Elliot Wave - ImpulseLets dabble a bit into Elliot Waves.

This is a simple script which tries to identify Wave 1 and 2 of Elliot Impulese Wave and then projects for Wave 3.

Ratios are taken from below link: elliottwave-forecast.com - Section 3.1 Impulse

Wave 2 is 50%, 61.8%, 76.4%, or 85.4% of wave 1 - used for identifying the pattern.

Wave 3 is 161.8%, 200%, 261.8%, or 323.6% of wave 1-2 - used for setting the targets

Important input parameters

Length : Zigzag Length. Keep the numbers low if you are looking for smaller and shorter trades. Keep the numbers high if you are looking for longer and bigger trades.

Error Percent : Adjustments for ratios as it is not always possible to find exactly equal retracement ratio.

Entry Percent : Once Wave 2 is formed, entry is set after reversing 30% of wave 2. This number can be increased or decreased. Caution: Keeping the number too low may result in false signals.

Ignore Trend Direction : If unchecked, it will only look for pattern if Wave 1 has made a higher high. If not, it will ignore Wave 1 condition and only look at wave 1 to 2 ratio.

Handle Duplicates : Since, the labels are generated upon crossover of entry price, this crossover may happen multiple times. Or sometimes wave 2 can further extend and generate new signal with same wave 1. This parameter says how to handle such cases. Keep Last is set to default and is most preferred option.

ShowRatios and ShowWaves lets you display wave line and retracement ratios for each pivots

Волны Эллиотта

Linear Regression & RSI Multi-Function Screener with Table-LabelHi fellow traders..

Happy to share a Linear Regression & RSI Multi-Function Custom Screener with Table-Labels...

The Screener scans for Linear Regression 2-SD Breakouts and RSI OB/OS levels for the coded tickers and gives Summary alerts

Uses Tables (dynamica resizing) for the scanner output instead of standard labels!

This Screener cum indicator collection has two distinct objectives..

1. Attempt re-entry into trending trades.

2. Attempt Counter trend trades using linear regression , RSI and Zigzag.

Briefly about the Screener functions..

a. It uses TABLES as Labels a FIRST for any Screener on TV.

b. Tables dynamically resize based on criteria..

c. Alerts for breakouts of the UPPER and the LOWER regression channels.(2 SD)

d. In addition to LinReg it also Screens RSI for OB/OS levels so a multifunction Screener.

e. Of course has the standard summary Alerts and programmable format for Custom functions.

f. Uses only the inbuilt Auto Fib and Lin Reg code for the screener.(No proprietary stuff)

g. The auto Zigzag code is derived(Auto fib).

Question what are all these doing in a single screener ??

ZigZag is very useful in determining Trend Up or Down from one Pivot to another.

So Once you have a firm view of the Current Trend for your chosen timeframe and ticker…

We can consider few possible trading scenarios..

a. Re-entry in an Up Trend - Combination of OS Rsi And a Lower Channel breach followed by a re-entry back into the regression channel CAN be used as an effective re-entry.

b. Similarily one can join a Down Trend on OB Rsi and Upper Channel line breach followed by re-entry into the regression channel.

If ZigZag signals a range-bound market, bound within channel lines then the Upper breakout can be used to Sell and vice-versa!

In short many possibilities for using these functions together with Scanner and Alerts.

This facilitates timely PROFITABLE Trending and Counter trend opportunities across multiple tickers.

You must give a thorough READ to the various available tutorials on ZigZag / Regression and Fib retracements before attempting counter trend trades using these tools!!

A small TIP – Markets are sideways or consolidating 70% of the time!!

Acknowledgements: - Thanks a lot DGTRD for the Auto ZigZag code and also for the eagerness to help wherever possible..Respect!!

Disclaimer: The Alerts and Screener are just few tools among many and not any kind of Buy/Sell recommendations. Unless you have sufficient trading experience please consult a Financial advisor before investing real money.

*The alerts are set for crossovers however for viewing tickers trading above or below the channel use code in line 343 and 344 after setting up the Alerts!

** RSI alerts are disabled by default to avoid clutter, but if needed one can activate code lines 441,442,444 and 445

Wish you all, Happy Profitable Trading!

Auto Fib Time Zones and Trend-Based Fib Time by DGTFibonacci time zones, based on the Fibonacci number sequence, are vertical lines that represent potential areas where a swing high, low, or reversal could occur.

