Stochastic RSI w/ Crossover Alerts (by WJ)NOTE:

// STOCH RSI CODE TAKEN FROM DEFAULT INDICATOR

// I HAVE ONLY MADE SOME ADJUSTMENTS FOR VISUAL AID

// I MADE THIS FOR MY OWN USE BUT HAVE DECIDED TO PUBLISH AND SHARE IN CASE ANYBODY WANTS TO USE IT

This is the normal default built-in Stochastic RSI indicator which I have added some stuff for visual aid:

Added middle line (50)

Stoch RSI background turns green when K line crosses D line UPWARDS, K line is below the 50 level, and price is above 200 EMA

Stoch RSI background turns red when K line crosses D line DOWNWARDS, K line is above the 50 level, and price is below 200 EMA

Alert notification on the crossover candle with background colour change conditions met

Стохастический осциллятор

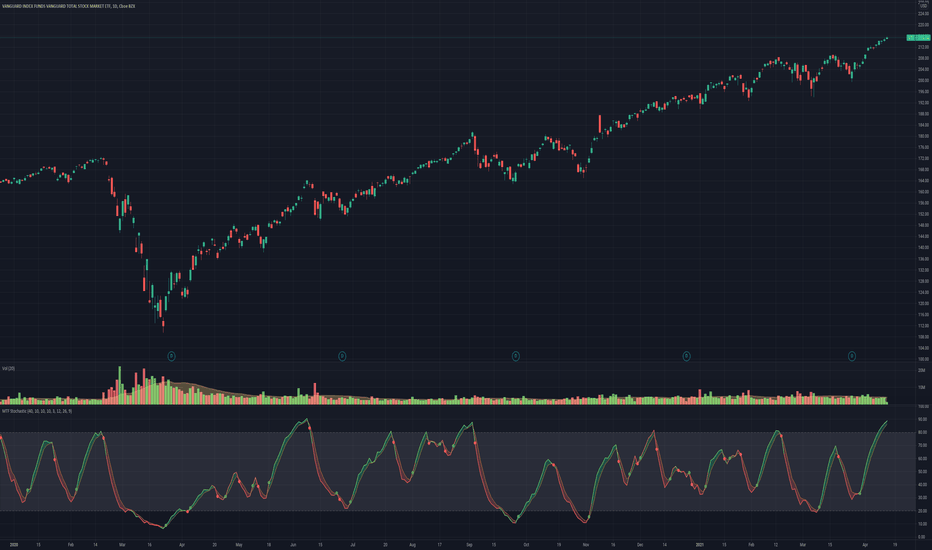

[GJ]IFRSITHE INVERSE FISHER TRANSFORM STOCH RSI

HOW IT WORKS

This indicator uses the inverse fisher transform on the stoch RSI for clear buying and selling signals. The stoch rsi is used to limit it in the range of 0 and 100. We subtract 50 from this to get it into the range of -50 to +50 and multiply by .1 to get it in the range of -5 to +5. We then use the 9 period weighted MA to remove some "random" trade signals before we finally use the inverse fisher transform to get the output between -1 and +1

HOW TO USE

Buy when the indicator crosses over –0.5 or crosses over +0.5 if it has not previously crossed over –0.5.

Sell when the indicator crosses under +0.5 or crosses under –0.5 if it has not previously crossed under +0.5.

We can see multiple examples of good buy and sell signals from this indicator on the attached chart for QCOM. Let me know if you have any suggestions or thoughts!

Stochastic RVIBased on the Stochastic RSI but uses RVI (Relative Volatility Index) as source. Another great tool for finding market lows and entry points. This oscillator is also good for finding accurate diversions.

(JS) Triple StochasticSo I ended up adding a ton of stuff to my prior Double Stochastic script which you can see here .

The concept of the Double was to smooth out the existing Stochastic by applying a Stochastic to the existing Stochastic (hence the Double). My concept for the Triple Stochastic is much different. It combines a regular stochastic, stochastic RSI, and the double stochastic to get a smoothed output based on all 3.

