Money Flow Oscillator [BullByte]

Overview :

The Money Flow Oscillator is a versatile technical analysis tool designed to provide traders with insights into market momentum through the Money Flow Index (MFI). By integrating trend logic, dynamic support/resistance levels, multi-timeframe analysis, and additional indicators like ADX and Choppiness, this script delivers a detailed view of market conditions and signal strength—all while adhering to TradingView’s publication guidelines.

Key Features :

Money Flow Analysis :

Uses the MFI to assess buying and selling pressure, helping traders gauge market momentum.

Trend Switch Logic :

Employs ATR-based calculations to determine trend direction. The background color adjusts dynamically to signal bullish or bearish conditions, and a prominent center line changes color to reflect the prevailing trend.

Dynamic Support/Resistance :

Calculates oscillator support and resistance over a pivot lookback period. These levels help you identify potential breakouts or reversals as the MFI moves above or below prior levels.

Signal Metrics & Classifications :

Combines MFI values with additional metrics to classify signals into categories such as “Strong Bullish,” “Bullish,” “Bearish,” or “Strong Bearish.” An accompanying note provides details on momentum entry and overall signal strength.

Multi-Timeframe Order Flow Confirmatio n:

Analyzes the MFI on a higher timeframe to confirm order flow. This extra layer of analysis helps verify the short-term signals generated on your primary chart.

Volume and ADX Integration :

Incorporates volume analysis and a manual ADX calculation to further validate signal strength and trend stability. A dashboard displays these metrics for quick reference.

Choppiness Indicator :

Includes a choppiness index to determine if the market is trending or choppy. When the market is identified as choppy, the script advises caution by adjusting the overall signal note.

Comprehensive Dashboard :

A built-in dashboard presents key metrics—including ADX, MFI, order flow, volume score, and support/resistance details—allowing you to quickly assess market conditions at a glance.

How to Use :

Trend Identification : Monitor the dynamic background and center line colors to recognize bullish or bearish market conditions.

Signal Confirmation : Use the oscillator support/resistance levels along with the signal classifications and dashboard data to make informed entry or exit decisions.

Multi-Timeframe Analysis : Validate short-term signals with the higher timeframe MFI order flow confirmation.

Risk Management : Always combine these insights with your own risk management strategy and further analysis.

Disclaimer :

This indicator is provided for educational and informational purposes only. It does not constitute financial advice. Always perform your own analysis and use proper risk management before making any trading decisions. Past performance is not indicative of future results.

Индикаторы и стратегии

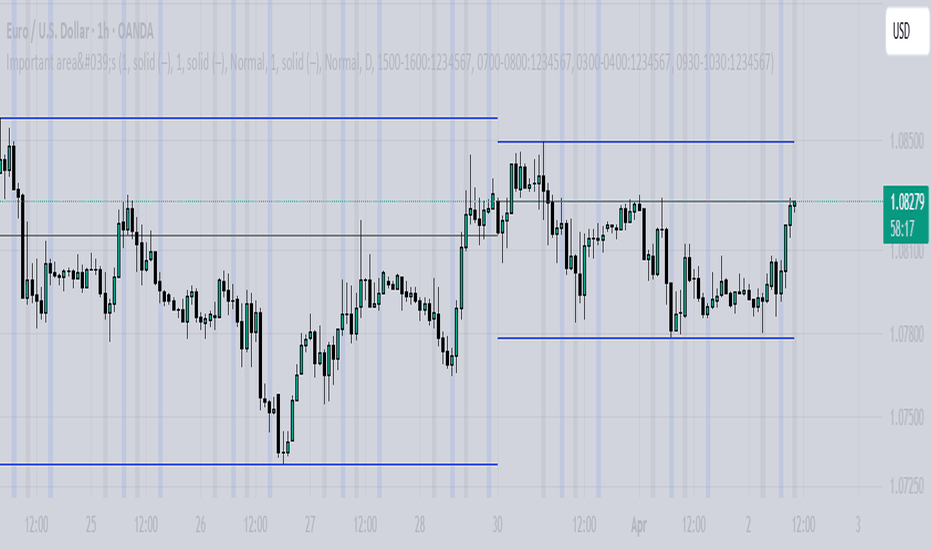

Important area'sI have tried to mark levels and zones I look for trades in, and kept the styling in way it doesn't messes up the chart, you can add it and look how these levels and zones have performed on previous data.

M2 for BTC [CryptoSoldier]Global M2 Liquidity design specially for BITCOIN with an Offset of 75 bars by Default

Cz ASR indicatorAverage session range indicator built by me. Great tool to gauge volatility and intraday reversal zones. Great for FX as there is an included table that shows range in pips; however, this can be applied across all assets as a volatility measure.

