CVD Divergence Insights📘 CVD Divergence Insights – by Colicoid

Pine Script v6 | Volume Delta Divergence Oscillator with Spike Detection

⸻

🔍 Overview

CVD Divergence Insights is a volume-aware oscillator and divergence spike detector that helps you spot smart money activity, absorption, failed pressure, and hidden strength or weakness — even when price action alone gives little away.

It works by comparing normalized Cumulative Volume Delta (CVD) against normalized price movement, and optionally applying a volume-weighting layer to highlight when aggressive participation is truly behind the divergence. The result is a dynamic visual tool that identifies tension in the market, and helps you trade based on how that tension resolves.

⸻

🧠 Core Concept

• When price moves one way and CVD moves another, it reflects imbalance between aggression and result.

• Divergence is not a trigger — it’s a build-up of pressure.

• The real edge lies in the resolution of that pressure.

• Optional volume-weighting helps you ignore noise and focus on high-conviction moves only.

⸻

⚙️ How It Works

1. CVD Calculation

CVD is generated using lower-timeframe delta volume (buy vs. sell pressure), accumulated per bar.

2. Oscillator

A normalized divergence between the smoothed CVD and smoothed price.

3. Volume Weighting (optional)

Emphasizes divergences occurring on higher-than-normal volume, deprioritizes low-volume noise.

4. Signal Line (optional)

A short EMA of the oscillator to help track momentum shifts (hidden by default).

5. Divergence Spikes

Statistical spike detection using standard deviation — green/red dots highlight unusually large divergence activity.

⸻

🎛️ Inputs

Anchor Period

Higher timeframe where the CVD is accumulated and processed.

Lower Timeframe

Optional override for granularity of buy/sell volume data.

SMA Length

Used for smoothing both price and CVD before divergence is calculated.

Volume Weighted?

Enables adaptive weighting based on relative volume size.

Volume Normalization Length

Lookback period used to define what is “normal” volume.

Divergence Spike Threshold

StdDev-based threshold to detect abnormally large divergences.

Signal Line Length

Controls the EMA smoothing of the optional signal line (hidden by default).

⸻

📈 Trade Setup Example: Hidden Bullish Divergence

1. Price forms a higher low, but CVD forms a lower low — hidden bullish divergence.

2. This shows aggressive sellers are trying, but price is resilient — likely absorption.

3. You wait for a "convergent signal bar":

• A bullish candle with strong structure or body

• Confirmed by CVD starting to turn upward

4. That’s your trigger bar — the tension resolves upward.

⸻

🤝 Recommended Pairings

For best results, combine CVD Divergence Insights with the companion script:

🔗 Cumulative Volume Delta Line (also by Colicoid)

This lets you:

• See the raw CVD line and its SMA visually

• Spot standard and hidden divergences in price/CVD directly

• Use the Insights indicator to evaluate divergence quality and flag aggressive bull/bear behavior

• Use the same SMA length on both indicators for alignment

👉 Tip: To save screen space, drag the CVD Line indicator into the same panel as CVD Divergence Insights.

⸻

🧰 Why Use This?

• ✅ Catch absorption setups and failed pressure zones

• ✅ Filter out low-quality divergences using volume context

• ✅ Understand why price is hesitating or breaking out

• ✅ Add smart confirmation to breakout/reversal trades

• ✅ Align your execution with who’s actually in control

⸻

📎 Created by Colicoid

Built in Pine Script v6 for advanced price-volume analysis, with focus on effort vs result, market psychology, and smart money detection.

Объем

malama's volume spikeThe "malama's volume spike" indicator identifies and highlights bars where the trading volume significantly exceeds the average, signaling potential market interest or activity. It calculates a Simple Moving Average (SMA) of the volume over a user-defined period and compares the current volume against this average multiplied by a specified threshold factor. Bars where the volume surpasses this threshold are colored yellow on the chart, providing a visual cue for traders to identify potential trading opportunities.

How It Works:

Volume Moving Average (SMA): The indicator computes the SMA of the volume over a period defined by the user (default is 20 bars).

Threshold Calculation: It multiplies the SMA by a user-defined factor (default is 2.0) to set the volume spike threshold.

Volume Spike Detection: If the current volume exceeds this threshold, the corresponding bar is highlighted in yellow.

Usage:

Volume MA Length: Adjust this parameter to set the period over which the volume SMA is calculated. A shorter length responds more quickly to recent volume changes, while a longer length smooths out short-term fluctuations.

Volume Threshold Factor: Modify this factor to set the sensitivity of the volume spike detection. A lower value will highlight more bars, while a higher value will highlight fewer, more significant spikes.

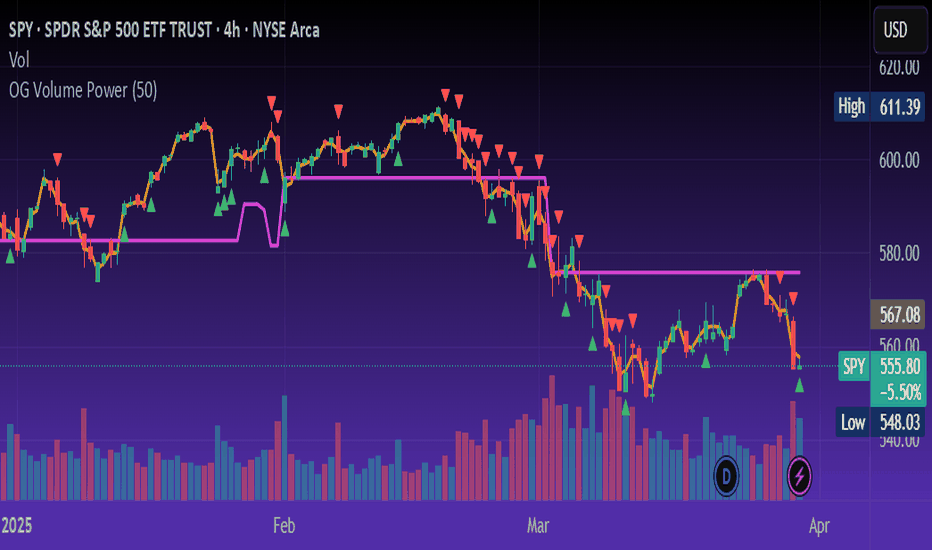

OG Volume PowerDescription:

The OG Volume Power is an elite-level volume analysis suite built for identifying momentum surges, trend continuation, and buyer/seller imbalances at critical price levels. It combines real-time VWAP tracking, a dynamic Point of Control (POC), and volume delta clusters to give traders a complete picture of price and volume interaction.

🔍 Key Features:

Real-Time VWAP:

Tracks volume-weighted average price to identify mean reversion and intraday fair value zones. Ideal for institutional-level entries and exits.

Dynamic POC (Point of Control):

Automatically finds the price level with the highest volume over the last N candles (default 50), helping traders pinpoint where market participants are most committed.

Buyer/Seller Volume Delta Clusters:

Highlights imbalances between buying and selling pressure using bullish and bearish volume deltas that exceed the 20-bar volume average — excellent for momentum detection and early trend recognition.

⚙️ How It Works:

Green triangle: Buyer surge (bullish delta + above average volume)

Red triangle: Seller surge (bearish delta + above average volume)

Magenta line: Dynamic POC (highest volume price over recent candles)

Orange line: VWAP (acts as a magnetic force for price)

📈 Best For:

Intraday scalping or swing trading on SPY, QQQ, BTC, or Forex

Volume flow confirmation before breakout entries

Filtering false breakouts with delta strength signals

🧠 Pro Tip:

Use OG Volume Power alongside your trend indicators (like OG EMA Stack or OG Supertrend) to confirm that volume is backing the move. Look for surges near VWAP or POC zones for sniper-level entries.

