erb.KAMA ChannelsKaufman channels. Period 21. Bands show fill and values between 0.89 and 1 upwards and downwards. I took the multiplier as 4. I used ohlc4 as the source.

Индикаторы и стратегии

Customizable RSI/StochRSI Double ConfirmationBelow are the key adjustable parameters in the script and their usage:

RSI Parameters

RSI Length: The number of periods used to calculate the RSI, with a default value of 7. Adjusting this parameter changes the sensitivity of the RSI—shorter periods make it more sensitive, while longer periods make it smoother.

RSI Source: The price source used for RSI calculation, defaulting to the closing price (close). This can be changed to the opening price or other price types as needed.

StochRSI Parameters

StochRSI Length: The number of periods used to calculate the StochRSI, with a default value of 5. This affects how quickly the StochRSI reacts to changes in the RSI.

StochRSI Smooth K: The smoothing period for the StochRSI %K line, with a default value of 3. This is used to reduce noise.

StochRSI Smooth D: The smoothing period for the StochRSI %D line, with a default value of 3. It works in conjunction with %K to provide more stable signals.

Signal Thresholds

RSI Buy Threshold: A buy signal is triggered when the RSI crosses above this value (default 20).

RSI Sell Threshold: A sell signal is triggered when the RSI crosses below this value (default 80).

StochRSI Buy Threshold: A buy signal is triggered when the StochRSI %K crosses above this value (default 20).

StochRSI Sell Threshold: A sell signal is triggered when the StochRSI %K crosses below this value (default 80).

Signals

RSI Buy/Sell Signals: When the RSI crosses the buy/sell threshold, a green "RSI Buy" or red "RSI Sell" is displayed on the chart.

StochRSI Buy/Sell Signals: When the StochRSI %K crosses the buy/sell threshold, a yellow "StochRSI Buy" or purple "StochRSI Sell" is displayed.

Double Buy/Sell Signals: When both RSI and StochRSI simultaneously trigger buy/sell signals, a green "Double Buy" or red "Double Sell" is displayed, indicating a stronger trading opportunity.

The volatility of different cryptocurrencies varies, and different parameters may be suitable for each. Users need to experiment and select the most appropriate parameters themselves.

Disclaimer: This script is for informational purposes only and should not be considered financial advice; use it at your own risk.

GQT GPT - Volume-based Support & Resistance Zones V2搞钱兔,搞钱是为了更好的生活。

Title: GQT GPT - Volume-based Support & Resistance Zones V2

Overview:

This strategy is implemented in PineScript v5 and is designed to identify key support and resistance zones based on volume-driven fractal analysis on a 1-hour timeframe. It computes fractal high points (for resistance) and fractal low points (for support) using volume moving averages and specific price action criteria. These zones are visually represented on the chart with customizable lines and zone fills.

Trading Logic:

• Entry: The strategy initiates a long position when the price crosses into the support zone (i.e., when the price drops into a predetermined support area).

• Exit: The long position is closed when the price enters the resistance zone (i.e., when the price rises into a predetermined resistance area).

• Time Frame: Trading signals are generated solely from the 1-hour chart. The strategy is only active within a specified start and end date.

• Note: Only long trades are executed; short selling is not part of the strategy.

Visualization and Parameters:

• Support/Resistance Zones: The zones are drawn based on calculated fractal values, with options to extend the lines to the right for easier tracking.

• Customization: Users can configure the appearance, such as line style (solid, dotted, dashed), line width, colors, and label positions.

• Volume Filtering: A volume moving average threshold is used to confirm the fractal signals, enhancing the reliability of the support and resistance levels.

• Alerts: The strategy includes alert conditions for when the price enters the support or resistance zones, allowing for timely notifications.

