EMA Envelope + EMA Bollinger BandsEMA envelope and bollinger bands together. It works on the principal of exponential moving average useful in identifying rallies top and bottoms.

Precision is high on higher timeframes like weekly and daily and monthly for swingtrades

Индикаторы и стратегии

GranDoc - Week, Day, Month, and Session Separator5Indicator Name: GranDoc's - Week, Day, Month, and Session Separator

Version: Pine Script v5

Author: Jonpaul Nnamdi Opara (GranDoc )

Description

The "GranDoc - Week, Day, Month, and Session Separator" is a highly customizable TradingView indicator designed to enhance chart analysis by visually marking critical time-based transitions. Developed by Jonpaul Nnamdi Opara, this tool plots vertical lines with labels or background highlights to denote the start and end of weeks, days, months, and major trading sessions (Frankfurt, London, NY Morning, NY Afternoon, Sydney, and Tokyo). Traders can tailor colors, line styles, widths, transparency, and session times to align with their strategies and timezones.

Ideal for forex, stocks, futures, and crypto traders, this indicator simplifies the identification of key market periods—such as session openings/closings or new weeks—that often signal increased volatility or trend shifts. It’s optimized for intraday timeframes for session separators but supports all timeframes for week, day, and month markers, making it a versatile addition to any trader’s toolkit.

Features

Week Separators: Marks Monday starts with customizable lines and "Week Start" labels.

Day Separators: Highlights daily openings with lines and "Day Start" labels.

Month Separators: Indicates new months with lines and "Month Start" labels.

Session Separators: Plots lines and labels for major trading sessions’ start and end:

Frankfurt (default: 07:00–15:00 UTC)

London (default: 08:00–16:00 UTC)

NY Morning (default: 13:00–16:00 UTC)

NY Afternoon (default: 16:00–21:00 UTC)

Sydney (default: 22:00–06:00 UTC)

Tokyo (default: 00:00–08:00 UTC)

Timezone Support: Adjusts session times with a UTC offset (±12 hours).

Display Flexibility : Toggle between labeled vertical lines or background highlights.

Customization: Fine-tune colors, line styles (solid, dashed, dotted), widths, and transparency.

Background Mode: Highlights periods with translucent backgrounds for cleaner charts.

[ i]Labeled Lines: Each line includes descriptive labels (e.g., "London Open", "Tokyo Closed") when not in background mode.

How to Use

Add to Chart:

Copy the script into TradingView’s Pine Editor.

Click "Add to Chart" to apply the indicator.

Customize Settings:

Open settings via double-click or the "Settings" gear icon.

Timezone Offset: Set your UTC offset (e.g., -5 for EST) to align sessions.

Toggles: Enable/disable week, day, month, or session separators.

Appearance: Adjust colors, line styles, widths, and transparency for each separator.

Session Times: Modify start/end hours and minutes if defaults don’t suit your market.

Background Mode: Enable "Show as Background" for colored backgrounds instead of lines, and tweak "Session Background Transparency."

Labels: Labeled lines (e.g., "Sydney Open") appear automatically unless background mode is active.

Chart Compatibility:

Session separators require intraday timeframes (e.g., 1-minute to 4-hour).

Week, day, and month separators work across all timeframes.

Confirm your chart’s timezone aligns with your analysis.

Analyze:

Use separators to pinpoint session transitions, daily openings, or weekly shifts for trade planning.

Labels make it easy to spot key periods on busy charts.

Pair with indicators like RSI, volume, or support/resistance for deeper insights.

Example Use Cases

Forex Trading: Highlight London and NY session opens/closes for high-liquidity entries.

Day Trading: Reset strategies at daily separators and monitor intraday volatility.

Swing Trading: Use week/month separators to track longer-term trends.

Session Focus: Isolate sessions like Tokyo for regional market analysis.

Chart Clarity: Background mode declutters charts while marking key times.

Notes

Session separators are disabled on daily+ timeframes to prevent clutter.

Verify timezone offset for accurate session alignment.

Background mode suits lower timeframes for readability.

Labels are visible only when background mode is disabled.

Feedback

Share your thoughts or suggestions to make this indicator even better! Reach out via TradingView or connect with the author for insights. Happy trading!

