Scaled RSI CCI +DivNormal RSI overlaid with Dynamic Scaling CCI.

Customizable static or dynamic normalization with vertical offset to ensure CCI and RSI are scaled appropriately on top of each other.

Includes divergences for each, and an additional set of threshold levels.

Default settings have the RSI as the base and CCI dynamically normalized. Threshold levels are standard RSI 30/50/70 levels and is also fully customizable. Includes standard RSI signal line.

CCI will not be perfectly scaled, the default settings are the best fit; but both the RSI and the CCI can be customized individually.

Осцилляторы

RT-RSI 2.0 + Signal📈 RT-RSI 2.0 + Signal – Enhanced RSI Divergence Detection

RT-RSI 2.0 + Signal is a powerful and flexible RSI-based divergence indicator designed for traders who want smarter market entries using real-time confirmations.

This script identifies bullish and bearish RSI divergences, visualizes them directly on the RSI pane, and provides clear output signals (numeric: 1.0 for bullish, 2.0 for bearish) for use in external strategy scripts like RT-Signal 2.0.1.

🔍 Core Features:

✔️ Detects classic RSI divergences (bullish & bearish)

✔️ Includes automatic pivot detection and flexible lookback settings

✔️ External signal output for use in multi-pattern or strategy systems

✔️ Optimized RSI calculation per market type (BTC, DAX, Gold, Forex, etc.)

✔️ Customizable moving average & Bollinger Band smoothing

✔️ Signal is output via plot() (non-displayed) for remote use

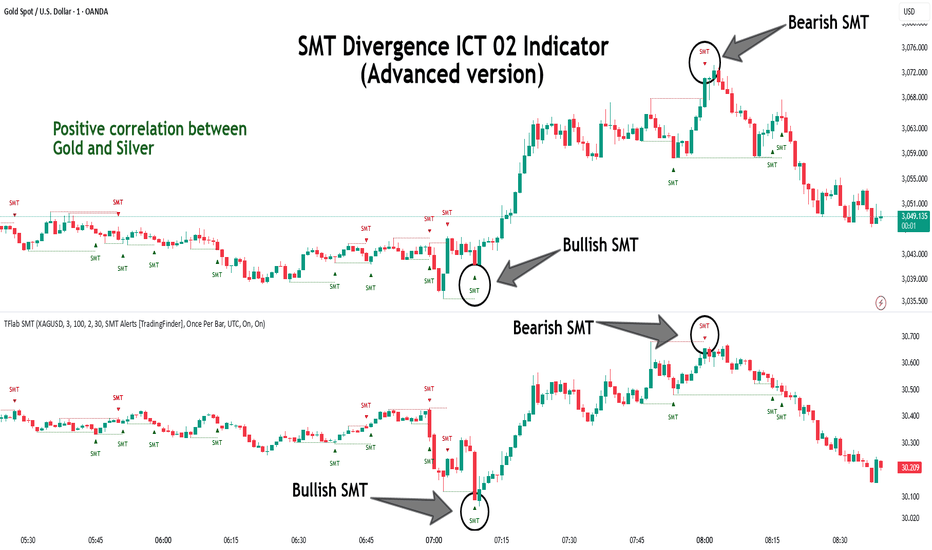

SMT Divergence ICT 02 [TradingFinder] Smart Money Technique SMC🔵 Introduction

SMT Divergence (Smart Money Technique Divergence) is a price action-based trading concept that detects discrepancies in market behavior between two assets that are generally expected to move in the same direction. Rooted in ICT (Inner Circle Trader) methodology, this approach helps traders recognize subtle signs of market manipulation or imbalance, often ahead of traditional indicators.

The core idea behind SMT divergence is simple: when two correlated instruments—such as currency pairs, indices, or assets from the same sector—start forming different swing points (highs or lows), this can reveal a lack of confirmation in the trend. Such divergence is often a precursor to a price reversal or pause in momentum.

This technique works effectively across various markets including Forex, stocks, and cryptocurrencies. It’s particularly valuable when used alongside concepts like liquidity sweeps, market structure breaks (MSBs), or order block identification.

In advanced use cases, Sequential SMT helps uncover patterns of alternating divergences across sessions, often signaling engineered liquidity traps before price reacts.

When combined with the Quarterly Theory—which segments market behavior into Accumulation, Manipulation, Distribution, and Continuation/Reversal phases—traders gain insight not only into where divergence happens, but when it's most likely to be significant within the market cycle.

Bullish SMT :

Bullish SMT Divergence occurs when one asset prints a higher low while the correlated asset forms a lower low. This asymmetry often suggests that the downside move is losing strength, hinting at a potential bullish shift.

Bearish SMT :

Bearish SMT Divergence is formed when one asset creates a higher high, while the second asset fails to confirm by printing a lower high. This typically signals weakening bullish pressure and the possibility of a reversal to the downside.

🔵 How to Use

The SMT Divergence indicator is designed to detect imbalances between two positively correlated assets—such as major currency pairs, indices, or commodities. These divergences often indicate early signs of market inefficiency or smart money manipulation and can help traders anticipate trend shifts with higher precision.

Unlike traditional divergence indicators or earlier versions of this script, this upgraded version does not rely solely on consecutive pivot comparisons. Instead, it dynamically scans all available pivots within the chart to identify divergences at any structural level—major or minor—across the price action. This broader detection method increases the reliability and frequency of meaningful SMT signals.

Moreover, when integrated with Sequential SMT logic, the indicator is capable of identifying multiple divergence sequences across sessions. These sequences often signal engineered liquidity traps and can be mapped within the Quarterly Theory framework, allowing traders to pinpoint not just the presence of divergence but also the phase of the market cycle it appears in (Accumulation, Manipulation, Distribution, or Continuation).

🟣 Bullish SMT Divergence

This signal occurs when the primary asset forms a higher low, while the correlated asset forms a lower low. This pattern implies weakening bearish momentum and a potential shift to the upside.

If the correlated asset breaks its previous low but the primary asset does not, this divergence suggests absorption of selling pressure and possible accumulation by smart money—making it a strong bullish signal, especially when aligned with a favorable market phase (e.g., the end of a manipulation phase in Q2).

🟣 Bearish SMT Divergence

This signal occurs when the primary asset creates a higher high, while the correlated asset forms a lower high. This mismatch indicates fading bullish momentum and a potential reversal to the downside.

If the correlated asset fails to confirm a breakout made by the main asset, the divergence may point to distribution or exhaustion. When seen within Q3 or Q4 phases of the Quarterly Theory, this pattern often precedes sharp declines or fake-outs engineered by smart money

🔵 Settings

⚙️ Logical Settings

Symbol : Choose the secondary asset to compare with the main chart asset (e.g., XAUUSD, US100, GBPUSD).

