Volume Flow Scalper PRO+ (RSI & EMA Filters)

### 📊 Volume Flow Scalper PRO+ Strategy (with RSI & EMA Filters)

**Overview:**

The *Volume Flow Scalper PRO+* is a dynamic momentum-based strategy that leverages volume flow direction, enhanced with RSI and EMA trend filters, to generate precise scalping signals. This tool is designed for intraday and short-term traders who want to capitalize on high-probability buy and sell zones driven by real-time market sentiment.

---

**Core Components:**

✅ **Volume Flow Analysis**

Measures the net bullish vs. bearish volume based on price movement (up or down candle) and smooths it using your chosen Moving Average type (EMA, SMA, WMA, or VWMA). This forms the core of signal generation.

✅ **RSI Bias Filter (Optional)**

Filters trades based on RSI momentum. Buy signals require RSI to be above a user-defined level (default: 50), while sell signals require it to be below.

✅ **EMA Trend Filter (Optional)**

Ensures entries align with the trend. Buy signals require price to be above the EMA; sell signals require it to be below.

✅ **VWAP Filter (Optional)**

For traders who favor institutional price levels, this option restricts signals to when price is above (buy) or below (sell) the Volume Weighted Average Price.

---

**Signals:**

- 🔼 **Buy Signal**: Triggered when the Volume Flow MA crosses **above** a threshold, with filters confirming bullish conditions.

- 🔽 **Sell Signal**: Triggered when the Volume Flow MA crosses **below** a negative threshold, with filters confirming bearish conditions.

---

**Strategy Features:**

- 📈 **Customizable Take Profit / Stop Loss** levels based on percentage distance from entry.

- 🔍 **Fully Adjustable Settings** including MA types, thresholds, filter usage, and indicator lengths.

- ⚙️ Works on any timeframe and any market (crypto, forex, stocks, etc.).

---

**Best Use Cases:**

- Scalping on lower timeframes (1m, 5m, 15m)

- Filtering high-quality entries with trend confirmation

- Combining with price action or support/resistance zones

Индикаторы и стратегии

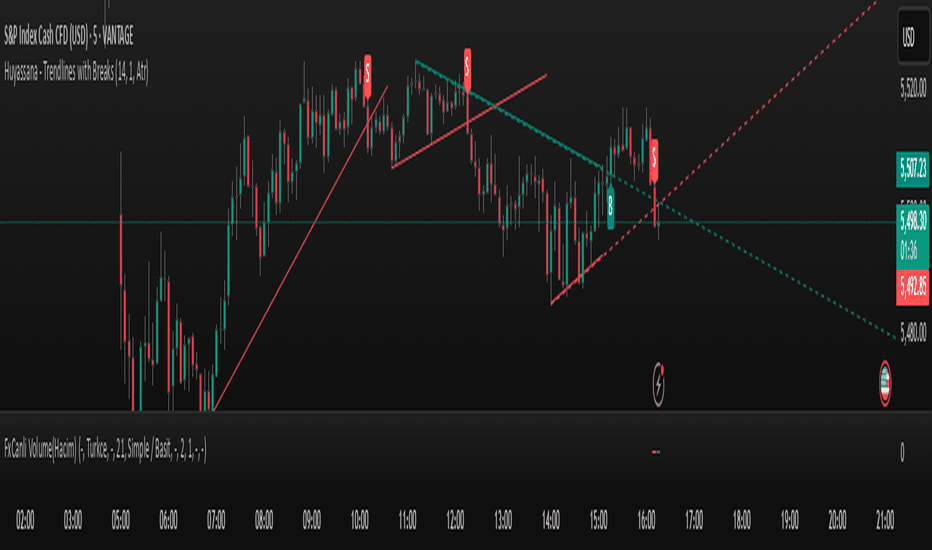

Zonas Prohibidas Topstep (NQ) - Auto🛡️ Topstep Restricted Zones (Auto Previous Close) — by Dragonthegood

This script is built for traders using Topstep or other prop firm accounts that enforce risk rules near daily price limits (such as on futures like NQ, the E-mini Nasdaq-100).

🧠 What does this indicator do?

🔹 Automatically fetches the previous day's closing price

🔹 Based on that close, it calculates:

The 7% daily price limit (up and down)

The 2% restricted zone near those limits, where Topstep does not allow trading

🔹 Visually draws two red horizontal zones (upper and lower) on the chart, indicating where you should not open or hold positions

🔹 Optionally displays the previous close as a label on the chart for reference

🔒 Why is it useful?

