Aggressive Predictor+ (Last Bar, Vol, Wick)# Aggressive Predictor+ Pine Script Indicator

**Version:** Based on the script incorporating Last Bar analysis, Volume Confirmation, and Wick Rejection.

## Overview

This TradingView Pine Script indicator aims to predict the likely directional bias of the **next** candle based on an aggressive analysis of the **last closed candle's** price action, volume, and wick characteristics relative to recent market volatility (ATR).

It is designed to be **highly reactive** to the most recent bar's information. The prediction is visualized directly on the chart through shapes, a projected line, a text label, and an information table.

**Please Note:** Predicting the next candle is inherently speculative. This indicator provides a probability assessment based on its specific logic and should be used as a supplementary tool within a broader trading strategy, not as a standalone signal. Its performance heavily depends on market conditions and the chosen settings.

## Core Logic Explained

The indicator follows these steps for each new bar, looking back at the **last closed bar** (` `):

1. **Calculate Recent Volatility:** Determines the Average True Range (ATR) over the specified `ATR Lookback Period` (`atr_len`). This provides context for how volatile the market has been recently.

2. **Analyze Last Bar's Body:** Calculates the price change from open to close (`close - open `) of the last completed bar.

3. **Compare Body to Volatility:** Compares the absolute size of the last bar's body to the calculated ATR (`prev_atr`) multiplied by a sensitivity threshold (`threshold_atr_mult`).

* If the body size (positive) exceeds the threshold, the initial prediction is "Upward".

* If the body size (negative) exceeds the negative threshold, the initial prediction is "Downward".

* Otherwise, the initial prediction is "Neutral".

4. **Check Volume Confirmation:** Compares the volume of the last bar (`volume `) to its recent average volume (`ta.sma(volume, vol_avg_len) `). If the volume is significantly higher (based on `vol_confirm_mult`), it adds context ("High Vol") to directional predictions.

5. **Check for Wick Rejection:** Analyzes the wicks of the last bar.

* If the initial prediction was "Upward" but there was a large upper wick (relative to the body size, defined by `wick_rejection_mult`), it indicates potential selling pressure rejecting higher prices. The prediction is **overridden to "Neutral"**.

* If the initial prediction was "Downward" but there was a large lower wick, it indicates potential buying pressure supporting lower prices. The prediction is **overridden to "Neutral"**.

6. **Determine Final Prediction:** The final state ("Upward", "Downward", or "Neutral") is determined after considering potential wick rejection overrides. Context about volume or wick rejection is added to the display text.

## Visual Elements

* **Prediction Shapes:**

* Green Up Triangle: Below the bar for an "Upward" prediction (without wick rejection).

* Red Down Triangle: Above the bar for a "Downward" prediction (without wick rejection).

* Gray Diamond: Above/Below the bar if a directional move was predicted but then neutralized due to Wick Rejection.

* **Prediction Line:**

* Extends forward from the current bar's close for `line_length` bars (Default: 20).

* Color indicates the final predicted state (Green: Upward, Red: Downward, Gray: Neutral).

* Style is solid for directional predictions, dotted for Neutral.

* The *slope/magnitude* of the line is based on recent volatility (ATR) and the `projection_mult` setting, representing a *potential* magnitude if the predicted direction holds, scaled by recent volatility. **This is purely a visual projection, not a precise price forecast.**

* **Prediction Label:**

* Appears at the end of the Prediction Line.

* Displays the final prediction state (e.g., "Upward (High Vol)", "Neutral (Wick Rej)").

* Shows the raw price change of the last bar's body and its size relative to ATR (e.g., "Last Body: 1.50 (120.5% ATR)").

* Tooltip provides more detailed calculation info.

* **Info Table:**

* Displays the prediction state, color-coded.

* Shows details about the last bar's body size relative to ATR.

* Dynamically positioned near the latest bar (offsets configurable).

## Configuration Settings (Inputs)

These settings allow you to customize the indicator's behavior and appearance. Access them by clicking the "Settings" gear icon on the indicator name on your chart.

### Price Action & ATR

* **`ATR Lookback Period` (`atr_len`):**

* *Default:* 14

* *Purpose:* Number of bars used to calculate the Average True Range (ATR), which measures recent volatility.

* **`Body Threshold (ATR Multiplier)` (`threshold_atr_mult`):**

* *Default:* 0.5

* *Purpose:* Key setting for **aggression**. The last bar's body size (`close - open`) must be greater than `ATR * this_multiplier` to be initially classified as "Upward" or "Downward".

* *Effect:* **Lower values** make the indicator **more aggressive** (easier to predict direction). Higher values require a stronger price move relative to volatility and result in more "Neutral" predictions.

### Volume Confirmation

* **`Volume Avg Lookback` (`vol_avg_len`):**

* *Default:* 20

* *Purpose:* Number of bars used to calculate the simple moving average of volume.

* **`Volume Confirmation Multiplier` (`vol_confirm_mult`):**

* *Default:* 1.5

* *Purpose:* Volume on the last bar is considered "High" if it's greater than `Average Volume * this_multiplier`.

* *Effect:* Primarily adds context "(High Vol)" or "(Low Vol)" to the display text for directional predictions. Doesn't change the core prediction state itself.

### Wick Rejection

* **`Wick Rejection Multiplier` (`wick_rejection_mult`):**

* *Default:* 1.0

* *Purpose:* If an opposing wick (upper wick on an up-candle, lower wick on a down-candle) is larger than `body size * this_multiplier`, the directional prediction is overridden to "Neutral".

* *Effect:* Higher values require a much larger opposing wick to cause a rejection override. Lower values make wick rejection more likely.

### Projection Settings

* **`Projection Multiplier (ATR based)` (`projection_mult`):**

* *Default:* 1.0

* *Purpose:* Scales the projected *magnitude* of the prediction line. The projected price change shown by the line is `+/- ATR * this_multiplier`.

* *Effect:* Adjusts how far up or down the prediction line visually slopes. Does not affect the predicted direction.

* **`Prediction Line Length (Bars)` (`line_length`):**

* *Default:* 20

* *Purpose:* Controls how many bars forward the **visual** prediction line extends.

* *Effect:* Purely visual length adjustment.

### Visuals

* **`Upward Color` (`bullish_color`):** Color for Upward predictions.

* **`Downward Color` (`bearish_color`):** Color for Downward predictions.

* **`Neutral Color` (`neutral_color`):** Color for Neutral predictions (including Wick Rejections).

* **`Show Prediction Shapes` (`show_shapes`):** Toggle visibility of the triangles/diamonds on the chart.

* **`Show Prediction Line` (`show_line`):** Toggle visibility of the projected line.

* **`Show Prediction Label` (`show_label`):** Toggle visibility of the text label at the end of the line.

* **`Show Info Table` (`show_table`):** Toggle visibility of the information table.

### Table Positioning

* **`Table X Offset (Bars)` (`table_x_offset`):**

* *Default:* 3

* *Purpose:* How many bars to the right of the current bar the info table should appear.

* **`Table Y Offset (ATR Multiplier)` (`table_y_offset_atr`):**

* *Default:* 0.5

* *Purpose:* How far above the high of the last bar the info table should appear, measured in multiples of ATR.

## How to Use

1. Open the Pine Editor in TradingView.

2. Paste the complete script code.

3. Click "Add to Chart".

4. Adjust the input settings (especially `threshold_atr_mult`) to tune the indicator's aggressiveness and visual preferences.

5. Observe the prediction elements alongside your other analysis methods.

## Disclaimer

**This indicator is for informational and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset.** Trading financial markets involves significant risk, and you could lose money. Predictions about future price movements are inherently uncertain. The performance of this indicator depends heavily on market conditions and the settings used. Always perform your own due diligence and consider multiple factors before making any trading decisions. Use this indicator at your own risk.

Графические паттерны

Probability Grid [LuxAlgo]The Probability Grid tool allows traders to see the probability of where and when the next reversal would occur, it displays a 10x10 grid and/or dashboard with the probability of the next reversal occurring beyond each cell or within each cell.

🔶 USAGE

By default, the tool displays deciles (percentiles from 0 to 90), users can enable, disable and modify each percentile, but two of them must always be enabled or the tool will display an error message alerting of it.

The use of the tool is quite simple, as shown in the chart above, the further the price moves on the grid, the higher the probability of a reversal.

