거증몸감 탐색기Signature Trading Strategy by “Insaeng2mak”

Volume-Up Body-Down Scanner

As the name suggests, this scanner looks for cases where the candle body size has decreased compared to the previous candle, while the trading volume has increased. This is referred to as “Volume-Up Body-Down” (거증몸감), implying a potential trend reversal.

Please note that the accuracy of this indicator is low.

Do not use it to enter long or short positions based solely on its signals.

It's a rough version and hasn't been optimized yet, so feel free to tweak the values and experiment to improve it.

인생2막님의 시그너치 매매법

거증몸감 탐색기입니다

말그대로 캔들에서 직전 캔들에 비해 몸통이 감소하고 거래량이 증가했다면 추세반전이 이뤄질 수 있다는 의미에서 거증몸감이라고 하는데

지표의 정확도는 낮습니다. 이거보고 롱숏 치시면 안됩니다. 롱숏치려고 만든 지표가 아니에요.저도 안쓰는 지표입니다.

만들어두고 최적값도 안찾아놔서 수치 이것저것 건드려보시면서 발전시켜주세요

"야반꿀"

Индикаторы и стратегии

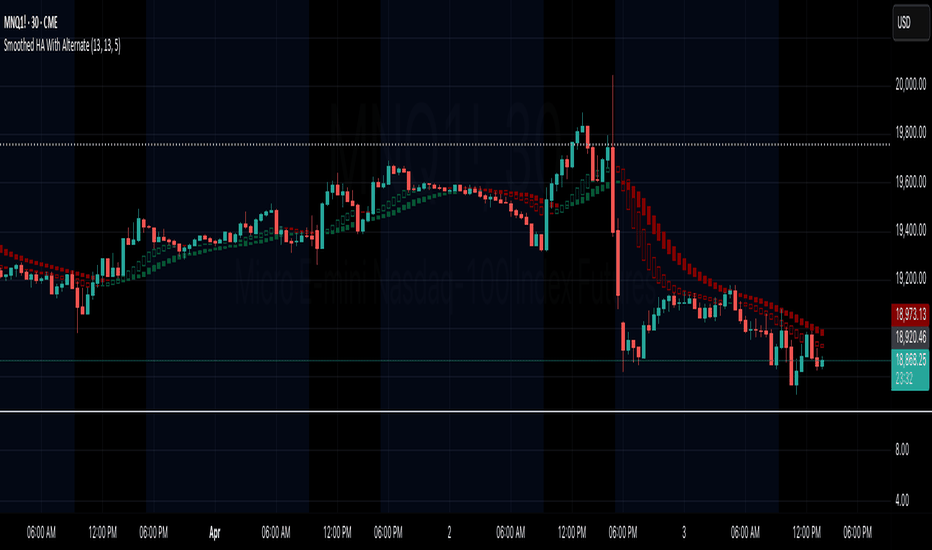

Smoothed Heiken Ashi Candles With Alternate Chart IntervalWhen trading, we tend to have one or more preferred chart time interval. If using HA candles for trend analysis, you may watch HA candles on each of those preferred interval, using multiple charts for a given symbol. However, having an indicator that plots HA candles for the given chart interval, as well the HA candles based on another interval on the same chart, provides the ability to watch HA reactions on multiple chart intervals more easily.

As an example, you like to watch the 5 minute chart with HA candles, but also prefer to use the 30 minute chart and HA candles for confirmation of a reversal/retrace. This indicator provides the convenience of monitoring your 5 minute chart, and setting alternate HA interval to 30 minute, thereby showing each set of the HA candles together on the same chart.

The alternate HA candles are calculated based on the selected chart interval, defaulting to 5 minutes.

The default HA and alternate HA candles are calculated and smoothed using the selected EMA length. Both default to 13.

3SMA +30 Stan Weinstein +200WMA +alert-crossingIndicator Description: Stan Weinstein Strategy + Key Moving Averages

🔹 Introduction

This indicator combines the Classic Stan Weinstein Strategy with a modern update based on the author’s latest recommendations. It includes key moving averages that help identify trends and potential entry or exit points in the market.

📊 Included Moving Averages (Fully Customizable)

All moving averages in this indicator have modifiable parameters, allowing users to adjust values in the input settings.

