Gold Futures vs Spot (Candlestick + Line Overlay)📝 Script Description: Gold Futures vs Spot

This script was developed to compare the price movements between Gold Futures and Spot Gold within a specific time frame. The primary goals of this script are:

To analyze the price spread between Gold Futures and Spot

To identify potential arbitrage opportunities caused by price discrepancies

To assist in decision-making and enhance the accuracy of gold market analysis

🔧 Key Features:

Fetches price data from both Spot and Futures markets (from APIs or chart sources)

Converts and aligns data for direct comparison

Calculates the price spread (Futures - Spot)

Visualizes the spread over time or exports the data for further analysis

📅 Date Created:

🧠 Additional Notes:

This script is ideal for investors, gold traders, or analysts who want to understand the relationship between the Futures and Spot markets—especially during periods of high volatility. Unusual spreads may signal shifts in market sentiment or the actions of institutional players.

Educational

MACD Boundary PSA - CoffeeKillerMACD Boundary PSA - CoffeeKiller Indicator Guide

Welcome traders! This guide will walk you through the MACD Boundary PSA indicator, a powerful market analysis tool developed by CoffeeKiller that enhances the traditional MACD with advanced boundary detection and peak signaling features.

🔔 **Warning: This Indicator Has No Signal Line or MACD Line** 🔔 This indicator is my version of the MACD, that I use in conjunction with the Rev&Line indicator.

Core Concept: Enhanced MACD Analysis

The foundation of this indicator builds upon the classic Moving Average Convergence Divergence (MACD) indicator, adding boundary tracking and peak detection systems to provide clearer signals and market insights.

Histogram Bars: Market Momentum

- Positive Green Bars: Bullish momentum

- Negative Red Bars: Bearish momentum

- Color intensity varies based on momentum strength

- Special coloring for new high/low boundaries

Marker Lines: Dynamic Support/Resistance

- High Marker Line (Magenta): Tracks the highest point reached during a bullish phase

- Low Marker Line (Cyan): Tracks the lowest point reached during a bearish phase

- Acts as dynamic boundaries that help identify strength of current moves

Peak Detection System:

- Triangular markers identify significant local maxima and minima

- Background highlighting shows important momentum peaks

- Helps identify potential reversal points and momentum exhaustion

Core Components

1. MACD Calculation

- Customizable fast and slow moving averages

- Signal line smoothing options

- Flexible MA type selection (SMA or EMA)

- Custom source input options

2. Boundary Tracking System

- Automatic detection of highest values in bullish phases

- Automatic detection of lowest values in bearish phases

- Step-line visualization of boundaries

- Color-coded for easy identification

3. Peak Detection System

- Identification of local maxima and minima

- Background highlighting of significant peaks

- Triangle markers for peak visualization

- Zero-line cross detection for trend changes

4. Time Resolution Control

- Normal mode: calculations based on chart timeframe

- Custom resolution mode: calculations based on specified timeframe

Main Features

Time Resolution Settings

- Normal mode: calculations match your chart's timeframe

- Custom resolution mode: calculations based on specified timeframe

- Helps identify stronger signals from other timeframes

Visual Elements

- Color-coded histogram bars

- Dynamic marker lines for boundaries

- Peak triangles for significant turning points

- Background highlighting for peak identification

Signal Generation

- Zero-line crosses for trend change signals

- Boundary breaks for momentum strength

- Peak formation for potential reversals

- Color changes for momentum direction

Customization Options

- MA types and lengths

- Signal smoothing

- Color schemes

- Marker line visibility

- Peak background display options

Trading Applications

1. Trend Identification

- Histogram crossing above zero: bullish trend beginning

- Histogram crossing below zero: bearish trend beginning

- Histogram color: indicates momentum direction

- Consistent color intensity: trend strength

2. Reversal Detection

- Peak triangles after extended trend: potential exhaustion

- Background highlighting: significant reversal points

- Histogram approaching marker lines: potential trend change

- Color shifts from bright to muted: decreasing momentum

3. Momentum Analysis

- Histogram breaking above previous high boundary: accelerating bullish momentum

- Histogram breaking below previous low boundary: accelerating bearish momentum

- Special coloring (magenta/cyan): boundary breaks indicating strength

- Distance from zero line: overall momentum magnitude

4. Market Structure Assessment

- Consecutive higher peaks: strengthening bullish structure

- Consecutive lower troughs: strengthening bearish structure

- Peak comparisons: relative strength of momentum phases

- Boundary line steps: market structure levels

Optimization Guide

1. MACD Settings

- Fast Length: Shorter values (8-12) for responsiveness, longer values (20+) for smoother signals

- Slow Length: Shorter values (21-34) for more signals, longer values (72+) for major moves

- Default settings (22, 72, 9): balanced approach for most timeframes

- Consider using 8, 21, 5 for shorter timeframes and 34, 144, 5 for longer timeframes

2. MA Type Selection

- EMA: More responsive, follows price more closely

- SMA: Smoother, fewer false signals, potentially more lag

- Mix and match for oscillator and signal lines based on your preference

3. Time Resolution

- Match chart timeframe: for aligned analysis

- Use higher timeframe: for filtering signals

- Lower timeframe: for earlier entries but more noise

4. Color Customization

- Normal bullish/bearish colors: represent standard momentum

- High/low marker line colors: customize visibility

- Peak marker colors: adjust for your visual preference

- Consider chart background when selecting colors

Best Practices

1. Signal Confirmation

- Wait for zero-line crosses to confirm trend changes

- Look for peak formations to identify potential reversals

- Check for boundary breaks to confirm strong momentum

- Use custom timeframe option for higher timeframe confirmation

2. Timeframe Selection

- Lower timeframes: more signals, potential noise

- Higher timeframes: cleaner signals, less frequent

- Custom resolution: allows comparison across timeframes

- Consider using multiple timeframes for confirmation

3. Market Context

- Strong bullish phase: positive histogram breaking above marker line

- Strong bearish phase: negative histogram breaking below marker line

- Histogram approaching zero: potential trend change

- Peak formations: potential exhaustion points

4. Combining with Other Indicators

- Use with trend indicators for confirmation

- Pair with oscillators for overbought/oversold conditions

- Combine with volume analysis for validation

- Consider support/resistance levels with boundary lines

Advanced Trading Strategies

1. Boundary Break Strategy

- Enter long when histogram breaks above previous high marker line

- Enter short when histogram breaks below previous low marker line

- Use zero-line as initial stop-loss reference

- Take profits at formation of opposing peaks

2. Peak Trading Strategy

- Identify significant peaks with triangular markers

- Look for consecutive lower peaks in bullish phases for shorting opportunities

- Look for consecutive higher troughs in bearish phases for buying opportunities

- Use zero-line crosses as confirmation

3. Multi-Timeframe Strategy

- Use custom resolution for higher timeframe MACD trend

- Enter trades when both timeframes align

- Higher timeframe for trend direction

- Chart timeframe for precise entry

4. Histogram Color Strategy

- Enter long when histogram turns bright green (increasing momentum)

- Enter short when histogram turns bright red (increasing momentum)

- Exit when color intensity fades (decreasing momentum)

- Use marker lines as dynamic support/resistance

Practical Analysis Examples

Bullish Market Scenario

- Histogram crosses above zero line

- Green bars grow in height and intensity

- High marker line forms steps upward

- Peak triangles appear at local maxima

- Background highlights appear at significant momentum peaks

Bearish Market Scenario

- Histogram crosses below zero line

- Red bars grow in depth and intensity

- Low marker line forms steps downward

- Peak triangles appear at local minima

- Background highlights appear at significant momentum troughs

Consolidation Scenario

- Histogram oscillates around zero line

- Bar colors alternate frequently

- Marker lines remain relatively flat

- Few or no new peak highlights appear

- Histogram values remain small

Understanding Market Dynamics Through MACD Boundary PSA

At its core, this indicator provides a unique lens to visualize market momentum and boundaries:

1. Momentum Strength: The histogram height/depth shows the strength of current momentum, with color intensity providing additional context about acceleration or deceleration.

2. Dynamic Boundaries: The marker lines create a visual representation of the "high water marks" of momentum in both directions, helping to identify when markets are making new momentum extremes.

3. Exhaustion Signals: The peak detection system highlights moments where momentum has reached a local maximum or minimum, often precursors to reversals or consolidations.

4. Trend Confirmation: The histogram color and intensity provide instant feedback about the current trend direction and strength, with special colors highlighting particularly significant moves.

