Crypto Volatility Bitcoin Correlation Strategy Description:

The Crypto Volatility Bitcoin Correlation Strategy is designed to leverage market volatility specifically in Bitcoin (BTC) using a combination of volatility indicators and trend-following techniques. This strategy utilizes the VIXFix (a volatility indicator adapted for crypto markets) and the BVOL7D (Bitcoin 7-Day Volatility Index from BitMEX) to identify periods of high volatility, while confirming trends with the Exponential Moving Average (EMA). These components work together to offer a comprehensive system that traders can use to enter positions when volatility and trends are aligned in their favor.

Key Features:

VIXFix (Volatility Index for Crypto Markets): This indicator measures the highest price of Bitcoin over a set period and compares it with the current low price to gauge market volatility. A rise in VIXFix indicates increasing market volatility, signaling that large price movements could occur.

BVOL7D (Bitcoin 7-Day Volatility Index): This volatility index, provided by BitMEX, measures the volatility of Bitcoin over the past 7 days. It helps traders monitor the recent volatility trend in the market, particularly useful when making short-term trading decisions.

Exponential Moving Average (EMA): The 50-period EMA acts as a trend indicator. When the price is above the EMA, it suggests the market is in an uptrend, and when the price is below the EMA, it suggests a downtrend.

How It Works:

Long Entry: A long position is triggered when both the VIXFix and BVOL7D indicators are rising, signaling increased volatility, and the price is above the 50-period EMA, confirming that the market is trending upward.

Exit: The strategy exits the position when the price crosses below the 50-period EMA, which signals a potential weakening of the uptrend and a decrease in volatility.

This strategy ensures that traders only enter positions when the volatility aligns with a clear trend, minimizing the risk of entering trades during periods of market uncertainty.

Testing and Timeframe:

This strategy has been tested on Bitcoin using the daily timeframe, which provides a longer-term perspective on market trends and volatility. However, users can adjust the timeframe according to their trading preferences. It is crucial to note that this strategy does not include comprehensive risk management, aside from the exit condition when the price crosses below the EMA. Users are strongly advised to implement their own risk management techniques, such as setting appropriate stop-loss levels, to safeguard their positions during high volatility periods.

Utility:

The Crypto Volatility Bitcoin Correlation Strategy is particularly well-suited for traders who aim to capitalize on the high volatility often seen in the Bitcoin market. By combining volatility measurements (VIXFix and BVOL7D) with a trend-following mechanism (EMA), this strategy helps identify optimal moments for entering and exiting trades. This approach ensures that traders participate in potentially profitable market moves while minimizing exposure during times of uncertainty.

Use Cases:

Volatility-Based Entries: Traders looking to take advantage of market volatility spikes will find this strategy useful for timing entry points during market swings.

Trend Confirmation: By using the EMA as a confirmation tool, traders can avoid entering trades that go against the trend, which can result in significant losses during volatile market conditions.

Risk Management: While the strategy exits when price falls below the EMA, it is important to recognize that this is not a full risk management system. Traders should use caution and integrate additional risk measures, such as stop-losses and position sizing, to better manage potential losses.

How to Use:

Step 1: Monitor the VIXFix and BVOL7D indicators. When both are rising and the Bitcoin price is above the EMA, the strategy will trigger a long entry, indicating that the market is experiencing increased volatility with a confirmed uptrend.

Step 2: Exit the position when the price drops below the 50-period EMA, signaling that the trend may be reversing or weakening, reducing the likelihood of continued upward price movement.

This strategy is open-source and is intended to help traders navigate volatile market conditions, particularly in Bitcoin, using proven indicators for volatility and trend confirmation.

Risk Disclaimer:

This strategy has been tested on the daily timeframe of Bitcoin, but users should be aware that it does not include built-in risk management except for the below-EMA exit condition. Users should be extremely cautious when using this strategy and are encouraged to implement their own risk management, such as using stop-losses, position sizing, and setting appropriate limits. Trading involves significant risk, and this strategy does not guarantee profits or prevent losses. Past performance is not indicative of future results. Always test any strategy in a demo environment before applying it to live markets.