How it works:

The script measures the range of sessions, including Asia, London, and New York. The lookback period could be adjusted so you can find what length works best and is most accurate. This is then averaged out to provide the ASR. This provides us with an upper and lower bound of which the price could potentially fluctuate in based on the past session ranges. I have also added the 50% ASR, which is also a super useful metric for reversals or continuations.

There is also a configurable UTC so that you can adjust the indicator so it can accurately measure the range within certain sessions.

Note - different session start and stop times vary from market to market. I have set the code to the standard forex market opens however, if you wish to change the time ,you are able to do so by editing the variables in the script

Enjoy :)

Up/Down Volume Up/Down Vol Price Breaks High of Previous Candlehorizontal line create and alert crossover and crossbelow

AsianRange&Midnight 2.2### Midnight Setup: Trading Strategy

#### **Bias Definition (Trend Identification)**

- The Daily (D) bias is defined the previous day and validated on the line chart.

- On the Daily chart, identify the nearest V-shaped formation that has broken close to the current price. This formation determines the Daily bias direction.

#### **H4 Bias Analysis (Trend Confirmation)**

- Switch to an H4 chart to refine the analysis.

- Identify a similar V-shaped formation that has broken in the H4 timeframe.

- If the Daily and H4 biases are aligned, the setup is valid.

#### **Entry Strategy (Position Entries)**

- **Bearish Bias (D and H4 identical):**

- Short entry at the high level of the Midnight range.

- **Bullish Bias (D and H4 identical):**

- Long entry at the low level of the Midnight range.

#### **Bias Divergence (Context Adaptation)**

- If the H4 bias is opposite to the Daily bias, this indicates an H4 retracement of the Daily bias.

- Enter a counter-trend trade with reduced risk.

- No TP target beyond 50% of the extension validating the Daily break. It is also not recommended to enter against this divergence beyond 50%.

#### **Divergence Scenarios (Reactions to Divergences)**

- **Daily Bearish Bias, H4 Bullish Bias:**

- Long entry at the Midnight Low.

- **Daily Bullish Bias, H4 Bearish Bias:**

- Short entry at the Midnight High.

#### **Daily Bias Resumption (Trend Alignment)**

- As soon as the H4 bias resumes the Daily bias direction, follow this trend and adjust the position accordingly.

#### **Instructions for Divergent Bias (Managing Divergence)**

- When holding a position with a divergent bias, it is crucial to manage it carefully.

- Exit counter-trend trades as soon as the H4 bias realigns with the Daily bias.

- Limit the duration of counter-trend trades per session and adjust the H4 bias for the next session if needed.

#### **SL/TP Management (Profit Taking and Protection Optimization)**

- **Take Profit (TP):**

- Entry in M15 with a minimum RR of 3.

- TP at 5H NYE, or RR 5, or 15H NYE.

- **Stop Loss (SL):**

- Minimum 15 pips, placed just above the nearest swing to the entry point to protect capital.

- **Red Announcement Days:**

- Either abstain from trading or set a 40-pip SL to limit volatility impact.

- **At 6H/7H NYE:**

- Manage the trade based on its progress: exit, set to BE (Break Even), or keep the SL in place.

- Any SL adjustment outside these rules can only be made if supported by data or backtests.

#### **Risk Management (Capital Protection)**

- Maximum risk of **1% of capital per trade** (allowing for **10 consecutive losses** without significantly affecting capital).

- In case of a loss, **reduce risk by 50% on the next trade** until the loss is recovered.

#### **Efficiency Conditions (When This Setup Works Best)**

- This setup is particularly effective in **strong trends**, where the market has a clear direction.

- It is **less effective in ranging markets**, where prices move within a narrow range without a clear trend.

