Auto Fibonacci [Misu]█ This indicator shows an automatic Fibonacci retracement levels.

This indicator is designed based on highs, lows, and trend interpretation to orientate the fibonacci retracement in the good direction.

Fibonacci analysis uses a logical sequence of numbers to predict trends and price action.

█ Usages:

The Fibonacci retracement is used to identify hidden support and resistance levels that an investor can use for entry, exit, and stop placement.

Depending on your usage, you can track breakouts above and below retracement levels to provide early entry points for major breakouts and breakdowns.

█ Features:

> Choose Fib levels

> Color Fib Levels all in one

> Color Fib Levels Individually

█ Parameters:

Deviation: A parameter used to calculate pivots.

Depth: A parameter used to calculate pivots.

UI Settings: Select Fibs levels and colors.

Priceaction

((Bearish)) Candle Above EMASGood Morning from the UK.

Todays script is a simple vieweing of when candles close above a certain moving average - when the market is bearish conditions - candle which close above the moving average can be viewed as a bearish signal along with confluences such as price action. This script is best on the Daily and we can expect big price moves away from this area.

The below example, we have a bearish set up with a break of trendline and then a break of a base which would 1) strong area as price is unlikely to go past this area which would make this a supply zone.

This was then followed by the signal of the candle closing above the 100ema and the 50ema.

The script is likened to my one of my previous scripts which portrays the bullish ema candle closes.

I will be making a price action publish soon if that is of interest to the public.

Price Line Extended to the Right with Price Label | by Octopu$🔖 Price Line Extended to the Right with Price Label | by Octopu$

This is an Add-On customization tool for your Chart Price Level.

Tired of having the TradingView's priceline all across the Chart?

And not having the Option to turn it off/extend to right only?

Worry you not. Got solutions for any problems you may have!

As well as many arms.

This Indicator provides an extended price line to the right only,

Starting from the current candle, towards the price levels.

Additionally, provides a quick price label for fast reference.

You can turn on/off the line,

As well as on/off the label.

Colors change according to candle direction:

Up/Down matching Green/Red.

Please remember to turn OFF TradingView's price line.

Otherwise it'll overlap. Price Line/Tag "replaces" that.

Works in Any Time Frame.

On Any Ticker.

(Using ES 5m just as an example:)

www.tradingview.com

SPY

Features:

• Price Tag

• Price Line

• Extend to Right

• Automatic color change

Options:

• Toggle On/Off Price Line

• Toggle On/Off Price Tag

Notes:

v1.0

Indicator release

Changes and updates can come in the future for additional functionalities or per requests.

Did you like it? Boost it. Shoot a message! I'd appreciate if you dropped by to say thanks.

- Octopu$

🐙

MARKET BOSS FOR ALLTHIS STRATEGY USE FOR ANY TYPE OF MARKET INDIAN,COMMODITY,FOREX ,CRYPTO...This strategy used to determine and anticipate potential changes in market price and reversals. The Highs referred to in the title are created based on the number of bars that exhibit lower highs on either side of a High, whereas the Lows are created based on the number of bars that exhibit higher lows on either side Low.it also analyzing price changes and reversals, a trader has more of an ability to determine and predict price patterns and general price trends...

The backtest results are based on BANKNIFTY last year's data. It has an initial capital of 10000 and the size of the lot is 1. The commission paid is 50 RS cash per trade and the slippage is 5 ticks per trade. Some of the Indian broker's commission is only 10 cash per trade. Adjust the commission as per your broker. Trades are conducted based on the intraday time in India set from 9.20 am to 3:20 pm. All positions will get square off at 3.20 pm. All other parameters are suitable for Robo trading with Indian stock brokers.

Also added Quantity feature it automatically double the quantity on losing trade

reasons why to use strategy

1) human psychology never focus on one thing... We never follow one strategy for long time... Bcs we hve greed... If some one says indicator give u 95% than we chnge our strategy which on we r working but indicator didn't give u back testing... Our strategy gives back testing... On 5 min chart of banknifty future... Tv on premium membership give one year back testing... And on crypto it gives 2month backtesing on 5min chart

2) we hve sufficient back testing trades... On 1year back testing minimum 700 trade should be done for back testing bcs thn we know how our strategy work on all market conditions.... For crypto in 2 month back testing more thn 300 trade needed to know it's performance... Our strategy produce suffiend trades... So we know how it works on all market conditions

