SUPeR TReND 2.718An evolved version of the classic Supertrend, SUPeR TReND 2.718 is built to deliver elegant, high-precision trend detection using Euler's constant (e = 2.718) as its default multiplier. Designed for clarity and visual flow, this indicator brings together smooth line work, intelligent color logic, and a minimalistic tally system that tracks trend persistence — all in a highly customizable, overlay-ready format.

Unlike traditional implementations, this version maintains line visibility regardless of fill opacity, ensuring crisp tracking even in complex environments. Ideal for traders who value both aesthetics and actionable structure.

__________________________________________________________

🔑 Key Features:

- 📐 ATR-based Supertrend with default multiplier = e (2.718)

- 📉 Dynamic trend line with optional fill beneath price

- ⏳ Trend duration tally label (count-only or full format)

- ⬆️ Higher-timeframe Supertrend overlay (optional)

- 🟢 Directional candle coloring for clarity

- 🟡 Subtle anchor line to guide perception without clutter

- ⚙️ PineScript v6 compliant, efficient and modular

__________________________________________________________

🧠 Interpretation Guide:

- The Supertrend line tracks trend support or resistance — beneath price in uptrends, above in downtrends.

- The shaded fill reflects direction with 70% transparency.

- The trend tally label counts how long the current trend has lasted.

- Candle colors confirm direction without overtaking price action.

- The optional HTF line shows higher-timeframe context.

- A soft yellow anchor line stabilizes the fill relationship without distraction.

__________________________________________________________

⚙️ Inputs & Controls:

- ✏️ ATR Length – Volatility lookback

- 🧮 Multiplier – Default = 2.718 (Euler's number)

- 🕰️ Higher Timeframe – Choose your bias frame

- 👁️ Show HTF / Main – Toggle each trend layer

- 🧾 Show Label / Simplify – Show trend duration, with or without arrows

- 🎨 Color Candles – Turn directional bar coloring on or off

- 🪄 Show Fill – Toggle the shaded visual rhythm

- 🎛️ All visuals use tuned colors and transparencies for clarity

__________________________________________________________

🚀 Best Practices:

- ✅ Works on any time frame; shines on 1h v. 1D

- 🔁 Use the HTF line for macro bias filtering

- 📊 Combine with volume or liquidity overlays for edge

- 🧱 Use as a structural base layer with minimalist stacks

__________________________________________________________

📈 Strategy Tips:

- 🧭 MTF Trend Alignment: Enable the HTF line to filter trades. If the HTF trend is up, only take longs on the lower frame, and vice versa.

- 🔁 Pullback Entries: During a strong trend, consider short-term dips below the Supertrend line as possible re-entry zones — only if HTF remains aligned.

- ⏳ Tally for Exhaustion: When the bar count exceeds 15+, look for confluence (volume divergence, key levels, reversal signals).

- ⚠️ HTF Flip + Extended Trend: When the HTF trend reverses while the main trend is extended, that may be a macro exit or fade signal.

- 🚫 Solo Mode: Disable HTF and use the main trend + tally as a standalone signal layer.

- 🧠 Swing Setup Friendly: Especially powerful on 1D or 1h in swing systems or trend-based grid strategies.

Волатильность

Cz ASR indicatorAverage session range indicator built by me. Great tool to gauge volatility and intraday reversal zones. Great for FX as there is an included table that shows range in pips; however, this can be applied across all assets as a volatility measure.

How it works:

The script measures the range of sessions, including Asia, London, and New York. The lookback period could be adjusted so you can find what length works best and is most accurate. This is then averaged out to provide the ASR. This provides us with an upper and lower bound of which the price could potentially fluctuate in based on the past session ranges. I have also added the 50% ASR, which is also a super useful metric for reversals or continuations.

There is also a configurable UTC so that you can adjust the indicator so it can accurately measure the range within certain sessions.

Note - different session start and stop times vary from market to market. I have set the code to the standard forex market opens however, if you wish to change the time ,you are able to do so by editing the variables in the script

Enjoy :)

