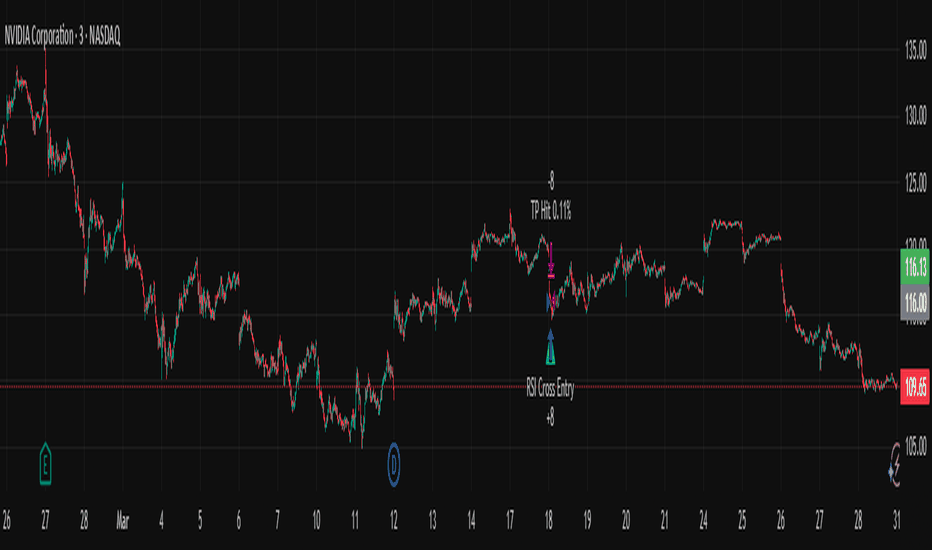

RSI Pro+ (Bear market, financial crisis and so on EditionIn markets defined by volatility, fear, and uncertainty – the battlegrounds of bear markets and financial crises – you need tools forged in resilience. Introducing RSI Pro+, a strategy built upon a legendary indicator born in 1978, yet engineered with modern visual clarity to remain devastatingly effective even in the chaotic financial landscapes of 3078.

This isn't about complex algorithms predicting the unpredictable. It's about harnessing the raw, time-tested power of the Relative Strength Index (RSI) to identify potential exhaustion points and capitalize on oversold conditions. RSI Pro+ cuts through the noise, providing clear, actionable signals when markets might be poised for a relief bounce or reversal.

Core Technology (The 1978 Engine):

RSI Crossover Entry: The strategy initiates a LONG position when the RSI (default period 11) crosses above a user-defined low threshold (default 30). This classic technique aims to enter when selling pressure may be waning, offering potential entry points during sharp downturns or periods of consolidation after a fall.

Modern Enhancements (The 3078 Cockpit):

RSI Pro+ isn't just about the signal; it's about providing a professional-grade visual experience directly on your chart:

Entry Bar Highlight: A subtle background flash on the chart signals the exact bar where the RSI crossover condition is met, alerting you to potential entry opportunities.

Trade Bar Coloring: Once a trade is active, the price bars are subtly colored, giving you immediate visual confirmation that the strategy is live in the market.

Entry Price Line: A clear, persistent line marks your exact average entry price for the duration of the trade, serving as a crucial visual anchor.

Take Profit Line: Your calculated Take Profit target is plotted as a distinct line, keeping your objective clearly in sight.

Custom Entry Marker: A precise shape (▲) appears below the bar where the trade entry was actually executed, pinpointing the start of the position.

On-Chart Info Table (HUD): A clean, customizable Heads-Up Display appears when a trade is active, showing vital information at a glance:

Entry Price: Your position's average cost basis.

TP Target: The calculated price level for your Take Profit exit.

Current PnL%: Real-time Profit/Loss percentage for the open trade.

Full Customization: Nearly every aspect is configurable via the settings menu:

RSI Period & Crossover Level

Take Profit Percentage

Toggle ALL visual enhancements on/off individually

Position the Info Table wherever you prefer on the chart.

How to Use RSI Pro+:

Add to Chart: Apply the "RSI Pro+ (Bear market...)" strategy to your TradingView chart. Ensure any previous versions are removed.

Access Settings: Click the cogwheel icon (⚙️) next to the strategy name on your chart.

Configure Inputs (Crucial Step):

RSI Crossover Level: This is key. The default (30) targets standard oversold conditions. In severe downturns, you might experiment with lower levels (e.g., 25, 20) or higher ones (e.g., 40) depending on the asset and timeframe. Observe where RSI(11) typically bottoms out on your chart.

Take Profit Percentage (%): Define your desired profit target per trade (e.g., enter 0.5 for 0.5%, 1.0 for 1%). The default is a very small 0.11%.

RSI Period: While default is 11, you can adjust this (e.g., the standard 14).

Visual Enhancements: Enable or disable the visual features (background highlights, bar coloring, lines, markers, table) according to your preference using the checkboxes. Adjust table position.

Observe & Backtest: Watch how the strategy behaves on your chosen asset and timeframe. Use TradingView's Strategy Tester to analyze historical performance based on your settings. No strategy works perfectly everywhere; testing is essential.

Important Considerations:

Risk Management: This specific script version focuses on a Take Profit exit. It does not include an explicit Stop Loss. You MUST manage risk through appropriate position sizing, potentially adding a Stop Loss manually, or by modifying the script.

Oversold ≠ Reversal: An RSI crossover is an indicator of potential exhaustion, not a guarantee of a price reversal.

Fixed TP: A fixed percentage TP ensures small wins but may exit before larger potential moves.

Backtesting Limitations: Past performance does not guarantee future results.

RSI Pro+ strips away complexity to focus on a robust, time-honored principle, enhanced with modern visuals for the discerning trader navigating today's (and tomorrow's) challenging markets

Индикаторы и стратегии

111D SMA / (350D SMA * 2)Indicator: Pi Cycle Ratio

This custom technical indicator calculates a ratio between two moving averages that are used for the PI Cycle Top indicator. The PI Cycle Top indicator triggers when the 111-day simple moving average (111D SMA) crosses up with the 350-day simple moving average (350D SMA *2).

The line value is ratio is calculated as:

Line Value = 111DSMA / (350D SMA × 2)

When the 111D SMA crosses with the 350D SMA triggering the PI Cycle Top, the value of the ratio between the two lines is 1.

This visualizes the ratio between the two moving averages into a single line. This indicator can be used for technical analysis for historical and future moves.

Econometrica by [SS]This is Econometrica, an indicator that aims to bridge a big gap between the resources available for analysis of fundamental data and its impact on tickers and price action.

I have noticed a general dearth of available indicators that offer insight into how fundamentals impact a ticker and provide guidance on how they these economic factors influence ticker behaviour.

