ProfitPivotProfitPivot dynamically shows the difference between unit cost and current market price of an asset, both in absolute term and in percentage. Traders can ascertain the profit level of a particular asset at a glance. Traders can input or change unit cost of the asset at any time directly through attribute settings. Previous bar close price will be used by default if the unit cost is not supplied.

ProfitPivot is developed by @isarab with the assistance of Copilot. It is licensed under Mozilla Public License Version 2.0.

Точки разворота и уровни

Wick Reversal Detector ProTime is Money. As Supply & Demand Wick Trader we cannot sit in front of the computer the whole day and wait for the magic to happen. I wrote this script to detects equal highs and equal lows with an adjustable wick size and alert function. Use LuxAlgo Swing Failure Pattern and my VIX-RSI Wick Hunt to identify Supply & Demand Zone Reversals.

RH_SanityCheckShows a quick calculation of key pullback levels in relation to current or all time highs.

Allows you to adjust the calculation based on All time high or pick a specific date to calculate from

CPR BEAST with Previous Day High/Low, SMA, EMA, VWAP by MRS*Indicator Name:

**CPR BEAST with EMAs, VWAP & Previous Day High/Low by Rajasekhar Muvvala**

Description:

This powerful indicator combines **Central Pivot Range (CPR)**, **Daily/Weekly/Monthly Pivot Points**, **Moving Averages (SMA, EMA, 200-Day EMA)**, **Volume Weighted Average Price (VWAP)**, and **Previous Day High/Low** into a single, easy-to-use tool for traders. It is designed to help traders identify key support and resistance levels, trends, and potential reversal zones across multiple timeframes.

Key Features:

1. Central Pivot Range (CPR):

- CPR is calculated based on daily pivot points and includes three lines: "Central Pivot (CP)", "Bottom Central Pivot (BC)", and "Top Central Pivot (TC)".

- Enabled by default but can be toggled off from the settings.

- Customizable colors for all three lines.

2. Daily Pivot Points:

- Includes **Support (S1, S2, S3)** and **Resistance (R1, R2, R3)** levels.

- Levels 1 and 2 (S1/R1, S2/R2) are enabled by default, while Level 3 (S3/R3) can be optionally displayed.

- Resistance lines are red, and Support lines are green by default (colors customizable).

3. Weekly and Monthly Pivot Points:

- Weekly and Monthly pivots include **Pivot**, **Support (S1, S2, S3)**, and **Resistance (R1, R2, R3)** levels.

- Weekly levels are displayed as crossed (`+`) lines, while Monthly levels are displayed as circled (`o`) lines for better visual distinction.

- All weekly and monthly levels are optional and can be toggled on/off.

4. Moving Averages:

- Includes **Simple Moving Average (SMA)**, **Exponential Moving Average (EMA)**, and **200-Day EMA**.

- Customizable lengths and colors for each moving average.

- Helps identify trends and potential entry/exit points.

5. Volume Weighted Average Price (VWAP):

- Displays VWAP for intraday trading.

- Can be toggled on/off and customized for color.

6. Previous Day High/Low:

- Highlights the "Previous Day High" and "Previous Day Low" on the chart.

- Useful for identifying breakout or reversal zones.

- Customizable colors for both high and low levels.

7. Visibility Settings:

- All pivot points, CPR, VWAP, and previous day high/low are "hidden on daily and above timeframes" by default.

- Ensures the indicator is optimized for intraday trading.

8. Customization Options:

- Toggle visibility of CPR, pivot points, moving averages, VWAP, and previous day high/low.

- Customize colors, lengths, and styles for all elements.

- Adjust input sources for calculations (e.g., close, open, etc.).

---

How to Use:

Intraday Trading: Use the CPR and daily pivot points to identify key support and resistance levels. Combine these with VWAP and moving averages to confirm trends and find potential entry/exit points.

Swing Trading: Use weekly and monthly pivot points to identify longer-term support and resistance zones.

Breakout Trading: Monitor the previous day's high and low for potential breakout opportunities.

Trend Analysis: Use the moving averages (SMA, EMA, 200-Day EMA) to identify the overall trend direction.

---

Default Settings:

- **CPR**: Enabled by default (Central Pivot line cannot be disabled).

