Z-SCORE Currency Strength Indicator by Lukas"you must have" indicator if you trade Forex major pairs.

So far this is the most reliable script i have for trade forex pairs.

This indicator will give us information of momentum, strength and cycle.

What i like about Z-SCORE, it's calculate price and volume.

Setting :

1. Set Color 0 and Color 2 into thick line, it will give you strength information.

The strength information is base on cumulative Currency price Vs. 7 others currency,

When Source Price above EMA and Above LWMA "Color 0" active, above EMA "Color 2" active, below EMA "Color 1" active

so it's important to set the thickness.

2. You can set EMA length as thickness filter

3. You can set Signal line between EMA and LWMA

EMA = smoother

LWMA = reactive

Strong currency signal when Color 0 active and they are on upward movement, crossing -80 or above 0

Weak Color 1 active and they are on downward movement, crossing 80 or below 0

Trade Strong Vs. Weak

Any feedback are welcome.

Hope it useful!

I also have unpublished OBV and smooth RSI indicator,

OBV can give you earlier bull/bear sign, let me know if you are interested~

Thank you.

K-macd

KINSKI Flexible MACDFlexible MACD (Moving Average Convergence/Divergence) Indicator

The Moving Average Convergence Divergence consists of three elements: two moving averages (the MACD line and the signal line) and a histogram. The blue MACD line is the difference between a longer and a shorter EMA (here 13 and 21 periods preset), the red signal line is an SMA (here 8 preset) on the MACD line. The histogram (green: ascending, red: descending) shows the difference between both lines.

As soon as the blue MACD line crosses the red signal line, circles are generated that indicate an up/down trend. If the red signal line is greater than or equal to the blue MACD line, this indicates a downward trend (red circle). If the blue MACD line is greater than or equal to the red signal line, this indicates an upward trend (green circle).

The special thing about this MACD indicator is the many setting options, especially the definition of the MA variants for MACD (Fast, Slow) and signal. You can define the following MA types: "COVWMA", "DEMA", "EMA", "EHMA", "FRAMA", "HMA", "KAMA", "RMA", "SMA", "SMMA", "VIDYA", "VWMA", "WMA".

You also have the following display options:

- "Up/Down Movements: On/Off" - Shows ascending and descending MACD, signal lines

- "Up/Down Movements: Rising Length" - Defines the length from which ascending or descending lines are detected

- "Bands: On/Off" - Fills the space between MACD and signal lines with colors to indicate up or down trends

- "Bands: Transparency" - sets the transparency of the fill color

Disclaimer: I am not a financial advisor. For purpose educate only. Use at your own risk.

Elder EMA, ATR & MACD Indicator, 5X Time Frame & Divergences.This indicator is elaborated following the 3 window strategy described by Elder.

The fast, slow averages and MACD histogram are taken from a time frame 5 times higher than the active time frame and indicate bullish / bearish trends as well as divergences (bottom) of the hostogram with the price.

MACD 0 AxisThe "Kline Kinetic Energy Theory" believes that, when the price touches the "MACD 0 Axis", there will be an opposite force to push it to leave that axis.

This script show that axis on the overlay of kline.

ALT_FLAMES00.00 - alt-flames

component breakdown:

a) various combinations of EMA crossovers taken from the primeval_series to create a complete sequence of background colored-lines that subdivide into a bullish portion

and a bearish portion for directional identification

b) specific macd crossovers for predictive power in the form of directional flames located directly above the chart price (navy & yellow flames)

c) unique fast & slow rsi combinations for momentum + strength in the form of power flames located directly above the chart price (orange, red, green, & lime flames)

when the alternation of flames are used in concert with the sequence of background colors, one can identify impending explosive price action, can better navigate through periods of slower activity, identify where they are currently in the trend's lifecycle and, MOST IMPORTANTLY, improve the TIMELINESS of entry and exit strategies

