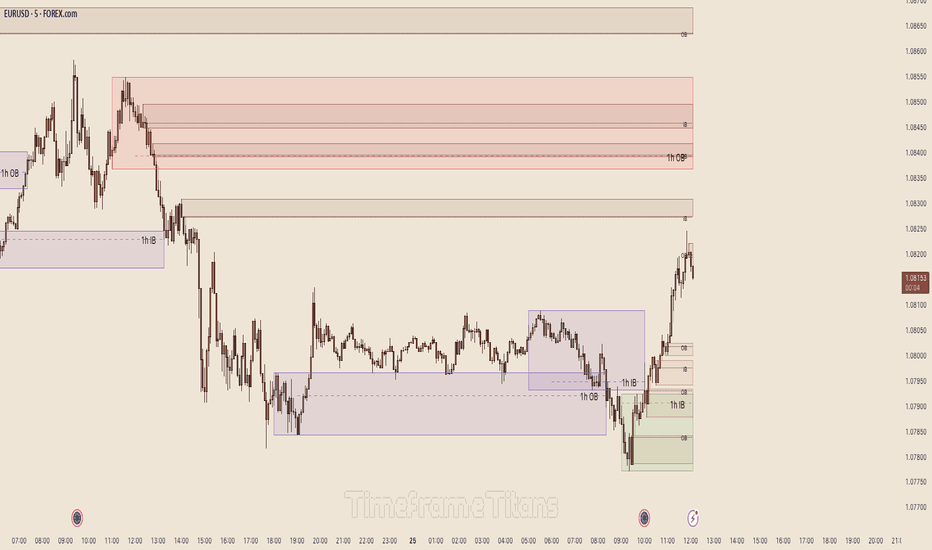

Timeframe Titans: MTF Order blocksThis script identifies two distinct order block patterns: Standard Order Blocks and Imbalance Order Blocks .

- Standard Order Block : A three-candle pattern that signals a shift in market participation (buying to selling or vice versa), accompanied by imbalance. These zones indicate potential areas where orders may become trapped.

- Imbalance Order Block: A momentum-driven order cluster confirmed by imbalance, highlighting areas of increased order activity leading to directional movement.

Both block types include defined mitigation criteria, marking the point at which the block's influence is considered invalidated.

The script provides a multi-timeframe analysis, displaying order blocks on both the selected chart timeframe and a higher timeframe. Blocks are color-coded to reflect their bullish/bearish bias and mitigation status, with updates in real-time as conditions change.

Unique features of this script include a non-repainting higher timeframe set of order blocks. These order blocks are created on confirmed HTF data but mitigated in real time.

Candlestick analysis

Full Breakout Alert (Yesterday’s Open & Close)For this Script

Horizontal 1 will be your resistance from the opening candle of yesterday

Horizontal 2 will be your support from the closing candle of yesterday

If you manually input the value, the line will change. Then you can add alert and it will just trigger if the Body and the Wick is above/below (whatever you choose from) from the value itself

Demo GPT - Gaussian Channel Strategy v3.1 AdaptedGaussian Channel Strategy v3.1 Adapted

An automated trading strategy combining Gaussian Channel, Stochastic RSI, and SMA for trend filtering.

Overview

This strategy uses a dynamic Gaussian Channel to identify price channels, Stochastic RSI for overbought/oversold conditions, and a 50-period SMA as a trend filter. It enters long/short positions based on price breaking channel bands, Stochastic RSI signals, and SMA alignment.

Key Components

Gaussian Channel

Source : Midpoint price (hlc3).

Parameters :

N: Number of poles (1-9) controlling channel smoothness.

per: Sampling period (default 100) for dynamic lag adjustment.

mult_base: Multiplier for channel width (default 1.5), scaled by ATR for volatility adaptation.

Features :

Reduces lag when modeLag is enabled.

Faster response when modeFast is enabled.

Channels :

filt: Central filter line (midpoint of the channel).

hband/lband: Upper/lower bands = filt ± (ATR × mult_base).

Stochastic RSI

Parameters :

RSI Length: 10.

Stochastic Length: 10.

Smooth K/D: 5 periods.

Signals :

Overbought: K > 80 (long bias).

Oversold: K < 20 (short bias).