Trend-Based Fib Time shows probable price corrections in an existing trend. A useful tool to use in addition to Elliot Wave counting, Fib Time helps to identify how far the wave is likely to travel

Please note, Time zones aren't concerned with price, only time

Disclaimer :

Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

The script is for informational and educational purposes only. Use of the script does not constitute professional and/or financial advice. You alone have the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

Zig Zag Channels [LuxAlgo]The Zig Zag indicator is a useful indicator when it comes to visualizing past underlying trends in the price and can make the process of using drawing tools easier. The indicator consists of a series of lines connecting points where the price deviates more than a specific percentage from a maximum/minimum point ultimately connecting local peaks and troughs.

This indicator by its very nature backpaints by default, meaning that the displayed components are offset in the past.

🔶 USAGE

The Zig Zag indicator is commonly used to returns points of references for the usage of specific drawing tools, such as Fibonacci retracements, fans, squares...etc.

The proposed indicator estimates peaks and troughs by using rolling maximums/minimums with a window size determining their significance. This window size approach allows us to have an indicator that works with a certain regularity no matter the scale of the price, something the percentage-based approach struggles with. Additionally, one upper and lower extremity are displayed, highlighting the price point that deviates the most from the Zig Zag lines.

A common usage also includes the easy determination of Elliot wave patterns in the price.

The Zig Zag indicator above highlights a downtrending motive wave.

🔹 Extremities

The novel approach taken by this Zig Zag indicator is the addition of two extremities derived from the distance between the price and the Zig Zag line, thus returning channels. It is uncommon seeing extremities in Zig Zag indicators since the line connecting peaks and troughs has rarely any other utility than seeing trend variations with more clarity and is not meant to provide an accurate estimate of underlying local trends in the price.

This channel can be useful to study the potential relationship between underlying trends and the Zig Zag line. A low width between the Zig Zag and the upper extremity indicates price variations mostly located below the Zig Zag while equal width indicates more linear trends.

When the indicator is extended to the last line, the extremities provide potential support and resistances, thus making this indicator able to forecast price variations.

🔶 SETTINGS

Length: Determines the significance of the detected peaks and troughs.

Extend To Last Bar: Extend the most recent line to the most recent closing price value.

Show Extremities: Displays the extremities.

Show Labels: Display labels highlighting the high/low prices located at peaks and troughs.

🔹 Style

Upper Extremity Color: Color of the upper extremity displayed by the indicator.

Zig Zag Color: Color of the ZigZag lines.

Lower Extremity Color: Color of the lower extremity displayed by the indicator.

ZigZag (Using Line Array)This is standard zigzag indicator. I just coded them using lines array feature of pine - so that it can be done in least number of lines of code.

Few possible improvements:

Use label array to mark HH, HL, LH and LL

Add standard deviation check

Detrended Rhythm Oscillator (DRO)How to detect the current "market beat" or market cycle?

A common way to capture the current dominant cycle length is to detrend the price and look for common rhythms in the detrended series. A common approach is to use a Detrended Price Oscillator (DPO). This is done in order to identify and isolate short-term cycles.

A basic DPO description can be found here:

www.tradingview.com

Improvements to the standard DPO

The main purpose of the standard DPO is to analyze historical data in order to observe cycle's in a market's movement. DPO can give the technical analyst a better sense of a cycle's typical high/low range as well as its duration. However, you need to manually try to "see" tops and bottoms on the detrended price and measure manually the distance from low-low or high-high in order to derive a possible cycle length.

Therefore, I added the following improvements:

1) Using a DPO to detrend the price

2) Indicate the turns of the detrended price with a ZigZag lines to better see the tops/bottoms

3) Detrend the ZigZag to remove price amplitude between turns to even better see the cyclic turns ("rhythm")

4) Measure the distance from last detrended zigzag pivot (high-high / low-low) and plot the distance in bars above/below the turn

Now, you can clearly see the rhythm of the dataset indicated by the Detrended Rhythm Oscillator including the exact length between the turns. This makes the procedure to "spot" turns and "measure" distance more simple for the trader.

How to use this information

The purpose is to check if there is a common rhythm or beat in the underlying dataset. To check that, look for recurring pattern in the numbers. E.g. if you often see the same measured distance, you can conclude that there is a major dominant cycle in this market. Also watch for harmonic relations between the numbers. So in the example above you see the highlighted cluster of detected length of around 40,80 and 120. There three numbers all have a harmonic relation to 40.