- **Daily Pivot Points**: Levels 1 and 2 (S1/R1, S2/R2) are enabled by default.

- **Weekly/Monthly Pivot Points**: Disabled by default (can be enabled from settings).

- **Moving Averages**: SMA (20), EMA (21), and 200-Day EMA are enabled by default.

- **VWAP**: Enabled by default.

- **Previous Day High/Low**: Enabled by default.

---

Customization Options:

- **CPR**:

- Enable/Disable CPR lines.

- Customize colors for CP, BC, and TC lines.

- **Pivot Points**:

- Enable/Disable daily, weekly, and monthly pivot points.

- Customize colors for support and resistance levels.

- **Moving Averages**:

- Adjust lengths for SMA, EMA, and 200-Day EMA.

- Customize colors for each moving average.

- **VWAP**:

- Enable/Disable VWAP.

- Customize color.

- **Previous Day High/Low**:

- Enable/Disable previous day high/low.

- Customize colors for high and low levels.

---

Best Practices:

1. **Combine Indicators**: Use CPR and pivot points in conjunction with moving averages and VWAP to confirm trends and identify high-probability trading setups.

2. **Timeframe Optimization**: The indicator is designed for intraday trading, so it hides unnecessary elements on daily and above timeframes.

3. **Color Coding**: Customize colors to match your chart theme and improve readability.

4. **Backtesting**: Test the indicator on historical data to understand how it behaves in different market conditions.

---

Disclaimer:

This indicator is intended for educational and informational purposes only. It does not provide financial advice or guarantee profits. Always conduct your own research and consult with a professional before making trading decisions.

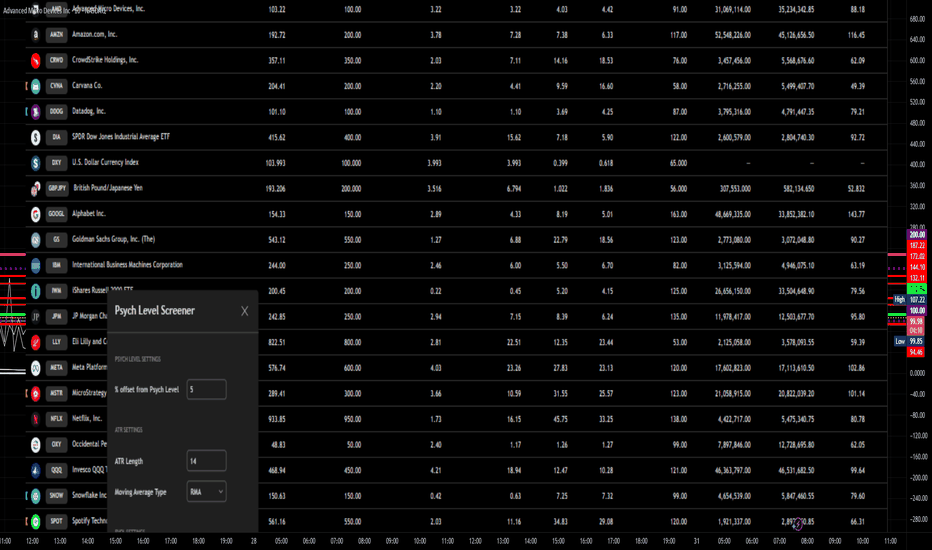

Psych Level ScreenerThis Script is intended for Pine Screener and is not designed as a indicator!!!

Pine Screener is something TradingView has recently added and is still only a Beta version.

Pine Screener itself is currently only available to members that are Premium and above.

What it does:

This screener will actively look for tickers that are close to Pysch level in your watchlist.

Psych level here refers to price levels that are round numbers such as 50,100,1000.

Users can specify the offset from a psych level (in %) and scanner will scan for tickers that are within the offset. For example if offset is set at 5% then it will scan for tickers that are within +/-5% of a ticker. (for $100 psych level it will scan for ticker in $95-105 range)

Once scan is completed you will be able to see:

- Current price of ticker

- Closest psych level for that ticker

- % and $ move required for it to hit that psych level

- Ticker's day range and Average range (with % of average range completed for the day)

- Ticker volume and average volume

Setting up:

www.tradingview.com

Above link will help you guide how to setup Pine screener.