Also - since I love being able to see a Squeeze (see my Squeeze Pro indicators - Squeeze Pro 2 & Squeeze Pro Overlays ) I added the Squeeze to the Stochastic (the dots). If you're unfamiliar with how a Squeeze works, or what it is, check out my links for explanation. A quick explanation however is that the Squeeze is an indicator that was invented by John Carter that detects price compression before a big move out of a range. This is done by using Bollinger Bands and Keltner Channels, the BB shrink inside the KC. The color of the dots represent the depth of the BB in the KC, white (or black) being the lightest squeeze, red being the standard squeeze, and yellow being the strongest squeeze. Now on to the indicator:

The first thing you'll notice is the options available for the type of Stochastic you'd like to use:

Standard : This is a regular Stochastic

Stochastic RSI : This is the standard Stochastic RSI

Double : This is the Stochastic on top of a Stochastic from the prior version

Triple : This is simply an average of all 3 of the above combined together

(Top indicator shows the Triple Stochastic)

The options "K", "D", and "Smooth" are the settings from a regular Stochastic used to set up the type of Stochastic you choose to use.

Now let's say you're not sure how one type performs compared to another, or you like the quickest momentum change but also like to see the smoothest trend, or you want to use the same types of Stochastic and watch for them to cross like moving averages - for these reasons I added the ability to add a second Stochastic for comparison.

(2nd indicator shows a fast and slow Triple Stochastic together)

Quite obviously, the "K 2", "D 2", and "Smooth 2" are what is used in order to set the parameters for the second Stochastic.

Now another thing I added was the option to replace the regular Stochastic and instead look at the distance between the K and D. By turning off "Use K% and D%" you get to see this in action. To put it simply, a cross above zero would indicate a positive Stochastic crossover, and a cross below zero would represent the opposite. There's also an option titled "SMA Length using Difference" which, to smooth this out a bit, allows you to apply a moving average to the distance. By setting it at 1 you'd see the actual distance between K and D.

(3rd indicator shows the K and D distance used as a plot)

Another thing I wanted to do was add a different type of background that wasn't based on the indicator itself. I decided to use ADX & DMI which is a great way to determine the trend. When you select "ADX/DMI BG" the BG colors will change from being based on the indicator to being based on ADX and DMI.

(The 3rd indicator also shows the ADX/DMI BG being used).

And now finally the last feature I decided to add takes us back to the Squeeze. Essentially it is just the Stochastic shown through the lens of Squeeze momentum, as I ended up plugging the Stochastic output into the Squeeze momentum formula to create an oscillator. By selecting "Use Oscillator" you will see this in action as well.

(Bottom indicator shows the oscillator addition)

Stochastic(4,3,2) Spread By Rajv1: This indicator plots a spread of %K - %D of the stochastic(4,3,2).

STOCHASTIC+Stochastic Oscillators are used to determine Overbought and Oversold Market conditions. This Stoch is set to a quicker Length then normal with an RSI that changes color depending on Momentum. When RSI is Overbought you well get a red shadow to indicate the market is setting up for a sell. When the RSI is Oversold you will get a green shadow to indicate the market is setting up for a buy

FUERSTUses Normalized Price Oscillator and Stochastics and combines them as an ADX weighted measure.

During low trend intensity Stochastics gets higher weighted than Price Oscillator, and vice-versa in times of high trend-intensity.

Stochastic Structure AnalyzerA momentum indicator that uses the highest and lowest values for price in three different lookback lengths to find the performance relative to three timeframes.

- Stochastic can be used for buy and sell signals as usual.

- The bars at the back represent the stochastic value of the OBV based structure calculation.

- The color of the stochastic line is a preliminary indicator of an up move.

- The fill color between the stochastic lines indicate the trend strength,

How to use: I suggest combining this with a higher timeframe to buy when the both stochastics are crossing below 20 line. And sell when one of the stochastics crosses-down.

