RSI & MACDThis indicator presents standart RSI and MACD indicators in a single indicator. The appearances of these indicators have been modified a little bit and squeezed into one window. To overcome the scale problem the MACD values has expanded with 1000 and divided by the current price to use both indicators in the same scale. Original values could be determined from there. Original Tradingview codes have been used to get full control of graphs.

Bu indikatör RSI ve MACD gösterfgelerini tek bir indikatörde sunuyor. İndikatörlerin görünüşleri bir miktar modifiye edilip iki indikatörğn tek bir pencereden takip edilmesine olanak sağlanmıştır. İki indikatördeki farklı ölçek kullanımından ortaya çıkan ölçek sorunu MACD değerlerinin 1000 ile genişletilip, ürünün güncel fiyatına bölünmesiyle giderilmiştir. Her iki indikatiör için de orjinal Tradingview kodları kullanılmıştır.

K-macd

[laoowai]BNB_USDT_3m_3Commas_Bollinger_MACD_RSI_StrategyBNB_USDT _3m

Release Notes:

Time: 3min

Pair: BNB_USDT

Use: {{strategy.order.alert_message}}

What's the difference with 3Commas Bollinger Strategy by tedwardd:

1. Initial capital: 1210 USDT (10$ Base order / 400$*3 Safety order), if you will change, please change JUST safety order volume or number of safety orders 2-3

2. Using just 2(3) safety order (original script 4)

3. More high-performance strategy for BNB_USDT

4. Using MACD to sell order (original script take profit by scale), thanks Drun30 .

5. Using RSI to analyze the market conditions.

Need to change:

bot_id = input(title="3Commas Bot ID", defval=" YOUR DATA ")

email_token = input(title="Bot Email Token", defval=" YOUR DATA ")

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

FAQ copy from tedwardd

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

This strategy is intended for use as a way of backtesting various parameters available on 3commas.

The primary inputs for the strategy are:

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

// USER INPUTS

Short MA Window - The length of the Short moving average

Long MA Window - The length of the Long moving average

Upper Band Offset - The offset to use for the upper bollinger offset

Lower Band Offset - The offset to use for the lower bollinger offset

Long Stop Loss % - The stop loss percentage to test

Long Take Profit % - The Take profit percentage to test

Initial SO Deviation % - The price deviation percentage required to place to first safety order

Safety Order Vol Step % - The volume scale to test

3Commas Bot ID - (self-explanatory)

Bot Email Token - Found in the deal start message for your bot (see link in the previous section for details)

3Commas Bot Trading Pair - The pair to include for composite bot start deals (should match the format of 3commas, not TradingView IE. USDT_BTC not BTCUSDT )

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Start Date, Month, Year and End Date, Month, and Year all apply to the backtesting window. By default, it will use as much data as it can give the current period select (there is less historical data available for periods below 1H) back as far as 2016 (there appears to be no historical data on Trading view much before this). If you would like to test a different period of time, just change these values accordingly.

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Composite bot using a Bollinger band type trading strategy. While its primary intention is to provide users a way of backtesting bot parameters, it can also be used to trigger a deal start by either using the {{strategy.order.alert_message}} field in your alert and providing the bot details in the configuration screen for the strategy or by including the usual deal start message provided by 3commas.

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Original script:

1. 3Commas Bollinger Strategy by tedwardd

2. Momentum Strategy ( BTC /USDT; 1h) - MACD (with source code) by Drun30

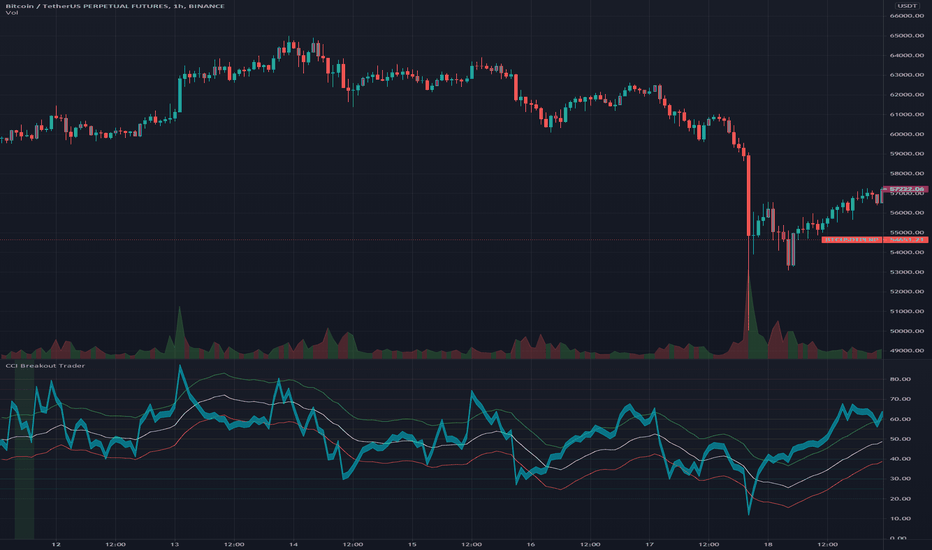

CCI Breakout TraderWorks well on Bitcoin or most altcoins on a 15min chart or higher.

What is this exactly?

This is an indicator that uses horizontal RSI + EMA lines with a CCI line on top of it to provide optimal entry and exit positions for trading. There is also a breakout indicator based on the width of Bollinger Bands.

How to use:

If the blue stream passes upwards on the red heading to the white - it's heading towards a good BUY signal. To be safe you wait until it passes above the white line, then BUY LONG. Another signal to buy long is when the blue stream passes above the white and green lines.

Selling is essentially the opposite, if the blue stream is passing down from the green or white lines, then it's time to sell and exit your trade.

If you need help knowing when to enter and exit a trade the indicator will draw a grey candle on your chart to signal it's time to exit a long trade and it will draw a purple candle when it's time to enter a long.

--

Breakout alert:

If you see a green vertical bar it's a warning that there is a potential breakout in price coming for whichever coin you are looking at. The price breakout could go either direction, so make sure you watch the blue stream.

--

Important tips:

The direction of the green/white/red lines are important - if they are heading down that means it might not be the best time to enter your trade, even if the blue stream crosses up on the red and/or white lines.

The colored horizontal lines are there to let you know if the blue stream is near the bottom of those lines (anywhere from hline 15 to 50) and heading upwards, you will more likely have a longer positive trade. If the blue stream is above 60 hline and it looks like a good trade (passing up on the red and white lines), expect to have a shorter trade.

I use this for swing trading various crypto currencies, once you learn how to read it, you can catch amazing uptrends really early and you can exit trades before some big drops happen.

MACD Moving Average Convergence/Divergence - DurbtradeDurbtrade MACD - macd line changes color based on vertical direction. This makes it easier to see and discern movements and also helps the indicator to retain maximum functionality when taking up less chart real estate (also, having the color change really helps me see charts on small screens... such as when it's bright outside and I'm driving in my car and glancing at a chart on my phone... it helps having the info pop visually). A fill option is included to fill the space between the macd and signal lines, though I personally prefer to disable this function. Also, you get a zero line if you want it, and it doesn't extend past the current time, removing unnecessary info and keeping your chart looking a bit cleaner. Finally, there are color-coded, cross-over and cross-under background fills, signaling when the macd line crosses the signal line.

This is my 2nd published script, and 2nd script ever. If you like this style, see my 1st published script: Durbtrade Bollinger Bands Width.

Hope you find this useful.

Feel free to comment.

MR. ROBOT v.1.0.0This script consists of a logical blend of TD Sequental, MACD and Stochastic RSI based on the Supertrend function. In addition, these indicators use the golden proportional point of each candle as a source.

