Inside Bar Multi-Currency ScannerDescription:

This script is an Inside Bar Scanner that allows you to monitor multiple currency pairs across different timeframes (15 minutes, 1 hour, and 4 hours). Its main features include:

Inside Bar Detection:

An Inside Bar is a candlestick where both the High and Low are within the range of the previous candle.

The script automatically identifies Inside Bars and displays the results in a table.

Customizable Timeframes:

Supports scanning in 15-minute, 1-hour, and 4-hour timeframes.

Results are displayed for each timeframe separately.

Multi-Currency Support:

Scan up to 10 currency pairs simultaneously.

Currency pairs are customizable and selected by the user.

Candle Coloring:

Inside Bars are highlighted with colors:

Semi-transparent green for bullish Inside Bars.

Semi-transparent red for bearish Inside Bars.

Colors are customizable and selected by the user.

Alerts:

Custom alerts for detecting Inside Bars in selected timeframes.

Receive notifications when an Inside Bar is detected in any of the selected currency pairs.

How to Use:

Select your desired currency pairs from the Scanner Currencies section.

Enable your preferred timeframes in the Scanner Timeframe section.

The script will display a table of results with Inside Bar information for each currency pair and timeframe.

Optionally, customize the candle colors in the Scanner InsideBar Color section.

Additional Explanation for Timeframe Status:

In each selected timeframe, there are three possible states for the candles:

Previous Candle is an Inside Bar:

Displayed with a green background and the symbol ✔.

Previous Candle is NOT an Inside Bar:

Displayed with a red background and the symbol ✘.

Current Candle is an Inside Bar:

Displayed with an orange background and the symbol ⌕.

These visual indicators provide a clear and quick overview of the Inside Bar status for each selected currency pair and timeframe.

Индикатор Inside Bar

Inside Bar with Swing PointsSwing Points with Inside Bar

This script combines swing point analysis with an inside bar pattern visualization, merging essential concepts to identify and visualize key price levels and potential trend reversals. This is especially useful for traders looking to understand price action through swing levels and reactions within inside bar boundaries, making it effective for short-term trend analysis and reversal zone identification.

Script Features:

Swing Point Analysis:

The script identifies swing points based on fractals with a configurable number of bars, allowing for a choice between three and five bars, helping traders fine-tune sensitivity to price movements.

Swing points are visualized as labels, highlighting potential reversal or continuation zones in the price chart.

Inside Bar Visualization:

Inside bars are defined as bars where both the high and low are contained within the previous bar. These often signal consolidation before a potential breakout.

The script displays boundaries of the mother bar (the initial bar encompassing inside bars) and colors candles accordingly, highlighting those within these boundaries.

This feature helps traders focus on price areas where a breakout or trend shift may occur.

Utility and Application:

The script enables traders to visualize inside bars and swing points, which is particularly useful for short-term traders focused on reversal or trend continuation strategies.

Combining swing point analysis with inside bar identification offers a unique approach, helping traders locate key consolidation zones that may precede significant price moves.

This provides not only strong support and resistance levels but also insights into probable breakout points.

How to Use the Script:

Set the number of bars for swing point analysis (3 or 5) to adjust fractal sensitivity.

Enable mother bar boundary visualization and color indication for inside bars to easily spot consolidation patterns.

Pay attention to areas with multiple swing points and inside bars, as these often signal potential reversal or breakout zones.

This script offers flexible tools for analyzing price movements through both swing analysis and consolidation zone identification, aiding decision-making under uncertainty and enhancing market structure understanding.

P.I.B. System (Pin Bar | Inside Bar) // AlgoFyreThe "P.I.B. System (Pin Bar | Inside Bar)" identifies bullish and bearish pin bars and inside bars on a price chart. It highlights potential market reversals by plotting labels and colorizing bars, providing traders with visual cues for better decision-making.

Description

The "P.I.B. System (Pin Bar | Inside Bar)" script is designed to help traders identify potential reversal points in the market by detecting bullish and bearish pin bars and inside bars. A pin bar is a candlestick pattern that indicates a potential reversal, characterized by a small body and a long wick. Inside bars are candlestick patterns where the current bar's high and low are within the previous bar's range, indicating potential consolidation before a breakout.

This script allows customization of various parameters to fine-tune the identification of pin bars and inside bars. When a pin bar or an inside bar is detected, the script plots a label on the chart and colorizes the bars to highlight these patterns. This tool is useful for traders looking to identify potential reversal points and make informed trading decisions.

Explanation of All Options

Pin-Wick Size Ratio Minimum Value : The minimum ratio of the wick size to the total candle size for a pin bar to be considered valid. Default is 0.66.

Candle Body Size Ratio Maximum Value : The maximum ratio of the body size to the total candle size for a pin bar to be considered valid. Default is 0.4.

Handle-Wick Wick Size Ratio Maximum Value : The maximum ratio of the opposite wick size to the total candle size for a pin bar to be considered valid. Default is 0.4.

Filter Out Small Candles : Option to filter out small candles based on the previous candle's size. Default is true.

Small Candle Size Ratio : The ratio used to determine if a candle is considered small compared to the previous candle. Default is 2.0.