3) we provide banknifty strategy for intraday... So it's open trade after 9 20 and close all position on 15: 20...so it's backtesing is sure shot perfect

4) for banknifty option strategy... We have made it to book profit or loss in 5 to 15 min... So no time factor effect... So vry profitable for option buyers

5) for banknifty option we had made it fully auto it's automatically buy at auto strike price.. So no tension to select strike price

6) u can also choose weekly or monthly expirey

7) we hve provided table for monthly proprofits... So we know how it's work on every month

8) last but not least...key of 🔑Sucess in stock market and crypto is following the right path for long time... With non biased strategy with positive backtesting result... And all the best

PA Swings [TTA]Hello traders!

This script helps identify swing high levels of resistance and swing low levels of support via price action.

The indicator is designed to help identify support and resistance by measuring retracements. When the retracement has reached the threshold, the indicator identifies the high or low with a horizontal, solid line.

This line will continue until it is violated. Once it is violated it will adjust to a dashed line and continue until it is violated again (retested).

Therefore, a solid line resembles an unviolated swing level; a dashed line resembles a violated swing level that has yet to be retested.

Ideally, this script will filter some movements by identifying impulses in the market. Knowing that price is in a trending move rather than bouncing around in a range can help traders in their analysis. In range bound conditions the indicator will show small impulses, sometimes trapped by a support and/or resistance line. In trending markets there will be separation between the support and resistance lines.

Retests are also identified by the indicator.

Retests of swing highs and lows may induce precise, repeatable price moves - something a trader might find advantageous. A log is included to help identify potential price levels based on historical actions when an impulse or a retest occurs.

Consequently, this may help traders identify take-profit targets and avoid stop losses that are too close to the entry point.

The indicator has a color identity panel to help you get familiar with the colored lines, line types, and what they mean. The color panel is concealable. Additional customization options are available, such as toggling the chart labels. These labels distinguish impulses up and down, retests, and the distance price has traveled since breaking or creating a support or resistance level.

This can be toggled off. A High-Volume Swings only option is available for those that wish to filter out low volume movements (such as extended market hours).

You also have the option of hiding far away lines and can define what is “far away” for them % wise. It is defaulted to 15% which may need to be adjusted on lower timeframes.

Inactive lines can be shown or they can be removed in the settings as well. While this indicator can find some great levels of support or resistance it is important to remember that, should you find this script helpful, it is a tool in your toolbox!! (:

Hope you enjoy and thank you for checking this out!

Volume and Trend reversal scalping scriptThe Vtrend X script allows for both trend based and scalping trading entries, it gives you all the trend and reversal information at hand that is necessary. It works best in a trending market.

The fundamental part of the script, is the volume weighted bands in blue and red, which help determine the trend and dynamic support and resistance . The blue band is a shorter length than the red band.

When the blue band dips below the red band, this tells us there is a downtrend. And when the blue band is trending above the red band, this is bullish uptrend price action. You will be able to note price whatever the timeframe really respects these bands, and you can use that to your advantage flicking through the high and low timeframes on where price will go next, combined with your own support and resistance levels.

Combined with the candle colors, which change whether they close above or below the main trend colored line (shown below), help identify a change in price action and trend. This allows for low timeframe plays also.

The uptrend and downtrend cicle signals are shown in a few different colors. Green and red are with the trend and have met all conditions. Orange and purple are against the trend calculations, and Olive circles risky trades against all the filters used to calculate signals.

The reversal signals, are the diamond plots in black, These also represent take profit areas as well.

Another key feature is the Daily / Weekly / Monthly and Yearly open levels displayed as colored dots. A lot of the plays i take use the Daily opens as key levels to take a trade off.

The indicator is designed to give you key information, but be quite customisable as well to suit your exact trading style.

Recommended timeframes i use for this script; Weekly (for key liquidity areas), Trading on the Daily, 6h, 4h, 2h, 1h and 25 minutes.

