Volume Profile Matrix [LuxAlgo]The Volume Profile Matrix indicator extends from regular volume profiles by also considering calculation intervals within the calculation window rather than only dividing the calculation window in rows.

Note that this indicator is subject to repainting & back-painting, however, treating the indicator as a tool for identifying frequent points of interest can still be very useful.

🔶 SETTINGS

Lookback: Number of most recent bars used to calculate the indicator.

Columns: Number of columns (intervals) used to calculate the volume profile matrix.

Rows: Number of rows (intervals) used to calculate the volume profile matrix.

🔶 USAGE

The Volume Profile Matrix indicator can be used to obtain more information regarding liquidity on specific time intervals. Instead of simply dividing the calculation window into equidistant rows, the calculation is done through a grid.

Grid cells with trading activity occurring inside them are colored. More activity is highlighted through a gradient and by default, cells with a color that are closer to red indicate that more trading activity took place within that cell. The cell with the highest amount of trading activity is always highlighted in yellow.

Each interval (column) includes a point of control which highlights an estimate of the price level with the highest traded volume on that interval. The level with the highest traded volume of the overall grid is extended to the most recent bar.

Профиль объёма

Range Sentiment Profile [LuxAlgo]The Range Sentiment Profile indicator is inspired from the volume profile and aims to indicate the degree of bullish/bearish variations within equidistant price areas inside the most recent price range.

The most bullish/bearish price areas are highlighted through lines extending over the entire range.

🔶 SETTINGS

Length: Most recent bars used for the calculation of the indicator.

Rows: Number of price areas the price range is divided into.

Use Intrabar: Use intrabar data to compute the range sentiment profile.

Timeframe: Intrabar data timeframe.

🔶 USAGE

This tool can be used to easily determine if a certain price area contain more significant bullish or bearish price variations. This is done by obtaining an estimate of the accumulation of all the close to open variations occurring within a specific profile area.

A blue range background indicates a majority of bullish variations within each area while an orange background indicates a majority of bearish variations within each area.

Users can easily identify the areas with the most bullish/bearish price variations by looking at the bullish/bearish maximums.

It can be of interest to see where profile bins might have no length, these can indicate price areas with price variations with alternating signs (bullish variations are followed by a bearish sign) and similar body. They can also indicate a majority of either bullish or bearish variations alongside a minority of more significant opposite variations.

These areas can also provide support/resistance, as such price entering these areas could reverse.

Users can obtain more precise results by allowing the profile to use intrabar data. This will change the calculation of the profile, see the details section for more information.

🔶 DETAILS

The Range Sentiment Profile's design is similar to the way a volume profile is constructed.

First the maximum/minimum values over the most recent Length bars are obtained, these define the calculation range of the profile.

The range is divided into Rows equidistant areas. We then see if price lied within a specific area, if it's the case we accumulate the difference between the closing and opening price for that specific area.

Let d = close - open . The length of the bin associated to a specific area is determined as follows:

length = Width / 100 * Area / Max

Where Area is the accumulated d within the area, and Max the maximum value between the absolute value of each accumulated d of all areas.

The percentage visible on each bin is determined as 100 multiplied by the accumulated d within the area divided by the total absolute value of d over the entire range.

🔹 Intrabar Calculation

When using intrabar data the range sentiment profile is calculated differently.

For a specific area and candle within the interval, the accumulated close to open difference is accumulated only if the intrabar candle of the user selected timeframe lies within the area.

This can return more precise results compared to the standard method, at the cost of a higher computation time.

