Momentum Shift [Bigbeluga]

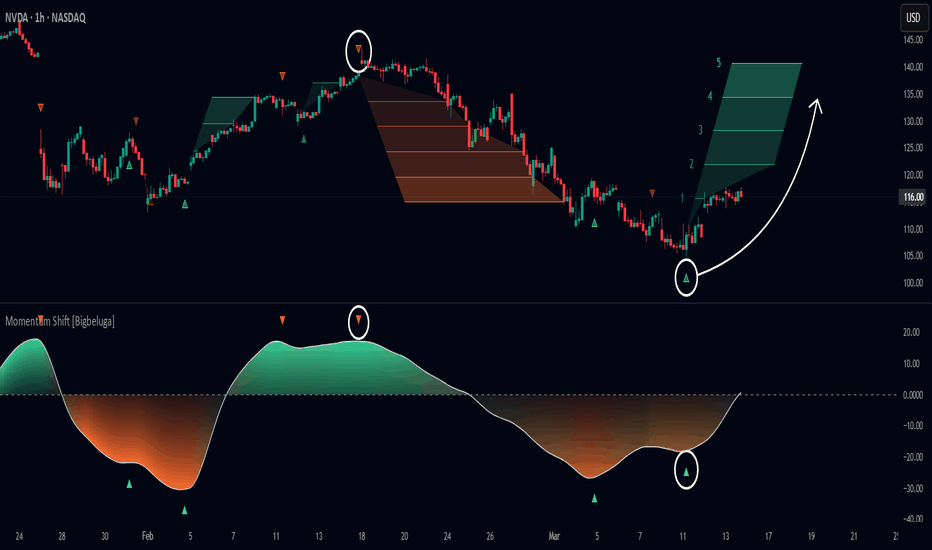

This indicator identifies momentum shifts using a smoothed momentum calculation. It plots dynamic shift zones consisting of five levels that expand or contract based on price action. When momentum rises, the indicator creates an upward shift zone, and when momentum falls, it generates a downward shift zone. The shift zones dynamically react to price, stopping extension when a level is crossed.

🔵Key Features:

Smoothed Momentum Calculation:

➣ Utilizes a Hull Moving Average (HMA) to smooth momentum and reduce noise.

➣ Identifies momentum shifts with crossovers between the current momentum value and its previous state.

➣ Uses a gradient color scheme to highlight momentum strength.

Dynamic Shift Zones:

➣ When momentum rises, the indicator plots an upper shift zone with five incremental levels.

➣ When momentum falls, a lower shift zone is formed with five descending levels.

➣ Each level within the shift zone represents a progressively stronger momentum shift.

Level Extension Control:

➣ Shift zones stop extending once a level is crossed by price.

➣ Levels closer to price act as key momentum resistance or support zones.

➣ If price retraces after a shift, the remaining levels stay intact for further reference.

Momentum Direction Indications:

➣ Labels (▲ and ▼) appear at momentum shift points to indicate rising or falling momentum.

🔵Usage:

Momentum-Based Entries: Identify momentum shifts early by using shift zones as confirmation for trade entries.

Trend Continuation & Exhaustion: Observe which shift levels price respects—if momentum shift zones hold, the trend may continue; if they break, momentum may reverse.

Dynamic Support & Resistance: Use the five-level shift zones as temporary support and resistance areas that adapt to momentum shifts.

Momentum Strength Analysis: If price moves through multiple shift levels in one direction, it signals strong momentum in that direction.

Momentum Shift is a powerful tool for traders looking to analyze momentum shifts with structured visual zones. By combining smoothed momentum calculations with dynamic shift zones, this indicator provides a clear view of market momentum and helps traders navigate price action effectively.

Zonetrading

Unmitigated 50% of the RangeThis indicator is designed to display unmitigated 50% zones of price ranges within two swing (High and Low) points. The 50% level serves as a probable target for retracements before the price resumes its movement in the direction of the most recent swing. The underlying theory is that Price Action tends to correct unbalanced price zones by returning to 50% of the range.