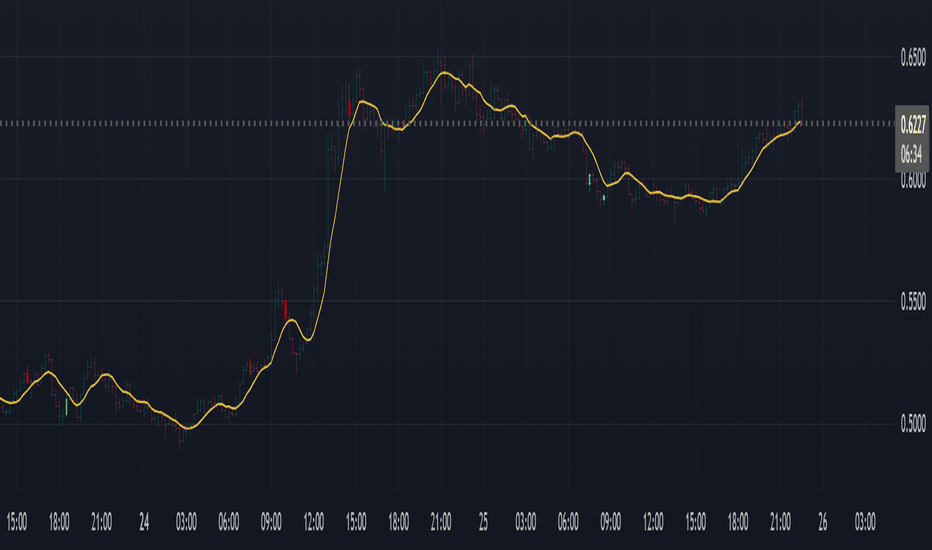

WMA and Intraday Highest Volume Candle Levels🔹 WMA Calculation (Weighted Moving Averages)

Custom WMA Function:

Uses a manual weighted average calculation.

Assigns more weight to recent prices for smoother trend detection.

Three Timeframes:

5-Minute WMA (Yellow)

15-Minute WMA (Blue)

30-Minute WMA (Red)

🔹 Intraday Highest Volume Candle Levels

Finds the candle with the highest volume for the selected intraday timeframe.

Stores its High & Low levels to act as support/resistance.

Deletes and redraws lines daily to reflect the latest session's highest volume candle.

Plots horizontal lines:

Green Line: High of the highest volume candle.

Red Line: Low of the highest volume candle.

Customization: User can choose the analysis timeframe (default: 3 minutes).

✅ Benefits of This Indicator

✔ Multi-timeframe trend analysis using WMA.

✔ Key intraday levels based on highest volume candle.

✔ Dynamic support & resistance levels based on real-time volume activity.

✔ Customizable timeframe for volume analysis.

Supertrend + MACD with Advanced FiltersDetailed Guide

1. Indicator Overview

Purpose:

This enhanced indicator combines Supertrend and MACD to signal potential trend changes. In addition, it now includes several extra filters for more reliable signals:

Multi-Timeframe (MTF) Confirmation: Checks a higher timeframe’s trend.

ADX (Momentum) Filter: Ensures the market is trending strongly.

Dynamic Factor Adjustment: Adapts the Supertrend sensitivity to current volatility.

Volume Filter: Verifies that current volume is above average.

Each filter can be enabled or disabled according to your preference.

How It Works:

The Supertrend calculates dynamic support/resistance levels based on ATR and an adjustable factor, while MACD identifies momentum shifts via its crossovers. The additional filters then confirm whether the conditions meet your criteria for a trend change. If all enabled filters align, the indicator plots a shape and triggers an alert.

2. Supertrend Component with Dynamic Factor

Base Factor & ATR Period:

The Supertrend uses these inputs to compute its dynamic bands.

Dynamic Factor Toggle:

When enabled, the factor is adjusted by comparing the current ATR to its simple moving average. This makes the indicator adapt to higher or lower volatility conditions, helping to reduce false signals.

3. MACD Component

Parameters:

Standard MACD settings (Fast MA, Slow MA, Signal Smoothing) determine the responsiveness of the MACD line. Crossovers between the MACD line and its signal line indicate potential trend reversals.

4. Multi-Timeframe (MTF) Filter

Function:

If enabled, the indicator uses a higher timeframe’s simple moving average (SMA) to confirm the prevailing trend.

Bullish Confirmation: The current close is above the higher timeframe SMA.

Bearish Confirmation: The current close is below the higher timeframe SMA.

5. ADX Filter (Momentum)

Custom Calculation:

Since the built-in ta.adx function may not be available, a custom ADX is calculated. This involves:

Determining positive and negative directional movements (DMs).

Smoothing these values to obtain +DI and -DI.

Calculating the DX and then smoothing it to yield the ADX.

Threshold:

Only signals where the ADX exceeds the set threshold (default 20) are considered valid, ensuring that the market is trending strongly enough.

6. Volume Filter

Function:

Checks if the current volume exceeds the average volume (SMA) multiplied by a specified factor. This helps confirm that a price move is supported by sufficient trading activity.

7. Combined Signal Logic & Alerts

Final Signal:

A bullish signal is generated when:

MACD shows a bullish crossover,

Supertrend indicates an uptrend,

And all enabled filters (MTF, ADX, volume) confirm the signal.

The bearish signal is generated similarly in the opposite direction.

Alerts:

Alert conditions are set so that TradingView can notify you via pop-up, email, or SMS when these combined conditions are met.

8. User Adjustments

Toggle Filters:

Use the on/off switches for MTF, ADX, and Volume filters as needed.

Parameter Tuning:

Adjust the ATR period, base factor, higher timeframe settings, ADX period/threshold, and volume multiplier to match your trading style and market conditions.

Backtesting:

Always backtest your settings to ensure that they perform well with your strategy.

Volume Histogram with ThresholdsVolume Histogram with Thresholds

Description:

This indicator displays a histogram of volume bars with color coding based on customizable volume thresholds. It helps traders quickly identify potential breakouts and breakdowns by comparing current volume against a moving average of past volume.

Features:

Customizable Average Volume Period – Allows you to set a lookback period for calculating average volume.

Color-Coded Bars for Quick Visual Reference:

Gray: Below average volume (low activity)

Blue: Near average volume (normal activity)

Green: Above average volume (potential breakout/breakdown)

Red: Significantly above average volume (high-confidence move)

Plots an Orange Reference Line – Represents the average volume for easy comparison.

Usage:

Adjust "Average Volume Period" to set the moving average length for volume.

Modify "Above Average" and "High Volume" multipliers to fine-tune breakout/breakdown sensitivity.

Look for green and red bars to confirm strong moves in price action.

This indicator can help confirm the validity of breakouts and breakdowns by visually emphasizing volume surges. 🚀

Explanation of Presets in the Indicator

The indicator comes with three user-configurable settings that determine how volume is analyzed and displayed. Here’s what they do and why they matter:

1. Average Volume Period (Default: 50)

This setting controls the number of past bars used to calculate the Simple Moving Average (SMA) of volume.

A larger value (e.g., 100) smooths out fluctuations and gives a broader view of average volume trends.

A smaller value (e.g., 20) makes the average more responsive to recent volume changes.

2. Above Average Threshold (Multiplier, Default: 1.5)

This defines the first level of volume increase that is considered above average.

If the current volume is 1.5 times greater than the moving average volume, the histogram bar turns green.

You can lower this value (e.g., 1.2) to make the indicator more sensitive or increase it (e.g., 2.0) to filter out smaller spikes.

3. High Volume Threshold (Multiplier, Default: 2.5)

This determines the threshold for what is considered significantly above average volume.

If the current volume is 2.5 times greater than the moving average volume, the histogram bar turns red.

This setting helps highlight extremely strong volume surges, which are more likely to indicate high-confidence breakouts or breakdowns.

How to Adjust These Presets for Different Market Conditions

If you trade high-volatility assets, you might want to increase the multipliers (e.g., 2.0 and 3.5) to focus only on the strongest moves.

If you trade low-liquidity assets, you might need to lower the multipliers (e.g., 1.2 and 2.0) to capture smaller but meaningful volume shifts.

Short-term traders (scalping/day trading) may prefer a lower average volume period (e.g., 20) to get faster signals.

By tweaking these settings, you can adapt the indicator to your trading style and the asset you’re analyzing. 🚀

VCP Pattern with Pocket Pivots by Mark MinerviniBelow is a Pine Script designed to identify and plot Mark Minervini's Volatility Contraction Pattern (VCP) along with Pocket Pivots on TradingView. The VCP is characterized by a series of price contractions (tightening price ranges) with decreasing volume, often followed by a breakout. Pocket Pivots, a concept from Chris Kacher and Gil Morales, identify early buying opportunities within a consolidation or uptrend based on volume surges. This script combines both concepts to help traders spot potential setups.

Relative Crypto Dominance Polar Chart [LuxAlgo]The Relative Crypto Dominance Polar Chart tool allows traders to compare the relative dominance of up to ten different tickers in the form of a polar area chart, we define relative dominance as a combination between traded dollar volume and volatility, making it very easy to compare them at a glance.

🔶 USAGE

The use is quite simple, traders just have to load the indicator on the chart, and the graph showing the relative dominance will appear.

The 10 tickers loaded by default are the major cryptocurrencies by market cap, but traders can select any ticker in the settings panel.

Each area represents dominance as volatility (radius) by dollar volume (arc length); a larger area means greater dominance on that ticker.