Backtested Settings and Pairs;

Pair - Timeframe - Signals Inputs - Reversal Inputs - ATR Multiplier - MA Filter

BTCUSD - 1 hr - 3 - 2.8 - 5.5 - NA

ETHUSD - 1 hr - 4 - 2.8 - 5.5 - NA

USDCAD - 1 hr - 4 - 2.8 - 5.5 - NA

GBPUSD - 1 hr - 4 - 2.8 - 5.5 - NA

US30 - 1 hr - 4 - 2.8 - 5.5 - NA

BTCUSD - 4 hr - 2.5 - 2.5 - 3.5 - NA

BTCUSD - 25 mins - 5 - 2.5 - 5.5 - NA

ORBox | by Octopu$📈 ORBox | by Octopu$

ORBox is a Box for the Opening Range Breakout

The Box is added automatically according to the User preferences through GUI

This Indicator includes a Dropdown selection for which Range for the Breakout you want to use

ORBox has built-in Alerts for when the Breakout happens according to your preferences

Works in any Timeframe with any Ticker

(Using SPY 5m just as an example:)

www.tradingview.com

SPY

Features:

• Opening Breakout Range (ORB)

• Dropdown menu selection to choose which TF to watch

• Built-in Alerts for Momentum Awareness

Options:

• Customization for Box Colors and Sizes

• Display ORB for Current Day or Previous

Notes:

v1.0

ORBox Indicator release

Changes and updates can come in the future for additional functionalities or per requests.

Did you like it? Shoot me a message! I'd appreciate if you dropped by to say thanks.

- Octopu$

🐙

Wick-off Check Pattern [Misu]█ This Indicator shows a wick-off check pattern.

This pattern appears when a candle goes below a level (support or resistance) and closes above it OR when it goes above a level and finishes below it. This causes a wick to go through the level: a wick-off check .

This can confirm a pullback or a breakout.

█ Usages:

This indicator can be used to validate a resistance or support level.

It can also be used to validate breaking levels.

█ Parameters:

Deviation: Parameter used to calculate pivots.

Depth: Parameter used to calculate pivots.

Wickoff Mode: Mode used to detect Wickoff check pattern.

> counter pattern: only shows "pullback" wickoff check.

> breakout pattern: only shows "breakout moves" wickoff check.

> both: shows both.

Lenght Avg Body: Lenght used to calculate the average body size.

First Breakout Factor:

Lenght Avg Wick Validation: This factor multiplied by the "body avg" filters out the non-significant breakout.

Factor Avg Wick Validation: Lenght used to calculate the average wick size.

Max Bars Wickoff: This factor multiplied by the "wick avg", filters out the non-significant wickoff signals.

SBS AlgoHello traders, I am here again with a new and improved indicator.

This indicator is based on a pivot breakout algorithm which gives buy and sell signals according to the breakout of trendline. This is an advanced version of another script. It also takes price action into consideration along with some basic indicators like MACD and ADX to give good entry signals.

NOTE: This indicator is not designed to take entries completely based on signals it gives. Please use it along with your trading strategy to add more confluence to your trading system and maximize your profits.

I hope you guys will like this one too .Enjoy 👍

In case you find any bug, please do report in comment section .Thank you.

NSDT Gap FinderThis script plots gaps between candles.

It uses the "round_to_mintick" feature in the Pinescript code, so it works on any instrument out to 3 decimal places.

If there is a Gap Up (open of current candle is greater than the close of previous candle) it will plot a green arrow under the current candle and plot a label above the current candle to show the Gap Amount.

If there is a Gap Down (open of current candle is less than the close of previous candle) it will plot a red arrow over the current candle and plot a label below the current candle to show the Gap Amount.

You can turn the label and/or the arrow on and off.

I created this indicator to more easily identify gaps in the market. The probability of a gap being filled is extremely high. Some are right away (intraday candle to candle), some take a while (gap from previous day close to current day open), and some make take a long time (close at end of previous week to open at beginning of current week).

This is published free to use and open source code.

Please see my other similar Gap Indicators.

Daily Gap Range

USA Session - Previous Day Close Gap to Current Day Open

Price Action CandlesThis simple script provides a visual aid for price action traders by coloring outside & inside candles, which in effect leaves the trader with 6 possible candle colors:

-Regular bullish candle

-Outside bullish candle

-Inside bullish candle

-Regular bearish candle

-Outside bearish candle

-Inside bearish candle

These candlesticks may provide powerful signals when used in conjunction with key levels, market structure and chart patterns.

Make sure to disable the regular candlesticks (body, borders and wicks) in the symbol tab inside the configuration menu!

Hope it can help someone!

