Green*DiamondGreen*Diamond (GD1)

Unleash Dynamic Trading Signals with Volatility and Momentum

Overview

GreenDiamond is a versatile overlay indicator designed for traders seeking actionable buy and sell signals across various markets and timeframes. Combining Volatility Bands (VB) bands, Consolidation Detection, MACD, RSI, and a unique Ribbon Wave, it highlights high-probability setups while filtering out noise. With customizable signals like Green-Yellow Buy, Pullback Sell, and Inverse Pullback Buy, plus vibrant candle and volume visuals, GreenDiamond adapts to your trading style—whether you’re scalping, day trading, or swing trading.

Key Features

Volatility Bands (VB): Plots dynamic upper and lower bands to identify breakouts or reversals, with toggleable buy/sell signals outside consolidation zones.

Consolidation Detection: Marks low-range periods to avoid choppy markets, ensuring signals fire during trending conditions.

MACD Signals: Offers flexible buy/sell conditions (e.g., cross above signal, above zero, histogram up) with RSI divergence integration for precision.

RSI Filter: Enhances signals with customizable levels (midline, oversold/overbought) and bullish divergence detection.

Ribbon Wave: Visualizes trend strength using three EMAs, colored by MACD and RSI for intuitive momentum cues.

Custom Signals: Includes Green-Yellow Buy, Pullback Sell, and Inverse Pullback Buy, with limits on consecutive signals to prevent overtrading.

Candle & Volume Styling: Blends MACD/RSI colors on candles and scales volume bars to highlight momentum spikes.

Alerts: Set up alerts for VB signals, MACD crosses, Green*Diamond signals, and custom conditions to stay on top of opportunities.

How It Works

Green*Diamond integrates multiple indicators to generate signals:

Volatility Bands: Calculates bands using a pivot SMA and standard deviation. Buy signals trigger on crossovers above the lower band, sell signals on crossunders below the upper band (if enabled).

Consolidation Filter: Suppresses signals when candle ranges are below a threshold, keeping you out of flat markets.

MACD & RSI: Combines MACD conditions (e.g., cross above signal) with RSI filters (e.g., above midline) and optional volume spikes for robust signals.

Custom Logic: Green-Yellow Buy uses MACD bullishness, Pullback Sell targets retracements, and Inverse Pullback Buy catches reversals after downmoves—all filtered to avoid consolidation.

Visuals: Ribbon Wave shows trend direction, candles blend momentum colors, and volume bars scale dynamically to confirm signals.

Settings

Volatility Bands Settings:

VB Lookback Period (20): Adjust to 10–15 for faster markets (e.g., 1-minute scalping) or 25–30 for daily charts.

Upper/Lower Band Multiplier (1.0): Increase to 1.5–2.0 for wider bands in volatile stocks like AEHL; decrease to 0.5 for calmer markets.

Show Volatility Bands: Toggle off to reduce chart clutter.

Use VB Signals: Enable for breakout-focused trades; disable to focus on Green*Diamond signals.

Consolidation Settings:

Consolidation Lookback (14): Set to 5–10 for small caps (e.g., AEHL) to catch quick consolidations; 20 for higher timeframes.

Range Threshold (0.5): Lower to 0.3 for stricter filtering in choppy markets; raise to 0.7 for looser signals.

MACD Settings:

Fast/Slow Length (12/26): Shorten to 8/21 for scalping; extend to 15/34 for swing trading.

Signal Smoothing (9): Reduce to 5 for faster signals; increase to 12 for smoother trends.

Buy/Sell Signal Options: Choose “Cross Above Signal” for classic MACD; “Histogram Up” for momentum plays.

Use RSI Div + MACD Cross: Enable for high-probability reversal signals.

RSI Settings:

RSI Period (14): Drop to 10 for 1-minute charts; raise to 20 for daily.

Filter Level (50): Set to 55 for stricter buys; 45 for sells.

Overbought/Oversold (70/30): Tighten to 65/35 for small caps; widen to 75/25 for indices.

RSI Buy/Sell Options: Select “Bullish Divergence” for reversals; “Cross Above Oversold” for momentum.

Color Settings:

Adjust bullish/bearish colors for visibility (e.g., brighter green/red for dark themes).

Border Thickness (1): Increase to 2–3 for clearer candle outlines.

Volume Settings:

Volume Average Length (20): Shorten to 10 for scalping; extend to 30 for swing trades.

Volume Multiplier (2.0): Raise to 3.0 for AEHL’s volume surges; lower to 1.5 for steady stocks.

Bar Height (10%): Increase to 15% for prominent bars; decrease to 5% to reduce clutter.

Ribbon Settings:

EMA Periods (10/20/30): Tighten to 5/10/15 for scalping; widen to 20/40/60 for trends.

Color by MACD/RSI: Disable for simpler visuals; enable for dynamic momentum cues.

Gradient Fill: Toggle on for trend clarity; off for minimalism.

Custom Signals:

Enable Green-Yellow Buy: Use for momentum confirmation; limit to 1–2 signals to avoid spam.

Pullback/Inverse Pullback % (50): Set to 30–40% for small caps; 60–70% for indices.

Max Buy Signals (1): Increase to 2–3 for active markets; keep at 1 for discipline.

Tips and Tricks

Scalping Small Caps (e.g., AEHL):

Use 1-minute charts with VB Lookback = 10, Consolidation Lookback = 5, and Volume Multiplier = 3.0 to catch $0.10–$0.20 moves.

Enable Green-Yellow Buy and Inverse Pullback Buy for quick entries; disable VB Signals to focus on Green*Diamond logic.

Pair with SMC+ green boxes (if you use them) for reversal confirmation.

Day Trading:

Try 5-minute charts with MACD Fast/Slow = 8/21 and RSI Period = 10.

Enable RSI Divergence + MACD Cross for high-probability setups; set Max Buy Signals = 2.

Watch for volume bars turning yellow to confirm entries.

Swing Trading:

Use daily charts with VB Lookback = 30, Ribbon EMAs = 20/40/60.

Enable Pullback Sell (60%) to exit after rallies; disable RSI Color for cleaner candles.

Check Ribbon Wave gradient for trend strength—bright green signals strong bulls.

Avoiding Noise:

Increase Consolidation Threshold to 0.7 on volatile days to skip false breakouts.

Disable Ribbon Wave or Volume Bars if the chart feels crowded.

Limit Max Buy Signals to 1 for disciplined trading.

Alert Setup:

In TradingView’s Alerts panel, select:

“GD Buy Signal” for standard entries.

“RSI Div + MACD Cross Buy” for reversals.

“VB Buy Signal” for breakout plays.

Set to “Once Per Bar Close” for confirmed signals; “Once Per Bar” for scalping.

Backtesting:

Replay on small caps ( Float < 5M, Price $0.50–$5) to test signals.

Focus on “GD Buy Signal” with yellow volume bars and green Ribbon Wave.

Avoid signals during gray consolidation squares unless paired with RSI Divergence.

Usage Notes

Markets: Works on stocks, forex, crypto, and indices. Best for volatile assets (e.g., small-cap stocks, BTCUSD).

Timeframes: Scalping (1–5 minutes), day trading (15–60 minutes), or swing trading (daily). Adjust settings per timeframe.

Risk Management: Combine with stop-losses (e.g., 1% risk, $0.05 below AEHL entry) and take-profits (3–5%).

Customization: Tweak inputs to match your strategy—experiment in replay to find your sweet spot.