🔹 Choosing Period

The tool supports up to five different periods

Hourly

Daily

Weekly

Monthly

Yearly

By default, the tool period is set on auto mode, which means that the tool will choose the period depending on the chart timeframe

timeframes up to 2m: Hourly

timeframes up to 15m: Daily

timeframes up to 1H: Weekly

timeframes up to 4H: Monthly

larger timeframes: Yearly

🔹 Sorting & Sizing

Traders can sort the graph areas by volatility (radius of each area) in ascending or descending order; by default, the tickers are sorted as they are in the settings panel.

The tool also allows you to adjust the width of the chart on a percentage basis, i.e., at 100% size, all the available width is used; if the graph is too wide, just decrease the graph size parameter in the settings panel.

🔹 Set your own style

The tool allows great customization from the settings panel, traders can enable/disable most of the components, and add a very nice touch with curved lines enabled for displaying the areas with a petal-like effect.

🔶 SETTINGS

Period: Select up to 5 different time periods from Hourly, Daily, Weekly, Monthly and Yearly. Enable/disable Auto mode.

Tickers: Enable/disable and select tickers and colors

🔹 Style

Graph Order: Select sort order

Graph Size: Select percentage of width used

Labels Size: Select size for ticker labels

Show Percent: Show dominance in % under each ticker

Curved Lines: Enable/disable petal-like effect for each area

Show Title: Enable/disable graph title

Show Mean: Enable/disable volatility average and select color

Volume Pro Indicator## Volume Pro Indicator

A powerful volume indicator that visualizes volume distribution across different price levels. This tool helps you easily identify where trading activity concentrates within the price range.

### Key Features:

- **Volume visualization by price levels**: Green (lower zone), Magenta (middle zone), Cyan (upper zone)

- **VPOC (Volume Point of Control)**: Shows the price level with the highest volume concentration

- **High and Low lines**: Highlights the extreme levels of the analyzed price range

- **Customizable historical analysis**: Configurable number of days for calculation

### How to use it:

- Colored volumes show where trading activity concentrates within the price range

- The VPOC helps identify the most significant price levels

- Different colors allow you to quickly visualize volume distribution in different price areas

Customizable with numerous options, including analysis period, calculation resolution, colors, and visibility of different components.

### Note:

This indicator works best on higher timeframes (1H, 4H, 1D) and liquid markets. It's a visual analysis tool that enhances your understanding of market structure.

#volume #vpoc #distribution #volumeprofile #trading #analysis #indicator #professional #pricelevels #volumedistribution

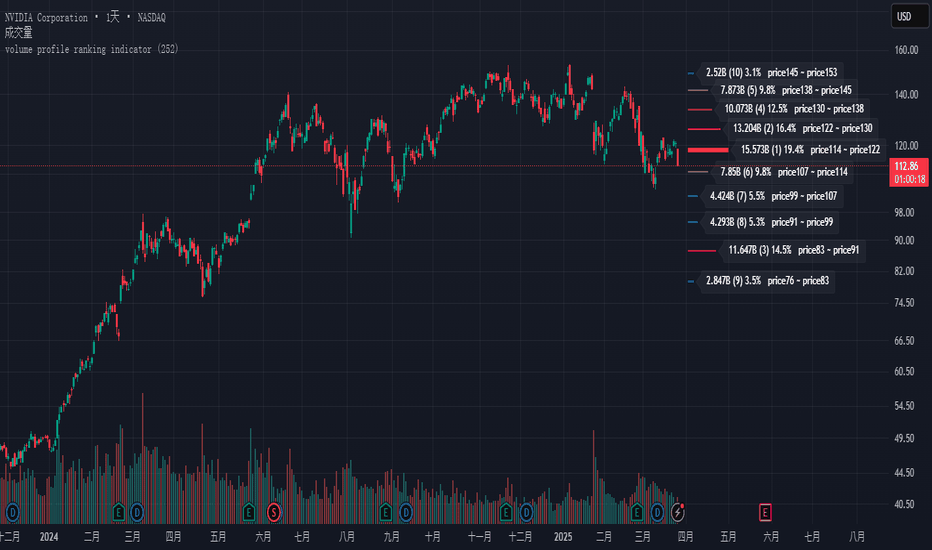

volume profile ranking indicator📌 Introduction

This script implements a volume profile ranking indicato for TradingView. It is designed to visualize the distribution of traded volume over price levels within a defined historical window. Unlike TradingView’s built-in Volume Profile, this script gives full customization of the profile drawing logic, binning, color gradient, and the ability to anchor the profile to a specific date.

⚙️ How It Works (Logic)

1. Inputs

➤POC Lookback Days (lookback): Defines how many bars (days) to look back from a selected point to calculate the volume distribution.

➤Bin Count (bin_count): Determines how many price bins (horizontal levels) the price range will be divided into.

➤Use Custom Lookback Date (useCustomDate): Enables/disables manually selecting a backtest start date.

➤Custom Lookback Date (customDate): When enabled, the profile will calculate volume based on this date instead of the most recent bar.

2. Target Bar Determination

➤If a custom date is selected, the script searches for the bar closest to that date within 1000 bars.

➤If not, it defaults to the latest bar (bar_index).

➤The profile is drawn only when the current bar is close to the target bar (within ±2 bars), to avoid unnecessary recalculations and performance issues.

3. Volume Binning

➤The price range over the lookback window is divided into bin_count segments.

➤For each bar within the lookback window, its volume is added to the appropriate bin based on price.

➤If the price falls outside the expected range, it is clamped to the first or last bin.

4. Ranking and Sorting

➤A bubble sort ranks each bin by total volume.

➤The most active bin (POC, or Point of Control) is highlighted with a thicker bar.

5. Rendering

➤Horizontal bars (line.new) represent volume intensity in each price bin.

➤Each bar is color-coded by volume heat: more volume = more intense color.

➤Labels (label.new) show:

➤Total volume

➤Rank

➤Percentage of total volume

➤Price range of the bin

🧑💻 How to Use

1. Add the Script to Your Chart

➤Copy the code into TradingView’s Pine Script editor and add it to your chart.

2. Set Lookback Period

➤Default is 252 bars (about one year for daily charts), but can be changed via the input.

3. (Optional) Use Custom Date

●Toggle "Use Custom Lookback Date" to true.

➤Pick a date in the "Custom Lookback Date" input to anchor the profile.

4. Analyze the Volume Distribution

➤The longest (thickest) red/orange bar represents the Point of Control (POC) — the price with the most volume traded.

➤Other bars show volume distribution across price.

➤Labels display useful metrics to evaluate areas of high/low interest.

✅ Features

🔶 Customizable anchor point (custom date).

🔶Adjustable bin count and lookback length.

🔶 Clear visualization with heatmap coloring.

🔶 Lightweight and performance-optimized (especially with the shouldDrawProfile filter)

Low Liquidity Zones [PhenLabs]📊 Low Liquidity Zones

Version: PineScript™ v6

📌 Description

Low Liquidity Zones identifies and highlights periods of unusually low trading volume on your chart, marking areas where price movement occurred with minimal participation. These zones often represent potential support and resistance levels that may be more susceptible to price breakouts or reversals when revisited with higher volume.

Unlike traditional volume analysis tools that focus on high volume spikes, this indicator specializes in detecting low liquidity areas where price moved with minimal resistance. Each zone displays its volume delta, providing insight into buying vs. selling pressure during these thin liquidity periods. This combination of low volume detection and delta analysis helps traders identify potential price inefficiencies and weak structures in the market.

🚀 Points of Innovation

• Identifies low liquidity zones that most volume indicators overlook but which often become significant technical levels

• Displays volume delta within each zone, showing net buying/selling pressure during low liquidity periods

• Dynamically adjusts to different timeframes, allowing analysis across multiple time horizons

• Filters zones by maximum size percentage to focus only on precise price levels

• Maintains historical zones until they expire based on your lookback settings, creating a cumulative map of potential support/resistance areas

🔧 Core Components

• Low Volume Detection: Identifies candles where volume falls below a specified threshold relative to recent average volume, highlighting potential liquidity gaps.

• Volume Delta Analysis: Calculates and displays the net buying/selling pressure within each low liquidity zone, providing insight into the directional bias during low participation periods.

• Dynamic Timeframe Adjustment: Automatically scales analysis periods to match your selected timeframe preference, ensuring consistent identification of low liquidity zones regardless of chart settings.

• Zone Management System: Creates, tracks, and expires low liquidity zones based on your configured settings, maintaining visual clarity on the chart.

🔥 Key Features

• Low Volume Identification: Automatically detects and highlights candles where volume falls below your specified threshold compared to the moving average.