Helps you avoid violations of Topstep's high-risk zone rules

Prevents you from getting stuck in a trade if the market hits limit up or limit down

Works in real-time, without needing to manually input the previous close

🛠️ How to use it:

Apply the script to your chart (works on any timeframe)

The danger zones will auto-draw based on yesterday’s close

If price is inside the red zone — don’t trade (per Topstep rules)

No daily configuration required

📌 Perfect for:

Futures traders in funded accounts (Topstep, Apex, etc.)

Scalpers and day traders using NQ, ES, RTY, etc.

Anyone managing risk during high-volatility conditions

Ehlers Reverse EMAOverview

The Ehlers Reverse EMA is an advanced momentum indicator designed by John Ehlers and implemented here with additional features for improved trading decision-making. This indicator helps identify trend direction, potential reversals, and generates precise buy/sell signals based on multiple confirmation methods.

What Makes It Unique

Unlike conventional EMAs, the Ehlers Reverse EMA uses a sophisticated reverse-engineering approach to provide smoother, more responsive signals with reduced lag. The indicator combines a proprietary EMA calculation with optional moving average confirmation to filter out market noise and highlight meaningful price movements.

Features

Dynamic Color Coding: Green when momentum is positive, red when negative

Moving Average Overlay: Optional MA with selectable types (SMA, EMA, WMA, VWMA)

Multiple Signal Generation Methods:

Zero-Line Crossovers: Signals when momentum shifts from positive to negative or vice versa

MA Crossovers: Signals when the Ehlers EMA crosses its own moving average

Combined Confirmation: Requires both zero-line and MA crossovers for highest probability signals

On-Chart Signal Visualization: Clear buy/sell arrows directly on the price chart

Customizable Parameters: Adjust alpha value, MA type, and signal generation to suit your trading style

How To Use

Add the main "Ehlers Reverse EMA" indicator to your chart

Add the companion "EREMA Signals" indicator to display buy/sell signals on the price chart

Ensure both indicators have matching settings for consistency

Signal Interpretation

Buy Signals (Green Triangles): Appear below price bars when conditions are met

Sell Signals (Red Triangles): Appear above price bars when conditions are met

Recommended Timeframes

Works well on all timeframes from 5-minute to daily charts. For swing trading, 4H or daily timeframes often provide the most reliable signals.

Strategy Applications

Trend Following: Use zero-line crossovers to enter with the trend

Momentum Trading: Use MA crossovers for entry and exit points

Confirmation Tool: Combine with price action or other indicators for higher-probability trades

Divergence Analysis: Compare indicator movement with price action to spot potential reversals

Parameter Settings

Alpha (Default: 0.1): Lower values create smoother lines but more lag; higher values increase responsiveness but may increase false signals

MA Length (Default: 14): Adjust based on your trading timeframe and style

This versatile indicator helps identify high-probability trading opportunities while filtering out market noise, making it valuable for both novice and experienced traders alike.

Rally Starter BandsEnglish Description:

Rally Starter Bands – Pine Script Indicator

This is a Pine Script indicator designed to identify potential rally opportunities in the market using Bollinger Bands. It plots the traditional Bollinger Bands and highlights specific conditions where the upper and middle bands are rising while the lower band is falling. When these conditions are met, the indicator displays a green up arrow below the price bar, signaling a potential upward momentum.

---

Credits:

Strategy: Adem Ayan (x.com/ademayan66/status/1901706968508637483)

Screening Codes: Dip Avcısı (x.com/dipavcisi007)

Trama gradientsshows the gradients of 3 Luxalgo 'TRAMA' lines (length of 20,50 and 200) (trend regularity adaptive moving average), and displays the distance between price, and this value of the 200 TRAMA

Daily Separator with Daythis indicator about vertical lines at weekly days. Add at chart a 2 part of this indicator - Weekdays Labels to have all advantages this indicator

Dynamic VWAP with AnchorThe Dynamic VWAP with Anchor is a powerful price-based indicator that enhances the traditional Volume Weighted Average Price (VWAP) by introducing a flexible anchoring mechanism. Instead of calculating the VWAP from the beginning of a session or day, this version allows traders to anchor the VWAP dynamically to a specific point in time or event—such as a swing high/low, breakout, earnings release, or any significant price level.