Pivot Period : Sets the sensitivity of the pivot detection algorithm. A smaller value increases responsiveness to price swings.

Activate Max Pivot Back : When enabled, limits the maximum number of past pivots to be considered for divergence detection.

Max Pivot Back Length : Defines how many past pivots can be used (if the above toggle is active).

Pivot Sync Threshold : The maximum allowed difference (in bars) between pivots of the two assets for them to be compared.

Validity Pivot Length : Defines the time window (in bars) during which a divergence remains valid before it's considered outdated.

🎨 Display Settings

Show Bullish SMT Line : Draws a line connecting the bullish divergence points.

Show Bullish SMT Label : Displays a label on the chart when a bullish divergence is detected.

Bullish Color : Sets the color for bullish SMT markers (label, shape, and line).

Show Bearish SMT Line : Draws a line for bearish divergence.

Show Bearish SMT Label : Displays a label when a bearish SMT divergence is found.

Bearish Color : Sets the color for bearish SMT visual elements.

🔔 Alert Settings

Alert Name : Custom name for the alert messages (used in TradingView’s alert system).

Message Frequency :

All : Every signal triggers an alert.

Once Per Bar : Alerts once per bar regardless of how many signals occur.

Per Bar Close : Only triggers when the bar closes and the signal still exists.

Time Zone Display : Choose the time zone in which alert timestamps are displayed (e.g., UTC).

Bullish SMT Divergence Alert : Enable/disable alerts specifically for bullish signals.

Bearish SMT Divergence Alert : Enable/disable alerts specifically for bearish signals

🔵Conclusion

The SMT Plus indicator offers a refined and powerful approach to detecting smart money behavior through divergence analysis between correlated assets. By removing the limitations of consecutive pivot comparisons and allowing for broader structural detection, it captures more accurate and timely signals that often precede major market moves.

When paired with frameworks like Sequential SMT and the Quarterly Theory, the indicator not only highlights where divergence occurs, but also when in the market cycle it's most likely to matter. Its flexible settings, customizable visuals, and integrated alert system make it suitable for intraday scalpers, swing traders, and even long-term macro analysts.

Whether you're using it as a standalone decision-making tool or combining it with other ICT concepts, SMT Plus gives you an edge in recognizing manipulation, timing reversals, and staying in sync with the real market narrative—not just the chart.

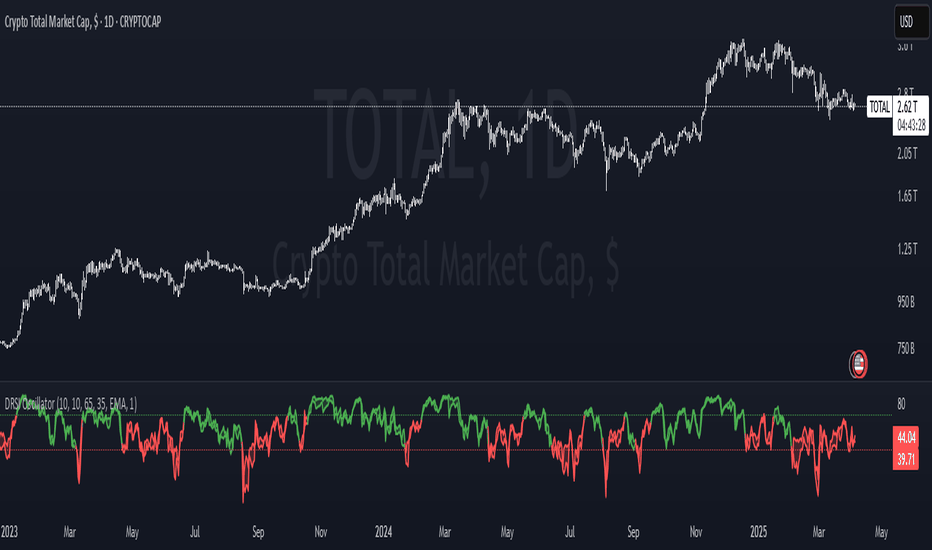

Bottom and Top finder [theUltimator5]🧭 Bottom and Top Finder — Multi-Symbol Momentum Divergence Detector

The Bottom and Top Finder by theUltimator5 is a highly configurable, momentum-based indicator designed to identify potential market reversal points using a multi-symbol relative strength comparison framework. It evaluates Directional Movement Index (DMI) values from up to three correlated or macro-influential assets to determine when the current instrument may be approaching a bottom (oversold exhaustion) or a top (overbought exhaustion).

🧠 How It Works

This script computes both the +DI (positive directional index) and -DI (negative directional index) for:

The currently selected chart symbol

Up to three user-defined reference symbols (e.g., sector leaders, macro ETFs, currencies, volatility proxies)

It uses a logarithmic percent-change approach to normalize all movement metrics, ensuring results are scale-invariant and price-neutral — meaning it works consistently whether a stock trades at $1 or $100,000. This makes the comparison between different assets meaningful, even if they trade on different scales or volatility levels.

The indicator then:

Compares the +DI values of the reference symbols to the current symbol’s +DI → seeking bottoming signals (suggesting the current symbol is unusually weak).

Compares the -DI values of the reference symbols to the current symbol’s -DI → seeking topping signals (suggesting the current symbol is unusually strong on the downside).

These comparisons are aggregated using a weighted average, where you control the influence (multiplier) of each reference symbol.

🔁 Trigger Logic

The indicator generates two dynamic lines:

Bot Line (Bottom Line): Based on reference +DI vs. current +DI

Top Line: Based on reference -DI vs. current -DI

If the Bot Line rises above the user-defined threshold, it may signal that capitulation or oversold conditions are developing. Similarly, if the Top Line rises above its threshold, it may indicate a blow-off top or overbought selling pressure.

To avoid false positives, a second smoothing-based condition must also be met:

The line must significantly exceed its moving average, confirming momentum divergence.

When both conditions are true, the indicator highlights the background in light red (bottom alert) or green (top alert) for easy visual scanning.

🔧 Key Inputs & Customization

You can fine-tune this tool using the following parameters:

Smoothing Length: Controls how smooth or sensitive the DI values are.

Reference Symbols: Up to 3 assets (default: RSP, HYG, DXY) — customizable for sector, macro, or inverse relationships.

Influence Multipliers: Adjust the weight each symbol has on the overall signal.

Display Options:

Toggle to highlight the chart background during trigger conditions.

Toggle to display a real-time table of reference symbols and their influence levels.