About the Author

Dr. Jonpaul Nnamdi Opara, a PhD graduate from Ehime University, Japan, is a researcher and developer specializing in AI and machine learning. His work on automated landslide mapping and defect detection, published in journals like GEOMATE, showcases his precision-driven approach. With the "GranDoc" indicator, Jonpaul brings intuitive, data-driven clarity to financial markets, reflecting his expertise in creating impactful tools.

Trend Dashboard (Short / Medium / Long)🔍 Overview

This script:

Calculates the short, medium, and long-term trend based on moving average crossovers

Displays the current trend status in a color-coded table on your TradingView chart

Helps you visually identify market trend direction at a glance — great for quick decision making

🧱 1. Inputs Section

shortMA_len = input.int(9, title="Short-Term MA")

mediumMA_short = input.int(21, title="Medium-Term Fast MA")

mediumMA_long = input.int(50, title="Medium-Term Slow MA")

longMA_short = input.int(50, title="Long-Term Fast MA")

longMA_long = input.int(200, title="Long-Term Slow MA")

This part lets you customize the moving averages used to determine each trend type:

Short-term: 9 vs 21 SMA

Medium-term: 21 vs 50 SMA

Long-term: 50 vs 200 SMA

You can change these from the indicator settings on your chart.

📈 2. Calculating the Moving Averages

shortMA = ta.sma(close, shortMA_len)

mediumFast = ta.sma(close, mediumMA_short)

mediumSlow = ta.sma(close, mediumMA_long)

longFast = ta.sma(close, longMA_short)

longSlow = ta.sma(close, longMA_long)

This section calculates:

The short MA (e.g. 9-period)

The medium fast & slow MAs (21 & 50)

The long fast & slow MAs (50 & 200)

📊 3. Determining the Trend

shortTrend = shortMA > mediumFast ? "Bullish" : shortMA < mediumFast ? "Bearish" : "Neutral"

mediumTrend = mediumFast > mediumSlow ? "Bullish" : mediumFast < mediumSlow ? "Bearish" : "Neutral"

longTrend = longFast > longSlow ? "Bullish" : longFast < longSlow ? "Bearish" : "Neutral"

Here, each trend is determined by a simple moving average crossover:

If the fast MA is above the slow MA → Bullish

If below → Bearish

If equal → Neutral

🎨 4. Trend Color Helper Function

getColor(trend) =>

trend == "Bullish" ? color.lime : trend == "Bearish" ? color.red : color.gray

Returns a color based on the trend type:

Green for Bullish

Red for Bearish

Gray for Neutral

📋 5. Creating and Updating the Table

var table trendTable = table.new(position.top_right, 2, 4, border_width=1)

This creates a 2-column, 4-row table in the top-right of the chart.

pinescript

Copy

Edit

table.cell(...)

Updates the table every few bars:

Row 1: headers

Row 2: Short-term trend

Row 3: Medium-term trend

Row 4: Long-term trend

Each trend is colored based on its status.

📌 6. Optional: Plot the Moving Averages

plot(shortMA, ...)

plot(mediumFast, ...)

...

Just to give you a visual reference, it plots each moving average on the chart in a different color.

✅ Summary: What You Get

🧠 Short-Term Trend: (e.g., 9 vs 21 SMA)

📈 Medium-Term Trend: (e.g., 21 vs 50 SMA)

📉 Long-Term Trend: (e.g., 50 vs 200 SMA)

🎨 Color-coded dashboard for instant recognition

📊 Great for trend-following, filtering trades, and quick analysis

[blackcat] L2 Ehlers Convolution Indicator V2OVERVIEW The L2 Ehlers Convolution Indicator V2 is an advanced technical analysis tool that applies convolution techniques to identify market trends and potential reversal points. It uses adaptive filtering to analyze price movements across multiple timeframes.

FEATURES

• Advanced convolution algorithm based on Ehlers' methodology

• Multiple timeframe analysis (S2 through S60)

• Dynamic color coding for trend direction:

Red: Downward trend

Green: Upward trend • Adjustable sensitivity through period inputs

HOW TO USE

Input Parameters:

• ShortestPeriod: Minimum period length for calculations

• LongestPeriod: Maximum period length for calculations

Interpretation:

• Red bars indicate downward momentum

• Green bars indicate upward momentum

• Bar height corresponds to the timeframe analyzed

LIMITATIONS

• Requires sufficient historical data for accurate calculations

• May produce false signals during volatile markets

• Performance depends on selected period parameters

NOTES

• The indicator uses arrays to store correlation, slope, and convolution values

• Each bar represents a different timeframe analysis

• Color intensity varies based on the strength of the signal

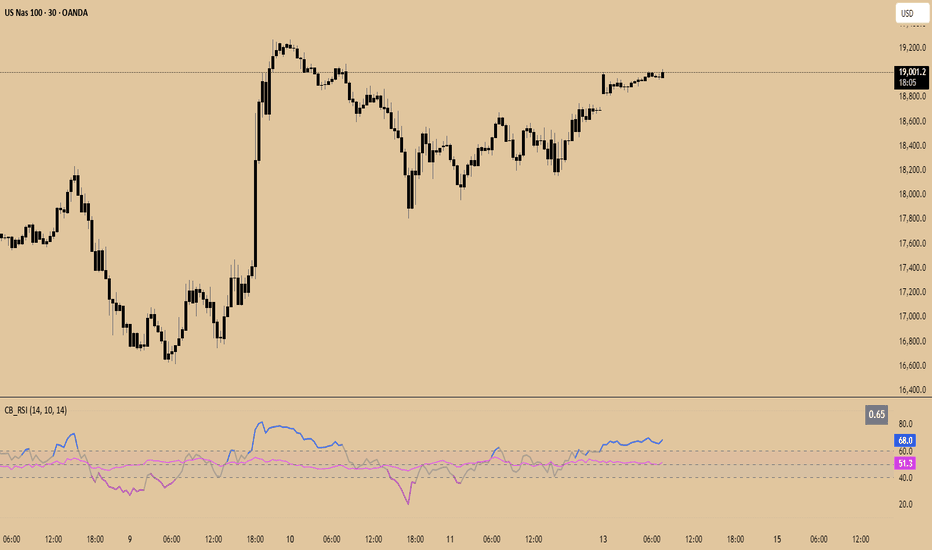

Constance Brown RSI with Composite IndexConstance Brown RSI with Composite Index

Overview

This indicator combines Constance Brown's RSI interpretation methodology with a Composite Index and ATR Distance to VWAP measurement to provide a comprehensive trading tool. It helps identify trends, momentum shifts, overbought/oversold conditions, and potential reversal points.

Key Features

Color-coded RSI zones for immediate trend identification

Composite Index for momentum analysis and divergence detection

ATR Distance to VWAP for identifying extreme price deviations

Automatic divergence detection for early reversal warnings

Pre-configured alerts for key trading signals

How to Use This Indicator

Trend Identification

The RSI line changes color based on its position:

Blue zone (RSI > 50): Bullish trend - look for buying opportunities

Purple zone (RSI < 50): Bearish trend - look for selling opportunities

Gray zone (RSI 40-60): Neutral/transitional market - prepare for potential breakout

The 40-50 area (light blue fill) acts as support during uptrends, while the 50-60 area (light purple fill) acts as resistance during downtrends.

// From the code:

upTrendZone = rsiValue > 50 and rsiValue <= 90

downTrendZone = rsiValue < 50 and rsiValue >= 10

neutralZone = rsiValue > 40 and rsiValue < 60

rsiColor = neutralZone ? neutralRSI : upTrendZone ? upTrendRSI : downTrendRSI

Momentum Analysis

The Composite Index (fuchsia line) provides momentum confirmation:

Values above 50 indicate positive momentum

Values below 40 indicate negative momentum

Crossing above/below these thresholds signals potential momentum shifts

// From the code:

compositeIndexRaw = rsiChange / ta.stdev(rsiValue, rsiLength)

compositeIndex = ta.sma(compositeIndexRaw, compositeSmoothing)

compositeScaled = compositeIndex * 10 + 50 // Scaled to fit 0-100 range

Overbought/Oversold Detection

The ATR Distance to VWAP table in the top-right corner shows how far price has moved from VWAP in terms of ATR units:

Extreme positive values (orange/red): Potentially overbought

Extreme negative values (purple/red): Potentially oversold

Near zero (gray): Price near average value

// From the code:

priceDistance = (close - vwapValue) / ta.atr(atrPeriod)

// Color coding based on distance value

Divergence Trading

The indicator automatically detects divergences between the Composite Index and price:

Bullish divergence: Price makes lower low but Composite Index makes higher low

Bearish divergence: Price makes higher high but Composite Index makes lower high

// From the code:

divergenceBullish = ta.lowest(compositeIndex, rsiLength) > ta.lowest(close, rsiLength)

divergenceBearish = ta.highest(compositeIndex, rsiLength) < ta.highest(close, rsiLength)

Trading Strategies

Trend Following

1. Identify the trend using RSI color:

Blue = Uptrend, Purple = Downtrend

2. Wait for pullbacks to support/resistance zones:

In uptrends: Buy when RSI pulls back to 40-50 zone and bounces

In downtrends: Sell when RSI rallies to 50-60 zone and rejects

3. Confirm with Composite Index:

Uptrends: Composite Index stays above 50 or quickly returns above it

Downtrends: Composite Index stays below 50 or quickly returns below it

4. Manage risk using ATR Distance:

Take profits when ATR Distance reaches extreme values

Place stops beyond recent swing points

Reversal Trading

1. Look for divergences

Bullish: Price makes lower low but Composite Index makes higher low

Bearish: Price makes higher high but Composite Index makes lower high

2. Confirm with ATR Distance:

Extreme readings suggest potential reversals

3. Wait for RSI zone transition:

Bullish: RSI crosses above 40 (purple to neutral/blue)

Bearish: RSI crosses below 60 (blue to neutral/purple)

4. Enter after confirmation:

Use candlestick patterns for precise entry

Place stops beyond the divergence point

Four pre-configured alerts are available:

Momentum High: Composite Index above 50

Momentum Low: Composite Index below 40

Bullish Divergence: Composite Index higher low

Bearish Divergence: Composite Index lower high

Customization

Adjust these parameters to optimize for your trading style:

RSI Length: Default 14, lower for more sensitivity, higher for fewer signals

Composite Index Smoothing: Default 10, lower for quicker signals, higher for less noise

ATR Period: Default 14, affects the ATR Distance to VWAP calculation

This indicator works well across various markets and timeframes, though the default settings are optimized for daily charts. Adjust parameters for shorter or longer timeframes as needed.

Happy trading!

Session Markers: 00:00, London, NY (Last 7 Days)This script marks key time(s) -

1. midnight open

2. london session open

3. ny session open

The session markers show up in blue color with a gray text annotation.

[blackcat] L2 Ehlers Autocorrelation Periodogram V2OVERVIEW

The Ehlers Autocorrelation Periodogram is a sophisticated technical analysis tool that identifies market cycles and their dominant frequencies using autocorrelation and spectral analysis techniques.

BACKGROUND

Developed by John F. Ehlers and detailed in his book "Cycle Analytics for Traders" (2013), this indicator combines autocorrelation functions with discrete Fourier transforms to extract cyclic information from price data.

FUNCTION

The indicator works through these key steps:

Calculates autocorrelation using minimum three-bar averaging

Applies discrete Fourier transform to extract cyclic information

Uses center-of-gravity algorithm to determine dominant cycle

ADVANTAGES

• Rapid response within half-cycle periods

• Accurate relative cyclic power estimation over time

• Correlation constraints between -1 and +1 eliminate amplitude compensation needs

• High resolution independent of windowing functions

HOW TO USE

Add the indicator to your chart

Adjust AvgLength input parameter:

• Default: 3 bars

• Higher values increase smoothing

• Lower values increase sensitivity

Interpret the results:

• Colored bars represent spectral power

• Red to yellow spectrum indicates cycle strength

• White line shows dominant cycle period

INTERPRETATION

• Strong colors indicate significant cyclic activity

• Sharp color transitions suggest potential cycle changes

• Dominant cycle line helps identify primary market rhythm

LIMITATIONS

• Requires sufficient historical data

• Performance may vary in non-cyclical markets

• Results depend on proper parameter settings

NOTES

• Uses highpass and super smoother filtering techniques

• Spectral estimates are normalized between 0 and 1

• Color intensity varies based on spectral power

THANKS

This implementation is based on Ehlers' original work and has been adapted for TradingView's Pine Script platform.

Auto Anchored VWAPs for FuturesAbout the Script

This indicator automatically plots five anchored VWAPs based on predefined starting times, offering traders key reference points across multiple timeframes. These starting points are hardcoded and cannot be customized, ensuring consistency across all time zones. Below are the anchored VWAPs and their respective starting times:

NY Session: Starts daily at 9:30 AM EST

Globex: Starts daily at 6:00 PM EST

Weekly: Resets every Sunday at 6:00 PM EST

Monthly: Anchored to the first session of the month at 6:00 PM EST

Yearly: Anchored to the first session of the year at 6:00 PM EST

How to Use the Script

1) Add the script to your chart.