Usdt

Crypto Stablecoin Supply - Indicator [presentTrading]█ Introduction and How it is Different

The "Stablecoin Supply - Indicator" differentiates itself by focusing on the aggregate supply of major stablecoins—USDT, USDC, and DAI—rather than traditional price-based metrics. Its premise is that fluctuations in the total supply of these stablecoins can serve as leading indicators for broader market movements, offering traders a unique vantage point to anticipate shifts in market sentiment.

BTCUSD 6h for recent bull market

BTCUSD 8h

█ Strategy, How it Works: Detailed Explanation

🔶 Data Collection

The strategy begins with the collection of the closing supply for USDT, USDC, and DAI stablecoins. This data is fetched using a specified timeframe (**`tfInput`**), allowing for flexibility in analysis periods.

🔶 Supply Calculation

The individual supplies of USDT, USDC, and DAI are then aggregated to determine the total stablecoin supply within the market at any given time. This combined figure serves as the foundation for the subsequent statistical analysis.

🔶 Z-Score Computation

The heart of the indicator's strategy lies in the computation of the Z-Score, which is a statistical measure used to identify how far a data point is from the mean, relative to the standard deviation. The formula for the Z-Score is:

Z = (X - μ) / σ

Where:

- Z is the Z-Score

- X is the current total stablecoin supply (TotalStablecoinClose)

- μ (mu) is the mean of the total stablecoin supply over a specified length (len)

- σ (sigma) is the standard deviation of the total stablecoin supply over the same length

A moving average of the Z-Score (**`zScore_ma`**) is calculated over a short period (defaulted to 3) to smooth out the volatility and provide a clearer signal.

🔶 Signal Interpretation

The Z-Score itself is plotted, with its color indicating its relation to a defined threshold (0.382), serving as a direct visual cue for market sentiment. Zones are also highlighted to show when the Z-Score is within certain extreme ranges, suggesting overbought or oversold conditions.

Bull -> Bear

█ Trade Direction

- **Entry Threshold**: A Z-Score crossing above 0.382 suggests an increase in stablecoin supply relative to its historical average, potentially indicating bullish market sentiment or incoming capital flow into cryptocurrencies.

- **Exit Threshold**: Conversely, a Z-Score dropping below -0.382 may signal a reduction in stablecoin supply, hinting at bearish sentiment or capital withdrawal.

█ Usage

Traders can leverage the "Stablecoin Supply - Indicator" to gain insights into the underlying market dynamics that are not immediately apparent through price analysis alone. It is particularly useful for identifying potential shifts in market sentiment before they are reflected in price movements. By integrating this indicator with other technical analysis tools, traders can develop a more rounded and informed trading strategy.

█ Default Settings

- Timeframe Input (`tfInput`): Allows users to specify the timeframe for data collection, adding flexibility to the analysis.

- Z-Score Length (`len`): Set to 252 by default, representing the period over which the mean and standard deviation of the stablecoin supply are calculated.

- Color Coding: Uses distinct colors (green for bullish, red for bearish) to indicate the Z-Score's position relative to its thresholds, enhancing visual clarity.

- Extreme Range Fill: Highlights areas between defined high and low Z-Score thresholds with distinct colors to indicate potential overbought or oversold conditions.

By integrating considerations of stablecoin supply into the analytical framework, the "Stablecoin Supply - Indicator" offers a novel perspective on cryptocurrency market dynamics, enabling traders to make more nuanced and informed decisions.

STABLECOINS DEPEG FINDERSTABLECOINS DEPEG FINDER

With this script, you will be able to understand how DePeg in stablecoins USDT, USDC, and FDUSD can influence the TOTAL Market Cap.

WHAT IS DEPEG?

DePeg occurs when a stablecoin loses its peg. It can't maintain the $1.00 price for a while (or anymore). Traders can use DePeg for high-quality trading both in Crypto and Stablecoins. Usually, a Negative DePeg (e.g., 0.98%) means you can buy Stablecoins at a 2% discount. This translates to a 2% gain when the Stablecoin returns to its peg. Additionally, a Positive DePeg could be a good moment for selling or withdrawal.

