Statistical Trailing Stop [LuxAlgo]The Statistical Trailing Stop tool offers traders a way to lock in profits in trending markets with four statistical levels based on the log-normal distribution of volatility.

The indicator also features a dashboard with statistics of all detected signals.

🔶 USAGE

The tool works out of the box, traders can adjust the data used with two parameters: data & distribution length.

By default, the tool takes volatility measures of groups of 10 candles, and statistical measures of the last 100 of these groups then traders can adjust the base level to use as trailing, the larger the level, the more resistant the tool will be to moves against the trend.

🔹 Base Levels

Traders can choose up to 4 different levels of trailing, all based on the statistical distribution of volatility.

As we can see in the chart above, each higher level is more resistant to market movements, so level 0 is the most reactive and level 3 the least.

It is up to the trader to determine the best level for each underlying, time frame and market conditions.

🔹 Dashboard

The tool provides a dashboard with the statistics of all trades, making it very easy to assess the performance of the parameters used for any given market.

As we can see on the chart, all Daily BTC signals with default parameters but different base levels, level 2 is the best performing of all four, giving a positive expectation of $2435 per trade, taking into account all long and short trades.

Of note are the long trades with a win rate of 76.47% and a risk-to-reward of 3.34, giving a positive expectation of $4839 per trade, with winners having an average duration of 210 days and losers 32 days.

This, compared to short trades with negative expectation, speaks to the uptrend bias of this particular market.

🔶 SETTINGS

Data Length: Select how many bars to use per data point

Distribution Length: Select how many data points the distribution will have

Base Level: Choose between 4 different trailing levels

🔹 Dashboard

Show Statistics: Enable/disable dashboard

Position: Select dashboard position

Size: Select dashboard size

Трендовый анализ

Dskyz (DAFE) Turning Point Indicator - Dskyz (DAFE) Turning Point Indicator — Smart Reversal Signals

Inspired by the intelligent logic of a pervious indicator I saw. This script represents a next-generation reversal detection system—completely re-engineered with cutting-edge filters, adaptive logic, and intelligent dashboards.

The Dskyz (DAFE) Turning Point Indicator

🧠 What Is It?

is designed to identify key market reversal zones with extraordinary accuracy by combining trend direction, volatility confirmation, price action patterns, and smart filtering layers—all visualized in a highly interactive and informative chart overlay.

This isn’t just a signal generator—it’s a decision-making assistant.

⚙️ Inputs & How to Use Them

All input fields are grouped for ease-of-use and explanation:

🔸 Reversal Logic Settings

Source: The price source used for signal generation (default: hlcc4). Can be changed to any standard price formula (open, close, hl2, etc.).

ATR Period: Used for determining volatility and dynamic trailing stop logic.

Supertrend Factor / Period: Calculates directional movement to detect trending vs choppy zones.

Reversal Sensitivity Thresholds: Internal logic filters minor pullbacks from true reversals.

🔸 Filters

Trend Filter: Enables trend-only signals (optional).

Volume Spike Filter: Confirms reversals with significant volume activity.

Volatility Zone Coloring: Visually highlights high-volatility areas to avoid late entries or fakeouts.

Custom High/Low Detection: Smart local top/bottom scanning to reinforce accuracy.

🔸 Visual & Dashboard Options

Signal Labels: Toggle signal labels on the chart.

Color Theme: Choose your visual theme for easier visibility.

Dashboard Toggle: Activate a compact dashboard summarizing strategy health (win rate, drawdown, trend state, volatility).

🧩 Functions Used

ta.supertrend(): Determines trend direction for signal confirmation and filtering.

ta.atr(): Calculates real-time volatility to determine trailing stop exits and visual zones.

ta.rsi() (internally optimized): Helps filter overbought/oversold conditions.

Local High/Low Scanner: Tracks recent pivots using a custom dynamic lookback.

Signal Engine: Consolidates multiple confirmation layers before plotting.

🚀 What Makes It Unique?

Unlike traditional reversal indicators, this one combines:

Multi-factor signal validation: No single indicator makes the call—volume, trend, price action, and volatility all contribute.

Adaptive filtering: The indicator evolves with the market—less noise, smarter signals.

Visual volatility heatmap zones: Avoid entering during uncertainty or manipulation spikes.

Interactive trend dashboard: Immediate insight into the strength and condition of the current market phase.

Highly customizable: Turn features on/off to match your trading style—scalping, swing, or trend-following.

Precision timing: Uses optimized versions of RSI and ATR that adjust automatically with price context.

🧬 Recommended for:

Commodity: Futures, Forex, Crypto

Timeframes: 1m to 1h for active traders. 4h+ for swing trades.

Pair With: Support/resistance zones, Fibonacci levels, and smart money concepts for additional confluence.

🎯 Why It Works

- Traditional reversal signals suffer from lag and noise. This system filters both by:

- Using multi-source confirmation, not just price movement.

-Tracking volatility directly, not assuming static markets.

-Detecting exhaustion, not just divergence.

-Keeping your screen clean, with only the most relevant data shown.

🧾 Credit & Acknowledgement

🧠 Original Concept Inspiration: This project was deeply inspired by the work of Enes_Yetkin_ and their approach to reversal detection. This version expands on the concept with additional technical layers, updated visuals, and real-time adaptability.

📌 Final Thoughts

This is more than a reversal tool. It's a market condition interpreter, entry/exit planner, and risk assistant all in one. Every aspect is engineered to give you an edge—especially when timing means everything.

Use it with discipline. Use it with clarity. Trade smarter.

**I will continue to release incredible strategies and indicators until I turn this into a brand or until someone offers me a contract.

-Dskyz

FeraTrading Relative Volume IndicatorThis FeraTrading Relative Volume Indicator measures relative volume pressure by comparing buying and selling activity, smoothed using a configurable average. It helps traders identify volume-driven momentum shifts, offering dynamic buy and sell signals based on weighted pressure values.

Key Features:

📈 Relative Volume (RV) Line: Measures net buying/selling pressure using volume-weighted price action.

🟢 Buy Signals: Triggered when RV crosses above a smoothed moving average (SMA 1).

🔴 Sell Signals (optional): Triggered when RV crosses below a separate SMA (SMA 2).

🔍 Customizable Inputs: Adjust smoothing length, weight, and signal sensitivity.

🕯️ Weighted Candles (optional): Visualizes custom OHLC based on volume-weighted volatility.

📊 Two SMAs: Use separate or combined moving averages to analyze trends in pressure.

🎨 Flexible Styling: Customize line and signal colors to match your chart setup.

Use Cases:

Spotting accumulation/distribution phases

Timing entries during volume surges

Confirming breakout momentum with underlying volume pressure

This indicator was developed by FeraTrading to visualize relative volume pressure.