1️⃣ 30-Week SMA (Stan Weinstein): A long-term trend indicator defining the asset’s main trend.

2️⃣ 40-Week SMA (Weinstein Update): An adjusted version recommended by the author in his recent updates.

3️⃣ 10-Day SMA: Displays short-term price action and helps confirm trend changes.

4️⃣ 100-Day SMA: A medium-term trend measure used by traders to assess trend strength.

5️⃣ 200-Day WMA (Weighted Moving Average): A very long-term indicator that filters market noise and confirms solid trends.

🔍 How to Interpret It

✔️ 30/40-Week SMA in an uptrend → Confirms an accumulation phase or an upward price trend.

✔️ Price above the 200-WMA → Indicates a strong and healthy long-term trend.

✔️ 10-SMA crossing other moving averages → Can signal an early entry or exit opportunity.

✔️ 100-SMA vs. 200-WMA → A breakout of the 100-SMA above the 200-WMA may signal a new bullish phase.

🚨 Built-in Alerts (Key Crossovers)

The indicator includes automatic alerts to notify traders when key moving averages cross, allowing timely reactions:

🔔 10-SMA crossing the 40-SMA → Possible medium-term trend shift.

🔔 10-SMA crossing the 200-WMA → Confirmation of a stronger trend.

🔔 40-SMA crossing the 200-WMA → Long-term trend reversal signal.

💡 Customization: All moving average periods can be adjusted in the input settings, making the indicator flexible for different trading strategies.

Open Vertical Lines [TradeWithRon]This indicator allows traders to draw vertical lines manually or automatically based on the current or specified higher timeframes. It is a versatile tool designed to help users identify and mark significant changes in the market, such as new candle formations, based on a selected or auto-adjusted timeframe.

Open Source

Features:

Timeframe Customization: Users can either manually specify a desired timeframe (e.g., 1-hour, 1-day, etc.) or enable the "Auto" feature, which automatically adjusts the timeframe based on the current chart's timeframe for better alignment with different trading strategies.

Customizable Line Style: The vertical line can be drawn in three different styles: Solid, Dashed, or Dotted, giving users the flexibility to choose their preferred appearance for better chart readability.

Line Color: Users can select the color of the vertical line with transparency options to match their chart's visual preferences.

Auto Timeframe Adjustments: The "Auto Align" option dynamically adjusts the timeframe used for vertical lines depending on the chart's current timeframe. For example, if you’re using a lower timeframe (e.g., 5 minutes), the indicator will automatically switch to a higher timeframe (e.g., 1 hour or daily) to mark vertical lines, ensuring the lines correspond to higher timeframe price action.

Vertical Line Placement:

A vertical line is placed each time a new candle appears on the chart, marking key moments for the user to analyze market movements. This can be helpful for marking the start of new trading sessions or significant events in the market.

How to Use:

1. Apply the indicator to your chart.

2. Configure the preferred timeframe settings (either fixed or auto-align).

3. Customize the line style and color according to your visual preference.

4. The indicator will automatically place vertical lines on the chart when a new candle is formed, based on your selected timeframe.

Bollinger Bands with Narrow ConsolidationBollinger Bands with Narrow Consolidation

🔹 Indicator Description

This indicator is an enhanced version of the classic Bollinger Bands with a built-in narrow consolidation detection function. It helps identify low-volatility phases that may precede strong price movements.

🔹 How Does the Indicator Work?

Bollinger Bands Calculation: Based on the selected moving average type (SMA, EMA, RMA, WMA, VWMA) with an adjustable standard deviation.

Narrow Consolidation Detection: The indicator calculates the relative band width and highlights low-volatility zones.

Flexible Settings:

Choice of base moving average type.

Adjustable sensitivity to narrow consolidations.

Option to hide Bollinger Bands outside consolidation zones.

🔹 How to Use?

Monitoring Consolidation Zones: If the price is tightening in a narrow range, a strong movement may follow.

Combining with Other Tools: The indicator works well with volume analysis and oscillators.

Signal Filtering: You can hide Bollinger Bands and only display narrow consolidation zones.