Identify Inside Bars : Option to identify inside bars following a pin bar. Default is true.

Show Only P.I.B. : Option to show only the bars where a pin bar is followed by an inside bar. Default is true.

Hide Horizontal Rays : Option to hide horizontal rays drawn from the last identified pin bars. Default is false.

How to Use

To use this script, add it to your chart. Customize the input parameters to match your trading strategy. The script will automatically identify and highlight bullish and bearish pin bars and inside bars on the chart. Use the visual cues provided by the labels and colorized bars to make informed trading decisions.

Swing Trend AnalysisIntroducing the Swing Trend Analyzer: A Powerful Tool for Swing and Positional Trading

The Swing Trend Analyzer is a cutting-edge indicator designed to enhance your swing and positional trading by providing precise entry points based on volatility contraction patterns and other key technical signals. This versatile tool is packed with features that cater to traders of all timeframes, offering flexibility, clarity, and actionable insights.

Key Features:

1. Adaptive Moving Averages:

The Swing Trend Analyzer offers multiple moving averages tailored to the timeframe you are trading on. On the daily chart, you can select up to four different moving average lengths, while all other timeframes provide three moving averages. This flexibility allows you to fine-tune your analysis according to your trading strategy. Disabling a moving average is as simple as setting its value to zero, making it easy to customize the indicator to your needs.

2. Dynamic Moving Average Colors Based on Relative Strength:

This feature allows you to compare the performance of the current ticker against a major index or any symbol of your choice. The moving average will change color based on whether the ticker is outperforming or underperforming the selected index over the chosen period. For example, on a daily chart, if the 21-day moving average turns blue, it indicates that the ticker has outperformed the selected index over the last 21 days. This visual cue helps you quickly identify relative strength, a key factor in successful swing trading.

3. Visual Identification of Price Contractions:

The Swing Trend Analyzer changes the color of price bars to white (on a dark theme) or black (on a light theme) when a contraction in price is detected. Price contractions are highlighted when either of the following conditions is met: a) the current bar is an inside bar, or b) the price range of the current bar is less than the 14-period Average Daily Range (ADR). This feature makes it easier to spot price contractions across all timeframes, which is crucial for timing entries in swing trading.

4. Overhead Supply Detection with Automated Resistance Lines:

The indicator intelligently detects the presence of overhead supply and draws a single resistance line to avoid clutter on the chart. As price breaches the resistance line, the old line is automatically deleted, and a new resistance line is drawn at the appropriate level. This helps you focus on the most relevant resistance levels, reducing noise and improving decision-making.

5. Buyable Gap Up Marker: The indicator highlights bars in blue when a candle opens with a gap that remains unfilled. These bars are potential Buyable Gap Up (BGU) candidates, signaling opportunities for long-side entries.

6. Comprehensive Swing Trading Information Table:

The indicator includes a detailed table that provides essential data for swing trading:

a. Sector and Industry Information: Understand the sector and industry of the ticker to identify stocks within strong sectors.

b. Key Moving Averages Distances (10MA, 21MA, 50MA, 200MA): Quickly assess how far the current price is from key moving averages. The color coding indicates whether the price is near or far from these averages, offering vital visual cues.

c. Price Range Analysis: Compare the current bar's price range with the previous bar's range to spot contraction patterns.

d. ADR (20, 10, 5): Displays the Average Daily Range over the last 20, 10, and 5 periods, crucial for identifying contraction patterns. On the weekly chart, the ADR continues to provide daily chart information.

e. 52-Week High/Low Data: Shows how close the stock is to its 52-week high or low, with color coding to highlight proximity, aiding in the identification of potential breakout or breakdown candidates.

f. 3-Month Price Gain: See the price gain over the last three months, which helps identify stocks with recent momentum.

7. Pocket Pivot Detection with Visual Markers:

Pocket pivots are a powerful bullish signal, especially relevant for swing trading. Pocket pivots are crucial for swing trading and are effective across all timeframes. The indicator marks pocket pivots with circular markers below the price bar:

a. 10-Day Pocket Pivot: Identified when the volume exceeds the maximum selling volume of the last 10 days. These are marked with a blue circle.

b. 5-Day Pocket Pivot: Identified when the volume exceeds the maximum selling volume of the last 5 days. These are marked with a green circle.

The Swing Trend Analyzer is designed to provide traders with the tools they need to succeed in swing and positional trading. Whether you're looking for precise entry points, analyzing relative strength, or identifying key price contractions, this indicator has you covered. Experience the power of advanced technical analysis with the Swing Trend Analyzer and take your trading to the next level.