00.01 - primeval_series - overview

the primeval_series is a group of transformed universally-renowned mathematical constants that have been transformed and embedded into a series of EMAs

each of these EMAs relates in some meaningful way to the "original wave' or 'wave_0': i.e. the wave that began at t=0, when humanity first made technological progress

the transformations made ensure that the inherent linkages to the original wave remain intact while being applicable to the structures inherent to indicator development

for the purposes of the alt-flames indicator, certain numbers selected from the primeval_series exist and are the basis of each ema , MACD and RSI calculation made herein

00.02 - alt-flames - best practices, and ideal targets

for best use: start with the daily timeframe for broad pattern, then use hourly going forward

ideal for swing trades, shorter-term options, and stocks that already have well-established uptrends, but have also started consolidating for 1+ week

patience is required to catch the ideal break, so best to use mildly OTM calls with at least 2 weeks on them before expiry.

for great use: pick out stocks that have recently broken out heavily from their pivot . Do not enter until the retracement from the top has a defined local low

for average use: any sort of intraday play. this tool is meant for swing trades and sustained breakouts. picking out significant bottom reversals.

the MACD portion is not geared for big reversals here. Rather, it is complementary to the EMA sequences, which are at the core of the indicator

not useful for: shorting stocks that are trending downward or that are in sideways trends

MACD Binary Strategy by Hashtag_binary MACD Binary Options Strategy is an trend momentum system, It's based on the double MACD in the sub window below the chart.

- Markets: Stocks, Indicies, Metals, Forex. This binary strategy works good on the Indicies ( S&P 500, DAX, FTSE, ).

- MACD Binary System il also good as trading system for to trade.

- Time Frame 30 min or higher ( best 4H).

- Expires Time 3 bars after. (90 min, 180 min, 720 min, 3 daily).

Rules MACD Binary Options Strategy

Buy Call:

- EMA 6 over EMA 13;

- MACD ( 5, 15, 1) crosses upward MACD ( 12,26,1 );

- MACD (5,15, 1) over level 0.

Buy Put:

- EMA 6 under EMA 13;

- MACD ( 5, 15, 1) crosses downward MACD ( 12,26,1 );

- MACD (5,15, 1) under level 0.

The same conditions for entry trade.

Exit position options:

- When MACD (5, 15, 1,) crosses in opposite direction MACD (12,26,1);

- When exponential moving average crosses in opposite direction;

- Make profit with ratio 1:3 stop loss.

- Initial stop loss at the previous swing.

MACD minutesIt´s a multiple (3) Moving Average Convergence Divergence (MACD) indexes.

It was created to help traders to identify trend changes in multilple time frames, in the same graph.

P-MACD by DGTPrice and Moving Averages Convergence/Divergence, shortly named as P-MACD

P-MACD is a trend-following momentum indicator that shows the relationship between Price and Long-term Moving Average (PMACD), and the relationship between two Moving Averages (MAMACD). P-MACD is composed of two lines, and an histogram, showing price distance (convergence/divergence) to its Long-term MA (PMACD), showing short-term MA distance (convergence/divergence) to long-term MA (MAMACD), and a histogram showing the difference (momentum) between the PMACD and MAMACD

The PMACD is calculated by dividing the Price to Long-term Moving Average (200-period SMA/EMA) and finally smoothed with 9-period SMA/EMA

- PMACD Line Formula : (Price / SlowMovingAverage -1) * 100 and smoothed with 9-period SMA/EMA

The MAMACD is calculated by dividing the Short-term Moving Average (such as 20 SMA/EMA) to the Long-term Moving Average (such as 200-period SMA/EMA)

- MAMACD Line Formula : (FastMovingAverage / SlowMovingAverage -1) * 100

The Histogram is calculated by subscripting PMACD and MAMACD

- Formula : PMACD - MAMACD

Optional

Trend Cloud calculated based on fast and slow version of MAMACD

What to look for:

- Line Crosses : PMACD Line can function as a trigger(signal) for buy and sell signals. Buy when the PMACD crosses above the MAMACD line and sell - or short - when the PMACD crosses below the MAMACD line