🔹 Trading Strategies

✅ Breakout Strategy – A sharp move beyond the narrow range may signal a trade entry.

✅ Range Trading – Buy near the lower band and sell near the upper band in sideways markets.

✅ Signal Filtering with Oscillators – Use RSI or MACD to confirm directional moves.

🔹 Disclaimer

This indicator is for analytical purposes only and does not constitute financial advice. Trading in financial markets involves risks, including potential loss of capital. Always verify signals, use proper risk management, and never invest more than you can afford to lose.

🔹 Conclusion

The indicator helps traders identify low-volatility periods and prepare for strong moves. Its flexible settings allow customization for any trading strategy.

📈 Add this indicator to your toolkit and stay ahead of the market! 🚀

Полосы Боллинджера с узкой консолидацией

🔹 Описание индикатора

Этот индикатор – улучшенная версия классических полос Боллинджера с функцией определения узкой консолидации. Он помогает выявлять фазы низкой волатильности, которые могут предшествовать сильным движениям цены.

🔹 Как работает индикатор?

Полосы Боллинджера: Рассчитываются на основе выбранного типа скользящей средней (SMA, EMA, RMA, WMA, VWMA) с регулируемым стандартным отклонением.

Определение узкой консолидации: Индикатор вычисляет относительную ширину полос и выделяет зоны сжатой волатильности.

Гибкие настройки:

Выбор типа базовой скользящей средней.

Регулируемая чувствительность к узкой консолидации.

Режим скрытия полос Боллинджера вне зон консолидации.

🔹 Как использовать?

Мониторинг зон консолидации: Если цена сжимается в узком диапазоне, стоит подготовиться к сильному движению.

Комбинация с другими инструментами: Индикатор отлично сочетается с объемами и осцилляторами.

Фильтрация сигналов: Можно скрыть полосы Боллинджера и оставить только зоны узкой консолидации.

🔹 Торговые стратегии

✅ Пробой консолидации – Резкое движение за границы узкой зоны может служить сигналом на вход в рынок.

✅ Торговля от границ – Покупка у нижней границы и продажа у верхней при флэтовом движении.

✅ Фильтрация сигналов с осцилляторами – Использование RSI или MACD для подтверждения направленного движения.

🔹 Предупреждение

Этот индикатор предназначен исключительно для аналитики и не является финансовым советом. Торговля на финансовых рынках сопряжена с рисками, включая возможную потерю капитала. Всегда проверяйте сигналы, используйте управление рисками и не инвестируйте больше, чем можете позволить себе потерять.

🔹 Заключение

Индикатор помогает трейдерам находить периоды низкой волатильности и готовиться к мощным движениям. Гибкие настройки позволяют адаптировать его под любую стратегию.

📈 Добавьте индикатор в свой арсенал и оставайтесь на шаг впереди рынка! 🚀

Open, Close & High-Low BandsThis indicator attempts to display candlestick chart in a more linear view where you can see the the rate of change of the open, high, close, and low

ISSU_LevelMonthly, weekly, daily level

Quarter session

EMA 20,50

Daily close level

IST 10:30am Level

Estratégia Original com SL/TPA powerful TradingView indicator combining:

✅ Supertrend (trend filter)

✅ RSI 2 (early reversals)

✅ SMA 4/9 crossover (momentum confirmation)

✅ Auto Stop Loss & Take Profit (ATR-based or fixed)

🔥 Key Features:

Buy Signals (↑): Supertrend green + RSI 2 > 30 + SMA 4 > SMA 9

Sell Signals (↓): Supertrend red + SMA 4 < SMA 9 (low false signals)

Risk Management: Dynamic SL (1.5x ATR) & TP (2x ATR)

Clean Visualization: Entry/exit arrows + SL/TP lines

📊 Ideal For: Crypto, Forex, and Stocks (H1/Daily timeframes)

🎯 Why Use It?

Aggressive entries with RSI 2 + SMA 4

Conservative exits to lock profits

Fully customizable settings

My Bar IndexA simple script to display bar index at the bottom of the chart. It will be a handy tool for those who like to do bar counts.

