Full CRYPTO pack macd, rsi, obv, ema strategyThis is a simple, yet very efficient crypto strategy, adapted to 4h time frame, on big coins like ETH and BTC. However it can be adapted to other markets, timeframes etc

For this strategy I use a combination of a trend line, an oscillator, price action and volume.

This strategy has both the opportunity to go long and short.

As well, it has a leverage simulator .

The rules are the next ones:

Long : we check that current candle is ascending and above the moving average, the macd is in positive range, rsi is below overbought level and volume is bigger than the moving avg of volume.

For short, we have the opposite long rules.

If you have any questions, please let me know !

Акции

MACD oscillator with EMA alert version 4HThis is the study/indicator alert version of the macd + ema strategy.

The strategy details are the following :

Is a simple, yet efficient strategy, which is made from a combination of an oscillator and a moving average.

Its setup for 4h candles with the current settings, however it can be adapted to other different timeframes.

It works nicely ,beating the buy and hold for both BTC and ETH over the last 3 years.

As well with some optimizations and modifications it can be adapted to futures market, indexes(NASDAQ, NIFTY etc), forex( GBPUSD ), stocks and so on.

Components:

MACD

EMA

Time condition

Long/short option

For long/exit short we enter when we are above the ema , histogram is positive and current candle is higher than previous.

For short /exit long , when close below ema , histo negative and current candles smaller than previous

If you have any questions please let me know !

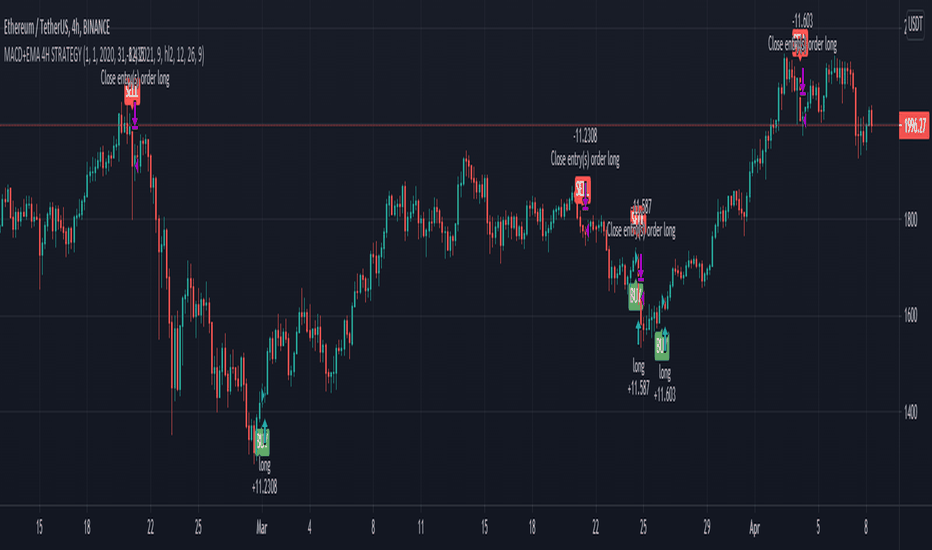

MACD oscillator with EMA strategy 4H This is a simple, yet efficient strategy, which is made from a combination of an oscillator and a moving average.

Its setup for 4h candles with the current settings, however it can be adapted to other different timeframes.

It works nicely ,beating the buy and hold for both BTC and ETH over the last 3 years.

As well with some optimizations and modifications it can be adapted to futures market, indexes(NASDAQ,NIFTY etc), forex(GBPUSD), stocks and so on.

Components:

MACD

EMA

Time condition

Long/short option

For long/exit short we enter when we are above the ema, histogram is positive and current candle is higher than previous.

For short /exit long , when close below ema, histo negative and current candles smaller than previous

If you have any questions please let me know !

Volume RSI Crypto This is a special version RSI, in this case , I am using the volume, which is measuring the speed and change of volume to the price both up and down size.

