Fibonacci StochasticMy attempt to smooth out the classic Stochastic indicator based on Fibonacci levels - 0.236, 0.382, 0.5, 0.618, 0.786

Includes optional "Smoothed Moving Average" (SMMA), SMA and EMA.

This is an interesting experiment, comments would be helpful to improve this indicator.

Стохастический осциллятор

TKP McClellan Summation Index Stochastics StrategyThis strategy uses NYSE McClellan summation Index as an input for Stochastics to produce Buy/Sell signals. Buy signal is produced when Stochastics K Line Closes over 50, and Sell signal when closes under 50.

Info on McClellan Summation Index: www.investopedia.com

Info on Stochastics: www.investopedia.com

Simple yet effective strategy, let me know if you have any questions!

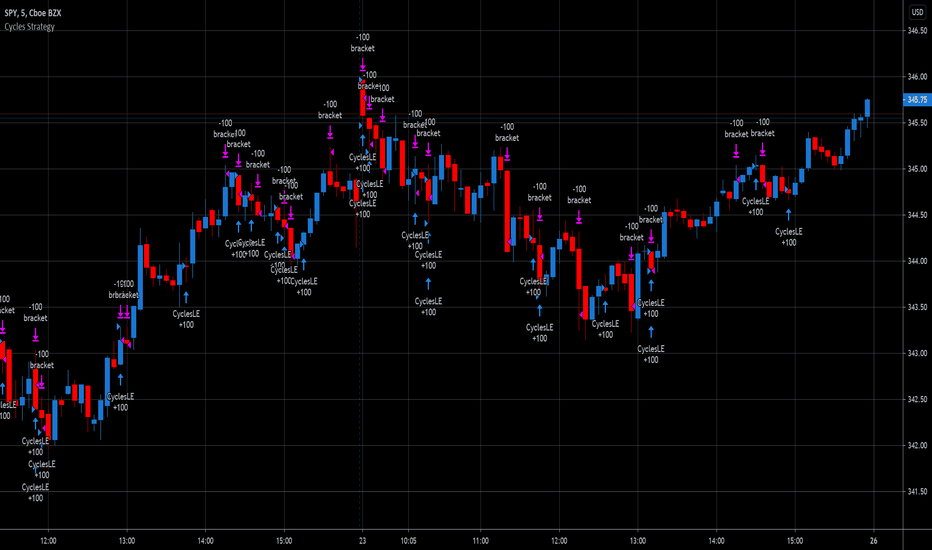

Cycles StrategyThis is back-testable strategy is a modified version of the Stochastic strategy. It is meant to accompany the modified Stochastic indicator: "Cycles".

Modifications to the Stochastic strategy include;

1. Programmable settings for the Stochastic Periods (%K, %D and Smooth %K).

2. Programmable settings for the MACD Periods (Fast, Slow, Smoothing)

3. Programmable thresholds for %K, to qualify a potential entry strategy.

4. Programmable thresholds for %D, to qualify a potential exit strategy.

5. Buttons to choose which components to use in the trading algorithm.

6. Choose the month and year to back test.

The trading algorithm:

1. When %K exceeds the upper/lower threshold and then hooks down/up, in the direction of the Moving Average (MA). This is the minimum entry qualification.

2. When %D exceeds the lower/upper threshold and angled in the direction of the trade, is the exit qualification.

3. Additional entry filters include the direction of MACD, Signal and %D. Also, the "cliff", being a long entry is a higher high or a short entry is a lower low.

4. Strategy can only go "Long" or "Short" depending on the selected setting.

5. By matching the settings in the "Cycles" indicator, you can (almost) see what the strategy is doing.

6. Be sure to select the "Recalculate" buttons, to recalculate on every new Tick, for best results.

Please click the Like button and leave a comment if you appreciate this script. Improvements will be implemented as time goes on.

I am not a licensed trade advisor. This strategy is for entertainment only. Use at your own risk!

STOCH 1 KENVINThis is Stochastic was cusumize by Kenvin Hoang

More smooth and clear

Plot color : RED = SELL SIGNAL when signal line in Red-Range

Plot color : GREEN = BUY SIGNAL when signal line in Green-Range

CyclesThis is a modified Stochastic indicator. Modifications include:

1. The output is now centered on "0" and the scale is from -50 to +50, so that histograms and columns can be used to plot the output.

