Hull Moving Average Adaptive RSI (Ehlers)Hull Moving Average Adaptive RSI (Ehlers)

The Hull Moving Average Adaptive RSI (Ehlers) is an enhanced trend-following indicator designed to provide a smooth and responsive view of price movement while incorporating an additional momentum-based analysis using the Adaptive RSI.

Principle and Advantages of the Hull Moving Average:

- The Hull Moving Average (HMA) is known for its ability to track price action with minimal lag while maintaining a smooth curve.

- Unlike traditional moving averages, the HMA significantly reduces noise and responds faster to market trends, making it highly effective for detecting trend direction and changes.

- It achieves this by applying a weighted moving average calculation that emphasizes recent price movements while smoothing out fluctuations.

Why the Adaptive RSI Was Added:

- The core HMA line remains the foundation of the indicator, but an additional analysis using the Adaptive RSI has been integrated to provide more meaningful insights into momentum shifts.

- The Adaptive RSI is a modified version of the traditional Relative Strength Index that dynamically adjusts its sensitivity based on market volatility.

- By incorporating the Adaptive RSI, the HMA visually represents whether momentum is strengthening or weakening, offering a complementary layer of analysis.

How the Adaptive RSI Influences the Indicator:

- High Adaptive RSI (above 65): The market may be overbought, or bullish momentum could be fading. The HMA turns shades of red, signaling a possible exhaustion phase or potential reversals.

- Neutral Adaptive RSI (around 50): The market is in a balanced state, meaning neither buyers nor sellers are in clear control. The HMA takes on grayish tones to indicate this consolidation.

- Low Adaptive RSI (below 35): The market may be oversold, or bearish momentum could be weakening. The HMA shifts to shades of blue, highlighting potential recovery zones or trend slowdowns.

Why This Combination is Powerful:

- While the HMA excels in tracking trends and reducing lag, it does not provide information about momentum strength on its own.

- The Adaptive RSI bridges this gap by adding a clear visual layer that helps traders assess whether a trend is likely to continue, consolidate, or reverse.

- This makes the indicator particularly useful for spotting trend exhaustion and confirming momentum shifts in real-time.

Best Use Cases:

- Works effectively on timeframes from 1 hour (1H) to 1 day (1D), making it suitable for swing trading and position trading.

- Particularly useful for trading indices (SPY), stocks, forex, and cryptocurrencies, where momentum shifts are frequent.

- Helps identify not just trend direction but also whether that trend is gaining or losing strength.

Recommended Complementary Indicators:

- Adaptive Trend Finder: Helps identify the dominant long-term trend.

- Williams Fractals Ultimate: Provides key reversal points to validate trend shifts.

- RVOL (Relative Volume): Confirms significant moves based on volume strength.

This enhanced HMA with Adaptive RSI provides a powerful, intuitive visual tool that makes trend analysis and momentum interpretation more effective and efficient.

This indicator is for educational and informational purposes only. It should not be considered financial advice or a guarantee of performance. Always conduct your own research and use proper risk management when trading. Past performance does not guarantee future results.

Скользящие средние

Golden Death Cross IndicatorThis indicator uses moving average to detect both a Golden Cross and Death Cross on any timeframe but is recommended for use on the daily and 24 hour timeframes only.

We have also provided instructions on how to create alerts for these indicators below.

Happy Trading!

Moving Averages: We’ll use Simple Moving Averages (SMA). The 50-day SMA looks at the average price over the last 50 periods, and the 200-day SMA does the same for 200 periods.

Crossovers: We’ll check when the 50-day SMA crosses above (Golden Cross) or below the 200-day SMA (Death Cross).

Set Up Alerts

Now, let’s make sure you get notified when a cross happens:

Open the Alerts Menu

On the chart, click the bell icon (top right of the screen) to create an alert.

Configure the Golden Cross Alert

In the “Condition” dropdown, select “Cross Alerts” (the name of your script).

Below that, select “Golden Cross.”

Set “Once Per Bar Close” in the next dropdown (this ensures it only triggers after the period ends, avoiding false signals mid-bar).

Choose how you want to be notified (e.g., popup, email, or phone app—set this under “Notifications”).

Name the alert (e.g., “Golden Cross Alert”) and click “Create.”

Configure the Death Cross Alert

Click the bell icon again to create a second alert.

Condition: “Cross Alerts” > “Death Cross.”

Set “Once Per Bar Close” again.

Choose your notification method.

Name it (e.g., “Death Cross Alert”) and click “Create.”

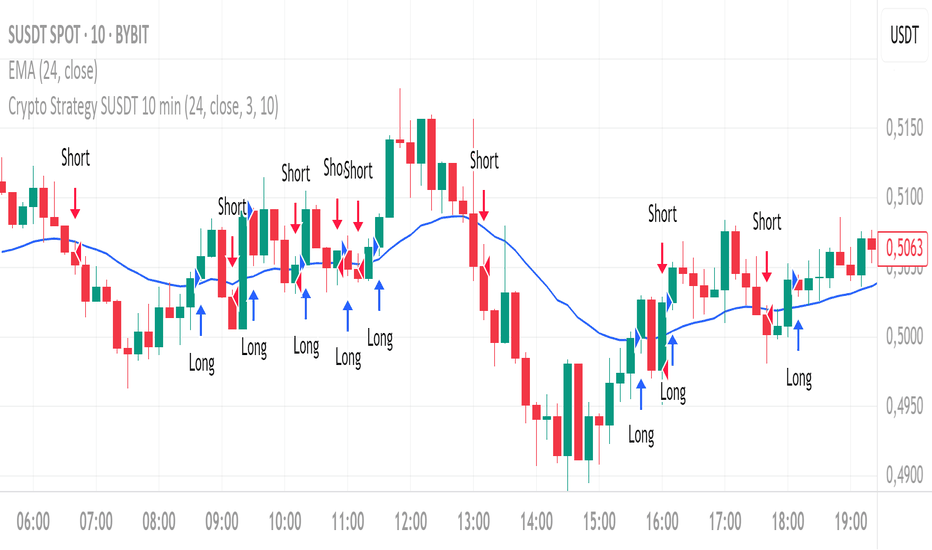

Crypto Strategy SUSDT 10 minThis strategy is designed to trade the **SUSDT** pair on a **10-minute time frame**, using a combination of an Exponential Moving Average (EMA) and percentage-based Stop Loss (SL) and Take Profit (TP) levels.

### How the strategy works:

1. **EMA Calculation**:

- The strategy calculates a 24-period Exponential Moving Average (EMA) based on the closing price.

- This EMA serves as the primary trend indicator.

2. **Entry Conditions**:

- **Long Position**: A long position is entered when the closing price is above the EMA and the opening price is below the EMA. This indicates a potential upward trend.

- **Short Position**: A short position is entered when the closing price is below the EMA and the opening price is above the EMA. This indicates a potential downward trend.

3. **Stop Loss and Take Profit**:

- Both Stop Loss (SL) and Take Profit (TP) are calculated based on the entry price of the position.

- **For Long Positions**:

- Stop Loss is set as a percentage below the entry price.

- Take Profit is set as a percentage above the entry price.

- **For Short Positions**:

- Stop Loss is set as a percentage above the entry price.

- Take Profit is set as a percentage below the entry price.

- The percentage values for SL and TP can be adjusted in the strategy's settings (default: SL = 2%, TP = 4%).

4. **Exit Conditions**:

- The position is closed automatically when either the Stop Loss or Take Profit level is reached.

5. **Visualization**:

- The 24-period EMA is plotted on the chart as a blue line, helping visualize the trend direction.

### Key Features:

- **Pair and Time Frame**: The strategy is optimized for the SUSDT pair on a 10-minute time frame.