Volume RSI attempts to gauge price trend changes via changes in bullish and bearish movements.

Its formula is :

VoRSI = 100 - 100 / (1 + VoRS)

where VoRS is Volume Relative Strength over specified period which is calculated as a ratio between averages of Up-Volumes and Down-Volumes:

VoRS = (Average Up-Volume) / (Average Down-Volume)

The logic for this strategy is simple

We entry long when we have a crossover with the Overbought level and we entry short when we have a crossunder with oversold level.

If you have any questions, please let me knw !

MasterChartsTrading Price Action Indicators-6.0These are upgraded MasterChartsTrading Price Action Indicators with future projections

---

How to understand price action.

It is very easy to read price action if you have a reference point. These support/resistance lines are there to help you read where the buyers and sellers are likely to make a stand.

You can also think of these indicators as moving pivot points .

MasterChartsTrading Price Action Indicators show good price levels to enter or exit a trade.

The Blue indicator line serves as a Bullish Trend setter.

If your instrument closes above the Blue line, we think about going Long (buying).

For commodities and Forex, when your trading instrument closes below the Red line, we think about Shorting (selling).

For Stocks, I prefer to use the Yellow line as my Bearish Trend setter (on Daily charts ). A stock has to close below the Yellow line first, then rally towards the Red line and top out there. This is where I would short it.

Financial Highlights [Fundamentals]█ OVERVIEW

This indicator plot basic key financial data to imitate the presentation format of several popular finance site, make it easier for a quick glance of overall company financial health without switching tabs for every single stocks.

█ Financial Data Available:

- Revenue & PAT (Profit after Tax)

- Net Profit Margin (%)

- Gross Profit Margin (%)

- Earnings Per Share (EPS)

- Dividend

█ Features:

- Toggle between Quarter/Annual Financial Data (Notes: For Dividends, it will always be plotted based on Annual data, at Financial Year ending period)

- Options to plot at either at Quarter/Yearly ending period OR Financial Data published date

█ Limitation

- The accuracy of the data subject to Tradingview's source, but from my observation it's accurate 95% of the time

- Recently published data might not be available immediately. e.g. MYX exchange tends to have 1-3 days lag

- More information on Tradingview's financial data can be read here -> www.tradingview.com

█ Disclaimer

Past performance is not an indicator of future results.

My opinions and research are my own and do not constitute financial advice in any way whatsoever.

Nothing published by me constitutes an investment recommendation, nor should any data or Content published by me be relied upon for any investment/trading activities.

I strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Any ideas to further improve this indicator are welcome :)

NSDT Pre-Market Breakout LevelsA simple way to identify potential breakouts at the New York market open. This indicator plots the high and low of the New York Pre-Market, providing a great visual of a potential breakout levels.

[astropark] price levelsDear Followers,

today another awesome Analysis Tool, that you can use in your trading journey: Price Levels !

Are you a range trading player? a scalper? or maybe a day-trader or a swing-trader? This is for you then. Indeed it's for everyone.

This indicator works on every timeframe, market and pair.

It keeps track of recent important levels generated by price action:

Monday high, low and middle range level

Tuesday high and low

Wednesday high and low

Thursday high and low

Friday high and low

Weekly open, high and low

Monthly open, high and low

Yearly open, high and low

Previous weekly open, high and low

Previous monthly open, high and low

Previous yearly open, high and low

You can:

choose price levels to hide and show

change each level color / thickness / display style (solid or dotted)

choose to show or hide price labels and change their size

Why such indicator should be helpful? How can I use it to do profit?

