Pot SizeA little FREE script - which may help people set their trade size and stop levels for bitcoin trades.

NOTE :- This script conveys information that requires "indicator arguments" to be turned on.

TO USE :- To adjust to your requirements, click the cog wheel next to the indicator, and adjust "POT SIZE" (how much dollar you have), "RISK %" (the percentage of your dollar portfolio you would like to risk on this trade) and "BITCOIN AMOUNT" - until the short and long 'stop' lines are in the right place in your estimation, for a stop loss that represents the risk you want in relation to the current price for this trade.

The script takes its reference from the closing price; and doesn't include calculations for spread, fees, true range, and volatility etc. That is left open for anyone to add that if they wish. Anyone using this has to make their own adjustments for such considerations not being in this script and therefore make their own compensations.

Anyone wanting to change anything (because values don't go far enough for you) but doesn't know pinescript, can change the numbers next to "defval", "minval", "maxval", and "step" to their suiting in the script itself.

If you use this, you have to work out for yourself if it is useful for you or not. If you depend on it, you must have your own confidence that the calculations in it are acceptable and correct for your use, and you should check yourself and seek advice before trusting it. I convey no confidence in these calculations or this script, and they must be assumed to be acceptable by you if you use it.

Thanks

M

Схождение/расхождение скользящих средних (MACD)

CM MACD Custom Indicator - Multiple Time Frame - V2***For a Detailed Video Overview Showing all of the Settings...

Click HERE to View Video

New _CM_MacD_Ult_MTF _V2 Update 07-28-2021

Thanks to @SKTennis for help in Updating code to V2

Added Groups to Settings Pane.

Added Color Plots to Settings Pane

Switched MTF Logic to turn ON/OFF automatically w/ TradingView's Built in Feature

Updated Color Transparency plots to work in future update

Added Ability to Turn ON/OFF Show MacD & Signal Line

Added Ability to Turn ON/OFF Show Histogram

Added Ability to Change MACD Line Colors Based on Trend

Added Ability to Highlight Price Bars Based on Trend

Added Alerts to Settings Pane.

Customized how Alerts work. Must keep Checked in Settings Pane, and When you go to Alerts Panel, Change Symbol to Indicator (CM_Ult_MacD_MTF_V2)

Customized Alerts to Show Symbol, TimeFrame, Closing Price, MACD Crosses Up & MACD Crosses Down Signals in Alert

Alerts are Pre-Set to only Alert on Bar Close

See Video for Detailed Overview

New Updates Coming Soon!!!

***Please Post Feedback and Any Feature Requests in the Comments Section Below***

MACD ReLoadedA different approach to Gerald Appel's classical Moving Average Convergence Divergence.

Appel originaly set MACD with exponential moving averages.

In this version users can apply 11 different types of moving averages which they can benefit from their smoothness and vice versa sharpnesses...

Built in Moving Average type defaultly set as VAR but users can choose from 11 different Moving Average types like:

SMA : Simple Moving Average

EMA : Exponential Moving Average

WMA : Weighted Moving Average

DEMA : Double Exponential Moving Average

TMA : Triangular Moving Average

VAR : Variable Index Dynamic Moving Average a.k.a. VIDYA

WWMA : Welles Wilder's Moving Average

ZLEMA : Zero Lag Exponential Moving Average

TSF : True Strength Force

HULL : Hull Moving Average

TILL : Tillson T3 Moving Average

In shorter time frames backtest results shows us TILL, WWMA, VIDYA (VAR) could be used to overcome whipsaws because they have less numbers of signals.

In longer time frames like daily charts WMA, Volume Weighted MACD V2, and MACDAS and SMA are more accurate according to backtest results.

My interpretation of Buff Dormeier's Volume Weighted MACD V2:

Thomas Aspray's MACD: (MACDAS)

CryptoSignalScanner - MACD Multiple Time FramesDESCRIPTION:

After receiving some multiple request to provide a MACD indicator that displays multiple timeframes at the same time I created this simple script.

You can use this script for free and adjust it as much you like.

With this script you can plot 6 MACD lines & 6 Signal lines.

• Current Timeframe MACD Line

• Current Timeframe Signal Line

• 15 minute candle MACD Line

• 15 minute candle Signal Line

• 30 minute candle MACD Line

• 30 minute candle Signal Line

• 1 hour candle MACD Line

• 1 hour candle Signal Line

• 2 hour candle MACD Line

• 2 hour candle Signal Line

• 4 hour candle MACD Line

• 4 hour candle Signal Line

HOW TO USE:

• When multiple MACD lines on an uptrend are grouped together it is time to SELL.

