ Scalpers and momentum traders who rely on trend confirmation.

🔔 Set up alerts for automated trade notifications and never miss a setup!

ATR - Asymmetric Turbulence Ribbon🧭 Asymmetric Turbulence Ribbon (ATR)

The Asymmetric Turbulence Ribbon (ATR) is an enhanced and reimagined version of the standard Average True Range (ATR) indicator. It visualizes not just raw volatility, but the structure, momentum, and efficiency of volatility through a multi-layered visual approach.

It contains two distinct visual systems:

1. A zero-centered histogram that expresses how current volatility compares to its historical average, with intensity and color showing speed and conviction

2. A braided ribbon made of dual ATR-based moving averages that highlight transitions in volatility behavior—whether volatility is expanding or contracting

The name reflects its purpose: to capture asymmetric, evolving turbulence in market behavior, through structure-aware volatility tracking.

_______________________________________________________________

🔧 Inputs (Fibonacci defaults)

ATR Length

Lookback period for ATR calculation (default: 13)

ATR Base Avg. Length

Moving average period used as the zero baseline for histogram (default: 55)

ATR ROC Lookback

Number of bars to measure rate of change for histogram color mapping (default: 8)

Timeframe Override

Optionally calculate ATR values from a higher or fixed timeframe (e.g., 1D) for macro-volatility overlay

Show Ribbon Fill

Toggles colored fill between ATR EMA and HMA lines

Show ATR MAs

Toggles visibility of ATR EMA and HMA lines

Show Crossover Markers

Shows directional triangle markers where ATR EMA and HMA cross

Show Histogram

Toggles the entire histogram display

_______________________________________________________________

📊 Histogram Component: Volatility Energy Profile

The histogram shows how far the current ATR is from its moving average baseline, centered around zero. This lets you interpret volatility pressure—whether it's expanding, contracting, or preparing to reverse.

To complement this, the indicator also plots the raw ATR line in aqua. This is the actual average true range value—used internally in both the histogram and ribbon calculations. By default, it appears as a slightly thicker line, providing a clear reference point for comparing historical volatility trends and absolute levels.

Use the baseline ATR to:

- Compare real-time volatility to previous peaks or troughs

- Monitor how ATR behaves near histogram flips or ribbon crossovers

- Evaluate volatility phases in absolute terms alongside relative momentum

The ATR line is particularly helpful for users who want to keep tabs on raw volatility values while still benefiting from the enhanced visual storytelling of the histogram and ribbon systems.

Each histogram bar is colored based on the rate of change (ROC) in ATR: The faster ATR rises or falls, the more intense the color. Meanwhile, the opacity of each bar is adjusted by the effort/result ratio of the price candle (body vs. range), showing how much price movement was achieved with conviction.

Color Interpretation:

🔴 Red

Strong volatility expansion

Market entering or deepening into a volatility burst

Seen during breakouts, panic moves, or macro shock events

Often accompanied by large real candle bodies

🟠 Orange

Moderate volatility expansion

Heating up phase, often precedes breakouts

Common in strong trending environments

Signals tightening before acceleration

🟡 Yellow

Mild volatility increase

Transitional state—energy building, not yet exploding

Appears in early trend development or pullbacks

🟢 Green

Mild volatility contraction

ATR cooling off

Seen during consolidation, reversion, or range balance

Good time to assess upcoming directional setups

🔵 Aqua

Moderate compression

Volatility is clearly declining

Signals consolidation within larger structure

Pre-breakout zones often form here

🔵 Deep Blue

Strong volatility compression

Market is coiling or dormant

Can signal upcoming squeeze or fade environment

Often followed by sharp expansion

Opacity scaling:

Brighter bars = efficient, directional price action (strong bodies)

Faded bars = indecision, chop, absorption, or wick-heavy structure

Together, color and opacity give a 2D view of market volatility: Hue = the type and direction of volatility

Opacity = the quality and structure behind it

Use this to gauge whether volatility is rising with conviction, fading into neutrality, or compressing toward breakout potential.

_______________________________________________________________

🪡 Ribbon Component: Volatility Rhythm Structure

The ribbon overlays two moving averages of ATR:

EMA (yellow) – faster, more reactive

HMA (orange) – smoother, more rhythmic

Their relationship creates the ribbon logic:

Yellow fill (EMA > HMA)

Short-term volatility is increasing faster than the longer-term rhythm

Signals active expansion and engagement

Orange fill (HMA > EMA)

Volatility is decaying or leveling off

Suggests possible exhaustion, pullback, or range

Crossover triangle markers (optional, off by default to avoid clutter) identify the moment of shift in volatility phase.

