VOLD IndicatorVOLD-Indicator can show us the trend of the day. The indicator shows us the value of the VOLD that is a ratio of the volume flowing in up-stocks divided by the volume flowing in down stocks. Readings above 3 and below -3 can be seen as relevant for a trend day.

Фундаментальный анализ

Fundamentaldaten: Umsatz, Free Cashflow, NettogewinnGraphical representation of revenue, free cash flow, and net profit for U.S. stocks

PRIME 2.0PRIME 2.0 — Precision Entry Tool

PRIME 2.0 is a smart price action-based indicator designed for intraday traders who want to catch high-probability moves during the London session. It uses a combination of market structure shifts (CHOCH – Change of Character) and session-based timing to identify potential entries.

🔍 Key Features:

Session-Based Logic: Activates after the London market opens, filtering noise from other sessions.

CHOCH Detection: Spots shifts in market structure by identifying crossover and crossunder of candle highs/lows.

Visual Entry Points: Plots real-time entry points based on structure change.

🧠 Who Is It For?

Scalpers and day traders

Traders who follow Smart Money Concepts (SMC)

Anyone looking to improve entry precision without clutter

⚠️ Disclaimer:

This indicator does not generate buy/sell signals or exit points. It is meant to be used as a tool within a broader trading strategy. Combine it with your own risk management and market knowledge for best results

Balancelink : Partition Function 1.0This script computes the partition function values 𝑝(𝑛) using Euler’s Pentagonal Number Theorem and displays them in a horizontally wrapped table directly on the chart. The partition function is a classic function in number theory that counts the number of ways an integer 𝑛 can be expressed as a sum of positive integers, disregarding the order of the summands.

Key Features

Efficient Calculation:

The script computes 𝑝(𝑛) for all orders from 0 up to a user-defined maximum (set by the "End Order" input). The recursive computation leverages Euler’s Pentagonal Number Theorem, ensuring the function is calculated correctly for each order.

Display Range Selection:

Users can select a specific range of orders (for example, from 𝑛 = 100 to 𝑛 = 200 to display.) This means you can focus on a particular segment of the partition function results without cluttering the chart.

Horizontally Wrapped Table:

The partition values are organized into a clean, horizontal table with a customizable number of columns per row (default is 20). When the number of values exceeds the maximum columns, the table automatically wraps onto a new set of rows for better readability.

Medium Text Size:

The table cells use a medium (normal) text size for easy viewing and clarity.

How to Use

Inputs:

Start Order (n): The starting index from which you want to display the partition function (default is 100).

End Order (n): The ending index up to which the partition function values will be displayed (default is 200).

Max Columns Per Row: Determines how many results are shown per row before wrapping to the next (default is 20).

Calculation:

The script calculates all 𝑝(𝑛) values from 0 up to the specified "End Order". It then extracts and displays only the values in the chosen range.

Visualization:

The computed values are shown in a neatly arranged table at the top right of your TradingView chart, making it simple to scroll through and inspect the partition function values.

Use Cases

Educational & Research:

Ideal for educators and students exploring concepts of integer partitions and number theory.

Data Analysis & Pattern Recognition:

Useful for those interested in the behavior and growth of partition numbers as 𝑛 increases.

Retirement Portfolio Dashboard1. Set It Up

Paste the script into the Pine Script editor in TradingView

Add to chart (use a daily chart for any TSX ticker)

Configure the inputs on the right panel:

Choose your ETF tickers (default: VFV, XAW, XIC)

Enter your target allocations (U.S., Global, Canada, Cash)

Set your current portfolio value and contribution plan

Adjust your expected return and rebalance trigger

📊 2. What It Tracks

💼 Allocation Overview

Target vs. actual % for each asset class

CAD value of each component

Performance YTD based on Jan 2nd start

Drift % to see how far each asset has deviated

📈 Growth Forecast

Future value projection with contributions

Weighted return (based on typical historical returns)

Inflation-adjusted real return (assuming 2% inflation)

⚠ Rebalancing

If any drift exceeds your set threshold (e.g., 5%), the script:

Highlights the issue in red

Displays "⚠ Rebalance Suggested"

Triggers a TradingView alert if you've activated it

🔔 3. Set Up Alerts

Go to Alerts > Create Alert

Choose your script from the dropdown

Under Condition, select "Rebalance Alert"

Choose your desired alert type (popup, email, webhook, etc.)

✅ 4. How to Use It Effectively

Task What to Do

Monitor allocations Check dashboard weekly or monthly

Spot imbalances Use Drift % and Status (green/red)

Forecast retirement growth Adjust contributions, return rate, and horizon

Prepare to rebalance Use alerts when drift > threshold

Tune assumptions Change expected returns or inflation rate as needed

💡 Tips

You can edit return assumptions (e.g., make Global equity more conservative)

Use this on a “blank” ticker (like TSX:XIC) so you don't overlay the chart

Copy values from your broker or retirement account to update real allocations

OverUnder Yield Spread🗺️ OverUnder is a structural regime visualizer , engineered to diagnose the shape, tone, and trajectory of the yield curve. Rather than signaling trades directly, it informs traders of the world they’re operating in. Yield curve steepening or flattening, normalizing or inverting — each regime reflects a macro pressure zone that impacts duration demand, liquidity conditions, and systemic risk appetite. OverUnder abstracts that complexity into a color-coded compression map, helping traders orient themselves before making risk decisions. Whether you’re in bonds, currencies, crypto, or equities, the regime matters — and OverUnder makes it visible.

