Triangular Hull Moving Average [BigBeluga X PineIndicators]This strategy is based on the original Triangular Hull Moving Average (THMA) + Volatility indicator by BigBeluga. Full credit for the concept and design goes to BigBeluga.

The strategy blends smoothed trend-following logic using a Triangular Hull Moving Average with dynamic volatility overlays, providing actionable trade signals with responsive visual feedback. It's designed for traders who want a non-lagging trend filter while also monitoring market volatility in real time.

How the Strategy Works

1. Triangular Hull Moving Average (THMA) Core

At its core, the strategy uses a Triangular Hull Moving Average (THMA) — a variation of the traditional Hull Moving Average with triple-smoothing logic:

It combines multiple weighted moving averages (WMAs) to create a faster and smoother trend line.

This reduces lag without compromising trend accuracy.

The THMA reacts more responsively to price movements than classic MAs.

THMA Formula:

thma(_src, _length) =>

ta.wma(ta.wma(_src,_length / 3) * 3 - ta.wma(_src, _length / 2) - ta.wma(_src, _length), _length)

This logic filters out short-term noise while still being sensitive to genuine trend shifts.

2. Volatility-Enhanced Candle Plotting

An optional volatility mode overlays the chart with custom candles that incorporate volatility bands:

Wicks expand and contract dynamically based on market volatility.

The volatility value is computed using a HMA of high-low range over a user-defined length.

The candle bodies reflect THMA values, while the wicks reflect the current volatility spread.

This feature allows traders to visually gauge the strength of price moves and anticipate possible breakouts or slowdowns.

3. Trend Reversal Signal Detection

The strategy identifies trend reversals when the THMA line crosses over/under its own past value:

A bullish signal is triggered when THMA crosses above its value from two bars ago.

A bearish signal is triggered when THMA crosses below its value from two bars ago.

These shifts are marked on the chart with triangle-shaped signals for clear visibility.

This logic helps detect momentum shifts early and enables reactive trade entries.

Trade Entry & Exit Logic

Trade Modes Supported

Users can choose between:

Only Long – Enters long trades only.

Only Short – Enters short trades only.

Long & Short – Enables both directions.

Entry Conditions

Long Entry:

Triggered when a bullish crossover is detected.

Active only if the strategy mode allows long trades.

Short Entry:

Triggered when a bearish crossover is detected.

Active only if the strategy mode allows short trades.

Exit Conditions

In Only Long mode, the strategy closes long positions when a bearish signal appears.

In Only Short mode, the strategy closes short positions when a bullish signal appears.

In Long & Short mode, the strategy does not auto-close positions — instead, it opens new positions on each confirmed signal.

Dashboard Visualization

In the bottom-right corner of the chart, a live dashboard displays:

The current trend direction (🢁 for bullish, 🢃 for bearish).

The current volatility level as a percentage.

This helps traders quickly assess market status and adjust their decisions accordingly.

Customization Options

THMA Length: Adjust how smooth or reactive the trend detection should be.

Volatility Toggle & Length: Enable or disable volatility visualization and set sensitivity.

Color Settings: Choose colors for up/down trend visualization.

Trade Direction Mode: Limit the strategy to long, short, or both types of trades.

Use Cases & Strategy Strengths

1. Trend Following

Use the THMA-based candles and triangle signals to enter with momentum. The indicator adapts quickly, reducing lag and improving trade timing.

2. Volatility Monitoring

Visualize the strength of the trend with volatility wicks. Use expanding bands to confirm breakouts and contracting ones to detect weakening moves.

3. Signal Confirmation

Combine this tool with other indicators or use the trend shift triangles as confirmations for manual entries.

Conclusion

The THMA + Volatility Strategy is a non-repainting trend-following system that integrates:

Triangular Hull MA for advanced trend detection.

Real-time volatility visualization.

Clear entry signals based on trend reversals.

Configurable trade direction settings.

It is ideal for traders who:

Prefer smoothed price analysis.

Want to follow trends with precision.

Value visual volatility feedback for breakout detection.

Full credit for the original concept and indicator goes to BigBeluga.

Скользящие средние

Litecoin Trailing-Stop StrategyAltcoins Trailing-Stop Strategy

This strategy is based on a momentum breakout approach using PKAMA (Powered Kaufman Adaptive Moving Average) as a trend filter, and a delayed trailing stop mechanism to manage risk effectively.

It has been designed and fine-tuned Altcoins, which historically shows consistent volatility patterns and clean trend structures, especially on intraday timeframes like 15m and 30m.

