Optimized WPR Strategy with Filters (Debug)Identifying Market Trends:

The 200-period EMA is used to determine the short-term trend of the market.

When the price is above the 200-period EMA, it suggests a potential bullish market and an uptrend, and the strategy will only look for buying opportunities.

When the price is below the 200-period EMA, it suggests a potential bearish market and a downtrend, and the strategy will only look for selling opportunities.

When the 200-period EMA intersects with the price, it indicates that the market may be in a directionless consolidation phase.

Identifying Potential Reversal Points:

The strategy employs two Williams %R (WPR) indicators: one with a 9-period (fast WPR) and another with a 28-period (slow WPR).

WPR is a momentum indicator used to identify overbought and oversold conditions in the market. Its value oscillates between -100 and 0, with values near -100 indicating oversold conditions and values near 0 indicating overbought conditions.

In an uptrend (when the price is above the 200 EMA), the strategy seeks buying opportunities when both WPR indicators cross above -80 (the oversold zone) from below. This is considered a bullish signal, suggesting the market may be about to rebound. Sell signals are ignored at this time.

In a downtrend (when the price is below the 200 EMA), the strategy seeks selling opportunities when both WPR indicators cross below -20 (the overbought zone) from above. This is considered a bearish signal, suggesting the market may be about to reverse downward. Buy signals are ignored at this time.

Summary:

In summary, this strategy first uses the 200-period EMA to determine the overall trend direction of the market. Then, within the confirmed trend direction, it utilizes the simultaneous crossing of the overbought or oversold zones by the dual WPR indicators to identify potential reversal points as entry signals for trading. The strategy emphasizes that trading signals are only valid when both WPR indicators meet the conditions.

Candlestick analysis

Overlay Hourly Candle [odnac] * This script overlays 1-hour candlestick representations on the chart.

* It captures the open, close, high, and low prices for each hourly period.

* The script dynamically updates as new hourly candles form and adjusts the

* box and wick positions accordingly.

*

* Features:

* - Draws an hourly candle with body and wicks.

* - Colors bullish candles in green and bearish candles in red.

* - Updates dynamically as new hourly candles form.

* - Uses TradingView's box and line functions to represent candle structures.

*

* Usage:

* - Add the script to your TradingView chart as an overlay.

* - Observe how the hourly candles appear distinctly on any timeframe.

Highest High & Lowest Low of 2nd/3rd Candle - Every DayHighest High & Lowest Low of 2nd/3rd Candle - Every Day

Natural Gas 1H EMA-SMA StrategyKey Fixes & Explanation

✅ Combined SMA & EMA Conditions:

You can now trigger a long trade if either the EMA or SMA condition is met.

If you want only one, use longCondition1 (EMA) or longCondition2 (SMA).

zanx 1.0Analyze context, define trend 5/15 min with execution at 1 min. Entry on breakouts with target of 1:1 or 1:1.8.

VWAP + EMA200 + RSI + ATR StrategyThis is a high-frequency intraday trend-following strategy with a mean-reversion trigger and strict realism layers. It's designed to scale small capital responsibly while maintaining tight risk and high execution realism.

Vega Drop Scalping ScannerVega Drop Strategy is a strategy that will you give you precise entry on when to exit or enter. For Example if Vega for CE Drops, you enter on PE and vice versa.

NeoTrend AINeoTrend AI is a sophisticated trading signal indicator that combines a kernel-based predictive model with adaptive volatility analysis. It processes historical price data using a Gaussian kernel matrix to generate a statistically informed forecast. This forecast is then integrated with dynamic volatility bands, which serve as adaptive support and resistance levels, ultimately producing clear BUY and SELL signals.

Originality and Usefulness

Innovative Integration: NeoTrend AI goes beyond traditional indicators by fusing a novel kernel forecasting method with volatility analysis. This dual approach not only tracks market trends but also identifies key price zones with enhanced precision.

Actionable Insights: By analyzing both trend direction and market volatility, the indicator offers a robust framework for making informed trading decisions.