Fractal Wave MarkerFractal Wave Marker is an indicator that processes relative extremes of fluctuating prices within 2 periodical aspects. The special labeling system detects and visually marks multi-scale turning points, letting you visualize fractal echoes within unfolding cycles dynamically.

What This Indicator Does

Identifies major and minor swing highs/lows based on adjustable period.

Uses Phi in power exponent to compute a higher-degree swing filter.

Labels of higher degree appear only after confirmed base swings — no phantom levels, no hindsight bias. What you see is what the market has validated.

Swing points unfold in a structured, alternating rhythm . No two consecutive pivots share the same hierarchical degree!

Inspired by the Fractal Market Hypothesis, this script visualizes the principle that market behavior repeats across time scales, revealing structured narrative of "random walk". This inherent sequencing ensures fractal consistency across timeframes. "Fractal echoes" demonstrate how smaller price swings can proportionally mirror larger ones in both structure and timing, allowing traders to anticipate movements by recursive patterns. Cycle Transitions highlight critical inflection points where minor pivots flip polarity such as a series of lower highs progress into higher highs—signaling the birth of a new macro trend. A dense dense clusters of swing points can indicate Liquidity Zones, acting as footprints of institutional accumulation or distribution where price action validates supply and demand imbalances.

Visualization of nested cycles within macro trend anchors - a main feature specifically designed for the chartists who prioritize working with complex wave oscillations their analysis.

Trend Breakout [Uncle Sam Trading]Trend Breakout Indicator

Overview

The Trend Breakout Indicator is a powerful, non-repainting tool designed to help traders identify high-probability breakout and trend reversal setups on any market and timeframe. By leveraging pivot points, this indicator draws dynamic support and resistance channels, highlights counter-trend breakouts, and provides visual cues for market direction. It’s ideal for traders looking to simplify their analysis while targeting key price levels for entries and exits.

Key Features

Pivot-Based Channels: Draws a red upper channel (resistance) and a green lower channel (support) by connecting recent pivot highs and lows.

Counter-Trend Breakout Signals:

Blue “CT Breakup” signal (▲) when the price breaks above the upper channel during a downtrend, indicating a potential reversal or pullback.

Orange “CT Breakdown” signal (▼) when the price breaks below the lower channel during an uptrend, signaling a potential downmove.

Trend Visualization: Background color shifts to green for uptrends and red for downtrends, making it easy to gauge market direction.

Customizable Settings: Adjust pivot detection sensitivity with “Pivot Left Bars” (default: 5) and “Pivot Right Bars” (default: 1), and control channel extension with “Channel Extension Bars” (default: 50).

Optional Trend Signals: Enable “Show Trend Change Signals” to display trend shifts with green (uptrend) or red (downtrend) arrows.

Alert Conditions: Set alerts for counter-trend breakouts and trend changes directly on TradingView.

Example Performance (BTCUSDT, 1-Hour Chart)

On the BTCUSDT 1-hour chart:

A “CT Breakdown” signal appeared on April 6 at 8:00 AM at $82,700, followed by a drop to $74,400 within hours—a 10% move.

A “CT Breakup” signal occurred on April 9 at 1:00 AM at $76,600, leading to a rally to $86,600 in a few hours—a 9% gain.

These examples highlight the indicator’s ability to spot significant price movements, though results depend on market conditions, your trading style, and risk management.

Settings

Pivot Left Bars (default: 5): Number of bars to the left for pivot detection.

Pivot Right Bars (default: 1): Number of bars to the right for pivot confirmation (ensures non-repainting signals).

Channel Extension Bars (default: 50): How far the channels extend to the right.

Show Pivot Points (default: true): Displays small triangles at pivot highs (maroon) and lows (navy).

Show Counter-Trend Breakout Signals (default: true): Shows CT Breakup and CT Breakdown signals.

Show Trend Change Signals (default: false): Displays trend shift arrows when enabled.

How to Use

Add the indicator to your chart via TradingView’s indicator library.

Adjust the settings to match your trading style and timeframe.

Watch for “CT Breakup” and “CT Breakdown” signals to identify potential trade setups.

Use the background color (green/red) to confirm the current trend.

Set alerts for breakouts or trend changes to stay updated on key signals.

Always combine with proper risk management and your own analysis—past performance is not a guarantee of future results.

Notes

The indicator is non-repainting, meaning signals are confirmed and won’t disappear after they form.

Works on any market (crypto, forex, stocks) and timeframe, such as the BTCUSDT 1-hour chart shown.

Performance varies based on market volatility and your trading strategy.

This is a free tool created to support the TradingView community—feedback is welcome in the comments!

Disclaimer

Trading involves risk, and this indicator is not a guaranteed predictor of future price movements. Always conduct your own analysis and manage risk appropriately. The examples provided (e.g., BTCUSDT signals) are for educational purposes only and reflect past performance, which may not repeat.

Dynamic Trade [Dakon]DYNAMIC TRADE

This indicator is designed for advanced trade management using three sets of long/short conditions, each with individual take profit logic. It helps traders track exit opportunities with precision across multiple strategies or layers of entries.

Features:

Multi-layer Take Profit system:

Separate TP logic for Long/Short from Condition 1, 2, and 3

Visual TP levels plotted directly on chart

ATR-based Trend Filter: Filters out trades that go against the current trend, using Average True Range logic to determine directional strength.

Alerts for TP hits (optional)

Noted :

Dynamic Take Profit Calculation: TP levels are calculated as a percentage above/below the entry price.

"Trend filter color is based on ATR and Signal condition to avoid bull and bear traps."

Long Entry: Enter only when all indicators show the same bullish color and signal confirmation

Short Entry: Enter only when all indicators show the same bearish color and signal confirmation

For better accuracy, it's recommended to use this indicator in conjunction with other tools or confirmation signals.

💡 Recommendation:

To increase the reliability of the signals, it's recommended to combine this indicator with other confirmation tools, such as the Support and Resistance indicator or momentum-based tools.

GIGANEVA V6.61 PublicSummary

This enhanced Fibonacci script for TradingView is a powerful, all-in-one tool that calculates Fibonacci Levels, Fans, Time Pivots, and Golden Pivots on both logarithmic and linear scales. Its ability to compute time pivots via fan intersections and Range interactions, combined with user-friendly features like Bool Fib Right, sets it apart. The script maximizes TradingView’s plotting capabilities, making it a unique and versatile tool for technical analysis across various markets.

1. Overview of the Script

The script appears to be a custom technical analysis tool built for TradingView, improving upon an existing script from TradingView’s Community Scripts. It calculates and plots:

Fibonacci Levels: Standard retracement levels (e.g., 0.236, 0.382, 0.5, 0.618, etc.) based on a user-defined price range.

Fibonacci Fans: Trendlines drawn from a high or low point, radiating at Fibonacci ratios to project potential support/resistance zones.

Time Pivots: Points in time where significant price action is expected, determined by the intersection of Fibonacci Fans or their interaction with key price levels.