Strategy Logic:

Entry Conditions:

Long when PKAMA indicates an upward move

Short when PKAMA detects a downward trend

Minimum spacing of 30 bars between trades to avoid overtrading

Trailing Stop:

Activated only after a customizable delay (delayBars)

User can set trailing stop % and delay independently

Helps avoid premature exits due to short-term volatility

Customizable Parameters:

This strategy uses a custom implementation of PKAMA (Powered Kaufman Adaptive Moving Average), inspired by the work of alexgrover

PKAMA is a volatility-aware moving average that adjusts dynamically to market conditions, making it ideal for altcoins where trend strength and direction change frequently.

This script is for educational and experimental purposes only. It is not financial advice. Please test thoroughly before using it in live conditions, and always adapt parameters to your specific asset and time frame.

Feedback is welcome! Feel free to clone and adapt it for your own trading style.

Four MAs with Bands Pack by Rising Falcon# **Four MAs with Bands Pack by Rising Falcon**

## **Overview**

The **Four MAs with Bands Pack** is a dynamic multi-moving average indicator designed to enhance trend identification, momentum analysis, and volatility assessment. It allows traders to configure and visualize up to four different moving averages (MAs) with an optional **higher timeframe Hull MA (HMA)** for advanced trend confirmation. The indicator also incorporates **band structures** around each MA, providing additional insights into price volatility, breakout zones, and trend strength.

---

## **Fundamental Aspects**

Moving Averages (MAs) are a foundational tool in technical analysis, widely used to **smooth out price fluctuations** and identify directional bias over time. This indicator leverages four MAs of varying lengths to **capture different time horizons** of market trends, making it useful for:

- **Short-Term Analysis (Scalping):** Fast MAs (e.g., 20, 50) respond quickly to price action, allowing traders to catch early trend shifts.

- **Mid-Term Analysis (Swing Trading):** Medium-length MAs (e.g., 100) help validate trend continuation.

- **Long-Term Analysis (Position Trading):** Slow MAs (e.g., 200) provide macro trend direction and filter noise from short-term fluctuations.

By **color-coding** the MAs based on trend direction and incorporating a **band system**, the indicator helps traders identify price momentum shifts, consolidation zones, and potential breakout opportunities.

---

## **Technical Aspects**

### **1. Configurable Moving Averages**

Each of the four MAs can be customized using three calculation methods:

- **SMA (Simple Moving Average):** A traditional average of past prices, best for stable trend confirmation.

- **EMA (Exponential Moving Average):** Gives more weight to recent price action, making it more reactive to new trends.

- **WMA (Weighted Moving Average):** Assigns greater importance to more recent data, reducing lag while maintaining smoothness.

#### **Formulae:**

1. **SMA:**

\

2. **EMA:**

\

where \( k = \frac{2}{N+1} \)

3. **WMA:**

\

where \( W_i \) is the weight assigned to each period.

Each moving average has an optional **higher timeframe setting**, allowing traders to plot an MA from a larger timeframe on their current chart for **multi-timeframe analysis (MTA)**. This is useful for confirming trends and filtering noise from lower timeframes.

---

### **2. Dynamic Bands & Volatility Visualization**

Each moving average has an associated band, defined by:

- **Upper Band:** The MA value at the current bar.

- **Lower Band:** The MA value from two bars ago (**lagging component** for trend assessment).

- **Color Coding:**

- **Green:** Uptrend (price above the moving average).

- **Red:** Downtrend (price below the moving average).

- **Orange:** Neutral (no strong trend bias).

The band thickness and transparency are customizable, helping traders **visually assess market conditions**:

- **Expanding Bands:** Increased price volatility (potential breakout).

- **Contracting Bands:** Reduced volatility (possible consolidation).

Mathematically, the **band region is defined by**:

\

This concept is similar to **Keltner Channels** or **Bollinger Bands**, but instead of standard deviations, it uses historical MA differences to capture trend momentum.

---

### **3. Trend Alerts & Crossover Signals**

To assist traders in making timely decisions, the indicator generates alerts when **fast MAs cross slow MAs**:

- **Bullish Crossover (Uptrend Confirmation):**

\

- **Bearish Crossover (Downtrend Confirmation):**

\

- These alerts can be used to set up **automated notifications** for trade entries/exits.

---

## **How to Use This Indicator**

### **Scalping Strategy**

1. Use **shorter length MAs (20, 50)** with **higher timeframe Hull MA** enabled.

2. Look for **bullish crossovers** of fast MAs over slow MAs.

3. Ensure the band is **expanding** before entering a trade.

4. Exit when the opposite crossover occurs or when bands **contract**.

### **Swing Trading Strategy**

1. Use a combination of **medium and long MAs (50, 100, 200)** for trend confirmation.

2. Look for **price pullbacks** into the bands before **trend continuation**.

3. Set alerts for **crossovers** to validate trend direction.

### **Trend Reversal Strategy**

1. Look for **bearish crossovers** near resistance levels for short trades.

2. Wait for **bullish crossovers** at support levels for long trades.

3. Confirm with **higher timeframe MA direction** to reduce false signals.

---

## **Key Benefits**

✅ **Versatile:** Works for scalping, swing trading, and trend following.