Trend Filter (SMA 50)

Confirms bullish trend when close > SMA50 (long entry).

Confirms bearish trend when close < SMA50 (short entry).

Trade Logic

Long Entry Conditions :

Channel Uptrend : filt > previous filt (rising channel midline).

Price Break : close > hband (price exceeds upper channel band).

Stochastic RSI : K > 80 (overbought) or K < 20 (oversold rebound).

Trend Filter : close > SMA50.

Short Entry Conditions :

Channel Downtrend : filt < previous filt (falling channel midline).

Price Break : close < lband (price falls below lower band).

Stochastic RSI : K < 20 (oversold) or K > 80 (overbought reversal).

Trend Filter : close < SMA50.

Exit Conditions :

Automatic Exit :

strategy.exit with trailing stop (trail_offset=1000, trail_points=5000).

Immediate Close :

Long: close crosses below hband.

Short: close crosses above lband.

Parameters & Settings

Initial Capital : $100,000.

Commission : 0.1% per trade.

Position Sizing : 75% of equity per trade.

Pyramiding : Max 1 open position.

Date Range : Adjustable (default 2025–2069 for backtesting).

Risk Notes

Volatility Sensitivity : Channel width adjusts with ATR; may widen during volatile markets.

Overlapping Signals : Stochastic RSI allows entries at both extremes (overbought/oversold), which may lead to whipsaws.

SMA Lag : Trend filter may delay entries during rapid price moves.

Optimization Tips

Adjust mult_base to control channel width based on asset volatility.

Test N and per for smoother or more responsive channels.

Refine Stochastic RSI parameters for fewer false signals.

P177 - Relative Strength VNStock What is this Indicator?

The Relative Strength VN (RSVN) indicator measures the relative strength of a stock compared to the VNINDEX. It helps investors assess whether a stock is stronger or weaker than the overall market.

🔹 Application in Trading:

- Finding strong stocks to buy: If RS stays above 1.0 and continues to rise, the stock is outperforming VNINDEX, which is a positive signal.

- Avoiding weak stocks: If RS falls below 0.9 and keeps declining, the stock is underperforming the market.

- Confirming trends: The EMA(RS) helps confirm the long-term trend of RS and reduces noise.

📈 Summary:

- This indicator helps investors identify stocks that are stronger than the market and avoid weaker ones.

- Combine it with other indicators (MACD, RSI, Volume) to determine the best buy/sell points.

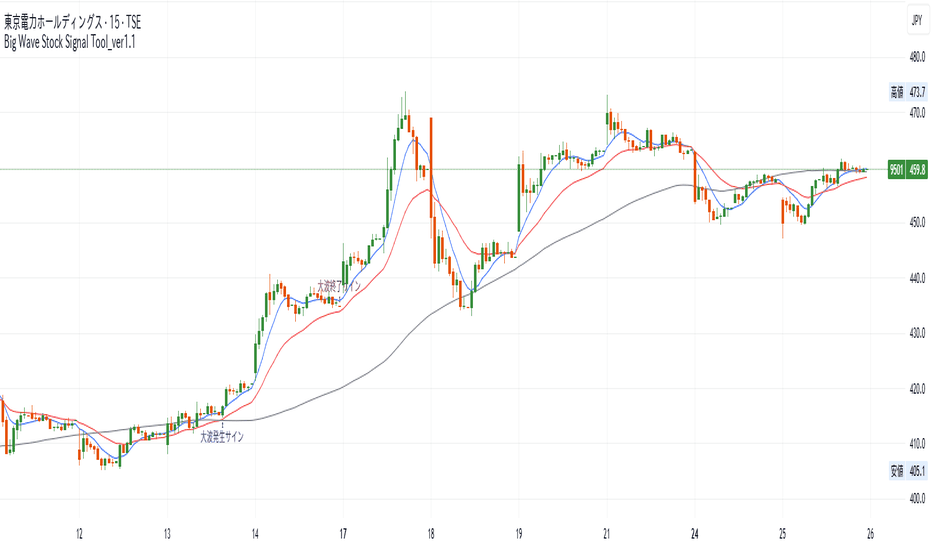

Big Wave Stock Signal Tool_ver1.1Description(説明文)

【大波株サインツール】

✅ Big Wave Signal (Buy Signal)