• Volume Delta Visualization: Shows the net volume delta within each zone, providing insight into whether buyers or sellers were dominant despite the low overall volume.

• Flexible Timeframe Analysis: Analyze low liquidity zones across multiple predefined timeframes or use a custom lookback period specific to your trading style.

• Zone Size Filtering: Filters out excessively large zones to focus only on precise price levels, improving signal quality.

• Automatic Zone Expiration: Older zones are automatically removed after your specified lookback period to maintain a clean, relevant chart display.

🎨 Visualization

• Volume Delta Labels: Each zone displays its volume delta with “+” or “-” prefix and K/M suffix for easy interpretation, showing the strength and direction of pressure during the low volume period.

• Persistent Historical Mapping: Zones remain visible for your specified lookback period, creating a cumulative map of potential support and resistance levels forming under low liquidity conditions.

📖 Usage Guidelines

Analysis Timeframe

Default: 1D

Range/Options: 15M, 1HR, 3HR, 4HR, 8HR, 16HR, 1D, 3D, 5D, 1W, Custom

Description: Determines the historical period to analyze for low liquidity zones. Shorter timeframes provide more recent data while longer timeframes offer a more comprehensive view of significant zones. Use Custom option with the setting below for precise control.

Custom Period (Bars)

Default: 1000

Range: 1+

Description: Number of bars to analyze when using Custom timeframe option. Higher values show more historical zones but may impact performance.

Volume Analysis

Volume Threshold Divisor

Default: 0.5

Range: 0.1-1.0

Description: Maximum volume relative to average to identify low volume zones. Example: 0.5 means volume must be below 50% of the average to qualify as low volume. Lower values create more selective zones while higher values identify more zones.

Volume MA Length

Default: 15

Range: 1+

Description: Period length for volume moving average calculation. Shorter periods make the indicator more responsive to recent volume changes, while longer periods provide a more stable baseline.

Zone Settings

Zone Fill Color

Default: #2196F3 (80% transparency)

Description: Color and transparency of the low liquidity zones. Choose colors that stand out against your chart background without obscuring price action.

Maximum Zone Size %

Default: 0.5

Range: 0.1+

Description: Maximum allowed height of a zone as percentage of price. Larger zones are filtered out. Lower values create more precise zones focusing on tight price ranges.

Display Options

Show Volume Delta

Default: true

Description: Toggles the display of volume delta within each zone. Enabling this provides additional insight into buying vs. selling pressure during low volume periods.

Delta Text Position

Default: Right

Options: Left, Center, Right

Description: Controls the horizontal alignment of the delta text within zones. Adjust based on your chart layout for optimal readability.

✅ Best Use Cases

• Identifying potential support and resistance levels that formed during periods of thin liquidity

• Spotting price inefficiencies where larger players may have moved price with minimal volume

• Finding low-volume consolidation areas that may serve as breakout or reversal zones when revisited

• Locating potential stop-hunting zones where price moved on minimal participation

• Complementing traditional support/resistance analysis with volume context

⚠️ Limitations

• Requires volume data to function; will not work on symbols where the data provider doesn’t supply volume information

• Low volume zones don’t guarantee future support/resistance - they simply highlight potential areas of interest

• Works best on liquid instruments where volume data has meaningful fluctuations

• Historical analysis is limited by the maximum allowed box count (500) in TradingView

• Volume delta in some markets may not perfectly reflect buying vs. selling pressure due to data limitations

💡 What Makes This Unique

• Focus on Low Volume: Unlike some indicators that highlight high volume events particularly like our very own TLZ indicator, this tool specifically identifies potentially significant price zones that formed with minimal participation.

• Delta + Low Volume Integration: Combines volume delta analysis with low volume detection to reveal directional bias during thin liquidity periods.

• Flexible Lookback System: The dynamic timeframe system allows analysis across any timeframe while maintaining consistent zone identification criteria.

• Support/Resistance Zone Generation: Automatically builds a visual map of potential technical levels based on volume behavior rather than just price patterns.

🔬 How It Works

1. Volume Baseline Calculation:

The indicator calculates a moving average of volume over your specified period to establish a baseline for normal market participation. This adaptive baseline accounts for natural volume fluctuations across different market conditions.

2. Low Volume Detection:

Each candle’s volume is compared to the moving average and flagged when it falls below your threshold divisor. The indicator also filters zones by maximum size to ensure only precise price levels are highlighted.

3. Volume Delta Integration:

For each identified low volume candle, the indicator retrieves the volume delta from a lower timeframe. This delta value is formatted with appropriate scaling (K/M) and displayed within the zone.

4. Zone Management:

New zones are created and tracked in a dynamic array, with each zone extending rightward until it expires. The system automatically removes expired zones based on your lookback period to maintain a clean chart.

💡 Note:

Low liquidity zones often represent areas where price moved with minimal participation, which can indicate potential market inefficiencies. These zones frequently become important support/resistance levels when revisited, especially if approached with higher volume. Consider using this indicator alongside traditional technical analysis tools for comprehensive market context. For best results, experiment with different volume threshold settings based on the specific instrument’s typical volume patterns.

SMA7 Tail Reversal📌 Description:

The SMA7 Tail Reversal indicator is designed to identify potential counter-trend trading opportunities by checking if candle wicks (tails) respect a key moving average level (SMA7).

This indicator highlights price action where candles are clearly separated from the moving average, suggesting a possible reversal or temporary correction.

📌 How It Works:

Moving Average Calculation:

Calculates a simple moving average (SMA) of length 7 to act as the primary trend filter.

Candle Classification:

Bullish Candle: A candle where the closing price is higher than the opening price, with a short upper wick.

Bearish Candle: A candle where the closing price is lower than the opening price, with a short lower wick.

Conditions for Coloring Candles:

Long Condition (Green Candle):

High & Low are both below the SMA7 line.

Volume is above the 20-period average.

A bullish candle is detected.

Short Condition (Red Candle):

High & Low are both above the SMA7 line.

Volume is above the 20-period average.

A bearish candle is detected.

📌 Visual Representation:

Green Candles: Potential long signals when price action stays below the SMA7 line.

Red Candles: Potential short signals when price action stays above the SMA7 line.

Yellow Line: SMA7, used as the dynamic threshold for signal generation.

📌 Usage:

Best applied to volatile markets with clear trends.

Effective in detecting counter-trend opportunities where price diverges from the SMA7 line.

Works well with additional confirmation tools for better accuracy.

VSA Vol Key VSA Signals

(1) No Demand – Bearish Signal

Low volume, narrow spread.

Price rises, but volume does not increase → Weak market, lack of buyers.

If this appears in an uptrend, it may indicate a potential reversal.

(2) No Supply – Bullish Signal

Low volume, narrow spread.

Price declines, but volume does not increase → Weak selling pressure.

If this appears in an uptrend, it may confirm the continuation of the uptrend.

(3) Stopping Volume – Bullish Reversal Signal

Strong price decline, but unusually high volume.

Candle shows a long lower wick, closing near the top.

Indicates Smart Money absorbing supply, signaling a potential reversal upwards.

(4) Climactic Volume – Possible Trend Reversal

Extremely high volume with a sharp price increase or decrease.

If this occurs after a long trend, it may indicate a trend reversal.

Smart Money may be taking profits after a prolonged price movement.

(5) Effort vs. Result

If volume is high but price movement is weak → Inefficient buying/selling, possible reversal.

If volume is high and price moves strongly in the same direction → Trend is likely to continue.

Nef33-Volume Footprint ApproximationDescription of the "Volume Footprint Approximation" Indicator

Purpose

The "Volume Footprint Approximation" indicator is a tool designed to assist traders in analyzing market volume dynamics and anticipating potential trend changes in price. It is inspired by the concept of a volume footprint chart, which visualizes the distribution of trading volume across different price levels. However, since TradingView does not provide detailed intrabar data for all users, this indicator approximates the behavior of a footprint chart by using available volume and price data (open, close, volume) to classify volume as buy or sell, calculate volume delta, detect imbalances, and generate trend change signals.

The indicator is particularly useful for identifying areas of high buying or selling activity, imbalances between supply and demand, delta divergences, and potential reversal points in the market. It provides specific signals for bullish and bearish trend changes, making it suitable for traders looking to trade reversals or confirm trends.

How It Works

The indicator uses volume and price data from each candlestick to perform the following calculations:

Volume Classification:

Classifies the volume of each candlestick as "buy" or "sell" based on price movement:

If the closing price is higher than the opening price (close > open), the volume is classified as "buy."

If the closing price is lower than the opening price (close < open), the volume is classified as "sell."

If the closing price equals the opening price (close == open), it compares with the previous close to determine the direction:

If the current close is higher than the previous close, it is classified as "buy."

