RogTrader AlgoA simple BUY/SELL algorithm based on Moving Averages (EMA), MACD, RSI, Stochastic, ADX, ATR, CCI, OBV, Pivot Points, and Parabolic Sar, and Volume averaged.

Simple algo that uses multiples indicator strengths and weight them to generate buy and sell signals

Indicator strengths are displayed on each candle (green is bullish and red is bearish)

Green Buy and Red Sell shall be primarily used for long positions

Bull and Bear Strengths are created based on Price Action, and Volume, the length of the array shows upward or downward strength

Indicators' Signal Strength shows number Indicators' indication for the direction.

Bollinger Bands are in red and green filled

VWAP Bands are in gray, green, and red

Linear Regression is the blue line

Check multiple timeframes.

K-macd

Stock Market Strategy : VWAP, MACD, EMA, Breakout, BBHello there,

Today I bring you a stock market strategy, specialized in NASDAQ stocks.

Its a daytrading strategy, that can only do a max of 1 trade per day. In this case it only trades the first 2 opening hours of the market.

The rules are simple :

We follow the trend based on a big EMA, in this case 200, after that, we check for VWAP direction , then, we check histogram from MACD. This is the simple logic of the strategy.

Inside there is another strategy, that not just do the above, but also uses Bollinger bands, and checks for breakout of bottom or top line. Also it uses Average directional Index, for even a bigger criteria .

So for example a long condition it would be : candle is above the ema, and candle is above vwap, and histogram is positive, and candle break the top bb level and ADI < 40 -> long signal . The opposite works for short(ADI > 20).

In this case all this criterias are between the first 2 hours of market. So we enter between the first hour, and exit in the next hour. For this we need to use very short time frames.

Hope you enjoy it.

Let me know if you have any questions

MACD/EMA Golden CrossThis is a slight modification to the MACD indicator. The golden cross indicator makes use of EMA 7 and EMA 21 as well as MACD together, in which it will turn the MACD line yellow & fill the MACD with a yellow background when MACD is above the signal line and EMA7 is above EMA21. This is best suited for swing trading on a daily timeframe.

My BTST RSI MACD X-BODYMy trial of script base on EMA , RSI and MACD to filter the best Candle which has likely hood of uptrend in a practice of " Buy Today Sell Tomorrow".

Blue candle : 40 to 70 % RSI

Orange candle > 80 % RSI

Yellow candle < 30 % RSI - buy and can hold

Lime candle buy above MACD line.

Also i added the label when 2 EMAs and SMA cross each other in solid body candle.

Buy on Blue, Lime.

Buy and hold on Yellow candle.

Good luck!

NIFTY Money Flow - Scalping/SwingBrief Description About Script

It considers the change of price in the direction

change of price is +Ve then considered as +Ve money flow

-Ve then considered as -Ve money flow

and it multplied by Volume change

This Strategy works best with NIFTY

For Scalping:-

Settings:- 1 Min Candle Time Frame, Length 20

For Swing:-

Setting:- 30 Min Candle Time Frame, Length 11

How to use it?

Common usage:-

Buy - When turns Red to Green Buy by keeping 1.5 * ATR as SL or Trailing SL(Optional) at the same time frame

Sell - When turns Green to Red SL by keeping 1.5 * ATR as SL or Trailing SL(Optional) at the same time frame

Trend reversal:-

Draw Divergence between indicator and price

Buy - Indicator forms Higher Highs(Red Side), Price Lower Lows

Sell - Indicator forms Lower Lows(Green Side), Price Higher Highs

Breakouts:-(Less Accurate compared to other scenarios)

End of Triangel/Box Indicator Turns Red to Green - Bullish Breakout, Green to Red Bearish Breakout

can use for breakouts chart patterns and guess which side it's going to break

can use for reversal as well by observing divergence between price & indicator

Note:-

In the future, an updated version is coming with it auto-generated buy/sell signal on the chart & gives backtesting results as a strategy

RSI/RSX Divergance on chart [Anan]This script points Regular/Hidden Bull/Bear RSI/RSX divergences on the chart.

Options:

-RSI/RSX source

-RSI/RSX length

-Show/hide Regular/hidden Bull/Bear divergences

KMACThis is a heavily modified MACD indicator that includes two different measurements, either regular, or weighted. Weighted is either EMA or KAMA dependent. I personally only use this in certain scenarios but it has proved handy for overall trend as it's slower.