In this case, the reversal took place on the cell with a probability of 9%, which means that there is a probability of 91% within the square defined by the last reversal and this cell.

🔹 Grid vs Dashboard

The tool can display a grid starting from the last reversal and/or a dashboard at three predefined locations, as shown in the chart above.

🔶 DETAILS

🔹 Raw Data vs Normalized Data

By default the tool displays the normalized data, this means that instead of using the raw data (price delta between reversals) it uses the returns between each reversal, this is useful to make an apples to apples comparison of all the data in the dataset.

This can be seen in the left side of the chart above (BTCUSD Daily chart) where normalize data is disabled, the percentiles from 0 to 40 overlap and are indistinguishable from each other because the tool uses the raw price delta over the entire bitcoin history, with normalize data enabled as we can see in the right side of the chart we can have a fair comparison of the data over the entire history.

🔹 Probability Beyond or Within Each Cell

Two different probability modes are available, the default mode is Probability Beyond Each Cell, the number displayed in each cell is the probability of the next reversal to be located in the area beyond the cell, for example, if the cell displays 20%, it means that in the area formed by the square starting from the last reversal and ending at the cell, there is an 80% probability and outside that square there is a 20% probability for the location of the next reversal.

The second probability mode is the probability within each cell, this outlines the chance that the next reversal will be within the cell, as we can see on the right chart above, when using deciles as percentiles (default settings), each cell has the same 1% probability for the 10x10 grid.

🔶 SETTINGS

Swing Length: The maximum length in bars used to identify a swing

Maximum Reversals: Maximum number of reversals included in calculations

Normalize Data: Use returns between swings instead of raw price

Probability: Choose between two different probability modes: beyond and inside each cell

Percentiles: Enable/disable each of the ten percentiles and select the percentile number and line style

🔹 Dashboard

Show Dashboard: Enable or disable the dashboard

Position: Choose dashboard location

Size: Choose dashboard size

🔹 Style

Show Grid: Enable or disable the grid

Size: Choose grid text size

Colors: Choose grid background colors

Show Marks: Enable/disable reversal markers

H4 3-Candle Pattern (Persistent Signals)Below is an example in Pine Script v5 that detects a pattern using the last three completed 4H candles and then plots a permanent arrow on the fourth candle (i.e. on the current bar) when the conditions are met. The arrow stays on that bar even after new bars form.

In this version, the pattern is evaluated as follows on each bar (when there are enough candles):

Bullish Pattern:

The candle three bars ago (oldest of the three) is bullish (its close is greater than its open).

The candle two bars ago closes above the high of that older candle.

The last completed candle (one bar ago) closes at or above the low of the candle two bars ago.

Bearish Pattern:

The candle three bars ago is bearish (its close is less than its open).

The candle two bars ago closes below the low of that older candle.

The last completed candle closes at or below the high of the candle two bars ago.

When the conditions are met the script draws a green up arrow below the current (fourth) candle for a bullish pattern and a red down arrow above the current candle for a bearish pattern. These arrows are drawn as regular plot symbols and remain on the chart permanently.

Copy and paste the code into TradingView’s Pine Script Editor:

Next Candle PredictorNext Candle Predictor for TradingView

This Pine Script indicator helps predict potential price movements for the next candle based on historical price action patterns. It analyzes recent candles' characteristics including body size, wick length, and volume to calculate a directional bias.

Key Features

Analyzes recent price action to predict next candle direction (Bullish, Bearish, or Neutral)

Visual indicators include small directional arrows and a prediction line

Customizable sensitivity and lookback period

Works best on lower timeframes for short-term price action trading

Displays clear prediction labels that extend into future bars

How It Works

The script analyzes recent candles by examining:

Candle body size (weighted by your preference)

Wick length (weighted by your preference)

Volume activity (weighted by your preference)

These factors combine to create a directional strength indicator that determines if the next candle is likely to be bullish, bearish, or neutral.

Visual Feedback

Green up arrows indicate bullish predictions

Red down arrows indicate bearish predictions

A directional line extends from the last candle showing predicted price movement

A label displays the prediction text at the end of the line

Information table in the top right displays the current prediction

Settings

Lookback Candle Count: Number of historical candles to analyze (2-20)

Wick/Body/Volume Weight Factors: Adjust importance of each component

Prediction Sensitivity: Threshold for triggering directional bias

Prediction Line Length: How far the prediction line extends

Perfect for day traders and scalpers looking for an edge in short-term directional bias.

Ross Cameron-Inspired Day Trading StrategyExplanation for Community Members:

Title: Ross Cameron-Inspired Day Trading Strategy

Description:

This script is designed to help you identify potential buy and sell opportunities during the trading day. It combines several popular trading strategies to provide clear signals.

Key Features:

Gap and Go: Identifies stocks that have gapped up or down at the open.

Momentum Trading: Uses RSI and EMA to identify momentum-based entry points.

Mean Reversion: Uses RSI and SMA to identify potential reversals.

How to Use:

Apply to Chart: Add this script to your TradingView chart.

Set Timeframe: Works best on 5-minute and 10-minute timeframes.

Watch for Signals: Look for green "BUY" labels for entry points and red "SELL" labels for exit points.

Parameters:

Gap Percentage: Adjust to identify larger or smaller gaps.

RSI Settings: Customize the RSI length and overbought/oversold levels.

EMA and SMA Lengths: Adjust the lengths of the moving averages.

Confirmation Period: Set how many bars to wait for confirmation.

Visual Elements:

BUY Signals: Green labels below the price bars.

SELL Signals: Red labels above the price bars.

Indicators: Displays EMA (blue) and SMA (orange) for additional context.

This script is a powerful tool for day trading on NSE and BSE indices, combining multiple strategies to provide robust trading signals. Adjust the parameters to suit your trading style and always combine with your own analysis for best results.

NY First Candle Break and RetestStrategy Overview

Session and Time Parameters:

The strategy focuses on the New York trading session, starting at 9:30 AM and lasting for a predefined session length, typically 3 to 4 hours. This timing captures the most active market hours, providing ample trading opportunities.

Strategy Parameters:

Utilizes the Average True Range (ATR) to set dynamic stop-loss levels, ensuring risk is managed according to market volatility.

Employs a reward-to-risk ratio to determine take profit levels, aiming for a balanced approach between potential gains and losses.

Strategy Settings:

Incorporates simple moving averages (EMA) and the Volume Weighted Average Price (VWAP) to identify trend direction and price levels.

Volume confirmation is used to validate breakouts, ensuring trades are based on significant market activity.

Trade Management:

Features a trailing stop mechanism to lock in profits as the trade moves in favor, with multiple take profit levels to secure gains incrementally.

The strategy is designed to handle both long and short positions, adapting to market conditions.

Alert Settings:

Provides alerts for key events such as session start, breakout, retest, and entry signals, helping traders stay informed and act promptly.

Visual cues on the chart highlight entry and exit points, making it easier for beginners to follow the strategy.

This strategy is particularly suited for the current volatile market environment, where simplicity and clear guidelines can help beginner traders navigate the complexities of trading. It emphasizes risk management and uses straightforward indicators to make informed trading decisions.

I put together this Trading View scalping strategy for futures markets with some help from Claude AI. Shoutout to everyone who gave me advice along the way—I really appreciate it! I’m sure there’s room for improvement, so feel free to share your thoughts… just go easy on me. :)

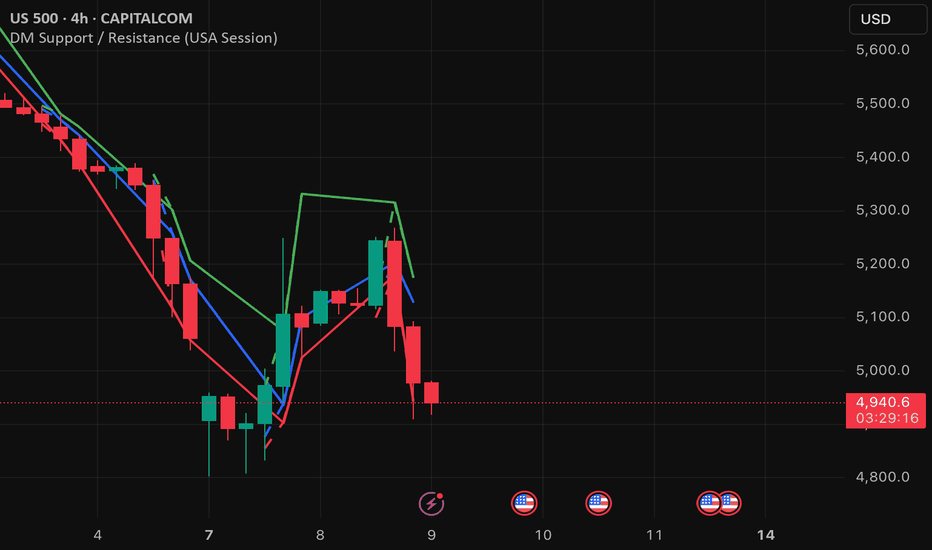

DM Support / Resistance (USA Session)This indicator is specifically designed for use on the 4-hour time frame and helps traders identify key support and resistance levels during the USA trading session (9:30 AM to 4:00 PM Eastern Time). The indicator calculates important price levels to assist in making well-informed entry and exit decisions, particularly for those focusing on swing trades or longer-term intraday strategies. It also includes a feature to skip setups when relevant fundamental news is scheduled, ensuring you avoid trading during periods of high volatility.