Use steps below to guide you the setup for this specific screener:

1. Open Pine Screener (open new tab, select screener the "Pine")

2. At the top, click on "Choose Indicator" and select "Psych Level Screener"

3. At the top again, click "Indicator Psych Level Screener" and select settings.

4. Change setting to your needs. Hit Apply when done.

a)"% offset from Psych Level" will scan for any stocks in your watchlist which are +/- from the offset you chose for any given psych level. Default is 5. (e.g. If offset is 5%, it will scan for stocks that are between $95-$105 vs $100 psych level, $190-$210 for $200 psych level and so on)

b) ATR length is number of previous trading days you want to include in your calculation. Moving Average Type is calculation method.

c) Rvol length is number of previous trading days you want to include in your calculation.

5. On top left, click "Price within specified offset of Psych. Level" and select true. Then select "Scan" which is located at the top next to "Indicator Psych Level Screener". This will filter out all the stock that meets the condition.

6. At the end of the column on the right there is a "+" symbol. From there you can add/remove columns. 30min/1hr/4hr/1D Trend are disabled by default so if this is needed please enable them.

7. You can change the order of ticker by ascending and descending order of each column label if needed. Just click on the arrow that comes up when you move the cursor to any of the column items.

8. You can specify advanced filter settings based on the variables in the column. (e.g., set price range of stock to filter out further) To do so, click on the column variable name in interest, located above the screener table (or right below "scan") and select "manual setup".

How to read the column:

Current Price: Shows current price of the ticker when scan was done. Currently Pine Screener does NOT support pre/post-hours data so no PM and AH price.

Psych Level: Psych level the current price is near to.

% to Psych Level: Price movement in % necessary to get to the Psych level.

$ to Psych Level: Price movement in $ necessary to get to the Psych level.

DTR: Daily True Range of the stock. i.e. High - Low of the ticker on the day.

ATR: Average True Range of stock in the last x days, where x is a value selected in the setting. (See step 3 in Previous section)

DTR vs ATR: Amount of DTR a ticker has done in % with respect to ATR. (e.g., 90% means DTR is 90% of ATR)

Vol.: Volume of a ticker for the day. Currently Pine Screener does NOT support pre/post-hours data so no PM and AH volume.

Avg. Vol: Average volume of a ticker in the last x days, where x is a value selected in the setting. (See step 3 in Previous section)

Rvol: Relative volume in percentage, measured by the ratio of day's volume and average volume.

30min/1hr/4hr/1D Trend: Trend status to see if the chart is Bullish or Bearish on each of the time frame. Bullishness or Bearishness is defined by the price being over or under the 34/50 cloud on each of the time frame. Output of 1 is Bullish, -1 is Bearish. 0 means price is sitting inside the 34/50 cloud. Currently Pine Screener does NOT support pre/post-hours data so 34/50 cloud is based on regular trading hours data ONLY.

Some things user should be aware of:

- Pine Screener itself is currently only available to TradingView members with Premium Subscription and above. (I can't to anything about this as this is NOT set by me, I have no control) For more info: www.tradingview.com

- The Pine Screener itself is a Beta version and this screener can stop working anytime depending on changes made by TradingView themselves. (Again I cannot control this)

- Pine Screener can only run on Watchlists for now. (as of 03/31/2025) You will have to prepare your own watchlists. In a Watchlist no more than 1000 tickers may be added. (This is TradingView rules)

- Psych level included are currently 50 to 1500 in steps of 50. If you need a specific number please let me know. Will add accordingly.

- Unfortunately this screener does not update automatically, so please hit "scan" to get latest screener result.

- I cannot add 10min trend to the column as Pine Screener does NOT support 10min timeframe as of now. (03/31/2025)

- This code is only meant for Pine Screener. I do NOT recommend using this as an indicator.

- Currently Pine Screener does NOT support pre/post-hours data. So data such as Price, Volume and EMA values are based on market hours data ONLY! (If I'm wrong about this please correct me / let me know and will make look into and make changes to the code)

Other useful links about Pine Screener:

Quick overview of the Screener’s functionality: www.tradingview.com

what do you need to know before you start working? : www.tradingview.com

These links will go over the setting up with GIFs so is easier to understand.

-----------------------------------------------------------------------------------------------------------------

If there are other column variables that you think is worth adding please let me know! Will try add it to the screener!