Enter Econometrica. Econometrica is a math based indicator that aims to co-integrate and model indicator price action in relation to critical economic metrics.

Econometrica supports the following US based economic data:

CPI

Non-Farm Payroll

Core Inflation

US Money Supply

US Central Bank Balance Sheet

GDP

PCE

Let's go over the functions of Econometrica.

Creating a Regression Cointegrated Model

The first thing Econometrica does is creates a co-integrated regression, as you see in the main chart, predicting ticker value ranges from fundamental economic data.

You can visualize this in the main chart above, but here are some other examples:

SPY vs Core Inflation:

BA vs PCE:

QQQ vs US Balance Sheet:

The band represents the anticipated range the ticker should theoretically fall in based on the underlying economic value. The indicator will breakdown the relationship between the economic indicator and the ticker more precisely. In the images above, you can see how there are some metrics provided, including Stationairty, lagged correlation, Integrated Correlation and R2. Let's discuss these very briefly:

Stationarity: checks to ensure that the relationship between the economic indicator and ticker is stationary. Stationary data is important for making unbiased inferences and projections, so having data that is stationary is valuable.

Lagged Correlation: This is a very interesting metric. Lagged correlation means whether there is a delay in the economic indicator and the response of the ticker. Typically, you will observed a lagged correlation between an economic indicator and price of a ticker, as it can take some time for economic changes to reach the market. This lagged correlation will provide you with how long it takes for the economic indicator to catch up with the ticker in months.

Integrated Correlation: This metric tells you how good of a fit the regression bands are in relation to the ticker price. A higher correlation, means the model is better at consistent and accurate information about the anticipated range for the ticker in relation to the economic indicator.

R2: Provides information on the variance and degree of model fit. A high R2 value means that the model is capable of explaining a large amount of variance between the economic indicator and the ticker price action.

Explaining the Relationship

Owning to the fact that the indicator is a bit on the mathy side (it has to be to do this kind of task), I have included ability for the indicator to explain and make suggestions based on the underlying data. It can assess the model's fit and make suggestions for tweaking. It can also explain the implications of the data being presented in the model.

Here is an example with QQQ and the US Balance Sheet:

This helps to simplify and interpret the results you are looking at.

Forecasting the Economic Indicator

In addition to assessing the economic indicator's impact on the ticker, the indicator is also capable of forecasting out the economic indicator over the next 25 releases.

Here is an example of the CPI forecast:

Overall use of the indicator

The indicator is meant to bridge the gap between Technical Analysis and Fundamental Analysis.

Any trader who is attune to fundamentals would benefit from this, as this provides you with objective data on how and to what extent fundamental and economic data impacts tickers.

It can help affirm hypothesis and dispel myths objectively.

It also omits the need from having to perform these types of analyses outside of Tradingview (i.e. in excel, R or Python), as you can get the data in just a few licks of enabling the indicator.

Conclusion

I have tried to make this indicator as user friendly as possible. Though it uses a lot of math, it is fairly straight forward to interpret.

The band plotted can be considered the fair market value or FMV of the ticker based on the underlying economic data, provided the indicator tells you that the relationship is significant (and it will blatantly give you this information verbatim, you don't have to interpret the math stuff).

This is US economic data only. It does not pull economic data from other countries. You can absolutely see how US economic data impacts other markets like the TSX, BANKNIFTY, NIFTY, DAX etc. but the indicator is only pulling US economic data.

That is it!

I hope you enjoy it and find this helpful!

Thanks everyone and safe trades as always 🚀🚀🚀

FiveFactorEdgeUses ATR14, TSI, RSI, Fast Stochastic and Slow Stochastic information to determine potential high and low price, trend strength and direction. The information ia easy to read, self-descriptive and color coded for quick reference. Since it incorporates 5 different elements it could be used by itself but as with any indicator it's highly recommended to use it with other tried and true indicators.

malama's volume spikeThe "malama's volume spike" indicator identifies and highlights bars where the trading volume significantly exceeds the average, signaling potential market interest or activity. It calculates a Simple Moving Average (SMA) of the volume over a user-defined period and compares the current volume against this average multiplied by a specified threshold factor. Bars where the volume surpasses this threshold are colored yellow on the chart, providing a visual cue for traders to identify potential trading opportunities.

How It Works:

Volume Moving Average (SMA): The indicator computes the SMA of the volume over a period defined by the user (default is 20 bars).

Threshold Calculation: It multiplies the SMA by a user-defined factor (default is 2.0) to set the volume spike threshold.

Volume Spike Detection: If the current volume exceeds this threshold, the corresponding bar is highlighted in yellow.

Usage:

Volume MA Length: Adjust this parameter to set the period over which the volume SMA is calculated. A shorter length responds more quickly to recent volume changes, while a longer length smooths out short-term fluctuations.

Volume Threshold Factor: Modify this factor to set the sensitivity of the volume spike detection. A lower value will highlight more bars, while a higher value will highlight fewer, more significant spikes.

OG Trend MeterDescription:

The OG Trend Meter gives you a visual snapshot of multiple timeframe trends in one glance. Built for speed and clarity, it helps confirm direction across key intraday timeframes: 1m, 5m, 15m, and 30m.

How it works:

Each timeframe analyzes EMA alignment, price action, and momentum.

Displays clear green/red indicators for bullish/bearish trends on each timeframe.

Great for aligning trades with higher timeframe bias.

Best for:

Traders who want multi-timeframe confirmation before pulling the trigger.

Reducing fakeouts by staying with the dominant trend.

Scalping with the 1m chart while respecting 5m–30m direction.

Pair With: OG Supertrend or EMA Stack for high-probability confluence.

OG ATR RangeDescription:

The OG ATR Tool is a clean, visualized version of the Average True Range indicator for identifying volatility, stop-loss levels, and realistic price movement expectations.

How it works:

Calculates the average range (in points/pips) of recent candles.

Overlays ATR bands to help define breakout potential or squeeze zones.

Can be used to size trades or set dynamic stop-loss and target levels.

Best for:

Intraday traders who want to avoid unrealistic targets.

Volatility-based setups and breakout strategies.

Creating position sizing rules based on instrument volatility.

Pro Tip: Combine with your trend indicators to set sniper entries and exits that respect volatility.