Customizable Settings: With adjustable parameters such as lookback period, prediction offset, smoothness factor, and volatility multiplier, NeoTrend AI can be tailored to suit various markets and trading styles.

Omissions and Realistic Claims

Transparent Methodology: The signals are generated solely through historical data analysis using proven mathematical techniques. There are no exaggerated claims—past performance does not guarantee future results.

Evidence-Based Performance: All metrics and signal accuracies are clearly derived from the underlying methodology, ensuring that the tool provides useful insights rather than definitive trading outcomes.

Strategy Results

Kernel Forecasting:

The script constructs a Gaussian kernel matrix over a specified lookback period, smoothing historical price data to produce a dynamically adjusting predictive price.

Adaptive Volatility Bands:

A volatility band is determined by measuring the difference between the actual price and the forecasted price, scaled by a user-defined multiplier. These bands adjust in real time to act as dynamic support and resistance levels.

Signal Generation:

BUY Signal: Triggered when the current price exceeds the upper volatility band and the predicted price shows an upward trend.

SELL Signal: Triggered when the price drops below the lower volatility band while the predicted price is trending downward.

Visual Examples

The chart clearly displays the generated buy and sell signals, making it easy to identify key trading moments.

Usage Tips

Parameter Customization: Experiment with the lookback period, smoothness factor, and volatility multiplier to match your trading timeframe and current market conditions.

Combine with Other Tools: For optimal results, use NeoTrend AI in conjunction with other technical indicators and solid risk management strategies.

Backtesting: Conduct thorough backtesting to fully understand the indicator's behavior across different market scenarios.

Final Remarks

NeoTrend AI is designed to offer traders original, data-driven insights into market trends without resorting to exaggerated promises. Its emphasis on innovation and practicality ensures that you receive actionable signals based on sound statistical principles.

noteThis Pine Script (v5) is designed to display 200MA (Moving Averages) and pivot points for both lower timeframes (LTF) and higher timeframes (HTF).

🔹 Key Features

User-Selectable Moving Average Type

The user can choose between EMA (Exponential Moving Average) or SMA (Simple Moving Average) for both LTF and HTF.

Automatic HTF Selection

The script automatically determines the higher timeframe (HTF) based on the current timeframe (LTF).

Example mappings:

1-hour (60) → Daily (D)

4-hour (240) → Weekly (W)

15-minute (15) → 4-hour (240)

5-minute (5) → 1-hour (60)

If the timeframe is Daily (D), Weekly (W), or Monthly (M), the HTF calculation is disabled (na).

200MA Calculation for LTF & HTF

The script calculates the 200-period moving average for both the current timeframe and the higher timeframe (if applicable).

It uses request.security() to fetch the HTF 200MA only when HTF is valid.

Pivot Point Detection (LTF & HTF)

LTF Pivots

Detects pivot highs and pivot lows using a user-defined pivotLength (default: 6).

Plots diamond-shaped markers on the chart.

HTF Pivots

Detects pivot highs and pivot lows for the higher timeframe using a pivotLengthhtf (default: 96).

Plots white diamond markers to differentiate HTF pivots.

Latest Pivot Line Calculation

The script stores the most recent pivot high and low for both LTF and HTF, which can be used for further analysis.

barcountbygThe Bar Count by G indicator counts and displays numbers on every odd-numbered bar in a trading session, starting from the first bar of the day at 9:15 AM. The count resets daily and provides a clear visual reference below each odd-numbered bar.