Disclaimer

Green*Diamond is a technical tool to assist with trade identification, not a guarantee of profits. Trading involves risks, and past performance doesn’t predict future results. Always conduct your own analysis, manage risk, and test settings before live trading.

Feedback

Love Green*Diamond? Found a killer setup?

Трендовый анализ

Global M2 Money+ Supply Input Lead (USD)Global M2 Money Supply + INR+CAD Input Lead (USD)

This indicator calculates the global M2 money supply in USD by aggregating M2 data from multiple economies, converted to USD using their respective exchange rates. It overlays the scaled M2 data on the chart with a user-defined time shift to analyze potential correlations with asset prices, such as Bitcoin. The indicator is designed to help traders assess global liquidity trends with a customizable lead or lag.

Countries Included:

Eurozone (EUM2)

North America: United States (USM2), Canada (CAM2)

Non-EU Europe: Switzerland (CHM2), United Kingdom (GBM2), Finland (FIM2), Russia (RUM2)

Pacific: New Zealand (NZM2)

Asia: China (CNM2), Taiwan (TWM2), Hong Kong (HKM2), India (INM2), Japan (JPM2), Philippines (PHM2), Singapore (SGM2)

Latin America: Brazil (BRM2), Colombia (COM2), Mexico (MXM2)

Middle East: United Arab Emirates (AEM2), Turkey (TRM2)

Africa: South Africa (ZAM2)

Input for Lead/Lag:

Time Shift (days): Adjust this input to shift the M2 data forward (positive values) or backward (negative values) on the chart. For example, setting a lead of 85 days shifts the M2 data 85 days into the future, helping traders analyze potential leading indicators for price movements.

Triple Confirmation Scalper v2 - Alarm CompatibleTriple Confirmation Scalper Strategy

A high-probability scalping strategy combining trend momentum, overbought/sold conditions, and volume confirmation to filter low-noise signals.

📊 Strategy Logic

Trend Direction

Dual EMA crossover (9 & 21 periods) for momentum and trend bias.

Overbought/Oversold Zones

RSI (14-period) to avoid entries at extremes.

Volume Spike Filter

OBV + 20-period volume average to confirm breakout validity.

Dynamic Risk Management

Stop-loss: Adaptive to recent price action (5-candle low/high ±1%).

Take-profit: 1.5% target (1.5:1 risk/reward).

🔍 Advanced Features

Precision VWAP (20-period, HLC3-based) for dynamic S/R levels.

Visual Aids:

EMA/VWAP bands + trend-colored background.

Volume spike alerts.

TradingView Alerts pre-configured for long/short signals.

⚙️ Default Settings

Commission: 0.1% factored into backtests.

Mode: Supports both long/short positions.

⚠️ Disclaimer

This is a technical analysis tool, not financial advice.

Past performance ≠ future results. Test thoroughly in a demo account.

Adjust parameters (e.g., EMA periods, RSI thresholds) to match your risk tolerance.

✅ TradingView Compliance Notes:

No exaggerated claims (e.g., "100% win rate").

Clear disclaimer included.

Focus on objective strategy logic (no promotional language).

Weekly Open (Current Week Only)📘 Indicator Name: Weekly Open (Current Week Only)

📝 Description:

This indicator plots a horizontal line representing the weekly open price, visible only during the current trading week. At the beginning of each new week (based on TradingView’s weekly time segmentation), the indicator captures the open price of the first candle and draws a constant line across the chart until the week ends. Once the new week begins, the line resets and updates with the new weekly open.

🎯 How to Use – ICT Concepts Integration (Weekly Profile):

This tool is designed to complement ICT (Inner Circle Trader) trading strategies, particularly within the weekly profile framework, by offering a clear and persistent visual of the weekly open, which is a critical reference point in ICT’s market structure theory.

✅ Use Cases:

Directional Bias:

According to ICT concepts, price trading above the weekly open suggests a bullish bias for the week, while trading below it implies bearish conditions.

Traders can use the weekly open line to align their intraweek trades with higher timeframe directional bias.

Dealing Ranges:

Weekly open helps frame the weekly dealing range, especially when combined with other levels like weekly high/low or previous week’s range.

It allows traders to identify potential liquidity pools or areas where price may seek to rebalance.

Mean Reversion Entries:

Price often reverts to or reacts from the weekly open. Traders may use this as a target or entry level, particularly during Monday/Tuesday setups.

Works well in conjunction with concepts like OTE (Optimal Trade Entry) and Judas Swings.

Risk Management:

Acts as a clean and visual anchor to structure stop losses or take-profits based on weekly bias shifts.

Moving Average Shift WaveTrend StrategyMoving Average Shift WaveTrend Strategy

🧭 Overview

The Moving Average Shift WaveTrend Strategy is a trend-following and momentum-based trading system designed to be overlayed on TradingView charts. It executes trades based on the confluence of multiple technical conditions—volatility, session timing, trend direction, and oscillator momentum—to deliver logical and systematic trade entries and exits.

🎯 Strategy Objectives

Enter trades aligned with the prevailing long-term trend

Exit trades on confirmed momentum reversals

Avoid false signals using session timing and volatility filters

Apply structured risk management with automatic TP, SL, and trailing stops

⚙️ Key Features

Selectable MA types: SMA, EMA, SMMA (RMA), WMA, VWMA

Dual-filter logic using a custom oscillator and moving averages

Session and volatility filters to eliminate low-quality setups

Trailing stop, configurable Take Profit / Stop Loss logic

“In-wave flag” prevents overtrading within the same trend wave

Visual clarity with color-shifting candles and entry/exit markers

📈 Trading Rules

✅ Long Entry Conditions:

Price is above the selected MA

Oscillator is positive and rising

200-period EMA indicates an uptrend

ATR exceeds its median value (sufficient volatility)

Entry occurs between 09:00–17:00 (exchange time)

Not currently in an active wave

🔻 Short Entry Conditions:

Price is below the selected MA

Oscillator is negative and falling

200-period EMA indicates a downtrend

All other long-entry conditions are inverted

❌ Exit Conditions:

Take Profit or Stop Loss is hit

Opposing signals from oscillator and MA

Trailing stop is triggered

🛡️ Risk Management Parameters

Pair: ETH/USD

Timeframe: 4H

Starting Capital: $3,000

Commission: 0.02%

Slippage: 2 pips

Risk per Trade: 2% of account equity (adjustable)

Total Trades: 224

Backtest Period: May 24, 2016 — April 7, 2025

Note: Risk parameters are fully customizable to suit your trading style and broker conditions.

🔧 Trading Parameters & Filters

Time Filter: Trades allowed only between 09:00–17:00 (exchange time)

Volatility Filter: ATR must be above its median value

Trend Filter: Long-term 200-period EMA

📊 Technical Settings

Moving Average

Type: SMA

Length: 40

Source: hl2

Oscillator

Length: 15

Threshold: 0.5

Risk Management

Take Profit: 1.5%

Stop Loss: 1.0%

Trailing Stop: 1.0%

👁️ Visual Support

MA and oscillator color changes indicate directional bias

Clear chart markers show entry and exit points

Trailing stops and risk controls are transparently managed

🚀 Strategy Improvements & Uniqueness

In-wave flag avoids repeated entries within the same trend phase

Filtering based on time, volatility, and trend ensures higher-quality trades

Dynamic high/low tracking allows precise trailing stop placement

Fully rule-based execution reduces emotional decision-making

💡 Inspirations & Attribution

This strategy is inspired by the excellent concept from:

ChartPrime – “Moving Average Shift”

It expands on the original idea with advanced trade filters and trailing logic.