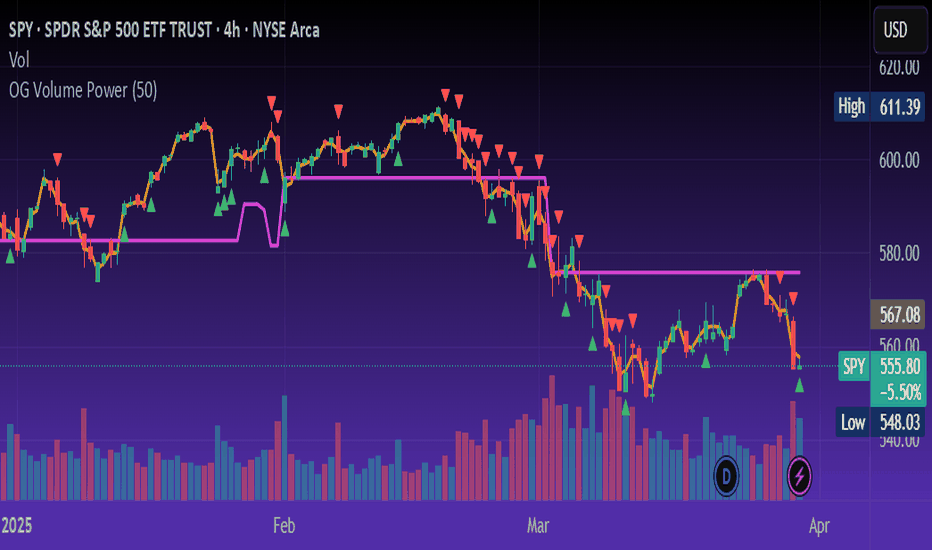

OG Volume PowerDescription:

The OG Volume Power is an elite-level volume analysis suite built for identifying momentum surges, trend continuation, and buyer/seller imbalances at critical price levels. It combines real-time VWAP tracking, a dynamic Point of Control (POC), and volume delta clusters to give traders a complete picture of price and volume interaction.

🔍 Key Features:

Real-Time VWAP:

Tracks volume-weighted average price to identify mean reversion and intraday fair value zones. Ideal for institutional-level entries and exits.

Dynamic POC (Point of Control):

Automatically finds the price level with the highest volume over the last N candles (default 50), helping traders pinpoint where market participants are most committed.

Buyer/Seller Volume Delta Clusters:

Highlights imbalances between buying and selling pressure using bullish and bearish volume deltas that exceed the 20-bar volume average — excellent for momentum detection and early trend recognition.

⚙️ How It Works:

Green triangle: Buyer surge (bullish delta + above average volume)

Red triangle: Seller surge (bearish delta + above average volume)

Magenta line: Dynamic POC (highest volume price over recent candles)

Orange line: VWAP (acts as a magnetic force for price)

📈 Best For:

Intraday scalping or swing trading on SPY, QQQ, BTC, or Forex

Volume flow confirmation before breakout entries

Filtering false breakouts with delta strength signals

🧠 Pro Tip:

Use OG Volume Power alongside your trend indicators (like OG EMA Stack or OG Supertrend) to confirm that volume is backing the move. Look for surges near VWAP or POC zones for sniper-level entries.

Posaunist 4h j1Title: 4-Hour Opening Price with Trendline and Label on the Right (Customizable Time Zone)

Description:

“This indicator plots horizontal lines at every 4-hour interval (00:00, 04:00, 08:00, etc.) with customizable labels showing the opening price. Users can choose to display or hide the time and price labels for each interval, with the option to adjust the color, width, transparency, and size of the labels and trendlines. Additionally, users can select their time zone offset.”

Previous Week & Day High/LowPrevious Week & Day High/Low Indicator

The Previous Week & Day High/Low Indicator is designed to provide traders with key support and resistance levels based on historical price data. It automatically plots the previous day's and previous week's highs and lows as horizontal lines, offering a clear visual reference for potential breakout or reversal zones.

Features:

Clear Visual Levels: Displays previous day's highs and lows in green and red for easy identification.

Weekly Context: Plots previous week's highs and lows using distinct color-coded lines.

Real-Time Updates: Adjusts to new weekly and daily highs and lows as they are confirmed.

Labeled Lines: Each level is labeled directly on the chart, ensuring clarity without clutter.

TR Buy/Sell Signal PanelI scripted this with chatgpt have fun guys

📊 TR Buy/Sell Signal Panel – Smart Trade Signals with Visual Clarity

The TR Buy/Sell Signal Panel is a standalone indicator inspired by the powerful Traders Reality (TR) methodology.

It detects potential long and short trade setups using classic market behavior patterns such as volume spikes, EMA crossovers, and session-based timing – all visualized cleanly and statically on your chart.

✅ Key Features

Buy Signals (LONG):

Green PVSRA candle (strong bullish candle with momentum)

EMA13 crossing above EMA50

Volume spike (current volume exceeds 20-period average × multiplier)

Triggered only during London or New York trading sessions (UTC)

Sell Signals (SHORT):

Red PVSRA candle (strong bearish move)

EMA13 crossing below EMA50

Volume spike

Also restricted to active session times

📌 Visual Components

Green/Red arrows on the chart indicate Buy/Sell entries

A static info panel in the bottom-right corner displays all signal conditions:

PVSRA active ✅

Volume Spike ✅

EMA Crossover ✅

Session Time ✅

Last Signal: 🟢 BUY / 🔴 SELL

Current Direction: 🟢 LONG / 🔴 SHORT / ❌ NONE

⚙️ Fully Customizable

Adjustable volume spike multiplier

Optional toggle for showing/hiding short signals

Extremely user-friendly layout – ideal for both beginners & experienced traders

📦 Best For:

Scalpers & Intraday Traders

Traders who follow the Traders Reality / Market Maker Method

Anyone who values clean, rule-based trade entries

Note: Works across all timeframes with sufficient volume (e.g., 5min – 4hr). Sessions are based on UTC time – adjust if needed based on your timezone or trading hours.

PowerZone Trading StrategyExplanation of the PowerZone Trading Strategy for Your Users

The PowerZone Trading Strategy is an automated trading strategy that detects strong price movements (called "PowerZones") and generates signals to enter a long (buy) or short (sell) position, complete with predefined take profit and stop loss levels. Here’s how it works, step by step:

1. What is a PowerZone?

A "PowerZone" (PZ) is a zone on the chart where the price has shown a significant and consistent movement over a specific number of candles (bars). There are two types:

Bullish PowerZone (Bullish PZ): Occurs when the price rises consistently over several candles after an initial bearish candle.

Bearish PowerZone (Bearish PZ): Occurs when the price falls consistently over several candles after an initial bullish candle.

The code analyzes:

A set number of candles (e.g., 5, adjustable via "Periods").

A minimum percentage move (adjustable via "Min % Move for PowerZone") to qualify as a strong zone.

Whether to use the full candle range (highs and lows) or just open/close prices (toggle with "Use Full Range ").

2. How Does It Detect PowerZones?

Bullish PowerZone:

Looks for an initial bearish candle (close below open).

Checks that the next candles (e.g., 5) are all bullish (close above open).

Ensures the total price movement exceeds the minimum percentage set.

Defines a range: from the high (or open) to the low of the initial candle.

Bearish PowerZone:

Looks for an initial bullish candle (close above open).

Checks that the next candles are all bearish (close below open).