⸻

搞钱兔,搞钱是为了更好的生活。

标题: GQT GPT - 基于成交量的支撑与阻力区间 V2

概述:

本策略使用 PineScript v5 实现,旨在基于成交量驱动的分形分析,在1小时级别的图表上识别关键支撑与阻力区间。策略通过成交量移动平均线和特定的价格行为标准计算分形高点(阻力)和分形低点(支撑),并以自定义的线条和区间填充形式直观地显示在图表上。

交易逻辑:

• 进场条件: 当价格进入支撑区间(即价格跌入预设支撑区域)时,策略在没有持仓的情况下发出做多信号。

• 离场条件: 当价格进入阻力区间(即价格上升至预设阻力区域)时,持有多头头寸则会被平仓。

• 时间范围: 策略的信号仅基于1小时级别的图表,并且仅在指定的开始日期与结束日期之间生效。

• 备注: 本策略仅执行多头交易,不进行空头操作。

可视化与参数设置:

• 支撑/阻力区间: 根据计算得出的分形值绘制支撑与阻力线,可选择将线条延伸至右侧,便于后续观察。

• 自定义选项: 用户可以调整线条样式(实线、点线、虚线)、线宽、颜色及标签位置,以满足个性化需求。

• 成交量过滤: 策略使用成交量移动平均阈值来确认分形信号,提高支撑和阻力区间的有效性。

• 警报功能: 当价格进入支撑或阻力区间时,策略会触发警报条件,方便用户及时关注市场变化。

⸻

StrategyTemplate-Pro-v1# TrendScope Pro – Adaptive Trend-Following Strategy

### 🔍 Overview

TrendScope Pro is a highly adaptable and professional Pine Script strategy template designed for disciplined, trend-based trading. Built using Pine Script v6, it supports modular configuration, risk control, and flexible exit management to meet both beginner and advanced trader needs.

---

### 📐 Core Logic

The strategy focuses on confirming strong trend entries using a combination of:

- **EMA Crossovers**: Short-term trend detection

- **Higher Timeframe EMA**: Confirms overall market direction

- **MACD**: Measures momentum of price movement

- **RSI & ADX Filters** *(optional)*: Adds further confirmation

- **ATR**: Used to dynamically set profit targets, stop losses, and trailing logic

---

### 📊 Entry Rules

#### 🟢 Buy Entry:

- Price is above EMA from higher timeframe (or custom long EMA)

- Fast EMA > Slow EMA (bullish crossover)

- MACD Line > Signal Line (positive momentum)

- Candle is bullish and strong (body/candle ratio threshold)

- RSI not in overbought zone *(if enabled)*

- ADX above threshold *(if enabled)*

- Cooldown period (X bars) passed since last trade

#### 🔴 Sell Entry:

- Price below EMA200 or long EMA

- Fast EMA < Slow EMA

- MACD Line < Signal Line

- Bearish candle with sufficient strength

- RSI not in oversold zone *(if enabled)*

- ADX confirms trend strength *(if enabled)*

---

### 🔁 Exit Options

1. **Fixed TP/SL** using ATR multipliers

2. **Trailing Stop** with adjustable ATR-based logic

3. **Partial Exit** at intermediate profit target (e.g., ATR * 1.5), remaining position uses trailing

4. **Profit Lock**: Closes trade early if sufficient profit is reached and the candle shows reversal behavior

5. **Max Loss Limit** per trade to protect capital

---

### ⚙️ Customization

| Module | Description |

|--------|-------------|

| RSI / ADX | Enable or disable as filters |

| EMA Source | Use custom or higher timeframe |

| Dynamic Size | Increase size when signal is strong |

| Trailing Stop | Replace fixed SL with trailing logic |

| Partial Exit | Take partial profits earlier |

| Profit Lock | Exit trades early on reversal signs |

| Alerts | Get real-time alerts on entry |

---

### 📦 Use Cases

- A ready-to-use base for trend-following strategies

- Can be expanded with custom indicators

- Perfect for traders who value logic, safety, and modularity

- Suitable for scalping or swing trading depending on timeframe

---

### 👨💻 Author

Published by: **emad_alwan**

Pine Script v6 | License: Open Use | Fully Commented & Modular

[francrypto®] Heikin Ashi Supertrend + Multi-Indicator v6This indicator combines HEIKIN ASHI candles with a SUPER TREND calculated from HEIKIN ASHI data (BNFOREX version), specifically created for SSR SMART strategy backtesting.