🧠 Core Logic

Built to show the slope and intent of a selected rate pair, the OverUnder Yield Spread defaults to 🇺🇸US10Y-US2Y, but can just as easily compare global sovereign curves or even dislocated monetary systems. This value is continuously monitored and passed through a debounce filter to determine whether the curve is:

• Inverted, or

• Steepening

If the curve is flattening below zero: the world is bracing for contraction. Policy lags. Risk appetite deteriorates. Duration gets bid, but only as protection. Stocks and speculative assets suffer, regardless of positioning.

📍 Curve Regimes in Bull and Bear Contexts

• Flattening occurs when the short and long ends compress . In a bull regime, flattening may reflect long-end demand or fading growth expectations. In a bear regime, flattening often precedes or confirms central bank tightening.

• Steepening indicates expanding spread . In a bull context, this may signal healthy risk appetite or early expansion. In a bear or crisis context, it may reflect aggressive front-end cuts and dislocation between short- and long-term expectations.

• If the curve is steepening above zero: the world is rotating into early expansion. Risk assets behave constructively. Bond traders position for normalization. Equities and crypto begin trending higher on rising forward expectations.

🖐️ Dynamically Colored Spread Line Reflects 1 of 4 Regime States

• 🟢 Normal / Steepening — early expansion or reflation

• 🔵 Normal / Flattening — late-cycle or neutral slowdown

• 🟠 Inverted / Steepening — policy reversal or soft landing attempt

• 🔴 Inverted / Flattening — hard contraction, credit stress, policy lag

🍋 The Lemon Label

At every bar, an anchored label floats directly on the spread line. It displays the active regime (in plain English) and the precise spread in percent (or basis points, depending on resolution). Colored lemon yellow, neither green nor red, the label is always legible — a design choice to de-emphasize bias and center the data .

🎨 Fill Zones

These bands offer spatial, persistent views of macro compression or inversion depth.

• Blue fill appears above the zero line in normal (non-inverted) conditions

• Red fill appears below the zero line during inversion

🧪 Sample Reading: 1W chart of TLT

OverUnder reveals a multi-year arc of structural inversion and regime transition. From mid-2021 through late 2023, the spread remains decisively inverted, signaling persistent flattening and credit stress as bond prices trended sharply lower. This prolonged inversion aligns with a high-volatility phase in TLT, marked by lower highs and an accelerating downtrend, confirming policy lag and macro tightening conditions.

As of early 2025, the spread has crossed back above the zero baseline into a “Normal / Steepening” regime (annotated at +0.56%), suggesting a macro inflection point. Price action remains subdued, but the shift in yield structure may foreshadow a change in trend context — particularly if follow-through in steepening persists.

🎭 Different Traders Respond Differently:

• Bond traders monitor slope change to anticipate policy pivots or recession signals.

• Equity traders use regime shifts to time rotations, from growth into defense, or from contraction into reflation.

• Currency traders interpret curve steepening as yield compression or divergence depending on region.

• Crypto traders treat inversion as a liquidity vacuum — and steepening as an early-phase risk unlock.

🛡️ Can It Compare Different Bond Markets?

Yes — with caveats. The indicator can be used to compare distinct sovereign yield instruments, for example:

• 🇫🇷FR10Y vs 🇩🇪DE10Y - France vs Germany

• 🇯🇵JP10Y vs 🇺🇸US10Y - BoJ vs Fed policy curves

However:

🙈 This no longer visualizes the domestic yield curve, but rather the differential between rate expectations across regions

🙉 The interpretation of “inversion” changes — it reflects spread compression across nations , not within a domestic yield structure

🙊 Color regimes should then be viewed as relative rate positioning , not absolute curve health

🙋🏻 Example: OverUnder compares French vs German 10Y yields

1. 🇫🇷 Change the long-duration ticker to FR10Y

2. 🇩🇪 Set the short-duration ticker to DE10Y

3. 🤔 Interpret the result as: “How much higher is France’s long-term borrowing cost vs Germany’s?”

You’ll see steepening when the spread rises (France decoupling), flattening when the spread compresses (convergence), and inversions when Germany yields rise above France’s — historically rare and meaningful.

🧐 Suggested Use

OverUnder is not a signal engine — it’s a context map. Its value comes from situating any trade idea within the prevailing yield regime. Use it before entries, not after them.

• On the 1W timeframe, OverUnder excels as a macro overlay. Yield regime shifts unfold over quarters, not days. Weekly structure smooths out rate volatility and reveals the true curvature of policy response and liquidity pressure. Use this view to orient your portfolio, define directional bias, or confirm long-duration trend turns in assets like TLT, SPX, or BTC.

• On the 1D timeframe, the indicator becomes tactically useful — especially when aligning breakout setups or trend continuations with steepening or flattening transitions. Daily views can also identify early-stage regime cracks that may not yet be visible on the weekly.

• Avoid sub-daily use unless you’re anchoring a thesis already built on higher timeframe structure. The yield curve is a macro construct — it doesn’t oscillate cleanly at intraday speeds. Shorter views may offer clarity during event-driven spikes (like FOMC reactions), but they do not replace weekly context.

Ultimately, OverUnder helps you decide: What kind of world am I trading in? Use it to confirm macro context, avoid fighting the curve, and lean into trades aligned with the broader pressure regime.

Fair value and MOSShowing the fair value and margin of safety for a Stock.

Works best with 12 months timeframe.

The calculations are based on historical data for multiple years, up to 10 years.

You will see the following as numbers at the indicator line:

- Forward EPS Growth in %

- Forward PE Calculated

- Forward PE Estimated

The two lines will be shown in green if they are above the current price and in red if the price is bellow the lines.

- The upper line shows the fair value of the stock, calculated with 15% (or 4x in 10 years) expected EPS growth for your investment.

- The lower line shows the margin of safety, calculated at 50% of the fair value.

You can adjust the values at "Forward EPS Growth in %" and "Expected future PE" in order to show your fair price and the price with margin of safety.