TurboRSI [PQ_MOD]This indicator, TurboRSI, is a sophisticated momentum and overbought/oversold oscillator that combines a True Strength Index (TSI) calculation with a multi-length RSI smoothing mechanism and regression analysis to deliver real-time market insights. It first computes the TSI using user-defined short and long periods along with a signal EMA, then linearly scales and logarithmically transforms the results to accentuate price momentum extremes. Concurrently, it aggregates RSI values over a customizable range to derive separate smoothed averages for bullish and bearish conditions, which form upper and lower channel boundaries. A regression line is calculated over a specified period to serve as a dynamic reference, and the deviation of price from this line is normalized and mapped to a gradient to create an intuitive candle heatmap. Additional visual elements include plotted channels, filled overbought/oversold zones, and reference lines at key levels (80, 50, and 20), with an optional table displaying key metrics. Overall, TurboRSI provides traders with a multi-faceted view of momentum, trend strength, and potential reversal zones.

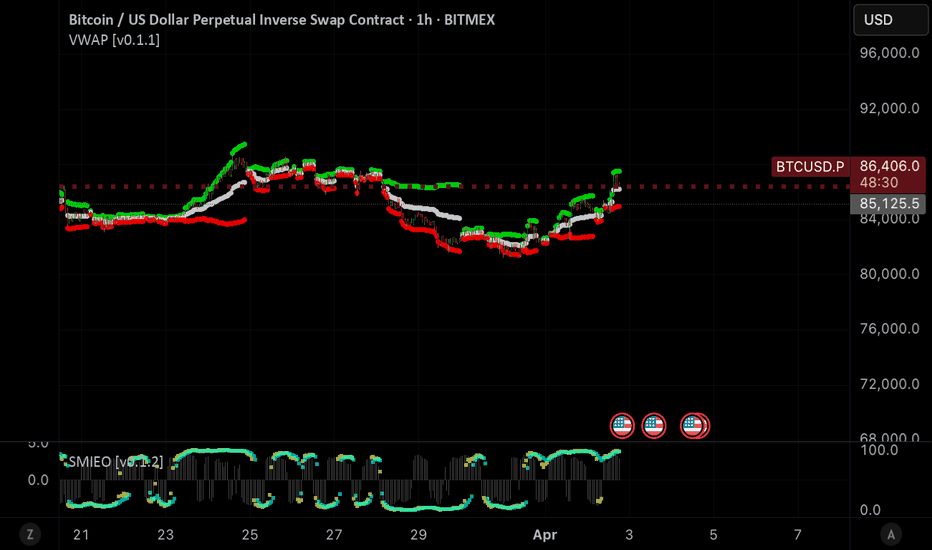

AltSeasonality - MTFAltSeason is more than a brief macro market cycle — it's a condition. This indicator helps traders identify when altcoins are gaining strength relative to Bitcoin dominance, allowing for more precise entries, exits, and trade selection across any timeframe.

The key for altcoin traders is that the lower the timeframe, the higher the alpha.

By tracking the TOTAL3/BTC.D ratio — a real-time measure of altcoin strength versus Bitcoin — this tool highlights when capital is rotating into or out of altcoins. It works as a bias filter, helping traders avoid low-conviction setups, especially in chop or during BTC-led conditions.

________________________________________________________________________

It works well on the 1D chart to validate swing entries during strong altcoin expansion phases — especially when TOTAL3/BTC.D breaks out while BTCUSD consolidates.

On the 4H or 1D chart, rising TOTAL3/BTC.D + a breakout on your altcoin = high-conviction setup. If BTC is leading, fade the move or reduce size. Consider pairing with the Accumulation - Distribution Candles, optimized for the 1D (not shown).

🔍 Where this indicator really excels, however, is on the 1H and 15M charts, where short-term traders need fast bias confirmation before committing to a move. Designed for scalpers, intraday momentum traders, and tactical swing setups.

Use this indicator to confirm whether an altcoin breakout is supported by broad market flow — or likely to fail due to hidden BTC dominance pressure.

________________________________________________________________________

🧠 How it works:

- TOTAL3 = market cap of altcoins (excl. BTC + ETH)

- BTC.D = Bitcoin dominance as % of total market cap

- TOTAL3 / BTC.D = a normalized measure of altcoin capital strength vs Bitcoin

- BTCUSD = trend baseline and comparison anchor

The indicator compares these forces side-by-side, using a normalized dual-line ribbon. There is intentionally no "smoothing".