TurboRSI [PQ_MOD]This indicator, TurboRSI, is a sophisticated momentum and overbought/oversold oscillator that combines a True Strength Index (TSI) calculation with a multi-length RSI smoothing mechanism and regression analysis to deliver real-time market insights. It first computes the TSI using user-defined short and long periods along with a signal EMA, then linearly scales and logarithmically transforms the results to accentuate price momentum extremes. Concurrently, it aggregates RSI values over a customizable range to derive separate smoothed averages for bullish and bearish conditions, which form upper and lower channel boundaries. A regression line is calculated over a specified period to serve as a dynamic reference, and the deviation of price from this line is normalized and mapped to a gradient to create an intuitive candle heatmap. Additional visual elements include plotted channels, filled overbought/oversold zones, and reference lines at key levels (80, 50, and 20), with an optional table displaying key metrics. Overall, TurboRSI provides traders with a multi-faceted view of momentum, trend strength, and potential reversal zones.

Supertrend (7,3) with Trailing SLSupertrend (7,3) with Trailing SL Strategy for Bitcoin long and short future. Minumum loss, max profit.

Sigma Expected Movement)Okay, here's a brief description of what the final Pine Script code achieves:

Indicator Description:

This indicator calculates and plots expected price movement ranges based on the VIX index for daily, weekly, or monthly periods. It uses user-selectable VIX data (Today's Open / Previous Close) and a center price source (Today's Open / Previous Close).

Key features include:

Up to three customizable deviation levels, based on user-defined percentages of the calculated expected move.

Configurable visibility, color, opacity (default 50%), line style, and width (default 1) for each deviation level.

Optional filled area boxes between the 1st and 2nd deviation levels (enabled by default), with customizable fill color/opacity.

An optional center price line with configurable visibility (disabled by default), color, opacity, style, and width.

All drawings appear only within a user-defined time window (e.g., specific market hours).

Does not display price labels on the lines.

Optional rounding of calculated price levels.

Swing Structure + Session Sweeps“Scalper-Friendly Trend & Sweep Detector”

Swing Structure + Session Sweeps with TEMA Cloud

This powerful all-in-one tool is designed for intraday traders, swing traders, and scalpers who want to spot high-probability reversals, trend continuations, and liquidity sweeps with confluence.

🔹 Core Features

Multi-layered TEMA Cloud (9, 20, 34, 50) for clear trend structure

Dynamic Bull/Bear labels when the trend flips

Centerline for TEMA 20 to visualize core trend direction

Session-based liquidity sweep detection (Asia, London, NY)

Volume and absorption dots to catch hidden pressure

Swing high/low detection (external and internal)

Visual VWAP, daily highs/lows, and customizable session zones

Optional alerts for volume spikes, absorption, and reversal sweeps

📈 Use it to:

Confirm directional bias

Anticipate pullbacks and breakouts

Identify volume-backed reversals

Align trades with session strength and swing confluence

⚙️ Built for scalpers, intraday opportunists, and precision chartists alike.

SMIEO [PQ_MOD]This indicator computes a smoothed momentum oscillator by first calculating the True Strength Index (TSI) of a chosen price source using customizable short and long periods. It then derives a signal line by applying an exponential moving average (EMA) to the TSI over a user-defined period. The oscillator itself is determined as the difference between the TSI and its signal line, offering insight into momentum shifts. Additionally, the indicator visually represents both the TSI and the signal line using translucent circle plots, while the oscillator is displayed as a histogram, thereby enabling traders to easily identify potential overbought or oversold conditions as well as trend reversals.

Candle RvolCandle Rvol is designed to be used on the 10minute chart, using it on other timeframes will result in unintended outcomes.

Candle Rvol has two dynamic features:

- creates and array for every 10m candle over the last 14 trading days, the current candle volume is then compared against the average of the corresponding candles from the past 14 days to give a dynamic relative volume expressed as a percentage (this means the high volume near the open and close does not skew the average volume data)

- for the current candle Rvol percentage, a check is made every 1m during the 10m candle and if the volume is on track to being over 100% the background will dynamically show a green colour.

Options Trading Strategy with AlertsTitle: Options Trading Strategy with Buy/Sell Alerts

Description:

This script is designed for day traders and short-term options traders who focus on directional and trend-based trades. It integrates key indicators to identify high-probability entry and exit points for call and put options.

Features & Strategy Logic:

✅ Moving Averages (9 EMA, 21 EMA, 200 EMA) → Identifies short-term and long-term trends.

