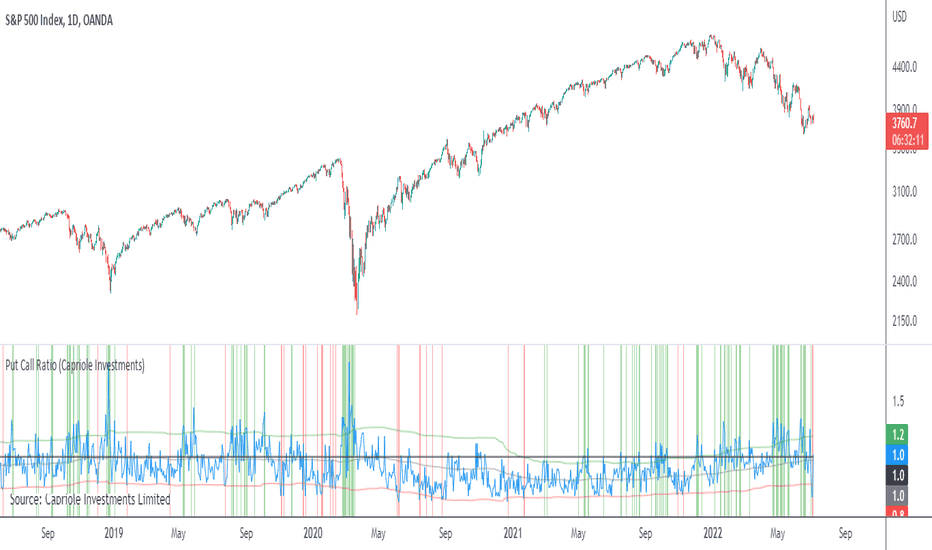

Put Call RatioPlots the CBOE Put Call Ratio and marks up locations of extremities.

Useful as a factor of confluence in identifying extremities in the market.

Акции

Magic CandleThis indicator is very simple, but surprisingly effective, and I haven't found any mention of something similar, so here it is. I hope it helps you in your stock trading.

Someone made a comment in a trading room that the 8 am candle of the stock looked odd, so I quickly checked all the other stocks I had on my screen, and for all of them, the 8 am candle was just a little strange. What's more, is that the stock would often respond to the high and low values of that 8 am candle later on in the day. It turned out to be quite an important support and resistance level indicator for stocks which I've used in my trading ever since I discovered it.

After testing it out day after day on multiple stocks, I decided to write this indicator, which not only projects the high and low values of the 8 am candle, but also the previous day's closing price.

If you find that there's another "magic candle" out there for Forex or Crypto, please let me know!

You have the option to set the "magic candle" to another time, if you want to experiment with things.

ETS MA Deviation ExtremesWhile trading, I noticed that emphasis is often placed on how far price has moved from the moving average (whichever a trader prefers). In these cases I also found that Bollinger Bands only sometimes played a factor in determining whether price had moved "too far" from the moving average to potentially result in a sharp move back to the average.

Because I wanted something more objective than a "gut feeling" that price has moved away from the average enough to make it move back, I decided to see what I could do to determine the standard deviation of how price action moved away from the average , in order to determine when it could potentially have a "rubber band effect" to jump back to the "norm". The result of that is the ETS MA Deviation Extremes indicator, and I hope that it will help you in your trading.

The indicator also has bar coloring included, which can be turned off, which gives a good on-chart visual to warn you that the price action might reverse. This has often helped me to be a bit more cautious before just jumping into a trade that might be on the brink of reversing and taking my position out, and it actually turned out to be a good indicator for a reversal trade strategy.

The histogram bars give an indication of how far the price has moved away from the average, and I look for a potential reversal as soon as the histograms move back inside the deviation lines after having been outside it. The bar coloration actually depend on more than one set of deviation lines, but putting all of that on the chart just makes it confusing, so I removed the ones that I felt were not essential to make it clearer.

I hope it helps you in your trading and makes it easier for you to trade successfully!

Trendflex - Another new Ehlers indicatorSource: Stocks and Commodities V38

Hooray! Another new John Ehlers indicator!

John claims this indicator is lag-less and uses the SPY on the Daily as an example.