Setup Midnight : Stratégie de Trading

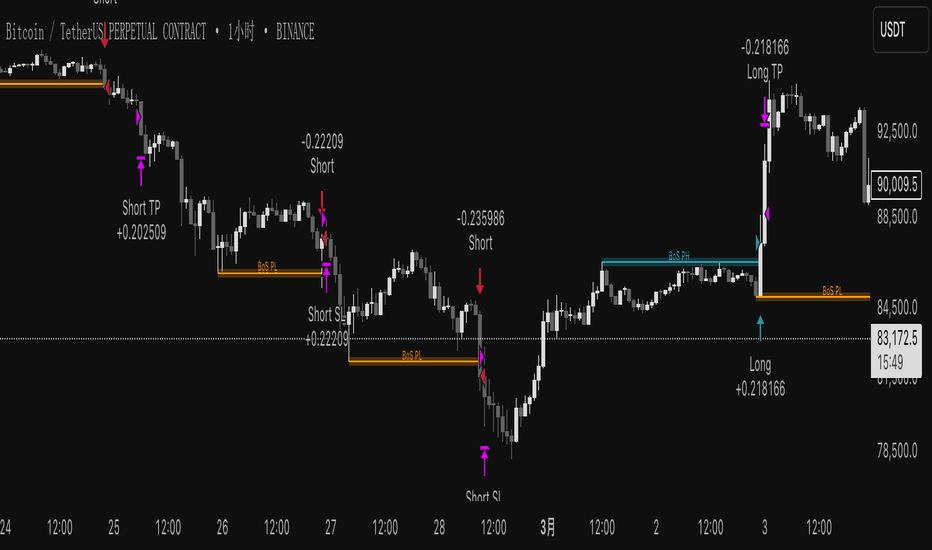

Smart Money Pivot Strategy [Jason Kasei]This strategy is designed to identify key pivot points (Pivot High and Pivot Low) in the market and leverage the "Smart Money" concept to capture price breakout opportunities. It supports both long and short trades, offering customizable stop-loss (SL) and take-profit (TP) settings, while visually plotting pivot points and breakout signals on the chart.

Core Features

Pivot Point Detection:

Utilizes ta.pivothigh and ta.pivotlow functions to detect the highest (Pivot High) and lowest (Pivot Low) points within a specified period (default: 20 bars).

Trading Signals:

Long Signal: Triggered when the price breaks above a previous Pivot High, indicating a potential uptrend.

Short Signal: Triggered when the price breaks below a previous Pivot Low, indicating a potential downtrend.

How It Works

Detects Pivot High (PH) and Pivot Low (PL) over the specified period and records their price and time.

Triggers a long entry when the price breaks above a Pivot High and a short entry when it falls below a Pivot Low.

Sets exit conditions automatically based on predefined SL and TP percentages after entry.

Plots breakout points and levels on the chart for analysis.

Considerations

The strategy relies on accurate pivot point detection; adjust the period parameter based on market volatility.

In highly volatile markets, consider widening the stop loss to avoid frequent triggering.

Combine with other indicators or analysis methods to validate signals and avoid blind trading.

Larry Williams POIV A/D [tradeviZion]Larry Williams' POIV A/D - Release Notes v1.0

=================================================

Release Date: 01 April 2025

OVERVIEW

--------

The Larry Williams POIV A/D (Price, Open Interest, Volume Accumulation/Distribution) indicator implements Williams' original formula while adding advanced divergence detection capabilities. This powerful tool combines price movement, open interest, and volume data to identify potential trend reversals and continuations.

FEATURES

--------

- Implements Larry Williams' original POIV A/D formula

- Divergence detection system:

* Regular divergences for trend reversal signals

* Hidden divergences for trend continuation signals

- Fast Mode option for earlier pivot detection

- Customizable sensitivity for divergence filtering

- Dynamic color visualization based on indicator direction

- Adjustable smoothing to reduce noise

- Automatic fallback to OBV when Open Interest is unavailable

FORMULA

-------

POIV A/D = CumulativeSum(Open Interest * (Close - Close ) / (True High - True Low)) + OBV

Where:

- Open Interest: Current period's open interest

- Close - Close : Price change from previous period

- True High - True Low: True Range

- OBV: On Balance Volume

DIVERGENCE TYPES

---------------

1. Regular Divergences (Reversal Signals):

- Bullish: Price makes lower lows while indicator makes higher lows

- Bearish: Price makes higher highs while indicator makes lower highs

2. Hidden Divergences (Continuation Signals):

- Bullish: Price makes higher lows while indicator makes lower lows

- Bearish: Price makes lower highs while indicator makes higher highs

REQUIREMENTS

-----------

- Works best with futures and other instruments that provide Open Interest data

- Automatically adapts to work with any instrument by using OBV when OI is unavailable

USAGE GUIDE

-----------

1. Apply the indicator to any chart

2. Configure settings:

- Adjust sensitivity for divergence detection

- Enable/disable Fast Mode for earlier signals

- Customize visual settings as needed

3. Look for divergence signals:

- Regular divergences for potential trend reversals

- Hidden divergences for trend continuation opportunities

4. Use the alerts system for automated divergence detection

KNOWN LIMITATIONS

----------------

- Requires Open Interest data for full functionality

- Fast Mode may generate more signals but with lower reliability

ACKNOWLEDGEMENTS

---------------

This indicator is based on Larry Williams' work on Open Interest analysis. The implementation includes additional features for divergence detection while maintaining the integrity of the original formula.