2. Added visual trade setup triggers. A trigger to the up side is a cycle high and indicates a "sell signal". A trigger to the down side is a cycle low and indicates a "buy" signal.

3. Added an alert trigger to be used to setup alerts. Selecting "Alert" to be Greater Than (>) Value = 0.00 will trigger an alert if either the buy or sell triggers occur.

4. Added a force indicator output. This indicates the rate of change in "D", or mathematically "dD/dt", as was done in the Power Analyzer indicator. When Force and D are in-phase, the maximum power is achieved.

5. Added "Slow Average Momentum" and "Slow Average Force" as was done in the Power Analyzer indicator.

6. Added an internal MACD and EMA as part of the trade setup trigger equation. There is a new input variable for the EMA length.

7. Added an input variable for the "Trigger Threshold", which ranges from -50 to 50, to be used as a screening filter.

Stoch+RSI (SLOW D)_By Josef_HakkakStoch+RSI (SLOW D)_By Josef_Hakkak

Stochastic and RSI by SLOW D%

-> How to use:

B UY = When the yellow line (D of Slow Stoch ) goes out of the green range, it is better that the purple line ( RSI ) is be low

SELL = When the yellow line (D of Slow Stoch ) goes out of the red range, it is better to have the purple line ( RSI ) is be high

This script was previously written by RRanjanFX and has now been edited by me and changes have been made to optimize for shorter timeframes.

Edited and updated and optimized from:

RRanjanFX

Many thanks and loyal to RRanjanFX

STOCH RSI [Rogulabo] 2 indicators in 1.

Included Indicators are:

- RSI

- Stochastics

Basic usage of these indicators respectively are:

- RSI values above 70 is commonly overbought, whilst below 30 is oversold.

- Stochastics for describing the momentum and turning points of price swings.

Please recognize that these are simplified explanations.

Reasons for 2 in 1 assembly:

This indicator is intended to be used by students, and followers of Dan Takahashi

(a prominent educator of investing in Japan who is also a user of TradingView) .

Those who wants to use and learn with the same setup as Dan, would greatly benefit from this since,

the complex setting up process which can be a pain for beginners can be skipped with a simple click.

Every stylistic choice of color and placement were made to make it similar to the chart used by Dan.

Simple customizations are available such as:

- Changing color

- Changing the values

- Hide/show controls

Notes:

This is intended to be used alongside “EMA ICHI BB ” for the complete the setup.

Any questions, please refer to:

@rogulabo

==

高橋ダンさんが使用されてるチャートと同様のセットアップの為にご活用ください。

複数のインジケータをグループにしておりますので、無料版を使われてる方は効率よく使っていただけると思います。

また、“EMA ICHI BB ”どいうタイトルのインジケータも同時に公開しておりますので、セットアップを完成させたい方はこちらもご活用ください。

以下のインジケータを含みます。

・ストキャスティクス

・RSI

カスタマイズされたい方はご自由に値を変更ください。

ご質問は @rogulabo までよろしくお願いいたします。

CASH TRAP OSILADORESFor Best Results, Collect Minimum of 4 Confirmations. When the Relative Strength Index is above the top line, look for sales. If it is below the bottom line, Find purchases.

If the Stochastic Oscillator is above the upper line, look for sales, If it is below the bottom line, look for purchases. (also applying price action and looking for bounce points)

PARAMETERS

RSI= 4 (70,30)

STOCH= 5/1/1 (80,20)

MTF Stoch RSI ScreenerDisplays when multiple timeframes of Stochastic RSI are overbought/oversold. Multiple consecutive timeframes being overbought/oversold can signify a short term top or bottom.

Thanks to Micse in Pinescripters telegram who helped remove a few errors from this.

