Gold Scalping Basic+This script is the "Basic+ Gold Scalping Strategy," specifically designed for scalping XAUUSD on the 5-minute chart. It combines smart indicator filters with price action logic to help traders identify high-probability entries and exits. The strategy is based on market structure, trend bias, and momentum confirmation, making it ideal for short-term traders who want clarity in fast-moving gold markets.

Key Features:

Trend-based entry signals using price action

Indicator filters to avoid false setups

Works best in volatile conditions

Optimized for 5M timeframe

Includes visual signals for buy/sell zones

Индикаторы и стратегии

Intraday MA55 Swing PatternsHow This Code Works

Moving Average & Tolerance:

The script calculates the 55‑period moving average (ma55) and then checks if the current price is within a given percentage (tolerancePerc) of the MA.

Trend & Swing Conditions:

It defines an uptrend (price above MA55 and MA55 rising) and a downtrend (price below MA55 and MA55 falling). It then looks at the previous candle for an “acknowledgeable” down swing (for a bullish setup) or an up swing (for a bearish setup) using the user‑defined swingThreshold.

Candlestick Patterns:

Three bullish patterns are defined:

• Bullish Engulfing

• Bullish Wick (a bullish candle with a long lower wick)

• Bullish Doji (small body relative to range)

Similarly, three bearish patterns are defined with inverse logic.

Signal Conditions:

A buy signal is generated only when:

The market is in an uptrend

Price is near the MA55

The previous candle shows a down swing

One of the bullish candlestick patterns appears in the current candle

A sell signal is generated using the opposite conditions.

Plotting & Alerts:

The MA55 is plotted, and buy/sell signals are marked with shapes and optional labels. Alerts are set up so you can use TradingView’s alert system.

First EMA Touch (Last N Bars)Okay, here's a description of the "First EMA Touch (Last N Bars)" TradingView indicator:

Indicator Name: First EMA Touch (Last N Bars)

Core Purpose:

This indicator is designed to visually highlight on the chart the exact moment when the price (specifically, the high/low range of a price bar) makes contact with a specified Exponential Moving Average (EMA) for the first time within a defined recent lookback period (e.g., the last 20 bars).

How it Works:

EMA Calculation: It first calculates a standard Exponential Moving Average (EMA) based on the user-defined EMA Length and EMA Source (e.g., close price). This EMA line is plotted on the chart, often serving as a dynamic level of potential support or resistance.

"Touch" Detection: For every price bar, the indicator checks if the bar's range (from its low to its high) overlaps with or crosses the calculated EMA value for that bar. If low <= EMA <= high, it's considered a "touch".

"First Touch" Logic: This is the key feature. The indicator looks back over a specified number of preceding bars (defined by the Lookback Period). If a "touch" occurs on the current bar, and no "touch" occurred on any of the bars within that preceding lookback window, then the current touch is marked as the "first touch".

Visual Signal: When a "first touch" condition is met, the indicator plots a distinct shape (by default, a small green triangle) below the corresponding price bar. This makes it easy to spot these specific events.

Key Components & Settings:

EMA Line: The calculated EMA itself is plotted (typically as an orange line) for visual reference.

First Touch Signal: A shape (e.g., green triangle) appears below bars meeting the "first touch" criteria.

EMA Length (Input): Determines the period used for the EMA calculation. Shorter lengths make the EMA more reactive to recent price changes; longer lengths make it smoother and slower.

Lookback Period (Input): Defines how many bars (including the current one) the indicator checks backwards to determine if the current touch is the first one. A lookback of 20 means it checks if there was a touch in the previous 19 bars before signalling the current one as the first.

EMA Source (Input): Specifies which price point (close, open, high, low, hl2, etc.) is used to calculate the EMA.

Interpretation & Potential Uses:

Identifying Re-tests: The signal highlights when price returns to test the EMA after having stayed away from it for the duration of the lookback period. This can be significant as the market re-evaluates the EMA level.

Potential Reversal/Continuation Points: A first touch might indicate:

A potential area where a trend might resume after a pullback (if price bounces off the EMA).

A potential area where a reversal might begin (if price strongly rejects the EMA).

A point of interest if price consolidates around the EMA after the first touch.