Opens, Closes, Highs and Lows.Hello Traders, the script below is designed to display the monthly, weekly, previous days' and current days' open, close, high and low.

I designed it to assist in top down analysis by knowing the monthly and weekly opens and closes it makes it a lot easier to make trading decisions on the lower timeframes.

As the user you can choose which price values you'd like displayed on the chart by selecting them in the user inputs.

Enjoy!!

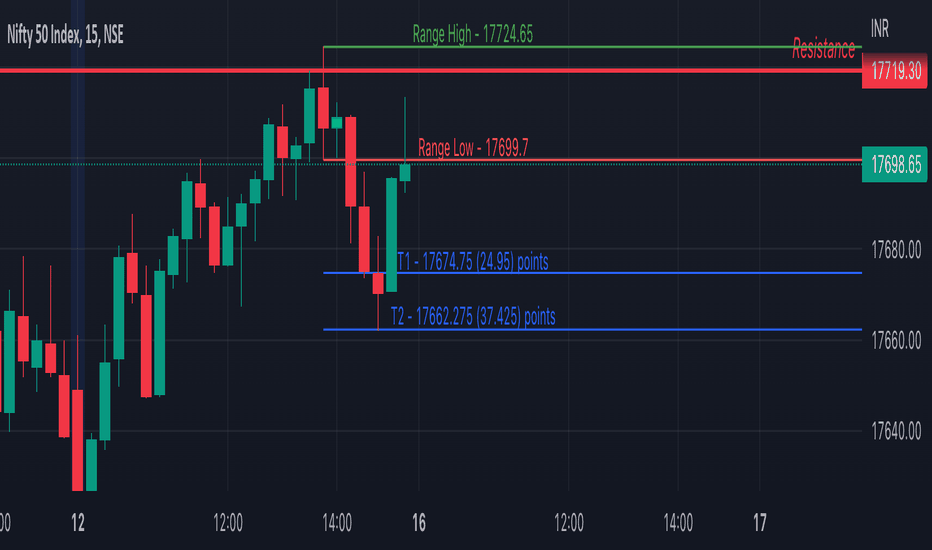

Inside Bar SetupScript Details

- This script plots Inside Bar for given day in selected time-frame (applicable only for Timeframes < Day)

- Basis plotted inside bar, relevant targets are marked on the chart

- Targets can be customised from script settings. Example, if range of mother candle is 10 points, then T1 is 10 * x above/below mother candle and T2 is 10 * y above/below mother candle. This x & y are configured via script settings

How to use this script ?

- This script works well on 10-15 mins timeframe for stocks, 15/30 mins timeframe for nifty index and 30/60 mins time frame for bank nifty index

- If mother candle high is broken, take long trade with SL of mother candle low and if low is broken, take short trade with SL of mother candle high

Remember:

1. Above logic is to be combined with support/resistances i.e. price action. This script is an add-on to price action analysis giving you more conviction.

2. If range of mother candle is very high, it is recommended to avoid the trade.

3. Basis inside bar formed on higher time frame, take trade on basis of lower time frame i.e if inside bar is formed on 60 mins, take trade on the basis of 10-15 mins time frame

Example:

1. As seen in the chart, Nifty is near it's resistance and we are seeing Inside Bar being formed, In such scenario, even if High of Mother Candle is broken, we should be more interested to short as we are near resistance and probability of getting our targets in long side is less.

2. So, if I see breakdown of mother candle i.e. price going below low of mother candle, we will short with SL of high of mother candle.

3. As seen in the chart, both the targets are achieved.

Additional Info:

1. Targets on Long/Short Side can be configured via settings. For indices 1 times/1.5 times the range works well.

2. This script plots targets basis the first inside bar formed in the day for selected time frame.

3. Inside bars formed through out the day are coloured separately but lines are plotted only on the basis of 1st formed inside bar as this strategy works well for the first formed inside bar)

4. Don't forget to check volume in case of breakout/breakdown.

Note:

1. Mother Candle - First Candle of Inside Bar

2. Child Candle - Candle formed inside Mother Candle (Second Candle of Inside Bar)

Happy Trading :)

Fibonacci + Support/Resistant + Trendline (Price action)This is opening source code version: Fibonacci + Support/Resistant + Trendline (One of Advanced Price action Analysis).