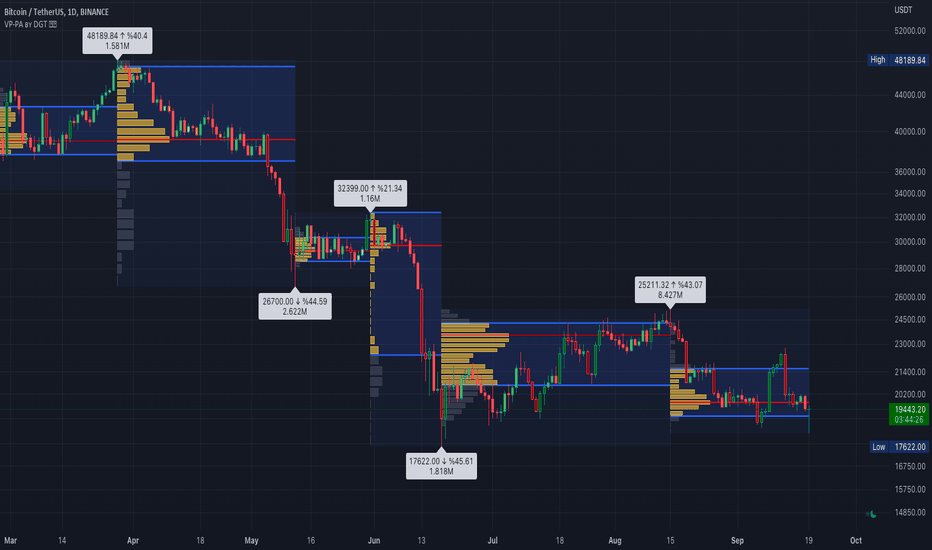

Volume Profile Fixed Range Support and Resistance LevelsThis script is based on the excellent Volume Profile / Fixed Range indicator by @LonesomeTheBlue, so all credit for the foundations of this indicator goes to @LonesomeTheBlue

I basically made 5 instances of the original script and added horizontal lines at the beginning and end of the each Value Area. To use the script as a support and resistance tool without the Value Areas and Point of Control (POC) labels you just need to untick "Boxes" and "Labels" in the "Style" section of the “Settings”.

The default look-back periods (in bars) are 7, 30, 60, 180 and 365, but you can change this or the colour of the lines easily in the “Settings”.

The dashed lines are the respective POC.

I find this tool to be very useful for quickly identifying interest levels on any chart while also ensuring a certain amount of objectivity in your TA.

Hope you find it useful and thanks again to @LonesomeTheBlue for going through the trouble of coding this and being so generous to share it with the rest of us!

Good luck out there!

Angled Volume Profile [Trendoscope]Volume profile is useful tool to understand the demand and supply zones on horizontal level. But, what if you want to measure the volume levels over trend line? In trending markets, the feature to measure volume over angled levels can be very useful for traders who use these measures. Here is an attempt to provide such tool.

🎲 How to use

🎯 Interactive input for selecting starting point and angle.

Upon loading the script, you will be prompted to select

Start time and price - this is a point which you can select by moving the maroon highlighted label.

End price - though this is shown as maroon bullet, this is price only input. Hence, when you click on the bullet, a horizontal line will appear. Users can move the line to use different End price.

Start and End price are used for identifying the angle at which volume profile need to be calculated. Whereas start time is used as starting time of the volume profile. Last bar of the chart is considered as ending bar.

🎯 Other settings.

From settings, users can select the colour of volume profile and style. Step multiplier defines the distance at which the profile lines needs to be drawn. Higher multiplier leads to less dense profile lines whereas lower multiplier leads to higher density of profile lines.

🎲 Limitations

🎯 Max 500 lines

Pinescript only allows max 500 lines on an indicator. Due to this, if we set very low multiplier - this can lead to more than 500 profile lines. Due to this some lines can get removed.

On the contrary, if multiplier is too high, then you will see very few lines which may not be meaningful.

Hence, it is important to select optimal multiplier based on your timeframe

🎯 No updates on new bar

Since the profile can spawn many bars, it is not possible to recalculate the whole volume profile when price creates new bars. Hence, there will not be visual update when new bars are created. But, to update the chart, users only need to make another movement of Start or ending point on interactive input.

Bar Magnified Volume Profile/Fixed Range [ChartPrime]This indicator draws a volume profile by utilizing data from the lower timeframe to get a more accurate representation of where volume occurred on a bar to bar basis. The indicator creates a price range, and then splits that price range into 100 grids by default. The indicator then drops down to the lower timeframe, approximately 16 times lower than the current timeframe being viewed on the chart, and then parses through all of the lower timeframe bars, and attributes the lower timeframe bar volume to all grids that it is touching. The volume is dispersed proportionally to the grids which it is touching by whatever percent of the candle is inside each grid. For example, if one of the lower timeframe bars is interacting with "2" of the grids in the profile, and 60% of the candle is inside of the top grid, 60% of the volume from said candle will be attributed to the grid.

To make all of this magic happen, this script utilizes a quadratic time complexity algorithm while parsing and attributing the volume to all of the grids. Due to this type of algorithm being used in the script, many of the user inputs have been limited to allow for simplicity, but also to prevent possible errors when executing loops. For the most part, all of the settings have been thoroughly tested and configured with the right amount of limitations to prevent these errors, but also still give the user a broad range of flexibility to adjust the script to their liking.

📗 SETTINGS

Lookback Period: The lookback period determines how many bars back the script will search for the "highest high" and the "lowest low" which will then be used to generate the grids in-between

Number Of Levels: This setting determines how many grids there will be within the volume profile/fixed range. This is personal preference, however it is capped at 100 to prevent time complexity issues

Profile Length: This setting allows you to stretch or thin the volume profile. A higher number will stretch it more, vise versa a smaller number will thin it further. This does not change the volume profiles results or values, only its visual appearance.