This is the stochastic version of the structure analyzer().

Upgraded Stochastic by YenJust an enhanced version of stochastic which added with special symbol whenever K and D line crossing up or down.

Background color is green whenever K line is above middle level 50 and red when below middle level 50.

You may also turn on the histogram in settings.

EL Fly Candle (spinning top) by Epullemanhighlight spinning top candle with alerted volume > vol sma 20 and stoch above 50

Stoch DMIStochastics applied to adjusted ADX to represent the trend direction. DM based sub-indicators added to hint the momentum and changes in the ADX.

MTF ComboMiddle stochastic is the HTF stochastic of price. The color coding indicates the trend in even higher timeframe.

- The graph on top is the stochastic of ATR (with HTF and current one with RSI and macd histogram).

- The green graph at the bottom is the stochastic of the OBV (with HTF and current one with RSI and macd histogram).

- Purple histogram and area underneath the mid-stochsatic are the macd histogram and the stochastic RSI.

- The dots in the middle are determined by the combined score of all

Stochastic ATR IIStochastic ATR(Higher timeframe)

- stochastic of macd of ATR.

- stochastic rsi of ATR

Stochastic OBV IIUses OBV to plot a stochastic graph. Incorporates the macd of obv and plots a stochastic of this macd. Additionally stochastic rsi of OBV is plotted in histograms.

The stochastic OBV is in the higher timeframe(current time frame * 4).

Stochastic MTF IICombines Stochastics, RSI and MACD Histogram to give a complete picture of the momentum.

The main two lines are stochastics from the higher time frame(current time frame* 4).

The red columns are stochastic of macd histogram.

The green histogram is the stochastic rsi of price.

The dots at 50 line is the correlation between price and macd+rsi combo.

Dull Volume by EpullemanDull volume indicator with Stochastic oscillator

Blue = Dull

Red = Super Dull

helps to determine low volume movement on oversold

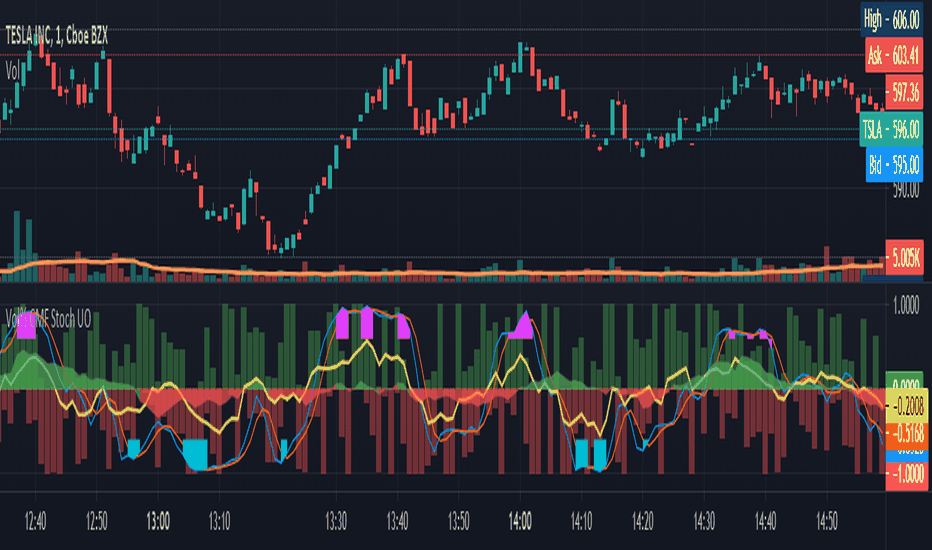

Vol Buy/Sell %s, CMF, and Stocahstic Osc & UOPlots % Buy / Sell Volume , Chaikin Money Flow , Stochastic Oscillator, and Ultimate Oscillator on same axis, bound -1 to 1.