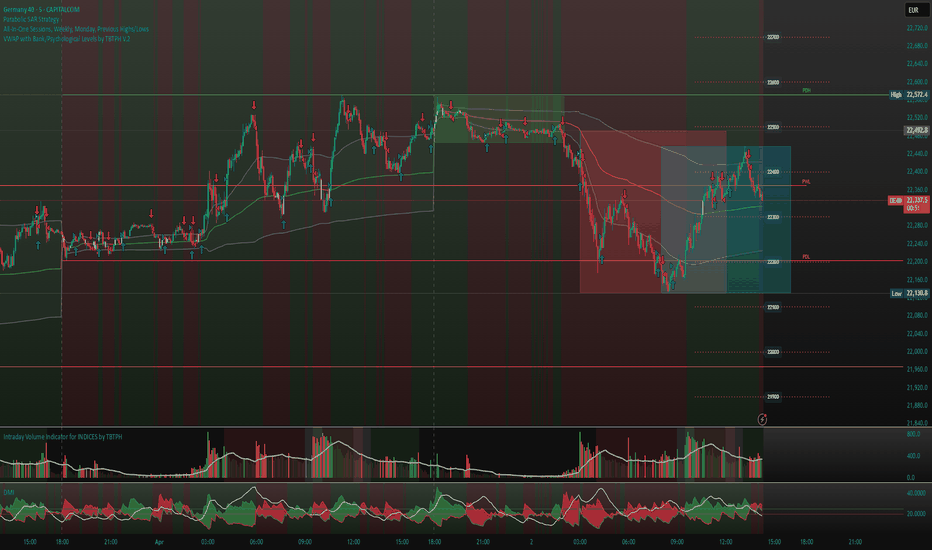

VWAP with Bank/Psychological Levels by TBTPH V.2This Pine Script defines a custom VWAP (Volume Weighted Average Price) indicator with several additional features, such as dynamic bands, bank levels, session tracking, and price-crossing detection. Here's a breakdown of the main elements and logic:

Key Components:

VWAP Settings:

The VWAP calculation is based on a source (e.g., hlc3), with an option to hide the VWAP on daily (1D) or higher timeframes.

You can choose the VWAP "anchor period" (Session, Week, Month, etc.) for adjusting the VWAP calculation to different time scales.

VWAP Bands:

The script allows you to plot bands above and below the VWAP line.

You can choose the calculation mode for the bands (Standard Deviation or Percentage), and the bands' width can be adjusted with a multiplier.

These bands are drawn using a gray color and can be filled to create a shaded area.

Bank Level Calculation:

The concept of bank levels is added as horizontal levels spaced by a user-defined multiplier.

These levels are drawn as dotted lines, and price labels are added to indicate each level.

You can define how many bank levels are drawn above and below the base level.

Session Indicators (LSE/NYSE):

The script identifies the open and close times of the London Stock Exchange (LSE) and the New York Stock Exchange (NYSE) sessions.

It limits the signals to only appear during these sessions.

VWAP Crossing Logic:

If the price crosses the VWAP, the script colors the candle body white to highlight this event.

Additional Plot Elements:

A background color is applied based on whether the price is above or below the 50-period Simple Moving Average (SMA).

The VWAP line dynamically changes color based on whether the price is above or below it (green if above, red if below).

Explanation of Key Sections:

1. VWAP and Band Calculation:

pinescript

Copy

= ta.vwap(src, isNewPeriod, 1)

vwapValue := _vwap

stdevAbs = _stdevUpper - _vwap

bandBasis = calcModeInput == "Standard Deviation" ? stdevAbs : _vwap * 0.01

upperBandValue1 := _vwap + bandBasis * bandMult_1

lowerBandValue1 := _vwap - bandBasis * bandMult_1

This code calculates the VWAP value (vwapValue) and standard deviation-based bands (upperBandValue1 and lowerBandValue1).

2. Bank Levels:

pinescript

Copy

baseLevel = math.floor(currentPrice / bankLevelMultiplier) * bankLevelMultiplier

The base level for the bank levels is calculated by rounding the current price to the nearest multiple of the bank level multiplier.

Then, a loop creates multiple bank levels:

pinescript

Copy

for i = -bankLevelRange to bankLevelRange

level = baseLevel + i * bankLevelMultiplier

line.new(x1=bar_index - 50, y1=level, x2=bar_index + 50, y2=level, color=highlightColor, width=2, style=line.style_dotted)

label.new(bar_index, level, text=str.tostring(level), style=label.style_label_left, color=labelBackgroundColor, textcolor=labelTextColor, size=size.small)

3. Session Logic (LSE/NYSE):

pinescript

Copy

lse_open = timestamp("GMT", year, month, dayofmonth, 8, 0)

lse_close = timestamp("GMT", year, month, dayofmonth, 16, 30)

nyse_open = timestamp("GMT-5", year, month, dayofmonth, 9, 30)

nyse_close = timestamp("GMT-5", year, month, dayofmonth, 16, 0)

The script tracks session times and filters the signals based on whether the current time falls within the LSE or NYSE session.

4. VWAP Crossing Detection:

pinescript

Copy

candleCrossedVWAP = (close > vwapValue and close <= vwapValue) or (close < vwapValue and close >= vwapValue)

barcolor(candleCrossedVWAP ? color.white : na)

If the price crosses the VWAP, the candle's body is colored white to highlight the cross.

Relative Volume Indicator (RVOL)Relative Volume Indicator (RVOL)

The Relative Volume Indicator (RVOL) helps traders identify unusual volume activity by comparing the current volume to the average historical volume. This makes it easier to spot potential breakouts, reversals, or significant market events that are accompanied by volume confirmation.