Once you have this cyclic information, you can use this number to optimize or tune technical indicators based on the current dominant cycle length. E.g. set the length parameter of a technical indicator to the detected harmonic length with the DRO indicator.

Example Use-Case

You can use this information to set the input for the following free public open-source script:

Disclaimer

This is not meant to be a technical indicator on its own and the derived cyclic length should not be used to forecast the next turn per se. The indicator should give you an indication of the current market beat or dominant beats which can be use to further optimize other oscillator or trading related settings.

Options & settings

The indicator allows to plot different versions. It allows to plot the original DPO, the DRO with ZigZag lines, the DRO with detrended ZigZag lines and length labels on/off. You can turn on or off these version in the indicator settings. So you can tweak it visually to your own needs.

Zig Lines with Percent & ValueOverview, Features, and Usage:

The Zig Lines with Percent & Value is an indicator that highlights the highest and lowest points of the market from pivot points and zigzag lines based on the ZigZag Period setting. By a default value of 13 for the ZigZag Period this works well on Bitcoin or other alt coins on the 1 hour or higher timeframe charts.

What makes this indicator unique is that it draws a green line to signify an uptrend or a red line to signify a down trend. It will also show the percent difference between the previous point/line, for example: If you see a -negative percentage point with a red line drawn to it, then you are looking at a low pivot point and then as the green line is drawn to a +positive percentage value the percentage you see is the difference between the two points. This is great to see a trend reversal as you can look at previous pivot points and notice about how far the price moves before it changes direction (trend reversal).

There is an invisible EMA line that is used to assist with coloring the negative vs positive values. The value above or below the percentage is the lowest or highest price at that pivot point . The display of the price at the pivot point depends on your ZigZag Period setting and the timeframe of your chart.

Added Bollinger Bands as it fits perfectly with the visuals of the Zig Lines & Pivots.

Usage of Bollinger Bands:

~As the price or candle gets close to the top or bottom of the Bollinger band it can give you a better confirmation that the pivot location is at it's final place, and the trend is more likely to switch directions.

It’s important to know this indicator should not be used for alerts of any type it does repaint as the green or red line is drawing based on live chart data and it can change depending on the direction of the market. This is a great visual tool for trend analysis or to be used with other indicators as a confirmation for a possible good entry or exit position.

Credits ( and consent to use ):

Credits go to user LonesomeTheBlue for creation of this 'Double Zig Zag with HHLL' script.

The addition of the Value above/below the Percentages is from user Noldo and that script is found here:

The Bollinger Bands setup was suggested by user countseven12 and his script that uses the same BB setup is found here:

References:

1. Chen, James. (2021 March 15). Zig Zag Indicator . Received from http: www.investopedia.com

2. Mitchell, Cory. (2021 April 30). Pivot Points . Received from http: www.investopedia.com

ADX SignalsThis script uses the Average Direction Index, On Balance Volume, and Exponential Moving Average, Moving Average Cross, MACD, Donchian Channels and two Parabolic SARs for stop loss, a normal one and a line one.

I tried to make the script as straightforward as possible, Buy when there is a buy signal and sell when there is a sell signal. I like using it on the smaller time-frames because I'm a scalper and I like going in and out quickly, but this indicator can be used on any timeframe and works on any instrument. The buy signal is triggered when the DI+ goes above the 30 level, the ADX is not increasing, on balance volume is at it's lowest, the price is above the lower Donchian Channel and last MACD hist bar is lower than the previous one. The sell signal is triggered when the DI- goes above the 30 level, the ADX is not increasing, on balance volume is at it's highest, the price is below the upper Donchian Channel and last MACD hist bar is upper than the previous one.

If you have any suggestions feel free to leave them in the comments below or Message me directly.

LTB Zigzag CirclesHello All,

Today I am here with a new idea and script, " LTB Zigzag Circles ". The idea is to create Circles using last 2 zigzag waves and to catch the breakouts earlier than horizontal lines. if a circle is broken then the script shows entry for Long/Short positions. and if broken circle reappears again then the position is closed. You can change Zigzag period as you wish and see the different results.