Key Features:

Support and Resistance Levels (S1 & R1):

The indicator calculates and displays Support 1 (S1) and Resistance 1 (R1) levels, which act as key barriers for price action and help traders spot potential reversal or breakout zones on the chart.

Pivot Point (PP):

The Pivot Point (PP) is calculated as the average of the previous period's high, low, and close. It serves as a central reference point for market direction, allowing traders to evaluate whether the market is in a bullish or bearish trend.

Market Bias:

The Bias is shown as a histogram that helps traders assess the strength of the market trend. A positive bias suggests bullish sentiment, while a negative bias signals bearish conditions. This can be used to confirm the overall trend direction.

4-Hour Time Frame:

The indicator is optimized for the 4-hour time frame, making it suitable for traders looking for swing trades or those who wish to capture longer-term trends within the USA session. The key support, resistance, and pivot levels are recalculated dynamically to reflect price action over 4-hour periods.

Dynamic Plotting and Alerts:

Support and resistance levels are drawn as dashed horizontal lines, updating in real-time to reflect the most current market data during the USA session. Alerts can be set for significant price movements crossing these levels.

Stop-Loss Strategy Based on 15-Minute Time Frame:

A unique feature of this indicator is its stop-loss strategy, which uses 15-minute time frame support and resistance levels. When a long or short entry is triggered on the 4-hour chart, traders should place their stop-loss according to the relevant 15-minute support or resistance level.

If the price closes above the 15-minute support for a long entry, or closes below the 15-minute resistance for a short entry, it signals the need to exit or adjust your position based on these levels.

Fundamental News Filter:

To avoid unnecessary risk, the indicator incorporates a fundamental news filter. If there is relevant news scheduled during the USA session, such as high-impact economic data or central bank announcements, the indicator will skip the setup for that period. This prevents traders from entering positions during times of elevated volatility caused by news events, which could result in unpredictable price movements.

How to Use:

Long Entry: When the Bias is positive and the price breaks above Support 1 (S1), this signals a potential bullish move. Consider entering a long position at this point.

Stop-Loss Strategy: Set your stop-loss at the respective 15-minute support level. If the price closes below this level, it could signal a reversal, prompting you to exit the trade.

Short Entry: When the Bias is negative and the price breaks below Resistance 1 (R1), this signals a potential bearish move. Enter a short position at this point.

Stop-Loss Strategy: Set your stop-loss at the respective 15-minute resistance level. If the price closes above this level, exit the short trade as it could indicate a bullish reversal.

Pivot Point (PP): The Pivot Point serves as a reference level to gauge potential price reversals. A move above the PP suggests a bullish bias, while trading below the PP suggests a bearish outlook.

Bias Histogram: The Bias Histogram helps confirm trend direction. A positive bias confirms long positions, while a negative bias reinforces short trades.

Avoid Trading During High-Impact News: If there is significant economic news or fundamental events scheduled during the USA session, the indicator will automatically skip any potential setup. This feature ensures you avoid entering trades that might be affected by unexpected news-driven volatility, keeping your trading strategy safer and more reliable.

Why Use This Indicator:

The 4-hour time frame is ideal for traders who prefer swing trading or those looking to capture longer-term trends in a structured manner. This indicator provides crucial insights into market direction, support/resistance levels, and potential entry/exit points.

The stop-loss management based on the 15-minute support and resistance levels helps traders protect their positions from sudden price reversals, ensuring more precise risk management.

The fundamental news filter is particularly useful for avoidance of high-risk periods. By skipping setups during high-impact news events, traders can avoid entering trades when price volatility could be unpredictable.

Overall, this indicator is a powerful tool for traders who want to make data-driven decisions based on technical analysis while ensuring that their positions are managed responsibly and avoiding news-driven risk.

Gold Opening 15-Min ORB INDICATOR by AdéThis indicator is designed for trading Gold (XAUUSD) during the first 15 minutes of major market openings: Asian, European, and US sessions. It highlights these key time windows, plots the high and low ranges of each session, and generates breakout-based buy/sell signals. Ideal for traders focusing on volatility at market opens.

Features:Session Windows:

Asian: 1:00–1:15 AM Barcelona time (23:00–23:15 UTC, CEST-adjusted).

European: 9:00–9:15 AM Barcelona time (07:00–07:15 UTC).

US: 3:30–3:45 PM Barcelona time (13:30–13:45 UTC).

Marked with yellow (Asian), green (Europe), and blue (US) triangles below bars.

High/Low Ranges:Plots horizontal lines showing the highest high and lowest low of each session’s first 15 minutes.Lines appear after each session ends and persist until the next day, color-coded to match the sessions.Breakout Signals:Buy (Long): Triggers when the closing price breaks above the highest high of the previous 5 bars during a session window (lime triangle above bar).Sell (Short): Triggers when the closing price breaks below the lowest low of the previous 5 bars during a session window (red triangle below bar).

Signals are restricted to the 15-minute session periods for focused trading.Usage:Timeframe: Optimized for 1-minute XAUUSD charts.Timezone: Set your chart to UTC for accurate session timing (script uses UTC internally, based on Barcelona CEST, UTC+2 in April).Strategy:

Use buy/sell signals for breakout trades during volatile market opens, with session ranges as support/resistance levels.Customization: Adjust the lookback variable (default: 5) to tweak signal sensitivity.Notes:Tested for April 2025 (CEST, UTC+2).

Adjust timestamp values if using outside daylight saving time (CET, UTC+1) or for different broker timezones.Best for scalping or short-term trades during high-volatility periods. Combine with other indicators for confirmation if desired.How to Use:Apply to a 1-minute XAUUSD chart.Watch for session markers (triangles) and breakout signals during the 15-minute windows.Use the high/low lines to gauge potential breakout targets or reversals.

Dskyz Adaptive Futures Elite (DAFE)Dskyz Adaptive Futures Edge (DAFE)

imgur.com

A Dynamic Futures Trading Strategy

DAFE adapts to market volatility and price action using technical indicators and advanced risk management. It’s built for high-stakes futures trading (e.g., MNQ, BTCUSDT.P), offering modular logic for scalpers and swing traders alike.

Key Features

Adaptive Moving Averages

Dynamic Logic: Fast and slow SMAs adjust lengths via ATR, reacting to momentum shifts and smoothing in calm markets.

Signals: Long entry on fast SMA crossing above slow SMA with price confirmation; short on cross below.

RSI Filtering (Optional)

Momentum Check: Confirms entries with RSI crossovers (e.g., above oversold for longs). Toggle on/off with custom levels.

Fine-Tuning: Adjustable lookback and thresholds (e.g., 60/40) for precision.

Candlestick Pattern Recognition

Eng|Enhanced Detection: Identifies strong bullish/bearish engulfing patterns, validated by volume and range strength (vs. 10-period SMA).

Conflict Avoidance: Skips trades if both patterns appear in the lookback window, reducing whipsaws.

Multi-Timeframe Trend Filter

15-Minute Alignment: Syncs intrabar trades with 15-minute SMA trends; optional for flexibility.

Dollar-Cost Averaging (DCA) New!

Scaling: Adds up to a set number of entries (e.g., 4) on pullbacks/rallies, spaced by ATR multiples.

