Wolfpack Id with DivergenceThis indicator simply identifies if the markets are in an up or down trend. You should always use it in combination with other indicators, just as Wavetrends.

This indicator is mostly known because of Market Cipher. The script that was published under the name Wolfpack Id is for some reason closed source, but as it turns out there is of course no secret sauce involved, the original indicator goes way back and the thing that was then called Wolfpack Indicator is simply a MACD Signal Line with 3,8 settings. I added a simple divergence hunter for some extra Informations that might help, brought it up to contemporary pinescript standards, added Alerts and made the whole script open source, as it should be and as the original script also once was. Have fun!

Расхождение

+ JMA KDJ with RSI OB/OS SignalsSo, what is the KDJ indicator? If you're familiar with the Stochastic, then you'll know that the two oscillating lines are called the 'K' and 'D' lines. Now you know that this is some sort of implementation of the Stochastic. But, then, what is the J? The 'J' is simply the measure of convergence/divergence of the 'K' and 'D' lines, and the 'J' crossing the 'K' and 'D' lines is representational of the 'K' and 'D' lines themselves crossing. Is this an improvement over simply using the Stochastic as it is? Beats me. I don't use the Stochastic. I stumbled upon the KDJ while surfing around the web, and it sounded cool, so I thought I'd look at it. I do like it a bit more as the 'J' line being far overextended from the other two (usually into overbought/sold territory) does give a clear visual representation of the divergence of the 'K' and 'D' lines, which you might not notice otherwise. So, from that perspective I suppose it is nicer.

But let's get to the good stuff now, shall we? What did I do here?

Well, first thing you're wondering is why there are only two lines when based on my explanation (or your previous experience with the indicator) there should be three. I found this script here on TV, by x4random, who took the 'K' and 'D' lines and made an average of them, so there is only one line instead of the two. So, fewer lines on the indicator, but still the same usefulness. It was in older TV code, so I took it to version4 and cleaned up the code slightly. His indicator included the RSI ob/os plots, and I thought this was neat (even though the RSI being os/ob doesn't tell you much except that the trend is strong, and you should be buying pullback or selling rallies) so I kept them in. His indicator was also the most visually appealing one that I saw on here, so that attracted me too. Credit to x4random for the indicator, though.

Aside from code cleanup and adding the usual bells and whistles (which I will get to) the big thing I did here was change is RMA that he was using for the 'K' and 'D' lines to a Jurik MA's, which smooth a lot of the noise of other moving averages while maintaining responsiveness. This eliminates noise (false signals) while keeping the signals of significance. It took me a while to figure out how to substitute the JMA for the RMA, but thanks to QuantTherapy's "Jurik PPO" indicator I was able to nail down the implementation. One thing you might notice is that there is no input to change signal length. I fiddled with this for a time before sticking to using the period, instead of the signal (thus eliminating the use of the signal input altogether), length to generate the 'K' and 'D' calculations. To make any adjustments other than the period length use the Jurik Power input. You can use the phase input as well, but it has much less of an effect.

Everything else I changed is pretty much cosmetic.

Candle coloring with the option to color candles based on either the 'J' line or the 'KD' line.

color.from_gradients with color inputs to make it beautiful (this is probably my best looking indicator, imo)

plots for when crosses occur (really wish there was a way to plot these over candlesticks! If anyone has any suggestions I'd love to see!)

I think that's about it. Alerts of course.

Enjoy!

Below is a comparison chart of my JMA implementation to the original RMA script.

You can see how much smoother the JMA version is. Both of these had the default period of 55 set, and the JMA version is using the default settings, while the original version is using a length of 3 for the signal line.

RSI Divergency and Golden RatioHow to calculate:

Positive mismatch finds the lowest trough within the distance you choose. It then compares it to the current closing value.

If the past low is above the current closing level, it means that the bottoms of the price are descending.

The RSI level at the furthest bottom of the price is detected. And the current RSI level is detected. If the current RSI level is higher than the previous RSI level, there is a positive divergence.

When a positive divergence occurs, a green pole forms above the RSI indicator on the chart.

Negative finds the highest peak level within the distance you choose. It then compares it to the current closing value.

If the past high is below the current close, it means that the highs of the price are rising.

