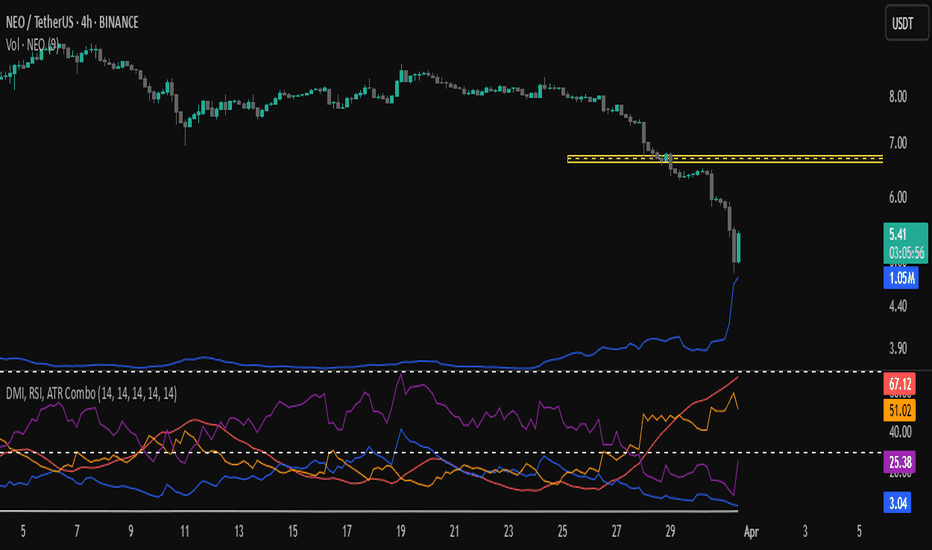

DMI, RSI, ATR Combo// Usage:

// 1. Add this script to your TradingView chart.

// 2. The ADX line helps determine trend strength.

// 3. The +DI and -DI lines indicate bullish or bearish movements.

// 4. The RSI shows momentum and potential overbought/oversold conditions.

// 5. The ATR measures volatility, helping traders assess risk.

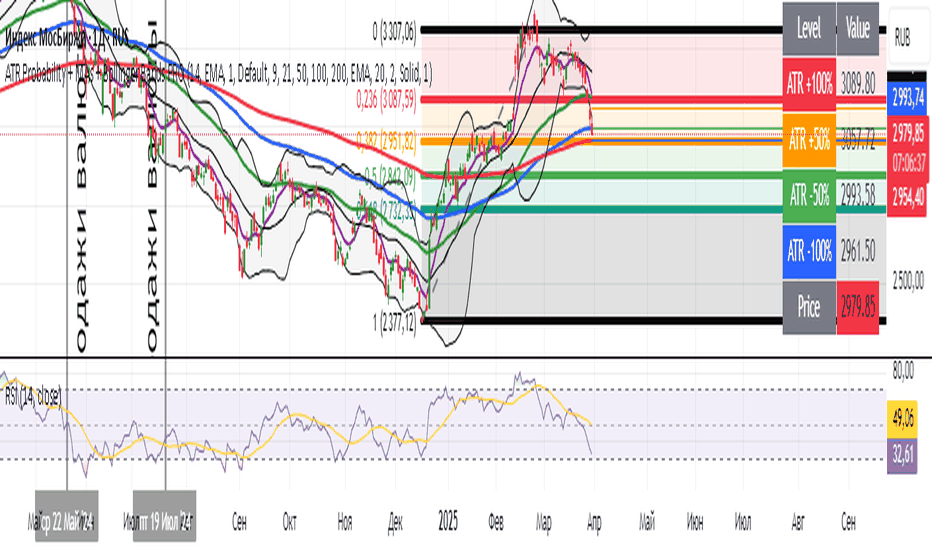

Волатильность

ATR Probability + MAs + Bollinger Bands PROATR Probability + MAs + Bollinger Bands

Made by DeepSeek))

The Crypto Wizard# The Crypto Wizard (Cwiz)

## Advanced Trading Framework for Cryptocurrency Markets

! (placeholder.com)

The Crypto Wizard (Cwiz) offers a customizable, robust trading framework designed specifically for cryptocurrency market volatility. This open-source foundation provides essential components for building profitable automated trading strategies.

### Key Performance Indicators

| Metric | Value |

|--------|-------|

| Profit Factor | 1.992 |

| Sortino Ratio | 5.589 |

| Win Rate | ~40% |

| Max Drawdown | 15.82% |

### Core Features

- **Position Scaling System**: Intelligent position sizing with customizable multipliers and risk controls

- **Multi-layered Exit Strategy**: Combined take-profit, fixed stop-loss, and trailing stop mechanisms

- **Customizable Entry Framework**: Easily integrate your own entry signals and conditions

- **Comprehensive Visualization Tools**: Real-time performance tracking with position labels and indicators

### Setup Instructions

```pine PHEMEX:FARTCOINUSDT.P

// 1. Add to your chart and configure basic parameters

// 2. Adjust risk parameters based on your risk tolerance

// 3. Customize entry conditions or use defaults

// 4. Back-test across various market conditions

// 5. Enable live trading with careful monitoring

```

### Risk Management

Cwiz implements a sophisticated risk management system with:

- Automatic position size scaling

- User-defined maximum consecutive trades

- ATR-based dynamic stop loss placement

- Built-in circuit breakers for extreme market conditions

### Customization Options

The framework is designed for flexibility without compromising core functionality. Key customization points:

- Entry signal generation

- Position sizing parameters

- Stop loss and take profit multipliers

- Visualization preferences

### Recommended Usage

Best suited for volatile cryptocurrency markets with sufficient liquidity. Performs optimally in trending conditions but includes mechanisms to manage ranging markets.