Ensures the total price movement exceeds the minimum percentage.

Defines a range: from the high to the low (or close) of the initial candle.

These zones are drawn on the chart with lines: green or white for bullish, red or blue for bearish, depending on the color scheme ("DARK" or "BRIGHT").

3. When Does It Enter a Trade?

The strategy waits for a breakout from the PowerZone range to enter a trade:

Buy (Long): When the price breaks above the high of a Bullish PowerZone.

Sell (Short): When the price breaks below the low of a Bearish PowerZone.

The position size is set to 100% of available equity (adjustable in the code).

4. Take Profit and Stop Loss

Take Profit (TP): Calculated as a multiple (adjustable via "Take Profit Factor," default 1.5) of the PowerZone height. For example:

For a buy, TP = Entry price + (PZ height × 1.5).

For a sell, TP = Entry price - (PZ height × 1.5).

Stop Loss (SL): Calculated as a multiple (adjustable via "Stop Loss Factor," default 1.0) of the PZ height, placed below the range for buys or above for sells.

5. Visualization on the Chart

PowerZones are displayed with lines on the chart (you can hide them with "Show Bullish Channel" or "Show Bearish Channel").

An optional info panel ("Show Info Panel") displays key levels: PZ high and low, TP, and SL.

You can also enable brief documentation on the chart ("Show Documentation") explaining the basic rules.

6. Alerts

The code generates automatic alerts in TradingView:

For a bullish breakout: "Bullish PowerZone Breakout - LONG!"

For a bearish breakdown: "Bearish PowerZone Breakdown - SHORT!"

7. Customization

You can tweak:

The number of candles to detect a PZ ("Periods").

The minimum percentage move ("Min % Move").

Whether to use highs/lows or just open/close ("Use Full Range").

The TP and SL factors.

The color scheme and what elements to display on the chart.

Practical Example

Imagine you set "Periods = 5" and "Min % Move = 2%":

An initial bearish candle appears, followed by 5 consecutive bullish candles.

The total move exceeds 2%.

A Bullish PowerZone is drawn with a high and low.

If the price breaks above the high, you enter a long position with a TP 1.5 times the PZ height and an SL equal to the height below.

The system executes the trade and exits automatically at TP or SL.

Conclusion

This strategy is great for capturing strong price movements after consolidation or momentum zones. It’s automated, visual, and customizable, making it useful for both beginner and advanced traders. Try it out and adjust it to fit your trading style!

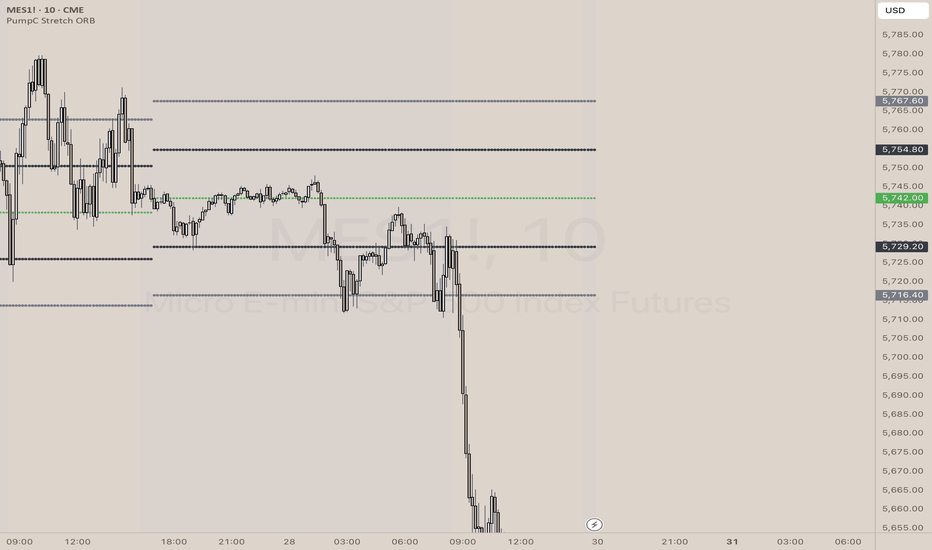

PumpC Opening Range Breakout (ORB) Stretch RangePumpC ORB Stretch

The PumpC ORB Stretch is a volatility-based indicator that helps traders identify potential breakout zones by analyzing how price typically behaves around the open. This tool is inspired by concepts introduced by Toby Crabel in his well-known book “Day Trading with Short-Term Price Patterns and Opening Range Breakout.”

Rather than predicting market direction, this indicator highlights areas where price is likely to expand based on recent volatility. It is designed for traders who prefer dynamic, data-driven breakout levels over static support and resistance zones.

What Is the "Stretch"?

In Toby Crabel’s framework, the Stretch is the average of the smaller of two price moves:

The distance from the open to the high of the bar

The distance from the open to the low of the bar

This smaller value captures the “quiet side” of the candle and reflects recent price compression. Averaged over multiple periods (commonly 10 daily bars), it creates a baseline to assess how far price may move away from the open under typical market conditions.

How the Indicator Works

The PumpC ORB Stretch follows this process:

Uses a higher timeframe (such as daily) to calculate the open, high, and low.

For each bar, measures the smaller of the two distances: open to high or open to low.

Applies a moving average to the result over a user-defined number of bars (default is 10).

Multiplies the average stretch by customizable levels (e.g., 0.382, 1.0, 2.0).

Plots breakout levels above and below the open of the selected timeframe.

The result is a set of adaptive levels that expand or contract with market volatility.

Customization Options

Stretch Timeframe: Choose the timeframe used for stretch calculation (default: Daily).

Stretch Length: Set the number of bars to include in the moving average.

Breakout Levels: Enable or disable individual levels and define multipliers.

Color Settings: Customize colors for each range level for easy visual distinction.

Plot Style: Circular markers are used to reduce chart clutter and improve readability.

How to Use It

Use plotted levels to anticipate possible breakouts from the open.

Adjust stretch length to reflect short-term or longer-term volatility trends.

Combine this tool with momentum indicators, volume, or price action for confirmation.

Use levels to help guide stop placement or profit targets in breakout strategies.

Important Notes

This script is based on an interpretation of Crabel’s concepts and is not affiliated with Crabel Capital or the original author.

The indicator does not predict direction; it is a tool for context and structure.

It is recommended that users test and validate this tool in a simulated environment before applying it to live trading.

This indicator is intended for educational purposes only.

Licensing and Attribution

This script is built entirely in Pine Script v5 and follows TradingView’s open-source standards. It does not include any third-party or proprietary code. If you modify or share it, please credit the original idea and follow all TradingView script publishing rules.

Nasan Risk Score & Postion Size Estimator** THE RISK SCORE AND POSITION SIZE WILL ONLY BE CALCUTAED ON DIALY TIMEFRAME NOT IN OTHER TIMEFRAMES.