Source reference:

📌 Summary

The Moving Average Shift WaveTrend Strategy offers a rule-based, reliable approach to trend trading. By combining trend and momentum filters with robust risk controls, it provides a consistent framework suitable for various market conditions and trading styles.

⚠️ Disclaimer

This script is for educational purposes only. Trading involves risk. Always use proper backtesting and risk evaluation before applying in live markets.

RTH and ETH RangesKey Functions :

Visualizes Regular Trading Hours (RTH) and Extended Trading Hours (ETH) price ranges

Tracks session highs, lows, and 50% levels where significant market reactions occur

Detects breakouts beyond previous session extremes

Trading Applications :

Exposes potential liquidity raids at session boundaries where smart money targets stop orders

Identifies critical price thresholds where institutional activity concentrates

Highlights divergences between RTH and ETH behavior that precede directional moves

Provides measurement of session volatility differences

Maps key price levels for objective entry and exit parameters

Reveals market dynamics at session transitions where institutional positioning changes

Machine Learning RSI ║ BullVisionOverview:

Introducing the Machine Learning RSI with KNN Adaptation – a cutting-edge momentum indicator that blends the classic Relative Strength Index (RSI) with machine learning principles. By leveraging K-Nearest Neighbors (KNN), this indicator aims at identifying historical patterns that resemble current market behavior and uses this context to refine RSI readings with enhanced sensitivity and responsiveness.

Unlike traditional RSI models, which treat every market environment the same, this version adapts in real-time based on how similar past conditions evolved, offering an analytical edge without relying on predictive assumptions.

Key Features:

🔁 KNN-Based RSI Refinement

This indicator uses a machine learning algorithm (K-Nearest Neighbors) to compare current RSI and price action characteristics to similar historical conditions. The resulting RSI is weighted accordingly, producing a dynamically adjusted value that reflects historical context.

📈 Multi-Feature Similarity Analysis

Pattern similarity is calculated using up to five customizable features:

RSI level

RSI momentum

Volatility

Linear regression slope

Price momentum

Users can adjust how many features are used to tailor the behavior of the KNN logic.

🧠 Machine Learning Weight Control

The influence of the machine learning model on the final RSI output can be fine-tuned using a simple slider. This lets you blend traditional RSI and machine learning-enhanced RSI to suit your preferred level of adaptation.

🎛️ Adaptive Filtering

Additional smoothing options (Kalman Filter, ALMA, Double EMA) can be applied to the RSI, offering better visual clarity and helping to reduce noise in high-frequency environments.

🎨 Visual & Accessibility Settings

Custom color palettes, including support for color vision deficiencies, ensure that trend coloring remains readable for all users. A built-in neon mode adds high-contrast visuals to improve RSI visibility across dark or light themes.

How It Works:

Similarity Matching with KNN:

At each candle, the current RSI and optional market characteristics are compared to historical bars using a KNN search. The algorithm selects the closest matches and averages their RSI values, weighted by similarity. The more similar the pattern, the greater its influence.

Feature-Based Weighting:

Similarity is determined using normalized values of the selected features, which gives a more refined result than RSI alone. You can choose to use only 1 (RSI) or up to all 5 features for deeper analysis.

Filtering & Blending:

After the machine learning-enhanced RSI is calculated, it can be optionally smoothed using advanced filters to suppress short-term noise or sharp spikes. This makes it easier to evaluate RSI signals in different volatility regimes.

Parameters Explained:

📊 RSI Settings:

Set the base RSI length and select your preferred smoothing method from 10+ moving average types (e.g., EMA, ALMA, TEMA).

🧠 Machine Learning Controls:

Enable or disable the KNN engine

Select how many nearest neighbors to compare (K)

Choose the number of features used in similarity detection

Control how much the machine learning engine affects the RSI calculation

🔍 Filtering Options:

Enable one of several advanced smoothing techniques (Kalman Filter, ALMA, Double EMA) to adjust the indicator’s reactivity and stability.

📏 Threshold Levels:

Define static overbought/oversold boundaries or reference dynamically adjusted thresholds based on historical context identified by the KNN algorithm.

🎨 Visual Enhancements:

Select between trend-following or impulse coloring styles. Customize color palettes to accommodate different types of color blindness. Enable neon-style effects for visual clarity.

Use Cases:

Swing & Trend Traders

Can use the indicator to explore how current RSI readings compare to similar market phases, helping to assess trend strength or potential turning points.

Intraday Traders

Benefit from adjustable filters and fast-reacting smoothing to reduce noise in shorter timeframes while retaining contextual relevance.

Discretionary Analysts

Use the adaptive OB/OS thresholds and visual cues to supplement broader confluence zones or market structure analysis.

Customization Tips:

Higher Volatility Periods: Use more neighbors and enable filtering to reduce noise.

Lower Volatility Markets: Use fewer features and disable filtering for quicker RSI adaptation.

Deeper Contextual Analysis: Increase KNN lookback and raise the feature count to refine pattern recognition.

Accessibility Needs: Switch to Deuteranopia or Monochrome mode for clearer visuals in specific color vision conditions.

Final Thoughts:

The Machine Learning RSI combines familiar momentum logic with statistical context derived from historical similarity analysis. It does not attempt to predict price action but rather contextualizes RSI behavior with added nuance. This makes it a valuable tool for those looking to elevate traditional RSI workflows with adaptive, research-driven enhancements.

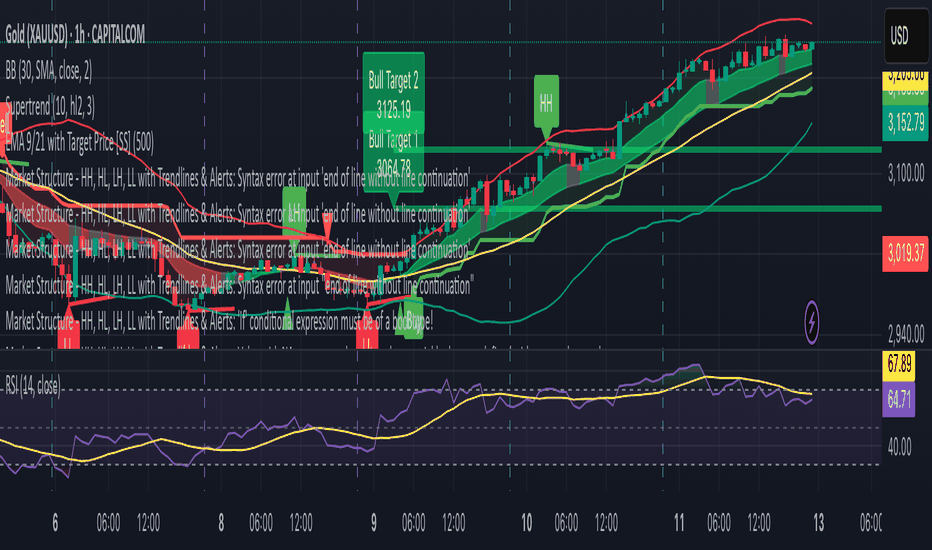

Market Structure - HH, HL, LH, LL with Trendlines & AlertsMarket Structure Script – HH, HL, LH, LL with Trendlines & Alerts

This Pine Script is designed to help identify key market structure patterns such as Higher Highs (HH), Higher Lows (HL), Lower Highs (LH), and Lower Lows (LL) on price charts. It also draws trendlines connecting the respective swing points and provides alerts when these important price patterns occur.