The exclamations on the signal indicating signs express the strength of the signal and consist of four levels;

! : Weak level signal

!! : Partial level signal

!!! : Medium signal

!!!! : High level signal

The fact that these interjections refer to four different levels is related to the programmatic consideration of four different indicators and functions. Since the script is based on four different indicators

basically, the exclamation numbers of the signals are related to how many indicators are signaling at the same time. However, it does not always overlap. For example, when 3 indicators signal at the same time, 3 exclamation points may not appear on the signal sign. This is because the script also takes into account special bar algorithms.

The only setting that you can intervene on the script - for now - is the multiplier and length values of the supertrend function. Changing these settings changes the signal strengths and frequencies. The script is based on the supertrend function alone, it is the ability to follow the trend after the signals given by the internal indicators. This situation decreases the rate of false signals and frequent signals in internal indicators.

This script or its author is not responsible in any way for any profits or losses arising from transactions. Does not contain investment advice.

Bollinger Bands strategy with RSI and MACD v1.0 This is a strategy based on the Bollinger Bands, where buy trades are made when the price crosses the lower line of the Bollinger Bands upwards, and sell trades are made when the price crosses the upper line downwards.

In addition, it is possible through the inputs to enable trading with RSI and MACD, so that buy or sell trades are supported by these two indicators.

Trades are partially and fully closed in the following way, a buy trade will close half of the position when the price touches the middle line of the Bollinger bands and will be fully closed when the price touches the upper band. In the case of a sell position, half of the position will be closed if the price touches the middle band and the entire position will be closed when the price touches the lower band. Alternatively, a fixed take profit can be placed. In case the price moves against us, trailing stops can be placed.

In case of selecting to use RSI, MACD, or MACD variation, trades will be executed as long as The Bollinger Bands, and all the above-mentioned indicators give the same signals, either buy or sell.

For example in the case of selecting only Use RSI, buy trades would be made as long as RSI and BB give buy signals.

Strategy inputs:

-BB source: Bollinger Bands price source.

-Bollinger Bands SMA length: Bollinger Bands simple moving average length.

-Bollinger Bands StdDev length: Bollinger Bands standard deviation length.

-Trail Long Loss (%): Distance in percentage at which the stop loss will initially be placed for buy trades.

-Trail Short Loss (%): Distance in percentage at which the stop loss will be initially placed for sell trades.

-Maximum orders: Maximum of simultaneous operations, for example, if it is 3, up to 3 parallel operations of buy and up to 3 parallel operations of sell will be carried out.

-Position size: Number of contracts per trade.

-Use RSI: If selected, the strategy will also trade based on oversold or overbought signals provided by the RSI.

-RSI source: RSI price source.

-RSI period: The RSI period to use.

-RSI value for buy: If the RSI is below this value, it will give a buy signal.

-RSI value for sell: If the RSI value is above this value, it will give a sell signal.

-Use MACD: If selected, buy trades will be made when the MACD crosses 0 upwards, and sell trades will be made when the MACD crosses 0 downwards.

-Use MACD variation: Only available if MACD is previously selected. In this case, buy trades are made if the MACD value in the last 3 candles has been decreasing, and sell trades are made if the MACD value has been increasing.

-MACD source: MACD price source.

-MACD fast length: MACD fast EMA lenght.

-MACD slow length: MACD slow EMA lenght.

-MACD signal length: MACD signal EMA lenght.

-Use maximum TP long: If selected, a fixed take profit will be placed for buy trades. The position could be closed before reaching this take profit if the price touches one of the lower or upper lines first.

-Maximum take profit long (%): Distance in percentage at which the take profit will be placed for buy trades.

-Use maximum TP short: if selected, a fixed take profit will be placed for sell trades. The position could be closed before reaching this take profit if the price touches one of the lower or upper lines first.

-Maximum take profit short (%): Distance in percentage at which the take profit will be set for sell trades.

I hope you like it and as always all feedback is welcome.

Multiple Screeners with AlertsI already published few version of my custom screeners. Unfortunately, because of TradingView's security function call limit you can't use more than 40 stocks in 1 screener.

Fortunately, you can compute multiple values in your function and screen few indicators at once.

In this script I show how you can compute 5 indicators at the same time for 40 instruments. I display then in different labels.