Control: Caps exposure and resets on exit, enhancing trend-following potential.

Trade Execution & Risk Management

Entry Rules: Prioritizes moving averages or patterns (user choice), with volume, volatility, and time filters.

Stops & Trails:

Initial Stop: ATR-based (2–3.5x, volatility-adjusted).

Trailing Stop: Locks profits with configurable ATR offset and multiplier.

Discipline

Cooldown: Pauses post-exit (e.g., 0–5 minutes).

Min Hold: Ensures trades last a set number of bars (e.g., 2–10).

Visualization & Tools

Charts: Overlays MAs, stops, and signals; trend shaded in background.

Dashboard: Shows position, P&L, win rate, and more in real-time.

Debugging: Logs signal details for optimization.

Input Parameters

Parameter Purpose Suggested Use

Use RSI Filter - Toggle RSI confirmation *Disable 4 price-only

trading

RSI Length - RSI period (e.g., 14) *7–14 for sensitivity

RSI Overbought/Oversold - Adjust for market type *Set levels (e.g., 60/40)

Use Candlestick Patterns - Enables engulfing signals *Disable for MA focus

Pattern Lookback - Pattern window (e.g., 19) *10–20 bars for balance

Use 15m Trend Filter - Align with 15-min trend *Enable for trend trades

Fast/Slow MA Length - Base MA lengths (e.g., 9/19) *10–25 / 30–60 per

timeframe

Volatility Threshold - Filters volatile spikes *Max ATR/close (e.g., 1%)

Min Volume - Entry volume threshold *Avoid illiquid periods

(e.g., 10)

ATR Length - ATR period (e.g., 14) *Standard volatility

measure

Trailing Stop ATR Offset - Trail distance (e.g., 0.5) *0.5–1.5 for tightness

Trailing Stop ATR Multi - Trail multiplier (e.g., 1.0) *1–3 for trend room

Cooldown Minutes - Post-exit pause (e.g., 0–5) *Prevents overtrading

Min Bars to Hold - Min trade duration (e.g., 2) *5–10 for intraday

Trading Hours - Active window (e.g., 9–16) *Focus on key sessions

Use DCA - Toggle DCA *Enable for scaling

Max DCA Entries - Cap entries (e.g., 4) *Limit risk exposure

DCA ATR Multiplier Entry spacing (e.g., 1.0) *1–2 for wider gaps

Compliance

Realistic Testing: Fixed quantities, capital, and slippage for accurate backtests.

Transparency: All logic is user-visible and adjustable.

Risk Controls: Cooldowns, stops, and hold periods ensure stability.

Flexibility: Adapts to various futures and timeframes.

Summary

DAFE excels in volatile futures markets with adaptive logic, DCA scaling, and robust risk tools. Currently in prop account testing, it’s a powerful framework for precision trading.

Caution

DAFE is experimental, not a profit guarantee. Futures trading risks significant losses due to leverage. Backtest, simulate, and monitor actively before live use. All trading decisions are your responsibility.

Failed Breakout DetectionThis indicator is a reverse-engineered copy of the FBD Detection indicator published by xfuturesgod. The original indicator aimed at detecting "Failed Breakdowns". This version tracks the opposite signals, "Failed Breakouts". It was coded with the ES Futures 15 minute chart in mind but may be useful on other instruments and time frames.

The original description, with terminology reversed to explain this version:

'Failed Breakouts' are a popular set up for short entries.

In short, the set up requires:

1) A significant high is made ('initial high')

2) Initial high is undercut with a new high

3) Price action then 'reclaims' the initial high by moving +8-10 points from the initial high

This script aims at detecting such set ups. It was coded with the ES Futures 15 minute chart in mind but may be useful on other instruments and time frames.

Business Logic:

1) Uses pivot highs to detect 'significant' initial highs

2) Uses amplitude threshold to detect a new high above the initial high; used /u/ben_zen script for this

3) Looks for a valid reclaim - a red candle that occurs within 10 bars of the new high

4) Price must reclaim at least 8 points for the set up to be valid

5) If a signal is detected, the initial high value (pivot high) is stored in array that prevents duplicate signals from being generated.

6) FBO Signal is plotted on the chart with "X"

7) Pivot high detection is plotted on the chart with "P" and a label

8) New highs are plotted on the chart with a red triangle

Notes:

User input

- My preference is to use the defaults as is, but as always feel free to experiment

- Can modify pivot length but in my experience 10/10 work best for pivot highs

- New high detection - 55 bars and 0.05 amplitude work well based on visual checks of signals

- Can modify the number of points needed to reclaim a high, and the # of bars limit over which this must occur.

Alerts:

- Alerts are available for detection of new highs and detection of failed breakouts

- Alerts are also available for these signals but only during 7:30PM-4PM EST - 'prime time' US trading hours

Limitations:

- Current version of the script only compares new highs to the most recent pivot high, does not look at anything prior to that

- Best used as a discretionary signal

Order Flow Hawkes Process [ScorsoneEnterprises]This indicator is an implementation of the Hawkes Process. This tool is designed to show the excitability of the different sides of volume, it is an estimation of bid and ask size per bar. The code for the volume delta is from www.tradingview.com

Here’s a link to a more sophisticated research article about Hawkes Process than this post arxiv.org

This tool is designed to show how excitable the different sides are. Excitability refers to how likely that side is to get more activity. Alan Hawkes made Hawkes Process for seismology. A big earthquake happens, lots of little ones follow until it returns to normal. Same for financial markets, big orders come in, causing a lot of little orders to come. Alpha, Beta, and Lambda parameters are estimated by minimizing a negative log likelihood function.

How it works

There are a few components to this script, so we’ll go into the equation and then the other functions used in this script.

hawkes_process(params, events, lkb) =>

alpha = clamp(array.get(params, 0), 0.01, 1.0)

beta = clamp(array.get(params, 1), 0.1, 10.0)

lambda_0 = clamp(array.get(params, 2), 0.01, 0.3)

intensity = array.new_float(lkb, 0.0)

events_array = array.new_float(lkb, 0.0)

for i = 0 to lkb - 1

array.set(events_array, i, array.get(events, i))

for i = 0 to lkb - 1

sum_decay = 0.0

current_event = array.get(events_array, i)

for j = 0 to i - 1

time_diff = i - j

past_event = array.get(events_array, j)

decay = math.exp(-beta * time_diff)

past_event_val = na(past_event) ? 0 : past_event

sum_decay := sum_decay + (past_event_val * decay)

array.set(intensity, i, lambda_0 + alpha * sum_decay)

intensity

The parameters alpha, beta, and lambda all represent a different real thing.

Alpha (α):

Definition: Alpha represents the excitation factor or the magnitude of the influence that past events have on the future intensity of the process. In simpler terms, it measures how much each event "excites" or triggers additional events. It is constrained between 0.01 and 1.0 (e.g., clamp(array.get(params, 0), 0.01, 1.0)). A higher alpha means past events have a stronger influence on increasing the intensity (likelihood) of future events. Initial value is set to 0.1 in init_params. In the hawkes_process function, alpha scales the contribution of past events to the current intensity via the term alpha * sum_decay.

Beta (β):

Definition: Beta controls the rate of exponential decay of the influence of past events over time. It determines how quickly the effect of a past event fades away. It is constrained between 0.1 and 10.0 (e.g., clamp(array.get(params, 1), 0.1, 10.0)). A higher beta means the influence of past events decays faster, while a lower beta means the influence lingers longer. Initial value is set to 0.1 in init_params. In the hawkes_process function, beta appears in the decay term math.exp(-beta * time_diff), which reduces the impact of past events as the time difference (time_diff) increases.

Lambda_0 (λ₀):

Definition: Lambda_0 is the baseline intensity of the process, representing the rate at which events occur in the absence of any excitation from past events. It’s the "background" rate of the process. It is constrained between 0.01 and 0.3 .A higher lambda_0 means a higher natural frequency of events, even without the influence of past events. Initial value is set to 0.1 in init_params. In the hawkes_process function, lambda_0 sets the minimum intensity level, to which the excitation term (alpha * sum_decay) is added: lambda_0 + alpha * sum_decay

Alpha (α): Strength of event excitation (how much past events boost future events).

Beta (β): Rate of decay of past event influence (how fast the effect fades).