The medium-term MA (EMA21) crosses above the long-term MA (SMA80) → Golden Cross

The short-term MA (WMA10) is sloping upward

The medium-term MA (EMA21) is also sloping upward

The MAs are aligned: Short-term > Medium-term > Long-term

The daily candlestick is bullish (Close > Open)

❌ Big Wave End Signal (Sell Signal)

The short-term MA (WMA10) crosses below the medium-term MA (EMA21) → Death Cross

P177-TrendThe P177-Trend is a trend indicator that helps identify buy and sell signals based on the Weighted Moving Average (WMA) combined with a volatility band calculated from the Average True Range (ATR).

Ideal for trend-following traders.

Can be combined with other technical analysis tools to optimize trading strategies.

Works across multiple timeframes to confirm strong trends.

The P177-Trend indicator helps traders quickly identify trends, reduce noise, and optimize entry points!

Segnale di VenditaA possible reversal candle:

A candle that opens, takes the previous candle's high, and closes with its body below the previous candle's low.

Segnale di acquistoA possible reversal candle:

A candle that opens, takes the previous candle's low, and closes with its body above the previous candle's high.

P177-PPThe Pocket Pivot indicator helps traders identify potential buying points based on price action and volume. This indicator is especially useful in stock trading and momentum investing, as it helps determine when a stock is absorbing selling pressure and may continue to rise strongly.

Suitable for Momentum Traders:

🔹 Easily identifies strong buying points without the need for complex analysis tools.

🔹 Filters out noise by combining with other indicators such as MA, RSI, or MACD to confirm signals.

Triangle Reversal Indicator v3With this new script you can remove the triangle on top or at the bottom and you can directly color the body of the bar. For example using a black and white color for the candle and a green color for the bullish engulfing and a red color for the bearish engulfing

Reversal Candles + RSI Divergence + Volume Filter + DashboardFinds 3 types of candles. Hammer , reversal hammer, and star.

Enhanced Candlestick Pattern & Next Move Prediction✅ Added More Patterns:

Morning Star 🌅

Evening Star 🌆

Three White Soldiers 📈

Three Black Crows 📉

Piercing Line 🔼

Dark Cloud Cover 🔽

✅ More Accurate Next Candle Prediction:

Combines RSI, MACD, EMA, and Volume Strength

Filters out weak signals

✅ Customizable Settings:

Adjustable pattern sensitivity

Toggle different candlestick patterns

✅ Compact Visualization:

Smaller shape markers to prevent chart clutter

Trend bar for overall market sentiment

✅ Improved Alerts for Traders 🚨

🔹 What's New?

🔼 Added More Candlestick Patterns for higher accuracy

🔼 Dynamic Trend Filtering to avoid weak signals

🔼 Compact Visualization using smaller markers

🔼 Trend Signal Bar shows market sentiment clearly

🔼 Fully Customizable Inputs to show/hide specific patterns

@AtriumAtrium is an indicator for traders that helps filter market noise, determine the trend, assess the impact of BTC, and choose the best trading hours. Its goal is to increase entry accuracy and minimize the impact of random movements.

🔥 Key features of Atrium

📌📉 Market noise filtering📌

The market often shows sharp jumps and abnormal movements that can be confusing. Atrium automatically excludes such interference, allowing you to focus on the pure price movement.

✅ What does it provide?

✔️ Reduced number of false signals

✔️ More reliable market behavior picture

📌📊 Trend strength and direction assessment📌

The indicator analyzes price dynamics, determining the dominant trend and its strength. This helps traders make more accurate entries and avoid questionable areas.

✅ What does it provide?

✔️ Clear understanding of when the trend is stable

✔️ Filtering out weak and uncertain movements

📌🔗 BTC correlation analysis📌

The cryptocurrency market is closely linked to BTC's movement, but the impact of this connection on different assets is not the same. Atrium helps determine how much the current asset depends on Bitcoin and consider this factor when trading.

✅ What does it provide?

✔️ Understanding whether the asset moves in sync with BTC or independently

✔️ Ability to find more stable instruments

📌⏳ Optimal trading time selection📌

Not all market hours are equally good for entries. Atrium highlights the most active and liquid trading periods and shows when it is better to refrain from trading.

✅ What does it provide?

