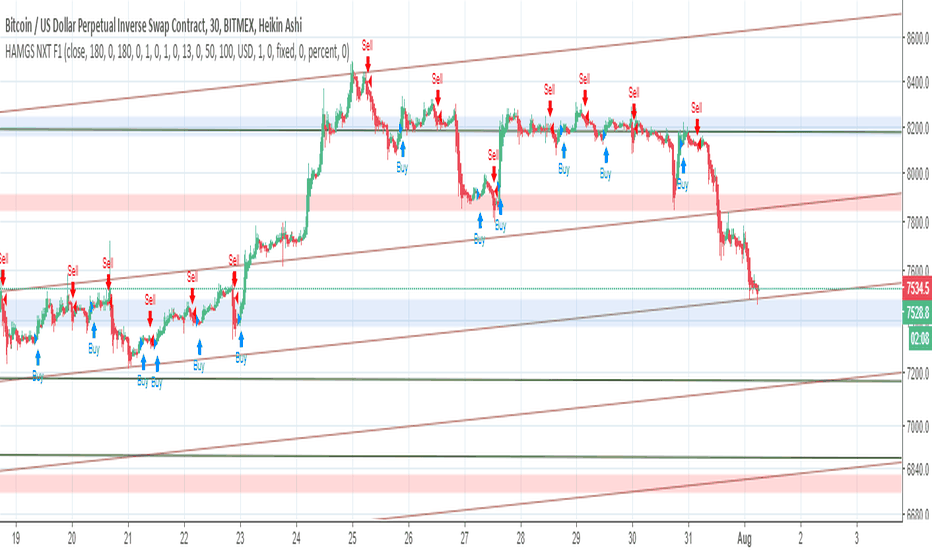

MAC DADDY GNOME PROHello Fellow Traders!

-------------------------------------------

This is the newest addition to Gnome Alerts PRO!

This is one of the newer scripts that we are using for scalping on the lower time frames on Bitmex & Binance.

This is a script that can be used on all time frames and includes back-testing. All of our scripts included back-testing and BUY & SELL alerts.

This Script allows you to fire Long, Short, or Flip with Both

Also Includes TTM Squeeze Bubbles for Manual trading.

INCLUDES:

------------------------

*Autoview Ready*

BUY ALERTS

- supports pyramiding

- sell based of %gain

SELL ALERTS

- supports pyramiding

- sell based of %gain

- stop loss configured

- sell on gain configured

Backtesting is also available!

More info on how gain access in my profile!

Signals

Heikin Ashi Margin Scalping script for BitmexA script made for a lot of trades (scalping) and good solid profits on the Tested and it generates very attractive profits. Test it for yourself.

- Made for BITCOIN / US DOLLAR PERPETUAL INVERSE SWAP CONTRACT XBTUSD on Bitmex.

- Only 40% of these trades are profitable, but within this 40 percent, it catches all the spikes and lows. And therefore a lot more profit then loss. The most loss is generated at the moment BTC is falling still and there is not a lot of volatility.

- I use it to create alerts and sent these to my bot, so i don't have to do manual trading.

You can ask for access and try this strategy for yourself for 5 days. When you are convinced and want to have the script with alerts to be shared with you, I ask for a small donation of 0.02 BTC. This allows me to create other scripts and to improve this script.

I only sell this script to 50 people, so that it remains exclusive.

COINCIYIZ CROSSOVER 1.1A crossover is used by a technical analyst to forecast how a stock will perform in the near future. For most models, the crossover signals that it’s time to either buy or sell the underlying asset. Investors use crossovers along with other indicators to track things like turning points, price trends and money flow.

Crossovers indicating a moving average are generally the cause of breakouts and breakdowns. Moving averages can determine a change in the price trend based on the crossover. For example, a technique for trend reversal is using a five-period simple moving average along with a 9/21-period simple moving average. A crossover between the two will signal a reversal in trend, or a breakout or breakdown.

A breakout would be indicated by the five-period moving average crossing up through the 21-period. This is also indicative of an uptrend, which is made of higher highs and lows. A breakdown would be indicated by the five-period moving average crossing down through the 9/21-period. This is also indicative of a downtrend, composed of lower highs and lows.

Longer time frames result in stronger signals. For example, a daily chart carries more weight than a one-minute chart. Conversely, the shorter time frames give earlier indicators, but they are also susceptible to false signals as well.

(R: investopedia)

Short signal - Yellow

Long signal - Blue

Cyatophilum Trend IndicatorHOW TO USE

Step 1 : Adjust the Trend Parameter to the most profitable number.