✅ **Multi-Timeframe Support:** View higher timeframe MAs for broader trend validation.

✅ **Customizable:** Adjust MA type, length, color coding, and band visibility.

✅ **Alerts:** Automatic notifications for trend shifts and crossovers.

✅ **Clear Visualization:** Helps traders identify breakout zones, volatility spikes, and reversals.

---

## **Final Thoughts**

The **Four MAs with Bands Pack by Rising Falcon** is an advanced yet intuitive tool for traders looking to enhance their trend-following strategies. By combining **multiple moving averages, band structures, and trend color coding**, it provides a comprehensive view of price action, helping traders make **informed trading decisions** with greater confidence.

Hypersonic MAIN Intersection StrategyStrategy that shows the intersection point of two Items of Interest. Backtesting showed the best was Candle (close) & EMA 9.

1. I added 2 auxiliary EMA's that you can view or hide because I know some people like to see the EMA 200.

2. You select the First and Second Item of Interest and it'll plot it in the background. First EMA and Second EMA correspond to whether you select them or not. The BWMA stuff is near the bottom. And in the middle is how you can show/hide the data table in the top-right. If you choose "candle" then it'll use the close of the candle for plotting.

3. you can show/hide different lines in the Style section.

4. on the Style tab of Settings, you can turn off the whole table as well as the Trades, just the signal of the trade, or just the quantity of the trade.

3 EMAs with Price Action by Sap KarCombines three EMAs with Price Action. Price action visible as GREEN and RED ARROWS below and above bars.

Buy when bars start forming above 9,21 emas GREEN arrows starts forming below bars.

Sell when bars start forming below 9,21 emas RED arrows starts forming above bars.

Sap Kar 3 EMAs + PA; (P)This script plots 3 EMAs and also shows price action in the form of GREEN ARROWS at the bottom of the bars for LONG trades and RED ARROWS @ top of the bars for SHORT TRADE.

Will be useful for trend and momentum following. The input parameters for price action ae

1. No of Bars for price action calculation:- This should be ideally between 3 to 6.

2. Maximum Close % should preferably be above 75 and should always be above 50.

3. Minimum Close % should preferably be below 25 and should always be below 50.

Should buy when above EMAs and green arrows start forming below bars. Should sell when below EMAs and red arrows start forming above bars.

MA Distance (% and ATR) + Threshold CountMA Distance (% & ATR) + Threshold Count

This script visualizes how far price is extended from key moving averages using both percentage and ATR-based distance. It includes a dynamic threshold system that tracks how unusually extended price is, based on historical volatility.

🔍 Features:

Calculates distance from:

10 EMA, 20 SMA, 50 SMA, 100 SMA, 200 SMA

Measures both:

% distance from each MA

ATR-multiple distance from each MA

Automatically calculates dynamic upper/lower thresholds using a rolling standard deviation

Plots a colored dot when distance exceeds these thresholds

Dots appear above or below the bar depending on direction

Color-coded summary table displays:

% distance

ATR distance

Threshold extremes

Total number of threshold hits

🎯 Customization:

Toggle which MAs to display in the table

Set your own lookback window and threshold sensitivity (via stdev multiplier)

Show/hide dots based on how many thresholds are hit

Use this tool to identify when price is overextended from its moving averages and approaching historically significant levels of deviation. Great for spotting mean reversion setups, parabolic runs, or deep pullbacks.

EMA 5m Nightingale🔁 EMA 5m Nightingale Strategy — Smart Compounding Recovery

This strategy combines classic EMA cross entries with a disciplined Nightingale position sizing system to manage losses and enhance recovery.

📌 Features:

✅ EMA 20/50 crossover entries, confirmed by trend (EMA 200)

🔄 Fixed-step Nightingale logic:

Trade sizing steps: $200 → $200 → $250 → $400 → $800 → $1600 → $3200 → $6000

Automatically resets to $200 after a profitable trade

🛑 2% equity-based stop loss

📉 Trade size increases only after a loss — never on a win

🔔 Built-in buy/sell alerts for automation or notifications

Perfect for testing controlled risk escalation and recovery on volatile 3-minute or 5-minute charts.

