5-Min First Candle Breakout/BreakdownAwesome! Here's a basic Pine Script (v5) for a First 5-minute candle breakout/breakdown strategy with Buy/Sell signals and price labels. This script works by capturing the high and low of the first candle of the session and then showing signals when those levels are broken.

You can customize it further for Entry, Stop Loss, Target, etc., but this gives you the foundation with labels for buys/sells based on breakout/breakdown.

Educational

V Pattern TrendDESCRIPTION:

The V Pattern Trend Indicator is designed to identify and highlight V-shaped reversal patterns in price action. It detects both bullish and bearish V formations using a five-candle structure, helping traders recognize potential trend reversal points. The indicator filters out insignificant patterns by using customizable settings based on ATR, percentage, or points, ensuring that only meaningful V patterns are displayed.

CALCULATION METHOD

The user can choose how the minimum length of a V pattern is determined. The available options are:

- ATR (Average True Range) – Filters V patterns based on ATR, making the detection adaptive to market volatility.

- Percentage (%) – Considers V patterns where the absolute price difference between the V low and V high is greater than a user-defined percentage of the V high.

- Points – Uses a fixed number of points to filter valid V patterns, making it useful for assets with consistent price ranges.

ATR SETTINGS

- ATR Length – Defines the number of periods for ATR calculation.

- ATR Multiplier – Determines the minimum V length as a multiple of ATR.

PERCENTAGE THRESHOLD

- Sets a minimum percentage difference between the V high and V low for a pattern to be considered valid.

POINTS THRESHOLD

- Defines the minimum price movement (in points) required for a V pattern to be considered significant.

PATTERN VISUALIZATION

- A bullish V pattern is plotted using two upward-sloping lines, with a filled green region to highlight the formation.

- A bearish V pattern is plotted using two downward-sloping lines, with a filled red region to indicate the reversal.

- The indicator dynamically updates and marks only the most recent valid patterns.

UNDERSTANDING V PATTERNS

A V pattern is a sharp reversal formation where price moves strongly in one direction and then rapidly reverses in the opposite direction, forming a "V" shape on the chart.

BULLISH V PATTERN

- A bullish V pattern is formed when the price makes three consecutive lower lows, followed by two consecutive higher lows.

- The pattern is confirmed when the highest high of the formation is greater than the previous highs within the structure.

- This pattern suggests a potential trend reversal from bearish to bullish.

- The lowest point of the pattern represents the V low, which acts as a support level.

bull_five_candle_v = low > low and low > low and low > low and low > low

and high > math.max(high , high , high ) and high > math.max(high , high , high )

BEARISH V PATTERN

- A bearish V pattern is detected when the price makes three consecutive higher highs, followed by two consecutive lower highs.

- The pattern is confirmed when the lowest low of the formation is lower than the previous lows within the structure.

- This pattern signals a possible trend reversal from bullish to bearish.

- The highest point of the pattern represents the V high, which acts as a resistance level.

bear_five_candle_v = high < high and high < high and high < high and high < high

and low < math.min(low , low , low ) and low < math.min(low , low , low )

HOW THIS IS UNIQUE

- Advanced Filtering Mechanism – Unlike basic reversal indicators, this tool provides customizable filtering based on ATR, percentage, or points, ensuring that only significant V patterns are displayed.

- Enhanced Visual Clarity – The indicator uses color-coded fills and structured plotting to make reversal patterns easy to recognize.

- Works Across Market Conditions – Adaptable to different market environments, filtering out weak or insignificant price fluctuations.

- Multi-Timeframe Usability – Can be applied across different timeframes and asset classes, making it useful for both intraday and swing trading.

HOW TRADERS CAN USE THIS INDICATOR

- Identify potential trend reversals early based on structured price action.

- Filter out weak or insignificant reversals to focus only on strong V formations.

- Use the V pattern’s highs and lows as key support and resistance zones for trade entries and exits.

- Combine with other indicators like moving averages, trendlines, or momentum oscillators for confirmation.

20 Day Moving Average with Profit TargetsThis Pine Script indicator plots a 20-day simple moving average (SMA) on the chart and displays profit target labels relative to an initial buy price.

The script allows the user to input a custom buy price and calculates profit levels at 10%, 20%, 30%, and 50% above the buy price. Labels are shown on the last bar of the chart for each profit level and the buy price, with the labels offset to the right to avoid overlapping with the price action.

The labels are color-coded based on the profit levels, and the buy price label is blue.

Elliptic bands

Why Elliptic?

Unlike traditional indicators (e.g., Bollinger Bands with constant standard deviation multiples), the elliptic model introduces a cyclical, non-linear variation in band width. This reflects the idea that price movements often follow rhythmic patterns, widening and narrowing in a predictable yet dynamic way, akin to natural market cycles.

Buy: When the price enters from below (green triangle).

Sell: When the price enters from above (red triangle).

Inputs

MA Length: 50 (This is the period for the central Simple Moving Average (SMA).)

Cycle Period: 50 (This is the elliptic cycle length.)

Volatility Multiplier: 2.0 (This value scales the band width.)

Mathematical Foundation

The indicator is based on the ellipse equation. The basic formula is:

Ellipse Equation:

(x^2) / (a^2) + (y^2) / (b^2) = 1

Solving for y:

y = b * sqrt(1 - (x^2) / (a^2))

Parameters Explained:

a: Set to 1 (normalized).

x: Varies from -1 to 1 over the period.

b: Calculated as:

ta.stdev(close, MA Length) * Volatility Multiplier

(This represents the standard deviation of the close prices over the MA period, scaled by the volatility multiplier.)

y (offset): Represents the band distance from the moving average, forming the elliptic cycle.

Behavior

Bands:

The bands are narrow at the cycle edges (when the offset is 0) and become widest at the midpoint (when the offset equals b).