---

*Disclaimer: Trading involves significant risk. Past performance is not indicative of future results. Always test thoroughly before live deployment.*

02 SMC + BB Breakout (Improved)This strategy combines Smart Money Concepts (SMC) with Bollinger Band breakouts to identify potential trading opportunities. SMC focuses on identifying key price levels and market structure shifts, while Bollinger Bands help pinpoint overbought/oversold conditions and potential breakout points. The strategy also incorporates higher timeframe trend confirmation to filter out trades that go against the prevailing trend.

Key Components:

Bollinger Bands:

Calculated using a Simple Moving Average (SMA) of the closing price and a standard deviation multiplier.

The strategy uses the upper and lower bands to identify potential breakout points.

The SMA (basis) acts as a centerline and potential support/resistance level.

The fill between the upper and lower bands can be toggled by the user.

Higher Timeframe Trend Confirmation:

The strategy allows for optional confirmation of the current trend using a higher timeframe (e.g., daily).

It calculates the SMA of the higher timeframe's closing prices.

A bullish trend is confirmed if the higher timeframe's closing price is above its SMA.

This helps filter out trades that go against the prevailing long-term trend.

Smart Money Concepts (SMC):

Order Blocks:

Simplified as recent price clusters, identified by the highest high and lowest low over a specified lookback period.

These levels are considered potential areas of support or resistance.

Liquidity Zones (Swing Highs/Lows):

Identified by recent swing highs and lows, indicating areas where liquidity may be present.

The Swing highs and lows are calculated based on user defined lookback periods.

Market Structure Shift (MSS):

Identifies potential changes in market structure.

A bullish MSS occurs when the closing price breaks above a previous swing high.

A bearish MSS occurs when the closing price breaks below a previous swing low.

The swing high and low values used for the MSS are calculated based on the user defined swing length.

Entry Conditions:

Long Entry:

The closing price crosses above the upper Bollinger Band.

If higher timeframe confirmation is enabled, the higher timeframe trend must be bullish.

A bullish MSS must have occurred.

Short Entry:

The closing price crosses below the lower Bollinger Band.

If higher timeframe confirmation is enabled, the higher timeframe trend must be bearish.

A bearish MSS must have occurred.

Exit Conditions:

Long Exit:

The closing price crosses below the Bollinger Band basis.

Or the Closing price falls below 99% of the order block low.

Short Exit:

The closing price crosses above the Bollinger Band basis.

Or the closing price rises above 101% of the order block high.

Position Sizing:

The strategy calculates the position size based on a fixed percentage (5%) of the strategy's equity.

This helps manage risk by limiting the potential loss per trade.

Visualizations:

Bollinger Bands (upper, lower, and basis) are plotted on the chart.

SMC elements (order blocks, swing highs/lows) are plotted as lines, with user-adjustable visibility.

Entry and exit signals are plotted as shapes on the chart.

The Bollinger band fill opacity is adjustable by the user.

Trading Logic:

The strategy aims to capitalize on Bollinger Band breakouts that are confirmed by SMC signals and higher timeframe trend. It looks for breakouts that align with potential market structure shifts and key price levels (order blocks, swing highs/lows). The higher timeframe filter helps avoid trades that go against the overall trend.

In essence, the strategy attempts to identify high-probability breakout trades by combining momentum (Bollinger Bands) with structural analysis (SMC) and trend confirmation.

Key User-Adjustable Parameters:

Bollinger Bands Length

Standard Deviation Multiplier

Higher Timeframe

Higher Timeframe Confirmation (on/off)

SMC Elements Visibility (on/off)

Order block lookback length.

Swing lookback length.

Bollinger band fill opacity.

This detailed description should provide a comprehensive understanding of the strategy's logic and components.

***DISCLAIMER: This strategy is for educational purposes only. It is not financial advice. Past performance is not indicative of future results. Use at your own risk. Always perform thorough backtesting and forward testing before using any strategy in live trading.***

Volatility Layered Supertrend [NLR]We’ve all used Supertrend, but do you know where to actually enter a trade? Volatility Layered Supertrend (VLS) is here to solve that! This advanced trend-following indicator builds on the classic Supertrend by not only identifying trends and their strength but also guiding you to the best trade entry points. VLS divides the main long-term trend into “Strong” and “Weak” Zones, with a clear “Trade Entry Zone” to help you time your trades with precision. With layered trends, dynamic profit targets, and volatility-adaptive bands, VLS delivers actionable signals for any market.

Why I Created VLS Over a Plain Supertrend

I built VLS to address the gaps in traditional Supertrend usage and make trade entries clearer:

Single-Line Supertrend Issues: The default Supertrend sets stop-loss levels that are too wide, making it impractical for most traders to use effectively.

