Silver BulletSilver Bullet — A Strategic Approach

The Silver Bullet indicator simplifies trading by focusing on three core elements: Time Frame, Price Levels, and Optimal Trade Entries.

Time Frame

Silver Bullet targets a precise intraday window to capture key market moves. By zeroing in on specific time frames, it aligns trade setups with real-time momentum and dynamic price action.

Price Levels

Using Fibonacci-based levels, Fair Value Gaps (FVGs), and Volume Imbalances (VIs), Silver Bullet highlights high-probability zones for entries and exits.

Optimal Trade Entry

By combining strategic time windows with precise price zones, Silver Bullet pinpoints ideal trade moments — maximizing potential while keeping risk tightly controlled.

Included in the Silver Bullet TradingView Indicator

• Macro Time Highlight (09:50 - 10:10 EST)

• Fibonacci Levels

• Fair Value Gaps (FVGs)

• Volume Imbalances (VIs)

• Tweezer Candlestick Reversal Detection

⸻

Live Support & More

For live support, updates, and access to premium features, visit silverbullet.trade .

Ict

LTF HTF CANDLE fast deployThe "LTF Candle Fast Deploy" script allows you to clearly and dynamically display candles from lower timeframes (LTF) and higher timeframes (HTF) on the same chart. With the cursor function, it becomes simple to move the end line and analyze completely different points. You can configure the number of candles and timeframes, as well as customize colors and borders. One of its key features is temporal alignment: the last LTF candle is forced to coincide with a defined end date (end_date), with a transparent background applied to highlight the area around this date.

Additionally, the script supports two different timeframes, allowing you to simultaneously compare two series of candles, with adjustable width and spacing options to better fit the chart. A summary table can be displayed in an overlay to show information about timeframes and the amount of candles, while a triangle visually marks the candle corresponding to the end date.

Finally, there are performance limits in place to ensure optimal functioning, such as the maximum number of bars analyzed and a limit on the offset, to prevent slowdowns in the chart.

--------------------------------------------------KEY FEATURES--------------------------------------------------

1. **Display of HTF and LTF Candles**

This feature allows you to plot on the chart a configurable number (Amount of Candles) of candles from both a lower timeframe (e.g., 30m) and a higher timeframe (e.g., 4H). The candles are drawn using `box.new` for the body and `line.new` for the wicks, with customizable colors and borders.

2. **Temporal Alignment on Start and End Dates**

The user defines an "end_date" (configurable by the user). The last LTF candle is forced to horizontally align with the corresponding bar at the end_date, calculating a dynamic offset. A semi-transparent background is applied to all bars near the end_date to highlight the concluding period. By simply moving the cursor, you can shift the focus to another area.

3. **Customizable Dual Timeframe**

In addition to the primary LTF, the script supports a second timeframe (2nd Timeframe), with the same offset, buffer, and coloring logic. It is recommended to use an HTF or the same timeframe as the chart. This feature allows you to simultaneously compare two sets of candles from different timeframes on the same chart.

4. **Candle Width and Buffer Controls**

The width (Candle Width) and spacing (Candle Buffer) of the candles are variable, as is the extra horizontal offset (extra_offset). These parameters allow precise adjustment of the visual clutter and alignment with the chart bars.

5. **Summary Table in Overlay**

Upon the last tick (if activated), a table (Show Table) appears in one of the eight available positions (e.g., top right). The table displays:

- LTF: lower timeframe

- HTF: higher timeframe

- Ch TF: chart timeframe

- AoC: amount of candles

- c AoC: amount of chart candles corresponding to the observed zone

Additionally, a triangle (`plotshape`) is drawn above the candle corresponding to the end_date on the main chart to visually identify the alignment moment.

6. **Performance and Limit Management**

The script sets limits on the number of bars analyzed (max_bars_back, max_boxes_count) and an offset maximum (future limit of 500 bars) to prevent slowdowns or excessive drawing.

Candlestick pattern + FVG + sessionThis script includes three main features:

1) Candlestick Pattern Identification: It highlights bullish and bearish candlestick sequences.

2) Fair Value Gap (FVG) Detection: It detects Fair Value Gaps (FVG) and highlights them on the chart.

3) Session Ranges: The script allows the user to define and visualize trading session ranges (Session 1 and Session 2), as well as their high and low points.

*Let me know in the comments if you'd like to see more indicators like this one.

-------------------------------------KEY FEATURES-------------------------------------

CANDLESTICK PATTERN IDENTIFICATION:

(The script checks for a specific candlestick pattern)

Bullish Pattern: The script identifies two consecutive candles where both are BLACK (downward trend).

Bearish Pattern: The script identifies two consecutive green candles (upward trend).

If the pattern is identified, it colors the bars of the candles accordingly:

Green for bullish (upward).

black for bearish (downward).

FAIR VALUE GAP (FVG) DETECTION:

The script identifies Bullish and Bearish Fair Value Gaps (FVG):

A Bullish FVG occurs when the low of the current bar is higher than the high of the bar two periods ago.

A Bearish FVG occurs when the high of the current bar is lower than the low of the bar two periods ago.

When a gap is detected, a colored box is drawn on the chart to represent the gap area. The user can customize the color and opacity of the boxes.

SESSION RANGES:

The user can define the time range for Session 1 and Session 2.

"Session 1 is by default configured to align with the regular trading hours, starting at 9:30 AM (market open) and ending at 4:00 PM (market close).

Session 2 is by default configured to begin at 9:30 AM (market open) and conclude 30 minutes thereafter."

The script can plot the high and low points of each session and display them on the chart as lines. These points can be customized to be visible or hidden, and the session ranges can also be highlighted with a box.

Additionally, the script allows users to control whether the max/min points for each session should be displayed.

This script can be used by traders who want to identify candlestick patterns, detect FVGs, and monitor session ranges on their charts. It is particularly useful for traders who focus on price action and market structure, as it allows for visual analysis of inefficient areas during the trading sessions of the day

( This script has been tested only on the H4 timeframe.)

ICT SMC Liquidity Grabs and OBsICT SMC Liquidity Grabs + Order Blocks + Fibonacci OTE Levels

A High-Probability Entry Engine for Smart Money Concept Traders

This script combines three powerful Smart Money Concepts (SMC) into a single tool: Liquidity Grabs, Order Block Zones, and Fibonacci OTE Levels, allowing traders to identify institutional entry models with clean, rule-based visual signals.

It’s designed to simplify SMC trading by highlighting confluence zones where price is likely to reverse or continue — with clear visual zones, entry arrows, and take profit projections.

🔍 What This Script Does:

Detects Liquidity Grabs

Identifies when price sweeps above/below the highest high or lowest low within a user-defined lookback period and closes back inside.

Plots orange labels on the chart to signal potential liquidity events (LG-H / LG-L).

Plots Order Blocks After Liquidity Grabs

After a liquidity grab, the script looks for displacement candles (strong bullish or bearish moves) and draws highlighted OB zones extending several bars to the right.

These zones represent potential institutional footprints for price reversals.