Trend:

The central moving average (MA) shows the overall trend direction, while the bands adjust according to the volatility.

Signals:

Standard buy and sell signals are generated when the price interacts with the bands.

Practical Use

Trend Identification:

If the price is above the MA, it indicates an uptrend; if below, a downtrend.

Support and Resistance:

The elliptic bands act as dynamic support and resistance levels.

Narrowing bands may signal potential trend reversals.

Breakouts:

Nebula Volatility and Compression Radar (TechnoBlooms)This dynamic indicator spots volatility compression and expansion zones, highlighting breakout opportunities with precision. Featuring vibrant Bollinger Bands, trend-colored candles and real-time signals, Nebula Volatility and Compression Radar (NVCR) is your radar for navigating price moves.

Key Features:-

1. Gradient Bollinger Bands - Visually stunning bands with gradient fills for clear price boundaries.

The gradient filling is coded simply so that even beginners can easily understand the concept. Trader can change the gradient color according to their preference.

fill(pupBB, pbaseBB,upBB,baseBB,top_color=color.rgb(238, 236, 94), bottom_color=color.new(chart.bg_color,100),title = "fill color", display =display.all,fillgaps = true,editable = false)

fill(pbaseBB, plowBB,baseBB,lowBB,top_color=color.new(chart.bg_color,100),bottom_color=color.rgb(230, 20, 30),title = "fill color", display =display.all,fillgaps = true,editable = false)

These two lines are used for giving gradient shades. You can change the colors as per your wish to give preferred color combination.

For Example:

Another Example:

2. Customizable Settings - Adjust Bollinger Bands, ATR and trend lengths to fit your trading styles.

3. Trend Insights - Candles turn green for uptrends, red for downtrends, and gray for neutral zones.

Nebula Volatility and Compression Radar create dynamic cloud like zones that illuminate trends with clarity.

Geometric Momentum Breakout with Monte CarloOverview

This experimental indicator uses geometric trendline analysis combined with momentum and Monte Carlo simulation techniques to help visualize potential breakout areas. It calculates support, resistance, and an aggregated trendline using a custom Geo library (by kaigouthro). The indicator also tracks breakout signals in a way that a new buy signal is triggered only after a sell signal (and vice versa), ensuring no repeated signals in the same direction.

Important:

This script is provided for educational purposes only. It is experimental and should not be used for live trading without proper testing and validation.

Key Features

Trendline Calculation:

Uses the Geo library to compute support and resistance trendlines based on historical high and low prices. The midpoint of these trendlines forms an aggregated trendline.

Momentum Analysis:

Computes the Rate of Change (ROC) to determine momentum. Breakout conditions are met only if the price and momentum exceed a user-defined threshold.

Monte Carlo Simulation:

Simulates future price movements to estimate the probability of bullish or bearish breakouts over a specified horizon.

Signal Tracking:

A persistent variable ensures that once a buy (or sell) signal is triggered, it won’t repeat until the opposite signal occurs.

Geometric Enhancements:

Calculates an aggregated trend angle and channel width (distance between support and resistance), and draws a perpendicular “breakout zone” line.

Table Display:

A built-in table displays key metrics including:

Bullish probability

Bearish probability

Aggregated trend angle (in degrees)

Channel width

Alerts:

Configurable alerts notify when a new buy or sell breakout signal occurs.

Inputs

Resistance Lookback & Support Lookback:

Number of bars to look back for determining resistance and support points.

Momentum Length & Threshold:

Period for ROC calculation and the minimum percentage change required for a breakout confirmation.

Monte Carlo Simulation Parameters:

Simulation Horizon: Number of future bars to simulate.

Simulation Iterations: Number of simulation runs.

Table Position & Text Size:

Customize where the table is displayed on the chart and the size of the text.

How to Use

Add the Script to Your Chart:

Copy the code into the Pine Script editor on TradingView and add it to your chart.

Adjust Settings:

Customize the inputs (e.g., lookback periods, momentum threshold, simulation parameters) to fit your analysis or educational requirements.

Interpret Signals:

A buy signal is plotted as a green triangle below the bar when conditions are met and the state transitions from neutral or sell.

A sell signal is plotted as a red triangle above the bar when conditions are met and the state transitions from neutral or buy.

Alerts are triggered only on the bar where a new signal is generated.

Examine the Table:

The table displays key metrics (breakout probabilities, aggregated trend angle, and channel width) to help evaluate current market conditions.

Disclaimer

This indicator is experimental and provided for educational purposes only. It is not intended as a trading signal or financial advice. Use this script at your own risk, and always perform your own research and testing before using any experimental tools in live trading.

Credit

This indicator uses the Geo library by kaigouthro. Special thanks to Cryptonerds and @Hazzantazzan for their contributions and insights.

Elliptic Curve SAROverview

The Elliptic Curve SAR indicator is an innovative twist on the traditional Parabolic SAR. Instead of relying solely on a fixed parabolic acceleration, this indicator incorporates elements from elliptic curve mathematics. It uses an elliptic curve defined by the equation y² = x³ + ax + b* along with a configurable base point, dynamically adjusting its acceleration factor to potentially offer different smoothing and timing in trend detection.

How It Works

Elliptic Curve Parameters:

The indicator accepts curve parameters a and b that define the elliptic curve.

A base point (x_p, y_p) on the curve is used as a starting condition.

Dynamic Acceleration:

Instead of a fixed acceleration step, the script computes a dynamic acceleration based on the current value of an intermediate variable (derived via the elliptic curve's properties).

An arctan function is used to non-linearly adjust the acceleration between a defined initial and maximum bound.

Trend & Reversal Detection:

The indicator tracks the current trend (up or down) using the computed SAR value.

It identifies trend reversals by comparing the current price with the SAR, and when a reversal is detected, it resets key parameters such as the Extreme Point (EP).