In multiple ways! Let's talk about Monday Range :

when Monday range is formed, price acceptance below Monday low is a bearish signal, so will more likely want to short / sell

equally price acceptance above Monday high is a bullish signal, so will more likely want to long / buy

it can happen that Monday high is simply retested, with price not being able to stay above it: this is called a retest (in case of a simple wick) or a deviation (in case of price staying above the level just for some candles) and what usually happens is price falling back to Monday middle range level and even back to Monday low.

the opposite can happen of course: you will become bullish if Monday low is tested or a deviation appears below Monday low: price tends to bounce on such occasions back to Monday middle range or even Monday high

Tuesday is usually a marker day within a trading week:

if Monday was pretty bullish, Tuesday high may mark the weekly top, following some red days

if Monday was pretty bearish, Tuesday low may mark the weekly bottom, following some green days

Thursday is the day when big players start to take profits, as the trading week is going to end the next day, so in an all-green week Thursday may be a red one, while in an all-red week it may be a bullish day

Thursday is the day when big players start to take profits, as the trading week is going to end the next day:

in an all-green week, Thursday may be a red one and it's low tends to mark the weekly low

while in an all-red week, it tends to be a bullish day, so here you will refill your shorts for the next blooding day

Let's talk now about the Weekly, Monthly and Yearly price levels : here it is the interesting part for Swing Traders

Weekly open is usually a defining level: on retest, if price keeps staying below then more downside is expected, if price keeps staying above then more upside is expected (similarly to what we said about Monday high and low)

Monthly and Yearly open price levels are usually a "no-brainer" buy level in a bullish trend or equally a sell level in a bearish trend: in this scenarios, a deviation structure is even more powerful in term of price reaction and efficiency

We trade Weekly, Monthly and Yearly high and low price levels as explained for the Monday high and low, but with a swing traders perspective (so a medium-long term trade)

Previous Weekly/Monthly/Yearly price levels are usually very useful as targets in your trades

Here below some screenshots that resumes what said above.

Weekly Open as support (bullish) and Monday High deviation (bearish)

Tuesday High, Weekly Open failing as support: bearish

Monday Low deviation (bullish)

Price Acceptance above Monday High and Weekly Open (bullish)

Yearly Open retests as buy opportunities

Deviation below Monthly Open (bullish), Price Acceptance below Monthly and Yearly Open (bearish)

This is a premium indicator , so send me a private message in order to get access to this script.

Custom Screener with Alerts V2 [QuantNomad]TradingView just recently announced the alert() function that allows you to create dynamic alerts from both strategies and studies.

So I decided to update custom screener I published before. It was based on alerts from orders in strategies, that was the only way to create dynamic alerts in PineScript at that point.

With the alert() function code become cleaner and more readable.

It works for up to 40 symbols at the same time.

You can create an alert from it easily by selecting screener name from the list and then selecting "Any alert() function call".

No additional configuration is required, message and alert on close I set up in the code.

I created as an example a screener that tracks both overbought (RSI > 70) and oversold stocks (RSI < 30).

To create your own screener you have to change only screenerFunc().

By design it should output 2 values:

cond - True/False Boolean variable. Should this instrument be displayed in the screener?

value - Additional numeric value you can display in your screener. I display RSI level for selected stocks for example.

Link to the old screener:

Disclaimer

Please remember that past performance may not be indicative of future results.

Due to various factors, including changing market conditions, the strategy may no longer perform as good as in historical backtesting.

This post and the script don’t provide any financial advice.

CRYPTOOO FOX (Alert of Trading System)CRYPTOOO FOX (Alert of Trading System) .

---DISCRIPTION---

How Indicator Work :

--Indicator is working on higher time frame so i use two high time frame

the higher is ( 2 H or 3 H or 4 H or 8 H or 12 H or Daily ) and the highest is ( Daily ) Time frame .

-- When the higher time frame cross over the Daily time frame( the Highest ) this mean the TREND and

the PRICE also going UP this strategy is going to long position ( Buy position ) .

-- When the higher time frame cross under Daily time frame( the Highest ) this mean the TREND and

the PRICE also going DOWN strategy going to ( close position ) .

-- Notes :

--Indicator use some averages to calculate the higher time frame .

--Indicator use parabolic indicator to filter entries which name is ( Filter )

--Indicator use one more candle close to confirm entry ( Filter 2 )

--This the best time frame ( HIGHER , HIGHEST ) in this strategy in profit and draw down .