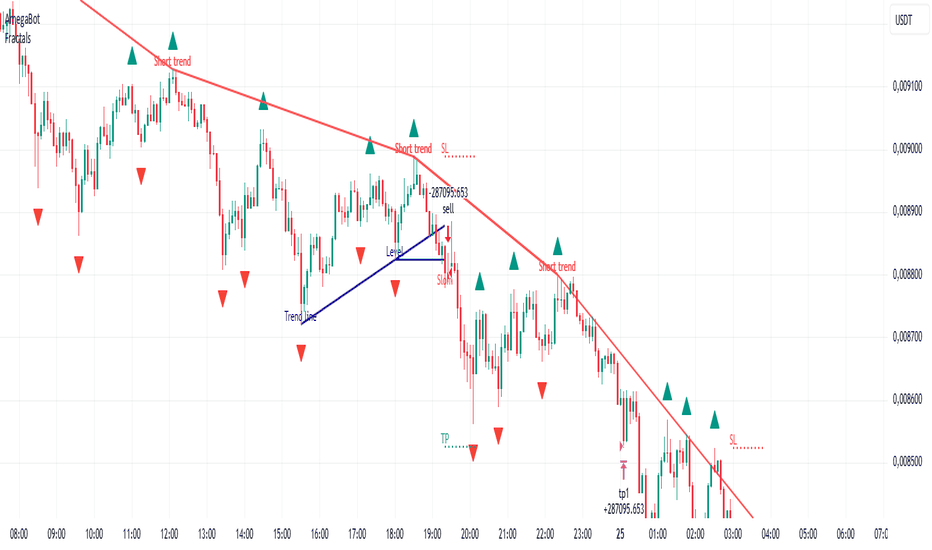

Amega Bot SetTester strategy for Amega Bot Trend.

Several strategies: level, trend, break-in trend, break-and-outs of level.

IU Bigger than range strategyDESCRIPTION

IU Bigger Than Range Strategy is designed to capture breakout opportunities by identifying candles that are significantly larger than the previous range. It dynamically calculates the high and low of the last N candles and enters trades when the current candle's range exceeds the previous range. The strategy includes multiple stop-loss methods (Previous High/Low, ATR, Swing High/Low) and automatically manages take-profit and stop-loss levels based on user-defined risk-to-reward ratios. This versatile strategy is optimized for higher timeframes and assets like BTC but can be fine-tuned for different instruments and intervals.

USER INPUTS:

Look back Length: Number of candles to calculate the high-low range. Default is 22.

Risk to Reward: Sets the target reward relative to the stop-loss distance. Default is 3.

Stop Loss Method: Choose between:(Default is "Previous High/Low")

- Previous High/Low

- ATR (Average True Range)

- Swing High/Low

ATR Length: Defines the length for ATR calculation (only applicable when ATR is selected as the stop-loss method) (Default is 14).

ATR Factor: Multiplier applied to the ATR to determine stop-loss distance(Default is 2).

Swing High/Low Length: Specifies the length for identifying swing points (only applicable when Swing High/Low is selected as the stop-loss method).(Default is 2)

LONG CONDITION:

The current candle’s range (absolute difference between open and close) is greater than the previous range.

The closing price is higher than the opening price (bullish candle).

SHORT CONDITIONS:

The current candle’s range exceeds the previous range.

The closing price is lower than the opening price (bearish candle).

LONG EXIT:

Stop-loss:

- Previous Low

- ATR-based trailing stop

- Recent Swing Low

Take-profit:

- Defined by the Risk-to-Reward ratio (default 3x the stop-loss distance).

SHORT EXIT:

Stop-loss:

- Previous High

- ATR-based trailing stop

- Recent Swing High

Take-profit:

- Defined by the Risk-to-Reward ratio (default 3x the stop-loss distance).

ALERTS:

Long Entry Triggered

Short Entry Triggered

WHY IT IS UNIQUE:

This strategy dynamically adapts to different market conditions by identifying candles that exceed the previous range, ensuring that it only enters trades during strong breakout scenarios.

Multiple stop-loss methods provide flexibility for different trading styles and risk profiles.

The visual representation of stop-loss and take-profit levels with color-coded plots improves trade monitoring and decision-making.

HOW USERS CAN BENEFIT FROM IT:

Ideal for breakout traders looking to capitalize on momentum-driven price moves.

Provides flexibility to customize stop-loss methods and fine-tune risk management parameters.

Helps minimize drawdowns with a strong risk-to-reward framework while maximizing profit potential.