RT-RSI 2.0 + Signal📈 RT-RSI 2.0 + Signal – Enhanced RSI Divergence Detection

RT-RSI 2.0 + Signal is a powerful and flexible RSI-based divergence indicator designed for traders who want smarter market entries using real-time confirmations.

This script identifies bullish and bearish RSI divergences, visualizes them directly on the RSI pane, and provides clear output signals (numeric: 1.0 for bullish, 2.0 for bearish) for use in external strategy scripts like RT-Signal 2.0.1.

🔍 Core Features:

✔️ Detects classic RSI divergences (bullish & bearish)

✔️ Includes automatic pivot detection and flexible lookback settings

✔️ External signal output for use in multi-pattern or strategy systems

✔️ Optimized RSI calculation per market type (BTC, DAX, Gold, Forex, etc.)

✔️ Customizable moving average & Bollinger Band smoothing

✔️ Signal is output via plot() (non-displayed) for remote use

Simple Fundamental Analysis Fundamental Analysis

This indicator provides comprehensive fundamental analysis directly on your chart, displaying key financial metrics in a color-coded table format. It goes beyond basic metrics by calculating fair value estimates and generating buy/sell signals based on overall fundamental health.

Key features:

14 essential fundamental metrics including EPS, P/E Ratio, PEG Ratio, and valuation ratios

Fair value calculation (PE × EPS) showing potential under/overvaluation

Value gap percentage to quickly identify investment opportunities

Color-coded values (green for healthy, red for concerning)

Automatic buy/sell/neutral signals based on overall fundamental analysis

Percentage rating showing the strength of buy/sell signals

This tool helps traders and investors make informed decisions based on fundamental data rather than just technical indicators. Perfect for value investors looking to identify fundamentally sound companies trading at attractive prices.

Disclaimer

This indicator is provided for informational and educational purposes only. The buy/sell signals and fundamental analysis presented are not investment advice or recommendations to buy, sell, or hold any security.

The financial data used is sourced from TradingView's database and may not always be current or accurate. Some metrics may be unavailable for certain stocks, which could affect the overall rating. Different industries have different norms for "good" metrics - what's healthy for one sector may not be for another.

The fair value calculation uses a standard PE ratio of 15, which may not be appropriate for all companies or industries. High-growth companies typically command higher multiples, while mature companies may trade at lower multiples.

Past performance is not indicative of future results. Always conduct your own research and consider consulting a financial advisor before making investment decisions.

Constant Valuation Multiple LevelsThis indicator adds price levels at constant multiples based on your preferred valuation metric. The settings provides options for setting this metric while Operational Income is the default one.

This indicator is not perfect as it relies on historical earnings data but does not have forecast data (not available in pinescript), thus its not a guide for future price level. It also does not account for "adjusted" earnings which may skew levels for some quarters.

However this script provides a quick way to see the stock price against your preferred valuation multiple to see if it's undervalued and worth investigating further for quality and earnings forecast.

Days Live CounterThis quite simply tracks how many days an asset has been on Trading View for.

The indicator calculates the day count based on the timestamp of the first visible bar in your current chart view. Since monthly charts generally load data from further back in time than daily or intraday charts, they'll show a larger day count.

This isn't a bug in the indicator - it's correctly counting the days from the first bar it can see in each timeframe.

BeSight Mega SpotBeSight Mega Spot – Zone Based Price Grid Indicator

สคริปต์นี้ถูกออกแบบมาเพื่อช่วยเทรดเดอร์มองเห็นโซนราคาสำคัญที่ราคาอาจเกิดปฏิกิริยา โดยอ้างอิงจากระดับราคาที่ลงท้ายด้วย 0 และ 5 (เช่น 1350, 1355, 1360 เป็นต้น) ซึ่งมักเป็นระดับที่มีการตั้งคำสั่งซื้อขายจำนวนมากในตลาด

BeSight Mega Spot – Zone-Based Price Grid Indicator

This indicator is designed to help traders visualize key price zones where the market often reacts, based on price levels ending with 0 or 5 (e.g., 1350, 1355, 1360). These levels are commonly used for pending orders, liquidity, or price clustering zones.

It displays horizontal grid lines at fixed step intervals (default: every 5 points), covering the entire visible price range of the chart. Each price level is labeled for better clarity and planning.

🟦 Blue lines: Price levels ending in 0

⬜ Gray lines: Price levels ending in 5

This tool is useful for identifying potential institutional behavior zones, price consolidation, accumulation/distribution areas, or psychological support/resistance levels.

🧠 Notes:

- This indicator is not a buy/sell signal tool or predictive system.

- It works best when used in conjunction with other technical tools such as Supply/Demand zones or Smart Money Concepts (SMC) analysis.

- Compatible with all instruments: stocks, futures, forex, crypto, etc.

✅ How to use:

1. Add the indicator to your chart

2. Observe how price interacts with the 0/5 grid zones

3. Use the lines to assist with breakout, retest, or reversal planning

4. Combine with price action or other indicators for higher precision

✨ Developed by BeSight – A Community Of Traders

---------------------------------------------------------------------------------------

อินดิเคเตอร์นี้จะแสดงเส้นแนวนอนแบบตาราง (Grid) ที่แบ่งช่วงราคาออกเป็นระยะ ๆ ตามค่าที่ผู้ใช้กำหนด เช่น ทุก ๆ 5 จุด และครอบคลุมช่วงราคาทั้งหมดของกราฟ โดยแสดงเป็นเส้นแบบ dotted พร้อมป้ายราคาเพื่อให้มองเห็นได้ชัดเจน