Every label consist of list of instruments satisfying current indicator conditions and a value for it. It can be absolute value as for RSI or -1/1 representing Bullish/Bearish event.

Also you can create 1 alert with result of all screeners inside.

In this example I took 5 indicators with following conditions:

RSI - "RSI < 30" or "RSI > 70"

TSI - "TSI < -30" or "RSI >30"

ADX - "ADX > 40"

MACD - "MACD Bullish Cross" or "MACD Bearish Cross" (1 and -1 in screener)

AO - "AO Crosses 0 UP" or "AO Crosses 0 DOWN" (1 and -1 in screener)

Params

- bars_apart - this parameter define how may bars apart you labels are on your chart. If you see labels overlapping, increase this number.

- Parameters for all used indicators

- 40 symbol inputs for instruments you want to use in this screener

Alerts

You can create an alert from it easily by selecting screener name from the list and then selecting "Any alert() function call".

No additional configuration is required, message and alert on close is generated in the code.

You should better change default name for your alert. Sometimes because of big amount of inputs you might receive an error.

Disclaimer

Please remember that past performance may not be indicative of future results.

Due to various factors, including changing market conditions, the strategy may no longer perform as good as in historical backtesting.

This post and the script don’t provide any financial advice.

Highlighter Strategy V2// Based on Normalized Smoothed MACD by Dreadblitz

Old one was just an oscillator, I changed a few things

1) It now paints the line green/orange

2) The trigger (green/red) is now based on a signal

3) The signal is basically isUp, but with some additional controls, e.g.

4) (new) There is an embedded stoploss. This is a growth/decay function that decays slower than it grows.

5) Signal is filtered additionally by the stoploss (no green under the decaying line)

Baz: Mcdx+This indicator is based on Relative Strength Index(RSI) with different periods and bases to show the volatility of the price movement. However, this indicator's signal is delayed or based on historical price movement and should not be used as the only buy or sell indicator. Though, it is a useful confimation tool.

*Histogram

Red : Banker volume

Light Red : Weak Banker volume / possibility of unloading

White : Hot money volume

Green : Retailer volume

*MACD crosses

User can choose different type of moving averages and value for fast and slow signal. Default (5ema, 10ema)

Golden cross : Bull force

Dead cross: Bear force

*Diamonds:

Blue : Oversold, RSI < 30

Red : Overbought, RSI > 70

Release Notes:

1. Light red Column to filter out noise

2. Fast and slow moving average signals

3. Disable Offset

4. Enable Banker, Hot money and Retailers moving averages

5. Enable "More Sensitive" Setting

@Credit to Mango2Juice's magic formula

Highlighter StrategyOG COINBASE:BTCUSD

Based on Normalized Smoothed MACD by Dreadblitz

Updated slightly the rules about when it'll take a signal, and made it an overlay so that you see "green" and "red" on the price bar.

Things you might want to do when using it.

- Add a stoploss/trailing stop probably a MA of your choosing.

- Check different time frames to confirm a strong entry

rsi and macdRSI and MACD in the chart:

- small circles -> oversold/overbought

- big circles -> oversold/overbought rising/falling

- small diamonds -> macd over/under signal with macd over/under zero

Please comment if you have an idea to improve it ;)

3commas BNB/USD 1H Strategy*** DISCLAIMER ***

This script is speculative - it uses a highly aggressive model and may not make you money. It has worked well for me so far but you need to do your own DD and make your own decisions. I accept no liability for anything that happens as a result of using this script. Use this at your own caution.

My first published work! I took a few concepts I found in other scripts, tweaked them to match what I had in mind, added some ideas of my own and then added 3commas hooks. Essentially this script is a variable MACD indicator with linear regression and a lot of curve smoothing. It will buy and sell like any other MACD indicator, though it won't exactly match the MACD line you will see on regular MACD indicators due to the smoothing and linear regression. The stop loss should prevent the biggest losses though you will still lose some rounds as this is very aggressive. The parameters I have set up here work best for BNB however feel free to experiment with other coins. The linear regression is set high by default which is what I've found works best for BNB/USD.