• When multiple MACD lines on a downtrend are grouped together it is time to BUY.

• The higher to length of the MACD lines the stronger the BUY/SELL signal.

FEATURES:

• You can show/hide the preferred MACD lines.

• You can show/hide the preferred Signal lines.

How MACD works

The MACD indicator is generated by subtracting two exponential moving averages (EMAs) to create the main line (MACD line), which is then used to calculate another EMA that represents the signal line. In addition, there is the MACD histogram, which is calculated based on the differences between those two lines. The histogram, along with the other two lines, fluctuates above and below a center line, which is also known as the zero line.

The MACD indicator consists of three elements moving around the zero line:

• The MACD line. By default the MACD line is calculated by subtracting the 26-day EMA from the 12-day EMA.

MACD line = 12d EMA - 26d EMA

• The signal line. By default the signal line is calculated from a 9-day EMA of the MACD line.

Signal line = 9d EMA of MACD line

• Histogram. The histogram is nothing more than a visual record of the relative movements of the MACD line and the signal line.

It is simply calculated as: MACD line - signal line

REMARKS:

• This advice is NOT financial advice.

• We do not provide personal investment advice and we are not a qualified licensed investment advisor.

• All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice.

• We will not and cannot be held liable for any actions you take as a result of anything you read here.

• We only provide this information to help you make a better decision.

• While the information provided is believed to be accurate, it may include errors or inaccuracies.

Good Luck,

SEOCO

Micro MACDMicro version of the MACD

Positioning

ATR - uses ATR to position indicator 1.5x above high of the Nth bar (needs improvement)

Absolute - allows you to specify the zero line position using price on the chart.

[Sidders] MACDEMASAR IndicatorCame across a cool idea for a strategy that couldn't find in the indicator database, so decided to code it up myself for your pleasure.

Indicators consists of 3 indicators: EMA(200) to determine the overall trend, and the MACD & Parabolic SAR to determine entries (and exits).

Long entry contains 4 conditions and is generated when price is above the 200EMA (1), the MACD crosses above the signal line (2), while they are both below 0 line (3) and when the parabolic SAR is below the closing price of the bar (4).

Short entry is build up the same but in reverse: price is below the 200EMA(1), signal line crosses below the MACD line (2), while they are both above the 0 line (3) and when the parabolic SAR is above the closing price of the bar (4).

Place the stoploss on the parabolic SAR dot below/above the candle that created the signal. Profit target 1:1 risk:reward ratio, but can ofcourse be changed according to your risk apetite. Might add automatically drawn SL/TPs in a later update.

Concept behind the strategy should work on all timeframes, but will require proper backtesting. I think with additional filters the strategy can also be way more finetuned and profitable, personally haven't had the time yet to dive into that.

Have also added alerts for your convenience.

Enjoy!

All in One StudyHere is my All in One Strategy converted into a Study with Alert Conditions you can use for whatever purpose you wish.

Each condition is set up similarly to the way I had the strategy set up, if you pick the indicators you want to base your alerts on it will alert you only if the check box is true.

You can pick one or more of the indicators if you'd like. I only suggest to pick one at a time so you don't have overlapping buy/sell alerts.

I think everyone will find the message of the market falling alert amusing :-)

Forward Cross ProjectionA quick script used to predict the average value the price should have to create a cross between a slow and fast MA at a given time. The line is red when the current cross is bullish and the line is green when the current cross is bearish. Crossing a red line downwards means that the price is getting lower and a bearish death cross is impending. Crossing a green line upwards means that the price is rising and a bullish cross is impending. Script was made thanks to the idea of Dannii

MACD-RSI Confluence SimplifiedAnother simple version of the MACD RSi Confluence script. But this is one is more simplified with simple signals. Again to fully understand macd & RSI you should already have some type of knowledge of how they work. With understanding this script & it's signals are great for those who do. This script is based on Barcolor signals reflected by macd & RSI data

SimpleScalper2.0MACDThis indicator should be implemented with more indicators, by itself it is not recommended. SimpleScalper 2.0 MACD its strong are the negative values during the major corrections or waves of impulse of downtrend and see divergences with better visibility

Table: Relative Strength Index (Multiple Timeframes) DESCRIPTION

It is the most popular and dependent Indicator, Relative Strength Index (RSI) . Now, I put inside a table to view chart momentum from Multiple timeframes.

This indicator tells different Timeframe (30 minutes, 1 hour, 4 hour, 1 day, 1 week, 1 month) of RSI value within table form.

HOW TO USE

Can consider a Long position when all timeframes go oversold while Short position when all timeframes go overbought. Alarm function is available. It sounds as all timeframes are overbought or oversold.

