MTF Moving AveragesThe MTF Moving Averages indicator allows users to plot multiple moving averages on different timeframes within the same chart on TradingView. This indicator supports four different timeframes: daily, weekly, monthly, and intraday.

For each timeframe, users can choose up to four moving averages to plot. They can also select the type of moving average (SMA, EMA, or WMA), the source (e.g., close price), and the length of each moving average. Additionally, users have the option to enable a "Trend Suite" for the second moving average on the daily timeframe. The Trend Suite adds 2 moving averages with source low and high.

In the intraday timeframe, the second moving average is calculated and plotted based on the daily timeframe.

The indicator provides customization options for colors, allowing users to define the colors for each moving average line.

The settings in the indicator are designed in a clear and organized manner.

Have fun

Простое скользящее среднее (SMA)

Moving Average with Start LineThis script paints a vertical line on the starting bar of a simple moving average to help anticipate directional changes. The line is the same color as the MA.

TTP Pair Slope/HedgePair slope/hedge uses linear regression to calculate the hedge ratio (slope) between the two assets within a period.

It allows you to specify a "from" and a "to" candle.

Example:

"A regression from 1000 candles back in time and ignore the last 100 candles. This would result in making a regression of 900 candles in total."

The formula used to perform the regression with the assts X and Y is:

Hedge =

mean( (X-mean(X))^2 )

——————————————————

mean( (X-mean(X)) * (Y-mean(Y)) )

You can later use the hedge in a chart of X - Hedge * Y

(Confirm with 1 / hedge )

If the plot is stationary the period tested should look like stationary.

If you cross an imaginary horizontal line across all the values in the period used it should look like a flat channel with values crossing above and below the line.

The purpose of this indicator is to help finding the linear regression test used for conintegration analysis. Conintegration assets is one of the requirements to consider assets for pair and hedge trading.

Interactive MA Stop Loss [TANHEF]This indicator is "Interactive." Once added to the chart, you need to click the start point for the moving average stoploss. Dragging it afterward will modify its position.

Why choose this indicator over a traditional Moving Average?

To accurately determine that a wick has crossed a moving average, you must examine the moving average's range on that bar (blue area on this indicator) and ensure the wick fully traverses this area.

When the price moves away from a moving average, the average also shifts towards the price. This can make it look like the wick crossed the average, even if it didn't.

How is the moving average area calculated?

For each bar, the moving average calculation is standard, but when the current bar is involved, its high or low is used instead of the close. For precise results, simply setting the source in a typical moving average calculation to 'Low' or 'High' is not sufficient in calculating the moving average area on a current bar.

Moving Average Options:

Simple Moving Average

Exponential Moving Average

Relative Moving Average

Weighted Moving Average

Indicator Explanation

After adding indicator to chart, you must click on a location to begin an entry.

The moving average type can be set and length modified to adjust the stoploss. An optional profit target may be added.

A symbol is display when the stoploss and profit target are hit. If a position is create that is not valid, "Overlapping MA and Bar" is displayed.

Alerts

'Check' alerts to use within indicator settings (stop hit and/or profit target hit).

Select 'Create Alert'

Set the condition to 'Interactive MA''

Select create.

Alert messages can have additional details using these words in between two Curly (Brace) Brackets:

{{stop}} = MA stop-loss (price)

{{upper}} = Upper MA band (price)

{{lower}} = Lower MA band (price)

{{band}} = Lower or Upper stoploss (word)

{{type}} = Long or Short stop-loss (word)

{{stopdistance}} = Stoploss Distance (%)

{{targetdistance}} = Target Distance (%)

{{starttime}} = Start time of stoploss (day:hour:minute)

{{maLength}} = MA Length (input)

{{maType}} = MA Type (input)

{{target}} = Price target (price)

{{trigger}} = Wick or Close Trigger input (input)

{{ticker}} = Ticker of chart (word)

{{exchange}} = Exchange of chart (word)

{{description}} = Description of ticker (words)

{{close}} = Bar close (price)

{{open}} = Bar open (price)

{{high}} = Bar high (price)

{{low}} = Bar low (price)

{{hl2}} = Bar HL2 (price)

{{volume}} = Bar volume (value)

{{time}} = Current time (day:hour:minute)

{{interval}} = Chart timeframe

{{newline}} = New line for text

I will add further moving averages types in the future. If you suggestions post them below.