Filtering Noise: By focusing only on the first touch within a period, it can help filter out repeated touches that might occur during choppy or consolidating price action around the EMA.

Confluence: Traders might use this signal in conjunction with other forms of analysis (e.g., horizontal support/resistance, trendlines, candlestick patterns, other indicators) to strengthen trade setups.

Limitations:

Lagging: Like all moving averages, the EMA is a lagging indicator.

Not Predictive: The signal indicates a specific past event (the first touch) occurred; it doesn't guarantee a future price movement.

Parameter Dependent: The effectiveness and frequency of signals heavily depend on the chosen EMA Length and Lookback Period. These may need tuning for different assets and timeframes.

Requires Confirmation: It's generally recommended to use this indicator as part of a broader trading strategy and not rely solely on its signals for trade decisions.

In essence, the "First EMA Touch (Last N Bars)" indicator provides a specific, refined signal related to price interaction with a moving average, helping traders focus on potentially significant initial tests of the EMA after a period of separation.

EMA Channel Key K-LinesEMA Channel Setup :

Three 32-period EMAs (high, low, close prices)

Visually distinct colors (red, blue, green)

Gray background between high and low EMAs

Key K-line Identification :

For buy signals: Close > highest EMA, K-line height ≥ channel height, body ≥ 2/3 of range

For sell signals: Close < lowest EMA, K-line height ≥ channel height, body ≥ 2/3 of range

Alternating signals only (no consecutive buy/sell signals)

Visual Markers :

Green "BUY" labels below key buy K-lines

Red "SELL" labels above key sell K-lines

Clear channel visualization

Logic Flow :

Tracks last signal direction to prevent consecutive same-type signals

Strict conditions ensure only significant breakouts are marked

All calculations based on your exact specifications

COT Index Indicatormodified version from community script.

This version added support for viewing "Leverage Fund" "Asset Manager" "Producer Merchant" user type. It also shows the total open interest as percent of previous period.

Only works with weekly chart.

Professional MSTI+ Trading Indicator"Professional MSTI+ Trading Indicator" is a comprehensive technical analysis tool that combines over 20 indicators to generate high-quality trading signals and assess market sentiment. The script integrates standard indicators (MACD, RSI, Bollinger Bands, Stochastic, Simple Moving Averages, and Volume Analysis) with advanced components (Squeeze Momentum, Fisher Transform, True Strength Index, Heikin-Ashi, Laguerre RSI, Hull MA) and further includes metrics such as ADX, Chaikin Money Flow, Williams %R, VWAP, and EMA for in-depth market analysis.

Key Features:

Multiple Presets for Different Trading Styles:

Choose from optimal configurations like Professional, Swing Trading, Day Trading, Scalping, or Reversal Hunter. Note that the presets may not work perfectly on all pairs, and manual calibration might be required. This flexibility allows you to fine-tune the settings to align with your unique strategies and signals.

Multi-Layered Signal Filtering:

Filters based on trend, volume, and volatility help eliminate false signals, enhancing the accuracy of market entries.

Comprehensive Fear & Greed Index:

The indicator aggregates data from RSI, volatility, momentum, trend, and volume to gauge overall market sentiment, providing an additional layer of market context.

Dynamic Information Panel:

Displays detailed status updates for each component (e.g., MACD, RSI, Laguerre RSI, TSI, Fisher Transform, Squeeze, Hull MA, etc.) along with a visual strength bar that represents the intensity of the trading signal.

Signal Generation:

Buy and sell signals are generated when a predefined number of conditions are met and confirmed over multiple bars. These signals are clearly displayed on the chart with arrows, making it easier to spot potential entry and exit points.

Alert Setup:

Built-in alert conditions allow you to receive real-time notifications when trading signals are generated, helping you stay on top of market movements.

"Professional MSTI+ Trading Indicator" is designed to enhance your trading strategy by providing a multi-faceted market analysis and an intuitive visual interface. While the presets offer a robust starting point, they may require manual calibration on certain pairs, giving you the flexibility to configure your own unique strategies and signals.

RK 50 crossover RK 50 Crossover Indicator. This indicator shows momentum. When RSI crosses the 50 line, we should understand that momentum is forming in the market. We just have to wait for confirmation.