NasyINasy MTF EMA/MA with labels.

固定了我常用的EMA和MA,包括2m 13/48, 5m 9/21/48/200, 1d 50/100/200等

以label显示,不会太乱和有太多线。

---

Fixed my commonly used EMA and MA, including 2m 13/48, 5m 9/21/48/200, 1d 50/100/200, etc.

Displayed in label, it won't be too messy and there are too many lines.

Heikin Ashi + Supertrend SSR SMART-BNFOREXThis indicator combines HEIKIN ASHI candles with a SUPER TREND calculated from HEIKIN ASHI data (BNFOREX version), specifically created for SSR SMART strategy backtesting.

EMA & RSI & MACD & Stochastic sec TTD

---

## **EMA & RSI & MACD – Trend Dashboard by Timeframe**

This script is a **multi-timeframe trend dashboard** that combines several popular technical indicators across key timeframes to give traders a **quick snapshot of trend direction**.

---

### 🔍 **What This Indicator Does**

This indicator visually displays the **trend bias** from five key indicators:

- **EMA 50/200**: Long-term trend (classic golden/death cross logic)

- **EMA 5/7/9**: Short-term trend

- **RSI (14)**: Momentum trend using RSI vs its own 14-SMA

- **MACD**: MACD line vs Signal line

- **EMA 5 vs SMA 14**: A unique short-to-mid-term trend perspective

Each trend is represented by an emoji symbol:

- 🟢 **Uptrend**

- 🔴 **Downtrend**

- ⚫️ **Neutral**

---

### 🕒 **Covered Timeframes**

You can toggle on/off each timeframe as needed:

- 2H

- 3H

- 4H

- 8H

- 12H

- 1D

These are displayed vertically, with trend indicators across columns, so you can spot multi-timeframe confluence easily.

---

### 📊 **Dashboard Features**

- Positioned **on chart** at customizable screen locations (e.g., Middle Right, Bottom Left, etc.)

- **Table color, text size, and emojis** can all be customized in the settings

- **Live updating table** (last bar only) to reduce lag and clutter

---

### 📈 **Calculation Logic**

Each trend indicator is derived as follows:

#### ✅ **EMA 5/7/9 Trend**

- 🟢 if 5 > 7 > 9 (short-term bullish)

- 🔴 if 5 < 7 < 9 (short-term bearish)

- ⚫️ otherwise (neutral)

#### ✅ **EMA 50/200 Trend**

- 🟢 if price > EMA50 > EMA200 (classic bullish)

- 🔴 if price < EMA50 < EMA200 (classic bearish)

- ⚫️ otherwise

#### ✅ **RSI Trend**

- 🟢 if RSI > SMA(RSI)

- 🔴 if RSI < SMA(RSI)

- ⚫️ otherwise

#### ✅ **MACD Trend**

- 🟢 if MACD Line > Signal Line

- 🔴 if MACD Line < Signal Line

- ⚫️ otherwise

#### ✅ **EMA 5 vs SMA 14 Trend**

- 🟢 if EMA5 > SMA14

- 🔴 if EMA5 < SMA14

- ⚫️ otherwise

---

### 🛠️ **Customization**

In the settings panel, users can:

- Show/hide each timeframe

- Change the table's position

- Adjust text size and color

- Customize emoji symbols used for trends

---

### 📌 Use Case

This dashboard is ideal for:

- **Swing traders** and **intraday traders** monitoring multiple timeframes

- Identifying **trend confluence zones** across indicators

- Making quick, high-confidence trading decisions

---

Imbalance(FVG) DetectorImbalance (FVG) Detector

Overview

The Imbalance (FVG) Detector is a technical analysis tool designed to highlight price inefficiencies by identifying Fair Value Gaps (FVGs). These gaps occur when rapid price movement leaves an area with little to no traded volume, which may later act as a zone of interest. The indicator automatically detects and marks these imbalances on the chart, allowing users to observe historical price behavior more effectively.

Key Features

- Automatic Imbalance Detection: Identifies bullish and bearish imbalances based on a structured three-bar price action model.

- Customizable Sensitivity: Users can adjust the minimum imbalance percentage threshold to tailor detection settings to different assets and market conditions.

- Real-time Visualization: Marked imbalances are displayed as colored boxes directly on the chart.

- Dynamic Box Updates: Imbalance zones extend forward in time until price interacts with them.

- Alert System: Users can set alerts for when new imbalances appear or when price tests an existing imbalance.