If the current close is lower than the previous close, it is classified as "sell."

If the current close equals the previous close, the classification from the previous bar is used.

Delta Calculation:

Calculates the volume delta as the difference between buy volume and sell volume (buyVolume - sellVolume).

A positive delta indicates more buy volume; a negative delta indicates more sell volume.

Imbalance Detection:

Identifies imbalances between buy and sell volume:

A buy imbalance occurs when buy volume exceeds sell volume by a defined percentage (default is 300%).

A sell imbalance occurs when sell volume exceeds buy volume by the same percentage.

Delta Divergence Detection:

Positive Delta Divergence: Occurs when the price is falling (for at least 2 bars) but the delta is increasing or becomes positive, indicating that buyers are entering despite the price decline.

Negative Delta Divergence: Occurs when the price is rising (for at least 2 bars) but the delta is decreasing or becomes negative, indicating that sellers are entering despite the price increase.

Trend Change Signals:

Bullish Signal (trendChangeBullish): Generated when the following conditions are met:

There is a positive delta divergence.

The delta has moved from a negative value (e.g., -500) to a positive value (e.g., +200) over the last 3 bars.

There is a buy imbalance.

The price is near a historical support level (approximated as the lowest low of the last 50 bars).

Bearish Signal (trendChangeBearish): Generated when the following conditions are met:

There is a negative delta divergence.

The delta has moved from a positive value (e.g., +500) to a negative value (e.g., -200) over the last 3 bars.

There is a sell imbalance.

The price is near a historical resistance level (approximated as the highest high of the last 50 bars).

Visual Elements

The indicator is displayed in a separate panel below the price chart (overlay=false) and includes the following elements:

Volume Histograms:

Buy Volume: Represented by a green histogram. Shows the volume classified as "buy."

Sell Volume: Represented by a red histogram. Shows the volume classified as "sell."

Note: The histograms overlap, and the last plotted histogram (red) takes visual precedence, meaning the sell volume may cover the buy volume if it is larger.

Delta Line:

Delta Volume: Represented by a blue line. Shows the difference between buy and sell volume.

A line above zero indicates more buy volume; a line below zero indicates more sell volume.

A dashed gray horizontal line marks the zero level for easier interpretation.

Imbalance Backgrounds:

Buy Imbalance: Light green background when buy volume exceeds sell volume by the defined percentage.

Sell Imbalance: Light red background when sell volume exceeds buy volume by the defined percentage.

Divergence Backgrounds:

Positive Delta Divergence: Lime green background when a positive delta divergence is detected.

Negative Delta Divergence: Fuchsia background when a negative delta divergence is detected.

Trend Change Signals:

Bullish Signal: Green label with the text "Bullish Trend Change" when the conditions for a bullish trend change are met.

Bearish Signal: Red label with the text "Bearish Trend Change" when the conditions for a bearish trend change are met.

Information Labels:

Below each bar, a label displays:

Total Vol: The total volume of the bar.

Delta: The delta volume value.

Alerts

The indicator generates the following alerts:

Positive Delta Divergence: "Positive Delta Divergence Detected! Price is falling, but delta is increasing."

Negative Delta Divergence: "Negative Delta Divergence Detected! Price is rising, but delta is decreasing."

Bullish Trend Change Signal: "Bullish Trend Change Signal! Positive Delta Divergence, Delta Rise, Buy Imbalance, and Near Support."

Bearish Trend Change Signal: "Bearish Trend Change Signal! Negative Delta Divergence, Delta Drop, Sell Imbalance, and Near Resistance."

These alerts can be configured in TradingView to receive real-time notifications.

Adjustable Parameters

The indicator allows customization of the following parameters:

Imbalance Threshold (%): The percentage required to detect an imbalance between buy and sell volume (default is 300%).

Lookback Period for Divergence: Number of bars to look back for detecting price and delta trends (default is 2 bars).

Support/Resistance Lookback Period: Number of bars to look back for identifying historical support and resistance levels (default is 50 bars).

Delta High Threshold (Bearish): Minimum delta value 2 bars ago for the bearish signal (default is +500).

Delta Low Threshold (Bearish): Maximum delta value in the current bar for the bearish signal (default is -200).

Delta Low Threshold (Bullish): Maximum delta value 2 bars ago for the bullish signal (default is -500).

Delta High Threshold (Bullish): Minimum delta value in the current bar for the bullish signal (default is +200).

Practical Use

The indicator is useful for the following purposes:

Identifying Trend Changes:

The trend change signals (trendChangeBullish and trendChangeBearish) indicate potential price reversals. For example, a bullish signal near a support level may be an opportunity to enter a long position.

Detecting Divergences:

Delta divergences (positive and negative) can anticipate trend changes by showing a disagreement between price movement and underlying buying/selling pressure.

Finding Key Levels:

Imbalances (green and red backgrounds) often coincide with support and resistance levels, helping to identify areas where the market might react.

Confirming Trends:

A consistently positive delta in an uptrend or a negative delta in a downtrend can confirm the strength of the trend.

Identifying Failed Auctions:

Although not detected automatically, you can manually identify failed auctions by observing a price move to new highs/lows with decreasing volume in the direction of the move.

Limitations

Intrabar Data: It does not use detailed intrabar data, making it less precise than a native footprint chart.

Approximations: Volume classification and support/resistance detection are approximations, which may lead to false signals.

Volume Dependency: It requires reliable volume data, so it may be less effective on assets with inaccurate volume data (e.g., some forex pairs).

False Signals: Divergences and imbalances do not always indicate a trend change, especially in strongly trending markets.

Recommendations

Combine with Other Indicators: Use tools like RSI, MACD, support/resistance levels, or candlestick patterns to confirm signals.

Trade on Higher Timeframes: Signals are more reliable on higher timeframes like 1-hour or 4-hour charts.

Perform Backtesting: Evaluate the indicator's accuracy on historical data to adjust parameters and improve effectiveness.

Adjust Parameters: Modify thresholds (e.g., imbalanceThreshold or supportResistanceLookback) based on the asset and timeframe you are trading.

Conclusion

The "Volume Footprint Approximation" indicator is a powerful tool for analyzing volume dynamics and anticipating price trend changes. By classifying volume, calculating delta, detecting imbalances and divergences, and generating trend change signals, it provides traders with valuable insights into market buying and selling pressure. While it has limitations due to the lack of intrabar data, it can be highly effective when used in combination with other technical analysis tools and on assets with reliable volume data.

Aggregated Spot vs Perp Volume (% Change)Aggregated Spot vs Perp Volume (% Change)

Description

The "Aggregated Spot vs Perp Volume (% Change)" indicator helps crypto traders compare the momentum of spot and perpetual futures (perp) trading volumes across 12 major exchanges. It calculates the percentage change in volume from one bar to the next, highlighting divergences and showing which market—spot or perp—is leading a move. By focusing on relative changes, it eliminates the issue of absolute volume differences, making trends clear.

The indicator aggregates data from Binance, Bybit, OKX, Coinbase, Bitget, MEXC, Phemex, BingX, WhiteBIT, BitMEX, Kraken, and HTX. Users can toggle exchanges and choose to measure volume in coin units (e.g., BTC) or USD.

How It Works

Volume Aggregation:

Fetches spot and perp volume data for the selected crypto (e.g., BTC) from up to 12 exchanges.

Spot volume is included only if perp volume is available for the same pair, ensuring consistency.

Volume can be measured in coin units or USD (volume × spot price).

Percentage Change:

Calculates the percentage change in spot and perp volumes from the previous bar:

Percentage Change = ((Current Volume − Previous Volume) / Previous Volume) ×100

This focuses on relative momentum, making spot and perp volumes directly comparable.

Visualization:

Spot volume % change is plotted as a blue line, and perp volume % change as a red line, both with a linewidth of 1.

Who Should Use It

Crypto Traders: To understand spot vs. perp market dynamics across exchanges.

Momentum Traders: To spot which market is driving price moves via volume divergences.

Scalpers/Day Traders: For identifying short-term shifts in market activity.

Analysts: To study liquidity and sentiment in crypto markets.

How to Use It

Blue line: Spot volume % change.

Red line: Perp volume % change.

Look for divergences (e.g., a sharp rise in the red line but not the blue line suggests perp markets are leading).

Combine with Price:

Use alongside price charts to confirm trends or spot potential reversals.

Context

Spot markets reflect actual asset trading, while perp markets, with leverage, attract speculative activity and often show higher volumes. This indicator uses percentage change to compare their momentum, helping traders identify market leadership and divergences. For example, a 50% increase in both spot and perp volumes plots at the same level, making it easy to see relative shifts across exchanges.