Combined Strategy with Williams %R, ROC, and VolumeCombined Strategy with Williams %R, ROC, and Volume

EMA 7/25/99 Strategy📊 Script Overview:

This Pine Script, titled "EMA 7/25/99 Strategy", is designed to plot three Exponential Moving Averages (EMAs) and generate buy/sell signals based on the crossover of the EMAs.

TR FVG & Swing High Low FinderTR FVG & Swing Level Finder

Overview:

The TR FVG & Swing Level Finder is a powerful Pine Script indicator designed for traders who want to identify Fair Value Gaps (FVGs) and Swing Highs/Lows on their charts. This indicator combines two essential technical analysis tools into one, helping traders spot potential areas of support, resistance, and trend reversals. FVGs are price gaps that often act as areas of interest for price to return to, while swing highs and lows help identify key turning points in the market. The indicator is highly customizable, allowing users to adjust colors, limits, and display options to suit their trading style.

Key Features:

1: Fair Value Gap (FVG) Detection:

- Identifies Bullish FVGs: Occur when the high of two candles ago is lower than the low of the current candle, indicating a potential upward price movement.

- Identifies Bearish FVGs: Occur when the low of two candles ago is higher than the high of the current candle, indicating a potential downward price movement.

- Displays FVGs as colored boxes on the chart, with customizable border and fill colors based on the timeframe.

- Labels each FVG box with the corresponding timeframe (e.g., "1m FVG", "1h FVG", "Daily FVG").

2: Swing High and Swing Low Detection:

- Detects Swing Highs: A 3-candle pattern where the middle candle's high is higher than the highs of the candles on either side.

- Detects Swing Lows: A 3-candle pattern where the middle candle's low is lower than the lows of the candles on either side.

- Draws a solid black line with 50% opacity at each swing high and low, extending 5 bars to the right for better visibility.

- Adds a small Swing High or Swing Low label at the right end of each line, colored according to user-defined settings.

3: Timeframe-Specific FVG Visualization:

- FVGs are color-coded based on the chart's timeframe, making it easy to distinguish between FVGs on different timeframes.

- Each timeframe has its own fill color for bullish and bearish FVGs, with adjustable transparency for better chart clarity.

- A dashed black line is drawn in the middle of each FVG box to highlight the midpoint of the gap.

4: Customizable Display Options:

- FVG Limit: Control the maximum number of FVGs displayed on the chart (from 1 to 20).

- Extend Options for FVG Boxes:

- "None": FVG boxes extend only 2 bars to the right.

- "Limited": FVG boxes extend a user-defined number of candles to the right (1 to 100 candles).

- "Default": FVG boxes extend 3 bars to the right of the current bar.

- Color Customization:

- Set border colors for bullish and bearish FVGs.

- Adjust fill colors for FVGs on different timeframes (1m, 5m, 15m, 30m, 1h, 4h, Daily, Weekly, Monthly).

- Customize the colors of swing high and swing low labels.

5: Performance Optimization:

- The indicator only plots FVGs and swings on the last confirmed bar (barstate.islastconfirmedhistory), ensuring efficient performance and reducing chart clutter.

- Limits the number of displayed FVGs and swings to the user-defined fvgLimit, keeping the chart clean and focused on the most recent price action.

6: Inputs and Customization:

- Number of FVGs to Show (fvgLimit): Set the maximum number of FVGs and swings to display (default: 3, range: 1 to 20).

- Bullish FVG Border Color (bullishColor): Choose the border color for bullish FVGs (default: green).

- Bearish FVG Border Color (bearishColor): Choose the border color for bearish FVGs (default: red).

- Swing High Color (swingHighColor): Set the color for swing high labels (default: blue).

- Swing Low Color (swingLowColor): Set the color for swing low labels (default: purple).

- Extend Options:

- Extend Option (extendOption): Choose how far FVG boxes extend to the right ("None", "Limited", or "Default"; default: "Default").