The RSI level at the furthest high of the price is detected. And the current RSI level is detected. If the current RSI level is lower than the previous RSI level, there is negative divergence.

When a negative divergence occurs, a red pole forms above the RSI indicator on the chart.

As can be seen in the image, the points marked with red are the regions where incompatibility occurs. At the same time, the signals that occur when the RSI cuts its own moving average and the signals that occur when the RSI cuts its own golden ratio are also very strong signals.

Waiting for your ideas and comments. I am open to criticism. We can improve.

[blackcat] L1 volume Oscillator IndicatorLevel: 1

Background

Omega Research proposed volume oscillator indicator in June 2000.

Function

This is actually a volume-price indicator. With columns greater than zero line, which indicates a up trend. Otherwise, it is a down trend. Green columns indicate up trend pump; yellow columns indicate up trend retracements; red columns indicate down trend dump; blue columns indicate down trend re-bounce.

Key Signal

VolOsc --> volume osillator indicator.

Remarks

This is a Level 1 free and open source indicator.

Feedbacks are appreciated.

Trend Momentum with Buyers / Sellers PowerHi there!

With this indicator, you can hunt big trends before they start.

This indicator is combined with RSI and Momentum indicators

It can show you the power of trend and which side it wants to go

It can help you to open a position at the first point of a new trend or at the safe and proven point of the trend, also it can help you to close your position before the trend change its direction (it's not recommended to use it to close your positon, but sometimes it can help you to find the ending point of big pumps)

Rules:

* Baseline is ZERO ( 0 ) line

* When gray line crossover red line, it shows us a powerful uptrend

* When the gray line crossunder the red line it shows us a powerful upward trend

Signals:

* Only use Buy signals(Long) when they are above or crossing-up baseline

* Only use Sell signals(Short) when they are under or crossing-down baseline

* If they both (red and gray lines) are too high and they suddenly starting to come back to baseline, it shows we have a range trend, the trend is weak or a reversal trend is coming!!

!! WARNING: DO NOT USE THIS INDICATOR ALONE !!

Suggestions :

-Use 1H, 4H, daily, or Weekly timeframes

-Use ADX and DI or three WMA's

-Use divergence

-You can use it for scalping but you need to change the inputs (not recommended)

If you have any idea about making new indicators(what information do you want from the chart?), comment please, then I can research and make it for all of us! =)

RSI Divergence + EMA @DaviddTechVery simple strategy that will look for Divergence on the RSI.

My Strategy for this was mixed with the 55 EMA which you can activate in the settings.

WARNING:

- For purpose educate only - My mission is to debunk fake strategies with code to find THE ONE.

- Plots EMAs and other values on chart.

- This script to change bars colors.

Stochastic Weighted RSI w/ Divergence + Signals🐢 Tawtis' Stochastic Weighted Relative Strength Index , aka SWRSI

This indicator combines the Stochastic RSI and the classic RSI we all know and love to create a more effective indication of seller/buyer dominance, and in turn, trend. I have named it the "Stochastic Weighted RSI". The script also includes a standard RSI, so you can use both at the same time!

Loads of customisation, pretty much every input can be changed to fit your preferences, however, the default settings are what I would personally recommend for the best results. Either way, feel free to change them!

By looking at the indicator, you can also establish the trend that may follow in the candles to come.

Typically, an indicator reading of over 70 is considered overbought, and an indicator reading of under 30 is considered oversold.

The calculations for the SWRSI and its signals take into account a multitude of exponential moving averages, a Stochastic RSI and a classic RSI, among other things.

There are 2 types of signals provided by the indicator, being strong and weak. You do not have to follow these, and they aren't always accurate (it's impossible to be accurate 100% of the time), however, they can give a good idea of the trend that will ensue.

Strong buy signals are created when:

SWRSI is under 30

SWRSI is over the EMA (default 2) of the SWRSI

Short EMA (default 20) is under the long EMA (default 50)

Strong sell signals are created when:

SWRSI is over 70

SWRSI is under the EMA (default 2) of the SWRSI

Short EMA (default 20) is over the long EMA (default 50)

Weak buy and sell signals are printed as green and red background highlights, and operate the same as the strong buy and sells, without the short/long EMA criterion. Both of these signal types can be toggled off using the settings if you do not want to see them.

Enjoy!