Show Volume Percentage, displaying buying as green and positive, selling as red and negative.

Showing the CMF, with green / red fill for positive / negative values.

Modified Stochastic Oscillator, converting bounds to -1 and 1, moving overbought/sold to -0.6 and 0.6, accordingly. Green fill (buy signal) with %D below -0.6 and %K lower than %D. Red fill (sell signal) with %D above 0.6 and %K higher than %D. Fill is between %D and bound, to be more visible.

Modified Ultimate Oscillator, converting bounds to -1 and 1, moving overbought/sold to -0.6 and 0.6, accordingly.

Stochastic with MACD filter + SL/TP + AlertsLong Arrow : close of the candle is above ema + Stochastic is oversold + MACD is below 0 + Stochastic cross up

Short Arrow : close of candle is below ema + Stochastic is overbought + MACD is above 0 + Stochastic cross down

Also added SL, 1:1 and TP where SL can be varied by ATR value and TP is set to 2:1 RR but it can be varied too.

It is not meant to take every single trade even though that might already be profitable.

For higher winrate look for the higher timeframe trend for example when trading the 15min look if the Daily 8ema is going up or down.

Also only take trades when there is either a hidden divergence on RSI or a smaller normal divergence.

The I take the normal divergenes alo when there is no higher high like an M or lower low for longs like a W these tend to work out pretty good too.

Alerts are in it too.

Have Fun :)

Uber Stochastic Index v2 + HistogramRealized how useful a histogram could be for a Stochastic, so I added it to my Uber Stochastic. It actually has two histograms - one on the primary stochastic, and one on a stochastic of the stochastic. So you can histogram while you histogram and stoch while you stoch.

The second stoch is actually really useful sometimes as a early warning but can get ugly on some settings. The histograms are also quite fast on fast settings.

What separates the Uber from the standard stoch? Well, you get 7 K stochastics, technically, to weigh together into one. Looks like one, but I assure you its 7 complete stochastics. You can have a long term stochastic with short term influence or a short term with long term influence, or have one thats all-encompassing.

Why histograms? Stochastic is already read similar to MACD, with crossover signals derived from two lines reflected in one another, one slower then the other. It just makes sense. This way, with a slower running histogram, you can more readily "see" it close in. After all, the best trades are rarely made when the stochastic crosses, but rather as it approaches crossing.

I included a lot of settings for max tweaking. The histograms seem to shift in size considerably depending how you have it set, hence the resolution settings for each. I actually recommend setting the 2nd histogram to inverted resolution, that way you can see them more clearly, but you will also see them on both sides of 0.

And yes, I offset the stochastic so the histogram would look right.

"Wealth beyond measure, Outlander" -Unknown Dunmer

Stochastic 90 30 30This is a modified version of the KD indicator, in which %K is sma30 of 90-bar stochastic and %D is sma30 of %K. Instead of using %K as sma3 of 14- or 9-bar stochastic and %D as sma3 of %K, this modification reduces the sensitivity of the indicator, providing a better trading signal for a longer trading timeframe. The indicator also provides an entry signal when %K < 50 and %K crossovers %D.

The indicator provides the best signal when using together with the turbulence indicator.

Medium Term Weighted Stochastic (STPMT) by DGTLa Stochastique Pondérée Moyen Terme (STPMT) , or Mᴇᴅɪᴜᴍ Tᴇʀᴍ Wᴇɪɢʜᴛᴇᴅ Sᴛᴏᴄʜᴀꜱᴛɪᴄꜱ created by Eric Lefort in 1999, a French trader and author of trading books

█ The STPMT indicator is a tool which concerns itself with both the direction and the timing of the market. The STPMT indicator helps the trader with:

The general trend by observing the level around which the indicator oscillates

The changes of direction in the market

The timing to open or close a position by observing the oscillations and by observing the relative position of the STPMT versus its moving average

STPMT Calculation

stpmt = (4,1 * stoch(5, 3) + 2,5 * stoch(14, 3) + stoch(45, 14) + 4 * stoch(75, 20)) / 11.6

Where the first argument of the stoch function representation above is period (length) of K and second argument smoothing period of K. The result series is then plotted as red line and its moving average as blue line. By default disabled gray lines are the components of the STPMT

The oscillations of the STPMT around its moving average define the timing to open a position as crossing of STMP line and moving average line in case when both trends have same direction. The moving average determines the direction.