Price Volume Trend Crosses This script is a modified version of the Price Volume Trend ( PVT ) that uses a moving average of the PVT as a signal ( sig ) line.

The length of the signal line can be adjusted as needed by changing the "PVTC Signal Length" value inside the indicator settings menu.

"PVTC Signal Type" allows you to pick between EMA and SMA as the signal line.

Logic behind this script:

If PVT > sig it indicates an bullish environment and gets coloured with the UP color.

If PVT < sig it indicates a bearish environment and get coloured with the DOWN color.

Colors can be modified in the indicator settings menu.

Crosses can be highlighted by ticking the "Highlight Crosses" box in the indicator settings menu.

"Fill Gaps" fills the gap between PVT and sig with the prevailing trends color.

PVTC should not be used on its own but in conjunction with other indicators!

VWAP with CharacterizationThis indicator is a visual representation of the VWAP (Volume Weighted Average Price), it calculates the weighted average price based on trading volume. Essentially, it provides a measure of the average price at which an asset has traded during a given period, but with a particular focus on trading volume. In our case, the indicator calculates the VWAP for the current trading symbol, using a predefined simple moving average (SMA) with a period of 14. This volume-weighted moving average offers a clearer view of the behavior of the VWAP and, of consequence of market dynamics.

One of the distinctive features of this indicator is its ability to provide a more "linear" representation of the data. This means that the data is "smoothed" to remove noise, allowing you to more easily identify the direction of the market trend. This smoother representation is especially useful because the financial market can be subject to significant fluctuations and volatility, and this indicator can help get a more stable view of the trend.

The indicator also offers a visualization of the market trend in a very intuitive way. Using an evaluation of the highs and lows of the last 10 days, determine whether the market is in an uptrend, downtrend, or no trend at all. To make this evaluation even clearer and more immediate, the indicator line is colored dynamically. When the trend is bullish, the line is blue, while in case of a bearish trend, it takes on a distinctive color, such as pink. If the trend is not defined, the line will be colored differently, for example light yellow. This coloration gives traders an immediate visual indication of the prevailing trend, allowing them to make more informed decisions regarding trading operations.

One potential strategy involves watching candles when they cross the VWAP line strongly. If, for example, a candlestick breaks above the VWAP line, we may look for retest areas near key support levels to gauge a potential long entry. In other words, we would consider that the price may have the potential to rise further after breaking above the VWAP line, and we would look to enter a long position to take advantage of this opportunity.

On the other hand, if a candlestick crosses below the VWAP line, we might consider looking for retest areas near the VWAP line itself, which now serves as potential resistance. This could indicate a possible short entry opportunity, as the price may struggle to break above the resistance represented by the VWAP line after breaking it down. In this case, we would look to take advantage of the expected continuation of the downtrend.

In both cases, the idea is to exploit significant movements across the VWAP line as signals of potential reversal or continuation of the trend. This strategy can help identify key entry points based on price behavior relative to the VWAP line.

Tribute to David PaulI made this indicator as a tribute to the late David Paul .

He mentioned quite a lot about 89 periods moving average (especially on 4h), also the 21 and 55.

I put up some entries when three ma are crossed by price in the same direction, bull/bear backgrounds and a color code for candles because who doesn't love the feeling of a lasting trend.

To be more specific :

The indicator plots sma21, sma55, sma89 and AMA = (sma21+sma55+sma89)/3

When the closing price crosses the highest of the 3 sma, it is considered a bullish confirmation.

At this moment two lines appear, one on the bottom of the candle that crossed, one on the crossing point.

The lowest line can be used as the stop loss value of a long.

The highest line can be used as an entry point for a long.

When the closing price crosses the lowest of the 3 sma, it is considered a bearish confirmation.

At this moment two lines appear, one on the top of the candle that crossed, one on the crossing point.

The highest line can be used as the stop loss value of a short.

The lowest line can be used as an entry point for shorts.

When the closing price is above AMA, it is considered a bullish confirmation.

At this time a blue background appears at the crossing point.

The highest line can be used as the stop loss value for a long.

The starting point of the background can be used as the entry point for a long.

When the closing price is below AMA, it is considered a bearish confirmation.

At this time a red background appears at the crossing point.

The highest line can be used as the stop loss value for a short.

The starting point of the background can be used as the entry point for a short.

When the price is above 3 sma the candles turn blue. Signifying an upward trend.

When the price is below 3 sma the candles turn red. Signifying a bearish trend.