Here you can see how the script calculates and draws the Circles:

Below you can see how the script draws part of the circle on each bar:

Optionally the script can show levels:

P.S. I haven't tested it as a strategy, Result and Performance may change by Zigzag period, you need to find best Zigzag period according to your strategy. By the way, my Zigzag Circles idea can be improved, if you have any recommendation let me know please ;)

Enjoy!

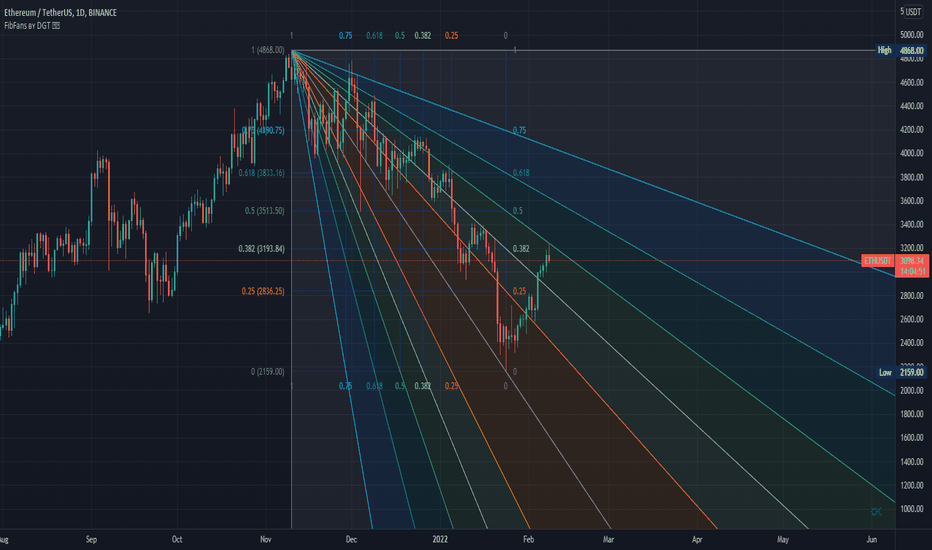

Auto PitchFan, Fib Extension/Retracement and ZigZag by DGT Aᴜᴛᴏ PɪᴛᴄʜFᴀɴ, Fɪʙ Exᴛᴇɴꜱɪᴏɴ/Rᴇᴛʀᴀᴄᴇᴍᴇɴᴛ ᴀɴᴅ ZɪɢZᴀɢ

This study aim to automate PitchFan drawing tool and combines it with Fibonacci Extentions/Retracements and ZigZag.

Common setting options, applied to all components of the study

Deviation , is a multiplier that affects how much the price should deviate from the previous pivot in order for the bar to become a new pivot. Increasing its value is one way to get higher timeframe Levels

Depth , affects the minimum number of bars that will be taken into account when building

Historical PitchFan / Fibonacci Levels option will allow plotting of PitchFan / Fibonacci Levels on previous Pivot Highs/Lows

█ PɪᴛᴄʜFᴀɴ — is a set of rays spreading out of the point of a trend's beginning. These rays inclined with the coefficients formed by a Fibonacci number sequence. It is recommended to adjust the Pitchfan plottings to fit after the first wave of the trend has passed and the correction has clearly begun.

PitchFan rays corresponding to Fibonacci levels appear on a chart and represent inclined lines of support and resistance. Price areas near these rays are estimated areas from which the price can turn around or make a significant rebound. The whole logic of working with a pitchfan is based on one simple idea - if the price has bounced off the level, then the correction is likely to end, and the trend will continue. If the price has broken the first resistance, you should wait for the next level test

- Automatically plots PitchFan Rays, based on Pivot Lows/Highs.

- Ability to set ALERTs for each PitchFan Ray Level

- PitchFan Labels displays the price of the line at the last bar, the price value will be recalculated in each new bar

Please check the link provided below with the educational post of how to apply pitchfork, application of pitchfan is same keeping in mind the recommendation stated above

█ Fɪʙ Rᴇᴛʀᴀᴄᴇᴍᴇɴᴛs / Exᴛᴇɴꜱɪᴏɴꜱ

Fibonacci retracements is a popular instrument used by technical analysts to determine support and resistance areas. In technical analysis, this tool is created by taking two extreme points (usually a peak and a trough) on the chart and dividing the vertical distance by the key Fibonacci coefficients equal to 23.6%, 38.2%, 50%, 61.8%, and 100%.