This indicator also has a colorized histogram for the rising/falling of momentum, as well as arrows and crosses to indicate the "death" crosses, "golden" crosses, and falling above/below the "0-Line". 0-Line is embedded into the indicator as well, the user need not worry about drawing it on top of the indicator.

BSKL Short-Term Momentum TradingIndicator to identify the beginning of a Momentum, designed to use for the Malaysian market(I haven't tried it on other markets).

Best to use on 30 minute timeframe. When all criteria is fulfilled, there will be a "^" logo appearing below the candlestick .

Not to be commercialised, feel free to PM me for any improvement or suggestion.

Happy trading.

Divergence of Market Breadth & Price deduction indicatorHow it begin?

Traders and investors use market breadth in order to assess the index’s overall health. Market breadth can be a reliable, if not an accurate, indicator of an upcoming price rise in the index. Similarly, it can also provide early warning signs for a future price decline.

What is it?

market breadth in this case refer to percentage of stocks above 20 Simple Moving Average,which could be used as a barometer for the market.

How it works?

This paticular indicator compare the divergence of Nasdaq 100 and Russell 2000 percentage of stocks above 20 Simple Moving Average.

This indicator also include a deduction price method ,which is inspired from LEI & LoneCapital

RSI and market strength with alerts By combining the true strength of the Nasdaq (NDX) and S&P500 ( SPY ) we can then compare that against the volatility /fear index ( VIX ). The true strength of the Volatility Index ( VIX ) is shown by the red area and the Nasdaq (NDX) and S&P500 ( SPY ) by the silver /teal areas.

The yellow EMA area shows the average difference between the VIX and the NDX/ SPY indexes. When the yellow area crosses above the zero line and is climbing it means that the NDX/ SPY are strengthening. When the yellow area is decreasing or crosses under the zero line it means the fear/volatility index ( VIX ) is becoming stronger and NDX/ SPY are weakening. The RSI is overlaid as a white line to show the correlation of the instrument strength compared to the market.

When looking at charts of companies/components listed on the Nasdaq and/or S&P 500 you will notice a frequent correlation between the movement of the yellow area depicting index health and the RSI of the chart you are viewing. It’s a very quick and effective method of seeing the strength and fear within the market indexes and how they are effecting your chart.

The background color changes when the market strength combined with the active symbol RSI and higher timeframe MACD signals are aligned. Green is a buy zone, Red is a sell zone.

There are also red and green indicator x’s at the top/bottom of the indicator. They show a drastic change in Relative strength within a short period. This often indicates a buy or sell opportunity.

It is tested and works well on all timeframes with Stocks listed on NASDAQ & S&P500 .

Buy, Sell, Exit Buy and Exit Sell alerts are included.

There are also red and green indicator x’s at the top/bottom of the indicator. They show a drastic change in Relative strength within a short period. This often indicates a buy or sell opportunity.

MA MTF Momentum HistogramMy own interpretation indicator which i call multi time frame moving averages momentum with NO LAG EMA support (Optional).

The indicator is calculated by subtracting the long-term EMA from the short-term EMA .

This pretty much resembles the MACD moving averages calculation but without the smoothing of the histogram.

Can also be used to find divergences.

The background shows the main trend with higher time frame which can be set in the settings.

Aimed to use with Higher time frame (Double or more) but can also work with lower time frame.

How to use the indicator?

==Histogram==

Green: Momentum of asset is positive and increasing.

Lighter Green: Momentum of asset is still positive but decreasing and can revert to negative momentum.

Red: Momentum of asset is negative and increasing.

Lighter Red: Momentum of asset is still negative but increasing and revert to positive momentum.

==Background Color - Main Trend==

Green: HTF (Higher time frame) momentum is positive.

RED: HTF momentum is negative.