✅ VWAP (Volume Weighted Average Price) → Tracks institutional buying/selling pressure.

✅ RSI (Relative Strength Index, 14) → Confirms momentum and trend strength.

✅ MACD (12, 26, 9) → Detects shifts in momentum for trend continuation or reversals.

✅ Buy & Sell Alerts → Automatically notifies traders when optimal conditions are met.

How It Works:

• BUY (Call Signal):

• 9 EMA crosses above 21 EMA (bullish momentum).

• Price is above VWAP (institutional buying pressure).

• RSI is above 50 (bullish confirmation).

• MACD is trending upward.

• Trigger: Green “BUY” label appears below the candle.

• SELL (Put Signal):

• 9 EMA crosses below 21 EMA (bearish momentum).

• Price is below VWAP (institutional selling pressure).

• RSI is below 50 (bearish confirmation).

• MACD is trending downward.

• Trigger: Red “SELL” label appears above the candle.

How to Use:

1. Apply the script to 5-minute or 15-minute charts for best results.

2. Look for buy/sell labels and confirm with market context before entering trades.

3. Set alerts to receive real-time notifications when conditions align.

Ideal For:

✔️ Day traders looking for quick, high-probability trades.

✔️ Options traders focusing on directional movement.

✔️ Scalpers and momentum traders who rely on trend confirmation.

🔔 Set up alerts for automated trade notifications and never miss a setup!

Gioteen-NormThe "Gioteen-Norm" indicator is a versatile and powerful technical analysis tool designed to help traders identify key market conditions such as divergences, overbought/oversold levels, and trend strength. By normalizing price data relative to a moving average and standard deviation, this indicator provides a unique perspective on price behavior, making it easier to spot potential reversals or continuations in the market.

The indicator calculates a normalized value based on the difference between the selected price and its moving average, scaled by the standard deviation over a user-defined period. Additionally, an optional moving average of this normalized value (Green line) can be plotted to smooth the output and enhance signal clarity. This dual-line approach makes it an excellent tool for both short-term and long-term traders.

***Key Features

Divergence Detection: The Gioteen-Norm excels at identifying divergences between price action and the normalized indicator value. For example, if the price makes a higher high while Red line forms a lower high, it may signal a bearish divergence, hinting at a potential reversal.

Overbought/Oversold Conditions: Extreme values of Red line (e.g., significantly above or below zero) can indicate overbought or oversold conditions, helping traders anticipate pullbacks or bounces.

Trend Strength Insight: The normalized output reflects how far the price deviates from its average, providing a measure of momentum and trend strength.

**Customizable Parameters

Traders can adjust the period, moving average type, applied price, and shift to suit their trading style and timeframe.

**How It Works

Label1 (Red Line): Represents the normalized price deviation from a user-selected moving average (SMA, EMA, SMMA, or LWMA) divided by the standard deviation over the specified period. This line highlights the relative position of the price compared to its historical range.

Label2 (Green Line, Optional): A moving average of Label1, which smooths the normalized data to reduce noise and provide clearer signals. This can be toggled on or off via the "Draw MA" option.

**Inputs

Period: Length of the lookback period for normalization (default: 100).

MA Method: Type of moving average for normalization (SMA, EMA, SMMA, LWMA; default: EMA).

Applied Price: Price type used for calculation (Close, Open, High, Low, HL2, HLC3, HLCC4; default: Close).

Shift: Shifts the indicator forward or backward (default: 0).

Draw MA: Toggle the display of the Label2 moving average (default: true).

MA Period: Length of the moving average for Label2 (default: 50).

MA Method (Label2): Type of moving average for Label2 (SMA, EMA, SMMA, LWMA; default: SMA).

**How to Use

Divergence Trading: Look for discrepancies between price action and Label1. A bullish divergence (higher low in Label1 vs. lower low in price) may suggest a buying opportunity, while a bearish divergence could indicate a selling opportunity.

Overbought/Oversold Levels: Monitor extreme Label1 values. For instance, values significantly above +2 or below -2 could indicate overextension, though traders should define thresholds based on the asset and timeframe.

Trend Confirmation: Use Label2 to confirm trend direction. A rising Label2 suggests increasing bullish momentum, while a declining Label2 may indicate bearish pressure.