Unclear Entry Points: Standard Supertrend doesn’t tell you where to enter a trade, often leaving you guessing or entering too early or late.

Multi-Line Supertrend Enhancement: Many traders use short, medium, and long Supertrends, which is helpful but can lack focus. In VLS, I include Short, Medium, and Long trends (using multipliers 1 to 3), and add multipliers 4 and 5 to track extra long-term trends—helping to avoid fakeouts that sometimes occur with multiplier 3.

My Solution: I focused on the main long-term Supertrend and split it into “Weak Zone” and “Strength Zone” to show the trend’s reliability. I also defined a “Trade Entry Zone” (starting from the Mid Point, with the first layer’s background hidden for clarity) to guide you on where to enter trades. The zones include Short, Medium, and Long Trend layers for precise entries, exits, and stop-losses.

Practical Trading: This approach provides realistic stop-loss levels, clear entry points, and a “Profit Target” line that aligns with your risk tolerance, while filtering out false signals with longer-term trends.

Key Features

Layered Trend Zones: Short, Medium, Long, and Extra Long Trend layers (up to multipliers 4 and 5) for timing entries and exits.

Strong & Weak Zones: See when the trend is reliable (Strength Zone) or needs caution (Weak Zone).

Trade Entry Zone: A dedicated zone starting from the Mid Point (first layer’s background hidden) to show the best entry points.

Dynamic Profit Targets: A “Profit Target” line that adjusts with the trend for clear goals.

Volatility-Adaptive: Uses ATR to adapt to market conditions, ensuring reliable signals.

Color-Coded: Green for uptrends, red for downtrends—simple and clear.

How It Works

VLS enhances the main long-term Supertrend by dividing it into two zones:

Weak Zone: Indicates a less reliable trend—use tighter stop-losses or wait for the price to reach the Trade Entry Zone.

Strength Zone: Signals a strong trend—ideal for entries with wider stop-losses for bigger moves.

The “Trade Entry Zone” starts at the Mid Point (last layer’s background hidden for clarity), showing you the best area to enter trades. Each zone includes Short, Medium, Long, and Extra Long Trend sublevels (up to multipliers 4 and 5) for precise trade timing and to filter out fakeouts. The “Profit Target” updates dynamically based on trend direction and volatility, giving you a clear goal.

How to Use

Spot the Trend: Green bands = buy, red bands = sell.

Check Strength: Price in Strength Zone? Trend’s reliable—trade confidently. In Weak Zone? Use tighter stops or wait.

Enter Trades: Use the “Trade Entry Zone” (from the Mid Point upward) for the best entry points.

Use Sublevels: Short, Medium, Long, and Extra Long layers in each zone help fine-tune entries and exits.

Set Targets: Follow the Profit Target line for goals—it updates automatically.

Combine Tools: Pair with RSI, MACD, or support/resistance for added confirmation.

Settings

ATR Length: Adjust the ATR period (default 10) to change sensitivity.

Up/Down Colors: Customize colors—green for up, red for down, by default.

ICT Order Blocks v2 (Debug) ICT Breaker Blocks v2 (Break Refined) Indicator Explanation

This document provides a comprehensive overview of the ICT Breaker Blocks v2 (Break Refined) indicator, which is designed to identify and visualize Breaker Blocks in trading. A Breaker Block represents a prior Order Block that has failed to hold price, indicating potential institutional support or resistance levels. The indicator highlights these flipped zones, allowing traders to anticipate future price reactions based on previous market behavior.

Purpose

The primary purpose of the ICT Breaker Blocks v2 indicator is to identify Breaker Blocks, which are crucial for understanding market dynamics. When price decisively breaks through an Order Block, it can change its role from support to resistance or vice versa. This indicator helps traders visualize these changes, providing insights into potential areas for price reactions.

How it Works

The indicator operates through a series of steps on each bar:

1. Identify Potential Order Blocks (OBs)

The indicator continuously searches for the most recent potential Order Blocks based on basic price action:

Potential Bullish OB: The last down-closing candle before an upward move that breaks its high.

Potential Bearish OB: The last up-closing candle before a downward move that breaks its low.

It retains the price range (high/low) and location of the most recent potential OB of each type.

2. Detect the "Break" of a Potential OB

A Breaker is confirmed when the price fails to respect a potential OB and moves decisively through it. The indicator checks:

If the current price closes above the high of the stored potential Bearish OB.

If the current price closes below the low of the stored potential Bullish OB.

3. Apply Displacement Filter (Optional)

To enhance the accuracy of break detection, traders can enable the "Require Displacement on Break?" filter in the settings. This filter adds a condition that the candle causing the break must have a larger body size than the preceding candle, indicating stronger momentum.

4. Store the Active Breaker Block

When a valid break occurs (and passes the displacement filter if active):

A Bullish Breaker (+BB) is confirmed if a potential Bearish OB is broken to the upside, storing the high/low price range of that original Bearish OB.

A Bearish Breaker (-BB) is confirmed if a potential Bullish OB is broken to the downside, storing the high/low price range of that original Bullish OB.

The indicator tracks only the most recent valid, unmitigated Breaker Block of each type, replacing the previous one when a new one forms.