When the price is neither simultaneously above nor below the 3 sma, the candles are gray and the background linked to AMA becomes less vivid. Meaning a loss of vitality of the current trend or an absence of a clear trend.

Ideally, you should take a position towards "Real Long/Short Entry", set your stop loss towards "Ideal Long/Short Entry", and close the trade either when the background ends (riskier but more potential), or when the candles become gray (more conservative but noisier).

In the inputs, you can modify the display rules (explained in the tooltips), by default everything is displayed.

MA Support & Resistance SignalThis indicator is to show MA Support/Resistance and trend of a stock.

It contains three (3) Moving Averages that can be set to SMA or EMA:

1. Upper Line : SMA 5 (default)

2. Lower Line : SMA 20 (default)

3. Support/Resistance Line : SMA 10 (default)

Other signals:

1. Bull and Blue Dotted Line signal: Upper Line (SMA 5) crossover with Lower Line (SMA 20).

2. Bear and Red Dotted Line signal: Lower Line (SMA 20) crossover with Upper Line (SMA 5).

3. Red Triangle signal: Price closes below Support/Resistance Line (SMA 10).

4. Green Bar signal: Price breaks Support/Resistance Line (SMA 10).

The way how I use it:

- Since I don't like my chart to be crowded with a lot of moving averages, I will disable SMA 5 and SMA 10 and will only leave SMA 20 as my final support line.

- Entry when only:

1. Bull signal appeared.

2. Green bar appeared, or;

3. Price rebound on SMA 20.

I let the script open so that you guys can custom it based on your own preferences. Hope you guys enjoy it.

Moving Averages w/Signals [CSJ7]Unlock the power of three dynamic moving averages: Fast, Medium, and Slow. Choose between the reliability of Simple or the responsiveness of Exponential MAs. Plus, with our tailored Buy and Sell signals based on user-defined crossing scenarios, you're equipped with a clear roadmap in the ever-changing landscape of the markets.

1. Spot Trends with Ease: Our color-coded system makes identifying the market's direction intuitive. Green signals bullish momentum, while red indicates bearish movements.

2. Precision Signals: Navigate the markets confidently with our Buy and Sell signals, designed to highlight potential entry and exit points.

3. Gauge Trend Strength: The color intensity between the Medium and Slow MAs offers a visual cue on the trend's strength, ensuring you're always in the know.

Limitations:

- Inherent Lag: As with all moving average tools, there's a natural delay. But it's this reflective nature that offers valuable insights.

- Stay Alert in Sideways Markets: During consolidative phases, the indicator might produce occasional false signals. Always cross-reference with other tools.

- Customization is Key: The tool's true potential shines when you adjust the settings to align with your trading style and strategy.

4. How to Use:

Quick Setup: Select your preferred MA type, set the lengths, and define your ideal crossover scenarios. It's that simple!

Interpreting Signals: A green triangle below the price suggests a potential buying zone, while a red triangle above hints at a selling opportunity.

Trend Insights: The color gradient between the Medium and Slow MAs offers a visual representation of the trend's vigor. The more vibrant, the stronger the trend.

Elevate your trading strategy with the Moving Averages w/Signals & AutoTrade . With clarity and precision, it's the companion every trader deserves.

SMA/EMA/RSImagic 36.963 by IgorPlahutaTwo Elements in this script:

Alerts: These are notifications that draw your attention to specific market conditions. There are two types:

RSI Higher Lows or Lower Highs: This alert triggers when the Relative Strength Index (RSI) forms higher lows or lower highs.

RSI Exiting 30 (Up) or RSI Exiting 70 (Down): These alerts activate when the RSI crosses the 30 threshold upwards or the 70 threshold downwards.

ALL BUY/SELL: to catch both of them with one setting

To Set Up an Alert: To configure an alert, select the one relevant to your trading strategy, choose the "Greater than" option, and input a value of "0" (this essentially activates the alert). Adjust other settings as per your requirements.

Please note that these alerts should be used in conjunction with a system you trust for confirmation.

Moving Averages: This involves monitoring several moving averages:

SMA12, SMA20, EMA12, EMA20: These moving averages are highlighted with background colors to help you quickly identify changes or crossovers. They are superimposed on each other for easy comparison.

SMA 50, SMA200: These moving averages are also highlighted with background colors to spot crossovers, and their lines change color depending on their direction (falling in red or rising in green).

