[R&D] Harmonic deviationsI'm publishing it for research purposes & welcome any ideas and/or explanations whether it's actually possible or nah to do what I'm doing right now.

...

Idea is simple - if we can do Harmonic Mean, can we do Harmonic Standard Deviations? It should be the same logic, the only difference is instead of actual datapoints we gotta use reciprocals.

In reality I've found smth really curios, it's possible to get these Harmonic Standard Deviations, however, somewhy, depends on your timeframe, u gotta do final sqrt different amount of times. And looks like... the market reacts to these levels.

That's why in the script settings there is a menu where you can choose how many times to perform sqrt operation.

Pls check it out, play with it, see maybe you'll see smth interesting.

Гармонические паттерны

Simple Harmonic Oscillator (SHO)The indicator is based on Akram El Sherbini's article "Time Cycle Oscillators" published in IFTA journal 2018 (pages 78-80) (www.ftaa.org.hk)

The SHO is a bounded oscillator for the simple harmonic index that calculates the period of the market’s cycle. The oscillator is used for short and intermediate terms and moves within a range of -100 to 100 percent. The SHO has overbought and oversold levels at +40 and -40, respectively. At extreme periods, the oscillator may reach the levels of +60 and -60. The zero level demonstrates an equilibrium between the periods of bulls and bears. The SHO oscillates between +40 and -40. The crossover at those levels creates buy and sell signals. In an uptrend, the SHO fluctuates between 0 and +40 where the bulls are controlling the market. On the contrary, the SHO fluctuates between 0 and -40 during downtrends where the bears control the market. Reaching the extreme level -60 in an uptrend is a sign of weakness. Mostly, the oscillator will retrace from its centerline rather than the upper boundary +40. On the other hand, reaching +60 in a downtrend is a sign of strength and the oscillator will not be able to reach its lower boundary -40.

Centerline Crossover Tactic

This tactic is tested during uptrends. The buy signals are generated when the WPO/SHI cross their centerlines to the upside. The sell signals are generated when the WPO/SHI cross down their centerlines. To define the uptrend in the system, stocks closing above their 50-day EMA are considered while the ADX is above 18.

Uptrend Tactic

During uptrends, the bulls control the markets, and the oscillators will move above their centerline with an increase in the period of cycles. The lower boundaries and equilibrium line crossovers generate buy signals, while crossing the upper boundaries will generate sell signals. The “Re-entry” and “Exit at weakness” tactics are combined with the uptrend tactic. Consequently, we will have three buy signals and two sell signals.

Sideways Tactic

During sideways, the oscillators fluctuate between their upper and lower boundaries. Crossing the lower boundary to the upside will generate a buy signal. On the other hand, crossing the upper boundary to the downside will generate a sell signal. When the bears take control, the oscillators will cross down the lower boundaries, triggering exit signals. Therefore, this tactic will consist of one buy signal and two sell signals. The sideway tactic is defined when stocks close above their 50-day EMA and the ADX is below 18

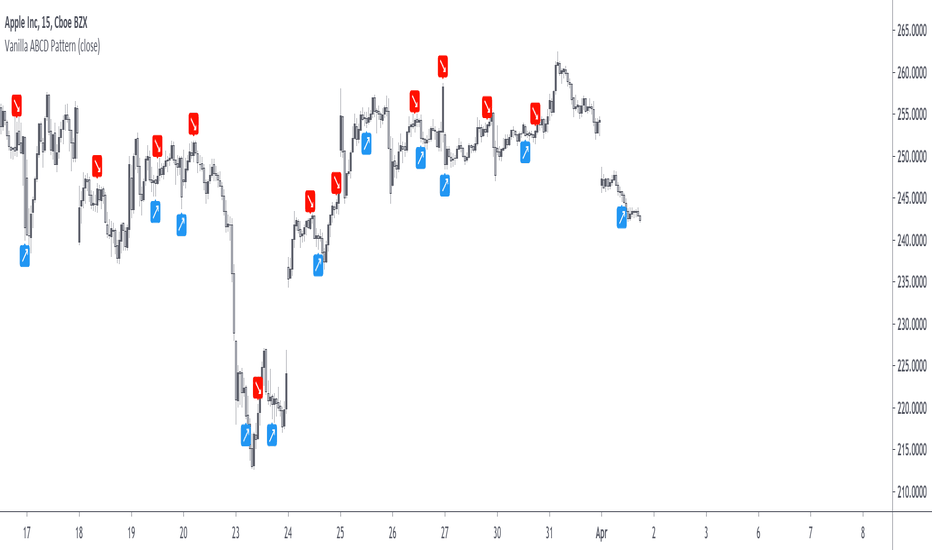

Vanilla ABCD PatternPatterns makes parts of the many predictive tools available to technical analysts, the most simples ones can be easily detected by using scripts. The proposed tool detect the simple (vanilla) form of the ABCD pattern, a pattern aiming to detect potential price swings. The script can use an additional confirmation condition that aim to filter potential false signals.

