STOCH_HVP(picte)This indicator is made up of a stochastic oscillator and of historical volatility percentile. Historical volatility percentile basically tells you how volatile the market is based on how volatile it has been in the history.

Historical volatility is great for trading options but i have also found it to be great at finding trades with good risk/reward ratio. When market has extremely low volatility we can expect a bigger move to emerge along with expansion of volatility. But since historical volatility does not imply the direction of the market i added a stochastic oscillator with some horizontal levels i have found to serve as good support/resistance levels.

I found it useful for trading Forex pairs but it is especially powerful with bitcoin.

Trendreversal

All RSI Signals v1Hi All,

RSI is a widely accepted indicator by most of the traders. I built this indicator to present all the RSI buying and selling signals that can be missed to get the best use of this indicator.

The indicator is composed of:

1. RSI

2. Stochastic RSI

3. Linear regression for the RSI

The short signals provided by the stochastic will support short term traders to catch every move and maximize the profit. The idea is that:

1. The stochastic stochastic RSI will give the RSI a colour based on the potential movement. blue colour for uptrend and red for the downtrend

2. The linear regression will provide the directions of the RSI and facilitate the indication of any divergence with the stock or commodity trend

3. Based on my tests, It's better to buy only if the RSI is between 30 to 70 and the stochastic between 20 and 60 to ensure a strong trend and capture the right amount of the revenue

Hope you enjoy it and remember that all the variables are editable to support you in customizing it based on your experience and market behaviour

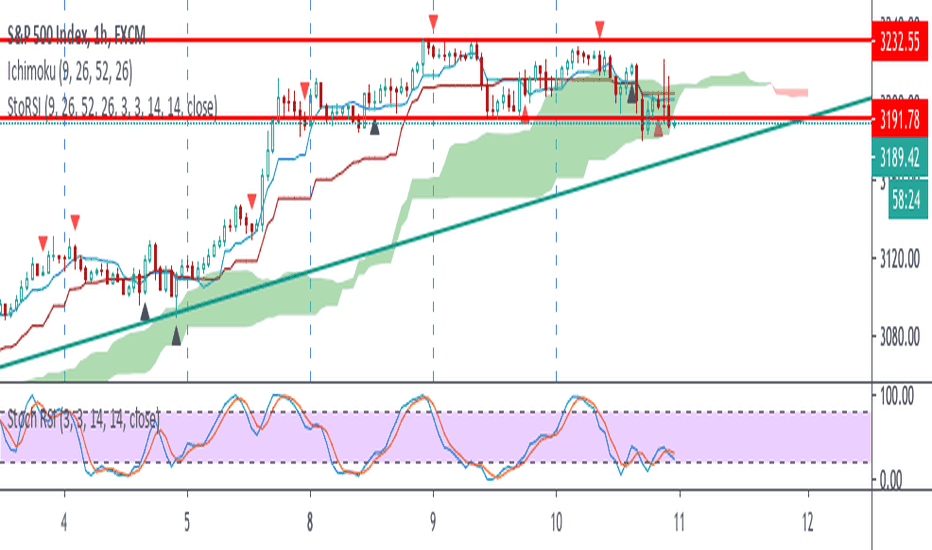

Sto RSI and kijun-sen line to determine and follow the trend This script uses 25-75 treshold of stochastic RSI with the help of kijun-sen as confirmation, to find entry points to any trend either newly developed or an established one. I just realized it on the 1 hour SPX chart. Sure it can be used on other symbols. Crossing above/below 25/75 line of sto RSI is considered as buy/sell signal. Signals are evaluated whether price be above/below kijun-sen line. If a sell signal below kijun-sen is generated it is a continuation signal for downtrend, otherwise it is a countertrend signal (maybe a signal for a new downtrend). A countertrend signal must be evaluated carefully and only accepted in the right side of kijun-sen. e.g entering a sell signal generated above kijun-sen should be accepted only below the kijun-sen, vice-versa.