--Indicator is working only in Long position i am not recommend to use it in short positions .

--THIS IS NO REPAINT Indicator .

--DON'T use it in DAILY time frame

--I recommend so mush to use take profit and stop loss although the low draw down but some time

the market have a huge movements .

CRYPTOOO FOX (Trading System)CRYPTOOO FOX (Trading System)

---DISCRIPTION---

How Strategy Work :

--Strategy is working on higher time frame so i use two high time frame

the higher is ( 2 H or 3 H or 4 H or 8 H or 12 H or Daily ) and the highest is ( Daily ) Time frame .

-- When the higher time frame cross over the Daily time frame( the Highest ) this mean the TREND and

the PRICE also going UP this strategy is going to long position ( Buy position ) .

-- When the higher time frame cross under Daily time frame( the Highest ) this mean the TREND and

the PRICE also going DOWN strategy going to ( close position ) .

-- Notes :

--Strategy use some averages to calculate the higher time frame .

--Strategy use parabolic indicator to filter entries which name is ( Filter )

--Strategy use one more candle close to confirm entry ( Filter 2 )

--This the best time frame ( HIGHER , HIGHEST ) in this strategy in profit and draw down .

--Strategy is working only in Long position i am not recommend to use it in short positions .

--THIS IS NO REPAINT STRATEGY .

--DON'T use it in DAILY time frame

--I recommend so mush to use take profit and stop loss although the low draw down but some time

the market have a huge movements .

---- Strategy Settings which we publish now :

Fees = 0.1 the same as market fees .

Equity = 10 % and you can change it as you want .

Filter = 4 .

Filter 2 = true ( Just mark in check box beside Filter 2 ) .

Charts which working in these settings :

Eth/Usdt- 30 min/Binance ( Current image ) .

Btc/Usdt- 30 min/Binance .

Bch/Usdt- 30 min/Binance .

We do a lot of tests to get the best profit and also the lowest draw down

we will update the new settings for new charts

DBT MoMo Divergence FinderThis Indicator is an experimental Divergence Finder using the DBT MoMo formula. See DBT MoMo v.4 for details on the main script.

It uses a slower version of the DBT MoMo Price Line to smooth out the trend and color codes the Price Line based on its trend.

Bullish Divergence is denoted by Blue Labels below the Price Line.

Bearish Divergence is denoted by Orange Labels above the Price Line.

Alerts can be setup in Tradingview for both Bullish and Bearish Divergence Signals.

This indicator is brand new and experimental, make sure to double check the Divergence Alerts before blindly trading them. There can be a mathematical divergence without there being a visual divergence, this will trigger a false alert.

Everyone with access to the DBT MoMo will have access to this indicator as well.

TradiKator F1 Finance AnalysisTradiKator F1(Finance series 1st) Finance Analysis is a data panel showing a company financial outlook.

In setting, it has color changing function and free plan support.

Please enjoy.

TradiKator is Traders' indicator.

Please visit TraiKator for more free scripts.

We also support the Chinese.

Happy new year!

Wishing you a great and successful journey in the Chinese Zodiac Bull Year.

[astropark] Trend Skywalker V1 [alarms]Dear Followers,

today another awesome Swing and Scalping Trading Strategy indicator: Trend Skywalker !

It shows a trend cloud that reacts very fast to price action, so it's perfect for trending markets: it helps a lot to find out

when a trend is going to end and a new is going to start

when to enter again within a trending market

where to put your stoploss

In this example below you can see the three points above:

In fact in a trending market it will highlight that:

price consolidation within the could is a trend weakening signal , so you can easily spot when a trend is going to end and a new is going to start

bullish/bearish trend cloud retests are nice opportunity to re-enter within a trending market, especially if cloud is thick

where to put your stoploss ( below the cloud and/or recent low in a buy scenario , above the cloud and/or recent high in a sell scenario )

This strategy/indicator has the following options:

change analysis window (the lower, the more reactive; the higher, the less reactive)

enable/disable signals on chart

enable/disable "more confirmations" signals filter

enable/disable bars and background coloring based on trend

enable/disable an automatic Trailing Stop strategy option (Automatic Stops)

enable/disable a peak profit tracker (the max percentage profit labels)

enable/disable highlights of trend cloud retests

enable/disable highlights of trend cloud price breakouts

Here below some examples how the indicator works on many markets and timeframe.