Remember:

- Combine signals from histogram, marker lines, and peak formations

- Use appropriate timeframe settings for your trading style

- Customize the indicator to match your visual preferences

- Consider market conditions and correlate with price action

This indicator works best when:

- Used as part of a comprehensive trading system

- Combined with proper risk management

- Applied with an understanding of current market conditions

- Signals are confirmed by price action and other indicators

**DISCLAIMER**: This indicator and its signals are intended solely for educational and informational purposes. They do not constitute financial advice. Trading involves significant risk of loss. Always conduct your own analysis and consult with financial professionals before making trading decisions.

STH Unrealized Profit/Loss Ratio (STH-NUPL) | [DeV]STH-NUPL

The Short-Term Holder Net Unrealized Profit/Loss Ratio (STH-NUPL) is an analytical tool designed to approximate the unrealized profit or loss of Bitcoin’s short-term holders (STHs)—typically those holding coins for less than 155 days—within the constraints of TradingView’s price-based environment. Drawing inspiration from the canonical STH-NUPL metric, which assesses the difference between the market value and realized value of STH-held coins, this indicator adapts the concept into a normalized ratio using Bitcoin’s price data as a proxy. It offers a window into the sentiment and behavior of short-term market participants, who are often more sensitive to price fluctuations than long-term holders.

In its raw form, STH-NUPL oscillates around a break-even threshold of 0, where positive values indicate aggregate unrealized profits for STHs (market value exceeds realized value), and negative values suggest losses. This inflection point frequently acts as a key level: in bear markets, it can signal capitulation as STHs sell at break-even or below, while in bull markets, it may reflect reluctance to realize losses, providing support. The indicator enhances this metric with smoothing, a moving average overlay, and sophisticated visualization options, delivering a statistically informed perspective on short-term holder dynamics tailored for institutional-grade analysis.

STH-NUPL Settings -

Lookback Length (Default: 150 days): Defines the SMA period for estimating realized value. This 150-day window aligns with traditional STH definitions (e.g., <155 days), capturing a broad yet relevant historical cost basis for short-term holders, ideal for assessing cyclical behavior.

Smoothing Period (Default: 5 days): Applies an EMA to the raw STH-NUPL ratio, with a short default period to maintain responsiveness to recent price shifts while filtering out daily volatility. This setting is particularly suited for tactical analysis.

Moving Average Settings -

MA Lookback Length (Default: 90 days): Sets the period for the STH-NUPL’s moving average, offering a medium-term trend signal that contrasts with the 150-day lookback, enabling detection of momentum shifts within broader market phases.

MA Type (Default: EMA): Provides six moving average types, from the straightforward SMA to the volume-sensitive VWMA. The default EMA balances smoothness and reactivity, while options like HMA or VWMA cater to specialized needs, such as emphasizing recent action or volume trends.

Display Settings -

Show Moving Average (Default: True): Toggles the visibility of the STH-NUPL MA plot, allowing users to focus solely on the smoothed ratio when desired.

Show Background Colors (Default: True): Activates dynamic background shading to visually reinforce market regimes.

Background Color Source (Default: STH-NUPL): Enables users to tie the background to either the STH-NUPL’s midline (reflecting sthNupl > 0) or the MA’s trend direction (maNupl > maNupl ), aligning the visual context with the chosen analytical focus.

Analytical Applications -

Bear Market Capitulation: When the smoothed STH-NUPL approaches or falls below zero, it often signals loss realization among STHs, a precursor to capitulation in downtrends. A declining MA crossing zero can confirm this selling pressure.

Bull Market Support: Positive STH-NUPL values with a rising MA indicate STHs are in profit and reluctant to sell at a loss, forming support zones in uptrends as sell pressure wanes.

Sentiment Extremes: Significant deviations above or below zero highlight over-optimism or despair among STHs, offering contrarian opportunities when paired with price action or other on-chain metrics.

**Limitations**

As a TradingView-based approximation, this indicator uses price data (close) rather than true on-chain STH supply and realized price, which are available through providers like Glassnode. The 150-day SMA for realized value simplifies the cost basis, potentially underrepresenting the diversity of STH transactions. Despite this, the smoothed ratio and moving average overlay provide a practical proxy for tracking STH sentiment within TradingView’s ecosystem.

Stop Loss / Take Profit Table// (\_/)

// ( •.•)

// (")_(")

📈 Introducing the Stop Loss / Take Profit Table Indicator! 📈

Enhance your trading strategy with our powerful Stop Loss / Take Profit Table indicator, designed for traders in the Crypto, Stock, and Forex markets. This easy-to-use tool helps you manage risk and maximize profits by clearly displaying your Stop Loss and Take Profit levels based on your trading position.

Key Features:

Custom Asset Types: Choose between Crypto, Stock, or Forex to tailor the indicator to your specific trading style.

Dynamic Stop Loss & Take Profit Calculation: Set your desired Stop Loss percentage, and the indicator will automatically calculate your Stop Loss and two Take Profit levels based on different timeframes (1 min to 240 min).

Position Type Flexibility: Whether you're trading Long or Short, the indicator adjusts the calculations accordingly, providing you with precise price levels for effective risk management.

Visual Representation: Stop Loss and Take Profit levels are marked directly on the chart with distinctive horizontal lines in vibrant colors for easy reference.

Informative Table Display: A dedicated table displayed on the chart shows your asset type, position type, and calculated prices for Stop Loss and Take Profit levels, ensuring you have all critical data at a glance.

Alert Notifications: Stay informed with optional alerts that signal when your Stop Loss or Take Profit levels are hit, allowing you to react swiftly in fast-moving markets.

Why Use This Indicator?

Managing your trades is critical for success in the financial markets. With our Stop Loss / Take Profit Table, you can easily set your parameters and visually track your risk and reward levels, making it a practical addition to any trader's toolkit.

Get started today and take control of your trading strategy! ✨

Happy trading! 📊🚀

RSI3M3+ v.1.8RSI3M3+ v.1.8 Indicator

This script is an advanced trading indicator based on Walter J. Bressert's cycle analysis methodology, combined with an RSI (Relative Strength Index) variation. Let me break it down and explain how it works.

Core Concepts

The RSI3M3+ indicator combines:

A short-term RSI (3-period)

A 3-period moving average to smooth the RSI

Bressert's cycle analysis principles to identify optimal trading points

RSI3M3+ Indicator VisualizationImage Walter J. Bressert's Cycle Analysis Concepts

Walter Bressert was a pioneer in cycle analysis trading who believed markets move in cyclical patterns that can be measured and predicted. His key principles integrated into this indicator include:

Trading Cycles: Markets move in cycles with measurable time spans from low to low

Timing Bands: Projected periods when the next cyclical low or high is anticipated

Oscillator Use: Using oscillators like RSI to confirm cycle position

Entry/Exit Rules: Specific rules for trade entry and exit based on cycle position

Key Parameters in the Script

Basic RSI Parameters

Required bars: Minimum number of bars needed (default: 20)

Overbought region: RSI level considered overbought (default: 70)

Oversold region: RSI level considered oversold (default: 30)

Bressert-Specific Parameters

Cycle Detection Length: Lookback period for cycle identification (default: 30)

Minimum/Maximum Cycle Length: Expected cycle duration in days (default: 15-30)

Buy Line: Lower threshold for buy signals (default: 40)

Sell Line: Upper threshold for sell signals (default: 60)

How the Indicator Works

RSI3M3 Calculation:

Calculates a 3-period RSI (sRSI)

Smooths it with a 3-period moving average (sMA)

Cycle Detection:

Identifies bottoms: When the RSI is below the buy line (40) and starting to turn up

Identifies tops: When the RSI is above the sell line (60) and starting to turn down

Records these points to calculate cycle lengths

Timing Bands:

Projects when the next cycle bottom or top should occur

Creates visual bands on the chart showing these expected time windows

Signal Generation:

Buy signals occur when the RSI turns up from below the oversold level (30)

Sell signals occur when the RSI turns down from above the overbought level (70)

Enhanced by Bressert's specific timing rules

Bressert's Five Trading Rules (Implemented in the Script)

Cycle Timing: The low must be 15-30 market days from the previous Trading Cycle bottom

Prior Top Validation: A Trading Cycle high must have occurred with the oscillator above 60

Oscillator Behavior: The oscillator must drop below 40 and turn up

Entry Trigger: Entry is triggered by a rise above the price high of the upturn day

Protective Stop: Place stop slightly below the Trading Cycle low (implemented as 99% of bottom price)

How to Use the Indicator

Reading the Chart

Main Plot Area:

Green line: 3-period RSI

Red line: 3-period moving average of the RSI

Horizontal bands: Oversold (30) and Overbought (70) regions

Dotted lines: Buy line (40) and Sell line (60)

Yellow vertical bands: Projected timing windows for next cycle bottom

Signals:

Green up arrows: Buy signals

Red down arrows: Sell signals

Trading Strategy

For Buy Signals:

Wait for the RSI to drop below the buy line (40)

Look for an upturn in the RSI from below this level

Enter the trade when price rises above the high of the upturn day

Place a protective stop at 99% of the Trading Cycle low

For Sell Signals:

Wait for the RSI to rise above the sell line (60)

Look for a downturn in the RSI from above this level

Consider exiting or taking profits when a sell signal appears

Alternative exit: When price moves below the low of the downturn day

Cycle Timing Enhancement:

Pay attention to the yellow timing bands

Signals occurring within these bands have higher probability of success

Signals outside these bands may be less reliable

Practical Tips for Using RSI3M3+

Timeframe Selection:

The indicator works best on daily charts for intermediate-term trading

Can be used on weekly charts for longer-term position trading

On intraday charts, adjust cycle lengths accordingly

Market Applicability:

Works well in trending markets with clear cyclical behavior

Less effective in choppy, non-trending markets

Consider additional indicators for trend confirmation

Parameter Adjustment:

Different markets may have different natural cycle lengths

You may need to adjust the min/max cycle length parameters

Higher volatility markets may need wider overbought/oversold levels

Trade Management:

Enter trades when all Bressert's conditions are met

Use the protective stop as defined (99% of cycle low)

Consider taking partial profits at the projected cycle high timing

Advanced Techniques

Multiple Timeframe Analysis:

Confirm signals with the same indicator on higher timeframes

Enter in the direction of the larger cycle when smaller and larger cycles align

Divergence Detection:

Look for price making new lows while RSI makes higher lows (bullish)

Look for price making new highs while RSI makes lower highs (bearish)

Confluence with Price Action:

Combine with support/resistance levels

Use with candlestick patterns for confirmation

Consider volume confirmation of cycle turns

This RSI3M3+ indicator combines the responsiveness of a short-term RSI with the predictive power of Bressert's cycle analysis, offering traders a sophisticated tool for identifying high-probability trading opportunities based on market cycles and momentum shifts.

THANK YOU FOR PREVIOUS CODER THAT EFFORT TO CREATE THE EARLIER VERSION THAT MAKE WALTER J BRESSERT CONCEPT IN TRADINGVIEW @ADutchTourist

Strategy Stats [presentTrading]Hello! it's another weekend. This tool is a strategy performance analysis tool. Looking at the TradingView community, it seems few creators focus on this aspect. I've intentionally created a shared version. Welcome to share your idea or question on this.

█ Introduction and How it is Different

Strategy Stats is a comprehensive performance analytics framework designed specifically for trading strategies. Unlike standard strategy backtesting tools that simply show cumulative profits, this analytics suite provides real-time, multi-timeframe statistical analysis of your trading performance.

Multi-timeframe analysis: Automatically tracks performance metrics across the most recent time periods (last 7 days, 30 days, 90 days, 1 year, and 4 years)

Advanced statistical measures: Goes beyond basic metrics to include Information Coefficient (IC) and Sortino Ratio

Real-time feedback: Updates performance statistics with each new trade

Visual analytics: Color-coded performance table provides instant visual feedback on strategy health

Integrated risk management: Implements sophisticated take profit mechanisms with 3-step ATR and percentage-based exits

BTCUSD Performance

The table in the upper right corner is a comprehensive performance dashboard showing trading strategy statistics.

Note: While this presentation uses Vegas SuperTrend as the underlying strategy, this is merely an example. The Stats framework can be applied to any trading strategy. The Vegas SuperTrend implementation is included solely to demonstrate how the analytics module integrates with a trading strategy.

⚠️ Timeframe Limitations

Important: TradingView's backtesting engine has a maximum storage limit of 10,000 bars. When using this strategy stats framework on smaller timeframes such as 1-hour or 2-hour charts, you may encounter errors if your backtesting period is too long.

Recommended Timeframe Usage:

Ideal for: 4H, 6H, 8H, Daily charts and above

May cause errors on: 1H, 2H charts spanning multiple years

Not recommended for: Timeframes below 1H with long history

█ Strategy, How it Works: Detailed Explanation

The Strategy Stats framework consists of three primary components: statistical data collection, performance analysis, and visualization.

🔶 Statistical Data Collection

The system maintains several critical data arrays:

equityHistory: Tracks equity curve over time

tradeHistory: Records profit/loss of each trade

predictionSignals: Stores trade direction signals (1 for long, -1 for short)

actualReturns: Records corresponding actual returns from each trade

For each closed trade, the system captures:

float tradePnL = strategy.closedtrades.profit(tradeIndex)

float tradeReturn = strategy.closedtrades.profit_percent(tradeIndex)

int tradeType = entryPrice < exitPrice ? 1 : -1 // Direction

🔶 Performance Metrics Calculation

The framework calculates several key performance metrics:

Information Coefficient (IC):

The correlation between prediction signals and actual returns, measuring forecast skill.

IC = Correlation(predictionSignals, actualReturns)

Where Correlation is the Pearson correlation coefficient:

Correlation(X,Y) = (nΣXY - ΣXY) / √

Sortino Ratio:

Measures risk-adjusted return focusing only on downside risk:

Sortino = (Avg_Return - Risk_Free_Rate) / Downside_Deviation

Where Downside Deviation is:

Downside_Deviation = √

R_i represents individual returns, T is the target return (typically the risk-free rate), and n is the number of observations.

Maximum Drawdown:

Tracks the largest percentage drop from peak to trough:

DD = (Peak_Equity - Trough_Equity) / Peak_Equity * 100

🔶 Time Period Calculation

The system automatically determines the appropriate number of bars to analyze for each timeframe based on the current chart timeframe:

bars_7d = math.max(1, math.round(7 * barsPerDay))

bars_30d = math.max(1, math.round(30 * barsPerDay))

bars_90d = math.max(1, math.round(90 * barsPerDay))

bars_365d = math.max(1, math.round(365 * barsPerDay))

bars_4y = math.max(1, math.round(365 * 4 * barsPerDay))

Where barsPerDay is calculated based on the chart timeframe:

barsPerDay = timeframe.isintraday ?

24 * 60 / math.max(1, (timeframe.in_seconds() / 60)) :

timeframe.isdaily ? 1 :

timeframe.isweekly ? 1/7 :

timeframe.ismonthly ? 1/30 : 0.01

🔶 Visual Representation

The system presents performance data in a color-coded table with intuitive visual indicators:

Green: Excellent performance

Lime: Good performance

Gray: Neutral performance

Orange: Mediocre performance

Red: Poor performance

█ Trade Direction

The Strategy Stats framework supports three trading directions:

Long Only: Only takes long positions when entry conditions are met

Short Only: Only takes short positions when entry conditions are met

Both: Takes both long and short positions depending on market conditions

█ Usage

To effectively use the Strategy Stats framework:

Apply to existing strategies: Add the performance tracking code to any strategy to gain advanced analytics

Monitor multiple timeframes: Use the multi-timeframe analysis to identify performance trends

Evaluate strategy health: Review IC and Sortino ratios to assess predictive power and risk-adjusted returns

Optimize parameters: Use performance data to refine strategy parameters

Compare strategies: Apply the framework to multiple strategies to identify the most effective approach

For best results, allow the strategy to generate sufficient trade history for meaningful statistical analysis (at least 20-30 trades).

█ Default Settings

The default settings have been carefully calibrated for cryptocurrency markets:

Performance Tracking:

Time periods: 7D, 30D, 90D, 1Y, 4Y

Statistical measures: Return, Win%, MaxDD, IC, Sortino Ratio

IC color thresholds: >0.3 (green), >0.1 (lime), <-0.1 (orange), <-0.3 (red)

Sortino color thresholds: >1.0 (green), >0.5 (lime), <0 (red)

Multi-Step Take Profit:

ATR multipliers: 2.618, 5.0, 10.0

Percentage levels: 3%, 8%, 17%

Short multiplier: 1.5x (makes short take profits more aggressive)

Stop loss: 20%

External Signals Strategy TesterExternal Signals Strategy Tester

This strategy is designed to help you backtest external buy/sell signals coming from another indicator on your chart. It is a flexible and powerful tool that allows you to simulate real trading based on signals generated by any indicator, using input.source connections.

🔧 How It Works

Instead of generating signals internally, this strategy listens to two external input sources:

One for buy signals

One for sell signals

These sources can be connected to the plots from another indicator (for example, custom indicators, signal lines, or logic-based plots).

To use this:

Add your indicator to the chart (it must be visible on the same pane as this strategy).

Open the settings of the strategy.

In the fields Buy Signal and Sell Signal, select the appropriate plot (line, value, etc.) from the indicator that represents the buy/sell logic.