Time Segmented Volume with divergence and Kumo cloud backgroundThis is a Time Segmented Volume (TSV) indicator with added divergence hunter, crossing signals, Kumo cloud background and alert functions

Please keep in mind that this indicator is a tool and not a strategy, do not blindly trade signals, do your own research first!

EMA Price DistanceEMA Price Distance, EMAPD for short, is a trend following indicator that can help you predict how price is going to move, in respect to your EMA. It can give overbought and oversold signals, as well as ranging market and retracement signals. The indicator consists of three parts, the Difference Line, the Average Line, and the Histograms.

- The blue line is the Difference Line. It is calculated from difference between the close price and the EMA. An increasing Difference Line indicates price moving further away from the EMA.

- The purple line is the Average Line. It is calculated based on the average of the difference Line for a certain lookback period.

- The Histograms are the difference between the Difference Line and the Average Line

Some basic signals:

- The easiest signal to spot is when the Difference Line is further away from the Average Line than normal. This usually signifies a retracement in the near future.

- Another signal is when the histograms are making smaller peaks or troughs, approaching 0. Signifies that price is retracing towards EMA. This can also be seen when the Difference Line is below the Average Line

How to Use:

The first use case is to detect when the market is ranging. This can be seen when both lines near 0 like so:

Another use case, is to use the indicator to signify how strong the current trend is / how likely it is to continue. This is signified by the Difference Line and Average line making higher highs

We can see that as the trend continues, both lines increase in harmony.

EMAPD can also be used to give easy to see signs of retracement or reversal.

Here we can see that the Difference line made a lower high as well as crossed below the Average Line. Whether this is a retracement or reversal usually depends on how the long the trend has occurred. The longer, the more likely of a trend reversal

One of the best use cases is to keep you out of bad trades. This usually happens right before a trend starts, when the market is choppier. This is when you usually get a lot of fake outs and false signals.

Here are 2 examples of where someone trading Supply and Demand would've been kept out of a losing trade.

In the first purple oval, a supply zone is formed. As price re enters the zone, it would be tempting to go long but the EMAPD is creating lower lowers on the histograms, signifying that price is moving closer to its average instead of expanding. We also get the Difference Line to cross under the average line, signifying price is moving closer to the EMA than it has been recently. These signals tell us that price has a good chance to "re group" with the EMA, which it ends up doing.

This also kept us out of the second trade, signified by the second purple oval. Here, we can see the difference line creating lower lows, signaling that price is moving closer to the EMA.

RSI Hidden Divergence + Stochastic + 200 EMA @DaviddTechHey Traders,

This is my first strategy of many I hope. Inspired by a strategy I found on YouTube I wanted to see if it would work with a BOT strategy.

The idea is :

## LONG ##

* When the price is above 200 EMA take only LONG positions.

* Look for Bullish hidden divergence.

* Stochastic crossover to find our entry.

## SHORTS ##

* When the price is below 200 EMA take only SHORTpositions.

* Look for Bearish hidden divergence.

* Stochastic crossunder to find our entry.

You can used a fixed percentage, ATR, HH/LL or a FIB level to take profit.

Everything is very visual and can be connected easily to a bot.

I will be doing a video on HOW-TO setup in a couple of days.

## MUTLI LEVEL PROFITS ##

This will show you on backtest is you take profits at 3 levels however I have not tested on a BOT strategy.

NOTE : This is for educational purposes and please test on a paper account, as I said this is my first strategy.

I will be working and back testing new strategies every week.

- Made with ♥ @DaviddTech

Multiple Oscillator Crossing - TradingEDThis case study is based on different previous studies: ADX Triple , MACD Triple & RSI Triple , with three different counts to compare different oscillations of each indicator. Actually, this indicator is complementary to those previously mentioned . The use of this indicator is restricted to private use, and it can be used only by invitation. Different functionalities have been added to the original codes, such as alerts and signals that seek to make trading much easier to interpret by any type of trading operator of any experience level , from beginner to intermediate and advanced .

Key components of the original ADX indicator:

• The DIRECTIONAL MOVEMENT INDEX (DMI) is a technical indicator that measures both the strength and direction of a price movement and is intended to reduce false signals.

• The DMI uses two standard indicators, one negative ( -DI ) and one positive ( +DI ), in conjunction with a third, the AVERAGE DIRECTIONAL INDEX ( ADX ), which is non-directional but shows momentum.

