MDTrader DashboardMDtrader Script that looks at moving averages, weekly and daily levels to help guide the trading day and establish a bias

Скользящие средние

Global Foreigners SMA, WMA IndicatorThis Indicator is a custom technical analysis tool designed to overlay multiple moving averages on a price chart, helping traders analyze price trends and potential trading opportunities.

It features both a Simple Moving Average (SMA) and Weighted Moving Averages (WMAs) with different period settings.

Key Features:

1. SMA and WMA Calculations:

- SMA 1: A simple moving average (SMA) calculated over a user-defined period (default: 1).

- WMA 1 - WMA 5: Five weighted moving averages (WMA) with different periods (5, 10, 20, 30, 40). WMAs give more importance to recent price movements, helping to identify short-term trends.

2. Customizable Periods:

- The indicator allows users to adjust the lookback period for each moving average via input settings.

3. Color-Coded Moving Averages:

- Each moving average is assigned a unique color for easy differentiation:

- SMA 1 → Black

- WMA 1 (5-period) → Blue

- WMA 2 (10-period) → Peach

- WMA 3 (20-period) → Orange

- WMA 4 (30-period) → Lavender

- WMA 5 (40-period) → Purple

4. Line Thickness:

- Each moving average is plotted with a line width of 2, making them clearly visible on the chart.

How This Indicator is Used:

Trend Analysis:

The alignment of the WMA sequence (e.g., WMA 5 > WMA 4 > WMA 3 > WMA 2 > WMA 1) can

indicate a bullish trend.

The opposite alignment suggests a bearish trend.

Dynamic Support & Resistance:

Shorter-period WMAs (5 & 10) react faster to price changes and can be used as dynamic

support or resistance levels for short-term trades.

Longer-period WMAs (20, 30, 40) smooth out price fluctuations and are useful for detecting

long-term trends.

Signal Confirmation:

The SMA 1 acts as a quick price reference, and traders can look for crossovers between the

WMA lines to confirm trend changes.

Who Can Use This Indicator?

Scalpers & Day Traders:

The faster WMAs (5 & 10) can be used to catch quick price reversals.

Swing Traders & Position Traders:

The combination of short-term and long-term moving averages helps identify key trend

shifts.

Algorithmic Traders:

Can be used alongside other indicators for automated signal generation.

This indicator is not a buy/sell signal generator but rather a trend-following tool that helps traders visually interpret market movements using moving averages. It works well when combined with momentum indicators (e.g., MACD, RSI) to confirm entry and exit points.

Crypto MA Cross StrategyBuy with MA crossover. Take profit when price reaches your percentage target. Stops at defined percentage below the buy price

SMA 12, 36, 200 with Signals and AlertsFeatures:

✅ Simple Moving Averages:

SMA 12 (short-term)

SMA 36 (mid-term)

SMA 200 (long-term trend filter)

✅ Buy & Sell Signals:

Buy: When SMA 12 crosses above SMA 36

Sell: When SMA 12 crosses below SMA 36

✅ Built-in Alerts:

Receive real-time alerts when a signal is triggered.

🧠 Strategy Overview – Multi-Timeframe Trading

This script is designed to be used with multi-timeframe analysis:

1H Chart – Trend Direction

If the price is above the SMA 200 on the 1-hour chart → look for Long opportunities.

If the price is below the SMA 200 on the 1-hour chart → look for Short opportunities.

5-Min Chart – Entry Timing

Once the higher-timeframe trend is clear, switch to the 5-minute chart.

Use SMA 12 and SMA 36 crossovers to time your entry in the direction of the main trend.

This approach helps filter out false signals and improves overall trade accuracy.