Charts should be set to BNB/USD 1HR. I used Binance.us as I was building this but you should have success using other exchanges that offer BNB as well.

This script is set up to use with a 3commas DCA bot though you need access to the entire script in order for that to happen. You can add it and manually place orders or use alarms to test. If you want full access so you can set your 3commas alerts, message me and we can figure something out!

GSO + RSI + MACD + MFI + Bollinger BandsThis script uses a Gann Swing Oscillator , RSI , MACD , MFI and Bollinger Bands to generate long and short signals for cryptocurrencies on the 5 minute chart.

The Gann Swing Oscillator was inspired by HPotter's GSO.

This script is for educational purposes only. This script is NOT to be used as financial advice. I will not accept liability for any losses which may occur as a result of using this script.

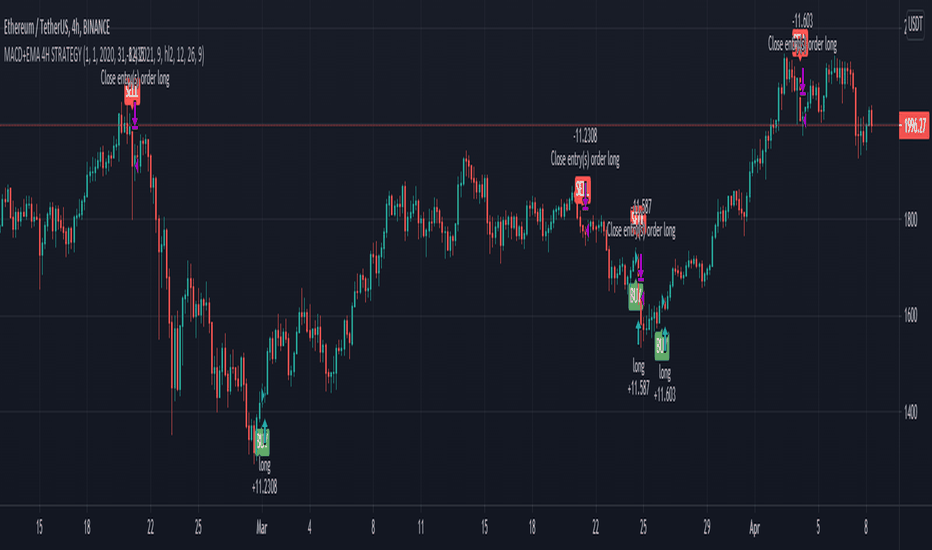

MACD oscillator with EMA alert version 4HThis is the study/indicator alert version of the macd + ema strategy.

The strategy details are the following :

Is a simple, yet efficient strategy, which is made from a combination of an oscillator and a moving average.

Its setup for 4h candles with the current settings, however it can be adapted to other different timeframes.

It works nicely ,beating the buy and hold for both BTC and ETH over the last 3 years.

As well with some optimizations and modifications it can be adapted to futures market, indexes(NASDAQ, NIFTY etc), forex( GBPUSD ), stocks and so on.

Components:

MACD

EMA

Time condition

Long/short option

For long/exit short we enter when we are above the ema , histogram is positive and current candle is higher than previous.

For short /exit long , when close below ema , histo negative and current candles smaller than previous

If you have any questions please let me know !