Stochastic Oscillator [SystemAlpha]This is a Stochastic Oscillator enhanced with:

- Show Buy and Sell Alert

- Show Regular and Hidden divergence

- Show Divergence Labels

- Generate Alerts: Buy/Sell and Divergence

Stoch X, an Indicator of Indicators by DGTStochastic refers to a randomly determined process and financial markets use stochastic models to represent the seemingly random behaviour of assets and then used by quantitative analysts to value options on asset prices

The stochastic oscillator, developed by George Lane, presents the location of the closing price of a stock in relation to the high and low range of the price of a stock over a period of time. Lane has said that the stochastic oscillator does not follow price or volume or anything similar. He indicates that the oscillator follows the speed or momentum of price.

Traditionally, readings over 80 are considered in the overbought range, and readings under 20 are considered oversold. Please note that, very strong trends can maintain overbought or oversold conditions for an extended period and traders should look to changes in the stochastic oscillator for clues about future trend shifts. It is advised to check the higher timeframe of your trading timeframe and see where you are in the “big picture”

Signal crosses , intersection of stochastic and its signal line is considered to be a signal that a reversal may be in the works

Divergence between the stochastic oscillator and trending price action is also seen as an important reversal signal

Lane also reveals in interviews that, as a rule, the momentum or speed of the price of a stock changes before the price changes itself . In this way, the stochastic oscillator can be used to foreshadow reversals when the indicator reveals bullish or bearish divergences. This signal is the first, and arguably the most important, trading signal Lane identified.

What is Stochastic X ?

Stochastic X , is essentially an indicator of an indicator, providing stochastic calculation to some of well known indicators, such as RSI, MFI, OBV, etc. This means that it is a measure of selected specific indicator relative to its own high/low range over a user defined period of time.

Features of Stoch X

1- Displays Stoch of and indicator plus a companion indicator (companion display can be disabled from user dialog box)

Available options

Stoch Source plus PM A, where Source is close price and PMA refers to Price Distance to its Moving Average (for further details you may check my study of Price Distance to its MA by DGT, and different application of distance concept available with “MACD-X, More Than MACD" And “P-MACD”)

Stoch RSI plus RSI , Stoch RSI, developed by Tushar Chande and Stanley Kroll, is a build-in indicator available on Trading View, where Stoch X adds RSI as a companion indicator to Stoch RSI

Stoch MFI and MFI , where MFI is Money Flow Index, measures buying and selling pressure through analyzing both price and volume

Stoch OBV + VO , Where OBV is On Balance Volume, is a momentum indicator that measures positive and negative volume flow. VO stands for Volume Oscillator which aims to confirm a market turnaround or trend reversal

Stoch EWO + EWO , EWO stands for Elliott Wave Oscillator

By default the threshold levels are indicated and are displayed differently for the regular Stoch or Stoch RSI. Overbought band (70-80), oversold band (20-30) and middle line (0) are emphasized

Warning : Centered Oscillators base line is moved from 0 to 50 to better suit with Stoch X, which is applied to PMA, VO and EWO

2- Can be plotted along with Stoch in the same window using the same scaling

To avoid misinterpreting the area between Stoch X and its Signal Line is highlighted automatically in case Stoch is selected to be plotted

3- Squeeze Indicator added as Add-on in the bottom of the Stoch X

During volatile market conditions the stochastic oscillator has been known to produce false signals. One way to help with this is to take the price trend as a filter, or basic chart pattern analysis can help to identify major, underlying trends and increase the Stoch X's accuracy.

This study implements Squeeze Indicator to help and add additional insight for filtering false signals. Blue diamond shapes indicates the squeeze release, that is volatility increased and according to momentum direction the buy/sell possibility can be considered. Orange ones displays consolidation periods, that is low volatility and the market is assumed to be in squeeze and no trade is recommended. in this phase.

Disclaimer: Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

The script is for informational and educational purposes only. Use of the script does not constitutes professional and/or financial advice. You alone the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

Stochastic / RSI (Wilder's [RMA] or Arnaud Legoux [ALMA])This script displays the Stochastic and Relative Strength Index ("RSI") indicators. Each indicator can be displayed standalone or shown together. The Stochastic indicator also has functionality to highlight overbought/oversold levels as well as relative placement of K and D. The RSI indicator can also be updated to utilize the Arnaud Legoux Moving Average ("ALMA") (vs. the standard Wilder's Moving Average).