Draws Fibonacci OTE Levels (Optimal Trade Entry)

Uses recent swing high and low pivots to automatically calculate OTE zones (default: 62% and 75% retracement levels).

Draws these retracement zones for both bullish and bearish setups.

Marks Valid OTE Entry Zones

Buy/Sell zones only trigger when:

A liquidity grab occurs,

Price enters the OTE zone,

And a strong confirming candle is present.

Plots green/red arrows for valid buy/sell OTE entries.

Auto-Draws Take Profit Zones

TP1 = Previous swing high/low

TP2 = Risk-based R-multiplied extension (e.g., 1.5R — customizable)

Alerts

Triggers alerts when valid buy or sell OTE setups are detected.

⚙️ Customization Features:

Toggle each feature: Liquidity Grabs, Order Blocks, Fibonacci OTE levels

Set Fibonacci retracement percentages (e.g., 0.62 / 0.75)

Adjust lookback window for liquidity detection

Customize the take-profit multiplier (R-based)

Full control over visuals: colors, labels, and lines

💡 How to Use:

Use this script to scan for high-confluence trade setups based on Smart Money principles.

Combine with session timing (e.g., New York open), major swing structure, or Kill Zone windows for maximum edge.

Look for arrows inside OB zones or OTE levels following liquidity sweeps for cleaner entries.

🔗 Works Best With:

✅ First FVG — Opening Range Fair Value Gap Detector: Identify early inefficiencies to set the narrative for the day.

✅ Liquidity Levels — Smart Swing Lows: Spot key structural lows that can fuel stop hunts and reversals.

✅ ICT Turtle Soup — Liquidity Reversal: Add a classic reversal pattern to your toolkit to catch fakeouts cleanly.

Together, these tools build a complete Smart Money ecosystem for entry precision, risk management, and price behavior forecasting.

ICT Turtle Soup (Liquidity Reversal)ICT Turtle Soup — Liquidity Reversal Detection

Trap the Trap: A Precision Reversal Strategy from the Inner Circle Trader Playbook

This indicator implements the Turtle Soup liquidity reversal setup — a widely used ICT (Inner Circle Trader) concept that targets false breakouts beyond recent swing highs or lows. These patterns typically occur when price grabs liquidity above or below a known level, then snaps back, trapping retail traders and creating a high-probability reversal scenario.

🔍 What This Script Does:

Detects Liquidity Sweeps Above/Below Key Swing Levels

Uses a customizable swing lookback to identify recent swing highs and lows.

Triggers a Bearish Turtle Soup when price runs above a previous swing high and closes back below.

Triggers a Bullish Turtle Soup when price sweeps below a prior swing low and closes back above.

Plots Clear Visual Signals

Reversal signals appear as 🐢🔻 (Bearish) or 🐢🔺 (Bullish) markers directly on your chart.

Optional labels can be enabled for enhanced journaling and review.

Real-Time Alerts

Receive alert notifications when a Turtle Soup setup is detected — ideal for scalpers or intraday traders watching for reversals around liquidity pools.

⚙️ Customization Options:

Set the swing lookback sensitivity (default: 5)

Enable or disable labels

Choose label font size

Customize colors for bullish and bearish signals

💡 How to Use:

Deploy on intraday timeframes (e.g. 5m–15m) for high-resolution liquidity analysis.

Watch for signals at key highs/lows, session extremes, or zones where liquidity is likely resting.

Combine with tools like FVGs, Order Blocks, and OTE zones for layered confirmation.

🔗 Combine With These Tools for a Complete SMC Edge:

✅ First FVG — Opening Range Fair Value Gap Detector

✅ ICT SMC Liquidity Grabs + OB + Fibonacci OTE Levels

✅ Liquidity Levels — Smart Swing Lows

Together, these tools form a high-precision Smart Money toolkit — helping traders map, anticipate, and act on institutional-level liquidity events with clarity and confidence.

ICT Turtle Soup Ultimate V2📜 ICT Turtle Soup Ultimate V2 — Advanced Liquidity Reversal System

Overview:

The ICT Turtle Soup Ultimate V2 is a next-generation liquidity reversal indicator built on the principles of smart money concepts (SMC) and the classic ICT Turtle Soup setup. It is designed to detect false breakouts (liquidity grabs) at key swing points, enhanced by proprietary logic that filters out low-quality signals using a combination of trend context, kill zone timing, candle wick behavior, and multi-timeframe imbalance zones.

This tool is ideal for intraday traders seeking high-probability entry signals near liquidity pools and imbalance zones — where smart money makes its move.

🔍 What This Script Does

🧠 Liquidity Grab Detection (Turtle Soup Core Logic)

The script scans for recent swing highs/lows using a user-defined lookback.

A signal is generated when price breaks above/below a previous swing level but closes back inside — indicating a liquidity run and likely reversal.

A special Wick Trap Mode enhances this logic by detecting long-wick fakeouts — where the wick grabs stops but the candle body closes opposite the breakout direction.

📉 Trend Filter with ATR Buffer

Optional trend filter uses a simple moving average (SMA) to gauge market direction.

Instead of hard filtering, it applies an ATR-based buffer to allow for entries near the trend line, reducing signal suppression from micro-fluctuations.

🕰️ Kill Zone Session Filtering

Only show signals during institutional trading hours:

London Session

New York AM

Or any custom user-defined session

Helps traders avoid low-volume hours and focus on where stop hunts and price expansions typically occur.

🧱 Multi-Timeframe FVG Confluence (Optional)

Signal validation is strengthened by checking if price is within a higher timeframe Fair Value Gap — commonly used to identify imbalances or inefficiencies.

Filters out setups that lack underlying displacement or order flow justification.

🎨 Visual Feedback

Plots 🔺 bullish and 🔻 bearish markers at signal candles.

Optionally displays:

Swing High/Low Labels (SH / SL)

Reversal distance labels

Background color shading on valid signals

Includes built-in alerts for automated trade notification.

🔑 Unique Benefits

Wick Trap Detection: A proprietary approach to detecting stop hunts via wick behavior, not just candle closes.

ATR-based trend filtering: Avoids unnecessary filtering while still maintaining directional bias.

All-in-one system: No need to stack multiple indicators — swing detection, reversal logic, session filtering, and imbalance confirmation are all integrated.

💡 How to Use

Enable Wick Trap Mode to detect stealthy liquidity grabs with strong wicks.

Use Kill Zone filters to trade only when institutions are active.

Optionally enable FVG confluence to improve confidence in reversal zones.

Watch for Bullish signals near SL levels and Bearish signals near SH levels.

Combine with your own execution strategy or other SMC tools for optimal results.

🔗 Best Used With:

Maximize your edge by combining this script with complementary SMC-based tools:

✅ First FVG — Opening Range Fair Value Gap Detector

✅ ICT SMC Liquidity Grabs + OB + Fibonacci OTE Levels

✅ Liquidity Levels — Smart Swing Highs and Lows with horizontal line projections

ICT Turtle Soup (Liquidity Reversal)ICT Turtle Soup — Liquidity Reversal Detection

Classic Liquidity Trap Reversal Strategy for Smart Money Traders

This indicator implements the ICT Turtle Soup concept — a classic liquidity-based reversal pattern — which occurs when price runs above or below a recent swing level to grab liquidity, then sharply reverses. This pattern is commonly used in Smart Money Concepts (SMC) and Inner Circle Trader (ICT) strategies to anticipate false breakouts and high-probability reversals.

