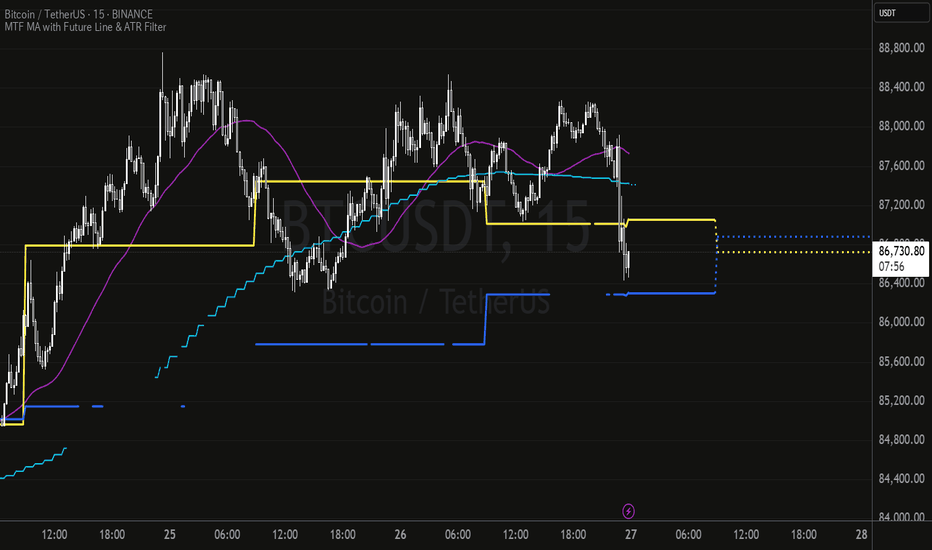

MTF MA with Future Line & ATR Filter● Feature Summary

This is a multi-timeframe moving average indicator.

You can choose between SMA and EMA, and the core logic follows standard moving average calculations.

Its standout feature is the ability to calculate the value of the moving average one bar ahead using the current price.

This allows traders to anticipate potential support and resistance levels, as well as detect early signs of future golden crosses or death crosses based on multiple MAs.

As an additional feature, the indicator includes an optional mode that limits the MA display range using ATR.

This helps prevent the chart from becoming overly compressed when MTF-MAs deviate significantly from the current price.

● Projected Moving Average One Bar Ahead

This feature assumes the current price as the future closing price and plots the moving average accordingly at the appropriate position one bar ahead.

In addition, the moving average on the latest bar is extended to the end of the selected timeframe’s session.

As a result, the moving average appears as one continuous line from the present into the future.

This allows traders to anticipate the next state of the MA even before the current session closes.

For example, it becomes possible to predict future golden crosses, death crosses, or perfect order setups by observing the relationship between multiple MAs.

● Preventing Chart Compression by Limiting MA Display

When the "Visible Mode: Show When Near" option is enabled, only moving averages that are close to the current price will be displayed.

As of the March 2025 version of TradingView, the chart automatically adjusts its scale to fit all visible elements, including moving averages.

If an MA is far from the current price, this can cause the entire chart to appear compressed.

This feature is designed to prevent that by hiding distant MAs.

You can set it to show MAs only when they are within a specified range, calculated as a multiple of the ATR from the high or low.

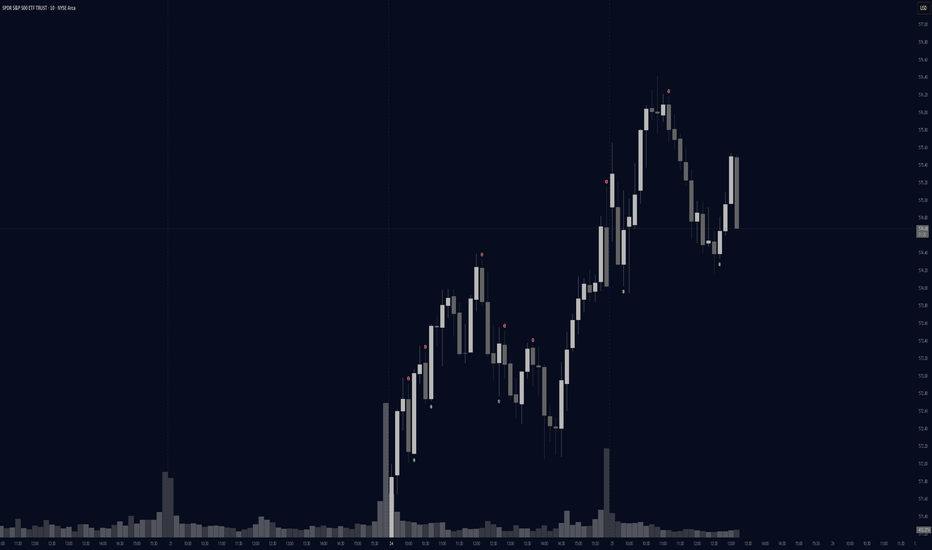

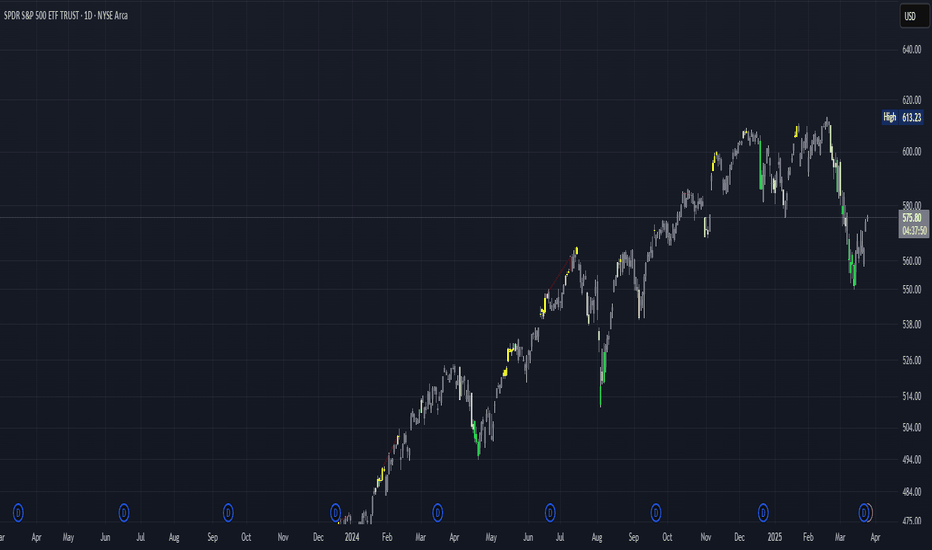

Normal Display Mode:

Show When Near Mode:

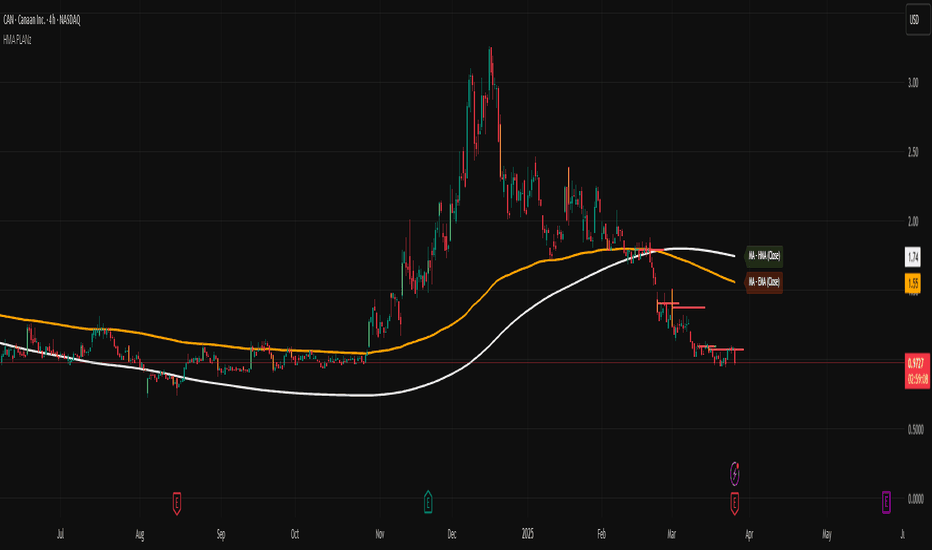

Candlestick analysis

HMA PLANz1. High Liquidity Candle Detection:

The indicator looks for candles with high liquidity (identified by comparing the current candle's volume with the highest volume of the last 10 candles).

If a candle has high liquidity, it is highlighted in yellow.

2. Midpoint Calculation of the Candle:

The midpoint of the candle is calculated by averaging the High and Low prices of the candle:

Midpoint

=

High

+

Low

2

Midpoint=

2

High+Low

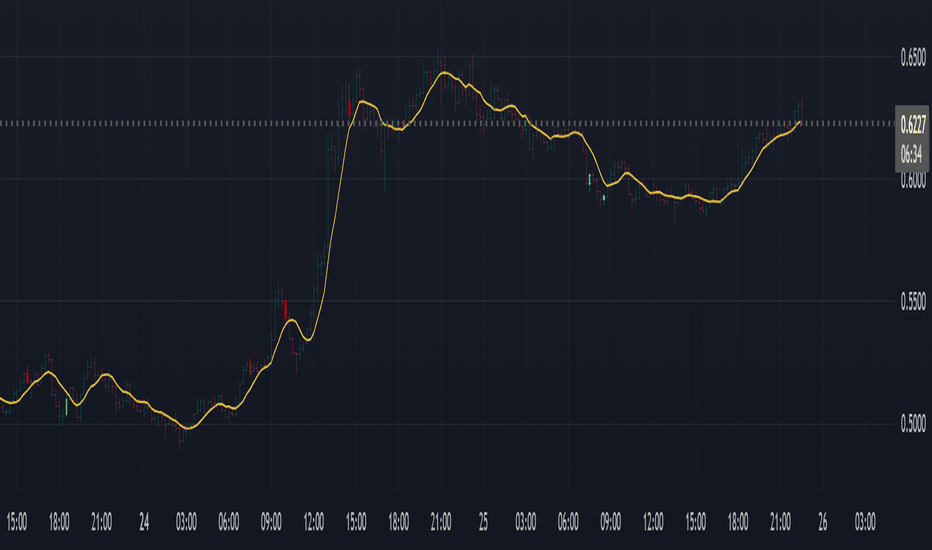

3. Draw a Line at the Midpoint of the High Liquidity Candle:

A horizontal line is drawn at the calculated midpoint value of the high liquidity candle and continues for the next five candles.

4. Change Line Color Based on Price vs. Midpoint:

If the current price is above the midpoint, the line is drawn in green.

If the current price is below the midpoint, the line is drawn in red.

5. Moving Averages (MA):

In addition to liquidity analysis, the indicator calculates and plots two moving averages on the chart.

Users can choose between EMA, SMA, WMA, or HMA for each moving average.

Users can also select the source for the moving averages (Close, High, Low).

The length for each moving average is customizable.

6. Display Moving Averages with Labels:

The moving average lines are plotted on the chart.

Labels are displayed above each moving average to show its type and source (e.g., "MA - HMA (Close)").

Summary of Key Features:

High Liquidity Candle Detection: Highlighted in yellow.

Draw a Horizontal Line at the Midpoint of the high liquidity candle: The line color changes based on price relation to the midpoint.

Moving Averages: Allows customization of types and lengths.

Labels: Shows details of the moving averages.

3min Breakout StrategyBreakout Strategy - Publication Notes

Overview

A Pine Script v5 strategy using multi-timeframe analysis to trade breakouts. Identifies peaks and dips on the 3-minute chart and enters trades on the 1-minute chart with momentum confirmation.