Step 2 : Create Automatic Alerts for Buy (L) and Sell (S) signals.

BONUS :

Trend horizontal Line: Use this line to avoid risky trades.

Get This Indicator Today!

Purchase at blockchainfiesta.com

SAMPLE USE CASES

BTCUSD 1 D

BTCUSD 4 h

ETHUSD 1 D

ETH/BTC 1 D

Get This Indicator Today!

Purchase at blockchainfiesta.com

View a video tutorial on how to use this indicator at the link above.

Have Fun !

Technical Indicator PoolThis is for Bundle holders who want to use the Technical Indicator Pool for scalping binary options.

Understanding the Technical Indicator Pool

The Technical Indicator Pool is a strategy that operates on the premise that when many technical indicators project the same sentiment, they are concurrently more precise. The technical indicator pool contains five indicators

1. Small MACD Moving Average (SFMA) (10,15)

2. Large MACD Moving Average (LFMA) (13,18)

3. Parabolic Stop and Reverse (PSAR) (0.05, 0.05, 0.05)

4. Relative Strength Index (RSI) (14, 70, 30)

5. H/L Pivot (13)

When all five indicators project the same sentiment within a defined period (known as BarPeriod), an order is placed in the direction of sentiment.

Note:

Due to the nature of the indicator pool, such as the moving averages within the MACD and RSI as well as the High/Low Pivot, false positives may occur before the bar has closed within the time stamp.

This point of reference is to be used in combination with an arsenal of trading tools and should not be used as direct investment advice.

Option strategies should always include stop losses.

This strategy operates using a lot size of 2.5.

Previous CandlesThis is an indicator based on the average of the maximum and minimum of the past candle, and there is another strategy that makes the filter, it is very good for binary options, if you combine our indicator CCI and All4 it gets even better!

Currency: Any pair.

TimeFrame: 5m

Execute order: You can enter 1 minute or 5 minutes.

In the graph below the ICC, you can see the green and red squares, it works as follows.

Before giving any input you have to enter the change of a color.

Example: It was red and now it's green, so you could give the entry, but you must have at least 3 squares of red before, if only 1 squared has appeared, the hit percentage will be low!

The CCI indicator is for confirmation.

Any doubt I am available!

Note: This indicator does not make magic nor is it a holy grall, it is only an indicator to aid in binary operations!

Magic MA by jaycryptotraderModified moving average for signals.

Let me know if you want to try it out.

Shouldn't be used without knowing the general trend!

Fibonacci VWAPFibonacci VWAP bands provide extremely accurate pivot points and a visual scale of deviation from VWAP.

TradeSpot Pro || All Purpose Advanced Trading Indicator & AlertsTradeSpot Pro Indicator

Version: 1.0

TradeSpot Community Website

TradeSpot is a community of traders that specialise in using automated bots to execute spot & margin trading, you can join up via the above link where you too can discuss cryptocurrency, general trading, investments and get informed on the latest botting tools to enhance your day to day trading.

For an in-depth explanation and briefing on what this indicator is capable of, please contact me directly.

Features

Inclusion of all 4 highly regarded indicators previously used by the indicator and combined into one cross-functional powerhouse script sporting different strategies eg. EMA, RMI, RSI, BB based signals (and more!

Neat presentable UI for easily displaying the quality of your current settings.

Incredible customisation, one of the most heavily parameterised scripts on TradingView - this is not a plug and play solution but rather a script you can learn and tweak to really fine tune your strategy, ultimately improving results.

Big list of features listed on the community Discord server that will be developed and added to the indictor in good time (and a backtesting script!).

Combine indicators, a heavily asked for feature finally here - being able to match the signals between included indicators to create an even more robust trading signal.

Scripted with a full array of custom and alerts and more coming for use in manual trading endeavours to never miss a trade or for use with automated bot solutions that can be seen on the community site.

Access

Discord Server

For trial access please follow the link the server above and use the '!trial' command on the chat channel. If you don't use Discord please private message me on here.

Block Sale Transaction Alert!Understanding Block Transactions

Block transactions are transactions that are of a significantly high value. This can be a transaction of any

security that is large enough to have an impact on the market price and cause a flow-on effect of

investment that will ensue.

Block transactions are significant because the party who initiated the transaction is likely to be more

confident than the retail investor. Confidence can be assumed by the value of the transaction and the

source can be either,

a) an institutional fund with access to detailed and reliable information

or

b) a party with secret, insider knowledge that is currently undisclosed to the market.

For these reasons, being aware of block transactions is extremely important for anyone looking for a

new investment opportunity or risk management of current holdings.