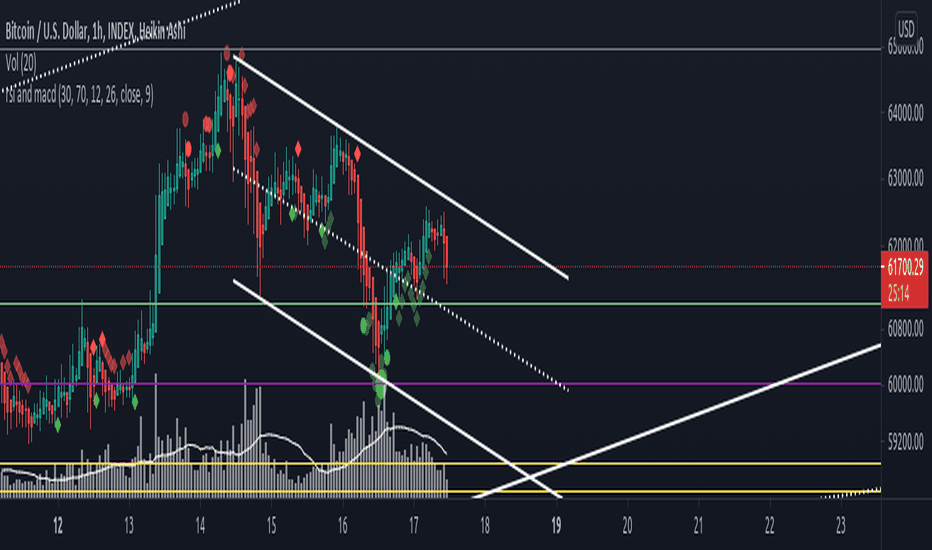

MACD oscillator with EMA strategy 4H This is a simple, yet efficient strategy, which is made from a combination of an oscillator and a moving average.

Its setup for 4h candles with the current settings, however it can be adapted to other different timeframes.

It works nicely ,beating the buy and hold for both BTC and ETH over the last 3 years.

As well with some optimizations and modifications it can be adapted to futures market, indexes(NASDAQ,NIFTY etc), forex(GBPUSD), stocks and so on.

Components:

MACD

EMA

Time condition

Long/short option

For long/exit short we enter when we are above the ema, histogram is positive and current candle is higher than previous.

For short /exit long , when close below ema, histo negative and current candles smaller than previous

If you have any questions please let me know !

Redbear MACD + RSIHello . I make script that combine MACD and RSI

Green area is BUY SELL signal when rsi >45

you can custom parameter .

Avatar trading indicatorIndicator description:

The Avatar indicator is to provide trading insights including trend and momentum, reversal points, Fibonacci retracement, and projections of future reversal or breakout levels.

Avatar is four indicators built into one.

Trend power: shows strength of trend and a change in momentum.

Red: The trend has been determined and is short

Lime: The trend has been determined and is long

Aqua: Continuation of the down trend, but showing down trend is in weakness.

Fuchsia: Continuation of the up trend, but showing up trend is in weakness

Yellow: Trend is reversing or trend is missing direction

Zig Zag: is used to help identify price trends. It plots points on a chart whenever prices reverse.

Major

The trend is graphed based on changes in price. The major trend should be used in deciding which way to enter the trade.

Minor

The minor trend is similar to the major but it is used to determine your entry point. It is easy to spot higher highs or lower lows. Take not when the minor trend fails to set a new high or a new low.

Channels : are price ranges that can provide useful trading information.

These dotted lines are provided as a quick guide to determine where the trend is headed. They show if price is getting squeezed and we should look for a break out using a flag or pennant pattern or is there an ever widening channel creating a broadening wedge . Look for hesitation or a reversal near the channel lines.

Fibonacci base on Zigzag

The Fibonacci retracement is created by taking two reverse points of major Zig Zag on a stock chart and dividing the vertical distance by the key Fibonacci ratios of 0%, 50%, and 100%.

Strategies for using the indicator

To be decided by traders. You are welcome to discuss trading strategies base on Avatar indicator, if your strategies are really good, we can write codes and do backtest on it.

Notes:

1) The code use 'valuewhen' feature which will cause repaint.

2) You can not use it to setup alerts.

Log MACDThis is just a MACD indicator using the log of the closing price rather than the normal closing price. Useful for exponentially growing stocks and cryptocurrency.

MACD Multi-Timeframe IndicatorHello everyone, this is indicator has always been my go-to MACD indicator for many years. It is such a beautiful easy to understand indicator. You can also view different timeframe resolutions which is helpful. When the MACD crosses up the signal line it is green, and when it crosses below the signal line it is red. The signal line is the constant yellow line. MACD histogram is dark green when increasing buying momentum, and you'll see the green get lighter when buy momentum is decreasing. As well, MACD histogram is dark red when increasing sell momentum, and you'll see the red get lighter when sell momentum is decreasing. I hope you guys love this macd design. Happy trading!