- Extend Candles (extendCandles): If "Limited" is selected, specify the number of candles to extend FVG boxes (default: 8, range: 1 to 100).

- Timeframe-Specific Fill Colors:

- Customize fill colors for bullish and bearish FVGs on various timeframes (1m, 5m, 15m, 30m, 1h, 4h, Daily, Weekly, Monthly).

- Each fill color has a default transparency (e.g., 93% for most timeframes, 90% for 30m), which can be adjusted as needed.

How to Use:

1: Add the Indicator to Your Chart:

- Open TradingView, go to the Pine Editor, and paste the script.

- Click "Add to Chart" to apply the indicator to your current chart.

2: Adjust Settings:

- Open the indicator settings by clicking the gear icon next to the indicator name on your chart.

- Modify the inputs to suit your preferences:

- Set the number of FVGs and swings to display.

- Choose your preferred colors for FVGs and swings.

- Adjust the extend options for FVG boxes.

3: Interpret the Indicator:

- FVG Boxes: Look for colored boxes on the chart, which represent Fair Value Gaps. Bullish FVGs (green borders by default) suggest potential buying opportunities, while bearish FVGs (red borders by default) suggest potential selling opportunities. The label inside each box indicates the timeframe of the FVG.

- Swing Highs and Lows: Identify key turning points with solid black lines (50% opacity) at swing highs and lows. Each line extends 5 bars to the right, with an "SH" (Swing High) or "SL" (Swing Low) label at the end. Swing highs can act as resistance levels, while swing lows can act as support levels.

4: Combine with Your Strategy:

- Use FVGs to identify areas where price might return to fill the gap, often acting as support or resistance.

- Use swing highs and lows to spot potential trend reversals or to set stop-loss and take-profit levels.

- Combine the indicator with other tools (e.g., trendlines, moving averages) for a more comprehensive trading strategy.

Notes:

- The indicator works on all timeframes, but the appearance of FVGs and swings will vary depending on the chart's timeframe.

- For best results, use the indicator on a clean chart to avoid visual clutter, especially if you increase the fvgLimit.

- The swing high/low lines are drawn with 50% opacity to ensure they don’t overpower other chart elements, but they are still clearly visible.

Author’s Note:

This script was developed to help traders identify key price levels with ease. I hope it adds value to your trading! If you have any feedback or suggestions for improvement, feel free to leave a comment. Happy trading!

Thien ThienFair Value Gap indicator: Paints FVGs and their midlines (CEs). Stops painting when CE is hit, or when fully filled; user choice of threshold. This threshold is also used in the Alert conditions.

~~Plotted here on ES1! (CME), on the 15m timeframe~~

-A FVG represents a 'naked' body where the wicks/tails on either side do not meet. This can be seen as a type of 'gap', which price will have a tendency to want to re-fill (in part or in full).

-The midline (CE, or 'Consequent encroachment') of FVGs also tend to show price sensitivity.

-This indicator paints all FVGs until priced into, and should give an idea of which are more meaningful and which are best ignored (based on context: location, Time of day, market structure, etc).

-This is a simpler and more efficient method of painting Fair value gaps which auto-stop painting when price reaches them.

//Aims of Publishing:

-Education of ICT concepts of Fair Value Gaps and their midlines (CEs): To easily see via forward testing or backtesting, the sensitivity that price shows to these areas & levels.

-Demonstration of a much more efficient way of plotting FVGs which terminate at price, thanks to a modification of @Bjorgums's clever looping method referenced below.

//Settings:

-Toggle on/off upward and downward FVGs independe

NY Midnight Strategy with Advanced OptionsThe purpose of this script was originally to test one of ICT 's statements and check where it works best. In this case it was to set positions towards the direction of the New York midnight opening price inside ICT Killzones .

The default settings of this script work best with S&P E-mini futures (ES!), but can work just as well with other instruments. Often the parameters need to be adjusted.

To see results, use the 1h chart in the Tradingview strategy tester.