🟦 เส้นสีน้ำเงิน: แสดงระดับราคาที่ลงท้ายด้วย 0

⬜ เส้นสีเทา: แสดงระดับราคาที่ลงท้ายด้วย 5

เหมาะสำหรับผู้ที่ต้องการดูโซนราคา "หยุดพัก / เก็บของ / เปิดโพซิชัน" ซึ่งอาจสะท้อนพฤติกรรมของผู้เล่นรายใหญ่หรือสถาบันในตลาด

🧠 ข้อควรรู้:

- อินดิเคเตอร์นี้ไม่ได้บอกจุดเข้าเทรดหรือการคาดการณ์ แต่ช่วยในการวางแผนแนวรับ-แนวต้านร่วมกับเครื่องมือวิเคราะห์อื่น ๆ

- รองรับทุกสินทรัพย์ที่มีหน่วยราคาคงที่ (หุ้น, ฟิวเจอร์ส, ฟอเร็กซ์, คริปโต ฯลฯ)

✅ วิธีใช้งาน:

1. เพิ่มอินดิเคเตอร์นี้ลงบนกราฟ

2. ใช้เส้น Grid เป็นแนวประกอบในการดูพฤติกรรมราคา เช่น การหยุดลง, การเบรกแนว, การกลับตัว

3. ผสมผสานกับโซน Demand/Supply หรือโซน SMC เพื่อความแม่นยำ

✨ พัฒนาโดย BeSight – คอมมูนิตี้ของเทรดเดอร์ตัวจริง

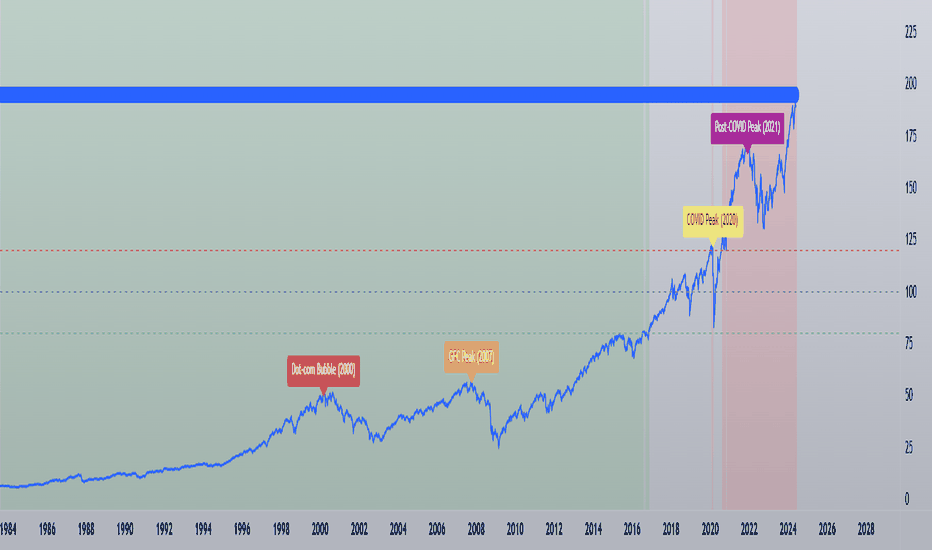

Buffett Indicator with Historical Bubbles (Clean)The Buffett Indicator is a trusted macroeconomic gauge that compares the total US stock market capitalization to the nation’s GDP. Popularized by Warren Buffett, this metric highlights periods of overvaluation and undervaluation in the market.

This tool offers a clean and accurate visualization of the Buffett Indicator, enhanced with historical bubble annotations for key market events:

Dot-com Bubble (2000)

Global Financial Crisis Peak (2007)

COVID-19 Pre-crash Peak (2020)

Post-COVID Bull Market Peak (2021)

Features:

Dynamic Buffett Ratio (%) calculation using Wilshire 5000 Index as the market cap proxy.

Customizable GDP input for accuracy (update quarterly).

Visual thresholds for fair value, undervaluation, and overvaluation zones.

Historical event markers for educational and analytical context.

Optimized to display clearly across all timeframes: Daily, Weekly, Monthly.

How to Use:

Manually update the GDP input as new data is released.

Use this indicator for macro-level market sentiment analysis and valuation tracking.

Combine with other tools and risk management strategies for comprehensive market insights.

Disclaimer:

This indicator is for educational purposes only. It does not constitute financial advice. Always perform your own research and analysis.

Version: 1.0

we ask Allah reconcile and repay

#BuffettIndicator #MarketValuation #MacroAnalysis #BubbleDetector #LongTermInvestor #USMarket #Wilshire5000 #TradingViewScript

The Silver Lining – GSR🍯 This tool converts the Gold/Silver Ratio (GSR) into a precision timing lens for short-term traders operating inside digital silver markets. It reveals structural dominance, trend exhaustion, and regime inflection by comparing the GSR to its smoothed baseline and historical percentile rhythm. On high timeframes (1D+), it reflects macroeconomic sentiment shifts 📈.

🧐 The lower the timeframe, the higher the alpha; the 15m and 1h charts are where you will the hidden pots of gold. For LTF traders, it becomes a hyper-responsive bias filter — especially when paired with volatility-based confirmation systems like SUPeR TReND 2.718, as shown.

🧠 The core logic compares the GSR (gold ÷ silver) against a user-defined moving average (VWMA or EMA). A color-coded fill shifts based on direction: amber when gold leads, teal when silver gains strength. Percentile bands (20th, 50th, 80th) map structural zones — helping traders anchor trades based on confluence, not hype.

📊 In the example chart, four theoretical long trades are shown on the 1h chart, manually drawn on the 15m timeframe. Each begins when the GSR reverses from the 80th percentile or breaks below its MA. The trades occur precisely as silver tested support, with confirmation from SUPeR TReND’s trend shift. Although idealized, these aren’t guesses — they are compression-to-expansion sequences backed by macro relative strength flow. Several yielded gains exceeding 4%.