What This Indicator Shows

This indicator displays volume as a multiple of average volume, where:

- 1.0x means 100% of average volume

- 2.0x means 200% of average volume (twice the average)

- 0.5x means 50% of average volume (half the average)

Color Coding

The volume bars are color-coded based on configurable thresholds:

- Red: Below average volume (< Average Volume Threshold)

- Yellow: Average volume (between Average Volume and Above Average thresholds)

- Green: Above average volume (between Above Average and Extreme thresholds)

- Magenta: Extreme volume (> Extreme Volume Threshold)

Horizontal Reference Lines

Three dotted horizontal reference lines help you visualize the thresholds:

- Lower gray line: Average Volume Threshold (default: 0.8x)

- Upper gray line: Above Average Threshold (default: 1.25x)

- Magenta line: Extreme Volume Threshold (default: 4.0x)

How To Use This Indicator

1. Volume Confirmation: Use green bars to confirm breakouts or trend changes - stronger moves often come with above-average volume.

2. Low Volume Warning: Red bars during price movements may indicate weak conviction and potential reversals.

3. Extreme Volume Events: Magenta bars (extreme volume) often signal major market events or potential exhaustion points that could lead to reversals.

4. Volume Divergence: Look for divergences between price and volume - for example, if price makes new highs but volume is decreasing (more yellow/red bars), the move may be losing strength.

Settings Configuration

- Average Volume Lookback Period: Number of bars used to calculate the average volume (default: 20)

- Average Volume Threshold: Volume below this level is considered below average (default: 0.8x)

- Above Average Threshold: Volume above this level is considered above average (default: 1.25x)

- Extreme Volume Threshold: Volume above this level is considered extreme (default: 4.0x)

- Colors: Customize colors for each volume category

Important Note: Adjust threshold values only through the indicator settings (not in the Style tab). Changing values in the Style tab will not adjust the coloring of the volume bars.

Adjust these settings based on the specific asset being analyzed and your trading timeframe. More volatile assets may require higher thresholds, while less volatile ones might need lower thresholds.

ATR - Asymmetric Turbulence Ribbon🧭 Asymmetric Turbulence Ribbon (ATR)

The Asymmetric Turbulence Ribbon (ATR) is an enhanced and reimagined version of the standard Average True Range (ATR) indicator. It visualizes not just raw volatility, but the structure, momentum, and efficiency of volatility through a multi-layered visual approach.

It contains two distinct visual systems:

1. A zero-centered histogram that expresses how current volatility compares to its historical average, with intensity and color showing speed and conviction

2. A braided ribbon made of dual ATR-based moving averages that highlight transitions in volatility behavior—whether volatility is expanding or contracting

The name reflects its purpose: to capture asymmetric, evolving turbulence in market behavior, through structure-aware volatility tracking.

_______________________________________________________________

🔧 Inputs (Fibonacci defaults)

ATR Length

Lookback period for ATR calculation (default: 13)

ATR Base Avg. Length

Moving average period used as the zero baseline for histogram (default: 55)

ATR ROC Lookback

Number of bars to measure rate of change for histogram color mapping (default: 8)

Timeframe Override

Optionally calculate ATR values from a higher or fixed timeframe (e.g., 1D) for macro-volatility overlay

Show Ribbon Fill

Toggles colored fill between ATR EMA and HMA lines

Show ATR MAs

Toggles visibility of ATR EMA and HMA lines

Show Crossover Markers

Shows directional triangle markers where ATR EMA and HMA cross

Show Histogram

Toggles the entire histogram display

_______________________________________________________________

📊 Histogram Component: Volatility Energy Profile

The histogram shows how far the current ATR is from its moving average baseline, centered around zero. This lets you interpret volatility pressure—whether it's expanding, contracting, or preparing to reverse.

To complement this, the indicator also plots the raw ATR line in aqua. This is the actual average true range value—used internally in both the histogram and ribbon calculations. By default, it appears as a slightly thicker line, providing a clear reference point for comparing historical volatility trends and absolute levels.

Use the baseline ATR to:

- Compare real-time volatility to previous peaks or troughs

- Monitor how ATR behaves near histogram flips or ribbon crossovers

- Evaluate volatility phases in absolute terms alongside relative momentum

The ATR line is particularly helpful for users who want to keep tabs on raw volatility values while still benefiting from the enhanced visual storytelling of the histogram and ribbon systems.

Each histogram bar is colored based on the rate of change (ROC) in ATR: The faster ATR rises or falls, the more intense the color. Meanwhile, the opacity of each bar is adjusted by the effort/result ratio of the price candle (body vs. range), showing how much price movement was achieved with conviction.