Key Features:

Swing High and Low Detection:

The script uses the ta.pivothigh and ta.pivotlow functions to identify significant swing highs and swing lows based on the pivot length (pivotLen). These points mark local peaks and troughs in the price action.

Dynamic Pivot Length:

The script adjusts the pivotLen (which defines the number of bars used to calculate swing points) based on the current timeframe of the chart. For example, for a 15-minute chart, it uses a pivot length of 5 bars, while for a daily chart, it uses 10 bars. This dynamic adjustment ensures that the script works across different timeframes.

Higher Highs (HH), Higher Lows (HL), Lower Highs (LH), Lower Lows (LL):

Higher High (HH): Identifies a price peak that is higher than the previous swing high, indicating an uptrend.

Higher Low (HL): Identifies a price trough that is higher than the previous swing low, supporting the idea of an ongoing uptrend.

Lower High (LH): Identifies a price peak that is lower than the previous swing high, suggesting a potential reversal or downtrend.

Lower Low (LL): Identifies a price trough that is lower than the previous swing low, indicating a downtrend.

Trendlines:

For each identified Higher High, Higher Low, Lower High, or Lower Low, the script automatically draws a trendline connecting the corresponding swing points. These trendlines provide a visual representation of the market’s price structure, showing support and resistance levels.

Labels:

The script places labels on the chart next to the respective swing points. These labels mark whether the point is a Higher High (HH), Higher Low (HL), Lower High (LH), or Lower Low (LL). This helps traders easily visualize the price pattern at a glance.

Alerts:

Alert conditions are set for when a Higher High (HH), Higher Low (HL), Lower High (LH), or Lower Low (LL) is detected. Users can set up alerts to be notified whenever one of these key market structure patterns forms. Alerts are an essential feature for traders who want to act quickly when important trend changes are happening.

Dskyz (DAFE) MAtrix with ATR-Powered Precision Dskyz (DAFE) MAtrix with ATR-Powered Precision

This cutting‐edge futures trading strategy built to thrive in rapidly changing market conditions. Developed for high-frequency futures trading on instruments such as the CME Mini MNQ, this strategy leverages a matrix of sophisticated moving averages combined with ATR-based filters to pinpoint high-probability entries and exits. Its unique combination of adaptable technical indicators and multi-timeframe trend filtering sets it apart from standard strategies, providing enhanced precision and dynamic responsiveness.

imgur.com

Core Functional Components

1. Advanced Moving Averages

A distinguishing feature of the DAFE strategy is its robust, multi-choice moving averages (MAs). Clients can choose from a wide array of MAs—each with specific strengths—in order to fine-tune their trading signals. The code includes user-defined functions for the following MAs:

imgur.com

Hull Moving Average (HMA):

The hma(src, len) function calculates the HMA by using weighted moving averages (WMAs) to reduce lag considerably while smoothing price data. This function computes an intermediate WMA of half the specified length, then a full-length WMA, and finally applies a further WMA over the square root of the length. This design allows for rapid adaptation to price changes without the typical delays of traditional moving averages.

Triple Exponential Moving Average (TEMA):

Implemented via tema(src, len), TEMA uses three consecutive exponential moving averages (EMAs) to effectively cancel out lag and capture price momentum. The final formula—3 * (ema1 - ema2) + ema3—produces a highly responsive indicator that filters out short-term noise.

Double Exponential Moving Average (DEMA):

Through the dema(src, len) function, DEMA calculates an EMA and then a second EMA on top of it. Its simplified formula of 2 * ema1 - ema2 provides a smoother curve than a single EMA while maintaining enhanced responsiveness.

Volume Weighted Moving Average (VWMA):

With vwma(src, len), this MA accounts for trading volume by weighting the price, thereby offering a more contextual picture of market activity. This is crucial when volume spikes indicate significant moves.

Zero Lag EMA (ZLEMA):

The zlema(src, len) function applies a correction to reduce the inherent lag found in EMAs. By subtracting a calculated lag (based on half the moving average window), ZLEMA is exceptionally attuned to recent price movements.

Arnaud Legoux Moving Average (ALMA):

The alma(src, len, offset, sigma) function introduces ALMA—a type of moving average designed to be less affected by outliers. With parameters for offset and sigma, it allows customization of the degree to which the MA reacts to market noise.

Kaufman Adaptive Moving Average (KAMA):

The custom kama(src, len) function is noteworthy for its adaptive nature. It computes an efficiency ratio by comparing price change against volatility, then dynamically adjusts its smoothing constant. This results in an MA that quickly responds during trending periods while remaining smoothed during consolidation.

Each of these functions—integrated into the strategy—is selectable by the trader (via the fastMAType and slowMAType inputs). This flexibility permits the tailored application of the MA most suited to current market dynamics and individual risk management preferences.

2. ATR-Based Filters and Risk Controls

ATR Calculation and Volatility Filter:

The strategy computes the Average True Range (ATR) over a user-defined period (atrPeriod). ATR is then used to derive both:

Volatility Assessment: Expressed as a ratio of ATR to closing price, ensuring that trades are taken only when volatility remains within a safe, predefined threshold (volatilityThreshold).

ATR-Based Entry Filters: Implemented as atrFilterLong and atrFilterShort, these conditions ensure that for long entries the price is sufficiently above the slow MA and vice versa for shorts. This acts as an additional confirmation filter.

Dynamic Exit Management:

The exit logic employs a dual approach:

Fixed Stop and Profit Target: Stops and targets are set at multiples of ATR (fixedStopMultiplier and profitTargetATRMult), helping manage risk in volatile markets.

Trailing Stop Adjustments: A trailing stop is calculated using the ATR multiplied by a user-defined offset (trailOffset), which captures additional profits as the trade moves favorably while protecting against reversals.

3. Multi-Timeframe Trend Filtering

The strategy enhances its signal reliability by leveraging a secondary, higher timeframe analysis:

15-Minute Trend Analysis:

By retrieving 15-minute moving averages (fastMA15m and slowMA15m) via request.security, the strategy determines the broader market trend. This secondary filter (enabled or disabled through useTrendFilter) ensures that entries are aligned with the prevailing market direction, thereby reducing the incidence of false signals.

4. Signal and Execution Logic

Combined MA Alignment:

The entry conditions are based primarily on the alignment of the fast and slow MAs. A long condition is triggered when the current price is above both MAs and the fast MA is above the slow MA—complemented by the ATR filter and volume conditions. The reverse applies for a short condition.

Volume and Time Window Validation:

Trades are permitted only if the current volume exceeds a minimum (minVolume) and the current hour falls within the predefined trading window (tradingStartHour to tradingEndHour). An additional volume spike check (comparing current volume to a moving average of past volumes) further filters for optimal market conditions.

Comprehensive Order Execution:

The strategy utilizes flexible order execution functions that allow pyramiding (up to 10 positions), ensuring that it can scale into positions as favorable conditions persist. The use of both market entries and automated exits (with profit targets, stop-losses, and trailing stops) ensures that risk is managed at every step.

5. Integrated Dashboard and Metrics

For transparency and real-time analysis, the strategy includes:

On-Chart Visualizations:

Both fast and slow MAs are plotted on the chart, making it easy to see the market’s technical foundation.

Dynamic Metrics Dashboard:

A built-in table displays crucial performance statistics—including current profit/loss, equity, ATR (both raw and as a percentage), and the percentage gap between the moving averages. These metrics offer immediate insight into the health and performance of the strategy.