Volume Patterns [SS]Hey everyone,

Been a while since doing anything with Pinescript.

Here is my iteration of a Volume Pattern identification, inspired by Bulkowski's work on patterns and volume.

The indicator aims to identify the 4 major types of volume patterns, these are:

Bullish Breakout Volume

Bearish Breakout Volume

Inverted Domes

Domes

Classification

These patterns are all assigned to a classification based on theory. For example, dome volume is usually bearish, inverted dome is usually bullish, etc. etc. However, in order to accommodate changing sentiments and volatility, I have coded logic into the indicator to assess for the actual sentiment associated with these patterns itself.

The indicator calculates the average return associated with each pattern, scaling the data into a percent return. It then has the ability to re-scale the target using the close price associated with the pattern at the time of pattern signaling, to calculate the target price and plot the target on the chart for you.

Additionally, it provides you with the following:

Labels to signal when a pattern has happened

A table that shows you the average returns associated with the 4 major patterns

Target lines with labels that visually show you the target price associated with the pattern, as well as which pattern they are associated with.

All of these things can be toggled on or off depending on your preference.

Customizing the indicator

In addition to being able to toggle the visuals on or off depending on what you want to see or not see, there are some minor customization abilities in terms of training the indicator to recognize the patterns and predict the TP.

The first one is the Training length

In the settings, you will see "Train", and the default is 500. This is the amount the indicator is looking back in history to learn the patterns and returns associated with them. This 500 is appropriate in most cases and on most timeframes.

Lastly, the Lookforward Length

The look forward length represents the number of bars forward you want to determine the returns for. It is defaulted to 10, but you can modify it.

So, if you are on the 1-Minute chart and have the look forward set to 10, then once a signal happens, the target price is calculated based on 10 minutes from the time of signal. You can increase this or decrease this based on your preference.

Longer look forwards can be good for swingers but should be used on the larger timeframes, shorter are good for scalpers but should be used on the shorter timeframes.

The indicator's use is incredibly simple, you'll pick it up in no time!

Hope you enjoy it and as always, safe trades!

Just an FYI for those who may have questions:

The indicator is open source. This means you are free to take it and modify it as you wish. You do not need to ask me.

Please read the description carefully, as 100% of questions I am asked about indicators are covered in the description. ;-)

Have a good one guys and gals! 🚀🚀🚀

db.Volume Spike IndicatorAn indicator that finds the average volume of the previous 10 candles and compares it with the volume of the last closed candle. If the volume of the last candle is 5 times the average of the last 10 candles, it marks this candle with a yellow symbol above or below the candle, depending on the direction of the candle.

=====

Индикатор, который находит среднее значение объём предыдущих 10 свечей и сравнивает его с объёмом последней закрытой свечи. Если объём последней свечи в 5 раз больше среднего за последние 10, то помечает эту свечу жёлтым символом над или под свечой в зависимости от направления свечи.

Volume Profile & Smart Money Explorer🔍 Volume Profile & Smart Money Explorer: Decode Institutional Footprints

Master the art of institutional trading with this sophisticated volume analysis tool. Track smart money movements, identify peak liquidity windows, and align your trades with major market participants.

🌟 Key Features:

📊 Triple-Layer Volume Analysis

• Total Volume Patterns

• Directional Volume Split (Up/Down)

• Institutional Flow Detection

• Real-time Smart Money Tracking

• Historical Pattern Recognition

⚡ Smart Money Detection

• Institutional Trade Identification

• Large Block Order Tracking

• Smart Money Concentration Periods

• Whale Activity Alerts

• Volume Threshold Analysis

📈 Advanced Profiling

• Hourly Volume Distribution

• Directional Bias Analysis

• Liquidity Heat Maps

• Volume Pattern Recognition

• Custom Threshold Settings

🎯 Strategic Applications:

Institutional Trading:

• Track Big Player Movements

• Identify Accumulation/Distribution

• Follow Smart Money Flow

• Detect Institutional Trading Windows

• Monitor Block Orders

Risk Management:

• Identify High Liquidity Windows

• Avoid Thin Market Periods

• Optimize Position Sizing

• Track Market Participation

• Monitor Volume Quality

Market Analysis:

• Volume Pattern Recognition

• Smart Money Flow Analysis

• Liquidity Window Identification

• Institutional Activity Cycles

• Market Depth Analysis

💡 Perfect For:

• Professional Traders

• Volume Profile Traders

• Institutional Traders

• Risk Managers

• Algorithmic Traders

• Smart Money Followers

• Day Traders

• Swing Traders

📊 Key Metrics:

• Normalized Volume Profiles

• Institutional Thresholds

• Directional Volume Split

• Smart Money Concentration

• Historical Patterns

• Real-time Analysis

⚡ Trading Edge:

• Trade with Institution Flow

• Identify Optimal Entry Points

• Recognize Distribution Patterns

• Follow Smart Money Positioning

• Avoid Thin Markets

• Capitalize on Peak Liquidity

🎓 Educational Value:

• Understand Market Structure

• Learn Volume Analysis

• Master Institutional Patterns

• Develop Market Intuition

• Track Smart Money Flow

🛠️ Customization:

• Adjustable Time Windows

• Flexible Volume Thresholds

• Multiple Timeframe Analysis

• Custom Alert Settings

• Visual Preference Options

Whether you're tracking institutional flows in crypto markets or following smart money in traditional markets, the Volume Profile & Smart Money Explorer provides the deep insights needed to trade alongside the biggest players.

Transform your trading from retail guesswork to institutional precision. Know exactly when and where smart money moves, and position yourself ahead of major market shifts.

#VolumeProfile #SmartMoney #InstitutionalTrading #MarketAnalysis #TradingView #VolumeAnalysis #CryptoTrading #ForexTrading #TechnicalAnalysis #Trading #PriceAction #MarketStructure #OrderFlow #Liquidity #RiskManagement #TradingStrategy #DayTrading #SwingTrading #AlgoTrading #QuantitativeTrading

Dual Volume Divergence LineDual Volume Divergence Line (DVD/Line)

🔹 Overview

The Dual Volume Divergence Line (DVD/Line) is a custom Pine Script™ indicator designed to identify potential trend reversals and continuations by analyzing volume and price divergences. This script is inspired by the original concept of the Dual Volume Divergence Index (DVDI) by DonovanWall and has been modified and enhanced by keremertem. Special thanks to DonovanWall for the original concept. The indicator combines volume-based calculations with price action to generate signals for bullish and bearish divergences, both normal and hidden. Below is a detailed breakdown of its components and functionality.

🔹 Key Features of the DVD/Line Indicator

1. Dual Volume Divergence Calculation:

- The indicator calculates two primary volume-based indices: the Positive Volume Index (PVI) and the Negative Volume Index (NVI).

- PVI measures the impact of volume on price when the price increases, while NVI measures the impact when the price decreases.

- These indices are used to detect divergences between volume and price, which can signal potential reversals or continuations.

2. Customizable Inputs:

- DVD Sampling Period: Adjusts the sensitivity of the indicator by controlling the lookback period for calculating the volume-weighted moving averages (VWMA) of PVI and NVI.

- Band Width: Defines the range for calculating the upper and lower bands, which act as dynamic support and resistance levels.

- Source: Allows users to select the price source (e.g., `hlc3`, `close`, etc.) for calculations.

3. Volume-Weighted Moving Averages (VWMA):

- Instead of using traditional moving averages, the script employs VWMA to smooth the PVI and NVI signals. This ensures that the indicator is more responsive to changes in volume.

4. Upper and Lower Bands:

- The upper and lower bands are calculated using the Root Mean Square (RMS) of the highest and lowest values of the DVD line over a user-defined period. These bands help identify overbought and oversold conditions.

5. Divergence Detection:

- The script identifies four types of divergences:

- Normal Bullish Divergence: Occurs when price makes a lower low, but the DVD line makes a higher low.

- Hidden Bullish Divergence: Occurs when price makes a higher low, but the DVD line makes a lower low.

- Normal Bearish Divergence: Occurs when price makes a higher high, but the DVD line makes a lower high.

- Hidden Bearish Divergence: Occurs when price makes a lower high, but the DVD line makes a higher high.

- These divergences are visually highlighted on the chart using labels.

6. Customizable Divergence Selection:

- Users can choose between two types of divergence calculations:

- DVDI: Based on the raw divergence values.

- DVD Line: Based on the smoothed DVD line.

7. Visual Enhancements:

- The DVD line is plotted with a color-coded scheme: blue when the DVD line is above its signal line (bullish) and pink when it is below (bearish).

- The upper and lower bands are displayed as step lines, making it easier to identify key levels.