Golden Pivots: Specific time pivots calculated when the 0.5 Fibonacci Fan (on a logarithmic or linear scale) intersects with its counterpart.

The script supports both logarithmic and linear price scales, ensuring versatility across different charting preferences. It also includes a feature to extend Fibonacci Fans to the right, regardless of whether the user selects the top or bottom of the range first.

2. Key Components Explained

a) Fibonacci Levels and Fans from Top and Bottom of the "Range"

Fibonacci Levels : These are horizontal lines plotted at standard Fibonacci retracement ratios (e.g., 0.236, 0.382, 0.5, 0.618, etc.) based on a user-defined price range (the "Range"). The Range is typically the distance between a significant high (top) and low (bottom) on the chart.

Example : If the high is $100 and the low is $50, the 0.618 retracement level would be at $80.90 ($50 + 0.618 × $50).

Fibonacci Fans : These are diagonal lines drawn from either the top or bottom of the Range, radiating at Fibonacci ratios (e.g., 0.382, 0.5, 0.618). They project potential dynamic support or resistance zones as price evolves over time.

From Top : Fans drawn downward from the high of the Range.

From Bottom : Fans drawn upward from the low of the Range.

Log and Linear Scale:

Logarithmic Scale : Adjusts price intervals to account for percentage changes, which is useful for assets with large price ranges (e.g., cryptocurrencies or stocks with exponential growth). Fibonacci calculations on a log scale ensure ratios are proportional to percentage moves.

Linear Scale : Uses absolute price differences, suitable for assets with smaller, more stable price ranges.

The script’s ability to plot on both scales makes it adaptable to different markets and user preferences.

b) Time Pivots

Time pivots are points in time where significant price action (e.g., reversals, breakouts) is anticipated. The script calculates these in two ways:

Fans Crossing Each Other:

When two Fibonacci Fans (e.g., one from the top and one from the bottom) intersect, their crossing point represents a potential time pivot. This is because the intersection indicates a convergence of dynamic support/resistance zones, increasing the likelihood of a price reaction.

Example: A 0.618 fan from the top crosses a 0.382 fan from the bottom at a specific bar on the chart, marking that bar as a time pivot.

Fans Crossing Top and Bottom of the Range:

A fan line (e.g., 0.5 fan from the bottom) may intersect the top or bottom price level of the Range at a specific time. This intersection highlights a moment where the fan’s projected support/resistance aligns with a key price level, signaling a potential pivot.

Example : The 0.618 fan from the bottom reaches the top of the Range ($100) at bar 50, marking bar 50 as a time pivot.

c) Golden Pivots

Definition : Golden pivots are a special type of time pivot calculated when the 0.5 Fibonacci Fan on one scale (logarithmic or linear) intersects with the 0.5 fan on the opposite scale (or vice versa).

Significance : The 0.5 level is the midpoint of the Fibonacci sequence and often acts as a critical balance point in price action. When fans at this level cross, it suggests a high-probability moment for a price reversal or significant move.

Example : If the 0.5 fan on a logarithmic scale (drawn from the bottom) crosses the 0.5 fan on a linear scale (drawn from the top) at bar 100, this intersection is labeled a "Golden Pivot" due to its confluence of key Fibonacci levels.

d) Bool Fib Right

This is a user-configurable setting (a boolean input in the script) that extends Fibonacci Fans to the right side of the chart.

Functionality : When enabled, the fans project forward in time, regardless of whether the user selected the top or bottom of the Range first. This ensures consistency in visualization, as the direction of the Range selection (top-to-bottom or bottom-to-top) does not affect the fan’s extension.

Use Case : Traders can use this to project future support/resistance zones without worrying about how they defined the Range, improving usability.

3. Why Is This Code Unique?

Original calculation of Log levels were taken from the Comunity Scripts, modified and applied to Fib fans. The script’s uniqueness stems from its comprehensive integration of Fibonacci-based tools and its optimization for TradingView’s plotting capabilities. Here’s a detailed breakdown:

All-in-One Fibonacci Tool:

Most Fibonacci scripts on TradingView focus on either retracement levels, extensions, or fans.

This script combines :

Fibonacci Levels : Static horizontal lines for retracement and extension.

Fibonacci Fans : Dynamic trendlines for projecting support/resistance.

Time Pivots : Temporal analysis based on fan intersections and Range interactions.

Golden Pivots : Specialized pivots based on 0.5 fan confluences.

By integrating these functions, the script provides a holistic Fibonacci analysis tool, reducing the need for multiple scripts.

Log and Linear Scale Support :

Many Fibonacci tools are designed for linear scales only, which can distort projections for assets with exponential price movements. By supporting both logarithmic and linear scales, the script caters to a wider range of markets (e.g., stocks, forex, crypto) and user preferences.

Time Pivot Calculations:

Calculating time pivots based on fan intersections and Range interactions is a novel feature. Most TradingView scripts focus on price-based Fibonacci levels, not temporal analysis. This adds a predictive element, helping traders anticipate when significant price action might occur.

Golden Pivot Innovation:

The concept of "Golden Pivots" (0.5 fan intersections across scales) is a unique addition. It leverages the symmetry of the 0.5 level and the differences between log and linear scales to identify high-probability pivot points.

Maximized Plot Capabilities:

TradingView imposes limits on the number of plots (lines, labels, etc.) a script can render. This script is coded to fully utilize these limits, ensuring that all Fibonacci levels, fans, pivots, and labels are plotted without exceeding TradingView’s constraints.

This optimization likely involves efficient use of arrays, loops, and conditional plotting to manage resources while delivering a rich visual output.

User-Friendly Features:

The Bool Fib Right option simplifies fan projection, making the tool intuitive even for users who may not consistently select the Range in the same order.

The script’s flexibility in handling top/bottom Range selection enhances usability.

4. Potential Use Cases

Trend Analysis : Traders can use Fibonacci Fans to identify dynamic support/resistance zones in trending markets.

Reversal Trading: Time pivots and Golden Pivots help pinpoint moments for potential price reversals.

Range Trading : Fibonacci Levels provide key price zones for trading within a defined range.

Cross-Market Application: Log/linear scale support makes the script suitable for stocks, forex, commodities, and cryptocurrencies.

ZI CAPITALZI Capital — Real-Time Signal Provider

This indicator is designed to provide accurate and timely signals based on smart technical analysis and market behavior.

🧠 Features:

✅ Real-time signals (optimized for intraday/swing trading)

📊 Works with any market: Crypto, Forex, Stocks, Indices

🔄 Auto-refresh logic to prevent signal repainting

⚙️ Customizable settings for signal sensitivity & filters

📅 Ideal for scalping, day trading, or position trading

🚀 How to Use:

Wait for a Buy (🟢) or Sell (🔴) label to appear on the chart.

Confirm with volume or trend indicators if needed.

Use proper risk management—this is a signal tool, not a guarantee.