Input Parameters: Detailed Breakdown

Every input is meticulously designed to offer granular control:

Fast & Slow Lengths:

Determine the window size for the fast and slow moving averages. Smaller values yield more sensitivity, while larger values provide a smoother, delayed response.

Fast/Slow MA Types:

Choose the type of moving average for fast and slow signals. The versatility—from basic SMA and EMA to more complex ones like HMA, TEMA, ZLEMA, ALMA, and KAMA—allows customization to fit different market scenarios.

ATR Parameters:

atrPeriod and atrMultiplier shape the volatility assessment, directly affecting entry filters and risk management through stop-loss and profit target levels.

Trend and Volume Filters:

Inputs such as useTrendFilter, minVolume, and the volume spike condition help confirm that a trade occurs in active, trending markets rather than during periods of low liquidity or market noise.

Trading Hours:

Restricting trade execution to specific hours (tradingStartHour and tradingEndHour) helps avoid illiquid or choppy markets outside of prime trading sessions.

Exit Strategies:

Parameters like trailOffset, profitTargetATRMult, and fixedStopMultiplier provide multiple layers of risk management and profit protection by tailoring how exits are generated relative to current market conditions.

Pyramiding and Fixed Trade Quantity:

The strategy supports multiple entries within a trend (up to 10 positions) and sets a predefined trade quantity (fixedQuantity) to maintain consistent exposure and risk per trade.

Dashboard Controls:

The resetDashboard input allows for on-the-fly resetting of performance metrics, keeping the strategy’s performance dashboard accurate and up-to-date.

Why This Strategy is Truly Exceptional

Multi-Faceted Adaptability:

The ability to switch seamlessly between various moving average types—each suited to particular market conditions—enables the strategy to adapt dynamically. This is a testament to the high level of coding sophistication and market insight infused within the system.

Robust Risk Management:

The integration of ATR-based stops, profit targets, and trailing stops ensures that every trade is executed with well-defined risk parameters. The system is designed to mitigate unexpected market swings while optimizing profit capture.

Comprehensive Market Filtering:

By combining moving average crossovers with volume analysis, volatility thresholds, and multi-timeframe trend filters, the strategy only enters trades under the most favorable conditions. This multi-layered filtering reduces noise and enhances signal quality.

-Final Thoughts-

The Dskyz Adaptive Futures Elite (DAFE) MAtrix with ATR-Powered Precision strategy is not just another trading algorithm—it is a multi-dimensional, fully customizable system built on advanced technical principles and sophisticated risk management techniques. Every function and input parameter has been carefully engineered to provide traders with a system that is both powerful and transparent.

For clients seeking a state-of-the-art trading solution that adapts dynamically to market conditions while maintaining strict discipline in risk management, this strategy truly stands in a class of its own.

****Please show support if you enjoyed this strategy. I'll have more coming out in the near future!!

-Dskyz

Caution

DAFE is experimental, not a profit guarantee. Futures trading risks significant losses due to leverage. Backtest, simulate, and monitor actively before live use. All trading decisions are your responsibility.

PBOC Balance Sheet (Approx USD Trillions)This indicator displays the People's Bank of China (PBOC) Balance Sheet in approximate USD trillions, converted from CNY data (ECONOMICS:CNCBBS) using a fixed exchange rate of 1 USD ≈ 7 CNY. The data is smoothed with a 3-month SMA and plotted as a black line in a separate pane, with a reference line at 6.0 USD trillions. Ideal for analyzing long-term macroeconomic trends and correlations with other financial metrics like bond yields or asset prices, it includes error handling for missing data to ensure reliable visualization.

China 10-Year Yield Inverted with Time Lead (Months)The "China 10-Year Yield Inverted with Time Lead (Months)" indicator is a Pine Script tool for TradingView that displays the inverted China 10-Year Government Bond Yield (sourced from TVC:CN10Y) with a user-defined time lead or lag in months. The yield is inverted by multiplying it by -1, making a rising yield appear as a downward movement and vice versa, which helps visualize inverse correlations with other assets. Users can input the number of months to shift the yield forward (lead) or backward (lag), with the shift calculated based on the chart’s timeframe (e.g., 20 bars per month on daily charts). The indicator plots the shifted, inverted yield as a blue line in a separate pane, with a zero line for reference, enabling traders to analyze leading or lagging relationships with other financial data, such as the PBOC Balance Sheet or Bitcoin price.

Relative Strength MatrixThe Relative Strength Matrix (RSPS M) is a powerful comparison tool that analyzes and ranks up to 10 selected assets based on their relative performance. It does this by calculating price ratios between all asset pairs and applying a consistent strength criterion across each comparison. The results are displayed in a live-updating matrix, showing how each asset performs relative to the rest of the group.

By default, the indicator uses a momentum-based approach (via RSI) to evaluate strength, but it’s fully customizable. Users can modify the valuation logic by replacing the built-in ta.rsi function under the “Inputs your criterion below” section in the code. This makes the tool highly flexible—allowing for different styles of comparison such as trend-following, volatility-adjusted, or custom factor-based ranking methods.

Each asset’s total dominance score is color-coded and ranked, making it easy to spot outperformers and underperformers within any chosen basket. Whether you're tracking crypto pairs, sectors, or other groups, RSPS M provides a clear, objective framework for relative strength monitoring and rotation strategies—perfect for spotting leaders, laggards, and shifts in momentum across markets.

ICT MACRO MAX RETRI ( ALERT )🖤 ICT Reversal Detector – Minimalist Edition

This indicator is designed for traders who follow Inner Circle Trader (ICT) concepts, particularly focused on liquidity sweeps and displacement reversals.

It detects:

• Swing Highs & Lows that occur during the most reactive windows of each hour

→ Specifically the last 20 minutes and first 15 minutes

(ICT teaches these moments often reveal macro-level reversals. I’ve expanded the window slightly to give the indicator more room to catch valid setups.)

• Liquidity Sweeps of previous highs/lows

• Displacement (State Change): defined as a manipulation wick followed by 1–3 strong candles closing in the opposite direction

Visually:

• Clean black lines pointing right from the liquidity sweep wick

• White triangle markers inside black label boxes only when valid displacement occurs

• No clutter, no unnecessary shapes — just focused signal

Built for:

• 5-minute charts, especially NASDAQ (NAS100) and S&P 500 (SPX500)

• Confirm setups manually on the 15-minute chart for extra precision

This is a partial automation tool for ICT-style reversal traders who prefer clarity, minimalism, and sharp intuition over noise.

Let it alert you to setups — then decide like a sniper.