🏆 Best-case long trades occur when GSR rotates down through the 50th percentile and silver catches a reactive bid. Shorts appear when GSR rises through the upper percentile band while silver fails to hold key intraday levels. The percentile bands function like behavioral tiers:

🥈 Below 20th = Silver Dominance

⚠️ Around 50th = Crossover Area

🥇 Above 80th = Gold Dominance

🥈 Why silver? It’s faster, more emotional, and more manipulated than gold — which paradoxically makes it more tradable on low timeframes. Its range-bound nature is ideal for rinse-and-repeat systems. Because we trade the derivative (XAGUSD), there’s no friction or delivery constraint — just price action, clean and liquid.

⚖️ The underlying strategy isn’t just technical; it’s alchemical. The system begins with short-term trading in digital silver and funnels gains into physical gold — converting volatility into wealth. Over time, this establishes a perpetual motion model: when profits allow, trade silver, extract value, cash out and convert into gold. The account stays active, and the hedge keeps growing.

🔁 The Silver Lining isn’t a signal engine. It’s a structural overlay. It tells you when the market’s invisible bias is shifting — so your tactics stay aligned with macro rhythm.

🌊 Silver moves fast. Gold moves first. The Silver Lining helps you bridge that gap — with clarity, confluence, and edge.

Risk-On vs Risk-Off Meter (Pro)Risk-On vs Risk-Off Meter (Pro)

This macro-based tool analyzes capital flows across key assets to gauge overall market risk sentiment. It does not use ES, SPY, or stock data directly—making it a powerful confirmation tool for ES traders looking to align with macro forces.

🔹 Core Idea:

Tracks capital rotation between copper/gold, bonds, dollar, crude oil, VIX, and yield spreads to generate a normalized risk score (0–1). This score reflects whether macro money is flowing into risk or safety.

🔹 Use:

Use this indicator as confirmation of directional bias when scalping or day trading ES.

– Green Zone (>0.75): Risk-On environment. Favor long setups.

– Red Zone (<0.45): Risk-Off. Favor short setups or stand aside.

– Yellow Zone: Neutral, use caution.

– Divergence Alerts: Signals when ES price disagrees with macro risk trend—potential reversals or exhaustion zones.

HOT TO USE

– Combine with your existing price action or order flow signals

– Avoid trading against the macro sentiment unless strong setup

– Use divergence as a heads-up for fading or exiting trades

This gives you a macro-informed lens to validate or filter your entries.

Risk-On / Risk-Off ScoreRisk-On / Risk-Off Score (Macro Sentiment Indicator)

This indicator calculates a custom Risk-On / Risk-Off Score to objectively assess the current market risk sentiment using a carefully selected basket of macroeconomic assets and intermarket relationships.

🧠 What does this indicator do?

The score is based on 14 key components grouped into three categories:

🟢 Risk-On Assets (rising = appetite for risk)

(+1 if performance over X days is positive, otherwise –1)

NASDAQ 100 (NAS100USD)

S&P 500 (SPX)

Bitcoin (BTCUSD)

Copper (HG1!)

WTI Crude Oil (CLK2025)

🔴 Risk-Off Assets (rising = flight to safety)

(–1 if performance is positive, otherwise +1)

Gold (XAUUSD)

US Treasury Bonds (TLT ETF) (TLT)

US Dollar Index (DXY)

USD/CHF

USD/JPY

US 10Y Yields (US10Y) (yields are interpreted inversely)

⚖️ Risk Spreads / Relative Indicators

(+1 if rising, –1 if falling)

Copper/Gold Ratio → HG1! / XAUUSD

NASDAQ/VIX Ratio → NAS100USD / VIX

HYG/TLT Ratio → HYG / TLT

📏 Score Calculation

Total score = sum of all components

Range: from –14 (extreme Risk-Off) to +14 (strong Risk-On)

Color-coded output:

🟢 Score > 2 = Risk-On

🟠 –2 to +2 = Neutral

🔴 Score < –2 = Risk-Off

Displayed as a line plot with background color and signal markers

🧪 Timeframe of analysis:

Default: 5 days (adjustable via input)

Calculated using Rate of Change (% change)

🧭 Use Cases:

Quickly assess macro sentiment

Filter for position sizing, hedging, or intraday bias

Especially useful for:

Swing traders

Day traders with macro filters

Volatility and options traders

📌 Note:

This is not a buy/sell signal indicator, but a contextual sentiment tool designed to help you stay aligned with overall market conditions.

Metatrader CalculatorThe “ Metatrader Calculator ” indicator calculates the position size, risk, and potential gain of a trade, taking into account the account balance, risk percentage, entry price, stop loss price, and risk/reward ratio. It supports the XAUUSD, XAGUSD, and BTCUSD pairs, automatically calculating the position size (in lots) based on these parameters. The calculation is displayed in a table on the chart, showing the lot size, loss in dollars, and potential gain based on the defined risk.

AltSeasonality - MTFAltSeason is more than a brief macro market cycle — it's a condition. This indicator helps traders identify when altcoins are gaining strength relative to Bitcoin dominance, allowing for more precise entries, exits, and trade selection across any timeframe.

The key for altcoin traders is that the lower the timeframe, the higher the alpha.

By tracking the TOTAL3/BTC.D ratio — a real-time measure of altcoin strength versus Bitcoin — this tool highlights when capital is rotating into or out of altcoins. It works as a bias filter, helping traders avoid low-conviction setups, especially in chop or during BTC-led conditions.