📈 Visual Output

Two plotted lines: One for bottoms and one for tops

Dynamically colored based on how far they exceed thresholds

Background highlights to mark trigger zones

Optional table displaying the current reference symbol setup and weights

🛠 Best Use Cases

This tool is ideal for:

Identifying short-term tops or bottoms using momentum exhaustion

Spotting divergences between an asset and broader market or sector health

Macro analysis with assets like SPY, QQQ, GME, MSFT, BTC, etc...

Pair trading signals or market breadth confirmation/disagreement

It complements other technical indicators like RSI, MACD, Bollinger Bands, or price structure patterns (double bottoms/tops, etc.)

PumpC RSI NTZ BarsPumpC RSI NTZ Bars — Slope-Aware RSI Momentum Overlay

The PumpC RSI NTZ Bars indicator builds on the classic RSI by combining it with slope detection and custom bar highlighting, helping traders quickly identify strong momentum breakouts while avoiding sideways chop — the (NTZ) or No Trade Zone .

What is (NTZ)?

(NTZ) stands for No Trade Zone — the neutral RSI area between bullish and bearish thresholds. In this zone, RSI lacks directional strength, which often reflects indecision or consolidation in price. This indicator helps visually separate the chop from true momentum, so you can trade the breakout, not the noise .

Core Features

Dynamic RSI-Based Bar Coloring with Slope Awareness

Bars change color based on RSI value and its slope:

Bright Green: RSI ≥ Bullish Threshold and sloping upward

Teal Green: RSI ≥ Bullish Threshold but sloping downward

Bright Red: RSI ≤ Bearish Threshold and sloping downward

Orange: RSI ≤ Bearish Threshold but sloping upward

White: RSI is between thresholds (NTZ)

Slope Detection Logic

RSI slope is used to confirm directional bias and filter out weak or fading momentum.

Clean Visual Integration

Choose how signals appear: full bar color, border-only style, background shading, or a mix of all three.

RSI Smoothing Option

Optional smoothing to reduce noise — especially useful on faster timeframes.

Built-In Alerts

RSI crossing above the bullish threshold with an upward slope

RSI crossing below the bearish threshold with a downward slope

User Inputs & Customization Options

RSI Length: Default 14

RSI Source: Default Close

Smooth RSI: On or Off

Smoothing Length: Default 2

Bullish Threshold: Default 60

Bearish Threshold: Default 40

Bar Highlight Style: Full Bar or Border Only

Display Mode: Bar Color, Background, or Both

How to Use It

Step 1 – Adjust Your RSI Settings:

Start by setting the RSI Length (default is 14) and choosing which price source to use — typically close , but you can experiment with hl2 , ohlc4 , etc.

You can also turn on smoothing if you want to reduce noise, especially on fast timeframes like the 1m or 5m chart.

Step 2 – Define Your No Trade Zone (NTZ):

The NTZ is the space between the bullish and bearish thresholds (default 60 and 40).

This is where momentum is weak and price is often ranging or chopping. You don’t want to trade in this zone — you're waiting for RSI to break out of it with conviction.

Step 3 – Choose Your Visual Style:

You can choose to: Highlight the entire candle (Full Bar)

Just highlight the outline (Border Only)

Add a background color behind the chart

Or use a combination of the above This makes the signal easy to see without changing your whole chart look.

Step 4 – Read the Colors for Quick Clarity:

Bright Green / Bright Red = Strong Momentum (with RSI slope confirmation)

Teal / Orange = Momentum is weakening — RSI value is above/below threshold but losing slope strength

White = RSI is in the No Trade Zone (NTZ) — not enough strength to trade

Use this color feedback to stay out during weak periods and act when the trend gains strength.

Step 5 – Use Alerts for Clean Signals:

Set alerts when RSI breaks out of the NTZ with slope confirmation .

These are high-quality signals you can use to trigger your setups or review potential entries.

Disclaimer

This indicator is for educational and informational purposes only and should not be considered financial advice. Always combine tools like this with proper market context and risk management.

Adaptable Relative Momentum Index [ParadoxAlgo]The Adaptable Relative Momentum Index (RMI) by ParadoxAlgo is an advanced momentum-based indicator that builds upon the well-known RSI (Relative Strength Index) concept by introducing a customizable momentum length. This indicator measures price momentum over a specified number of periods and applies a Rolling Moving Average (RMA) to both the positive and negative price changes. The result is a versatile tool that can help traders gauge the strength of a trend, pinpoint overbought/oversold levels, and potentially identify breakout opportunities.

⸻

Smart Configuration Feature

What sets this version of the RMI apart is ParadoxAlgo’s exclusive “Smart Configuration” functionality. Instead of manually adjusting parameters, traders can simply select their Asset Class (e.g., Stocks, Forex, Futures/Indices, Crypto, Commodities) and Trading Style (e.g., Scalping, Day Trading, Swing Trading, Short-Term Investing, Long-Term Investing). Based on these selections, the indicator automatically optimizes its core parameters:

• Length – The period over which the price changes are smoothed.

• Momentum Length – The number of bars used to calculate the price change.

By automating this process, users save time on tedious trial-and-error adjustments, ensuring that the RMI’s settings are tailored to the characteristics of specific markets and personal trading horizons.

⸻

Key Features & Benefits

1. Momentum-Based Insights

• Uses RMA to smooth price movements, helping identify shifts in market momentum more clearly than a basic RSI.

• Enhanced adaptability for a wide range of asset classes and time horizons.

2. Simple Yet Powerful Configuration

• Smart Configuration automatically sets optimal parameter values for each combination of asset class and trading style.

• Eliminates guesswork and manual recalibration when switching between markets or timeframes.

3. Overbought & Oversold Visualization

• Integrated highlight zones mark potential overbought and oversold extremes (default at 80 and 20).

• Optional breakout highlighting draws attention to times when the indicator crosses these key thresholds, helping spot possible entry or exit signals.

4. Intuitive Design & Ease of Use

• Clean plotting and color-coded signal lines make it easy to interpret bullish or bearish shifts in momentum.

• Straightforward dropdown menus keep the interface user-friendly, even for novice traders.

⸻

Practical Applications

• Early Trend Detection: Spot emerging trends when the RMI transitions from oversold to higher levels or vice versa.

• Breakout Confirmation: Confirm potential breakout trades by tracking overbought/oversold breakouts alongside other technical signals.

• Support/Resistance Confluence: Combine RMI signals with horizontal support/resistance levels to reinforce trade decisions.

• Trade Timing: Quickly gauge when momentum could be shifting, helping you time entries and exits more effectively.

⸻

Disclaimer

As with any technical indicator, the Adaptable Relative Momentum Index should be used as part of a broader trading strategy that includes risk management, fundamental analysis, and other forms of technical confirmation. Past performance does not guarantee future results.