• The larger the spread between the two primary lines, the stronger the price trend. If +DI is way above -DI the price trend is strongly up. If -DI is way above +DI then the price trend is strongly down.

• ADX measures the strength of the trend, either up or down; a reading above 20 indicates a strong trend.

ADX is plotted as a single line with values ranging from a low of zero to a high of 100. ADX is non-directional; it registers trend strength whether price is trending up or down. The indicator is usually plotted in the same window as the two DMI lines, from which ADX is derived. When +DI is above -DI, there is more upward pressure than downward pressure in the price. Conversely, if -DI is above +DI, then there is more downward pressure on the price. This indicator may help traders assess the trend direction. Crossovers between the lines are also sometimes used as trade signals to buy or sell, theay are the main trade signals. A long trade is taken when the +DI crosses above the -DI and an uptrend could be underway. Meanwhile, a sell signal occurs when the +DI instead crosses below the -DI.

Key components of the original RSI indicator:

● The Relative Strength Index ( RSI ) is a popular momentum oscillator developed in 1978.

● The RSI provides technical traders signals about bullish and bearish price momentum, and it is often plotted beneath the graph of an asset's price.

● An asset is usually considered overbought when the RSI is above 70% and oversold when it is below 30%.

It is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to assess overbought or oversold conditions in the price of an asset. The RSI is displayed as an oscillator (a line chart moving between two extremes) and can read from 0 to 100. Overbought does not necessarily mean that the price will reverse lower, just as oversold does not mean that the price will reverse higher. Rather, the overbought and oversold conditions simply alert traders that the RSI is near the extremes of its recent readings.

Key components of the original MACD indicator:

● The Moving Average Convergence Divergence ( MACD ) is calculated by subtracting a long period (26) Exponential Moving Average ( EMA ) from a short (12) period EMA .

● MACD triggers technical signals when it crosses above (to buy) or below (to sell) its signal line.

● The speed of crossovers is also taken as a signal of a market is overbought or oversold.

● MACD helps traders to understand whether the bullish or bearish movement in the price is strengthening or weakening.

It is a momentum indicator that follows the trend and shows the relationship between two moving averages of the price of a security. It can function as a trigger for buy and sell signals, when you cross above (to buy) or below (to sell) your signal line. It helps to understand if the movement is bullish or bearish , if it is getting stronger or weaker. The further the MACD is above or below its baseline, it indicates that the distance between the two EMAs will be growing, often shown with a histogram that graphically represents the distance between the MACD and its signal line, and It is used to identify when the bullish or bearish momentum.

Main functions of this modified indicator:

1) The SOURCE for the counts can be determined by the trader (close, open, etc).

2) In some cases, you can select the type of MOVING AVERAGE , among many available options ( SMA , EMA , DEMA , HMA , etc.)

3) The MEASURE can be based on a CANDLES count if you are trading OHLC Charts from 1D onwards , or if your trading is intraday, you can also select counts by MINUTES , HOURS or DAYS , depending on your trading style.

4) LENGTH , by default it will be loaded as in the STRATEGY , but considering the previous point, you can modify it according to your convenience.

5) You have the option to hide or show a LABEL at the top of the chart, with respect to the signals: BULLISH green, BEARISH red. *

6) You have the option to hide or show INDICATORS or SIGNALS based on EACH OSCILLATION .

Main performance functions of this modified indicator:

I) In the case of the PERFORMANCE that appears at the right of the chart, you have the option to adjust the WIDTH of each box.

II) The TEXT of the PERFORMANCE is not modifiable, but you can customize the default color. *

III) The BACKGROUND of the PERFORMANCE , you can customize the default color. *

IV) You have the option to hide or show a PERFORMANCE that appears at the right of the chart.

Main functions to customize the style of this indicator:

a) For any type of SIGNAL , it is painted as a VERTICAL LINE in the graph, you can change the color that comes by default. *

b) In the case of the LABELS that appear at the top, the text is not modifiable, but you can customize both the type of label and change the default color. *

c) When you have a SHORT SIGNAL or a LONG SIGNAL , you can change the EMOTICON that comes by default. **

* By default, they are marked as red for downtrends and green for uptrends.