Combine with Other Tools: Pair Gioteen-Norm with support/resistance levels, RSI, or volume indicators for a more robust trading strategy.

**Notes

The indicator is non-overlay, meaning it plots below the price chart in a separate panel.

Avoid using a Period value of 1, as it may lead to unstable results due to insufficient data for standard deviation calculation.

This tool is best used as part of a broader trading system rather than in isolation.

**Why Use Gioteen-Norm?

The Gioteen-Norm indicator offers a fresh take on price normalization, blending statistical analysis with moving average techniques. Its flexibility and clarity make it suitable for traders of all levels—whether you're scalping on short timeframes or analyzing long-term trends. By publishing this for free, I hope to contribute to the TradingView community and help traders uncover hidden opportunities in the markets.

**Disclaimer

This indicator is provided for educational and informational purposes only. It does not constitute financial advice. Always backtest and validate any strategy before trading with real capital, and use proper risk management.

Gufs VWAPI expanded on a public script to be able to show customizable horizontal price lines (and standard) on multiple timeframes (session, week, month, year) with corresponding text labels.

I like my charts clutter free, and this helps me accomplish that.

Let me know what you think, it's my first publish. Thanks!

Niveles del Día Anterior y Pivot PointsTraza el alto, bajo, apertura y cierre del dia anterior y adicional traza los pivots

Altion RSI indicator"This 'Altcoin RSI Indicator' is a simple yet effective tool designed for traders to identify potential buy and sell signals based on the Relative Strength Index (RSI). Using a 7-period RSI calculated from the closing price, it generates a Buy signal when RSI crosses above 15 and a Sell signal when RSI crosses below 85. The script visualizes these signals with green 'Buy' labels below the bars and red 'Sell' labels above them, while also plotting the RSI line with overbought (85) and oversold (15) levels marked for reference. Ideal for altcoin trading or any market where RSI-based strategies are applicable.

Disclaimer: This script is for informational purposes only and should not be considered financial advice; use it at your own risk.

Piorun-ZEUS Setup AutoDetects market structure and generates LONG or SHORT signals

The script analyzes market structure based on predefined conditions (e.g., trendline break, BOS, CHOCH, OB, FVG, candlestick patterns).

When all conditions of your strategy are met (trend, structure, candle pattern, FVG, OB) — the script automatically displays an Entry signal for LONG (buy) or SHORT (sell).

It does not react to random moves — the signal will only appear when all the key criteria are fulfilled.

Automatically draws Entry, SL, TP1, TP2, TP3 levels on the chart

After detecting a valid setup, the script plots the exact levels:

Entry – suggested entry price

SL (Stop Loss) – level to protect against loss

TP1, TP2, TP3 (Take Profit) – target levels to secure profits (minimum RRR 1:3)

✅ Once a trade is opened, these levels are marked on the chart so you can clearly see your targets and risk.

Creates alerts in TradingView for both directions (LONG & SHORT)

The script generates alert signals in TradingView, so you will be notified when a valid trading setup appears — whether it's a buy (LONG) or sell (SHORT) opportunity.

Highlight Fascia Oraria 07:00-21:00Highlight Time Range 07:00–21:00 + New Year's Line

This script automatically highlights the time range between 07:00 and 21:00 (based on the chart’s server time) with a light green semi-transparent background — perfect for traders focusing on specific intraday sessions.

It also adds a red vertical line every January 1st, clearly marking the start of each new year on the chart.

Ideal for:

Intraday trading and session analysis

Seasonal or yearly pattern tracking

Clear visual reference for time cycles

💡 Easy to customize: You can adjust the startHour and endHour values to set your preferred time range.