⸻

Enjoy using the Adaptable RMI and experience a more streamlined, flexible approach to momentum analysis. Feel free to explore different asset classes and trading styles to discover which configurations resonate best with your unique trading preferences.

RSI Support & Resistance Breakouts with OrderblocksThis tool is an overly simplified method of finding market squeeze and breakout completely based on a dynamic RSI calculation. It is designed to draw out areas of price levels where the market is pushing back against price action leaving behind instances of short term support and resistance levels you otherwise wouldn't see with the common RSI.

It uses the changes in market momentum to determine support and resistance levels in real time while offering price zone where order blocks exist in the short term.

In ranging markets we need to know a couple things.

1. External Zone - It's important to know where the highs and lows were left behind as they hold liquidity. Here you will have later price swings and more false breakouts.

2. Internal Zone - It's important to know where the highest and lowest closing values were so we can see the limitations of that squeeze. Here you will find the stronger cluster of orders often seen as orderblocks.

In this tool I've added a 200 period Smoothed Moving Average as a trend filter which causes the RSI calculation to change dynamically.

Regular Zones - without extending

The Zones draw out automatically but are often too small to work with.

To solve this problem, you can extend the zones into the future up to 40 bars.

This allows for more visibility against future price action.

--------------------------------------------

Two Types of Zones

External Zones - These zones give you positioning of the highest and lowest price traded within the ranging market. This is where liquidity will be swept and often is an ultimate breaking point for new price swings.

How to use them :

External Zones - External zones form at the top of a pullback. After this price should move back into its impulsive wave.

During the next corrective way, if price breaches the top of the previous External Zone, this is a sign of trend weakness. Expect a divergence and trend reversal.

Internal Zones - (OrderBlocks) Current price will move in relation to previous internal zones. The internal zone is where a majority of price action and trading took place. It's a stronger SQUEEZE area. Current price action will often have a hard time closing beyond the previous Internal Zones high or low. You can expect these zones to show you where the market will flip over. In these same internal zones you'll find large rejection candles.

**Important Note** Size Doesn't Matter

The size of the internal zone does not matter. It can be very small and still very powerful.

Once an internal zone has been hit a few times, its often not relevant any longer.

Order Block Zone Examples

In this image you can see the Internal Zone that was untouched had a STRONG price reaction later on.

Internal Zones that were touched multiple times had weak reactions later as price respected them less over time.

Zone Overlay Breakdown

The Zones form and update in real time until momentum has picked up and price begins to trend. However it leaves behind the elements of the inducement area and all the key levels you need to know about for future price action.

Resistance Fakeout : Later on after the zone has formed, price will return to this upper zone of price levels and cause fakeouts. A close above this zone implies the market moves long again.

Midline Equilibrium : This is simply the center of the strongest traded area. We can call this the Point of Control within the orderblock. If price expands through both extremes of this zone multiple times in the future, it eliminates the orderblock.

Support Fakeout : Just like its opposing brother, price will wick through this zone and rip back causing inducement to trap traders. You would need a clear close below this zone to be in a bearish trend.

BARCOLOR or Candle Color: (Optional)

Bars are colored under three conditions

Bullish Color = A confirmed bullish breakout of the range.

Bearish Color = A confirmed bearish breakout of the range.

Squeeze Color = Even if no box is formed a candle or candles can have a squeeze color. This means the ranging market happened within the high and low of that singular candle.

EMA Distance OscillatorI was inspired to make this because I rely on ema trading in my SPY day trading strategy.

## 📈 **EMA Distance Oscillator**

**Author:** *Your Name or Alias*

**Category:** Trend Strength / Momentum

**Timeframes:** Optimized for 1–5min, works on all

---

### 🔍 **What It Does**

The **EMA Distance Oscillator** is a dual-purpose tool that helps visualize **momentum shifts**, **trend strength**, and **EMA divergence/convergence** in real time.

It plots two separate signals:

#### 1. 🟩 Histogram Bars

A zero-centered histogram that shows the **difference between two EMAs** (default: EMA 48 and EMA 200).

- Color-coded based on:

- Whether the EMA spread is **above or below zero**

- Whether the spread is **increasing or decreasing**

- Helps visualize **trend acceleration** or **loss of momentum**

#### 2. 📉 Delta Line

A smooth line showing the **difference between a second EMA pair** (default: EMA 13 and EMA 48).

- Color-coded:

- **White** when rising (spread widening)

- **Gray** when falling (spread tightening)

---

### ⚙️ **Customizable Inputs**

You have full control over:

- EMA lengths for **both histogram and line**

- Smoothing for each plot

- Colors for each bar state and line condition

- Momentum thresholds (±1 by default, adjustable)

---

### 🧠 **How to Use It**

- Use the **bar histogram** to quickly spot moments when short-term and long-term EMAs are diverging or converging

- Use the **delta line** to track smoother shifts in short-term momentum

- Look for:

- Expanding green bars = uptrend gaining strength

- Shrinking bars = potential reversals or cooldowns

- Line crossing zero = EMA crossover (fast vs slow)

- **Threshold lines** at +1 / -1 help mark **high-momentum zones** (fully customizable)

---

### 🧭 **Pro Tips**

- Try with EMA 13/48 for the line and EMA 48/200 for the histogram on 1–5min charts

- Add alerts (optional) for when:

- Histogram changes color (momentum flip)

- Line crosses zero

- Threshold levels are breached

---

Let me know if you want me to help prep alert conditions or auto-generate different versions (e.g., strategy version, simplified mode, mobile-friendly layout, etc).

[SM-042] EMA 5-8-13 with ADX FilterWhat is the strategy?

The strategy combines three exponential moving averages (EMAs) — 5, 8, and 13 periods — with an optional ADX (Average Directional Index) filter. It is designed to enter long or short positions based on EMA crossovers and to exit positions when the price crosses a specific EMA. The ADX filter, if enabled, adds a condition that only allows trades when the ADX value is above a certain threshold, indicating trend strength.

Who is it for?

This strategy is for traders leveraging EMAs and trend strength indicators to make trade decisions. It can be used by anyone looking for a simple trend-following strategy, with the flexibility to adjust for trend strength using the ADX filter.

When is it used?

- **Long trades**: When the 5-period EMA crosses above the 8-period EMA, with an optional ADX condition (if enabled) that requires the ADX value to be above a specified threshold.

- **Short trades**: When the 5-period EMA crosses below the 8-period EMA, with the ADX filter again optional.

- **Exits**: The strategy exits a long position when the price falls below the 13-period EMA and exits a short position when the price rises above the 13-period EMA.