- **Customizable Parameters**: Users can adjust the Stop Loss and Take Profit percentages to suit their risk tolerance and trading style.

- **Trend-Following Approach**: The strategy uses the EMA to identify and follow the current market trend.

This strategy is simple yet effective for capturing trends while managing risk through predefined Stop Loss and Take Profit levels.

ETH/USDT EMA Crossover Strategy - OptimizedStrategy Name: EMA Crossover Strategy for ETH/USDT

Description:

This trading strategy is designed for the ETH/USDT pair and is based on exponential moving average (EMA) crossovers combined with momentum and volatility indicators. The strategy uses multiple filters to identify high-probability signals in both bullish and bearish trends, making it suitable for traders looking to trade in trending markets.

Strategy Components

EMAs (Exponential Moving Averages):

EMA 200: Used to identify the primary trend. If the price is above the EMA 200, it is considered a bullish trend; if below, a bearish trend.

EMA 50: Acts as an additional filter to confirm the trend.

EMA 20 and EMA 50 Short: These short-term EMAs generate entry signals through crossovers. A bullish crossover (EMA 20 crosses above EMA 50 Short) is a buy signal, while a bearish crossover (EMA 20 crosses below EMA 50 Short) is a sell signal.

RSI (Relative Strength Index):

The RSI is used to avoid overbought or oversold conditions. Long trades are only taken when the RSI is above 30, and short trades when the RSI is below 70.

ATR (Average True Range):

The ATR is used as a volatility filter. Trades are only taken when there is sufficient volatility, helping to avoid false signals in quiet markets.

Volume:

A volume filter is used to confirm sufficient market participation in the price movement. Trades are only taken when volume is above average.

Strategy Logic

Long Trades:

The price must be above the EMA 200 (bullish trend).

The EMA 20 must cross above the EMA 50 Short.

The RSI must be above 30.

The ATR must indicate sufficient volatility.

Volume must be above average.

Short Trades:

The price must be below the EMA 200 (bearish trend).

The EMA 20 must cross below the EMA 50 Short.

The RSI must be below 70.

The ATR must indicate sufficient volatility.

Volume must be above average.

How to Use the Strategy

Setup:

Add the script to your ETH/USDT chart on TradingView.

Adjust the parameters according to your preferences (e.g., EMA periods, RSI, ATR, etc.).

Signals:

Buy and sell signals will be displayed directly on the chart.

Long trades are indicated with an upward arrow, and short trades with a downward arrow.

Risk Management:

Use stop-loss and take-profit orders in all trades.

Consider a risk-reward ratio of at least 1:2.

Backtesting:

Test the strategy on historical data to evaluate its performance before using it live.

Advantages of the Strategy

Trend-focused: The strategy is designed to trade in trending markets, increasing the probability of success.

Multiple filters: The use of RSI, ATR, and volume reduces false signals.

Adaptability: It can be adjusted for different timeframes, although it is recommended to test it on 5-minute and 15-minute charts for ETH/USDT.

Warnings

Sideways markets: The strategy may generate false signals in markets without a clear trend. It is recommended to avoid trading in such conditions.

Optimization: Make sure to optimize the parameters according to the market and timeframe you are using.

Risk management: Never trade without stop-loss and take-profit orders.

Author

Jose J. Sanchez Cuevas

Version

v1.0

Air Gap MTF with alert settingsWhat it shows:

This indicator will show a horizontal line at a price where each EMAs are on on different time frames, which will remove the effort of having to flick through different time frames or look at different chart.

The lines itself will move in real time as price moves and therefore as the EMA values changes so no need to manually adjustment the lines.

How to use it:

The price gap between each of the lines are known as "air gaps", which are essentially zones price can move with less resistance. Therefore bigger the airgap there is more likely more movement in price.

In other words, where lines are can be a resistance (or support) and can expect price stagnation or rejection.

On the chart it is clear to see lines are acting as resistances/supports.

Key settings:

The time frame are fixed to: 30min, 1hr and 4hr. This cannot be changed as of now.

EMA values for each time frame are user changeable in the settings, and up to 4 different values can be chosen for each time frame. Default is 5,12,34 and 50 for each timeframe.

Line colour, thickness and style can be user adjusted. Start point for where line will be drawn can be changed in the settings, either: start of day, user defined start or across the chart. In case of user defined scenario user can input a number that specifies a offset from current candle.

Label colour, font, alignment, text size and text itself can be user adjusted in the settings. Price can be also displayed if user chooses to do so. Position of label (offset from current candle) is user specified and can be adjusted by the user.

Both the lines and labels can be turned off (both and individually), for each lines.

Alert Settings:

Manually, user can set alerts for when price crosses a specific line.

This can be done by:

right click on any of line

choose first option (add alert on...)

On the second option under condition, use the dropdown menu to choose the desired EMA/timeframe to set alert for.

Hit "create" at bottom right of option

----------------------------------------------------------------------

If anything is not clear please let me know!

ALMA 20, 50, 200The ALMA (Arnaud Legoux Moving Average) crossover strategy uses two ALMA lines (fast and slow) to generate buy/sell signals, aiming to reduce lag and noise compared to traditional moving averages, and is often combined with volume filters for improved accuracy.

Here's a more detailed explanation:

What it is:

The ALMA indicator is a moving average (MA) variant designed to reduce lag and improve responsiveness while maintaining a smooth curve, using a Gaussian filter.

How it works:

ALMA calculates two moving averages, one from left to right and one from right to left, and then processes the output through a customizable formula for increased smoothness or responsiveness.

Crossover Strategy:

A common ALMA strategy involves using two ALMA lines with different lengths (fast and slow). A buy signal is generated when the fast ALMA crosses above the slow ALMA, and a sell signal when the fast ALMA crosses below the slow ALMA.

Benefits:

ALMA offers advantages like reduced lag, smoothness, and filtering capabilities, making it useful for identifying trends and potential reversals.

Potential Risks:

Like any indicator, ALMA can produce false signals, so it's crucial to combine it with other indicators and analyze price action.

Parameters:

ALMA has parameters like "Length" (number of periods), "Sigma" (filter's range, affecting responsiveness), and "Offset" (for accessing data of different candles).

Other uses:

ALMA can also be used for trend identification, dynamic support and resistance, and combined with other indicators to enhance trading strategies.

Multi-Faceted Analysis ToolHere’s a detailed description for the **Multi-Faceted Analysis Tool** TradingView indicator:

---

## Multi-Faceted Analysis Tool

### Overview

The **Multi-Faceted Analysis Tool** is a powerful TradingView indicator designed to enhance your technical analysis by combining several popular indicators: Simple Moving Average (SMA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). This indicator provides traders with insightful market signals that can be tailored to fit various trading strategies and timeframes.

### Key Features

1. **Simple Moving Average (SMA)**:

- Plots a customizable SMA on the price chart. The length of the SMA can be adjusted to suit your analysis needs (default is set to 50). The SMA helps identify the overall trend direction.

2. **Relative Strength Index (RSI)**:

- Calculates and plots RSI values, providing insights into potential overbought or oversold market conditions. The user can customize the length of the RSI calculation (default is 14).

- Overbought (70) and oversold (30) levels are visually marked, helping traders identify potential reversal points.

3. **MACD**:

- Computes MACD values with customizable parameters for fast length, slow length, and signal length (defaults are 12, 26, and 9 respectively).

- The MACD histogram is displayed, highlighting the difference between the MACD line and the signal line, which can help traders visualize momentum shifts.

4. **Buy and Sell Signals**:

- Generates clear buy and sell signals based on RSI crossover with established thresholds (buy when RSI crosses above 30, sell when RSI crosses below 70). These signals are visually represented on the chart for easy decision-making.