When TOTAL3/BTC.D is leading, the ribbon shifts to an “altseason active” phase. When BTCUSD regains control, the ribbon flips back into BTC dominance — signaling defensive posture.

________________________________________________________________________

💡 Strategy Example:

On the 1H chart, a crossover into altseason → check the 15M chart for confirmation. Consider adding the SUPeR TReND 2.718 for confirmation (not shown). If both align, you have trend + flow confluence. If BTCUSD is leading or ribbon is mixed, reduce exposure or wait for confirmation. Further confirmation via Volume breakouts in your specific coin.

⚙️ Features:

• MTF source selection (D, 1H, 15M)

• Normalized ribbon (TOTAL3/BTC.D vs BTCUSD)

• Cross-aware fill shading

• Custom color and transparency controls

• Optional crossover markers

• Midline + zone guides (0.2 / 0.5 / 0.8)

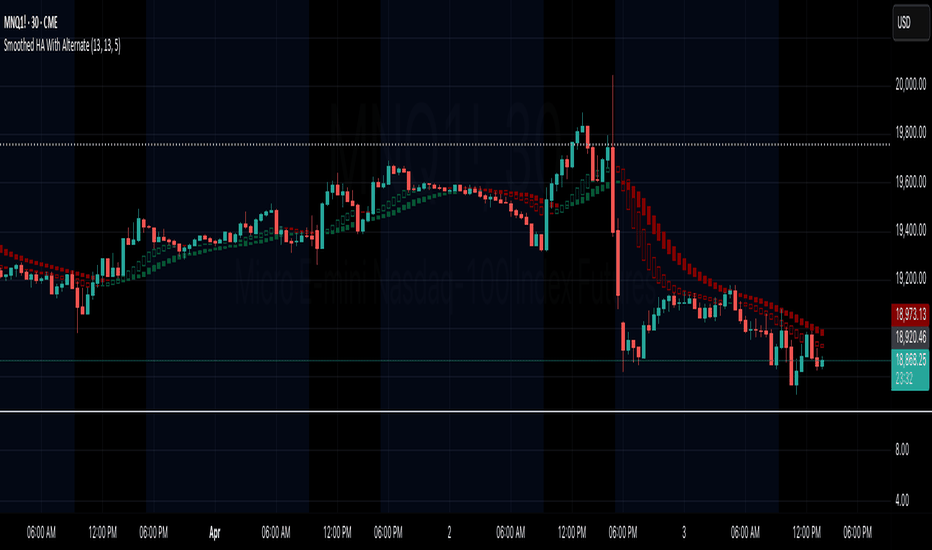

Smoothed Heiken Ashi Candles With Alternate Chart IntervalWhen trading, we tend to have one or more preferred chart time interval. If using HA candles for trend analysis, you may watch HA candles on each of those preferred interval, using multiple charts for a given symbol. However, having an indicator that plots HA candles for the given chart interval, as well the HA candles based on another interval on the same chart, provides the ability to watch HA reactions on multiple chart intervals more easily.

As an example, you like to watch the 5 minute chart with HA candles, but also prefer to use the 30 minute chart and HA candles for confirmation of a reversal/retrace. This indicator provides the convenience of monitoring your 5 minute chart, and setting alternate HA interval to 30 minute, thereby showing each set of the HA candles together on the same chart.

The alternate HA candles are calculated based on the selected chart interval, defaulting to 5 minutes.

The default HA and alternate HA candles are calculated and smoothed using the selected EMA length. Both default to 13.

Moving Average Crossover ScannerThis is a scanner for Multiple Indicators like MA Cross, MACD, RSI, Adx. You can get clear market trend data by using it. Enjoy the Script!

Canadian Elections & PM TimelineThis script displays major Canadian federal election years along with the names and party affiliations of elected Prime Ministers, directly on your price chart. It provides a quick visual reference for key political events that may have had market impact, helping traders correlate price movements with changes in leadership.