ETH/USD 4h

EUR/USD 15m

LTC/BTC 1h

This strategy only trigger 1 buy (where to start a long trade) or 1 sell (for short trade).

Keep in mind that proper risk management and money management strategies are very important to manage your trades (DM me if you need any clarification on these points).

This script will let you set all notifications you may need in order to be alerted on each triggered signals.

The one for backtesting purpose can be found by searching for the astropark's "Trend Skywalker" and then choosing the indicator with "strategy" suffix in the name, or you can find here below:

This is a premium indicator , so send me a private message in order to get access to this script.

[astropark] Trend Skywalker V1 [strategy]Dear Followers,

today another awesome Swing and Scalping Trading Strategy indicator: Trend Skywalker !

It shows a trend cloud that reacts very fast to price action, so it's perfect for trending markets: it helps a lot to find out

when a trend is going to end and a new is going to start

when to enter again within a trending market

where to put your stoploss

In this example below you can see the three points above:

In fact in a trending market it will highlight that:

price consolidation within the could is a trend weakening signal , so you can easily spot when a trend is going to end and a new is going to start

bullish/bearish trend cloud retests are nice opportunity to re-enter within a trending market, especially if cloud is thick

where to put your stoploss ( below the cloud and/or recent low in a buy scenario , above the cloud and/or recent high in a sell scenario )

This strategy/indicator has the following options:

change analysis window (the lower, the more reactive; the higher, the less reactive)

enable/disable signals on chart

enable/disable "more confirmations" signals filter

enable/disable bars and background coloring based on trend

enable/disable an automatic Trailing Stop strategy option (Automatic Stops)

enable/disable a peak profit tracker (the max percentage profit labels)

enable/disable highlights of trend cloud retests

enable/disable highlights of trend cloud price breakouts

Here below some examples how the indicator works on many markets and timeframe.

ETH/USD 4h

EUR/USD 15m

LTC/BTC 1h

This strategy only trigger 1 buy (where to start a long trade) or 1 sell (for short trade).

Keep in mind that proper risk management and money management strategies are very important to manage your trades (DM me if you need any clarification on these points).

This script will let you backtest the strategy performance over the backtesting period you set in input (it may be a lower period, depending on tradingview candles limitation related to your account).

The one for setting alarms can be found by searching for the astropark's "Trend Skywalker" and then choosing the indicator with "alarms" suffix in the name.

Strategy results are calculated on the time window from February 2018 to now, so about 3 years, using 10000$ as initial capital and working at 1x leverage (so no leverage at all! If you like to use leverage, be sure to use a safe option, like 2x or 3x at most in order to have liquidation price very far).

This is not the "Holy Grail", so use proper money and risk management strategies.

This is a premium indicator , so send me a private message in order to get access to this script.

Ehler Fisher applied on distance EMAThis is an improved version of Fisher, which use as a source the distance from EMA , compared to the initial source which was on the close of a candle.

It can be used in any market, any time frame .

For conditions we have multiple conditions for the logic, in this case initially if our fisher is above 0 is a long direction ,if its belowe 0 its a short direction.

Also we can improve this condition even further, in this case if we cross up our previous line its a buy signal, and if we cross down its a sell signal.

For best usage combine the cross together with the position of fisher respecting the 0.

If you have any other questions, let me know with a private message.

© 2021 - SwingSwiss - BUY/SELL© 2021 - Dan Chetrit - BUY/SELL"

Product Description:

The Indicator combines the Relative Strength Index, Moving Average Convergence Divergence as well as Volume and Stochastic.