Fibonacci extensions are a tool that traders can use to establish profit targets or estimate how far a price may travel AFTER a retracement/pullback is finished. Extension levels are also possible areas where the price may reverse.

IMPORTANT NOTE: Fibonacci extensions option may require to do further adjustment of the study parameters for proper usage. Extensions are aimed to be used when a trend is present and they aim to measure how far a price may travel AFTER a retracement/pullback. I will strongly suggest users of this study to check the education post for further details where to use extensions and where to use retracements

- Automatically plots possible Support and Resistance levels, based on Pivot Lows/Highs.

- Ability to set ALERTs for each Fibonacci Extension/Retracement Level

- Labels displays the level and the level price

█ Zɪɢ Zᴀɢ — The Zig Zag indicator is used to help identify price trends and changes in price trends. The Zig Zag indicator plots points on a chart whenever prices reverse by a percentage greater than a Deviation variable. Straight lines are then drawn, connecting these points. The Zig Zag indicator serves base for PitchFan and Fibonacci Retracements / Extensions

█ OTHER

PitchFan is often used in combination with the other indicators and/or drawing tools such as Fibonacci Retracement, Fibonacci Channels, Fibonacci Time Zone and others. It allows identify the most powerful areas from which price can turn and to get more accurate trading signal

Andrews’ Pitchfork, how to apply pitchfork and automated pitchfork study

Fibonacci Fans, how to apply fibonacci fans and automated fibonacci speed and resistance fans study

Fibonacci Extension / Retracement, where to use extensions and where to use retracements and automated fibonacci extension / retracement / pivot points study

Others

Fibonacci Channels, how to apply fibonacci channels and automated fibonacci channels study

Linear Regression Channels, , what linear regression channels are? and linear regression channel/curve/slope study

Disclaimer :

Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

The script is for informational and educational purposes only. Use of the script does not constitute professional and/or financial advice. You alone have the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

Fibonacci Extension / Retracement / Pivot Points by DGTFɪʙᴏɴᴀᴄᴄɪ Exᴛᴇɴᴛɪᴏɴ / Rᴇᴛʀᴀᴄᴍᴇɴᴛ / Pɪᴠᴏᴛ Pᴏɪɴᴛꜱ

This study combines various Fibonacci concepts into one, and some basic volume and volatility indications

█ Pɪᴠᴏᴛ Pᴏɪɴᴛꜱ — is a technical indicator that is used to determine the levels at which price may face support or resistance. The Pivot Points indicator consists of a pivot point (PP) level and several support (S) and resistance (R) levels. PP, resistance and support values are calculated in different ways, depending on the type of the indicator, this study implements Fibonacci Pivot Points

The indicator resolution is set by the input of the Pivot Points TF (Timeframe). If the Pivot Points TF is set to AUTO (the default value), then the increased resolution is determined by the following algorithm:

for intraday resolutions up to and including 5 min, 4HOURS (4H) is used

for intraday resolutions more than 5 min and up to and including 45 min, DAY (1D) is used

for intraday resolutions more than 45 min and up to and including 4 hour, WEEK (1W) is used

for daily resolutions MONTH is used (1M)

for weekly resolutions, 3-MONTH (3M) is used

for monthly resolutions, 12-MONTH (12M) is used

If the Pivot Points TF is set to User Defined, users may choose any higher timeframe of their preference

█ Fɪʙ Rᴇᴛʀᴀᴄᴇᴍᴇɴᴛ — Fibonacci retracements is a popular instrument used by technical analysts to determine support and resistance areas. In technical analysis, this tool is created by taking two extreme points (usually a peak and a trough) on the chart and dividing the vertical distance by the key Fibonacci coefficients equal to 23.6%, 38.2%, 50%, 61.8%, and 100%. This study implements an automated method of identifying the pivot lows/highs and automatically draws horizontal lines that are used to determine possible support and resistance levels

█ Fɪʙᴏɴᴀᴄᴄɪ Exᴛᴇɴꜱɪᴏɴꜱ — Fibonacci extensions are a tool that traders can use to establish profit targets or estimate how far a price may travel AFTER a retracement/pullback is finished. Extension levels are also possible areas where the price may reverse. This study implements an automated method of identifying the pivot lows/highs and automatically draws horizontal lines that are used to determine possible support and resistance levels.