This indicator is a slight modification of Reflex, which I have posted here

I think it's better for Stocks and ETFs than Reflex since it factors in long trends. It tends to keep you in winning trades for a long time.

I believe this indicator can be used for entries or exits, potentially both.

Entry

1. Entering Long positions at the pivot low points (Stocks and ETFs)

2. Entering Long when the Reflex crosses above the zero lines (Stocks, ETFs, Commodities )

Exit

1. Exiting Long positions at a new pivot high point (Stocks and ETFs)

2. Exiting Long when the Reflex crosses below the zero lines (Stocks, ETFs, Commodities )

In this example, I place a Long order on the SPY every time the Reflex crosses above the zero level and exit when it crosses below or pops my stop loss, set at 1.5 * Daily ATR.

2/3 Wins

+16.05%

Let me know in the comment section if you're able to use this in a strategy.

Reflex - A new Ehlers indicatorSource: Stocks and Commodities V38

Hooray! A new John Ehlers indicator!

John claims this indicator is lag-less and uses the SPY on the Daily as an example.

He states that drawing a line from peak to peak (or trough to trough) will correspond perfectly with the Asset.

I have to say I agree! There is typically one bar of lag or no lag at all!

I believe this indicator can be used for either entries or exits, but not both.

Entry

1. Entering Long positions at the pivot low points (Stocks and ETFs)

2. Entering Long when the Reflex crosses above the zero lines (Stocks, ETFs, Commodities)

Exit

1. Exiting Long positions at a new pivot high point (Stocks and ETFs)

2. Exiting Long when the Reflex crosses below the zero lines (Stocks, ETFs, Commodities)

In this example, I place a Long order on the SPY every time the Reflex crosses above the zero level and exit when it crosses below or pops my stop loss, set at 1.5 * Daily ATR.

4/6 Wins

+10.76%

For me, that's good enough to create a strategy and backtest on several Indices and ETFs, which is what I have a hunch this will work on.

I think there is a lot of promise from a single Indicator!

Let me know in the comment section if you're able to use this in a strategy.

Performance ComparatorThis indicator allows to compare the performance (% change) of a given symbol with the larger market ( AMEX:SPY ) and/or with a custom symbol, which defaults to AMEX:XLK (an ETF tracking technology companies from the S&P 500).

The performance for the current symbol is displayed as a blue histogram, while performance for the AMEX:SPY and the custom symbol are respectively displayed as orange and white lines, making it easy to spot when the symbol outperformed the market.

Features:

Configurable time resolution (default: same as chart)

Comparison using change percentage or its EMA/WMA/SMA (default: EMA)

Configurable moving average length

Optionally hide AMEX:SPY or the custom symbol from the chart

Relative Strength Auto ComparisonRelative Strength Comparison with automatic selection of relevant index

Added support for most european and north american exchanges.

FauxLife EFIModification to Elder's Force Index (EFI)

Ability to change calculation from standard EMA to your choice of SMA, EMA, WMA, or HMA. Very interesting results!

Adjust lookback from standard/suggested 13 candlesticks

Added a color indication to positive or negative force reading

Added background color tint for an easier read on dashboard setups

Suggested pair with my On Balance Volume with Cross to use as a filter & entry/exit setup. Enter or exit trades when the two indicators switch at the same time or within 1-2 candlesticks of each other.

Terminal : Important U.S Indices Change (%) DataHello.

This script is a simple U.S Indices Data Terminal.

You can also set the period to look back manually in the menu.

In this way, an idea can be obtained about Major U.S Indices.

Features

Value changes on a percentage basis (%)

Recently, due to increasing interest, the NQNACE index has been added.

Index descriptions are printed on the information panel.

Sentiment NYSE ARCA and AMEX indices added.