The idea is to cross multiple data and signals from these indicators in order to trigger buy when crossing above and sell when crossing below the signal line.

The idea was also to find a mathematical function that will trade the convergence of these lines trying to predict the market.

This indicator works better on a daily chart.

The indicator works long and short but is better for long positions.

The script also includes an EMA 50 line as well as an overbought/oversold RSI background.

The indicator can be used on every type of market: indices, stocks, cryptocurrencies, currencies, and others but, according to backtesting, it works better for the US stock market.

This study is not a guaranteed profit. You should backtest or trade virtual money before using this study on your real portfolio, as it is intended to be a tool. Do your research and learn about the company you are investing in.

Disclaimer:

Trading and investing in the financial markets involves substantial risk of loss and is not suitable for every investor.

All trading strategies are used at your own risk.

Please send me a private message or comment on TradingView to gain access to the script.

MACD Bull Crossover and RSI Oversold - AlertsHello everyone, these are the alerts for my previous "MACD Bull Crossover and RSI Oversold" Long Strategy. This version currently does not support stoploss and takeprofit alerts but the next update will.

3 Weeks Tight - CANSLIM Technical Indicator3 Weeks Tight - Introduction

3 weeks tight is a bullish continuation pattern discovered by IBD's founder, William O'Neil.

The pattern can used as an opportunity to add to an existing position as it often occurs after a breakout above a cup with handle or other technical pattern.

The 3 weeks tight pattern forms when a stock closes within approximately 1% to 1.5% of the prior week's close for at least two weeks. The reason for the bullishness is that it indciates that investors who moved the stock upward in price since the breakout are not taking profits, the price is holding steady.

The buy point is just above the area of resistance formed at the highs of the three weeks plus 10 cents. The ten cent addition to the price is to ensure a push through the resistance at the high of the range.

Key Points:

It's preferred that closes for each week are in the upper half of the stock's range.

Ideally, volume will increase significantly as the stocks moves past the buy point.

This pattern generally performs best when the market is in an uptrend.

Features:

A configurable horizontal bar that spans the 3 week period.

A vertical band that highlights the tightness pattern.

A label to show the buy price after 3 week tight pattern.

Optional alert when the 3 weeks tight pattern is recognized.

Heikin-Ashi Change Strategy/ Indicator

Today I bring you a simple and efficient indicator/strategy based only on HA.

Can be used together with other TA tools or alone.

The idea behind is simple :

We have to forms to calculate the candle, using inner HA candles or normal candles. Once we have that we apply certain rules to get the max high, min low, open and close(ohlc)

With that then we check for changing in the patters like for example

For long close is higher than open and the previos close is lower than open. For short is going to be the opposite of long condition.

For the purpose of this example, I only use long direction and exit once we have the short signal.

If you have any questions, please let me know in private chat !

Fin_PanelStock Financial Panel

Basic financial analysis.

Able to FY/FQ switch.

Free plan users please turn on the "Free Plan" checkbox.

There is no proper category, so I chose my fav Tech indicators category.

MACD Crossover with signalsMACD Crossover with signals - a simple trading indicator based on classic MACD.

It shows crossovers and plots them on chart as "Long" or "Short".

The MACD itself is not plotted in order to keep your charts cleaner.

By default, all the crossovers are displayed on the chart.

However, you can use only trend-based ones. They are filtered according to the trend (which is plotted and colored using 200 period EMA) and the "zero-line rule" of the MACD.

So if you consider using only trend-based signals, the indicator will only show Long signals on an uptrend and Short signals on a downtrend.

All signals/lines can be turned on/off and styled in the settings menu.

It can be used with all major timeframes and assets (crypto, fx, cfd, stocks, commodities etc).

Consider using it with respect to your trading style, money- and risk-management as well as other strategies and indicators.

If it was useful for you – hit the Like button and share it with your friends - it's free 😉