Lambda_0 (λ₀): Baseline event rate (background intensity without excitation).

Other parts of the script.

Clamp

The clamping function is a simple way to make sure parameters don’t grow or shrink too much.

ObjectiveFunction

This function defines the objective function (negative log-likelihood) to minimize during parameter optimization.It returns a float representing the negative log-likelihood (to be minimized).

How It Works:

Calls hawkes_process to compute the intensity array based on current parameters.Iterates over the lookback period:lambda_t: Intensity at time i.event: Event magnitude at time i.Handles na values by replacing them with 0.Computes log-likelihood: event_clean * math.log(math.max(lambda_t_clean, 0.001)) - lambda_t_clean.Ensures lambda_t_clean is at least 0.001 to avoid log(0).Accumulates into log_likelihood.Returns -log_likelihood (negative because the goal is to minimize, not maximize).

It is used in the optimization process to evaluate how well the parameters fit the observed event data.

Finite Difference Gradient:

This function calculates the gradient of the objective function we spoke about. The gradient is like a directional derivative. Which is like the direction of the rate of change. Which is like the direction of the slope of a hill, we can go up or down a hill. It nudges around the parameter, and calculates the derivative of the parameter. The array of these nudged around parameters is what is returned after they are optimized.

Minimize:

This is the function that actually has the loop and calls the Finite Difference Gradient each time. Here is where the minimizing happens, how we go down the hill. If we are below a tolerance, we are at the bottom of the hill.

Applied

After an initial guess the parameters are optimized with a mix of bid and ask levels to prevent some over-fitting for each side while keeping some efficiency. We initialize two different arrays to store the bid and ask sizes. After we optimize the parameters we clamp them for the calculations. We then get the array of intensities from the Hawkes Process of bid and ask and plot them both. When the bids are greater than the ask it represents a bullish scenario where there are likely to be more buy than sell orders, pushing up price.

Tool examples:

The idea is that when the bid side is more excitable it is more likely to see a bullish reaction, when the ask is we see a bearish reaction.

We see that there are a lot of crossovers, and I picked two specific spots. The idea of this isn’t to spot crossovers but avoid chop. The values are either close together or far apart. When they are far, it is a classification for us to look for our own opportunities in, when they are close, it signals the market can’t pick a direction just yet.

The value works just as well on a higher timeframe as on a lower one. Hawkes Process is an estimate, so there is a leading value aspect of it.

The value works on equities as well, here is NASDAQ:TSLA on a lower time frame with a lookback of 5.

Inputs

Users can enter the lookback value and timeframe.

No tool is perfect, the Hawkes Process value is also not perfect and should not be followed blindly. It is good to use any tool along with discretion and price action.

Smarter Money Concepts - OBs [PhenLabs]📊 Smarter Money Concepts - OBs

Version: PineScript™ v6

📌 Description

Smarter Money Concepts - OBs (Order Blocks) is an advanced technical analysis tool designed to identify and visualize institutional order zones on your charts. Order blocks represent significant areas of liquidity where smart money has entered positions before major moves. By tracking these zones, traders can anticipate potential reversals, continuations, and key reaction points in price action.

This indicator incorporates volume filtering technology to identify only the most significant order blocks, eliminating low-quality signals and focusing on areas where institutional participation is likely present. The combination of price structure analysis and volume confirmation provides traders with high-probability zones that may attract future price action for tests, rejections, or breakouts.

🚀 Points of Innovation

Volume-Filtered Block Detection : Identifies only order blocks formed with significant volume, focusing on areas with institutional participation

Advanced Break of Structure Logic : Uses sophisticated price action analysis to detect legitimate market structure breaks preceding order blocks

Dynamic Block Management : Intelligently tracks, extends, and removes order blocks based on price interaction and time-based expiration

Structure Recognition System : Employs technical analysis algorithms to find significant swing points for accurate order block identification

Dual Directional Tracking : Simultaneously monitors both bullish and bearish order blocks for comprehensive market structure analysis

🔧 Core Components

Order Block Detection : Identifies institutional entry zones by analyzing price action before significant breaks of structure, capturing where smart money has likely positioned before moves.

Volume Filtering Algorithm : Calculates relative volume compared to a moving average to qualify only order blocks formed with significant market participation, eliminating noise.

Structure Break Recognition : Uses price action analysis to detect legitimate breaks of market structure, ensuring order blocks are identified only at significant market turning points.

Dynamic Block Management : Continuously monitors price interaction with existing blocks, extending, maintaining, or removing them based on current market behavior.

🔥 Key Features

Volume-Based Filtering : Filter out insignificant blocks by requiring a minimum volume threshold, focusing only on zones with likely institutional activity

Visual Block Highlighting : Color-coded boxes clearly mark bullish and bearish order blocks with customizable appearance

Flexible Mitigation Options : Choose between “Wick” or “Close” methods for determining when a block has been tested or mitigated

Scan Range Adjustment : Customize how far back the indicator looks for structure points to adapt to different market conditions and timeframes

Break Source Selection : Configure which price component (close, open, high, low) is used to determine structure breaks for precise block identification

🎨 Visualization

Bullish Order Blocks : Blue-colored rectangles highlighting zones where bullish institutional orders were likely placed before upward moves, representing potential support areas.

Bearish Order Blocks : Red-colored rectangles highlighting zones where bearish institutional orders were likely placed before downward moves, representing potential resistance areas.

Block Extension : Order blocks extend to the right of the chart, providing clear visualization of these significant zones as price continues to develop.

📖 Usage Guidelines

Order Block Settings

Scan Range : Default: 25. Defines how many bars the indicator scans to determine significant structure points for order block identification.

Bull Break Price Source : Default: Close. Determines which price component is used to detect bullish breaks of structure.

Bear Break Price Source : Default: Close. Determines which price component is used to detect bearish breaks of structure.

Visual Settings

Bullish Blocks Color : Default: Blue with 85% transparency. Controls the appearance of bullish order blocks.

Bearish Blocks Color : Default: Red with 85% transparency. Controls the appearance of bearish order blocks.

General Options

Block Mitigation Method : Default: Wick, Options: Wick, Close. Determines how block mitigation is calculated - “Wick” uses high/low values while “Close” uses close values for more conservative mitigation criteria.

Remove Filled Blocks : Default: Disabled. When enabled, order blocks are removed once they’ve been mitigated by price action.

Volume Filter

Volume Filter Enabled : Default: Enabled. When activated, only shows order blocks formed with significant volume relative to recent average.

Volume SMA Period : Default: 15, Range: 1-50. Number of periods used to calculate the average volume baseline.

Min. Volume Ratio : Default: 1.5, Range: 0.5-10.0. Minimum volume ratio compared to average required to display an order block; higher values filter out more blocks.

✅ Best Use Cases

Identifying high-probability support and resistance zones for trade entries and exits

Finding optimal stop-loss placement behind significant order blocks

Detecting potential reversal areas where price may react after extended moves

Confirming breakout trades when price clears major order blocks

Building a comprehensive market structure map for medium to long-term trading decisions

Pinpointing areas where smart money may have positioned before major market moves

⚠️ Limitations

Most effective on higher timeframes (1H and above) where institutional activity is more clearly defined

Can generate multiple signals in choppy market conditions, requiring additional filtering

Volume filtering relies on accurate volume data, which may be less reliable for some securities

Recent market structure changes may invalidate older order blocks not yet automatically removed

Block identification is based on historical price action and may not predict future behavior with certainty

💡 What Makes This Unique

Volume Intelligence : Unlike basic order block indicators, this script incorporates volume analysis to identify only the most significant institutional zones, focusing on quality over quantity.

Structural Precision : Uses sophisticated break of structure algorithms to identify true market turning points, going beyond simple price pattern recognition.

Dynamic Block Management : Implements automatic block tracking, extension, and cleanup to maintain a clean and relevant chart display without manual intervention.

Institutional Focus : Designed specifically to highlight areas where smart money has likely positioned, helping retail traders align with institutional perspectives rather than retail noise.

🔬 How It Works

1. Structure Identification Process :

The indicator continuously scans price action to identify significant swing points and structure levels within the specified range, establishing a foundation for order block recognition.

2. Break Detection :

When price breaks an established structure level (crossing below a significant low for bearish breaks or above a significant high for bullish breaks), the indicator marks this as a potential zone for order block formation.

