Multiple Trend Overview

-----------------

Hey there!

The indicator is used for both an overall and a short trend assessment. Both superordinate structures and subordinate movements are mapped. With the help of calculations via Ema , MACD and other tools, graphic trends can be visualized.

The green areas always signal an uptrend, while the red areas indicate a downtrend. The red & blue ema enclose the area of the minor trend. Orange & Green signal the overall trend. Ideally, both Ema faces run in the same direction as the multi-color line. Special alerts in the charts show this again directly in the chart. The multiple setting to display the trends from different time frames is innovative!

For all asset classes!

The indicator is designed for the m30 chart. But it can also be used well on other time frames. In addition, the display can be adjusted via the options and set to any time frame. The indicator has various settings and options that can be activated or deactivated separately.

Caution: Past results do not guarantee future profits!

Follow the link below to get access to this indicator or get us a PM to get access.

--------------------------------------------------------------------------------------------------------------

--------------------------------------------------------------------------------------------------------------

-----------------

Willkommen!

Der Indikator dient sowohl für eine übergeordnete als auch eine untergeordnete Trendeinschätzung. Hierbei werden sowohl übergeordnete Strukturen als auch untergeordnete Bewegungen abgebildet. Mit Hilfe von Berechnungen über Ema , MACD und weiteren Hilfsmittel lassen sich grafische Trends visualisieren.

Die grünen Flächen signalisieren immer einen Aufwärtstrend, während die roten Flächen einen Abwärtstrend anzeigen. Der rote & der blaue Ema schließen die Fläche des untergeordneten Trends ein. Orange & Grün signalisieren den übergeordneten Trend. Idealerweise laufen beide Ema Flächen in die gleiche Richtung wie die Multi-Farben Linie. Spezielle Alerts im Charts zeigen dies auch nochmal direkt im Chart. Innovativ ist die multiple Einstellung die Trends aus verschiedenen Timeframes abzubilden!

Für alle Asset Klassen!

Der Indikator ist für den m30 Chart ausgelegt. Lässt sich aber auch auf anderen Timeframes gut nutzen. Zusätzlich kann die Anzeige über die Optionen angepasst werden und auf jede Timeframe eingestellt werden. Der Indikator besitzt verschiedene Einstellungsmöglichkeiten und Zusätze die separat aktiviert oder deaktiviert werden können.

Achtung: Vergangene Ergebnisse garantieren keine zukünftigen Gewinne!

Verwenden Sie den folgenden Link, um Zugriff auf diesen Indikator zu erhalten oder schreibe uns eine PM um Zugriff zu erhalten.

Trading

Infiten's Price Percentage Oscillator Channel (PPOC Indicator)What is the script used for?

Infiten's Price Percentage Oscillator (PPOC Indicator) can be used as a contrarian indicator for volatile stocks and futures to indicate reversals, areas of support and resistance. For longer term trading, if the Short SMA or prices go above the High PPO Threshold line, it is a sign that the asset is overbought, whereas prices or the Short SMA going below the Low PPO Threshold line indicates that the asset is oversold.

What lines can be plotted?

Low PPO Thresh - Calculated as -PPO Threshold * Short MA + Long MA : Gives the price below which the PPO hits your lower threshold

High PPO Thresh - Calculated as PPO Threshold * Short MA + Long MA : Gives the price above which the PPO hits your upper threshold

MA PPO : Plots candles with the Low PPO Thresh as the low, High PPO Thresh as the high, Short MA as the open, and Long MA as the close.

Short SMA : plots the short simple moving average

Long SMA : plots the long simple moving average

Customizable Values :

Short MA Length : the number of bars back used to calculate the short moving average for a PPO

Long MA Length : the number of bars back used to calculate the long moving average for a PPO

PPO Threshold : the percent difference from the moving average expressed as a decimal (0.5 = 50%)

Recommendations:

Longer timeframes like 300 days are best with larger PPO Thresholds, I recommend using a PPO Threshold of 0.5 or higher. For shorter timeframes like 14 days I recommend setting smaller PPO Thresholds, like 0.3 or lower. I find that these values typically capture the most extremes in price action.

[TTI] Pinch AVWAPs––––History & Credit

This indicator came from studying Alpha trends and the concept from CMT Brian Shannon

–––––What it does

Upon uploading choose two dates from which the script will calculate Anchored VWAP from both dates. The dates can be easily moved for faster adjustment and re-calculation.

–––––How to use it

If you are trading a breakout methodology like myself, look for the "pinch" of the AVWAPs. Preferably, a bottom AVWAP moving up and a top AVWAP moving down. Choose important dates (this is rather subjective) for the AVWAP dates. These can be important events like Earnings or Divident Announcements. Or places where there is a change of structure of the Supply and Demand dynamic.