2) Select the appropriate Daylight Savings Time format.

3) Customize the visual appearance to your preference.

4) Click "OK" to apply the changes.

Once configured, the VWAP levels will automatically adjust based on the predefined timeframes.

How the Script Works

The script calculates and plots anchored VWAPs at the predefined starting times listed above. As each session, week, month, and year progresses, the corresponding VWAP is recalculated and updated on the chart, providing traders with dynamic insights into market trends and volume-weighted price action.

[blackcat] L2 Ehlers Autocorrelation Indicator V2OVERVIEW

The Ehlers Autocorrelation Indicator is a technical analysis tool developed by John F. Ehlers that measures the correlation between price data and its lagged versions to identify potential market cycles and reversals.

BACKGROUND

Originally introduced in Ehlers' "Cycle Analytics for Traders" (2013), this indicator leverages autocorrelation principles to detect patterns in market data that deviate from random noise or perfect sine waves.

FEATURES

• Calculates Pearson correlation coefficients for lags from 0 to 60 bars

• Visualizes correlations using colored bars ranging from red (negative correlation) to yellow (positive correlation)

• Provides minimum averaging option through AvgLength input parameter

• Displays sharp reversal signals at price turning points

• Shows variations in bar thickness and count over time

HOW TO USE

Add the indicator to your chart

Adjust the AvgLength input as needed:

• Set to 0 for no averaging

• Increase value for smoother results

Interpret the colored bars:

• Red: Negative correlation

• Yellow: Positive correlation

• Sharp transitions indicate potential reversal points

LIMITATIONS

• Requires sufficient historical data for accurate calculations

• Performance may vary across different market conditions

• Results depend on proper parameter settings

NOTES

• The indicator uses highpass filtering and super smoother filtering techniques

• Color intensity varies based on correlation strength

• Multiple lag periods are displayed simultaneously for comprehensive analysis

THANKS

This implementation is based on Ehlers' original work and has been adapted for TradingView's Pine Script platform.

Trap Zone 2 minTrap Zone 2 Min — Visual Detection of Trap and Expansion Zones

This indicator is designed to clearly identify key price zones on lower timeframes, particularly the 2-minute chart. It's ideal for scalpers and intraday traders looking for structured, high-probability setups.

Trap Zone (No Trade Zone)

A central shaded area where trading is discouraged.

Marks potential liquidity traps or manipulation zones.

Calculated using recent highs, lows, and moving averages (MA20 and MA200).

Zones + and -

Positioned two times the size of an EB (Elephant Bar) above and below the trap zone.

Represent the first expansion level.

Useful for identifying potential long or short entries based on price breakout direction.

Zones ++ and --

Extend from the first + or - level to the next line outward.

Represent a second expansion layer, often aligning with price continuation or reaction zones.

Helpful for profit-taking or adjusting risk.

Zones +++ and ---

The most extreme levels plotted.

Serve as final take-profit areas or potential reversal zones.

Additional Features

Optional display of MA20 and MA200.

Configurable ADR (Average Daily Range) labels.

Full visual customization for better chart integration.

Best For

Scalpers and intraday traders.

Identifying and reacting to structured market zones.

Mapping price expansions and potential reversal points.

Intraday vs Overnight Change TrackerThis indicator tracks a synthetic price path based on either intraday or overnight return behavior, allowing users to analyze which component of daily price movement is contributing more to long-term performance.

***THIS INDICATOR ONLY WORKS ON THE DAILY TIMEFRAME***

Intraday mode compounds price change from market open to close: close / open

Overnight mode compounds price change from previous close to current open: open / close

The user can select one of these two modes using a dropdown input. The synthetic price series starts from the second bar of the chart and compounds forward bar-by-bar using the selected return type. The result is a line that reflects cumulative return based solely on either intraday or overnight activity.

⚙️ Inputs

Synthetic Price Type: Select between "Intraday" or "Overnight" to visualize the respective compounded price series.

📈 Usage Notes

This indicator is intended for visual comparison of intraday vs. overnight price dynamics over time. It can be useful for identifying behavioral patterns, session-based return anomalies, or testing session bias strategies.