Profile Offset: This setting allows you to offset the profile to the left or right, in the event the user does not appreciate the positioning of the default location of the profile. A higher number will shift it to the right, vise versa a lower number will shift it to the left. This is personal preference and does not affect the results or values of the profile.

🧰 UTILITY

The volume profile/fixed range can be used in many ways. One of the most popular methods is to identify high volume areas on the chart to be used as trade entries or exits in the event of the price revisiting the high volume areas. Take this picture as an example. The image clearly demonstrates how the 2 highest areas of volume within this magnified volume profile also line up to great areas of support and resistance in the market.

Here are some other useful methods of using the volume profile/fixed range

Identify Key Support and Resistance Levels for Setups

Determine Logical Take Profits and Stop Losses

Calculate Initial R Multiplier

Identify Balanced vs Imbalanced Markets

Determine Strength of Trends

Open Interest with Heikin Ashi candlesA simple modification of the Tradingview free script of futures Open Interest to Heikin Ashi candles. It displays the volume of the Open Interest futures contracts by applying the HA formula.

I use it to clear out the "noise" of up's and down's especially in intraday small time frames when I am scalping in crypto.

Background color can be turned on/off.

Just to give back a little something to a community that gave me A LOT!

Let me know what you think and if you need anything to add.

Have fun :)

P.S. The way I use it is to try to find traps in the market and take (fast) advantage of them. When the OI are going up really fast in small time frames (which means either longs or shorts are going up) this creates a good opportunity for a squeeze (the trap).

Of course I use other indicators/oscillators to determine that but it gets me on my toes to look for... something ;)

Volume and vPOC InsightsThe vPOC or volume point of control shows where most of the volume was traded. This is important because this is where the institutions and market makers have opened their positions, and these are the ones that move the markets!

This indicator is designed to cut through the volume noise, and enable the hiding of lower volume data.

The main setting allows you to define a lookback, and obscure the candles whose volume is less than x % of the highest volume in this lookback.

Of the remaining candles, their vPOC will be displayed. There are extra settings to extend naked vPOCs, as well as the highs and lows of these high volume candles, plus an EMA based on the vPOC price levels.

I must credit quantifytools @quantifytools who allowed me to utilize his code, for finding vPOCs using lower timeframe candles - there are comments in the code also. It works perfectly so why reinvent the wheel?

RS: Market ProfileA Market Profile (time price opportunity) implementation with an option to mark a point of control (POC) based on volume.

Config: Hide default candles. Select a session time using exchange timezone. Experiment with tick multiplier value to achieve desired level of detail. Choose the symbols of your choice, e.g. squares or A-Z chars. For multiple sessions you will have to add additional instances of this script with a different time configuration.

Limitations: TradingView has a hard limit for the number of characters (500), if it's reached, label rendering stops. Try increasing tick multiplier value to reduce the number of labels rendered or reduce the window size.

Features:

Use symbols or A-Z chars for TPOs

Mark POC

Calculate Value Area (volume or time based)

Highlight single prints (SP)

Highlight VWAP

Show daily bar

Highlight Open and Close

Highlight current price row (during live market)

Highlight initial balance (IB)

[potatoshop] Volume Profile lower timeframeThis script is a volume profile that displays the volume of transactions in price blocks over a recent period of time.

For a more detailed representation, OHCLV values on the time frame lower than the time zone on the chart were called and expressed.

Low time frames are adjustable.

You can adjust the number of blocks and the most recent time period that you want to view.

Although it cannot be compared to the volume indicators provided for paid users of Trading-View, it has functioned by displaying transactions that are difficult to find on open source.

Displays the amount traded in each block and the percentage of the total over a given period.

POC represents the middle value of the block with the highest transaction volume as a line.

TPOC represents the block that stayed the longest regardless of the volume of transaction.

The reversal line appears when you determine the trading advantage of the rising and falling closing on a block basis and then have a different value from the neighboring blocks.

(I didn't mean it much, but I just put it in for fun.)

It represents the total volume of transactions traded in each block, and there are also check boxes in the settings window that represent the volume of transactions that closed higher and closed lower.

You can specify the color of each block.

The highest and lowest values for the set period and the total sum of each block are displayed at the bottom of the box.

Because it was made using a lot of arrays, the total transaction volume was marked separately to check the value.

When expressing the price block according to the trading volume percentage, it was a pity that the minimum pixel was 1 bar, so it could not be expressed delicately.

Although set to bar_time in Box properties xloc, 1 bar was actually the minimum unit of the X-axis value.

The logic used to place the transaction volume for each block is as follows.

1. Divide the difference between the high and low values of 1 LTF bar by the transaction volume .

2. Find the percentage of this LTF bar within each block.

3. Multiply the ratio by the transaction volume again.

4. Store the value in each block cell.

Below are the codes of the people I referred to this time.