5EMA + VP IGHola Divinis

En una villa nació, fue deseo de Dios

Crecer y sobrevivir a la humilde expresión

Enfrentar la adversidad

Con afán de ganarse a cada paso la vida

En un potrero forjó una zurda inmortal

Con experiencia, sedienta ambición de llegar

De cebollita, soñaba jugar un Mundial

Y consagrarse en Primera

Tal vez jugando pudiera a su familia ayudar

En una villa nació, fue deseo de Dios

Crecer y sobrevivir a la humilde expresión

Enfrentar la adversidad

Con afán de ganarse a cada paso la vida

En un potrero forjó una zurda inmortal

Con experiencia, sedienta ambición de llegar

De cebollita, soñaba jugar un Mundial

Y consagrarse en Primera

Tal vez jugando pudiera a su familia ayudar

A poco que debutó (Maradó, Maradó)

La 12 fue quien coreó (Maradó, Maradó)

Su sueño tenía una estrella

Llena de gol y gambetas

Y todo el pueblo cantó (Maradó, Maradó)

Nació la mano de Dios (Maradó, Maradó)

Llenó alegría en el pueblo

Regó de gloria este suelo

Carga una cruz en los hombros por ser el mejor

Por no venderse jamás, al poder enfrentó

Curiosa debilidad, si Jesús tropezó

¿Por qué él no habría de hacerlo?

La fama le presentó una blanca mujer

De misterioso sabor y prohibido placer

Que lo hizo adicto al deseo de usarla otra vez

Involucrando su vida

Y es un partido que un día el Diego está por ganar

A poco que debutó (Maradó, Maradó)

La 12 fue quien coreó (Maradó, Maradó)

Su sueño tenía una estrella

Llena de gol y gambetas

Y todo el pueblo cantó (Maradó, Maradó)

Nació la mano de Dios (Maradó, Maradó)

Llenó alegría en el pueblo

Llenó de gloria este suelo

Olé, olé, olé, olé

¡Diego, Diego!

Olé, olé, olé, olé

¡Diego, Diego!

Olé, olé, olé, olé

¡Diego, Diego!

Olé, olé, olé, olé

¡Diego, Diego!

Y todo el pueblo cantó (Maradó, Maradó)

La 12 fue quien coreó (Maradó, Maradó)

Su sueño tenía una estrella

Llena de gol y gambetas

Y todo el pueblo cantó (Maradó, Maradó)

Nació la mano de Dios (Maradó, Maradó)

Llenó alegría en el pueblo

Regó de gloria este suelo

Regó de gloria este suelo

Regó de gloria

Agregar a la playlist

Tamaño

A

A

Cifrado

Imprimir

Corregir

Optimised RSI strategy for Reversals (by Coinrule)The most common way to use the RSI to spot a good buy opportunity is to check for values lower than 30. Unfortunately, the RSI can remain in oversold territory for long periods, and that could leave you trapped in a trade in loss. It would be appropriate to wait for a confirmation of the trend reversal.

In the example above I use a short-term Moving Average (in this case, the MA9) coupled with an RSI lower than 40. This combination of events is relatively rare as reversal confirmations usually come when RSI values are already higher. As unusual as this setup is, it provides buy-opportunities with much higher chances of success.

The parameters of this strategy would be:

ENTRY: RSI lower than 40 and MA9 lower than the price

TAKE PROFIT and STOP-LOSS with a ratio of at least 2. That means that if you set up a take profit of 3%, your stop-loss shouldn’t be larger than 1.5%.

The advantage of this approach is that it has a high rate of success and allows you the flexibility of setting up the percentages of the take profit and stop-loss according to your preferences and risk appetite.

MACD Multiple AlertsThis script help traders to catch bullish and bearish momentum. It creates an alert for 40 altcoins based on the MACD cross over and cross under.

The MACD input are adjustable in the settings and you can choose your favorite assets.

Simply add this indicator to the chart wait that if finish to load and then create an alert on the time frame of your choice.

Enjoy your trading

F_rank_01

Maddrix_club III (strategy)Maddrix club III (STRATEGY) is an advanced trading algorithm that goes long and short in spite of the market condition. It aims to capture large moves. It is the fruit of over a thousand hours of work, trials, errors, research, etc.

The STUDY version is also posted.

There are 5 main variables to adjust the indicator:

Framework length – Use this to establish the environment. Shorter length = volatile environment. Longer length = steadier.

Framework multiplier – Use this to adjust the environment to the asset. Lower value for less volatile price action and higher value for very volatile price action.

Search timeframe – Use this to lookback for a fractal . In theory, the longer the lookback the more reliable the fractal recognition.

Trigger line – Use this to adjust the trigger level. In theory, the lower the trigger the more signals you get.

Threshold – Use this to filter the signals. The higher the threshold, the less signal you get.

The best way to go about changing the settings, is to start off the default value. I’d do a monthly check-in playing with few of them and readjusting based on results from the exchange.

They are different, as this one can show you the equity curve.

It works on many markets as long as there is sufficient activity to create patterns and repetition.

You will notice a slight difference between the strategy calculation and the algo calculation (built in the algo) - this is because the exits are not exactly at the same levels. I left this on purpose, so that you can see that even with a little slippage, overall this is positive.

Very good results have been observed on the 15 min time frame though it technically works on all timeframe (5 min for example, 1 hour also). On the example above ETHUSDT – 15 min, the back test shows consistency in the results for the last 2 years. The theory behind it is based on probabilities, human emotions, and repetition in market patterns.