WHY DEPEG MATTERS IN THE CRYPTO SPACE

Depeg in Crypto markets is primarily a matter of "earning from small differences in peg." If well understood, it can help traders and analysts to spot whales' next moves. Usually, when a negative DePeg (below $1) occurs, it means whales are in a hurry to sell their Stablecoin tokens for Crypto Tokens. In this hurry, they sell Stablecoins at a discount. In the short term, a Crypto pump is likely planned, and they buy the next x100 token.

On the other hand, a positive DePeg (above $1) means whales are in a hurry to convert tokens into Stablecoins because they are heavily selling Crypto Tokens. This leads to them paying more for Stablecoins. Positive Depeg is more interesting than Negative DePeg. Usually, it signifies an important sell-off in the crypto environment, creating high tension to safeguard your hard-earned money. Whales hurry to convert altcoins and tokens into stablecoins, causing a Positive Depeg (they are willing to pay more to be safe). Positive DePeg is plotted as Intense Background Color.

Identifying 'areas' where this occurs could help traders and analysts understand this highly manipulative market better and take positions.

THE SCRIPT

This script will help traders and analysts understand when USDT, USDC, and FDUSD depegged and how the crypto market reacted. It comes with the possibility to check and plot backgrounds when there's Positive DePeg or Negative DePeg for USDT, USDC, or FDUSD.

It's pretty useful for data analysis. In the bottom-right part, you can check the actual stablecoin peg for the three Stablecoins:

- Highest Positive DePeg in a given BackTrace

- Average Positive DePeg in a given BackTrace

- Actual Peg for USDT, USDC, FDUSD

- Average Negative DePeg in a given BackTrace

- Lowest Negative DePeg in a given BackTrace

UNDERSTANDING THE BACKGROUND PLOT

NEGATIVE DEPEG

For each Stablecoin, negative DePeg is plotted as Translucent Background Color: USDT lime, USDC aqua, FDUSD grey. You can choose from settings whether it needs to be enabled or disabled for each token.

POSITIVE DEPEG

For each Stablecoin, positive DePeg is plotted as Intense Background Color: USDT lime, USDC aqua, FDUSD grey. You can choose from settings whether it needs to be enabled or disabled for each token.

USE CASE EXAMPLES

With this script you can plan to be alerted WHEN one of those stablecoin are depegging over a threesold. Than you can act accordingly.

BUY OPPORTUNITY

Let' suppose you want to see how USDC can influence Crypto Price when deppeged

I've setup signal to be plotted only for negative Depeg when USDC goes below 0.998. As you can see it was a very good and nice buy area for the entire crypto market

SELL OPPORTUNITY

Spot a selling point could be harder. In the example below let's see how USDC positive DePeg can show signal of Crypto dump earlier in daily TF

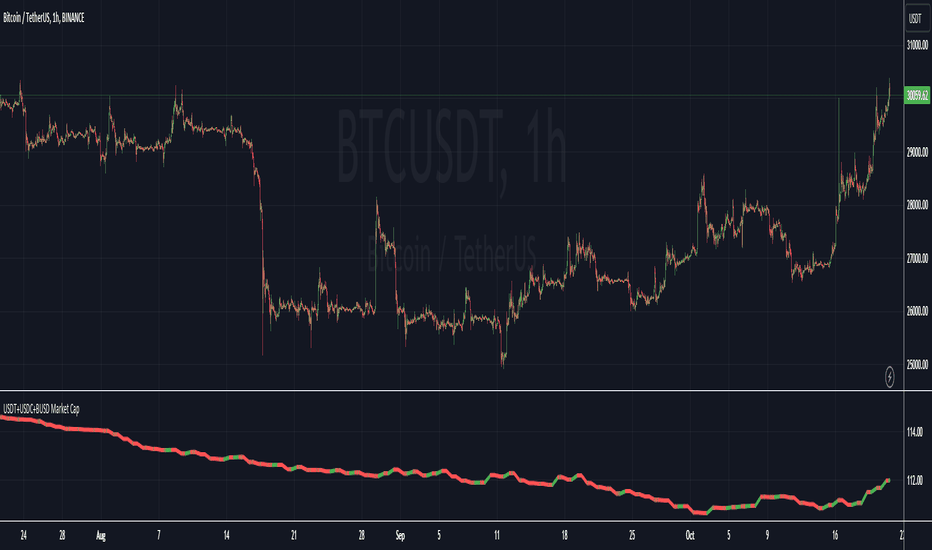

USDT+USDC+BUSD Market CapThis Pine Script indicator visualizes the combined market capitalization of three prominent stablecoins: USDT, USDC, and BUSD, on a daily basis.