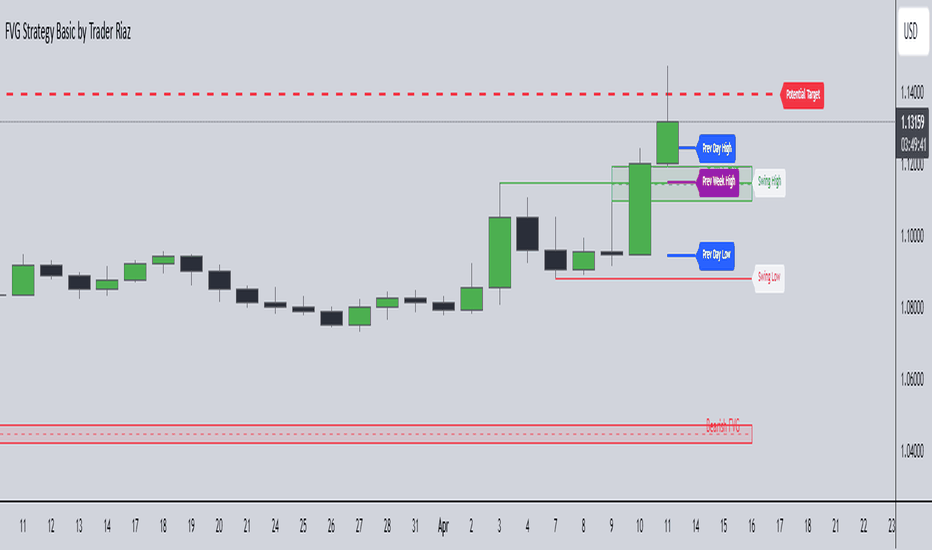

FVG, Swing, Target, D/W/M High Low Detector Basic by Trader Riaz"FVG, Swing, Target, D/W/M High Low Detector Basic by Trader Riaz " is a powerful TradingView indicator designed to enhance your trading strategy by identifying key market structures and levels. This all-in-one tool detects Fair Value Gaps (FVGs), Swing Highs/Lows, and previous Day, Previous Week, and Previous Month Highs/Lows, helping traders make informed decisions with ease.

Key Features:

Bullish & Bearish FVG Detection: Highlights Fair Value Gaps with customizable colors, labels, and extension options.

Swing Highs & Lows: Automatically detects and marks Swing Highs and Lows with adjustable display settings and extensions.

Next Target Levels: Identifies potential price targets based on market direction (rising or falling).

Daily, Weekly, and Monthly High/Low Levels: Displays previous day, week, and month highs/lows with customizable colors.

Customizable Settings: Fully adjustable inputs for colors, number of levels to display, and extension periods.

Clean Visuals: Intuitive and non-intrusive design with dashed lines, labels, and tooltips for better chart readability.

This indicator is ideal for traders looking to identify key price levels, improve market structure analysis, and enhance their trading strategies.

Happy Trading,

Trader Riaz

Global M2 10-Week Lead (for bitcoin)This script displays a combined view of the Global M2 Money Supply, converted to USD and adjusted with a configurable forward lead (default 10 weeks). It is designed to help visualize macro liquidity trends and anticipate potential impacts on Bitcoin price movements across any timeframe.

🔹 Main Features:

- Aggregates M2 data from 18 countries and regions including the USA, Eurozone, China, Japan, and more.

- All M2 values are converted to USD using respective exchange rates.

- Customizable “Slide Weeks Forward” setting lets you project global liquidity data into the future.

- Works on all timeframes by adjusting the projection logic dynamically.

- Toggle each country’s data on or off to customize the liquidity model.

💡 Use Case:

Global liquidity is often a leading indicator for major asset classes. This tool helps traders and analysts assess macro-level trends and their potential influence on Bitcoin by looking at changes in M2 money supply worldwide.

💡 Inspired By:

This tool mimics the Global M2 10-Week Lead liquidity indicator often referenced by Raoul Pal of Real Vision and Global Macro Investor, used for macro analysis and Bitcoin movement prediction.

📊 Note:

All economic and FX data is sourced from TradingView’s built-in datasets (ECONOMICS and FX_IDC). Data availability may vary depending on your plan.

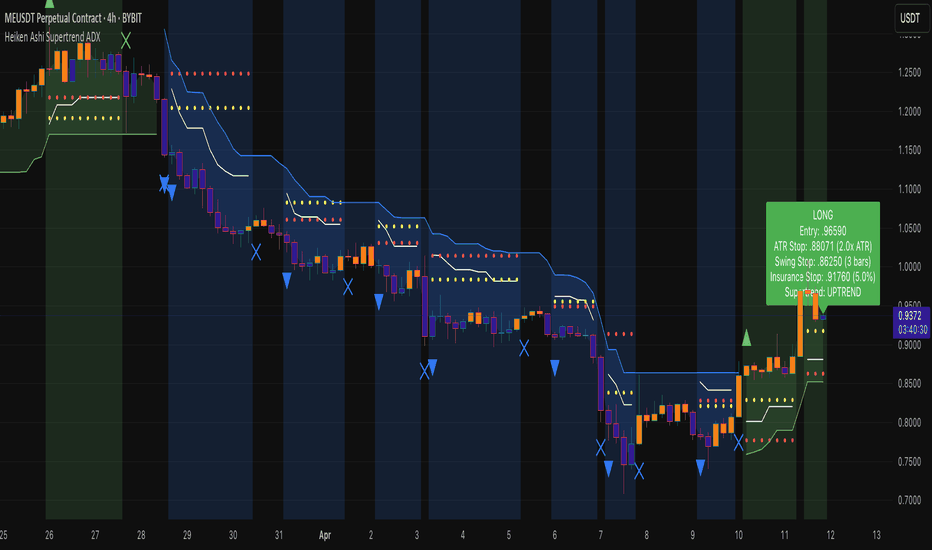

Heiken Ashi Supertrend ADXHeiken Ashi Supertrend ADX Indicator

Overview

This indicator combines the power of Heiken Ashi candles, Supertrend indicator, and ADX filter to identify strong trend movements across multiple timeframes. Designed primarily for the cryptocurrency market but adaptable to any tradable asset, this system focuses on capturing momentum in established trends while employing a sophisticated triple-layer stop loss mechanism to protect capital and secure profits.

Strategy Mechanics

Entry Signals

The strategy uses a unique blend of technical signals to identify high-probability trade entries:

Heiken Ashi Candles: Looks specifically for Heiken Ashi candles with minimal or no wicks, which signal strong momentum and trend continuation. These "full-bodied" candles represent periods where price moved decisively in one direction with minimal retracement. These are overlayed onto normal candes for more accuarte signalling and plotting

Supertrend Filter: Confirms the underlying trend direction using the Supertrend indicator (default factor: 3.0, ATR period: 10). Entries are aligned with the prevailing Supertrend direction.

ADX Filter (Optional) : Can be enabled to focus only on stronger trending conditions, filtering out choppy or ranging markets. When enabled, trades only trigger when ADX is above the specified threshold (default: 25).

Exit Signals

Positions are closed when either:

An opposing signal appears (Heiken Ashi candle with no wick in the opposite direction)

Any of the three stop loss mechanisms are triggered

Triple-Layer Stop Loss System

The strategy employs a sophisticated three-tier stop loss approach:

ATR Trailing Stop: Adapts to market volatility and locks in profits as the trend extends. This stop moves in the direction of the trade, capturing profit without exiting too early during normal price fluctuations.

Swing Point Stop: Uses natural market structure (recent highs/lows over a lookback period) to place stops at logical support/resistance levels, honoring the market's own rhythm.

Insurance Stop: A percentage-based safety net that protects against sudden adverse moves immediately after entry. This is particularly valuable when the swing point stop might be positioned too far from entry, providing immediate capital protection.

Optimization Features

Customizable Filters : All components (Supertrend, ADX) can be enabled/disabled to adapt to different market conditions

Adjustable Parameters : Fine-tune ATR periods, Supertrend factors, and ADX thresholds

Flexible Stop Loss Settings : Each of the three stop loss mechanisms can be individually enabled/disabled with customizable parameters

Best Practices for Implementation

[Recommended Timeframes : Works best on 4-hour charts and above, where trends develop more reliably

Market Conditions: Performs well across various market conditions due to the ADX filter's ability to identify meaningful trends

Performance Characteristics

When properly optimized, this has demonstrated profit factors exceeding 3 in backtesting. The approach typically produces generous winners while limiting losses through its multi-layered stop loss system. The ATR trailing stop is particularly effective at capturing extended trends, while the insurance stop provides immediate protection against adverse moves.