The indicator identifies highs and lows utilizing the “Left Swing Sensitivity” setting, which detects the high/low points within the specified number of bars. It then ensures that the zone meets a minimum size requirement, configured via the “Minimum Leg Size” setting, to filter out smaller legs/zones that would not provide sufficient profit and loss opportunities for entries at 50% and take profit at the most recent swing point.

To prevent duplication of zones when the price is gradually moving up, an "Auto Adjust Levels" setting is available. Enabled by default, this feature automatically cleans up smaller zones, retaining only the primary zone between the most recent swing point and the outer swing.

Additionally, the indicator automatically removes mitigated zones where the price has returned to the 50% level, thus maintaining clean charts.

There are several visualization settings available, offering comprehensive control over what is displayed on the charts:

Control the color and style of the lines representing the 1, 0, and 50% levels.

Choose whether to display labels and if they should show the price at the rendered levels.

Optionally extend the lines/labels to the right for each level.

Breaker Blocks + Order Blocks confirm [TradingFinder] BBOB Alert🔵 Introduction

In the realm of technical analysis, various tools and concepts are employed to identify key levels on price charts. These tools assist traders in analyzing market trends with greater precision, enabling them to optimize their trading decisions. Among these tools, the Order Block and Breaker Block hold a significant place, serving as effective instruments for analyzing market structure.

🟣 Order Block

An Order Block refers to zones on a chart where large financial institutions and high-volume traders place their orders. Due to the substantial volume of buy or sell orders in these areas, they are often regarded as pivotal points for potential price reversals or temporary pauses in a trend. Order Blocks are particularly crucial when prices react to these zones after a strong market move, acting as strong support or resistance levels.

🟣 Breaker Block

On the other hand, a Breaker Block refers to areas on a chart that previously functioned as Order Blocks but where the price has managed to break through and continue in the opposite direction. These zones are typically recognized as key points where market trends might shift, helping traders identify potential reversal points in the market.

🟣 Overlapping Block (BBOB)

Now, imagine a scenario where these two essential concepts in technical analysis—Order Blocks and Breaker Blocks—overlap on a chart. Although this overlap is not specifically discussed within the ICT (Inner Circle Trader) trading framework, exploring and utilizing this overlap can provide traders with powerful insights into strong support and resistance zones. The combination of these two robust concepts can highlight critical areas in trading, potentially offering significant advantages in making informed trading decisions.

In this article, we will delve into the concept of this overlap, explaining how to utilize it in trading strategies. Additionally, we will analyze the potential outcomes and benefits of incorporating this concept into your trading decisions.

Bullish Overlapping Block (BBOB) :

Bearish Overlapping Block (BBOB) :

🔵 How to Use

The overlap between Order Blocks and Breaker Blocks is a compelling and powerful concept that can help traders identify key levels on the chart with a high probability of success. This overlap is particularly valuable because it combines two well-regarded concepts in technical analysis—zones of high order volume and critical market shifts.

🟣 Here’s how to effectively use this overlap in your trading

1. Dentifying the Overlapping Block : To make the most of the overlap between Order Blocks and Breaker Blocks, begin by identifying these zones separately. Order Blocks are areas where price typically reacts and reverses after a strong market move.

Breaker Blocks are areas where a previous Order Block has been breached, and the price continues in the opposite direction. When these two zones overlap on a chart, it’s crucial to pay close attention to this area, as it represents a high-probability reaction zone.

2. Analyzing the Overlapping Block : After identifying the overlap zone, carefully analyze price action within this region. Candlestick patterns and price behavior can provide essential clues.

If the price reaches this overlap zone and strong reversal patterns such as Pin Bars or Engulfing patterns are observed, it’s likely that this zone will act as a pivotal reversal point. In such cases, entering a trade with confidence becomes more feasible.