1. ‘Time & volume point of control (TPOC & VPOC)’ by quantifytools

2. ‘Volume Profile ’ by LuxAlgo

3. ‘Volume Profile and Volume Indicator by DGT’ by dgtrd

The script is for informational and educational purposes only.

이 스크립트는 최근 일정 기간동안의 거래량을 가격 블록단위로 표시해 주는 볼륨 프로화일입니다.

좀 더 자세한 표현을 위해 차트상의 시간대보다 낮은 시간 프레임상의 OHCLV 값들을 호출하여 표현하였습니다.

낮은 시간 프레임은 조절 가능합니다..

보고 싶은 최근 일정 기간과 블럭 갯수를 조절할 수 있습니다.

트뷰 유료 사용자들을 위해 제공하는 지표와는 비교할 수는 없지만, 오픈 소스상에서는 찾기 힘든 거래량을 표시해 기능을 넣었습니다.

각 블럭에서 거래되었던 양 과 주어진 기간 동안의 총량 대비 퍼센트를 표시해 줍니다.

POC는 거래량이 가장 많았던 블럭의 중간값을 라인으로 표현해 줍니다.

TPOC는 거래량에 상관없이 가장 오랜 시간 머물렸던 블럭을 표현해 줍니다.

반전선은 블럭 단위로 상승 마감과 하락 마감의 거래량 우세를 결정한 뒤, 이웃 블럭들하고 다른 값을 가질 때 나타납니다.

(어떤 뜻을 갖고 만든 건 아니고 그냥 재미로 넣어 보았습니다.)

각 블럭에서 거래되었던 총거래량을 표현해 주며, 또한 설정창에서 상승 마감한 거래량과 하락 마감한 거래량을 표현하는 체크 박스가 있습니다.

각 블럭의 색깔을 지정하실 수 있습니다.

설정된 기간 동안의 최고값과 최저값, 각 블럭을 합친 총량을 박스 하단에 표시해 두었습니다.

어레이를 많이 사용하여 만들었기 때문에 값의 확인을 위해 전체 거래량을 따로 표시하였습니다.

가격 블럭을 거래량 퍼센트에 따라 표현할 때, 최소 픽셀이 1bar 이어서 섬세하게 표현 할 수 없어 안타까웠습니다.

박스 속성을 xloc.bar_time 로 설정하였지만 실제로는 1 bar가 X축 값의 최소 단위였습니다.

각 블록 별로 거래량을 배치 할 때 쓰인 로직은 다음과 같습니다.

1. 1 LTF bar의 하이 와 로우 값의 차이를 거래량으로 나누어 줍니다.

2. 각 블록 안에서 이 LTF bar가 차지 하는 비율을 구합니다.

3. 그 비율에 다시 거래량을 곱해 줍니다.

4. 그 값을 각 블록 셀에 저장해 줍니다.

밑에 제가 이번에 참고한 분들의 코드들입니다.

1. ‘Time & volume point of control (TPOC & VPOC)’ by quantifytools

2. ‘Volume Profile ’ by LuxAlgo

3. ‘Volume Profile and Volume Indicator by DGT’ by dgtrd

Aggregated Volume Profile Spot & Futures ⚉ OVERVIEW ⚉

Aggregate Volume Profile - Shows the Volume Profile from 9 exchanges. Works on almost all CRYPTO Tickers!

You can enter your own desired exchanges, on/off any others, as well as select the sources of SPOT, FUTURES and others.

The script also includes several input parameters that allow the user to control which exchanges and currencies are included in the aggregated data.

The user can also choose how volume is displayed (in assets, U.S. dollars or euros) and how it is calculated (sum, average, median, or dispersion).

WARNING Indicator is for CRYPTO ONLY.

______________________

⚉ SETTINGS ⚉

‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾

Data Type — Choose Single or Aggregated data.

• Single — Show only current Volume.

• Aggregated — Show Aggregated Volume.

Volume By — You can also select how the volume is displayed.

• COIN — Volume in Actives.

• USD — Volume in United Stated Dollar.

• EUR — Volume in European Union.

• RUB — Volume in Russian Ruble.

Calculate By — Choose how Aggregated Volume it is calculated.

• SUM — This displays the total volume from all sources.

• AVG — This displays the average price of the volume from all sources.

• MEDIAN — This displays the median volume from all sources.

• VARIANCE — This displays the variance of the volume from all sources.

• Delta Type — Select the Volume Profile type.

• Bullish — Shows the volume of buyers.

• Bearish — Shows the volume of sellers.

• Both — Shows the total volume of buyers and sellers.