Key Features

Multi-Timeframe: Combines 3-minute trend analysis with 1-minute entries.

EMA-Based: Uses a 60-period EMA (3-min) for trend and key levels.

Peak/Dip Logic: Detects swing highs (peaks) and lows (dips).

Momentum: Confirms entries with RSI and EMA signals.

Stop Loss: Exits at the dip level.

How It Works

3-Minute: Tracks peaks above the EMA and dips below it (3+ bearish candles).

1-Minute: Enters long on a breakout above the peak with rising EMA and RSI; exits below the dip.

MJ EMA Cross AlertThe **MJ EMA Cross Alert** is a simple yet effective indicator that helps traders identify trend changes using Exponential Moving Averages (EMAs). It generates **buy and sell signals** when the fast EMA (default: 5) crosses the slow EMA (default: 13) and provides real-time alerts for potential trading opportunities.

#### **Features:**

✅ **Customizable EMA Lengths** – Adjust the fast and slow EMA values from the **Inputs** tab.

✅ **Clear Buy & Sell Signals** – Green "Buy" labels appear below candles when the fast EMA crosses above the slow EMA, while red "Sell" labels appear above candles when the fast EMA crosses below.

✅ **Single Alert Notification** – Get notified instantly when a crossover occurs, reducing the need to monitor charts constantly.

✅ **Overlay on Chart** – The indicator is plotted directly on the price chart for better visibility.

This indicator is ideal for traders looking to capture short-term trends efficiently. 🚀

Mvp Wave Sniper v1.0Overview: The Mvp Wave Sniper is a highly adaptive and strategic trading bot designed for cryptocurrency markets. It leverages advanced technical analysis tools to identify high-probability trading opportunities while maintaining a robust risk management system. Built with flexibility and performance in mind, this bot is ideal for traders looking to automate their strategies with precision.

Core Features:

Wave Confirmation Logic: Combines multi-timeframe wave analysis with customizable trend indicators to confirm bullish or bearish momentum.

ATR-Based Risk Management: Employs an Average True Range (ATR) multiplier for dynamically calculated stop-loss and take-profit levels.

Money Flow Index (MFI): Integrates MFI to gauge market liquidity and validate the strength of trade signals.

Trend and Filter Indicators: Includes customizable trend channels and a multi-moving-average filter to assess market direction.

Customizable Parameters: Offers full customization of inputs, including stop-loss, take-profit, trend length, and filter settings, enabling users to fine-tune the bot to suit their trading style.

API Compatibility: Designed for seamless integration with exchanges that support API trading via tradingview alerts, allowing for efficient execution of trades.

Advantages:

Risk Control: Automatically adjusts stop-loss and take-profit levels based on market volatility, reducing exposure to sudden price swings.

High Accuracy: Utilizes a blend of technical indicators, including OBV, MFI, and trend filters, to improve the precision of trade entries and exits.

Versatile Strategy: Works on multiple timeframes and supports both trend-following and reversal trading styles.

Detailed Feedback: Provides real-time labels on the chart to display stop-loss and take-profit levels, improving transparency and decision-making.

Best For:

Traders who prefer automation while retaining control over key parameters.

Those looking for a robust bot to trade cryptocurrencies such as Bitcoin and more.

Users seeking to refine their strategies with a mix of trend, volume, and volatility indicators.

STR by SiriusProtected Script Disclosure:

This script, STR by Sirius, is protected as invite-only due to its original and specialized approach to detecting structural price movements and directional inflection points across multiple timeframes. The algorithm integrates extrapolated line projections, cross-count logic, and stability detection mechanisms that are uniquely tailored for advanced market structure analysis. To preserve the proprietary methodology and ensure consistent usage by authorized traders, the source code remains closed.

Indicator Purpose and Logic Overview:

The STR by Sirius indicator is designed to identify directional momentum shifts, trend stability, and structural breakouts using a blend of historical price filters, extrapolated line segments, and smoothed moving average analysis. Its core logic centers on comparing historical pivot relationships over a defined timeframe and drawing vector-based lines to represent price structure changes.

It computes upward and downward cross-counts of these projected lines relative to real-time price, then classifies directional bias based on which cross-count is dominant. Additionally, the script incorporates a stability detection module that evaluates SMA variation over a defined number of bars to signal periods of trend consolidation or volatility contraction.

Visual Output and Elements:

Directional Line Segments: Plotted dynamically based on filtered price comparisons (open, close, high, or low), these lines can be optionally extended and color-coded (e.g., green for bullish, red for bearish).

Candle Overlay (Optional): The user can enable a colored candle overlay that visually reflects current directional bias and trend intensity.

Buy/Sell Signal Shapes: Triangle-up (blue) and triangle-down (red) markers appear below and above bars respectively when a new bullish or bearish signal is detected based on line crossing logic.

Color Logic: When directional strength exceeds a defined slope threshold and one direction dominates, the visuals adopt a color reflecting that bias. If no clear directional preference exists, a neutral color is used.

Inputs and Customization:

Filter Period & Mode: Users can choose the lookback interval and data type (close/high/low) for structural comparisons.

Line Settings: Adjustable width, length, color, transparency, and extension behavior.

Signal Width & Offset: Control over visual rendering and alignment of plotted outputs.

Stability Threshold: Users can configure the acceptable SMA range variation to define trend stability.

Trading Utility:

This indicator can be used to:

Identify shifts in structural market behavior.

Spot early signs of trend continuation or reversal via extrapolated line crossings.

Filter noise by detecting stable, consolidating periods using SMA-based variation control.

Enhance discretionary trading with directional bias overlays and clear signal markers.

It is particularly effective when used in conjunction with higher-timeframe confluence and other momentum or trend-following tools.