Results have also shown great adaptability, meaning the total profits don’t change considerably when we play with settings. This is very good because even if you try to fine tune a set of settings to the past, the probability that it keeps working in the future is rather high.

Very important note: the calculations DO NOT take into account any fee or slippage that you always experience on the exchanges.

The indicators only uses real time data, therefore it can’t repaint.

There are absolutely no guarantees about this algorithm and past results are not indicative of future performance.

Fees, slippage and API delay: for any algorithm you will use (from me or others), please keep in mind that fees add up, slippage and delay creates differences between algo theory and reality. We can put in place systems to circumvent that, but we will always have them.

VMC Oracle This is Oracle. It is a momentum driven indicator with behind-the-scenes filters designed to best indicate the oversold and overbought points on most assets. Oracle partially uses a regression equation displayed in line format with a predetermined spacing to indicate different support and resistance points within the last 100 bars. When used in combination with the smoothed oscillator and moving averages it becomes a powerful tool in your box. It is important to keep in mind that because this indicator is always looking at the last 100 bars the user will need to use the “replay” function on Tradingview for the best manual back-testing to the triggers as possible. It should become clear that when its in the red zone above the ‘zero’ line that the potential for downward movement is greater. The bottom or below ‘zero’ green zone indicates a potential time to buy.

In addition to the regression lines, the indicator is supplied with a basic moving average application involving cross analysis. The two lines in cooperation help the user determine when the overall trend is shifting. As an example, when the overall trend may be indicating a bearish market or downtrend it may be beneficial to consider any of Oracle’s triggers that may be opposite more closely. Some of the alerts will trigger in what appears to be opposite trending areas such as a buy trigger when the averages indicate a bearish period. When this happens, it is up to the user utilize other confirmation type tools to assist in the decision of the oracle triggers. The reason for this is that Oracle is designed to predict the change in the market before or during a peak or through area on the graph. The success can be large but this can reduce the automatic trigger’s success in which loss management must be executed.

The custom alert function built in is designed to automate the visual comparisons of the two items above. By considering trend, immediate resistance and support lines, and momentum we can help visually indicate the points of possible exhaustion in either direction.

When setting up the alert it's as simple as a new alert creation and selecting the VMC Oracle Indicator in the top drop down. After that its as simple as selecting Long Alert or Short alert. As with any tool it is recommended to understand the asset being traded and providing yourself with the best risk management rules to minimize unfavorable movements.

Maddrix_club I - Scalper (3commas)Maddrix club I Scalper (3commas version). The code is very different from the ALERTATRON version.

It really is not the same!

Maddrix Club I is a simple, straightforward trading algorithm that goes long or short, based on user’s choice. It is considered to be a scalper, because it aims to capture small profits that accumulates and compound over time.

The theory behind it is based on trend following and DCA .

Strategy type one uses momentum to generate signals.

Strategy type two uses price action only

Very good results have been observed on the 1 min time frame though it technically works on all timeframe (5 min for example, 1 hour also). The most important part of this algorithm is risk management and capital preservation.

You can run this with very little capital, and always make sure that in the worst case scenario, meaning when the market goes against you and all your SO (Safety Orders) are filled, you are using less than your account balance.

If you are in a trending up phase on the weekly time frame, you can go long. If this is a definite trend down, of course go short. During a bear market, stay long, during a bull market, evidently long as well.

For totally new traders, I would recommend to LONG only, and set super low risk settings (cover a 50% drop for example), and see how it runs. Then, as you become a more experienced trader, you can identify trends and short as well, and/or increase your risk.

It works on all markets as long as there is volatility .

The best way to go about changing the settings, is to start off the default values. I’d run it and see how it fits your risk preferences.

There are absolutely no guarantees about this algorithm and past results are not indicative of future performance.

Fees, slippage and API delay: for any algorithm you will use (from me or others), please keep in mind that fees add up, slippage and delay creates differences between algo theory and reality. We can put in place systems to circumvent that, but we will always have them.

*** This one is SPECIAL 3COMMAS**

3SMMA + Fractal Strategy [Kintsugi Trading]What is the 3SMMA + Fractal Strategy?

This premium indicator was inspired by my desire to find and place high probability forex trades in any market, direction, or time of day.

Why Forex?

The Forex markets operate 24 hours, 5.5 days a week

Access to meaningful leverage

Ability to easily trade long or short

High liquidity

How to use it!

----- First, start by choosing Breakout Additional PIP Size, Stop Additional PIP Size, and Target Profit (TP) PIP Size. -----

- Breakout Additional PIP Size = Additional PIPs beyond the default strategy entry point.

- Stop Additional PIP Size = The default stop is above/below the signal candle, depending on trade direction. This input allows the user to target more or less PIPs as a stopping-out point.

- Target Profit (TP) PIP Size = Number of PIPs set at a target profit.

----- Next, we set the Session Filter. -----

Set the Timezone and Trade Session you desire. If no specific session is desired, simply leave the box unchecked.