Fair Value Gap [Dovy]The Fair Value Gap (FVG) is a concept from Smart Money Concepts (SMC) and ICT (Inner Circle Trader) trading strategies. It helps identify imbalances in price action where liquidity was left behind, potentially acting as future support or resistance zones.

UntouchedIBOB [DTMM]UntouchedIBOB - Indicator for TradingView

What does this indicator do?

The UntouchedIBOB indicator helps you identify special candlestick patterns on your chart: Inside Bars (IB) and Outside Bars (OB). These patterns can provide important signals for your trading decisions.

The two most important patterns:

Outside Bar (OB) - A candle whose high is higher and low is lower than the previous candle. It completely "engulfs" the previous candle.

Inside Bar (IB) - A candle whose high is lower and low is higher than the previous candle. It moves completely "inside" the previous candle.

Tested and recommended by professionals:

We are the main provider of trading indicators for Oliver Klemm , one of the most renowned traders in Germany and the entire DACH region. Our indicators are used daily in real-money trading by successful professional traders and are continuously improved. You benefit from the same professional technology that is used and recommended by leading market experts.

Main features:

Colored candles: Inside and Outside Bars are displayed in different colors

Lines: Shows horizontal lines at the midpoints of IB/OB that remain active until the price breaks through them

Arrows: Optional arrows above/below the IB/OB for better visibility

Alerts: Can notify you when new Inside or Outside Bars form

Special feature:

The indicator not only shows where IB/OBs are located but also tracks which ones are still "untouched" - meaning the price has not broken through that level again. This can be particularly valuable as untouched IB/OB levels often represent important support and resistance areas.

Customization options:

Enable/disable lines, arrows, and areas

Adjust colors for all elements

Arrow size (tiny, small, normal, large)

Choose between solid or dashed lines

Alert functions for new Inside and Outs

ide Bars

Use this indicator to more easily identify important candlestick patterns and identify potential trend reversals or continuations early.

-----------------------------------------------------------------

UntouchedIBOB - Indikator für TradingView

Was macht dieser Indikator?

Der UntouchedIBOB-Indikator hilft Ihnen, spezielle Kerzenmuster im Chart zu erkennen: Inside Bars (IB) und Outside Bars (OB). Diese Muster können wichtige Signale für Ihre Trading-Entscheidungen sein.

Die zwei wichtigsten Muster:

Outside Bar (OB) - Eine Kerze, deren Hoch höher und deren Tief tiefer ist als die vorherige Kerze. Sie "umschließt" also die vorherige Kerze vollständig.

Inside Bar (IB) - Eine Kerze, deren Hoch niedriger und deren Tief höher ist als die vorherige Kerze. Sie bewegt sich also komplett "innerhalb" der vorherigen Kerze.

Von Profis getestet und empfohlen:

Wir sind der Hauptlieferant von Trading-Indikatoren für Oliver Klemm , einen der bekanntesten Trader Deutschlands und der gesamten DACH-Region. Unsere Indikatoren werden von erfolgreichen Profi-Tradern täglich im Echtgeld-Handel eingesetzt und kontinuierlich verbessert. Sie profitieren von der gleichen professionellen Technologie, die von führenden Marktexperten genutzt und empfohlen wird.

Hauptfunktionen:

Farbige Kerzen: Inside und Outside Bars werden in verschiedenen Farben dargestellt

Linien: Zeigt horizontale Linien an den Mittelpunkten der IB/OB, die aktiv bleiben bis der Preis sie durchbricht

Pfeile: Optionale Pfeile über/unter den IB/OB für bessere Sichtbarkeit

Alarme: Kann Sie benachrichtigen, wenn neue Inside oder Outside Bars entstehen

Besonderheit:

Der Indikator zeigt nicht nur an, wo sich IB/OBs befinden, sondern verfolgt auch, welche noch "unberührt" sind - das heißt, der Preis hat das Level noch nicht wieder durchbrochen. Dies kann besonders wertvoll sein, da unberührte IB/OB-Levels oft wichtige Unterstützungs- und Widerstandsbereiche darstellen.