Color Interpretation:

🔴 Red

Strong volatility expansion

Market entering or deepening into a volatility burst

Seen during breakouts, panic moves, or macro shock events

Often accompanied by large real candle bodies

🟠 Orange

Moderate volatility expansion

Heating up phase, often precedes breakouts

Common in strong trending environments

Signals tightening before acceleration

🟡 Yellow

Mild volatility increase

Transitional state—energy building, not yet exploding

Appears in early trend development or pullbacks

🟢 Green

Mild volatility contraction

ATR cooling off

Seen during consolidation, reversion, or range balance

Good time to assess upcoming directional setups

🔵 Aqua

Moderate compression

Volatility is clearly declining

Signals consolidation within larger structure

Pre-breakout zones often form here

🔵 Deep Blue

Strong volatility compression

Market is coiling or dormant

Can signal upcoming squeeze or fade environment

Often followed by sharp expansion

Opacity scaling:

Brighter bars = efficient, directional price action (strong bodies)

Faded bars = indecision, chop, absorption, or wick-heavy structure

Together, color and opacity give a 2D view of market volatility: Hue = the type and direction of volatility

Opacity = the quality and structure behind it

Use this to gauge whether volatility is rising with conviction, fading into neutrality, or compressing toward breakout potential.

_______________________________________________________________

🪡 Ribbon Component: Volatility Rhythm Structure

The ribbon overlays two moving averages of ATR:

EMA (yellow) – faster, more reactive

HMA (orange) – smoother, more rhythmic

Their relationship creates the ribbon logic:

Yellow fill (EMA > HMA)

Short-term volatility is increasing faster than the longer-term rhythm

Signals active expansion and engagement

Orange fill (HMA > EMA)

Volatility is decaying or leveling off

Suggests possible exhaustion, pullback, or range

Crossover triangle markers (optional, off by default to avoid clutter) identify the moment of shift in volatility phase.

The ribbon reflects the shape of volatility over time—ideal for mapping cyclical energy shifts, transitional states, and alignment between current and average volatility.

_______________________________________________________________

📐 Strategy Application

Use the Asymmetric Turbulence Ribbon to:

- Detect volatility expansions before breakouts or directional runs

- Spot compression zones that precede structural ruptures

- Visually separate efficient moves from noisy market activity

- Confirm or fade trade setups based on underlying energy state

- Track the volatility environment across multiple timeframes using the override

_______________________________________________________________

🎯 Ideal Timeframes

Designed to function across all timeframes, but particularly powerful on intraday to daily ranges (1H to 1D)

Use the timeframe override to anchor your chart in higher-timeframe volatility context, like daily ATR behavior influencing a 1H setup.

_______________________________________________________________

🧬 Customization Tips

- Increase ATR ROC Lookback for smoother color transitions

- Extend ATR Base Avg Length for more macro-driven histogram centering

- Disable the histogram for ribbon-only rhythm view

- Use opacity and color shifts in the histogram to detect stealth energy builds

- Align ATR phases with structure or order flow tools for high-quality setups

BTCUSDT 70 Candles Average x3 NotificationNotification when generating candles 3 times the length of 70 candles (excluding progress candles)

ATR Daily Progress 180Calculates the average number of points that the price has passed over the selected number of days, and also shows how much has already passed today in points and percentages.

The number of days can be adjusted at your discretion.

P.S. It does not work correctly on metals, stocks and crypto in terms of displaying items. But the percentages are shown correctly.

Maple&CBC StrategyEntry signal when:

ema's bullish or bearish in line + above/below vwap + cbc signal closed + profit taking on next cbc flip signal in reversed direction

First EMA Touch (Last N Bars)Okay, here's a description of the "First EMA Touch (Last N Bars)" TradingView indicator:

Indicator Name: First EMA Touch (Last N Bars)

Core Purpose:

This indicator is designed to visually highlight on the chart the exact moment when the price (specifically, the high/low range of a price bar) makes contact with a specified Exponential Moving Average (EMA) for the first time within a defined recent lookback period (e.g., the last 20 bars).

How it Works:

EMA Calculation: It first calculates a standard Exponential Moving Average (EMA) based on the user-defined EMA Length and EMA Source (e.g., close price). This EMA line is plotted on the chart, often serving as a dynamic level of potential support or resistance.

"Touch" Detection: For every price bar, the indicator checks if the bar's range (from its low to its high) overlaps with or crosses the calculated EMA value for that bar. If low <= EMA <= high, it's considered a "touch".

"First Touch" Logic: This is the key feature. The indicator looks back over a specified number of preceding bars (defined by the Lookback Period). If a "touch" occurs on the current bar, and no "touch" occurred on any of the bars within that preceding lookback window, then the current touch is marked as the "first touch".

Visual Signal: When a "first touch" condition is met, the indicator plots a distinct shape (by default, a small green triangle) below the corresponding price bar. This makes it easy to spot these specific events.

Key Components & Settings:

EMA Line: The calculated EMA itself is plotted (typically as an orange line) for visual reference.

First Touch Signal: A shape (e.g., green triangle) appears below bars meeting the "first touch" criteria.

EMA Length (Input): Determines the period used for the EMA calculation. Shorter lengths make the EMA more reactive to recent price changes; longer lengths make it smoother and slower.

Lookback Period (Input): Defines how many bars (including the current one) the indicator checks backwards to determine if the current touch is the first one. A lookback of 20 means it checks if there was a touch in the previous 19 bars before signalling the current one as the first.