Modified The source of indicator from ©BeeHolder named "Performance"

Easy Entry/Exit Trend Colors (With Alerts)This is an updated version of user Algokid's script called 'AK MACD BB INDICATOR V 1.00'. You can find that original script here:

I added many alerts along with the Bullish and Bearish alerts when the MACD crosses over the Upperband or crosses down on the Lowerband.

I personally use this indicator with Crypto charts (Bitcoin on a 15min, 1hour, and 4 hour timeframe) as one of many confirmations that it's a good time to enter a trade. This script was made to be easy to follow with the colors of GREEN triangles being a good uptrend or entry confirmation, and RED being a confirmation to sell/short or exit your trade.

It's important to use this indicator in combination with other indicators that can give you more confirmations to enter or exit a trade, and make sure you are on normal candles and not HA or any other candles as you can get wildly inaccurate results.

This script also has the Death & Golden crosses, which is the slow and fast moving averages crossing over each other. I don't use this as an additional confirmation, it's just nice to know where the cross happens.

Hopper Trigger - Free Cryptohopper WidgetWelcome to our Tradingview cryptohopper trigger widget.

We designed this script to give Cryptohopper users the possibility to set up an alarm when btc is trending down. Cause of the BTCs behavior as the supertrend coin for the market it is better to turn your hopper off or be extremly careful when BTC is trending down. We implemented to types of alarms, because atm its not possible to automate using them to deactivate your hopper. On Alarm setup could be used to send signals every minute to trigger a push notification on your App or to trigger your Alexa. The other type of alarm only sends one single signal for normal purposes.

We recommend using this indicator in the 30 minute or 1 hour timeframe and to deactivate your hopper and deleting all positions when a alarm is signaling. The risk of a larger drop is very high in this marketphase. Never take an drop again using this approach. Little drawdown in bearish or ranging times but high reward in bullish times.

Smartgrow-Trading is a community project with the aim of developing the best and most successful trading strategies and sharing them with the community.

The basic idea of this script is to calculate how far an coin is away from its ATH , to gave warning signals for deactivating coins after they reached there ATH . So it could also be used for other coins and pairs.

If there are questions, write them into the comments or contact us directly over the direct message or social media. Happy Trading!

Triple Exponential MACDA modification of the classic MACD to use Triple EMAs which tends to have less lag than the standard indicator. (I also have a Double Exp MACD indicator, I tend to use both simultaneously)

Alert conditions are pre-configured for simple line crosses and you can enable/disable the histogram from the indicator options menu.

Enjoy!

Double Exponential MACDA modification of the classic MACD to use Double EMAs which tends to have less lag than the standard indicator.

Alert conditions are pre-configured for simple line crosses and you can enable/disable the histogram from the indicator options menu.

Enjoy!

Simple Macd Momentum Reversal IndicatorThis Simple indicator uses the MACD history to check trend reversals. It primarily check if the histogram has moved up from a downtrend above a certain margin. If it has, it places a green B on the chart. If you were to use/improve this indicator, please use it with other indicators to confirm your position. This is NOT an indicator that can be well used alone.

Price Acceleration Convergence Divergence V2This is a fork of the previous PACD indicator i made by working out the RSI another two times. it works the exact same but is more leading in trend reversals and divergences.

this indicator plots 4x the RSI of the RSI of the price using the derivatives of RSI. Data is plotted just like the MACD.

points 5 and -5 are very strong support/resistance points and should be very important points to take note of.

use this indicator like the MACD essentially with the assistance of a 4x RSI momentum. enjoy

macZLSMA - Overlay**Overlay Version** Macd that shows instantaneous trend using ZLSMA. This crossover has the ability to reveal trend directions before it happens. With multi time frame option.

Above image shows 1 hour timeframe using 12hour setting on indicator

Example with 1 hour timeframe:

Example with 1 hour timeframe using daily setting on indicator:

Non overlay version available here:

macZLSMAMacd that shows instantaneous trend using ZLSMA. This crossover has the ability to reveal trend directions before it happens.

Price Acceleration Convergence Divergence [PACD]this indicator plots the acceleration of the price using the derivatives of RSI. Data is plotted just like the MACD. use this indicator like the MACD. enjoy

RSI & MACDThis indicator presents standart RSI and MACD indicators in a single indicator. The appearances of these indicators have been modified a little bit and squeezed into one window. To overcome the scale problem the MACD values has expanded with 1000 and divided by the current price to use both indicators in the same scale. Original values could be determined from there. Original Tradingview codes have been used to get full control of graphs.

