Lancelot RR StrategyDear all,

Free strategy again.

This strategy consists of 2 indicators I think works well with each other as a trend following strategy.

The 2 indicators are Renko chart and Relative Vigor Index.

This is a long-only breakout strategy that aims to capture the majority of the trend.

Works well on BTCUSD XBTUSD, as well as other major liquid Pair.

Please acknowledge my effort by like and follow.

And lastly,

Save Hong Kong, the revolution of our times.

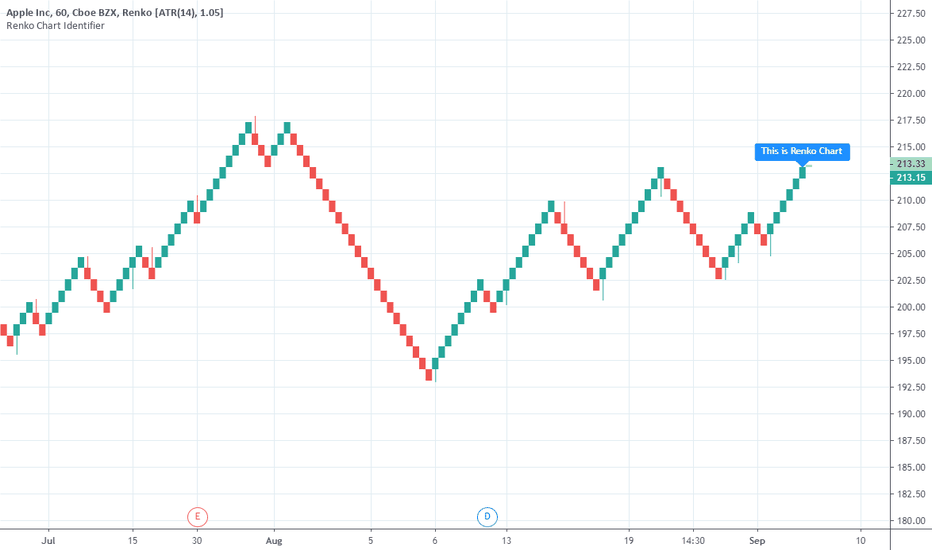

Renko

[RESEARCH] Chart Type IdentifierA viable and workable concept of chart type identification using Pine Script.

Was wollen wir trinken , sieben Tage lang

Was wollen wir trinken, so ein Durst!

Was wollen wir trinken, sieben Tage lang

Was wollen wir trinken, so ein Durst!

[RESEARCH] Renko Chart IdentifierDespite I am not a big fan of Renko I spent some time to solve a common problem of chart type identification using absolutely obvious technique: Renko bricks have the same size. That's all. Not a cutting-edge maths.

This tool allows to identify:

ATR Renko charts (see ^)

Traditional Renko charts

Here is example for Traditional Renko:

It also works correctly with other chart types:

Classic Candles

Heikin-Ashi

Kagi

PnF

Range Bars

Remember @everget !

And pay attention to the license before use)

Renko Plot StrategyThis strategy lets you plot Renko open and close values, based on your preferred Renko size brick, on normal candle chart. You can use it on any timeframe, define your preferred brick size and trailing stop.

RENKO MTFMultiframe RENKO panes with timeframe-weighted signal line and warning dots. All timeframes in settings MUST be <= your timeframe or it will repains on bigger timeframes.

RENKO strategyStandard simple strategy RENKO. Entry on the first reversing bar. No repaints. Caution arrows when price crossing RENKO levels

MouN1R - Basic Renko regression strategyBasic idea of how to untrend and calculate slope movement and derivative.

Have fun

Renko Strategy Open_CloseSimple Renko strategy, very profitable. Thanks to vacalo69 for the idea.

Rules when the strategy opens order at market as follows:

- Buy when previous brick (-1) was bearish and previous brick (-2) was bearish too and actual brick close is bullish

- Sell when previous brick (-1) was bullish and previous brick (-2) was bullish too and actual brick close is bearish

Rules when the strategy send stop order are the same but this time a stop buy or stop sell is placed (better overall results).

Note that strategy open an order only after that condition is met, at the beginning of next candle, so the actual close is not the actual price.

Only input is the brick size multiplier for stop loss and take profit: SL and TP are placed at (brick size)x(multiplier) Or put it very high if you want startegy to close order on opposite signal.

Adjust brick size considering:

- Strategy works well if there are three or more consecutive bricks of same "color"

- Expected Profit

- Drawdown

- Time on trade

This strategy uses Renko charts with TRADITIONAL bricks, so no repaint.