🔍 What This Script Does:

Identifies Swing Highs & Lows

Detects recent swing highs and lows using a customizable lookback period.

Tracks Liquidity Grabs

A bearish Turtle Soup setup is triggered when price breaks above a recent swing high but closes back below it.

A bullish Turtle Soup setup is triggered when price breaks below a recent swing low but closes back above it.

These conditions often signal liquidity traps, where price sweeps resting orders before reversing.

Plots Signals Directly on the Chart

Turtle Soup setups are marked with 🐢🔻 (bearish) and 🐢🔺 (bullish) labels.

Optional full-text labels can also be displayed for clarity and journaling.

Includes Alert Conditions

Alerts can be enabled to notify you of bullish or bearish Turtle Soup reversals in real-time.

⚙️ Customization Features:

Adjustable swing lookback period

Enable/disable Turtle Soup labels

Set label font size

Choose your preferred bullish/bearish signal colors

💡 How to Use:

Add this script to your chart (ideally on intraday timeframes such as 5m–15m).

Wait for a Turtle Soup signal near a key swing high/low or liquidity zone.

Combine with other confirmation tools (e.g., FVGs, Order Blocks, OTE) for stronger setups.

Use alerts to stay ahead of fast-moving reversals.

🧠 Why It Works:

Turtle Soup setups are rooted in liquidity theory — they exploit the market’s tendency to sweep obvious swing levels before reversing. These moves often trap retail traders and mark the beginning of Smart Money entries.

🔗 Best Used With:

Maximize the edge by combining this with other SMC tools:

✅ First FVG — Opening Range Fair Value Gap Detector

✅ ICT SMC Liquidity Grabs + OB + Fibonacci OTE Levels

✅ Liquidity Levels — Smart Swing Lows

Together, they create a complete ecosystem for identifying, confirming, and executing liquidity-driven trade setups with precision.

Liquidity Levels (Smart Swing Lows)Liquidity Levels — Smart Swing Low Detection

Efficient Liquidity Sweep Visualization for Smart Money Traders

This script automatically identifies and plots liquidity-rich swing lows based on pivot logic, filters them to remove redundant levels, and overlays daily highs/lows for added context — giving Smart Money Concept (SMC) traders a clean, actionable map of liquidity.

It’s designed to be minimal yet powerful: perfect for spotting potential liquidity grabs, mitigation zones, and sweep targets with zero chart clutter.

🔍 What This Script Does:

Detects Smart Swing Lows

Uses fixed pivot detection (left = 3, right = customizable) to identify structurally significant swing lows.

Filters out swing lows that are too close together using a percentage-based spacing threshold to reduce noise.

Mitigation Cleanup Logic

Tracks whether recent price action breaches past swing lows.

If breached, the swing level is automatically removed, keeping only relevant, unmitigated liquidity levels on your chart.

Plots Daily Highs and Lows

Each new trading day, horizontal rays mark the prior day’s high and low — useful for identifying resting liquidity and possible sweep zones.

Labeling and Style Customization

Optional labels for swing lows.

Full control over label size, color, and visibility to match any chart aesthetic.

Timeframe Filtering

Runs exclusively on 5m, 10m, and 15m charts to ensure optimal reliability and signal clarity.

⚙️ Customization Features:

Pivot sensitivity (Right side control)

Minimum distance between swing lows (in %)

Label visibility, size, and color

Line width and colors for both swing levels and daily highs/lows

Mitigation cleanup lookback length

💡 How to Use:

Add the script to a qualifying intraday chart (5–15m).

Use the swing low levels to monitor liquidity-rich zones.

Combine with your personal strategy to identify liquidity grabs, potential reversal zones, or entry points following a sweep.

Let the built-in cleanup logic remove any already-mitigated levels so you can focus on active targets.

🚀 What Makes It Unique:

This isn’t just another pivot plotter — it’s a smart, self-cleaning SMC tool designed for modern liquidity-based trading strategies.

A must-have for traders using concepts like liquidity grabs, mitigation blocks, or sweep-to-reverse trade models.

🔗 Best used in combination with:

✅ First FVG — Opening Range Fair Value Gap Detector: Pinpoint the day’s first imbalance zone for intraday setups.

✅ ICT SMC Liquidity Grabs + OB + Fibonacci OTE Levels: Confluence-based entries powered by liquidity logic, order blocks, and premium/discount zones.

Used together, these scripts form a complete Smart Money toolkit — helping you build high-probability setups with confidence, clarity, and clean charts.

First FVG Custom Time RangeFirst FVG — Opening Range Fair Value Gap Detector

Smart Money Opening Imbalance Strategy Tool

This script automatically detects and highlights the first Fair Value Gap (FVG) that forms between 9:30 and 10:00 AM Eastern Time (New York session open) — a critical period often referred to as the Opening Range. It’s designed for Smart Money traders looking to isolate early-morning inefficiencies that may influence market behavior throughout the trading day.

🔍 What This Script Does:

Automatically Detects the First FVG in the Opening Range

Scans price action between 9:30 and 10:00 AM ET and identifies the first valid bullish or bearish FVG that forms.

Only one FVG is shown per day — ensuring a clean, focused view.

Draws a Visual Zone

Once detected, the FVG zone is extended forward on the chart (customizable duration).

A labeled zone helps users track how price reacts to it throughout the session.

Optional Retest Alerts

Alerts you when price re-enters the zone — a potential reaction point used by SMC traders.

Customization Options

Set your preferred session time window

Adjust zone duration (in bars)

Customize label font size, colors, and visibility

Enable/disable alert on retest

📈 Why the First FVG Matters:

Time-Sensitive Setup: The first FVG typically forms no earlier than 9:31 AM ET and represents a potential “time distortion” or imbalance zone created by aggressive market participants during the open.

Behavioral Study: Many traders journal how price behaves around this zone each day — whether it acts as support, resistance, or gets traded through later in the session.

Predictive Value: Observing how this zone is respected or broken can provide anticipatory insight into intraday price action, rather than reactive analysis.

Great for New Traders: This opening FVG is often recommended as a starting reference point for building trade models and understanding how institutional imbalances unfold.

🚀 What Makes It Unique:

This tool doesn’t spam your chart with every FVG. It laser-focuses on a single, time-bound zone backed by institutional logic — the first presented imbalance of the day during the opening range.

Use it to:

Monitor price behavior around early inefficiencies

Plan journal entries and pattern recognition

Align intraday setups with a high-probability SMC model

Whether you’re scalping, journaling market structure, or refining entries based on liquidity behavior — this script helps you make the first 30 minutes count.