Dynamic Trailing [Dakon]

Overview:

This indicator is a dynamic trend-following tool designed to detect potential shift points in market trends using an adaptive trailing system based on ATR and smoothed filters.

Key Features:

Adaptive trailing stop that responds to price volatility

Detects potential trend reversals by tracking breakout zones

Includes dual RMA lines for broader trend filtering

Customizable sensitivity and ATR period

Visual coloring to distinguish bullish and bearish momentum

Parameters:

Sensitivity: Controls how reactive the trail is to price changes

ATR Period: Defines the length of the ATR calculation for volatility

MA Lines: Two RMA lines for trend context and filtering

Purpose:

This indicator helps identify potential trend phase shifts. It is not a buy/sell signal by itself, but rather a contextual tool to combine with other indicators for more accurate trade decisions.

Trading Value (Volume*Price in Million) by Asharifan v5📊 Trading Value (Price × Volume in Million) by Asharifan v5

This indicator visualizes trading value (Price × Volume) on each bar in millions and compares it to the 20-day and 50-day average values. It's a simple yet powerful tool for spotting changes in market participation and institutional interest.

🔍 What It Shows:

Today’s P×V: Price × Volume in millions, plotted as a colored column.

20-day & 50-day Averages: Smooths recent trading value activity for trend awareness.

🎯 Why Use It:

Trading Value (Price × Volume) can reveal real buying/selling power, especially during breakouts or pullbacks.

Helps differentiate low-value moves from high-conviction moves.

Provides insight into volume quality beyond raw volume bars.

🧠 How to Use:

Look for spikes above average lines → possible institutional activity.

When price breaks key levels with rising P×V → confirmation of strength.

When price rises but P×V is weak → caution, rally might lack support.

📊 TrendTracker Pro by Pinku📊 TrendTracker Pro by Pinku - A Powerful Trend Detection Tool 🚀

TrendTracker Pro by Pinku is a cutting-edge trading indicator designed to help traders identify the market’s trend with precision and clarity. Whether you're a beginner or an experienced trader, this tool simplifies the process of determining whether the market is in an uptrend, downtrend, or sideways.

🔍 Key Features:

Uptrend Detection 🔼: This indicator highlights when the market is moving upwards, signaling a potential buy opportunity.

Downtrend Detection 🔽: Identifies a downtrend in the market, indicating a possible selling opportunity.

Sideways Market ⏸️: The indicator also recognizes when the market is consolidating or moving sideways, allowing you to avoid risky trades during uncertain market conditions.

Customizable Settings: Adjust the Fast EMA and Slow EMA lengths, along with the sideways buffer percentage to fine-tune the trend detection based on your preferred trading strategy.

Table Display: The trend information is displayed in a clear and concise table on your chart, making it easy to track the market's direction at a glance.

Multiple Positions: You can choose where you want to position the trend table on your chart (Top Left, Top Right, Bottom Left, Bottom Right).

📈 How It Works:

The indicator uses a dual EMA strategy to detect market trends. By comparing the Fast EMA (20) and Slow EMA (50), it calculates the trend direction.

A buffer zone is applied to determine sideways market conditions when the difference between the two EMAs is minimal.

The result is a dynamic, easy-to-read trend table that updates in real-time as market conditions change.

💡 Perfect for:

Swing traders who want to capitalize on clear market trends.

Scalpers looking for precise and fast trend signals.

Trend-following traders who rely on moving averages and other technical indicators to make informed trading decisions.

New traders who are still learning how to identify trends and make profitable trades.

Why Use TrendTracker Pro?

In today’s fast-moving market, being able to identify trends quickly and accurately is crucial for success. TrendTracker Pro by Pinku streamlines this process by providing a simple yet powerful trend detection tool that can be used on any chart and time frame.

💥 Get Started Now: Simply add TrendTracker Pro by Pinku to your TradingView chart, adjust the settings according to your preference, and start seeing the market trends in real-time. Let it guide you to make smarter, more informed trading decisions.

Disclaimer:

Trading involves risk. Always do your own research and make decisions based on your risk tolerance and trading strategy.

This indicator does not guarantee profits and should be used as part of a broader risk management strategy.

TREND YILDIZ KKAYHANThis indicator will help you to detect trend reversals. It will make it easier for you to decide at the beginning and end of the trend.

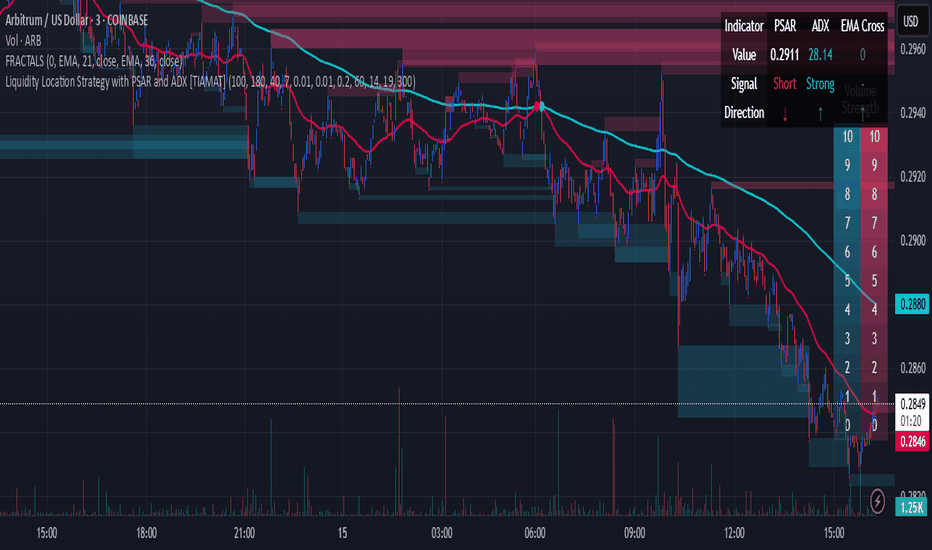

Liquidity Location Strategy with PSAR and ADX [TIAMAT]The script is called "Liquidity Location Strategy with PSAR and ADX ". It combines several technical indicators and concepts:

1. Liquidity zones

2. EMA (Exponential Moving Average) crossovers

3. Parabolic SAR (Stop and Reverse)

4. ADX (Average Directional Index)

### Inputs Section

The script allows users to customize various aspects of the strategy:

1. **Liquidity Zones Configuration**:

- `box_amount`: Number of liquidity zones to display (default 100)

- Colors for support and resistance zones with transparency settings

2. **EMA Configuration**:

- Two EMAs (fast and slow) with customizable periods and colors

- Default values: Fast EMA = 20, Slow EMA = 35

3. **Strategy Settings**:

- Toggle for using EMA crossover signals

- Toggle for using liquidity zones for signals

- Liquidity threshold for signal generation (minimum 7 by default)

4. **PSAR Settings**:

- Toggle for using Parabolic SAR

- Customizable parameters for PSAR (start, increment, maximum)

- Option for different timeframes

5. **ADX Settings**:

- Toggle for using ADX as a filter

- ADX length and threshold

- Option for different timeframes

6. **Backtesting Date Range**:

- Start and end dates for backtesting

### Calculations Section

1. **EMA Calculations**:

- Calculates fast and slow EMAs

- Identifies crossovers and crossunders between the EMAs

2. **Volume Normalization**:

- Normalizes volume data for use in liquidity zone calculations

- Creates a scale from 0-10 for volume strength

3. **Liquidity Zone Detection and Visualization**:

- Identifies potential support and resistance zones based on price action and volume

- Creates boxes to visualize these zones

- Manages box array to ensure not too many are displayed

4. **PSAR Calculations**:

- Implements the Parabolic SAR indicator

- Identifies when PSAR is above or below price (bearish or bullish signals)

5. **ADX Calculations**:

- Implements ADX (Average Directional Index) and its components (+DI and -DI)

- Identifies trend strength and direction

### Strategy Logic

The strategy combines the above indicators to generate trading signals:

1. **Base Signal Generation**:

- Long signals from EMA crossovers (fast crosses above slow)

- Short signals from EMA crossunders (fast crosses below slow)

2. **Signal Filtering**:

- PSAR filter: Long signals require PSAR below price, short signals require PSAR above price

- ADX filter: Long signals require +DI > -DI and ADX > threshold, short signals require -DI > +DI and ADX > threshold

- Liquidity filter: Long signals require strong support, short signals require strong resistance

3. **Trade Execution**:

- Enters long positions on long signals when not already long

- Enters short positions on short signals when not already short

- Closes positions when opposite signals occur

- Only executes trades within the specified date range

4. **Visualization**:

- Plots signals on the chart

- Displays an information table with current indicator values and signals

### Key Trading Logic

The strategy's main trading logic can be summarized as:

```

Long Entry Conditions:

- Fast EMA crosses above Slow EMA (if use_signals is true)

- PSAR is below price (if use_psar is true)

- ADX is above threshold and +DI > -DI (if use_adx is true)

- There's strong support detected (if use_liquidity is true)

- Not already in a long position

- Current time is within backtesting date range

Short Entry Conditions:

- Fast EMA crosses below Slow EMA (if use_signals is true)

- PSAR is above price (if use_psar is true)

- ADX is above threshold and -DI > +DI (if use_adx is true)

- There's strong resistance detected (if use_liquidity is true)

- Not already in a short position

- Current time is within backtesting date range

Exit Conditions:

- Long positions are closed on short signals

- Short positions are closed on long signals

```

### Unique Aspects of this Strategy

1. **Liquidity Zones**:

The strategy identifies "liquidity zones" based on price action and volume. These are areas where there might be significant buy or sell orders that could provide support or resistance. The strength of these zones is determined by normalized volume.

2. **Multiple Confirmation Filters**:

By combining EMA crossovers, PSAR, ADX, and liquidity zones, the strategy uses multiple confirmations before entering trades, which can reduce false signals.

3. **Visualization of Liquidity**:

The script visualizes liquidity zones with color-coded boxes and text indicating the strength of the zone.

4. **Information Dashboard**:

A real-time dashboard shows the current state of all indicators and their signals.

This strategy attempts to identify high-probability trade setups by combining trend-following indicators (EMAs, PSAR, ADX) with volume-based support and resistance zones. The user has significant flexibility to enable/disable different components and adjust parameters to suit their trading style and market conditions.

Likidite Boşlukları ve Likidite AvıAnalyzing key liquidity gaps and identifying potential stop hunt zones based on market structure, order flow, and imbalance areas.

This strategy helps spot where smart money might trap retail traders – turning confusion into sniper entries.

Perfect for scalping and precision trading.

#SmartMoney #LiquidityGrab #StopHunt #Forex #Crypto #PriceAction #SniperEntry

DynamicSupplyandDemandZonesPricesAlgoAlpha DynamicSupplyandDemandZone with Support and Resistance Prices

Weighted Ichimoku StrategyLSE:HSBA

The Ichimoku Kinko Hyo indicator is a comprehensive tool that combines multiple signals to identify market trends and potential buying/selling opportunities. My weighted variant of this strategy attempts to assign specific weights to each signal, allowing for a more nuanced and customizable approach to trend identification. The intent is to try and make a more informed trading decision based on the cumulative strength of various signals.

I've tried not to make it a mishmash of this and that + MACD + RSI and on and on; most people have their preferred indicator that focuses on just that that they can use in conjunction.

The signals used can be grouped into two groups the 'Core Ichimoku Signals' & the 'Additional Signals' (at the end you will find the signals and their assigned weights followed by the thresholds where they align).

The Core Ichimoku Signals are the primary signals used in Ichimoku analysis, including Kumo Breakout, Chikou Cross, Kijun Cross, Tenkan Cross, and Kumo Twist.

While the Additional Signals provide further insights and confirmations, such as Kijun Confirmation, Tenkan-Kijun Above Cloud, Chikou Above Cloud, Price-Kijun Cross, Chikou Span Signal, and Price Positioning.

Entries are triggered when the cumulative weight of bullish signals exceeds a specified buy threshold, indicating a strong uptrend or potential trend reversal.

Exits are initiated when the cumulative weight of bearish signals surpasses a specified sell threshold, or when additional conditions such as consolidation patterns or ATR-based targets are met.

There are various exit types that you can choose between, which can be used separately or in conjunction with one another. As an example you might want to exit on a different condition during consolidation periods than during other periods or just use ATR with some other backstop.

They are listed in evaluation order i.e. ATR trumps all, Consolidation exit trumps the regular Kumo sell and so on:

**ATR Sell**: Exits trades based on ATR-based profit targets and stop-losses.

**Consolidation Exit**: Exits trades during consolidation periods to reduce drawdown.

**Sell Below Kumo**: Exits trades when the price is below the Kumo, indicating a potential downtrend.

**Sell Threshold**: Exits trades when the cumulative weight of bearish signals surpasses a specified sell threshold.

There are various 'filters' which are really behavior modifiers:

**Kumo Breakout Filter**: Requires price to close above the Kumo for buy signals (essentially a entry delay).

**Whipsaw Filter**: Ensures trend strength over specified days to reduce false signals.

**Buy Cooldown**: Prevents new entries until half the Kijun period passes after an exit (prevents flapping).

**Chikou Filter**: Delays exits unless the previous close is below the Chikou Span.

**Consolidation Trend Filter**: Prevents consolidation exits if the trend is bullish (rare, but happens).

Then there are some debugging options. Ichimoku periods have some presets (personally I like 8/22/44/22) but are freely configurable, preset to the traditional values for purists.

The list of signals and most thresholds follow, play around with them. Thats all.