Where is it applied?

This strategy is applied on a chart with any asset on TradingView, with the EMAs and ADX plotted for visual reference. The strategy uses `strategy.entry` to open positions and `strategy.close` to close them based on the set conditions.

Why is it useful?

This strategy helps traders identify trending conditions and filter out potential false signals by using both EMAs (to capture short-term price movements) and the ADX (to confirm the strength of the trend). The ADX filter can be turned off if not desired, making the strategy flexible for both trending and range-bound markets.

How does it work?

- **EMA Crossover**: The strategy enters a long position when the 5-period EMA crosses above the 8-period EMA, and enters a short position when the 5-period EMA crosses below the 8-period EMA.

- **ADX Filter**: If enabled, the strategy checks whether the ADX value is above a set threshold (default is 20) before allowing a trade.

- **Exit Conditions**: Long positions are closed when the price falls below the 13-period EMA, and short positions are closed when the price rises above the 13-period EMA.

- **Plotting**: The strategy plots the three EMAs and the ADX value on the chart for visualization. It also displays a horizontal line at the ADX threshold.

This setup allows for clear decision-making based on the interaction between different time-frame EMAs and trend strength as indicated by ADX.

Deadzone Pro @DaviddTechDeadzone Pro by @DaviddTech – Adaptive Multi-Strategy NNFX Trading System

Deadzone Pro by @DaviddTech is a meticulously engineered trading indicator that strictly adheres to the No-Nonsense Forex (NNFX) methodology. It integrates adaptive trend detection, dual confirmation indicators, advanced volatility filtering, and dynamic risk management into one powerful, visually intuitive system. Ideal for traders seeking precision and clarity, this indicator consistently delivers high-probability trade setups across all market conditions.

🔥 Key Features:

The Setup:

Adaptive Hull Moving Average Baseline: Clearly identifies trend direction using an advanced, gradient-colored Hull MA that intensifies based on trend strength, providing immediate visual clarity.

Dual Confirmation Indicators: Combines Waddah Attar Explosion (momentum detector) and Bull/Bear Power (strength gauge) for robust validation, significantly reducing false entries.

Volatility Filter (ADX): Ensures entries are only made during strong trending markets, filtering out weak, range-bound scenarios for enhanced trade accuracy.

Dynamic Trailing Stop Loss: Implements a SuperTrend-based trailing stop using adaptive ATR calculations, managing risk effectively while optimizing exits.

Dashboard:

💎 Gradient Visualization & User Interface:

Dynamic gradient colors enhance readability, clearly indicating bullish/bearish strength.

Comprehensive dashboard summarizes component statuses, real-time market sentiment, and entry conditions at a glance.

Distinct and clear buy/sell entry and exit signals, with adaptive stop-loss levels visually plotted.

Candlestick coloring based on momentum signals (Waddah Attar) for intuitive market reading.

📈 How to Interpret Signals:

Bullish Signal: Enter when Hull MA baseline trends upward, both confirmation indicators align bullish, ADX indicates strong trend (>25), and price breaks above the previous trailing stop.

Bearish Signal: Enter short or exit long when Hull MA baseline trends downward, confirmations indicate bearish momentum, ADX confirms trend strength, and price breaks below previous trailing stop.

📊 Recommended Usage:

Timeframes: Ideal on 1H, 4H, and Daily charts for swing trading; effective on shorter (5M, 15M) charts for day trading.

Markets: Compatible with Forex, Crypto, Indices, Stocks, and Commodities.

The Entry & Exit:

🎯 Trading Styles:

Choose from three distinct trading modes:

Conservative: Requires full alignment of all indicators for maximum accuracy.

Balanced (Default): Optimized balance between signal frequency and reliability.

Aggressive: Fewer confirmations needed for more frequent trading signals.

📝 Credits & Originality:

Deadzone Pro incorporates advanced concepts inspired by:

Hull Moving Average by @Julien_Eche

Waddah Attar Explosion by @LazyBear

Bull Bear Power by @Pinecoders

ADX methodology by @BeikabuOyaji

This system has been significantly refactored and enhanced by @DaviddTech to maximize synergy, clarity, and usability, standing apart distinctly from its original components.

Deadzone Pro exemplifies precision and discipline, aligning fully with NNFX principles to provide traders with a comprehensive yet intuitive trading advantage.

RSI + ADX + ATR Combo Indicator: RSI + ADX + ATR Combo Filter

This indicator is a confluence filter tool that combines RSI, ADX, and ATR into a single, easy-to-read chart overlay. It is designed to help traders identify low-volatility, non-trending zones with balanced momentum—ideal for strategies that rely on breakouts or reversals.

🔍 Core Components:

RSI (Relative Strength Index)

Standard RSI with custom upper and lower bounds (default: 60 and 40).

Filters out extreme overbought/oversold regions and focuses on price consolidation zones.

ADX (Average Directional Index)

Measures trend strength.

When ADX is below a custom threshold (default: 20), it indicates a weak or range-bound trend.

ATR (Average True Range)

Represents volatility.

Low ATR values (default threshold: 2.5) are used to filter out high-volatility environments, helping refine entries.

🟣 Signal Logic:

A signal is highlighted with a background color when all three conditions are met:

RSI is between lower and upper bounds (e.g., 40 < RSI < 60) ✅

ADX is below the trend threshold (e.g., ADX < 20) ✅

ATR is below the volatility threshold (e.g., ATR < 2.5) ✅

These combined conditions suggest a low-volatility, low-trend strength, and balanced momentum zone—perfect for anticipating breakouts or strong directional moves.

Boosted Scalp Sniper🚀 Boosted Scalp Sniper | EMA, RSI & Volume Combination 🚀

An effective indicator designed for traders who want to execute fast and aggressive scalp trades!

Features:

EMA Cross (2 and 5 periods): Captures ultra-fast trend reversals using short-term EMA crossovers.

Dynamic RSI (7 period, 40-60 range): Confirms the strength and direction of momentum.

Volume Filter: Ensures more reliable trade signals by requiring volume to be above the 10-bar average.

How to Use:

A Buy (▲) signal indicates a potential short-term upward opportunity.

A Sell (▼) signal indicates a potential short-term downward opportunity.

You can test this indicator across different timeframes (1D, 1H, 15M, 5M, etc.) and optimize it to suit your trading style.

Important Notes:

This indicator provides visual entry signals only; apply your own risk management strategy.

Always use a stop-loss in your real trades to protect capital.

Good luck and happy trading! 📈

Stochastic Overlay [NLR]If you've ever traded with the Stochastic oscillator, you probably love its ability to gauge momentum and overbought/oversold conditions. However, one common frustration is interpreting its movements alongside the actual price chart. The oscillator, plotted separately, can feel disconnected from price action, forcing traders to constantly glance back and forth. That’s exactly the problem I wanted to solve with this indicator.