How It Works

The indicator identifies market imbalances using a three-bar price structure:

- Bullish Imbalance: Occurs when the high of three bars ago is lower than the low of the previous bar, forming a price gap.

- Bearish Imbalance: Occurs when the low of three bars ago is higher than the high of the previous bar, creating a downward gap.

When an imbalance is detected:

- Green Boxes indicate bullish imbalances.

- Red Boxes indicate bearish imbalances.

- Once price interacts with an imbalance, the box fades to gray, marking it as tested.

! Designed for Crypto Markets

This indicator is particularly useful in crypto markets, where frequent volatility can create price inefficiencies. It provides a structured way to visualize gaps in price movement, helping users analyze historical liquidity areas.

Customization Options

- Min Imbalance Percentage Size: Adjusts the sensitivity of the imbalance detection.

- Alerts: Users can enable alerts to stay notified of new or tested imbalances.

Important Notes

- This indicator is a technical analysis tool and does not provide trading signals or financial advice.

- It does not predict future price movement but highlights historical price inefficiencies.

- Always use this tool alongside other market analysis methods and risk management strategies.

Will%R by SizovOption for combining the Williams Range% indicator of different lengths, for working in trend and counter-trend modes, in TF from 15m to 4H (version 6.2.00)

For the short and long WR% line, I recommend using the Fibonacci numbers: 3, 5, 8, 13, 21, 34, 55, 89, 144

@YuryGST

Multi-Timeframe MA DashboardThis indicator monitors 5 timeframes: 5min, 15min, 1hr, 4hr, and Daily. It displays fast and slow moving averages for each timeframe, along with the current price. The trend direction is color-coded: green for bullish (fast MA above slow MA) and red for bearish (fast MA below slow MA).

The dashboard also shows the last crossover signal (Buy/Sell) for each timeframe.

Visual arrows are plotted on the chart for the current timeframe. A green up arrow indicates a potential bullish crossover (Buy signal), while a red down arrow indicates a potential bearish crossover (Sell signal).

The dashboard is elegant and professional, with alternating row colors for better readability. It can be placed in any corner of the screen and customized with user-defined colors for bullish and bearish trends.

Alerts are triggered when a crossover occurs on any timeframe. These alerts include the timeframe and signal type (e.g., "5min: ↑ BUY").

How to Read the Indicator

The dashboard displays the following for each timeframe:

Fast MA: The value of the fast moving average.

Slow MA: The value of the slow moving average.

Price: The current price for the timeframe.

Trend: The current trend direction (Bullish or Bearish).

Signal: The last crossover signal (↑ BUY or ↓ SELL).

On the chart, green up arrows indicate a bullish crossover (Fast MA crosses above Slow MA), while red down arrows indicate a bearish crossover (Fast MA crosses below Slow MA).

Green text in the dashboard indicates a bullish trend or signal, while red text indicates a bearish trend or signal.

How to Use the Indicator

Use the dashboard to monitor the trend direction across multiple timeframes. Look for confluence (agreement) between timeframes to identify stronger trends. Observe the "Signal" column in the dashboard for the last crossover on each timeframe. Use the arrows on the chart to identify potential crossover points for the current timeframe.

Enable alerts to be notified of crossover signals on any timeframe. Alerts include the timeframe and signal type for easy reference.

Adjust the fast and slow moving average lengths to suit your trading style. Choose between EMA, SMA, or WMA for the moving average type. Customize the dashboard placement and colors for better visibility.

Important Notes

This indicator is not a buy or sell recommendation. It is a tool to assist traders in their analysis. Always use this indicator in conjunction with other tools, such as support/resistance levels, volume analysis, and price action. Past performance of moving averages does not guarantee future results.

How to Add the Indicator

Add the indicator to your chart from the TradingView library. Configure the inputs:

Fast MA Length: Default is 20.

Slow MA Length: Default is 50.

MA Type: Choose between EMA, SMA, or WMA.

Dashboard Placement: Select the corner of the screen where the dashboard will appear.

Colors: Customize the colors for bullish and bearish trends.

Monitor the dashboard and chart for trends and signals.

Disclaimer

This indicator is for educational and informational purposes only. It does not provide financial, investment, or trading advice. Always perform your own analysis and consult with a financial advisor before making trading decisions.

Relative Directional Index (RDI)🔍 Overview

The Relative Directional Index (RDI) is a hybrid tool that fuses the Average Directional and the Relative Strength Indices (ADX and RSI) into a single, highly visual interface. While the former captures trend strength, the latter reveals momentum shifts and potential exhaustion. Together, they can confirm trend structure, anticipate reversals, and sharpen the timing entries and exits.

📌 Why Combine ADX with RSI?