Cheers,

**Core Ichimoku Signals**

**Kumo Breakout**

- 30 (Bullish) / -30 (Bearish)

- Indicates a strong trend when the price breaks above (bullish) or below (bearish) the Kumo (cloud). This signal suggests a significant shift in market sentiment.

**Chikou Cross**

- 20 (Bullish) / -20 (Bearish)

- Shows the relationship between the Chikou Span (lagging span) and the current price. A bullish signal occurs when the Chikou Span is above the price, indicating a potential uptrend. Conversely, a bearish signal occurs when the Chikou Span is below the price, suggesting a downtrend.

**Kijun Cross**

- 15 (Bullish) / -15 (Bearish)

- Signals trend changes when the Tenkan-sen (conversion line) crosses above (bullish) or below (bearish) the Kijun-sen (base line). This crossover is often used to identify potential trend reversals.

**Tenkan Cross**

- 10 (Bullish) / -10 (Bearish)

- Indicates short-term trend changes when the price crosses above (bullish) or below (bearish) the Tenkan-sen. This signal helps identify minor trend shifts within the broader trend.

**Kumo Twist**

- 5 (Bullish) / -5 (Bearish)

- Shows changes in the Kumo's direction, indicating potential trend shifts. A bullish Kumo Twist occurs when Senkou Span A crosses above Senkou Span B, and a bearish twist occurs when Senkou Span A crosses below Senkou Span B.

**Additional Signals**

**Kijun Confirmation**

- 8 (Bullish) / -8 (Bearish)

- Confirms the trend based on the price's position relative to the Kijun-sen. A bullish signal occurs when the price is above the Kijun-sen, and a bearish signal occurs when the price is below it.

**Tenkan-Kijun Above Cloud**

- 5 (Bullish) / -5 (Bearish)

- Indicates a strong bullish trend when both the Tenkan-sen and Kijun-sen are above the Kumo. Conversely, a bearish signal occurs when both lines are below the Kumo.

**Chikou Above Cloud**

- 5 (Bullish) / -5 (Bearish)

- Shows the Chikou Span's position relative to the Kumo, indicating trend strength. A bullish signal occurs when the Chikou Span is above the Kumo, and a bearish signal occurs when it is below.

**Price-Kijun Cross**

- 2 (Bullish) / -2 (Bearish)

- Signals short-term trend changes when the price crosses above (bullish) or below (bearish) the Kijun-sen. This signal is similar to the Kijun Cross but focuses on the price's direct interaction with the Kijun-sen.

**Chikou Span Signal**

- 10 (Bullish) / -10 (Bearish)

- Indicates the trend based on the Chikou Span's position relative to past price highs and lows. A bullish signal occurs when the Chikou Span is above the highest high of the past period, and a bearish signal occurs when it is below the lowest low.

**Price Positioning**

- 10 (Bullish) / -10 (Bearish)

- Shows indecision when the price is between the Tenkan-sen and Kijun-sen, indicating a potential consolidation phase. A bullish signal occurs when the price is above both lines, and a bearish signal occurs when the price is below both lines.

**Confidence Level**: Highly Sensitive

- **Buy Threshold**: 50

- **Sell Threshold**: -50

- **Notes / Significance**: ~2–3 signals, very early trend detection. High sensitivity, may capture noise and false signals.

**Confidence Level**: Entry-Level

- **Buy Threshold**: 58

- **Sell Threshold**: -58

- **Notes / Significance**: ~3–4 signals, often Chikou Cross or Kumo Breakout. Very sensitive, risks noise (e.g., false buys in choppy markets).

**Confidence Level**: Entry-Level

- **Buy Threshold**: 60

- **Sell Threshold**: -60

- **Notes / Significance**: ~3–4 signals, Kumo Breakout or Chikou Cross anchors. Entry point for early trends.

**Confidence Level**: Moderate

- **Buy Threshold**: 65

- **Sell Threshold**: -65

- **Notes / Significance**: ~4–5 signals, balances sensitivity and reliability. Suitable for moderate risk tolerance.

**Confidence Level**: Conservative

- **Buy Threshold**: 70

- **Sell Threshold**: -70

- **Notes / Significance**: ~4–5 signals, emphasizes stronger confirmations. Reduces false signals but may miss some opportunities.

**Confidence Level**: Very Conservative

- **Buy Threshold**: 75

- **Sell Threshold**: -75

- **Notes / Significance**: ~5–6 signals, prioritizes high confidence. Minimizes risk but may enter trades late.

**Confidence Level**: High Confidence

- **Buy Threshold**: 80

- **Sell Threshold**: -80

- **Notes / Significance**: ~6–7 signals, very strong confirmations needed. Suitable for cautious traders.

**Confidence Level**: Very High Confidence

- **Buy Threshold**: 85

- **Sell Threshold**: -85

- **Notes / Significance**: ~7–8 signals, extremely high confidence required. Minimizes false signals significantly.

**Confidence Level**: Maximum Confidence

- **Buy Threshold**: 90

- **Sell Threshold**: -90

- **Notes / Significance**: ~8–9 signals, maximum confidence level. Ensures trades are highly reliable but may result in fewer trades.

**Confidence Level**: Ultra Conservative

- **Buy Threshold**: 100

- **Sell Threshold**: -100

- **Notes / Significance**: ~9–10 signals, ultra-high confidence. Trades are extremely reliable but opportunities are rare.

**Confidence Level**: Extreme Confidence

- **Buy Threshold**: 110

- **Sell Threshold**: -110

- **Notes / Significance**: All signals align, extreme confidence. Trades are almost certain but very few opportunities.

Stochastic with EMA + BOS FOR XAUUSD 5MThis indicator combines multi-timeframe Stochastic signals (from M1, M5, M15, M30) with an EMA-based trend filter on M1 to generate bullish and bearish signals. It applies dynamic Stochastic thresholds depending on the M1 EMA trend (fast vs. slow), so the trigger levels for oversold/overbought conditions adjust according to recent market bias. Additionally, it blocks signals if price is too close to the 4H (or ~24H on a 5-minute chart) high or low, helping to avoid entries at potential extremes.

A simple Break of Structure (BOS) check tracks if a bullish or bearish break happened within the last few hours. Signals become stricter if a recent BOS favors the opposite side. The script also looks at the current 3-hour range to classify swing levels as low, medium, or high. Each valid signal is plotted (triangle on the chart) and tied to an alert condition that includes the swing classification. This makes it easier to spot potential high-conviction setups versus more conservative or lower-volatility ones.

Beware NEWS!

4 EMAs with Entry and Exit Strategy🔍 Purpose of the Script:

This strategy is designed to identify bullish trends using a combination of Exponential Moving Averages (EMAs) and the Relative Strength Index (RSI), and execute long entries and exits accordingly.

📈 Key Technical Indicators Used:

EMAs (Exponential Moving Averages):

ema9, ema21, ema63, and ema200 are calculated to determine short-, mid-, and long-term trends.