Visual Enhancements:

SAR Plot: Plotted as circles that change color based on trend direction (blue for uptrends, red for downtrends).

Extreme Point (EP): An orange line is drawn to show the highest high in an uptrend or the lowest low in a downtrend.

Reversal Markers: Green triangles for upward reversals and red triangles for downward reversals are displayed.

Background Color: A subtle background tint (light green or light red) reflects the prevailing trend.

How to Use the Indicator

Input Configuration:

Curve Parameters:

Adjust a and b to define the specific elliptic curve you wish to apply.

Base Point Settings:

Configure the base point (x_p, y_p) to set the starting conditions for the elliptic curve calculations.

Acceleration Settings:

Set the Initial Acceleration and Max Acceleration to tune the sensitivity of the indicator.

Chart Application:

Overlay the indicator on your price chart. The SAR values, Extreme Points, and reversal markers will be plotted directly on the price data.

Use the dynamic background color to quickly assess the current trend.

Customization:

You can further adjust colors, line widths, and shape sizes in the code to better suit your visual preferences.

Differences from the Traditional SAR

Calculation Methodology:

Traditional SAR relies on a parabolic curve with a fixed acceleration factor, which increases linearly as the trend continues.

Elliptic Curve SAR uses a mathematically-derived approach from elliptic curve theory, which dynamically adjusts the acceleration factor based on the curve’s properties.

Sensitivity and Signal Timing:

The use of the arctan function and elliptic curve addition provides a non-linear response to price movements. This may result in a different sensitivity to market conditions and potentially smoother or more adaptive signal generation.

Visual Enhancements:

The enhanced version includes trend-dependent colors, explicit reversal markers, and an Extreme Point plot that are not present in the traditional version.

The background color change further aids in visual trend recognition.

Conclusion

The Elliptic Curve SAR indicator offers an alternative approach to trend detection by integrating elliptic curve mathematics into its calculation. This results in a dynamic acceleration factor and enriched visual cues, providing traders with an innovative tool for market analysis. By fine-tuning the input parameters, users can adapt the indicator to better fit their specific trading style and market conditions.

TRP Stop-Loss and Position SizingScript is based on TRP to see both Long Stop Loss and Short Stop Loss, You can Also adjust the position size based on your capital and percentage risk.

DynamicHeikin-Ashi-RKDynamic Heikin-Ashi RK is an advanced Heikin-Ashi candle indicator with a unique ATR-based offset mechanism. This script refines traditional Heikin-Ashi calculations while dynamically shifting the candles using ATR multipliers, helping traders visualize market trends with greater clarity.

🔹 Features:

✔ Customizable Heikin-Ashi colors

✔ ATR-based dynamic candle offset

✔ Enhanced trend visualization

This tool is ideal for traders looking for a smoother trend representation while incorporating volatility-based adjustments. 🚀

Customizations Available in Dynamic Heikin-Ashi RK

This indicator allows several customizations to suit different trading styles:

🔹 Heikin-Ashi Candle Display: Toggle the visibility of Heikin-Ashi candles.

🔹 Custom Colors: Choose custom colors for bullish and bearish Heikin-Ashi candles.

🔹 ATR-Based Dynamic Offset: Adjust the ATR multiplier to control the offset of Heikin-Ashi candles, helping fine-tune trend visualization.

🔹 Refined Heikin-Ashi Calculation: Uses a smoother formula for Heikin-Ashi candles, enhancing clarity.

With these options, traders can personalize the indicator for better trend detection and volatility analysis. 🚀

Point and Figure Target ForecastPoint and Figure Target Forecast

This Pine Script provides a simple Point and Figure (P&F) chart target forecasting tool, designed to help traders estimate potential price targets based on the Point and Figure charting methodology.

The script calculates target levels using a user-defined box size and reversal factor, which are essential components of the Point and Figure technique. The targets are displayed as green (upward) and red (downward) lines on the chart, with labels marking the calculated target levels.

Key Features:

Box Size and Reversal Control: Allows users to set the size of each box and the number of boxes required for a reversal.

Target Forecasting: Calculates and plots potential upward and downward targets based on the selected parameters.

Visual Labels: Displays target levels with clear labels for easy visualization.

This tool provides a simplified approach to forecasting price targets using the Point and Figure charting method, ideal for traders looking to anticipate potential price movements and structure their trades accordingly.

Volume Buy/Sell ChartVolume Buy/Sell Chart

This script visualizes the distribution of buying and selling volume within each candlestick, helping traders identify dominant market pressure at a glance. It separates volume into Buy Volume (Green) and Sell Volume (Red) using a unique calculation based on price movement within a candle.

Features:

✅ Customizable Bar Display: Choose to display 5, 10, or 100 bars using a simple dropdown selection.

✅ Buy & Sell Volume Calculation: The script determines buying and selling volume dynamically based on price action within the candle.

✅ Custom Volume Threshold for Alerts: Set a percentage threshold (0–100) to trigger alerts when buy or sell volume exceeds a predefined level.

✅ Color-Coded Histogram:

Green Bars: Represent the estimated buy volume.

Red Bars: Represent the estimated sell volume.

✅ Alerts Integration: Automatically detect strong buy or sell signals when the respective volume percentage exceeds your set threshold.

How It Works:

The script calculates total price movement within a candle.

It then estimates buying and selling volume ratios based on whether the price closes higher or lower than it opened.

Finally, it normalizes the buy/sell volume against the total volume and plots it as a column chart.

Usage Guide:

Add the script to your chart.

Select how many bars to display (5, 10, or 100).

Adjust the Custom Volume Percentage Threshold (default: 75%).

Watch for significant buy/sell volume imbalances that might indicate market turning points!

This tool is great for traders looking to analyze volume flow and market sentiment with a simple yet effective visualization. 🚀

EZ_Algo Copyright label

This script overlays a fully adjustable watermark on your chart, featuring:

A bold Main Title (e.g., your brand or name) and Subtitle (e.g., a tagline or ID).