The typically accepted generic rule for risk management is not to risk more than 1% - 2 % of the capital in any given trade. It has its own basis however it does not take into account the stocks historic & current performance and does not consider the traders performance metrics (like win rate, profit ratio).

The Nasan Risk Score & Position size calculator takes into account all the listed parameters into account and estimates a Risk %. The position size is calculated using the estimated risk % , current ATR and a dynamically adjusted ATR multiple (ATR multiple is adjusted based on true range's volatility and stocks relative performance).

It follows a series of calculations:

Unadjusted Nasan Risk Score = (Min Risk)^a + b*

Min Risk = ( 5 year weighted avg Annual Stock Return - 5 year weighted avg Annual Bench Return) / 5 year weighted avg Annual Max ATR%

Max Risk = ( 5 year weighted avg Annual Stock Return - 5 year weighted avg Annual Bench Return) / 5 year weighted avg Annual Min ATR%

The min and max return is calculated based on stocks excess return in comparison to the Benchmark return and adjusted for volatility of the stock.

When a stock underperforms the benchmark, the default is, it does not calculate a position size , however if we opt it to calculate it will use 1% for Min Risk% and 2% for Max Risk% but all the other calculations and scaling remain the same.

Rationale:

Stocks outperforming their benchmark with lower volatility (ATR%) score higher.

A stock with high returns but excessive volatility gets penalized.

This ensures volatility-adjusted performance is emphasized rather than absolute returns.

Depending on the risk preference aggressive or conservative

Aggressive Risk Scaling: a = max (m, n) and b = min (m, n)

Conservative Scaling: a = min (m, n) and b = max (m, n)

where n = traders win % /100 and m = 1 - (1/ (1+ profit ratio))

A default of 50% is used for win factor and 1.5 for profit ratio.

Aggressive risk scaling increases exposure when the strategy's strongest factor is favorable.

Conservative risk scaling ensures more stable risk levels by focusing on the weaker factor.

The Unadjusted Nasan risk is score is further refined based on a tolerance factor which is based on the stocks maximum annual drawdown and the trader's maximum draw down tolerance.

Tolerance = /100

The correction factor (Tolerance) adjusts the risk score based on downside risk. Here's how it works conceptually:

The formula calculates how much the stock's actual drawdown exceeds your acceptable limit.

If stocks maximum Annual drawdown is smaller than Trader's maximum acceptable drawdown % , this results in a positive correction factor (indicating the drawdown is within your acceptable range and increases the unadjusted score.

If stocks maximum Annual drawdown exceeds Trader's maximum acceptable drawdown %, the correction factor will decrease (indicating that the downside risk is greater than what you are comfortable with, so it will adjust the risk exposure).

Once the Risk Score (numerically equal to Risk %) The position size is calculated based on the current market conditions.

Nasan Risk Score (Risk%) = Unadjusted Nasan Risk Score * Tolerance.

Position Size = (Capital * Risk% )/ ATR-Multiplier * ATR

The ATR Multiplier is dynamically adjusted based on the stocks recent relative performance and the variability of the true range itself. It would range between 1 - 3.5.

The multiplier widens when conditions are not favorable decreasing the position size and increases position size when conditions are favorable.

This Calculation /Estimate Does not give you a very different result than the arbitrary 1% - 2%. However it does fine tune the % based on sock performance, traders performance and tolerance level.

Multi-MA Strategy Analyzer with BacktestMulti-MA Strategy Analyzer with Backtest

This TradingView Pine Script indicator is designed to analyze multiple moving averages (SMA or EMA) dynamically and identify the most profitable one based on historical performance.

Features

Dynamic MA Range:

Specify a minLength, maxLength, and step size.

Automatically calculates up to 20 MAs.

Custom MA Calculation:

Uses custom SMA and EMA implementations to support dynamic length values.

Buy/Sell Logic:

Buy when price crosses above a MA.

Sell when price crosses below.

Supports both long and short trades.

Performance Tracking:

Tracks PnL, number of trades, win rate, average profit, and drawdown.

Maintains individual stats for each MA.

Best MA Detection:

Automatically highlights the best-performing MA.

Optional showBestOnly toggle to focus only on the best line and its stats.

Visualization:

Up to 20 plot() calls (static) for MAs.

Green highlight for the best MA.

Color-coded result table and chart.

Table View

When showBestOnly = false, the table displays all MAs with stats.

When showBestOnly = true, the table displays only the best MA with a summary row.

Includes:

Best MA length

Total PnL

Number of trades

Win rate

Avg PnL per trade

Max Drawdown

Configuration

minLength (default: 10)

maxLength (default: 200)

step (default: 10)

useEMA: Toggle between EMA and SMA

showBestOnly: Focus on best-performing MA only

Notes

MA plotting is static, limited to 20 total.

Table supports highlighting and is optimized for performance.

Script is structured to run efficiently using arrays and simple int where required.

Potential Extensions

Add visual buy/sell arrows

Export stats to CSV

Strategy tester conversion

Custom date range filtering for backtesting

Author: Muhammad Wasim

Version: 1.0

External Signals Strategy TesterExternal Signals Strategy Tester

This strategy is designed to help you backtest external buy/sell signals coming from another indicator on your chart. It is a flexible and powerful tool that allows you to simulate real trading based on signals generated by any indicator, using input.source connections.

🔧 How It Works

Instead of generating signals internally, this strategy listens to two external input sources:

One for buy signals

One for sell signals

These sources can be connected to the plots from another indicator (for example, custom indicators, signal lines, or logic-based plots).

To use this:

Add your indicator to the chart (it must be visible on the same pane as this strategy).

Open the settings of the strategy.

In the fields Buy Signal and Sell Signal, select the appropriate plot (line, value, etc.) from the indicator that represents the buy/sell logic.

The strategy will open positions when the selected buy signal crosses above 0, and sell signal crosses above 0.

This logic can be easily adapted by modifying the crossover rule inside the script if your signal style is different.

⚙️ Features Included

✅ Configurable trade direction:

You can choose whether to allow long trades, short trades, or both.

✅ Optional close on opposite signal:

When enabled, the strategy will exit the current position if an opposite signal appears.

✅ Optional full position reversal:

When enabled, the strategy will close the current position and immediately open an opposite one on the reverse signal.

✅ Risk Management Tools:

You can define:

Take Profit (TP): Position will be closed once the specified profit (in %) is reached.

Stop Loss (SL): Position will be closed if the price drops to the specified loss level (in %).

BreakEven (BE): Once the specified profit threshold is reached, the strategy will move the stop-loss to the entry price.

📌 If any of these values (TP, SL, BE) are set to 0, the feature is disabled and will not be applied.

🧪 Best Use Cases

Backtesting signals from custom indicators, without rewriting the logic into a strategy.