- Base Crosses : PMACD and/or MAMACD crosses above or below Baseline is another way to indicate the trend and momentum. MAMACD crosses of Baseline, MAMACD positive or negative, reflects short-term moving average crosses the long-term moving average and similarly, PMACD crosses of BaseLine, PMACD positive or negative, reflects price crosses a long-term moving average

- Momentum : P-MACD helps investors understand whether the bullish or bearish movement in the price is strengthening or weakening displayed with a histogram which graphs the distance between the PMACD and MAMACD. Additionally, upward momentum is confirmed with a bullish crossover, which occurs when PMACD and/or MAMACD crosses above Baseline. Conversely, downward momentum is confirmed with a bearish crossover, which occurs when PMACD and/or MAMACD crosses below Baseline

- Distance : Prices high above the moving average (MA) or low below it are likely to be remedied in the future by a reverse price movement. The more distant the PMACD is above or below its baseline indicates that the distance between the Price and its SMA is growing (regarding PMACD, You may find a detailed article explained in “Price Distance to its MA” indicator by DGT) . Similarly the more distant the MAMACD is above or below its baseline indicates that the distance between the two SMAs is growing

- Trend : A rising P-MACD indicates an uptrend, while a declining P-MACD indicates a downtrend

MACD vs. P-MACD

MACD measures the relationship between two MAs, while the P-MACD measures both the relationship between price and its MA, and the relationship between two MAs. MAMACD Line of P-MACD If set to same moving average type and same lengths as in MACD will produce the same line as MACD line, only values are represented as percentage with MAMACD. Both measure momentum in a market, but, because they measure different factors, they differentiate from each other even if they have similarities in presentation. P-MACD provides additional insights, not only to MA relation but also to Price and MA relation

Warning : Moving Average are calculated based on past prices, so they are lagging. The longer the time period for the moving average, the greater the lag as well as less sensitive to price changes. This study implements usage of 200-period long-term moving average, which implies that the P-MACD will provide insight especially for long-term trades, more suited for long-term trades, usage of P-MACD for short-term trades is recommend with lower timeframes (1H or lower).

Indicators aim to generate a potential signal/indication of an upcoming opportunity, but, the Indicators themselves do not guarantee the future movement of a given financial instrument, and are most useful when used in combination with other techniques.

Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

Disclaimer : The script is for informational and educational purposes only. Use of the script does not constitutes professional and/or financial advice. You alone the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd tradingview user liable for any possible claim for damages arising from any decision you make based on use of the script

Price Distance to its MA by DGTPrices high above the moving average (MA) or low below it are likely to be remedied in the future by a reverse price movement as stated in an Article by Denis Alajbeg, Zoran Bubas and Dina Vasic published in International Journal of Economics, Commerce and Management

Here comes a study to indicate the idea of this article, Price Distance to its Moving Averages (P/MA Ratio)

The analysis expressed in the paper indicates that there is a connection between the distance of the prices to moving averages and subsequent returns : portfolios of stocks with lower prices to moving averages generally outperformed portfolios of stocks with higher prices to moving averages. This “overextended” effect is more pronounced when using shorter moving averages of 20 and 50 days, and is especially strong in short-term holding periods like one and two weeks. The highest annual returns are recorded when buying in the range of 0-5% below shorter moving averages of 20/50 days, and 0-10% below longer moving averages of 100/200 days. However, buying very far below almost all moving averages on almost all holding periods produces the lowest returns.

The concept of this study recognizes three different modes of action.

In a clearly established upward trend traders should be buying when prices are near or below the MA line and selling when prices move too far above the MA.

Conversely, in downward trend stocks should be shorted when reaching or going above the moving average and covered when they drop too far below the MA line.