Optional extras like a copyright notice, logo symbol, warning message, and chart info (symbol, timeframe, timestamp, or close price).

A subtle repeating overlay pattern to deter theft.

Flexible positioning, sizing, and color options to match your vib

e

It’s built for traders who want to protect their charts and make them stand out, all in a few clicks.

How to Use It

Add to Chart: Click "Add to Chart" and watch the default watermark appear (e.g., "EZ ALGO" at the top).

Customize It:

Main Title: Set your brand (e.g., "EZ ALGO") under "Main Title". Tweak color, size, and alignment.

Subtitle: Add a tagline (e.g., "Algo Trading") and trader ID (e.g., "@EZ_Algo

") with matching style options.

Text Opacity: Adjust "Text Opacity" in "Appearance" to control title and subtitle transparency (0 = solid, 100 = invisible).

Chart Info: Toggle "Show Chart Info" to display symbol and timestamp, or add "Show Close Price" for extra data.

Extras: Enable "Show Copyright" for a © notice, "Show Logo" for a symbol (e.g., ★), or "Show Warning" to shout "DO NOT COPY".

Overlay Pattern: Turn on "Show Overlay Pattern" to repeat a phrase (e.g., "EZ Algo") across the chart.

Positioning: Pick vertical/horizontal spots (top, middle, bottom; left, center, right) or try "Randomize Main Position" for a surprise placement.

Appearance: Set a "Background Color" and "Background Opacity" for the watermark’s backdrop.

Cell Size: Adjust "Cell Width (%)" and "Cell Height (%)" to resize the watermark (0 = auto-fit).

Apply & Share: Hit "OK" to save settings, then screenshot or share your branded chart with confidence!

Tips

Use a semi-transparent background (e.g., 50 opacity) to keep the chart readable.

Experiment with "Randomize Main Position" for a dynamic look.

Pair a bold logo with a faint overlay pattern for max branding power.

Credits

Inspired by @KristaKT

thanks for the great ideas!

Enjoy marking your charts with flair and protection! Questions? Drop a comment below.

Multi-Timeframe MACD Strategy ver 1.0Multi-Timeframe MACD Strategy: Enhanced Trend Trading with Customizable Entry and Trailing Stop

This strategy utilizes the Moving Average Convergence Divergence (MACD) indicator across multiple timeframes to identify strong trends, generate precise entry and exit signals, and manage risk with an optional trailing stop loss. By combining the insights of both the current chart's timeframe and a user-defined higher timeframe, this strategy aims to improve trade accuracy, reduce exposure to false signals, and capture larger market moves.

Key Features:

Dual Timeframe Analysis: Calculates and analyzes the MACD on both the current chart's timeframe and a user-selected higher timeframe (e.g., Daily MACD on a 1-hour chart). This provides a broader market context, helping to confirm trends and filter out short-term noise.

Configurable MACD: Fine-tune the MACD calculation with adjustable Fast Length, Slow Length, and Signal Length parameters. Optimize the indicator's sensitivity to match your trading style and the volatility of the asset.

Flexible Entry Options: Choose between three distinct entry types:

Crossover: Enters trades when the MACD line crosses above (long) or below (short) the Signal line.

Zero Cross: Enters trades when the MACD line crosses above (long) or below (short) the zero line.

Both: Combines both Crossover and Zero Cross signals, providing more potential entry opportunities.

Independent Timeframe Control: Display and trade based on the current timeframe MACD, the higher timeframe MACD, or both. This allows you to focus on the information most relevant to your analysis.

Optional Trailing Stop Loss: Implements a configurable trailing stop loss to protect profits and limit potential losses. The trailing stop is adjusted dynamically as the price moves in your favor, based on a user-defined percentage.

No Repainting: Employs lookahead=barmerge.lookahead_off in the request.security() function to prevent data leakage and ensure accurate backtesting and real-time signals.

Clear Visual Signals (Optional): Includes optional plotting of the MACD and Signal lines for both timeframes, with distinct colors for easy visual identification. These plots are for visual confirmation and are not required for the strategy's logic.

Suitable for Various Trading Styles: Adaptable to swing trading, day trading, and trend-following strategies across diverse markets (stocks, forex, cryptocurrencies, etc.).

Fully Customizable: All parameters are adjustable, including timeframes, MACD Settings, Entry signal type and trailing stop settings.

How it Works:

MACD Calculation: The strategy calculates the MACD (using the standard formula) for both the current chart's timeframe and the specified higher timeframe.

Trend Identification: The relationship between the MACD line, Signal line, and zero line is used to determine the current trend for each timeframe.

Entry Signals: Buy/sell signals are generated based on the selected "Entry Type":

Crossover: A long signal is generated when the MACD line crosses above the Signal line, and both timeframes are in agreement (if both are enabled). A short signal is generated when the MACD line crosses below the Signal line, and both timeframes are in agreement.

Zero Cross: A long signal is generated when the MACD line crosses above the zero line, and both timeframes agree. A short signal is generated when the MACD line crosses below the zero line and both timeframes agree.

Both: Combines Crossover and Zero Cross signals.

Trailing Stop Loss (Optional): If enabled, a trailing stop loss is set at a specified percentage below (for long positions) or above (for short positions) the entry price. The stop-loss is automatically adjusted as the price moves favorably.

Exit Signals:

Without Trailing Stop: Positions are closed when the MACD signals reverse according to the selected "Entry Type" (e.g., a long position is closed when the MACD line crosses below the Signal line if using "Crossover" entries).

With Trailing Stop: Positions are closed if the price hits the trailing stop loss.

Backtesting and Optimization: The strategy automatically backtests on the chart's historical data, allowing you to assess its performance and optimize parameters for different assets and timeframes.