✔️ Avoid trading during low activity periods

✔️ Focus on times when the market is most predictable

📌📈 Market interest assessment (volumes)📌

The activity of major players and overall interest in an asset is a key factor for successful trading. Atrium helps determine when liquidity enters the market and when it’s better to wait.

✅ What does it provide?

✔️ Ability to follow major movements

✔️ Avoid trading during moments of weak interest

🎯 Why Atrium?

🔹 Signal accuracy — protection from random noise

🔹 In-depth analysis — understanding key market factors

🔹 BTC consideration — trading with global movements in mind

🔹 Optimal timing — entering the market at the most favorable moments

This indicator is designed for the cryptocurrency market, but in the future, it will be extended to support other markets as well.

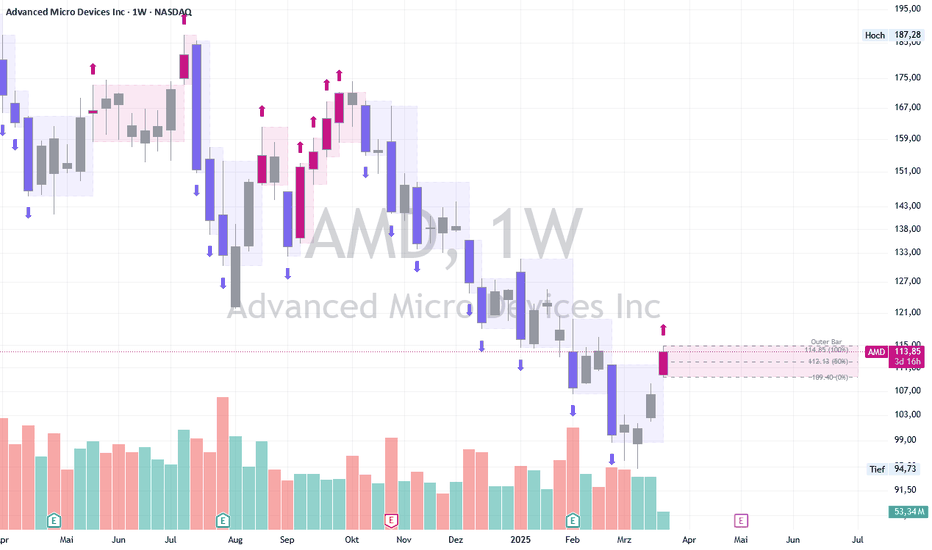

OuterBar [DTMM]OuterBar Indicator Description

The OuterBar Indicator is a powerful technical analysis tool for TradingView, based on the detection and visualization of "Outer Bars".

What is an Outer Bar?

An Outer Bar is a price candle whose closing price is outside the range of the previously identified Outer Bar. The indicator distinguishes between positive Outer Bars (closing price above the high of the previous Outer Bar) and negative Outer Bars (closing price below the low of the previous Outer Bar).

Tested and recommended by professionals:

We are the main provider of trading indicators for Oliver Klemm , one of the most renowned traders in Germany and the entire DACH region. Our indicators are used daily in real-money trading by successful professional traders and are continuously improved. You benefit from the same professional technology that is used and recommended by leading market experts.

Main Features

1. Automatic Detection of Outer Bars

- Identifies candles that exceed the previous Outer Bar's high or low

- Marks Outer Bars with customizable colors (default: magenta for positive and blue for negative)

- Optional: Marking of "Inner Bars" (candles between Outer Bars)

2. Visual Price Range Analysis

- Displays horizontal lines at the high, low, and midpoint of the current Outer Bar

- Price labels with percentage values (0%, 50%, 100%)

- Optional display of arrows showing the direction of Outer Bars

3. Zone Visualization

- Draws colored zones for each Outer Bar

- Keeps the last X Outer Bars on the chart (configurable)

- Zone area is precisely displayed from the beginning of an Outer Bar to the next

4. Advanced Customization Options

- Colors for positive/negative Outer Bars and Inner Bars

- Transparency for zones and zone borders

- Number of Outer Bars to retain

- Various display options (arrows, lines, price labels, etc.)