ICT SMC Liquidity Grabs and OBsICT SMC Liquidity Grabs + OB + Fibonacci OTE Levels

Smart Money Concepts Trading Assistant

This script is built for traders who follow ICT (Inner Circle Trader) and Smart Money Concepts. It intelligently combines three critical components of SMC trading: Liquidity Grabs, Order Blocks, and Fibonacci-based Optimal Trade Entry (OTE) zones — giving traders visual cues for potential high-probability reversals and entry points.

🔍 What This Script Does:

Detects Liquidity Grabs

Identifies swing highs/lows where price sweeps liquidity, then immediately reverses.

Labels them with orange markers when price takes out previous highs/lows but closes back inside.

Draws Order Blocks

After a liquidity grab, the script looks for strong bullish or bearish candles and automatically highlights the OB zone.

These OB zones are visualized with transparent colored boxes extending several bars forward.

Plots Fibonacci OTE Levels

Uses recent swing high/low pivots to dynamically draw customizable OTE retracement levels (e.g., 62% and 75%) for both long and short setups.

Highlights Optimal Entry Zones

Marks valid OTE-based buy/sell opportunities only when:

Liquidity has been taken,

Price enters the OTE zone,

And a strong confirming candle appears.

Adds visual zones, trade labels, and optional alerts for each qualified entry.

Includes Take Profit Targets

Automatically calculates take-profit levels based on previous structure and risk-reward ratios.

TP1 is the previous swing, and TP2 is an extended R-multiple (customizable by user).

⚙️ Customization Options:

Toggle each feature (Liquidity Grabs, OBs, Fibonacci Levels)

Adjust Fibonacci levels (default: 62% and 75%)

Set lookback period for liquidity checks

Customize the R-multiple for TP2 levels

💡 How to Use:

Enable desired features from the input panel.

Watch for Buy/Sell OTE zones highlighted in green/red.

Confirm with liquidity sweep and OB support for stronger signals.

Use the automatically generated TP levels to manage risk.

🚀 What Makes It Unique:

Unlike other open-source mashups, this script synchronizes multiple SMC concepts into a single tool that:

Waits for high-confidence conditions (not just blind fib or OB detection)

Validates entries using multiple confluences

Visually marks actionable setups

Automates trade management zones

Whether you're trend-trading, scalping, or swing trading ICT-style, this tool offers a streamlined, smart-money-aligned workflow directly on your chart.

ICT SMC Liquidity Grabs and OBsICT SMC Liquidity Grabs + OB + Fibonacci OTE Levels

Smart Money Concepts Trading Assistant

This script is built for traders who follow ICT (Inner Circle Trader) and Smart Money Concepts. It intelligently combines three critical components of SMC trading: Liquidity Grabs, Order Blocks, and Fibonacci-based Optimal Trade Entry (OTE) zones — giving traders visual cues for potential high-probability reversals and entry points.

🔍 What This Script Does:

Detects Liquidity Grabs

Identifies swing highs/lows where price sweeps liquidity, then immediately reverses.

Labels them with orange markers when price takes out previous highs/lows but closes back inside.

Draws Order Blocks

After a liquidity grab, the script looks for strong bullish or bearish candles and automatically highlights the OB zone.

These OB zones are visualized with transparent colored boxes extending several bars forward.

Plots Fibonacci OTE Levels

Uses recent swing high/low pivots to dynamically draw customizable OTE retracement levels (e.g., 62% and 75%) for both long and short setups.

Highlights Optimal Entry Zones

Marks valid OTE-based buy/sell opportunities only when:

Liquidity has been taken,

Price enters the OTE zone,

And a strong confirming candle appears.

Adds visual zones, trade labels, and optional alerts for each qualified entry.

Includes Take Profit Targets

Automatically calculates take-profit levels based on previous structure and risk-reward ratios.

TP1 is the previous swing, and TP2 is an extended R-multiple (customizable by user).

⚙️ Customization Options:

Toggle each feature (Liquidity Grabs, OBs, Fibonacci Levels)

Adjust Fibonacci levels (default: 62% and 75%)

Set lookback period for liquidity checks

Customize the R-multiple for TP2 levels

💡 How to Use:

Enable desired features from the input panel.

Watch for Buy/Sell OTE zones highlighted in green/red.

Confirm with liquidity sweep and OB support for stronger signals.

Use the automatically generated TP levels to manage risk.

🚀 What Makes It Unique:

Unlike other open-source mashups, this script synchronizes multiple SMC concepts into a single tool that:

Waits for high-confidence conditions (not just blind fib or OB detection)

Validates entries using multiple confluences

Visually marks actionable setups

Automates trade management zones

Whether you're trend-trading, scalping, or swing trading ICT-style, this tool offers a streamlined, smart-money-aligned workflow directly on your chart.

Trading Sessions [BigBeluga]

This indicator brings Smart Money Concept (ICT) session logic to life by plotting key global trading sessions with volume and delta analytics. It not only highlights session ranges but also tracks their midpoints — which often act as intraday support/resistance levels.

🔵 KEY FEATURES

Visual session boxes: Plots boxes for Tokyo, London, New York, and Sydney sessions based on user-defined UTC+0 time ranges.

Volume & delta metrics: Displays total volume and delta volume (buy–sell difference) within each session.

Mid, High & Low Range Extension: Once a session ends, the high, low, and midpoint levels automatically extend — ideal for detecting SR zones.

Session labels: Each box includes a label with session name, time, volume, and delta for quick reference.

Custom session control: Enable or disable sessions individually and configure start/end times.

Clean aesthetics: Transparent shaded boxes with subtle borders make it easy to overlay without clutter.

Sessions Dashboard: Shows the time range of each session and tells you whether the session is currently active.

🔵 USAGE

Enable the sessions you want to monitor (e.g., New York or Tokyo) from the settings.

Use session volume and delta values to gauge the strength and direction of institutional activity.

Watch for price interaction with the extended range — it often acts as dynamic support/resistance after the session ends.

Overlay it with liquidity tools or breaker blocks for intraday strategy alignment.

🔵 EXAMPLES

Extended Future Range acted as resistance/support.

Delta value helped confirm bullish pressure during New York open.

Multiple sessions helped identify kill zone overlaps and high-volume turns.

Trading Sessions is more than just a visual scheduler — it's a precision tool for traders who align with session-based volume dynamics and ICT methodology. Use it to define high-probability zones, confirm volume shifts, and read deeper into the true intent behind market structure.

FVG + Swings + ConfigurableOverview

This Pine Script v5 indicator highlights Fair Value Gaps (FVGs), plots swing‑high and swing‑low pivots, and marks single breakouts above the last swing‑high or below the last swing‑low by recoloring the breakout candle. Every aspect—gap size, count limits, colors, and feature toggles—is exposed as an input so you can tailor it to your own workflow.

Key Features

Fair Value Gaps

Detects bullish gaps when the high of bar i-2 is below the low of the current bar.

Detects bearish gaps when the low of bar i-2 is above the high of the current bar.

Draws a semi‑transparent rectangle spanning from bar i-2 to bar i + extension.