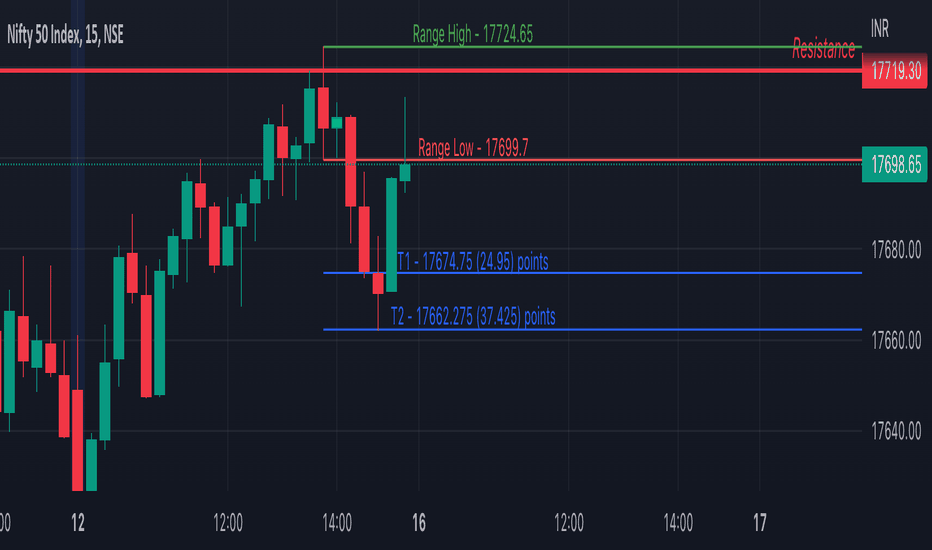

Inside Bar Setup [as]Inside Bar Setup Indicator Description

The **Inside Bar Setup ** indicator is a powerful tool for traders to identify and visualize inside bar patterns on their charts. An inside bar pattern occurs when the current candle's high is lower than the previous candle's high, and the current candle's low is higher than the previous candle's low. This pattern can indicate a potential breakout or a continuation of the existing trend.

Key Features:

1. **Highlight Inside Bar Patterns:**

- The indicator highlights inside bar patterns with distinct colors for bullish and bearish bars. Bullish inside bars are colored with the user-defined bull bar color (default lime), and bearish inside bars are colored with the user-defined bear bar color (default maroon).

2. **Marking Mother Candle High and Low:**

- The high and low of the mother candle (the candle preceding the inside bar) are marked with horizontal lines. The high is marked with a green line, and the low is marked with a red line.

- These levels are labeled as "Range High" and "Range Low" respectively, with the labels displayed a few bars to the right for clarity. The labels have a semi-transparent background for better visibility.

3. **Target Levels:**

- The indicator calculates and plots potential target levels (T1 and T2) for both long and short positions based on user-defined multipliers of the mother candle's range.

- For long positions, T1 and T2 are plotted above the mother candle's high.

- For short positions, T1 and T2 are plotted below the mother candle's low.

- These target levels are optional and can be toggled on or off via the input settings.

4. **Customizable Inputs:**

- **Colors:**

- Bull Bar Color: Customize the color for bullish inside bars.

- Bear Bar Color: Customize the color for bearish inside bars.

- **Long Targets:**

- Show Long T1: Toggle the display of the first long target.

- Show Long T2: Toggle the display of the second long target.

- Long T1: Multiplier for the first long target above the mother candle's high.

- Long T2: Multiplier for the second long target above the mother candle's high.

- **Short Targets:**

- Show Short T1: Toggle the display of the first short target.

- Show Short T2: Toggle the display of the second short target.

- Short T1: Multiplier for the first short target below the mother candle's low.

- Short T2: Multiplier for the second short target below the mother candle's low.

5. **New Day Detection:**

- The indicator detects the start of a new day and clears the inside bar arrays, ensuring that the pattern detection is always current.

#### Usage:

- Add the indicator to your TradingView chart.

- Customize the inputs to match your trading strategy.

- Watch for highlighted inside bars to identify potential breakout opportunities.

- Use the marked range highs and lows, along with the calculated target levels, to plan your trades.

This indicator is ideal for traders looking to capitalize on inside bar patterns and their potential breakouts. It provides clear visual cues and customizable settings to enhance your trading decisions.

Note:

This indicator is based on famous 15 min inside bar strategy shared by Subashish Pani on his youtube channel Power of stocks. Please watch his videos to use this indicator for best results.

Previous Candle + Inside/OutsideThe script uses the previous candle of the current timeframe to assess the state of the current candle.

1. Previous candle high/low and midpoint are displayed

2. Highlights current bar if INSIDE previous candle

3. Highlights current bar if POTENTIAL OUTSIDE bar. This condition uses the logic that if the previous high/low has been swept and price then reaches previous bar 50%, then an OUTSIDE bar is possible.

4. If current candle breaks previous high/low, a label is added to identify.

5. If above condition is true and current candle color is opposite of previous, then label is highlighted to show possible bull/bear condition.

6. If current candle live price is below previous midpoint, a BEAR label is shown

7. If current candle live price is above previous midpoint, a BULL label is shown

I personally use the indicator on Daily/Weekly/Monthly charts to help with my overall market assessment. However users may find their own use for the indicator...or modify it to their own preferences.

As ever, the indicator should only be used with live trading accounts after thorough backtesting using a large data range.

SMC Fake Zones + InsideBarThis indicator is useful for whom trade with "Smart Money Concept (SMC)" strategy.

It helps SMD traders to identify fake or weak zones in the chart, So they can avoid taking position in this zones.