3. Volume Qualification :

For each potential order block, the algorithm calculates the relative volume compared to the configured period average. Only blocks formed with volume exceeding the minimum ratio threshold are displayed.

4. Block Creation and Management :

Valid order blocks are created, tracked, and managed as price continues to develop. Blocks extend to the right of the chart until they are either mitigated by price action or expire after the designated timeframe.

5. Continuous Monitoring :

The indicator constantly evaluates price interaction with existing blocks, determining when blocks have been tested, mitigated, or invalidated, and updates the visual representation accordingly.

💡 Note:

Order Blocks represent areas where institutional traders have likely established positions and may defend these zones during future price visits. For optimal results, use this indicator in conjunction with other confluent factors such as key support/resistance levels, trendlines, or additional confirmation indicators. The most reliable signals typically occur on higher timeframes where institutional activity is most prominent. Start with the default settings and adjust parameters gradually to match your specific trading instrument and style.

False Breakout PRO📌 False Breakout PRO – Enhanced False Breakout Detection Tool

False Breakout PRO is an advanced version of the original "False Breakout (Expo)" indicator by .

This tool is designed to help traders detect bullish and bearish false breakouts with high precision. By offering a more customizable and smarter interface, it helps reduce noise and false signals through various filtering and visualization options.

🔍 How It Works

The script continuously scans for new highs or lows based on a user-defined period.

It identifies false breakouts when price briefly breaks out of a recent high/low but then quickly reverses. These are often seen as market traps, and this indicator aims to highlight them early.

✅ Key Features in the PRO Version

📌 Toggle to display all signals or only the most recent one

💬 Price labels with clean text and optional visibility

📊 Smart summary table for instant signal reference

📈 Auto-extended lines that follow price action

⚡ Lightweight and optimized for speed and real-time responsiveness

🛠 Configurable Settings

False breakout detection period

Signal validity window (how long a signal is considered active)

Smoothing types: Raw (💎), WMA, or HMA

Aggressive mode for early signal generation

Enable or disable:

Price labels

Summary table

Only latest signal mode

⚠️ License Notice

This script is derived from @Zeiierman’s original work and is published under the Creative Commons BY-NC-SA 4.0 license.

🔒 Commercial use is NOT allowed. Attribution to the original author is required.

🇸🇦 False Breakout PRO – أداة متقدمة لكشف الكسر الكاذب

False Breakout PRO هو إصدار مطور من السكريبت الأصلي "False Breakout (Expo)" من تطوير ، وتم تحسينه لتقديم تجربة استخدام أكثر احترافية ومرونة للمستخدمين للكشف عن الكسر الكاذب

🔍 آلية العمل

يقوم السكريبت بمراقبة القمم والقيعان الجديدة بناءً على فترة يتم تحديدها من قبل المستخدم.

ثم يحدد الكسر الكاذب عندما يكسر السعر مستوى مرتفعًا أو منخفضًا ثم يعود بسرعة. هذه الحركة غالبًا ما تكون خداعًا للمضاربين، ويقوم المؤشر بكشفها مبكرًا.

✅ أهم ميزات النسخة PRO

📌 التبديل بين عرض جميع الإشارات أو أحدث إشارة فقط

💬 عرض سعر الإشارة بنص نظيف واختياري

📊 جدول ملخص ذكي لعرض آخر الإشارات بسرعة

📈 تمديد تلقائي للخطوط لمتابعة حركة السعر

⚡ واجهة خفيفة وسريعة ومناسبة للعرض اللحظي

🛠 الإعدادات القابلة للتعديل

فترة تحديد الكسر الكاذب

مدة صلاحية الإشارة

أنواع الفلترة: 💎 خام، WMA، أو HMA

وضع الكشف العدواني (Aggressive)

خيارات العرض:

إظهار أو إخفاء السعر

إظهار أو إخفاء الجدول

عرض آخر إشارة فقط

⚠️ رخصة الاستخدام

تم تطوير هذا السكريبت بالاعتماد على السكريبت الأصلي من @Zeiierman

وهو مرخص بموجب Creative Commons BY-NC-SA 4.0

🔒 الاستخدام التجاري غير مسموح. ويجب نسب الفضل للمطور الأصلي.

Pullback Entry Zone FinderPullback Entry Zone Finder

Overview:

This indicator is designed to help traders identify potential buying opportunities during short-term pullbacks, particularly when faster-moving averages show signs of converging back towards slower ones. It visually flags potential zones where price might find support and resume its upward movement, based on moving average dynamics and price proximity.

How It Works:

The indicator utilizes four customizable moving averages (Trigger, Short-term, Intermediate, and Long-term) and Average True Range (ATR) to pinpoint specific conditions:

Pullback Detection: It identifies when the fast 'Trigger MA' is below the 'Short-term MA', indicating a potential short-term pullback or consolidation phase.

MA Convergence: Crucially, it looks for signs that the pullback might be weakening by detecting when the gap between the Short-term MA and the Trigger MA is narrowing (maConverging). This suggests the faster average is starting to catch up, potentially preceding a move back up.

Base Buy Zone (Orange Diamond): This signal appears when both the Pullback and Convergence conditions are met simultaneously. It indicates the general area where conditions are becoming favourable for a potential entry.

Refined Entry Zones:

Prime Entry Zone (Green Diamond): This appears within a Base Buy Zone if the bar's low comes within a specified percentage (Max Distance %) of the Short-term MA. It suggests price has pulled back close to the dynamic support of the Short MA.

ATR Entry Zone (Purple Diamond): This appears within a Base Buy Zone if the bar's low comes within the specified percentage (Max Distance %) of an ATR-based target level. This target level (Buy ATR Target Level, plotted as a purple line when active) is calculated by adding a multiple (ATR Multiplier %) of the ATR to the Short-term MA, providing a volatility-adjusted potential entry area.

Visual Elements:

Moving Averages: Four lines representing the Trigger, Short-term, Intermediate, and Long-term MAs (colors and opacity are customizable). Use the Intermediate and Long-term MAs to gauge the broader market trend.

Orange Diamond (Below Bar): Indicates a 'Base Buy Zone' where a pullback and MA convergence are detected.

Green Diamond (Below Bar): Indicates a 'Prime Entry Zone' where price is close to the Short-term MA during a Base Buy Zone.

Purple Diamond (Below Bar): Indicates an 'ATR Entry Zone' where price is close to the ATR-based target level during a Base Buy Zone.

Purple Line: Plots the calculated 'Buy ATR Target Level' only when the Base Buy Zone condition is active.

Input Parameters:

Moving Averages: Customize the Length and Type (EMA, SMA, WMA, VWMA) for all four moving averages.

ATR Settings: Adjust the ATR Length, the ATR Multiplier % (for calculating the target level), and the Max Distance % (for triggering the Prime and ATR Entry Zones).

Visualization: Set the colors for the four Moving Average lines.

How to Use:

Look for the Orange Diamond as the initial signal that pullback/convergence conditions are met.

The Green and Purple Diamonds suggest price has reached potentially more optimal entry levels within that zone, based on proximity to the Short MA or the ATR target, respectively.

Always consider the signals within the context of the broader trend, indicated by the Intermediate and Long-term MAs. This indicator is generally more effective when used to find entries during pullbacks within an established uptrend (e.g., Intermediate MA > Long MA).

Combine these signals with other forms of analysis, such as chart patterns, support/resistance levels, volume analysis, or other indicators for confirmation.

Disclaimer:

You should always use proper risk management techniques and conduct your own analysis before making any trading decisions. This indicator, or any other, will be of no use if you don't have good risk management.

Fibonacci Levels with SMA SignalsThis strategy leverages Fibonacci retracement levels along with the 100-period and 200-period Simple Moving Averages (SMAs) to generate robust entry and exit signals for long-term swing trades, particularly on the daily timeframe. The combination of Fibonacci levels and SMAs provides a powerful way to capitalize on major trend reversals and market retracements, especially in stocks and major crypto assets.

The core of this strategy involves calculating key Fibonacci retracement levels (23.6%, 38.2%, 61.8%, and 78.6%) based on the highest high and lowest low over a 365-day lookback period. These Fibonacci levels act as potential support and resistance zones, indicating areas where price may retrace before continuing its trend. The 100-period SMA and 200-period SMA are used to define the broader market trend, with the strategy favoring uptrend conditions for buying and downtrend conditions for selling.