----- Next, we set the Length of the 3 Smoothed Moving Averages. -----

Enter the Desired Moving Average Length:

Length 1 - Source

Length 2 - Source

Length 3 - Source

These inputs will determine whether the strategy looks for Long or Short positions.

----- Next, we set the Fractal Periods. -----

This user input re-programs the strategy to only allow for 'n' number of lower or higher candles on either side of a fractal signal.

For example: If the user inputs "5" for the number of Periods, Fractal indicator signals will only appear on candles with "5" candles higher or lower on both sides of the signal candle.

In combination with the 3 Smoothed Moving Averages, the Fractal signals help us determine when to take a trade and in what direction.

The strategy is essentially looking for trades going with the overall trend and placing potential trades after a low has been reached and is re-tested in the overall trend direction.

----- Finally, we backtest our ideas. -----

After using the 'Strategy Tester' tab on TradingView to thoroughly backtest your predictions you are ready to take it to the next level - Automated Trading!

This was my whole reason for creating the script. If you work a full-time job, live in a time zone that is hard to trade, or just don't have the patience, this will be a game-changer for you as it was for me.

Auto-Trading

When it comes to auto-trading this strategy I have included two options in the script that utilize the alert messages generated by TradingView.

*Note: Please trade on a demo account until you feel comfortable enough to use real money, and then please stick to 1%-2% of your total account value in risk per trade.*

AutoView

PineConnector

Good luck with your trading!

Oversold RSI with Tight Stop-Loss Strategy (by Coinrule)KRAKEN:LINKUSD

This is one of the best strategies that can be used to get familiar with technical indicators and start to include them in your rules on Coinrule .

ENTRY

1. This trading system uses the RSI (Relative Strength Index) to anticipate good points to enter positions. RSI is a technical indicator frequently used in trading. It works by measuring the speed and change of price movements to determine whether a coin is oversold (indicating a good entry point) or overbought (indicating a point of exit/entry for a short position). The RSI oscillates between 0 and 100 and is traditionally considered overbought when over 70 and oversold when below 30.

2. To pick the right moment to buy, the strategy enters a trade when the RSI falls below 30 indicating the coin is oversold and primed for a trend reversal.

EXIT

The strategy then exits the position when the price appreciates 7% from the point of entry. The position also maintains a tight stop-loss and closes the position if the price depreciates 1% from the entry price. The idea behind this is to cut your losing trades fast and let your winners ride.

The best time frame for this strategy based on our back testing data is the daily. Shorter time frames can also work well on certain coins, however in our experience, the daily works best. Feel free to experiment with this script and test it on a variety of your coins! With our back testing data a trading fee of 0.1% is taken into account. The fee is aligned to the base fee applied on Binance, which is the largest cryptocurrency exchange by volume. In the example shown, this strategy made a handsome net profit of 52.6% on Chainlink with 66.67% of trades being profitable.

You can execute this strategy on your favorite exchanges with Coinrule .

Bounce Manager TrendlinesThe trendline script is made for manual input of trendlines using point clicks on the chart. The script will then see if price respects these lines by the parameters you input in settings panel. On a respectable bounce it will print buy/sell arrows. The script also has functionality to send alerts, this is helpful if you want to automate trendlines . I created this script and many others under the bounce manager toolkit to expand on the signalling capabilities of popular drawing tools as I find using just a crossover to be lacking especialy for full automation.

components:

- Line respect: When price moves past this the script will no longer look for entry until a new trend has been established. The line can also be used as a stop loss.

- Confirmation: When price touches the line during a trend it

will wait to cross over this line to confirm a reaction from the line.

- Consolidation filter: A trend filtering system, this is a distance from

the line price has to break to confirm trend direction.

- Stop loss: This can be set to a percentage distance from the low after

bounce. Or it can be set to the line respect line

- Take profit: This can be a fixed take profit target or a risk to reward

based take profit. With risk to reward it will multiply the stop loss

distance by the input and use that to create target (green cross)

- ATR based or % based: there are 2 versions of the script, one for strict

percentage based logic and another one based on ATR values

If you are having problems figuring out which settings to use I recommend you check the Bounce Manager ATR script for reference as this script plots the components:

Zignaly automation settings:

zignaly integration, you can use the settings panel to decide your risk management. Option to use a fixed take profit % or an automatic risk to reward calculation based on the stop loss. Stop loss can get calculated using the max violation setting as a stop loss (this will put stop loss below line respect level) or when not checked it will use 0.01% below the low of the signal candle as stop loss. Just add your zignaly private key in the settings and use any alert function call as alert. Make sure to use zignaly.com as your webhook url.

If 5 trendlines are not enough use the 20 line input version, this script is for the clean strong trendline trader.

Part of the Honest Algo indicator suite

Range Filter + MA Strategy [Kintsugi Trading]What is the Range Filter + MA Strategy?

This premium indicator was inspired by my desire to find and place high probability forex trades in any market, direction, or time of day.

Why Forex?

The Forex markets operate 24 hours, 5.5 days a week

Access to meaningful leverage

Ability to easily trade long or short

High liquidity

How to use it!