How it works:

It find entry Long/Short by combining: Fibonacci + Support/Resistant + Trendline

1. Find Impulse wave:

To findind Impulse wave, It uses Pivot High/Low to find Impulse wave. In case find entry Long, If having Pivot High higher Pivot High before, it will draw an Impulse wave.

2. Find entry at Fibonacci levels:

Draw Fibonacci fibonacci retracement from Pivot Low to Pivot High. A Fibonacci retracement forecast is created by taking two extreme points on a chart and dividing the vertical distance by important Fibonacci ratios. 0% is considered to be the start of the retracement, while 100% is a complete reversal to the original price before the move. Horizontal lines are drawn in the chart for these price levels to provide support and resistance levels. Common levels are 23.6%, 38.2%, 50%, and 61.8%

3. Find entry at Support/Resistant Zone:

Support/Resistant Zone drawed from Pivot High before, which price just breaken and return to retest.

4. Find entry at Trendline:

Trendline drawed from Pivot High/Low before, which price just breaken and return to retest.

How do use it:

+ You can customize the thickness of the lines.

+ You can set up an alert when the price touchs important areas.

Impactful pattern and candles pattern AlertThe Alertion indicator!

impactful pattern:

pattern that happen near the zone or in the zone at lower timeframe and give us entry and stop limit price.

It is helpful for price action traders and those who want to decrease their risk.

There are 3 IP patterns:

Quasimodo

Head and shoulder

whipsaw engulfing

These patterns may occur near the zone or may not occur but by them, you can decrease your trading risk for example you can

trade with half lot before IP pattern and enter with other half after pattern.

how to use?

for example:

you find zone at 1h timeframe for short position

when price enter to your zone

you run this indicator and choose your lower timeframe, for example 15m and click on short position.

Then make the alert by right-click on your chart and choose the add alert and at condition box choose the impactful pattern and then click on create

now wait for message :)

Candles pattern:

like reversal bar, key reversal bar, exhaustion bar, pin bar, two-bar reversal, tree-bar reversal, inside bar, outside bar

these occur when the trend turn, so it is usable when the price enter to your zone or near your zone.

This pattern can decrease your risk.

Inside bar and outside bar:

if this pattern engulf up, it is bullish pattern and if engulf down, it is bearish pattern.

what does this indicator do?

this indicator is for making alert

it helps you to decrease your risk and failure.

You optimize it to alert you when IP pattern happen or candle pattern happen or inside bar or outside bar engulfing or all of them.

For IP pattern, it will message you entry and stop limit price.

It works at 2 different timeframes, so you can make alert for example in 1h TF for candles pattern and 15m TF for IP pattern.

Indicator will alert you for candles pattern at your chart timeframe and for IP pattern at timeframe you've chosen when you run the indicator, and it is changeable

in setting.

setting options

TIMEFRAME

IP: select the timeframe for IP patterns it means when IP pattern happen at that timeframe the indicator will alert you

example = your TF is 1h, you found the supply zone and want to trade, note that IP pattern happen in lower TF, so you select 15m TF or TF lower than 1h.

Short position: select it if you want to make short position.

BUFFERING

indicator send you entry and stop limit price

you can change it by amount of percent

it is your strategy to change your entry and stop loss or not

example= in head and shoulder pattern at short position, the stop limit is high price of head in pattern

so the indicator will message you the exact price but if you want to put

your stop limit 5 percent upper than exact price you can enter 5 in front of stop loss

or you want to enter 5 percent lower than exact high price of shoulder, you can optimize it.

ALERTION

you choose what alert you want

IP alert or candle alert or inside and outside bar alert

type your text for alert

you can write additional text for your message

ADVANCE

IP alert frequency option:

1. Once per bar : indicator will alert you for IP pattern once at your chat timeframe bar, and you should wait til next bar for next alert.

2. Once per bar close : alert you when your chart timeframe bar closed and next alert will happen when next bar is closed.

3. All: alert you all the times IP pattern happen

pivot left and right bars: lower will find smaller pattern

at the END:

this indicator is not strategy

it is part of your strategy that help you to increase your winning rate.

It is helpful for scalping and candle patterns finding.

After you make an alert, you can delete the indicator or change your timeframe or make another alert, your previous alert won’t change.

Thank you all.

PT OrderBlockVersion 1.0 of the PT OrderBlock indicator was developed to visually identify supply & demand zones within price. This indicator can be used on all timeframes. My preferred method is swing trading the higher timeframe.