The Solution: Stochastic Overlay

This indicator takes the familiar Stochastic oscillator and integrates it directly onto the price chart. Instead of struggling to correlate Stochastic signals with price movements, you now see the levels overlaid on the main chart, bringing momentum analysis into a more intuitive space.

What is the Stochastic Oscillator? (For the Newbies)

The Stochastic oscillator is a momentum-based indicator that measures the closing price relative to the high-low range over a specified period. It fluctuates between 0 and 100, helping traders identify potential reversals when the market is overbought (above 80) or oversold (below 20). The two key components are:

%K (fast-moving line)

%D (a smoothed moving average of %K)

Technical Details of the Overlay

The indicator adjusts the traditional Stochastic calculation by multiplying the timeframe (HTF multiplier), allowing traders to view higher-timeframe Stochastics. Set HTF Multiplier to 1 to see current timeframe Stochastics

It plots horizontal reference lines representing 0%, 20%, 40%, 50%, 60%, 80%, and 100% levels, giving a visual framework of price movement.

Color-coded fills help differentiate bullish and bearish zones—making it easy to spot potential turning points.

Why Do the %K & %D Lines Look “Crooked”?

Normally, the %K and %D lines range between 0 and 100, but in this overlay, they are scaled to fit the current price gap (the difference between the highest and lowest price in the selected period). This means their movement aligns more closely with price action, but it may appear distorted compared to a standard Stochastic oscillator.

For clarity, you can enable the visibility of %K and %D (Show %K %D option), allowing the scaled Stochastic values to be plotted within the price range.

Why Use This Overlay?

Better price interpretation: Instead of staring at a separate oscillator panel, you see momentum levels right where the price action unfolds.

Higher-timeframe integration: Adjusting the multiplier allows you to track the Stochastic behavior of larger timeframes without switching charts.

Clear visual cues: The colored fills and midpoint signals enhance readability for momentum shifts.

This tool transforms the way traders engage with Stochastic indicators, making momentum analysis more intuitive and efficient. Try it out, and see how your interpretation of price and momentum improves!

Blood IndicatorBlood Indicator

Weekly (FRED:TB3MS / FRED:BAMLH0A0HYM2) plotted against the 100 WK MA. If red be ready for a sell off. Use Confluence in price action to confirm trades.

Multi-Time Frame DMI with Gradient Bar ColoringDisplays a table showing the Directional Movement Index (DMI) sentiment for multiple time frames based on the Average Directional Index (ADX) value for each time frame.

Table Position and Text Size are configurable, with two styles (vertical or horizontal) available.

Time frame labels can be toggled off for color-only table.

Bars are colored based on the ADX value using a color gradient between the bullish and bearish color inputs. The neutral color is independent of the gradient for contrast.

Trailing Monster StrategyTrailing Monster Strategy

This is an experimental trend-following strategy that incorporates a custom adaptive moving average (PKAMA), RSI-based momentum filtering, and dynamic trailing stop-loss logic. It is designed for educational and research purposes only, and may require further optimization or risk management considerations prior to live deployment.

Strategy Logic

The strategy attempts to participate in sustained price trends by combining:

- A Power Kaufman Adaptive Moving Average (PKAMA) for dynamic trend detection,

- RSI and Simple Moving Average (SMA) filters for market condition confirmation,

- A delayed trailing stop-loss to manage exits once a trade is in profit.

Entry Conditions

Long Entry:

- RSI exceeds the overbought threshold (default: 70),

- Price is trading above the 200-period SMA,

- PKAMA slope is positive (indicating upward momentum),

- A minimum number of bars have passed since the last entry.

Short Entry:

- RSI falls below the oversold threshold (default: 30),

- Price is trading below the 200-period SMA,

- PKAMA slope is negative (indicating downward momentum),

-A minimum number of bars have passed since the last entry.

Exit Conditions

- A trailing stop-loss is applied once the position has been open for a user-defined number of bars.

- The trailing distance is calculated as a fixed percentage of the average entry price.

Technical Notes

This script implements a custom version of the Power Kaufman Adaptive Moving Average (PKAMA), conceptually inspired by alexgrover’s public implementation on TradingView .

Unlike traditional moving averages, PKAMA dynamically adjusts its responsiveness based on recent market volatility, allowing it to better capture trend changes in fast-moving assets like altcoins.

Disclaimer

This strategy is provided for educational purposes only.

It is not financial advice, and no guarantee of profitability is implied.

Always conduct thorough backtesting and forward testing before using any strategy in a live environment.

Adjust inputs based on your individual risk tolerance, asset class, and trading style.

Feedback is encouraged. You are welcome to fork and modify this script to suit your own preferences and market approach.

Scalping all timeframe EMA & RSIEMA 50 and EMA 100 combined with RSI 14

Should also be accompanied by the RSI 14 chart.

With the following conditions:

IF the EMAs are close but not crossing:

* Be prepared to take a Sell position if the first Bearish Candlestick crosses the lowest EMA, and the RSI value is equal to or below 40.

* Be prepared to take a Buy position if the first Bullish Candlestick crosses the highest EMA, and the RSI value is equal to or above 60.

IF the EMAs are overlapping and crossing:

* Be prepared to take a Sell position if the first Bearish Candlestick crosses both EMAs, and the RSI value crosses below 50.

*Be prepared to take a Buy position if the first Bullish Candlestick crosses both EMAs, and the RSI value crosses above 50.

50-Line Oscillator // (\_/)

// ( •.•)

// (")_(")

25-Line Oscillator

Description:

The 25-Line Oscillator is a sophisticated technical analysis tool designed to visualize market trends through the use of multiple Simple Moving Averages (SMAs). This indicator computes a series of 26 SMAs, incrementally increasing the base length, providing traders with a comprehensive view of price dynamics.

Features:

Customizable Base Length: Adjust the base length of the SMAs according to trading preferences, enhancing versatility for different market conditions.

Rainbow Effect: The indicator employs a visually appealing rainbow color scheme to differentiate between the various trend lines, making it easy to identify crossovers and momentum shifts.

Crossovers Detection: The script includes logic to detect crossover events between consecutive trend lines, which can serve as signals for potential entry or exit points in trading.

Clear Visualization: Suitable for both novice and seasoned traders, the plots enable quick interpretation of trends and market behavior.

How to Use:

Add the indicator to your chart and customize the base length as desired.

Observe the rainbow-colored lines for trend direction.

Look for crossover events between the SMAs as potential trading signals.