The strategy will open positions when the selected buy signal crosses above 0, and sell signal crosses above 0.

This logic can be easily adapted by modifying the crossover rule inside the script if your signal style is different.

⚙️ Features Included

✅ Configurable trade direction:

You can choose whether to allow long trades, short trades, or both.

✅ Optional close on opposite signal:

When enabled, the strategy will exit the current position if an opposite signal appears.

✅ Optional full position reversal:

When enabled, the strategy will close the current position and immediately open an opposite one on the reverse signal.

✅ Risk Management Tools:

You can define:

Take Profit (TP): Position will be closed once the specified profit (in %) is reached.

Stop Loss (SL): Position will be closed if the price drops to the specified loss level (in %).

BreakEven (BE): Once the specified profit threshold is reached, the strategy will move the stop-loss to the entry price.

📌 If any of these values (TP, SL, BE) are set to 0, the feature is disabled and will not be applied.

🧪 Best Use Cases

Backtesting signals from custom indicators, without rewriting the logic into a strategy.

Comparing the performance of different signal sources.

Testing external indicators with optional position management logic.

Validating strategies using external filters, oscillators, or trend signals.

📌 Final Notes

You can visualize where the strategy detected buy/sell signals using green/red markers on the chart.

All parameters are customizable through the strategy settings panel.

This strategy does not repaint, and it processes signals in real-time only (no lookahead bias).

Auto TrendLines [TradingFinder] Support Resistance Signal Alerts🔵 Introduction

The trendline is one of the most essential tools in technical analysis, widely used in financial markets such as Forex, cryptocurrency, and stocks. A trendline is a straight line that connects swing highs or swing lows and visually indicates the market’s trend direction.

Traders use trendlines to identify price structure, the strength of buyers and sellers, dynamic support and resistance zones, and optimal entry and exit points.

In technical analysis, trendlines are typically classified into three categories: uptrend lines (drawn by connecting higher lows), downtrend lines (formed by connecting lower highs), and sideways trends (moving horizontally). A valid trendline usually requires at least three confirmed touchpoints to be considered reliable for trading decisions.

Trendlines can serve as the foundation for a variety of trading strategies, such as the trendline bounce strategy, valid breakout setups, and confluence-based analysis with other tools like candlestick patterns, divergences, moving averages, and Fibonacci levels.

Additionally, trendlines are categorized into internal and external, and further into major and minor levels, each serving unique roles in market structure analysis.

🔵 How to Use

Trendlines are a key component in technical analysis, used to identify market direction, define dynamic support and resistance zones, highlight strategic entry and exit points, and manage risk. For a trendline to be reliable, it must be drawn based on structural principles—not by simply connecting two arbitrary points.

🟣 Selecting Pivot Types Based on Trend Direction

The first step is to determine the market trend: uptrend, downtrend, or sideways.

Then, choose pivot points that match the trend type :

In an uptrend, trendlines are drawn by connecting low pivots, especially higher lows.

In a downtrend, trendlines are formed by connecting high pivots, specifically lower highs.

It is crucial to connect pivots of the same type and structure to ensure the trendline is valid and analytically sound.

🟣 Pivot Classification

This indicator automatically classifies pivot points into two categories :

Major Pivots :

MLL : Major Lower Low

MHL : Major Higher Low

MHH : Major Higher High

MLH : Major Lower High

These define the primary structure of the market and are typically used in broader structural analysis.

Minor Pivots :

mLL: minor Lower Low

mHL: minor Higher Low

mHH: minor Higher High

mLH: minor Lower High

These are used for drawing more precise trendlines within corrective waves or internal price movements.

Example : In a downtrend, drawing a trendline from an MHH to an mHH creates structural inconsistency and introduces noise. Instead, connect points like MHL to MHL or mLH to mLH for a valid trendline.

🟣 Drawing High-Precision Trendlines

To ensure a reliable trendline :

Use pivots of the same classification (Major with Major or Minor with Minor).

Ensure at least three valid contact points (three touches = structural confirmation).

Draw through candles with the least deviation (choose wicks or bodies based on confluence).

Preferably draw from right to left for better alignment with current market behavior.

Use parallel lines to turn a single trendline into a trendline zone, if needed.

🟣 Using Trendlines for Trade Entries

Bounce Entry: When price approaches the trendline and shows signs of reversal (e.g., a reversal candle, divergence, or support/resistance), enter in the direction of the trend with a logical stop-loss.

Breakout Entry: When price breaks through the trendline with strong momentum and a confirmation (such as a retest or break of structure), consider trading in the direction of the breakout.

🟣 Trendline-Based Risk Management

For bounce entries, the stop-loss is placed below the trendline or the last pivot low (in an uptrend).

For breakout entries, the stop-loss is set behind the breakout candle or the last structural level.

A broken trendline can also act as an exit signal from a trade.

🟣 Combining Trendlines with Other Tools (Confluence)

Trendlines gain much more strength when used alongside other analytical tools :

Horizontal support and resistance levels

Moving averages (such as EMA 50 or EMA 200)

Fibonacci retracement zones

Candlestick patterns (e.g., Engulfing, Pin Bar)

RSI or MACD divergences

Market structure breaks (BoS / ChoCH)

🔵 Settings

Pivot Period : This defines how sensitive the pivot detection is. A higher number means the algorithm will identify more significant pivot points, resulting in longer-term trendlines.

Alerts

Alert :

Enable or disable the entire alert system

Set a custom alert name

Choose how often alerts trigger (every time, once per bar, or on bar close)

Select the time zone for alert timestamps (e.g., UTC)

Each trendline type supports two alert types :

Break Alert : Triggered when price breaks the trendline

React Alert : Triggered when price reacts or bounces off the trendline

These alerts can be independently enabled or disabled for all trendline categories (Major/Minor, Internal/External, Up/Down).

Display :

For each of the eight trendline types, you can control :

Whether to show or hide the line

Whether to delete the previous line when a new one is drawn

Color, line style (solid, dashed, dotted), extension direction (e.g., right only), and width

Major lines are typically thicker and more opaque, while minor lines appear thinner and more transparent.

All settings are designed to give the user full control over the appearance, behavior, and alert system of the indicator, without requiring manual drawing or adjustments.

🔵 Conclusion

A trendline is more than just a line on the chart—it is a structural, strategic, and flexible tool in technical analysis that can serve as the foundation for understanding price behavior and making trading decisions. Whether in trending markets or during corrections, trendlines help traders identify market direction, key zones, and high-potential entry and exit points with precision.

The accuracy and effectiveness of a trendline depend on using structurally valid pivot points and adhering to proper market logic, rather than relying on guesswork or personal bias.

This indicator is built to solve that exact problem. It automatically detects and draws multiple types of trendlines based on actual price structure, separating them into Major/Minor and Internal/External categories, and respecting professional analytical principles such as pivot type, trend direction, and structural location.

WMA and Intraday Highest Volume Candle Levels🔹 WMA Calculation (Weighted Moving Averages)

Custom WMA Function:

Uses a manual weighted average calculation.

Assigns more weight to recent prices for smoother trend detection.

Three Timeframes:

5-Minute WMA (Yellow)

15-Minute WMA (Blue)

30-Minute WMA (Red)

🔹 Intraday Highest Volume Candle Levels

Finds the candle with the highest volume for the selected intraday timeframe.

Stores its High & Low levels to act as support/resistance.

Deletes and redraws lines daily to reflect the latest session's highest volume candle.

Plots horizontal lines:

Green Line: High of the highest volume candle.

Red Line: Low of the highest volume candle.

Customization: User can choose the analysis timeframe (default: 3 minutes).

✅ Benefits of This Indicator

✔ Multi-timeframe trend analysis using WMA.

✔ Key intraday levels based on highest volume candle.

✔ Dynamic support & resistance levels based on real-time volume activity.

✔ Customizable timeframe for volume analysis.

Elliott Wave Identification By Akash Patel

This script is designed to visually highlight areas on the chart where there are consecutive bullish (green) or bearish (red) candles. It also identifies sequences of three consecutive candles of the same type (bullish or bearish) and highlights those areas with adjustable box opacity. Here's a breakdown of the functionality:

---

### Key Features:

1. **Bullish & Bearish Candle Identification:**

- **Bullish Candle:** When the closing price is higher than the opening price (`close > open`).

- **Bearish Candle:** When the closing price is lower than the opening price (`close < open`).

2. **Consecutive Candle Counter:**

- The script counts consecutive bullish and bearish candles, which resets when the direction changes (from bullish to bearish or vice versa).

- The script tracks these counts using the `bullishCount` and `bearishCount` variables, which are incremented based on whether the current candle is bullish or bearish.