Orderblocks are formed when there is a break in structure once a big buy/sell candle has formed. These "blocks" will eventually get revisited on a retest acting as major support/resistance. An orderblock for a demand zone is populated on the chart when there is a bearish candle before a swift move to the top side (opposite direction). The same goes for the orderblock that is formed for a supply zone, it is the last bullish candle before a swift move to the downside. Once you see such behavior, the indicator will populate the orderblock for you. When an orderblock gets mitigated (tapped into) the indicator will change colors of the block to allow you to distinguish between a fresh and already taped supply/demand zone. It has been proven effective to enter entries based on retests of the orderblocks which take place AFTER a break in market structure.

*PT OB Features:

-OBs that have been partially filled will remove a portion of the background zone to indicate how much of the orderblock is left to fill in the full zone (Toggle Highlight remaining OB).

-OB trigger can be switched between candle open & wick. I prefer wick because it increases the probability of catching a low/high.

Video with strategy will be uploaded shortly! It is included as part of the library. Just message us for access!

Average Price LineThis was published in substitute of the original AVG price line that was already implemented into TradingVIew.

Get the average price in the desired range you want.

Extreme Bars"Extreme Bars" is a simple but useful indicator that marks overbought and oversold candles. This indicator paints candles that fall far above the average red, and the candles that rise above the average green. Of course, they can change these colors if they want. "Extreme Bars" can be interpreted in many different ways. The starting points of colored candles can often be good support or resistance. In addition, it would be wise to close the positions opposite the colored candles and to maintain the positions compatible with the colored candles. It is also possible that the gaps formed by the colored candles will be closed in the future. The sensitivity of the indicator can be changed in the settings section.

JPY PPLPsychological Price Levels for JPY Pairs (Price Action Institutional Levels 1, 0.200, 0.500, 0.800, 1)

Applicable for forex Yen Pairs.

Levels are configurable for color, style.

Comments, Suggestions and Feedback are appreciated.

MA cloud + divergence tensionI noticed how well BTC often bounces off the 200 Moving Averages on the 4HR so started investigating ways of visualising the ongoing relationship between price and MAs.

Firstly, this draws a cloud which is made up of the SMA and the EMA, and it colours the cloud based on how far the price is diverging from the middle of the cloud. If the price is the most extreme distance out of the set (by default, the past 200) the cloud will be coloured dark blue. If it's the closest, it will be transparent.

I then looked at plotting these extremes. If the price passes the sensitivity threshold (default 99 - I will look at adding more sensitivity in the future), and by that I mean the price is more divergent than that percentage of other prices inspected in the range, it plots a circle - green if it's oversold, red if it's overbought.

These signal maximum tension between the price and the moving averages. Though when I say maximum, I'm only referring to the historic range! As you can see, often price diverges even further and so more signals are placed. But usually, this tension is resolved, either by the MA cloud moving towards the price or the price moving towards the cloud. With confluence from other indicators, these could be good points to start taking dollar cost averaging, or start taking profits.

Once that tension is released, and the price and cloud converge closely again, we get a blue "relief signal", which could signal that the price action is about to rebound again.

Please be careful with this, it's only for fun. Not investment advice!

If you have any suggestions, comments, criticism, I'd love to hear them,

Thanks

Smart Money ConceptSmart Money Concept is being used to understand the Market Structure, Demand/Supply, and Risk Management.

- Lines represent BoS and CHoCH.

- X-cross and Diamond shapes represent Peak and Trough.

- Numbers represent the Spread Percentages.

Distance From EMA (%) with TP TableThe indicator will help you to identify where an asset might change direction or where to take profit.

For scalping or day trading is very useful to know where to take profits.

When the price is too far from an EMA a reversal is very likely to occur.

You can set up your own EMA and the percentage where you want to take profits

Magnifying Glass (LTF Candles) by SiddWolf█ OVERVIEW

This indicator displays The Lower TimeFrame Candles in current chart, Like Zooming in on the Candle to see it's Lower TimeFrame Structure. It plots intrabar OHLC data inside a Label along with the volume structure of LTF candle in an eloquent format.

█ QUICK GUIDE

Just apply it to the chart, Hover the mouse on the Label and ta-da you have a Lower Timeframe OHLC candles on your screen. Move the indicator to the top and shrink it all the way up, because all the useful data is inside the label.