Only one synthetic line is shown at a time based on user selection.

If you want to view both intraday and overnight lines, then you can add the indicator twice, which is shown above.

[c3s] Average Entry Price Calculator# Average Entry Price Calculator

This powerful indicator helps you track your average entry price across multiple positions, displaying it clearly on your chart with customizable lines and labels.

## Features:

• Calculate average entry price for up to 5 different positions

• Display current price and profit/loss calculations

• Show percentage and absolute change from your average entry

• Customizable line styles, colors, and label positions

• Track your entry prices with clear visual references

## How It Works:

Enter your position details (entry price and amount in USDT), and the indicator will calculate your average entry price, displaying it as a horizontal line on your chart. The indicator also shows your individual entry prices as separate lines, making it easy to visualize your overall position.

## Perfect For:

• DCA (Dollar-Cost Averaging) strategies

• Position tracking across multiple entries

• Risk management and profit taking

• Visualizing entry zones on your chart

## Instructions:

1. Add the indicator to your chart

2. Enter your position details (price and amount)

3. Customize the visual appearance as needed

4. Use the displayed average entry line for decision making

All calculations are done locally in your browser - no sensitive data is transmitted or stored.

Enjoy more informed trading decisions with this essential position tracking tool!

VOLD IndicatorVOLD-Indicator can show us the trend of the day. The indicator shows us the value of the VOLD that is a ratio of the volume flowing in up-stocks divided by the volume flowing in down stocks. Readings above 3 and below -3 can be seen as relevant for a trend day.

Average Entry Price Calculator# Average Entry Price Calculator

This powerful indicator helps you track your average entry price across multiple positions, displaying it clearly on your chart with customizable lines and labels.

## Features:

• Calculate average entry price for up to 5 different positions

• Display current price and profit/loss calculations

• Show percentage and absolute change from your average entry

• Customizable line styles, colors, and label positions

• Track your entry prices with clear visual references

## How It Works:

Enter your position details (entry price and amount in USDT), and the indicator will calculate your average entry price, displaying it as a horizontal line on your chart. The indicator also shows your individual entry prices as separate lines, making it easy to visualize your overall position.

## Perfect For:

• DCA (Dollar-Cost Averaging) strategies

• Position tracking across multiple entries

• Risk management and profit taking

• Visualizing entry zones on your chart

## Instructions:

1. Add the indicator to your chart

2. Enter your position details (price and amount)

3. Customize the visual appearance as needed

4. Use the displayed average entry line for decision making

All calculations are done locally in your browser - no sensitive data is transmitted or stored.

Enjoy more informed trading decisions with this essential position tracking tool!

FTB Cheklist🔍 FTB Cheklist – Precision-Based Breakout Strategy for Options Traders

FTB Cheklist is a tactical script built for serious day and swing traders looking to catch high-probability breakouts with clarity, confidence, and control.

This system is designed around key institutional concepts — combining volume spike breakouts, PDH/PDL levels, EMA alignment (8/13/50/200), and ATR-based price targets across the 30-minute, 1-hour, and daily timeframes. It visually guides your session entries and filters out noise, giving you clean, confirmed trade opportunities.

🔧 What It Does:

✅ Breakout Arrows when price breaks previous day high/low with volume confirmation & trend bias

📊 Dynamic Volume Spike Detection with time-sensitive multipliers (1.5 pre-noon, 1.2 after)

📈 Stacked EMAs Filter: Only show setups when trend is clearly in your favor

🎯 ATR-Based Price Targets: Projects 30m, 1h, and Daily levels upon breakout

🕐 Trading Hours Guidance overlay: Calls out the best times to trade (9:40–11:30 & 2:00–3:30)

🧭 Clean On-Chart Labels & Guidance to keep your execution focused and frictionless

🔑 Best For:

Day & swing traders of SPY, QQQ, and large-cap options

Traders who value structure, trend alignment, and measured targets

Avoiding FOMO and chop through visual clarity & volume precision

🔥 Built to respect bias. Built to respect time. Built for discipline .

FTB Cheklist isn’t just an indicator — it’s a trade execution assistant for serious technical traders. Load it up, trust the conditions, and trade the Cheklist.