----- First, start by choosing a Risk/Reward Ratio and Stop PIP Size. -----

- Risk/Reward Ratio = If you have a .5 risk/reward, it means you are risking $100 to make $50.

- Stop PIP Size = How many PIPs will be representative of the max risk. i.e. - if you are risking $100 and you set the PIP stop to 10, that means 10 PIPs = $100.

----- Next, we set the Session Filter. -----

Set the Timezone and Trade Session you desire. If no specific session is desired, simply leave the box unchecked.

----- Next, we set the Moving Average Cloud. -----

Enter the Moving Average Type:

Simple Moving Average

Exponential Moving Average

Hull Moving Average

Weighted Moving Average

Smoothed Moving Average

Enter the fast and slow Moving Average Period.

These inputs will determine whether the strategy looks for Long or Short positions.

----- Next, we set the Range Filters. -----

In combination with the Moving Average Cloud, the Range Filter will help us determine when to take a trade and in what direction.

The strategy is essentially looking for small reversals going against the overall trend and placing a trade once that reversal ends and the price moves back in the direction of the overall trend.

The Range filter utilizes confirmation between two entirely separate Range Filter calculations (or set them both equal to use one).

Each Range Filter is completely customizable by:

Source Calculation (open, high, low, close, hl2, hlc3, ohlc4, hlcc4)

Sampling Period

Range Multiplier

----- Finally, we backtest our ideas. -----

After using the 'Strategy Tester' tab on TradingView to thoroughly backtest your predictions you are ready to take it to the next level - Automated Trading!

This was my whole reason for creating the script. If you work a full-time job, live in a time zone that is hard to trade, or just don't have the patience, this will be a game-changer for you as it was for me.

Auto-Trading

When it comes to auto-trading this strategy I have included two options in the script that utilize the alert messages generated by TradingView.

*Note: Please trade on a demo account until you feel comfortable enough to use real money, and then please stick to 1%-2% of your total account value in risk per trade.*

AutoView

PineConnector

Good luck with your trading!

trading YM based on pair tradingThis is inspired by some online free webinars. Didn't pay for the strategy/ course. I just figured it out myself. So there might be problem with this strategy.

Theory: It is based on something called cointegrated. Cointegration means the difference between 2 securities are stable in long term. When the difference is bigger / smaller than normal, then there is space to make profit. You can use some tests to check if they are cointegration. I don't think YM and NQ are strictly cointegrated. I used other platform to test the cointegration. They are not cointegrated. There are multiple ways to do pair trading. I use "Y = A - B * (A /B)" to do this. The back test on tradingview can only trade one security. This is not pair trading in this backtest. But only do long and short based on the theory of pair trading. The max drawdown is huge. You should be careful before doing anything with this strategy.

Welcome to give some advice on improvement.

Session Breakout Strategy [Kintsugi Trading]What is Session Breakout Strategy?

This premium indicator was inspired by my desire to find and place high probability forex trades in any market, direction, or time of day.

Why Forex?

The Forex markets operate 24 hours, 5.5 days a week

Access to meaningful leverage

Ability to easily trade long or short

High liquidity

How to use it!

----- First, start by choosing a Range Session and Trade Session. -----

- Range Session = Period of time you believe will be predictive of future price action. I like to overlay 'FX Market Sessions' by boitoki to target timeframes in which forex market sessions overlap. This period is indicative of buyers and sellers battling it out in an effort to choose a direction.

- Trade Session = Period of time you believe the price will act on the information gathered from the range session.

----- Next, we filter the Range Session by information that will help further predict price movement in the Trade Session. -----

Our tools are:

Moving Average Filter

Average RSI Filter

RSI Decision Level

None

Each parameter is customizable.

----- Next, we set our risk. -----

Enter the "stop pip size' you desire.

Enter the 'target profit pip size' you desire.

We can set out ($) dollar risk-per-trade in the inputs. The script does not know your actual account balance, so if you want to risk $100/trade you would enter '$10,000' in the account balance section and '1' in the Risk Per Trade% section.

For example, an '8' stop and an '8' tp would indicate a 1:1 risk-reward. *Note - although you may generate a higher win percent with a less favorable RR, it is rarely worth it.

----- Finally, we backtest our ideas. -----

After using the 'Strategy Tester' tab to thoroughly backtest your predictions you are ready to take it to the next level - Automated Trading!

This was my whole reason for creating the script. If you work a full-time job, live in a time zone that is hard to trade, or just don't have the patience, this will be a game-changer for you as it was for me.

Auto-Trading

When it comes to auto-trading this strategy I have included two options in the script that utilize the alert messages generated by TradingView.

*Note: Please trade on a demo account until you feel comfortable enough to use real money, and then please stick to 1%-2% of your total account value in risk per trade.*

AutoView

PineConnector

Good luck with your trading!