Automatically deletes oldest boxes when exceeding the user’s “Max FVG Boxes” limit.

Swing‑High / Swing‑Low Pivots

Identifies a swing‑high when the middle candle of a three‑bar sequence has the highest high.

Identifies a swing‑low when the middle candle has the lowest low.

Marks each pivot with a tiny dot above (high) or below (low) the bar.

Single Breakouts

Tracks the most recent swing‑high and swing‑low levels.

On the first close above the last swing‑high (or below the last swing‑low), recolors that single candle.

Prevents repeated coloring until a new swing pivot forms.

Full Customization

Show/Hide toggles for FVGs, swing pivots, breakouts.

Numeric inputs for FVG extension length and maximum retained boxes.

Color pickers for bullish/bearish gaps, swing pivots, and breakout candles.

Quarterly Theory ICT 04 [TradingFinder] SSMT 4Quarter Divergence🔵 Introduction

Sequential SMT Divergence is an advanced price-action-based analytical technique rooted in the ICT (Inner Circle Trader) methodology. Its primary objective is to identify early-stage divergences between correlated assets within precise time structures. This tool not only breaks down market structure but also enables traders to detect engineered liquidity traps before the market reacts.

In simple terms, SMT (Smart Money Technique) occurs when two correlated assets—such as indices (ES and NQ), currency pairs (EURUSD and GBPUSD), or commodities (Gold and Silver)—exhibit different reactions at key price levels (swing highs or lows). This lack of alignment is often a sign of smart money manipulation and signals a lack of confirmation in the ongoing trend—hinting at an imminent reversal or at least a pause in momentum.

In its Sequential form, SMT divergences are examined through a more granular temporal lens—between intraday quarters (Q1 through Q4). When SMT appears at the transition from one quarter to another (e.g., Q1 to Q2 or Q3 to Q4), the signal becomes significantly more powerful, often aligning with a critical phase in the Quarterly Theory—a framework that segments market behavior into four distinct phases: Accumulation, Manipulation, Distribution, and Reversal/Continuation.

For instance, a Bullish SMT forms when one asset prints a new low while its correlated counterpart fails to break the corresponding low from the previous quarter. This usually indicates absorption of selling pressure and the beginning of accumulation by smart money. Conversely, a Bearish SMT arises when one asset makes a higher high, but the second asset fails to confirm, signaling distribution or a fake-out before a decline.

However, SMT alone is not enough. To confirm a true Market Structure Break (MSB), the appearance of a Precision Swing Point (PSP) is essential—a specific candlestick formation on a lower timeframe (typically 5 to 15 minutes) that reveals the entry of institutional participants. The combination of SMT and PSP provides a more accurate entry point and better understanding of premium and discount zones.

The Sequential SMT Indicator, introduced in this article, dynamically scans charts for such divergence patterns across multiple sessions. It is applicable to various markets including Forex, crypto, commodities, and indices, and shows particularly strong performance during mid-week sessions (Wednesdays and Thursdays)—when most weekly highs and lows tend to form.

Bullish Sequential SMT :

Bearish Sequential SMT :

🔵 How to Use

The Sequential SMT (SSMT) indicator is designed to detect time and structure-based divergences between two correlated assets. This divergence occurs when both assets print a similar swing (high or low) in the previous quarter (e.g., Q3), but in the current quarter (e.g., Q4), only one asset manages to break that swing level—while the other fails to reach it.

This temporal mismatch is precisely identified by the SSMT indicator and often signals smart money activity, a market phase transition, or even the presence of an engineered liquidity trap. The signal becomes especially powerful when paired with a Precision Swing Point (PSP)—a confirming candle on lower timeframes (5m–15m) that typically indicates a market structure break (MSB) and the entry of smart liquidity.

🟣 Bullish Sequential SMT

In the previous quarter, both assets form a similar swing low.

In the current quarter, one asset (e.g., EURUSD) breaks that low and trades below it.

The other asset (e.g., GBPUSD) fails to reach the same low, preserving the structure.

This time-based divergence reflects declining selling pressure, potential absorption, and often marks the end of a manipulation phase and the start of accumulation. If confirmed by a bullish PSP candle, it offers a strong long opportunity, with stop-losses defined just below the swing low.

🟣 Bearish Sequential SMT

In the previous quarter, both assets form a similar swing high.

In the current quarter, one asset (e.g., NQ) breaks above that high.

The other asset (e.g., ES) fails to reach that high, remaining below it.

This type of divergence signals weakening bullish momentum and the likelihood of distribution or a fake-out before a price drop. When followed by a bearish PSP candle, it sets up a strong shorting opportunity with targets in the discount zone and protective stops placed above the swing high.

🔵 Settings

⚙️ Logical Settings

Quarterly Cycles Type : Select the time segmentation method for SMT analysis.

Available modes include: Yearly, Monthly, Weekly, Daily, 90 Minute, and Micro.

These define how the indicator divides market time into Q1–Q4 cycles.

Symbol : Choose the secondary asset to compare with the main chart asset (e.g., XAUUSD, US100, GBPUSD).

Pivot Period : Sets the sensitivity of the pivot detection algorithm. A smaller value increases responsiveness to price swings.

Activate Max Pivot Back : When enabled, limits the maximum number of past pivots to be considered for divergence detection.

Max Pivot Back Length : Defines how many past pivots can be used (if the above toggle is active).

Pivot Sync Threshold : The maximum allowed difference (in bars) between pivots of the two assets for them to be compared.

Validity Pivot Length : Defines the time window (in bars) during which a divergence remains valid before it's considered outdated.

🎨 Display Settings

Show Cycle :Toggles the visual display of the current Quarter (Q1 to Q4) based on the selected time segmentation

Show Cycle Label : Shows the name (e.g., "Q2") of each detected Quarter on the chart.

Show Bullish SMT Line : Draws a line connecting the bullish divergence points.

Show Bullish SMT Label : Displays a label on the chart when a bullish divergence is detected.

Bullish Color : Sets the color for bullish SMT markers (label, shape, and line).

Show Bearish SMT Line : Draws a line for bearish divergence.

Show Bearish SMT Label : Displays a label when a bearish SMT divergence is found.

Bearish Color : Sets the color for bearish SMT visual elements.

🔔 Alert Settings

Alert Name : Custom name for the alert messages (used in TradingView’s alert system).

Message Frequency :

All: Every signal triggers an alert.

Once Per Bar: Alerts once per bar regardless of how many signals occur.

Per Bar Close: Only triggers when the bar closes and the signal still exists.

Time Zone Display : Choose the time zone in which alert timestamps are displayed (e.g., UTC).

Bullish SMT Divergence Alert : Enable/disable alerts specifically for bullish signals.

Bearish SMT Divergence Alert : Enable/disable alerts specifically for bearish signals

🔵 Conclusion

The Sequential SMT (SSMT) indicator is a powerful and precise tool for identifying structural divergences between correlated assets within a time-based framework. Unlike traditional divergence models that rely solely on sequential pivot comparisons, SSMT leverages Quarterly Theory, in combination with concepts like liquidity sweeps, market structure breaks (MSB) and precision swing points (PSP), to provide a deeper and more actionable view of market dynamics.