5. Mitigation (Invalidation)

The indicator checks if the currently displayed Breaker zone has been invalidated by subsequent price action. The mitigation rules are as follows:

A Bullish Breaker is considered mitigated and removed if the price later closes below its low.

A Bearish Breaker is considered mitigated and removed if the price later closes above its high.

Visualization

For the currently active, unmitigated Breaker Block of each type (if enabled in settings):

A box is drawn representing the price zone (high/low) of the original Order Block that was broken.

The box starts from the bar where the break was confirmed.

If "Extend Breaker Boxes?" is enabled, the box extends to the right edge of the chart until the Breaker is mitigated.

A small label ("+BB" or "-BB") is added to the box, with colors and border styles configurable in the settings.

This indicator automates the identification of significant "flipped" zones, allowing traders to incorporate Breaker Blocks into their ICT analysis effectively. It is essential to evaluate the indicator's effectiveness on your chosen market and timeframe and consider using the displacement filter to refine the signals.

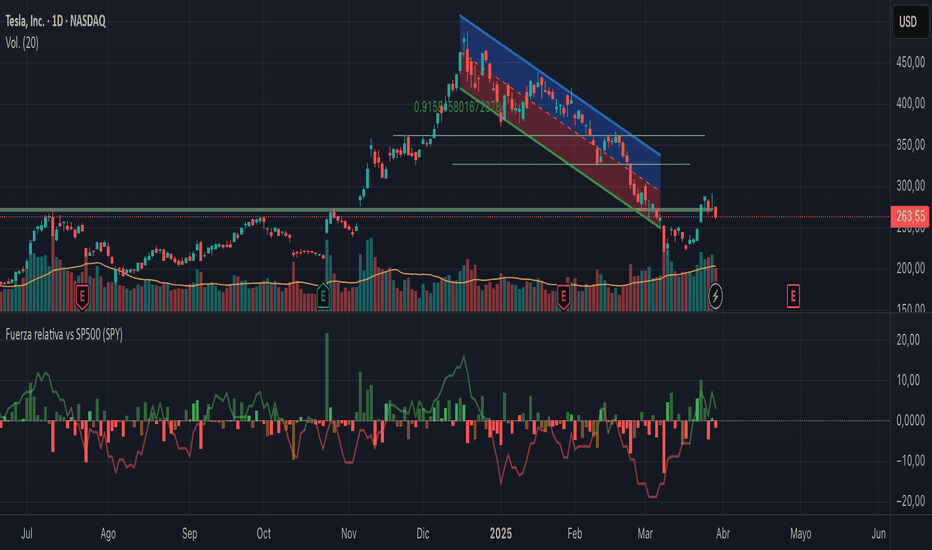

Fuerza relativa vs SP500This TradingView indicator analyzes the daily relative strength of a selected asset compared to the SP500, and provides both a visual histogram and a scoring system based on recent performance over the last 10 candles.

✅ Green: SP500 is down, but the asset is up (strong bullish signal).

🟧 Orange: SP500 is down, asset also down but performing better than the SP500 (mild strength).

🔴 Red: SP500 is down, and the asset performs even worse (clear weakness).

🟩 Light green: SP500 is up, and the asset performs better (moderate strength).

🟧 Light orange: SP500 is up, but the asset performs worse (mild weakness)

MA CloudsMA Clouds – Adaptive Moving Average Visualization (with Bollinger bands)

The MA Clouds indicator is designed to help traders visualize multiple moving averages simultaneously, providing a dynamic view of trend direction, momentum, and potential support/resistance zones. This tool overlays Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) in an easy-to-read cloud format, allowing traders to interpret market structure at a glance.

Key Features:

✅ Customizable Moving Averages – Adjust SMA and EMA lengths to suit your strategy.

✅ Cloud-Based Visualization – Color-coded clouds between different moving averages highlight areas of potential trend shifts.

✅ Toggle Price Lines – Option to enable or disable individual price lines for a cleaner chart.

✅ Bollinger Bands Integration – Adds upper and lower bands for additional confluence in volatility analysis.

✅ Quick Trend Identification – Helps traders gauge short-term and long-term trend strength.

✅ Preset View Modes – Toggle between a simplified 5-10 SMA/EMA setup or a full multi-timeframe cloud setup with one click.

This indicator is ideal for traders looking to combine trend-following strategies with dynamic support/resistance insights. Whether you're scalping intraday moves or managing longer-term swing trades, MA Clouds provides an efficient way to keep market structure in focus.

ATRs in Days📌 ATR in Days

This script tracks how price moves in relation to ATR over multiple days, providing a powerful volatility framework for traders.

🔹 Key Features:

✅ 4 ATRs in 5 Days – Measures if a stock has moved 4x its ATR within the last 5 days, identifying extreme volatility zones.

✅ Daily ATR Calculation – Tracks average true range over time to gauge market conditions.

✅ Clear Table Display – Real-time ATR readings for quick decision-making.

✅ Intraday & Swing Trading Compatible – Works across multiple timeframes for day traders & swing traders.

📊 How to Use:

Look for stocks that exceed 4 ATRs in 5 days to spot extended moves.

Use ATR as a reversion or continuation signal depending on market structure.

🚀 Perfect for traders looking to quantify volatility & structure trades effectively!