Block Transaction Utility

This indicator is compatible with instant E-mail and SMS notifications so that the investor will be well

informed of institutional activity and make trading decisions quickly.

If a block transaction occurs, the user will be able to visualize whether it was a purchase or sale as it will

be textualized above or below the current bar if used with the Block Transaction Buy Alert found here:

Input Values

The visual representation of the transactions are customizable as you can adjust the shape, color, and

location by clicking “ Format ” at the top left of your chart, next to the indicator label.

Setting up Text message or E-mail Notifications

In order to receive the text message and/or email alerts, you will need to make sure the correct contact

information is saved in your TradingView® account settings.

For more information on this indicator, and setting up alerts, view this PDF: www.kenzing.com

Crypto Signal Alerts ( Trial )- Features:

+ Optimized trading methods for multiple time frames 5M 15M 1H 4H (including Margin and Exchange Trading).

+ Build the rule of Stoploss / Takeprofit according to the risk management method according to the trader's strategy.

+ Real-time push alert system + Email + Popup on your desktop, laptop, tablet and smartphone => have time to enjoy trading live.

+ Our system runs 24/7.

*** Sign up for a 3-day trial here : goo.gl

Spectro™ M by HypesterThis is the commercial version of the Spectro™ M

The new BADASS Spectro™ M

Ok, I gotta say this is so cool that I've been dying to write this release note, we're really proud with the amazing features we are releasing and the fact we could deliver them without raising the prices.

Spectro™ Alerts New Settings

The classic and loved entry/exit point finder, and now you can set the Spectro™ Alerts to your own preferences from aggressive to the safest triggering style. So now it can adapt to any trading style easily, from minute-leveraged scalping to yearly positions.

Spectro™ Indicator (Pro 8X Indicator )

This is the Spectro™ brain, and before this update, it was an indicator that was worth extra $10, but now we decided to implement it on the M version for free! Knowing how Spectro™ is behaving will give you an edge when forecasting entry/exit points.

Spectro™ Direction Change Alerts

A life saver, subscriber's words not mine. Spectro™ plots warning signs when it detects possible trend changes before they happen!

Spectro™ Multi-Resolution

Another heavily requested feature, now you can check buy/sell alerts from other timeframes on your chart. Let's say you're trading on 5M but you only want the strongest signals, so you set your custom timeframe to 15M. Or if you are trading a 12H timeframe and you are sure of a reversal and you're trying to catch the bottom so you play around with the custom resolution around 30M~2H for a more reactive triggering.

Or you might just want to confirm if you have a buy on the Daily before proceeding, that's a smart way to check the mid-range trend.

Specter Clouds

This is dope. I wish I could be more polite but this is as badass as it gets. This awesome new feature will tell you when the price is growing or decreasing out of the "organic" area, therefore, it will warn that whatever you're seeing, you shouldn't. In plain English: It means a reversal is coming.

But it doesn't only warns you about reversals several bars before, it also forecasts the future price targets for the respective reversal!

Also, the coloring of the cloud helps you find the bottom/top, the very beginning of the following reversal.

X Algo Confirmations

This is practical as ****! We know you guys are always checking other indicators to improve your odds so we decided to do it for you, but faster, better and more precise. We called it X because it checks so many indicators that we just called it X.

This is a proprietary blend weighted average between several indicators, you can name all the common ones...STOCH, RSI, STOCH RSI, BB, DMI, ATR, MFI, OBV, CCI, MFI, DPO, MACD, EMO, TSI, Elliot Waves, Fractal Patterns, Fibonacci LEVELS...well you get it... plus 3 proprietary indicators on the conservative mode. Now speaking English: We check up to 20 indicators for you and deliver it in a way that all it takes is one second to check ALL of them.

It also has an aggressive, moderate and conservative mode. The difference is just the amount indicators we check for you, more confirmations you need, more conservative you are.

Trend Analyser 2.0

We offer 3 types of TA. A brand-new proprietary price-based trend analyzer that warns you about violent price change and corrections, an MA blend good for scalping and spotting trend reversals and a classic fully customizable MA crossing.

Spectro offers you 8 different types of the most popular moving averages for the custom mode, from Simple Moving Averages to Fractal Moving Averages - so that creates 64 basic trend analyzer options. You can change the lookback (length) period, time frame resolution, and more. Resulting in a very flexible, simple to use and powerful trend analyzer with endless customization options.

Crypto Signal Alerts ( Margin/Exchange )Crypto Signal Alert is an intuitive and easy-to-use graphing buying tool that helps traders save time and maximize profits ^$$$^

- Features:

+ Optimized trading methods for multiple time frames 5M 15M 1H 4H (including Margin and Exchange Trading).