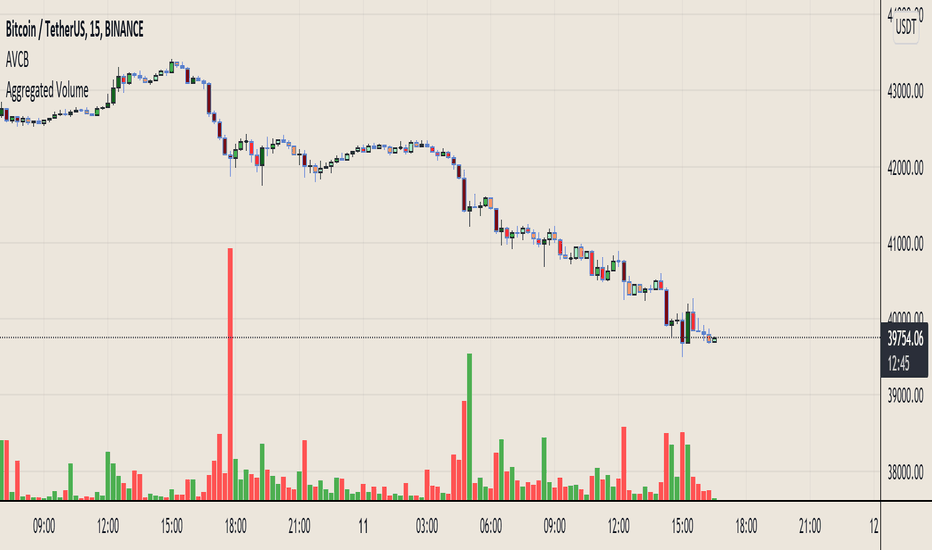

MACD of Aggregated Buy/Sell Pressure - InFinitoModified & Updated script from MARKET VOLUME by Ricardo M Arjona @XeL_Arjona that Includes Aggregated Volume

Aggregation code originally from Crypt0rus

***The indicator can be used for any coin/symbol to aggregate volume , but it has to be set up manually***

***The indicator can be used with specific symbol data only by disabling the aggregation option, which allows for it to be used on any symbol***

- Calculated based on Aggregated Volume instead of by symbol volume . Using aggregated data makes it more accurate and allows to compare volume flow between different kinds of markets (Spot, Futures , Perpetuals, Futures+Perpetuals and All Volume ).

- As well, in order to make the data as accurate as possible, the data from each exchange aggregated is normalized to report always in terms of 1 BTC . In case this indicator is used for another symbol, the calculations can be adjusted manually to make it always report data in terms of 1 contract/coin.

Buy to Sell Convergence / Divergence by @XeL_Arjona:

"It's a simple adaptation of the popular "Price Percentage Oscillator" or MACD but taking Buying Pressure against Selling Pressure Averages, so given a Positive oscillator reading (>0) represents Bullish dominant Trend and a Negative reading (<0) a Bearish dominant Trend. Histogram is the diff between RAW Volume Pressures Convergence/Divergence minus Normalized ones (Signal) which helps as a confirmatory."

Things to look for:

- Divergences: This indicator can very useful to spot tops and bottoms through divergences

Buy/Sell Aggregated Delta Pressure - InFinitoModified & Updated script from MARKET VOLUME by Ricardo M Arjona @XeL_Arjona that Includes Aggregated Volume , Delta Buy/Sell Pressure

Aggregation code originally from Crypt0rus

***The indicator can be used for any coin/symbol to aggregate volume , but it has to be set up manually***

***The indicator can be used with specific symbol data only by disabling the aggregation option, which allows for it to be used on any symbol***

- Calculated based on Aggregated Volume instead of by symbol volume . Using aggregated data makes it more accurate and allows to compare volume flow between different kinds of markets (Spot, Futures , Perpetuals, Futures+Perpetuals and All Volume ).

- As well, in order to make the data as accurate as possible, the data from each exchange aggregated is normalized to report always in terms of 1 BTC . In case this indicator is used for another symbol, the calculations can be adjusted manually to make it always report data in terms of 1 contract/coin.

- Buy/Sell Pressure: Smoothens the buy and sell volume into a signal for each. Which makes it easier to identify Buy and Sell Volume Flow.

- Buy/Sell Delta Pressure: Calculates the difference between Buy & Sell Pressure and plots a Delta signal that shows who is in control currently.

- Buy/Sell + Delta Pressure: Displays both Buy & Sell Pressure and Delta pressure. This can help to visualize who is in control but also how much pressure there is on each side.

- A Moving Average can be plotted to the Delta pressure. This, with confluence, can give great entries/exits

Things to look for:

- Divergences: If price keeps moving in one direction but the pressure to that side decreases it can be inferred that the move might slow down soon or revert. As well if pressure to one side increases but price does not react to it, it signals that the other side is stronger.

- MA/Zero Crossovers: Delta Pressure Crossover of its moving average or the 0 Line can indicate direction changes prematurely

Aggregated Volume Based Coloured Bars - InFinitoModified version of Kivanc's Volume Based Colored Bars that colors the bars with Aggregated Volume Data.