________________________________________________________________________

It works well on the 1D chart to validate swing entries during strong altcoin expansion phases — especially when TOTAL3/BTC.D breaks out while BTCUSD consolidates.

On the 4H or 1D chart, rising TOTAL3/BTC.D + a breakout on your altcoin = high-conviction setup. If BTC is leading, fade the move or reduce size. Consider pairing with the Accumulation - Distribution Candles, optimized for the 1D (not shown).

🔍 Where this indicator really excels, however, is on the 1H and 15M charts, where short-term traders need fast bias confirmation before committing to a move. Designed for scalpers, intraday momentum traders, and tactical swing setups.

Use this indicator to confirm whether an altcoin breakout is supported by broad market flow — or likely to fail due to hidden BTC dominance pressure.

________________________________________________________________________

🧠 How it works:

- TOTAL3 = market cap of altcoins (excl. BTC + ETH)

- BTC.D = Bitcoin dominance as % of total market cap

- TOTAL3 / BTC.D = a normalized measure of altcoin capital strength vs Bitcoin

- BTCUSD = trend baseline and comparison anchor

The indicator compares these forces side-by-side, using a normalized dual-line ribbon. There is intentionally no "smoothing".

When TOTAL3/BTC.D is leading, the ribbon shifts to an “altseason active” phase. When BTCUSD regains control, the ribbon flips back into BTC dominance — signaling defensive posture.

________________________________________________________________________

💡 Strategy Example:

On the 1H chart, a crossover into altseason → check the 15M chart for confirmation. Consider adding the SUPeR TReND 2.718 for confirmation (not shown). If both align, you have trend + flow confluence. If BTCUSD is leading or ribbon is mixed, reduce exposure or wait for confirmation. Further confirmation via Volume breakouts in your specific coin.

⚙️ Features:

• MTF source selection (D, 1H, 15M)

• Normalized ribbon (TOTAL3/BTC.D vs BTCUSD)

• Cross-aware fill shading

• Custom color and transparency controls

• Optional crossover markers

• Midline + zone guides (0.2 / 0.5 / 0.8)

Supertrend + MACD CrossoverKey Elements of the Template:

Supertrend Settings:

supertrendFactor: Adjustable to control the sensitivity of the Supertrend.

supertrendATRLength: ATR length used for Supertrend calculation.

MACD Settings:

macdFastLength, macdSlowLength, macdSignalSmoothing: These settings allow you to fine-tune the MACD for better results.

Risk Management:

Stop-Loss: The stop-loss is based on the ATR (Average True Range), a volatility-based indicator.

Take-Profit: The take-profit is based on the risk-reward ratio (set to 3x by default).

Both stop-loss and take-profit are dynamic, based on ATR, which adjusts according to market volatility.

Buy and Sell Signals:

Buy Signal: Supertrend is bullish, and MACD line crosses above the Signal line.

Sell Signal: Supertrend is bearish, and MACD line crosses below the Signal line.

Visual Elements:

The Supertrend line is plotted in green (bullish) and red (bearish).

Buy and Sell signals are shown with green and red triangles on the chart.

Next Steps for Optimization:

Backtesting:

Run backtests on BTC in the 5-minute timeframe and adjust parameters (Supertrend factor, MACD settings, risk-reward ratio) to find the optimal configuration for the 60% win ratio.

Fine-Tuning Parameters:

Adjust supertrendFactor and macdFastLength to find more optimal values based on BTC's market behavior.

Tweak the risk-reward ratio to maximize profitability while maintaining a good win ratio.

Evaluate Market Conditions:

The performance of the strategy can vary based on market volatility. It may be helpful to evaluate performance in different market conditions or pair it with a filter like RSI or volume.

Let me know if you'd like further tweaks or explanations!

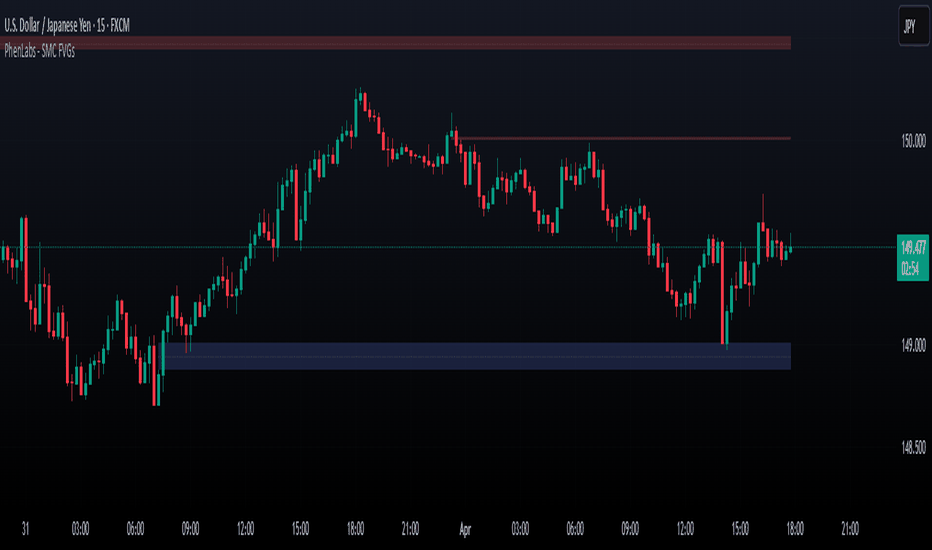

Smarter Money Concepts - FVGs [PhenLabs]📊 Smarter Money Concepts - FVGs

Version: PineScript™ v6

📌 Description

Smarter Money Concepts - FVGs is a sophisticated indicator designed to identify and track Fair Value Gaps (FVGs) in price action. These gaps represent market inefficiencies where price moves quickly, creating imbalances that often attract subsequent price action for mitigation. By highlighting these key areas, traders can identify potential zones for reversals, continuations, and price targets.