This indicator marks "Asia session" as well as "London and New York's Lunch Time (one hour before London and NY session starts)" zones.

It also marks Inside Bar candles which SMC trades consider as order flow. You can mark every Inside Bar or only those with opposite color via setting options.

*** As we know in SMC rules

1- Supply and Demand zones in "Asia session and Lunch Times" are fake zones for SMC trading and price will engulf them in most of times.

2- "Asia session high and low" has huge liquidity and usually price sweep that in London session.

This indicator will helps traders to visually identify those Fake zones and Asia session liquidity.

* You can change session times based on your time zone in settings.

* You can set options to show all Inside Bars or only with Opposite color in settings.

Inside Bars/Candles [CodeCraftedTrading]This Pine Script indicator is designed to identify and visually represent inside bars or candles. Here's a breakdown of its features and functionality:

1. Inputs:

insideCandlesColor: Color of the inside bars or candles.

highColor: Color of the horizontal line representing the high of the inside bar.

lowColor: Color of the horizontal line representing the low of the inside bar.

showHighLowLabel: Option to display labels for the high and low prices.

2. Logic:

The script checks for the conditions of an inside bar:

high < high and low > low

If an inside bar is detected and is not already in the range:

* Stores the high and low prices of the previous bar.

* Records the parent bar index and sets the broken flag to false.

If the current bar's high exceeds the stored high or the low falls below the stored low, the broken flag is set to true.

If the current bar is within the stored high and low range, it is considered in-range.

The script then dynamically plots horizontal lines at the high and low prices of the parent bar until the inside bar is broken.

3. Visualization:

The inside bars are colored based on the insideCandlesColor.

Horizontal lines are drawn at the high and low prices of the parent bar within the inside bar.

Optional labels display the rounded values of the high and low prices.

4. Usage:

Apply the script to your chart.

Adjust the input parameters according to your preferences.

The indicator will highlight inside bars with colored bars and draw lines representing the high and low prices. Labels are optional.

5. Note:

Inside bars are bars where the entire price range is within the high and low of the previous bar.

The script uses historical bar information and visualizes the inside bars dynamically on the chart.

Evolution Fractals with IBA standard fractal high has two lower high (or equal high) candles to its left and right.

For standard fractal low fractals this is vice versa.

-But this indicator plots has the option to plot standard fractals only after candle close is confirmed.

So if the current candle is still forming in live markets, only after this candle has fully closed, then the indicator checks if the fractal is valid and then plotted.

You can select this option On or Off

(with the standard fractal indicator there is a fractal plotted, but when this candle high (or low ) is broken again, the fractal disappears. This re-painting of fractals can cause confusion.

-Added an alert functionality.

When setting an alert on your chart, you can select this indicator to alert you upon the forming of a new fractal high or low.

-Added optional Inside Bar function.

When a candle High/Low does not breach the previous candle High/Low, then a different body color can be shown.

This is particular handy to quickly if this high/low is breached, without having to zoom in on the chart.

Bank Nifty ScalpingThis indicator is designed for scalping purposes.

Users have the option to input the desired source and enable or disable the following indicators:

Multiple EMA (Exponential moving average)

Simultaneously displays multiple moving averages to quickly identify shifts in momentum and obtain confirmation from slower-moving averages.

By default, the EMA display settings are configured to show the 20-day EMA and the 200-day EMA. However, users have the flexibility to modify the display settings according to their preferences. This means that users can customize the indicator to show the EMA values of their choice, such as EMA 50 and EMA 100.

VWAP ( Volume weighted average price )

Default value is set to ‘hl2’

A bullish trend is indicated when the price is above the Volume Weighted Average Price (VWAP), while a bearish trend is indicated when the price is below the VWAP.

VWMA ( Volume weighted moving average )

In the VWMA (Volume Weighted Moving Average) indicator, a default value of 20 is used. If the price is higher than the VWMA, it typically indicates a bullish trend. Conversely, if the price is lower than the VWMA, it suggests a bearish trend. The VWMA takes into account both price and volume, providing a weighted average that can help identify shifts in market sentiment.

Multiple SuperTrends

Default value is 10 and 2 / 10 and 3

A bullish trend is identified when the price is above the SuperTrend indicator, whereas a bearish trend is observed when the price is below the SuperTrend indicator.

Camarilla Pivot Points (Level 3 and 4 only)

Levels 3 and 4 serve as crucial support and resistance levels, acting as the final line of defense against strong trends. These levels are expected to generate reversals, where price often changes direction.

CPR ( Central Pivot Points)

The Daily Central Pivot Point Indicator is a popular tool used in technical analysis. It calculates several levels based on the previous day's high, low, and closing prices.

Strong Volume

The user has the ability to set the average volume for Nifty and BankNifty indices to calculate strong volume.

Elder Impulse System

The Impulse System, developed by Alexander Elder and discussed in his book "New Trading for a Living," is a censorship trading system designed to determine whether a trade should be allowed or prohibited. Additionally, it can be used to identify when a trend is starting to weaken. The Impulse System relies on the following factors:

1. Slope of a Fast Exponential Moving Average (EMA): The fast EMA's slope reflects the price's inertia or momentum.

2. Slope of the Moving Average Convergence Divergence (MACD): The MACD's slope indicates the strength or power of the price movement.