TQ_STOCHThis is a modified stochastic oscillator. It works very well with Forex pairs, traditional markets and has also proved itself profitable with BTC. The aim of this indicator is to help you predict a change in direction of the market.

When lower periods are above higher periods you are looking to buy of support and when lower periods are below higher periods you are looking to sell of resistance.

Lowest period: pink

Medium period: white

Longest period: turquoise

PERFECT LONG: pink line above the white and white above the turquoise. Turquoise should serve as support for the white line and white line should serve as support for the pink line. BUY when pink line tests the white line and bounces off.

PERFECT SHORT: pink line below the white and white below the turquoise. Turquoise should serve as resistance for the white line and white line should serve as resistance for the pink line. SELL when pink line tests the white line and bounces down.

You can also play less perfect signals where pink or white tests blue as support or where white is not above the blue line yet but you still get a test of the white from the pink. These are slightly more risky.

- SOME SIGNAL EXAMPLES:

Enjoy :)

Candlestick Reversal SystemHello Traders,

In the book "Secrets of a Pivot Boss: Revealing Proven Methods for Profiting in the Market" by Franklin Ochoa, Four different types of reversal systems were introduced and candlestick patterns are used to find reversals. I will not write a lot about the book, you should get/read it for yourself. There are many great ideas in the book, Candlesetick Reversal System, Following Trend, Time Price Opportunity, Advanced Camarilla Concepts and much more.

Reversal systems mentioned in the book are :

- Wick Reversal System

- Exteme Reversal System

- Outside Reversal System

- Doji Reversal System

I tried to add these four reversal systems to the script. If you need detailed info you better read the book ;)

Enjoy!

Bullish and Bearish Engulfing and RSI, DMI and PSAR confirmationThe study combines Bearish and Bullish Engulfing pivot strategy with strong trend confirmative indicators:

Directional Movement Index (DMI)

Parabolic SAR

RSI Bands

Engulfing patterns in market provide a useful way for traders to enter the market in anticipation of a possible reversal in the trend. Engulfing candles tend to signal a reversal of the current trend in the market. This specific pattern involves two candles with the latter candle "engulfing" the entire body of the candle before it. The engulfing candle can be bullish or bearish depending on where it forms in relation to the existing trend

The indicator can be applied to trading pairs with USD, USDT, ETH and BTC quote currencies. Indicator supports spot, futures and marginal trading exchanges. It calculates and compares values of the price action candles to define is there an engulfing and what type it is: bullish or bearish:

If there is a bullish engulfing the indicator fills price action candle with yellow color

If there is a bearish engulfing the indicator fills price action candle with purple color

Advantages of this indicator:

1. This indicator reveals presence of both types of engulfing simultaneously

2. Weak engulfment signals and market noises are filtered by RSI bands, DMI and PSAR confirmations. This allows to receive only strong and confirmed engulfments

3. This indicator includes both

Study with built-in custom alerts to use with your own software through web hook connection.

Strategy with configurable risk management settings (order size, commission, take profit, stop loss and trailing). This provides you opportunity of direct broker connection and allows to conduct backtests before applying the strategy to real account

At the chart you can see the historical price action of XBTUSD at BitMEX exchange from 9th of May 2020 till 17th of May 2020 indicator. Moments when the indicator triggered to enter a position are described with message clouds. Moments when a certain position should be closed are highlighted with circles and commented with clouds

How to use?

Long signals:

1. Apply indicator to the trading pair your are interested in

2. Once bullish engulfing conditions are met price action candle will be colored yellow.

3. Once price action breaks RSI resistance band, retraces and closes below the band the signal is finished and the position should be closed

Short signals:

1. Apply indicator to the trading pair your are interested in

2. Once bearish engulfing conditions are met price action candle will be colored purple.

3. Once price action breaks RSI support band, retraces and closes above the band the signal is finished and the position should be closed

Automatic strategy:

When conditions of long or short position from the strategy are met the script opens position.

Strategy.exit closes the position once risk management settings are met.