By using SSMT, traders gain not only the ability to identify where divergence occurs, but also when it matters most within the market cycle. This empowers them to anticipate major moves or traps before they fully materialize, and position themselves accordingly in high-probability trade zones.

Whether you're trading Forex, crypto, indices, or commodities, the true strength of this indicator is revealed when used in sync with the Accumulation, Manipulation, Distribution, and Reversal phases of the market. Integrated with other confluence tools and market models, SSMT can serve as a core component in a professional, rule-based, and highly personalized trading strategy.

PRIME 2.0PRIME 2.0 — Precision Entry Tool

PRIME 2.0 is a smart price action-based indicator designed for intraday traders who want to catch high-probability moves during the London session. It uses a combination of market structure shifts (CHOCH – Change of Character) and session-based timing to identify potential entries.

🔍 Key Features:

Session-Based Logic: Activates after the London market opens, filtering noise from other sessions.

CHOCH Detection: Spots shifts in market structure by identifying crossover and crossunder of candle highs/lows.

Visual Entry Points: Plots real-time entry points based on structure change.

🧠 Who Is It For?

Scalpers and day traders

Traders who follow Smart Money Concepts (SMC)

Anyone looking to improve entry precision without clutter

⚠️ Disclaimer:

This indicator does not generate buy/sell signals or exit points. It is meant to be used as a tool within a broader trading strategy. Combine it with your own risk management and market knowledge for best results

ICT Judas + Silver Bullet🔰 ICT Judas + Silver Bullet Indicator (SMC-based)

Built for Prop Firm and High Win Rate Intraday Traders

This indicator identifies key institutional setups from Inner Circle Trader (ICT) and Smart Money Concepts (SMC) strategies, optimized for XAUUSD, EURUSD, and other high-volume pairs on the 5-minute chart.

📌 Core Features:

✅ Asian Range Box (02:00–08:00 SGT) – used as manipulation anchor

✅ London Killzone (14:00–16:00 SGT) – Judas Swing detection

✅ New York Killzone (22:30–23:30 SGT) – Silver Bullet setups

✅ Automatic Fair Value Gap (FVG) detection

✅ Liquidity sweep detection based on 20-bar EQH/EQL

✅ Entry + Stop Loss + Take Profit visualization with adjustable RR

✅ Alerts for Judas and Silver setups

✅ Perfect for prop firm scalping and intraday swing logic

🛠️ How It Works:

- Judas Swing: triggers when liquidity above the Asian high is swept during London Killzone

- Silver Bullet: triggers when liquidity below recent lows is swept during NY Killzone

- Entry shown via circle, SL and TP lines based on user-defined RR and stop-loss pip distance

- Designed to be paired with SMC/ICT OB/FVG confirmation entries

⚙️ Settings:

- Adjustable session times

- Toggle FVG display

- Set RR and SL pips to match prop firm rules

- Compatible with alert webhooks for Telegram

🕰️ Note:

All times are fixed to **SGT (GMT+8)**. If you're in another timezone, adjust your TradingView timezone accordingly or update the session inputs manually during Daylight Saving Time changes.

🔔 Alert-Ready:

Use alerts for live signals and pair with webhooks for automation.

🔍 Recommended Pairings:

XAUUSD, EURUSD, GBPUSD, NAS100 on M5 chart

📈 Win Rate Potential:

Backtested with high-probability setups aligned with prop firm daily goals. Best used with strict discipline and 1-2 setups per day.

—

Built with ❤️ by a trader, for traders looking for precision-based executions using ICT logic.

ICT Liquidity Sweep MAX RETRI (ALERT)Strategy Description: SMC + ICT Reversal Sniper | 5-Min | R2 TP

This strategy applies Smart Money Concepts (SMC) and ICT methodology to identify high-probability reversal trades using a clean, rule-based system designed for the 5-minute timeframe.

⸻

Core Logic:

• Liquidity Sweep: Identifies stop hunts beyond recent swing highs/lows using a configurable lookback window.

• Break of Structure (BOS): Validates a directional shift after the sweep.

• Fixed R2 Risk-Reward: Entry is followed by a 2:1 take-profit target. Stop loss is set at the sweep candle’s high/low.

• No Entry Between 8 PM–12 AM NY Time: Avoids the manipulation-prone and illiquid zone.

• Discreet SL Handling: SL hits close trades silently — no labels or visuals.

⸻

Entry Precision & Timing Notes:

• The strategy may occasionally fire before a confirmed liquidity sweep — this is expected. If a sweep occurs later, you may still re-enter toward equilibrium, with take profit also targeted at equilibrium.

• Alerts or trades that trigger near 9:30 AM NY often align with real direction, but this time can be volatile.

• For more reliable and lower-risk entries, focus on the 1:30 PM to 2:00 PM silver bullet window, which tends to produce cleaner setups with more favorable flow. 🖤

RTH and ETH RangesKey Functions :

Visualizes Regular Trading Hours (RTH) and Extended Trading Hours (ETH) price ranges

Tracks session highs, lows, and 50% levels where significant market reactions occur

Detects breakouts beyond previous session extremes

Trading Applications :

Exposes potential liquidity raids at session boundaries where smart money targets stop orders

Identifies critical price thresholds where institutional activity concentrates

Highlights divergences between RTH and ETH behavior that precede directional moves

Provides measurement of session volatility differences

Maps key price levels for objective entry and exit parameters

Reveals market dynamics at session transitions where institutional positioning changes

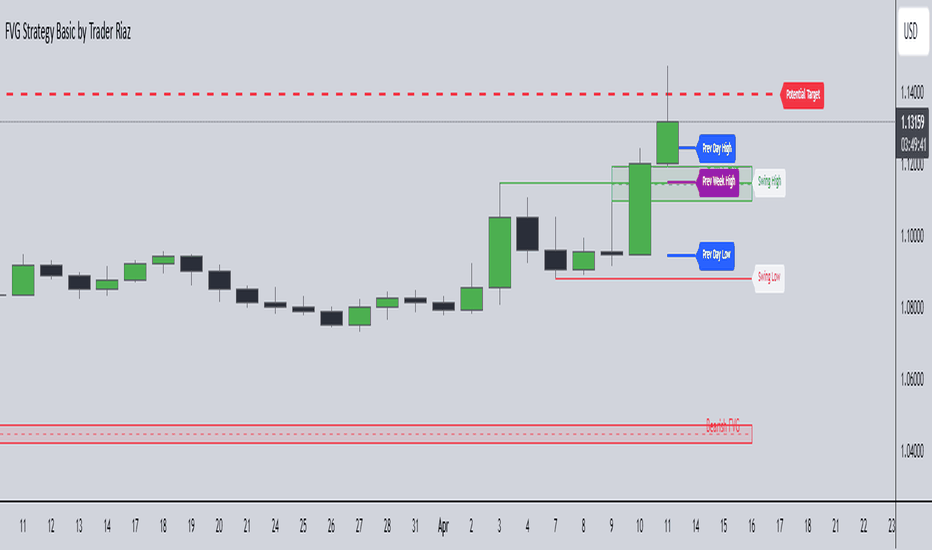

FVG, Swing, Target, D/W/M High Low Detector Basic by Trader Riaz"FVG, Swing, Target, D/W/M High Low Detector Basic by Trader Riaz " is a powerful TradingView indicator designed to enhance your trading strategy by identifying key market structures and levels. This all-in-one tool detects Fair Value Gaps (FVGs), Swing Highs/Lows, and previous Day, Previous Week, and Previous Month Highs/Lows, helping traders make informed decisions with ease.