Responsive VWAP Bands [PQ_MOD]This indicator calculates dynamic VWAP bands that adapt in real time to market conditions. It continuously aggregates volume‐weighted price data from a user-defined start point (either the very first bar or after a specified time) to compute a progressive VWAP (pvwap) and its associated volatility, derived from a volume-weighted variance of the price. The resulting standard deviation is scaled by a user-defined multiplier to generate upper and lower bands around the pvwap. Notably, the indicator features a customizable event-triggered reset mechanism—where the cumulative sums are reinitialized when a chosen condition (such as a periodic interval, a new higher high or lower low, a trend change indicated by a stochastic oscillator divergence, or an external event) is met—thereby enhancing its responsiveness to shifts in market structure. The VWAP, along with its bands, is then plotted on the chart using circle markers, offering a clear visual reference for potential support and resistance levels.

Vertical Line at Specified HoursThis script helps you easily separate time.

This indicator can be used for many different purposes. For example, I use it to separate different days and sessions.

Features :

1- Ability to use 10 vertical lines simultaneously

2- The Possibility to change the color of lines

3- The Possibility to change the line type

Tip : The times you enter in the input section must be in the New York time zone.

Customizable RSI/StochRSI Double ConfirmationBelow are the key adjustable parameters in the script and their usage:

RSI Parameters

RSI Length: The number of periods used to calculate the RSI, with a default value of 7. Adjusting this parameter changes the sensitivity of the RSI—shorter periods make it more sensitive, while longer periods make it smoother.

RSI Source: The price source used for RSI calculation, defaulting to the closing price (close). This can be changed to the opening price or other price types as needed.

StochRSI Parameters

StochRSI Length: The number of periods used to calculate the StochRSI, with a default value of 5. This affects how quickly the StochRSI reacts to changes in the RSI.

StochRSI Smooth K: The smoothing period for the StochRSI %K line, with a default value of 3. This is used to reduce noise.

StochRSI Smooth D: The smoothing period for the StochRSI %D line, with a default value of 3. It works in conjunction with %K to provide more stable signals.

Signal Thresholds

RSI Buy Threshold: A buy signal is triggered when the RSI crosses above this value (default 20).

RSI Sell Threshold: A sell signal is triggered when the RSI crosses below this value (default 80).

StochRSI Buy Threshold: A buy signal is triggered when the StochRSI %K crosses above this value (default 20).

StochRSI Sell Threshold: A sell signal is triggered when the StochRSI %K crosses below this value (default 80).

Signals

RSI Buy/Sell Signals: When the RSI crosses the buy/sell threshold, a green "RSI Buy" or red "RSI Sell" is displayed on the chart.

StochRSI Buy/Sell Signals: When the StochRSI %K crosses the buy/sell threshold, a yellow "StochRSI Buy" or purple "StochRSI Sell" is displayed.

Double Buy/Sell Signals: When both RSI and StochRSI simultaneously trigger buy/sell signals, a green "Double Buy" or red "Double Sell" is displayed, indicating a stronger trading opportunity.

The volatility of different cryptocurrencies varies, and different parameters may be suitable for each. Users need to experiment and select the most appropriate parameters themselves.

Disclaimer: This script is for informational purposes only and should not be considered financial advice; use it at your own risk.

TTM Squeeze Momentum MTF [Cometreon]TTM Squeeze Momentum MTF combines the core logic of both the Squeeze Momentum by LazyBear and the TTM Squeeze by John Carter into a single, unified indicator. It offers a complete system to analyze the phase, direction, and strength of market movements.

Unlike the original versions, this indicator allows you to choose how to calculate the trend, select from 15 different types of moving averages, customize every parameter, and adapt the visual style to your trading preferences.

If you are looking for a powerful, flexible and highly configurable tool, this is the perfect choice for you.

🔷 New Features and Improvements

🟩 Unified System: Trend Detection + Visual Style

You can decide which logic to use for the trend via the "Show TTM Squeeze Trend" input:

✅ Enabled → Trend calculated using TTM Squeeze

❌ Disabled → Trend based on Squeeze Momentum

You can also customize the visual style of the indicator:

✅ Enable "Show Histogram" for a visual mode using Histogram, Area, or Column

❌ Disable it to display the classic LazyBear-style line

Everything updates automatically and dynamically based on your selection.

🟩 Full Customization

Every base parameter of the original indicator is now fully configurable: lengths, sources, moving average types, and more.

You can finally adapt the squeeze logic to your strategy — not the other way around.