RK Swing Alert RK Swing Alert Indicator, this is an indicator that gives buy and sell signals. When the trend starts in the market, you just have to wait for the confirmation.

Along with this, another indicator you can use is the RK 50 Crossover Indicator. This indicator shows momentum.

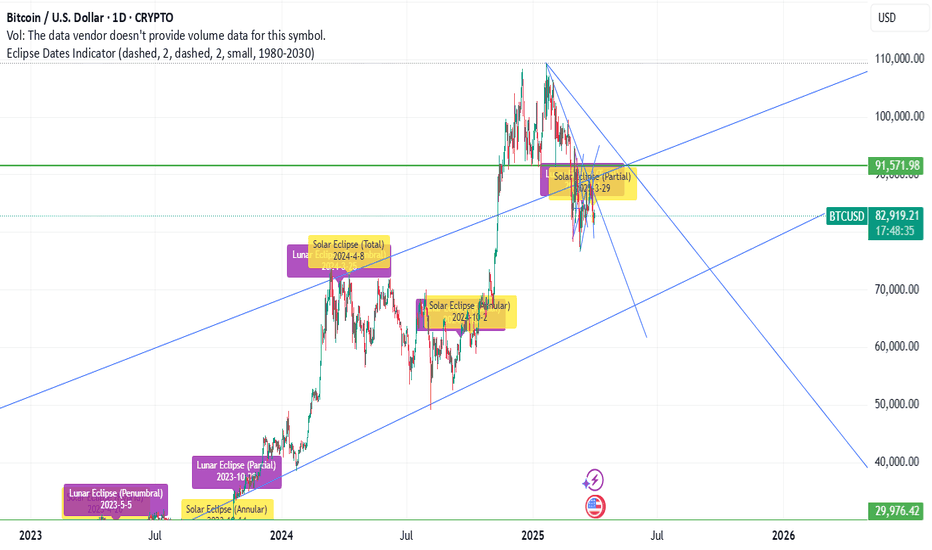

Eclipse Dates IndicatorThis TradingView indicator displays vertical lines on eclipse dates from 1980 to 2030, with comprehensive filtering options for different types of eclipses.

Features

Date Range: Covers 221 eclipse events from 1980 to 2030

Eclipse Types: Filter by Solar and/or Lunar eclipses

Eclipse Subtypes: Filter by Total, Partial, Annular, Penumbral, and Hybrid eclipses

Year Range Selection: Focus on specific decades (1980-1990, 1990-2000, etc.)

Visual Customization: Separate styling for Solar and Lunar eclipses

Line Appearance: Customize color, style, and width

Label Options: Show/hide labels with customizable appearance

Eclipse Types

Show Solar Eclipses: Toggle visibility of Solar eclipses

Show Lunar Eclipses: Toggle visibility of Lunar eclipses

Eclipse Subtypes

Show Total Eclipses: Toggle visibility of Total eclipses

Show Partial Eclipses: Toggle visibility of Partial eclipses

Show Annular Eclipses: Toggle visibility of Annular eclipses

Show Penumbral Eclipses: Toggle visibility of Penumbral eclipses

Show Hybrid Eclipses: Toggle visibility of Hybrid eclipses

Visual Settings

Solar/Lunar Eclipse Line Color: Set the color for eclipse lines

Solar/Lunar Eclipse Line Style: Choose between solid, dashed, or dotted lines

Solar/Lunar Eclipse Line Width: Set the width of eclipse lines

Solar/Lunar Label Text Color: Set the color for label text

Solar/Lunar Label Background Color: Set the background color for labels

General Settings

Show Eclipse Labels: Toggle visibility of eclipse labels

Label Size: Choose between tiny, small, normal, or large labels

Extend Lines to Chart Borders: Toggle whether lines extend to chart borders

Year Range: Filter eclipses by decade (1980-1990, 1990-2000, etc.)

Usage Tips

For optimal visualization, use daily or weekly timeframes

When analyzing specific periods, use the Year Range filter

To focus on specific eclipse types, use the type and subtype filters

For cleaner charts, you can hide labels and only show lines

Customize colors to match your chart theme

Data Source

Eclipse data is sourced from NASA's Five Millennium Catalog of Solar Eclipses and includes both solar and lunar eclipses from 1980 to 2030.