If you have any questions let me know as well, will reply soon as I can!

Have a good trading day and hope it helps!

Prev days openLabels are offset to the right of Lines

You can adjust the number of opens back to display

If you want to change the format of the label please read the tool tip

Original FrizLabz

Prev days openLabels are offset to the right of Lines

You can adjust the number of opens back to display

If you want to change the format of the label please read the tool tip

Original FrizLabz

CPR with Historical PeriodsThis TradingView indicator calculates and displays the Central Pivot Range (CPR) using a user-selected timeframe (Daily, Weekly, or Monthly). It plots the key levels—Pivot Point (PP), Bottom Central (BC), and Top Central (TC)—for the current period while retaining a configurable history of previous CPR sets. Customize colors, line width, and label display to suit your trading style and effectively identify potential support and resistance levels.

Price action plus//The system combines the divergence of A/D and OBV with identifying reversal points using Japanese candlestick patterns, creating an enhanced version of price action. This helps investors more easily and accurately recognize reversal patterns in technical analysis.

Divergence of A/D vs. OBV includes:

Positive divergence: Identifies smart money leaving the market.

Negative divergence: Identifies smart money entering the market.

Reversal candlestick patterns include:

Buy signals: Morning Star, Bullish Engulfing, Hammer.

Strong Buy signals: Buy signals + Negative divergence

Sell signals: Evening Star, Bearish Engulfing, Shooting Star.

Strong Sell signals : Sell signals + Positive divergence

//Hope this system will be helpful for you!

levels and eqsGenerates Range & EQ levels and removes duplicates. Prioritizes by higher timeframe for duplicates. For example, on Monday's open, weekly open is displayed while daily open is hidden automatically.

Original rumpypumpydumpy

Daily Weekly Monthly Yearly Opens/Highs/LowsThe "Daily Weekly Monthly Yearly Opens" indicator is a versatile tool designed to enhance your trading analysis by plotting the opening prices of various timeframes directly onto your charts. By displaying the current daily, weekly, monthly, and yearly opening levels, this indicator helps traders identify key support and resistance zones, facilitating more informed trading decisions.

**Key Features:**

- **Comprehensive Timeframe Coverage:** The indicator plots opening prices for daily, weekly, monthly, and yearly periods, providing a clear view of significant market levels across multiple timeframes.

- **Dynamic Display:** To maintain chart clarity, the indicator intelligently displays:

- Daily opens on intraday timeframes.

- Weekly opens on timeframes less than weekly.

- Monthly opens on timeframes less than monthly.

- **Customizable Visuals:** Users can adjust the color and style of the plotted lines to match their chart preferences, ensuring a personalized and clear visual experience.

- **Historical Reference:** An option to display previous period opens allows traders to analyze how current price action interacts with past opening levels, offering insights into potential support and resistance areas.

- **Alert Functionality:** Set up alerts to be notified when the price crosses any of the plotted opening levels, enabling timely responses to market movements.