Additional features

The remaining functions are responsible for the visual part of the Volume Profile and are intuitive and I recommend that you familiarize yourself with them simply by using them.

________________

⚉ NOTES ⚉

‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾‾

If you have any ideas what to add to my work to add more sources or make calculations cooler, suggest in DM .

Also I recommend exploring and trying out my similar work.

Volume-Weighted Price Levels (VWPL)Introduction:

In this script, we will be creating an indicator that plots horizontal lines on the chart for each unique price in a given range, and colors them based on the volume of that price.

Explanation:

First, we define the input "Length" as an integer. This will determine the number of bars back from the current bar to include in the range.

We then create two arrays: "price" and "vol." The "price" array will store all the unique prices in the given range, and the "vol" array will store the corresponding volumes for those prices.

Using a for loop, we iterate through the range of bars and check if the current close price is already included in the "price" array. If it is not, we add it to the array and also add the corresponding volume to the "vol" array. If it is already included, we find the index of that price in the "price" array and add the current volume to the volume stored at that index in the "vol" array.

After the for loop, we find the maximum volume in the "vol" array and use that to find the corresponding price in the "price" array. This will be the price at which we draw the horizontal line.

We then create an array of lines called "lines" and, using another for loop, we iterate through the "price" array and add a line to the "lines" array for each price. The color of each line is determined by the volume of that price, using a color gradient from blue (lowest volume) to red (highest volume).

Finally, we use an if statement to check if the current bar is the last bar in the chart, and if it is, we use another for loop to iterate through the "lines" array and delete all the lines. This is to prevent the lines from being carried over to the next bar and potentially being plotted multiple times.

Conclusion:

This script can be useful for visualizing the price levels with the highest volume in a given range, as well as seeing how volume is distributed among different price levels. It can be helpful for identifying areas of significant buying or selling pressure.

Volume profile zonesHi all!

This script calculates and shows the volume profile for the range of a higher timeframe candle. It then shows support or resistance (/supply or demand) zones based on the volume profiles with the most volume. The defaults are just my preferred settings so feel free to play with them! Also feel free to let me know about bugs and features. I already have a list of features to make, e.g.:

base on pivots

more info zone calculations, e.g. breaks and retests, virgin point of control etc.

add alerts

get rid of getPriceLevels()

get rid of _barVolumeProfile prefix

handle realtime

...

Best of trading luck!

[Pt] Periodic Volume ProfileThis script is an attempt to recreate the Periodic Volume Profile that is built-in by TradingView, with slightly different features. Related blog: www.tradingview.com

This script is based on another script "Volume Profile, Pivot Anchored" by @dgtrd

*Note that only limited number Volume Profile can be displayed on the chart due to limitations on displaying boxes and lines.

Description

This Periodic Volume Profile (PVP) indicator allows trades to view volume profiles for periods longer than the current timeframe. The indicator builds one general volume profile for each new period, set by the user through the “Periodic Timeframe” input parameter.

This script also has the option to extend Point of Control (POC) lines with optional end conditions: Until Bar Touch, Until Last Bar, Until Bar Cross, or None, which extends to the right.

Signals are generated for Naked POC touches and crosses by a triangle symbol and a cross symbol, by default.

Alerts are available for POC touches and crosses.

What is Volume Profile?

Volume profile is a technical analysis tool that shows the volume of trades at different prices for a given security or market over a specific period of time.

Volume profile can be used to identify key levels of support and resistance, as well as to assess the overall supply and demand for a security. For example, if there is a high volume of trades at a particular price level, this may indicate that there is a significant level of support or resistance at that price. On the other hand, if there is relatively low volume at a particular price, this may indicate that there is not much interest in trading at that level.

Traders can use volume profile to identify trends, make trading decisions, and set stop-loss and take-profit orders. It can also be useful for identifying patterns such as "pockets of liquidity," which are areas where there is a high volume of trades but relatively little price movement.

It is important to note that volume profile should be used in conjunction with other technical analysis tools and should not be relied upon in isolation. It is also important to consider the overall context and market conditions when interpreting volume profile data.

Key Difference with TradingView's PVP indicator - TradingView's PVP intraday period does not align with standard intraday timeframes as it is determined by # of bars. This script provides volume profiles that aligns with higher timeframe periods.

Enjoy~!

Open Interest Profile (OI)- By LeviathanThis script implements the concept of Open Interest Profile, which can help you analyze the activity of traders and identify the price levels where they are opening/closing their positions. This data can serve as a confluence for finding the areas of support and resistance , targets and placing stop losses. OI profiles can be viewed in the ranges of days, weeks, months, Tokyo sessions, London sessions and New York sessions.