5. **User-Friendly Customization**:

- All parameters are adjustable, allowing traders to set their preferred values based on individual strategies or market conditions. This flexibility ensures that the tool can cater to a wide range of trading styles.

Average MomentumThis indicator will calculate for any given equity four values: the simple average of the indicated equity for a timeframe of one month, three months, six months for twelve months. Then the script will create the average value of those four averages and display it in red if the value decreases and green if it progresses. It is useful as an indicator to go risk off.

Uptrick: Acceleration ShiftsIntroduction

Uptrick: Acceleration Shifts is designed to measure and visualize price momentum shifts by focusing on acceleration —the rate of change in velocity over time. It uses various moving average techniques as a trend filter, providing traders with a clearer perspective on market direction and potential trade entries or exits.

Purpose

The main goal of this indicator is to spot strong momentum changes (accelerations) and confirm them with a chosen trend filter. It attempts to distinguish genuine market moves from noise, helping traders make more informed decisions. The script can also trigger multiple entries (smart pyramiding) within the same trend, if desired.

Overview

By measuring how quickly price velocity changes (acceleration) and comparing it against a smoothed average of itself, this script generates buy or sell signals once the acceleration surpasses a given threshold. A trend filter is added for further validation. Users can choose from multiple smoothing methods and color schemes, and they can optionally enable a small table that displays real-time acceleration values.

Originality and Uniqueness

This script offers an acceleration-based approach, backed by several different moving average choices. The blend of acceleration thresholds, a trend filter, and an optional extra-entry (pyramiding) feature provides a flexible toolkit for various trading styles. The inclusion of multiple color themes and a slope-based coloring of the trend line adds clarity and user customization.

Inputs & Features

1. Acceleration Length (length)

This input determines the number of bars used when calculating velocity. Specifically, the script computes velocity by taking the difference in closing prices over length bars, and then calculates acceleration based on how that velocity changes over an additional length. The default is 14.

2. Trend Filter Length (smoothing)

This sets the lookback period for the chosen trend filter method. The default of 50 results in a moderately smooth trend line. A higher smoothing value will create a slower-moving trend filter.

3. Acceleration Threshold (threshold)

This multiplier determines when acceleration is considered strong enough to trigger a main buy or sell signal. A default value of 2.5 means the current acceleration must exceed 2.5 times the average acceleration before signaling.

4. Smart Pyramiding Strength (pyramidingThreshold)

This lower threshold is used for additional (pyramiding) entries once the main trend has already been identified. For instance, if set to 0.5, the script looks for acceleration crossing ±0.5 times its average acceleration to add extra positions.

5. Max Pyramiding Entries (maxPyramidingEntries)

This sets a limit on how many extra positions can be opened (beyond the first main signal) in a single directional trend. The default of 3 ensures traders do not become overexposed.

6. Show Acceleration Table (showTable)

When enabled, a small table displaying the current acceleration and its average is added to the top-right corner of the chart. This table helps monitor real-time momentum changes.

7. Smart Pyramiding (enablePyramiding)

This toggle decides whether additional entries (buy or sell) will be generated once a main signal is active. If enabled, these extra signals act as filtered entries, only firing when acceleration re-crosses a smaller threshold (pyramidingThreshold). These signals have a '+' next to their signal on the label.

8. Select Color Scheme (selectedColorScheme)

Allows choosing between various pre-coded color themes, such as Default, Emerald, Sapphire, Golden Blaze, Mystic, Monochrome, Pastel, Vibrant, Earth, or Neon. Each theme applies a distinct pair of colors for bullish and bearish conditions.

9. Trend Filter (TrendFilter)

Lets the user pick one of several moving average approaches to determine the prevailing trend. The options include:

Short Term (TEMA)

EWMA

Medium Term (HMA)

Classic (SMA)

Quick Reaction (DEMA)

Each method behaves differently, balancing reactivity and smoothness.

10. Slope Lookback (slopeOffset)

Used to measure the slope of the trend filter over a set number of bars (default is 10). This slope then influences the coloring of the trend filter line, indicating bullish or bearish tilt.

Note: The script refers to this as the "Massive Slope Index," but it effectively serves as a Trend Slope Calculation, measuring how the chosen trend filter changes over a specified period.

11. Alerts for Buy/Sell and Pyramiding Signals

The script includes built-in alert conditions that can be enabled or configured. These alerts trigger whenever the script detects a main Buy or Sell signal, as well as extra (pyramiding) signals if Smart Pyramiding is active. This feature allows traders to receive immediate notifications or automate a trading response.

Calculation Methodology

1. Velocity and Acceleration

Velocity is derived by subtracting the closing price from its value length bars ago. Acceleration is the difference in velocity over an additional length period. This highlights how quickly momentum is shifting.

2. Average Acceleration

The script smooths raw acceleration with a simple moving average (SMA) using the smoothing input. Comparing current acceleration against this average provides a threshold-based signal mechanism.

3. Trend Filter

Users can pick one of five moving average types to form a trend baseline. These range from quick-reacting methods (DEMA, TEMA) to smoother options (SMA, HMA, EWMA). The script checks whether the price is above or below this filter to confirm trend direction.

4. Buy/Sell Logic

A buy occurs when acceleration surpasses avgAcceleration * threshold and price closes above the trend filter. A sell occurs under the opposite conditions. An additional overbought/oversold check (based on a longer SMA) refines these signals further.

When price is considered oversold (i.e., close is below a longer-term SMA), a bullish acceleration signal has a higher likelihood of success because it indicates that the market is attempting to reverse from a lower price region. Conversely, when price is considered overbought (close is above this longer-term SMA), a bearish acceleration signal is more likely to be valid. This helps reduce false signals by waiting until the market is extended enough that a reversal or continuation has a stronger chance of following through.

5. Smart Pyramiding

Once a main buy or sell signal is triggered, additional (filtered) entries can be taken if acceleration crosses a smaller multiplier (pyramidingThreshold). This helps traders scale into strong moves. The script enforces a cap (maxPyramidingEntries) to limit risk.

6. Visual Elements

Candles can be recolored based on the active signal. Labels appear on the chart whenever a main or pyramiding entry signal is triggered. An optional table can show real-time acceleration values.

Color Schemes

The script includes a variety of predefined color themes. For bullish conditions, it might use turquoise or green, and for bearish conditions, magenta or red—depending on which color scheme the user selects. Each scheme aims to provide clear visual differentiation between bullish and bearish market states.

Why Each Indicator Was Part of This Component

Acceleration is employed to detect swift changes in momentum, capturing shifts that may not yet appear in more traditional measures. To further adapt to different trading styles and market conditions, several moving average methods are incorporated:

• TEMA (Triple Exponential Moving Average) is chosen for its ability to reduce lag more effectively than a standard EMA while still reacting swiftly to price changes. Its construction layers exponential smoothing in a way that can highlight sudden momentum shifts without sacrificing too much smoothness.

• DEMA (Double Exponential Moving Average) provides a faster response than a single EMA by using two layers of exponential smoothing. It is slightly less smoothed than TEMA but can alert traders to momentum changes earlier, though with a higher risk of noise in choppier markets.

• HMA (Hull Moving Average) is known for its balance of smoothness and reduced lag. Its weighted calculations help track trend direction clearly, making it useful for traders who want a smoother line that still reacts fairly quickly.

• SMA (Simple Moving Average) is the classic baseline for smoothing price data. It offers a clear, stable perspective on long-term trends, though it reacts more slowly than other methods. Its simplicity can be beneficial in lower-volatility or more stable market environments.

• EWMA (Exponentially Weighted Moving Average) provides a middle ground by emphasizing recent price data while still retaining some degree of smoothing. It typically responds faster than an SMA but is less aggressive than DEMA or TEMA.