Aggregation code originally from Crypt0rus

***The indicator can be used for any coin/symbol to aggregate volume , but it has to be set up manually***

***The indicator can be used with specific symbol data only by disabling the aggregation option, which allows for it to be used on any symbol***

- Calculated based on Aggregated Volume instead of by symbol volume . Using aggregated data makes it more accurate and allows to see if the move was supported (Volume-wise) in all exchanges.

- As well, in order to make the data as accurate as possible, the data from each exchange aggregated is normalized to report always in terms of 1 BTC . In case this indicator is used for another symbol, the calculations can be adjusted manually to make it always report data in terms of 1 contract/coin.

MZ Adaptive Ichimoku Cloud (Volume, Volatility, Chikou Filter) This study is a functional enhancement to conventionally used Ichimoku Clouds . It uses particular effective adaptive parameters (Relative Volume Strength Index (MZ RVSI ), Volatility and Chikou Backward Trend Filter) to adapt dynamic lengths for Kijun-sen, Tenkan-sen, Senkou-span and Chikou .

This study uses complete available Ichimoku Clouds trading methodology to provide trade confirmations. Its still in experimental phase so will be updated accordingly.

ADAPTIVE LENGTH PARAMETERS

Relative Volume Strength Index (MZ RVSI )

For adaptive length, I tried using Volume and for this purpose I used my Relative Volume Strength Index " RVSI " indicator. RVSI is the best way to detect if Volume is going for a breakout or not and based on that indication length changes.

RVSI breaking above provided value would indicate Volume breakout and hence dynamic length would accordingly make Ichimoku Clouds more over-fitted to better act as support and resistance . Similar case would happen if Volume goes down and dynamic length becomes more under-fit.

Original RVSI Library and study can be found here:

Volatility

Average true range is used as volatility measurement and detection tool. Dual ATR condition would decide over-fitting or under-fitting of curve.

Chikou Backward Trend Filter

Chikou is basically close value of ticker offset to close and it is a good for indicating if close value has crossed potential Support/Resistance zone from past. Chikou is usually used with 26 period.

Chikou filter uses a lookback length calculated from provided lookback percentage and checks if trend was bullish or bearish within that lookback period.

Original Chikou Filter library and study can be found here:

ADAPTIVE ICHIMOKU CLOUD

Tenkan-Sen (Conversion Line)

Tenkan-sen is a moving average that is calculated by taking the average of the high and the low for the last nine periods conventionally but in this study its length is dynamically adapted based on Volume, Volatility and Chikou filter. Default adaption range is set to 9-30 which I found universally applicable to almost every market on all time-frames.

Kijun-Sen (Base Line)

The Kijun-Sen is usually considered a support/resistance line which also acts as an indicator of price movements in the future and takes a longer period into consideration, usually 26 periods compared to Tenkan-Sen’s nine periods is used conventionally. In this study, its length is set to vary in range of 20-60 based on adaptive parameters.

Senkou-Span (Leading Span)

Senkou-Span A : Senkou Span A is the average of the highs and lows of Tenkan-Sen and Kijun-Sen so it automatically adapts accroding to dynamic lengths of Tenkan and Kijun.

Senkou-Span B : Senkou Span B is usually calculated by averaging highs and lows of the past 52 periods and plotting it 26 points to the right but this study uses adaptive parameters to adapt its dynamic length in range of 50-120 which makes Kumo (Ichimoku Cloud) a better area for support and resistance. I don’t consider its necessary to adapt Kumo’s displacement to the right, so I used conventional 26 period as offset.

Chikou -Span (Lagging Span)

The Chikou Span, also known as the lagging span is formed by taking the price source and offsetting it back 26 periods to the left but I used adaptive length in range 26-50 which makes this tool a better option to check for Chikou -Price cross check in wide range.

TRADE SIGNALS & CONFIRMATIONS

Volume : RVSI used to detect volume breakout about given point. By default, On Balance Volume based RVSI is selected for all dynamic length adaption and also for trade confirmations.

Cross(Tenkan,Kijun) : Easiest way to detect trend as if Tenkan is above Kijun then market is uptrend and vice versa.

Volatility : High volatility is a good way to confirm if price is on the move or not.

Tenkan = Kijun : Because of a wide range of Tenkan and Kijun length; their value can become equal before reversal.

Chikou > Source : A very conventional way to detect price momentum as if Chikou is above price then market is in uptrend and vice versa.

Chikou Momentum : Another simpler way to represent Chikou > Source as if momentum of price source is uptrend then price will tend to follow.

Source > Kumo : Using the best tool of Ichimoku Clouds i.e. Kumo. If price crosses both Senkou-Span A & B then market has broken potential resistance leading to a good uptrend and vice versa.

Source > Tenkan : Better way to detect price trend in short term.

Chikou Backward Trend Filter : Different from Chikou >Source in a way that Chikou filter makes sure that price crosses highest/lowest within defined period.

CHARTING

Bars Coloring : Bars coloring is set as following :

src > tenkan-Sen and src > kijun-Sen : Strong uptrend detection and shown by green bars.

src < tenkan-Sen and src < kijun-Sen : Strong downtrend detection and shown by green bars.

src > tenkan-Sen and src < kijun-Sen : Better way to detect bottom reversals as if price comes above tenkan but remains below kijun; that’s early signs of recovery. Light red bars are used for this by default.

src < tenkan-Sen and src > kijun-Sen : Better way to detect top reversals as if price comes below tenkan but remains above kijun; that’s early signs of losing potential in uptrend. Dark Grey bars are used for this by default.