A short introduction to Open Interest

Open Interest is a metric that measures the total amount of open derivatives contracts in a specific market at a given time. A valid contract is formed by both a buyer who opens a long position and a seller who opens a short position. This means that OI represents the total value of all open longs and all open shorts, divided by two. For example, if Open Interest is showing a value of $1B, it means that there is $1B worth of long and $1B worth of short contracts currently open/unsettled in a given market.

OI increasing = new long and short contracts are entering the market

OI decreasing = long and short contracts are exiting the market

OI unchanged = the net amount of positions remains the same (no new entries/exits or just a transfer of contracts occurring)

About this indicator

*This script is basically a modified version of my previous "Market Sessions and Volume Profile by @LeviathanCapital" indicator but this time, profiles are generated from Tradingview Open Interest data instead of volume (+ some other changes).

The usual representation of OI shows Open Interest value and its change based on time (for a particular day, time frame or each given candle). This indicator takes the data and plots it in a way where you can see the OI activity (change in OI) based on price levels. To put it simply, instead of observing WHEN (time) positions are entering/exiting the market, you can now see WHERE (price) positions are entering/exiting the market. This is the same concept as when it comes to Volume and Volume profile and therefore, similar strategies and ways of understanding the given data can be applied here. You can even combine the two to gain an edge (eg. high OI increase + Volume Profile showing dominant market selling = possible aggressive shorts taking place)

Green nodes = OI increase

Red nodes = OI decrease

A cluster of large green nodes can be used for support and resistance levels (*trapped traders theory) or targets (lots of liquidations and stop losses above/below), OI Profile gaps can present an objective for the price to fill them (liquidity gaps, imbalances, inefficiencies, etc), and more.

Indicator settings

1. Session/Lookback - Choose the range from where the OI Profile will be generated

2. OI Profile Mode - Mode 1 (shows only OI increase), Mode 2 (shows both OI increase and decrease), Mode 3 (shows OI decrease on left side and OI increase on the right side).

3. Show OI Value Area - Shows the area where most OI activity took place (useful as a range or S/R level )

4. Show Session Box - Shows the box around chosen sessions/lookback

5. Show Profile - Show/hide OI Profile

6. Show Current Session - Show/hide the ongoing session

7. Show Session Labels - Show/hide the text labels for each session

8. Resolution - The higher the value, the more refined a profile is, but fewer profiles are shown on the chart

9. OI Value Area % - Choose the percentage of VA (same as in Volume Profile's VA)

10. Smooth OI Data - Useful for assets that have very large spikes in OI over large bars, helps create better profiles

11. OI Increase - Pick the color of OI increase nodes in the profile

12. OI Decrease - Pick the color of OI decrease nodes in the profile

13. Value Area Box - Pick the color of the Value Area Box

14. Session Box Thickness - Pick the thickness of the lines surrounding the chosen sessions

Advice

The indicator calculates the profile based on candles - the more candles you can show, the better profile will be formed. This means that it's best to view most sessions on timeframes like 15min or lower. The only exception is the Monthly profile, where timeframes above 15min should be used. Just take a few minutes and switch between timeframes and sessions and you will figure out the optimal settings.

This is the first version of Open Interest Profile script so please understand that it will be improved in future updates.

Thank you for your support.

** Some profile generation elements are inspired by @LonesomeTheBlue's volume profile script

Volume Profile Volume Delta OI Delta [Kioseff Trading]Hello!

This script serves to distinguish volume delta for any asset and open interest delta for Binance perpetual futures.

The image above provides further explanation of functionality and color correspondence.

The image above shows the indicator calculating volume at each tick level and displaying the metric.

The label color outline (neon effect) is configurable; the image above is absent the feature.

The image above shows Open Interest (OI) Delta calculated - similar to how the script calculates volume delta - for a Binance Perpetual Future pair.

This feature only works for Binance Futures pairs; the script will not load when trying to calculate OI Delta on other assets.

Additionally, a heatmap is displayable should you configure the indicator to calculate it.

The image above shows a heatmap using volume delta calculations.

The image above shows a heatmap using OI delta calculations.

Of course, these calculations - when absent requisite data - require some assumptions to better replicate calculations with access to requisite data.

The indicator assumes a 60/40 split when a tick level is traded at and only one metric - "buy volume" or "sell volume" is recorded. This means there shouldn't be any levels recorded where "buy volume" is greater than 0 and "sell volume" equals 0 and vice versa. While this assumption was performed arbitrarily, it may help better replicate volume delta and OI delta calculations seen on other charting platforms.

This option is configurable; you can select to have the script not assume a 60/40 split and instead record volume "as is" at the corresponding tick level.

The script also divides volume and open interest if a one-minute bar violates multiple tick levels. The volume or open interest generated on the one-minute bar will be divided by the number of tick levels it exceeds. The results are, subsequently, appended to the violated tick levels.