The ribbon reflects the shape of volatility over time—ideal for mapping cyclical energy shifts, transitional states, and alignment between current and average volatility.

_______________________________________________________________

📐 Strategy Application

Use the Asymmetric Turbulence Ribbon to:

- Detect volatility expansions before breakouts or directional runs

- Spot compression zones that precede structural ruptures

- Visually separate efficient moves from noisy market activity

- Confirm or fade trade setups based on underlying energy state

- Track the volatility environment across multiple timeframes using the override

_______________________________________________________________

🎯 Ideal Timeframes

Designed to function across all timeframes, but particularly powerful on intraday to daily ranges (1H to 1D)

Use the timeframe override to anchor your chart in higher-timeframe volatility context, like daily ATR behavior influencing a 1H setup.

_______________________________________________________________

🧬 Customization Tips

- Increase ATR ROC Lookback for smoother color transitions

- Extend ATR Base Avg Length for more macro-driven histogram centering

- Disable the histogram for ribbon-only rhythm view

- Use opacity and color shifts in the histogram to detect stealth energy builds

- Align ATR phases with structure or order flow tools for high-quality setups

Malama's market chop"Malama's Market Chop" (MMC) is a TradingView indicator designed to help traders identify choppy, sideways market conditions where price movement lacks a clear trend. It solves a common problem for traders: avoiding false signals or unprofitable trades during periods of indecision in the market. By measuring market "choppiness" and visually highlighting these zones, MMC empowers users to either steer clear of trades or adjust their strategies (e.g., switching to range-bound tactics) when trends are weak.

How It Works

MMC is built around the Choppiness Index, a mathematical formula that quantifies how much a market is consolidating versus trending. Here’s the simple breakdown:

It looks at the price range (highs and lows) over a user-defined period (default: 14 bars).

It compares the sum of individual bar ranges to the total range across that period, then applies a logarithmic calculation to produce a value between 0 and 100.

A higher value (e.g., above 61.8 by default) indicates a choppy, non-trending market, while a lower value suggests a trending market.

The indicator then uses this data to:

Color the chart background yellow during choppy conditions.

Place a small blue triangle below bars when choppiness is detected.

Show the exact Choppiness Index value as a label on the latest bar for real-time monitoring.

How to Use It

Adding to TradingView: Open TradingView, click the "Indicators" button at the top, search for "Malama's Market Chop" (or paste the script into a new Pine Script editor and save it), and add it to your chart.

Configuring Settings:

Choppiness Period (default: 14): Adjust this to change how many bars the indicator analyzes. Shorter periods (e.g., 10) react faster but may be noisier; longer periods (e.g., 20) smooth the signal.

Choppiness Threshold (default: 61.8): This is the cutoff for what’s considered "choppy." Raise it (e.g., 70) for stricter chop detection or lower it (e.g., 50) to catch milder consolidation.

Interpreting Signals:

Yellow Background: The market is choppy—price is likely bouncing around without direction. Beginners might sit out or use range-trading strategies (e.g., buy low, sell high within the range).

Blue Triangle: A quick visual cue that choppiness is active on that bar.

ChopIndex Label: Check the number. Above the threshold (e.g., 61.8) means choppy; below suggests a trend might be forming.

Tips:

Beginners: Pair MMC with a simple trend indicator (like a moving average) to confirm when to avoid trades during yellow zones.

Pros: Experiment with the threshold on different timeframes (e.g., 5-minute vs. daily) or assets (stocks, forex, crypto) to fine-tune for your trading style.

Originality

What makes MMC stand out is its blend of clarity and practicality. While the Choppiness Index isn’t new, MMC enhances it with:

Visual Simplicity: The yellow background and blue triangles make choppy conditions instantly recognizable, even for beginners, without cluttering the chart.

Real-Time Feedback: The live ChopIndex label keeps you informed without needing to dig into settings or calculations.

Customization: Adjustable period and threshold settings let traders tailor it to their specific needs, unlike many static chop indicators.

This combination transforms a classic concept into a user-friendly, actionable tool that bridges the gap between novice intuition and professional precision.