3. **Highlighting Candle Areas:**

- If there are **3 or more consecutive bullish candles**, the script will highlight the background in a green color with 90% transparency (adjustable).

- Similarly, if there are **3 or more consecutive bearish candles**, the script will highlight the background in a red color with 90% transparency (adjustable).

4. **Three-Candle Sequence:**

- The script checks if there are three consecutive bullish candles (`threeBullish`) or three consecutive bearish candles (`threeBearish`).

- A box is drawn around these areas to visually highlight the sequence. The boxes extend to the right edge of the chart, and their opacity can be adjusted.

5. **Box Creation:**

- For bullish sequences, a green box is created using the high and low prices of the three candles in the sequence.

- For bearish sequences, a red box is created in the same manner.

- The box size is determined by the highest high and the lowest low of the three consecutive candles.

6. **Box Opacity:**

- You can adjust the opacity of the boxes through the input parameters `Bullish Box Opacity` and `Bearish Box Opacity` (ranging from 0 to 100).

- A higher opacity will make the boxes more solid, while a lower opacity will make them more transparent.

7. **Box Cleanup:**

- The script also includes logic to remove boxes when they are no longer needed, ensuring the chart remains clean without excessive box overlays.

8. **Extending Boxes to the Right:**

- When a bullish or bearish sequence is identified, the boxes are extended to the right edge of the chart for continued visibility.

---

### How It Works:

- **Bullish Area Highlight:** When three or more consecutive bullish candles are detected, the background will turn green to indicate a strong bullish trend.

- **Bearish Area Highlight:** When three or more consecutive bearish candles are detected, the background will turn red to indicate a strong bearish trend.

- **Three Consecutive Candle Box:** A green box will appear around three consecutive bullish candles, and a red box will appear around three consecutive bearish candles. These boxes can be extended to the right edge of the chart, making the sequence visually clear.

---

### Adjustable Parameters:

1. **Bullish Box Opacity:** Set the opacity (transparency) level of the bullish boxes. Ranges from 0 (completely transparent) to 100 (completely opaque).

2. **Bearish Box Opacity:** Set the opacity (transparency) level of the bearish boxes. Ranges from 0 (completely transparent) to 100 (completely opaque).

---

This indicator is useful for identifying strong trends and visually confirming market momentum, especially in situations where you want to spot sequences of bullish or bearish candles over multiple bars. It can be customized to suit different trading styles and chart preferences by adjusting the opacity of the boxes and background highlights.

Abhi's Bollinger Band Reversal SignalThis Pine Script indicator is designed to detect reversal trade opportunities using Bollinger Band breakouts. It identifies both buy and sell setups with clearly defined entry, stop-loss (SL), and target (TP) conditions. It also manages trades visually with real-time signal plotting, and limits entries per trading day.

⚙️ How It Works

🔽 Sell Signal Conditions

- The previous candle must close above the upper Bollinger Band, and its entire body must be above the band

- The current candle must fail to break the previous high, and must break below the previous low

- Entry is taken at the previous candle’s low, with SL at its high

- Target is calculated based on a configurable Risk:Reward ratio

🔼 Buy Signal Conditions

- The previous candle must close below the lower Bollinger Band, and its entire body must be below the band

- The current candle must fail to break the previous low, and must break above the previous high

- Entry is at the previous candle’s high, with SL at its low

- Target is calculated using the same Risk:Reward ratio

⏰ Time-Based Exit

- If a trade is still active by a user-defined exit time (e.g. 15:15), the trade is closed

- Labels are plotted to show whether this exit was a profit or loss

🧩 User Inputs

- Start Time for signals

- Exit Time for open trades

- Bollinger Band Settings: Period and Std Dev

- Max Entries Per Day

- Risk:Reward Ratio: Dropdown for 1:1, 1:1.5, ..., 1:3

🎨 Visual Features

✅ BUY and SELL signals are plotted when valid conditions are detected

🟢 TP and 🔴 SL labels show trade outcome

🕒 TIME EXIT labels appear at user-set exit time with green/red coloring based on profitability

📉 Bollinger Bands plotted for visual context

📌 Notes:

- Designed for intraday trading, resets entry counter daily

- Uses bar_index > tradeBarIndex to avoid SL/TP being triggered on the same candle as entry

- Tracks only one trade at a time (tradeActive) — ensures clear, non-overlapping logic

Correlation Coefficient TableThis Pine Script generates a dynamic table for analyzing how multiple assets correlate with a chosen benchmark (e.g., NZ50G). Users can input up to 12 asset symbols, customize the benchmark, and define the beta calculation periods (e.g., 15, 30, 90, 180 days). The script calculates Correlation values for each asset over these periods and computes the average beta for better insights.

The table includes:

Asset symbols: Displayed in the first row.

Correlation values: Calculated for each defined period and displayed in subsequent columns.

Average Correlation: Presented in the final column as an overall measure of correlation strength.

Color coding: Background colors indicate beta magnitude (green for high positive beta, yellow for near-neutral beta, red for negative beta).

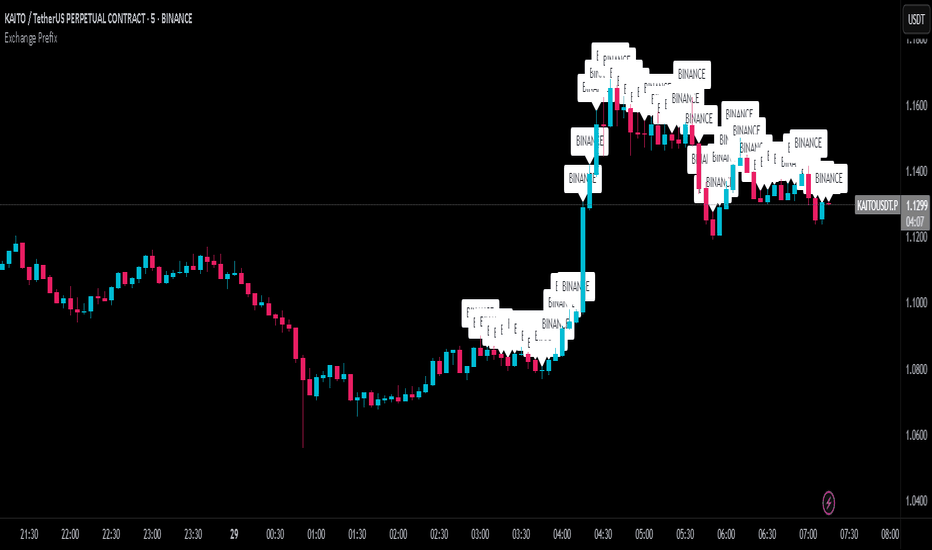

Exchange PrefixAllows users to show the exchange name of your currently-viewed ticker on the latest bars.

For example, viewing BTCUSDT on BINANCE would provide "BINANCE".

Similarly, viewing BTCUSDT on CRYPTO.COM would provide "CRYPTOCOM".

What is the purpose of this?

- Sometimes pine script coders would like to know the exact names of the exchanges. This script does the job.

EMA 10/55/200 - LONG ONLY MTF (4h with 1D & 1W confirmation)Title: EMA 10/55/200 - Long Only Multi-Timeframe Strategy (4h with 1D & 1W confirmation)

Description:

This strategy is designed for trend-following long entries using a combination of exponential moving averages (EMAs) on the 4-hour chart, confirmed by higher timeframe trends from the daily (1D) and weekly (1W) charts.

🔍 How It Works

🔹 Entry Conditions (4h chart):

EMA 10 crosses above EMA 55 and price is above EMA 55

OR

EMA 55 crosses above EMA 200

OR

EMA 10 crosses above EMA 500

These entries indicate short-term momentum aligning with medium/long-term trend strength.

🔹 Confirmation (multi-timeframe alignment):

Daily (1D): EMA 55 is above EMA 200

Weekly (1W): EMA 55 is above EMA 200

This ensures that we only enter long trades when the higher timeframes support an uptrend, reducing false signals during sideways or bearish markets.

🛑 Exit Conditions

Bearish crossover of EMA 10 below EMA 200 or EMA 500

Stop Loss: 5% below entry price

⚙️ Backtest Settings

Capital allocation per trade: 10% of equity

Commission: 0.1%

Slippage: 2 ticks

These are realistic conditions for crypto, forex, and stocks.

📈 Best Used On

Timeframe: 4h

Instruments: Trending markets like BTC/ETH, FX majors, or growth stocks

Works best in volatile or trending environments

⚠️ Disclaimer

This is a backtest tool and educational resource. Always validate on demo accounts before applying to real capital. Do your own due diligence.