Inside the label: The OHLC ltf candles are pretty straightforward. Volume strength of ltf candles is shown at bottom and Volume Profile on the left. Read the Details below for more information.

In the settings, you will find the option to change the UI and can play around with Lower TimeFrame Settings.

█ DETAILS

First of all, I would like to thank the @TradingView team for providing the function to get access to the lower timeframe data. It is because of them that this magical indicator came into existence.

Magnifying Glass indicator displays a Candle's Lower TimeFrame data in Higher timeframe chart. It displays the LTF candles inside a label. It also shows the Volume structure of the lower timeframe candles. Range percentage shown at the bottom is the percentage change between high and low of the current timeframe candle. LTF candle's timeframe is also shown at the bottom on the label.

This indicator is gonna be most useful to the price action traders, which is like every profitable trader.

How this indicator works:

I didn't find any better way to display ltf candles other than labels. Labels are not build for such a complex behaviour, it's a workaround to display this important information.

It gets the lower timeframe information of the candle and uses emojis to display information. The area that is shown, is the range of the current timeframe candle. Range is a difference between high and low of the candle. Range percentage is also shown at the bottom in the label.

I've divided the range area into 20 parts because there are limitation to display data in the labels. Then the code checks out, in what area does the ltf candle body or wick lies, then displays the information using emojis.

The code uses matrix elements for each block and relies heavily on string manipulation. But what I've found most difficult, is managing to fit everything correctly and beautifully so that the view doesn't break.

Volume Structure:

Strength of the Lower TimeFrame Candles is shown at the bottom inside the label. The Higher Volume is shown with the dark shade color and Lower Volume is shown with the light shade. The volume of candles are also ranked, with 1 being the highest volume, so you can see which candle have the maximum to minimum volume. This is pretty important to make a price action analysis of the lower timeframe candles.

Inside the label on the left side you will see the volume profile. As the volume on the bottom shows the strength of each ltf candles, Volume profile on the left shows strength in a particular zone. The Darker the color, the higher the volume in the zone. The Highest volume on the left represents Point of Control (Volume Profile POC) of the candle.

Lower TimeFrame Settings:

There is a limitation for the lowest timeframe you can show for a chart, because there is only so much data you can fit inside a label. A label can show upto 20 blocks of emojis (candle blocks) per row. Magnifying Glass utilizes this behaviour of labels. 16 blocks are used to display ltf candles, 1 for volume profile and two for Open and Close Highlighter.

So for any chart timeframe, ltf candles can be 16th part of htf candle. So 4 hours chart can show as low as 15 minutes of ltf data. I didn't provide the open settings for changing the lower timeframe, as it would give errors in a lot of ways. You can change the timeframe for each chart time from the settings provided.

Limitations:

Like I mentioned earlier, this indicator is a workaround to display ltf candles inside a label. This indicator does not work well on smaller screens. So if you are not able to see the label, zoom out on your browser a bit. Move the indicator to either top or bottom of all indicators and shrink it's space because all details are inside the label.

█ How I use MAGNIFYING GLASS:

This indicator provides you an edge, on top of your existing trading strategy. How you use Magnifying Glass is entirely dependent on your strategy.

I use this indicator to get a broad picture, before getting into a trade. For example I see a Doji or Engulfing or any other famous candlestick pattern on important levels, I hover the mouse on Magnifying Glass, to look for the price action the ltf candles have been through, to make that pattern. I also use it with my "Wick Pressure" indicator, to check price action at wick zones. Whenever I see price touching important supply and demand zones, I check last few candles to read chart like a beautiful price action story.

Also volume is pretty important too. This is what makes Magnifying Glass even better than actual lower timeframe candles. The increasing volume along with up/down trend price shows upward/downward momentum. The sudden burst (peak) in the volume suggests volume climax.

Volume profile on the left can be interpreted as the strength/weakness zones inside a candle. The low volume in a price zone suggests weakness and High volume suggests strength. The Highest volume on the left act as POC for that candle.

Before making any trade, I read the structure of last three or four candles to get the complete price action picture.

█ Conclusion

Magnifying Glass is a well crafted indicator that can be used to track lower timeframe price action. This indicator gives you an edge with the Multi Timeframe Analysis, which I believe is the most important aspect of profitable trading.

~ @SiddWolf