The indicator employs volume filtering ideology to highlight only the most significant FVGs, reducing noise and focusing on gaps formed during periods of higher relative volume. This combination of price structure analysis and volume confirmation provides traders with high-probability areas of interest that institutional smart money may target during future price movements.

🚀 Points of Innovation

Volume-Filtered Gap Detection : Eliminates low-significance FVGs by requiring a minimum volume threshold, focusing only on gaps formed with institutional participation

Equilibrium Line Visualization : Displays the midpoint of each gap as a potential precision target for trades

Automated Gap Mitigation Tracking : Monitors when price revisits and mitigates gaps, automatically managing visual elements

Time-Based Gap Management : Intelligently filters gaps based on a configurable timeframe, maintaining chart clarity

Dual Direction Analysis : Simultaneously tracks both bullish and bearish gaps, providing a complete market structure view

Memory-Optimized Design : Implements efficient memory management for smooth chart performance even with numerous FVGs

🔧 Core Components

Fair Value Gap Detection : Identifies price inefficiencies where the current candle’s low is higher than the previous candle’s high (bearish FVG) or where the current candle’s high is lower than the previous candle’s low (bullish FVG).

Volume Filtering Mechanism : Calculates relative volume compared to a moving average to qualify only gaps formed during significant market activity.

Mitigation Tracking : Continuously monitors price action to detect when gaps get filled, with options to either hide or maintain visual representation of mitigated gaps.

🔥 Key Features

Customizable Gap Display : Toggle visibility of bullish and bearish gaps independently to focus on your preferred market direction

Volume Threshold Control : Adjust the minimum volume ratio required for gap qualification, allowing fine-tuning between sensitivity and significance

Flexible Mitigation Methods : Choose between “Wick” or “Close” methods for determining when a gap has been mitigated, adapting to different trading styles

Visual Customization : Full control over colors, transparency, and style of gap boxes and equilibrium lines

🎨 Visualization

Gap Boxes : Rectangular highlights showing the exact price range of each Fair Value Gap. Bullish gaps indicate potential upward price targets, while bearish gaps show potential downward targets.

Equilibrium Lines : Dotted lines running through the center of each gap, representing the mathematical midpoint that often serves as a precision target for price movement.

📖 Usage Guidelines

General Settings

Days to Analyze : Default: 15, Range: 1-100. Controls how many days of historical gaps to display, balancing between comprehensive analysis and chart clarity

Visual Settings

Bull Color : Default:(#596fd33f). Color for bullish Fair Value Gaps, typically using high transparency for clear chart visibility

Bear Color : Default:(#d3454575). Color for bearish Fair Value Gaps, typically using high transparency for clear chart visibility

Equilibrium Line : Default: Enabled. Toggles visibility of the center equilibrium line for each FVG

Eq. Line Color : Default: Black with 99% transparency. Sets the color of equilibrium lines, usually kept subtle to avoid chart clutter

Eq. Line Style : Default: Dotted, Options: Dotted, Solid, Dashed. Determines the line style for equilibrium lines

Mitigation Settings

Mitigation Method : Default: Wick, Options: Wick, Close. Determines how gap mitigation is calculated - “Wick” uses high/low values while “Close” uses open/close values for more conservative mitigation criteria

Hide Mitigated : Default: Enabled. When enabled, gaps become transparent once mitigated, reducing visual clutter while maintaining historical context

Volume Filter

Volume Filter : Default: Enabled. When enabled, only shows gaps formed with significant volume relative to recent average

Min Ratio : Default: 1.5, Range: 0.1-10.0. Minimum volume ratio compared to average required to display an FVG; higher values filter out more gaps

Periods : Default: 15, Range: 5-50. Number of periods used to calculate the average volume baseline

✅ Best Use Cases

Identifying potential reversal zones where price may react after extended moves

Finding precise targets for take-profit placement in trend-following strategies

Detecting institutional interest areas for potential breakout or breakdown confirmations

Plotting significant support and resistance zones based on structural imbalances

Developing fade strategies at key market structure points

Confirming trade entries when price approaches significant unfilled gaps

⚠️ Limitations

Works best on higher timeframes where gaps reflect more significant market inefficiencies

Very choppy or ranging markets may produce small gaps with limited predictive value

Volume filtering depends on accurate volume data, which may be less reliable for some symbols

Performance may be affected when displaying a very large number of historical gaps

Some gaps may never be fully mitigated, particularly in strongly trending markets

💡 What Makes This Unique

Volume Intelligence : Unlike basic FVG indicators, this script incorporates volume analysis to identify the most significant structural imbalances, focusing on quality over quantity.

Visual Clarity Management : Automatic handling of mitigated gaps and memory management ensures your chart remains clean and informative even over extended analysis periods.

Dual-Direction Comprehensive Analysis : Simultaneously tracks both bullish and bearish gaps, providing a complete market structure picture rather than forcing a directional bias.

🔬 How It Works

1. Gap Detection Process :

The indicator examines each candle in relation to previous candles, identifying when a gap forms between the low of candle and high of candle (bearish FVG) or between the high of candle and low of candle (bullish FVG). This specific candle relationship identifies true structural imbalances.

2. Volume Qualification :

For each potential gap, the algorithm calculates the relative volume compared to the configured period average. Only gaps formed with volume exceeding the minimum ratio threshold are displayed, ensuring focus on institutionally significant imbalances.

3. Equilibrium Calculation :

For each qualified gap, the script calculates the precise mathematical midpoint, which becomes the equilibrium line - a key target that price often gravitates toward during mitigation attempts.