Cartera SuperTrends v4 PublicDescription

This script creates a screener with a list of ETFs ordered by their average ROC in three different periods representing 4, 6 and 8 months by default. The ETF

BIL

is always included as a reference.

The previous average ROC value shows the calculation using the closing price from last month.

The current average ROC value shows the calculation using the current price.

The previous average column background color represents if the ETF average ROC is positive or negative.

The current average column background color represents if the ETF average ROC is positive or negative.

The current average column letters color represents if the current ETF average ROC is improving or not from the previous month.

Changes from V2 to V3

Added the option to make the calculation monthly, weekly or daily

Changes from V3 to V4

Adding up to 25 symbols

Highlight the number of tickers selected

Highlight the sorted column

Complete refactor of the code using a matrix of arrays

Options

The options available are:

Make the calculation monthly, weekly or daily

Adjust Data for Dividends

Manual calculation instead of using ta.roc function

Sort table

Sort table by the previous average ROC or the current average ROC

Number of tickers selected to highlight

First Period in months, weeks or days

Second Period in months, weeks or days

Third Period in months, weeks or days

Select the assets (max 25)

Usage

Just add the indicator to your favorite indicators and then add it to your chart.

ML Deep Regression Pro (TechnoBlooms)ML Deep Regression Pro is a machine-learning-inspired trading indicator that integrates Polynomial Regression, Linear Regression and Statistical Deviation models to provide a powerful, data-driven approach to market trend analysis.

Designed for traders, quantitative analysts and developers, this tool transforms raw market data into predictive trend insights, allowing for better decision-making and trend validation.

By leveraging statistical regression techniques, ML Deep Regression Pro eliminates market noise and identifies key trend shifts, making it a valuable addition to both manual and algorithmic trading strategies.

REGRESSION ANALYSIS

Regression is a statistical modeling technique used in machine learning and data science to identify patterns and relationships between variables. In trading, it helps detect price trends, reversals and volatility changes by fitting price data into a predictive model.

1. Linear Regression -

The most widely used regression model in trading, providing a best-fit plotted line to track price trends.

2. Polynomial Regression -

A more advanced form of regression that fits curved price structures, capturing complex market cycles and improving trend forecasting accuracy.

3. Standard Deviation Bands -

Based on regression calculations, these bands measure price dispersion and identify overbought/ oversold conditions, similar to Bollinger Bands. By default, these lines are hidden and user can make it visible through Settings.

KEY FEATURES :-

✅ Hybrid Regression Engine – Combines Linear and Polynomial Regression to detect market trends with greater accuracy.

✅ Dynamic Trend Bias Analysis – Identifies bullish & bearish market conditions using real-time regression models.

✅ Standard Deviation Bands – Measures price volatility and potential reversals with an advanced deviation model.

✅ Adaptive EMA Crossover Signals – Generates buy/sell signals when price momentum shifts relative to the regression trend.

IU Smart Flow SystemDESCRIPTION

The IU Smart Flow System is a powerful and dynamic order flow-based strategy designed to capture high-probability trades by analyzing bullish and bearish imbalances, trend direction, and RSI strength. It identifies trading opportunities by aligning order flow conditions with the prevailing trend and momentum, making it suitable for trend-following and momentum-based trading.

This system utilizes a unique combination of:

- Order flow score to gauge market imbalance

- Trend filter using SMA and ATR to confirm market direction

- RSI to ensure entry only during strong momentum

USER INPUTS:

- Imbalance Length: Defines the lookback period for calculating bullish and bearish imbalances. (Default: 10)

- Trend Length: Determines the length of the SMA to evaluate the trend direction. (Default: 50)

- RSI Length: Specifies the RSI period to assess momentum strength. (Default: 14)

LONG CONDITIONS:

Long entries are triggered when:

- Order flow score is positive, indicating bullish imbalance

- Price is above the bullish trend level (SMA + ATR), confirming an uptrend

- RSI is above 50, indicating bullish momentum

- No active short position is currently open

SHORT CONDITIONS:

Short entries are triggered when:

- Order flow score is negative, indicating bearish imbalance

- Price is below the bearish trend level (SMA - ATR), confirming a downtrend

- RSI is below 50, indicating bearish momentum

- No active long position is currently open

WHY IT IS UNIQUE:

- Imbalance-Based Approach: Unlike traditional strategies that rely solely on price action, this system evaluates bullish and bearish imbalances to anticipate order flow direction.

- Adaptive Trend Filter: The combination of SMA and ATR dynamically adjusts to market volatility, providing a reliable trend confirmation mechanism.

- Momentum Validation with RSI: Ensures that entries are taken only in the direction of strong momentum, reducing false signals.

HOW USERS CAN BENEFIT FROM IT:

- Enhanced Trade Accuracy: Aligning order flow, trend, and momentum reduces false signals and improves trade success rates.

- Versatile Application: Suitable for various markets and timeframes, making it adaptable to different trading styles.

- Clear Trade Signals: Provides clear entry labels and alerts, ensuring traders never miss a potential opportunity.

- Visual Clarity: The filled region between bullish and bearish trends highlights trend direction, enhancing decision-making.

Nasdaq Risk Calculator - DTFXNasdaq Risk Calculator

This Pine Script (v5) indicator provides a dashboard-style tool for calculating trading risk based on manually input tick measurements for Nasdaq futures contracts (NQ and MNQ). Designed as an overlay on the main chart, it displays key risk metrics in a fixed-position table, allowing traders to assess contract type, lot size, risk ticks, and actual risk in dollars relative to a user-defined risk amount.

Features:

Manual Tick Input: Enter the number of ticks (e.g., from a ruler measurement) to define the price range for risk calculation.

Risk Calculation: Computes the optimal contract (NQ or MNQ), number of lots, risk ticks (half the input range), and actual risk in dollars, targeting the specified risk amount (default: $100).

Customizable Dashboard: Displays results in a single-cell table with a semi-transparent white background and gray border, positioned in one of four chart corners (Top Left, Top Right, Bottom Left, Bottom Right) via user selection.

Reset Option: Includes a toggle to clear the dashboard and start anew.

How to Use:

Add the indicator to your chart (best suited for NQ or MNQ futures).

In the settings, input your "Risk Amount ($)" and "Ticks" (e.g., 400 for a 100-point range on NQ).

Select the "Dashboard Corner" to position the table.

View the calculated risk details in the chosen corner.

Adjust inputs or reset as needed.

Notes:

NQ tick value is $5.00 (NQ_MULTIPLIER = 5.0), and MNQ tick value is $0.50 (MNQ_MULTIPLIER = 0.5).

Ideal for traders planning risk based on measured price ranges, such as support/resistance zones.

VCP Pattern with Pocket Pivots by Mark MinerviniBelow is a Pine Script designed to identify and plot Mark Minervini's Volatility Contraction Pattern (VCP) along with Pocket Pivots on TradingView. The VCP is characterized by a series of price contractions (tightening price ranges) with decreasing volume, often followed by a breakout. Pocket Pivots, a concept from Chris Kacher and Gil Morales, identify early buying opportunities within a consolidation or uptrend based on volume surges. This script combines both concepts to help traders spot potential setups.

DOPT---

## 🔍 **DOPT - Daily Open & Price Time Markers**

This script is designed to support directional bias development and price behavior analysis around key time-based reference points on the **1H and 4H timeframes**.

### ✨ **What It Does**

- **1800 Open Marker** (6 PM NY time): Plots the **daily open** from 1800 in **black dotted lines**.

- **0000 Open Marker** (Midnight NY time): Plots the **midnight open** in **blue dotted lines**.

- **Day Letters**: Each 1800 open is labeled with the corresponding **day of the week** (e.g., M, T, W...), helping visually segment your chart.

- **Hour Labels**: Select specific candles (e.g., 0000 = '0', 0800 = '8') to be labeled above the bar. These are fully customizable.

- **Candle Midpoints**: Option to mark the **50% level** of a specific candle (good for CE or CRT references).

- **CRT High/Low Tracking**: Ability to plot **extended high and low lines** from a selected candle back (e.g., for CRT modeling).

- **4H Timeframe Candle Numbering**: Helpful when analyzing sequences on the 4-hour timeframe. Candles are numbered `1`, `5`, and `9` for reference.

---

### 🧠 **How I Use It**

- I mostly use this on the **1-hour timeframe** to decide **directional bias** for the day:

- If price **closes above 1800 open**, I consider that a **green daily close** — potential bullish sentiment.

- If price **closes below**, I treat it as a **red daily close** — potential bearish behavior.

- Price often uses these opens as **support/resistance**, so I watch for reactions there.

- On the **4H**, the candle numbers help track structure and flow.

- Combine with CRT tools to mark **key candle highs/lows** and their **equilibrium (50%)** — great for refining entries or understanding how price is respecting a particular candle.