Dynamic Breakout Breakdown Trackerbreak out and break down calculator

you can calculate break out and break down from this indicator and this will calculate the levels dynamically

MA Cross with Monthly LinesA dual-purpose trading indicator combining Moving Average (MA) crossovers with a Monthly Line Separator. It visually tracks trend shifts using MA crosses while marking monthly boundaries for clear historical reference. Ideal for traders seeking both momentum signals and structured timeframes, enhancing decision-making with a streamlined, all-in-one charting tool.

Body Percentage of Range (Colored)Short Description:

This indicator measures the dominance of the candle's body relative to its total range (High - Low), providing a visual gauge of intra-candle strength versus indecision. Columns are colored based on whether the body constitutes more or less than a defined percentage (default 50%) of the candle's total height.

Detailed Description:

What it Does:

The "Body Percentage of Range" indicator calculates, for each candle, what percentage of the total price range (High minus Low) is occupied by the candle's body (absolute difference between Open and Close).

A value of 100% means the candle has no wicks (a Marubozu), indicating strong conviction during that period.

A value of 0% means the candle has no body (a Doji), indicating perfect indecision.

Values in between show the relative balance between the directional move (body) and the price exploration/rejection (wicks).

How to Interpret:

The indicator plots this percentage as columns:

Column Height: Represents the percentage of the body relative to the total range. Higher columns indicate a larger body dominance.

Column Color:

Green Columns: Appear when the body percentage is above the user-defined threshold (default 50%). This suggests that the directional move within the candle was stronger than the indecision (wicks). Often seen during trending moves or strong momentum candles.

Red Columns: Appear when the body percentage is at or below the user-defined threshold (default 50%). This suggests that wicks dominate the candle (body is 50% or less of the range), indicating significant indecision, struggle between buyers and sellers, or potential reversals. These are common in choppy, consolidating, or reversal market conditions.

Orange Line (Optional MA): A Simple Moving Average (SMA) of the body percentages is plotted to help smooth the readings and identify broader periods where candle structure indicates more trending (high MA) vs. ranging/indecisive (low MA) characteristics.

Potential Use Cases:

Identifying Choppy vs. Trending Markets: Sustained periods of low, predominantly red columns (and often a low/declining MA) can signal a choppy, range-bound market where trend-following strategies might underperform. Conversely, periods with frequent high, green columns suggest a more trending environment.

Confirming Breakouts/Momentum: High green columns appearing alongside increased volume during a breakout can add conviction to the move's strength.

Spotting Potential Exhaustion/Reversals: A very tall green column after a strong trend, followed immediately by a low red column (like a Doji or Spinning Top pattern appearing on the price chart), might signal potential exhaustion or a pending reversal, indicating indecision has suddenly entered the market.

Filtering Entries: Traders might avoid taking entries (especially trend-following ones) when the indicator shows a consistent pattern of low red columns, suggesting high market indecision.

Settings:

Color Threshold %: Allows you to set the percentage level above which columns turn green (default is 50%).

Smoothing MA Length: Adjusts the lookback period for the Simple Moving Average.

Disclaimer:

This indicator is a tool for technical analysis and should be used in conjunction with other methods (like price action, volume analysis, other indicators) and robust risk management. It does not provide direct buy/sell signals and past performance is not indicative of future results.

FunkyQuokka's $ Volume💡 Why $ Volume Matters

Share volume alone is a half-truth — 1M shares traded at $5 isn’t the same as 1M shares at $500. That’s where dollar volume steps in, offering a far more accurate view of institutional interest, breakout validity, liquidity zones and overall trader conviction.

📈 Features:

Clean histogram of dollar volume (close × volume)

Orange line showing customizable average $ volume

K/M/B formatting for axis scale (no huge ugly numbers)

Minimal design to blend into a multi-pane layout

⚙️ Inputs:

Tweakable average length – defaults to 20

By FunkyQuokka 🦘

Malama's big MACDMalama's Big MACD" is a versatile TradingView indicator designed to help traders identify high-probability buy and sell opportunities in fast-moving markets, particularly on short timeframes like 1-5 minute charts. It solves the common problem of filtering out market noise by combining a predictive price model (Stochastic Price Predictor, or SPP) with a comprehensive set of momentum and trend indicators (MACD, RSI, moving averages, and more). Whether you're scalping quick trades or confirming longer-term trends, this tool provides clear signals and visual cues to boost confidence and timing.