Alongside these moving average techniques, the script employs a slope calculation (referred to as the “Massive Slope Index”) to visually indicate whether the chosen filter is sloping upward or downward. This adds an extra layer of clarity to directional analysis. The indicator also uses overbought/oversold checks, based on a longer-term SMA, to help filter out signals in overstretched markets—reducing the likelihood of false entries in conditions where the price is already extensively extended.

Additional Features

Alerts can be set up for both main signals and additional pyramiding signals, which is helpful for automated or semi-automated trading. The optional acceleration table offers quick reference values, making momentum monitoring more intuitive. Including explicit alert conditions for Buy/Sell and Pyramiding ensures traders can respond promptly to market movements or integrate these triggers into automated strategies.

Summary

This script serves as a comprehensive momentum-based trading framework, leveraging acceleration metrics and multiple moving average filters to identify potential shifts in market direction. By combining overbought/oversold checks with threshold-based triggers, it aims to reduce the noise that commonly plagues purely reactive indicators. The flexibility of Smart Pyramiding, customizable color schemes, and built-in alerts allows users to tailor their experience and respond swiftly to valid signals, potentially enhancing trading decisions across various market conditions.

Disclaimer

All trading involves significant risk, and users should apply their own judgment, risk management, and broader analysis before making investment decisions.

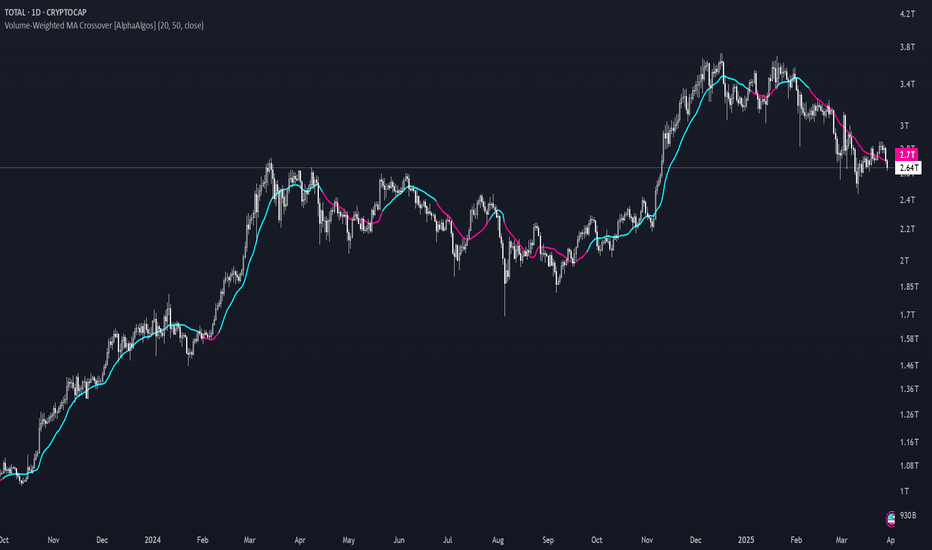

Volume-Weighted MA Crossover [AlphaAlgos]Volume-Weighted MA Crossover

Overview:

The Volume-Weighted MA Crossover is a sophisticated trend-following indicator designed to capture reliable trend reversals and trend continuation signals using volume and price action. By combining the power of Volume-Weighted Moving Averages (VWMA) and the simplicity of Simple Moving Averages (SMA) , this indicator provides a more robust and reliable trend filter. It ensures that trend signals are supported by strong market volume, offering a deeper insight into market strength and potential price movements.

How It Works:

The Volume-Weighted MA Crossover indicator calculates a Volume-Weighted Moving Average (VWMA) of the chosen price source (typically close ), which takes into account both the price and volume of each bar. This ensures that price movements with higher volume are weighted more heavily, providing a better reflection of actual market sentiment.

In conjunction with the VWMA, a traditional Simple Moving Average (SMA) is used to filter out noise and smooth price data, providing a more stable trend direction. The crossover between the VWMA and SMA serves as the primary trading signal:

Long Signal (Bullish Crossover) : The VWMA crosses above the SMA, indicating that a strong bullish trend is likely underway, supported by increased volume and price action.

Short Signal (Bearish Crossover) : The VWMA crosses below the SMA, signaling that a bearish trend is emerging, backed by decreasing volume and price reversal.

The Volume-Weighted MA Crossover can be used as a standalone indicator or in conjunction with other tools to enhance your trading strategy, offering both trend-following and volume confirmation.

Key Features:

Volume Sensitivity : The VWMA adjusts the moving average based on volume, providing a more accurate representation of price action during high-volume periods. This makes the indicator more sensitive to market dynamics, ensuring that price movements during significant volume spikes are prioritized.

Trend Confirmation : The crossover of the VWMA and SMA offers clear and actionable signals, helping traders identify trend reversals early and with more confidence.

Clean Signal Presentation : With color-coded signal markers , this indicator makes it easy to spot actionable entry points.

Customizable Settings : Tailor the VWMA and SMA periods, volume multiplier, and source price according to your preferred market conditions and timeframes, allowing the indicator to fit your trading style.

How to Use It:

Trend Direction : Look for crossovers between the VWMA and SMA to identify potential trend changes:

Volume Confirmation : The volume-weighted aspect of this indicator ensures that trends are confirmed by volume. A bullish trend with a VWMA crossing above the SMA suggests that the upward movement is supported by strong market sentiment (high volume). Conversely, a bearish trend with a VWMA crossing below the SMA indicates a reversal is supported by volume reduction.

Trend Continuation & Reversal : This indicator works particularly well during strong trending markets. However, it can also identify potential reversals, particularly during periods of high volume and rapid price changes.

Best Timeframe to Use:

This indicator is adaptable to multiple timeframes and can be used across various market types. However, it tends to work most effectively on medium to long-term charts (such as 1-hour, 4-hour, and daily charts) where trends have the potential to develop more clearly and with more volume participation.

Ideal for:

Trend-following traders looking for reliable signals that are confirmed by both price action and volume.

Swing traders who want to enter trades at the beginning of a new trend or after a confirmed trend reversal.

Day traders seeking clear and easy-to-read signals on intra-day charts, helping to pinpoint optimal entry and exit points during volatile market conditions.

Conclusion:

The Volume-Weighted MA Crossover is an essential tool for any trader looking to improve their trend-following strategy. By incorporating both volume and price action into a VWMA and SMA crossover , it offers a more refined approach to identifying and confirming trends. Whether you're a trend follower , swing trader , or day trader , this indicator provides clear, actionable signals backed by volume confirmation, giving you the confidence to execute your trades with precision.

Alpha Wave System @DaviddTechAlpha Wave DaviddTech System by DaviddTech is an advanced, meticulously engineered trading indicator adhering strictly to the DaviddTech methodology. Rather than simply combining popular indicators, Alpha Wave strategically integrates specially-selected technical components—each optimized to enhance their combined strengths while neutralizing individual weaknesses, providing traders with clear, consistent, and high-probability trading signals.

Valid Setup:

🎯 Why This Combination Matters:

Quantum Adaptive Moving Average (Baseline):

This advanced adaptive MA provides superior responsiveness to market shifts by dynamically adjusting its sensitivity, clearly indicating the primary market direction and reducing lag compared to standard moving averages.

WavePulse Indicator (CoralChannel-based Confirmation #1):

Precisely detects shifts in momentum and price acceleration, allowing traders to anticipate trend continuation or reversals effectively, significantly enhancing trade accuracy.

Quantum Channel (G-Channel-based Confirmation #2):

Dynamically captures price volatility ranges, offering reliable trend structure validation and clear support/resistance channels, further increasing signal reliability.