Application: This indicator is particularly useful for swing traders and trend followers who aim to capitalize on market momentum and identify reversals. By monitoring the behavior of multiple SMAs, traders can gain insights into the strength and direction of price movements over various time frames.

RSI SiaThis script is a custom indicator for TradingView written in Pine Script version 5. It calculates the Relative Strength Index (RSI) and uses it to generate trading signals. Here's a breakdown of what the script does:

Key Features:

RSI Calculation:

The script calculates the RSI using a 14-period window.

It also calculates the momentum of the RSI over a 9-period window (rsi delta) and a simple moving average (SMA) of the RSI over a 3-period window (rsi sma).

Composite Index (CI):

The composite index is calculated as the sum of rsi delta and rsi sma.

Horizontal Lines and Zones:

Several horizontal lines are plotted at different levels (e.g., 20, 40, 60, 80, 120, 150, 180) to indicate overbought and oversold conditions.

Filled zones are created between certain levels to highlight areas of interest.

Moving Averages:

The script plots SMA and EMA of the RSI when Enable RSI ma is set to true.

It also plots moving averages of the composite index.

Crossover Signals:

The script detects bullish and bearish crossovers between the SMA and EMA of the RSI.

It plots shapes (labels) on the chart to indicate buy (BUY) and sell (SELL) signals based on these crossovers.

Usage:

Enable RSIma: This input allows you to enable or disable the plotting of RSI moving averages.

i1: This variable is used to adjust the vertical position of the composite index and its moving averages.

Visualization:

The RSI is plotted in black.

The RSI fast trigger line (SMA of RSI) is plotted in green when enabled.

The RSI slow trigger line (EMA of RSI) is plotted in orange when enabled.

The composite index and its moving averages are plotted in red, green, and orange.

Buy and sell signals are indicated with green and red labels, respectively.

This script can be used to identify potential trading opportunities based on RSI crossovers and the composite index.

Double RSI OscillatorThe Double RSI Oscillator

Hello Gs,

I came back from the dead and tried to see what a little tweak to RSI could do, and I think it is quite interesting and might be worth checking out.

Warning:

This indicator has lots of false signals unfortunatly

How does the DRSI Oscillator work?

Very simple, the DRSI oscillator at the very base is just 2 RSIs that should smooth each other out, making a smoother trend signal generation for trend analysis. One RSI is set to have lower values, by considering the lowest point of the price, and one RSI is set to have higher values using pretty much the same thing. The trend changes from positive to negative if RSI with higher values crosses negative treshhold, and from negative to positive if RSI with lower value crosses positive treshhold. On top of this I added some additional settings to smooth or speed it further, if these were a good idea, I guess only time will tell :D.

Settings

Here is a guide of what setting changes what and how it might be suitable for you:

RSI Optimism length: length of the RSI with higher values (higher values will be better for longer term, lower for medium term)

RSI Pesimism length: length of the RSI with lower values (higher values will be better for longer term, lower for medium term)

Positive treshhold: The value RSI pesimism needs to pass in order to change trends (in case of using RSI avg. the value the average needs to pass), making this higher can give you faster signals, but expect more false ones

Negative treshholds: The value RSI optimism needs to pass in order to change trends (in case of using RSI avg. the value the average needs to pass), lowering this can give you faster signals, but expect more false ones

Smoothing type: Select the type of smoothing (or none) to smooth your signals as you want, this one you need to play around with.

Smoothing length: The length of your smoothing method (if none is selected it wont change anything)

Use RSI average instead: self-explanatory, go figure

Above/Below Mean Trend: Changes the way trend logic works

Why consider using this indicator?

The DRSI Oscillator is a tool that has huge flexibility (due to tons of settings that base RSI doesnt, like trend treshholds), and is smoother allowing traders and investors to get high quality or high speed signals, allowing great entries and exits

Z SMMA | QuantEdgeB📈 Introducing Z-Score SMMA (Z SMMA) by QuantEdgeB

🛠️ Overview

Z SMMA is a momentum-driven oscillator designed to track the standardized deviation of a Smoothed Moving Average (SMMA). By applying Z-score normalization, this tool dynamically adapts to price volatility, enabling traders to detect meaningful directional shifts and trend changes with enhanced clarity.

It serves both as a trend-following and mean-reversion system, identifying opportunities through standardized thresholds while remaining robust across volatile and calm market conditions.

✨ Key Features

🔹 Z-Score Normalization Engine

Applies Z-score to a custom SMMA baseline, allowing traders to compare price action relative to its recent volatility-adjusted mean.

🔹 Dynamic Trend Detection

Generates actionable long/short signals based on customizable Z-thresholds, making it adaptable across different asset classes and timeframes.

🔹 Overbought/Oversold Zones

Highlight reversion and profit-taking zones (default OB: +2 to +4, OS: -2 to -4), great for counter-trend or mean-reversion strategies.

🔹 Visual Reinforcement Tools

Includes candle coloring, gradient fills, and optional ALMA/EMA band overlays to visualize trend regime transitions.

🔍 How It Works

1️⃣ Z-Score SMMA Calculation

The core is a custom Smoothed Moving Average (SMMA) that is normalized by its standard deviation over a lookback period.

Final Formula:

Z = (SMMA - Mean) / StdDev

2️⃣ Signal Generation

• ✅ Long Bias: Z-Score > Long Threshold (default: 0)

• ❌ Short Bias: Z-Score < Short Threshold (default: 0)

3️⃣ Visual Aids

• Candle Color → Shows trend bias

• Band Fills → Highlight trend strength

• Overlays → Optional ALMA/EMA bands for structure analysis

⚙️ Custom Settings

• SMMA Length → Default: 12

• Z-Score Lookback → Default: 30

• Long Threshold → Default: 0

• Short Threshold → Default: 0

• Color Themes → Choose from 6 visual modes

• Extra Plots → Toggle advanced overlays (ALMA, EMA, bands)

• Label Display → Show/hide “𝓛𝓸𝓷𝓰” & “𝓢𝓱𝓸𝓻𝓽” markers

👥 Who Should Use It?

✅ Trend Traders → For early entries with confirmation from Z-score expansion

✅ Quantitative Analysts → Standardized deviation enables comparison across assets

✅ Mean-Reversion Traders → Use OB/OS zones to fade parabolic spikes

✅ Swing & Systematic Traders → Identify momentum shifts with optional ALMA/EMA overlays

📌 Conclusion

Z SMMA offers a smart, adaptive framework for tracking deviation from equilibrium in a quant-friendly format. Whether you're looking to follow trends or catch exhaustion points, Z SMMA provides a clear, standardized view of momentum and price extremes.