The visual components on the chart make it easy to follow the strategy's logic, with position status, entry prices, and current stop levels clearly displayed.

This indicator represents a complete trading system with clearly defined entry and exit rules, adaptive stop loss mechanisms, and built-in risk management through position sizing.

Heiken Ashi Supertrend ADX - StrategyHeiken Ashi Supertrend ADX Strategy

Overview

This strategy combines the power of Heiken Ashi candles, Supertrend indicator, and ADX filter to identify strong trend movements across multiple timeframes. Designed primarily for the cryptocurrency market but adaptable to any tradable asset, this system focuses on capturing momentum in established trends while employing a sophisticated triple-layer stop loss mechanism to protect capital and secure profits.

Strategy Mechanics

Entry Signals

The strategy uses a unique blend of technical signals to identify high-probability trade entries:

Heiken Ashi Candles: Looks specifically for Heiken Ashi candles with minimal or no wicks, which signal strong momentum and trend continuation. These "full-bodied" candles represent periods where price moved decisively in one direction with minimal retracement.

Supertrend Filter : Confirms the underlying trend direction using the Supertrend indicator (default factor: 3.0, ATR period: 10). Entries are aligned with the prevailing Supertrend direction.

ADX Filter (Optional) : Can be enabled to focus only on stronger trending conditions, filtering out choppy or ranging markets. When enabled, trades only trigger when ADX is above the specified threshold (default: 25).

Exit Signals

Positions are closed when either:

An opposing signal appears (Heiken Ashi candle with no wick in the opposite direction)

Any of the three stop loss mechanisms are triggered

Triple-Layer Stop Loss System

The strategy employs a sophisticated three-tier stop loss approach:

ATR Trailing Stop: Adapts to market volatility and locks in profits as the trend extends. This stop moves in the direction of the trade, capturing profit without exiting too early during normal price fluctuations.

Swing Point Stop : Uses natural market structure (recent highs/lows over a lookback period) to place stops at logical support/resistance levels, honoring the market's own rhythm.

Insurance Stop: A percentage-based safety net that protects against sudden adverse moves immediately after entry. This is particularly valuable when the swing point stop might be positioned too far from entry, providing immediate capital protection.

Optimization Features

Customizable Filters: All components (Supertrend, ADX) can be enabled/disabled to adapt to different market conditions

Adjustable Parameters: Fine-tune ATR periods, Supertrend factors, and ADX thresholds

Flexible Stop Loss Settings: Each of the three stop loss mechanisms can be individually enabled/disabled with customizable parameters

Best Practices for Implementation

Recommended Timeframes: Works best on 4-hour charts and above, where trends develop more reliably

Market Conditions: Performs well across various market conditions due to the ADX filter's ability to identify meaningful trends

Position Sizing: The strategy uses a percentage of equity approach (default: 3%) for position sizing

Performance Characteristics

When properly optimized, this strategy has demonstrated profit factors exceeding 3 in backtesting. The approach typically produces generous winners while limiting losses through its multi-layered stop loss system. The ATR trailing stop is particularly effective at capturing extended trends, while the insurance stop provides immediate protection against adverse moves.

The visual components on the chart make it easy to follow the strategy's logic, with position status, entry prices, and current stop levels clearly displayed.

This strategy represents a complete trading system with clearly defined entry and exit rules, adaptive stop loss mechanisms, and built-in risk management through position sizing.

Vwap Vision #WhiteRabbitVWAP Vision #WhiteRabbit

This Pine Script (version 5) script implements a comprehensive trading indicator called "VWAP Vision #WhiteRabbit," designed for analyzing price movements using the Volume-Weighted Average Price (VWAP) along with multiple customizable features, including adjustable color themes for better visual appeal.

Features:

Customizable Color Themes:

Choose from four distinct themes: Classic, Dark Mode, Fluo, and Phil, enhancing the visual layout to match user preferences.

VWAP Calculation:

Uses standard VWAP calculations based on selected anchor periods (Session, Week, Month, etc.) to help identify price trends.

Band Settings:

Multiple bands are calculated based on standard deviations or percentages, with customization options to configure buy/sell zones and liquidity levels.

Buy/Sell Signals:

Generates clear buy and sell signals based on price interactions with the calculated bands and the exponential moving average (EMA).

Real-time Data Display:

Displays real-time signals and VWAP values for selected trading instruments, including XAUUSD, NAS100, and BTCUSDT, along with related alerts for trading opportunities.

Volatility Analysis:

Incorporates volatility metrics using the Average True Range (ATR) to assess market conditions and inform trading decisions.

Enhanced Table Displays:

Provides tables for clear visualization of trading signals, real-time data, and performance metrics.

This script is perfect for traders looking to enhance their analysis and gain insights for making informed trading decisions across various market conditions.

Leavitt Convolution ProbabilityTechnical Analysis of Markets with Leavitt Market Projections and Associated Convolution Probability

The aim of this study is to present an innovative approach to market analysis based on the research "Leavitt Market Projections." This technical tool combines one indicator and a probability function to enhance the accuracy and speed of market forecasts.

Key Features

Advanced Indicators : the script includes the Convolution line and a probability oscillator, designed to anticipate market changes. These indicators provide timely signals and offer a clear view of price dynamics.

Convolution Probability Function : The Convolution Probability (CP) is a key element of the script. A significant increase in this probability often precedes a market decline, while a decrease in probability can signal a bullish move. The Convolution Probability Function:

At each bar, i, the linear regression routine finds the two parameters for the straight line: y=mix+bi.

Standard deviations can be calculated from the sequence of slopes, {mi}, and intercepts, {bi}.

Each standard deviation has a corresponding probability.

Their adjusted product is the Convolution Probability, CP. The construction of the Convolution Probability is straightforward. The adjusted product is the probability of one times 1− the probability of the other.

Customizable Settings : Users can define oversold and overbought levels, as well as set an offset for the linear regression calculation. These options allow for tailoring the script to individual trading strategies and market conditions.

Statistical Analysis : Each analyzed bar generates regression parameters that allow for the calculation of standard deviations and associated probabilities, providing an in-depth view of market dynamics.

The results from applying this technical tool show increased accuracy and speed in market forecasts. The combination of Convolution indicator and the probability function enables the identification of turning points and the anticipation of market changes.

Additional information:

Leavitt, in his study, considers the SPY chart.

When the Convolution Probability (CP) is high, it indicates that the probability P1 (related to the slope) is high, and conversely, when CP is low, P1 is low and P2 is high.

For the calculation of probability, an approximate formula of the Cumulative Distribution Function (CDF) has been used, which is given by: CDF(x)=21(1+erf(σ2x−μ)) where μ is the mean and σ is the standard deviation.

For the calculation of probability, the formula used in this script is: 0.5 * (1 + (math.sign(zSlope) * math.sqrt(1 - math.exp(-0.5 * zSlope * zSlope))))

Conclusions

This study presents the approach to market analysis based on the research "Leavitt Market Projections." The script combines Convolution indicator and a Probability function to provide more precise trading signals. The results demonstrate greater accuracy and speed in market forecasts, making this technical tool a valuable asset for market participants.

Daily LevelsOverview:

The Daily Levels indicator plots key price levels from the previous trading day, including the high, low, median (pivot), and projected extensions. These levels help traders identify potential support/resistance zones and anticipate breakout or reversal opportunities.