Momentum Density (Volatility Filter):

Ensures traders enter only during optimal volatility conditions by quantifying momentum intensity, effectively filtering out low-quality, low-momentum scenarios.

Dynamic ATR-based Trailing Stop (Exit System):

Automatically manages trade exits with optimized ATR-based stop levels, systematically securing profits while effectively managing risk.

These meticulously integrated components reinforce each other's strengths, providing traders with a robust, disciplined, and clearly structured approach aligned with the DaviddTech methodology.

🔥 Latest Update – Enhanced BUY & SELL Signals:

Alpha Wave now clearly displays automated BUY and SELL signals directly on your chart, coupled with a comprehensive dashboard table for immediate signal validation. Signals appear only when all components—including baseline, confirmations, and volatility—are in alignment, significantly improving trade accuracy and confidence.

📌 How Traders Benefit from the New Signals:

BUY Signal: Execute long trades when Quantum Adaptive MA signals bullish, confirmed by bullish WavePulse momentum, bullish Quantum Channel structure, and strong Momentum Density readings.

SELL Signal: Clearly marked for entering short positions under bearish market conditions verified through Quantum Adaptive MA, WavePulse bearish momentum, Quantum Channel confirmation, and sufficient Momentum Density.

Signal Validation: A dedicated dashboard provides immediate visual strength metrics, allowing traders to quickly validate signals before execution, significantly enhancing trading discipline and consistency.

📊 Recommended DaviddTech Trading Plan:

Baseline: Determine overall market direction using Quantum Adaptive MA. Only trade in the indicated baseline direction.

Confirmations: Validate potential entries with WavePulse and Quantum Channel alignment.

Volatility Filter: Confirm sufficient market volatility with Momentum Density before entry.

Trailing Stop Loss: Manage risk and secure profits using the dynamic ATR-based trailing stop system.

Entries & Exits: Only execute trades when signals and dashboard components unanimously align.

🖼️ Visual Examples:

Alpha Wave by DaviddTech clearly demonstrates how an intelligently integrated system provides significantly superior trading insights compared to standalone indicators, ensuring precise, disciplined, and profitable market entries and exits across all trading environments.

BTCUSD with adjustable sl,tpThis strategy is designed for swing traders who want to enter long positions on pullbacks after a short-term trend shift, while also allowing immediate short entries when conditions favor downside movement. It combines SMA crossovers, a fixed-percentage retracement entry, and adjustable risk management parameters for optimal trade execution.

Key Features:

✅ Trend Confirmation with SMA Crossover

The 10-period SMA crossing above the 25-period SMA signals a bullish trend shift.

The 10-period SMA crossing below the 25-period SMA signals a bearish trend shift.

Short trades are only taken if the price is below the 150 EMA, ensuring alignment with the broader trend.

📉 Long Pullback Entry Using Fixed Percentage Retracement

Instead of entering immediately on the SMA crossover, the strategy waits for a retracement before going long.

The pullback entry is defined as a percentage retracement from the recent high, allowing for an optimized entry price.

The retracement percentage is fully adjustable in the settings (default: 1%).

A dynamic support level is plotted on the chart to visualize the pullback entry zone.

📊 Short Entry Rules

If the SMA(10) crosses below the SMA(25) and price is below the 150 EMA, a short trade is immediately entered.

Risk Management & Exit Strategy:

🚀 Take Profit (TP) – Fully customizable profit target in points. (Default: 1000 points)

🛑 Stop Loss (SL) – Adjustable stop loss level in points. (Default: 250 points)

🔄 Break-Even (BE) – When price moves in favor by a set number of points, the stop loss is moved to break-even.

📌 Extra Exit Condition for Longs:

If the SMA(10) crosses below SMA(25) while the price is still below the EMA150, the strategy force-exits the long position to avoid reversals.

How to Use This Strategy:

Enable the strategy on your TradingView chart (recommended for stocks, forex, or indices).

Customize the settings – Adjust TP, SL, BE, and pullback percentage for your risk tolerance.

Observe the plotted retracement levels – When the price touches and bounces off the level, a long trade is triggered.

Let the strategy manage the trade – Break-even protection and take-profit logic will automatically execute.

Ideal Market Conditions:

✅ Trending Markets – The strategy works best when price follows strong trends.

✅ Stocks, Indices, or Forex – Can be applied across multiple asset classes.

✅ Medium-Term Holding Period – Suitable for swing trades lasting days to weeks.

MFI Nexus Pro [trade_lexx]📈 MFI Nexus Pro is your reliable trading assistant!

📊 What is MFI Nexus Pro ?

MFI Nexus Pro is a trading indicator that analyzes cash flows in the market. It shows where money is moving — into or out of an asset, and based on this, generates buy or sell signals.

💡 The main components of the indicator

📊 The MFI Cash Flow Index (MFI)

shows the strength of cash flow into an asset. Values above 70 indicate overbought (an early sale is possible), and values below 30 indicate oversold (an early purchase is possible).

📈 Moving Averages (MA)

The indicator uses 10 different types of moving averages to smooth the MFI line.:

- SMA: Simple moving average

- EMA: Exponential moving average

- WMA: Weighted moving average

And other more complex types (HMA, KAMA, VWMA, ALMA, TEMA, ZLEMA, DEMA)

The choice of the type of moving average affects the speed of the indicator's response to market changes.

🎯 Bollinger Bands (BB)

Bands around the moving average that widen and narrow depending on volatility. They help determine when the MFI is out of the normal range.

🔄 Divergences

Divergences show discrepancies between price and MFI:

- Bullish divergence: the price is falling and the MFI is rising — an upward reversal is possible

- Bearish divergence: the price is rising and the MFI is falling — a downward reversal is possible

🔍 Indicator signals

1️⃣ Moving average signals (MA)

Buy signal

- What happens: MFI crosses its moving average from bottom to top

- What does it look like: the green triangle labeled "MA" under the chart

- What does it mean: money begins to actively flow into the asset, price growth is possible

Sell signal

- What happens: the MFI crosses the moving average from top to bottom

- What does it look like: a red triangle with the label "MA" above the chart

- What does it mean: money starts to leave the asset, the price may fall

2️⃣ Bollinger Band Signals (BB)

Buy signal

- What's happening: The MFI crosses the lower Bollinger band from bottom to top

- What it looks like: the green triangle marked "BB"

- What it means: The MFI was too low and is now starting to recover

Sell Signal

- What's going on: MFI crosses the upper Bollinger band from top to bottom

- What it looks like: a red triangle marked "BB"

- What it means: The MFI was too high and is now starting to decline

3️⃣ Divergence Signals (Div)

Buy Signal (Bullish Divergence)

- What's going on: the price is falling more than the MFI

- What it looks like: a green triangle marked "Div"

- What it means: despite the fall in price, money is already starting to return to the asset

Sell signal (bearish divergence)

- What is happening: the price is rising more strongly than the MFI

- What does it look like: the red triangle with the label "Div"

- What does it mean: despite the price increase, money is already starting to leave the asset

🛠️ Filters to filter out false signals

1️⃣ Minimum distance between the signals

- What it does: sets the minimum number of candles between signals

- Why it is needed: prevents signals from being too frequent during strong market fluctuations

- How to set it up: Set the number from 0 and above (default: 5)

2️⃣ "Waiting for the opposite signal" mode

- What it does: waits for a signal in the opposite direction before generating a new signal

- Why you need it: it helps you not to miss important trend reversals

- How to set up: just turn the function on or off

3️⃣ Filter by MFI levels

- What it does: generates signals only when the MFI is in the specified ranges

- Why it is needed: it helps to catch the moments when the market is oversold or overbought

- How to set up:

- For buy signals: set a range for oversold (e.g. 1-30)

- For sell signals: set a range for overbought (e.g. 70-100)

4️⃣ The RSI filter

- What it does: additionally checks the RSI values to confirm the signals

- Why it is needed: adds additional confirmation from another popular indicator

- How to set up: Similar to the MFI filter, set ranges for buying and selling

🔄 Signal combination modes

1️⃣ Normal mode ("None")

- How it works: all signals (MA, BB, Div) work independently of each other

- When to use it: for general market analysis or when learning how to work with the indicator

2️⃣ "And" mode ("MA and BB and Div")

- How it works: the alarm appears only when several conditions are triggered simultaneously

- Combination options:

- MA+BB: signals from the moving average and Bollinger bands

- MA+Div: signals from the moving average and divergence

- BB+Div: signals from the Bollinger bands and divergence

- MA+BB+Div: all three signals simultaneously

- When to use: for more reliable but rare signals

3️⃣ "OR" mode ("MA or BB or Div")

- How it works: the alarm appears when any of the conditions are triggered

- When to use: for frequent signals when you don't want to miss any opportunity.