Key Features:

Bullish & Bearish FVG Detection: Highlights Fair Value Gaps with customizable colors, labels, and extension options.

Swing Highs & Lows: Automatically detects and marks Swing Highs and Lows with adjustable display settings and extensions.

Next Target Levels: Identifies potential price targets based on market direction (rising or falling).

Daily, Weekly, and Monthly High/Low Levels: Displays previous day, week, and month highs/lows with customizable colors.

Customizable Settings: Fully adjustable inputs for colors, number of levels to display, and extension periods.

Clean Visuals: Intuitive and non-intrusive design with dashed lines, labels, and tooltips for better chart readability.

This indicator is ideal for traders looking to identify key price levels, improve market structure analysis, and enhance their trading strategies.

Happy Trading,

Trader Riaz

CandelaCharts - Premium & Discount 📝 Overview

Premium and Discount are key concepts in ICT (Inner Circle Trader) trading strategies, used to pinpoint ideal entry and exit points in the market. These concepts are based on an understanding of market structure and the behavior of institutional traders, commonly referred to as Smart Money.

To understand the Premium and Discount zones, it's crucial to first grasp the concept of the equilibrium level, also known as the basic or fair value. The equilibrium represents the midpoint of a given price range and acts as a reference point, dividing the range into Premium and Discount zones.

The equilibrium reflects the "fair value" of the price within the considered range. Traders use this as a benchmark to assess whether the current price is in the Premium or Discount zone.

The Premium zone lies above the equilibrium level, while the Discount zone is located below it within the price range.

📦 Features

Swing-based detection

Custom detection

Modes

Styling

⚙️ Settings

Range: Determines how you will identify Premium and Discount, either by swing points or by custom date.

Mode: Controls what UI will be displayed

Premium: Sets the Premium color

Discount: Sets the Discount color

Equilibrium: Sets the Equilibrium color

Labels: Controls the labels visibility

⚡️ Showcase

Pro Mode

Solid Mode

Outlined Mode

Flat Mode

The Indicator can be effortlessly applied in replay mode to highlight premium and discount zones based on the most prominent market swings.

🚨 Alerts

The indicator does not provide any alerts!

⚠️ Disclaimer

Trading involves significant risk, and many participants may incur losses. The content on this site is not intended as financial advice and should not be interpreted as such. Decisions to buy, sell, hold, or trade securities, commodities, or other financial instruments carry inherent risks and are best made with guidance from qualified financial professionals. Past performance is not indicative of future results.

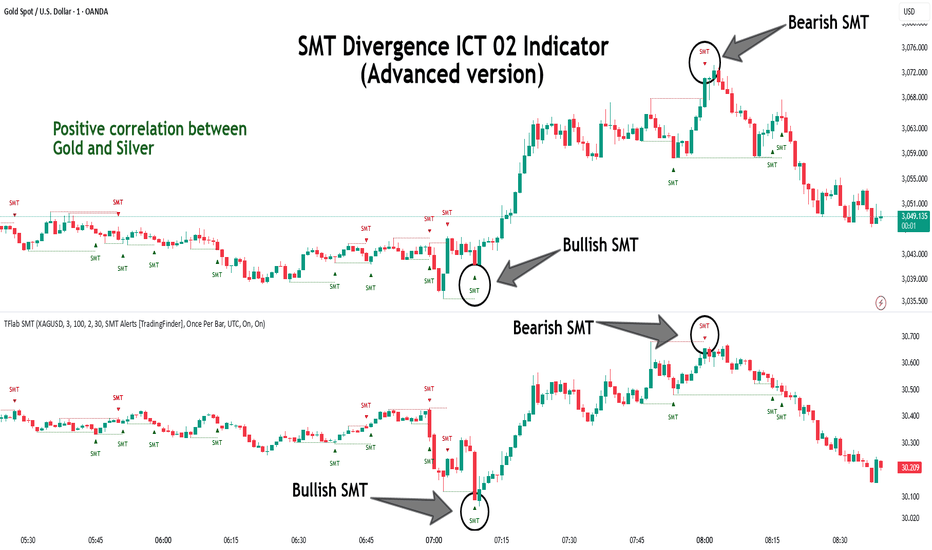

SMT Divergence ICT 02 [TradingFinder] Smart Money Technique SMC🔵 Introduction

SMT Divergence (Smart Money Technique Divergence) is a price action-based trading concept that detects discrepancies in market behavior between two assets that are generally expected to move in the same direction. Rooted in ICT (Inner Circle Trader) methodology, this approach helps traders recognize subtle signs of market manipulation or imbalance, often ahead of traditional indicators.

The core idea behind SMT divergence is simple: when two correlated instruments—such as currency pairs, indices, or assets from the same sector—start forming different swing points (highs or lows), this can reveal a lack of confirmation in the trend. Such divergence is often a precursor to a price reversal or pause in momentum.

This technique works effectively across various markets including Forex, stocks, and cryptocurrencies. It’s particularly valuable when used alongside concepts like liquidity sweeps, market structure breaks (MSBs), or order block identification.

In advanced use cases, Sequential SMT helps uncover patterns of alternating divergences across sessions, often signaling engineered liquidity traps before price reacts.

When combined with the Quarterly Theory—which segments market behavior into Accumulation, Manipulation, Distribution, and Continuation/Reversal phases—traders gain insight not only into where divergence happens, but when it's most likely to be significant within the market cycle.

Bullish SMT :

Bullish SMT Divergence occurs when one asset prints a higher low while the correlated asset forms a lower low. This asymmetry often suggests that the downside move is losing strength, hinting at a potential bullish shift.

Bearish SMT :

Bearish SMT Divergence is formed when one asset creates a higher high, while the second asset fails to confirm by printing a lower high. This typically signals weakening bullish pressure and the possibility of a reversal to the downside.

🔵 How to Use

The SMT Divergence indicator is designed to detect imbalances between two positively correlated assets—such as major currency pairs, indices, or commodities. These divergences often indicate early signs of market inefficiency or smart money manipulation and can help traders anticipate trend shifts with higher precision.

Unlike traditional divergence indicators or earlier versions of this script, this upgraded version does not rely solely on consecutive pivot comparisons. Instead, it dynamically scans all available pivots within the chart to identify divergences at any structural level—major or minor—across the price action. This broader detection method increases the reliability and frequency of meaningful SMT signals.