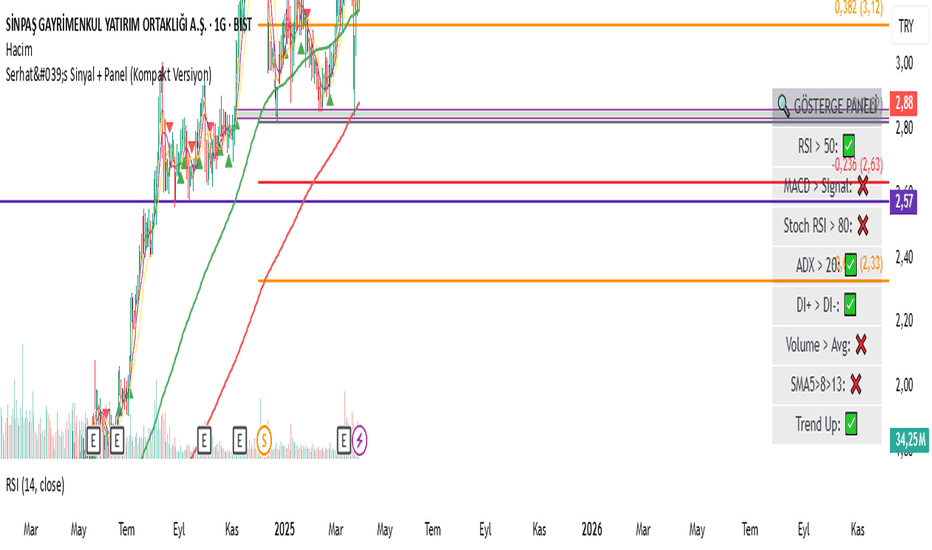

Serhat's Sinyal + Panel (Kompakt Versiyon)🔹 This indicator provides a clean and reliable signal system using a combination of multiple classic indicators: RSI, MACD, Stochastic RSI, ADX, DI+, Volume, and SMA sequences.

🔹 All signals are non-repetitive — once active, no new signal is given until the condition resets.

🔹 The compact panel summarizes all indicator statuses in real-time.

💡 Works best on daily and 4H charts.

Developed by: Serhat E.

Feedback is welcome!

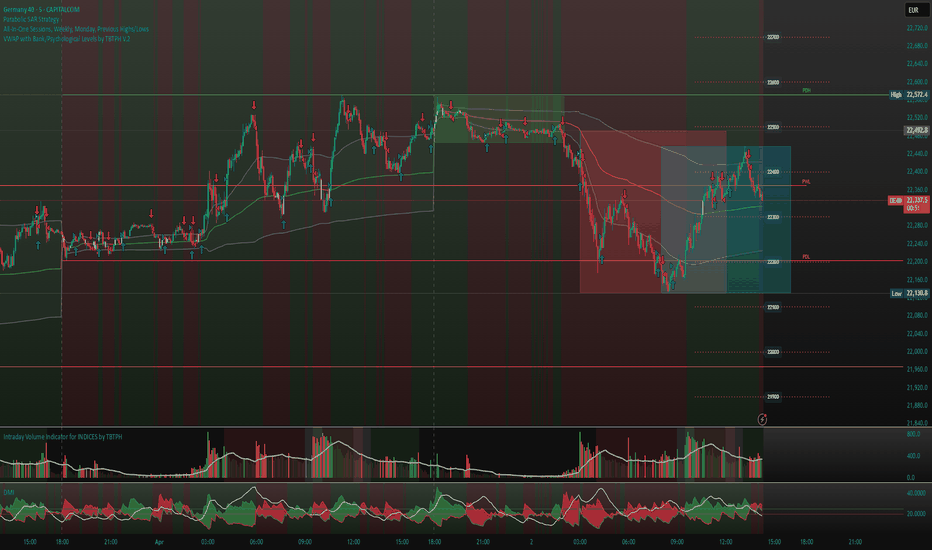

VWAP with Bank/Psychological Levels by TBTPH V.2This Pine Script defines a custom VWAP (Volume Weighted Average Price) indicator with several additional features, such as dynamic bands, bank levels, session tracking, and price-crossing detection. Here's a breakdown of the main elements and logic:

Key Components:

VWAP Settings:

The VWAP calculation is based on a source (e.g., hlc3), with an option to hide the VWAP on daily (1D) or higher timeframes.

You can choose the VWAP "anchor period" (Session, Week, Month, etc.) for adjusting the VWAP calculation to different time scales.

VWAP Bands:

The script allows you to plot bands above and below the VWAP line.

You can choose the calculation mode for the bands (Standard Deviation or Percentage), and the bands' width can be adjusted with a multiplier.

These bands are drawn using a gray color and can be filled to create a shaded area.