TESTING NOW FOR XRP 5M

DAMA OSC - Directional Adaptive MA OscillatorOverview:

The DAMA OSC (Directional Adaptive MA Oscillator) is a highly customizable and versatile oscillator that analyzes the delta between two moving averages of your choice. It detects trend progression, regressions, rebound signals, MA cross and critical zone crossovers to provide highly contextual trading information.

Designed for trend-following, reversal timing, and volatility filtering, DAMA OSC adapts to market conditions and highlights actionable signals in real-time.

Features:

Support for 11 custom moving average types (EMA, DEMA, TEMA, ALMA, KAMA, etc.)

Customizable fast & slow MA periods and types

Histogram based on percentage delta between fast and slow MA

Trend direction coloring with “Green”, “Blue”, and “Red” zones

Rebound detection using close or shadow logic

Configurable thresholds: Overbought, Oversold, Underbought, Undersold

Optional filters: rebound validation by candle color or flat-zone filter

Full visual overlay: MA lines, crossover markers, rebound icons

Complete alert system with 16 preconfigured conditions

How It Works:

Histogram Logic:

The histogram measures the percentage difference between the fast and slow MA:

hist_value = ((FastMA - SlowMA) / SlowMA) * 100

Trend State Logic (Green / Blue / Red):

Green_Up = Bullish acceleration

Blue_Up (or Red_Up, depending the display settings) = Bullish deceleration

Blue_Down (or Green_Down, depending the display settings) = Bearish deceleration

Red_Down = Bearish acceleration

Rebound Logic:

A rebound is detected when price:

Crosses back over a selected MA (fast or slow)

After being away for X candles (rebound_backstep)

Optional: filtered by histogram zones or candle color

Inputs:

Display Options:

Show/hide MA lines

Show/hide MA crosses

Show/hide price rebounds

Enable/disable blue deceleration zones

DAMA Settings:

Fast/Slow MA type and length

Source input (close by default)

Overbought/Oversold levels

Underbought/Undersold levels

Rebound Settings:

Use Close and/or Shadow

Rebound MA (Fast/Slow)

Candle color validation

Flat zone filter rebounds (between UnderSold and UnderBought)

Available MA type:

SMA (Simple MA)

EMA (Exponential MA)

DEMA (Double EMA)

TEMA (Triple EMA)

WMA (Weighted MA)

HMA (Hull MA)

VWMA (Volume Weighted MA)

Kijun (Ichimoku Baseline)

ALMA (Arnaud Legoux MA)

KAMA (Kaufman Adaptive MA)

HULLMOD (Modified Hull MA, Same as HMA, tweaked for Pine v6 constraints)

Notes:

**DEMA/TEMA** reduce lag compared to EMA, useful for faster reaction in trending markets.

**KAMA/ALMA** are better suited to noisy or volatile environments (e.g., BTC).

**VWMA** reacts strongly to volume spikes.

**HMA/HULLMOD** are great for visual clarity in fast moves.

Alerts Included (Fully Configurable):

Golden Cross:

Fast MA crosses above Slow MA

Death Cross:

Fast MA crosses below Slow MA

Bullish Rebound:

Rebound from below MA in uptrend

Bearish Rebound:

Rebound from above MA in downtrend

Bull Progression:

Transition into Green_Up with positive delta

Bear Progression:

Transition into Red_Down with negative delta

Bull Regression:

Exit from Red_Down into Blue/Green with negative delta

Bear Regression:

Exit from Green_Up into Blue/Red with positive delta

Crossover Overbought:

Histogram crosses above Overbought

Crossunder Overbought:

Histogram crosses below Overbought

Crossover Oversold:

Histogram crosses above Oversold

Crossunder Oversold:

Histogram crosses below Oversold

Crossover Underbought:

Histogram crosses above Underbought

Crossunder Underbought:

Histogram crosses below Underbought

Crossover Undersold:

Histogram crosses above Undersold

Crossunder Undersold:

Histogram crosses below Undersold

Credits:

Created by Eff_Hash. This code is shared with the TradingView community and full free. do not hesitate to share your best settings and usage.

Moving Average x5 (EMA/SMA) + ATR5 EMA/SMA lines at your disposal. Set your own timeframe. Made this by ChatGPT.

Plus ATR.

All things can be customized.

Trend Strength MeterThe Trend Strength Meter (TSM) is a powerful and versatile indicator designed to help traders identify market trends, measure their strength, and detect potential reversals with ease. This indicator combines the power of moving averages, divergence detection, and a clean, customizable dashboard to provide actionable insights for traders of all levels.

How It Works

Trend Strength Calculation:

1. The TSM calculates the trend strength using the difference between two Exponential Moving Averages (EMAs): a fast EMA (default: 20) and a slow EMA (default: 50).