Further, the script can be set to recalculate after a user-defined time threshold is exceeded. You can also define the percentage or tick distance between levels.

Also, it'd be great if this indicator can nicely replicate volume delta indicators on other charting platforms. If you've any ideas on how price action can be used to better assume volume at the corresponding price area please let me know!

Thank you (:

Time & volume point of control / quantifytoolsWhat are TPOC & VPOC?

TPOC (time point of control) and VPOC (volume point of control) are points in price where highest amount of time/volume was traded. This is considered key information in a market profile, as it shows where market participant interest was highest. Unlike full fledged market profile that shows total time/volume distribution, this script shows the points of control for each candle, plotted with a line (time) and a dot (volume). The script hides your candles/bars by default and forms a line in the middle representing candle range. In case of candles, borders will still be visible. This feature can be turned off in the settings.

Volume and time data are fetched from a lower timeframe that is automatically adjusted to fit the timeframe you're using. By default, the following settings are applied:

Charts <= 30 min: 1 minute timeframe

Charts > 30 min & <= 3 hours : 5 minute timeframe

Charts > 3 hours & <= 8 hours : 15 minute timeframe

Charts > 8 hours & <= 1D: 1 hour timeframe

Charts > 1D & <= 3D : 2 hour timeframe

Charts > 3D: 4 hour timeframe

Timeframe settings can be changed via input menu. The lower the timeframe, the more precision you get but with the cost of less historical data and slower loading time. Users can also choose which source to use for determining price for points of control, e.g. using close as source, the point of control is set to match the value of lower timeframe candle close. This could be replaced with OHLC4 for example, resulting in a point of control based on OHLC average.

To identify more profound points of market participant interest, TPOC & VPOC as percentage of total time/volume thresholds can be set via input menu. When a point of control is equal to or greater than the set percentage threshold, visual elements will be highlighted in a different color, e.g. 50% VPOC threshold will activate a highlight whenever volume traded at VPOC is equal to or greater than 50% of total volume. All colors are customizable.

VPOC is defined by fetching lower timeframe candle with the most amount of volume traded and using its close (by default) as a mark for point of control. For TPOC, each candle is divided into 10 lots which are used for calculating amount of closes taking place within the bracket values. The lot with highest amount of closes will be considered a point of control. This mark is displayed in the middle point of a lot:

How to utilize TPOC & VPOC

Example #1: Trapped market participants

One or both points of control at one end of candle range (wick tail) and candle close at the other end serves as an indication of market participants trapped in an awkward position. When price runs away further from these trapped participants, they are eventually forced to cover and drive price even further to the opposite direction:

Example #2: Trend initiation

A large move that leaves TPOC behind while VPOC is supportive serves as an indication of a trend initiation. Essentially, this is one way to identify an event where price traded sideways most of the time and suddenly moved away with volume:

Example #3: POC supported trend

A trend is healthy when it's supported by a point of control. Ideally you want to see either time or volume supporting a trend:

Market sessions and Volume profile - By LeviathanThis script allows you to keep track of Forex market sessions (Tokyo, London and New York), as well as Daily, Weekly and Monthly sessions. All of them are accompanied by Volume Profile options where you can view VP Histogram, Point of Control, Value Area High and Value Area Low.

Colors, lines and other design preferences are fully customizable.

* Volume Profile of shorter sessions (eg. Tokyo, London, New York) works better when using lower timeframes such as 15min, 5min, etc.

** Use timeframe higher than 15min when viewing Monthly sessions

Indicator settings overview:

SESSION TYPE

- Tokyo session (1:00 - 9:00 UTC/ GMT )

- London session (7:00 - 16:00 UTC/ GMT )

- New York session (13:00 - 22:00 UTC/ GMT )

- Daily session

- Weekly session

- Monthly session

DISPLAY

- Show Volume Profile (Show or hide Volume Profile histogram)

- Show POC (Show or hide Point Of Control line)

- Show VAL (Show or hide Value Area Low line)

- Show VAH (Show or hide Value Area High line)

- Show Live Zone (Show or hide the ongoing session)

VOLUME PROFILE SETTINGS

- Resolution (The higher the value, the more refined of a profile, but less profiles are shown on the chart)

- Smooth Volume Data (Useful for assets that have very large spikes in volume over large bars, helps create better profiles)

APPEARANCE

- Up Volume color (Pick a custom color for up/ bullish volume profile nodes)

- Down Volume color (Pick a custom color for down/ bearish volume profile nodes)

- POC color and thickness (Pick a custom color and thickness for Point Of Control line)

- VAH color and thickness (Pick a custom color and thickness for Value Area High line)

- VAL color and thickness (Pick a custom color and thickness for Value Area Low line)

- Session box thickness (Pick a custom thickness for the session box. Color is provided automatically with optimal contrast)

** Some VP elements are inspired by @LonesomeTheBlue's volume profile script

Average Volume ProfileAverage Volume Profile is an abstract based on a user suggestion.