FVGS by SiriusProtected Script Description: FVGS by Sirius

This script is published as invite-only due to the unique and advanced multi-timeframe Fair Value Gap (FVG) detection system it implements. The logic behind the script includes proprietary visual structuring, dynamic plotting behavior, and an extensive range of customizable settings designed to enhance decision-making in a wide array of trading strategies. Protecting the source code ensures the integrity and original design of the algorithm, which offers distinctive edge detection and confluence features not available in standard FVG tools.

Overview and Purpose

"FVGS by Sirius" is a comprehensive multi-timeframe Fair Value Gap (FVG) visualizer designed to highlight inefficiencies in price action that may indicate potential support or resistance zones. The indicator dynamically detects both traditional FVGs and their inverse variants (iFVGs) across eight adjustable timeframes ranging from 1-minute to 4-hour charts. It also provides customizable visual and analytical overlays to help traders analyze the behavior of price relative to institutional liquidity gaps.

Core Logic and Features

Fair Value Gaps (FVGs): Automatically detects bullish and bearish FVGs based on three-candle structures. These gaps are drawn using customizable boxes with visual enhancements like centerlines, borders, transparency, and labels. The indicator also includes touch counters to track how often price revisits a gap.

Inverse FVGs (iFVGs): Highlights unfilled gaps when price has not retraced into the FVG. These are marked with inverse color schemes for clarity.

Multi-Timeframe Support: Each of the eight timeframes can be toggled individually, and the script can auto-adjust timeframes based on the current chart resolution.

Dynamic Filtering: Users can filter FVGs based on gap size (price height) or proximity to current price to reduce chart clutter.

Date Range Control: Plots can be shown only within user-defined date ranges, ideal for historical studies or forward-testing specific periods.

Heikin Ashi Candle Overlay: When enabled, custom Heikin Ashi candles replace standard chart candles for smoother trend visualization.

Hull Moving Average Band: Includes a configurable variation of the Hull Moving Average (HMA, EHMA, THMA) as a trend-following band with optional trend-colored candles.

SuperTrend Integration: Imports and utilizes the SuperTrend logic from a third-party library to provide an additional layer of trend confirmation.

RSI/CCI Signal Confluence: Incorporates RSI and CCI crossovers and threshold logic for detecting momentum-based confirmation signals.

Volume Oscillator Filter: Analyzes volume using EMA-based oscillators to detect strong surges or drops.

Alerts: Generates confirmation alerts for buy/sell opportunities based on a combination of Hull MA direction, RSI behavior, and presence inside FVG zones.

Visual Outputs

Boxes and Lines: FVGs are drawn as boxes, optionally with centerlines (50% levels), borders, and textual labels.

Touch Counters: Labels dynamically update to reflect the number of times price has interacted with a gap.

Color Modes: Fully customizable with support for automatic bullish/bearish color schemes across timeframes.

Signals: Visual buy/sell markers appear when trend and oscillator conditions align (optional and configurable).

Background Highlighting: Search zones are optionally shaded based on user-selected date ranges.

Usage and Trading Context

This indicator is best used to:

Identify unmitigated price inefficiencies and potential entry/exit zones.

Monitor multi-timeframe liquidity structures for confluence with other strategies (e.g., order blocks, break of structure).

Confirm momentum using integrated RSI, CCI, and volume filters.

Determine trend direction and strength with the Hull MA and SuperTrend overlays.

Traders may use the script to locate potential areas of interest where price may reverse, consolidate, or accelerate, especially when FVGs from higher timeframes align with those on lower frames. The visualization aids discretionary decision-making or can be integrated into rule-based systems.

EQS by SiriusProtected Script Description: "EQS by Sirius"

This indicator is protected and published as invite-only due to its original multi-timeframe structure, advanced visual logic, and proprietary handling of liquidity zones and equal high/low detection. The complexity of its design—featuring adaptive time-based plotting, contextual tooltips, and dynamic zone tracking—reflects a level of custom development intended for professional use, necessitating source protection.

Purpose and Core Logic

“EQS by Sirius” is designed to detect and visualize Equal Highs and Equal Lows (EQS) across multiple timeframes. These levels are commonly interpreted as potential liquidity zones or key market structures, often used by traders for identifying breakout traps, stop hunts, or reversal points. The script applies a precision-based algorithm to identify these EQS levels, providing users with visual cues to support decision-making in various market contexts.

The detection logic is based on comparing the difference between two successive highs (or lows) relative to the high-low range of the bars, allowing the user to fine-tune sensitivity via a precision parameter. When valid EQS conditions are met, horizontal lines are drawn at the detected price level, accompanied by optional shadow trendlines to represent liquidity channels.

Visual Outputs and Features

The indicator provides a rich and customizable visual environment, including:

Multi-Timeframe EQS Detection: Configurable from 1-minute to 4-hour timeframes with automatic sequencing.

Zone Highlighting: Optional background shading for designated date intervals.

Dynamic Shadow Mode: Projects angled trendlines representing potential liquidity zones based on EQS formations.

Touch Counters: Real-time counting of price interactions with plotted EQS levels.

Tooltips: Each label includes a timestamp and price breakdown to provide contextual clarity.

Line Customization: Adjustable color, width, and transparency for each EQS type and its shadow projections.

Auto-zoom Scaling: Adapts visual density based on the active chart’s timeframe.

Visibility Filters: Adjustable proximity thresholds ensure only relevant lines are displayed based on current price action.

How to Use in Trading

Traders can use this tool to:

Identify liquidity targets where price may reverse or accelerate due to stop hunts or breakout traps.

Analyze multi-timeframe confluence by comparing EQS zones from higher timeframes with local market structure.

Monitor touch counts to assess the strength or weakening of support/resistance levels.

Visualize trendline-based liquidity zones using the “shadow mode” to infer possible manipulation or price magnet areas.

Integrate with existing strategies for entry/exit timing, particularly in breakout and mean-reversion models.