Quadruple Supertrend HTF FilterMultiple supertrend each with distinct TF, ART,& MULTIPLIER for multitimeframe analysis.

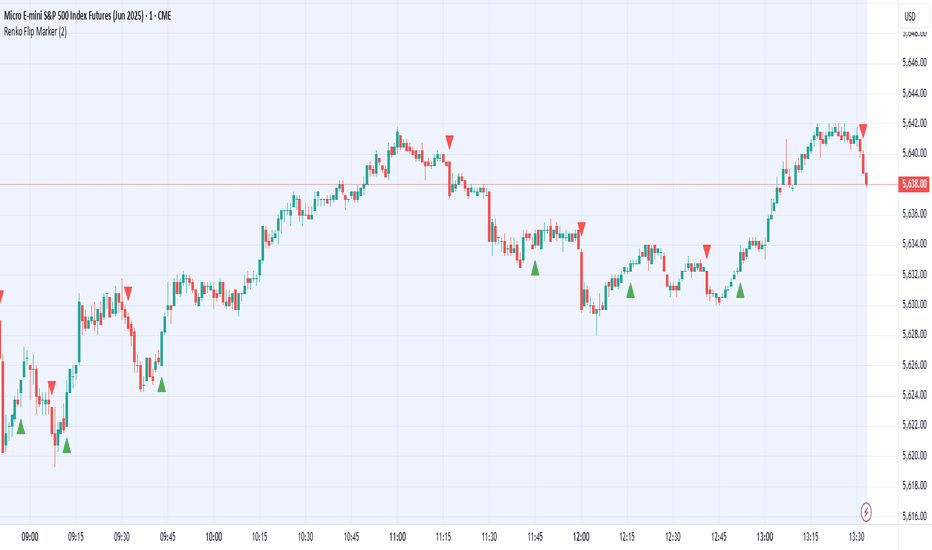

Renko Flip MarkerThis script shows on chart where Renko bricks flip for candlestick chart. I intended it for candlestick chart, but it seems to work Renko chart too from my testing so far. You may change the Renko size for your own scenario you're trading. Hopefully helps, Thank you.

Vertical Lines Every 30 MinShows a vertical Line every 30 minutes

The Line is pink

Not much more to it

TLP Swing Chart V2 + EMA Crosssự kết của swin ema 8 21 200 và tín hiệu nến isb osb giúp nhận diện trade tốt hơn.

Optimize Head-Touch and Bottom-GuessUniquely developed to empower your predictions with smart alerts and analysis using Moving Averages, Bollinger Bands, and VWAP.

Enhanced RSI, VWAP, Pivot Points,BB, Supertrend & SAREnhanced Adaptive RSI with VWAP, Pivots, Bollinger Bands, Supertrend & SAR

This comprehensive trading indicator offers a multi-faceted approach to market analysis, combining multiple adaptive and traditional technical indicators to enhance decision-making. It is ideal for traders looking to gain insights into price momentum, support and resistance levels, and potential trend reversals.

Key Features and Benefits

Adaptive RSI (ARSI)

Tracks market momentum using an adaptive Relative Strength Index, which responds to changing market conditions.

Smoothed with a Simple Moving Average for better clarity.

Provides buy and sell signals with clear visual markers.

VWAP (Volume Weighted Average Price)

Displays Daily, Weekly, Monthly, and Approximate Quarterly VWAP levels.

Useful for identifying fair market value and institutional activity.

Pivot Points with Camarilla S3 and R3

Calculates dynamic support and resistance levels.

Helps traders set effective entry and exit points.

Adaptive Bollinger Bands

Adjusts dynamically to market volatility.

Helps traders identify overbought and oversold conditions.

Adaptive Supertrend

Generates trend-following signals based on volatility-adjusted values.

Provides clear buy and sell markers with color-coded trend identification.

Adaptive Parabolic SAR

Assists in trailing stop-loss placement and identifying trend reversals.

Particularly useful in trending markets.

How to Use

Trend Identification: Follow the Supertrend and SAR for clear directional bias.

Support and Resistance: Use Pivot Points and VWAP levels to gauge market sentiment.

Volatility Management: Monitor Bollinger Bands for breakout or reversal opportunities.