Custom TABI Model with Layers(Top and Bottom Indicator) TABI RSI Heatmap with FOMO Layers is an original visualization model inspired by the teachings of James from InvestAnswers, who first introduced the concept of color-layered RSI as a way to spot market conditions and behavioral dynamics.

This script builds on that idea and adds several advanced layers:

A 10-color RSI zone system ranging from cool blues (oversold) to extreme reds (euphoria).

A smoothed RSI line with custom color transitions based on user-defined levels.

Blow-off top detection logic to catch euphoric spikes in RSI.

A real-time FOMO awareness table that tracks how recently the last top occurred.

It’s designed to help traders better visualize sentiment pressure in a clean, color-coded layout. Whether you're swing trading or investing long-term, this tool helps you avoid emotional decisions driven by herd mentality.

🔍 How to Use:

Add the indicator to your chart.

Adjust RSI color thresholds to suit your asset’s volatility.

Watch the top-right table for alerts on potential FOMO periods after euphoric moves.

💬 Feedback is welcome — this tool was created for community use and refinement.

📌 This script is open-source. All code and logic is provided for educational purposes.

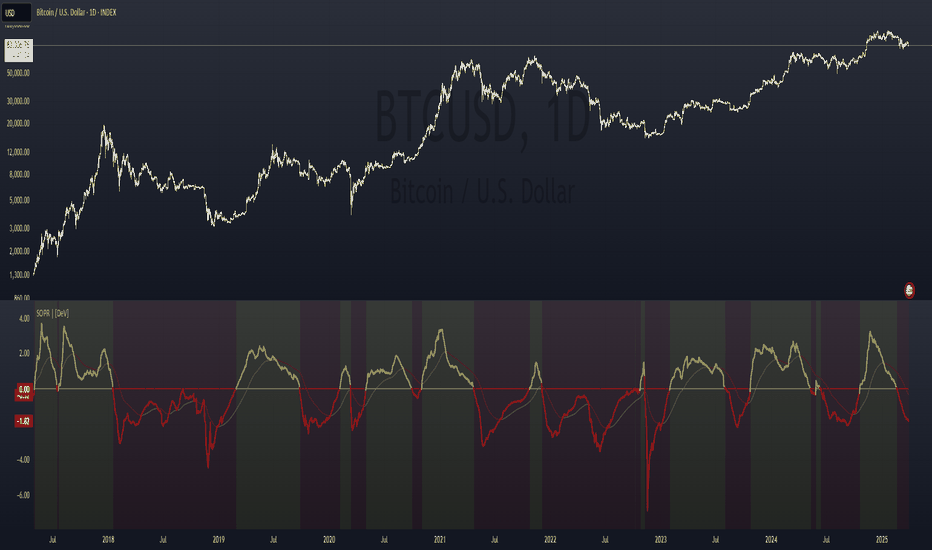

Spent Output Profit Ratio (SOPR) Z-Score | [DeV]SOPR Z-Score

The Spent Output Profit Ratio (SOPR) is an advanced on-chain metric designed to provide deep insights into Bitcoin market dynamics by measuring the ratio between the combined USD value of all Bitcoin outputs spent on a given day and their combined USD value at the time of creation (typically, their purchase price). As a member of the Realized Profit/Loss family of metrics, SOPR offers a window into aggregate seller behavior, effectively representing the USD amount received by sellers divided by the USD amount they originally paid. This indicator enhances this metric by normalizing it into a Z-Score, enabling a statistically robust analysis of market sentiment relative to historical trends, augmented by a suite of customizable features for precision and visualization.

SOPR Settings -

Lookback Length (Default: 150 days): Determines the historical window for calculating the Z-Score’s mean and standard deviation. A longer lookback captures broader market cycles, providing a stable baseline for identifying extreme deviations, which is particularly valuable for long-term strategic analysis.

Smoothing Period (Default: 100 days): Applies an EMA to the raw SOPR, balancing responsiveness to recent changes with noise reduction. This extended smoothing period ensures the indicator focuses on sustained shifts in seller behavior, ideal for institutional-grade trend analysis.

Moving Average Settings -

MA Lookback Length (Default: 90 days): Sets the period for the Z-Score’s moving average, offering a shorter-term trend signal relative to the 150-day Z-Score lookback. This contrast enhances the ability to detect momentum shifts within the broader context.

MA Type (Default: EMA): Provides six moving average types, from the simple SMA to the volume-weighted VWMA. The default EMA strikes an optimal balance between smoothness and responsiveness, while alternatives like HMA (Hull) or VWMA (volume-weighted) allow for specialized applications, such as emphasizing recent price action or incorporating volume dynamics.

Display Settings -

Show Moving Average (Default: True): Toggles the visibility of the Z-Score MA plot, enabling users to focus solely on the raw Z-Score when preferred.

Show Background Colors (Default: True): Activates dynamic background shading, enhancing visual interpretation of market regimes.

Background Color Source (Default: SOPR): Allows users to tie the background color to either the SOPR Z-Score’s midline (reflecting adjustedZScore > 0) or the MA’s trend direction (zScoreMA > zScoreMA ). This dual-source option provides flexibility to align the visual context with the primary analytical focus.