---

### ⚠️ **Note on Daylight Savings**

This is a **daylight saving time-dependent script**. When DST kicks in or out, you’ll need to **adjust the time inputs** accordingly to keep the opens accurate (e.g., 1800 might shift to 1700 depending on the season).

---

### 🔁 **Backtesting & Reference**

- The **1800 and 0000 opens** are plotted for **as far back** as your chart loads, making it great for backtesting historical reactions.

- The CRT marking tools only go back **50 candles max**, so use that for recent structure only.

---

Buy on 5% dip strategy with time adjustment

This script is a strategy called "Buy on 5% Dip Strategy with Time Adjustment 📉💡," which detects a 5% drop in price and triggers a buy signal 🔔. It also automatically closes the position once the set profit target is reached 💰, and it has additional logic to close the position if the loss exceeds 14% after holding for 230 days ⏳.

Strategy Explanation

Buy Condition: A buy signal is triggered when the price drops 5% from the highest price reached 🔻.

Take Profit: The position is closed when the price hits a 1.22x target from the average entry price 📈.

Forced Sell Condition: If the position is held for more than 230 days and the loss exceeds 14%, the position is automatically closed 🚫.

Leverage & Capital Allocation: Leverage is adjustable ⚖️, and you can set the percentage of capital allocated to each trade 💸.

Time Limits: The strategy allows you to set a start and end time ⏰ for trading, making the strategy active only within that specific period.

Code Credits and References

Credits: This script utilizes ideas and code from @QuantNomad and jangdokang for the profit table and algorithm concepts 🔧.

Sources:

Monthly Performance Table Script by QuantNomad:

ZenAndTheArtOfTrading's Script:

Strategy Performance

This strategy provides risk management through take profit and forced sell conditions and includes a performance table 📊 to track monthly and yearly results. You can compare backtest results with real-time performance to evaluate the strategy's effectiveness.

The performance numbers shown in the backtest reflect what would have happened if you had used this strategy since the launch date of the SOXL (the Direxion Daily Semiconductor Bull 3x Shares ETF) 📅. These results are not hypothetical but based on actual performance from the day of the ETF’s launch 📈.

Caution ⚠️

No Guarantee of Future Results: The results are based on historical performance from the launch of the SOXL ETF, but past performance does not guarantee future results. It’s important to approach with caution when applying it to live trading 🔍.

Risk Management: Leverage and capital allocation settings are crucial for managing risk ⚠️. Make sure to adjust these according to your risk tolerance ⚖️.

Enhanced Fuzzy SMA Analyzer (Multi-Output Proxy) [FibonacciFlux]EFzSMA: Decode Trend Quality, Conviction & Risk Beyond Simple Averages

Stop Relying on Lagging Averages Alone. Gain a Multi-Dimensional Edge.

The Challenge: Simple Moving Averages (SMAs) tell you where the price was , but they fail to capture the true quality, conviction, and sustainability of a trend. Relying solely on price crossing an average often leads to chasing weak moves, getting caught in choppy markets, or missing critical signs of trend exhaustion. Advanced traders need a more sophisticated lens to navigate complex market dynamics.

The Solution: Enhanced Fuzzy SMA Analyzer (EFzSMA)

EFzSMA is engineered to address these limitations head-on. It moves beyond simple price-average comparisons by employing a sophisticated Fuzzy Inference System (FIS) that intelligently integrates multiple critical market factors:

Price deviation from the SMA ( adaptively normalized for market volatility)

Momentum (Rate of Change - ROC)

Market Sentiment/Overheat (Relative Strength Index - RSI)

Market Volatility Context (Average True Range - ATR, optional)

Volume Dynamics (Volume relative to its MA, optional)

Instead of just a line on a chart, EFzSMA delivers a multi-dimensional assessment designed to give you deeper insights and a quantifiable edge.

Why EFzSMA? Gain Deeper Market Insights

EFzSMA empowers you to make more informed decisions by providing insights that simple averages cannot:

Assess True Trend Quality, Not Just Location: Is the price above the SMA simply because of a temporary spike, or is it supported by strong momentum, confirming volume, and stable volatility? EFzSMA's core fuzzyTrendScore (-1 to +1) evaluates the health of the trend, helping you distinguish robust moves from noise.

Quantify Signal Conviction: How reliable is the current trend signal? The Conviction Proxy (0 to 1) measures the internal consistency among the different market factors analyzed by the FIS. High conviction suggests factors are aligned, boosting confidence in the trend signal. Low conviction warns of conflicting signals, uncertainty, or potential consolidation – acting as a powerful filter against chasing weak moves.

// Simplified Concept: Conviction reflects agreement vs. conflict among fuzzy inputs

bullStrength = strength_SB + strength_WB

bearStrength = strength_SBe + strength_WBe

dominantStrength = max(bullStrength, bearStrength)

conflictingStrength = min(bullStrength, bearStrength) + strength_N

convictionProxy := (dominantStrength - conflictingStrength) / (dominantStrength + conflictingStrength + 1e-10)

// Modifiers (Volatility/Volume) applied...

Anticipate Potential Reversals: Trends don't last forever. The Reversal Risk Proxy (0 to 1) synthesizes multiple warning signs – like extreme RSI readings, surging volatility, or diverging volume – into a single, actionable metric. High reversal risk flags conditions often associated with trend exhaustion, providing early warnings to protect profits or consider counter-trend opportunities.

Adapt to Changing Market Regimes: Markets shift between high and low volatility. EFzSMA's unique Adaptive Deviation Normalization adjusts how it perceives price deviations based on recent market behavior (percentile rank). This ensures more consistent analysis whether the market is quiet or chaotic.

// Core Idea: Normalize deviation by recent volatility (percentile)

diff_abs_percentile = ta.percentile_linear_interpolation(abs(raw_diff), normLookback, percRank) + 1e-10

normalized_diff := raw_diff / diff_abs_percentile

// Fuzzy sets for 'normalized_diff' are thus adaptive to volatility

Integrate Complexity, Output Clarity: EFzSMA distills complex, multi-factor analysis into clear, interpretable outputs, helping you cut through market noise and focus on what truly matters for your decision-making process.

Interpreting the Multi-Dimensional Output

The true power of EFzSMA lies in analyzing its outputs together:

A high Trend Score (+0.8) is significant, but its reliability is amplified by high Conviction (0.9) and low Reversal Risk (0.2) . This indicates a strong, well-supported trend.

Conversely, the same high Trend Score (+0.8) coupled with low Conviction (0.3) and high Reversal Risk (0.7) signals caution – the trend might look strong superficially, but internal factors suggest weakness or impending exhaustion.

Use these combined insights to:

Filter Entry Signals: Require minimum Trend Score and Conviction levels.

Manage Risk: Consider reducing exposure or tightening stops when Reversal Risk climbs significantly, especially if Conviction drops.

Time Exits: Use rising Reversal Risk and falling Conviction as potential signals to take profits.

Identify Regime Shifts: Monitor how the relationship between the outputs changes over time.

Core Technology (Briefly)

EFzSMA leverages a Mamdani-style Fuzzy Inference System. Crisp inputs (normalized deviation, ROC, RSI, ATR%, Vol Ratio) are mapped to linguistic fuzzy sets ("Low", "High", "Positive", etc.). A rules engine evaluates combinations (e.g., "IF Deviation is LargePositive AND Momentum is StrongPositive THEN Trend is StrongBullish"). Modifiers based on Volatility and Volume context adjust rule strengths. Finally, the system aggregates these and defuzzifies them into the Trend Score, Conviction Proxy, and Reversal Risk Proxy. The key is the system's ability to handle ambiguity and combine multiple, potentially conflicting factors in a nuanced way, much like human expert reasoning.

Customization

While designed with robust defaults, EFzSMA offers granular control:

Adjust SMA, ROC, RSI, ATR, Volume MA lengths.

Fine-tune Normalization parameters (lookback, percentile). Note: Fuzzy set definitions for deviation are tuned for the normalized range.

Configure Volatility and Volume thresholds for fuzzy sets. Tuning these is crucial for specific assets/timeframes.

Toggle visual elements (Proxies, BG Color, Risk Shapes, Volatility-based Transparency).

Recommended Use & Caveats

EFzSMA is a sophisticated analytical tool, not a standalone "buy/sell" signal generator.

Use it to complement your existing strategy and analysis.

Always validate signals with price action, market structure, and other confirming factors.

Thorough backtesting and forward testing are essential to understand its behavior and tune parameters for your specific instruments and timeframes.

Fuzzy logic parameters (membership functions, rules) are based on general heuristics and may require optimization for specific market niches.