3. Entering the Trade : When sufficient signs of price reaction are present in the overlap zone, you can proceed to enter the trade. If the overlap zone is within an uptrend and bullish reversal signals are evident, a long position might be appropriate.

Conversely, if the overlap zone is in a downtrend and bearish reversal signals are observed, a short position would be more suitable.

4. Risk Management : One of the most critical aspects of trading in overlap zones is managing risk. To protect your capital, place your stop loss near the lowest point of the Order Block (for buy trades) or the highest point (for sell trades). This approach minimizes potential losses if the overlap zone fails to hold.

5. Price Targets : After entering the trade, set your price targets based on other key levels on the chart. These targets could include other support and resistance zones, Fibonacci levels, or pivot points.

Bullish Overlapping Block :

Bearish Overlapping Block :

🟣 Benefits of the Overlapping Block Between Order Block and Breaker Block

1. Enhanced Precision in Identifying Key Levels : The overlap between these two zones usually acts as a highly reliable area for price reactions, increasing the accuracy of identifying entry and exit points.

2. Reduced Trading Risk : Given the high importance of the overlap zone, the likelihood of making incorrect decisions is reduced, contributing to overall lower trading risk.

3. Increased Probability of Success : The overlap between Order Blocks and Breaker Blocks combines two powerful concepts, enhancing the likelihood of success in trades, as multiple indicators confirm the importance of the area.

4. Creation of Better Trading Opportunities : Overlap zones often provide traders with more robust trading opportunities, as these areas typically represent strong reversal points in the market.

5. Compatibility with Other Technical Tools : This concept seamlessly integrates with other technical analysis tools such as Fibonacci retracements, trend lines, and chart patterns, offering a more comprehensive market analysis.

🔵 Setting

🟣 Global Setting

Pivot Period of Order Blocks Detector : Enter the desired pivot period to identify the Order Block.

Order Block Validity Period (Bar) : You can specify the maximum time the Order Block remains valid based on the number of candles from the origin.

Mitigation Level Order Block : Determining the basic level of a Order Block. When the price hits the basic level, the Order Block due to mitigation.

Mitigation Level Breaker Block : Determining the basic level of a Breaker Block. When the price hits the basic level, the Breaker Block due to mitigation.

Mitigation Level Overlapping Block : Determining the basic level of a Overlapping Block. When the price hits the basic level, the Overlapping Block due to mitigation.

🟣 Overlapping Block Display

Show All Overlapping Block : If it is turned off, only the last Order Block will be displayed.

Demand Overlapping Block : Show or not show and specify color.

Supply Overlapping Block : Show or not show and specify color.

🟣 Order Block Display

Show All Order Block : If it is turned off, only the last Order Block will be displayed.

Demand Main Order Block : Show or not show and specify color.

Demand Sub (Propulsion & BoS Origin) Order Block : Show or not show and specify color.

Supply Main Order Block : Show or not show and specify color.

Supply Sub (Propulsion & BoS Origin) Order Block : Show or not show and specify color.

🟣 Breaker Block Display

Show All Breaker Block : If it is turned off, only the last Breaker Block will be displayed.

Demand Main Breaker Block : Show or not show and specify color.

Demand Sub (Propulsion & BoS Origin) Breaker Block : Show or not show and specify color.

Supply Main Breaker Block : Show or not show and specify color.

Supply Sub (Propulsion & BoS Origin) Breaker Block : Show or not show and specify color.

🟣 Order Block Refinement

Refine Order Blocks : Enable or disable the refinement feature. Mode selection.

🟣 Alert

Alert Name : The name of the alert you receive.

Alert Overlapping Block Mitigation :

On / Off

Message Frequency :

This string parameter defines the announcement frequency. Choices include: "All" (activates the alert every time the function is called), "Once Per Bar" (activates the alert only on the first call within the bar), and "Once Per Bar Close" (the alert is activated only by a call at the last script execution of the real-time bar upon closing). The default setting is "Once per Bar".