The MACD indicator can be used in many ways but my favorite way to use MACD by itself is by going long when macd < 0 & macd crosses above signal line, and going short when macd > 0 & macd crosses below signal line. I added those alerts for anyone interested.

MACD + PSAR SetupThis indicator combines 3 elements:-

1. MACD which will act as a source of potential Buy Signal

2. PSAR which provides the confirmation for buy signal and for potential Buy on Dip Strategy

3. Breakout candles which provides the confirmation signal for Buy on Breakout strategy

4. The direction of the trend is provided by the Exponential Moving Average

The strategy is to have any counters which has triggered the MACD Golden Cross signal. These counters are to be out under watchlist for further confirmation.

The Buy Signal is confirmed when:-

1. Price is above EMA Direction(standard is set at 200)

2. PSAR has given the Buy Signal OR a Breakout Candle occurs.

Buy Signal is shown with a Green Diamond symbol whilst the Sell Signal is shown in Red Diamond Symbol.

The bullish and bearish condition is set via a green and red background

The MACD and PSAR codes are derived from the standard codes which is available in tradingview.

cheesywedges MTF MACD+Stoch+Ichi+PSARThis is a heatmap created to show 4 key indicators MACD, Stochastic, Ichimoku and PSAR. Adjust TF accordingly. Default is incremental by 45 minutes.

One advantage is you can see as the indicator current candles change from green to red or the other way round as the current trend changes. Eg. MACD attempting to cross Signal and the candle will flicker red to green and you can see it happen on multiple TF.

Standard Settings

PSAR - Start, Increment and Max Value

Stochastic - K,D,Smooth, Upper and Lower

MACD - Fast, Slow and Smooth

Ichimoku - Conversion Line, Base Line Periods, Lagging Span and Displacement

Advanced Settings (MACD)

MACD/Signal Crossover , eg. Long = MACD > Signal

MACD/Signal + Histogram Crossover , eg. Long = MACD > Signal and Hist > 0 and Signal > 0

MACD/Signal Crossing, eg. Long = MACD > Signal and previous MACD < previous Signal

MACD/Signal + Histogram Crossing, eg. Long = MACD > Signal and previous MACD < previous Signal and Hist > 0 and Signal > 0 and previous Hist > previous Signal

For normal usage, just use MACD/Signal Crossover

Recommended Settings

Ichimoku 20, 60, 120, 30

If customized enhancement required drop a message and I'll see what I can do.

Three moving average strategies

If the short term (Default 7) moving average cuts the medium term (default 25) moving average, BUY. Conversely, it generates the SELL signal. If the long term (Default 99) moving average cuts its short term moving average, Quick SELL. Conversely, it can be interpreted as Fast SELL. You can change the moving average and the number of days as you wish, and you can trade in the short or long term. I hope it was useful.

MACD Crossover trend strategy, Long and ShortHey everybody,

This is my first strategy and script I wrote mostly myself. There's tons of content out there to learn how to code in Pinescript and it's exactly what I wanted and needed in this time of my life.

In any case, I made a rather simple MACD crossover strategy that only takes trades in the direction of both EMA and SMA (there are inputs to change the length of the moving averages and lots of other stuff too).

If the MACD line crosses upwards on the signal line, while above the zero point of the histogram and the price is above EMA + SMA , it's a long signal.

If the MACD line cosses downards on the signal line, while below zero on the histogram and the price is below EMA + SMA , it's a short signal.

There are a lot of default variables that make no sense, for basically any symbol you're going to be looking at. You're going to have to adjust the EMA , SMA , backtest date, take profit, stop loss and all that good stuff yourself to find decently profitable parameters.

I made this myself because I couldn't really find a strategy out there that allowed for so much customizing and it's an easy way to get started in Pinescript.

If you have any suggestions, tips or you see a flatout mistake in my code, please let me know. I'm still learning, everyday and I'm enjoying every second of it.