Enjoy using these tools in your trading endeavors!

3kilos BTC 15mThe "3kilos BTC 15m" is a comprehensive trading strategy designed to work on a 15-minute timeframe for Bitcoin (BTC) or other cryptocurrencies. This strategy combines multiple indicators, including Triple Exponential Moving Averages (TEMA), Average True Range (ATR), and Heikin-Ashi candlesticks, to generate buy and sell signals. It also incorporates risk management features like take profit and stop loss.

Indicators

Triple Exponential Moving Averages (TEMA): Three TEMA lines are used with different lengths and sources:

Short TEMA (Red) based on highs

Long TEMA 1 (Blue) based on lows

Long TEMA 2 (Green) based on closing prices

Average True Range (ATR): Custom ATR calculation with EMA smoothing is used for volatility measurement.

Supertrend: Calculated using ATR and a multiplier to determine the trend direction.

Simple Moving Average (SMA): Applied to the short TEMA to smooth out its values.

Heikin-Ashi Close: Used for additional trend confirmation.

Entry & Exit Conditions

Long Entry: Triggered when the short TEMA is above both long TEMA lines, the Supertrend is bullish, the short TEMA is above its SMA, and the Heikin-Ashi close is higher than the previous close.

Short Entry: Triggered when the short TEMA is below both long TEMA lines, the Supertrend is bearish, the short TEMA is below its SMA, and the Heikin-Ashi close is lower than the previous close.

Take Profit and Stop Loss: Both are calculated as a percentage of the entry price, and they are set for both long and short positions.

Risk Management

Take Profit: Set at 1% above the entry price for long positions and 1% below for short positions.

Stop Loss: Set at 3% below the entry price for long positions and 3% above for short positions.

Commission and Pyramiding

Commission: A 0.07% commission is accounted for in the strategy.

Pyramiding: The strategy does not allow pyramiding.

Note

This strategy is designed for educational purposes and should not be considered as financial advice. Always do your own research and consider consulting a financial advisor before engaging in trading.

EMA x 3 MAsThis indicator can be used for moving average strategies based on a EMA trigger over MAs (SMAs) : MA1 , MA2 , MA3 .

Based on those crossings, the background color will change for the upcoming candle showing green for upper crossing change (the more MA are crossed, the darker is the background). Order and priority of background colors :

1/ EMA x MA1

2/ EMA x MA2 (if EMA x MA1 confirmed)

3/ EMA x MA3 (if EMA x MA1and EMA x MA2 confirmed)

EMA and MAs can also be tuned with your own values in the parameters, therefore allowing you to try different strategies and to use the EMA and MAs as support/resistance indication.

You can set up the background and lines colors in the Style in the parameters.

MA Directional Table"MA Directional Table" primary objective is to analyze the direction of the trend based on two Moving Averages (MA) for various timeframes and customizing the inputs to match your preferred style.

Features:

Moving Average Type: You can select which type of Moving Average to use (SMA, EMA, VWMA).

Moving Average Lengths: You can set the lengths for the short-term and long-term moving averages.

Table Position: The indicator provides a table which can be placed at the top or bottom, and to the left or right of the chart. It shows the trend status for multiple timeframes (1 min, 5 min, 15 min, 1 hour, 4 hours, 1 day).

Table Orientation: The table can be oriented either horizontally or vertically.

Price Condition: Optionally, the table color can be set to yellow if the current price deviates from the Moving Average trend and crosses MA1.

Cloud Settings: You can opt to show a cloud between the two moving averages. The color of the cloud changes based on the direction of the trend (bullish or bearish).

Extra MA: Optionally, an extra Moving Average can be plotted on the chart.

Ultimate Momentum OscillatorThe Ultimate Momentum Oscillator is a tool designed to help traders identify the current trend direction and the momentum of the prices.

This oscillator is composed of one histogram and one line, paired with the two overbought and the two oversold levels.

The histogram is a trend-based algorithm that allows the user to read the market bias with multiple trend lengths combined.

The line is a momentum-based formula that allows traders to identify potential reversal and the speed of the price.

This tool can be used to:

- Identify the current trend direction

- Identify the momentum of the price

- Identify oversold and overbought levels

Average Range LinesThis Average Range Lines indicator identifies high and low price levels based on a chosen time period (day, week, month, etc.) and then uses a simple moving average over the length of the lookback period chosen to project support and resistance levels, otherwise referred to as average range. The calculation of these levels are slightly different than Average True Range and I have found this to be more accurate for intraday price bounces.