4. Mitigation Tracking :

The indicator continuously monitors price action against existing gaps, determining mitigation based on the selected method (wick or close). When price reaches the equilibrium point, the gap is considered mitigated and can be visually updated accordingly.

💡 Note:

Fair Value Gaps represent market inefficiencies that often, but not always, get filled. Use this indicator as part of a complete trading strategy rather than as a standalone system. The most valuable signals typically come from combining FVG analysis with other confirmatory indicators and overall market context. For optimal results, start with the default settings and gradually adjust parameters to match your specific trading timeframe and style.

Imbalance(FVG) DetectorImbalance (FVG) Detector

Overview

The Imbalance (FVG) Detector is a technical analysis tool designed to highlight price inefficiencies by identifying Fair Value Gaps (FVGs). These gaps occur when rapid price movement leaves an area with little to no traded volume, which may later act as a zone of interest. The indicator automatically detects and marks these imbalances on the chart, allowing users to observe historical price behavior more effectively.

Key Features

- Automatic Imbalance Detection: Identifies bullish and bearish imbalances based on a structured three-bar price action model.

- Customizable Sensitivity: Users can adjust the minimum imbalance percentage threshold to tailor detection settings to different assets and market conditions.

- Real-time Visualization: Marked imbalances are displayed as colored boxes directly on the chart.

- Dynamic Box Updates: Imbalance zones extend forward in time until price interacts with them.

- Alert System: Users can set alerts for when new imbalances appear or when price tests an existing imbalance.

How It Works

The indicator identifies market imbalances using a three-bar price structure:

- Bullish Imbalance: Occurs when the high of three bars ago is lower than the low of the previous bar, forming a price gap.

- Bearish Imbalance: Occurs when the low of three bars ago is higher than the high of the previous bar, creating a downward gap.

When an imbalance is detected:

- Green Boxes indicate bullish imbalances.

- Red Boxes indicate bearish imbalances.

- Once price interacts with an imbalance, the box fades to gray, marking it as tested.

! Designed for Crypto Markets

This indicator is particularly useful in crypto markets, where frequent volatility can create price inefficiencies. It provides a structured way to visualize gaps in price movement, helping users analyze historical liquidity areas.

Customization Options

- Min Imbalance Percentage Size: Adjusts the sensitivity of the imbalance detection.

- Alerts: Users can enable alerts to stay notified of new or tested imbalances.

Important Notes

- This indicator is a technical analysis tool and does not provide trading signals or financial advice.

- It does not predict future price movement but highlights historical price inefficiencies.

- Always use this tool alongside other market analysis methods and risk management strategies.

Professional MSTI+ Trading Indicator"Professional MSTI+ Trading Indicator" is a comprehensive technical analysis tool that combines over 20 indicators to generate high-quality trading signals and assess market sentiment. The script integrates standard indicators (MACD, RSI, Bollinger Bands, Stochastic, Simple Moving Averages, and Volume Analysis) with advanced components (Squeeze Momentum, Fisher Transform, True Strength Index, Heikin-Ashi, Laguerre RSI, Hull MA) and further includes metrics such as ADX, Chaikin Money Flow, Williams %R, VWAP, and EMA for in-depth market analysis.

Key Features:

Multiple Presets for Different Trading Styles:

Choose from optimal configurations like Professional, Swing Trading, Day Trading, Scalping, or Reversal Hunter. Note that the presets may not work perfectly on all pairs, and manual calibration might be required. This flexibility allows you to fine-tune the settings to align with your unique strategies and signals.

Multi-Layered Signal Filtering:

Filters based on trend, volume, and volatility help eliminate false signals, enhancing the accuracy of market entries.

Comprehensive Fear & Greed Index:

The indicator aggregates data from RSI, volatility, momentum, trend, and volume to gauge overall market sentiment, providing an additional layer of market context.

Dynamic Information Panel:

Displays detailed status updates for each component (e.g., MACD, RSI, Laguerre RSI, TSI, Fisher Transform, Squeeze, Hull MA, etc.) along with a visual strength bar that represents the intensity of the trading signal.

Signal Generation:

Buy and sell signals are generated when a predefined number of conditions are met and confirmed over multiple bars. These signals are clearly displayed on the chart with arrows, making it easier to spot potential entry and exit points.

Alert Setup:

Built-in alert conditions allow you to receive real-time notifications when trading signals are generated, helping you stay on top of market movements.

"Professional MSTI+ Trading Indicator" is designed to enhance your trading strategy by providing a multi-faceted market analysis and an intuitive visual interface. While the presets offer a robust starting point, they may require manual calibration on certain pairs, giving you the flexibility to configure your own unique strategies and signals.

Global Liquidity Index with Editable DEMA + 107 Day OffsetGlobal Liquidity DEMA (107-Day Lead)

This indicator visualizes a smoothed version of global central bank liquidity with a forward time shift of 107 days. The concept is based on the macroeconomic observation that markets tend to lag changes in global liquidity — particularly from central banks like the Federal Reserve, ECB, BOJ, and PBOC.

The script uses a Double Exponential Moving Average (DEMA) to smooth the combined balance sheets and money supply inputs. It then offsets the result into the future by 107 days, allowing you to visually align liquidity trends with delayed market reactions. A second plot (ROC SMA) is included to help identify liquidity momentum shifts.

🔍 How to Use:

Add this indicator to any chart (S&P 500, BTC, Gold, etc.)

Compare price action to the forward-shifted liquidity trend

Look for divergence, confirmation, or crossovers with price

Use as a macro timing tool for long-term entries/exits

📌 Included Features:

Editable DEMA smoothing length

ROC + SMA overlay for momentum signals

Fixed 107-day forward projection

Includes main DEMA and ROC SMA both real-time and shifted