Applications

The OuterBar Indicator is particularly useful for:

Identifying key price reversal points: Outer Bars often indicate a trend reversal or continuation

Determining support and resistance levels: The indicator's horizontal lines represent important price levels

Visualizing price impulses: The sequence of Outer Bars can illustrate the strength and direction of price movements

Multi-timeframe analysis: Applicable across different time frames (minutes, hours, days)

Unique Strengths

Clear visual representation: Color-coded candles and zones make price movements immediately recognizable

Flexible configuration: Adaptable to different trading styles and markets

Historical analysis: Retains the last X Outer Bars to identify long-term patterns

Easy interpretation: Visual representation of important price points understandable even for beginners

The OuterBar Indicator is based on the concept that significant price movements are often characterized by breakouts from the previous trading range. By visualizing these Outer Bars and their relationship to each other, the indicator provides valuable insight into market structure and potential trend reversals.

Dynamic CCI-BOLLThis indicator combines the characteristics of the CCI indicator and those of the Bollinger Bands, and clearly indicates the buy and sell signals. "B" stands for buying, and "S" stands for selling. Buy in batches and sell in batches. Don't carry out a full-position transaction all at once.

Trend Trader█ Overview

Trend Trader is a valuable indicator that calculates the probability of a breakout. In addition, the indicator displays an additional 3 levels for Targets

The indicator helps traders to make a decision to enter in to the market

█ Settings

• Percentage Step

The space between the levels can be adjusted with a percentage step. 1% means that each level is located 1% above/under the previous one.

• Number of Lines

Set the number of levels you want to display.

•

█ Any Alert function call

An alert is sent on candle open, and you can select what should be included in the alert.

█ How to use

• This indicator is a perfect tool for anyone that wants to understand the probability of a breakout and the likelihood that set levels are hit.

• The indicator can be used for setting a stop loss based on where the price is most likely not to reach.

Master Buy/Sell Signal with S/R & SuperTrend Highlights of Script:

Good use of var to store persistent support and resistance.

Clear conditions combining multiple indicators for stronger signals.

Sensitivity control for S/R validations is a nice touch.

Clean plotting and label placement

EMA + RSI + Volume SignalEMA + RSI + Volume Signal

When the chart background turns green, it is a BUY signal.

When the chart background turns red, it is a SELL signal.

The BUY arrow appears when there is a buy signal, and the SELL arrow appears when there is a sell signal.

🔹 Note: This is a support tool; you should still combine it with other technical analysis methods to improve accuracy.

High / Low (Patron 3 Velas)👌 Creator By Sebastian Garcia . Strategy Obtained By Trader Jose Bartolome .

Use only in UTC-4 Works Only For Trader Jose's Strategy.

THE NUMERIC FIBOnumeric support and resistance

numeric support and resistance

The support and resistance in a new way using the Fibonacci on automatic way, it work on all markets.

<50% Body CandleThis TradingView indicator highlights candlesticks where the body is less than 50% of the total range (high-low) by placing a small white dot at the center of the candle body.

Features:

✅ Identifies low-body candles (common in indecision or reversal points)

✅ Customizable body threshold (default: 50%)

✅ Stable dot placement for consistent visualization

✅ Lightweight & non-intrusive

Usage:

Helps spot Doji or weak momentum candles.

Useful for trend reversals & consolidation detection.

Works seamlessly on any timeframe & market.

🚀 Try it out and enhance your candlestick analysis!

Supertrend with EMA and RSIHow the Supertrend with EMA and RSI Strategy Works

This trading strategy is written in Pine Script (version 6) for use on TradingView. It combines three technical indicators—Supertrend, Exponential Moving Average (EMA), and Relative Strength Index (RSI)—to generate buy and sell signals. The strategy overlays on the price chart, includes initial capital and commission settings, and visually displays signals. Here’s a step-by-step breakdown of how it works:

1. Strategy Setup

The strategy starts by defining its basic parameters:

Name: "Supertrend with EMA and RSI"

Overlay: It plots directly on the price chart (overlay=true).

Initial Capital: 10,000 units (e.g., dollars or euros, depending on the asset).

Trade Size: Fixed at 3 units per trade (e.g., 3 shares or contracts).

Commission: 12% per trade, simulating transaction costs.

This sets the foundation for how the strategy operates in terms of money management and fees.