An unused ema126 is mentioned but commented out.

RSI (Relative Strength Index):

A 14-period RSI is calculated and used to avoid entries when the stock is overbought.

🟢 Entry Logic (Long):

The strategy enters a long position when:

A bullish trend is confirmed by EMA alignment:

ema9 > ema21 > ema63 > ema200

The closing price is above ema9

RSI is ≤ 60, to avoid entering overbought conditions

🔴 Exit Logic (Long Exit):

The strategy exits a long position when:

ema21 crosses below ema63 (bearish signal)

There are commented-out conditions like:

RSI > 80 (overbought)

Close > 1.4 × ema126 (price extended far above average)

🎨 Visualization:

EMAs are plotted in different colors for trend visibility.

Background color turns:

Light green in bullish trend

Light red in bearish trend

⚙️ Strategy Configuration:

Capital: ₹10,00,000

Position size: 10% of equity

Commission: 0.75% per trade (roundtrip)

Overlay: true (indicators and trades plotted on price chart)

✅ Highlights:

Clear trend detection with layered EMA logic

Avoids overbought entries using RSI ≤ 60

Customizable and extendable (e.g., you can uncomment EMA126 and add price-overextension logic)

VolumePrice Intensity AnalyzerVolumePrice Intensity Analyzer

The VolumePrice Intensity Analyzer is a Pine Script v6 indicator designed to measure market activity intensity through the trading value (Price * Volume, scaled to millions). It helps traders identify significant volume-price interactions, track trends, and gauge momentum by combining volume analysis with trend-following tools.

Features:

Volume-Based Analysis: Calculates Price * Volume in millions to highlight market activity levels.

Trend Identification: Plots 20-day and 50-day SMAs of the trading value to smooth fluctuations and reveal sustained trends.

Relative Strength: Displays the ratio of daily Price * Volume to the long-term SMA in a separate pane, helping traders assess activity intensity relative to historical averages.

Real-Time Metrics: A table shows the current Price * Volume and its ratio to the long SMA, updated continuously with bold text formatting (v6 feature).

Alerts: Triggers notifications for high trading values (when Price * Volume exceeds 1.5x the long SMA) and SMA crossovers (short SMA crossing above long SMA).

Visual Cues: Uses dynamic bar colors (teal for bullish, gray for bearish) and background highlights to mark significant market activity.

Customizable Inputs: Adjust SMA periods, scaling factor, and alert threshold via the settings panel, with tooltips for clarity (v6 feature).

Originality:

Unlike basic volume indicators, this tool combines Price * Volume with trend analysis (SMAs), relative strength (ratio plot), and actionable alerts. The real-time table and visual highlights provide a unique, at-a-glance view of market intensity, making it a valuable addition for volume and trend-focused traders.

Calculations:

Trading Value (P*V): (Close * Volume) * Scale Factor (default scale factor of 1e-6 converts to millions).

SMAs: 20-day and 50-day Simple Moving Averages of the trading value to identify short- and long-term trends.

Ratio: Daily Price * Volume divided by the 50-day SMA, plotted in a separate pane to show relative activity strength.

Bar Colors: Teal (RGB: 0, 132, 141) for bullish bars (close > open or close > previous close), gray for bearish or neutral bars.

Background Highlight: Light yellow (hex: #ffcb3b, 81% transparency) when Price * Volume exceeds the long SMA by the alert threshold.

Plotted Elements:

Short SMA P*V (M): Red line, 20-day SMA of Price*Volume in millions.

Long SMA P*V (M): Blue line, 50-day SMA of Price*Volume in millions.

Today P*V (M): Columns, daily Price*Volume in millions (teal/gray based on price action).

Daily V*P/Longer Term Average: Purple line in a separate pane, ratio of daily Price * Volume to the 50-day SMA.

Usage:

Spot High Activity: Look for Price * Volume columns exceeding the SMAs or spikes in the ratio plot to identify significant market moves.

Confirm Trends: Use SMA crossovers (e.g., short SMA crossing above long SMA) as bullish trend signals, or vice versa for bearish trends.

Monitor Intensity: The table provides real-time Price * Volume and ratio values, while background highlights signal high activity periods.

Versatility: Suitable for stocks, forex, crypto, or any market with volume data, across various timeframes.

How to Use:

Add the indicator to your chart.

Adjust inputs (SMA periods, scale factor, alert threshold) via the settings panel to match your trading style.

Watch for alerts, check the table for real-time metrics, and observe the ratio plot for relative strength signals.

Use the background highlights and bar colors to quickly spot significant market activity and price action.

This indicator leverages Pine Script v6 features like lazy evaluation for performance and advanced text formatting for better visuals, making it a powerful tool for traders focusing on volume, trends, and momentum.

Banesoul Auto SR Levels v4 - Clean🔹 Banesoul Auto SR Levels v4 🔹

This is a smarter, optimized version of the classic support/resistance indicator — now built with precision swing detection and zone strength logic.

✨ Key Features:

• Auto-detection of swing highs/lows using adjustable strength

• Dynamic zone padding based on price scale

• Real-time zone clustering with age-based opacity

• Touch count labels for each zone ("R 3" = Resistance touched 3x)

• Intraday-friendly and zoom-aware performance logic

• Minimalist visuals - red for resistance, green for support

🧠 Made for scalpers, swing traders, and SR-level lovers.

Built by Banesoul 🐉 — powered by logic, crafted with patience.

Banesoul v5: Zone Master🔥 Banesoul v5: Zone Master

This is the ultimate upgrade to my previous support/resistance tools — combining everything into a clean, optimized beast.

💡 Features:

✅ Auto Support/Resistance Zones

Swing high/low detection with adjustable strength

Clusters nearby zones to reduce noise

Adaptive padding & transparency (older = fainter)

Only plots strongest recent levels (optional touch-count filtering)

✅ Viewport Optimization

Only calculates zones visible on your current screen

Ultra-fast rendering for all timeframes

Optionally adjusts based on zoom

✅ Dynamic Trend Overlay

Custom-built SMMA trend lines: 21, 50, 100, 200

EMA(2) fill shows trend pressure (green/red cloud)

Clean visuals, optimized for both dark & light modes

✅ Modern Performance-Ready Architecture

Version 5 rewrite (v5 Pine Script)

Uses real-time zone refreshing

Auto clears old boxes, redraws on chart shift

🔧 Settings Include:

Swing Strength

Lookback Period

Max Zones

Show/Hide Trend Fill

Show/Hide SMMA lines

Opacity & Padding for Zones

🧠 Use it for:

Finding real supply/demand reaction zones

Detecting trending vs ranging price behavior

Pairing with your strategy/indicators for sniper entries

🔗 Credits & Notes:

Big thanks to everyone testing this — and Kai for keeping me from burning out 😂

Next update will bring session-based filtering + zone strength labels (stay tuned!)