Based on these factors, the Impulse System categorizes candles or price bars into three colors:

* Green Candle: When both the fast EMA and MACD are rising, indicating upward momentum.

* Red Candle: When both the fast EMA and MACD are declining, suggesting downward momentum.

* Blue Candle: In all other cases where the conditions for green or red candles are not met, representing a neutral or uncertain market condition.

By applying the Impulse System, traders can gain insights into the market trend, its strength, and potential shifts in momentum, helping them make informed trading decisions.

Happy Trading

Inside Bars (Multiple / Consecutive)Description

When an inside bar is found, the indicator remembers the high and low (= range) of the candle before the inside bar.

As long as price moves within the range, every bar is highlighted as an inside bar to the range.

Purpose

The indicator can assist when identifying valid pullbacks and buy-side liquidity (BSL) / sell-side liquidity (SSL).

Volatility patterns / quantifytools- Overview

Volatility patterns detect various forms of indecisive price action, on a larger scale as a compressed range and on a smaller scale as indecision candles. Indecisive and volatility suppressing price action can be thought of as a spring being pressed down. The more suppression, the more tension is built and eventually released as a spike or series of spikes in volatility. Each volatility pattern is assigned an influence period, during which average and peak relative volatility is recorded and stored to volatility metrics.

- Patterns

The following scenarios are qualified as indecision candles: inside candles, indecision engulfing candles and volatility shifts.

By default, each indecision candle is considered a valid pattern only when another indecision candle has taken place within 3 periods, e.g. prior inside candle + indecision engulfing candle = valid volatility pattern. This measurement is taken to filter noise by looking for multiple hints of pending volatility, rather than just one. Level of tolerated noise can be changed via input menu by using sensitivity setting, by default set to 2.

Sensitivity at 1: Any single indecision candle is considered a valid pattern

Sensitivity at 2: 2 indecision candles within 3 bars is considered a valid pattern

Sensitivity at 3: 2 indecision candles within 2 bars (consecutive) is considered a valid pattern

The following scenarios are qualified as range patterns: series of lower highs/higher lows and series of low volatility pivots.

A pivot is defined by highest/lowest point in price, by default within 2 periods back and 2 periods forward. When 4 pivots with qualities mentioned above are found, a box indicating compressed range will appear. Both required pivots and pivot definition can be adjusted via input menu.

- Influence time and metrics

By default, influence time for each volatility pattern is set to 6 candles, a period for which spike(s) in volatility is expected. For each influence period, average relative volatility (volatility relative to volatility SMA 20) and peak relative volatility is recorded and stored to volatility metrics. All metrics used in calculations are visible in "Data Window "tab. Average and peak volatility during influence period will vary depending on chart, timeframe and chosen settings. Tweaking the settings might result in an improvement and is worth experimenting with.

- Visuals

By default, indecision candles are visualized as yellow lines and range patterns as orange boxes. Influence time periods are respectively visualized as colored candle borders, applied as long as influence time period is active. All colors are fully customizable via input menu.

- Practical guide

Volatility patterns depict moments of equal strength from both bulls and bears. While this equilibrium is in place, price is stagnant and compresses until either side initiates volatility, releasing the built up tension. On top of hedging and playing the volatility using volatility based instruments, some other methods can be applied to take advantage of the somewhat tricky areas of indecision.

Example #1: Trading volatility

Volatility is not a bad thing from a trading perspective, but can actually be fertile ground for executing trade setups. Trading volatility influence periods from higher timeframes on lower timeframes gives greater resolution to work with and opportunities to take advantage of the wild swings created.

Example #2: Finding bias for patterns

Points of confluence where it anyway makes sense to favor one side over the other can be used for establishing bias for indecisive price action as well. At face value, it makes sense to expect bearish reactions at range highs and bullish reactions at range low, for which volatility patterns can provide a catalyst.

Example #3: Betting on initiation direction

Betting on direction of the first volatile move can easily go against you, but if risk/reward is able to compensate for the poor win rate, it's a valid idea to consider and explore.

InsideBar2.0Inside Bar: Inside Bar is defined as, " when candle body range falls within previous day candle body".

Some of us take the whole prices range . Here i have taken only the price range of the body of tehecandle.

I have created an indicator to identify Inside bras and draw target levels on both the sides. Traders can easily convert it into a strategy and checkout the success rate.

This script is written to identify InsideBar and then plot target 1 and target 2 irrespective the direction of following candles.

Inside Bar is here defined clearly when the whole body( Not high/Low, but Open and Close Only of the candle falls within the whole body of previous candle

Few static Variables are declared for one time use to store the following values

MotherCandle Index

High and Low of MotherCandle

Target 1 equal to size of the body of mother candle

Target 2 equal twice the size of Mother Candle

Depending upon the direction of the trend and breakout of the MotherCandle boundaries, target lines and labels are drawn.

Line.delete function is used to delete all the previous lines to keep the chart clean and not draw line on all every inside-bar detected in the past.