Analytical Applications -

Bear Market Resistance: When the Z-Score approaches or exceeds zero (raw SOPR near 1), it often signals resistance as sellers rush to exit at break-even, a pattern historically observed during downtrends. A rising Z-Score MA crossing zero can confirm this pressure.

Bull Market Support: Conversely, a Z-Score dropping below zero in uptrends indicates reluctance to sell at a loss, forming support as sell pressure diminishes. The MA’s bullish coloring reinforces confirmation of renewed buying interest.

Extreme Deviations: Values significantly above or below zero highlight overbought or oversold conditions, respectively, offering opportunities for contrarian positioning when paired with other on-chain or price-based metrics.

OG ATR RangeDescription:

The OG ATR Tool is a clean, visualized version of the Average True Range indicator for identifying volatility, stop-loss levels, and realistic price movement expectations.

How it works:

Calculates the average range (in points/pips) of recent candles.

Overlays ATR bands to help define breakout potential or squeeze zones.

Can be used to size trades or set dynamic stop-loss and target levels.

Best for:

Intraday traders who want to avoid unrealistic targets.

Volatility-based setups and breakout strategies.

Creating position sizing rules based on instrument volatility.

Pro Tip: Combine with your trend indicators to set sniper entries and exits that respect volatility.

OG ST+RSI ComboDescription:

The OG Supertrend + RSI Sniper Combo (Elite Edition) is a precision-based trend and momentum trading system. It fuses a modified Supertrend indicator with RSI-based sniper signals to catch clean entries in trending environments.

How it works:

Supertrend detects trend shifts based on price volatility.

RSI Sniper zones detect high-probability overbought/oversold reversals.

Entry signals appear only when Supertrend direction aligns with RSI zone confirmation, reducing false signals.

Best for:

Traders seeking high-conviction trend entries and exits.

5m, 15m, and 1H scalping or swing trade setups.

Works great on SPY, QQQ, BTC, and Forex pairs.

Use with: Clean chart setups. Avoid overlapping with other trend scripts unless necessary.

MACD + RSI + ADX + EMA Strategy PROThis strategy combines MACD crossovers, RSI momentum, ADX trend strength, EMA trend bias, and ATR-based filters to generate high-quality entries. It includes risk-based position sizing, trailing stops, and optional higher-timeframe confirmation for smarter, cleaner trades. Great for crypto, forex, and trending markets on intraday timeframes.

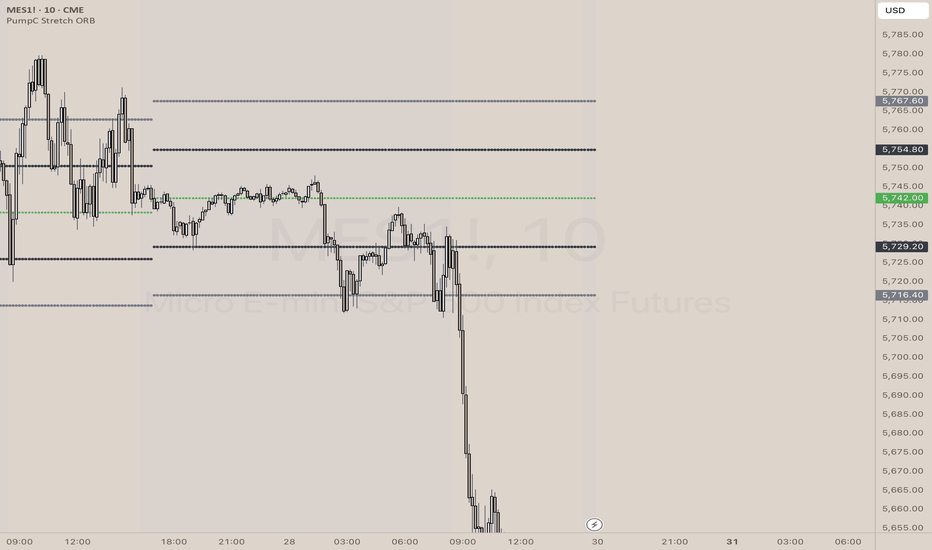

PumpC Opening Range Breakout (ORB) Stretch RangePumpC ORB Stretch

The PumpC ORB Stretch is a volatility-based indicator that helps traders identify potential breakout zones by analyzing how price typically behaves around the open. This tool is inspired by concepts introduced by Toby Crabel in his well-known book “Day Trading with Short-Term Price Patterns and Opening Range Breakout.”

Rather than predicting market direction, this indicator highlights areas where price is likely to expand based on recent volatility. It is designed for traders who prefer dynamic, data-driven breakout levels over static support and resistance zones.

What Is the "Stretch"?

In Toby Crabel’s framework, the Stretch is the average of the smaller of two price moves:

The distance from the open to the high of the bar

The distance from the open to the low of the bar

This smaller value captures the “quiet side” of the candle and reflects recent price compression. Averaged over multiple periods (commonly 10 daily bars), it creates a baseline to assess how far price may move away from the open under typical market conditions.

How the Indicator Works

The PumpC ORB Stretch follows this process:

Uses a higher timeframe (such as daily) to calculate the open, high, and low.

For each bar, measures the smaller of the two distances: open to high or open to low.

Applies a moving average to the result over a user-defined number of bars (default is 10).

Multiplies the average stretch by customizable levels (e.g., 0.382, 1.0, 2.0).