EMA Source (Input): Specifies which price point (close, open, high, low, hl2, etc.) is used to calculate the EMA.

Interpretation & Potential Uses:

Identifying Re-tests: The signal highlights when price returns to test the EMA after having stayed away from it for the duration of the lookback period. This can be significant as the market re-evaluates the EMA level.

Potential Reversal/Continuation Points: A first touch might indicate:

A potential area where a trend might resume after a pullback (if price bounces off the EMA).

A potential area where a reversal might begin (if price strongly rejects the EMA).

A point of interest if price consolidates around the EMA after the first touch.

Filtering Noise: By focusing only on the first touch within a period, it can help filter out repeated touches that might occur during choppy or consolidating price action around the EMA.

Confluence: Traders might use this signal in conjunction with other forms of analysis (e.g., horizontal support/resistance, trendlines, candlestick patterns, other indicators) to strengthen trade setups.

Limitations:

Lagging: Like all moving averages, the EMA is a lagging indicator.

Not Predictive: The signal indicates a specific past event (the first touch) occurred; it doesn't guarantee a future price movement.

Parameter Dependent: The effectiveness and frequency of signals heavily depend on the chosen EMA Length and Lookback Period. These may need tuning for different assets and timeframes.

Requires Confirmation: It's generally recommended to use this indicator as part of a broader trading strategy and not rely solely on its signals for trade decisions.

In essence, the "First EMA Touch (Last N Bars)" indicator provides a specific, refined signal related to price interaction with a moving average, helping traders focus on potentially significant initial tests of the EMA after a period of separation.

Body Percentage of Range (Colored)Short Description:

This indicator measures the dominance of the candle's body relative to its total range (High - Low), providing a visual gauge of intra-candle strength versus indecision. Columns are colored based on whether the body constitutes more or less than a defined percentage (default 50%) of the candle's total height.

Detailed Description:

What it Does:

The "Body Percentage of Range" indicator calculates, for each candle, what percentage of the total price range (High minus Low) is occupied by the candle's body (absolute difference between Open and Close).

A value of 100% means the candle has no wicks (a Marubozu), indicating strong conviction during that period.

A value of 0% means the candle has no body (a Doji), indicating perfect indecision.

Values in between show the relative balance between the directional move (body) and the price exploration/rejection (wicks).

How to Interpret:

The indicator plots this percentage as columns:

Column Height: Represents the percentage of the body relative to the total range. Higher columns indicate a larger body dominance.

Column Color:

Green Columns: Appear when the body percentage is above the user-defined threshold (default 50%). This suggests that the directional move within the candle was stronger than the indecision (wicks). Often seen during trending moves or strong momentum candles.

Red Columns: Appear when the body percentage is at or below the user-defined threshold (default 50%). This suggests that wicks dominate the candle (body is 50% or less of the range), indicating significant indecision, struggle between buyers and sellers, or potential reversals. These are common in choppy, consolidating, or reversal market conditions.

Orange Line (Optional MA): A Simple Moving Average (SMA) of the body percentages is plotted to help smooth the readings and identify broader periods where candle structure indicates more trending (high MA) vs. ranging/indecisive (low MA) characteristics.

Potential Use Cases:

Identifying Choppy vs. Trending Markets: Sustained periods of low, predominantly red columns (and often a low/declining MA) can signal a choppy, range-bound market where trend-following strategies might underperform. Conversely, periods with frequent high, green columns suggest a more trending environment.

Confirming Breakouts/Momentum: High green columns appearing alongside increased volume during a breakout can add conviction to the move's strength.

Spotting Potential Exhaustion/Reversals: A very tall green column after a strong trend, followed immediately by a low red column (like a Doji or Spinning Top pattern appearing on the price chart), might signal potential exhaustion or a pending reversal, indicating indecision has suddenly entered the market.

Filtering Entries: Traders might avoid taking entries (especially trend-following ones) when the indicator shows a consistent pattern of low red columns, suggesting high market indecision.

Settings:

Color Threshold %: Allows you to set the percentage level above which columns turn green (default is 50%).

Smoothing MA Length: Adjusts the lookback period for the Simple Moving Average.

Disclaimer:

This indicator is a tool for technical analysis and should be used in conjunction with other methods (like price action, volume analysis, other indicators) and robust risk management. It does not provide direct buy/sell signals and past performance is not indicative of future results.

ATR DistanceThis indicator plots two lines at distances defined by (Multiplier × ATR) above and below a selected price source (open, high, low, or close). By using a configurable Average True Range (ATR) length, it helps highlight volatility-based boundaries for more adaptive stop-loss or profit-taking decisions.

Litecoin Trailing-Stop StrategyAltcoins Trailing-Stop Strategy

This strategy is based on a momentum breakout approach using PKAMA (Powered Kaufman Adaptive Moving Average) as a trend filter, and a delayed trailing stop mechanism to manage risk effectively.