+ Build the rule of Stoploss / Takeprofit according to the risk management method according to the trader's strategy.

+ Real-time push alert system + Email + Popup on your desktop, laptop, tablet and smartphone => have time to enjoy trading live.

+ Our system runs 24/7.

*** Sign up for a 3-day trial here : goo.gl

Spectro PRO 8X by HypesterThis is the new Spectro™ Pro 8X update including the following features:

✓ Auto renews Each Month

✓ Cancel Any Time & No Extra Fees

✓ Works With Market, Asset & Timeframe

✓ Entry/Exit Points Alerts

✓ Direction Change Warnings

✓ Noise Reduction

✓ Trend Analyser w/ Multiple Resolutions

✓ 8 Types of Moving Average Crossings

✓ Fine Tuning Panel

(Available on Pro 8X only - )

✓ Fine Tuning Advanced Visual Tools

✓ Dynamic Triggering System

✓ Bollinger Band® Triggering System

✓ Highly Customizable For Maximum Precision

TES Ichimoku Cloud Signals v2TES Ichimoku Cloud Signals v2

A signal indicator that can sends buy signals to your exchange via Autoview.

This requires invite to use. Send a PM to grand access. Test it using the Backtester to see the great results it can provide.

- Use the moving average to sort out any bad signals. This trend is individual for each coin and by adjusting it, you can make the signals perfect for each coin you want to trade. Scroll through them all and find the best fit.

- Set stop loss % or leave it to let the signals buy on the downtrend

- Show your DCA %, if used in combination with ProfitTrailer.

Support the development and the future of great signal trading by donating.

BTC: 13qeJRZ1S2wGNYdHCNvKyieugWcVt2fiVg

ETH: 0xe73bfe4d981af78c2695cee4d495ca910ee8f49b

BNB: 0xe73bfe4d981af78c2695cee4d495ca910ee8f49b

TES Ichimoku Cloud Signals v2 (Backtester)TES Ichimoku Cloud Signals v2 (Backtester)

A signal indicator that can sends buy signals to your exchange via Autoview.

This backtester works together with the "TES Ichimoku Cloud Signals v2" witch requires invite to use.

Look at this backtester and play with the settings to see if you like and request access to the signal indicator by PM.

- Use the moving average to sort out any bad signals. This trend is individual for each coin and by adjusting it, you can make the signals perfect for each coin you want to trade. Scroll through them all and find the best fit.

- Set stop loss % or leave it to let the signals buy on the downtrend

- Show your DCA %, if used in combination with ProfitTrailer.

Support the development and the future of great signal trading by donating.

BTC: 13qeJRZ1S2wGNYdHCNvKyieugWcVt2fiVg

ETH: 0xe73bfe4d981af78c2695cee4d495ca910ee8f49b

BNB: 0xe73bfe4d981af78c2695cee4d495ca910ee8f49b

Money Flow Index + AlertsThis study is based on the work of TV user Beasley Savage ( ) and all credit goes to them.

Changes I've made:

1. Added a visual symbol of an overbought/oversold threshold cross in the form of a red/green circle, respectively. Sometimes it can be hard to see when a cross actually occurs, and if your scaling isn't set up properly you can get misleading visuals. This way removes all doubt. Bear in mind they aren't meant as trading signals, so DO NOT use them as such. Research the MFI if you're unsure, but I use them as an early warning and that particular market/stock is added to my watchlist.

2. Added 60/40 lines as the MFI respects these incredibly well in trends. E.g. in a solid uptrend the MFI won't go below 40, and vice versa. Use the idea of support and resistance levels on the indicator and it'll be a great help. I've coloured the zones. Strong uptrends should stay above 60, strong downtrends should stay below 40. The zone in between 40-60 I've called the transition zone. MFI often stays here in consolidation periods, and in the last leg of a cycle/trend the MFI will often drop into this zone after being above 60 or below 40. This is a great sign that you should get out and start looking to reverse your position. Hopefully it helps to spot divergences as well.

3. Added alerts based on an overbought/oversold cross. Also added an alert for when either condition is triggered, so hopefully that's useful for those struggling with low alert limits. Feel free to change the overbought/oversold levels, the alerts + crossover visual are set to adapt.

Like any indicator, don't use this one alone. It works best paired with indicators/techniques that contradict it. You'll often see a OB/OS cross, and price will continue on it's way for many weeks more. But MFI is a great tool for identifying upcoming trend changes.

Any queries please comment or PM me.

Cheers,

RJR