Indices

SP1! : S&P 500 Futures Index

DJI : Dow Jones Industrial Average Index

NDX : Nasdaq 100 Index

RUT : Russell 2000 Index

NYA : NYSE Composite Index

OSX : PHLX Oil Service Sector Index

HGX : PHLX Housing Sector Index

UTY : PHLX Utility Sector Index

SOX : PHLX Semiconductor Sector Index

SPSIBI : S&P Biotechnology Select Industry Index

XNG : NYSE ARCA Natural Gas Index

SPGSCI : S&P Goldman Sachs Commodity Index

XAU : PHLX Gold and Silver Sector Index

SPSIOP : S&P Oil and Gas Exploration and Production Select Industry Index

GDM : NYSE ARCA Gold Miners Index

DRG : NYSE ARCA Pharmaceutical Index

TOB : NYSE ARCA Tobacco Index

DFI : NYSE ARCA Defense Index

NWX : NYSE ARCA Networking Index

XCI : NYSE ARCA Computer Technology

XOI : AMEX Oil Index

XAL : AMEX Airline Index

NQNACE : Nasdaq Yewno North America Cannabis Economy Index

Portfolio and Risk Management: Gold Based Net Growth CoefficientHello, if our topic is stocks, whatever signal we get, we have to divide and reduce the risk.

Apart from the risk, we need inflation-free figures to detect a clear growth.

Gold is one of the most successful tools to beat inflation in this regard in the historical context.

When the economy is good, we have to beat both commodities and inflation.

For this purpose, I found it appropriate to develop a net growth factor free from gold growth.

Investors need several stocks with a high growth rate and as much risk-free as possible.

Personally, I think that the science of portfolio and risk management will last a lifetime and should continue.

I think this subject is a research and development subject.(R & D)

My research and publications on this matter will continue publicly.

I wish everyone a good day.

NOTE : You can determine the return in the time period you want to look back by adjusting the period in the rate you want from the menu.

The standard value is 200 days. (1 year)

Price CorrelationsThis indicator shows price correlations of your current chart to various well-known indices.

Values above 0 mean a positive correlation, below 0 a negative correlation (not correlated).

It works well with daily candle charts and above, but you may also try it on 1h candles.

The default indices:

- Gold

- S&p 500

- Mini Dow Jones

- Dow Jones

- Russel 2000

- Nasdaq 100

- Crude Oil

- Nikkei 225 (Japan)

- FTSE 100 (UK)

- Silver

- DAX Futures (DE)

You can change the defaults to compare prices with other indices or stocks.

VIX MonitorSimple VIX Monitor to track spikes.

Spikes in VIX are often followed by big moves up in stocks.

Useful when paired with "Correlation & Beta" Indicator.

For Bitcoin Traders: when Bitcoin is highly correlated to Stocks (such as now) it could be a good opportunity for a short-term long trade.

Yield Curve Inversion MonitorIdentifies when the US Treasury Yield Curve inverts (2 and 10 year bond rates).

When they ‘invert’ long-term bonds have a lower interest rate than short-term bonds. In other words, the bond market is pricing in a significant drop in future interest rates (which might be caused by the US Fed fighting off a recession in the future).

In the last 50 years, every time the US treasury yield curve inverted a recession followed within 3 years. On average the S&P500 gained 19.1% following the inversion and peaked 13 months later. In other words, as far as investors are concerned, the recession began roughly one year later.

However, once the market peaks, it then drops 37.6% on average, wiping out all those gains and more.

...Looks like 2020 is shaping up to be another prime example.

Gold-Stocks RatioA historic risk-off flag.

When the Gold-Stocks Ratio is above the 200 week moving average, investors may fair better holding gold and avoiding equities, as was the case for the last 20 years.

Double TRIX CrossoverTRIX is a great indicator to use on zero cross setups.... know what's even better? TRIX CROSS setups!!!

Faster in-and-out on trends, safer entry and exit signals in chop or consolidation. Base setup is 6 & 8 TRIX for longer time frames such as 4hr or 8hr; ideal or FX, Crypto, or volatile instruments. I haven't experimented with using this on lower time charts and adjusting the trix settings; if you do, drop a comment.

[e2] EDS Key & AvwapThis indicator shows a Key Level Support & Resistance level and VWAP that resets on your choice of the stock's Earnings , Dividends or Splits release date.

A maximum of 8 bands calculated using a factor of the anchored VWAP's standard deviation can be displayed.

Note

The script is designed for stock-trading only.

Credits

Inspired by timwest , LazyBear 's Earnings S/R Levels and MichelT 's Earnings, Splits, Dividends scripts.

BEST Supertrend CCIHello traders

Today I present you a Supertrend not based on candle close but based on a CCI (Commodity Channel Index)

How does it work?