Bu indikatör RSI ve MACD gösterfgelerini tek bir indikatörde sunuyor. İndikatörlerin görünüşleri bir miktar modifiye edilip iki indikatörğn tek bir pencereden takip edilmesine olanak sağlanmıştır. İki indikatördeki farklı ölçek kullanımından ortaya çıkan ölçek sorunu MACD değerlerinin 1000 ile genişletilip, ürünün güncel fiyatına bölünmesiyle giderilmiştir. Her iki indikatiör için de orjinal Tradingview kodları kullanılmıştır.

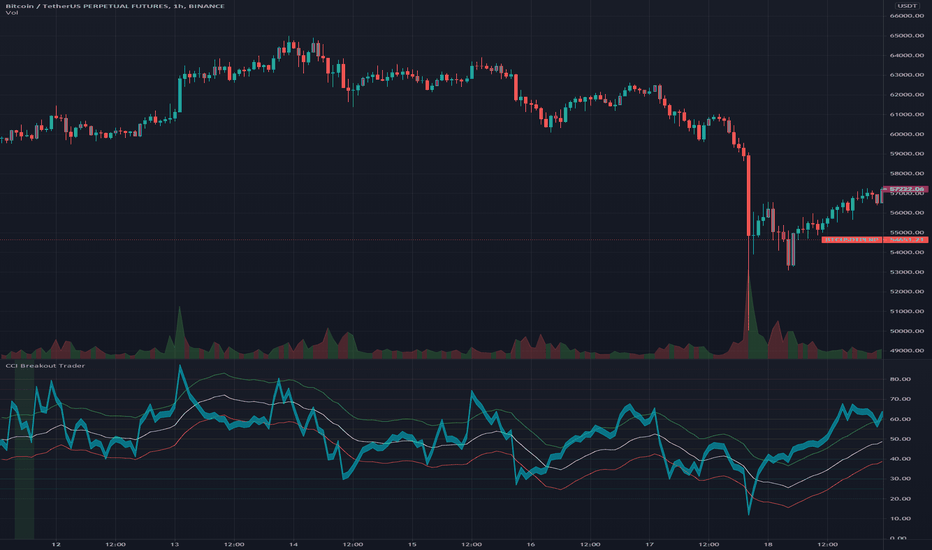

CCI Breakout TraderWorks well on Bitcoin or most altcoins on a 15min chart or higher.

What is this exactly?

This is an indicator that uses horizontal RSI + EMA lines with a CCI line on top of it to provide optimal entry and exit positions for trading. There is also a breakout indicator based on the width of Bollinger Bands.

How to use:

If the blue stream passes upwards on the red heading to the white - it's heading towards a good BUY signal. To be safe you wait until it passes above the white line, then BUY LONG. Another signal to buy long is when the blue stream passes above the white and green lines.

Selling is essentially the opposite, if the blue stream is passing down from the green or white lines, then it's time to sell and exit your trade.

If you need help knowing when to enter and exit a trade the indicator will draw a grey candle on your chart to signal it's time to exit a long trade and it will draw a purple candle when it's time to enter a long.

--

Breakout alert:

If you see a green vertical bar it's a warning that there is a potential breakout in price coming for whichever coin you are looking at. The price breakout could go either direction, so make sure you watch the blue stream.

--

Important tips:

The direction of the green/white/red lines are important - if they are heading down that means it might not be the best time to enter your trade, even if the blue stream crosses up on the red and/or white lines.

The colored horizontal lines are there to let you know if the blue stream is near the bottom of those lines (anywhere from hline 15 to 50) and heading upwards, you will more likely have a longer positive trade. If the blue stream is above 60 hline and it looks like a good trade (passing up on the red and white lines), expect to have a shorter trade.

I use this for swing trading various crypto currencies, once you learn how to read it, you can catch amazing uptrends really early and you can exit trades before some big drops happen.

MACD Moving Average Convergence/Divergence - DurbtradeDurbtrade MACD - macd line changes color based on vertical direction. This makes it easier to see and discern movements and also helps the indicator to retain maximum functionality when taking up less chart real estate (also, having the color change really helps me see charts on small screens... such as when it's bright outside and I'm driving in my car and glancing at a chart on my phone... it helps having the info pop visually). A fill option is included to fill the space between the macd and signal lines, though I personally prefer to disable this function. Also, you get a zero line if you want it, and it doesn't extend past the current time, removing unnecessary info and keeping your chart looking a bit cleaner. Finally, there are color-coded, cross-over and cross-under background fills, signaling when the macd line crosses the signal line.

This is my 2nd published script, and 2nd script ever. If you like this style, see my 1st published script: Durbtrade Bollinger Bands Width.

Hope you find this useful.

Feel free to comment.