It fetches the daily closing market caps of these stablecoins and sums them. The resulting line graph is displayed in its own separate pane below the main price chart.

The line is color-coded: green on days when the market cap is increasing compared to the previous day, and red when it's decreasing.

Stablecoins market capA simple indicator that displays either the aggregated market cap of the top five stablecoins, or it displays all coins at once (look in the settings).

Because of limitations with the sourced data the indicator only works on the daily timeframe or higher.

Fierytrading: Volatility DepthDear Tradingview community,

I'd like to share one of my staple indicators with you. The volatility depth indicator calculates the volatility over a 7-day period and plots it on your chart.

This indicator only works for the DAILY chart on BTC/USD.

Colors

I've color coded the indicator as follows:

- Red: Extreme Volatility

- Orange: High Volatility

- Yellow: Normal Volatility

- Green: Low Volatility

Red: extreme changes in price. Often during local tops and bottoms.

Orange: higher than average moves in price. Often before or after a "red" period. Often seen in the middle of bear or bull markets.

Yellow: normal price action. Often seen during early stage bull-markets and late stage bear-markets.

Green: very low price movement. Often during times of indecision. Once this indicator becomes green, you can expect a big move in either direction. Low volatility is always followed by high volatility.

In a long-term uptrend, a green period often signals a bullish break out. In a long-term downtrend it often signals a bearish break out.

How to use

Save the indicator and apply it to your chart. You can change the length in the settings, but it's optimized for 7 days, so no need to change it.

I've build in alerts for all 4 different volatility periods. In most cases, the low volatility alert is enough.

Good luck!

USDT Inflow TrackerUSDT INFLOW TRACKER

What does this script do? It looks for important inflow from USDT and write it below or above your chart.

Does it matter? Yes because Tether with planned USDT inflow highly manipulate the crypto market.

With this simple script you can study what and when something strange is going to happen on your favourite token.

HOW IT WORKS?

Pretty simple. It just continuosly check USDT (and USDC) Market Cap and verify if the last candle is way higher than last one. If it was way higher than expected it plot a green square and write a note with the total Inflow of USDT in the crypto market (not specifcially for your token)

Now you can see when an important inflow is done and start to plan your entry and exit strategy in the crypto market.

AUTOSET

With Autoset you can rely on standard values

5min TF : Inflow greater than of 15 mln (in 1 candle)

30min TF : Inflow greater than of 150 mln (in 1 candle)

60min TF : Inflow greater than of 300 mln (in 1 candle)

1Day TF : Inflow greater than of 900 mln (in 1 candle)

So you can check your favourite coin in no time looking for a good trading position

MANUAL SETTINGS

Otherwise you can set directly your Inflow to track based on your needs.

In the example below I've set to check everytime an Inflow of 25mln USDT or greater was done.

As you can see it highly influence the relative token.

BTC 4h bot 2.0 AlertsThis is Alert version of BTC 4h bot 2.0.

Optimized for pairs BTC vs stablecoins, 4h timeframe.

HOW IT WORKS:

Script is based on the fact that there are certain phases of the market when there is a greater probability that BTC will go to one side or the other. To evaluate which phase we are in, the script uses "Main trend" and "Confirmation signals".

Main trend

- Is composed of a combination of several supertrends and moving averages. A Supertrend is a trend following indicator that helps in identifying whether we are in an uptrend or a downtrend. A higher factor is used to capture the main trend and not just small movements. In case the market goes sideways, the Supertrend does not work well, so it is a combination of multiple supertrends along with moving averages to differentiate a real strong trend from a range.

- It can be seen on the graph as a thick solid line.

- In an uptrend is green, in a downtrend red, gray represents the neutral zone.