🔌 Connecting to trading strategies

The indicator can be connected to your trading strategies using 5 different channels.:

1. Channel for MA signals: connects only signals from moving averages

2. BB signal channel: connects only the signals from the Bollinger bands

3. Channel for divergence signals: connects only divergence signals

4. Channel for "And" mode: connects only combined signals

5. Channel for "OR" mode: connects signals from any source

🔔 Setting up alerts

The indicator can send alerts when alarms appear.:

- Alerts for MA: when the MFI crosses the moving average

- Alerts for BB: when the MFI crosses the Bollinger bands

- Divergence alerts: when a divergence is detected

- Combined alerts: for "AND" and "OR" modes

🎭 What does the indicator look like on the chart ?

- MFI main line: purple line

- Overbought/oversold levels: horizontal lines at levels 30 and 70

- Middle line: dotted line at level 50

- MFI Moving Average: yellow line

- Bollinger bands: green lines around the moving average

- Signals: green and red triangles with corresponding labels

📚 How to start using MFI Nexus Pro

1️⃣ Initial setup

- Add an indicator to your chart

- Select the type of moving average and the period (you can leave it as the default)

- Activate the desired signal types (MA, BB, Div)

2️⃣ Filter settings

- Set the distance between the signals to get rid of unnecessary noise

- Adjust the MFI and RSI levels depending on how volatile your asset is

- If you need more reliable signals, turn on the "Waiting for the opposite signal" mode.

3️⃣ Operation mode selection

- First, use the standard mode to see all possible signals.

- When you get comfortable, try the "And" mode for more reliable signals.

- For active trading, you can use the "OR" mode

4️⃣ Setting up Alerts

- Select the types of signals you want to be notified about

- Set up alerts for "AND" or "OR" modes if you use them

5️⃣ Verification and adaptation

- Check the operation of the indicator on historical data

- Adjust the parameters for a specific asset

- Adapt the settings to your trading style

🌟 Usage examples

For trend trading

- Use MA signals in the direction of the main trend

- Turn on the "Waiting for the opposite signal" mode

- Set stricter levels for filters

For trading in a sideways range

- Use BB signals to detect bounces from the range boundaries

- Use the MFI level filter to confirm overbought/oversold conditions

- Adjust the Bollinger bands according to the width of the range

To determine the pivot points

- Pay attention to the divergence signals

- Use the "And" mode by combining divergences with other signals

- Check the RSI filter for additional confirmation

Logarithmic Regression Channel-Trend [BigBeluga]

This indicator utilizes logarithmic regression to track price trends and identify overbought and oversold conditions within a trend. It provides traders with a dynamic channel based on logarithmic regression, offering insights into trend strength and potential reversal zones.

🔵Key Features:

Logarithmic Regression Trend Tracking: Uses log regression to model price trends and determine trend direction dynamically.

f_log_regression(src, length) =>

float sumX = 0.0

float sumY = 0.0

float sumXSqr = 0.0

float sumXY = 0.0

for i = 0 to length - 1

val = math.log(src )

per = i + 1.0

sumX += per

sumY += val

sumXSqr += per * per

sumXY += val * per

slope = (length * sumXY - sumX * sumY) / (length * sumXSqr - sumX * sumX)

average = sumY / length

intercept = average - slope * sumX / length + slope

Regression-Based Channel: Plots a log regression channel around the price to highlight overbought and oversold conditions.

Adaptive Trend Colors: The color of the regression trend adjusts dynamically based on price movement.

Trend Shift Signals: Marks trend reversals when the log regression line cross the log regression line 3 bars back.

Dashboard for Key Insights: Displays:

- The regression slope (multiplied by 100 for better scale).

- The direction of the regression channel.

- The trend status of the logarithmic regression band.

🔵Usage:

Trend Identification: Observe the regression slope and channel direction to determine bullish or bearish trends.

Overbought/Oversold Conditions: Use the channel boundaries to spot potential reversal zones when price deviates significantly.

Breakout & Continuation Signals: Price breaking outside the channel may indicate strong trend continuation or exhaustion.

Confirmation with Other Indicators: Combine with volume or momentum indicators to strengthen trend confirmation.

Customizable Display: Users can modify the lookback period, channel width, midline visibility, and color preferences.

Logarithmic Regression Channel-Trend is an essential tool for traders who want a dynamic, regression-based approach to market trends while monitoring potential price extremes.

Renz-GPT IndicatorThe Renz-GPT Indicator is a powerful, all-in-one trading tool designed to simplify decision-making and improve trade accuracy using a combination of trend, momentum, and volume analysis.

🔍 How It Works

Trend Detection:

Uses two EMAs (Exponential Moving Averages) to identify the current market trend.

A higher timeframe EMA acts as a trend filter to align trades with the larger market trend.

Momentum Confirmation:

RSI (Relative Strength Index) confirms the momentum strength.

Only takes trades when the momentum aligns with the trend.

Volume Confirmation:

Uses On-Balance Volume (OBV) to verify if volume supports the trend direction.

Signal Calculation:

Combines trend, momentum, and volume signals to create a high-probability trade setup.

Filters out weak signals to avoid false trades.

Entry, Stop Loss & Take Profit:

Displays clear LONG and SHORT markers on the chart.

Automatically calculates and displays Stop Loss and Take Profit levels based on ATR (Average True Range).

Alerts:

Sends real-time alerts when a valid buy or sell signal occurs.

Alerts include entry price, stop loss, and take profit levels.

Moving Averages By MoneyTribe21This custom indicator displays three Smoothed Moving Averages (SMAs) designed to help traders identify market trends, potential reversals, and key support/resistance levels. It is ideal for trend-following strategies, momentum trading, and confirming price direction in various timeframes.

Three Smoothed Moving Averages to track short-term, mid-term, and long-term trends:

21-Day SMA: Captures short-term price momentum and trend direction.

50-Day SMA: Represents the mid-term trend, often used as dynamic support/resistance.

200-Day SMA: The long-term trend filter, commonly watched by institutional traders.

Fully Customizable Settings

Adjust period length for each SMA to fit your strategy.

Modify line colors, thickness, and styles for better visibility.

Enable/disable specific SMAs based on preference.

Works Across All Markets

Compatible with Forex, Stocks, Commodities, Crypto, and Indices.

Supports multiple timeframes (1M, 5M, 1H, Daily, Weekly, etc.)