Feel free to comment and Follow to stay updated with upcoming scripts: www.tradingview.com

NOTE: BARS ARE COLORED BY DEFAULT WITH HISTOGRAM COLORS! (Can be changed in settings)

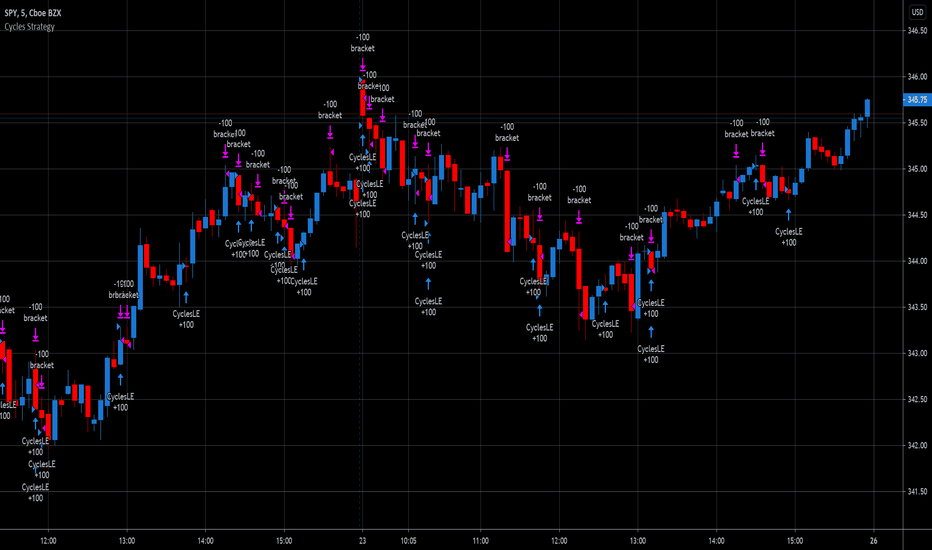

Cycles StrategyThis is back-testable strategy is a modified version of the Stochastic strategy. It is meant to accompany the modified Stochastic indicator: "Cycles".

Modifications to the Stochastic strategy include;

1. Programmable settings for the Stochastic Periods (%K, %D and Smooth %K).

2. Programmable settings for the MACD Periods (Fast, Slow, Smoothing)

3. Programmable thresholds for %K, to qualify a potential entry strategy.

4. Programmable thresholds for %D, to qualify a potential exit strategy.

5. Buttons to choose which components to use in the trading algorithm.

6. Choose the month and year to back test.

The trading algorithm:

1. When %K exceeds the upper/lower threshold and then hooks down/up, in the direction of the Moving Average (MA). This is the minimum entry qualification.

2. When %D exceeds the lower/upper threshold and angled in the direction of the trade, is the exit qualification.

3. Additional entry filters include the direction of MACD, Signal and %D. Also, the "cliff", being a long entry is a higher high or a short entry is a lower low.

4. Strategy can only go "Long" or "Short" depending on the selected setting.

5. By matching the settings in the "Cycles" indicator, you can (almost) see what the strategy is doing.

6. Be sure to select the "Recalculate" buttons, to recalculate on every new Tick, for best results.

Please click the Like button and leave a comment if you appreciate this script. Improvements will be implemented as time goes on.

I am not a licensed trade advisor. This strategy is for entertainment only. Use at your own risk!

ISS V5 Strategy for ETHUSDTSimple long/short strategy. Using MACD and few more oscillators.

Optimized for ETHUSDT 4h, Enjoy!

Simple and efficient MACD crypto strategy with risk managementToday I am glad to bring you another great creation suited for crypto markets.

MARKET

Its a simple and efficient strategy, designed for crypto markets( btcusd , btcusdt and so on), and suited for for higher time charts : like 1hour, 4hours, 1 day and so on.

Preferably to use 1h time charts.

COMPONENTS

MACD with simple moving average

ENTRY DESCRIPTION

For entries we have :

We check the direction with MACD . Depending if its an uptrend and positive level on histogram of MACD we go long, otherwise we go short.

RISK MANAGEMENT

In this strategy we use a stop loss based on our equity. For this example I choosed a 2% risk .That means if our account has 100.000 eur, it will automatically close the trade if we lose 2.000.

We dont use a take profit level.

In this example also we use a 100.000 capital account, risking 5% on each trade, but since its underleveraged, we only use 5000 of that ammount on every trade. With leveraged it can be achieved better profits and of course at the same time we will encounter bigger losses.

The comission applied is 5$ and a slippage of 5 points aswell added.

For any questions or suggestions regarding the script , please let me know.

High/low crypto strategy with MACD/PSAR/ATR/EWaveToday I am glad to bring you another great creation of mine, this time suited for crypto markets.