Confirmation signals

- Are several script-evaluated indicators such as RSI , MACD , ADX and others, which serve to confirm the trend. In this case, it is the opposite way to the Main trend. Confirmation signals are used here to detect small movements. They are trying to capture bullish and bearish price momentum.

- On the graph they are seen as dashed lines above or below the Main trend (in the gray zone they are in the middle).

- It indicates only two signals, green for buy and red for sell.

HOW TO USE IT:

if the Main trend and Confirmation signals are of the same color, it will send a buy or sell signal, depending on which phase of the trend it is in. If the Main trend is e.g. in an uptrend and the market is going up, Confirmation signals should generate a lot of signals. But if the market starts to go in the opposite direction, Confirmation signals should generate fewer signals or none at all, thus reducing the number of wrong trades. In the gray zone of the Main trend it does not open positions.

To close position is possible to use stop loss and take profit or alternative could be to set very high TP value, thereby letting the script close the positions by itself by Stop Long or Stop Short.

The recommended setting is:

TP: 3.9%

SL: 4.7%.

In this case, it is a Alert version, where can be seen all the signals, which the script generates.

Green triangels indicate open Long.

Red triangels indicate open Short.

Small blue triangels indicate Stop Long position.

Small orange triangels indicate Stop Short position.

Signal is valid after bar is closed, so do not open a position before.

Script works well on Bitstamp, but also other exchanges with pair BTC/USD or BTC/stablecoins.

The script works consistently well over a long period of time, using past probabilities, but this does not guarantee future results.

BTC 4h bot 2.0 StrategyThis is Strategy version of BTC 4h bot 2.0.

Optimized for pairs BTC vs stablecoins, 4h timeframe.

HOW IT WORKS:

Script is based on the fact that there are certain phases of the market when there is a greater probability that BTC will go to one side or the other. To evaluate which phase we are in, the script uses "Main trend" and "Confirmation signals".

Main trend

- Is composed of a combination of several supertrends and moving averages. A Supertrend is a trend following indicator that helps in identifying whether we are in an uptrend or a downtrend. A higher factor is used to capture the main trend and not just small movements. In case the market goes sideways, the Supertrend does not work well, so it is a combination of multiple supertrends along with moving averages to differentiate a real strong trend from a range.

- It can be seen on the graph as a thick solid line.

- In an uptrend is green, in a downtrend red, gray represents the neutral zone.

Confirmation signals

- Are several script-evaluated indicators such as RSI , MACD , ADX and others, which serve to confirm the trend. In this case, it is the opposite way to the Main trend. Confirmation signals are used here to detect small movements. They are trying to capture bullish and bearish price momentum.

- On the graph they are seen as dashed lines above or below the Main trend (in the gray zone they are in the middle).

- It indicates only two signals, green for buy and red for sell.

HOW TO USE IT:

if the Main trend and Confirmation signals are of the same color, it will send a buy or sell signal, depending on which phase of the trend it is in. If the Main trend is e.g. in an uptrend and the market is going up, Confirmation signals should generate a lot of signals. But if the market starts to go in the opposite direction, Confirmation signals should generate fewer signals or none at all, thus reducing the number of wrong trades. In the gray zone of the Main trend it does not open positions.

To close position is possible to use stop loss and take profit or alternative could be to set very high TP value, thereby letting the script close the positions by itself.

The default setting is:

TP: 3.9%

SL: 4.7%.

In this case, it is a strategy to find out how the script worked in the past period. The longest period in which it is possible to test BTCUSD is on the Bitstamp exchange. The script works consistently well over a long period of time, using past probabilities, but this does not guarantee future results.

Stablecoins DominanceStablecoins Dominance

The purpose of the script is to show Stablecoin's strength in the crypto markets.

5 Largest Stablecoins divided by Total Market Cap

Crypto Map Dashboard v1.0🔰Overview

Charts are an essential part of working with data, as they are a way to condense large amounts of data into an easy to understand format. Visualizations of data can bring out insights to someone looking at the data for the first time, as well as convey findings to others who won’t see the raw data. There are countless chart types out there, each with different use cases. Often, the most difficult part of creating a data visualization is figuring out which chart type is best for the task at hand.