Most indicators focus on either trend-following (like ADX) or momentum detection (like RSI)—but rarely both. Each comes with trade-offs:

- ADX alone confirms trend strength but ignores momentum.

- RSI alone signals overbought/oversold, but lacks trend context.

The RDI resolves this by integrating both, offering:

- Smarter filters for trend entries

- Early warnings of momentum breakdowns

- More confident signal validation

🧠 Design Note: Fibonacci Harmony

All default values—5, 13, 21—are Fibonacci numbers. This is intentional, as these values reflect the natural rhythm of market cycles, and promote harmonic calibration between price action and indicator logic.

🔥 Key Features

✅ ADX Histogram

- Green bars = trend gaining strength

- Red bars = trend weakening

- Adjustable transparency for visual tuning

✅ ADX Line (Orange)

- Measures trend strength over time

- Rising = accelerating trend

- Falling = trend may be fading

✅ RSI Line (Lemon Yellow)

- Captures momentum surges and slowdowns

- Above 50 = bullish control

- Below 50 = bearish pressure

✅ Trend Strength Squares

- Bright green = strong uptrend

- Bright red = strong downtrend

- Faded colors = range-bound or indecisive

✅ ADX/RSI Crossover Markers

- Yellow square = RSI crosses above ADX → momentum building

- Orange square = ADX crosses above RSI → trend still dominant

✅ Customizable Reference Lines

- Yellow (50) = strong trend threshold

- Red (30) = weak trend zone

- Green (70) = overextended, potential exhaustion

_______________________________________________________

🎯 How to Trade with the RDI

The RDI helps traders identify momentum-supported trends, catch early reversals, and avoid false signals during consolidation.

✅ Trend Confirmation Entries

🔼 Bullish → Enter long on pullbacks or resistance breakouts

- ADX rising above 30

- RSI above 50

- Green trend square visible

🔽 Bearish → Enter short on breakdowns or failed retests

- ADX rising

- RSI below 50

- Red trend square visible

🧯 Exit if RSI crosses back against trend direction or ADX flattens

🚨 Reversal Setups Using Divergence

📈 Bullish Divergence → Long entry after confirmation (e.g. engulfing bar, volume spike)

- Price prints lower low

- RSI prints higher low

- Green triangle

📉 Bearish Divergence → Short entry on breakdown

- Price prints higher high

- RSI prints lower high

- Red triangle

Tip: Stronger if ADX is declining (fading trend strength)

🔂 Breakout Detection via Cross Markers

- Yellow square = RSI > ADX → breakout brewing

- Orange square = ADX > RSI → trend continuation likely

⏸️ Avoid Choppy Markets

- RSI between 45–55

- Faded trend squares

- Flat ADX below 20–30

🧠 Pro Tips

- Combine RDI with VWAPs, moving averages and/or pitchforks

- Watch for alignment between trend and momentum

- Use divergence markers as confirmation, not stand-alone triggers

_______________________________________________________

⚠️ Hidden Divergence (Optional)

The RDI includes optional hidden divergence detection. These signals suggest trend continuation but are off by default. Use with discretion—best in established trends, not sideways markets.

🙈 Hidden Bullish

- Price prints higher low

- RSI prints lower low

🙈 Hidden Bearish

- Price prints lower high

- RSI prints higher high

Sessions [Key Sessions]Personal Script

This Pine Script (v5) indicator, "Sessions ," overlays trading session data on a TradingView chart. It supports four customizable sessions (default: New York, London, Tokyo, Sydney) with configurable time ranges, colors, and overlay options (Range, Trendline, Mean, VWAP, Max/Min). Session ranges are displayed as shaded boxes with adjustable transparency and optional outlines/labels. Timezone settings allow UTC offset or exchange timezone use. Daily dividers mark day changes with customizable line style (Solid, Dashed, Dotted), line color, text position (Top, Bottom), text color, and text size (Tiny, Small, Normal). Session dividers are optional, showing session transitions with dots and bars. The script uses functions to calculate averages, trendlines, VWAP, and ranges, plotting results with up to 500 bars back. Dashboard functionality is absent, focusing solely on session visualization and dividers.

Institutional Activity AnalysisThe Institutional Activity Analysis (IAA) indicator is a powerful tool designed to help traders identify potential institutional buying and selling activity in the market. By analyzing volume, price movement, and accumulation/distribution trends, this indicator provides insights into market dynamics that may signal significant activity.

This indicator is not a buy or sell recommendation but rather a tool to assist traders in understanding market behavior. It should be used in conjunction with other technical analysis tools and strategies for a comprehensive trading approach.