I use based on default settings. ALMA RSI can help indicate extent of drop/rise from Stochastic overbought/oversold levels.

Recognition due to @kurtsmock for the work on validating the ALMA calculation (pinescript built-in function has slight deviation from original design) ---> LINK ().

Hybrid Overbought/Oversold Detector + Put/Call SignalsThere are many indicators of overbought/oversold conditions out there. Some of more common ones are:

- Bollinger Bands %B

- Money Flow Index (MFI)

- Relative Strength Index (RSI)

- Stochastic

This script uses a combination of these 4 oscillators to confirm overbought/oversold and filter the signals of market reverse which could be used for trading binary options.

You may select which oscillators you want to apply and of course change the source, the length of the calculations and the overbought/oversold levels.

Also the script will draw a combined graph which is the average of the selected oscillators in the options.

Send me your ideas!

TESLA: RSI and StochasticThis script is part of the "TESLA" strategy and will help traders identifying overbought and oversold condition as well as other applications such as divergence. The features for this script are the following:

- 1 RSI index in order to identify market buying/selling strength

- 2x Stochastic in order to have fast and slow overbought and oversold zones.

Bollinger Band Reversal StudyThis strategy was inspired by ParallaxFX.

This strategy attempts to predict when a price reversal will happen. It uses bollinger bands, stochastics and candle formations.

The idea is that when an indecision candle, such as a doji, crosses outside the bollinger bands, then is followed by another candle that pushed sharply back inside the bands, you have a setup.

These setups are marked with green arrows to go long and red arrows to go short. Wait until the next candle begins before acting. The arrow may come and go as the price fluctuates, so wait until the candle closes.

Another play is when the same setup occurs, but on the middle bollinger band instead of the outer band.

These setups are marked with blue arrows to go long and yellow arrows to go short. Wait until the next candle begins before acting. The arrow may come and go as the price fluctuates, so wait until the candle closes.

Closing can happen a number of ways. You can use a predetermined risk-reward or look to sell when the price reaches another band.

In summary.

Go long when a green or blue arrow appears.

Go Short when a red or yellow arrow appears.

Green arrows show signs of reversal from lower BB.

Blue arrows show signs of reversal from middle BB.

Red arrows show signs of reversal from upper BB.

Yellow arrows show signs of reversal from middle BB.

Wait for candle with arrow to close before taking trade.

Stoch+RSI With Color Combination. Hello Everyone This Indicater Base on (RSI and Stoch) COMBINATION With Color Combination.

You Can also use for

1-Divergence.

2-Overbought.

3-Oversold.

4-Breakout.

5-Support & Resistance Zones.

Stochastic Weights - Basic [BigBitsIO]This script is a compilation of several different stochastic indicators (and RSI) where the K value of each indicator is equally weighted. The purpose of the indicator is to combine many indicators together in a fashion that weights them easier. By default, the Stochastic and Stochastic RSI are both enabled - the idea is to speed up the relatively slower Stochastic and to slow down the relatively fast Stochastic RSI. Other Stochastics are also available, including some of my own custom calculations that can also be added to the weighted calculation. Only the K value is weighted, as the D value is just a moving average of the weighted K.

Explained:

- Calculates enabled indicators

- Calculates the weighted value of K for enabled indicators

- Calculates a D value from the weighted K

FAQ:

- Why is this script useful?

- To weight multiple indicators together so that you can attempt to find optimal values shared amongst the indicators. Ex: If Stochastic RSI is 100 and Stochastic is 50, K would be 75 and not particularly high. If you add in a 50 RSI, the K would be 67 in this example. If we weight indicators together that all have a high value they could potentially help find elements that align together to produce a stronger signal.

DISCLAIMER: For educational and entertainment purposes only. Nothing in this content should be interpreted as financial advice or a recommendation to buy or sell any sort of security or investment including all types of crypto. DYOR, TYOB.

RSI, Stoch, DMI Stoch / By Mochero

With this indicator, we seek to find convergence of RSI, Stoch and DMI for purchases or sales.