Strategy.close closes the position once RSI band rejection is confirmed

If you want to obtain access to the indicator please send us a personal message

Best regards,

SkyRock Signals team

Ehlers Correlation Angle IndicatorThe Correlation Angle Indicator was created by John Ehlers (Stocks & Commodities V. 38:06 (8–15)) and this is technically three indicators in one so I'm splitting each one to a separate script. This particular indicator was designed for trend termination and simply buy when it is green and sell when it turns red.

Let me know if you would like to see me publish other scripts or if you want something custom done!

Pivot TrendHello Traders,

Another original idea is here with you. Actualy I can say that it's a breakout strategy that uses multiple Pivot Point's averages.

How it works?

- it finds the Pivot Points, you can set the length as you want

- it gets averages of Pivot Highs and Pivot Lows, you can set the number of Pivot Points to be included

- it compares the current closing price with averages of Pivot Highs and Pivot Lows

- if both are positive or negative then trend changes

You have two options:

- Pivot Point Period => is the length that is used to find Pivot Points. means it checks left/right bars if it's Pivot Point (4 by default)

- Number of PP to check => is the number of Pivot Points that the script finds and calculates the averages (3 by default)

An Example with the settings Pivot Point Period = 5 and Number of PP to check = 2

Play with settings as you wish. Comments are welcome, together we can improve it ;)

Enjoy!

Trend Analysis IndicatorThe Trend Analysis Indicator was created by Adam White (Stocks & Commodities V. 10:8 (358-360)) and this is not to be confused with the Trend Analysis Index which was also created by Adam White. The stock is trending when it is above the signal and loses steam when it falls below the signal. Generally you should buy when it is above it's signal and sell when it goes below the signal.

Let me know if you would like me to write more scripts!

Donchian Trend RibbonHello Traders,

I think you all know Donchian Channels. so I am not going to write about it.

With this indicator I tried to create Donchian Trend Ribbon by using Donchian Channels.

How it works ?

- it calculates main trend direction by using the length that is user-defined. so you can change it as you wish

- then it calculates trend direction for each 9 lower lengths. if you set the length = 20 then the lengths are 19, 18,...11

- and it checks if the trend directions that came from lower lengths is same or not with main trend direction.

- it changes the trend color of the ribbon.

-

Warning: Entry points may also represents trend reversal. So you should use stoploss line if you decide to take buy/sell positions.

P.S. I didn't backtest it, it's non-repainting, it should be used educational purposes only.

Published by user request. You may want to see following one:

Enjoy!

Donchian TrendHello All,

I think all of you knows Donchian Channels . so I am not going to write about it.

With this indicator I tried to create Trend Lines by using Donchian Channel upper/lower bands. I tried add possible entry levels as well.

How it works ?

- it calculates main trend direction by using the length that is user-defined. so you can change it as you wish

- then it calculates trend direction for 9 lower lengths. if you set the length = 20 then the lengths are 19, 18,...11

- and it checks if the trend directions that came from lower lengths is same or not with main trend direction.

- it changes the trendline color. lighter trend line means stonger trend, darker trend lines means entry points or possible trend reversal.

- it puts entry points by using trend directions that were created by using lower lengths. it gets entry points if high/low touches main trend line as well.

Warning: Arrows are entry points but it may also represents trend reversal. So you should use stoploss line if you decide to take buy/sell positions.

P.S. I didn't backtest it, it's non-repainting, it should be used educational purposes only . I believe it can be improved, so I am open for new ideas to improve it ;)

Enjoy!

Trend Exhaustion IndicatorThe Trend Exhaustion Indicator is a custom indicator of mine that is loosely based on the Trend Exhaustion Index created by Clifford L. Creel Ph.D. (Stocks & Commodities V. 9:1 (9-11))

This indicator will let you know the trend reversal points and when it falls below the signal line then the trend is ending vice versa. Buy when the indicator crosses above the signal line and sell when it falls below the signal line.

Let me know if you would like to see me write any other scripts!