Long examples

█ Tʜᴇ CYCLE Iɴᴅɪᴄᴀᴛᴏʀ is derived from the STPMT. It is

cycle = stpmt – stpmt moving average

It is indicates more clearly all buy and sell opportunities. On the other hand it does not give any information on market direction. The Cycle indicator is a great help in timing as it allows the trader to more easily see the median length of an oscillation around the average point. In this way the traders can simply use the time axis to identify both a favorable price and a favorable moment. The Cycle Indicator is presented as histogram

The Lefort indicators are not a trading strategy. They are tools for different purposes which can be combined and which can serve for trading all instruments (stocks, market indices, forex, commodities…) in a variety of time frames. Hence they can be used for both day trading and swing trading.

👉 For whom that would like simple version of the Cycle indicator on top of the main price chart with signals as presented below.

Please note that in the following code STMP moving average direction is not considered and will plot signals regardless of the direction of STMP moving average. It is not a non-repainting version too.

here is pine code for the overlay version

// © dgtrd

//@version=4

study("Medium Term Weighted Stochastic (STPMT) by DGT", "STPMT ʙʏ DGT ☼☾", true, format.price, 2, resolution="")

i_maLen = input(9 , "Stoch MA Length", minval=1)

i_periodK1 = input(5 , "K1" , minval=1)

i_smoothK1 = input(3 , "Smooth K1", minval=1)

i_weightK1 = input(4.1 , "Weight K1", minval=1, step=.1)

i_periodK2 = input(14 , "K2" , minval=1)

i_smoothK2 = input(3 , "Smooth K2", minval=1)

i_weightK2 = input(2.5 , "Weight K2", minval=1, step=.1)

i_periodK3 = input(45 , "K3" , minval=1)

i_smoothK3 = input(14 , "Smooth K3", minval=1)

i_weightK3 = input(1. , "Weight K3", minval=1, step=.1)

i_periodK4 = input(75 , "K4" , minval=1)

i_smoothK4 = input(20 , "Smooth K4", minval=1)

i_weightK4 = input(4. , "Weight K4", minval=1, step=.1)

i_data = input(false, "Components of the STPMT")

//------------------------------------------------------------------------------

// stochastic function

f_stoch(_periodK, _smoothK) => sma(stoch(close, high, low, _periodK), _smoothK)

//------------------------------------------------------------------------------

// calculations

// La Stochastique Pondérée Moyen Terme (STPMT) or Medium Term Weighted Stochastics calculation

stpmt = (i_weightK1 * f_stoch(i_periodK1, i_smoothK1) + i_weightK2 * f_stoch(i_periodK2, i_smoothK2) + i_weightK3 * f_stoch(i_periodK3, i_smoothK3) + i_weightK4 * f_stoch(i_periodK4, i_smoothK4)) / (i_weightK1 + i_weightK2 + i_weightK3 + i_weightK4)

stpmt_ma = sma(stpmt, i_maLen) // STPMT Moving Average

cycle = stpmt - stpmt_ma // Cycle Indicator

//------------------------------------------------------------------------------

// plotting

plotarrow(change(sign(cycle)), "STPMT Signals", color.green, color.red, 0, maxheight=41)

alertcondition(cross(cycle, 0), title="Trading Opportunity", message="STPMT Cycle : Probable Trade Opportunity {{exchange}}:{{ticker}}-> Price = {{close}}, Time = {{time}}")