Show Alert Time by Time Zone :

The date, hour, and minute you receive in alert messages can be based on any time zone you choose. For example, if you want New York time, you should enter "UTC-4". This input is set to the time zone "UTC" by default.

🔵 Conclusion

The overlap between Order Blocks and Breaker Blocks represents a critical and powerful area in technical analysis that can serve as an effective tool for determining entry and exit points in trading.

These zones, due to the combination of two key concepts in technical analysis, hold significant importance and can help traders make more confident trading decisions.

Although this concept is not specifically discussed in the ICT framework and is introduced as a new idea, traders can achieve better results in their trades through practice and testing.

Utilizing the overlap between Order Blocks and Breaker Blocks, in conjunction with other technical analysis tools, can significantly improve the chances of success in trading.

Stoch RSI, Div, Zone S3 by Gammaprod>> How to use this indicator :

1. Set your teadingview theme to dark theme.

2. My indicator is valid for forex, stock and but more valid for crypto.

3. Use three timeframe for more validation (choose between those, that fit to your trading style) :

- Timeframe 1m, 5m, and 15m for Scalping

- Timeframe 30m, 1h and 4h for Intraday

- Timeframe 4h, 1D and 1W for Swing Trading

4 . Always use THREE INDICATORS FROM GAMMAPROD, those three indicators is back to back each other, by the way, I only made those three indicators only (for now) :

- Trendlines Boll Ichi Crypto by Gammaprod

- Stoch RSI Divs Zone Crypto by Gammaprod

- MACD Volume Crypto by Gammaprod

>> How to setting :

1. Trendlines Boll Ichi Crypto by Gammaprod

A. Support and Resistence

- Well if you familiar with this indicator you can add it, but recommended for Timeframe 30m or more

B. Trendlines Primary or Trendlines Secondary

- Timeframe 1m you DON'T NEED Trendlines Primary or Trendlines Secondary

- Timeframe 5m you DON'T NEED Trendlines Secondary, but you CAN ADD Trendlines Primary if you fell it helpful (for me, it is helpful to find where the candles start or the end trend or a consolidation or where the candles will surpass a resistance or a support).

- Timeframe 15m you DON'T NEED Trendlines Secondary, DEFENITELY add Trendlines Primary it will help to find where the candles stop or a consolidation or where the candles will surpass a resistance or a support).

- Timeframe 30m or more, DEFENITELY NEED BOTH Trendlines Primary and Secondary Trendlines, it will help to find where the candle stop or consolidation or where the candle will surpass a resistance or support).

C. Bolinger, Ichimoku Cloud and Lagging Span

- Please DON'T CHANGE IT at all, it's really helpful to know when and where to make an entry decesion or a trend or a consolidation, if you don't understand how to read it, you better to learn it first (on "how to read" section and "How to OPEN position" the section below)

2. Stoch RSI Divs Zone Crypto by Gammaprod (DON'T CHANGE IT)

3. MACD Volume Crypto by Gammaprod (DON'T CHANGE IT)

>> How to read :

1. Sell or Buy Priority :

A. Buy Priority

- Color background on macd and stoch rsi is pink or purple sell is the priority, (if you're not sure to buy, just wait until the best moment to sell)

B. Buy Priority

- Color background on macd and stoch rsi Teal or light green buy is the priority, (if you're not sure to sell, just wait until the best moment to buy)

C. Indecision / Golden Moment

- Color background on stoch rsi yellow is indecision / golden moment of reversal pattern (wait until it formed background only on Stoch RSI), please becareful at this moment.

2. Trend / Consolidation :

A. BULLISH trend

- When Stoch RSI and MACD have teal or light green background that's means BULLISH trend, better to confirm by the candle is above green cloud and lagging span (red line) is also above the candle.

B. BEARISH trend

- When Stoch RSI and MACD have the Pink or purple background that's means BEARISH trend, better to confirm by the candle is above purple cloud and lagging span (red line) is also below the candle.