🔹 Key Takeaways:

1️⃣ Z-Score standardization ensures dynamic range awareness

2️⃣ SMMA base filters out noise, offering smoother signals

3️⃣ Color-coded visuals support faster reaction and cleaner charts

📌 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

📌 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before

Kernel Weighted DMI | QuantEdgeB📊 Introducing Kernel Weighted DMI (K-DMI) by QuantEdgeB

🛠️ Overview

K-DMI is a next-gen momentum indicator that combines the traditional Directional Movement Index (DMI) with advanced kernel smoothing techniques to produce a highly adaptive, noise-resistant trend signal.

Unlike standard DMI that can be overly reactive or choppy in consolidation phases, K-DMI applies kernel-weighted filtering (Linear, Exponential, or Gaussian) to stabilize directional movement readings and extract a more reliable momentum signal.

✨ Key Features

🔹 Kernel Smoothing Engine

Smooths DMI using your choice of kernel (Linear, Exponential, Gaussian) for flexible noise reduction and clarity.

🔹 Dynamic Trend Signal

Generates real-time long/short trend bias based on signal crossing upper or lower thresholds (defaults: ±1).

🔹 Visual Encoding

Includes directional gradient fills, candle coloring, and momentum-based overlays for instant signal comprehension.

🔹 Multi-Mode Plotting

Optional moving average overlays visualize structure and compression/expansion within price action.

📐 How It Works

1️⃣ Directional Movement Index (DMI)

Calculates the traditional +DI and -DI differential to derive directional bias.

2️⃣ Kernel-Based Smoothing

Applies a custom-weighted average across historical DMI values using one of three smoothing methods:

• Linear → Simple tapering weights

• Exponential → Decay curve for recent emphasis

• Gaussian → Bell-shaped weight for centered precision

3️⃣ Signal Generation

• ✅ Long → Signal > Long Threshold (default: +1)

• ❌ Short → Signal < Short Threshold (default: -1)

Additional overlays signal potential compression zones or trend resumption using gradient and line fills.

⚙️ Custom Settings

• DMI Length: Default = 7

• Kernel Type: Options → Linear, Exponential, Gaussian (Def:Linear)

• Kernel Length: Default = 25

• Long Threshold: Default = 1

• Short Threshold: Default = -1

• Color Mode: Strategy, Solar, Warm, Cool, Classic, Magic

• Show Labels: Optional entry signal labels (Long/Short)

• Enable Extra Plots: Toggle MA overlays and dynamic bands

👥 Who Is It For?

✅ Trend Traders → Identify sustained directional bias with smoother signal lines

✅ Quant Analysts → Leverage advanced smoothing models to enhance data clarity

✅ Discretionary Swing Traders → Visualize clean breakouts or fades within choppy zones

✅ MA Compression Traders → Use overlay MAs to detect expansion opportunities

📌 Conclusion

Kernel Weighted DMI is the evolution of classic momentum tracking—merging traditional DMI logic with adaptable kernel filters. It provides a refined lens for trend detection, while optional visual overlays support price structure analysis.

🔹 Key Takeaways:

1️⃣ Smoothed and stabilized DMI for reliable trend signal generation

2️⃣ Optional Gaussian/exponential weighting for adaptive responsiveness

3️⃣ Custom gradient fills, dynamic MAs, and candle coloring to support visual clarity

📌 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

📌 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Normalized DEMA Oscillator SD| QuantEdgeB📊 Introducing Normalized DEMA Oscillator SD (NDOSD) by QuantEdgeB

🛠️ Overview

Normalized DEMA Oscillator SD (NDOSD) is a powerful trend and momentum indicator that blends DEMA-based smoothing with a standard deviation-based normalization engine. The result is an oscillator that adapts to volatility, filters noise, and highlights both trend continuations and reversal zones with exceptional clarity.

It normalizes price momentum within an adaptive SD envelope, allowing comparisons across assets and market conditions. Whether you're a trend trader or mean-reverter, NDOSD provides the insight needed for smarter decision-making.

✨ Key Features

🔹 DEMA-Powered Momentum Core

Utilizes a Double EMA (DEMA) for smoother trend detection with reduced lag.

🔹 Normalized SD Bands

Price momentum is standardized using a dynamic 2× standard deviation range—enabling consistent interpretation across assets and timeframes.

🔹 Overbought/Oversold Detection

Includes clear OB/OS zones with shaded thresholds to identify potential reversals or trend exhaustion areas.

🔹 Visual Trend Feedback

Color-coded oscillator zones, candle coloring, and optional signal labels help traders immediately see trend direction and strength.

📐 How It Works

1️⃣ DEMA Calculation

The core of NDOSD is a smoothed price line using a Double EMA, designed to reduce false signals in choppy markets.

2️⃣ Normalization with SD

The DEMA is normalized within a volatility range using a 2x SD calculation, producing a bounded oscillator from 0–100. This transforms the raw signal into a structured format, allowing for OB/OS detection and trend entry clarity.

3️⃣ Signal Generation

• ✅ Long Signal → Oscillator crosses above the long threshold (default: 55) and price holds above the lower SD boundary.

• ❌ Short Signal → Oscillator drops below short threshold (default: 45), often within upper SD boundary context.

4️⃣ OB/OS Thresholds

• Overbought Zone: Above 100 → Caution / Consider profit-taking.

• Oversold Zone: Below 0 → Watch for accumulation setups.

⚙️ Custom Settings

• Calculation Source: Default = close

• DEMA Period: Default = 30

• Base SMA Period: Default = 20

• Long Threshold: Default = 55

• Short Threshold: Default = 45

• Color Mode: Choose from Strategy, Solar, Warm, Cool, Classic, or Magic

• Signal Labels Toggle: Show/hide Long/Short markers on chart

👥 Ideal For

✅ Trend Followers – Identify breakout continuation zones using oscillator thrust and SD structure

✅ Swing Traders – Catch mid-trend entries or mean reversion setups at OB/OS extremes

✅ Quant/Systemic Traders – Normalize signals for algorithmic integration across assets

✅ Multi-Timeframe Analysts – Easily compare trend health using standardized oscillator ranges

📌 Conclusion

Normalized DEMA Oscillator SD is a sleek and adaptive momentum toolkit that helps traders distinguish true momentum from false noise. With its fusion of DEMA smoothing and SD normalization, it works equally well in trending and range-bound conditions.

🔹 Key Takeaways:

1️⃣ Smoother momentum tracking using DEMA

2️⃣ Cross-asset consistency via SD-based normalization

3️⃣ Versatile for both trend confirmation and reversal identification

📌 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

📌 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Let me know if you want a strategy script or publish-ready layout for TradingView next!