2. The difference is expressed as a percentage of the slow EMA, providing a clear measure of the trend's strength and direction.

Histogram Visualization:

1. A color-coded histogram visually represents the trend strength:

Green: Bullish trend

Red: Bearish trend

Gray: Neutral or no significant trend

2. A smoothed trend strength line (SMA of the trend strength) is also plotted for better clarity.

Divergence Detection:

1. The indicator detects bullish and bearish divergences using the RSI (Relative Strength Index) and price action.

2. Bullish Divergence: Price makes a lower low, but RSI makes a higher low, signaling potential upward momentum.

3. Bearish Divergence: Price makes a higher high, but RSI makes a lower high, signaling potential downward momentum.

=> Divergences are marked with arrows on the chart:

Green Arrow: Bullish divergence

Red Arrow: Bearish divergence

Dashboard:

1. A clean and informative dashboard displays key information:

Trend Strength Value: The current strength of the trend

Trend Direction: Bullish, Bearish, or Neutral

Last Signal: Buy, Sell, or None (based on divergence signals)

The dashboard is fully customizable and can be positioned anywhere on the chart (e.g., top-right, bottom-left, center, etc.).

Key Features

1. Trend Strength Measurement: Quickly identify the strength and direction of the trend.

2. Divergence Detection: Spot potential reversals before they occur with bullish and bearish divergence signals.

3. Customizable Dashboard: Move the dashboard to your preferred location on the chart for better visibility.

4. User-Friendly Design: Clean visuals and intuitive color coding make it easy to interpret market conditions.

5. Actionable Signals: Provides clear Buy/Sell signals based on divergence, helping traders make informed decisions.

How to Use

1. Trend Confirmation:

Use the histogram and trend strength value to confirm the current market trend.

Green bars indicate a bullish trend, while red bars indicate a bearish trend.

2. Divergence Signals:

Look for divergence arrows (green for bullish, red for bearish) to anticipate potential reversals.

Combine divergence signals with other technical analysis tools for higher accuracy.

3. Dashboard Insights:

Monitor the dashboard for real-time updates on trend strength, direction, and the latest signal.

Use the "Last Signal" (Buy/Sell) to validate your trading decisions.

4. Custom Settings:

Adjust the EMA lengths and divergence lookback period to suit your trading style and timeframe.

Position the dashboard anywhere on the chart for convenience.

Best Practices

1. Use the TSM in conjunction with other indicators or price action analysis for confirmation.

2. Test the indicator on different timeframes to find the one that works best for your strategy.

3. Always practice proper risk management when trading.

Disclaimer

This indicator is a tool to assist in technical analysis and should not be used as a standalone trading strategy. Past performance is not indicative of future results. Always conduct your own research and consult with a financial advisor before making trading decisions.

Rainbow EMA Areas [Hypersonic]This indicator provides a nice visual representation of 6 EMA lines on your chart without adding to the clutter of other indicating lines. The starting values are 1, 9, 21, 55, 100, and 200. By default, the lines are hidden but they can be turned on in the Settings section. You can change the colors but not the gradient/transparency. There's nothing else to this indicator other than being a different visual representation of 6 EMA lines.

Hypersonic MAIN Intersection IndicatorIndicator that shows the intersection point of two Items of Interest. Backtesting showed the best was Candle/EMA 9.

1. I added 2 auxiliary EMA's that you can view or hide becuase I know some people like to see the EMA 200

2. You select the First and Second Item of Interest and it'll plot it in the background. First EMA and Second EMA correspond to whether you select them or not. The BWMA stuff is near the bottom. And in the middle is how you can show/hide the data table in the top-right.

3. you can show/hide different lines in the Style section

4. on the Style tab of Settings, you can turn off the whole table as well as the Trades, just the signal of the trade, or just the quantity of the trade

Moving Average 50+200+365Moving Average 50+200+365

What Are the 50, 200, and 365 Moving Averages for CRYPTOCAP:BTC ?

A Moving Average (MA) smooths out price data over a specified number of periods to reveal trends by filtering out short-term noise. For Bitcoin, these periods (50, 200, and 365) are typically applied on a daily chart, meaning they represent 50 days, 200 days, and 365 days, respectively.

50-period MA: A medium-term indicator, covering about 1.5–2 months (50 trading days), used to identify shorter-term trends in Bitcoin’s price.

200-period MA: A long-term indicator, spanning roughly 9–10 months (200 trading days), widely used to gauge Bitcoin’s overall trend.

365-period MA: A very long-term indicator, covering a full year (365 days), often used to assess multi-year trends or significant support/resistance levels in Bitcoin’s market cycles.