ABCD PATTERN

The ABCD pattern is not meant to be detected by analyzing individuals closing price observations but by analyzing longer term movements, this is done by using tools such as zig-zag. Like any pattern the ABCD one comes in different flavors, the simplest being based on the following structures:

Once price reach D we can expect a reversal. The classical pattern has the following conditions : BC = 0.618*AB and CD = 1.618*AB , as you can see this condition is based on 0.618 which is a ratio in the Fibonacci sequence. Other conditions are for AB to equal to CD or for CD to be 161.8% longer than AB. Why these conditions ? Cause Fibonacci of course .

The ABCD pattern that the proposed tool aim to detect is not based on the zig-zag but only on individual price observations and don't make use of any of the previously described conditions, thus becoming more like a candle pattern.

When the label is blue it means that the tool has detected a bullish ABCD pattern, while a red label means that the tool has detected a bearish ABCD pattern.

We can't expect patterns based on the analysis of 1,2,3 or 4 closing price observations to predict the reversal of mid/long term movements, this can be seen on the above chart, but we can see some signals predicting short term movements.

Since the pattern is based on a noisy variation, using smoother input can result in less signals.

Above the tool on BTCUSD using closing price as input. Below the tool using ohlc4 as input:

TOOL OPTIONS

Being to early can be as devastating as being to late, therefore a confirmation point can be beneficial, the tool allow you to wait for confirmation thus having a potentially better timing. Below is a chart of AMD with no confirmation:

As we can see there are many signals with some of them occurring to early, we can fix this by checking the confirmation option:

The confirmation is simply based on the candle color, for example if a bearish ABCD pattern has been detected in the past and the closing price is greater than the opening price then the tool return a buy signal. The same apply with a bearish ABCD pattern.

The "last bar repaint" option is true by default, this in order to show the bar where the D point of the pattern has been detected, since the closing price of the last bar is constantly changing the signals on the last bar can be constantly appearing/disappearing, unchecking the option will fix this but will no longer the bar where the D point of the pattern has been detected.

SUMMARY

The pattern is simple and can sometimes be accurate when predicting the direction of future short terms movements. The tool was a request, as it seems i don't post many pattern detectors, well thats true, and the reason is that for me patterns are not super significant, and their detection can be extremely subjective, this is why simple patterns are certainly the only ones worth a look.

Don't expect me to post many pattern related indicators in the future ^^'

Phi35 - Candlestick Reversal Patterns V1 ©Candlestick Reversal Pattern V1 by Phi35 - 9rd September 2016 ©

Check also my " Candlestick Continuation Pattern " indicator which will follow soon!

Do not modify the code without my permission!

If there is an issue or any suggestions, feel free to contact me on the link below

www.tradingview.com

www.tradingview.com

It seems to work well but still no guarantee on completeness!

RISK WARNING! PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. IN MAKING AN INVESTMENT DECISION, TRADERS MUST RELY ON THEIR OWN EXAMINATION OF THE ENTITY MAKING THE TRADING DECISIONS!

Wait always for confirmation (next opening price or closing price)!!

RECOGNIZABLE REVERSAL PATTERNS

01.Engulfing

02.Harami

03.Piercing Line

04.Morning Star

05.Evening Star

06.Belt Hold

07.Three White Soldiers

08.Three Black Crows

09.Three Stars in the South

10.Stick Sandwich

11.Meeting Line

12.Kicking

13.Ladder Bottom

Although the Engulfing and Harami Patterns are important but can occur too often and give false signals, I give you the option to turn them completely off.

Donchian Fibo Channels v2Updated and fixed version of DFC.

- fixed bugs

- added permanent setting for direction

- added color change for terminal and breakout bars

- added smart timings for line of 100% retracement

[RS]ZigZag PA V4 Advanced Patterns V0.01EXPERIMENTAL:

Method for detecting 4/5/6/7 point harmonics

included 3drive detection rates are rudimentary.

[RS]Fractals V9update: added optional option for marking the fractals with bgcolor (request for: faizal.mansor.908)

Spinning TopsThis is my script for a spinning top. It is just another form of a doji. It is an indecision bar. Enjoy.

[RS]ZigZag PA V1ZigZag Based on price oscilation.

added pattern recognition, also added recognition of head and shoulders and contracting/expanding triangles to previous list of patterns :p

Use Alt Timeframe: enables optional timeframes, use higher timeframes to reduce noise.

Timeframe: said Alt Timeframe.

Show Patterns: toggles Pattern Recognition on.

[RS]ZigZag (MA, Pattern Recognition) V2EXPERIMENTAL:

Best method so far to draw the zigzag.

Multi time frame options

[RS]Fractal Pattern Recognition V0EXPERIMENTAL: reads the rates for the last top/bottom in a zigzag fractal series, outputs XAB, XAD, ABC, and BCD rates, im interested in earing what your opinion is as im a total noob in harmonics :p.

use with Fractals V5 for visual confirmation ;).

Shooting Star automatic finding scriptHi

Let me introduce my Shooting Star automatic finding script.

This is a bearish reversal candlestick which occurs in an uptrend. It has a long

upper shadow with little, or no lower shadow, and a small real body near the lows

of the session.

Dark Cloud automatic finding scriptHi

Let me introduce my Dark Cloud automatic finding script.

This is a bearish reversal pattern formed by two candlesticks within a uptrend.

Consists of an up candlestick followed by a down candlestick which opens lower

than the prior candlestick and closes below the midrange of the prior candlestick.

It is the reverse of the Piercing Line.