Comparing the performance of different signal sources.

Testing external indicators with optional position management logic.

Validating strategies using external filters, oscillators, or trend signals.

📌 Final Notes

You can visualize where the strategy detected buy/sell signals using green/red markers on the chart.

All parameters are customizable through the strategy settings panel.

This strategy does not repaint, and it processes signals in real-time only (no lookahead bias).

Auto TrendLines [TradingFinder] Support Resistance Signal Alerts🔵 Introduction

The trendline is one of the most essential tools in technical analysis, widely used in financial markets such as Forex, cryptocurrency, and stocks. A trendline is a straight line that connects swing highs or swing lows and visually indicates the market’s trend direction.

Traders use trendlines to identify price structure, the strength of buyers and sellers, dynamic support and resistance zones, and optimal entry and exit points.

In technical analysis, trendlines are typically classified into three categories: uptrend lines (drawn by connecting higher lows), downtrend lines (formed by connecting lower highs), and sideways trends (moving horizontally). A valid trendline usually requires at least three confirmed touchpoints to be considered reliable for trading decisions.

Trendlines can serve as the foundation for a variety of trading strategies, such as the trendline bounce strategy, valid breakout setups, and confluence-based analysis with other tools like candlestick patterns, divergences, moving averages, and Fibonacci levels.

Additionally, trendlines are categorized into internal and external, and further into major and minor levels, each serving unique roles in market structure analysis.

🔵 How to Use

Trendlines are a key component in technical analysis, used to identify market direction, define dynamic support and resistance zones, highlight strategic entry and exit points, and manage risk. For a trendline to be reliable, it must be drawn based on structural principles—not by simply connecting two arbitrary points.

🟣 Selecting Pivot Types Based on Trend Direction

The first step is to determine the market trend: uptrend, downtrend, or sideways.

Then, choose pivot points that match the trend type :

In an uptrend, trendlines are drawn by connecting low pivots, especially higher lows.

In a downtrend, trendlines are formed by connecting high pivots, specifically lower highs.

It is crucial to connect pivots of the same type and structure to ensure the trendline is valid and analytically sound.

🟣 Pivot Classification

This indicator automatically classifies pivot points into two categories :

Major Pivots :

MLL : Major Lower Low

MHL : Major Higher Low

MHH : Major Higher High

MLH : Major Lower High

These define the primary structure of the market and are typically used in broader structural analysis.

Minor Pivots :

mLL: minor Lower Low

mHL: minor Higher Low

mHH: minor Higher High

mLH: minor Lower High

These are used for drawing more precise trendlines within corrective waves or internal price movements.

Example : In a downtrend, drawing a trendline from an MHH to an mHH creates structural inconsistency and introduces noise. Instead, connect points like MHL to MHL or mLH to mLH for a valid trendline.

🟣 Drawing High-Precision Trendlines

To ensure a reliable trendline :

Use pivots of the same classification (Major with Major or Minor with Minor).

Ensure at least three valid contact points (three touches = structural confirmation).

Draw through candles with the least deviation (choose wicks or bodies based on confluence).

Preferably draw from right to left for better alignment with current market behavior.

Use parallel lines to turn a single trendline into a trendline zone, if needed.

🟣 Using Trendlines for Trade Entries

Bounce Entry: When price approaches the trendline and shows signs of reversal (e.g., a reversal candle, divergence, or support/resistance), enter in the direction of the trend with a logical stop-loss.

Breakout Entry: When price breaks through the trendline with strong momentum and a confirmation (such as a retest or break of structure), consider trading in the direction of the breakout.

🟣 Trendline-Based Risk Management

For bounce entries, the stop-loss is placed below the trendline or the last pivot low (in an uptrend).

For breakout entries, the stop-loss is set behind the breakout candle or the last structural level.

A broken trendline can also act as an exit signal from a trade.

🟣 Combining Trendlines with Other Tools (Confluence)

Trendlines gain much more strength when used alongside other analytical tools :

Horizontal support and resistance levels

Moving averages (such as EMA 50 or EMA 200)

Fibonacci retracement zones

Candlestick patterns (e.g., Engulfing, Pin Bar)

RSI or MACD divergences

Market structure breaks (BoS / ChoCH)

🔵 Settings

Pivot Period : This defines how sensitive the pivot detection is. A higher number means the algorithm will identify more significant pivot points, resulting in longer-term trendlines.

Alerts

Alert :

Enable or disable the entire alert system

Set a custom alert name

Choose how often alerts trigger (every time, once per bar, or on bar close)

Select the time zone for alert timestamps (e.g., UTC)

Each trendline type supports two alert types :

Break Alert : Triggered when price breaks the trendline

React Alert : Triggered when price reacts or bounces off the trendline

These alerts can be independently enabled or disabled for all trendline categories (Major/Minor, Internal/External, Up/Down).

Display :

For each of the eight trendline types, you can control :

Whether to show or hide the line

Whether to delete the previous line when a new one is drawn

Color, line style (solid, dashed, dotted), extension direction (e.g., right only), and width

Major lines are typically thicker and more opaque, while minor lines appear thinner and more transparent.

All settings are designed to give the user full control over the appearance, behavior, and alert system of the indicator, without requiring manual drawing or adjustments.

🔵 Conclusion

A trendline is more than just a line on the chart—it is a structural, strategic, and flexible tool in technical analysis that can serve as the foundation for understanding price behavior and making trading decisions. Whether in trending markets or during corrections, trendlines help traders identify market direction, key zones, and high-potential entry and exit points with precision.

The accuracy and effectiveness of a trendline depend on using structurally valid pivot points and adhering to proper market logic, rather than relying on guesswork or personal bias.

This indicator is built to solve that exact problem. It automatically detects and draws multiple types of trendlines based on actual price structure, separating them into Major/Minor and Internal/External categories, and respecting professional analytical principles such as pivot type, trend direction, and structural location.

MACD Crossover Breakout Rays with VWAP & Breakout ConfirmationOverview

This script is designed to highlight potential strong breakout moves by combining MACD crossovers, VWAP confirmation, and price action breakouts. It helps traders identify momentum shifts and filter high-probability trade setups.

How It Works

1. MACD Crossover Detection

- The script detects bullish crossovers (MACD line crossing above the signal line) and bearish crossovers (MACD line crossing below the signal line).

- A horizontal ray is drawn at the high (bullish) or low (bearish) of the crossover candle.

2. Multi-Timeframe MACD Confirmation

- A secondary MACD crossover is checked on a lower timeframe (default: 5 minutes) to confirm the strength of the move.

- The script ensures alignment between the primary and lower timeframe MACD crossovers before signaling a strong move.

3. VWAP Confirmation

- A bullish breakout is valid only if the price is above the VWAP.

- A bearish breakout is valid only if the price is below the VWAP.