Example Use Cases:

Confirming Trend Strength: A trader on a 1-hour chart sees a bullish MACD crossover on the current timeframe. They check the MTF MACD strategy and see that the Daily MACD is also bullish, confirming the strength of the uptrend.

Filtering Noise: A trader using a 15-minute chart wants to avoid false signals from short-term volatility. They use the strategy with a 4-hour higher timeframe to filter out noise and only trade in the direction of the dominant trend.

Dynamic Risk Management: A trader enters a long position and enables the trailing stop loss. As the price rises, the trailing stop is automatically adjusted upwards, protecting profits. The trade is exited either when the MACD reverses or when the price hits the trailing stop.

Disclaimer:

The MACD is a lagging indicator and can produce false signals, especially in ranging markets. This strategy is for educational and informational purposes only and should not be considered financial advice. Backtest and optimize the strategy thoroughly, combine it with other technical analysis tools, and always implement sound risk management practices before using it with real capital. Past performance is not indicative of future results. Conduct your own due diligence and consider your risk tolerance before making any trading decisions.

Multi-Timeframe Parabolic SAR Strategy ver 1.0Multi-Timeframe Parabolic SAR Strategy (MTF PSAR) - Enhanced Trend Trading

This strategy leverages the power of the Parabolic SAR (Stop and Reverse) indicator across multiple timeframes to provide robust trend identification, precise entry/exit signals, and dynamic trailing stop management. By combining the insights of both the current chart's timeframe and a user-defined higher timeframe, this strategy aims to improve trading accuracy, reduce risk, and capture more significant market moves.

Key Features:

Dual Timeframe Analysis: Simultaneously analyzes the Parabolic SAR on the current chart and a higher timeframe (e.g., Daily PSAR on a 1-hour chart). This allows you to align your trades with the dominant trend and filter out noise from lower timeframes.

Configurable PSAR: Fine-tune the PSAR calculation with adjustable Start, Increment, and Maximum values to optimize sensitivity for your trading style and the asset's volatility.

Independent Timeframe Control: Choose to display and trade based on either or both the current timeframe PSAR and the higher timeframe PSAR. Focus on the most relevant information for your analysis.

Clear Visual Signals: Distinct colors for the current and higher timeframe PSAR dots provide a clear visual representation of potential entry and exit points.

Multiple Entry Strategies: The strategy offers flexible entry conditions, allowing you to trade based on:

Confirmation: Both current and higher timeframe PSAR signals agree and the current timeframe PSAR has just flipped direction. (Most conservative)

Current Timeframe Only: Trades based solely on the current timeframe PSAR, ideal for when the higher timeframe is less relevant or disabled.

Higher Timeframe Only: Trades based solely on the higher timeframe PSAR.

Dynamic Trailing Stop (PSAR-Based): Implements a trailing stop-loss based on the current timeframe's Parabolic SAR. This helps protect profits by automatically adjusting the stop-loss as the price moves in your favor. Exits are triggered when either the current or HTF PSAR flips.

No Repainting: Uses lookahead=barmerge.lookahead_off in the security() function to ensure that the higher timeframe data is accessed without any data leakage, preventing repainting issues.

Fully Configurable: All parameters (PSAR settings, higher timeframe, visibility, colors) are adjustable through the strategy's settings panel, allowing for extensive customization and optimization.

Suitable for Various Trading Styles: Applicable to swing trading, day trading, and trend-following strategies across various markets (stocks, forex, cryptocurrencies, etc.).

How it Works:

PSAR Calculation: The strategy calculates the standard Parabolic SAR for both the current chart's timeframe and the selected higher timeframe.

Trend Identification: The direction of the PSAR (dots below price = uptrend, dots above price = downtrend) determines the current trend for each timeframe.

Entry Signals: The strategy generates buy/sell signals based on the chosen entry strategy (Confirmation, Current Timeframe Only, or Higher Timeframe Only). The Confirmation strategy offers the highest probability signals by requiring agreement between both timeframes.

Trailing Stop Exit: Once a position is entered, the strategy uses the current timeframe PSAR as a dynamic trailing stop. The stop-loss is automatically adjusted as the PSAR dots move, helping to lock in profits and limit losses. The strategy exits when either the Current or HTF PSAR changes direction.

Backtesting and Optimization: The strategy automatically backtests on the chart's historical data, allowing you to evaluate its performance and optimize the settings for different assets and timeframes.

Example Use Cases:

Trend Confirmation: A trader on a 1-hour chart observes a bullish PSAR flip on the current timeframe. They check the MTF PSAR strategy and see that the Daily PSAR is also bullish, confirming the strength of the uptrend and providing a high-probability long entry signal.

Filtering Noise: A trader on a 5-minute chart wants to avoid whipsaws caused by short-term price fluctuations. They use the strategy with a 1-hour higher timeframe to filter out noise and only trade in the direction of the dominant trend.

Dynamic Risk Management: A trader enters a long position and uses the current timeframe PSAR as a trailing stop. As the price rises, the PSAR dots move upwards, automatically raising the stop-loss and protecting profits. The trade is exited when the current (or HTF) PSAR flips to bearish.

Disclaimer:

The Parabolic SAR is a lagging indicator and can produce false signals, particularly in ranging or choppy markets. This strategy is intended for educational and informational purposes only and should not be considered financial advice. It is essential to backtest and optimize the strategy thoroughly, use it in conjunction with other technical analysis tools, and implement sound risk management practices before using it with real capital. Past performance is not indicative of future results. Always conduct your own due diligence and consider your risk tolerance before making any trading decisions.

Multi-Timeframe PSAR Indicator ver 1.0Enhance your trend analysis with the Multi-Timeframe Parabolic SAR (MTF PSAR) indicator! This powerful tool displays the Parabolic SAR (Stop and Reverse) from both the current chart's timeframe and a higher timeframe, all in one convenient view. Identify potential trend reversals and set dynamic trailing stops with greater confidence by understanding the broader market context.