In a sideways movement traders are advised to buy if the price is too low below the moving average and sell when it goes too far above it

Short-term traders can expect to outperform in a one or two week time window if buying stocks with lower prices compared to their 20 and 50 SMA/EMA, one to two-week holding periods is quite high, ranging from 72,09% to 90,61% for the SMA(20, 50) and 85,03% to 87,5% for the EMA(20, 50). The best results for the SMA 20 and 50, on average, are concentrated in the region of 0-5% below the MA for the majority of holding periods. Buying very far below almost all MA in almost all holding periods turns out to be the worst possible option

Candle patterns, momentum could be used in conjunction with this indicator for better results. Try Colored DMI and Ichimoku colored SuperTrend by DGT

Bitcoin CME Retail vs Professionals MACD

This is an interesting study using the data provided by the Bitcoin CME Commitment of Traders report.

The MACD plot the difference between the Retail Traders positions and the Professional Traders positions.

The general idea is that Professional Traders have a better read on the market than Retail Traders.

The signal line helps to identify the trend that it is moving in.

I believe that this plot helps to visualize the overall market sentiment better than the raw COT data.

Try it out and let me know what you think!

MACD with BGThis is a standard MACD indicator with Background colour and the option to draw the Background colour of the next higher timeframe.

Cracking Cryptocurrency - Waddah Attar Explosion Cracking Cryptocurrency - Waddah Attar Explosion

An entry indicator that analyzes momentum and volume . This indicator is very sensitive and works very well on lower time frames for scalping, and higher time frames for confirming explosive movements or shifts in trend or rising directional momentum in the market.

This indicator can be used as an Initiator, Confirmer, or Vol. Filter. It's multiple components make it an extremely effective tool in any trader's tool belt.

Features & Functions

This indicator can be customized by adjusting the sensitivity levels, lengths, and multiplier. However, I find that the settings that I have made as default work very well. However, as with all indicators, nuance and customizing your settings to your asset class and time frame will yield greater results.

False Positive Filter - Enabling this, as it is by default, will dramatically change this indicator's sensitivity. This is designed to analyze long-term momentum and reduce the occurrence of "false positives". However, the trade off will be reduced reaction speed.

Entry Strategy - Print alerts and trading signals for many different permutations of entry strategies available with this indicator. Explosion Level Crossovers, Color Flips, Rising Explosion Level Cross, and Rising Explosion Level.

Exit Strategy - Print alerts and trading signals for many different permutations of exit strategies available with this indicator. Explosion Level Cross, Receding Delta, Color Flip, Falling Explosion Level.

Bar Coloring - This indicator colors the bars to indicate a buy or sell signal, as well as printing Up and Down arrows in the indicator pane itself. This can be disabled in the settings window.

Alerts - This indicator is programmed with Buy and Sell alerts, available from the Alerts Window.

---

Purpose

To identify likely turning points in the market, the existence of powerful momentum to confirm a directional bias, or the introduction of high volume or volatility into the market.

Yorks Mac 2This indicator fires trade entry based upon overall trend (Price above/below EMA), MACD Cross, and the MACD value being greater than or less than zero.

When all conditions are true, the signal fires.

Please PM me for access

CDC Action Zone V.2 Strategy BacktestPublished for backtest purpose

All credit to : CDC Action Zone V.2 by piriya33

จัดทำขึ้นเพื่อการดูผล Backtest เขียวซื้อแดงขาย

ตัวสคริปท์มีการเพิ่ม

- Strategy Long/Short/Both // ปรับได้ใน Setting

- Back test range // ปรับได้ใน Setting

3. AutoBots Trading - BACKTEST: MACDBACKTEST: Moving Average Convergence Divergence - MACD

1. Description: a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD is calculated by subtracting the 26-period Exponential Moving Average ( EMA ) from the 12-period EMA .

2. Strategy rules: defined based on the component, signal count, entry prices, open order count, position check, position averages, conditional closes and close signals.

3. Risk management: system was defined based on the choice of only long, only short or both sides. Defining the choice of take profit, stop loss and trailing stos (no repaint).

4. Symbol: PETR4 (only)

5. Suggested Timeframe: 2H

6. Parameter for optimization: 12, 8, 9, side: long, tp: 3%, sl: 1%, ts: na

7. Walk forward simulation

7.1. In sample period: jan/2018-jan/2020

7.2. Out of sample period: jan/2020 - ago/2020

** For purpose educate only

MACD Trend Following Strategy How it work ?