Study with alerts, MT4 expert advisor and jforex automatic strategy are available at request.

Please use comment section for any feedback.

Renko CandlesticksRenko charts are awesome . They reduce noise by only painting a brick on the chart when price moves by a specified amount up/down. When the price reverses, it must go twice the specified amount before a brick is painted. Time is not a factor, just price movement. Sometimes however, you want the pros of a renko chart, but on a regular candlestick chart. This indicator attempts to do just that.

A band is placed around price action showing the upper and lower bounds of what would be the current renko brick. The band only goes up/down when the price action itself moves up/down by the amount you specify. There are several ways of specifying the amount:

Fixed Price Amount: As the name says, you enter the brick size amount, i.e. the amount the price has to move before being in a new brick.

% of Price: This method will calculate the amount the price has to move as a percentage of the price itself. This way as price goes up/down, your brick size will adjust accordingly. Recommended values would be around 1% or less.

% of ATR: This option will make the brick size a percentage of the Average True Range. You can specify the ATR time frame to be different from your current time frame as well as the ATR length. For instance you could be on a 10 minute chart but specify the ATR to be daily with a length of 3 and a percentage amount of 15. This would make your brick size 15% of the Average True Range for the last 3 days. Recommended values are 10 to 20%.

Use this indicator on any time frame, even the 1 minute as the renko bands span the price action the same way on any time frame easily letting you know whether or not the price has moved appreciably, regardless of how much time has passed.

You can also set alerts easily, simply set the alert to crossing and choose “Renko Candlesticks” instead of “Value”. You will then see the options for the renko upper and lower bounds.

Tested on Bitcoin with the following values:

Fixed Price Amount: 30 ($30)

% of Price: 0.45 (if Bitcoin is $7000 then the brick size would be $31.50)

% of ATR: 15%, ATR Time Frame: 1D, ATR Length: 3 (3 days)

[AGHYAD]EMA-CROSS+CCI_BASED_ON_RENKO////////////////////////////////////////////

// 4 HOURS

// -------------------------- BUY --------------------------

// 1. MUST: Set Time_Frame To 1D

// 2. STRONG: Any Green Signal!!

////////////////////////////////////////////

EMA-CROSS + CCI SIGNALS BASED ON RENKO WITH CUSTOM TIME-FRAME

RENKO INDICATOR OVERLAY by CryptoJoncisA very simple and basic renko indicator for any time frame and ticker.

Please be aware, the minimum value for traditional renko box size = 0.0001 so if you are using this indicator for trading with cryptocurrencies, it might be better to use ATR for that.

Can be merged together with main chart for better performance.

Consider a tip if you find this helpful

BTC: 3FiBnveHo3YW6DSiPEmoCFCyCnsrWS3JBR

ETH: 0xac290B4A721f5ef75b0971F1102e01E1942A4578

AGHYAD_Renko+Sniper+PAB+TZ+ICHIMOKU_V21. MUST: RENKO ATR 2 YELOOW

2. STRONG: SNIPER 8,8 BUY SIGNAL

3. WEAK: TZ 6,6 BUY SIGNAL

========= SELL =========

1. STRONG: SNIPER 8,8 SELL SIGNAL

2. WEAK: TZ 6,6 SELL SIGNAL

3. WEAK: RENKO ATR 2 RED

=========NOTE=========

RENKO > SNIPER > TZ

6 minutes ago

the sniper buy signal is now based on renko

[Autoview][Alerts]Dual MA Ribbons R0.12 by JustUncleLSorry I have had trouble getting the TradingView to point to the "Alerts" script instead of the "Backtest".

This is the Alerts part of this pair of Scripts. This part creates alerts to be picked up by the Chrome Add-on.

[Autoview][BackTest]Dual MA Ribbons R0.12 by JustUncleLThis is an implementation of a strategy based on two MA Ribbons, a Fast Ribbon and a Slow Ribbon. This strategy can be used on Normal candlestick charts or Renko charts (if you are familiar with them).

The strategy revolves around a pair of scripts: One to generate alerts signals for Autoview and one for Backtesting, to tune your settings.

The risk management options are performed within the script to set SL(StopLoss), TP(TargetProfit), TSL(Trailing Stop Loss) and TTP (Trailing Target Profit). The only requirement for Autoview is to Buy and Sell as directed by this script, no complicated syntax is required.