Lines are plotted and labeled on the chart based on the following methodology:

+3.0: 3x the average high over the chosen timeframe and lookback period.

+2.5: 2.5x the average high over the chosen timeframe and lookback period.

+2.0: 2x the average high over the chosen timeframe and lookback period.

+1.5: 1.5x the average high over the chosen timeframe and lookback period.

+1.0: The average high over the chosen timeframe and lookback period.

+0.5: One-half the average high over the chosen timeframe and lookback period.

Open: Opening price for the chosen time period.

-0.5: One-half the average low over the chosen timeframe and lookback period.

-1.0: The average low over the chosen timeframe and lookback period.

-1.5: 1.5x the average low over the chosen timeframe and lookback period.

-2.0: 2x the average low over the chosen timeframe and lookback period.

-2.5: 2.5x the average low over the chosen timeframe and lookback period.

-3.0: 3x the average low over the chosen timeframe and lookback period.

Look for price to find support or resistance at these levels for either entries or to take profit. When price crosses the +/- 2.0 or beyond, the likelihood of a reversal is very high, especially if set to weekly and monthly levels.

This indicator can be used/viewed on any timeframe. For intraday trading and viewing on a 15 minute or less timeframe, I recommend using the 4 hour, 1 day, and/or 1 week levels. For swing trading and viewing on a 30 minute or higher timeframe, I recommend using the 1 week, 1 month, or longer timeframes. I don’t believe this would be useful on a 1 hour or less timeframe, but let me know if the comments if you find otherwise.

Based on my testing, recommended lookback periods by timeframe include:

Timeframe: 4 hour; Lookback period: 60 (recommend viewing on a 5 minute or less timeframe)

Timeframe: 1 day; Lookback period: 10 (also check out 25 if your chart doesn’t show good support/resistance at 10 days lookback – I have found 25 to be useful on charts like SPX)

Timeframe: 1 week; Lookback period: 14

Timeframe: 1 month; Lookback period: 10

The line style and colors are all editable. You can apply a global coloring scheme in the event you want to add this indicator to your chart multiple times with different time frames like I do for the weekly and monthly.

I appreciate your comments/feedback on this indicator to improve. Also let me know if you find this useful, and what settings/ticker you find it works best with!

Also check out my profile for more indicators!

Impulse MACD buy OwlPixelDescription:

The Impulse MACD Buy Indicator, developed by OwlPixel, is a powerful trading tool for traders using TradingView's Pine Script version 5. This indicator aims to provide valuable insights for identifying potential buy signals in the market using the popular MACD (Moving Average Convergence Divergence) oscillator.

Key Features:

MACD Analysis: The indicator displays the MACD line (blue) and the signal line (orange) on the chart, helping traders assess the momentum and trend direction of an asset.

Impulse Histo: The Impulse Histo (blue histogram) visualizes the difference between the MACD line and the signal line, making it easier to spot changes in market strength and potential trend reversals.

Impulse MACD CD Signal: This histogram (maroon color) highlights the divergence between the Impulse Histo and the signal line, providing further insights into trend shifts.

Background Boxes: The indicator features three rows of different colored background boxes that represent distinct market conditions - an uptrend (light green), a downtrend (light red), and a neutral trend (light yellow).

Crossover Points: Buy signals are marked with green circles when the MACD line crosses above the signal line, suggesting potential entry points for long positions.

Demand and Supply Bars: The demand (lime/green) and supply (red/orange) bars are intensified, aiding traders in identifying possible reversal areas.

Stop Loss and Take Profit:

The Impulse MACD Buy Indicator automatically calculates Stop Loss (SL) and Take Profit (TP) levels for buy signals. The SL level is set at the highest of the last three candles, while the TP level is determined by a user-defined percentage of the closing price. This information helps traders manage risk and optimize their profit potential.

Usage:

Apply the Impulse MACD Buy Indicator to your TradingView chart by copying the provided Pine Script into the Pine Editor.

Configure the input parameters, such as the MA Length and Signal Length, to suit your trading preferences.

Observe the MACD line, signal line, and histograms to gain insights into market momentum and trends.

Identify buy signals when the MACD line crosses above the signal line, signaled by green circles.

Utilize the provided Stop Loss and Take Profit levels for risk management and exit strategies.