Work like normal MACD because this is MACD without any modify but i add color of candlestick and strategy.

The color meaning :

Green= macd > signal and macd>0 (Buy)

Red= macd < signal and macd<0 (Sell)

Yellow= macd > signal and macd<0 (Maybe reversal point)

Blue= macd < signal and macd>0 (Maybe reversal point)

Feature

- Back test range

- Long/Short option

- Modifiable MACD Setting

MACD histogram relative open/closePrelude

This script makes it easy to capture MACD Histogram open/close for automated trading.

There seems to be no "magic" value for MACD Histogram that always works as a cut-off for trade entry/exit, because of the variation in market price over time.

The idea behind this script is to replicate the view of the MACD graph we (humans) see on the screen, in mathematics, so the computer can approximately detect when the curve is opening/closing.

Math

The maths for this is composed of 2 sections -

1. Entry -

i. To trigger entry, we normalize the Histogram value by first determining the lowest and highest values on the MACD curves (MACD, Signal & Hist).

ii. The lowest and highest values are taken over the "Frame of reference" which is a hyperparameter.

iii. Once the frame of reference is determined, the entry cutoff param can be defined with respect to the values from (i) (10% by default)

2. Exit

To trigger an exit, a trader searches for the point where the Histogram starts to drop "steeply".

To convert the notion of "steep" into mathematics -

i. Take the max histogram value reached since last MACD curve flip

ii. Define the cutoff with reference to the value from (i) (30% by default)

Plots

Gray - Dead region

Blue - Histogram opening

Red - Histogram is closing

Notes

A good value for the frame of reference can be estimated by looking at the timescale of the graph you generally work with during manual trading.

For me, that turned out to be ~2.5 hours. (as shown in the above graph)

For a 3-minute ticker, frame of reference = 2.5 * 60 / 3 = 50

Which is the default given in this script.

Ultimately, it is up to you to do grid search and find these hyperparams for the stock and ticker size you're working with.

Also, this script only serves the purpose of detecting the Histogram curve opening/closing.

You may want to add further checks to perform proper trading using MACD.

Bitcoin Dominance MomentumThis is a simple study of Bitcoin Dominance vs Altcoin Performance.

The general idea, is that as Bitcoin Dominance falls, Altcoins rise, and vice versa.

So, I decided to plot a MACD indicator of CRYPTOCAP:BTC.D to judge macro turning points in the cryptocurrency markets.

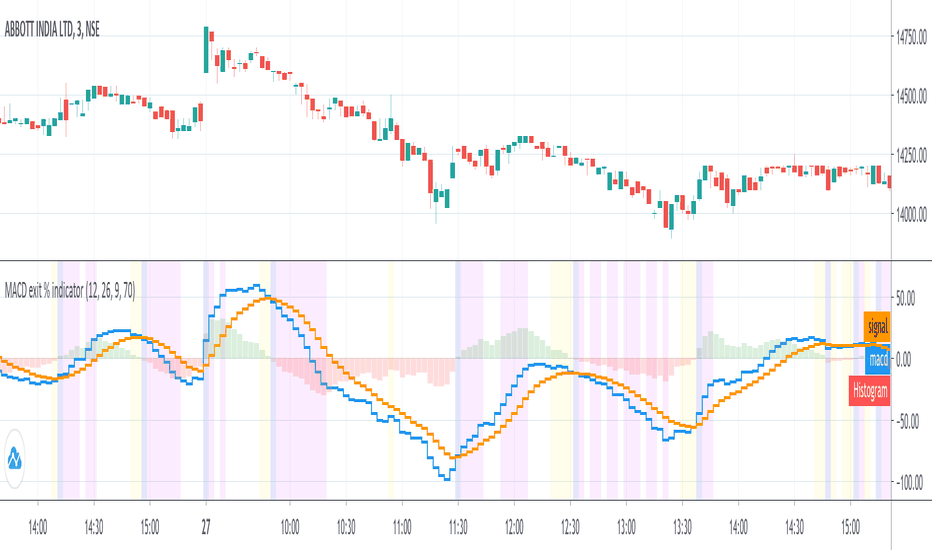

MACD exit % indicatorIntroduction

An exit indicator for MACD, good for triggering order exit via MACD.