The Dual Ribbons are designed to capture the inferred behavior of traders and investors by using two groups of averages:

> Traders MA Ribbon: Lower MA and Upper MA (Aqua=Uptrend, Blue=downtrend, Gray=Neutral), with center line Avg MA (Orange dotted line).

> Investors MAs Ribbon: Lower MA and Upper MA (Green=Uptrend, Red=downtrend, Gray=Neutral), with center line Avg MA (Fuchsia dotted line).

> Anchor time frame (0=current). This is the time frame that the MAs are calculated for. This way 60m MA Ribbons can be viewed on a 15 min chart to establish tighter Stop Loss conditions.

Trade Management options:

Option to specify Backtest start and end time.

Trailing Stop, with Activate Level (as % of price) and Trailing Stop (as % of price)

Target Profit Level, (as % of price)

Stop Loss Level, (as % of price)

BUY green triangles and SELL dark red triangles

Trade Order closed colour coded Label:

>> Dark Red = Stop Loss Hit

>> Green = Target Profit Hit

>> Purple = Trailing Stop Hit

>> Orange = Opposite (Sell) Order Close

Trade Management Indication:

Trailing Stop Activate Price = Blue dotted line

Trailing Stop Price = Fuschia solid stepping line

Target Profit Price = Lime '+' line

Stop Loss Price = Red '+' line

Dealing With Renko Charts:

If you choose to use Renko charts, make sure you have enabled the "IS This a RENKO Chart" option, (I have not so far found a way to Detect the type of chart that is running).

If you want non-repainting Renko charts you MUST use TRADITIONAL Renko Bricks. This type of brick is fixed and will not change size.

Also use Renko bricks with WICKS DISABLED. Wicks are not part of Renko, the whole idea of using Renko bricks is not to see the wick noise.

Set you chart Time Frame to the lowest possible one that will build enough bricks to give a reasonable history, start at 1min TimeFrame. Renko bricks are not dependent on time, they represent a movement in price. But the chart candlestick data is used to create the bricks, so lower TF gives more accurate Brick creation.

You want to size your bricks to 2/1000 of the pair price, so for ETHBTC the price is say 0.0805 then your Renko Brick size should be about 2*0.0805/1000 = 0.0002 (round up).

You may find there is some slippage in value, but this can be accounted for in the Backtest by setting your commission a bit higher, for Binance for example I use 0.2%

Special thanks goes to @CryptoRox for providing the initial Risk management Framework in his "How to automate this strategy for free using a chrome extension" example.

CryptoM173's Gimme MoneyLatest version. Nobody gave me feedback and managing requests to add people became a PITA. Enjoy.

I like money, you like money, this set up has the potential to make a LOT of it. That being said, I do NOTmake any warranties of this making you money, nor do I guarantee you will NOT lose money. In the end, you're the one configuring it and interpreting the results. Providing that you DO set it up correctly and it makes you obscene amounts of money, donations are always welcome (addresses below).

Before you start, it's probably you read EVERYTHING below.

You'll have to do some tweaking of the MA's to find a strat that best suits your needs. It is an indicator you're welcome to use to assist in your trading decisions. I made this script for renko charts and trading bitcoin -1.64% because the standard strat wasn't working out. if you find you're getting a lot of consecutive colored bars or crosses on Renko, you may need to switch from ATR 14 to something like Traditional 50. You will need to adjust the "box value" for traditional renko to fit the asset you're working with, on the time frame you're trading on. Smaller values (i.e. on bitcoin -1.64% I use a box value of 50 on 4hr and 1D with absurd success) but you need to make sure they're not too small, otherwise small moves may appear larger than they are, resulting in a bunch of break-even trades. If you're going to be trading cryptocurrency, it's easiest to switch back to ATR14 to get an idea of the Average Trading range to have a reference point to start from trading btc -1.64% (i.e .000034 rather than 50).

It's a great tool if you're looking to carry both swap and futs positions and keep an eye on the short term swap opportunities while monitoring the status of your futs position and help decide whether or not to close a long at a correction or not and while this strategy has been most effective for me with Renko bars, it's been very useful for monitoring futs positions on traditional charts.

For access, feel free to DM -0.34% me on twitter, @CryptoM173

If you're the generous type, feel free to donate Bitcoin to: 3BMEXWz6Es7iLdi9zAyMWWHHZPNbMKPqrV

Auto-FilterA least squares filter using the Auto line as source, practical for noise removal without higher phase shift.

Its possible to create another parameter for the auto-line length, just add a parameter Period or whatever you want.

r = round(close/round)*round

dev = stdev(close,Period)

Hope you enjoy :)