Disclaimer

Trading involves substantial risk. EFzSMA is provided for informational and analytical purposes only and does not constitute financial advice. No guarantee of profit is made or implied. Past performance is not indicative of future results. Use rigorous risk management practices.

Fuzzy SMA with DCTI Confirmation[FibonacciFlux]FibonacciFlux: Advanced Fuzzy Logic System with Donchian Trend Confirmation

Institutional-grade trend analysis combining adaptive Fuzzy Logic with Donchian Channel Trend Intensity for superior signal quality

Conceptual Framework & Research Foundation

FibonacciFlux represents a significant advancement in quantitative technical analysis, merging two powerful analytical methodologies: normalized fuzzy logic systems and Donchian Channel Trend Intensity (DCTI). This sophisticated indicator addresses a fundamental challenge in market analysis – the inherent imprecision of trend identification in dynamic, multi-dimensional market environments.

While traditional indicators often produce simplistic binary signals, markets exist in states of continuous, graduated transition. FibonacciFlux embraces this complexity through its implementation of fuzzy set theory, enhanced by DCTI's structural trend confirmation capabilities. The result is an indicator that provides nuanced, probabilistic trend assessment with institutional-grade signal quality.

Core Technological Components

1. Advanced Fuzzy Logic System with Percentile Normalization

At the foundation of FibonacciFlux lies a comprehensive fuzzy logic system that transforms conventional technical metrics into degrees of membership in linguistic variables:

// Fuzzy triangular membership function with robust error handling

fuzzy_triangle(val, left, center, right) =>

if na(val)

0.0

float denominator1 = math.max(1e-10, center - left)

float denominator2 = math.max(1e-10, right - center)

math.max(0.0, math.min(left == center ? val <= center ? 1.0 : 0.0 : (val - left) / denominator1,

center == right ? val >= center ? 1.0 : 0.0 : (right - val) / denominator2))

The system employs percentile-based normalization for SMA deviation – a critical innovation that enables self-calibration across different assets and market regimes:

// Percentile-based normalization for adaptive calibration

raw_diff = price_src - sma_val

diff_abs_percentile = ta.percentile_linear_interpolation(math.abs(raw_diff), normLookback, percRank) + 1e-10

normalized_diff_raw = raw_diff / diff_abs_percentile

normalized_diff = useClamping ? math.max(-clampValue, math.min(clampValue, normalized_diff_raw)) : normalized_diff_raw

This normalization approach represents a significant advancement over fixed-threshold systems, allowing the indicator to automatically adapt to varying volatility environments and maintain consistent signal quality across diverse market conditions.

2. Donchian Channel Trend Intensity (DCTI) Integration

FibonacciFlux significantly enhances fuzzy logic analysis through the integration of Donchian Channel Trend Intensity (DCTI) – a sophisticated measure of trend strength based on the relationship between short-term and long-term price extremes:

// DCTI calculation for structural trend confirmation

f_dcti(src, majorPer, minorPer, sigPer) =>

H = ta.highest(high, majorPer) // Major period high

L = ta.lowest(low, majorPer) // Major period low

h = ta.highest(high, minorPer) // Minor period high

l = ta.lowest(low, minorPer) // Minor period low

float pdiv = not na(L) ? l - L : 0 // Positive divergence (low vs major low)

float ndiv = not na(H) ? H - h : 0 // Negative divergence (major high vs high)

float divisor = pdiv + ndiv

dctiValue = divisor == 0 ? 0 : 100 * ((pdiv - ndiv) / divisor) // Normalized to -100 to +100 range

sigValue = ta.ema(dctiValue, sigPer)

DCTI provides a complementary structural perspective on market trends by quantifying the relationship between short-term and long-term price extremes. This creates a multi-dimensional analysis framework that combines adaptive deviation measurement (fuzzy SMA) with channel-based trend intensity confirmation (DCTI).

Multi-Dimensional Fuzzy Input Variables

FibonacciFlux processes four distinct technical dimensions through its fuzzy system:

Normalized SMA Deviation: Measures price displacement relative to historical volatility context

Rate of Change (ROC): Captures price momentum over configurable timeframes

Relative Strength Index (RSI): Evaluates cyclical overbought/oversold conditions

Donchian Channel Trend Intensity (DCTI): Provides structural trend confirmation through channel analysis

Each dimension is processed through comprehensive fuzzy sets that transform crisp numerical values into linguistic variables:

// Normalized SMA Deviation - Self-calibrating to volatility regimes

ndiff_LP := fuzzy_triangle(normalized_diff, norm_scale * 0.3, norm_scale * 0.7, norm_scale * 1.1)

ndiff_SP := fuzzy_triangle(normalized_diff, norm_scale * 0.05, norm_scale * 0.25, norm_scale * 0.5)

ndiff_NZ := fuzzy_triangle(normalized_diff, -norm_scale * 0.1, 0.0, norm_scale * 0.1)

ndiff_SN := fuzzy_triangle(normalized_diff, -norm_scale * 0.5, -norm_scale * 0.25, -norm_scale * 0.05)

ndiff_LN := fuzzy_triangle(normalized_diff, -norm_scale * 1.1, -norm_scale * 0.7, -norm_scale * 0.3)

// DCTI - Structural trend measurement

dcti_SP := fuzzy_triangle(dcti_val, 60.0, 85.0, 101.0) // Strong Positive Trend (> ~85)

dcti_WP := fuzzy_triangle(dcti_val, 20.0, 45.0, 70.0) // Weak Positive Trend (~30-60)

dcti_Z := fuzzy_triangle(dcti_val, -30.0, 0.0, 30.0) // Near Zero / Trendless (~+/- 20)

dcti_WN := fuzzy_triangle(dcti_val, -70.0, -45.0, -20.0) // Weak Negative Trend (~-30 - -60)

dcti_SN := fuzzy_triangle(dcti_val, -101.0, -85.0, -60.0) // Strong Negative Trend (< ~-85)

Advanced Fuzzy Rule System with DCTI Confirmation

The core intelligence of FibonacciFlux lies in its sophisticated fuzzy rule system – a structured knowledge representation that encodes expert understanding of market dynamics:

// Base Trend Rules with DCTI Confirmation

cond1 = math.min(ndiff_LP, roc_HP, rsi_M)

strength_SB := math.max(strength_SB, cond1 * (dcti_SP > 0.5 ? 1.2 : dcti_Z > 0.1 ? 0.5 : 1.0))

// DCTI Override Rules - Structural trend confirmation with momentum alignment

cond14 = math.min(ndiff_NZ, roc_HP, dcti_SP)

strength_SB := math.max(strength_SB, cond14 * 0.5)

The rule system implements 15 distinct fuzzy rules that evaluate various market conditions including:

Established Trends: Strong deviations with confirming momentum and DCTI alignment

Emerging Trends: Early deviation patterns with initial momentum and DCTI confirmation

Weakening Trends: Divergent signals between deviation, momentum, and DCTI

Reversal Conditions: Counter-trend signals with DCTI confirmation

Neutral Consolidations: Minimal deviation with low momentum and neutral DCTI

A key innovation is the weighted influence of DCTI on rule activation. When strong DCTI readings align with other indicators, rule strength is amplified (up to 1.2x). Conversely, when DCTI contradicts other indicators, rule impact is reduced (as low as 0.5x). This creates a dynamic, self-adjusting system that prioritizes high-conviction signals.

Defuzzification & Signal Generation

The final step transforms fuzzy outputs into a precise trend score through center-of-gravity defuzzification:

// Defuzzification with precise floating-point handling

denominator = strength_SB + strength_WB + strength_N + strength_WBe + strength_SBe

if denominator > 1e-10

fuzzyTrendScore := (strength_SB * STRONG_BULL + strength_WB * WEAK_BULL +

strength_N * NEUTRAL + strength_WBe * WEAK_BEAR +

strength_SBe * STRONG_BEAR) / denominator

The resulting FuzzyTrendScore ranges from -1.0 (Strong Bear) to +1.0 (Strong Bull), with critical threshold zones at ±0.3 (Weak trend) and ±0.7 (Strong trend). The histogram visualization employs intuitive color-coding for immediate trend assessment.

Strategic Applications for Institutional Trading

FibonacciFlux provides substantial advantages for sophisticated trading operations:

Multi-Timeframe Signal Confirmation: Institutional-grade signal validation across multiple technical dimensions

Trend Strength Quantification: Precise measurement of trend conviction with noise filtration

Early Trend Identification: Detection of emerging trends before traditional indicators through fuzzy pattern recognition

Adaptive Market Regime Analysis: Self-calibrating analysis across varying volatility environments

Algorithmic Strategy Integration: Well-defined numerical output suitable for systematic trading frameworks