CPR BEAST with Previous Day High/Low, SMA, EMA, VWAP by MRS*Indicator Name:

**CPR BEAST with EMAs, VWAP & Previous Day High/Low by Rajasekhar Muvvala**

Description:

This powerful indicator combines **Central Pivot Range (CPR)**, **Daily/Weekly/Monthly Pivot Points**, **Moving Averages (SMA, EMA, 200-Day EMA)**, **Volume Weighted Average Price (VWAP)**, and **Previous Day High/Low** into a single, easy-to-use tool for traders. It is designed to help traders identify key support and resistance levels, trends, and potential reversal zones across multiple timeframes.

Key Features:

1. Central Pivot Range (CPR):

- CPR is calculated based on daily pivot points and includes three lines: "Central Pivot (CP)", "Bottom Central Pivot (BC)", and "Top Central Pivot (TC)".

- Enabled by default but can be toggled off from the settings.

- Customizable colors for all three lines.

2. Daily Pivot Points:

- Includes **Support (S1, S2, S3)** and **Resistance (R1, R2, R3)** levels.

- Levels 1 and 2 (S1/R1, S2/R2) are enabled by default, while Level 3 (S3/R3) can be optionally displayed.

- Resistance lines are red, and Support lines are green by default (colors customizable).

3. Weekly and Monthly Pivot Points:

- Weekly and Monthly pivots include **Pivot**, **Support (S1, S2, S3)**, and **Resistance (R1, R2, R3)** levels.

- Weekly levels are displayed as crossed (`+`) lines, while Monthly levels are displayed as circled (`o`) lines for better visual distinction.

- All weekly and monthly levels are optional and can be toggled on/off.

4. Moving Averages:

- Includes **Simple Moving Average (SMA)**, **Exponential Moving Average (EMA)**, and **200-Day EMA**.

- Customizable lengths and colors for each moving average.

- Helps identify trends and potential entry/exit points.

5. Volume Weighted Average Price (VWAP):

- Displays VWAP for intraday trading.

- Can be toggled on/off and customized for color.

6. Previous Day High/Low:

- Highlights the "Previous Day High" and "Previous Day Low" on the chart.

- Useful for identifying breakout or reversal zones.

- Customizable colors for both high and low levels.

7. Visibility Settings:

- All pivot points, CPR, VWAP, and previous day high/low are "hidden on daily and above timeframes" by default.

- Ensures the indicator is optimized for intraday trading.

8. Customization Options:

- Toggle visibility of CPR, pivot points, moving averages, VWAP, and previous day high/low.

- Customize colors, lengths, and styles for all elements.

- Adjust input sources for calculations (e.g., close, open, etc.).

---

How to Use:

Intraday Trading: Use the CPR and daily pivot points to identify key support and resistance levels. Combine these with VWAP and moving averages to confirm trends and find potential entry/exit points.

Swing Trading: Use weekly and monthly pivot points to identify longer-term support and resistance zones.

Breakout Trading: Monitor the previous day's high and low for potential breakout opportunities.

Trend Analysis: Use the moving averages (SMA, EMA, 200-Day EMA) to identify the overall trend direction.

---

Default Settings:

- **CPR**: Enabled by default (Central Pivot line cannot be disabled).

- **Daily Pivot Points**: Levels 1 and 2 (S1/R1, S2/R2) are enabled by default.

- **Weekly/Monthly Pivot Points**: Disabled by default (can be enabled from settings).

- **Moving Averages**: SMA (20), EMA (21), and 200-Day EMA are enabled by default.

- **VWAP**: Enabled by default.

- **Previous Day High/Low**: Enabled by default.

---

Customization Options:

- **CPR**:

- Enable/Disable CPR lines.

- Customize colors for CP, BC, and TC lines.

- **Pivot Points**:

- Enable/Disable daily, weekly, and monthly pivot points.

- Customize colors for support and resistance levels.

- **Moving Averages**:

- Adjust lengths for SMA, EMA, and 200-Day EMA.

- Customize colors for each moving average.

- **VWAP**:

- Enable/Disable VWAP.

- Customize color.

- **Previous Day High/Low**:

- Enable/Disable previous day high/low.

- Customize colors for high and low levels.

---

Best Practices:

1. **Combine Indicators**: Use CPR and pivot points in conjunction with moving averages and VWAP to confirm trends and identify high-probability trading setups.

2. **Timeframe Optimization**: The indicator is designed for intraday trading, so it hides unnecessary elements on daily and above timeframes.

3. **Color Coding**: Customize colors to match your chart theme and improve readability.

4. **Backtesting**: Test the indicator on historical data to understand how it behaves in different market conditions.