Bank Level Calculation:

The concept of bank levels is added as horizontal levels spaced by a user-defined multiplier.

These levels are drawn as dotted lines, and price labels are added to indicate each level.

You can define how many bank levels are drawn above and below the base level.

Session Indicators (LSE/NYSE):

The script identifies the open and close times of the London Stock Exchange (LSE) and the New York Stock Exchange (NYSE) sessions.

It limits the signals to only appear during these sessions.

VWAP Crossing Logic:

If the price crosses the VWAP, the script colors the candle body white to highlight this event.

Additional Plot Elements:

A background color is applied based on whether the price is above or below the 50-period Simple Moving Average (SMA).

The VWAP line dynamically changes color based on whether the price is above or below it (green if above, red if below).

Explanation of Key Sections:

1. VWAP and Band Calculation:

pinescript

Copy

= ta.vwap(src, isNewPeriod, 1)

vwapValue := _vwap

stdevAbs = _stdevUpper - _vwap

bandBasis = calcModeInput == "Standard Deviation" ? stdevAbs : _vwap * 0.01

upperBandValue1 := _vwap + bandBasis * bandMult_1

lowerBandValue1 := _vwap - bandBasis * bandMult_1

This code calculates the VWAP value (vwapValue) and standard deviation-based bands (upperBandValue1 and lowerBandValue1).

2. Bank Levels:

pinescript

Copy

baseLevel = math.floor(currentPrice / bankLevelMultiplier) * bankLevelMultiplier

The base level for the bank levels is calculated by rounding the current price to the nearest multiple of the bank level multiplier.

Then, a loop creates multiple bank levels:

pinescript

Copy

for i = -bankLevelRange to bankLevelRange

level = baseLevel + i * bankLevelMultiplier

line.new(x1=bar_index - 50, y1=level, x2=bar_index + 50, y2=level, color=highlightColor, width=2, style=line.style_dotted)

label.new(bar_index, level, text=str.tostring(level), style=label.style_label_left, color=labelBackgroundColor, textcolor=labelTextColor, size=size.small)

3. Session Logic (LSE/NYSE):

pinescript

Copy

lse_open = timestamp("GMT", year, month, dayofmonth, 8, 0)

lse_close = timestamp("GMT", year, month, dayofmonth, 16, 30)

nyse_open = timestamp("GMT-5", year, month, dayofmonth, 9, 30)

nyse_close = timestamp("GMT-5", year, month, dayofmonth, 16, 0)

The script tracks session times and filters the signals based on whether the current time falls within the LSE or NYSE session.

4. VWAP Crossing Detection:

pinescript

Copy

candleCrossedVWAP = (close > vwapValue and close <= vwapValue) or (close < vwapValue and close >= vwapValue)

barcolor(candleCrossedVWAP ? color.white : na)

If the price crosses the VWAP, the candle's body is colored white to highlight the cross.

Williams Fractalssmall arrow for higher high identify and higher low and also lower low and lower high easy to understand

EMA Shakeout DetectorEMA Shakeout & Reclaim Zones

Description:

This Pine Script helps traders quickly identify potential shakeout entries based on price action and volume dynamics. Shakeouts often signal strong accumulation, where institutions drive the stock below a key moving average before reclaiming it, creating an opportunity for traders to enter at favorable prices.

How It Works:

1. Volume Surge Filtering:

a. Computes the 51-day Simple Moving Average (SMA) of volume.

b. Identifies days where volume surged 2x above the 51-day average.

c. Filters stocks that had at least two such high-volume days in the last 21 trading days (configurable).

2. Stock Selection Criteria:

a. The stock must be within 25% of its 52-week high.

b. It should have rallied at least 30% from its 52-week low.

Shakeout Conditions:

1. The stock must be trading above the 51-day EMA before the shakeout.

2. A sudden price drop of more than 10% occurs, pushing the stock below the 51-day EMA.

3. A key index (e.g., Nifty 50, S&P 500) must be trading above its 10-day EMA, ensuring overall market strength.

Visualization:

Shakeout zones are highlighted in blue, making it easier to spot potential accumulation areas and study price & volume action in more detail.

This script is ideal for traders looking to identify institutional shakeouts and gain an edge by recognizing high-probability reversal setups.