The indicator operates in two main layers:

Stochastic Price Predictor (SPP): This predictive engine forecasts short-term price movements using a simplified Monte Carlo simulation. It analyzes recent price changes, volatility (via ATR), and Stochastic RSI to estimate the likelihood of an upward or downward move within a set horizon (e.g., 3 bars). Buy signals trigger when the probability of an upward move exceeds a confidence threshold (default 65%) and the market isn’t overbought, while sell signals activate for downward moves when not oversold.

Comprehensive Indicator Suite: This layer combines classic tools like MACD (for momentum), RSI (for overbought/oversold conditions), moving averages (for trend direction), and ATR (for volatility-based levels). It generates signals when these align—e.g., a bullish MACD crossover paired with an oversold RSI and a rising fast MA. A unique "JKH RSI" (a fast RSI variant) adds extra confirmation, while manual sentiment input lets you tweak signals based on your market bias.

The script overlays these signals on your chart, color-codes trends, and highlights key levels (like stop-loss and profit targets) to make decision-making intuitive.

How to Use It

Adding to TradingView:

Copy the script into TradingView’s Pine Editor (under "Indicators" > "Pine Editor").

Click "Save," name it (e.g., "Malama's Big MACD"), then "Add to Chart."

Configuring Settings:

Open the indicator’s settings via the gear icon.

Adjust SPP settings (e.g., "Lookback Period" to 5 for short-term focus, "Confidence Threshold" to 65% for faster signals).

Tweak the Comprehensive settings (e.g., MACD lengths: 5/13/5 for scalping, or longer like 12/26/9 for swing trading).

Toggle visuals (e.g., enable "Show Predicted Range" or "Highlight Volume Spikes") under "Visual Settings."

Interpreting Signals:

SPP Signals: Green "BUY (SPP)" labels below bars or red "SELL (SPP)" above bars indicate predictive opportunities.

Comprehensive Signals: Lime "BUY (Comp)" or red "SELL (Comp)" labels show confirmed momentum trades. Blue/orange MACD arrows and green/red RSI dots add context.

Trend Line: Green means uptrend (fast MA > slow MA), red is downtrend, orange is neutral.

Extras: Purple ATR lines suggest stop-loss/profit targets; yellow backgrounds flag volume spikes.

Tips:

Beginners: Start with default settings and focus on SPP signals for quick trades. Use ATR lines to set safe exits.

Pros: Experiment with "Sentiment Input" (-1 to 1) to bias signals, or adjust MACD/MA lengths for your timeframe. Pair with volume spikes for breakout confirmation.

Originality

What makes "Malama's Big MACD" stand out is its hybrid approach: it fuses a predictive Monte Carlo model (SPP) with a robust multi-indicator confirmation system. Unlike standard MACD or RSI tools, it offers:

Short-Term Prediction: SPP’s probability-based signals cater to scalpers, rare in most indicators.

Layered Confirmation: Combines MACD, RSI, fast/slow MAs, and a custom JKH RSI for stronger filtering.

Visual Clarity: Trend coloring, predicted price ranges, and ATR-based levels make it a one-stop shop.

Flexibility: Adjustable for scalping or swing trading, with manual sentiment for personalized tuning.

This isn’t just another MACD—it’s a dynamic, all-in-one toolkit that adapts to your trading style, blending foresight with precision.

ATR DistanceThis indicator plots two lines at distances defined by (Multiplier × ATR) above and below a selected price source (open, high, low, or close). By using a configurable Average True Range (ATR) length, it helps highlight volatility-based boundaries for more adaptive stop-loss or profit-taking decisions.

Média de Volume - VXX & UVXY (Colorido)Explanation:

The code takes the daily volume of VXX and UVXY.

Calculates the average of the two volumes.

Plots a blue histogram, similar to the traditional volume indicator.

Adds a reference line at zero.

The histogram bars turn green when the price is above the 20 SMA and red when it is below.

Multiple VWMATradingView Indicator: Multiple VWMA

This TradingView indicator allows you to display up to five separate Volume Weighted Moving Averages (VWMAs) directly on your price chart.