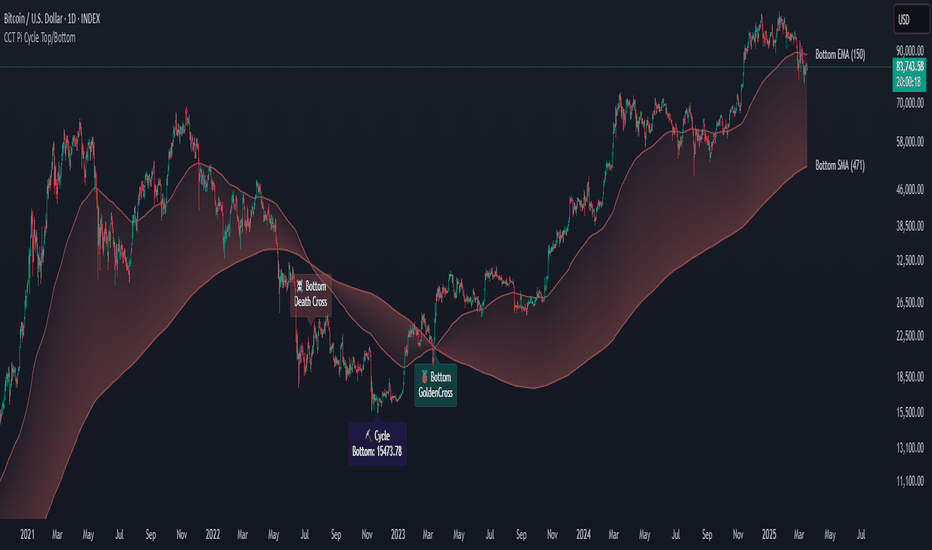

CCT Pi Cycle Top/BottomPi Cycle Top/bottom: The Ultimate Market Cycle Indicator

Introduction

The Pi Cycle Top/bottom Indicator is one of the most reliable tools for identifying Bitcoin market cycle peaks and bottoms. Its effectiveness lies in the strategic combination of moving averages that historically align with major market cycle reversals. Unlike traditional moving average crossovers, this indicator applies an advanced iterative approach to pinpoint price extremes with higher accuracy.

This version, built entirely with Pine Script™ v6, introduces unprecedented precision in detecting both the Pi Cycle Top and Pi Cycle Bottom, eliminating redundant labels, optimizing visual clarity, and ensuring the indicator adapts dynamically to evolving market conditions.

What is the Pi Cycle Theory?

The Pi Cycle Top and Pi Cycle Bottom were originally introduced based on a simple yet profound discovery: key moving average crossovers consistently align with macro market tops and bottoms.

Pi Cycle Top: The crossover of the 111-day Simple Moving Average (SMA) and the 350-day SMA multiplied by 2 has historically signaled market tops with astonishing accuracy.

Pi Cycle Bottom: The intersection of the 150-day Exponential Moving Average (EMA) and the 471-day SMA has repeatedly marked significant market bottoms.

While traditional moving average strategies often suffer from lag and false signals, the Pi Cycle Indicator enhances accuracy by applying a range-based scanning methodology, ensuring that only the most critical reversals are detected.

How This Indicator Works

Unlike basic moving average crossovers, this script introduces a unique iteration process to refine the detection of Pi Cycle points. Here’s how it works:

Detecting Crossovers:

Identifies the Golden Cross (bullish crossover) and Death Cross (bearish crossover) for both the Pi Cycle Top and Pi Cycle Bottom.

Iterating Through the Cycle:

Instead of plotting a simple crossover point, this script scans the range between each Golden and Death Cross to identify the absolute lowest price (Pi Cycle Bottom) and highest price (Pi Cycle Top) within that cycle.

Precision Labeling:

The indicator dynamically adjusts label positioning:

If the price at the crossover is below the fast moving average → the label is placed on the moving average with a downward pointer.

If the price is above the fast moving average → the label is placed below the candle with an upward pointer.

This ensures optimal visibility and prevents misleading signal placement.

Advanced Pine Script v6 Features:

Labels and moving average names are only shown on the last candle, reducing chart noise while maintaining clarity.

Offers full user customization, allowing traders to toggle:

Pi Cycle Top & Bottom visibility

Moving average labels

Crossover labels

Why This Indicator is Superior

This script is not just another moving average crossover tool—it is a market cycle tracker designed for long-term investors and analysts who seek:

✔ High-accuracy macro cycle identification

✔ Elimination of false signals using an iterative range-based scan

✔ Automatic detection of market extremes without manual adjustments

✔ Optimized visuals with smart label positioning

✔ First-of-its-kind implementation using Pine Script™ v6 capabilities

How to Use It?

Bull Market Tops:

When the Pi Cycle Top indicator flashes, consider the potential for a market cycle peak.

Historically, Bitcoin has corrected significantly after these signals.

Bear Market Bottoms:

When the Pi Cycle Bottom appears, it suggests a macro accumulation phase.

These signals have aligned perfectly with historical cycle bottoms.

Final Thoughts

The Pi Cycle Top/bottom Indicator is a must-have tool for traders, investors, and analysts looking to anticipate long-term trend reversals with precision. With its refined methodology, superior label positioning, and cutting-edge Pine Script™ v6 optimizations, this is the most reliable version ever created.

Heiken Ashi Supertrend ATR-SL StrategyThis indicator combines Heikin Ashi candle pattern analysis with Supertrend to generate high-probability trading signals with built-in risk management. It identifies potential entries and exits based on specific Heikin Ashi candlestick formations while providing automated ATR-based stop loss management.

Trading Logic:

The system generates long signals when a green Heikin Ashi candle forms with no bottom wick (indicating strong bullish momentum). Short signals appear when a red Heikin Ashi candle forms with no top wick (showing strong bearish momentum). The absence of wicks on these candles signals a high-conviction market move in the respective direction.

Exit signals are triggered when:

1. An opposite pattern forms (red candle with no top wick exits longs; green candle with no bottom wick exits shorts)

2. The ATR-based stop loss is hit

3. The break-even stop is activated and then hit

Technical Approach:

- Select Heiken Ashi Canldes on your Trading View chart. Entried are based on HA prices.

- Supertrend and ATR-based stop losses use real price data (not HA values) for trend determination

- ATR-based stop losses automatically adjust to market volatility

- Break-even functionality moves the stop to entry price once price moves a specified ATR multiple in your favor

Risk Management:

- Default starting capital: 1000 units

- Default risk per trade: 10% of equity (customizable in strategy settings)

- Hard Stop Loss: Set ATR multiplier (default: 2.0) for automatic stop placement

- Break Even: Configure ATR threshold (default: 1.0) to activate break-even stops

- Appropriate position sizing relative to equity and stop distance

Customization Options:

- Supertrend Settings:

- Enable/disable Supertrend filtering (trade only in confirmed trend direction)

- Adjust Factor (default: 3.0) to change sensitivity

- Modify ATR Period (default: 10) to adapt to different timeframes

Visual Elements:

- Green triangles for long entries, blue triangles for short entries

- X-marks for exits and stop loss hits

- Color-coded position background (green for long, blue for short)

- Clearly visible stop loss lines (red for hard stop, white for break-even)

- Comprehensive position information label with entry price and stop details

Implementation Notes:

The indicator tracks positions internally and maintains state across bars to properly manage stop levels. All calculations use confirmed bars only, with no repainting or lookahead bias. The system is designed for swing trading on timeframes from 1-hour and above, where Heikin Ashi patterns tend to be more reliable.

This indicator is best suited for traders looking to combine the pattern recognition strengths of Heikin Ashi candles with the trend-following capabilities of Supertrend, all while maintaining disciplined risk management through automated stops.

Smart MA CrossoverThe Smart MA Crossover indicator is a trend-following tool designed to help traders identify high-probability buy and sell signals based on a dynamic moving average and volume confirmation.