This indicator highlights high-probability zones for long or short swing setups based on Fibonacci retracements and the broader trend, using the 100 and 200 SMAs.

In addition, this strategy integrates alert conditions to notify the trader when these key conditions are met, providing real-time notifications for optimal entry and exit points. These alerts ensure that the trader does not miss significant trade opportunities.

Key Features:

Fibonacci Retracement Levels: The Fibonacci levels provide natural price zones that traders often watch for potential reversals, making them highly relevant in the context of swing trading.

100 and 200 SMAs: These moving averages help define the overall market trend, ensuring that the strategy operates in line with broader price action.

Buy and Sell Signals: The strategy generates buy signals when the price is above the 200 SMA and retraces to the 61.8% Fibonacci level. Sell signals are triggered when the price is below the 200 SMA and retraces to the 38.2% Fibonacci level.

Alert Conditions: The alert conditions notify traders when the price is at the key Fibonacci levels in the context of an uptrend or downtrend, allowing for efficient monitoring of trade opportunities.

Application:

This strategy is ideal for long-term swing trades in both stocks and major cryptocurrencies (such as BTC and ETH), particularly on the daily timeframe. The daily timeframe allows for capturing broader, more sustained trends, making it suitable for identifying high-quality entries and exits. By using the 100 and 200 SMAs, the strategy filters out noise and focuses on larger, more meaningful trends, which is especially useful for longer-term positions.

This script is optimized for swing traders looking to capitalize on retracements and trends in markets like stocks and crypto. By combining Fibonacci levels with SMAs, the strategy ensures that traders are not only entering at optimal levels but also trading in the direction of the prevailing trend.

Multi-Timeframe Price LevelsThis indicator displays key price levels from multiple timeframes on your chart, helping you identify important support and resistance zones.

## Features

- **Multiple Timeframes**: View price levels from 4H, Daily, 3-Day, Weekly, and Monthly charts simultaneously

- **Customizable Price Types**: Choose to display Open, Close, High, and Low prices

- **Color-Coded**: Each timeframe has its own color for easy identification

- **Fully Customizable**: Enable/disable specific timeframes and price types as needed

## How to Use

1. Add the indicator to your chart

2. Use the input options to select which timeframes and price types you want to display

3. Look for areas where multiple price levels converge - these often act as strong support/resistance zones

## Color Guide

- **Red**: 4-Hour timeframe

- **Blue**: Daily timeframe

- **Green**: 3-Day timeframe

- **Purple**: Weekly timeframe

- **Orange**: Monthly timeframe

For each timeframe, the transparency varies by price type:

- Open: 70% transparency

- Close: 50% transparency

- High: 30% transparency

- Low: 10% transparency (most visible)

## Trading Applications

- Identify key support and resistance levels

- Spot multi-timeframe confluences for stronger trade setups

- Plan entries and exits based on historical price reactions

- Set stop losses and take profit targets at significant levels

This indicator works best when combined with your existing trading strategy to confirm important price zones.

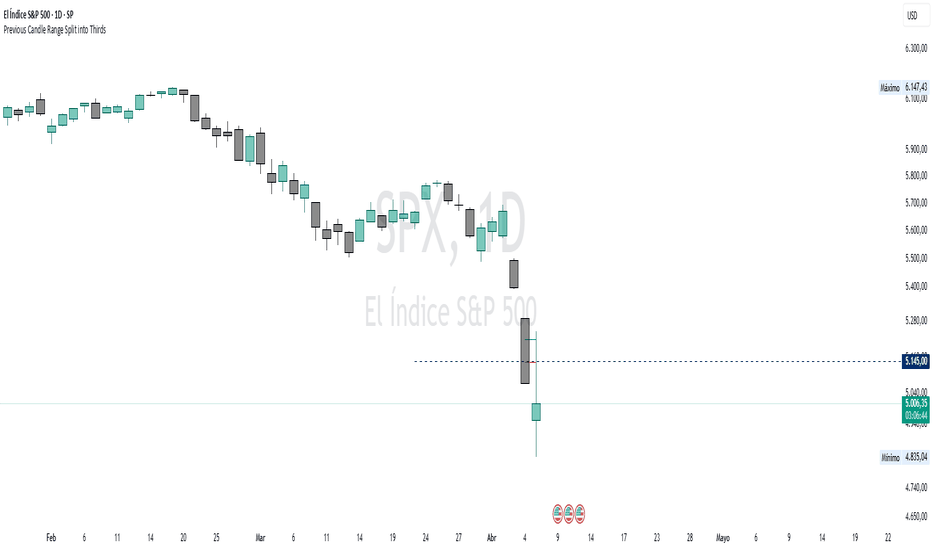

Previous Candle Range Split into ThirdsThis script plots two horizontal lines over the previous candle to divide its total range (high to low) into three equal parts. The first line marks 33% of the range from the low, and the second marks 66%. This helps users visually identify whether the previous candle closed in the lower, middle, or upper third of its range, providing context on potential buyer or seller dominance during that session.

Users can customize the color, width, and style (solid, dotted, dashed) of each line, as well as toggle their visibility from the script's input settings.

This indicator is designed as a discretionary analysis tool and does not generate buy or sell signals.

Custom Daily % Levels Table📘 Indicator Description

"Custom Daily % Levels – table" is a dynamic and customizable tool designed to help traders visualize daily percentage-based price ranges and key metrics in a compact, table-style format.

🧩 Key Features:

📐 Custom Percent Levels: Automatically calculates upper and lower price levels based on a user-defined base percentage and number of levels, relative to the previous daily close.

🟢🔴 Color Gradient Highlighting: Positive levels are shown with a green gradient, negative levels with red, and the level labels with a neutral tone for easy reference.

📊 Live Asset Info: Displays the current symbol, percentage change from the previous daily close, and 14-period RSI, all color-coded for quick interpretation.

⚙️ Header Control: Toggle the visibility of the main info headers and level headers independently.

📌 Position Customization: Choose where the table appears on your chart (top/bottom, left/right, center).

📈 Clean Layout: Makes it easy to visually track price movement relative to daily expected ranges.

This indicator is especially useful for intraday traders, scalpers, or anyone needing a clear visual of short-term price expansion and contraction based on predefined volatility zones.

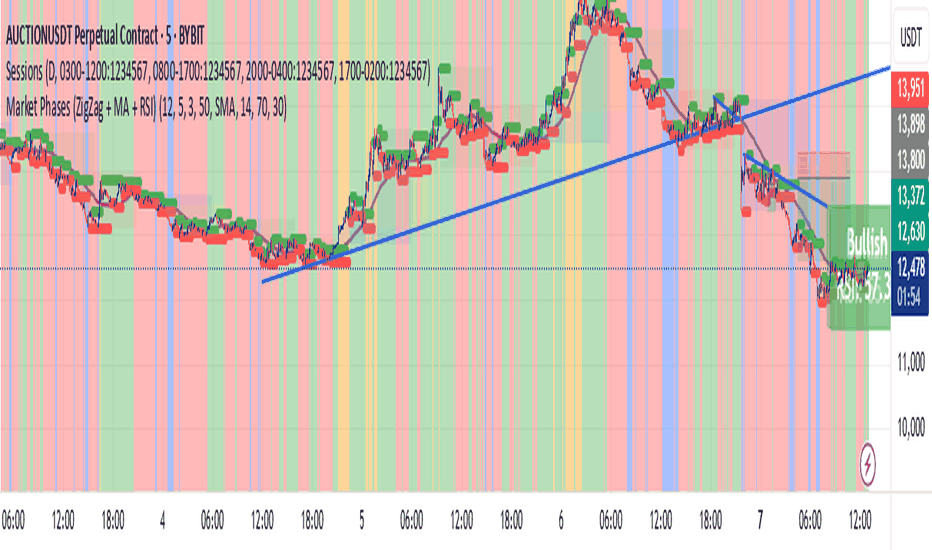

Market Phases (ZigZag + MA + RSI)This script is a TradingView Pine Script that visualizes market phases using the ZigZag pattern, Moving Averages (MA), and the Relative Strength Index (RSI). It allows traders to identify key market conditions, such as accumulating, distributing, bullish, and bearish phases based on price movements and momentum indicators.

#### Components

1. ZigZag Settings:

- Depth: Controls the sensitivity of the ZigZag indicator. A higher value results in fewer price points being considered as reversals.