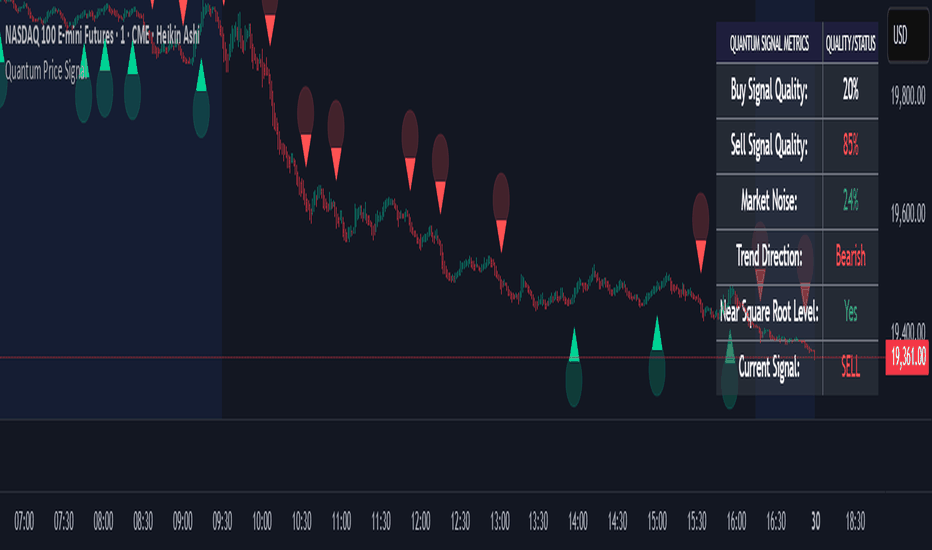

Quantum Price SignalQuantum Price Signal

This indicator combines square root price analysis with advanced technical filters to identify high-probability trading opportunities. Designed for practical use in real market conditions, it provides both visual signals and a comprehensive dashboard to enhance trading decisions.

Core Technology:

The Quantum Price Signal uses mathematical relationships based on square root price levels to identify key zones where price tends to react. These levels have proven to be powerful areas for reversals and continuations across multiple timeframes.

Detailed Usage Guide:

Signal Interpretation:

Green Triangle (Buy): Appears below candles at potential support levels. Look for these at market bottoms and pullbacks in uptrends

Red Triangle (Sell): Appears above candles at potential resistance levels. Most effective at market tops and rallies in downtrends

Dashboard Elements:

Buy/Sell Signal Quality: Shows relative strength of potential setups

Higher values indicate stronger signals with better probability

Use as comparative measure between different signals

Market Noise: Indicates market choppiness/volatility

Lower readings suggest cleaner price action and more reliable signals

Higher readings indicate choppy conditions requiring wider stops

Trend Direction: Overall market bias

Align trades with this direction for highest probability

Counter-trend trades require stronger signal quality

Near Square Root Level: Confirms price at significant mathematical level

"Yes" reading significantly strengthens any signal

These mathematical levels often act as strong support/resistance

Current Signal: Active trading recommendation

Shows most recent valid signal type

Use to quickly identify the indicator's bias

Practical Trading Applications:

Swing Trading Strategy:

Look for signals at key support/resistance levels

Confirm with trend direction on dashboard

Enter on close of signal candle

Place stops beyond recent swing points

Target next significant level or 1:2 risk-reward

Trend-Following Method:

Only take signals in direction of "Trend Direction"

Wait for pullbacks to Square Root levels

Require "Yes" for Near Square Root Level reading

Enter when signal appears at these levels

Trail stops using prior swing points

Reversal Detection:

Watch for signals against prevailing trend

Must have "Near Square Root Level" showing "Yes"

Confirm with pattern like engulfing or hammer

Look for divergence in momentum indicators

Use tighter stops as these are higher risk trades

Multiple Timeframe Approach:

Identify trend on higher timeframe

Look for signals on lower timeframe

Only take signals that align with higher timeframe trend

Add to position on additional signals in same direction

Exit when signal appears in opposite direction

Volume Confirmation Enhancement:

Check volume on signal candles

Stronger signals should have above-average volume

Low volume signals have higher failure rate

Volume increase on breakouts confirms strength

Volume decline near levels suggests potential failure

This indicator works best when combined with proper risk management and sound technical analysis principles. Use it as a decision support tool rather than an automated system, and always consider the broader market context when making trading decisions.RetryClaude can make mistakes. Please double-check responses.

S/R Zones (Daily and Weekly) from 1H CandlesSupport & Resistance Zone Indicator – Beta Version

Important Notice:

Higher timeframe accuracy through lower timeframe data – This indicator extracts data from lower timeframes (1H) to provide more precise daily and weekly support & resistance zones. However, due to Pine Script’s limitations, this script must be applied on a 1H chart, even it is designed for trading on the daily or weekly timeframes .

🚨 Usage Restriction:

✅ Apply this indicator ONLY on a 1H chart but trade on the daily and weekly timeframes for proper functionality.

❌ It will not work correctly if applied directly on daily or weekly charts. I regret that there is no way to bypass this limitation unless TradingView lifts its constraints for fetching data from lower timeframes.

⚠ Beta Version – This indicator is still under development and subject to refinements.

Support & Resistance Categorisation:

This indicator identifies S/R zones based on price-weighted volume on lower timeframes (1H), making it significantly more accurate than those relying solely on current or higher timeframes. To improve reliability, each zone requires a confirmation period of 3 days/weeks before appearing on the chart.