It has been designed and fine-tuned Altcoins, which historically shows consistent volatility patterns and clean trend structures, especially on intraday timeframes like 15m and 30m.

Strategy Logic:

Entry Conditions:

Long when PKAMA indicates an upward move

Short when PKAMA detects a downward trend

Minimum spacing of 30 bars between trades to avoid overtrading

Trailing Stop:

Activated only after a customizable delay (delayBars)

User can set trailing stop % and delay independently

Helps avoid premature exits due to short-term volatility

Customizable Parameters:

This strategy uses a custom implementation of PKAMA (Powered Kaufman Adaptive Moving Average), inspired by the work of alexgrover

PKAMA is a volatility-aware moving average that adjusts dynamically to market conditions, making it ideal for altcoins where trend strength and direction change frequently.

This script is for educational and experimental purposes only. It is not financial advice. Please test thoroughly before using it in live conditions, and always adapt parameters to your specific asset and time frame.

Feedback is welcome! Feel free to clone and adapt it for your own trading style.

Wick Reversal Detector ProTime is Money. As Supply & Demand Wick Trader we cannot sit in front of the computer the whole day and wait for the magic to happen. I wrote this script to detects equal highs and equal lows with an adjustable wick size and alert function. Use LuxAlgo Swing Failure Pattern and my VIX-RSI Wick Hunt to identify Supply & Demand Zone Reversals.

ATR Daily ProgressCalculates the average APR for 30 days in points, and also shows how many points the price has passed today.

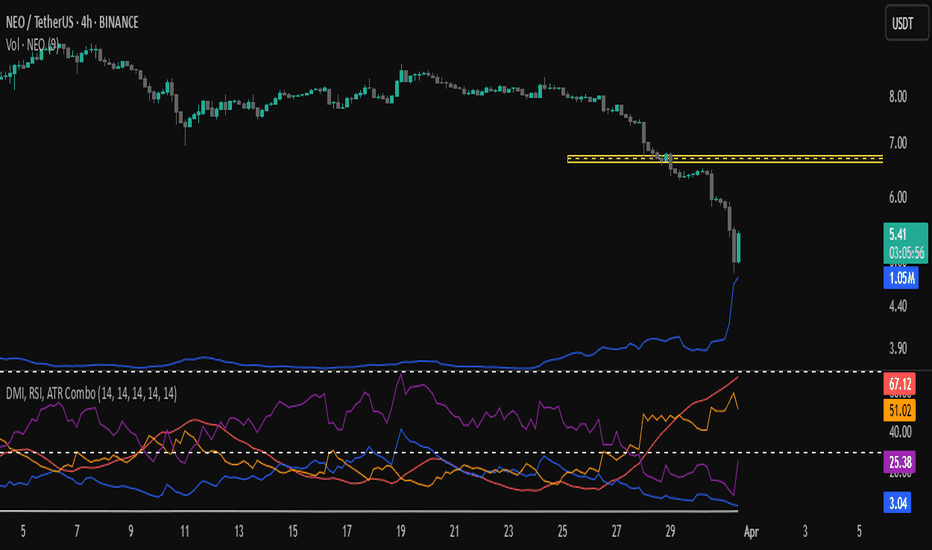

DMI, RSI, ATR Combo// Usage:

// 1. Add this script to your TradingView chart.

// 2. The ADX line helps determine trend strength.

// 3. The +DI and -DI lines indicate bullish or bearish movements.

// 4. The RSI shows momentum and potential overbought/oversold conditions.

// 5. The ATR measures volatility, helping traders assess risk.

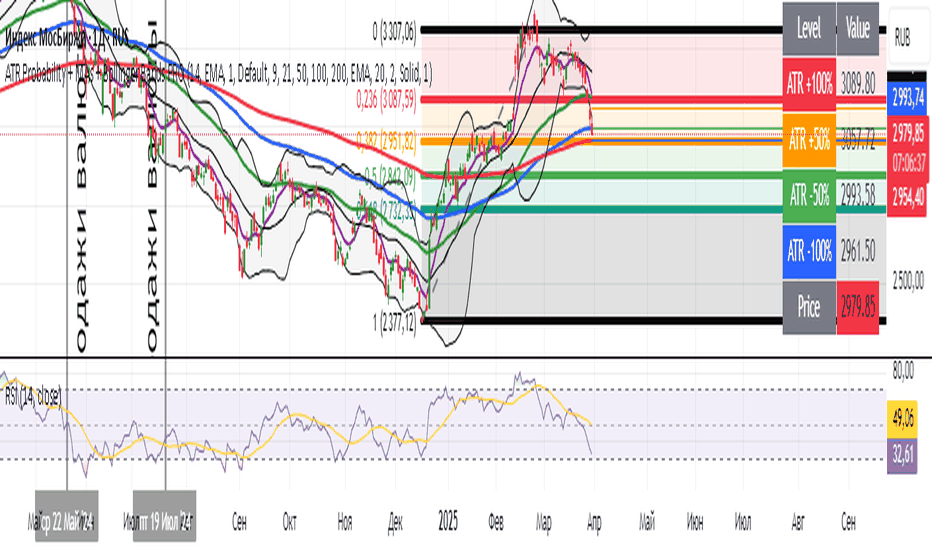

ATR Probability + MAs + Bollinger Bands PROATR Probability + MAs + Bollinger Bands

Made by DeepSeek))

The Crypto Wizard# The Crypto Wizard (Cwiz)

## Advanced Trading Framework for Cryptocurrency Markets

! (placeholder.com)

The Crypto Wizard (Cwiz) offers a customizable, robust trading framework designed specifically for cryptocurrency market volatility. This open-source foundation provides essential components for building profitable automated trading strategies.