C. CONSOLIDATION

- When Stoch RSI have the mix background that's means CONSOLIDATION, better to confirm by the candle is in or near to green / purple cloud and lagging span (red line) is also on the candle.

3. Special Mark

A. Ideal Bullish :

- Near line 20 and green / teal background = When Stoch RSI have the char R / H on lime color label, that's means divergence or hidden divergence for buy position, if you not see this label that's means just a standard confirmation for buy

B. Not an Ideal Bullish :

- Near line 80 and green / teal background = if this happens make sure you know what happen, it could be a false signal or bullish continual pattern

C. Ideal Bearish :

- Near line 80 and pink / purple background = When Stoch RSI have the char R / H on lime color label, that's means divergence or hidden divergence for buy position, if you not see this label that's means just a standard confirmation for sell position.

D. Not an Ideal Bearish:

- Near line 20 and pink / purple background = if this happens make sure you know what happen, it could be a false signal or bearish continual pattern

E. The Beginning of Reversal (from BEARISH to BULLISH) :

- When Stoch RSI line shaping GREEN position is near 20.

- MACD lines still PINK, position lines is UNDER the HISTOGRAM, but the HISTOGRAM start to SHAPE FALL PINK (light pink) and the BACKGROUND still PINK / PURPLE.

- Position CANDLES NEAR BLUE line, NEAR PURPLE CLOUD, and lagging span (red line) STILL ON the area candle. (it used to be confirmed with the golden moment).

F. The Beginning of Reversal (from BULLISH to BEARISH) :

- When Stoch RSI line shaping PINK position is near 80.

- MACD lines still GREEN, position lines is ABOVE the HISTOGRAM, but the HISTOGRAM start to SHAPE FALL GREEN (light green) and the BACKGROUND still TEAL / GREEN.

- Position CANDLES NEAR WHITE line, NEAR TEAL CLOUD, and lagging span (red line) STILL ON the area candle. (it used to be confirmed with the golden moment).

G. False Signals, or It could be a Golden Moment (better to see it on TF 15 or bigger):

- Near line 20 or 80 and yellow background = When Stoch RSI have the char R / H on color label, that's means divergence or hidden divergence for buy / sell position, if you not see this label that's means just a standard confirmation for buy / sell depends on where the Stoch RSI line if near 20 that's means buy, near 80 means sell

>> How to OPEN position:

A. Bullish

1. Trendlines Boll Ichi Crypto by Gammaprod

- The candles above the green cloud.

- Lagging span (red line) above the candles.

- then open buy near yellow line (the first option) / blue line (the second option) (always confirm the position with two other indicators below).

2. Stoch RSI Divs Zone Crypto by Gammaprod

- Teal or Green background.

- The lines is shaping green.

- Better if on the bottom (at a range 20).

3. MACD Volume Crypto by Gammaprod

- Teal or Green background.

- The lines is shaped or shaping green.

- Better if at the green histogram.

B. Bearish

1. Trendlines Boll Ichi Crypto by Gammaprod

- The candles below the purple cloud.

- Lagging span (red line) below the candles.

- then open buy near yellow line (the first option) / white line (the second option) (always confirm the position with two other indicators below).

2. Stoch RSI Divs Zone Crypto by Gammaprod

- Pink or purple background.

- The lines are shaping pink.

- Better if the line on the top (at a range 80).

3. MACD Volume Crypto by Gammaprod

- Pink or purple background.

- The lines are shaped or shaping green.

- Better if at the pink histogram.

C. Consolidation

1. Trendlines Boll Ichi Crypto by Gammaprod

- The candles on the cloud (green or purple).

- Lagging span (red line) on the candles.

- then open buy near the white or blue line (always confirm the position with two other indicators below).

2. Stoch RSI Divs Zone Crypto by Gammaprod

- Mix background specially on a timeframe 15m or more.

- The line move fast up and down.