Dskyz (DAFE) Aurora Divergence - Dskyz (DAFE) Aurora Divergence Indicator

Advanced Divergence Detection for Traders. Unleash the power of divergence trading with this cutting-edge indicator that combines price and volume analysis to spot high-probability reversal signals.

🧠 What Is It?

The Dskyz (DAFE) Aurora Divergence Indicator is designed to identify bullish and bearish divergences between the price trend and the On Balance Volume (OBV) trend. Divergence occurs when the price of an asset and a technical indicator (in this case, OBV) move in opposite directions, signaling a potential reversal. This indicator uses linear regression slopes to calculate the trends of both price and OBV over a specified lookback period, detecting when these two metrics are diverging. When a divergence is detected, it highlights potential reversal points with visually striking aurora bands, orbs, and labels, making it easy for traders to spot key signals.

⚙️ Inputs & How to Use Them

The indicator is highly customizable, with inputs grouped under "⚡ DAFE Aurora Settings" for clarity. Here’s how each input works:

Lookback Period: Determines how many bars are used to calculate the price and OBV slopes. Higher values detect longer-term trends (e.g., 20 for 1H charts), while lower values are more responsive to short-term movements.

Price Slope Threshold: Sets the minimum slope value for the price to be considered in an uptrend or downtrend. A value of 0 allows all slopes to be considered, while higher values filter for stronger trends.

OBV Slope Threshold: Similar to the price slope threshold but for OBV. Helps filter out weak volume trends.

Aurora Band Width: Adjusts the width of the visual bands that highlight divergence areas. Wider bands make the indicator more visible but may clutter the chart.

Divergence Sensitivity: Scales the strength of the divergence signals. Higher values make the indicator more sensitive to smaller divergences.

Minimum Strength: Filters out weak signals by only showing divergences above this strength level. A default of 0.3 is recommended for beginners.

Signal Cooldown (Bars): Prevents multiple signals from appearing too close together. Default is 5 bars, reducing chart clutter and helping traders focus on significant signals.

These inputs allow traders to fine-tune the indicator to match their trading style and timeframe.

🚀 What Makes It Unique?

This indicator stands out with its innovative features:

Price-Volume Divergence: Combines price trend (slope) and OBV trend for more reliable signals than price-only divergences.

Aurora Bands: Dynamic visual bands that highlight divergence zones, making it easier to spot potential reversals at a glance.

Interactive Dashboard: Displays real-time information on trend direction, volume flow, signal type, strength, and recommended actions (e.g., "Consider Buying" or "Consider Selling").

Signal Cooldown: Ensures only the most significant divergences are shown, reducing noise and improving usability.

Alerts: Built-in alerts for both bullish and bearish divergences, allowing traders to stay informed even when not actively monitoring the chart.

Beginner Guide: Explains the indicator’s visuals (e.g., aqua orbs for bullish signals, fuchsia orbs for bearish signals), making it accessible for new users.

🎯 Why It Works

The indicator’s effectiveness lies in its use of price-volume divergence, a well-established concept in technical analysis. When the price trend and OBV trend diverge, it often signals a potential reversal because the underlying volume support (or lack thereof) is not aligning with the price action. For example:

Bullish Divergence: Occurs when the price is making lower lows, but the OBV is making higher lows, indicating weakening selling pressure and potential upward reversal.

Bearish Divergence: Occurs when the price is making higher highs, but the OBV is making lower highs, suggesting weakening buying pressure and potential downward reversal.

The use of linear regression ensures smooth and accurate trend calculations over the specified lookback period. The divergence strength is then normalized and filtered based on user-defined thresholds, ensuring only high-quality signals are displayed. Additionally, the cooldown period prevents signal overload, allowing traders to focus on the most significant opportunities.

🧬 Indicator Recommendation

Best For: Traders looking to identify potential trend reversals in any market, especially those where volume data is reliable (e.g., stocks, futures, forex).

Timeframes: Suitable for all timeframes. Adjust the lookback period accordingly—smaller values for shorter timeframes (e.g., 1H), larger for longer ones (e.g., 4H or daily).

Pair With: Support and resistance levels, trend lines, other oscillators (e.g., RSI, MACD) for confirmation, and volume profile tools for deeper analysis.

Tips:

Look for divergences at key support/resistance levels for higher-probability setups.

Pay attention to signal strength; higher strength divergences are often more reliable.

Use the dashboard to quickly assess market conditions before entering a trade.

Set up alerts to catch divergences even when not actively watching the chart.

🧾 Credit & Acknowledgement

This indicator builds upon the classic concept of price-volume divergence, enhancing it with modern visualization techniques, advanced filtering, and user-friendly features. It is designed to provide traders with a powerful yet intuitive tool for spotting reversals.

📌 Final Thoughts

The Dskyz (DAFE) Aurora Divergence Indicator is more than just a divergence tool; it’s a comprehensive trading assistant that combines advanced calculations, intuitive visualizations, and actionable insights. Whether you’re a seasoned trader or just starting out, this indicator can help you spot high-probability reversal points with confidence.

Use it with discipline. Use it with clarity. Trade smarter.

**I will continue to release incredible strategies and indicators until I turn this into a brand or until someone offers me a contract.

-Dskyz

EMA + RSI Divergence Signal with Entry (Stable Version)EMA + RSI Divergence Signal with Entry (Stable Version)

This is a custom indicator that combines RSI divergence detection with EMA-based trend confirmation, designed to reduce noise and provide accurate entry signals. Suitable for both trend continuation and short-term reversal strategies, especially effective on M15 and H1 timeframes.

🔍 Key Features:

Automatically detects Regular and Hidden RSI divergences.

Confirms signal only when price closes above/below EMA 34 & 89 in the signal direction.

Visually displays Buy/Sell signals on chart.

Built-in entry alerts.

Adjustable EMA and RSI settings for customization.

🛠 How to Use:

Buy entry: Bullish RSI divergence + price closes above EMA 34 & 89.

Sell entry: Bearish RSI divergence + price closes below EMA 34 & 89.

Prefer entries near support/resistance zones or after a breakout from consolidation.

Combine with strong candlestick confirmations (Engulfing, Pin Bar, Marubozu, etc.).

⚠️ Common False Signals & How to Avoid Them:

False signals may occur when:

RSI divergence appears but price hasn't broken EMA.

Divergence goes against major trend direction.

Signals appear too frequently in ranging market.

No strong confirming candle or volume support.

To improve accuracy:

Only take trades when all conditions align: RSI divergence + price breaks EMA 34/89 + strong confirming candle + signal appears near S/R or after consolidation.

Favor trend-following trades in alignment with higher timeframe EMA direction.

Combine with: candlestick patterns, volume indicators (OBV, spikes), and price structure (HH–HL / LH–LL).

Optionally use momentum filters like ADX > 20 or EMA cross confirmation.