Please note that this indicator is for informational purposes only and should be used in conjunction with other analysis techniques to make well-informed trading decisions. Happy trading!

Quantitative Trend Strategy- Uptrend longTrend Strategy #1

Indicators:

1. SMA

2. Pivot high/low functions derived from SMA

3. Step lines to plot support and resistance based on the pivot points

4. If the close is over the resistance line, green arrows plot above, and vice versa for red arrows below support.

Strategy:

1. Long Only

2. Mutable 2% TP/1.5% SL

3. 0.01% commission

4. When the close is greater than the pivot point of the sma pivot high, and the close is greater than the resistance step line, a long position is opened.

*At times, the 2% take profit may not trigger IF; the conditions for reentry are met at the time of candle closure + no exit conditions have been triggered.

5. If the position is in the green and the support step line crosses over the resistance step line, positions are exited.

How to use it and what makes it unique:

Use this strategy to trade an up-trending market using a simple moving average to determine the trend. This strategy is meant to capture a good risk/reward in a bullish market while staying active in an appropriate fashion. This strategy is unique due to it's inclusion of the step line function with statistics derived from myself.

This description tells the indicators combined to create a new strategy, with commissions and take profit/stop loss conditions included, and the process of strategy execution with a description on how to use it. If you have any questions feel free to PM me and boost if you enjoyed it. Thank you, pineUSERS!

DMMAverages and IMAThis puts away multiple moving averages. The moving average line that this draws is calculated from the closing price, but it uses a slightly different method to determine if the moving average line is heard, and if the closing price is between the high and low moving averages, it counts. The ratio of each count is calculated and the rate of change (variance) is calculated. This value is used as the basis for the assistance. If the variance is high, it means that this average line is working. It also draws a label and displays its value. This value will change to the color of the moving average you are currently listening to. When you change the color yourself, it is indefinite.

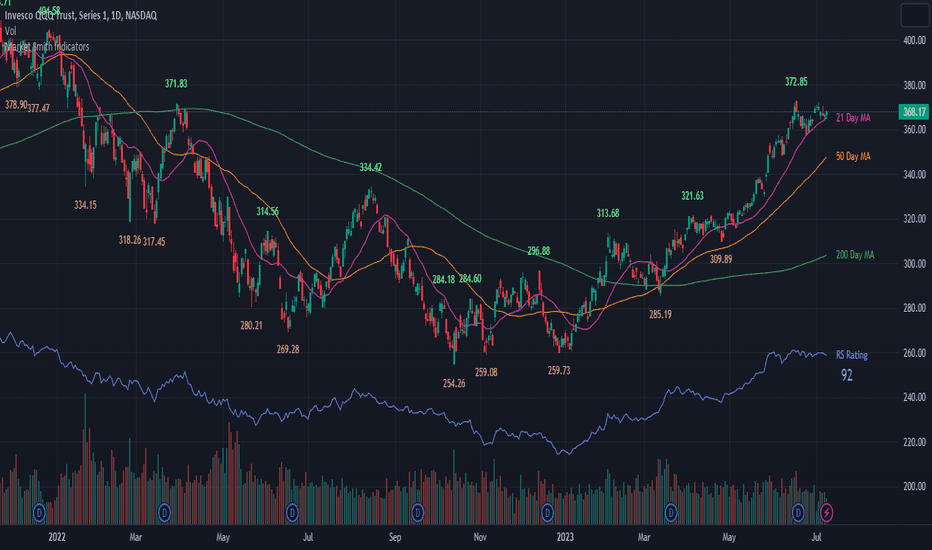

Market Smith IndicatorsMarket Smith has a collection of tools that are useful for identifying stocks. On their charts they have a 21/50/200 day moving averages, high and low pivot points, a relative strength line, and a relative strength rating. This script contains indicators for the following:

21/50/200 Day Moving Averages

High and Low pivot points

A Relative Strength line

A Relative Strength rating

21/50/200 Day Moving Averages

The 21/50/200 Day moving averages are simple moving averages. They are visible in any chart increment but to use them properly you need to set you charts to be by day. Labels will appear on the right of the lines to show that they are representative of 21/50/200 day moving averages.

High and Low pivot points

The High and Low pivot points are green for high pivot points and red for low points. They are show in the Market Smith style with the numbers simply above the pivot points.