5-Min EMA (5 & 20) + RSI + MACD StrategyThis strategy uses a combination of Exponential Moving Averages (EMA), Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) to identify potential buy (bullish) and sell (bearish) signals on a 5-minute intraday chart_______________By Million mantra Telugu

MA CloudsMA Clouds – Adaptive Moving Average Visualization (with Bollinger bands)

The MA Clouds indicator is designed to help traders visualize multiple moving averages simultaneously, providing a dynamic view of trend direction, momentum, and potential support/resistance zones. This tool overlays Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) in an easy-to-read cloud format, allowing traders to interpret market structure at a glance.

Key Features:

✅ Customizable Moving Averages – Adjust SMA and EMA lengths to suit your strategy.

✅ Cloud-Based Visualization – Color-coded clouds between different moving averages highlight areas of potential trend shifts.

✅ Toggle Price Lines – Option to enable or disable individual price lines for a cleaner chart.

✅ Bollinger Bands Integration – Adds upper and lower bands for additional confluence in volatility analysis.

✅ Quick Trend Identification – Helps traders gauge short-term and long-term trend strength.

✅ Preset View Modes – Toggle between a simplified 5-10 SMA/EMA setup or a full multi-timeframe cloud setup with one click.

This indicator is ideal for traders looking to combine trend-following strategies with dynamic support/resistance insights. Whether you're scalping intraday moves or managing longer-term swing trades, MA Clouds provides an efficient way to keep market structure in focus.

Adaptive ROC-Based Trading Strategy

Developed a quantitative trading strategy leveraging Rate of Change (ROC) and RSI for momentum-based entries.

Implements adaptive ROC thresholds to filter noise and enhance signal accuracy.

Dynamically adjusts position entries using a hybrid mean-reversion and trend-following approach.

Integrates Cobra Metrics for performance visualization, enabling real-time strategy evaluation.

Optimized for efficient execution and minimal computational overhead in TradingView.

Let me know if you want to highlight specific improvements or add more detail!

Ichimoku Cloud Auto TF🧠 Timeframe Breakdown for Ichimoku Cloud Auto TF

Each timeframe in this indicator is carefully calibrated to reflect meaningful Ichimoku behavior relative to its scale. Here's how each one is structured and what it's best used for:

⏱️ 1 Minute (1m)

Tenkan / Kijun / Span B: 5 / 15 / 45

Use: Scalping fast price action.

Logic: Quick reaction to short-term momentum. Best for highly active traders or bots.

⏱️ 2 Minutes (2m)

Tenkan / Kijun / Span B: 6 / 18 / 54

Use: Slightly smoother than 1m, still ideal for scalping with a little more stability.

⏱️ 5 Minutes (5m)

Tenkan / Kijun / Span B: 8 / 24 / 72

Use: Intraday setups, quick trend capture.

Logic: Balanced between reactivity and noise reduction.

⏱️ 15 Minutes (15m)

Tenkan / Kijun / Span B: 9 / 27 / 81

Use: Short-term swing and intraday entries with higher reliability.

⏱️ 30 Minutes (30m)

Tenkan / Kijun / Span B: 10 / 30 / 90

Use: Intra-swing entries or confirmation of 5m/15m signals.

🕐 1 Hour (1H)

Tenkan / Kijun / Span B: 12 / 36 / 108

Use: Ideal for swing trading setups.

Logic: Anchored to Daily reference (1H × 24 ≈ 1D).

🕐 2 Hours (2H)

Tenkan / Kijun / Span B: 14 / 42 / 126

Use: High-precision swing setups with better context.

🕒 3 Hours (3H)

Tenkan / Kijun / Span B: 15 / 45 / 135

Use: Great compromise between short and mid-term vision.

🕓 4 Hours (4H)

Tenkan / Kijun / Span B: 18 / 52 / 156

Use: Position traders & intraday swing confirmation.

Logic: Designed to echo the structure of 1D Ichimoku but on smaller scale.

📅 1 Day (1D)

Tenkan / Kijun / Span B: 9 / 26 / 52

Use: Classic Ichimoku settings.

Logic: Standard used globally for technical analysis. Suitable for swing and position trading.