What it does:

Plots 5 VWMAs: It calculates and draws five distinct VWMA lines (or other styles) on the chart.

Volume Weighting: Unlike simple moving averages, a VWMA gives more weight to prices where trading volume was higher, potentially offering a clearer picture of the trend strength confirmed by volume.

Highly Customizable: Each of the five VWMAs can be configured independently through the indicator's settings panel. For each one, you can set:

Length: The lookback period (number of bars) used for the calculation.

Source: The price data to use (e.g., close, open, high, low, hl2, etc.).

Timeframe: You can calculate each VWMA based on a different timeframe than the one currently displayed on your chart (e.g., view daily VWMAs on an hourly chart). Leave blank to use the chart's timeframe.

Offset: Shift the VWMA line forwards or backwards on the chart by a specific number of bars.

Style: Choose how each VWMA is displayed (Line, Histogram, or Cross).

Overlay: The VWMAs are plotted directly over the price bars for easy comparison.

Purpose:

This indicator is useful for traders who want to analyze trends using multiple volume-weighted perspectives simultaneously. By comparing VWMAs of different lengths or based on different timeframes, you can gain insights into short-term vs. long-term trends, potential support/resistance levels, and the significance of price movements based on accompanying volume.

Session Color Blocks🧠 Purpose:

To visually highlight different market sessions — Asia, London, Premarket (US), and New York — using colored background blocks on the chart for better timing, context, and trade planning.

🕓 Session Times Used (Eastern Time / New York Time):

Session Time (ET) Color

Asia 8:00 PM – 3:00 AM 🟨 Yellow

London 3:00 AM – 8:30 AM 🟥 Red

Premarket 8:30 AM – 9:30 AM 🟦 Blue

New York 9:30 AM – 4:00 PM 🟩 Green

(DST is automatically handled via "America/New_York" timezone)

✅ Features:

Session colors appear only when that session is active.

Sessions are mutually exclusive, so no overlapping blocks.

Works on any symbol, especially useful for US stock/futures traders.

Auto-adjusts for daylight savings (using TradingView's IANA timezones).

🔧 Future Enhancements (Optional):

Toggle each session on/off

Add vertical lines or labels for session opens

Extend to weekends or custom sessions

Bollinger Bands with EMAsHere's a TradingView Pine Script indicator that includes:

Bollinger Bands with default settings (20-period SMA and 2 standard deviations).

Three EMA lines with default values of 10, 20, and 50.

Settings and style options to adjust any parameter.

yatofxDescription: "Ramon Coto's 3 Session Bar Color" Indicator

This TradingView Pine Script indicator colors candlestick bars based on three custom trading sessions. It allows traders to visually distinguish different market timeframes on their charts.

Features:

Three configurable trading sessions with user-defined time ranges.

Customizable session colors:

Session A → Blue

Session B → Red

Session C → Lime

Enable/disable sessions independently using input toggles.

Automatic session detection: Bars are colored based on the active session.

Optimized for TradingView Mobile & Desktop with clear and efficient logic.

How It Works:

1. User Inputs: The script takes session time ranges and enables/disables each session.

2. Session Detection: The script checks whether the current time falls within any of the defined sessions.

3. Bar Coloring: If a session is active, the corresponding color is applied to the bars.

This indicator helps traders quickly recognize which market session they are in, improving decision-making for session-based strategies.

Sessions [Key Sessions]Personal Script

This Pine Script (v5) indicator, "Sessions ," overlays trading session data on a TradingView chart. It supports four customizable sessions (default: New York, London, Tokyo, Sydney) with configurable time ranges, colors, and overlay options (Range, Trendline, Mean, VWAP, Max/Min). Session ranges are displayed as shaded boxes with adjustable transparency and optional outlines/labels. Timezone settings allow UTC offset or exchange timezone use. Daily dividers mark day changes with customizable line style (Solid, Dashed, Dotted), line color, text position (Top, Bottom), text color, and text size (Tiny, Small, Normal). Session dividers are optional, showing session transitions with dots and bars. The script uses functions to calculate averages, trendlines, VWAP, and ranges, plotting results with up to 500 bars back. Dashboard functionality is absent, focusing solely on session visualization and dividers.