Due to the high level of customizability and visual control, the script is suitable for discretionary traders, smart money concept practitioners, and those seeking to combine structural analysis with liquidity mapping.

HH&LL by SiriusProtected Script Notice

This script, "HH&LL by Sirius", is published as invite-only to protect its proprietary logic, which implements a refined detection mechanism for higher highs, lower lows, and liquidity points using advanced price action filtering. The underlying architecture integrates custom zone-based plotting, pivot analysis, and dynamic support/resistance tracking that is tailored for discretionary or rule-based trading. The source code is protected to preserve the originality and tactical advantages it provides in identifying significant market structure changes.

Overview

The "HH&LL by Sirius" indicator is a comprehensive market structure tool that identifies and labels key swing points—Higher Highs (HH), Higher Lows (HL), Lower Highs (LH), and Lower Lows (LL)—to help traders visualize trend progression and potential reversal areas. It builds upon traditional pivot-based logic with extended historical comparisons, confirming points only when certain criteria are met to reduce noise and enhance reliability.

Key Features and Logic

Zigzag-like Market Structure Detection

The indicator derives its structure by calculating pivots and comparing sequences of highs/lows to identify meaningful HH, HL, LH, and LL patterns. These structures are refined through multi-level checks that validate each point using historical swing relationships.

Support and Resistance Zones (POIs)

Once structural points are confirmed, the script dynamically plots support (HLs) and resistance (LHs) lines that persist until invalidated by price. These Points of Interest (POIs) are labeled and include an optional hit-count system that displays how many times price has interacted with the level, providing insight into liquidity and potential breakout zones.

Label Customization and Visualization

Labels can include the price level, touch count, and confluence icons (e.g., 🐂 or 🐻) depending on configuration. Custom color settings allow for distinguishing bullish and bearish levels, and a separate logic manages label deletion or style change when a POI is invalidated.

Time-Based Session Filtering

The indicator supports two custom date ranges to filter plotting to specific market sessions. This is useful for focusing on key trading weeks or events. A background color option highlights active sessions.

All-Time High (ATH) Tracking

An optional feature tracks and plots the current all-time high on the chart. The ATH line includes extended styling options such as width, transparency band, and dynamic labeling on both sides of the chart.

Visual Outputs

Lines: Horizontal support and resistance lines drawn at HL and LH points, color-coded and styled based on user settings.

Labels: Detailed or minimalist annotations for POIs, touch count, and liquidity status. Labels can be positioned left/right and toggled for price visibility.

Zones: Optional background shading for specific date ranges, aiding in session-based analysis.

ATH Display: A prominently plotted line for all-time highs, including adjustable label and band features.

Trading Use Cases

Trend Confirmation: Use HH/HL or LH/LL sequences to confirm uptrends or downtrends.

Liquidity Traps and Sweeps: High POI hit counts or rapid invalidations can signal areas of engineered liquidity or breakout risk.

Zone-Based Confluence: Combine session filtering with structure plotting to find key zones of reversal or continuation.

Support/Resistance Breaks: Watch for price closing beyond a plotted POI to assess potential trend shifts or breakout opportunities.

Note

The script includes multiple internal optimizations and custom controls for advanced users. It is designed for traders seeking a deeper view of market structure beyond basic pivot plotting, with optional aesthetic and data visibility preferences to suit different trading workflows.

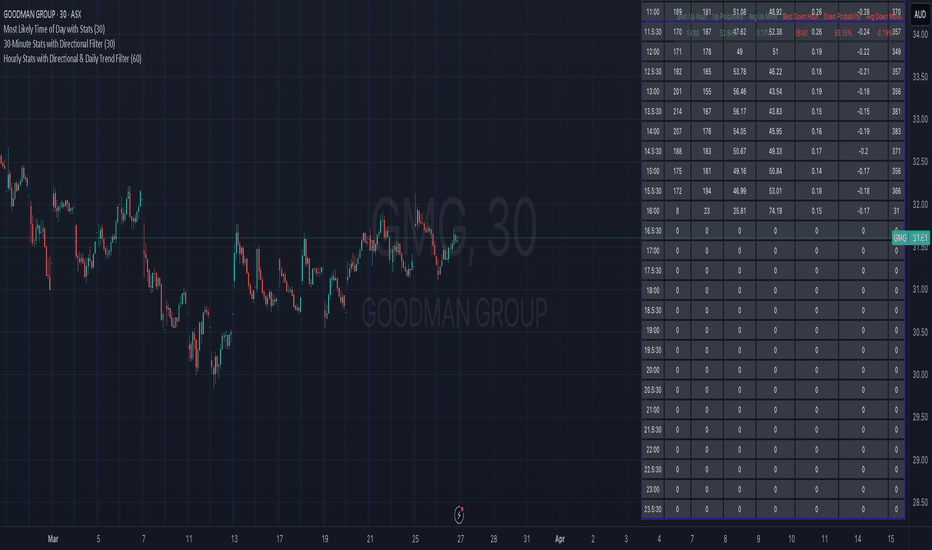

Hourly Stats with Directional & Daily Trend FilterThis tracks the chance of a consecutive candle occurring at time.

Eg. previous candle was up, 55% chance of this candle being up too.

Pre filter is that the stock/asset is red since the open already for a consecutive red candle,

or green on the day since the open (as this greatly improves odds)

SMA 22 with Color ChangeThis TradingView indicator plots a 22-period Simple Moving Average (SMA) with dynamic color changes based on its slope direction:

Green when the SMA is rising.

Red when the SMA is falling.

💡 Key Features:

Customizable SMA length (default: 22).

Visual color feedback to easily identify uptrends and downtrends.

Ideal for spotting momentum shifts and trend direction at a glance.

👉 This script enhances the default SMA indicator by adding color-coded slope visualization, making it easier to interpret price trends.