What are the types of metrics, features, or other variables that you plan on plotting? Although it depended on some multiple factors!

But my choices of the chart type for this Crypto datas was Pie chart or Donut char for crypto dominances ,and Colum (Bar) chart for Total MarketCaps .

The audiences that I plan on presenting this for them could be all tradingviewrs , especially crypto lovers ,or those who just aim to have an initial exploration for themselves ,like me!

so this indicator mostly could be an educational indicator script for pine coders !

We can use the " Crypto Map Dashboard " indicator to Get an quick overview of the crypto market and monitor where the smart money Flow changing by comparing the dominances and totals Caps .

In general, it consists of 4 parts:

✅1 =>> Table1 : If you like to see and compare and monitor the changes of dominances of (Bitcoin, Ethereum, Usdt , Usdc , etc.) and their market cap in different times you can see the table on The upper-right corner.

✅2 =>> Table2: Also, in the table lower-right corner, you can see the changes of the totals(Total, Total2 , Total3 and TotalDefi) in the same time periods.

✅3 =>> pie chart or donut chart: By viewing this , you understand better about Table1 Datas, that it depicts exactly how Dominance is distributed and specialized.

✅4 =>> column chart (bar chart) : And in the last you can clearly compare the total marketcaps and see how far they are from their ATHs.

You also can even notice the entry and exit of liquidity from the crypto market!

I must also mention that I am definitely still a beginner compared to more experienced pine coders, and there may be some bugs in my codes and calculations, but I am an open person and I welcome your comments ,Also Let me know if you have any questions.

Lots of Love to all tradingviewers and pineCoder ,Cheers!💚❤️💙

Stablecoins CorrelationThe indicator shows the correlation between stablecoins and bitcoin by means of liquidity flowing from stables to crypto and back. Where the indicator has highs, the bitcoin is usually the bottom and vice versa.

Stablecoin Bias [Moto]Hello traders,

This script provides a background color for the major stablecoins with directional bias above and below 1.

Generally, it's considered market beneficial if USDT is over one , and generally a market deficit if USDT is under 1. These are of course theoretical and shouldn't be taken solely into account.

Indicator includes biases for:

- USDT

- USDC

- DAI

- BUSD

- Average of two major stables

Warning: Tradingview's background color function seems graphically intensive. I don't recommend more than one or two biases active simultaneously, as it will slow down your chart and create mouse lag.

Cheers

KINSKI USDT Market Cap DominanceUSDT dominance charts are rare to find as almost everyone is fixated on BTC dominance. Bitcoin dominance gives us insight into investors' preferences when they have a choice between BTC and thousands of altcoins.

This oscillator gives insight into the state of the coin market. When people exchange their digital currencies like BTC and Altcoins for USDT, there is low confidence in the market. The opposite is true when BTC and Altcoins are bought because market sentiment is high.

So when USDT dominance rises, cryptocurrency prices fall, but when their dominance falls, cryptocurrency prices rise.

Features

Can be displayed as a moving average (default) or histogram.

Choice between 'CRYPTOCAP:USDT', 'CRYPTOCAP:USDT.D', 'CRYPTOCAP:OTHERS.D' => CRYPTOCAP:USDT.D is default.

Smoothing types Selectable

Upward and downward trend of MA line can be activated

Extensive style settings

USDT/USD PremiumKraken + FTX USDT premium indicator.

Inspired by John J Brown, forked from IAmSatoshi (Migrated to V5 and few changes + more markets coming).

John J Brown: "

USDt premium/discount exist because of conversion fees.

It is a good market indicator:

If USDt>USD, then market is growing and in need of liquidity;

If USDt<USD, then market is shrinking and has excess liquidity."

WhaleCrew Crypto Open InterestUse Crypto Open Interest Data available on TradingView to your advantage.

Features

Auto-Detect Symbol (based on chart)

Preset Symbols (BTC, ETH, BNB, XRP, LUNA, ADA, SOL, AVAX and DOT)

Exchanges ( Binance and BitMex )

Inverse and USDT Pairs

Override Data Option to use any OI Data on TradingView

Customizable Candles

WhaleCrew Binance Open InterestShows Open Interest of ANY Binance pair (BTCUSD, ETHUSD, ADAUSD, ...).