Uber Trend IndicatorThis is my first custom indicator that I created as a medium to long term trend indicator. Buy if it is above 0 and sell if it is below 0.

Since this is my first unique indicator, I would love to hear your feedback! Please let me know if you would like to see any other scripts!

Demand OscillatorThe Demand Oscillator was created by James Sibbet (Stocks & Commodities June, 1986) and I changed his formula quite a bit to what you see on here. If it rises above the signal then buy or if not then sell. This is my custom version of his formula so let me know what you think.

Let me know if you would like to see me write any other scripts!

Pivot Point SupertrendHello All,

There are many types of SuperTrend around. Recently I thought about a Supertrend based on Pivot Points then I wrote "Pivot Point SuperTrend" script. It looks it has better performance on keeping you in the trend more.

The idea is behind this script is finding pivot point, calculating average of them and like in supertrend creating higher/lower bands by ATR. As you can see in the algorithm the script gives weigth to past pivot points, this is done for smoothing it a bit.

As I wrote above it may keep you in the trend more, lets see an example:

As an option the script can show main center line and I realized that when you are in a position, this line can be used as early exit points. (maybe half of the position size)

While using Pivot Points, I added support resistance lines by using Pivot Point, as an option the script can show S/R lines:

And also it can show Pivot Points:

When you changed Pivot Point Period you can see its reaction, in following example PP period is 4 (default value is 2). Smaller PP periods more sensitive trendlines.

Alerts added for Buy/Sell entries and Trend Reversals. (when you set alerts use the option " Once Per Bar Close ")

ENJOY!

Trend Following MAs 3DHello All,

This is Moving Averages Trend Following 3D indicator. The idea is based on direction of MAs and relation between 20 moving averages (5 to 100 period).

Option to show different type of MAs: EMA, SMA, RMA, WMA, VWMA.

As I haved tested it looks succesful at calculating trend direction and trend strength.

For a better look I tried to make it 3D, it looks good I think, waiting comments ;)

Some screenshots:

By using RMA type:

When it gets tiny it means there is no trend:

An example for down trend:

ENJOY!

GBPUSD TREND DETECTION AND BUY/SELL ARROW SIGNALS INDICATORGBPUSD TREND DETECTION AND BUY/SELL ARROW SIGNALS INDICATOR

This script developed for active forex traders and based on Trend Analysis Indicators.

It used combination of Moving Averages, Volatility Indicator and Fractals and try to

detect reversal points of trends and generates buy/sell signals.

Works for all Forex currency pairs and time frames: 15MIN, 1H, 1DAY.

Can be used for swing trading and trend trading.

Advantage of this script indicator that all noise is filtered and signals detects long trends.

This make it useful as stand-alone trading strategy indicator or in combination with other indicators,

It is useful for day and intraday forex traders.

Main features of this indicator are:

✅ Forex Trend Reverse Points

✅ Forex breakout indicator

✅ Forex trend Signals

Haos Visual DivergencesThe Haos Visual is a trend indicator consisting of two WIlliams % indicators.

I have added divergences to spot trend reversals within assets, divergences have no repaint and require single candle confirmation.

www.prorealcode.com

Gann Trend OscillatorDeveloped by Robert Krausz, the Gann Trend Oscillator is a trend-following indicator used to determine the financial instruments long-term price direction.

Divergence for many indicator v3Hello Everyone. Almost one year later, with Pine version 4, I developed new version of the Divergence for many Indicator.

It analyses divergences for 10 predefined indicators and then draws line on the graph. Red for negatif divergence (means prices may go down or trend reversal), Lime for positive divergences (means prices may go up or trend reversal)

Divergences version 2 has latency because it waits higher time frame completion. in this new version the script uses Pivot Points and on every bar it checks divergence between last Pivot point and current bar and if it finds any then immediately draws line and removes old one. so there is no latency with this version.

There are predefined 10 indicators in the script, you have option to choose which indicators the script would analyse for divergence. (RSI , MACD , MACD Histogram, Stochastic , CCI , Momentum, OBV, Diosc, VWMACD and CMF)

In replay mode you can see how the script puts new divergence line and removes old one. you better see it for yourself by using replay mode.