Key Features:

Dual Timeframe Analysis: Simultaneously visualize the PSAR on your current chart and a user-defined higher timeframe (e.g., see the Daily PSAR while trading on the 1-hour chart). This helps you align your trades with the dominant trend.

Customizable PSAR Settings: Fine-tune the PSAR calculation with adjustable Start, Increment, and Maximum values. Optimize the indicator's sensitivity to match your trading style and the volatility of the asset.

Independent Timeframe Control: Choose to display either or both the current timeframe PSAR and the higher timeframe PSAR. Focus on the information most relevant to your analysis.

Clear Visual Representation: Distinct colors for the current and higher timeframe PSAR dots make it easy to differentiate between the two. Quickly identify potential entry and exit points.

Configurable Colors You can easily change colors of Current and HTF PSAR.

Standard PSAR Logic: Uses the classic Parabolic SAR algorithm, providing a reliable and widely-understood trend-following indicator.

lookahead=barmerge.lookahead_off used in the security function, there is no data leak or repainting.

Benefits:

Improved Trend Identification: Spot potential trend changes earlier by observing divergences between the current and higher timeframe PSAR.

Enhanced Risk Management: Use the PSAR as a dynamic trailing stop-loss to protect profits and limit potential losses.

Greater Trading Confidence: Make more informed decisions by considering the broader market trend.

Reduced Chart Clutter: Avoid the need to switch between multiple charts to analyze different timeframes.

Versatile Application: Suitable for various trading styles (swing trading, day trading, trend following) and markets (stocks, forex, crypto, etc.).

How to Use:

Add to Chart: Add the "Multi-Timeframe PSAR" indicator to your TradingView chart.

Configure Settings:

PSAR Settings: Adjust the Start, Increment, and Maximum values to control the PSAR's sensitivity.

Multi-Timeframe Settings: Select the desired "Higher Timeframe PSAR" resolution (e.g., "D" for Daily). Enable or disable the display of the current and/or higher timeframe PSAR using the checkboxes.

Interpret Signals:

Current Timeframe PSAR: Dots below the price suggest an uptrend; dots above the price suggest a downtrend.

Higher Timeframe PSAR: Provides context for the overall trend. Agreement between the current and higher timeframe PSAR strengthens the trend signal. Divergences may indicate potential reversals.

Trade Management:

Use PSAR dots as dynamic trailing stop.

Example Use Cases:

Confirming Trend Strength: A trader on a 1-hour chart sees the 1-hour PSAR flip bullish (dots below the price). They check the MTF PSAR and see that the Daily PSAR is also bullish, confirming the strength of the uptrend.

Identifying Potential Reversals: A trader sees the current timeframe PSAR flip bearish, but the higher timeframe PSAR remains bullish. This divergence could signal a potential pullback within a larger uptrend, or a warning of a more significant reversal.

Trailing Stops: A trader enters a long position and uses the current timeframe PSAR as a trailing stop, moving their stop-loss up as the PSAR dots rise.

Disclaimer: The Parabolic SAR is a lagging indicator and may produce false signals, especially in ranging markets. It is recommended to use this indicator in conjunction with other technical analysis tools and risk management strategies. Past performance is not indicative of future results.

XGBoost Approximation Indicator with HTF Filter Ver. 3.2XGBoost Approx Indicator with Higher Timeframe Filter Ver. 3.2

What It Is

The XGBoost Approx Indicator is a technical analysis tool designed to generate trading signals based on a composite of multiple indicators. It combines Simple Moving Average (SMA), Relative Strength Index (RSI), MACD, Rate of Change (ROC), and Volume to create a composite indicator score. Additionally, it incorporates a higher timeframe filter (HTF) to enhance trend confirmation and reduce false signals.

This indicator helps traders identify long (buy) and short (sell) opportunities based on a weighted combination of trend-following and momentum indicators.

How to Use It Properly

Setup and Configuration:

Add the indicator to your TradingView chart.

Customize input settings based on your trading strategy. Key configurable inputs include:

HTF filter (default: 1-hour)

SMA, RSI, MACD, and ROC lengths

Custom weightings for each component

Thresholds for buy and sell signals

Understanding the Signals:

Green "Long" Label: Appears when the composite indicator crosses above the buy threshold, signaling a potential buy opportunity.

Red "Short" Label: Appears when the composite indicator crosses below the sell threshold, signaling a potential sell opportunity.

These signals are filtered by a higher timeframe SMA trend to improve accuracy.

Alerts:

The indicator provides alert conditions for long and short entries.

Traders can enable alerts in TradingView to receive real-time notifications when a new signal is triggered.

Safety and Best Practices

Use in Conjunction with Other Analysis: Do not rely solely on this indicator. Combine it with price action, support/resistance levels, and fundamental analysis for better decision-making.

Adjust Settings for Your Strategy: The default settings may not suit all markets or timeframes. Test different configurations before trading live.

Backtest Before Using in Live Trading: Evaluate the indicator’s past performance on historical data to assess its effectiveness in different market conditions.

Avoid Overtrading: False signals can occur, especially in low volatility or choppy markets. Use additional confirmation (e.g., trendlines or moving averages).

Risk Management: Always set stop-loss levels and position sizes to limit potential losses.

Highs & Lows - Multi TimeFrame### **📌 HL-MWD (Highs & Lows - Multi Timeframe Indicator) – Community Release**

#### **🔹 Overview**

The **HL-MWD Indicator** is a **multi-timeframe support & resistance tool** that plots **historical highs and lows** from **daily, weekly, and monthly timeframes** onto an intraday chart. It helps traders **identify key levels of support and resistance** that have influenced price action over different timeframes.