Zone Colors & Labels:

Blue – Daily Support

Orange – Daily Resistance

Green – Weekly Support

Red – Weekly Resistance

By leveraging historical data and volume-based confirmation, this tool enhances support/resistance precision.

How to Use It:

This indicator is designed for daily & weekly trading setups but MUST be applied to a 1H chart.

Use these zones to identify retests and breakouts in your trading strategy.

Currently optimised for crypto & tech stocks. While it may work for commodities and FX, parameter adjustments might be required for optimal performance.

📌 Beta Build Limitations:

Displays only 20 historical daily zones and 10 historical weekly zones for now. Use replay mode to check earlier zones.

Future updates will introduce customisation options, including:

Number of historical zones displayed

Adjustable zone colors

Risk preference settings per timeframe

…

Final Thoughts:

This indicator acts as a signal generator for long and short trades and will soon be integrated with my risk indicator as part of a larger trading strategy.

As this is an early beta version, further refinements are planned, and I welcome any user feedback for improvements.

📢 Stay tuned for updates, and happy trading! 🚀

Skybull - TimeRay AnalyzerSkybull - TimeLine Analyzer

Unlock multi-timeframe mastery with TimeLine Analyzer, a premium indicator that projects High, Low, and Close levels from a higher timeframe as customizable horizontal rays—enhanced with a dynamic offset and real-time price proximity alerts. Designed for traders who demand precision, this tool bridges short-term action with long-term context, helping you spot key levels and act when it matters most.

What Makes It Unique?

TimeLine Analyzer isn’t just another level-plotter—it’s a dual-purpose powerhouse. The Dynamic Offset lets you rewind higher timeframe data (e.g., fetch the 4h High from 3 bars ago), revealing historical zones that shape today’s price. Paired with Price Proximity Alerts, it flags when the current price nears these levels within a custom percentage—think instant support/resistance signals. No free script combines this flexibility and live feedback.

How It Works

Using Pine Script, TimeLine fetches High, Low, and Close from your chosen higher timeframe, offset by a user-defined number of bars. These are drawn as rays with adjustable colors, widths, and extensions (None, Right, Both). The proximity alert calculates the percentage distance between the current price and each level, popping up labels when price gets close (e.g., within 0.5%). A sleek label shows your settings, keeping it mobile-friendly and clutter-free.

Features

Higher Timeframe Rays: Plots High, Low, and Close from any timeframe (1m to 1mo).

Dynamic Offset: Shift levels back 1–100 bars in the higher timeframe for historical insight.

Price Alerts: Flags when price is within 0.1–5% of a level, with live labels.

Customizable: Set ray colors, widths (1–10), and extensions to match your style.

Mobile-Ready: A compact label displays timeframe and offset.

Usage Examples

Breakout Prep: On a 15m chart, set a 1d timeframe with a 2-bar offset to see yesterday’s Close—get alerted when price nears it for a breakout.

Reversal Zones: Use a 4h timeframe with “Both” extension and a 0.5% alert threshold to catch reversals at historical Lows.

Scalping Edge: Bold rays (width 3) and a 1h offset on a 5m chart highlight key levels, with alerts for fast entries.

Settings

Higher Timeframe: Pick your timeframe (e.g., 4h, 1d).

Bars Back: Offset data 1–100 bars (default: 1).

Price Proximity Alert (%): Set 0.1–5% for alert sensitivity (default: 0.5).

Line Colors: Customize High, Low, and Close rays.

Line Width: Adjust thickness (1–10, default: 1).

Line Extension: None, Right, or Both.

Why It’s Worth It

TimeLine Analyzer delivers what free tools can’t: historical depth plus real-time precision. The offset uncovers hidden levels, while alerts turn static lines into live signals—perfect for scalpers, swing traders, and strategists. As an invite-only tool, it’s built for serious traders who want an edge without the noise.

Gann LV Price/Time (EN)Gann LV Price/Time

This indicator is based on William Gann’s methods, the Law of Vibration, and classic wave analysis. Unlike traditional Gann tools, it employs adaptive trend analysis, combining angular acceleration, price-to-time ratio, and resonance zones. This allows for more precise identification of key support and resistance levels and enhances the ability to forecast potential trend reversals.