Kumo Coloring : Following steps are used to derive Kumo’s dynamic color:

Average of Senkou-span A and B is calculated.

RSI with 14 period of that average is calculated.

Gradient color based on calculated RSI values with 0-100 range is derived which is final Kumo color.

Chikou Span Coloring : Dynamic coloring from Chikou Filter is used as Indicator’s Chikou ’s color.

Signals Overlay : Red and Green small triangles are used as signals overlay.

Botvenko ScriptI just test&learn pine script...

Damn, what should I write here? So... Its just a differense between the logarithms of two prices of different periods (You can set the period you want)... And it looks really nice... Ahem...

I hope, you enjoy this piece of... Have a nice day, my dear.

Aggregated Money Flow Index - InFinitoModified Version of In-Built Money Flow Index Indicator. Aggregated Volume is used for it's calculation + a couple of other features.

Aggregation code originally from Crypt0rus

***The indicator can be used for any coin/symbol to aggregate volume , but it has to be set up manually***

***The indicator can be used with specific symbol data only by disabling the aggregation option, which allows for it to be used on any symbol***

- Calculated based on Aggregated Volume instead of by symbol volume . Using aggregated data makes it more accurate and allows to compare volume flow between different kinds of markets (Spot, Futures , Perpetuals, Futures+Perpetuals and All Volume ).

- As well, in order to make the data as accurate as possible, the data from each exchange aggregated is normalized to report always in terms of 1 BTC . In case this indicator is used for another symbol, the calculations can be adjusted manually to make it always report data in terms of 1 contract/coin.

- Added Moving Average ( SMA , EMA , WMA , RMA, VWMA ) that can be plotted to the MFI

- Added 10/90 level and 45/55 range level

Things to look for:

- Divergences: Can be a very good reversal signal

- MA crossovers & Oversold/Overbought levels crossover: With proper confluence, entering a position at MA crossover and exiting at oversold/overbought levels can give very good swing setups (Or scalps on LTF)

- Center range retests: Once in a trend, retesting the middle range can give very good entries and confirmations of the trend

- Confluence of the latter: In combination, if more than one of these occur at the same time it can give more clarity regarding the current state of the market.

Aggregated Chaikin Money Flow - InFinitoModified Version of In-Built Chaikin Money Flow Indicator. Aggregated Volume is used for it's calculation + a couple of other features.

Aggregation code originally from Crypt0rus

***The indicator can be used for any coin/symbol to aggregate volume , but it has to be set up manually***

***The indicator can be used with specific symbol data only by disabling the aggregation option, which allows for it to be used on any symbol***

- Calculated based on Aggregated Volume instead of by symbol volume. Using aggregated data makes it more accurate and allows to compare volume flow between different kinds of markets (Spot, Futures , Perpetuals, Futures+Perpetuals and All Volume ).

- As well, in order to make the data as accurate as possible, the data from each exchange aggregated is normalized to report always in terms of 1 BTC. In case this indicator is used for another symbol, the calculations can be adjusted manually to make it always report data in terms of 1 contract/coin.

- Added Moving Average ( SMA , EMA , WMA , RMA, VWMA) that can be plotted to the CMF

- Changed 0 line to a small range which tends to be more relevant than the 0 line. This range can be manually modified

Things to look for:

- Divergences: Can be a very good reversal signal

- MA crossovers: Can be a very good confluent Buy/Sell signal

- Center range retests: CMF is normally defined as bullish above 0 and bearish below 0. In this case it is above or below the middle range. Even if the start of the move was missed. The retest of the middle range can give very good entries.

- Confluence of the latter

Aggregated On Balance Volume - InFinitoOn Balance Volume calculated with aggregated and normalized volume data and a few other features:

Aggregation code originally from Crypt0rus

Candle Plotting code from LonesomeTheBlue

***The indicator can be used for any coin/symbol to aggregate volume, but it has to be set up manually***

As normal OBV, this indicator can be used to find divergences and to have an idea of volume flow. Using aggregated data makes it more accurate and allows to compare volume flow between different kinds of markets (Spot, Futures, Perpetuals, Futures+Perpetuals and All Volume).

As well, in order to make the data as accurate as possible, the data from each exchange aggregated is normalized to report always in terms of 1 BTC. In case this indicator is used for another symbol, the calculations can be adjusted manually to make it always report data in terms of 1 contract/coin.

Extra features:

- Based off LonesomeTheBlue, OBV can be plotted as candles and as Heiken Aishi candles (which give wick information)

- A Moving Average (SMA, EMA, WMA, RMA, VWMA) can be plotted to the OBV. This can be used as a confluent signal to enter a trade on a crossover or to know the strength of the current move.

- The OBV basis can be reset to 0 periodically, making it more oscillator-like and allowing to focus only on a certain period of time.