📆 1 Week (1W)

Tenkan / Kijun / Span B: 12 / 24 / 120

Use: Long-term position trading & institutional swing confirmation.

Logic: Expanded ratios for broader perspective and noise filtering.

🗓️ 1 Month (1M)

Tenkan / Kijun / Span B: 6 / 12 / 24

Use: Macro-level trend visualization and investment planning.

Logic: Condensed but stable structure to handle longer data cycles.

📌 Summary

This indicator adapts Ichimoku settings dynamically to your chart's timeframe, maintaining logical ratios between Tenkan, Kijun, and Span B. This ensures each timeframe remains responsive yet meaningful for its respective market context.

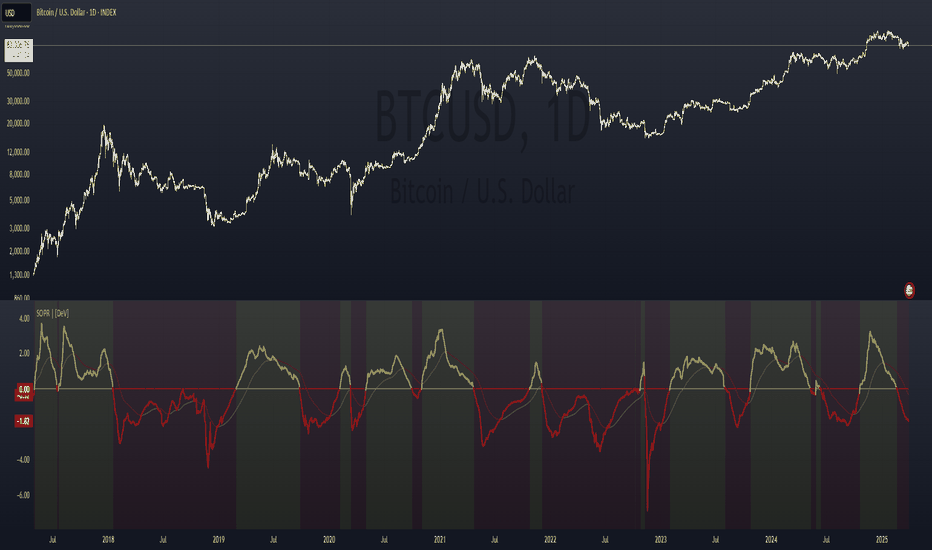

STH Unrealized Profit/Loss Ratio (STH-NUPL) | [DeV]STH-NUPL

The Short-Term Holder Net Unrealized Profit/Loss Ratio (STH-NUPL) is an analytical tool designed to approximate the unrealized profit or loss of Bitcoin’s short-term holders (STHs)—typically those holding coins for less than 155 days—within the constraints of TradingView’s price-based environment. Drawing inspiration from the canonical STH-NUPL metric, which assesses the difference between the market value and realized value of STH-held coins, this indicator adapts the concept into a normalized ratio using Bitcoin’s price data as a proxy. It offers a window into the sentiment and behavior of short-term market participants, who are often more sensitive to price fluctuations than long-term holders.

In its raw form, STH-NUPL oscillates around a break-even threshold of 0, where positive values indicate aggregate unrealized profits for STHs (market value exceeds realized value), and negative values suggest losses. This inflection point frequently acts as a key level: in bear markets, it can signal capitulation as STHs sell at break-even or below, while in bull markets, it may reflect reluctance to realize losses, providing support. The indicator enhances this metric with smoothing, a moving average overlay, and sophisticated visualization options, delivering a statistically informed perspective on short-term holder dynamics tailored for institutional-grade analysis.

STH-NUPL Settings -

Lookback Length (Default: 150 days): Defines the SMA period for estimating realized value. This 150-day window aligns with traditional STH definitions (e.g., <155 days), capturing a broad yet relevant historical cost basis for short-term holders, ideal for assessing cyclical behavior.