Quarters Theory Levels (Yotov Style)John Alex Sagwe's Quarters Theory Levels Script

This Pine Script, developed by John Alex Sagwe, is based on the concept of the "Quarters Theory" popularized by Illan Yotov. It aims to help traders identify key levels in the market using whole, half, and quarter-level calculations. The script plots major whole levels, half levels, and quarter levels above and below the current price, allowing traders to visualize potential price points where significant market action might occur.

The customizable parameters allow you to:

Set the base level and step size (for quarter levels),

Adjust the number of levels above and below the current price to be displayed,

Toggle between showing whole, half, or quarter levels,

Use price alerts when the market price nears these levels.

Whether you’re a novice or an experienced trader, this script can help you integrate the Quarters Theory into your trading strategy. It’s designed to be flexible and user-friendly, helping you visualize key market levels with ease.

Developed by: John Alex Sagwe, an avid trader and Pine Script enthusiast.

ScalpSwing Pro SetupScript Overview

This script is a multi-tool setup designed for both scalping (1m–5m) and swing trading (1H–4H–Daily). It combines the power of trend-following , momentum , and mean-reversion tools:

What’s Included in the Script

1. EMA Indicators (20, 50, 200)

- EMA 20 (blue) : Short-term trend

- EMA 50 (orange) : Medium-term trend

- EMA 200 (red) : Long-term trend

- Use:

- EMA 20 crossing above 50 → bullish trend

- EMA 20 crossing below 50 → bearish trend

- Price above 200 EMA = uptrend bias

2. VWAP (Volume Weighted Average Price)

- Shows the average price weighted by volume

- Best used in intraday (1m to 15m timeframes)

- Use:

- Price bouncing from VWAP = reversion trade

- Price far from VWAP = likely pullback incoming

3. RSI (14) + Key Levels

- Shows momentum and overbought/oversold zones

- Levels:

- 70 = Overbought (potential sell)

- 30 = Oversold (potential buy)

- 50 = Trend confirmation

- Use:

- RSI 30–50 in uptrend = dip buying zone

- RSI 70–50 in downtrend = pullback selling zone

4. MACD Crossovers

- Standard MACD with histogram & cross alerts

- Shows trend momentum shifts

- Green triangle = Bullish MACD crossover

- Red triangle = Bearish MACD crossover

- Use:

- Confirm swing trades with MACD crossover

- Combine with RSI divergence

5. Buy & Sell Signal Logic

BUY SIGNAL triggers when:

- EMA 20 crosses above EMA 50

- RSI is between 50 and 70 (momentum bullish, not overbought)

SELL SIGNAL triggers when:

- EMA 20 crosses below EMA 50

- RSI is between 30 and 50 (bearish momentum, not oversold)

These signals appear as:

- BUY : Green label below the candle

- SELL : Red label above the candle

How to Trade with It

For Scalping (1m–5m) :

- Focus on EMA crosses near VWAP

- Confirm with RSI between 50–70 (buy) or 50–30 (sell)

- Use MACD triangle as added confluence

For Swing (1H–4H–Daily) :

- Look for EMA 20–50 cross + price above EMA 200

- Confirm trend with MACD and RSI

- Trade breakout or pullback depending on structure

Market Session StrategyMarket Session Strategy Indicator Explanation

This is a TradingView Pine Script indicator called "Market Session Strategy" that monitors different market sessions and generates trading signals based on pattern analysis between sessions. Let me break down how it works:

Core Functionality

The indicator divides the trading day into three sessions:

Pre-Market (7:30 PM - 3:00 AM ET by default)

Regular Market (3:00 AM - 9:30 AM ET by default)

After Hours (9:30 AM - 4:00 PM ET by default)

For each session, it:

Tracks price action (open, high, low, close)

Calculates range percentages

Identifies session bias (bullish or bearish)

Draws visual session boxes on the chart

Generates trading signals based on historical patterns

Signal Generation Methodology

The indicator generates BUY/SELL signals at the beginning of the Regular Market and After Hours sessions using three main strategies:

1. Trend Continuation/Reversal Analysis

The script tracks how often a bullish/bearish trend in one session continues or reverses in the next session. For example:

If pre-market trends historically continue into regular hours 70% of the time and today's pre-market is bullish, it may generate a BUY signal.

If reversals are more common, it may generate a counter-trend signal.

2. Tight Range Breakout Signal

The indicator identifies "tight range" sessions (where price movement is unusually constrained compared to recent averages). A tight range with a bullish bias generates a BUY signal, while a bearish bias generates a SELL signal.