Inverse and USDT pairs

Preset-Pairs (BTC, ETH, XRP, ADA, SOL, DOT, ...)

Custom Candle Colors (candles can be turned off)

Linear trendSimple way how to use Linear Regression for trading.

What we use:

• Linear Regression

• EMA 200 as a trend filter

Logic:

Firstly we make two different linear regression movings as oscillator. For this we need to subtract slow moving from fast moving, so we get the single moving around zero. This is the green/red line which appears on the chart.

The trade open when LR cross over the threshold. The trade close when LR cross under the threshold below. Crossing over the threshold is the same as faster moving cross over slower moving.

Also we use EMA as a filter. The trades would be only when the price is over than EMA 200.

SSR - Stablecoin Supply Ratio - Bitcoin - CryptocurrencyThe Stablecoin Supply Ratio (SSR) is the ratio between Bitcoin supply and the supply of stablecoins, denominated in BTC.

When the SSR is low, the current stablecoin supply has more "buying power" to purchase BTC. It serves as a proxy for the supply/demand mechanics between BTC and USD.

MA&AOThat is quit simple strategy, which combines only two indicators: AO and MA. The logic of trades is also clear, when AO is bullish; slow ma is under the close price; fast ma > slow ma - buy.

Full Crypto Swing Strategy ALMA Cross with MACDThis is a full crypto swing strategy designed.

From my testing it looks like it perform the best on timeframes 4h +.

The below example has been adapted to BNB/USDT, using the entire period since 2017 until present day, with a comission of 0.03% ( which is the comission for the futures on binance).

Its components are :

ALMA Fast

ALMA Slow

MACD Histogram

Rules for entry

For long, we have a crossover of the fast alma with the slow one and the histogram is ascending.

For short, we have a crossunder of the fast alma with the slow one and the histogram is descending.

Rules for exit

We exit based on a risk management system for TP and SL, or when we receive an opposite condition than the initial one.

Regarding risk management

0.05 = 5% movement

2 = 200% movement

0.001 = 0.1% movement

If you have any questions, let me know !

Aroon Strategy long onlyThis is a simple long only strategy made of Aroon and Least Square moving average.

The rules are simple:

Long entry = crossover of upper part with the lower part from aroon and close of the candle is above the moving average

Long exit = crossunder of upper part with the lower part from aroon and close of the candle is below the moving average

IF you have any questions let me know !

Tether DataCONCEPT

A toolkit with a bunch of different metrics for the widely used stablecoin called tether (USDT).

It's very easy to use, just select in the settings what data you want to look at.

FEATURES

Value index.

The "index" setting shows a volume weighted index of different exchanges to give the most accurate average USDT/USD price.

Market cap.

Very straight forward. This shows you the current tether market cap.

Market cap changes.

This gives you a better visualization of increases (or sometimes decreases) in the tether market cap.

Dominance

This shows tether dominance in the market, same concept as bitcoin dominance.

It compares the USDT mcap to the total crypto mcap and then shows the dominance percentage wise.

It's considered bearish when USDT dominance goes up because it means people want to get out of coins and flee to something more stable.

BTC buying power.

This compares the tether market cap and compares it to the bitcoin market cap to give you an idea of how much BTC buying power has in theory.

The higher this ratio the more bitcoin could be bought with all the tether available.

You'll notice that this often looks very similar to the dominance metric.

Exchanges.

The tether price of multiple exchanges.

In the settings you can select which ones you want the indicator to show.

TRADING

I can't tell you exactly how useful this indicator is for trading, I don't have strong opinions on it.

Some people think a high tether price and dominance is bearish.

Some think the market cap increasing (because of new prints) is bullish.

The buying power metric can give you an idea of how much dry powder there is in the market.

The exchanges metric shows you where you can get the cheapest USDT...

Just some ideas.

This indicator is free so if you add it to your favourites you can start using it immediately (it's possible that you have to refresh Tradingview before it actually works).

Source code is visible for learning purposes.

Cheers.