Smoothing Period (Default: 5 days): Applies an EMA to the raw STH-NUPL ratio, with a short default period to maintain responsiveness to recent price shifts while filtering out daily volatility. This setting is particularly suited for tactical analysis.

Moving Average Settings -

MA Lookback Length (Default: 90 days): Sets the period for the STH-NUPL’s moving average, offering a medium-term trend signal that contrasts with the 150-day lookback, enabling detection of momentum shifts within broader market phases.

MA Type (Default: EMA): Provides six moving average types, from the straightforward SMA to the volume-sensitive VWMA. The default EMA balances smoothness and reactivity, while options like HMA or VWMA cater to specialized needs, such as emphasizing recent action or volume trends.

Display Settings -

Show Moving Average (Default: True): Toggles the visibility of the STH-NUPL MA plot, allowing users to focus solely on the smoothed ratio when desired.

Show Background Colors (Default: True): Activates dynamic background shading to visually reinforce market regimes.

Background Color Source (Default: STH-NUPL): Enables users to tie the background to either the STH-NUPL’s midline (reflecting sthNupl > 0) or the MA’s trend direction (maNupl > maNupl ), aligning the visual context with the chosen analytical focus.

Analytical Applications -

Bear Market Capitulation: When the smoothed STH-NUPL approaches or falls below zero, it often signals loss realization among STHs, a precursor to capitulation in downtrends. A declining MA crossing zero can confirm this selling pressure.

Bull Market Support: Positive STH-NUPL values with a rising MA indicate STHs are in profit and reluctant to sell at a loss, forming support zones in uptrends as sell pressure wanes.

Sentiment Extremes: Significant deviations above or below zero highlight over-optimism or despair among STHs, offering contrarian opportunities when paired with price action or other on-chain metrics.

**Limitations**

As a TradingView-based approximation, this indicator uses price data (close) rather than true on-chain STH supply and realized price, which are available through providers like Glassnode. The 150-day SMA for realized value simplifies the cost basis, potentially underrepresenting the diversity of STH transactions. Despite this, the smoothed ratio and moving average overlay provide a practical proxy for tracking STH sentiment within TradingView’s ecosystem.

EMA Momentum Projection# EMA Momentum Projection 20 50 200

## Overview

Visualizes the relative strength of three EMAs (20, 50, 200) through histogram projections. Measures momentum direction and intensity using slope-based calculations.

## Key Features

- Multi-timeframe EMA comparison

- Customizable projection horizon

- Non-repainting calculations

- Clear histogram visualization

## Parameters

- `Projection Bars`: Forward-looking momentum estimate (1-10)

- `Slope Period`: Historical window for slope calculation (2-20)

## Usage

1. Apply to any market/timeframe

2. Compare histogram heights:

- Green (20EMA): Short-term momentum

- Blue (50EMA): Medium-term force

- Red (200EMA): Long-term bias

3. Look for alignment between timeframes

## Limitations

- Works best with trending instruments

- Requires confirmation with price action

- Not a standalone trading system

## Educational Purpose

Designed to help identify:

- Momentum divergences

- Trend acceleration/deceleration

- Relative strength between time horizons

> Combine with volume analysis and support/resistance levels for best results

*This tool does not predict future prices - it estimates momentum based on historical slope calculations.

EMA 20/50/200 FIIlEMA Trend Zone Indicator

Visualize multi-timeframe momentum with dynamic color-coded EMAs

Core Functionality

This indicator plots three Exponential Moving Averages (20, 50, 200 periods) with:

Trend-responsive colors: Each EMA changes color based on its direction

Interactive zones: Two fill areas between EMAs reflecting market alignment

Visual cross alerts: Color shifts highlight potential Golden/Death Cross formations

Key Components

EMA 20: Short-term momentum (Green/Rose)

EMA 50: Medium-term trend (Blue/Orange)

EMA 200: Long-term bias (Purple/Red)