🔹 Key Features

✔ Customizable key points (A, B, C) – the user selects three significant points that form the basis of the analysis.

✔ Price calculation methods – the option to consider candle wicks, candle bodies, or an average price.

✔ Automatic trend structure analysis – the indicator determines whether the market is in an impulse or corrective phase.

✔ Support and resistance level forecasting – based on Gann’s Law of Vibration, making calculations dynamic.

✔ Identification of time-based reversal zones – key time cycles that influence trends are analyzed.

✔ Price resonance zones – special areas where the price reaches maximum sensitivity and may reverse direction.

✔ Market noise filtering – intelligent smoothing and volatility adaptation techniques are applied.

🔹 How Does the Indicator Work?

1️⃣ Defining Key Points A, B, C

These points serve as the foundation of the analysis, helping to determine trend direction and potential reversal zones.

2️⃣ Angular Acceleration Analysis

The indicator assesses whether the angle between points is accelerating or decelerating, allowing traders to identify trend strength and potential turning points.

3️⃣ Detection of Price Resonance Zones

Every market has its own natural vibration frequencies—moments when the price is most susceptible to trend shifts. The indicator analyzes these patterns and identifies key levels where reversals may occur.

4️⃣ Identification of Time-Based Trend Reversal Zones

Time cycles play a crucial role in price movements. By analyzing market rhythm patterns, the indicator forecasts probable trend reversal points, providing additional confirmation for trading decisions.

🔹 What Are Price Resonance Zones?

Resonance zones are areas on the chart where the price encounters an "invisible barrier" based on Gann’s Law of Vibration. These zones form when natural price and time rhythms align, creating an effect similar to acoustic or mechanical resonance.

Within these zones:

Trends slow down or accelerate.

There is a high probability of a reversal.

Key support and resistance levels become stronger.

The indicator automatically identifies these intersections, helping traders find optimal entry and exit points.

🔹 Where to Apply It?

✔ For identifying entry and exit points – helps detect the most probable trend reversal zones.

✔ For market cycle analysis – understanding market rhythms enables more accurate forecasting.

✔ For filtering false breakouts – resonance zones can confirm or invalidate potential breakouts.

📌 Important: This indicator does not guarantee profits; it serves as a supportive tool for comprehensive technical analysis.

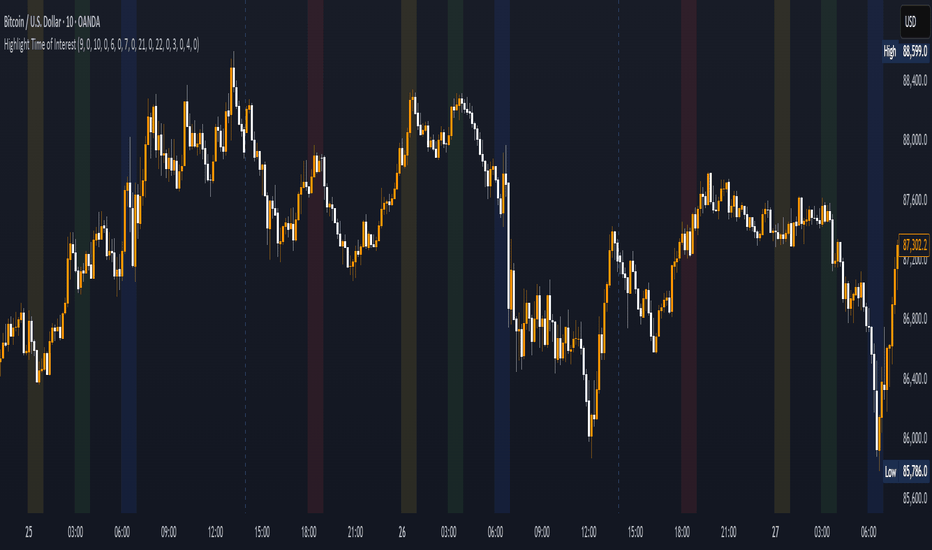

Highlight Time of InterestEST Time Period Background Indicator

This TradingView indicator visually highlights up to four custom-defined time periods on your chart using distinct background colors.

Key Features:

Custom Time Periods: Define up to four separate time intervals with individual start and end times, perfect for emphasizing key trading sessions or events.