Einstellungsmöglichkeiten:

Ein-/Ausschalten von Linien, Pfeilen und Bereichen

Anpassung der Farben für alle Elemente

Wahl zwischen durchgezogenen oder gestrichelten Linien

Alarmfunktionen für neue Inside und Outside Bars

Nutzen Sie diesen Indikator, um wichtige Kerzenmuster leichter zu erkennen und potenzielle Trendwechsel oder Fortsetzungen frühzeitig zu identifizieren.

15 Minute TouchlinesThe 15 Minute Touchlines indicator is designed to identify potential breakout levels on a 15-minute timeframe, providing visual and alert-based signals for traders. This indicator overlays on the price chart and helps traders spot key levels where price may react, offering both buy and sell signals.

Key Features:

Breakout Levels:

The indicator calculates breakout levels based on recent price action, identifying potential support and resistance zones.

Up Deviation and Down Deviation parameters allow for customization of these levels.

Trend Filter:

An optional trend filter using a Simple Moving Average (SMA) can be enabled to filter out signals that do not align with the overall trend.

The trend filter helps in reducing false signals by ensuring that breakouts occur in the direction of the prevailing trend.

Visual Signals:

Lines: The indicator plots horizontal lines at identified breakout levels, which can be extended to the right.

Arrows: Optional arrows can be displayed to indicate buy or sell signals, enhancing visual clarity.

Colors: Customizable colors for buy and sell lines and arrows.

Touch Counts:

The indicator tracks the number of times price touches the plotted lines.

Users can set the number of touches required to remove a line or trigger an alert, providing flexibility in managing active levels.

Alerts:

Alerts can be configured to notify traders when price touches a line a specified number of times, aiding in timely decision-making.

Low Pass Bands:

The indicator incorporates low pass bands to smooth out price fluctuations, helping to identify more reliable breakout levels.

Customizable parameters for the low pass bands allow traders to fine-tune the indicator's sensitivity.

Input Parameters:

History Lines to Show: Number of historical lines to display.

Show Lines: Toggle to display or hide the breakout lines.

Touches to Remove Line: Number of touches required to remove a line.

Touch Number for Alert: Number of touches required to trigger an alert.

Buy/Sell Line Color: Custom colors for buy and sell lines.

Up/Down Deviation: Deviation factors for calculating breakout levels.

Extend Lines to Right: Option to extend lines to the right edge of the chart.

Line Thickness: Thickness of the plotted lines.

Use Trend SMA Filter: Toggle to enable or disable the trend filter.

Trend SMA Period: Period for the trend SMA filter.

Usage:

Identify Breakouts: Use the plotted lines and arrows to identify potential breakout levels and direction.

Trend Confirmation: Enable the trend filter to ensure that breakouts align with the overall trend.

Alert Management: Set up alerts to be notified of price interactions with key levels, aiding in active trading strategies.

The 15 Minute Touchlines indicator is a versatile tool for traders looking to capitalize on short-term price movements, offering a blend of visual signals and customizable alerts to enhance trading decisions.

AnarchoEconomy 9-11 Weeks CyclesThis script is, with pleasure, written for the @AnarchoEconomy with his logic and strategy.

TO BE USED ONLY ON 1 WEEK TIMEFRAME!

1. Set the date in the settings to choose the all-time high on your pair.

2. The indicator divides price action into cycles.

3. A bullish cycle lasts 9 weeks.

4. A bearish cycle lasts 11 weeks.

5. A table displays the current symbol, trend, and week count.

For every next closed bullish cycle, you should know that the next two weeks could turn it into the bearish. If not, the new cycle will restart after 9 weeks of bullish close.

Basic Pivot-Based S/R with Stopping LinesBasic Pivot-Based S/R with Intrabar Pressure Analysis

Overview:

This indicator identifies potential support and resistance levels based on a combination of traditional pivot point analysis and a unique intrabar volume pressure assessment. It goes beyond simply identifying pivot highs and lows; it qualifies these pivots by examining the underlying buying and selling pressure within the candles that form the pivot. This approach aims to identify stronger, more reliable support and resistance levels than those based on price action alone.