Relative Strength line

The Relative Strength line is a line that shows the strength of the stock compared to the S&P 500. In this case we utilize the SPX ticker to compare the stock to. This line is almost identical to the Market Smith tool and is an excellent tool to determine how a stock is doing compared to the market. When movements in the stock and shown with sideways trending of the RS line that means that the stock is following the market. When a stock is outperforming the market the RS line will follow.

Relative Strength rating

Thank you to ©Fred6724 for the RS Rating inspiration. They wrote excellent open source code for a RS Rating comparable to Market Smith. As the RS Rating in Market Smith is not open source it is difficult to know exactly how it is being calculated. After simplifying Fred's code and building upon a few ideas I had I compared the RS Rating to multiple Market Smith Ratings. The rating is close but often off by multiple points. If there is anyone who has a better idea on how to get this rating or how to improve on the code please send me a PM or fork this project. This rating is a good indicator to see how a certain stock compares to other stocks in the market. In Market Smith they are able to utilize their database to compare it to all other stocks. Since we do not have access to the same tools we are only able to compare it to the percentage of stocks above the 200, 150, 100, 50, and 20 day moving average.

Using these tools together are a small fraction what make people like Bill O'neill and Jim Roppel so successful. I plan on updating the RS Rating as I continue to work on this project so if there is anyone who has ideas then please send me a PM. Ultimately the goal of this project is to have a solution that is identical to Market Smith.

All in One EMA indicator with Average EMA Calculations The Indicator displays multiple exponential moving averages (EMAs) on the chart. The six available options will let you adjust and set ]exponential moving averages ( EMAS) as per your choice. Additionally I have added an Average ema which will calculate the average of all the emas that you have selected. This average ema works very strong and greatly to find potential zone of dynamic supports and resistance as well as to gauge the overall trend .. The average ema will also allow you to keep your chart clean and you wont have to add too many emas together.

The average of the selected EMAs are displayed as a single line. This helps identify trends and potential reversals in the market. i hope this indicator will help you with trading...

Plz use the chart BINANCE:LINKBTC as reference, for back testing and educational purposes only.

Thumbs up if you liked the script.

Happy trading..

twisted SMA strategy [4h] Hello

I would like to introduce a very simple strategy that uses a combination of 3 simple moving averages ( SMA 4 , SMA 9 , SMA 18 )

this is a classic combination showing the most probable trend directions

Crosses were marked on the basis of the color of the candles (bulish cross - blue / bearish cross - maroon)

ma 100 was used to determine the main trend, which is one of the most popular 4-hour candles

We define main trend while price crosses SMA100 ( for bullish trend I use green candle color )

The long position strategy was created in combination of 3 moving averages with Kaufman's adaptive moving average by alexgrover

The strategy is very accurate and is easy to use indicators

the strategy uses only Buy (Long) signals in a combination of crossovers of the SMA 4, SMA 9, SMA 18 and the Kaufman Adaptive Moving Average.

As a signal to close a long position, only the opposite signal of the intersection of 3 different moving averages is used

the current strategy is recommended for higher time zones (4h +) due to the strength of the closing candles, which translates into signal strength

works fascinatingly well for long-term bullish market assets (for example 4h Apple, Tesla charts)

Enjoy and trade safe ;)

REVE Cohorts - Range Extension Volume Expansion CohortsREVE Cohorts stands for Range Extensions Volume Expansions Cohorts.

Volume is divided in four cohorts, these are depicted in the middle band with colors and histogram spikes.

0-80 percent i.e. low volumes; these get a green color and a narrow histogram bar

80-120 percent, normal volumes, these get a blue color and a narrow histogram bar

120-200 percent, high volume, these get an orange color and a wide histogram bar

200 and more percent is extreme volume, maroon color and wide bar.

All histogram bars have the same length. They point to the exact candle where the volume occurs.

Range is divided in two cohorts, these are depicted as candles above and below the middle band.

0-120 percent: small and normal range, depicted as single size, square candles

120 percent and more, wide range depicted as double size, rectangular candles.

The range candles are placed and colored according to the Advanced Price Algorithm (published script). If the trend is up, the candles are in the uptrend area, which is above the volume band, , downtrend candles below in the downtrend area. Dark blue candles depict a price movement which confirms the uptrend, these are of course in the uptrend area. In this area are also light red candles with a blue border, these depict a faltering price movement countering the uptrend. In the downtrend area, which is below the volume band, are red candles which depict a price movement confirming the downtrend and light blue candles with a red border depicting price movement countering the downtrend. A trend in the Advanced Price Algorithm is in equal to the direction of a simple moving average with the same lookback. The indicator has the same lagging.as this SMA.