---

Disclaimer:

This indicator is intended for educational and informational purposes only. It does not provide financial advice or guarantee profits. Always conduct your own research and consult with a professional before making trading decisions.

BTC SCALPERS By Anup## *BTC Scalper by Anup – Precision Trading for BTC Scalpers*

🔹 *BTC Scalper by Anup* is a high-accuracy scalping indicator designed specifically for Bitcoin traders. This tool combines multiple confirmations to ensure precise entry and exit points, reducing false signals and improving profitability.

### *🚀 Key Features:*

✅ *EMA Crossover Strategy* – Uses EMA to identify trend reversals.

✅ *ATR Volatility Filter* – Ensures trades are executed only in high-volatility conditions.

✅ *RSI Confirmation* – Prevents overbought/oversold entries by confirming trend strength.

✅ *Stochastic Momentum Check* – Filters weak signals and confirms valid trade setups.

✅ *Buy & Sell Signals* – Clearly marked entries and exits for easy decision-making.

### *📈 How It Works:*

📌 *BUY Signal* – When the EMA crosses above , ATR confirms volatility, RSI is above 50, and Stochastic shows momentum.

📌 *SELL Signal* – When the EMA crosses below , ATR confirms volatility, RSI is below 50, and Stochastic indicates bearish momentum.

🚀 Perfect for *scalpers and day traders* looking for *fast & reliable trade signals* on BTC ONLY!

📍 *Timeframe Recommendation:* Best suited for *M5 to M15 charts* for short-term trades.

🔔 *Try BTC Scalper by Anup and take your BTC trading to the next level!*

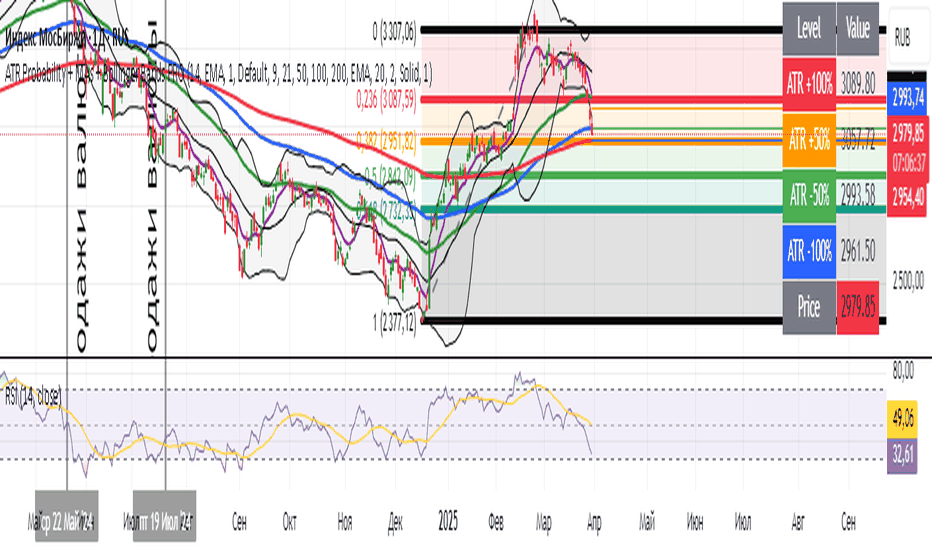

ATR Probability + MAs + Bollinger Bands PROATR Probability + MAs + Bollinger Bands

Made by DeepSeek))

Adv EMA Cloud v6 (ADX, Alerts)Summary:

This indicator provides a multi-faceted view of market trends using Exponential Moving Averages (EMAs) arranged in visually intuitive clouds, enhanced with an optional ADX-based range filter and configurable alerts for key market conditions. It aims to help traders quickly gauge trend alignment across short, medium, and long timeframes while filtering signals during potentially choppy market conditions.

Key Features:

Multiple EMAs: Displays 10-period (Fast), 20-period (Mid), and 50-period (Slow) EMAs.

Long-Term Trend Filter: Includes a 200-period EMA to provide context for the overall dominant trend direction.

Dual EMA Clouds:

Fast/Mid Cloud (10/20 EMA): Fills the area between the 10 and 20 EMAs. Defaults to Green when 10 > 20 (bullish short-term momentum) and Red when 10 < 20 (bearish short-term momentum).

Mid/Slow Cloud (20/50 EMA): Fills the area between the 20 and 50 EMAs. Defaults to Aqua when 20 > 50 (bullish mid-term trend) and Fuchsia when 20 < 50 (bearish mid-term trend).

Optional ADX Range Filter: Uses the Average Directional Index (ADX) to identify potentially non-trending or choppy markets. When enabled and ADX falls below a user-defined threshold, the EMA clouds will turn grey, visually warning that trend-following signals may be less reliable.