Plots breakout levels above and below the open of the selected timeframe.

The result is a set of adaptive levels that expand or contract with market volatility.

Customization Options

Stretch Timeframe: Choose the timeframe used for stretch calculation (default: Daily).

Stretch Length: Set the number of bars to include in the moving average.

Breakout Levels: Enable or disable individual levels and define multipliers.

Color Settings: Customize colors for each range level for easy visual distinction.

Plot Style: Circular markers are used to reduce chart clutter and improve readability.

How to Use It

Use plotted levels to anticipate possible breakouts from the open.

Adjust stretch length to reflect short-term or longer-term volatility trends.

Combine this tool with momentum indicators, volume, or price action for confirmation.

Use levels to help guide stop placement or profit targets in breakout strategies.

Important Notes

This script is based on an interpretation of Crabel’s concepts and is not affiliated with Crabel Capital or the original author.

The indicator does not predict direction; it is a tool for context and structure.

It is recommended that users test and validate this tool in a simulated environment before applying it to live trading.

This indicator is intended for educational purposes only.

Licensing and Attribution

This script is built entirely in Pine Script v5 and follows TradingView’s open-source standards. It does not include any third-party or proprietary code. If you modify or share it, please credit the original idea and follow all TradingView script publishing rules.

Nasan Risk Score & Postion Size Estimator** THE RISK SCORE AND POSITION SIZE WILL ONLY BE CALCUTAED ON DIALY TIMEFRAME NOT IN OTHER TIMEFRAMES.

The typically accepted generic rule for risk management is not to risk more than 1% - 2 % of the capital in any given trade. It has its own basis however it does not take into account the stocks historic & current performance and does not consider the traders performance metrics (like win rate, profit ratio).

The Nasan Risk Score & Position size calculator takes into account all the listed parameters into account and estimates a Risk %. The position size is calculated using the estimated risk % , current ATR and a dynamically adjusted ATR multiple (ATR multiple is adjusted based on true range's volatility and stocks relative performance).

It follows a series of calculations:

Unadjusted Nasan Risk Score = (Min Risk)^a + b*

Min Risk = ( 5 year weighted avg Annual Stock Return - 5 year weighted avg Annual Bench Return) / 5 year weighted avg Annual Max ATR%

Max Risk = ( 5 year weighted avg Annual Stock Return - 5 year weighted avg Annual Bench Return) / 5 year weighted avg Annual Min ATR%

The min and max return is calculated based on stocks excess return in comparison to the Benchmark return and adjusted for volatility of the stock.

When a stock underperforms the benchmark, the default is, it does not calculate a position size , however if we opt it to calculate it will use 1% for Min Risk% and 2% for Max Risk% but all the other calculations and scaling remain the same.

Rationale:

Stocks outperforming their benchmark with lower volatility (ATR%) score higher.

A stock with high returns but excessive volatility gets penalized.

This ensures volatility-adjusted performance is emphasized rather than absolute returns.

Depending on the risk preference aggressive or conservative

Aggressive Risk Scaling: a = max (m, n) and b = min (m, n)

Conservative Scaling: a = min (m, n) and b = max (m, n)

where n = traders win % /100 and m = 1 - (1/ (1+ profit ratio))

A default of 50% is used for win factor and 1.5 for profit ratio.

Aggressive risk scaling increases exposure when the strategy's strongest factor is favorable.

Conservative risk scaling ensures more stable risk levels by focusing on the weaker factor.

The Unadjusted Nasan risk is score is further refined based on a tolerance factor which is based on the stocks maximum annual drawdown and the trader's maximum draw down tolerance.

Tolerance = /100

The correction factor (Tolerance) adjusts the risk score based on downside risk. Here's how it works conceptually:

The formula calculates how much the stock's actual drawdown exceeds your acceptable limit.

If stocks maximum Annual drawdown is smaller than Trader's maximum acceptable drawdown % , this results in a positive correction factor (indicating the drawdown is within your acceptable range and increases the unadjusted score.

If stocks maximum Annual drawdown exceeds Trader's maximum acceptable drawdown %, the correction factor will decrease (indicating that the downside risk is greater than what you are comfortable with, so it will adjust the risk exposure).

Once the Risk Score (numerically equal to Risk %) The position size is calculated based on the current market conditions.

Nasan Risk Score (Risk%) = Unadjusted Nasan Risk Score * Tolerance.

Position Size = (Capital * Risk% )/ ATR-Multiplier * ATR

The ATR Multiplier is dynamically adjusted based on the stocks recent relative performance and the variability of the true range itself. It would range between 1 - 3.5.

The multiplier widens when conditions are not favorable decreasing the position size and increases position size when conditions are favorable.

This Calculation /Estimate Does not give you a very different result than the arbitrary 1% - 2%. However it does fine tune the % based on sock performance, traders performance and tolerance level.

Long Term Profitable Swing | AbbasA Story of a Profitable Swing Trading Strategy

Imagine you're sailing across the ocean, looking for the perfect wave to ride. Swing trading is quite similar—you're navigating the stock market, searching for the ideal moments to enter and exit trades. This strategy, created by Abbas, helps you find those waves and ride them effectively to profitable outcomes.