- Deviation: Defines the minimum percentage change needed to identify a ZigZag point, preventing small fluctuations from being registered.

- Backstep: Specifies the number of bars to look back for identifying highs and lows.

2. Moving Average Settings:

- MA Length: The number of periods used to calculate the moving average.

- MA Type: The type of moving average to use, either Simple Moving Average (SMA) or Exponential Moving Average (EMA).

3. RSI Settings:

- RSI Length: The period for calculating the RSI.

- Overbought Level: The threshold above which the asset is considered overbought.

- Oversold Level: The threshold below which the asset is considered oversold.

4. Calculations:

- Moving Average and RSI Calculation: The script calculates either an SMA or EMA and the RSI based on user-defined settings.

5. ZigZag Enhanced Calculation:

- It identifies swing highs and lows to determine the ZigZag points for improved trend analysis.

6. Trend Direction:

- The script checks the direction of the trend based on the latest ZigZag points.

7. Market Phase Determination:

- The script defines the market phase (Accumulation, Distribution, Bullish, Bearish) based on the trend direction and levels from the RSI and relationship with the moving average.

8. Background Colors:

- The background is tinted according to the identified market phase for visual clarity.

9. Labels and Plotting:

- Labels are generated at the last bar with the current phase and RSI value.

- The moving average and last ZigZag points are plotted on the chart for further reference.

### Conclusion

This script provides a comprehensive view of market conditions by integrating multiple indicators, helping traders make informed trading decisions based on market dynamics. The ability to visualize phases and key indicators aids in recognizing potential entry and exit points in trading strategies.

If you have any questions or need further modifications, feel free to ask!

Falcon SignalsThis script is a TradingView Pine Script for a trading strategy called "Falcon Signals." It combines multiple technical indicators and strategies to generate buy and sell signals. Here’s a breakdown of what the script does:

1. Supertrend Indicator:

The script calculates the Supertrend indicator using the Average True Range (ATR) and a specified multiplier (factor). The Supertrend is used to define the trend direction, with a green line for an uptrend and a red line for a downtrend.

2. EMA (Exponential Moving Average):

Two EMAs are used: a fast EMA (9-period) and a slow EMA (21-period). The script checks for crossovers of the fast EMA above or below the slow EMA as a basis for buying and selling signals.

3. RSI (Relative Strength Index):

The RSI (14-period) is used to measure the momentum of the price. A buy signal is generated when the RSI is less than 70, while a sell signal is generated when it’s greater than 30.

4. Take Profit (TP) and Stop Loss (SL):

The script allows users to set custom percentages for take profit and stop loss. The take profit is set at a certain percentage above the entry price for buy signals, and the stop loss is set at a percentage below the entry price, and vice versa for sell signals.

5. Trailing Stop:

A trailing stop can be enabled, which dynamically adjusts the stop loss level as the price moves in the favorable direction. If the price moves against the position by a certain trailing percentage, the position will be closed.

6. Engulfing Patterns:

The script checks for bullish and bearish engulfing candlestick patterns, indicating potential reversals. A bullish engulfing pattern is marked with a teal label ("🔄 Reversal Up"), and a bearish engulfing pattern is marked with a fuchsia label ("🔄 Reversal Down").

7. Plotting:

The script plots various indicators and signals:

Entry line: Shows where the buy or sell signal is triggered.

Take profit and stop loss levels are plotted as lines.

EMA and Supertrend lines are plotted on the chart.

Trailing stop line, if enabled, is also plotted.

8. Buy and Sell Labels:

The script places labels on the chart when buy or sell signals are triggered, indicating the price at which the order should be placed.

9. Exit Line:

The script plots an exit line when the trailing stop is hit, signaling when a position should be closed.

10. Alerts:

Alerts are set for both buy and sell signals, notifying the trader when to act based on the strategy's conditions.

This strategy combines trend-following (Supertrend), momentum (RSI), and price action patterns (EMA crossovers and engulfing candlestick patterns) to generate trade signals. It also offers the flexibility of take profit, stop loss, and trailing stop features.

High and Low DayHigh and Low Day

This indicator automatically tracks and displays the daily high and low of the current trading session directly on your chart.

Each new day, it resets the levels and plots horizontal lines:

Green Line for the daily high

Red Line for the daily low

It also adds labels (“High Day” and “Low Day”) for easy visual reference.

The levels update in real time as new highs or lows are formed throughout the day.

You can toggle the visibility of these lines and labels using the "Mostrar Linhas do Dia Atual" (Show Current Day Lines) setting.

Perfect for intraday traders looking to keep track of key support and resistance levels during the trading day.

Gap Days Identifier📌 Gap Days Identifier – Pine Script

This script identifies Gap Up and Gap Down days based on user-defined percentage thresholds. It is designed for daily charts and helps traders spot significant opening gaps relative to the previous day’s close.

🔍 Key Features:

Customizable Thresholds: Input your desired % gap for both Gap Up and Gap Down detection.

Visual Markers: Displays label arrows with actual % gap on the chart (green for Gap Up, red for Gap Down).

Live Statistics Table: Shows total count of Gap Up and Gap Down days based on your filters.

Clean Overlay: Designed to be non-intrusive and easy to interpret for any instrument.

✅ Use Case:

Perfect for traders who track gap-based breakout strategies, news/event impact, or want to filter days with strong overnight sentiment shifts.

ICT & SMC Multi-Timeframe by [KhedrFX]Transform your trading experience with the ICT & SMC Multi-Timeframe by indicator. This innovative tool is designed for traders who want to harness the power of multi-timeframe analysis, enabling them to make informed trading decisions based on key market insights. By integrating concepts from the Inner Circle Trader (ICT) and Smart Money Concepts (SMC), this indicator provides a comprehensive view of market dynamics, helping you identify potential trading opportunities with precision.

Key Features

- Multi-Timeframe Analysis: Effortlessly switch between various timeframes (5 minutes, 15 minutes, 30 minutes, 1 hour, 4 hours, daily, and weekly) to capture the full spectrum of market movements.

- High and Low Levels: Automatically calculates and displays the highest and lowest price levels over the last 20 bars, highlighting critical support and resistance zones.

- Market Structure Visualization: Identifies the last swing high and swing low, allowing you to recognize current market trends and potential reversal points.

- Order Block Detection: Detects significant order blocks, pinpointing areas of strong buying or selling pressure that can indicate potential market reversals.

- Custom Alerts: Set alerts for when the price crosses above or below identified order block levels, enabling you to act swiftly on trading opportunities.

How to Use the Indicator

1. Add the Indicator to Your Chart

- Open TradingView.

- Click on the "Indicators" button at the top of the screen.

- Search for "ICT & SMC Multi-Timeframe by " in the search bar.

- Click on the indicator to add it to your chart.

2. Select Your Timeframe

- Use the dropdown menu to choose your preferred timeframe (5, 15, 30, 60, 240, D, W) for analysis.

3. Interpret the Signals

- High Level (Green Line): Represents the highest price level over the last 20 bars, acting as a potential resistance level.

- Low Level (Red Line): Represents the lowest price level over the last 20 bars, acting as a potential support level.

- Last Swing High (Blue Cross): Indicates the most recent significant high, useful for identifying potential reversal points.

- Last Swing Low (Orange Cross): Indicates the most recent significant low, providing insight into market structure.

- Order Block High (Purple Line): Marks the upper boundary of a detected order block, suggesting potential selling pressure.

- Order Block Low (Yellow Line): Marks the lower boundary of a detected order block, indicating potential buying pressure.

4. Set Alerts

- Utilize the alert conditions to receive notifications when the price crosses above or below the order block levels, allowing you to stay informed about potential trading opportunities.

5. Implement Risk Management

- Always use proper risk management techniques. Consider setting stop-loss orders based on the identified swing highs and lows or the order block levels to protect your capital.

Conclusion

The ICT & SMC Multi-Timeframe by indicator is an essential tool for traders looking to enhance their market analysis and decision-making process. By leveraging multi-timeframe insights, market structure visualization, and order block detection, you can navigate the complexities of the market with confidence. Start using this powerful indicator today and take your trading to the next level.

⚠️ Trade Responsibly

This tool helps you analyze the market, but it’s not a guarantee of profits. Always do your own research, manage risk, and trade with caution.