Momentum Analysis: Track ARSI movements for early signals of trend continuation or reversal.

This indicator is a powerful all-in-one solution for day traders, swing traders, and even longer-term investors who want to optimize their trading strategy.

Ahmed Mo3Ty - Bollinger Bands 1Buy:

Enter long when price closes above upper Bollinger Band (plot green arrow)

Close long when price closes below lower Bollinger Band

Sell:

Enter short when price closes below lower Bollinger Band (plot red arrow)

Close short when price closes above upper Bollinger Band

Important: For successful investment in the financial markets, I advise you to use the following combination and not rely solely on technical analysis tools (experience + risk management plan + psychological control + combining technical analysis with fundamental analysis).

Risk Warning: This indicator is not a buy or sell recommendation. Rather, it is for educational purposes and should be combined with the previous combination. Any buy or sell order is yours alone, and you are responsible for it.

Buy/Sell### Description of the Pine Script:

This script generates buy and sell signals using a combination of **Exponential Moving Averages (EMAs)**, the **MACD histogram**, and the **Relative Strength Index (RSI)**. It is designed to reduce the number of signals and improve the win rate by adding multiple conditions to filter out less reliable trades.

### Key Components:

1. **Exponential Moving Averages (EMAs):**

- **EMA 5** (Short-Term Trend) and **EMA 20** (Long-Term Trend).

- These moving averages are used to identify the overall trend direction. A buy signal is generated when the price is above both EMAs, indicating a bullish trend, and a sell signal occurs when the price is below both EMAs, indicating a bearish trend.

2. **MACD Histogram:**

- The **MACD** (Moving Average Convergence Divergence) is a momentum indicator, and the histogram represents the difference between the MACD line and its signal line.

- A positive MACD histogram indicates bullish momentum, while a negative histogram indicates bearish momentum.

- Buy signals are only generated when the MACD histogram is above zero, indicating positive momentum, and sell signals when the MACD histogram is below zero, indicating negative momentum.

3. **Relative Strength Index (RSI):**

- The **RSI** is used to measure the strength of a trend. The script uses a threshold to identify when the market is in a strong condition.

- **RSI Buy Threshold:** Only allows a buy signal when the RSI is above 60, indicating strong buying pressure.

- **RSI Sell Threshold:** Only allows a sell signal when the RSI is below 40, indicating strong selling pressure.

### Conditions for Buy and Sell Signals:

- **Buy Condition:**

- The **price** is above both the **EMA 5** and **EMA 20**, indicating a strong uptrend.

- The **RSI** is above 60, indicating strong buying pressure.

- The **MACD histogram** is positive, confirming bullish momentum.

- **Sell Condition:**

- The **price** is below both the **EMA 5** and **EMA 20**, indicating a strong downtrend.

- The **RSI** is below 40, indicating strong selling pressure.

- The **MACD histogram** is negative, confirming bearish momentum.

### Plotting Signals:

- **Buy Signal**: When all the buy conditions are met, a green "BUY" label is plotted below the bar.

- **Sell Signal**: When all the sell conditions are met, a red "SELL" label is plotted above the bar.

### Purpose:

- This strategy is designed to provide more reliable signals by ensuring that trades are only taken when multiple conditions are met, reducing false signals.

- By combining trend (EMA), momentum (MACD), and strength (RSI) indicators, the script aims to filter out low-probability trades and increase the win rate.

Let me know if you'd like further clarification or adjustments!

CRT with Trend FilterExplanation of Functionality

The CRT RED DOG with Trend Filter indicator is a tool used to identify buy and sell signals on a price chart. It filters signals based on the market trend to ensure higher accuracy.

Main Components of the Indicator

Moving Average (EMA) Settings

Users can set the moving average (EMA) length as desired, with a default value of 50 days.

This moving average is used to determine the market trend.

Determining Market Trend

Uptrend: Occurs when the closing price is above the moving average.

Downtrend: Occurs when the closing price is below the moving average.

Identifying Buy and Sell Signals

Buy Signal: Occurs when the current bar's low is lower than the previous bar's low, and the closing price is higher than the previous bar's close, during an uptrend.

Sell Signal: Occurs when the current bar's high is higher than the previous bar's high, and the closing price is lower than the previous bar's close, during a downtrend.