20-50 Zone: Neon Green/Red/Yellow fills showing alignment

50-200 Zone: Blue/Red/Yellow fills indicating trend hierarchy

Practical Applications

Identify confluence between timeframes

Spot early trend reversal signals

Filter false breakouts using zone colors

Confirm momentum shifts across horizons

Usage Guidelines

Apply to preferred chart (works across all markets)

Combine with:

Price action patterns

Volume indicators

Support/resistance levels

Watch for:

Sustained zone color changes

EMA crosses with matching fills

Divergence between zones

Parameters & Customization

Default EMA periods: 20/50/200

Adjustable colors via Style tab

Transparency controls for zones

Limitations

Works best in trending markets

Requires confirmation from price action

Not optimized for sideways conditions

Development Notes

Built using Pine Script v5

No repainted calculations

Multiple EMA Crossover IndicatorMultiple EMA Crossover

Green Background when:

a) EMA50 > EMA100 plus

b) Price > EMA50

Adaptive Trend NavigatorThe Adaptive Trend Navigator is a dynamic, visually striking indicator tailored for medium-term trend analysis on daily charts. With a volatility-adjusted EMA base and adaptive smoothing, it shifts seamlessly with market conditions—reacting swiftly in strong trends and smoothing noise in consolidation. Its standout feature is a bold, neon-glowing trend line that lights up your chart with vibrant precision. Key highlights include:

- **Adaptive Base**: Blends 50 and 100-period EMAs using ATR for a balance of speed and stability.

- **Dynamic Smoothing**: Adjusts from 10 to 30 periods via ADX (or toggle to fixed), delivering a sleek, EMA-like curve.

- **Trend Detection**: Locks in direction with EMA slopes, ADX strength (threshold 20), and a 5-bar persistence filter for reliable signals.

- **Neon Visuals**: A thicker, brighter trend line—blazing green for uptrends, fiery red for downtrends, and glowing orange in transition—paired with teal/fuchsia Bollinger clouds and color-coded candles.

- **Signals**: Green buy arrows for entries, red sell and divergence arrows for tops, all with matching alerts.

Ideal for swing traders and investors targeting 1-3 month moves in assets like BTC/USDT, this indicator fuses adaptive functionality with a luminous, eye-catching design that’s as bold as it is effective.

Multi-Timeframe EMAsMulti Timeframe EMA's

The 'Multi-Timeframe EMA Band Comparison' indicator is a tool designed to analyze trend direction across multiple timeframes using Exponential Moving Averages. it calculates the 50, 100, and 200 period EMAs for fiver user defined timeframes and compares their relationships to provide a visual snapshot of bullish or bearish momentum.

How it Works:

EMA Calculations: For each selected timeframe, the indicator computes the 50, 100, and 200 period EMAs based on the closing price.

Band Comparisons: Three key relationships are evaluated:

50 EMA vs 100 EMA

100 EMA vs 200 EMA

50 EMA vs 200 EMA

Scoring System: Each comparison is assigned a score:

🟢 (Green Circle): The shorter EMA is above the longer EMA, signaling bullish momentum.

🔴 (Red Circle): The shorter EMA is below the longer EMA, signaling bearish momentum.

⚪️ (White Circle): The EMAs are equal or data is unavailable (rare).

Average Score:

An overall average score is calculated across all 15 comparisons ranging from 1 to -1, displayed with two decimal places and color coded.

Customization:

This indicator is fully customizable from the timeframe setting to the color of the table. The only specific part that is not changeable is the EMA bands.

EMA Supertrend StrategyAERVA EMA Supertrend Strategy

Original TradingView Script for Trend-following Strategy with Buy/Sell Signals

This strategy uses a combination of Exponential Moving Averages (EMA), Supertrend, and Fibonacci to identify potential Buy and Sell signals. The strategy focuses on detecting price action with two consecutive green candles crossing above the 200 EMA for a buy signal and two consecutive red candles crossing below the 200 EMA for a sell signal.