Moreover, when integrated with Sequential SMT logic, the indicator is capable of identifying multiple divergence sequences across sessions. These sequences often signal engineered liquidity traps and can be mapped within the Quarterly Theory framework, allowing traders to pinpoint not just the presence of divergence but also the phase of the market cycle it appears in (Accumulation, Manipulation, Distribution, or Continuation).

🟣 Bullish SMT Divergence

This signal occurs when the primary asset forms a higher low, while the correlated asset forms a lower low. This pattern implies weakening bearish momentum and a potential shift to the upside.

If the correlated asset breaks its previous low but the primary asset does not, this divergence suggests absorption of selling pressure and possible accumulation by smart money—making it a strong bullish signal, especially when aligned with a favorable market phase (e.g., the end of a manipulation phase in Q2).

🟣 Bearish SMT Divergence

This signal occurs when the primary asset creates a higher high, while the correlated asset forms a lower high. This mismatch indicates fading bullish momentum and a potential reversal to the downside.

If the correlated asset fails to confirm a breakout made by the main asset, the divergence may point to distribution or exhaustion. When seen within Q3 or Q4 phases of the Quarterly Theory, this pattern often precedes sharp declines or fake-outs engineered by smart money

🔵 Settings

⚙️ Logical Settings

Symbol : Choose the secondary asset to compare with the main chart asset (e.g., XAUUSD, US100, GBPUSD).

Pivot Period : Sets the sensitivity of the pivot detection algorithm. A smaller value increases responsiveness to price swings.

Activate Max Pivot Back : When enabled, limits the maximum number of past pivots to be considered for divergence detection.

Max Pivot Back Length : Defines how many past pivots can be used (if the above toggle is active).

Pivot Sync Threshold : The maximum allowed difference (in bars) between pivots of the two assets for them to be compared.

Validity Pivot Length : Defines the time window (in bars) during which a divergence remains valid before it's considered outdated.

🎨 Display Settings

Show Bullish SMT Line : Draws a line connecting the bullish divergence points.

Show Bullish SMT Label : Displays a label on the chart when a bullish divergence is detected.

Bullish Color : Sets the color for bullish SMT markers (label, shape, and line).

Show Bearish SMT Line : Draws a line for bearish divergence.

Show Bearish SMT Label : Displays a label when a bearish SMT divergence is found.

Bearish Color : Sets the color for bearish SMT visual elements.

🔔 Alert Settings

Alert Name : Custom name for the alert messages (used in TradingView’s alert system).

Message Frequency :

All : Every signal triggers an alert.

Once Per Bar : Alerts once per bar regardless of how many signals occur.

Per Bar Close : Only triggers when the bar closes and the signal still exists.

Time Zone Display : Choose the time zone in which alert timestamps are displayed (e.g., UTC).

Bullish SMT Divergence Alert : Enable/disable alerts specifically for bullish signals.

Bearish SMT Divergence Alert : Enable/disable alerts specifically for bearish signals

🔵Conclusion

The SMT Plus indicator offers a refined and powerful approach to detecting smart money behavior through divergence analysis between correlated assets. By removing the limitations of consecutive pivot comparisons and allowing for broader structural detection, it captures more accurate and timely signals that often precede major market moves.

When paired with frameworks like Sequential SMT and the Quarterly Theory, the indicator not only highlights where divergence occurs, but also when in the market cycle it's most likely to matter. Its flexible settings, customizable visuals, and integrated alert system make it suitable for intraday scalpers, swing traders, and even long-term macro analysts.

Whether you're using it as a standalone decision-making tool or combining it with other ICT concepts, SMT Plus gives you an edge in recognizing manipulation, timing reversals, and staying in sync with the real market narrative—not just the chart.

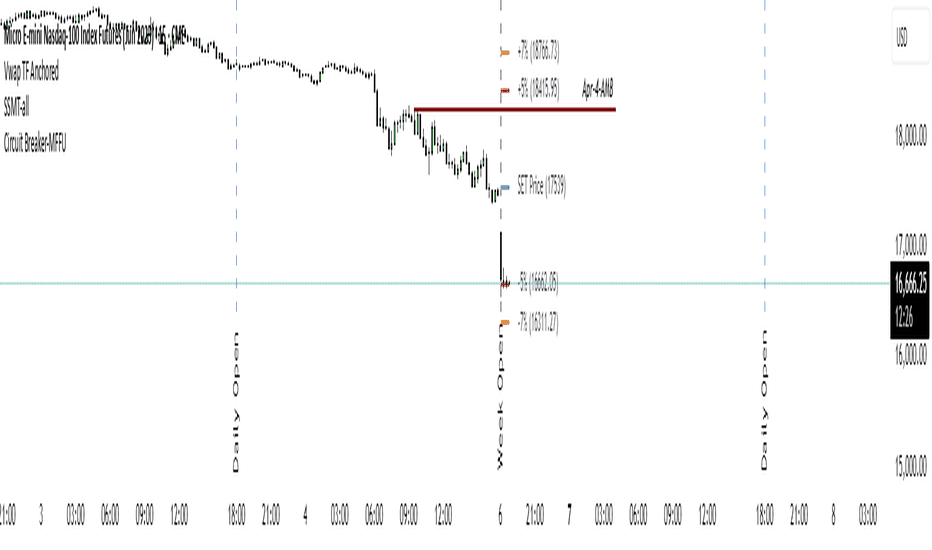

Circuit Breaker - MFFUThis Indicator Is Used To Protect User From Over Trading After Market Hit The Circuit Breakers.

The CME Exchange Usually Halts Trading If Market Hit + or - 7%.

To Protect Users From Extreme Volatile Condition MFFU, Halts Trading If Market Hits + or - 5%.

This Indicator helps us to plot the circuit breaking lines helping us to when to stop trading.

CISD with Alerts [neo|]█ OVERVIEW

CISD (or Change in State of Delivery) is an ICT concept and reversal pattern which may allow traders to identify reversals or changes in market structure early, compared to using traditional market structure. This script aims to correctly identify, and update these levels and provide alerts, so that traders can take advantage of this concept with ease.

█ CONCEPTS

Simply put, CISD may be identified when price closes above the open of the candle which started the most recent downtrend or liquidity sweep. Generally, it is most powerful when applied to key points in the market as a confirmation from where you may want price to reverse.

For example, when price is in a downtrend, we take the open of the last consecutive downwards candle and observe the CISD once price closes above it, beginning an uptrend.

Examples:

COMEX:GC1!

CME_MINI:NQ1!

█ How to use

To use the indicator, simply apply it to your chart and modify any of your desired inputs.

• Bullish CISD color allows you to change the color of +CISD levels.

• Bearish CISD color allows you to change the color of -CISD levels.

• Line width allows you to modify the width of +-CISD lines.

• Line extension bars allows you to change how far ahead CISD levels are drawn (by default it is 5).

• Keep old CISD levels will allow you to preserve all past CISD levels if you would like to observe the logic.

• Enable stat table will let you add a table on your chart which will tell you the current CISD trend, as well as your ticker and timeframe.

• Table position allows you to customize where the table will appear on your chart.