** By default, they are marked with an emoticon indicating the possible direction of the price, down if it is bearish or up if it is bullish .

MACD hist divergence strategy with switch v2

sum Macd hist to compare their strength,the DIAMOND means total strength , if the strength divergence, the trend may change

Macd 面積比較力度, 鑽石代表總力度, 力度背離即可能發生反轉

for the bullish market, I will suggest you to close the sw of buying energy divergence ex:btc

對於大牛市會建議您將買點能量背離關掉ex 比特幣

this strategy only have long order by now

目前此策略只支援做多

按鈕簡介

switch info

1.macd 面積背離時價格是否有背離的開關

1.A divergence switch btw price and MACD hist

2.macd 快線下穿0軸賣出的選項

2. Once MACD fast_line crossunder 0 stop loss switch

3.the setting logic and method is like this

設定如下

A1. 大牛股 for bullish market

B1. 高勝率低利潤 for high winning rate but lower profit

C1 高頻適合小級別 for high frq trading, useful in low period

D1 極小級別 for extremeness low period

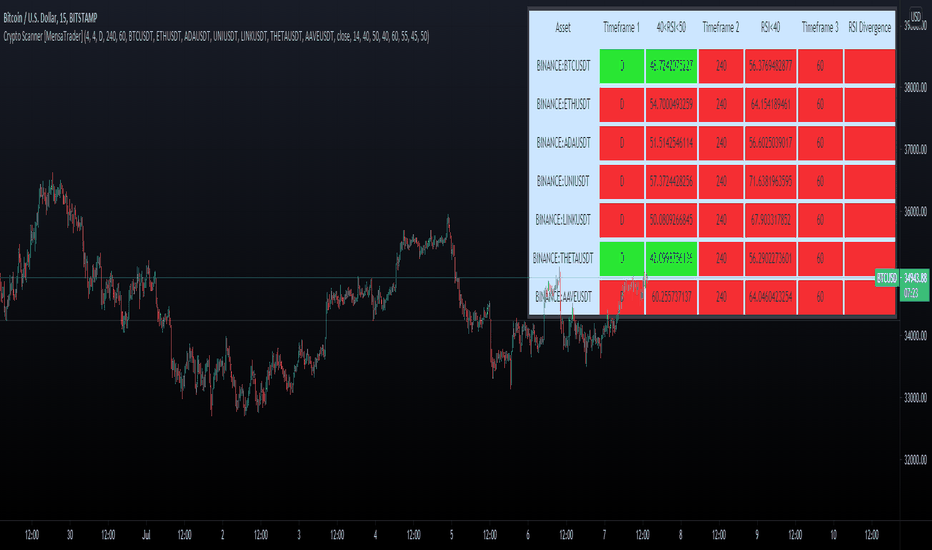

Crypto Scanner [MensaTrader]Market Scanner

By default set up to scan 7 Crypto Currencies on 3 different Time frames

Default assets are from Binance listing, but can be changed in settings.

First timeframe is set to Daily, (all timeframes can be changed in the settings), The RSI value for the Daily resolution is printed. The current conditions need it to be between the value of 40 and 50, If this condition is met then the box will light are green, if they are not they will stay red.

Second timeframe is set to 4 Hour, RSI for this timeframe and assset will also be printed here, the conditions for it are different though. Currently set up so if the RSI value is lower than 40 the box will light up green. This 40 value can be changed in the settings aswell.

Third timeframe is set to 1 Hour, This timeframe is looking for divergences. If a Divergence is found, the box will light up green and say "Bullish Divergence", This will stay green until either of the 2 invalidation conditions are met.

One condition is (For Bullish Divergence) to be cleared, If the recent Low where the divergence was formed gets taken out. Then the divergence sign will dissappear

Second condition is if the RSI Value climbs above 55, Then once again the Divergence sign will dissappear.

Use this to help scan multiple assets at once and find RSI values which suit your trading set ups.

I have tried to make as many options adjustable as possible including the Size of the Scanner, all in the settings.

3GBH - MoneyMeter (Stablecoins RSI)This indicator tracks the Market Caps of

- USDT

- USDC

- DAI

The data is presented on the RSI.

The intent of this indicator is to help determine whether money is flowing into the market or not.

If the major stablecoins are green, money is entering the market.

The opposite applies, if red, money is leaving the market.