Overextension Oscillator [by MR_LUCAS_01]The Overextension Oscillator is a custom TradingView indicator designed to detect market overextension by analyzing swing highs/lows, price distance from swings, and momentum shifts. It helps traders identify potential reversal zones where price is likely to retrace after an overextended move.

---

Key Features:

✅ Swing High/Low Detection – Identifies key pivot points to measure market extension.

✅ Overextension Calculation – Measures how far price has moved from recent swings.

✅ Oscillator with Smoothing – Uses EMA-based smoothing to generate reliable signals.

✅ Buy & Sell Signals – Highlights potential entry points when price reaches extreme zones.

✅ Color-Coded Candle Plotting – Enhances visibility of bullish and bearish zones.

✅ Threshold-Based Alerts – Notifies traders when price extends beyond a calculated limit.

---

How It Works:

1. Swing Point Detection:

Detects pivot highs/lows over a defined number of bars.

Measures the percentage difference between recent swing highs and lows.

2. Overextension Calculation:

Determines how far price has moved from the last significant swing.

Compares this movement to historical averages to assess overextension.

3. Oscillator Processing:

Creates an oscillator with smoothing to filter noise.

Highlights when price moves too far from equilibrium.

4. Buy & Sell Signal Generation:

Buy Signal: Price falls below a threshold relative to the last swing low.

Sell Signal: Price rises above a threshold relative to the last swing high.

Includes a cooldown period to avoid rapid repeated signals.

---

Visualization:

Bullish & Bearish Candles:

Green candles indicate bullish overextensions (potential reversals up).

Red candles indicate bearish overextensions (potential reversals down).

Signal Line (Neutral Color):

Plots a smoothed oscillator to track overextension movements.

Reference Levels:

0 Line: Center equilibrium.

+20 & -20 Bands: Indicate potential reversal zones.

Buy & Sell Signal Markers:

Green circles (Buy Signals) at oversold conditions.

Red circles (Sell Signals) at overbought conditions.

---

Customization Options:

Swing Detection Lengths – Adjust bar lookback periods for pivots.

Oscillator Smoothing – Modify EMA lengths for signal clarity.

Threshold Sensitivity – Fine-tune overextension criteria.

Cooldown Period – Prevent excessive signals in rapid moves.

---

Use Cases:

✔ Reversal Traders – Identify overextended price action for mean reversion trades.

✔ Trend Traders – Use as a filter to confirm pullback entries in trends.

✔ Scalpers & Swing Traders – Find quick reversals in volatile markets.

---

Conclusion:

The Overextension Oscillator is a powerful tool that helps traders identify extreme price movements and anticipate potential reversals. By combining swing analysis, distance measurements, and smoothed oscillations, it provides clear buy/sell signals in overextended markets.

TradeCove Glam Oscillator (Tuned Buy/Sell Boxes)The Glam Oscillator gives you high-confidence Buy and Sell signals by detecting powerful RSI reversals — filtering out the noise and only highlighting moments that actually matter.

Perfect for traders who want fewer, smarter entries with stylish, clutter-free visual alerts. ✅📈

Buy and Sell Signals (London & New York Opens)this is the indicator only helpful in 5 min time frame when previous day candle is in sell direction only take sell signal as entry uncheck buy option in settings and when previous day candle is in buy direction only take buy signal then uncheck sell option risk is swing high reward is 2 times to risk

Three Red WicksThe indicator will mark spots on your chart where three red candles appear in a row. You can modify the marker's color, shape, or position by adjusting the plotshape parameters if desired.

Would you like me to modify anything in this indicator, like changing the marker style or adding additional conditions?

Advanced Multi-Indicator Strategy"Advanced Multi-Indicator Strategy" is a sophisticated trading strategy designed to analyze multiple market indicators and provide buy and sell signals based on a combination of technical factors. The strategy uses various indicators, including moving averages, momentum oscillators, trend-following indicators, and price patterns to create a robust entry and exit framework for trading.

Key Components:

Price Action and Trend Indicators:

The strategy considers the price action by ensuring that the closing price is greater than the opening price (bullish indication) and the closing price is above 1.

It also incorporates a set of Exponential Moving Averages (EMAs) of various periods (EMA3, EMA5, EMA8, EMA13, EMA21, EMA55, EMA100) to confirm the trend direction. A buy signal is generated only when all EMAs are aligned in a bullish sequence, i.e., the shorter-period EMAs are above the longer-period EMAs.

Momentum Indicators:

MACD: The strategy uses the MACD to confirm momentum. A buy signal is generated when the MACD value is positive and the MACD signal line is below the MACD line, indicating bullish momentum.

RSI (Relative Strength Index): The strategy checks that the RSI is below 70, ensuring that the market is not overbought, and room remains for upward movement.

Rate of Change (ROC): This is used to identify the speed of price movement. A ROC value less than 100 is required to avoid excessive price volatility.

Commodity Channel Index (CCI): A positive CCI indicates the market is in an uptrend.

Money Flow Index (MFI): The strategy ensures that the MFI is below 80, indicating that there is no excessive buying pressure.

Volume and Market Strength:

The On-Balance Volume (OBV) indicator is used to ensure that the volume is confirming the price movement. A positive OBV is required for a buy signal.

Additionally, the strategy checks that the volume multiplied by the closing price is greater than 10 million, ensuring there is substantial market activity backing the move.

Pattern Recognition:

Stochastic RSI: The Stochastic RSI values (%K and %D) are monitored to ensure the market is not in an overbought or oversold condition.

Parabolic SAR: The strategy ensures that the SAR (Stop-and-Reverse) is below the current price, confirming an uptrend.

Hanging Man Candlestick: The strategy checks for a Hanging Man candlestick pattern as a potential sell signal if detected during a price move.

ADX (Average Directional Index):

The ADX and its components (+DI and -DI) are used to confirm the strength of the trend. The strategy ensures that +DI is above the ADX and -DI, indicating a strong upward trend.

Buy Condition:

A buy signal is generated when:

The closing price is greater than the opening price.