Bull event: CCI crossing over the 0 line

Bear event: CCI crossing below the 0 line

When the event is triggered, the script will plot the Supertrend as follow

UP Trend = High + ATR * Factor

DOWN Trend = Low - ATR * Factor

This is an alternative of the classical Supertrend based on candle close being above/beyond the previous Supertrend level.

Hope you'll enjoy it and it will improve your trading making you a better trader

Dave

Candlesticks ANN for Stock Markets TF : 1WHello, this script consists of training candlesticks with Artificial Neural Networks (ANN).

In addition to the first series, candlesticks' bodies and wicks were also introduced as training inputs.

The inputs are individually trained to find the relationship between the subsequent historical value of all candlestick values 1.(High,Low,Close,Open)

The outputs are adapted to the current values with a simple forecast code.

Once the OHLC value is found, the exponential moving averages of 5 and 20 periods are used.

Reminder : OHLC = (Open + High + Close + Low ) / 4

First version :

Script is designed for S&P 500 Indices,Funds,ETFs, especially S&P 500 Stocks,and for all liquid Stocks all around the World.

NOTE: This script is only suitable for 1W time-frame for Stocks.

The average training error rates are less than 5 per thousand for each candlestick variable. (Average Error < 0.005 )

I've just finished it and haven't tested it in detail.

So let's use it carefully as a supporter.

Best regards !

Trendy Bar Trend ColorTrendy Bar Trend Color

Inspired by trend candlestick charts on other trading platforms. Changes bar colors to stay in trend much like Heikin Ashi candles without the ATR price distortion. This is done by comparing the HL2 and/or Open-Close values of current candlestick to the prior candlestick.

ZoneBand (@Mido_yuiya)Bollinger band is converted to EMA , and support and resistance bands are made into regions

Rolling Moving Average, SMA/EMA, for IPO stocksThe script replicates the standard EMA/SMA used by tradingview, but also adds an estimate for the first X periods, where X is the length of the moving average. This allows for an estimate of support resistance in IPO stocks, when fewer date is available

InfoPanel - SeasonalityThis panel will show which is the best month to buy a stock, index or ETF or even a cryptocurrency in the past 5 years.

Script to use only with MONTHLY timeframe.

Thanks to: RicardoSantos for his hard work.

Please use comment section for any feedback.

Mega Trend Plus - S&P 500 Trend Follower / Market GaugeFirstly, 100% of the credit goes to Greg Morris @ Stockcharts.com for the article detailing the concept and most of the settings/components. I've simply implemented his idea. I haven't sought permission from him, but given that he was open with the components of the indicator I'm assuming he's happy for me to go ahead and code this in pinescript. See the article here: stockcharts.com

Okay, so this is part of a system/indicator Greg outlined in the article that he calls Trend Gauge. The idea is fairly simple: take a group of indexes that cover the breadth of the market you want to trade, track their relationship/position to their 200 period Exponential Moving Average (EMA), and assign scores to bull/bear crosses + relative location to the EMA. Once you've normalized and aggregated the scores you finish up with a trend following indicator that works surprisingly well.

This part is called Mega Trend Plus, and tracks whether an index is above or below its 200 period EMA. I'll be releasing the second part ("Trend Strength") soon. Once that's done I'll combine them to form the full "Trend Gauge" indicator.

I decided to provide the base version that people can then experiment with and tweak to their liking, so Greg's version shown in the article is smoother than the one provided here. It's up to you to play with smoothing options, and potentially tweak the weightings of the various components. Please see the script for info on what the various inputs are - I've added notes there.

So, how does it do? Well, as you can see from the chart above it works pretty well overall. The S&P 500 has been fairly trendy over the last few decades, so it's been prime territory for a system like this. It would have kept you out of the big bear markets (particularly GFC & 2015-16), and that's the goal of any trend-based system. They thrive on how little they lose, not necessarily on how much they make.

As you can see, the indicator is pretty choppy. So it's not designed (in the current configuration) to provide accurate buy/hold/sell signals. It currently functions more as a market gauge / strength indicator.

Hopefully you find this concept interesting. It's simple, but the best systems often are.

Please add comments below if you come up with an interesting configuration or variation.

Let me know if you have any queries.

DD