Automatic Time zone Conversion: Automatically calculates the offset between the broker’s time zone and New York time (EST) so that your periods are correctly aligned with the Eastern market hours.

Visual Clarity:*Each period can be assigned a unique background color, providing clear visual cues directly on your chart for easier analysis and decision-making.

This indicator is ideal for traders who need a clear, automated visual reference for specific trading sessions or periods, streamlining the analysis process by highlighting critical timeframes directly on the chart.

百万哥ORBorb the simplest indicator for breakout,

ORB stands for opening range breakout, often used by traders

Triple Lookback Key Levels +now saved with a daily level .This indicator alone is great but works extrememly well with green*diamond.It shows a short,long and extra long lookback for support and resistance levels + a key daily level that makes this indicator top notch :)

Higher Highs, Higher Lows, Lower Highs, Lower Lowsshows Higher Highs and Higher Lows, and Lower Highs and Lower Lows

Prior Day/Week/Month Key LevelsThe Prior Day/Week/Month Key Levels indicator provides a visual reference for key historical price levels, helping traders to identify potential areas of support and resistance. It plots horizontal lines for the previous period's high, low, and opening prices across daily, weekly, and monthly timeframes, updating dynamically as new periods begin. Additionally, the indicator features "wick boxes" based on 15-minute timeframe data that highlight significant intraday extremes, which may signal potential reversals or breakout areas. With a modern, minimalistic settings panel, users can customize colors, line styles, widths, and label positions, ensuring the tool seamlessly integrates with various charting styles and trading strategies.

Triple Lookback Key LevelsI love this tool.It keeps up with intraday support and resistance levels which im finding very helpfull...simple easy to use !

Previous Week & Day High/LowPrevious Week & Day High/Low Indicator

The Previous Week & Day High/Low Indicator is designed to provide traders with key support and resistance levels based on historical price data. It automatically plots the previous day's and previous week's highs and lows as horizontal lines, offering a clear visual reference for potential breakout or reversal zones.

Features:

Clear Visual Levels: Displays previous day's highs and lows in green and red for easy identification.

Weekly Context: Plots previous week's highs and lows using distinct color-coded lines.

Real-Time Updates: Adjusts to new weekly and daily highs and lows as they are confirmed.

Labeled Lines: Each level is labeled directly on the chart, ensuring clarity without clutter.

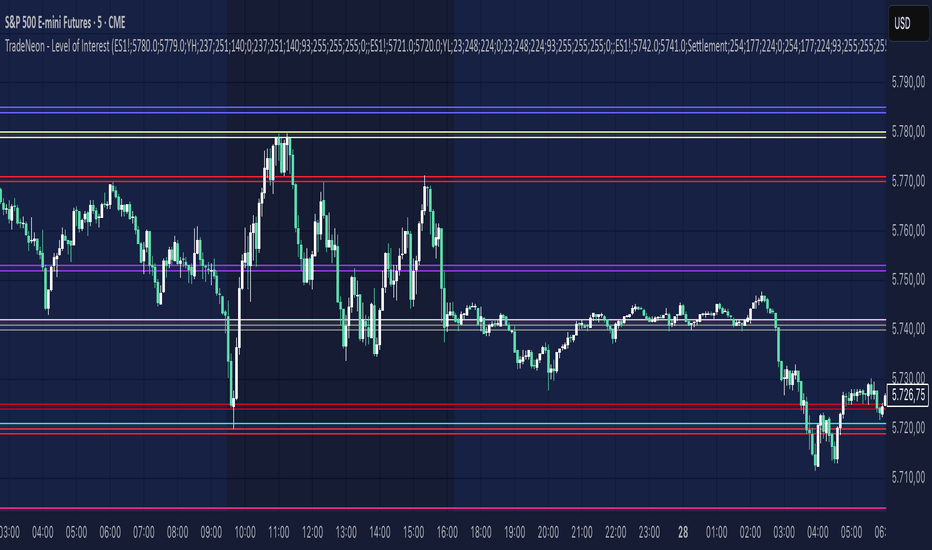

TradeNeon - Level of InterestUse the daily, professional market analyses to your advantage. Our experts with years of experience identify precise price areas of institutional interest. Maximize your trading potential and use these high-quality trading locations for your individual strategies.

tradeneon-academy.com/level-of-interest/