🟩 Multi-MA Engine

Choose from 15 different Moving Averages for each part of the calculation:

SMA (Simple Moving Average)

EMA (Exponential Moving Average)

WMA (Weighted Moving Average)

RMA (Smoothed Moving Average)

HMA (Hull Moving Average)

JMA (Jurik Moving Average)

DEMA (Double Exponential Moving Average)

TEMA (Triple Exponential Moving Average)

LSMA (Least Squares Moving Average)

VWMA (Volume-Weighted Moving Average)

SMMA (Smoothed Moving Average)

KAMA (Kaufman’s Adaptive Moving Average)

ALMA (Arnaud Legoux Moving Average)

FRAMA (Fractal Adaptive Moving Average)

VIDYA (Variable Index Dynamic Average)

🟩 Dynamic Signal Line

Apply a moving average to the momentum for real-time cross signals, with full control over its length and type.

🟩 Multi-Timeframe & Multi-Ticker Support

You're no longer limited to the chart's current timeframe or ticker. Apply the squeeze to any symbol or timeframe without repainting.

🔷 Technical Details and Customizable Inputs

This indicator offers a fully modular structure with configurable parameters for every component:

1️⃣ Squeeze Momentum Settings – Choose the source, length, and type of moving average used to calculate the base momentum.

2️⃣ Trend Mode Selector – Toggle "Show TTM Squeeze Trend" to select the trend logic displayed on the chart:

✅ Enabled – Shows the trend based on TTM Squeeze (Bollinger Bands inside/outside Keltner Channel)

❌ Disabled – Displays the trend based on Squeeze Momentum logic

🔁 The moving average type for the Keltner Channel is handled automatically, so you don't need to select it manually, even if the custom input is disabled.

3️⃣ Signal Line – Toggle the Signal Line on the Squeeze Momentum. Select its length and MA type to generate visual cross signals.

4️⃣ Bollinger Bands – Configure the length, multiplier, source, and MA type used in the bands.

5️⃣ Keltner Channel – Adjust the length, multiplier, source, and MA type. You can also enable or disable the True Range option.

6️⃣ Advanced MA Parameters – Customize the parameters for advanced MAs (JMA, ALMA, FRAMA, VIDYA), including Phase, Power, Offset, Sigma, and Shift values.

7️⃣ Ticker & Input Source – Select the ticker and manage inputs for alternative chart types like Renko, Kagi, Line Break, and Point & Figure.

8️⃣ Style Settings – Choose how the squeeze is displayed:

Enable "Show Histogram" for Histogram, Area, or Column style

Disable it to show the classic LazyBear-style line

Use Reverse Color to invert line colors

Toggle Show Label to highlight Signal Line cross signals

Customize trend colors to suit your preferences

9️⃣ Multi-Timeframe Options - Timeframe – Use the squeeze on higher timeframes for stronger confirmation

🔟 Wait for Timeframe Closes -

✅ Enabled – Prevents multiple signals within the same candle

❌ Disabled – Displays the indicator smoothly without delay

🔧 Default Settings Reference

To replicate the default settings of the original indicators as they appear when first applied to the chart, use the following configurations:

🟩 TTM Squeeze (John Carter Style)

Squeeze

Length: 20

MA Type: SMA

Show TTM Squeeze Trend: Enabled

Bollinger Bands

Length: 20

Multiplier: 2.0

MA Type: SMA

Keltner Channel

Length: 20

Multiplier: 1.0

Use True Range: ON

MA Type: EMA

Style

Show Histogram: Enabled

Reverse Color: Enabled

🟩 Squeeze Momentum (LazyBear Style)

Squeeze

Length: 10

MA Type: SMA

Show TTM Squeeze Trend: Disabled

Bollinger Bands

Length: 20

Multiplier: 1.5

MA Type: SMA

Keltner Channel

Length: 10

Multiplier: 1.5

Use True Range: ON

MA Type: SMA

Style

Show Histogram: Disabled

Reverse Color: Disabled

⚠️ These values are intended as a starting point. The Cometreon indicator lets you fully customize every input to fit your trading style.