Configurable Alerts: Provides several built-in alert conditions using Pine Script's alertcondition function:

Confluence Condition: Triggers when a 10/20 EMA crossover occurs while both EMA clouds show alignment (both bullish/green/aqua or both bearish/red/fuchsia) and price respects the 200 EMA filter and the ADX filter indicates a trend (if filters are enabled).

MA Filter Cross: Triggers when price crosses above or below the 200 EMA filter line.

Full Alignment Start: Triggers on the first bar where full bullish or bearish alignment occurs (both clouds aligned + MA filter respected + ADX trending, if filters are enabled).

How It Works:

EMA Calculation: Standard Exponential Moving Averages are calculated for the 10, 20, 50, and 200 periods based on the closing price.

Cloud Creation: The fill() function visually shades the area between the 10 & 20 EMAs and the 20 & 50 EMAs.

Cloud Coloring: The color of each cloud is determined by the relationship between the two EMAs that define it (e.g., if EMA 10 is above EMA 20, the first cloud is bullish-colored).

ADX Filter Logic: The script calculates the ADX value. If the "Use ADX Trend Filter?" input is checked and the calculated ADX is below the specified "ADX Trend Threshold", the script considers the market potentially ranging.

ADX Visual Effect: During detected ranging periods (if the ADX filter is active), the plotCloud12Color and plotCloud23Color variables are assigned a neutral grey color instead of their normal bullish/bearish colors before being passed to the fill() function.

Alert Logic: Boolean variables track the specific conditions (crossovers, cloud alignment, filter positions, ADX state). The alertcondition() function creates triggerable alerts based on these pre-defined conditions.

Potential Interpretation (Not Financial Advice):

Trend Alignment: When both clouds share the same directional color (e.g., both bullish - Green & Aqua) and price is on the corresponding side of the 200 EMA filter, it may suggest a stronger, more aligned trend. Conversely, conflicting cloud colors may indicate indecision or transition.

Dynamic Support/Resistance: The EMA lines themselves (especially the 20, 50, and 200) can sometimes act as dynamic levels where price might react.

Range Warning: Greyed-out clouds (when ADX filter is enabled) serve as a visual warning that trend-based strategies might face increased difficulty or whipsaws.

Confluence Alerts: The specific confluence alerts signal moments where multiple conditions align (crossover + cloud agreement + filters), which some traders might view as higher-probability setups.

Customization:

All EMA lengths (10, 20, 50, 200) are adjustable via the Inputs menu.

The ADX length and threshold are configurable.

The MA Trend Filter and ADX Trend Filter can be independently enabled or disabled.

Disclaimer:

This indicator is provided for informational and educational purposes only. Trading financial markets involves significant risk. Past performance is not indicative of future results. Always conduct your own thorough analysis and consider your risk tolerance before making any trading decisions. This indicator should be used in conjunction with other analysis methods and tools. Do not trade based solely on the signals or visuals provided by this indicator.

Custom EMAs, SMA y VWAP con Puntos en CrucesHighly configurable moving average indicator for each person's trading strategy.

Average Price Bar (APB) with Dynamic EMATrading Made Simple: APB + Dynamic EMA with Stochastic (8,3,3) Strategy

Introduction

The "Trading Made Simple" strategy, originally developed by BigE on ForexFactory in 2011, is a powerful yet straightforward approach to trading that combines price action, moving averages, and momentum indicators to identify high-probability setups. This enhanced version integrates:

Average Price Bar (APB) – A smoothed candlestick representation that filters market noise.

Dynamic EMA (5-period, HLC3-based) – Acts as a trend filter, changing color based on its position relative to price.

Stochastic (8,3,3) – A fast momentum oscillator to confirm overbought/oversold conditions.

Core Trading Rules (BigE's Original Concept)

Trend Direction: The EMA defines the trend (bullish if price is above, bearish if below).

Stochastic Confirmation:

Long Trades: Look for Stochastic crossing up from oversold (<20) while price is above the EMA.

Short Trades: Look for Stochastic crossing down from overbought (>80) while price is below the EMA.

APB as Entry Confirmation:

A bullish APB close above the EMA strengthens long signals.

A bearish APB close below the EMA strengthens short signals.

Why This Combination Works

APB + EMA provides a clean trend bias, reducing false signals.

Stochastic (8,3,3) adds momentum confirmation, ensuring entries are timed well.

The background color shift (green/red) makes trend reversals visually intuitive.

This system is ideal for swing traders and day traders looking for a rule-based, discretionary approach that removes emotional decision-making while keeping trading simple and effective.