3. Day of Week Pattern Analysis

The script analyzes which days of the week show stronger trend continuation probabilities. If a particular day (like Monday) historically shows strong trend continuation and the threshold is met, it generates a signal accordingly.

Visual Components

The indicator provides several visual elements:

Colored session boxes showing high/low ranges

Signal labels at entry points

Session background colors with high transparency

A comprehensive dashboard showing session status, range percentages, bias, and signals

Performance Tracking

The script tracks trade success by session and day of week, which helps refine future signals. A trade is considered successful if:

A BUY signal is followed by a close higher than open

A SELL signal is followed by a close lower than open

Mark Days with >4% Gain (vs. Previous Close)Shows days when the overall market increased by more than 4%

Session extensions [dani]Session Extension

Indicator Description

The Session Extensions indicator is a customizable tool designed to visually represent key price levels during a specified trading session. It calculates and displays the high, low, and midpoints of the session, along with extension levels based on user-defined multipliers. These extensions help traders identify potential support and resistance zones beyond the initial session range.

This indicator is particularly useful for intraday traders who rely on session-based analysis to make informed decisions. It overlays directly on the chart, ensuring seamless integration with price action.

Key Features

Session-Based Analysis : Tracks and highlights key price levels (high, low, midpoint) during a specific trading session.

Customizable Extension Levels : Allows users to define up to six extension levels (both above and below the session range) with unique multipliers, colors, styles, and widths.

Real-Time Updates : Automatically updates during the active session and resets at the start of a new session.

Usage Guidelines

Add the Indicator to Your Chart : Apply the Session Extensions indicator to your chart to visualize key session-based levels.

Intraday Focus : This indicator is optimized for intraday trading. Ensure that the chart's timeframe is set to an intraday interval (e.g., 1-minute, 5-minute).

Session Alignment : Verify that the session time aligns with your trading schedule and timezone. Misalignment may result in incorrect session detection. (This indicator use America - New York timezone)

Avoid Overcrowding : While the indicator supports multiple extension levels, enabling too many levels simultaneously may clutter the chart. Use discretion when configuring extension levels.

Customize Line Styles and Colors : Tailor the appearance of lines and labels to align with your trading style. Use solid, dashed, or dotted lines, and choose colors that enhance visibility without cluttering the chart.

Combine with Other Tools : Pair this indicator with other technical analysis tools (e.g., moving averages, volume profiles) to enhance decision-making.

Disclaimer & Chat

The Session Extensions indicator is intended for educational and analytical purposes only. It does not provide financial advice or guarantee trading success. Users are responsible for verifying the accuracy of session times and ensuring proper configuration before using the indicator in live trading. This indicator is not a trading signal generator.

Thank you for choosing this indicator! I hope it becomes a valuable part of your trading toolkit. Remember, trading is a journey, and having the right tools can make all the difference. Whether you're a seasoned trader or just starting out, this indicator is designed to help you stay organized and focused on what matters most—price action. Happy trading, and may your charts be ever in your favor! 😊

From, Dani.

Daily Volume High Notifier📜 Script Description – Daily Volume High Notifier

This indicator monitors trade volume and sends an alert whenever a new daily high in volume is reached. The high volume is reset at the beginning of each trading day, allowing traders to stay informed of significant intraday volume spikes.

🛠️ Features:

Tracks the highest trade volume for the current day.

Resets the volume high tracker at the start of each new day.

Sends a real-time notification (alert()) whenever a new volume high is detected.

Useful for identifying unusual activity, potential breakouts, or institutional participation.

📊 Visual Elements:

Blue histogram for standard volume.

Red line showing the current day’s highest volume so far.

🔔 How to Use:

Add the script to any chart.

Enable alerts using the built-in alert() function.

Receive notifications every time volume hits a new high for the day.

🔔 Setting up Alerts in TradingView:

After adding this indicator to your chart:

Click the Alarm Clock (Alerts) icon.

Set condition: Daily Volume High Notifier → alert() function call .

Choose your alert type (app notification, email, popup, etc.).

Name it something like "Volume High Alert" and hit Create.

This tool is ideal for day traders, scalpers, and volume-based strategy traders who want to be instantly notified of spikes in market activity.

vidya only apply on option chartapply on option chart for 5 min with white line sl and target line upward and trail