Search Buy when,

-Rsi over sold

-Stoch over sold

-DMI Over sold

Search Sell when,

-Rsi oon purchased

-Stoch on purchased

-DMI on purchased

Suggested values

Rsi: 4

Stoch: 5.1.1

DMI: 10.3

Suggested time, 5M 15M

CCU MFI + RSI + STOCH RSIThis demonstrates the accuracy of entry signal of the MFI + RSI + STOCH RSI strategy

Stochastic PC [BigBitsIO]This script is a very simple stochastic calculation similar to Stochastic RSI that calculates a stochastic value of a moving average of the percentage price change. The purpose of the indicator is to find positive and negative volatility momentum peaks which might be able to help identify changes in trends. Like other stochastic indicators, it may be best used in combination with other indicators.

Explained:

- First gets the % change for the candle from open to close. Green candles produce positive values, red candles produce negative values.

- Then it creates a moving average of that number to try and reduce impacts of very large moves, although this can be changed with the super-fast smoothed length setting. Set it to 1 to remove all smoothing.

- After that, it creates a K value using a stochastic calculation based on the range of the price change moving average we created in the previous step. Set the smoothK to one to use a fast stochastic calculation, it is a slow stochastic calculation by default (3-period SMA of stochastic)

- Finally, to create the D value it calculates a 3-period SMA of the K value.

FAQ:

- Why is this script useful?

- This script can help identify the peaks and valleys of volatility momentum

DISCLAIMER: For educational and entertainment purposes only. Nothing in this content should be interpreted as financial advice or a recommendation to buy or sell any sort of security or investment including all types of crypto. DYOR, TYOB.

Pro StochasticsMy take on coding a Stochastic Indicator for professional use.

Contains many options and settings for you to tweak, and can be used on different timeframes.

I've also decided to make the code Open to all to use.

But it would be great if you credit me when you use my code. :)

Stochastic based on Closing Prices - Identify and Rank TrendsStochClose is a trend indicator that can be used on its own to measure trend strength, in a scan to rank a group of securities according to trend strength or as part of a trend following strategy. Moreover, it acts as a volatility-adjusted trend indicator that puts securities on an equal footing.

StochClose measures the location of the current close relative to the close-only high-low range over a given period of time. In contrast to the traditional Stochastic Oscillator, this indicator only uses closing prices. Traditional Stochastic uses intraday highs and lows to calculate the range. The focus on closing prices reduces signal noise caused by intraday highs and lows, and filters out errant or irrationally exuberant price spikes.

Here are some examples when the high or low was out of proportion and suspect. Perhaps most famously, there were errant spike lows in dozens of ETFs in August 2015 (XLK, IJR, ITB). There were other spikes in VMBS (October 2014), IJR (October 2008) and KRE (May 2011). Elsewhere, there were suspicious spikes in IEI (April 2020), CHD (March 2020), CCRN (March 2020) and FNB (March 2020)

The preferred setting to identify medium and long-term uptrends is 125 days with 5 days smoothing. 125 days covers around six months. Thus, StochClose(125,5) is a 5-day SMA of the 125-day Stochastic based on closing prices. Smoothing with the 5-day SMA introduces a little lag, but reduces whipsaws and signal noise.

StochClose fluctuates between 0 and 100 with 50 as the midpoint. Values above 80 indicate that the current price is near the high end of the 125-day range, while values below 20 indicate that price is near the low end of the range. For signals, a move above 60 puts the indicator firmly in the top half of the range and points to an uptrend. A move below 40 puts the indicator firmly in the bottom half of the range and points to a downtrend.

StochClose values can also be ranked to separate the leaders from the laggards. In contrast to Rate-of-Change and Percentage Above/Below a Moving Average, StochClose acts as a volatility-adjusted indicator that can identify trend strength or weakness. The Consumer Staples SPDR is unlikely to win in a Rate-of-Change contest with the Technology SPDR. However, it is just as easy for the Consumer Staples SPDR to get in the top of its range as it is for the Technology SPDR. StochClose puts securities on an equal footing.

StochClose measures trend direction and trend strength with one number. The indicator value tells us immediately if the security is trending higher or lower. Furthermore, we can compare this value against the values for other securities. Securities with higher StochClose values are stronger than those with lower values.