Signals are placed in the vacated spaces, e.g. during an uptrend the downtrend area is vacated.

There are six signals, which arise as follows:

1 Two blue triangles up on top of each other: high or extreme volume in combination with wide range confirming uptrend. This indicates strong and effective up pressure in uptrend

2 Two pink tringles down on top of each other: high or extreme volume in combination with wide range down confirming downtrend. This indicates strong and effective down pressure in downtrend

3 Blue square above pink down triangle down: extreme volume in combination with wide range countering uptrend. This indicates a change of heart, down trend is imminent, e.g. during a reversal pattern. Down Pressure in uptrend

4 Pink square below blue triangle up: extreme volume in combination with wide range countering downtrend. This indicates a change of heart, reversal to uptrend is imminent. Up Pressure in downtrend

5 single blue square: a. extreme volume in combination with small range confirming uptrend, b. extreme volume in combination with small range countering downtrend, c. high volume in combination with wide range countering uptrend. This indicates halting upward price movement, occurs often at tops or during distribution periods. Unresolved pressure in uptrend

6 Single pink square: a extreme volume in combination with small range confirming downtrend, b extreme volume in combination with small range countering uptrend, c high volume in combination with wide range countering downtrend. This indicated halting downward price movement. Occurs often at bottoms or during accumulation periods. Unresolved pressure in downtrend.

The signals 5 and 6 are introduced to prevent flipping of signals into their opposite when the lookback is changed. Now signals may only change from unresolved in directional or vice versa. Signals 3 and 4 were introduced to make sure that all occurrences of extreme volume will result in a signal. Occurrences of wide volume only partly lead to a signal.

Use of REVE Cohorts.

This is the indicator for volume-range analyses that I always wanted to have. Now that I managed to create it, I put it in all my charts, it is often the first part I look at, In my momentum investment system I use it primarily in the layout for following open positions. It helps me a lot to decide whether to close or hold a position. The advantage over my previous attempts to create a REVE indicator (published scripts), is that this version is concise because it reports and classifies all possible volumes and ranges, you see periods of drying out of volume, sequences of falter candles, occurrences of high morning volume, warning and confirming signals.. The assessment by script whether some volume should be considered low, normal, high or extreme gives an edge over using the standard volume bars.

Settings of REVE Cohorts

The default setting for lookback is ‘script sets lookback’ I put this in my indicators because I want them harmonized, the script sets lookback according to timeframe. The tooltip informs which lookback will be set at which timeframe, you can enable a feedback label to show the current lookback. If you switch ‘script sets lookback’ off, you can set your own preferred user lookback. The script self-adapts its settings in such a way that it will show up from the very first bar of historical chart data, it adds volume starting at the fourth bar.

You can switch off volume cohorts, only range candles will show while the middle band disappears. Signals will remain if volume is present in the data. Some Instruments have no volume data, e.g. SPX-S&P 500 Index,, then only range candles will be shown.

Colors can be adapted in the inputs. Because the script calculates matching colors with more transparency it is advised to use 100 percent opacity in these settings.

Take care, Eykpunter

Bollinger Bands and SMA Channel Buy and Sell

This Indicator is a combination of a standard BB indicator incorporated with a SSL Channel by ErwinBeckers which is Simple Moving average with a length of set at 10 (Default) and calculates the high and low set for the default 10 to form a Channel.

The Settings for the Bollinger Band is the standard settings on a normal Bollinger Band - Length 20, source close and Standard dev 2

The setting for the SMA is length 10 and the high and low calculated or that length to form a channel.

The SMA Channel gives a green line for the Up channel and the Red line for the down Channel.

The basis of the indicator is that the Candle close above the Basis line of the BB and the SMA green line will give a buy indicator

and the same for Sell indicator the candle close below the basis BB and the SMA line Red will give a Sell indicator.

Please note that this indicator is a mix of 2 basic indicators found in Trading view, giving Buy and Sell indicators to make things easier to not look for this visually.

This code will be open source for anyone to use or back test or use it for whatever they want.

This code is for my own personal trading and cannot be relied upon. This indicator cannot be used and cannot guarantee anything, and caution should always be taken when trading. Use this with other indicators to give certanty.

Again use this for Paper Trading only.

I want to thank TradingView for its platform that facilitates development and learning.