### Key Performance Indicators

| Metric | Value |

|--------|-------|

| Profit Factor | 1.992 |

| Sortino Ratio | 5.589 |

| Win Rate | ~40% |

| Max Drawdown | 15.82% |

### Core Features

- **Position Scaling System**: Intelligent position sizing with customizable multipliers and risk controls

- **Multi-layered Exit Strategy**: Combined take-profit, fixed stop-loss, and trailing stop mechanisms

- **Customizable Entry Framework**: Easily integrate your own entry signals and conditions

- **Comprehensive Visualization Tools**: Real-time performance tracking with position labels and indicators

### Setup Instructions

```pine PHEMEX:FARTCOINUSDT.P

// 1. Add to your chart and configure basic parameters

// 2. Adjust risk parameters based on your risk tolerance

// 3. Customize entry conditions or use defaults

// 4. Back-test across various market conditions

// 5. Enable live trading with careful monitoring

```

### Risk Management

Cwiz implements a sophisticated risk management system with:

- Automatic position size scaling

- User-defined maximum consecutive trades

- ATR-based dynamic stop loss placement

- Built-in circuit breakers for extreme market conditions

### Customization Options

The framework is designed for flexibility without compromising core functionality. Key customization points:

- Entry signal generation

- Position sizing parameters

- Stop loss and take profit multipliers

- Visualization preferences

### Recommended Usage

Best suited for volatile cryptocurrency markets with sufficient liquidity. Performs optimally in trending conditions but includes mechanisms to manage ranging markets.

---

*Disclaimer: Trading involves significant risk. Past performance is not indicative of future results. Always test thoroughly before live deployment.*

02 SMC + BB Breakout (Improved)This strategy combines Smart Money Concepts (SMC) with Bollinger Band breakouts to identify potential trading opportunities. SMC focuses on identifying key price levels and market structure shifts, while Bollinger Bands help pinpoint overbought/oversold conditions and potential breakout points. The strategy also incorporates higher timeframe trend confirmation to filter out trades that go against the prevailing trend.

Key Components:

Bollinger Bands:

Calculated using a Simple Moving Average (SMA) of the closing price and a standard deviation multiplier.

The strategy uses the upper and lower bands to identify potential breakout points.

The SMA (basis) acts as a centerline and potential support/resistance level.

The fill between the upper and lower bands can be toggled by the user.

Higher Timeframe Trend Confirmation:

The strategy allows for optional confirmation of the current trend using a higher timeframe (e.g., daily).

It calculates the SMA of the higher timeframe's closing prices.

A bullish trend is confirmed if the higher timeframe's closing price is above its SMA.

This helps filter out trades that go against the prevailing long-term trend.

Smart Money Concepts (SMC):

Order Blocks:

Simplified as recent price clusters, identified by the highest high and lowest low over a specified lookback period.

These levels are considered potential areas of support or resistance.

Liquidity Zones (Swing Highs/Lows):

Identified by recent swing highs and lows, indicating areas where liquidity may be present.

The Swing highs and lows are calculated based on user defined lookback periods.

Market Structure Shift (MSS):

Identifies potential changes in market structure.

A bullish MSS occurs when the closing price breaks above a previous swing high.

A bearish MSS occurs when the closing price breaks below a previous swing low.

The swing high and low values used for the MSS are calculated based on the user defined swing length.

Entry Conditions:

Long Entry:

The closing price crosses above the upper Bollinger Band.

If higher timeframe confirmation is enabled, the higher timeframe trend must be bullish.

A bullish MSS must have occurred.

Short Entry:

The closing price crosses below the lower Bollinger Band.

If higher timeframe confirmation is enabled, the higher timeframe trend must be bearish.

A bearish MSS must have occurred.

Exit Conditions:

Long Exit:

The closing price crosses below the Bollinger Band basis.

Or the Closing price falls below 99% of the order block low.

Short Exit:

The closing price crosses above the Bollinger Band basis.

Or the closing price rises above 101% of the order block high.

Position Sizing:

The strategy calculates the position size based on a fixed percentage (5%) of the strategy's equity.

This helps manage risk by limiting the potential loss per trade.

Visualizations:

Bollinger Bands (upper, lower, and basis) are plotted on the chart.