4. Breakout Validation

- The script waits for price action confirmation—a breakout is only valid when a candle closes above (bullish) or below (bearish) the horizontal ray.

- Once confirmed, the ray color changes to blue to signal a strong move.

5. Label Alerts for Strong Moves

- When all conditions align, the script prints "STRONG 💪 MOVE" above or below the breakout candle.

- The previous label is automatically removed to keep the chart clean.

Customization Options

- MACD Settings: Adjust fast/slow lengths and signal smoothing.

- Lower Timeframe Confirmation: Choose a different timeframe for multi-timeframe MACD validation.

- VWAP Filtering: Ensure breakouts align with volume-weighted trends.

- Ray Length & Colors: Customize the horizontal ray length, width, and colors.

- Breakout Confirmation Window: Adjust how many bars to check for MACD alignment.

Best Use Cases

✅ Identifying high-probability breakouts with trend confirmation.

✅ Filtering out false signals by requiring multi-timeframe agreement.

✅ Helping traders stay in momentum-driven moves with strong confirmation.

⚠ Note: This script is for educational purposes only and does not constitute financial advice. Always conduct your own analysis before making trading decisions.

WMA and Intraday Highest Volume Candle Levels🔹 WMA Calculation (Weighted Moving Averages)

Custom WMA Function:

Uses a manual weighted average calculation.

Assigns more weight to recent prices for smoother trend detection.

Three Timeframes:

5-Minute WMA (Yellow)

15-Minute WMA (Blue)

30-Minute WMA (Red)

🔹 Intraday Highest Volume Candle Levels

Finds the candle with the highest volume for the selected intraday timeframe.

Stores its High & Low levels to act as support/resistance.

Deletes and redraws lines daily to reflect the latest session's highest volume candle.

Plots horizontal lines:

Green Line: High of the highest volume candle.

Red Line: Low of the highest volume candle.

Customization: User can choose the analysis timeframe (default: 3 minutes).

✅ Benefits of This Indicator

✔ Multi-timeframe trend analysis using WMA.

✔ Key intraday levels based on highest volume candle.

✔ Dynamic support & resistance levels based on real-time volume activity.

✔ Customizable timeframe for volume analysis.

Elliott Wave Identification By Akash Patel

This script is designed to visually highlight areas on the chart where there are consecutive bullish (green) or bearish (red) candles. It also identifies sequences of three consecutive candles of the same type (bullish or bearish) and highlights those areas with adjustable box opacity. Here's a breakdown of the functionality:

---

### Key Features:

1. **Bullish & Bearish Candle Identification:**

- **Bullish Candle:** When the closing price is higher than the opening price (`close > open`).

- **Bearish Candle:** When the closing price is lower than the opening price (`close < open`).

2. **Consecutive Candle Counter:**

- The script counts consecutive bullish and bearish candles, which resets when the direction changes (from bullish to bearish or vice versa).

- The script tracks these counts using the `bullishCount` and `bearishCount` variables, which are incremented based on whether the current candle is bullish or bearish.

3. **Highlighting Candle Areas:**

- If there are **3 or more consecutive bullish candles**, the script will highlight the background in a green color with 90% transparency (adjustable).

- Similarly, if there are **3 or more consecutive bearish candles**, the script will highlight the background in a red color with 90% transparency (adjustable).

4. **Three-Candle Sequence:**

- The script checks if there are three consecutive bullish candles (`threeBullish`) or three consecutive bearish candles (`threeBearish`).

- A box is drawn around these areas to visually highlight the sequence. The boxes extend to the right edge of the chart, and their opacity can be adjusted.

5. **Box Creation:**

- For bullish sequences, a green box is created using the high and low prices of the three candles in the sequence.

- For bearish sequences, a red box is created in the same manner.

- The box size is determined by the highest high and the lowest low of the three consecutive candles.

6. **Box Opacity:**

- You can adjust the opacity of the boxes through the input parameters `Bullish Box Opacity` and `Bearish Box Opacity` (ranging from 0 to 100).

- A higher opacity will make the boxes more solid, while a lower opacity will make them more transparent.

7. **Box Cleanup:**

- The script also includes logic to remove boxes when they are no longer needed, ensuring the chart remains clean without excessive box overlays.

8. **Extending Boxes to the Right:**

- When a bullish or bearish sequence is identified, the boxes are extended to the right edge of the chart for continued visibility.

---

### How It Works:

- **Bullish Area Highlight:** When three or more consecutive bullish candles are detected, the background will turn green to indicate a strong bullish trend.

- **Bearish Area Highlight:** When three or more consecutive bearish candles are detected, the background will turn red to indicate a strong bearish trend.

- **Three Consecutive Candle Box:** A green box will appear around three consecutive bullish candles, and a red box will appear around three consecutive bearish candles. These boxes can be extended to the right edge of the chart, making the sequence visually clear.

---

### Adjustable Parameters:

1. **Bullish Box Opacity:** Set the opacity (transparency) level of the bullish boxes. Ranges from 0 (completely transparent) to 100 (completely opaque).

2. **Bearish Box Opacity:** Set the opacity (transparency) level of the bearish boxes. Ranges from 0 (completely transparent) to 100 (completely opaque).

---

This indicator is useful for identifying strong trends and visually confirming market momentum, especially in situations where you want to spot sequences of bullish or bearish candles over multiple bars. It can be customized to suit different trading styles and chart preferences by adjusting the opacity of the boxes and background highlights.

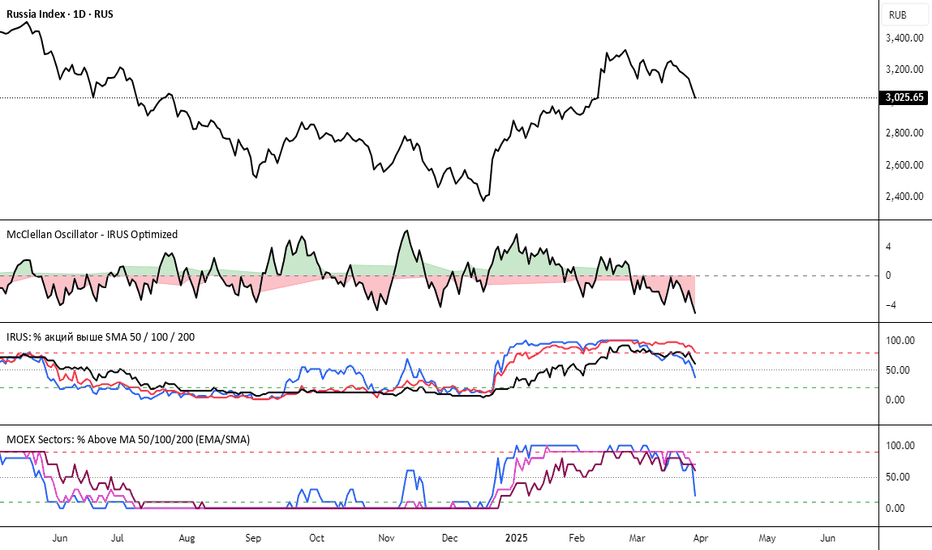

McClellan Oscillator - IRUS Optimized🧠 McClellan Oscillator (IRUS Index)

Type: Market Breadth Indicator

Category: Breadth, Momentum

Purpose: Gauge the internal strength of the IRUS index and anticipate trend reversals

📌 Based on

This indicator is built on the concept of advancing vs. declining issues — the number of stocks rising vs. falling each day within the IRUS index (a custom group of 40 Russian stocks).