Key Components:

50 EMA and 200 EMA: Used to identify the trend and signal potential reversals or continuations.

Supertrend: Helps visualize the trend direction and smooths out price movements.

Fibonacci: Adds an additional layer of confluence for trade entries.

Buy Condition: A buy signal is triggered when two consecutive green candles cross above the 200 EMA.

Sell Condition: A sell signal is triggered when two consecutive red candles cross below the 200 EMA.

Features:

Buy/Sell Signals: Clear visual cues on the chart, with arrows and labels marking the entry points.

Supertrend: Displays green/red trends to help confirm the overall market direction.

Fibonacci: Plotting Fibonacci levels to support your decision-making for potential trade setups.

Risk Management & Backtesting: This script supports backtesting within the TradingView environment, and the strategy includes realistic commission and slippage parameters to reflect more accurate trade results.

The script is designed for traders who want a clear and systematic approach to identifying potential trend-following trade opportunities using a combination of classic technical indicators and price action.

Hashtags:

#AERVA #EMA #Supertrend #TradingStrategy #TechnicalAnalysis #TrendFollowing #BuyAndSellSignals #StockTrading #CryptoTrading #ForexTrading #TradingView #Backtesting #MarketTrends #Fibonacci #TechnicalIndicators #PriceAction #SwingTrading #DayTrading #TradingSystem #CustomStrategy #PineScript

Spent Output Profit Ratio (SOPR) Z-Score | [DeV]SOPR Z-Score

The Spent Output Profit Ratio (SOPR) is an advanced on-chain metric designed to provide deep insights into Bitcoin market dynamics by measuring the ratio between the combined USD value of all Bitcoin outputs spent on a given day and their combined USD value at the time of creation (typically, their purchase price). As a member of the Realized Profit/Loss family of metrics, SOPR offers a window into aggregate seller behavior, effectively representing the USD amount received by sellers divided by the USD amount they originally paid. This indicator enhances this metric by normalizing it into a Z-Score, enabling a statistically robust analysis of market sentiment relative to historical trends, augmented by a suite of customizable features for precision and visualization.

SOPR Settings -

Lookback Length (Default: 150 days): Determines the historical window for calculating the Z-Score’s mean and standard deviation. A longer lookback captures broader market cycles, providing a stable baseline for identifying extreme deviations, which is particularly valuable for long-term strategic analysis.

Smoothing Period (Default: 100 days): Applies an EMA to the raw SOPR, balancing responsiveness to recent changes with noise reduction. This extended smoothing period ensures the indicator focuses on sustained shifts in seller behavior, ideal for institutional-grade trend analysis.

Moving Average Settings -

MA Lookback Length (Default: 90 days): Sets the period for the Z-Score’s moving average, offering a shorter-term trend signal relative to the 150-day Z-Score lookback. This contrast enhances the ability to detect momentum shifts within the broader context.

MA Type (Default: EMA): Provides six moving average types, from the simple SMA to the volume-weighted VWMA. The default EMA strikes an optimal balance between smoothness and responsiveness, while alternatives like HMA (Hull) or VWMA (volume-weighted) allow for specialized applications, such as emphasizing recent price action or incorporating volume dynamics.

Display Settings -

Show Moving Average (Default: True): Toggles the visibility of the Z-Score MA plot, enabling users to focus solely on the raw Z-Score when preferred.

Show Background Colors (Default: True): Activates dynamic background shading, enhancing visual interpretation of market regimes.

Background Color Source (Default: SOPR): Allows users to tie the background color to either the SOPR Z-Score’s midline (reflecting adjustedZScore > 0) or the MA’s trend direction (zScoreMA > zScoreMA ). This dual-source option provides flexibility to align the visual context with the primary analytical focus.