Label.delete function is used to delete all the previous labels for Target levels to clearly show current target levels.

barcolor() function is used to change the inside bar candle changed to "Yellow" .

ATR PivotsThe "ATR Pivots" script is a technical analysis tool designed to help traders identify key levels of support and resistance on a chart. The indicator uses various metrics such as the Average True Range (ATR), Daily True Range ( DTR ), Daily True Range Percentage (DTR%), Average Daily Range (ADR), Previous Day High ( PDH ), and Previous Day Low ( PDL ) to provide a comprehensive picture of the volatility and movement of a security. The script also includes an EMA cloud and 200 EMA for trend identification and a 1-minute ATR scalping strategy for traders to make informed trading decisions.

ATR Detail:-

The ATR is a measure of the volatility of a security over a given period of time. It is calculated by taking the average of the true range (the difference between the high and low of a security) over a set number of periods. The user can input the number of periods (ATR length) to be used for the ATR calculation. The script also allows the user to choose whether to use the current close or not for the calculation. The script calculates various levels of support and resistance based on the relationship between the security's range ( high-low ) and the ATR. The levels are calculated by multiplying the ATR by different Fibonacci ratios (0.236, 0.382, 0.5, 0.618, 0.786, 1.000) and then adding or subtracting the result from the previous close. The script plots these levels on the chart, with the -100 level being the most significant level. The user also has an option to choose whether to plot all Fibonacci levels or not.

DTR and DTR% Detail:-

The Daily True Range Percentage (DTR%) is a metric that measures the daily volatility of a security as a percentage of its previous close. It is calculated by dividing the Daily True Range ( DTR ) by the previous close. DTR is the range between the current period's high and low and gives a measure of the volatility of the security on a daily basis. DTR% can be used as an indicator of the percentage of movement of the security on a daily basis. In this script, DTR% is used in combination with other metrics such as the Average True Range (ATR) and Fibonacci ratios to calculate key levels of support and resistance for the security. The idea behind using DTR% is that it can help traders to better understand the daily volatility of the security and make more informed trading decisions.

For example, if a security has a DTR% of 2%, it suggests that the security has a relatively low level of volatility and is less likely to experience significant price movements on a daily basis. On the other hand, if a security has a DTR% of 10%, it suggests that the security has a relatively high level of volatility and is more likely to experience significant price movements on a daily basis.

ADR:-

The script then calculates the ADR (Average Daily Range) which is the average of the daily range of the security, using the formula (Period High - Period Low) / ATR Length. This gives a measure of the average volatility of the security on a daily basis, which can be useful for determining potential levels of support and resistance .

PDH /PDL:-

The script also calculates PDH (Previous Day High) and PDL (Previous Day Low) which are the High and low of the previous day of the security. This gives a measure of the previous day's volatility and movement, which can be useful for determining potential levels of support and resistance .

EMA Cloud and 200 EMA Detail:-

The EMA cloud is a technical analysis tool that helps traders identify the trend of the market by comparing two different exponential moving averages (EMAs) of different lengths. The cloud is created by plotting the fast EMA and the slow EMA on the chart and filling the space between them. The user can input the length of the fast and slow EMA , and the script will calculate and plot these EMAs on the chart. The space between the two EMAs is then filled with a color that represents the trend, with green indicating a bullish trend and red indicating a bearish trend . Additionally, the script also plots a 200 EMA , which is a commonly used long-term trend indicator. When the fast EMA is above the slow EMA and the 200 EMA , it is considered a bullish signal, indicating an uptrend. When the fast EMA is below the slow EMA and the 200 EMA , it is considered a bearish signal, indicating a downtrend. The EMA cloud and 200 EMA can be used together to help traders identify the overall trend of the market and make more informed trading decisions.

1 Minute ATR Scalping Strategy:-

The script also includes a 1-minute ATR scalping strategy that can be used by traders looking for quick profits in the market. The strategy involves using the ATR levels calculated by the script as well as the EMA cloud and 200 EMA to identify potential buy and sell opportunities. For example, if the 1-minute ATR is above 11 in NIFTY and the EMA cloud is bullish , the strategy suggests buying the security. Similarly, if the 1-minute ATR is above 30 in BANKNIFTY and the EMA cloud is bullish , the strategy suggests buying the security.

Inside Candle:-

The Inside Candle is a price action pattern that occurs when the current candle's high and low are entirely within the range of the previous candle's high and low. This pattern indicates indecision or consolidation in the market and can be a potential sign of a trend reversal. When used in the 15-minute chart, traders can look for Inside Candle patterns that occur at key levels of support or resistance. If the Inside Candle pattern occurs at a key level and the price subsequently breaks out of the range of the Inside Candle, it can be a signal to enter a trade in the direction of the breakout. Traders can also use the Inside Candle pattern to trade in a tight range, or to reduce their exposure to a current trend.

Risk Management:-

As with any trading strategy, it is important to practice proper risk management when using the ATR Pivots script and the 1-minute ATR scalping strategy. This may include setting stop-loss orders, using appropriate position sizing, and diversifying your portfolio. It is also important to note that past performance is not indicative of future results and that the script and strategy provided are for educational purposes only.