It works by considering and the .

Then, it just exits when the % change in these values surpasses a threshold.

Indicators

blue line - MACD

orange line - Signal

green/red columns - Histogram

aqua background - Last Histogram Flip

fuchsia background - Max abs(Histogram) value after last flip

orange Background - Exit region

{INDYAN} Ichimoku for IntradayIts based on ichimoku, i removed cloud and mod some changes for better use in intraday trading. It can be used in stocks and index as well.Not tested on MCX and Forex.

Just watch at crossover of tenkan and kijun that RSI macd is above 60 and zero or not? If all three parameters meet go for long... exit when again another cross happen or rsi go below 40.for sell side watch for rsi below 40 and macd below zero line while crossover of kijun tenkan.

Better to use it with RSI+Macd Fast to get more accurate results.

#for better confirmation look value of VWAP and decide accordingly

Do back test before using it.

Happy Trading

Love INDyAN

#change line color as per ur wish but value should be same as it was default entered.

Crypto Monitor / DashboardI created a Crypto Monitoring Dashboard!

Here is the idea behind it:

Monitor up to 4x Symbols on one chart

Monitor 2x Time Frames at once

Monitor 3x indicators

So to get into the details a bit more and how to use it. There are 4 separate rows for each symbol

Row 1: Shows the status of the MACD indicator on the higher and lower time frame and color codes them accordingly.

Row 2: Shows the higher time frame RSI value compared to pre-determined values for bullish , oversold, and overbought.

Row 3: Shows the lower time frame RSI value compared to pre-determined values for bullish , oversold, and overbought.

Row 4: Shows the status of the price compared to the moving average. Price greater then the MA is considered bullish ; below is bearish

Since things get rather cramped with the multiple symbols on all at once, the intention is that you enlarge this and look at just ( aka not with the bar chart) this for your favorite 4 coins and then when you see the conditions you want, you close it and open the chart of your coin.

Please feel free to leave a comment if you have questions or suggestions on how to improve it! Appreciate the feedback

{INDYAN} RSI + MACDModded RSI and MACD for intraday use. If rsi above 60 and macd is above zero line then go for buy and if rsi is below 40 and macd below zero line then go for sell side. use it in small timeframe i.e. 3 minute or less.

better for scalp trading

Happy Trading

Love INDYAN

#It can be used best with INDYAN Go With Trend

MACD Bull Crossover and RSI Oversold 5 Candles Ago-Long StrategyHello everyone, I've been having a great time perfecting this strategy for a few weeks now. I finally feel like it's time to release it to the public and share what I have been working on.

This strategy only enters a long trade when the MACD crosses over the signal line and the RSI was oversold looking back 5 candles ago. The logic behind this is to wait for RSI to enter the oversold territory, and then when the market starts to recovery the MACD will crossover telling us the sell off is over.

This strategy will close once these 2 conditions are met.

1. MACD Histogram is above 0 and MACD crosses under the signal line.

2. RSI was overbought 5 previous candles ago.

In the strategies settings, you'll be able to enable visual stop-loss and profit levels and change those levels to what you like, enable up to 5 EMA'S,

ADDONS That Affect Strategy:

* Enable visual stop-loss and profit levels as soon as a buy signal is triggered.

* Modify stop-loss and profit levels.

* Modify RSI oversold and RSI overbought levels.

* Modify MACD Fast and Slow moving average.

ADDONS That Do Not Affect Strategy:

* Enable up to 5 EMA's. (This will not affect strategy, and is the only purpose is for people who like following EMA's.)

Thank you for taking the time to try my strategy. I hope you have the best success. I will be making a short strategy, and alerts for this strategy soon. Follow me for updates!