Key Features:

✅ Previous Day High & Low – Visualizes the prior day’s high and low as dynamic support/resistance levels.

✅ Median (Pivot) Line – Calculates the midpoint between the previous day’s high and low, acting as a key intraday reference.

✅ Projected Levels – Extends the high/low range symmetrically above and below the median, highlighting potential breakout zones.

✅ Customizable Display – Toggle visibility, adjust colors, and modify line styles (solid, dotted, dashed).

✅ Price Labels – Clear on-chart labels showing exact price values for quick reference.

✅ Built-in Alerts – Get notified when price crosses any of the key levels.

How to Use:

Trend Identification: If price holds above the median, the bias is bullish; below suggests bearish momentum.

Breakout Trading: Watch for moves beyond the projected levels for potential continuation.

Mean Reversion: Fade moves toward the previous day’s high/low if the median holds as support/resistance.

Ideal For:

Day Traders – Intraday support/resistance levels.

Swing Traders – Context for multi-day trends.

Breakout/Reversal Strategies – Clear levels for trade triggers.

Settings Recommendations:

High/Low Lines: Use semi-transparent colors (e.g., green/red) for clarity.

Projections: Helpful for anticipating extended moves (e.g., teal for upper, orange for lower).

Alerts: Enable notifications for key crosses (e.g., median or high/low breaks).

Filtered Swing Pivot S&R )Pivot support and resis🔍 Filtered Swing Pivot S&R - Overview

This indicator identifies and plots tested support and resistance levels using a filtered swing pivot strategy. It focuses on high-probability zones where price has reacted before, helping traders better anticipate future price behavior.

It filters out noise using:

Customizable pivot detection logic

Minimum price level difference

ATR (Average True Range) volatility filter

Confirmation by price retesting the level before plotting

⚙️ Core Logic Explained

✅ 1. Pivot Detection

The script uses Pine Script's built-in ta.pivothigh() and ta.pivotlow() functions to find local highs (potential resistance) and lows (potential support).

Pivot Lookback/Lookahead (pivotLen):

A pivot is confirmed if it's the highest (or lowest) point within a lookback and lookahead range of pivotLen bars.

Higher values = fewer, stronger pivots.

Lower values = more, but potentially noisier levels.

✅ 2. Pending Pivot Confirmation

Once a pivot is detected:

It is not drawn immediately.

The script waits until price re-tests that pivot level. This retest confirms the market "respects" the level.

For example: if price hits a previous high again, it's treated as a valid resistance.

✅ 3. Dual-Level Filtering System

To reduce chart clutter and ignore insignificant levels, two filters are applied:

Fixed Threshold (Minimum Level Difference):

Ensures a new pivot level is not too close to the last one.

ATR-Based Filter:

Dynamically adjusts sensitivity based on current volatility using the formula:

java

Copy

Edit

Minimum distance = ATR × ATR Multiplier

Only pivots that pass both filters are plotted.

✅ 4. Line Drawing

Once a pivot is:

Detected

Retested

Filtered

…a horizontal dashed line is drawn at that level to highlight support or resistance.

Resistance: Red (default)

Support: Green (default)

These lines are:

Dashed for clarity

Extended for X bars into the future (user-defined) for forward visibility

🎛️ Customizable Inputs

Parameter Description

Pivot Lookback/Lookahead Bars to the left and right of a pivot to confirm it

Minimum Level Difference Minimum price difference required between plotted levels

ATR Length Number of bars used in ATR volatility calculation

ATR Multiplier for Pivot Multiplies ATR to determine volatility-based pivot separation

Line Extension (bars) How many future bars the level line will extend for better visibility

Resistance Line Color Color for resistance lines (default: red)

Support Line Color Color for support lines (default: green)

📈 How to Use It

This indicator is ideal for:

Identifying dynamic support & resistance zones that adapt to volatility.

Avoiding false levels by waiting for pivot confirmation.

Visual guidance for entries, exits, stop placements, or take-profits.

🔑 Trade Ideas:

Use support/resistance retests for entry confirmations.

Combine with candlestick patterns or volume spikes near drawn levels.

Use in confluence with trendlines or moving averages.

🚫 What It Does Not Do (By Design)

Does not repaint or remove past levels once confirmed.

Does not include labels or alerts (but can be added).

Does not auto-scale based on timeframes (manual tuning recommended).

🛠️ Possible Enhancements (Optional)

If desired, you could extend the functionality to include:

Labels with “S” / “R”

Alert when a new level is tested or broken

Toggle for support/resistance visibility

Adjustable line width or style

tance indicator

Stoch_RSIStochastic RSI – Advanced Divergence Indicator

This custom indicator is an advanced version of the Stochastic RSI that not only smooths and refines the classic RSI input but also automatically detects both regular and hidden divergences using two powerful methods: fractal-based and pivot-based detection. Originally inspired by contributions from @fskrypt, @RicardoSantos, and later improved by developers like @NeoButane and @FYMD, this script has been fully refined for clarity and ease-of-use.

Key Features:

Dual Divergence Detection:

Fractal-Based Divergence: Uses a four-candle pattern to confirm top and bottom fractals for bullish and bearish divergences.

Pivot-Based Divergence: Employs TradingView’s built-in pivot functions for an alternate view of divergence conditions.

Customizable Settings:

The inputs are organized into logical groups (Stoch RSI settings, Divergence Options, Labels, and Market Open Settings) allowing you to adjust smoothing periods, RSI and Stochastic lengths, and divergence thresholds with a user-friendly interface.

Visual Enhancements:

Plots & Fills: The indicator plots both the K and D lines with corresponding fills and horizontal bands for quick visual reference.

Divergence Markers: Diamond shapes and labeled markers indicate regular and hidden divergences on the chart.

Market Open Highlighting: Optional histogram plots highlight the market open candle based on different timeframes for stocks versus non-forex symbols.

CandelaCharts - Premium & Discount 📝 Overview

Premium and Discount are key concepts in ICT (Inner Circle Trader) trading strategies, used to pinpoint ideal entry and exit points in the market. These concepts are based on an understanding of market structure and the behavior of institutional traders, commonly referred to as Smart Money.

To understand the Premium and Discount zones, it's crucial to first grasp the concept of the equilibrium level, also known as the basic or fair value. The equilibrium represents the midpoint of a given price range and acts as a reference point, dividing the range into Premium and Discount zones.

The equilibrium reflects the "fair value" of the price within the considered range. Traders use this as a benchmark to assess whether the current price is in the Premium or Discount zone.

The Premium zone lies above the equilibrium level, while the Discount zone is located below it within the price range.

📦 Features

Swing-based detection

Custom detection

Modes

Styling

⚙️ Settings

Range: Determines how you will identify Premium and Discount, either by swing points or by custom date.

Mode: Controls what UI will be displayed

Premium: Sets the Premium color

Discount: Sets the Discount color

Equilibrium: Sets the Equilibrium color

Labels: Controls the labels visibility

⚡️ Showcase

Pro Mode

Solid Mode

Outlined Mode

Flat Mode

The Indicator can be effortlessly applied in replay mode to highlight premium and discount zones based on the most prominent market swings.

🚨 Alerts

The indicator does not provide any alerts!

⚠️ Disclaimer

Trading involves significant risk, and many participants may incur losses. The content on this site is not intended as financial advice and should not be interpreted as such. Decisions to buy, sell, hold, or trade securities, commodities, or other financial instruments carry inherent risks and are best made with guidance from qualified financial professionals. Past performance is not indicative of future results.