This indicator is useful for **day traders, swing traders, and position traders** who rely on **multi-timeframe analysis** to spot critical price levels.

---

### **🔥 Key Features**

✅ **Plots Highs & Lows for Daily, Weekly, and Monthly Timeframes**

✅ **Customizable Lookback Periods for Each Timeframe**

✅ **Adjustable Line Colors, Styles (Solid, Dotted, Dashed), and Widths**

✅ **Extend Lines into the Future to Identify Key Price Levels**

✅ **Option to Display Price Labels for Each Level**

✅ **Gradient Option to Highlight Recent Highs & Lows (Disabled by Default)**

✅ **Compatible with Intraday, Daily, and Weekly Charts**

---

### **📈 How It Works**

- **Daily Highs & Lows:** Captures the **highest and lowest prices** within the selected lookback period (default: **14 bars**).

- **Weekly Highs & Lows:** Marks the **highest and lowest prices** within the chosen weekly lookback (default: **52 bars**).

- **Monthly Highs & Lows:** Displays the **high and low points** from the monthly timeframe (default: **36 bars**).

- **Extended Lines:** Project past highs and lows **into the future** to help identify **potential support & resistance zones**.

---

### **⚠️ TradingView Lookback Limitations**

🔹 **TradingView has a limit on how many historical bars can be accessed per timeframe**, which affects how far back the indicator can retrieve data.

🔹 **Intraday charts (e.g., 5m, 15m) have a limited number of past bars**, meaning:

- **You won’t be able to view 36 months' worth of monthly levels** on a **5-minute chart**, because TradingView doesn’t store that much data in lower timeframes.

- **If multiple timeframes (e.g., weekly + monthly) are enabled at the same time**, some historical data may **not be available on shorter timeframes**.

🔹 **Recommendation:**

- If using **monthly lookbacks (36 months+), view them on a daily or higher timeframe**.

- If using **weekly lookbacks (52 weeks+), higher intraday timeframes (e.g., 1-hour, 4-hour) are better suited**.

- **Lower timeframes (1m, 5m, 15m) may miss some levels** if TradingView's bar limit is exceeded.

---

### **⚙️ Customization Options**

| **Setting** | **Default Value** | **Description** |

|------------------|----------------|----------------|

| **Daily Lookback** | `14` | Number of bars used to calculate daily highs/lows. |

| **Weekly Lookback** | `52` | Number of bars used to calculate weekly highs/lows. |

| **Monthly Lookback** | `36` | Number of bars used to calculate monthly highs/lows. |

| **Line Colors** | Daily: `Blue` Weekly: `Green` Monthly: `Red` | Customizable colors for each timeframe. |

| **Line Style** | `Solid` | Options: Solid, Dashed, Dotted. |

| **Line Width** | `1` | Thickness of the plotted lines. |

| **Extend Line** | `1` | Controls how far the highs/lows extend into the future. |

| **Display Price Labels** | `Enabled` | Shows price labels on each level. |

---

### **🛠️ How to Use It**

- **Enable/disable different timeframes** based on your strategy.

- **Customize colors, line styles, and widths** to match your charting style.

- **Use extended lines to identify support & resistance zones.**

- **Watch price reactions at these levels** for potential entries, exits, and stop-loss placements.

---

### **🚀 Final Thoughts**

The **HL-MWD Indicator** is a **powerful multi-timeframe tool** that helps traders **visualize key support & resistance levels** from higher timeframes on an intraday chart.

⚠️ **However, TradingView’s lookback limits apply—so for longer-term levels, higher timeframes are recommended.**

📌 **Now published for the community!** Let me know if you need any last-minute tweaks! 🔥

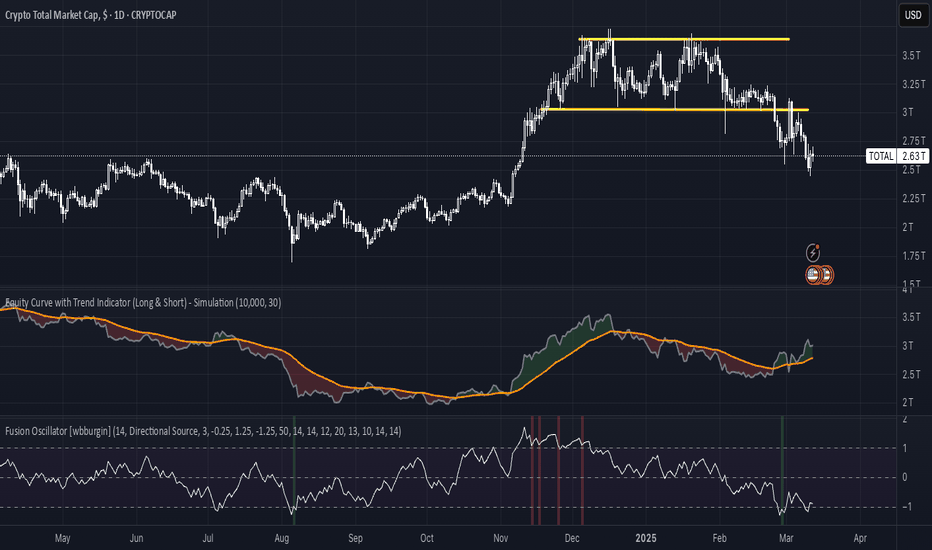

Equity Curve with Trend Indicator (Long & Short) - SimulationOverview:

Market Regime Detector via Virtual Equity Curve is a unique indicator that simulates the performance of a trend-following trading system—incorporating both long and short trades—to help you identify prevailing market regimes. By generating a “virtual equity” curve based on simple trend signals and applying trend analysis directly on that curve, this indicator visually differentiates trending regimes from mean-reverting (or sideways) periods. The result is an intuitive display where green areas indicate a trending (bullish) regime (i.e., where trend-following strategies are likely to perform well) and red areas indicate a mean-reverting (bearish) regime.