This is another tool which may provide help to build confluence in your trading or analysis.

-----

Default length is set to 168 to see the momentum of the past 7 days on the 1-hour timeframe.

Martyv Auto Fib Retracement with Logarithmic SupportSimple & easy auto-fib levels. Took the out-of-the-box version provided by TradingView and added Logarithmic support and a nicer palette, and made the controls a bit nicer to use (in my opinion lol). Enjoy.

RSI Signals by HBRELATIVE STRENGTH INDEX (RSI)

This is a tool that is widely used

Especially for Overbought and Oversold systems, but I have made some changes in this indicator,

How to use it...!

I have set it as the default setting

- RSI Length: 7

- Overbought: 70

- Oversold: 30

What is unique about this tool?

we can see 3 conditions:

1) RSI Overbought / Oversold with Bullish Engulfing / Bearish Engulfing

2) RSI Overbought / Oversold with Hammer and Shooting Star

3) RSI Overbought / Oversold with 2 Bullish Bars / 2 Bearish Bars

4) RSI Overbought / Oversold with All Patterns at the same time

When the RSI reaches its Oversold line, the code will wait for Bullish Engulfing pattren , when oversold and Bullish engulfing matched, This indicator will generate a buy signal when the condition is met,

and same as for Bear market, When the RSI reaches its Overbought line, the code will wait for Bearish Engulfing pattren , This indicator will generate a sell/exit signal when the condition is met,

2nd condition is that a Hammer candle will be waited for when RSI touches the Overbought line, for Bullish Move

and Shooting Star candle will be waited for when RSI touches the Overbought line, for Bullish Move, for Bearish Move

3rd Condition is also the same as Condition 1 and Condition 2,

When the RSI reaches its Oversold line, the code will wait for 2 Bullish Bars , when oversold and 2 Bullish Bars matched then this indicator will generate a buy signal, and same as for Bear market,

When the RSI reaches its Overbought line, the code will wait for 2 Bearish Bars , when overbought and 2 Bearish Bars matched then this indicator will generate a Sell signal,

4th Condition is that we can use All Conditions at the same time,

- Bullish Engulfing / Bearish Engulfing

- Hammer and Shooting Star

- 2 Bullish Bars / 2 Bearish Bars

Tipsy EMA Tipsy EMA

v0.2a

Coded by vaidab.

A simple strategy to buy dips in an uptrend.

How to use:

- buy on trend when price retraces to the orange "buy" line and compound orders

- sell when price reaches red line (stop loss) or at 💰 (take profit)

Note that you can reverse trade on the 💰 sign for a short scalp / day trade.

Uptrend: green/red background. Danger zone: orange bg. No go zone: no bg.

Potential buys (in a clear trend): 55, 100, 200 EMA touches and

fibo retracements to .382 and .618.

Potential stop loss: when price breaks the 200 EMA (marked by a red line).

Exit signs: opposite trend divergences (RSI).

Take profit: EMA 55 crossing down EMA 100.

Use it in confluence with market structure. E.g. If 200 EMA ligns up with

past market structure, if there are whole numbers or if there's a monthly level.

Tested BTCUSDT D, 4H

Trend Power Index [Fournier-Eaton]Trend Power Index measures the power of a given trend relative to its past strength.

Increasing values indicate strengthening of an upward trend or weakening of a downward trend

Decreasing values indicate strengthening of a downward trend or weakening of an upward trend.

Crossing zero is a confirmation of trend initiation in the respective direction

Note: Parameters may be changed to account for low cycle times and high volatility

As always, please make any suggestions you might have or share problems or successes. Any feedback is helpful.

MashumeHullTV█ OVERVIEW

This plots the Hull Moving Average Turning Points and Concavity

with the addition of colored segments representing concavity and turning points: maxima, minima and inflection.

a fast way to determine the trend direction and possible reversals based on concavity of the trend

Dark Green: Concave Up but HMA decreasing. The 'mood' has changed and the declining trend of the HMA is slowing. Possible trend change to Uptrend soon

Light Green: Concave up and HMA increasing. Price is increasing, and since the curve is still concave up, it is accelerating upward. Uptrend

Orange: Concavity is now downward, and though price is still increasing, the rate has slowed, perhaps the mood has become less enthusiastic. Possible trend change to Downtrend soon

Red: Concave down and HMA decreasing. Downtrend

Buy signals generated when Hull turns from Dark Green -> Light Green

Sell signals generated when Hull turns from Orange -> Red

To best determine if this is a entry point or a trend reversal, it is recommended to use in conjunction with the QQEMoMoTV indicator

█ FEATURES

Calculations

Calculates the concavity of the Hull Moving Average comparing the Hull concavity of the current bar to the previous bar and displays the concavity in the form of 4 different colors.