- Better if on the bottom or the top of the lines (at a range 20 or 80).

3. MACD Volume Crypto by Gammaprod

- Changing the background.

- The line is near the middle line.

- Have small Histogram.

>> The secret ingridient is comparing the timeframe :

The example scalping (Timeframe 1m, 5m and 15m)

- TF 1m is for making an open position.

- TF 5m is for making a judgement of the trend market.

- TF 15m is to confirm that judgement from TF 5m, be careful if it not similar then it used to be a consolidation or the beginning of the reversal.

There's a lot a way to open the position than above information that i gave it to you, but consider there are a limit char on this column, I hope it will help your trading and make a more profit on it.

MTF Order Block FinderAn Order Block is a special type of pivot point that satisfies the following requirement:

A Bull/Bear candle followed by X consecutive candles in the opposite direction.

Order Blocks are interesting areas that are frequently revisited and can be treated as Support/Resistance levels.

Often, you can see explosive price rejection of these areas via long wicks, high volume, and rapid price change.

Features

Choose from two themes:

- LIGHT: a classic Red and Green representing Bearish and Bullish OBs, respectively

- DARK: a clean Blue and White scheme

Choose from two drawing styles:

- LINE: three lines representing the High, Low, and Mid price levels of the OB candle

- BOX: a bounded area similar to the "rectangle" tool

Chose a custom timeframe:

- From 1 Minute (useful for Seconds interval) up to 1 Month

Note, this setting is experimental and choosing a timeframe that is extraordinarily large may not function properly.

Filter order blocks with two settings:

- Number of consecutive bars

- Minimum % change of the potential OB bar (default 0.25%)

Keep your charts clean and show only relevant OBs

- Maximum number of Bullish zones to show

- Maximum number of Bearish zones to show

FAQ

Q: How do I trade with this indicator?

A:Personally, I use a fast entry indicator to confirm Long/Short position when price is rejected. I set my SL and TP based on the current Zone and the next one, if available.

Q: Does this repaint?

A:Yes and this is okay! The "Bear" and "Bull" signals are not meant for taking positions, only showing which candle reveals the Order Block. The Zone is much more useful to us and can result in several successful trades in the near future when treated as a support/resistance area.

Q What's the winrate?

A:Hard to say - this isn't a standalone strategy and I haven't been able to properly backtest it quite yet.

[RickAtw] ZONE Trend 3█ OVERVIEW

This indicator tracks current trends. Trends are determined by the zones created for them, the brighter the zone, the higher the probability of a market reversal.

█ FEATURES

The indicator adapts to any market.

You can set your own values for your system

Any timeframe can be used

You can increase the number of zones

█ HOW TO USE

If the market starts to enter the red zone, open buy and hold until the second or third zone.

If the market moves towards the blue zone, we sells and hold until the next zone.

█ The author of the work

Rick Atwood

Automatic FibonacciFibonacci retracements are popular among technical traders. In technical analysis, a Fibonacci retracement is created by taking two extreme points (usually a peak and a trough) on a stock chart and dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8%, and 100%. Basic fibo levels are often known to be 14.6%, 23.6%, 38.2%, 50%, 61.8%, 76.4%, 88.6% and 100%.

This indicator will draw the fibonacci levels automatically. Once these levels are identified, horizontal lines are drawn and used to identify possible support and resistance levels including zones. The fibo levels on this indicator gives you the option to use basic fibo or new paradigm fibo levels. New paradigm fibo levels may be new to most traders, however, the application of new paradigm fibo does allow one to trade with least risk due to the precision of the price action surrounding the fibo levels and zones.

One of the most efficient and great ways to apply this auto fibo indicator and the new paradigm fibo is by only leaving the fibo levels that do have hits and un-selecting the fibo levels that do not have any. You can further remove any other levels so you can trade the zones that these fibo levels create.

In addition, you can also switch the timeframe of the fibo from 1D to different number of days to 1W.