The information displayed could be summed up as a volume profile divided by a market profile.

This indicator is a profile which displays the average volume of an area (of price).

It also calculates and displays the highest average volume point (HAV) and the relating value zones (calculated in the similar fashion to a volume profile).

Most of the code is directly from my "Volume/Market Profile" Indicator

I am not entirely sure of how to make use of the information displayed in this indicator or how useful it is.

However, I have added some things I figured would be useful to comprehend this information, such as:

- Read-out for highest average volume

- Read-out for current price average volume

- Read-out for current candle distributed volume (labeled as: "Vol")

- Floating line to visualize the current distributed volume in relation to the rest of the profile.

- Color changing labels for when the current distributed volume is higher than the current price avg volume.

Enjoy!

PWV - Price Weighted VolumeThis indicator charts

PWV = volume * close

in order to better visualize exchange volume.

Overnight inventoryThe indicator is dedicated for market / volume profile traders. It presents overnight inventory as a yellow number next to the indicator name on your charts. It does not plot anything.

If the number is positive then the inventory is net long and vice versa.

It is calibrated for US indicies, so it makes sense to use it only on US futures.

Volume Profile, Pivot Anchored by DGTVolume Profile (also known as Price by Volume ) is an charting study that displays trading activity over a specified time period at specific price levels. It is plotted as a horizontal histogram on the finacial isntrumnet's chart that highlights the trader's interest at specific price levels. Specified time period with Pivots Anchored Volume Profile is determined by the Pivot Levels, where the Pivot Points High Low indicator is used and presented with this Custom indicator

Finally, Volume Weighted Colored Bars indicator is presneted with the study

Different perspective of Volume Profile applications;

Anchored to Session, Week, Month etc : Anchored-Volume-Profile

Custom Range, Interactive : Volume-Profile-Custom-Range

Fixed Range with Volume Indicator : Volume-Profile-Fixed-Range

Combined with Support and Resistance Indicator : Price-Action-Support-Resistance and Volume-Profile

Combined with Supply and Demand Zones, Interactive : Supply-Demand-and-Equilibrium-Zones

Disclaimer : Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

The script is for informational and educational purposes only. Use of the script does not constitutes professional and/or financial advice. You alone the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

Volume Profile PremiumHello, my friends, this is a new fine-grained volume profile indicator. As is known to all, the volume profile indicator is a charting tool that shows how much volume has occurred at each price throughout the trading session. The volume profile indicates the prices favored by the market or those ignored by the market, which can give traders clues as to where prices are likely to go shortly.

(1) Indicator description

This indicator is based on the function "request.security_lower_tf". See the related usage note for details if you need it.

Support for obtaining volume from a lower timeframe than the current chart and calculating a more fine-grained volume distribution

Due to the increased complexity of the calculation, you need to set a reasonable timeframe to avoid calculation timeout.

(2) Key parameters

- Support/Resistance Clustering

Max of Lookback Forward: The maximum number of historical K-lines

Min Resolution (Minute): lower timeframe, unit: minute

Display Volume Profile: ways to display volume profile

Rows of Volume Profile: rows of volume profile

Placement of Volume Profile: location of volume profile

Width of Volume Profile: width of volume profile

Horizontal Offset: horizontal offset of volume profile

Happy trading, and enjoy your life!

————————————————————————————————————————

各位朋友大家好,这是一个具有更高细粒度的成交量分布指标。众所周知,成交量分布是一种图表分析工具(或指标),它显示了在整个交易时段内每个价格上发生了多少成交量。 成交量分布指出了受到市场青睐的价格以及被市场忽略的价格,这可以为交易者提供有关近期价格可能走向何方的线索。

(1) 指标说明

该指标基于 request.security_lower_tf 函数,详情可以查看相关使用说明

支持从比当前图表分辨率更低的时间周期获取成交量,并计算更加细粒度的成交量分布

由于增加了计算复杂度,您需要设置合理的时间周期以避免计算超时

(2) 关键参数

- Volume Profile Parameters

Max of Lookback Forward: 用于统计成交量分布的最大回顾的K线数量

Min Resolution (Minute): 细粒度的时间周期

Display Volume Profile: 展示成交量分布的方式

Rows of Volume Profile: 成交量分布的行数

Placement of Volume Profile: 成交量分布的位置

Width of Volume Profile: 成交量分布的宽度

Horizontal Offset: 成交量分布的水平偏移

祝大家交易愉快