This indicator allows traders to customize the moving average type (SMA, EMA, HMA, WMA, VWMA, SMMA, or VWAP) while incorporating an ATR-based filter for better signal clarity.

How It Works

The script analyzes price movements in relation to a selected moving average and volume conditions to generate trend-based trade signals:

🟢 Buy Signal:

- Price is trading above the moving average for at least two bars.

- A sudden upward momentum is detected (price > open * 1.005).

- Volume is higher than the 50-period SMA of volume.

- The price was trading below the moving average three bars ago.

🔴 Sell Signal:

- Price is trading below the moving average for at least two bars.

- A sudden downward movement is detected (price < open * 0.995).

- Volume is higher than the 50-period SMA of volume.

- The price was trading above the moving average three bars ago.

- When these conditions are met, a label appears on the chart, marking the potential trade signal.

Key Features

- Customizable Moving Averages – Choose between SMA, EMA, HMA, WMA, VWMA, SMMA, or VWAP.

- Dynamic Trend Detection – Moving average color changes based on trend direction.

- Volume Confirmation – Avoid false signals by filtering trades using SMA-based volume analysis.

- ATR-Based Signal Placement – Labels are positioned dynamically based on ATR values to improve visibility.

- Background Trend Highlighting – The background changes color depending on whether price is above (green) or below (red) the moving average.

- Alerts for Buy & Sell Signals – Get real-time notifications when a trade signal is generated.

How to Use

- This indicator is best suited for trend-following strategies and works across different markets, including stocks, forex, and crypto.

- It can be used on multiple timeframes, but traders should combine it with additional analysis to refine trade decisions.

- ATR-based signal placement ensures that buy/sell labels do not clutter the chart.

Important Notes

- This indicator does not predict future price movements—it is a trend-based tool meant to assist with trade decisions.

- No financial advice – Always use risk management when trading.

- TradingView users who do not read Pine Script can still fully utilize this script thanks to clear labels and alerts.

Best MA Pair Finder (Crossover Strategy)This indicator automatically identifies the optimal pair of moving averages (MAs) for a crossover strategy using all available historical data. It offers several MA options—including SMA, EMA, and TEMA—allowing users to select the desired type in the settings. The indicator supports two strategy modes: “Long Only” and “Buy & Sell”, which can be chosen via the options.

For each MA pair combination, the indicator performs a backtest and calculates the profit factor, considering only those pairs where the total number of trades meets or exceeds the user-defined "Minimum Trades" threshold. This parameter ensures that the selected optimal pair is based on a statistically meaningful sample rather than on a limited number of trades.

The results provided by this indicator are based on historical data and backtests, which may not guarantee future performance. Users should conduct their own analysis and use proper risk management before making trading decisions.

20 Day Moving Average with Profit TargetsThis Pine Script indicator plots a 20-day simple moving average (SMA) on the chart and displays profit target labels relative to an initial buy price.

The script allows the user to input a custom buy price and calculates profit levels at 10%, 20%, 30%, and 50% above the buy price. Labels are shown on the last bar of the chart for each profit level and the buy price, with the labels offset to the right to avoid overlapping with the price action.

The labels are color-coded based on the profit levels, and the buy price label is blue.

ROC + SMI Auto Adjust

This indicator combines the Rate of Change (ROC) and the Stochastic Momentum Index (SMI) with automatically adjusted parameters for different time frames (short, medium, long). It normalizes the ROC to match the SMI levels, displays the ROC as a histogram and the SMI as lines, highlights overbought/oversold zones and includes a settings table. Ideal for analyzing momentum on different time frames.

Key Features:

Automatic Parameter Adjustment:

The script detects the current chart time frame (e.g. 1-minute, 1-hour, daily) and adjusts the parameters for the ROC and SMI accordingly.

Parameters such as ROC length, SMI length and smoothing periods are optimized for short, medium and long term time frames.

Rate of Change (ROC):

ROC measures the percentage change in price over a specified period.

The script normalizes the ROC values to match the SMI range, making it easier to compare the two indicators on the same scale.

The ROC is displayed as a histogram, where positive values are colored green and negative values are colored red.

Stochastic Momentum Index (SMI):

SMI is a momentum oscillator that identifies overbought and oversold conditions.

The script calculates the SMI and its signal line, plotting them on the chart.

Overbought and oversold levels are displayed as dotted lines for convenience.

SMI and SMI Signal Crossover:

When the main SMI crosses the signal line from below upwards, it may be a buy signal (bullish signal).

When the SMI crosses the signal line from above downwards, it may be a sell signal (bearish signal).

Configurable Inputs:

Users can use the automatically adjusted settings or manually override the parameters (e.g. ROC length, SMI length, smoothing periods).

Overbought and oversold levels for SMI are also configurable.

Parameter Table:

A table is displayed on the chart showing the current parameters (e.g. timeframe, ROC length, SMI length) for transparency and debugging.

The position of the table is configurable (e.g. top left, bottom right).

How it works:

The script first detects the chart timeframe and classifies it as short-term (e.g. 1M, 5M), medium-term (e.g. 1H, 4H) or long-term (e.g. D1, W1).

Based on the timeframe, it sets default values for the ROC and SMI parameters.

ROC and SMI are calculated and normalized so that they can be compared on the same scale.

ROC is displayed as a histogram, while SMI and its signal line are displayed as lines.

Overbought and oversold levels are displayed as horizontal lines.

Use cases:

Trend identification: ROC helps to identify the strength of the trend, while SMI indicates overbought/oversold conditions.

Momentum analysis: The combination of ROC and SMI provides insight into both price momentum and potential reversals.

Time frame flexibility: The auto-adjustment feature makes the script suitable for scalping (short-term), swing trading (medium-term) and long-term investing.

Support & Resistance + EMA + Swing SL (3 Min)### **📌 Brief Description of the Script**

This **Pine Script indicator** for TradingView displays **Support & Resistance levels, EMAs (21 & 26), and Swing High/Low-based Stop-Loss (SL) points** on a **3-minute timeframe**.

---

### **🔹 Key Features & Functionality**

1️⃣ **🟥 Support & Resistance Calculation:**

- Finds the **highest & lowest price over the last 50 candles**

- Plots **Resistance (Red) & Support (Green) levels**

2️⃣ **📈 EMA (Exponential Moving Averages):**

- **21 EMA (Blue)** and **26 EMA (Orange)** for trend direction

- Helps in identifying bullish or bearish momentum

3️⃣ **📊 Swing High & Swing Low Detection:**

- Identifies **Swing Highs (Higher than last 5 candles) as SL for Short trades**

- Identifies **Swing Lows (Lower than last 5 candles) as SL for Long trades**

- Plots these levels as **Purple (Swing High SL) & Yellow (Swing Low SL) dotted lines**

4️⃣ **📌 Labels on Swing Points:**

- **"HH SL"** is placed on Swing Highs

- **"LL SL"** is placed on Swing Lows

5️⃣ **⚡ Breakout Detection:**

- Detects if **price crosses above Resistance** (Bullish Breakout)

- Detects if **price crosses below Support** (Bearish Breakout)

- Background color changes to **Green (Bullish)** or **Red (Bearish)**

6️⃣ **🚨 Alerts for Breakouts:**

- Sends alerts when **price breaks above Resistance or below Support**

---

### **🎯 How to Use This Indicator?**

- **Trade with Trend:** Follow **EMA crossovers** and Support/Resistance levels

- **Set Stop-Loss:** Use **Swing High as SL for Shorts** & **Swing Low as SL for Longs**

- **Look for Breakouts:** Enter trades when price **crosses Resistance or Support**

This script is **ideal for scalping & intraday trading** in a **3-minute timeframe** 🚀🔥

Let me know if you need **any modifications or improvements!** 📊💹