🔷 How to Use Squeeze Momentum Pro

🔍 Identifying Trends

Squeeze Momentum Pro supports two different methods for identifying the trend visually, each based on a distinct logic:

Squeeze Momentum Trend (LazyBear-style):

Displays 3 states based on the position of the Bollinger Bands relative to the Keltner Channel:

🔵 Blue = No Squeeze (BB outside KC and KC outside BB)

⚪️ White = Squeeze Active (BB fully inside KC)

⚫️ Gray = Neutral state (none of the above)

TTM Squeeze Trend (John Carter-style):

Calculates the difference in width between the Bollinger Bands and the Keltner Channel:

🟩 Green = BB width is greater than KC → potential expansion phase

🟥 Red = BB are tighter than KC → possible compression or pre-breakout

📈 Interpreting Signals

Depending on the active configuration, the indicator can provide various signals, including:

Trend color → Reflects the current compression/expansion state (based on selected mode)

Momentum value (above or below 0) → May indicate directional pressure

Signal Line cross → Can highlight momentum shifts

Color change in the momentum → May suggest a potential trend reversal

🛠 Integration with Other Tools

Squeeze Momentum Pro works well alongside other indicators to strengthen market context:

✅ Volume Profile / OBV – Helps confirm accumulation or distribution during squeezes

✅ RSI – Useful to detect divergence between momentum and price

✅ Moving Averages – Ideal for defining primary trend direction and filtering signals

☄️ If you find this indicator useful, leave a Boost to support its development!

Every piece of feedback helps improve the tool and deliver an even better trading experience.

🔥 Share your ideas or feature requests in the comments!

ORB Lines - Opening Range Breakout [GC Trading Systems]A simple indicator that draws your opening range + custom fib extension targets.

Trendingline ZMDConfirming the Breakout

To avoid false breakouts, consider these confirmation signals:

A candle close beyond the trendline.

Increased volume during the breakout.

Retesting the trendline as support/resistance.

Trading the Breakout

Entry: Enter a trade after confirmation signals.

Stop Loss: Place a stop loss slightly beyond the trendline to limit risk.

Take Profit: Set profit targets based on support/resistance levels or Fibonacci extensions.

Trendline Retest Strategy

After breaking a trendline, the price often retests the broken trendline before continuing in the new direction. If the price respects the trendline as a new support/resistance, it adds further confirmation.

By following these steps, traders can effectively use trendline breakouts to identify high-probability trading opportunities.

MFI Module (Raw Output)Outputs raw Money Flow Index (MFI) values for modular use in other scripts.

Useful for confluence-based strategies that reference external modules via request.security().

MULTI-SESSION GLM🎯 "MULTI-SESSION GLM" Indicator

Highlight 3 customizable trading sessions directly on your chart, each with unique colors—ideal for spotting market overlaps or key trading hours.

✨ Features:

✅ 3 independent sessions (adjust time ranges & colors).

✅ Transparent overlay (non-intrusive to price action).

✅ Perfect for Forex, Futures, and Stock traders.

✅ Easy setup (configure in seconds).

⚙️ How to Use:

Open the indicator settings.

Set your sessions (e.g., "0800-1200").

Pick colors for each zone.

Multi-Timeframe EMAs with PivotThis is a well-designed multi-timeframe EMA indicator with pivot points for TradingView. Here's a detailed analysis:

Core Components

Multi-Timeframe EMAs

Tracks 5, 20, and 48-period EMAs across 4 timeframes (1m, 5m, 15m, 1h)

Uses request.security() to fetch higher timeframe data accurately

Each EMA is toggleable via input settings

Pivot Point System

Calculates classic pivot point: (Prev High + Prev Low + Prev Close)/3

Flexible timeframe selection (default: Daily)

Displays as a yellow line with labeled value

Visual Design

Color-coded EMAs for easy identification

Clean plotting with na values for disabled EMAs

Dynamic pivot line that auto-centers on last bar

EMA Çoklu Zamanlı GöstergesiEMA 8,EMA 34,EMA 55,EMA 99 VE EMA 200 indikatörlerinin tek gösterge altında toplanması

SMIEO [PQ_MOD]This indicator computes a smoothed momentum oscillator by first calculating the True Strength Index (TSI) of a chosen price source using customizable short and long periods. It then derives a signal line by applying an exponential moving average (EMA) to the TSI over a user-defined period. The oscillator itself is determined as the difference between the TSI and its signal line, offering insight into momentum shifts. Additionally, the indicator visually represents both the TSI and the signal line using translucent circle plots, while the oscillator is displayed as a histogram, thereby enabling traders to easily identify potential overbought or oversold conditions as well as trend reversals.