Displaying Signals on the Chart

Buy signals are displayed with a green arrow below the candlestick.

Sell signals are displayed with a red arrow above the candlestick.

Time frame Day >> 15M

SCE GANN PredictionsThis is a script designed to give an insight on price direction from being above or below a GANN Value.

What Are GANN Waves?

The SCE GANN Predictions indicator is inspired by the work of W.D. Gann, a renowned trader who believed that price movements follow geometric and mathematical patterns. GANN waves use past price behavior—specifically momentum or "velocity"—to forecast where prices might head next.

How Does the Indicator Work?

Calculating Velocity

The script starts by measuring the "velocity" of price movement over a user-defined lookback period (denoted as n). This velocity is the average difference between the close and open prices over n bars. Think of it as the market’s speed in a given direction.

Predicting the Future Price

Using this velocity, the indicator estimates a future price after a specific time horizon—calculated as n + n*2 bars into the future (e.g., if n = 15, it predicts 45 bars ahead). It scales the velocity by a ratio (Gr) to determine the "end price." This is the raw GANN prediction.

Optimizing the Ratio (Gr)

The key to a good prediction is finding the right Gr. The script tests a range of Gr values (from Gr_min to Gr_max, stepping by Gr_step) and evaluates each one by calculating the sum of squared errors (SSE) between the predicted prices and the actual historical close prices. The Gr with the lowest SSE is deemed "optimal" and used for the final prediction.

Smoothing with an SMA

The raw GANN prediction is then smoothed using a simple moving average (SMA) over the lookback period (n). This SMA is plotted on your chart, serving as a dynamic trend line. The plot’s color changes based on the current price: teal if the close is above the SMA (bullish), and red if below (bearish).

Visuals

This example shows how the value explains price strength and changes color. When the price is above the line, and it’s green, we’re showing an up trend. The opposite is when the price is below the line, and it’s red, showing a down trend.

We can see that there may be moments where price drops under the value for just that one bar.

In scenarios with sideways price action, even though the price crosses, there is no follow through. This is a shortcoming of the overall concept.

Customizable Inputs

Timeframe: Choose the timeframe for analysis (default is 2 minutes).

Show GANN Wave: Toggle the GANN SMA plot on or off (default is true).

Lookback Period (Gn): Set the number of bars for velocity and SMA calculations (default is 15).

Min Ratio (Gr_min): The lower bound for the Gr optimization (default is 0.05).

Max Ratio (Gr_max): The upper bound for Gr (default is 0.2).

Step for Gr (Gr_step): The increment for testing Gr values (default is 0.01).

How to Use SCE GANN Predictions

Trend Direction

The colored SMA provides a quick visual cue. Teal suggests an uptrend, while red hints at a downtrend. Use this to align your trades with the broader momentum.

Crossover Signals

Watch for the close price crossing the GANN SMA. A move above could signal a buy opportunity, while a drop below might indicate a sell. Combine this with other indicators for confirmation.

Fine-Tuning

Experiment with the lookback period (Gn) and Gr range to optimize for your market. Shorter lookbacks might suit fast-moving assets, while longer ones could work for slower trends.

Like any technical tool, SCE GANN Predictions isn’t a crystal ball. It’s based on historical data and mathematical assumptions, so it won’t always be spot-on.

Volume-Powered S/R TraderThis advanced TradingView indicator combines volume analysis, dynamic support/resistance levels, and technical indicators to identify high-probability trading opportunities. It focuses on detecting institutional-level activity through volume spikes at key price levels.

Key Components

Volume Analysis Engine

Tracks volume spikes (150%+ of 20-period average)

Color-coded volume bars:

Green: Bullish volume spike (high volume + bullish candle)

Red: Bearish volume spike (high volume + bearish candle)

Dynamic Support/Resistance System

Auto-detects swing points using pivot high/low

Maintains rolling arrays of:

Support Levels (green semi-transparent lines)

Resistance Levels (red semi-transparent lines)

Displays only the 5 most recent levels for clarity

Trend Analysis

50-period EMA trend filter

RSI momentum indicator (14-period)

Trend direction classification:

Bullish: EMA rising

Bearish: EMA falling