Features:

Simulated Trade Performance:

Uses a built-in trend-following logic (a simple 10/50 SMA crossover example) to simulate both long and short trades. This simulation creates a virtual equity curve that reflects the cumulative performance of the system over time.

Equity Trend Analysis:

Applies an Exponential Moving Average (EMA) to the simulated equity curve to filter short-term noise. The EMA acts as a trend filter, enabling the indicator to determine if the equity curve is in an upward (trending) or downward (mean-reverting) phase.

Dynamic Visual Regime Detection:

Fills the area between the equity curve and its EMA with green when the equity is above the EMA (indicating a healthy trending regime) and red when below (indicating a mean-reverting or underperforming regime).

Customizable Parameters:

Easily adjust the initial capital, the length of the equity EMA, and other settings to tailor the simulation and visual output to your trading style and market preferences.

How It Works:

Trade Simulation:

The indicator generates trading signals using a simple SMA crossover:

When the 10-period SMA is above the 50-period SMA, it simulates a long entry.

When the 10-period SMA is below the 50-period SMA, it simulates a short entry. The virtual equity is updated bar-by-bar based on these simulated positions.

Equity Trend Filtering:

An EMA is calculated on the simulated equity curve to smooth out fluctuations. The relative position of the equity curve versus its EMA is then used as a proxy for the market regime:

Bullish Regime: Equity is above its EMA → fill area in green.

Bearish Regime: Equity is below its EMA → fill area in red.

Visualization:

The indicator plots:

A gray line representing the simulated equity curve.

An orange line for the EMA of the equity curve.

A dynamic fill between the two lines, colored green or red based on the prevailing regime.

Inputs & Customization:

Initial Capital: Set your starting virtual account balance (default: 10,000 USD).

Equity EMA Length: Specify the lookback period for the EMA applied to the equity curve (default: 30).

Trend Signal Logic:

The current implementation uses a simple SMA crossover for demonstration purposes. Users can modify or replace this logic with their own trend-following indicator to tailor the simulation further.

ATR Percentages BoxThis custom indicator provides a quick visual reference for volatility-based price ranges, directly on your TradingView charts. It calculates and displays three ranges derived from the Daily Average True Range (ATR) with a standard 14-period setting:

5 Min (3% ATR): Ideal for very short-term scalping and quick intraday moves.

1 Hour (5% ATR): Useful for hourly setups, short-term trades, and intraday volatility assessment.

Day (10% ATR): Perfect for daily volatility context, swing trades, or placing stops and targets.

The ranges are clearly shown in a compact box at the top-right corner, providing traders immediate insights into realistic price movements, helping to optimise entries, stops, and profit targets efficiently.

Smart Scalper Indicator🎯 How the Smart Scalper Indicator Works

1. EMA (Exponential Moving Average)

EMA 10 (Blue Line):

Shows the short-term trend.

If the price is above this line, the trend is bullish; if below, bearish.

EMA 20 (Orange Line):

Displays the longer-term trend.

If EMA 10 is above EMA 20, it indicates a bullish trend (Buy signal).

2. SuperTrend

Green Line:

Represents support levels.

If the price is above the green line, the market is considered bullish.

Red Line:

Represents resistance levels.

If the price is below the red line, the market is considered bearish.

3. VWAP (Volume Weighted Average Price)

Purple Line:

Indicates the average price considering volume.

If the price is above the VWAP, the market is strong (Buy signal).

If the price is below the VWAP, the market is weak (Sell signal).

4. ATR (Average True Range)

Used to measure market volatility.

An increasing ATR indicates higher market activity, enhancing the reliability of signals.

ATR is not visually displayed but is factored into the signal conditions.

⚡ Entry Signals

Green Up Arrow (Buy):

EMA 10 is above EMA 20.

The price is above the SuperTrend green line.

The price is above the VWAP.

Volatility (ATR) is increasing.

Red Down Arrow (Sell):

EMA 10 is below EMA 20.

The price is below the SuperTrend red line.

The price is below the VWAP.

Volatility (ATR) is increasing.

🔔 Alerts

"Buy Alert" — Notifies when a Buy condition is met.

"Sell Alert" — Notifies when a Sell condition is met.

✅ How to Use the Indicator:

Add the indicator to your TradingView chart.

Enable alerts to stay updated on signal triggers.

Check the signal:

A green arrow suggests a potential Buy.

A red arrow suggests a potential Sell.

Set Stop-Loss:

Below the SuperTrend line or based on ATR levels.

Take Profit:

Target 1-2% for short-term trades.

AutoFibGauge (TechnoBlooms) AutoFibGauge help users to understand Fibonacci retracement with auto-drawn levels from previous candes, dual moving average crossover for trend confirmation, and a thermometer for quick Fib level identification.

This indicator is designed to streamline your trading decisions. By automatically plotting the Fibonacci levels based on previous candles, it aids in identifying key support and resistance zones. User can choose the number of previous candles for which the Fibonacci is calculated.

Paired with a dual moving average crossover system for robust trend confirmation, this tools helps in aligning with the market's direction.

A dynamic thermometer display that instantly highlights critical Fib levels, making it easier than ever to spot opportunities at a glance.

Nifty/Gold RatioPrice of NIFTY in GOLD. Highs indicate that Gold is getting cheaper, Lows indicate Nifty is getting cheaper.

[COW] Day Percent LevelsThis indicator plots on your chart 2 levels, the daily percentage changes required to know by most prop firms and other exchanges. 5% is often a cutoff point for prop firm day traders and can get you banned if you trade past these levels. This indicator allows you to adjust the percentage as well as the lines and labels to your liking.

This is key when using prop firms as it is a level you must be aware of when trading. This can help you avoid being banned, your account being closed, or other disciplinary action based on trading past these levels.

Enjoy!