🔹 How the Indicator Works

1. Volume-Based Calculations:

- The script starts by calculating the PVI and NVI based on the selected price source and volume data.

- PVI increases when the price rises, while NVI decreases when the price falls. These indices are then smoothed using VWMA to generate signals.

2. DVD Line Calculation:

- The DVD line is derived by combining the divergences of PVI and NVI. It is further smoothed using a Weighted Moving Average (WMA) and a linear regression line for trend analysis.

3. Divergence Detection:

- The script identifies pivot points in the DVD line and compares them with price action to detect divergences.

- Normal divergences indicate potential reversals, while hidden divergences suggest trend continuations.

4. Dynamic Bands:

- The upper and lower bands are calculated using RMS, which provides a more accurate representation of volatility compared to standard deviation or fixed-width bands.

5. Labeling:

- Divergences are labeled directly on the chart with clear text and color coding:

🟢 Bullish Divergence: Green label with "Bull".

🟩 Bearish Divergence: Red label with "Bear".

🔴 Hidden Bullish Divergence: Lime label with "hid.".

🟧 Hidden Bearish Divergence: Orange label with "hid.".

🔹 Unique Aspects of This Script

1. Volume-Weighted Smoothing:

- Unlike traditional divergence indicators that rely on simple moving averages, this script uses VWMA and WMA to ensure that volume plays a significant role in signal generation.

2. Dynamic Bands with RMS:

- The use of RMS for calculating bands provides a more adaptive and accurate representation of market conditions, especially in volatile markets.

3. Flexible Divergence Selection:

- Users can choose between raw divergence values (DVDI) or smoothed values (DVD Line), allowing for greater customization based on trading style.

4. Comprehensive Divergence Detection:

- The script detects both normal and hidden divergences, providing a complete picture of potential trend reversals and continuations.

5. User-Friendly Visuals:

- The color-coded DVD line and cross-style bands make it easy to interpret the indicator at a glance.

🔹 How to Use the Indicator

1. Trend Identification:

- Use the Middle Band and its color to identify the current trend. A green line suggests bullish momentum, while a red line indicates bearish momentum. Additionally, a bullish momentum may be indicated when the DVD line crosses up, and a bearish momentum may be indicated when it crosses down the Middle Band.

2. Divergence Trading:

- Look for divergences between the DVD line and price action. Normal divergences can be used for counter-trend trades, while hidden divergences can confirm trend continuations.

3. Band Breakouts:

- Monitor the upper and lower bands for potential breakout or reversal signals. A break above the upper band may indicate overbought conditions, while a break below the lower band may suggest oversold conditions.

4. Customization:

- Adjust the sampling period and band width to suit different timeframes and trading strategies. Shorter periods are more sensitive, while longer periods provide smoother signals.

🔹 Conclusion

The Dual Volume Divergence Line (DVD/Line) is a powerful and versatile indicator that combines volume analysis with price action to generate actionable trading signals. Its unique use of volume-weighted smoothing, dynamic bands, and comprehensive divergence detection sets it apart from traditional divergence indicators. Whether you're a day trader or a long-term investor, this tool can help you identify high-probability trading opportunities with greater accuracy and confidence.

📌 Disclaimer: This script is for educational purposes only and does not constitute financial advice. Always conduct your own analysis before making trading decisions.

Nef33 Forex & Crypto Trading Signals PRO

1. Understanding the Indicator's Context

The indicator generates signals based on confluence (trend, volume, key zones, etc.), but it does not include predefined SL or TP levels. To establish them, we must:

Use dynamic or static support/resistance levels already present in the script.

Incorporate volatility (such as ATR) to adjust the levels based on market conditions.

Define a risk/reward ratio (e.g., 1:2).

2. Options for Determining SL and TP

Below, I provide several ideas based on the tools available in the script:

Stop Loss (SL)

The SL should protect you from adverse movements. You can base it on:

ATR (Volatility): Use the smoothed ATR (atr_smooth) multiplied by a factor (e.g., 1.5 or 2) to set a dynamic SL.

Buy: SL = Entry Price - (atr_smooth * atr_mult).

Sell: SL = Entry Price + (atr_smooth * atr_mult).

Key Zones: Place the SL below a support (for buys) or above a resistance (for sells), using Order Blocks, Fair Value Gaps, or Liquidity Zones.

Buy: SL below the nearest ob_lows or fvg_lows.

Sell: SL above the nearest ob_highs or fvg_highs.

VWAP: Use the daily VWAP (vwap_day) as a critical level.

Buy: SL below vwap_day.

Sell: SL above vwap_day.

Take Profit (TP)

The TP should maximize profits. You can base it on:

Risk/Reward Ratio: Multiply the SL distance by a factor (e.g., 2 or 3).

Buy: TP = Entry Price + (SL Distance * 2).

Sell: TP = Entry Price - (SL Distance * 2).

Key Zones: Target the next resistance (for buys) or support (for sells).

Buy: TP at the next ob_highs, fvg_highs, or liq_zone_high.

Sell: TP at the next ob_lows, fvg_lows, or liq_zone_low.

Ichimoku: Use the cloud levels (Senkou Span A/B) as targets.

Buy: TP at senkou_span_a or senkou_span_b (whichever is higher).

Sell: TP at senkou_span_a or senkou_span_b (whichever is lower).

3. Practical Implementation

Since the script does not automatically draw SL/TP, you can:

Calculate them manually: Observe the chart and use the levels mentioned.

Modify the code: Add SL/TP as labels (label.new) at the moment of the signal.

Here’s an example of how to modify the code to display SL and TP based on ATR with a 1:2 risk/reward ratio:

Modified Code (Signals Section)

Find the lines where the signals (trade_buy and trade_sell) are generated and add the following:

pinescript

// Calculate SL and TP based on ATR

atr_sl_mult = 1.5 // Multiplier for SL

atr_tp_mult = 3.0 // Multiplier for TP (1:2 ratio)

sl_distance = atr_smooth * atr_sl_mult

tp_distance = atr_smooth * atr_tp_mult

if trade_buy

entry_price = close

sl_price = entry_price - sl_distance

tp_price = entry_price + tp_distance

label.new(bar_index, low, "Buy: " + str.tostring(math.round(bull_conditions, 1)), color=color.green, textcolor=color.white, style=label.style_label_up, size=size.tiny)

label.new(bar_index, sl_price, "SL: " + str.tostring(math.round(sl_price, 2)), color=color.red, textcolor=color.white, style=label.style_label_down, size=size.tiny)

label.new(bar_index, tp_price, "TP: " + str.tostring(math.round(tp_price, 2)), color=color.blue, textcolor=color.white, style=label.style_label_up, size=size.tiny)

if trade_sell

entry_price = close

sl_price = entry_price + sl_distance

tp_price = entry_price - tp_distance

label.new(bar_index, high, "Sell: " + str.tostring(math.round(bear_conditions, 1)), color=color.red, textcolor=color.white, style=label.style_label_down, size=size.tiny)

label.new(bar_index, sl_price, "SL: " + str.tostring(math.round(sl_price, 2)), color=color.red, textcolor=color.white, style=label.style_label_up, size=size.tiny)

label.new(bar_index, tp_price, "TP: " + str.tostring(math.round(tp_price, 2)), color=color.blue, textcolor=color.white, style=label.style_label_down, size=size.tiny)

Code Explanation

SL: Calculated by subtracting/adding sl_distance to the entry price (close) depending on whether it’s a buy or sell.

TP: Calculated with a double distance (tp_distance) for a 1:2 risk/reward ratio.

Visualization: Labels are added to the chart to display SL (red) and TP (blue).

4. Practical Strategy Without Modifying the Code

If you don’t want to modify the script, follow these steps manually:

Entry: Take the trade_buy or trade_sell signal.

SL: Check the smoothed ATR (atr_smooth) on the chart or calculate a fixed level (e.g., 1.5 times the ATR). Also, review nearby key zones (OB, FVG, VWAP).

TP: Define a target based on the next key zone or multiply the SL distance by 2 or 3.

Example:

Buy at 100, ATR = 2.

SL = 100 - (2 * 1.5) = 97.

TP = 100 + (2 * 3) = 106.

5. Recommendations

Test in Demo: Apply this logic in a demo account to adjust the multipliers (atr_sl_mult, atr_tp_mult) based on the market (forex or crypto).

Combine with Zones: If the ATR-based SL is too wide, use the nearest OB or FVG as a reference.

Risk/Reward Ratio: Adjust the TP based on your tolerance (1:1, 1:2, 1:3)

Volume Order Blocks [BigBeluga]Volume Order Blocks is a powerful indicator that identifies significant order blocks based on price structure, helping traders spot key supply and demand zones. The tool leverages EMA crossovers to determine the formation of bullish and bearish order blocks while visualizing their associated volume and relative strength.