Core Concepts and Calculations:

Pivot Points: The indicator uses the standard ta.pivothigh() and ta.pivotlow() functions to detect pivot highs and lows. The user can choose whether to use the candle wicks ("Wick" mode) or the candle bodies ("Body" mode) for pivot detection. The leftBars and rightBars parameters control the number of bars on either side of the pivot used in the calculation.

Intrabar Volume Pressure: This is the indicator's key differentiator. It analyzes the volume distribution within each candle by accessing data from a lower timeframe (specified by the user, defaulting to 1-second data). For each candle:

Up Volume: The total volume associated with price increases within the candle is calculated (on the lower timeframe). This uses the volume multiplied by how much the price has moved up.

Down Volume: The total volume associated with price decreases within the candle is calculated (on the lower timeframe). This uses the volume multiplied by how much the price has moved down.

These up and down volumes are then summed across all lower timeframe candles.

Pressure Imbalance at Pivots: The indicator then checks for a specific condition at each identified pivot point

These lines are dynamic. They continue to extend to the right as long as the price does not decisively cross them.

A support line (green) stops extending if the price closes below the line.

A resistance line (red) stops extending if the price closes above the line. *This behavior reflects the idea that a support/resistance level is "validated" as long as the price respects it and "invalidated" once the price breaks through.

Interpretation and Usage:

The core idea is that a pivot point where the internal volume pressure contradicts the external price action (e.g., a green candle with more selling pressure) is a stronger and more reliable support or resistance level. This suggests that there's hidden buying or selling interest at that level, which may not be immediately obvious from the candlestick pattern alone.

Green Lines (Support): Indicate potential areas where buyers are likely to step in, even if the price is currently declining. These are levels where buying pressure was surprisingly strong despite a red candle forming at a pivot low.

Red Lines (Resistance): Indicate potential areas where sellers are likely to emerge, even if the price is currently rising. These are levels where selling pressure was surprisingly strong despite a green candle forming at a pivot high.

Line Extensions: The length of the line indicates how long the support or resistance level has held. Longer lines suggest stronger, more established levels.

Line Breaks: When a line stops extending, it indicates that the support or resistance level has been broken. This can be a signal of a potential trend change or a breakout.

Advantages:

Combines Price and Volume: Integrates both price action (pivots) and volume information (intrabar pressure) for a more comprehensive analysis.

Identifies "Hidden" S/R: Highlights support and resistance levels that might be missed by traditional pivot analysis.

Dynamic Lines: The lines adapt to market conditions, extending only as long as the S/R level remains valid.

Simple Visualization: Uses clear, horizontal lines for easy identification of potential support and resistance.

High Resolution Data: Uses data from a user selectable lower timeframe for better accuracy.

Limitations:

Lower Timeframe Data Dependency: The accuracy of the intrabar pressure analysis depends on the availability and quality of lower timeframe data.

Parameter Sensitivity: The indicator's performance is influenced by the pivot detection parameters (leftBars, rightBars) and the chosen lowerTimeframe.

Not a Standalone System: This indicator, like all indicators, should be used in conjunction with other forms of analysis and as part of a complete trading strategy.

In summary, this indicator offers a refined approach to identifying support and resistance levels by combining classic pivot point analysis with a detailed examination of the volume dynamics within the candles that form those pivots. This provides a more nuanced view of buying and selling pressure, potentially leading to the identification of stronger and more reliable S/R levels.

Lukiano BTC 369 Close MarkerThis indicator highlights candles where the closing price reduces to 3, 6, or 9 based on digital root calculation (sum of digits).

🔵 Blue dot = 3

🟢 Green dot = 6

🔴 Red dot = 9

Inspired by Tesla’s 369 theory and adapted for BTC traders who want to explore alternative energy-based signals.

Created by @Lukiano