2. User-Defined Inputs

The strategy allows customization through user inputs:

Supertrend Inputs:

ATR Period: Default is 10 bars, used to calculate the Average True Range (ATR), a measure of volatility.

ATR Multiplier: Default is 3.0 (adjustable in steps of 0.1), which controls how wide the Supertrend bands are.

Change ATR Method: A true/false option (default true) to switch between two ATR calculation methods.

EMA and RSI Inputs:

EMA Period: Default is 50 bars, determining the smoothness of the Exponential Moving Average.

RSI Period: Default is 14 bars, setting the lookback period for the Relative Strength Index.

RSI Threshold: Default is 50, used as a midpoint to judge bullish or bearish momentum.

These inputs let users tweak the indicators to suit their trading style.

3. Supertrend Indicator Calculation

The Supertrend indicator identifies whether the market is in a bullish (up) or bearish (down) trend. Here’s how it’s calculated:

Source Price: The average of the high and low prices ((high + low) / 2), often called hl2.

ATR Calculation:

If changeATR is true, it uses the standard ATR (ta.atr(Periods)).

If false, it uses a simple moving average of the true range (ta.sma(ta.tr, Periods)).

Upper Band (up): hl2 - (Multiplier * ATR).

Lower Band (dn): hl2 + (Multiplier * ATR).

Band Adjustments:

If the previous close is above the previous upper band, the new upper band is the higher of the current up or the previous band.

If the previous close is below the previous lower band, the new lower band is the lower of the current dn or the previous band.

Trend Direction:

Starts as 1 (bullish).

Switches to -1 (bearish) if the close falls below the upper band.

Switches back to 1 if the close rises above the lower band.

The Supertrend uses these bands to signal trend changes.

4. EMA and RSI Calculations

Two additional indicators are calculated to filter the Supertrend signals:

EMA: An Exponential Moving Average of the closing price over 50 bars (default). It shows the longer-term trend direction.

RSI: A Relative Strength Index of the closing price over 14 bars (default). It measures momentum, ranging from 0 to 100.

5. Defining Trend and Momentum Conditions

The strategy uses the EMA and RSI to confirm trends and momentum:

Uptrend: True if the closing price is above the EMA.

Downtrend: True if the closing price is below the EMA.

Bullish RSI: True if RSI is above 50 (default threshold).

Bearish RSI: True if RSI is below 50.

These conditions ensure the Supertrend signals align with broader market trends and momentum.

6. Supertrend Signals

The Supertrend generates preliminary signals based on trend changes:

Buy Signal: Occurs when the trend switches from -1 (bearish) to 1 (bullish).

Sell Signal: Occurs when the trend switches from 1 (bullish) to -1 (bearish).

These are raw signals that need confirmation.

7. Confirmed Trading Signals

The strategy only trades when the Supertrend signals are confirmed by the EMA and RSI:

Confirmed Buy Signal:

Supertrend gives a buy signal.

Price is above the EMA (uptrend).

RSI is above 50 (bullish momentum).

Confirmed Sell Signal:

Supertrend gives a sell signal.

Price is below the EMA (downtrend).

RSI is below 50 (bearish momentum).

This triple confirmation reduces false signals.

8. Executing Trades

The strategy executes trades based on confirmed signals:

Buy (Long): Enters a long position when a confirmed buy signal occurs.

Sell (Short): Enters a short position when a confirmed sell signal occurs.

9. Visualizing the Strategy

The strategy plots the following on the chart:

Supertrend Bands:

A green line shows the upper band during an uptrend.

A red line shows the lower band during a downtrend.

Signals:

A green "BUY" label appears below the bar for confirmed buy signals.

A red "SELL" label appears above the bar for confirmed sell signals.

This makes it easy to see the strategy in action.

Summary

This strategy combines three indicators for better trading decisions:

Supertrend: Detects trend direction (bullish or bearish).

EMA: Confirms the trend by checking if the price is above or below the average.

RSI: Ensures momentum supports the trend (above or below 50).

Buy Condition: Bullish Supertrend + Price > EMA + RSI > 50.

Sell Condition: Bearish Supertrend + Price < EMA + RSI < 50.

By requiring all three indicators to agree, the strategy aims to filter out noise and improve accuracy. It’s a powerful tool for traders who want to combine trend-following and momentum analysis.