The EMAs are in a bullish sequence (shorter EMAs above longer EMAs).

The MACD is above 0, and the MACD line crosses above the signal line.

The RSI is below 70 (avoiding overbought conditions).

Aroon values suggest a strong uptrend.

The Bollinger Bands upper band is above the close price.

On-Balance Volume (OBV) confirms buying volume.

The ADX confirms the trend strength.

Additional filters such as ROC, CCI, MFI, and Stochastic RSI ensure market conditions are favorable for a buy.

Sell Condition:

The strategy considers a sell signal when:

The EMA5 crosses below EMA8 (a trend reversal).

There have been three consecutive bearish candles (close < open).

A Hanging Man candlestick pattern is detected.

ADX or +DI / -DI values indicate weakening trend strength.

Indicator Plots:

EMAs (3, 5, 8, 13, 21, 55, 100) are plotted on the main chart to visualize trend direction.

Bollinger Bands upper band is plotted to confirm overbought conditions.

ADX, +DI, and -DI are plotted in a separate subchart to monitor trend strength.

Stochastic RSI values (%K and %D) are plotted in a separate subchart to analyze momentum.

This strategy combines multiple indicators to generate reliable buy and sell signals, making it suitable for traders who prefer a multi-faceted approach to market analysis, ensuring better decision-making and potentially higher profitability in trending markets.

Price Action Agreements [BH]This simple indicator will detect when a reversal has taken place on two consecutive bars, meaning that if a green bar is followed by a red bar or vice versa, then we have what is considered to be a price agreement at either the high or low of where the bars have set the highest/lowest price.

Red or green dots can be displayed to show whether it is a bearish or bullish agreement.

You can set alerts for bullish and bearish detection.

Notes that the detection will only be set when the current bar closes and the bodies of both bars must be larger than 0.10.

Reversal & Breakout Strategy with ORB### Reversal & Breakout Strategy with ORB

This strategy combines three distinct trading approaches—reversals, trend breakouts, and opening range breakouts (ORB)—into a single, cohesive system. The goal is to capture high-probability setups across different market conditions, leveraging a mashup of technical indicators for confirmation and risk management. Below, I’ll explain why this combination works, how the components interact, and how to use it effectively.

#### Why the Mashup?

- **Reversals**: Identifies overextended moves using RSI (overbought/oversold) and SMA50 crosses, filtered by VWAP and SMA200 trend direction. This targets mean-reversion opportunities in trending markets.

- **Breakouts**: Uses EMA9/EMA20 crossovers with VWAP and SMA200 confirmation to catch momentum-driven trend continuations.

- **Opening Range Breakout (ORB)**: Detects early momentum by breaking the high/low of a user-defined opening range (default: 15 bars) with volume confirmation. This adds a time-based edge, ideal for intraday trading.

The synergy comes from blending these methods: reversals catch pullbacks, breakouts ride trends, and ORB exploits early volatility—all filtered by trend (SMA200) and anchored by VWAP for context.

#### How It Works

1. **Indicators**:

- **EMA9/EMA20**: Fast-moving averages for breakout signals.

- **SMA50**: Medium-term trend filter for reversals.

- **SMA200**: Long-term trend direction to align trades.

- **RSI (14)**: Measures overbought (>70) or oversold (<30) conditions.

- **VWAP**: Acts as a dynamic support/resistance level.

- **ATR (14)**: Sets stop-loss distance (default: 1.5x ATR).

- **Volume**: Confirms ORB breakouts (1.5x average volume of opening range).

2. **Entry Conditions**:

- **Long**: Triggers on reversal (SMA50 cross + RSI < 30 + below VWAP + uptrend), breakout (EMA9 > EMA20 + above VWAP + uptrend), or ORB (break above opening range high + volume).

- **Short**: Triggers on reversal (SMA50 cross + RSI > 70 + above VWAP + downtrend), breakout (EMA9 < EMA20 + below VWAP + downtrend), or ORB (break below opening range low + volume).

3. **Risk Management**:

- Risks 5% of equity per trade (based on the initial capital set in the strategy tester).

- Stop-loss: Based on lowest low/highest high over 7 bars ± 1.5x ATR.

- Targets: Two exits at 1:1 and 1:2 risk:reward (50% of position at each).

- Break-even: Stop moves to entry price after the first target is hit.

4. **Backtesting Settings**:

- Commission: Hardcoded at 0.1% per trade (realistic for most brokers).

- Slippage: Hardcoded at 2 ticks (realistic for most markets).

- Tested on datasets yielding 100+ trades (e.g., 2-min or 5-min charts over months).

#### How to Use It

- **Timeframe**: Works best on intraday (2-min, 5-min) or daily charts. Adjust `Opening Range Bars` (e.g., 15 bars = 30 min on 2-min chart) for your timeframe.

- **Settings**:

- Set your initial equity in the TradingView strategy tester’s "Properties" tab under "Initial Capital" (e.g., $10,000). The script automatically risks 5% of this equity per trade.

- Adjust `Stop Loss ATR Multiplier` or `Risk:Reward Targets` based on your risk tolerance.

- Note that commission (0.1%) and slippage (2 ticks) are fixed in the script for backtesting consistency.

- **Execution**: Enter on signal, monitor plotted stop (red) and targets (green/blue). The strategy supports pyramiding (up to 2 positions) for scaling into trends.

#### Backtesting Notes

Results are realistic with commission (0.1%) and slippage (2 ticks) included. For a sufficient sample, test on volatile instruments (e.g., stocks, forex) over 3-6 months on lower timeframes. The default 1.5x ATR stop may seem wide, but it’s justified to avoid premature exits in volatile markets—feel free to tweak it with justification. The script assumes an initial capital of $10,000 in the strategy tester for the 5% risk calculation (e.g., $500 risk per trade); adjust this in the "Properties" tab as needed.

This mashup isn’t just a random mix; it’s a deliberate fusion of complementary strategies, offering traders flexibility across market phases. Questions? Let me know!