🌊 Finding the Perfect Wave (Entry)

Our journey begins with two simple signs that tell us a great trading opportunity is forming:

- Moving Averages: We use two lines that follow price trends—the faster one (EMA 16) reacts quickly to recent price moves, and the slower one (EMA 30) gives us a longer-term perspective. When the faster line crosses above the slower line, it's like a clear signal saying, "Hey! The wave is rising, and prices might move higher!"

- RSI Momentum: Next, we check a tool called the RSI, which measures momentum (how strongly prices are moving). If the RSI number is above 50, it means there's enough strength behind this rising wave to carry us forward.

When both signals appear together, that's our green light. It's time to jump on our surfboard and start riding this promising wave.

⚓ Safely Riding the Wave (Risk Management)

While we're riding this wave, we want to ensure we're safe from sudden surprises. To do this, we use something called the Average True Range (ATR), which measures how volatile (or bumpy) the price movements are:

- Stop-Loss: To avoid falling too hard, we set a safety line (stop-loss) 8 times the ATR below our entry price. This helps ensure we exit if the wave suddenly turns against us, protecting us from heavy losses.

- Take Profit: We also set a goal to exit the trade at 11 times the ATR above our entry. This way, we capture significant profits when the wave reaches a nice high point.

🌟 Multiple Rides, Bigger Adventures

This strategy allows us to take multiple positions simultaneously—like riding several waves at once, up to 5. Each trade we make uses only 10% of our trading capital, keeping risks manageable and giving us multiple opportunities to win big.

🗺️ Easy to Follow Settings

Here are the basic settings we use:

- Fast EMA**: 16

- Slow EMA**: 30

- RSI Length**: 9

- RSI Threshold**: 50

- ATR Length**: 21

- ATR Stop-Loss Multiplier**: 8

- ATR Take-Profit Multiplier**: 11

These settings are flexible—you can adjust them to better suit different markets or your personal trading style.

🎉 Riding the Waves of Success

This simple yet powerful swing trading approach helps you confidently enter trades, clearly know when to exit, and effectively manage your risk. It’s a reliable way to ride market waves, capture profits, and minimize losses.

Happy trading, and may you find many profitable waves to ride! 🌊✨

Please test, and take into account that it depends on taking multiple longs within the swing, and you only get to invest 25/30% of your equity.

Average Directional Movement Index (ADX)here is new updated ADX

add bollinger band with Adx

Adx line when going up from 20 level

keep eyes on this

watch d+ green line and red line behaviour

if green line going up ten market goes to upword

if red line also going up market going to down

Volatility-Based StDV LevelsManually Enter the VIX and VXN and the Opening Price to get the Standard Deviation quadrants for the day

Correlation Coefficient TableThis Pine Script generates a dynamic table for analyzing how multiple assets correlate with a chosen benchmark (e.g., NZ50G). Users can input up to 12 asset symbols, customize the benchmark, and define the beta calculation periods (e.g., 15, 30, 90, 180 days). The script calculates Correlation values for each asset over these periods and computes the average beta for better insights.

The table includes:

Asset symbols: Displayed in the first row.

Correlation values: Calculated for each defined period and displayed in subsequent columns.

Average Correlation: Presented in the final column as an overall measure of correlation strength.

Color coding: Background colors indicate beta magnitude (green for high positive beta, yellow for near-neutral beta, red for negative beta).

SIE Rang Pandey Custom KC (5 Bands)This is 5 band Custom Keltner Channel Indicator.

Made for Smart Index Edge.

Source - Close Price.

ATR & PTR TableThe ATR & PTR Table Indicator displays a dynamic table that provides Average True Range (measures market volatility over 1D, 1W, and 1M timeframes), Price trading range (difference between the high and low prices over the same periods) & percentage of the typical range that has been traded. This indicator will help traders identify potential breakout zones and assess volatility across multiple timeframes.

This had been optimized to show ATR and PTR on every time frame. The (1D) represents ATR on whatever timeframe you are currently on.

ATR SL and TP with Candle Freeze & DataWindowThis indicator uses the Average True Range (ATR) to automatically calculate your stop loss (SL) and take profit (TP) levels based on the current market volatility and your chosen multipliers. Here's how it works:

ATR Calculation:

The indicator computes the ATR, which measures the average market volatility over a set period. This value helps gauge how much the price typically moves.

SL and TP Determination:

Depending on whether you're in a long or short trade, the SL and TP are calculated relative to the current price:

For a long trade, the stop loss is set below the current price (by subtracting a multiple of the ATR) and the take profit is set above it (by adding a multiple of the ATR).

For a short trade, the calculations are reversed.

Candle Freeze Feature:

Once a new candle starts, the calculated SL and TP values are "frozen" for that candle. This means they remain constant during the candle's formation, preventing them from updating continuously as the price fluctuates. This can make it easier to plan your trades without the levels shifting mid-candle.

Data Window & Labels:

The SL and TP values are plotted on the chart as lines and displayed in labels for quick reference. Additionally, they appear in TradingView's Data Window, so you can easily copy the price numbers if needed.

Overall, the indicator is designed to help you manage your trades by setting dynamic, volatility-adjusted SL and TP levels that only update at the start of each new candle, aligning with your chosen timeframe. Let me know if you have any more questions or need further adjustments!