IMPORTANT NOTE: Fibonacci extensions option may require to do further adjustment of the study parameters for proper usage. Extensions are aimed to be used when a trend is present and they aim to measure how far a price may travel AFTER a retracement/pullback. I will strongly suggest users of this study to check the education post for further details, where to use extensions and where to use retracements

Important input options for both Fibonacci Extensions and Retracements

Deviation, is a multiplier that affects how much the price should deviate from the previous pivot in order for the bar to become a new pivot. Increasing its value is one way to get higher timeframe Fib Retracement Levels

Depth, affects the minimum number of bars that will be taken into account when building

█ Volume / Volatility Add-Ons

High Volatile Bar Indication

Volume Spike Bar Indication

Volume Weighted Colored Bars

This study benefits from build-in auto fib retracement tv study and modifications applied to get extentions and also to fit this combo

Disclaimer:

Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

The script is for informational and educational purposes only. Use of the script does not constitute professional and/or financial advice. You alone have the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

Auto Fib Speed Resistance Fans by DGTFibonacci Speed and Resistance Fan is an analytical drawing tool used to indicate the support and resistance levels of an existing trend and the price level at which possible changes in the trend may occur.

A Fibonacci Speed Resistance Fan consists of a trend line drawn between two extreme points - a trough and opposing peak or a peak and opposing trough - on which a set of sequential speed resistance lines are drawn above (which represents time) and below (which represents price). These lines are drawn based on time/price percentages of the distance between the beginning and the end of the trend line.

Speed resistance lines not only help to measure trend corrections but also measure the speed of a trend (the rate at which a trendline ascends or descends)

Traders can use the lines of the Fibonacci Speed and Resistance Fan to predict key points of resistance or support, at which they might expect price trends to reverse. Once a trader identifies patterns within a chart, they can use those patterns to predict future price movements and future levels of support and resistance. Traders use the predictions to time their trades. Key support and resistance levels tend to occur frequently at the 61.8-percent level on both uptrends and downtrends.

Please check for further details in the education post that I will share shortly after this publication :

Nobody appears to know whether Fibonacci tools work because markets exhibit some form of natural pattern or because many investors use Fibonacci ratios to predict price movements, making them a self-fulfilling prophecy.

█ Study OPTIONS

Auto Fibonacci Speed and Resistance Fan , the main aim of the study

- Pivot threshold can be adjusted via “Deviation” and “Depth” input options

- Historical Fans option will allow plotting of Speed and Resistance Fans on previous pivot high/lows

- Ability to set ALERTs for the Speed and Resistance Levels

- Price Grid Lines if extended it will result with Fib Retracement levels

- All lines, line levels are customizable, default values are set exactly to the same with the available Fib Speed and Resistance Fan drawing tool

Zig Zag – Derived from build-in Auto Fib Retracement with some customization options.

Example Usages :

Disclaimer :

Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

The script is for informational and educational purposes only. Use of the script does not constitute professional and/or financial advice. You alone have the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

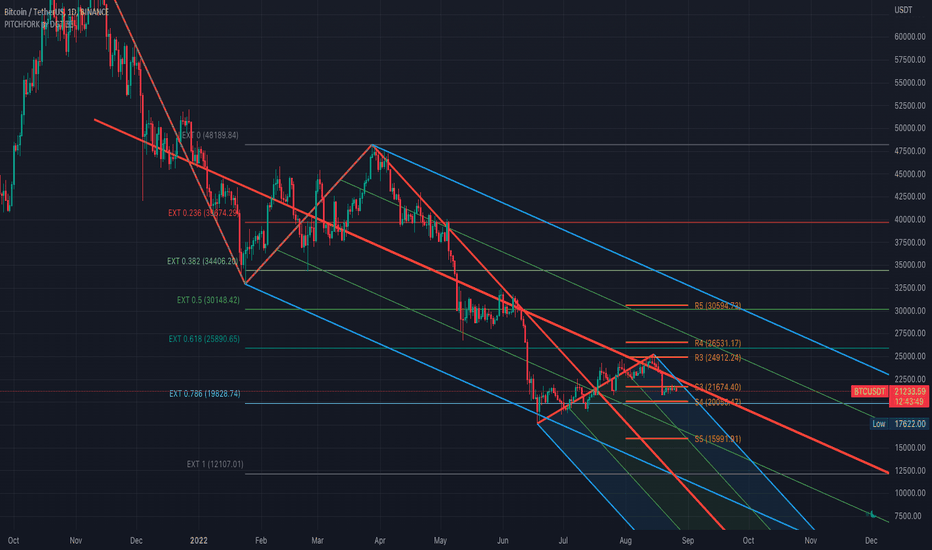

Auto Pitchfork, Fib Retracement and Zig Zag by DGTPitchfork is a technical indicator for a quick and easy way for traders to identify possible levels of support and resistance of an asset's price. It is presents and based on the idea that the market is geometric and cyclical in nature