Key Features:

Smart Money Flow Index (SMFI):

1). Tracks the flow of "smart money" by analyzing price action relative to volume.

2). Helps identify whether institutional activity is bullish or bearish.

Accumulation/Distribution (Acc/Dist):

1). Measures buying and selling pressure in the market.

2). Indicates whether the market is in an accumulation (buying) or distribution (selling) phase.

Volume Spike Detection:

1. Identifies unusual volume spikes that may signal institutional activity.

2. Highlights these spikes with a yellow circle on the chart.

Significant Price Movement:

1. Detects strong price movements accompanied by high volume.

2. Marks these movements with a green triangle on the chart.

Customizable Dashboard:

1. Displays key metrics such as volume flow, smart money flow, accumulation/distribution, and volatility.

2. Includes visual signals for volume spikes and significant moves.

3. The dashboard can be positioned anywhere on the chart or turned off.

Heatmap for Activity Intensity:

1. Visualizes the intensity of market activity by combining volume and price volatility.

How to Read the Indicator:

Smart Money Flow (SMFI):

1. A positive SMFI value indicates bullish institutional activity.

2. A negative SMFI value suggests bearish institutional activity.

3. The blue line on the indicator represents the smoothed SMFI.

Accumulation/Distribution (Acc/Dist):

1. A positive slope indicates accumulation (buying pressure).

2. A negative slope indicates distribution (selling pressure).

3. The purple line on the indicator shows the smoothed Acc/Dist slope.

Volume Spikes:

1. Yellow circles on the chart indicate unusual volume spikes.

2. These spikes may signal institutional interest or significant market activity.

Significant Price Movements:

1. Green triangles on the chart highlight strong price movements with high volume.

2. These movements may indicate potential breakouts or reversals.

Dashboard:

The dashboard provides a quick summary of key metrics:

1. Volume Flow: Indicates whether volume is above or below the average.

2. Smart Money: Shows whether institutional activity is bullish or bearish.

3. Acc/Dist: Displays whether the market is in accumulation or distribution.

4. Volatility: Provides the current volatility level.

5. Signals: Highlights whether there are volume spikes or significant moves.

How to Use the Indicator:

Identify Institutional Activity:

1. Look for confluences between volume spikes, significant price movements, and the direction of the SMFI and Acc/Dist slope.

2. For example, a volume spike combined with a positive SMFI and accumulation may indicate bullish institutional activity.

Confirm Market Trends:

1. Use the indicator to confirm trends by analyzing the direction of the SMFI and Acc/Dist slope.

2. A rising SMFI and positive Acc/Dist slope suggest a strong uptrend, while the opposite indicates a downtrend.

Monitor Volatility:

1. High volatility combined with volume spikes may signal potential breakouts or reversals.

2. Use the volatility metric on the dashboard to gauge market conditions.

Set Alerts:

1. Use the built-in alert conditions to get notified of volume spikes and significant price movements.

2. Alerts can help you stay informed about potential market opportunities.

Important Notes:

1. This is not a buy or sell recommendation. The IAA indicator is a technical analysis tool designed to provide insights into market activity. Always use it in conjunction with other tools and strategies.

2. The indicator works best when combined with other forms of analysis, such as support/resistance levels, trendlines, and candlestick patterns.

3. Past performance is not indicative of future results. Always practice proper risk management and trade responsibly.

Customization:

The indicator includes several customizable settings:

1. Volume Spike Threshold: Adjust the sensitivity for detecting volume spikes.

2. Smoothing Period: Change the period for calculating SMFI and Acc/Dist.

3. Price Movement Threshold: Modify the sensitivity for detecting significant price movements.

4. Dashboard Position: Move the dashboard to any corner of the chart or turn it off.

5. Visual Settings: Customize the colors and transparency of the dashboard and signals.

Example Use Case:

Imagine you're analyzing a stock that has been consolidating for several days. Suddenly, the IAA indicator detects:

1. A volume spike (yellow circle),

2. A significant price movement (green triangle),

3. A positive SMFI (bullish smart money flow),

4. And an accumulation phase (positive Acc/Dist slope).

This confluence of signals may indicate that institutional buyers are entering the market, potentially leading to a breakout. You can then use this information to plan your trade, such as setting alerts or monitoring for confirmation from other indicators.

Disclaimer:

The Institutional Activity Analysis (IAA) indicator is for educational and informational purposes only. It is not financial advice or a recommendation to buy or sell any security. Always conduct your own research and consult with a financial advisor before making trading decisions. Use this tool responsibly and at your own risk.