Note: may cause repainting, so recommended to use with another indicator such as the QQEMoMoTV indicator to confirm signals.

Calculates divergence between the calculated HMA and the actual price and displays this in the Divergence Label.

Calculates the local minima, maxima and inflection points with the ability to display these as auto support/resistance lines.

Inputs

You can use the script's inputs to configure:

• Calculation Source (default HL2)

• HMA Length (default 21)

• Lookback (default 2)

• Whether to show Auto Support/Resist Lines

• Whether to show Buy/Sell Arrows

• Whether to show Divergence Label

• Whether to extend Local Auto Support/Resist Lines

Alerts

Buy Signal alert based on HMA crossing above MA_Min/Hull Support, when Hull turns from Dark Green -> Light Green, Bullish

Sell Signal alert based on HMA crossing below MA_Max/Hull Resistance, when Hull turns from Orange -> Red, Bearish

Experimental support for applying the indicator to higher time frames

eg. charting the hourly MashumeHull indicator on 15 min chart. See the commented code to access this feature

█ CREDITS

Original Author: Seth Urion (Mashume)

Feature upgrades and usage: Xiuying

Converted to Tradingview by: Machdragon

HTF Candles by DGThigher timeframe (multi timeframe) candles

a simple study introducing new pine function box.new

[Sidders] LTFDIV - Strategy version (beta)Strategy version of my previously released LTF divergence scalper. Currently being beta tested prior to full release as a premium indicator.

Description of the indicator: The indicator uses several trades of divergences and overbought/oversold levels (which can be defined) of several indicators on the 1 minute timeframe. Long signals are only given if the overall trend is bullish (determined by either moving averages or the Ichimoku system). Short signals are only given if the overall trend is bearish (determined yet again by either the moving averages or the Ichimoku system).

The strategy contains several additional filters that can be applied to sharpen the strategy and improve overall winrate and profitability. Additionally it contains a multitude of different ways of setting your stoplosses and setting your profit targets. I've also included many other customization options, such as time zones, trading periods and even the possibility to base the entire strategy on Ichimoku (either classic or crypto settings) instead of moving averages. The sky is the limit with regards to customization.

Lastly, but still a major feature: I've included a way to automate the strategy through the use of 3Comma bots. This takes away the need to sit behind your pc and trade the strategy yourself and automates everything after you've set it up properly.

Access to the strategy is currently limited. A full release will follow in the coming week. If you're interested, send me a message and I can more details (e.g. pricing). Cheers!

Volume per PointHello everyone <3

I present to you guys my new indicator Volume per Point (VP)

As suggested by the title, this script gives you the volume for every point.

Here's a run down on specific features:

SUBCHART COLUMNS:

The columns can be the following four colors:

Green - There was an increase in VP

Red - There was a decrease in VP

Yellow - There was divergence between volume and candle range

Purple - There are signs of exhaustion compared to the previous candlestick

SUBCHART HISTOGRAM:

The histogram can be the following two colors:

Lime - Buying volume

Red - Selling volume

I left you guys the ability to change the multiplier on the volume in settings just incase it's too small or too big compared to the VP. Decimals are allowed!

CANDLESTICK CHART:

The candlesticks can the following two colors:

Yellow - There was a divergence between volume and candle range

Purple - There are signs of exhaustion compared to the previous candlestick

FILTERS

In the settings, you're able to add the following two filters:

RSI Filters - RSI must be below or above the specified value for the divergence or exhaustion to trigger

Percent Filters - The candlestick range or volume must be higher or lower than the specified value depending whether it's divergence or exhaustion.

This is a very helpful tool if you're interesting in reading volume. It also facilitates finding market maker activity depending on the size of the VP. Sudden abnormal spikes in VP usually do signal something and that's up for you to figure out :)

Thank you for your time to read this

~July <3