Hope you Enjoy!

Trend Trader-RemasteredA trend trading study which allows trend line to work as stoploss level. Take profit and re-entry points have been remastered with trend algorithm.

NCTA Trend BiasTrend Bias

The NCTA Trend Bias indicator is designed to show traders the overall directional bias of the market. It is excellent in short 1, 3, and 5 minute timeframes for futures traders and short term options traders. Longer timeframes such as the 5, 10, and 30 minute timeframes work well for options traders.

This indicator is used by displaying it twice on the chart. For 1, 3, and 5 minute charts, one of the Trend Bias indicators is set at Fast and the other is set at Medium.

For 30 min or higher charts, one Trend Bias Indicator is set at Medium and the other one is set at Slow.

The indicator consists of three trend lines; a fast signal, a medium signal, and a slow signal. There is a possible trade entry when the fast signal crosses either the medium and/or slow signals.

HOW TO USE: The most effective way to use this indicator is to have it displayed twice, using the settings described above for the relevant chart timeframe.

When both indicators show the fast line (blue line) crossing above the medium (red) or the slow (green) line, it implies an opportunity to go long or buy a call. When both indicators show the fast line crossing below the medium and/or slow line, it implies an opportunity to go short or buy a put.

The Trend Bias Indicator also provides a powerful directional bias entry when used in alignment with the Awesome Oscillator. Green AO aligned with a long Trend Bias entry or red AO aligned with a short Trend Bias entry.

For information on gaining access to this indicator, please see the link below in our signature field.

RTYZ2019

NASDAQ:AMZN

Simply Trendy RasterChartThis is my "Simply Trendy RasterChart" using PSv4.0 freely available to ALL! Simply Trendy, shown with the multiple color schemes on the bottom portion of the chart, is an indicator that differentiates with color between trending moments up and down, but is also effective at identifying trend reversals clearly. The bottom of the indicator is most reactive and indicates reversals, while the upper portion of the indicator commonly shows enduring trends. I included a horizontal rule to approximately gauge at what level you may wish to have before entering/exiting a trade upon identifying a trend change. This gizmo functions on all assets on time frames ranging from one second bars up to the "All" chart having monthly bars. Possible uses are quickly identifying assets that are not only opportunistic towards buying, but also selling/shorting when that time arrives later.

I decided to release this freely so members can become familiar with how my RasterCharts function. However, it may serve as another tool in the trend analysis tool belt you may want to have. It's the most basic of RasterCharts that I may have, and it gives the user an opportunity to witness/grasp RasterChart fundamental theory and operation in real time. Underneath the hood, the code is truly VERY SIMPLE also, hence the entitled name given. This was originally an experiment that turned out to be impressive, exceeding my expectations of attempting it. It's behavior is similarly close to my "TrendSetter RasterChart" and may serve as a trainer before acquiring that, any other RasterCharts I have currently, or shall create in the future. With that said, I hope you find this "simply" handy , and I'm also wishful for it to potentially garner a "trendy" reputation among the many members who may discover it.

I provided multiple color schemes for those of you who may have color blindness vision impairments. You may contact me in private if these color schemes are not suitable for your diagnosed visual impairment, and you would wish to contribute to seeing the color schemes improved along with other future indicators I shall release.

Features List Includes:

"Color Scheme" selection (all displayed above)

"RasterChart Transparency" control

"Source" selection

"Horizontal Rule" adjustment

The comments section below is solely just for commenting and other remarks, ideas, compliments, etc... regarding only this indicator, not others. When available time provides itself, I will consider your inquiries, thoughts, and concepts presented below in the comments section if you do have any questions or comments regarding this indicator. When my indicators achieve more prevalent use by TV members, I may implement more ideas when they present themselves as worthy additions. As always, "Like" it if you simply just like it with a proper thumbs up, and also return to my scripts list occasionally for additional postings. Have a profitable future everyone!