PSP - Precision CandlePSP Precision Spotting Points (PSP) Indicator

The PSP Precision Spotting Points (PSP) Indicator is designed for traders seeking to identify high-probability reversal zones by detecting PSP setups with precision. PSPs are Potential Swing Points that often precede market reversals or significant price reactions. This indicator simplifies the process of spotting these opportunities by highlighting areas of interest based on market structure, correlation imbalances, and wick rejections.

📌 Key Features:

PSP Detection: Accurately identifies Potential Swing Points by scanning for candle patterns that suggest a shift in momentum.

Precision Entry Zones: Marks areas where price is likely to react, offering clear visual cues for optimal trade execution.

Smart Filtering: Filters out low-quality signals using advanced volatility and liquidity analysis.

Wick Confirmation: Validates PSP setups using wick rejections and correlation cracks, enhancing the probability of a successful trade.

Customizable Alerts: Stay informed with real-time notifications when a PSP is detected.

🛠️ How It Works:

Candle Analysis: Scans for specific price action patterns where candle body-to-wick ratios and volatility suggest a Potential Swing Point.

Correlation Cracks: Detects discrepancies between correlated instruments, adding confluence to PSP setups.

POI Alignment: Highlights areas near Points of Interest (POIs) like Fair Value Gaps (FVGs), previous highs/lows, and session kill zones.

Rejection Confirmation: Ensures PSPs are validated through wick-based rejection patterns, minimizing false signals.

Combined RSI EnsembleCoding-Assistent

Absolut! Hier ist die Übersetzung der Beschreibung des Indikators "Combined RSI Ensemble" ins Englische:

Indicator Description: "Combined RSI Ensemble"

This indicator combines the relative strength indices (RSI) of different periods (5, 9, and 14) and evaluates them to identify overbought and oversold conditions. It uses custom inputs for overbought and oversold thresholds and assigns colors to candles based on the strength of the overbought or oversold signals.

How it works:

RSI Calculation: The indicator calculates three RSI values with different periods (5, 9, and 14).

Evaluation: An evaluation is made for each RSI period. If the RSI is above the overbought threshold, a score of 1 is assigned. If the RSI is below the oversold threshold, a score of 1 is also assigned.

Total Evaluation: The scores for the overbought and oversold conditions are added separately.

Candle Coloring: Based on the total scores, the candles are colored:

3: Surely overbought/oversold (strongest signal)

2: Probably overbought/oversold

1: Slightly overbought/oversold

0: Neutral

SMA7 Tail Reversal📌 Description:

The SMA7 Tail Reversal indicator is designed to identify potential counter-trend trading opportunities by checking if candle wicks (tails) respect a key moving average level (SMA7).

This indicator highlights price action where candles are clearly separated from the moving average, suggesting a possible reversal or temporary correction.

📌 How It Works:

Moving Average Calculation:

Calculates a simple moving average (SMA) of length 7 to act as the primary trend filter.

Candle Classification:

Bullish Candle: A candle where the closing price is higher than the opening price, with a short upper wick.

Bearish Candle: A candle where the closing price is lower than the opening price, with a short lower wick.

Conditions for Coloring Candles:

Long Condition (Green Candle):

High & Low are both below the SMA7 line.

Volume is above the 20-period average.

A bullish candle is detected.

Short Condition (Red Candle):

High & Low are both above the SMA7 line.

Volume is above the 20-period average.

A bearish candle is detected.

📌 Visual Representation:

Green Candles: Potential long signals when price action stays below the SMA7 line.

Red Candles: Potential short signals when price action stays above the SMA7 line.

Yellow Line: SMA7, used as the dynamic threshold for signal generation.

📌 Usage:

Best applied to volatile markets with clear trends.

Effective in detecting counter-trend opportunities where price diverges from the SMA7 line.

Works well with additional confirmation tools for better accuracy.

NakInvest - Inside Bar no Eden dos Traders (Stormer)📌 NakInvest - Inside Bar Detector (Éden dos Traders Enhanced Detection)

This indicator is designed to identify Inside Bars that occur during strong trending conditions, following the popular Éden dos Traders strategy by Stormer, famous brazilian trader. It uses the relationship between two EMAs (Short EMA & Long EMA) to determine whether the market is in a bullish or bearish trend, and highlights Inside Bars that meet specific criteria.

⸻

🔍 What This Indicator Does:

1. EMA-Based Trend Detection:

• Identifies Uptrends when the Short EMA is above the Long EMA.

• Identifies Downtrends when the Short EMA is below the Long EMA.

2. Inside Bar Detection:

• An Inside Bar is detected when the entire candle (body & wicks) is contained within the body of the previous candle.

• This pattern suggests consolidation and potential breakouts, especially when found within a strong trend.

3. Debug Mode for Transparency:

• When enabled, provides visual markers to indicate when the conditions for trend detection and Inside Bars are met.

• Helps traders understand why certain candles are detected and others are not.

⸻

📈 How to Use:

• Apply this indicator to any market and timeframe, but it’s most effective on higher timeframes (H1, H4, Daily).

• Ideal for traders looking for trend-continuation setups or reversal signals after periods of consolidation.

• Combine this indicator with other tools (e.g., Volume Analysis, Price Action Patterns) for greater accuracy.

⸻

⚙️ Indicator Settings:

1. Short EMA Length: The period for the fast-moving average (default: 8).

2. Long EMA Length: The period for the slow-moving average (default: 80).

3. Enable Debug Mode: Toggle visibility of debug markers to better understand condition logic.

⸻

📢 Alerts:

This script includes labels for:

• IB (Up): Inside Bar detected during an uptrend.

• IB (Down): Inside Bar detected during a downtrend.

⸻

📌 Disclaimer:

This indicator is intended for educational purposes only and is not financial advice. Always perform your own research and consult with a financial professional before making any trading decisions.