MARKET

Its a high and low strategy, designed for crypto markets( btcusd , btcusdt and so on), and suited for for higher time charts : like 1hour, 4hours, 1 day and so on.

Preferably to use 1h time charts.

COMPONENTS

Higher high and lower low between different candle points

MACD with simple moving average

PSAR for uptrend and downtrend

Trenddirection made of a modified moving average and ATR

And lastly elliot wave oscillator to have an even better precision for entries and exits.

ENTRY DESCRIPTION

For entries we have : when the first condition is meet(we have a succession on higher high or lower lows), then we check the macd histogram level, then we pair that with psar for the direction of the trend, then we check the trend direction based on atr levels with MA applied on it and lastly to confirm the direction we check the level of elliot wave oscillator. If they are all on the same page we have a short or a long entry.

STATS

Its a low win percentage , we usually have between 10-20% win rate, but at the same time we use a 1:30 risk reward ratio .

By this we achieve an avg profit factor between 1.5- 2.5 between different currencies.

RISK MANAGEMENT

In this example, the stop loss is 0.5% of the price fluctuation ( 10.000 -> 9950 our sl), and tp is 15% (10.000 - > 11500).

In this example also we use a 100.000 capital account, risking 5% on each trade, but since its underleveraged, we only use 5000 of that ammount on every trade. With leveraged it can be achieved better profits and of course at the same time we will encounter bigger losses.

The comission applied is 5$ and a slippage of 5 points aswell added.

For any questions or suggestions regarding the script , please let me know.

MACD and EMA200 With SignalsThis is my first indicator. It PROVIDES BUY, SHORT, and FALSE Signals by taking the MACD and the 200EMA.

PWTPROv5 TrendIndicator with LONG/SHORT BTC ETH alerts

This PWTPRO indicator is based on VWAP , MACD and EMAs

Best fits for BTC /USDT and ETH/USDT trading for 1H timeframe for positional trading (3-5 trades per week)

15min TF is good for intraday scalping. 4H is good for longterm. Fits for any coin, forex, metals, oil and bonds.

There are 4 types of entries, 1,3 and 4 are on by default. It's more accurate. Rest you can test.

Warning. Not yet works with huge trend continuation. Use it manually with you own risk management, don't forget stop-losses.

Show take profits and stop-loss (It's off by defaults)

You can now add 3 take-profit and 1 stop-loss labels on chart in %

Use 0 values to remove any of them from the charts.

New option: Show entering position price as label

Minor visual improvements with price labels (y position is now correctly above/below bars)

+added new option to round prices for integer values (i.e. 9251 for btc instead of 9251.35) off by defaults and now fits for altcoins and any asses that has price below 1 (usd, btc etc)

This is invite only script. PM me if you want to test it.

MACD Multiple Time Frames Weighted Momentum Score OscillatorThis script looks at the current momentum direction (up or down) for the 5 minute, 30 minute, 1 hour, 4 hour and daily and allows you to set scores of importance to these.

These scores are then added up to create an oscillator matching your preferences. Tune the indicator to match what you believe is the most important time frames that people use and score it accordingly. The values I put by default are just for demonstration.

For example, (and if you want to test to verify it's working), set the scores to 0 for everything except for the daily). Look at the daily macD by adding it as an indicator and set a score. Whenever the macD is trending up it will add the appropriate value to the score and likewise remove it when it's not.

Enjoy!

Ampleforth Rebase MACDThis script reveals Ampleforth rebase levels which are going to always work. In addition to that is MACD crossovers serving as potential buy/sell entries. You can set alerts for MACD crossovers and price entering balanced value area (0.96 - 1.06).

MACD signals can be used to automatically open a position and entering a balanced value area can be used as take-profit. Since the price will always move to this level, using this strategy without leverage should be profitable.

Ampleforth seems like a nice asset to trade since it is unlikely to correlate with anything else. At least not when it gets to the extreme levels.

MACD & RSIThis indicator shows the MACD and the RSI in one chart. So that both oscillators can be displayed, the RSI was subtracted by 50.

The RSI ranges between 50 and -50 (default 0-100)

The MACD is in the normal setting.

Adaptive MACDThis is part 6 of 11 in the system named Ninetales/Volt V2 you can find on Tradingview.

Add custom values to backtest, it will return the most accurate of them.