Developed by Alan Andrews, so sometimes called Andrews’ Pitchfork

It is created by placing three points at the end of previous trends

Schiff and Modified Pitchfork is a technical analysis tool derived from Andrews' Pitchfork

In general, traders will purchase the asset when the price falls near the support of either the center trendline or the lowest trendline. Conversely, they'll sell the asset when it approaches the resistance of either the center line or the highest trendline.

█ Study OPTIONS

Auto Pitchfork , the main aim of the study

Pivots threshold can be customized by “Deviation” and “Depth” input options

Pitchfork Type selection, available options Andrews' Pitchfork (Original), Schiff and Modified Pitchfork

Ability to set ALERTs for the Pitchfork Levels

Ability to add customized levels (all level lines customizable)

Auto Fib Retracement – This is the build-in study of TradingView, slight changes applied to fit with Auto Pitchfork

Zig Zag – Derived from build-in Auto Fib Retracement with some customization options.

█ Usage Tips :

Andrews' Pitchfork (Original) best fit in a Strong Trending Market

Schiff and Modified Pitchfork better with Correcting or Sideways Market. Modified Pitchfork is almost identical to a Parallel Chanel

Disclaimer :

Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

The script is for informational and educational purposes only. Use of the script does not constitute professional and/or financial advice. You alone have the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

Support and Resistance Levels (v.3)Support and Resistance Levels augmanted and reprocessed

Description:

This is an augmented version of my earlier script that can be found here:

This time it features zigzag and channel lines, signal generation and filtering and performance testing. Signal generation and filtering procedures are used only for performance testing, not for the actual labelling. The labelling is governed by zigzag logic.

Donchian Zig-Zag [LuxAlgo]The following indicator returns a line bouncing of the extremities of a Donchian channel, with the aim of replicating a "zig-zag" indicator. The indicator can both be lagging or lagging depending on the settings user uses.

Various extended lines are displayed in order to see if the peaks and troughs made by the Donchian zig-zag can act as potential support/resistance lines.

User Settings

Length : Period of the Donchian channel indicator, higher values will return fewer changes of directions from the zig-zag line

Bounce Speed : Determine the speed of bounces made by the zig-zag line, with higher values making the zig-zag line converge faster toward the extremities of the Donchian channel.

Gradient : Determine whether to use a gradient to color the area between each Donchian channel extremities, "On" by default.

Transparency : Transparency of the area between each Donchian channel extremities.

Usage

It is clear that this is not a very common indicator to see, as such usages can be limited and very hypothetical. Nonetheless, when a bounce speed value of 1 is used, the zig-zag line will have the tendency to lag behind the price, and as such can provides crosses with the prices which can provide potential entries.

The advantage of this approach against most indicators relying on crosses with the price is that the linear nature of the indicator allows avoiding retracements, thus potentially holding a position for the entirety of the trend.

Altho this indicator would not necessarily be the most adapted to this kind of usage.

When using a bounce speed superior to 1, we can see the predictive aspects of the indicator:

We can link the peaks/troughs made by the zig-zag with the precedent ones made to get potential support and resistance lines, while such a method is not necessarily accurate it still allows for an additional to interpret the indicator.

Conclusions

We presented an indicator aiming to replicate the behaviour of a zig-zag indicator. While somehow experimental, it has the benefits of being innovative and might inspire users in one way or another.

zigzag support&resistance levels [LM]Hello Traders,

I would like to introduce you zigzag support&resistance levels. It is based on the ZigZag semafor script made by DevLucem so shout out to him

The Semafor is used to spot future multi-level Supports and Resistance zones.

It is also useful to spot HL or LL or HH or LH zones at different Depth settings.

The red zones are the extreme places where the market has a higher chance of reversing while the green zones have the lowest setting with lower chances of the market reversal

I have refactored script and extended it with the horizontals.