🔵 Key Features:

Order Block Detection via EMA Crossovers:

Plots bullish order blocks at recent lows when the short EMA crosses above the long EMA.

Plots bearish order blocks at recent highs when the short EMA crosses below the long EMA.

Uses customizable sensitivity through the “Sensitivity Detection” setting to fine-tune block formation.

Volume Collection and Visualization:

Calculates the total volume between the EMA crossover bar and the corresponding high (bearish OB) or low (bullish OB).

Displays the absolute volume amount next to each order block for clear volume insights.

Percentage Volume Distribution:

Shows the percentage distribution of volume among bullish or bearish order blocks.

100% represents the cumulative volume of all OBs in the same category (bullish or bearish).

Order Block Removal Conditions:

Bullish order blocks are removed when the price closes below the bottom of the block.

Bearish order blocks are removed when the price closes above the top of the block.

Helps maintain chart clarity by only displaying relevant and active levels.

Midline Feature:

Dashed midline inside each order block indicates the midpoint between the upper and lower boundaries.

Traders can toggle the midline on or off through the settings.

Shadow Trend:

Shadow Trend dynamically visualizes trend strength and direction by adapting its color intensity based on price movement.

🔵 Usage:

Supply & Demand Zones: Use bullish and bearish order blocks to identify key market reversal or continuation points.

Volume Strength Analysis: Compare volume percentages to gauge which order blocks hold stronger market significance.

Breakout Confirmation: Monitor block removal conditions for potential breakout signals beyond support or resistance zones.

Trend Reversals: Combine EMA crossovers with order block formation for early trend reversal detection.

Risk Management: Use OB boundaries as potential stop-loss or entry points.

Volume Order Blocks is an essential tool for traders seeking to incorporate volume-based supply and demand analysis into their trading strategy. By combining price action, volume data, and EMA crossovers, it offers a comprehensive view of market structure and potential turning points.

BCVC - Volume & Big Candle ColorThe BCVC (Volume & Big Candle Color) indicator helps traders identify significant price movements accompanied by unusual volume activity. By dynamically coloring bars based on volume spikes and candle size, it highlights potential momentum shifts, breakouts, or reversals. This tool is ideal for traders who want to:

Spot institutional buying/selling activity.

Confirm trend strength using volume and price volatility.

Filter noise by focusing on high-impact bars.

Key Features

Volume Spike Detection:

Compares current volume to a moving average (EMA) of volume.

Highlights bars where volume exceeds the average by a user-defined multiplier.

Big Candle Detection:

Identifies bars with a range (high-low) larger than the historical average range (EMA of candle ranges).

Thresholds for "big candles" are customizable.

Color-Coded Logic:

White Bars: High volume + Big candle + Bullish (close > open).

Orange Bars: High volume + Big candle + Bearish (close < open).

Blue Bars: High volume + Regular candle + Bullish.

Maroon Bars: High volume + Regular candle + Bearish.

Input Parameters

Volume Settings:

Volume Period: EMA length for average volume calculation (default: 20).

Volume Multiplier: Threshold multiplier for volume spikes (e.g., 1.25 = 25% above average).

Candle Size Settings:

Lookback Period: EMA length for average candle range (default: 7).

Big Candle Multiplier: Threshold multiplier for large candles (e.g., 1.3 = 30% above average range).

How It Works

Volume Analysis:

The indicator calculates an EMA of volume over the specified period.

If the current bar’s volume exceeds Average Volume × Volume Multiplier, it’s flagged as a high-volume bar.

Candle Range Analysis:

The average candle range (high-low) is calculated using an EMA over the lookback period.

A "big candle" is identified when the current bar’s range exceeds Average Range × Big Candle Multiplier.

Combined Signals:

High-volume bars are colored based on whether they are bullish/bearish and whether their range exceeds the big-candle threshold.

Example: A white bar (high volume + big candle + bullish) suggests strong buying pressure with institutional participation.

Usage Scenarios

Breakout Confirmation: A white/orange bar at a support/resistance level may validate a breakout.

Reversal Signals: A maroon/orange bar after a long trend could indicate exhaustion and potential reversal.

Trend Strength: Clusters of blue/white bars during uptrends (or maroon/orange in downtrends) confirm momentum.

Benefits

Visual Clarity: Instantly spot high-impact bars without manually scanning volume or candle size.

Customizable Sensitivity: Adjust multipliers to filter noise (e.g., increase for fewer signals).

Universal Application: Works on all timeframes and instruments (stocks, forex, crypto).

Notes

Best Paired With: Trendlines, support/resistance levels, or momentum oscillators (e.g., RSI).

Avoid False Signals: Use higher multipliers (e.g., 1.5) on lower timeframes to reduce noise.

Session Profile AnalyzerWhat’s This Thing Do?

Hey there, trader! Meet the Session Profile Analyzer (SPA) your new go-to pal for breaking down market action within your favorite trading sessions. It’s an overlay indicator that mixes Rotation Factor (RF), Average Subperiod Range (ASPR), Volume Value Area Range (VOLVAR), and TPO Value Area Range (TPOVAR) into one tidy little toolkit. Think of it as your market vibe checker momentum, volatility, and key levels, all served up with a grin.

The Cool Stuff It Does:

Rotation Factor (RF) : Keeps tabs on whether the market’s feeling bullish, bearish, or just chilling. It’s like a mood ring for price action shows “UP ↑,” “DOWN ↓,” or “NONE ↔.”

ASPR : Averages out the range of your chosen blocks. Big swings? Tiny wiggles? This tells you the session’s energy level.

VOLVAR : Dives into volume to find where the action’s at, with a smart twist it adjusts price levels based on the session’s size and tiny timeframe moves (capped at 128 so your chart doesn’t cry).

TPOVAR : Grabs lower timeframe data to spot where price hung out the most, TPO-style. Value zones, anyone?

Dynamic Precision : No ugly decimal overload SPA matches your asset’s style (2 decimals for BTC, 5 for TRX, you get it).

How to Play With It:

Session Start/End : Pick your trading window (say, 0930-2200) and a timezone (America/New_York, or wherever you’re at).

Block Size : Set the chunk size for RF and ASPR like 30M if you’re into half-hour vibes.

Value Area Timeframe : Go micro with something like 1S for VOLVAR and TPOVAR precision.

Label : Size it (small to huge), color it (white, neon pink, whatever), and slap it where you want (start, mid, end).

How It All Works (No PhD Required):

RF : Imagine breaking your session into blocks (via Block Size). For each block, SPA checks if the high beats the last high (+1) or not (0), and if the low dips below the last low (-1) or not (0). Add those up, and boom positive RF means upward vibes, negative means downward, near zero is “meh.” Use it to catch trends or spot when the market’s napping.

ASPR : Takes those same blocks, measures high-to-low range each time, and averages them. It’s your volatility pulse big ASPR = wild ride, small ASPR = snooze fest. Great for sizing up session action.

VOLVAR : Here’s the fun part. It takes the session’s full range (high minus low), divides it by the average range of your tiny Value Area Timeframe bars (e.g., 1S), and picks a sensible number of price levels capped at 128 so it doesn’t overthink. Then it bins volume into those levels, finds the busiest price (POC), and grows a 70% value area around it. Perfect for spotting where the big players parked their cash.

TPOVAR : Grabs midpoints from those tiny timeframe bars, sorts them, and snips off the top and bottom 15% to find the 70% “value zone” where price chilled the most. Think of it as the market’s comfort zone great for support/resistance hunting.

Why You’ll Like It:

Whether you’re scalping crypto, swinging forex, or dissecting stocks, SPA’s got your back. Use RF to catch momentum shifts like jumping on an “UP ↑” trend or fading a “DOWN ↓” exhaustion. ASPR’s your secret weapon for sizing up trades: a big ASPR (say, 100 on BTC) means you can aim for juicy targets (like 1-2x ASPR) or set invalidations tight when it’s tiny (e.g., 0.001 on TRX) to dodge chop. VOLVAR and TPOVAR are your level-finders nail those key zones where price loves to bounce or break, perfect for entries, stops, or profit grabs. It’s like having a trading co-pilot who’s chill but knows their stuff.

Heads-Up:

Load enough history for those micro timeframes to shine (1S needs some bars to work with).

Keeps things light won’t bog down your chart even with decent-sized sessions.

Let’s Roll:

Slap SPA on your chart, tweak it to your style, and watch it spill the beans on your session. Happy trading, fam may your pips be plenty and your losses few!