It calculates the net advances (advancers minus decliners), then applies two exponential moving averages (EMA):

java

Copy

Edit

McClellan Oscillator = EMA_19(Net Advances) - EMA_39(Net Advances)

Where:

Net Advances = Number of advancing stocks - Number of declining stocks

Calculated from a fixed set of 40 IRUS stocks

🧭 What it shows

Above 0 → more stocks are rising: market is internally strong.

Below 0 → more stocks are falling: underlying weakness.

Rising from below -100 → oversold breadth, possible bullish reversal.

Falling from above +100 → overbought breadth, possible correction.

🎯 How to use it

1. Buy/Sell Signals

Buy: Oscillator drops below -100 and turns up → oversold, potential rally.

Sell: Oscillator rises above +100 and turns down → overbought, risk of pullback.

2. Trend Strength Confirmation

Sustained above 0 → confirms bullish trend.

Crosses below 0 → early warning of weakening market breadth.

3. Divergences with IRUS Price

IRUS rises, but Oscillator falls → narrowing leadership, bearish divergence.

IRUS falls, but Oscillator rises → improving breadth, bullish divergence.

⚠️ Notes

The oscillator measures participation, not price.

Works best with daily timeframe.

Does not account for volume or magnitude of price moves.

Use with price action or other indicators for confirmation.

⚙️ Custom Implementation

This version is specifically adapted for the IRUS index, using a fixed list of 40 component stocks.

Optimized for Pine Script v6 and complies with TradingView's request limits (max 40).

MOEX Sectors: % Above MA 50/100/200 (EMA/SMA)🧠 Name:

MOEX Sectors: % Above MA 50/100/200 (EMA/SMA)

📋 Description (for TradingView “Description” tab):

This indicator shows the percentage of Moscow Exchange sectoral indices trading above the selected moving average (SMA or EMA) with periods of 50, 100, or 200.

It uses 10 official MOEX sector indices:

MOEXOG (Oil & Gas)

MOEXCH (Chemicals)

MOEXMM (Metals & Mining)

MOEXTN (Transport)

MOEXCN (Consumer)

MOEXFN (Financials)

MOEXTL (Telecom)

MOEXEU (Utilities)

MOEXIT (IT)

MOEXRE (Real Estate)

The indicator plots up to 3 lines representing the % of sectors trading above MA 50, 100, and/or 200. The MA type is user-selectable: EMA (default) or SMA.

Horizontal reference levels (90, 50, 10) help interpret market conditions:

🔼 >90% — Overbought zone, potential market exhaustion

⚖️ ~50% — Neutral state

🔽 <10% — Oversold zone, possible rebound

📈 How to Use in Strategy:

✅ 1. Trend Filter

If >50% of sectors are above MA 200 → market in long-term uptrend

If <50% → avoid long bias, bearish regime likely

✅ 2. Bottom Detection

When <10% of sectors are above MA 200, the market is heavily oversold — often a bottoming signal

✅ 3. Trend Confirmation

If the main index is rising and % of sectors above MA is growing, the trend is supported by breadth

If the index rises while breadth declines → bearish divergence

✅ 4. Contrarian Setups

>90% of sectors above MA 50 → market may be overheated, watch for pullback

<20% above MA 50 → potential local bottom

⚙️ Tips:

Overlay this indicator on the IMOEX index chart to detect narrow leadership

Combine with other breadth metrics or RSI on the index

Use the EMA/SMA toggle to fine-tune sensitivity

Long Term Profitable Swing | AbbasA Story of a Profitable Swing Trading Strategy

Imagine you're sailing across the ocean, looking for the perfect wave to ride. Swing trading is quite similar—you're navigating the stock market, searching for the ideal moments to enter and exit trades. This strategy, created by Abbas, helps you find those waves and ride them effectively to profitable outcomes.

🌊 Finding the Perfect Wave (Entry)

Our journey begins with two simple signs that tell us a great trading opportunity is forming:

- Moving Averages: We use two lines that follow price trends—the faster one (EMA 16) reacts quickly to recent price moves, and the slower one (EMA 30) gives us a longer-term perspective. When the faster line crosses above the slower line, it's like a clear signal saying, "Hey! The wave is rising, and prices might move higher!"

- RSI Momentum: Next, we check a tool called the RSI, which measures momentum (how strongly prices are moving). If the RSI number is above 50, it means there's enough strength behind this rising wave to carry us forward.

When both signals appear together, that's our green light. It's time to jump on our surfboard and start riding this promising wave.

⚓ Safely Riding the Wave (Risk Management)

While we're riding this wave, we want to ensure we're safe from sudden surprises. To do this, we use something called the Average True Range (ATR), which measures how volatile (or bumpy) the price movements are:

- Stop-Loss: To avoid falling too hard, we set a safety line (stop-loss) 8 times the ATR below our entry price. This helps ensure we exit if the wave suddenly turns against us, protecting us from heavy losses.

- Take Profit: We also set a goal to exit the trade at 11 times the ATR above our entry. This way, we capture significant profits when the wave reaches a nice high point.

🌟 Multiple Rides, Bigger Adventures

This strategy allows us to take multiple positions simultaneously—like riding several waves at once, up to 5. Each trade we make uses only 10% of our trading capital, keeping risks manageable and giving us multiple opportunities to win big.

🗺️ Easy to Follow Settings

Here are the basic settings we use:

- Fast EMA**: 16

- Slow EMA**: 30

- RSI Length**: 9

- RSI Threshold**: 50

- ATR Length**: 21

- ATR Stop-Loss Multiplier**: 8

- ATR Take-Profit Multiplier**: 11

These settings are flexible—you can adjust them to better suit different markets or your personal trading style.

🎉 Riding the Waves of Success

This simple yet powerful swing trading approach helps you confidently enter trades, clearly know when to exit, and effectively manage your risk. It’s a reliable way to ride market waves, capture profits, and minimize losses.

Happy trading, and may you find many profitable waves to ride! 🌊✨

Please test, and take into account that it depends on taking multiple longs within the swing, and you only get to invest 25/30% of your equity.