SMC elements (order blocks, swing highs/lows) are plotted as lines, with user-adjustable visibility.

Entry and exit signals are plotted as shapes on the chart.

The Bollinger band fill opacity is adjustable by the user.

Trading Logic:

The strategy aims to capitalize on Bollinger Band breakouts that are confirmed by SMC signals and higher timeframe trend. It looks for breakouts that align with potential market structure shifts and key price levels (order blocks, swing highs/lows). The higher timeframe filter helps avoid trades that go against the overall trend.

In essence, the strategy attempts to identify high-probability breakout trades by combining momentum (Bollinger Bands) with structural analysis (SMC) and trend confirmation.

Key User-Adjustable Parameters:

Bollinger Bands Length

Standard Deviation Multiplier

Higher Timeframe

Higher Timeframe Confirmation (on/off)

SMC Elements Visibility (on/off)

Order block lookback length.

Swing lookback length.

Bollinger band fill opacity.

This detailed description should provide a comprehensive understanding of the strategy's logic and components.

***DISCLAIMER: This strategy is for educational purposes only. It is not financial advice. Past performance is not indicative of future results. Use at your own risk. Always perform thorough backtesting and forward testing before using any strategy in live trading.***

Volatility Layered Supertrend [NLR]We’ve all used Supertrend, but do you know where to actually enter a trade? Volatility Layered Supertrend (VLS) is here to solve that! This advanced trend-following indicator builds on the classic Supertrend by not only identifying trends and their strength but also guiding you to the best trade entry points. VLS divides the main long-term trend into “Strong” and “Weak” Zones, with a clear “Trade Entry Zone” to help you time your trades with precision. With layered trends, dynamic profit targets, and volatility-adaptive bands, VLS delivers actionable signals for any market.

Why I Created VLS Over a Plain Supertrend

I built VLS to address the gaps in traditional Supertrend usage and make trade entries clearer:

Single-Line Supertrend Issues: The default Supertrend sets stop-loss levels that are too wide, making it impractical for most traders to use effectively.

Unclear Entry Points: Standard Supertrend doesn’t tell you where to enter a trade, often leaving you guessing or entering too early or late.

Multi-Line Supertrend Enhancement: Many traders use short, medium, and long Supertrends, which is helpful but can lack focus. In VLS, I include Short, Medium, and Long trends (using multipliers 1 to 3), and add multipliers 4 and 5 to track extra long-term trends—helping to avoid fakeouts that sometimes occur with multiplier 3.

My Solution: I focused on the main long-term Supertrend and split it into “Weak Zone” and “Strength Zone” to show the trend’s reliability. I also defined a “Trade Entry Zone” (starting from the Mid Point, with the first layer’s background hidden for clarity) to guide you on where to enter trades. The zones include Short, Medium, and Long Trend layers for precise entries, exits, and stop-losses.

Practical Trading: This approach provides realistic stop-loss levels, clear entry points, and a “Profit Target” line that aligns with your risk tolerance, while filtering out false signals with longer-term trends.

Key Features

Layered Trend Zones: Short, Medium, Long, and Extra Long Trend layers (up to multipliers 4 and 5) for timing entries and exits.

Strong & Weak Zones: See when the trend is reliable (Strength Zone) or needs caution (Weak Zone).

Trade Entry Zone: A dedicated zone starting from the Mid Point (first layer’s background hidden) to show the best entry points.

Dynamic Profit Targets: A “Profit Target” line that adjusts with the trend for clear goals.

Volatility-Adaptive: Uses ATR to adapt to market conditions, ensuring reliable signals.

Color-Coded: Green for uptrends, red for downtrends—simple and clear.

How It Works

VLS enhances the main long-term Supertrend by dividing it into two zones:

Weak Zone: Indicates a less reliable trend—use tighter stop-losses or wait for the price to reach the Trade Entry Zone.

Strength Zone: Signals a strong trend—ideal for entries with wider stop-losses for bigger moves.

The “Trade Entry Zone” starts at the Mid Point (last layer’s background hidden for clarity), showing you the best area to enter trades. Each zone includes Short, Medium, Long, and Extra Long Trend sublevels (up to multipliers 4 and 5) for precise trade timing and to filter out fakeouts. The “Profit Target” updates dynamically based on trend direction and volatility, giving you a clear goal.

How to Use

Spot the Trend: Green bands = buy, red bands = sell.

Check Strength: Price in Strength Zone? Trend’s reliable—trade confidently. In Weak Zone? Use tighter stops or wait.

Enter Trades: Use the “Trade Entry Zone” (from the Mid Point upward) for the best entry points.

Use Sublevels: Short, Medium, Long, and Extra Long layers in each zone help fine-tune entries and exits.

Set Targets: Follow the Profit Target line for goals—it updates automatically.

Combine Tools: Pair with RSI, MACD, or support/resistance for added confirmation.

Settings

ATR Length: Adjust the ATR period (default 10) to change sensitivity.

Up/Down Colors: Customize colors—green for up, red for down, by default.