Professional MSTI+ Trading Indicator"Professional MSTI+ Trading Indicator" is a comprehensive technical analysis tool that combines over 20 indicators to generate high-quality trading signals and assess market sentiment. The script integrates standard indicators (MACD, RSI, Bollinger Bands, Stochastic, Simple Moving Averages, and Volume Analysis) with advanced components (Squeeze Momentum, Fisher Transform, True Strength Index, Heikin-Ashi, Laguerre RSI, Hull MA) and further includes metrics such as ADX, Chaikin Money Flow, Williams %R, VWAP, and EMA for in-depth market analysis.

Key Features:

Multiple Presets for Different Trading Styles:

Choose from optimal configurations like Professional, Swing Trading, Day Trading, Scalping, or Reversal Hunter. Note that the presets may not work perfectly on all pairs, and manual calibration might be required. This flexibility allows you to fine-tune the settings to align with your unique strategies and signals.

Multi-Layered Signal Filtering:

Filters based on trend, volume, and volatility help eliminate false signals, enhancing the accuracy of market entries.

Comprehensive Fear & Greed Index:

The indicator aggregates data from RSI, volatility, momentum, trend, and volume to gauge overall market sentiment, providing an additional layer of market context.

Dynamic Information Panel:

Displays detailed status updates for each component (e.g., MACD, RSI, Laguerre RSI, TSI, Fisher Transform, Squeeze, Hull MA, etc.) along with a visual strength bar that represents the intensity of the trading signal.

Signal Generation:

Buy and sell signals are generated when a predefined number of conditions are met and confirmed over multiple bars. These signals are clearly displayed on the chart with arrows, making it easier to spot potential entry and exit points.

Alert Setup:

Built-in alert conditions allow you to receive real-time notifications when trading signals are generated, helping you stay on top of market movements.

"Professional MSTI+ Trading Indicator" is designed to enhance your trading strategy by providing a multi-faceted market analysis and an intuitive visual interface. While the presets offer a robust starting point, they may require manual calibration on certain pairs, giving you the flexibility to configure your own unique strategies and signals.

BuySell Strategy OD📘 Strategy Summary – Orkoin Trend Strategy v1

This strategy identifies strong trend-based buy/sell opportunities using:

ADX > 25 for trend confirmation

RSI < 30 / > 70 to detect oversold or overbought zones

Stochastic RSI < 20 / > 80 for momentum shifts

Price < VWAP / > VWAP for value filtering

🔹 A BUY signal triggers when at least 3 of the buy conditions are met.

🔹 A SELL signal triggers when at least 3 of the sell conditions are met.

Ideal for 15m charts. Backtest-ready.

Multi_MM_r.a.traderIndicador criado por Ruda Alves

This indicator shows daily moving average on any time frame.

It helps to see where it is with no need to go to a daily chart.

iFVG StrategySimple iFVG strategy that tracks inversion fair value gaps and enters anticipating a reversal.

Segnali C/V (Ibrido LinReg + ATR)“Discover the new LinReg + ATR Hybrid Bot: your compass in the markets!

Forget old static strategies: our system integrates the power of Linear Regression with the ATR indicator, detecting buying and selling opportunities in real time based on volatility and trends. Simple to use, quick to make decisions and designed to follow the market with intelligent trailing stops, the Hybrid Bot helps you maximize your entries and protect your profits. Try it now and take your trading to the next level!”

CISD with Alerts [neo|]█ OVERVIEW

CISD (or Change in State of Delivery) is an ICT concept and reversal pattern which may allow traders to identify reversals or changes in market structure early, compared to using traditional market structure. This script aims to correctly identify, and update these levels and provide alerts, so that traders can take advantage of this concept with ease.

█ CONCEPTS

Simply put, CISD may be identified when price closes above the open of the candle which started the most recent downtrend or liquidity sweep. Generally, it is most powerful when applied to key points in the market as a confirmation from where you may want price to reverse.

For example, when price is in a downtrend, we take the open of the last consecutive downwards candle and observe the CISD once price closes above it, beginning an uptrend.

Examples:

COMEX:GC1!

CME_MINI:NQ1!

█ How to use

To use the indicator, simply apply it to your chart and modify any of your desired inputs.

• Bullish CISD color allows you to change the color of +CISD levels.

• Bearish CISD color allows you to change the color of -CISD levels.

• Line width allows you to modify the width of +-CISD lines.

• Line extension bars allows you to change how far ahead CISD levels are drawn (by default it is 5).

• Keep old CISD levels will allow you to preserve all past CISD levels if you would like to observe the logic.

• Enable stat table will let you add a table on your chart which will tell you the current CISD trend, as well as your ticker and timeframe.

• Table position allows you to customize where the table will appear on your chart.