In conclusion, the "ATR Pivots" script is a powerful tool that can help traders identify key levels of support and resistance , as well as trend direction. The additional metrics such as DTR , DTR%, ADR, PDH , and PDL provide a more comprehensive picture of the volatility and movement of the security, making it easier for traders to make better trading decisions. The inclusion of the EMA cloud and 200 EMA for trend identification, and the 1-minute ATR scalping strategy for quick profits can further enhance a trader's decision-making process. However, it is important to practice proper risk management and understand that past performance is not indicative of future results.

Special thanks to satymahajan for the idea of clubbing Average True Range with Fibonacci levels.

Simple STRAT Tool by nnamWhat this Indicator Does

This indicator is a very simple tool created specifically for experienced Straters. It was created for those Straters who fully understand the 1-2-3 Strat Scenarios, are in need of an easy to use tool, and do not want or need a lot of messy markings on their chart.

The indicator simply allows the user to color code the Strat 1, 2 ,3 (Inside /Outside /Up / Down) Bars as desired and by default extends lines to the right of the chart from the Highs and Lows of the previous 2 Bars giving the user a simple reference for Strat scenario structure breaks.

As shown above, the bars are color coded, but the original bar color is maintained via the border and wick.

If a bar is an Outside Bar or an Inside Bar, it is still easy to identify whether or not the bar was a Bullish or Bearish 1 or 3.

The same goes for 2UP and 2Down Bars - It is easy to identify Bullish or Bearish UP or DOWN Bars.

Optionally, as show in the screenshot below, the user can extend the lines in both directions to get an "at a glance" better understanding of where price is currently vs previous support and resistance areas.

For Straters that prefer to trade only INSIDE BAR BREAKOUTS there is an optional input setting labeled "Trade Inside Bars ONLY".

This setting turns OFF the lines that extend from the 2nd previous bar back and only displays and extend lines from the previous bar IF and ONLY IF the current bar is an INSIDE (one) bar. .

The User Input settings allow for the following customizations:

1. Custom Outside Bar Color

2. Custom Inside Bar Color

3. Custom 2 Up Bar Color

4. Custom 2 Down Bar Color

5. Turn ON or OFF color coded bars

6. Trade only INSIDE Bar Breakouts

7. Extend Lines Both Directions

8. Hide all Lines

The customizable settings above allow the user to hide all lines and turn OFF color coding without having to fully remove the indicator from the chart. This is convenient when the user has another indicator that uses color coded bars or the lines conflict with another indicator and they need to be temporarily disabled.

If you have any questions regarding this indicator please let me know. If you have any suggestions for minor tweaks to the indicator do not hesitate to ask for them.

I hope you enjoy this indicator and get some usefulness from it... HAPPY TRADING!!

Inside Candle and mother candle range with alert++>>This script allows you the inside bar candle and the cnadle is shown in white.

The range of the mother candle is identified and tracked until it breaks.

Once the first range is over ridden then the next similar pattern will be occured and the tracking will be done for the mother candle latest occurrence.

It also has the alert mechanism where you can go and the alert for the indicator in Alerts.

5 min is the most preferrable time frame and while saving the alert Note to save the time frame of the chart. For which ever time frame is saved the Alert will be triggered for the same .

And when th inside bar is triggered it throws an alert condition. this alert condition has to be configured in your alerts and will be buzzing on the screen.

Oct 20

Release Notes: updated with Mother candle top and bottom lines of previous occurrences and tracks the current latest Inside bar mother candle

Release Notes: this script allows you the inside bar cnadle and the cnadle is shown in white. highlighter is configurable and line colors as well.

Strategy Myth-Busting #10 - InsideBar+EMA - [MYN]This is part of a new series we are calling "Strategy Myth-Busting" where we take open public manual trading strategies and automate them. The goal is to not only validate the authenticity of the claims but to provide an automated version for traders who wish to trade autonomously.

Our 10th one we are automating is the " 75% Win Rate High Profit Inside Bar Trading Strategy - What If You ... " strategy from " Trade Pro " who claims to have backtested this manually and achieved 11,063% profit with a 75% winrate over 100 trades. I was unable to emulate these results consistently accommodating for slippage and commission but even so, the results look promising. I was only able to achieve this win-rate with some multiple take profit staggering. Even so the markdown is above where I would normally consider comfortable (>20%).

If you know of or have a strategy you want to see myth-busted or just have an idea for one, please feel free to message me.

This strategy uses a combination of 2 open-source public indicators:

Inside Bar Ind/Alert by CMA

EMA (built-in)

Trading Rules

4 hour candles

Stop Loss at EMA Line with TP Target 1.5x the risk

Long Entry when these conditions are true

inside bar and bullish

Bar close's above 50 ema

Price action rises above high of inside bar .

Short Entry when these conditions are true

inside bar and bearish

Bar close below 50 ema

Price action falls below low of inside bar

Confined Range Candle FinderThis indicator finds candlesticks which are confined within the range of a previous candlestick. This indicates volatility contraction which often leads to volatility expansion, i.e. large price movements.

While every confined range will contain at least 1 inside bar, this indicator differs from the Inside Bar Finder which only finds consecutive inside bars.