Analytical Applications -

Bear Market Resistance: When the Z-Score approaches or exceeds zero (raw SOPR near 1), it often signals resistance as sellers rush to exit at break-even, a pattern historically observed during downtrends. A rising Z-Score MA crossing zero can confirm this pressure.

Bull Market Support: Conversely, a Z-Score dropping below zero in uptrends indicates reluctance to sell at a loss, forming support as sell pressure diminishes. The MA’s bullish coloring reinforces confirmation of renewed buying interest.

Extreme Deviations: Values significantly above or below zero highlight overbought or oversold conditions, respectively, offering opportunities for contrarian positioning when paired with other on-chain or price-based metrics.

111D SMA / (350D SMA * 2)Indicator: Pi Cycle Ratio

This custom technical indicator calculates a ratio between two moving averages that are used for the PI Cycle Top indicator. The PI Cycle Top indicator triggers when the 111-day simple moving average (111D SMA) crosses up with the 350-day simple moving average (350D SMA *2).

The line value is ratio is calculated as:

Line Value = 111DSMA / (350D SMA × 2)

When the 111D SMA crosses with the 350D SMA triggering the PI Cycle Top, the value of the ratio between the two lines is 1.

This visualizes the ratio between the two moving averages into a single line. This indicator can be used for technical analysis for historical and future moves.

SMA Crossover + MACD Zero Filter by AaronEscaThis indicator combines Simple Moving Average crossovers with a MACD zero-line filter to provide reliable buy/sell signals with momentum confirmation.

Toggle between:

20/50 SMA crossover – classic trend confirmation

9/20 SMA crossover – early reversal signals

Includes:

Visual fill between SMAs

MACD filter to confirm momentum

Instant BUY/SELL labels

Alerts for bullish and bearish entries

Created by AaronEsca to help traders reduce noise and act with confidence. Great for swing traders and intraday setups on the 15m–4H timeframes.

OG EMA+VWAPDescription:

The OG EMA Stack + VWAP + Auto Fibonacci Pivots is a powerful trend-following and confluence-based trading tool. It combines 6 key exponential moving averages (8, 21, 50, 100, 200, 400), VWAP, and automatic Fibonacci pivot zones to help traders identify dynamic support/resistance levels, trend strength, and high-probability trade zones.

How it works:

EMAs are color-coded to show bullish/bearish stacking.

VWAP serves as an intraday mean reversion benchmark.

Fibonacci Pivots are automatically plotted based on recent swing highs/lows to reveal key retracement levels.

Best for:

Identifying trend strength and potential reversals.

Spotting confluences of EMAs, VWAP, and Fibonacci levels for sniper entries.

Scalping, swing trading, and intraday setups.

Tip: Use this on clean charts to spot when price bounces between stacked EMAs and VWAP with pivot zone rejections.

ORB Strategy with VWAP and 21 EMA Confluencesorta works just gotta filter out bad signals fr if ur good at daily bias this is a good orb indictor

20EMA📈 20 EMA Multi-Period Indicator

This indicator displays 20 Exponential Moving Averages (EMA) with customizable periods ranging from 10 to 200. It helps visualize market dynamics by overlaying multiple EMAs on the price chart.

🔥 Features:

✅ Fully customizable 20 EMAs (period & price source)

✅ Ideal for identifying short, medium, and long-term trends

✅ Suitable for scalping, day trading, and swing trading

✅ Works as an overlay directly on the price chart

⚙️ Customizable Settings:

EMA Periods: Adjust each EMA length to match your strategy

Price Source: Choose between close, open, high, low, etc.

💡 How to Use:

A strong trend is confirmed when EMAs are aligned in one direction

Crossovers between EMAs may indicate trend reversals

EMAs can act as dynamic support and resistance levels

Add this indicator to your trading toolkit to analyze trends and optimize your trade entries and exits! 🚀📊

Trend V2 (2025 Colorized) /w filterSame trend candle logic from before, but with a linear regression slope filter. The idea is going long when both are green and short when both are red. Simple and seems to be pretty effective.