The lines can be extended like so if you want to see

The lines also can expire when the price will reach it you can change this in general settings:

Also you can use view from the original script with just label circles

Enjoy!

SemaforHello Traders!

I have been away for a while but am recovering back gradually! Here is a gift to all of you.

It is based on the much loved ZigZag++ Script

The Semafor is used to spot future multi-level Supports and Resistance zones.

It is also useful to spot HL or LL or HH or LH zones at different Depth settings.

The red zones are the extreme places where the market has a higher chance of reversing while the green zones have the lowest setting with lower chances of the market reversal

To ease understanding of the code, I used the function `zigzag()` to show the simplicity in calculation

More will be coming this Year!

Tweezers and Kangaroo TailHello Traders,

Here Tweezers and Kangaroo Tail script is in your service. The script searches for Tweezer / Kangaroo Tail candlestick patterns and shows them as T (Tweezer) and K (Kangaroo Tail). Thanks to RorschachT who game me the idea and some details while working on this script.

What are these candlestick patterns?

Tweezers :

- A tweezers pattern occurs when the highs/Lows of two candlesticks occur at almost exactly the same level

- Both candles must have wicks

- Bigger Wick / Smaller Wick rate should not be greater than 150% ( 150% by default and you have option to change it)

- First Candle must be highest/lowest for last 5 candles (5 by default and you have option to change it)

- The level of High for Top, Low for Bottom must be almost lower than 20% of the bigger wick of tweezer candles (20% by default and you have option to change it)

- The Candles can be right next to each other or apart but not more than 12 candles apart (12 by default and you have option to change it)

- You will see that Tweezers pattern occurs frequently

Kangaroo Tail:

- Looks almost like a Hammer or Inverted Hammer candle

- They have both its open and close in the top or bottom third of the candle

- There must be some space/room on the left of the kangaroo tail

- The open and close of the Kangaroo Tail candle must be inside the range of the previous candlestick

- The next candle should create a new high or new low

- You have several options to set details about the "Room" that should be on the left and also options for Wick/Body rates

- You can see example below

You have option to enable/disable any of these patterns.

as far as I have tested they are strong reversal patterns but none of the indicators or patterns may not be enough alone. so you should confirm the signals using other indicators or tools

If you need more information you can find a lot of info on the net ;)

Example: Tweezers - Aparted

Example: Kangaroo Tail - Bullish

Enjoy!

Double Zig Zag with HHLLHello Traders,

Here Double Zig Zag with HHLL script is with you. it calculates 2 Zig Zag simultaneously and draws them, and also it calculates and puts Higher High, Lower Low, Higher Low, Lower High labels. All these are done dynamically, it means last HH/HL/LL/LH can change. if price continues to go up then HL can turn to LL or if price continues to go down then LH can turn to HH. This script can be used for different purposes such trend analysis, support/resistance levels, breakouts etc.

I tried to make many things optional:

You can set Periods for Zig Zags as you wish

You can set different colors for both Zig Zag Up/Down lines

You have option to show both Zig Zag, one of them or none them

You have option to show both HHLL, one of them or none them

You can set Zig Zag 1 line style as Dashed or Dotted

You can set Line Widths for Zig Zags

Some examples:

Enjoy!

Easy System 420In this strategy, 15 indicators are used, each giving its results as a numerical value, which then is added or subtracted from the total points, gathered from all 15 indicators.

Many thanks to RafaelZioni for his great work making the EasySys1 script which i modified to create this script.

Onchart is drawn some of the indicators, but not all, a info panel is drawn showing the value each indicator has calculated. The info panel can be turned on or off.

Many of the indicator settings can be changed by user, and this is recommended, to tune the strategy to users chosen pair/timeframe.

Therefore any pair or timeframe can be used, the strategy tester results showing possible results, remember to set commission to match your broker. example chart settings here have common crypto exchange commission value: 0.25%

indicator list : SAR + STT + ZigZag + ROC + DMI + CCI + Weis + SMA + AO + MOM + Hist + BB + Ichimoku + HMA

ABCD Harmonic PatternsShows Bullish and Bearish AB=CD Harmonic Patterns with Pivot High, Pivot Low and Pivot Line

Zig Zag High LowZig Zag script that uses local minimums and maximums as pivot points. It can be used as a source for pattern recognition.