This indicator includes options such as:

- The minimum number of candlesticks confined within the range of a previous candlestick to trigger the indicator

- Labels to indicate the number of confined candles

- Signal lines to indicate the high and low of the containing candlestick

Try out this indicator with different options on different timeframes to see if confined ranges increase the probability of identifying the direction of price movements. Breaks or closes outside signal lines can be used to trigger trade signals.

Price Action CandlesThis simple script provides a visual aid for price action traders by coloring outside & inside candles, which in effect leaves the trader with 6 possible candle colors:

-Regular bullish candle

-Outside bullish candle

-Inside bullish candle

-Regular bearish candle

-Outside bearish candle

-Inside bearish candle

These candlesticks may provide powerful signals when used in conjunction with key levels, market structure and chart patterns.

Make sure to disable the regular candlesticks (body, borders and wicks) in the symbol tab inside the configuration menu!

Hope it can help someone!

Inside Bar HighlightInside Bar have at least 2 candles.

They include one mother candle and multiple child candles. Mother candle will cover whole child candles ( child candles have high and low within mother candle)

This script will highlight Inside Bars

How to use :

When we analyze market structure, we can combine mother candle and children candles and see them as a candle.

This script will help us do this easily.

Inside Bar SetupScript Details

- This script plots Inside Bar for given day in selected time-frame (applicable only for Timeframes < Day)

- Basis plotted inside bar, relevant targets are marked on the chart

- Targets can be customised from script settings. Example, if range of mother candle is 10 points, then T1 is 10 * x above/below mother candle and T2 is 10 * y above/below mother candle. This x & y are configured via script settings

How to use this script ?

- This script works well on 10-15 mins timeframe for stocks, 15/30 mins timeframe for nifty index and 30/60 mins time frame for bank nifty index

- If mother candle high is broken, take long trade with SL of mother candle low and if low is broken, take short trade with SL of mother candle high

Remember:

1. Above logic is to be combined with support/resistances i.e. price action. This script is an add-on to price action analysis giving you more conviction.

2. If range of mother candle is very high, it is recommended to avoid the trade.

3. Basis inside bar formed on higher time frame, take trade on basis of lower time frame i.e if inside bar is formed on 60 mins, take trade on the basis of 10-15 mins time frame

Example:

1. As seen in the chart, Nifty is near it's resistance and we are seeing Inside Bar being formed, In such scenario, even if High of Mother Candle is broken, we should be more interested to short as we are near resistance and probability of getting our targets in long side is less.

2. So, if I see breakdown of mother candle i.e. price going below low of mother candle, we will short with SL of high of mother candle.

3. As seen in the chart, both the targets are achieved.

Additional Info:

1. Targets on Long/Short Side can be configured via settings. For indices 1 times/1.5 times the range works well.

2. This script plots targets basis the first inside bar formed in the day for selected time frame.

3. Inside bars formed through out the day are coloured separately but lines are plotted only on the basis of 1st formed inside bar as this strategy works well for the first formed inside bar)

4. Don't forget to check volume in case of breakout/breakdown.

Note:

1. Mother Candle - First Candle of Inside Bar

2. Child Candle - Candle formed inside Mother Candle (Second Candle of Inside Bar)

Happy Trading :)

PopGun Trading, PG Pattern DetectorPopGun Bar Pattern Strategy

PG Trading

The indicator does the following:

It detects the Outside Bar, the smaller inside Bar and the 3rd Pop Gun that is bigger, than the inside Bar.

When the Pop Gun was detected, the indicator will calculate 3 targets for long and short trades.

In our understanding, a Pop Gun is neutral. The next candles after the Pop Gun will decide if the PG breakout is bullish or bearish.

So if one of the next candles after the PG is breaking the high or low of the PG Candle, this is a breakout confirmation and can traded long or short.

We are using the PG Indicator for Stock, Futures and Index Trading.

The Script uses 3 targets per default, but you can extend the target dots up to 6.

If you want to see the targets in plain text, you can activate the PG Box.

The targets are calculated really easy: Just the height of the candle multiplied with 1, 2 and 3 (4,5 and 6 additionally). In some communities there is an ATR calculation for more extended targets but it seems, that the ATR Calculation will sometimes lead to unreachable targets if the ATR is really high intraday...

We trade PopGuns starting at M15 chart. I think PGs smaler than M15 are not worth a trade...

Maybe i will add the ATR Function in the future just to compare the 2 ways to calculate PG targets. We are really doing well with 1,2,3 targets based on the PG Candle size. (Low to High).

Please leave a comment if you have some feature requests or input to make this the best Pop Gun Indicator in Trading View ;-)

Inside Bar FinderInside bars occur when the range of a candlestick falls entirely within the previous candlestick's range. This indicates volatility contraction which often leads to volatility expansion, i.e. large price movements.

This indicator includes options such as:

- The number of consecutive inside bars required to trigger the indicator

- Signal lines to indicate the high and low of the outermost or innermost bars

Try out this indicator with different options on different timeframes to see if inside bars increase the probability of identifying the direction of price movements. Breaks or closes outside the inside or outside signal lines can be used to trigger trade signals.